0000949157DEF 14Afalse00009491572022-01-012022-12-310000949157cenx:GaryMember2022-01-012022-12-31iso4217:USD0000949157cenx:GaryMember2021-01-012021-12-310000949157cenx:BlessMember2021-01-012021-12-3100009491572021-01-012021-12-310000949157cenx:BlessMember2020-01-012020-12-3100009491572020-01-012020-12-310000949157ecd:PeoMembercenx:GaryMembercenx:StockAwardsAdjustmentsMember2022-01-012022-12-310000949157cenx:EquityAwardAdjustmentsMemberecd:PeoMembercenx:GaryMember2022-01-012022-12-310000949157ecd:PeoMembercenx:GaryMembercenx:ChangeInPensionValueMember2022-01-012022-12-310000949157ecd:PeoMembercenx:GaryMembercenx:PensionAdjustmentsServiceCostMember2022-01-012022-12-310000949157ecd:PeoMembercenx:GaryMembercenx:StockAwardsAdjustmentsMember2021-01-012021-12-310000949157cenx:EquityAwardAdjustmentsMemberecd:PeoMembercenx:GaryMember2021-01-012021-12-310000949157ecd:PeoMembercenx:GaryMembercenx:ChangeInPensionValueMember2021-01-012021-12-310000949157ecd:PeoMembercenx:GaryMembercenx:PensionAdjustmentsServiceCostMember2021-01-012021-12-310000949157ecd:PeoMembercenx:BlessMembercenx:StockAwardsAdjustmentsMember2021-01-012021-12-310000949157cenx:EquityAwardAdjustmentsMemberecd:PeoMembercenx:BlessMember2021-01-012021-12-310000949157ecd:PeoMembercenx:ChangeInPensionValueMembercenx:BlessMember2021-01-012021-12-310000949157ecd:PeoMembercenx:PensionAdjustmentsServiceCostMembercenx:BlessMember2021-01-012021-12-310000949157ecd:PeoMembercenx:BlessMembercenx:StockAwardsAdjustmentsMember2020-01-012020-12-310000949157cenx:EquityAwardAdjustmentsMemberecd:PeoMembercenx:BlessMember2020-01-012020-12-310000949157ecd:PeoMembercenx:ChangeInPensionValueMembercenx:BlessMember2020-01-012020-12-310000949157ecd:PeoMembercenx:PensionAdjustmentsServiceCostMembercenx:BlessMember2020-01-012020-12-310000949157ecd:NonPeoNeoMembercenx:StockAwardsAdjustmentsMember2022-01-012022-12-310000949157cenx:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000949157cenx:ChangeInPensionValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000949157cenx:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000949157ecd:NonPeoNeoMembercenx:StockAwardsAdjustmentsMember2021-01-012021-12-310000949157cenx:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000949157cenx:ChangeInPensionValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000949157cenx:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000949157ecd:NonPeoNeoMembercenx:StockAwardsAdjustmentsMember2020-01-012020-12-310000949157cenx:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000949157cenx:ChangeInPensionValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000949157cenx:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedDuringTheYearUnvestedMembercenx:GaryMember2022-01-012022-12-310000949157ecd:PeoMembercenx:GaryMembercenx:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000949157ecd:PeoMembercenx:GaryMembercenx:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310000949157cenx:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercenx:GaryMember2022-01-012022-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedDuringTheYearUnvestedMembercenx:GaryMember2021-01-012021-12-310000949157ecd:PeoMembercenx:GaryMembercenx:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000949157ecd:PeoMembercenx:GaryMembercenx:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310000949157cenx:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercenx:GaryMember2021-01-012021-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedDuringTheYearUnvestedMembercenx:BlessMember2021-01-012021-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedInPriorYearsUnvestedMembercenx:BlessMember2021-01-012021-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedInPriorYearsVestedMembercenx:BlessMember2021-01-012021-12-310000949157cenx:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercenx:BlessMember2021-01-012021-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedDuringTheYearUnvestedMembercenx:BlessMember2020-01-012020-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedInPriorYearsUnvestedMembercenx:BlessMember2020-01-012020-12-310000949157ecd:PeoMembercenx:EquityAwardsGrantedInPriorYearsVestedMembercenx:BlessMember2020-01-012020-12-310000949157cenx:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercenx:BlessMember2020-01-012020-12-310000949157cenx:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000949157cenx:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000949157cenx:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000949157cenx:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-01-012022-12-310000949157cenx:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000949157cenx:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000949157cenx:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000949157cenx:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-01-012021-12-310000949157cenx:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000949157cenx:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000949157cenx:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000949157cenx:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-01-012020-12-31000094915712022-01-012022-12-31000094915722022-01-012022-12-31000094915732022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

Filed by the Registrant x | | |

Filed by a Party other than the Registrant o | | |

| Check the appropriate box: | | |

| o | Preliminary Proxy Statement | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement | |

| o | Definitive Additional Materials | | |

| o | Soliciting Material Pursuant to § 240.14a-12 | | |

| | |

| CENTURY ALUMINUM COMPANY |

| (Name of Registrant as Specified in its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee Computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Dear Fellow Shareholders,

In 2022 we faced significant volatility throughout the markets and regions in which we operate. Despite these challenging conditions, we were able to achieve strong financial results, posting full-year adjusted EBITDA of $144 million, while continuing to focus on our long-term goal of providing innovative aluminum products to our customers through reliable supply chains.

Importantly, we continued to make progress on our first priority of providing a safe and sustainable workplace for our people and the communities in which we operate. We want all our employees to return home safely at the end of each day. While we will never be satisfied until we achieve zero workplace injuries, our team should be proud to have reduced injuries by 10% compared to 2021 levels. We hope to significantly improve on this trend in 2023.

On a macro level, aluminum prices reached 30-year highs last spring, driving strong financial performance across Century's businesses in the first half of the year. However, market conditions faltered over the second half of 2022, as high global inflation was met with rising interest rates, resulting in a significant strengthening in the US dollar and falling aluminum prices. At the same time, the war in Ukraine and resulting energy crisis drove power prices to unsustainable levels across the world. The resulting energy crisis in Europe caused over half of Europe's remaining primary aluminum production to curtail. US energy markets were also affected, with energy prices in the MISO power markets in which our Kentucky smelters operate hitting levels four times higher than their historical average over the summer months. In this context, we made the difficult decision to curtail operations at our Hawesville smelter until market conditions improve.

Despite these market-driven challenges, our team made significant progress on several long-term initiatives last year, including the restart program at Mt. Holly, which returned the smelter's production to 75% of capacity. At Sebree, we completed the first stages of our casthouse debottlenecking projects, increasing our billet and slab capacity by approximately 10k tonnes each. We will start the next phase of these programs in 2023, which we expect will expand our total billet and slab capacity by an additional 10k tonnes each by the end of 2024. In Iceland, we made significant progress on the completion of our new 150,000MT low-carbon billet casthouse, which will begin selling Natur-Al billet into the European market in 2024. Once each of these projects is complete, we expect to be able to sell approximately 80% of Century's total production as value-added products in the form of billet, slab, foundry alloys or Natur-Al low carbon aluminum.

While 2022 presented macro headwinds, the global aluminum market continues to benefit from positive, long-term trends towards lightweighting, electrification, and renewable energy. At the same time, supply remains constrained, especially in our core markets in the US and Europe, where our growing value-added product portfolio will allow us to meet the increasing need for these products. We are well positioned and excited to execute on these opportunities in 2023.

I want to thank our entire Century team for their dedication and perseverance in navigating these complex times and their hard work and commitment to Century. We remain focused on delivering long-term value to our shareholders and look forward to continued success in the years ahead.

Sincerely,

| | | | | |

Andrew Michelmore Chairman of the Board | Jesse Gary President and Chief Executive Officer |

|

|

|

|

|

|

|

|

|

| | | | | |

| Page |

| |

2023 Annual Meeting of Stockholders | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

TABLE OF CONTENTS

(continued)

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 5, 2023

___________

To the Stockholders of Century Aluminum Company:

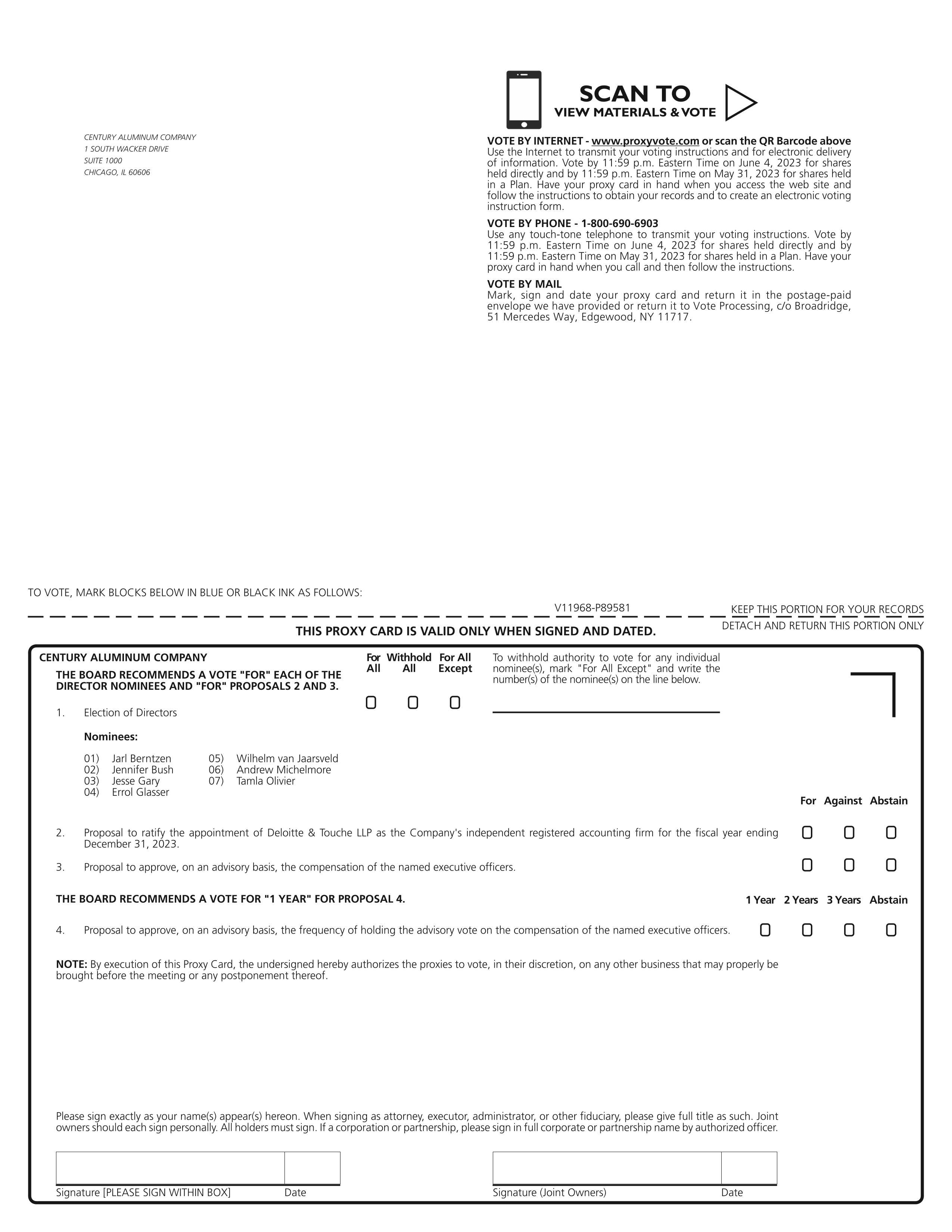

We cordially invite you to attend our 2023 Annual Meeting of Stockholders. The meeting this year will be held on Monday, June 5, 2023, at 8:30 a.m., Central Time, at Hyatt Place Chicago/Downtown – The Loop, 28 North Franklin Street, Chicago, Illinois 60606. At the meeting, we will hold votes to:

1. Elect the seven director nominees named in this Proxy Statement as Directors, each for a term of one year

2. Ratify Deloitte & Touche LLP as our independent registered public accounting firm for 2023

3. Approve, by non-binding advisory vote, the compensation of our named executive officers

4. Approve, by non-binding advisory vote, the frequency of holding the advisory vote on the compensation of our named executive officers

5. Address any other business that properly comes before the meeting

All holders of our common stock as of the close of business on April 6, 2023, are entitled to vote at the meeting. You can also vote before the meeting - by telephone, online or by mail. Your vote is important. Whether or not you plan to attend the meeting, please vote as soon as possible to ensure that your shares are represented and voted at the meeting. Instructions on how to vote are found in the section “How do I vote?” on page 5.

| | | | | |

Chicago, Illinois April 18, 2023 | By Order of the Board of Directors, |

|

| John DeZee |

| Executive Vice President, General Counsel and Corporate Secretary |

| | |

| Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Stockholders to be held on Monday, June 5, 2023: Our Proxy Statement and 2022 Annual Report are available free of charge on our website at www.centuryaluminum.com or www.proxyvote.com. |

Cautionary Statement Regarding Forward-Looking Statements

This proxy statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are statements about future events and are based on our current expectations. These forward-looking statements may be identified by the words “believe,” “expect,” “hope,” “target,” “anticipate,” “intend,” “plan,” “seek,” “estimate,” “potential,” “project,” “scheduled,” “forecast” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” or “may.” Any statement that reflects expectations, assumptions or projections about the future, other than statements of historical fact, is a forward-looking statement. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. Important factors that could cause actual results and events to differ from those described in such forward-looking statements can be found in the risk factors and forward-looking statements cautionary language contained in our Annual Report on Form 10-K, quarterly reports on Form 10-Q and in other filings made with the Securities and Exchange Commission (the “SEC”). Although we have attempted to identify those material factors that could cause actual results or events to differ from those described in such forward-looking statements, there may be other factors that could cause actual results or events to differ from those anticipated, estimated or intended. Many of these factors are beyond our ability to control or predict. Given these uncertainties, investors are cautioned not to place undue reliance on our forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Incorporation by Reference

Neither the Compensation Committee Report nor the Audit Committee Report shall be deemed soliciting material or filed with the SEC and neither of them shall be deemed incorporated by reference into any prior or future filings made by us under the Securities Act or the Exchange Act, except to the extent that we specifically incorporate such information by reference. In addition, this document includes references to our website as well as to our Sustainability Report; however, the information contained on our website, or any other website, or in our Sustainability Report is not incorporated by reference into or otherwise made a part of this proxy statement.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. For more complete information regarding Century Aluminum Company’s 2022 performance, please review our 2022 Annual Report filed on Form 10-K with the Securities and Exchange Commission and any amendments thereto. References to “Century,” “the Company”, “we”, “us” or “our” refer to Century Aluminum Company.

2023 Annual Meeting of Stockholders

| | | | | |

| Time and Date: | 8:30 a.m. Central Time, Monday, June 5, 2023 |

| Place: | Hyatt Place Chicago/Downtown – The Loop, 28 North Franklin Street, Chicago, Illinois 60606 |

| Voting: | Only holders of our common stock as of the record date (April 6, 2023) are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

Admission: | An admission ticket is required to enter Century’s 2023 Annual Meeting of Stockholders. Please follow the instructions under “How do I vote?” on page 5 of the proxy statement in order to obtain an admission ticket. |

Voting Proposals and Board Vote Recommendations

| | | | | | | | |

| Voting Proposals | Board Vote

Recommendation | Page Reference (for more detail) |

Item 1 - Election of the Seven Directors Named in this Proxy Statement to Serve a One-Year Term Expiring 2024 | FOR each Director Nominee | 8 |

Item 2 - Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2023 | FOR | 24 |

Item 3 - Advisory Vote to Approve the Compensation of our Named Executive Officers | FOR | 26 |

Item 4 - Advisory Vote on the Frequency of the Non-Binding Advisory Vote to Approve Compensation of our Named Executive Officers | FOR a Frequency of “ONE YEAR” | 57 |

Board Nominees

Our Board of Directors (the “Board”) currently consists of six members. The Board, acting on the recommendation of the Governance and Nominating Committee (the “G&N Committee”), has nominated each of the current directors and Ms. Tamla Olivier for election at the 2023 Annual Meeting. The G&N Committee identified Ms. Olivier as a potential nominee through an active search assisted by Heidrick & Struggles, which was engaged to assist the G&N Committee in its search for potential director nominees. After completing its interview and vetting process, the G&N Committee recommended to the full Board that Ms. Olivier be nominated for election as a director of the Company.

The following table provides summary information about each director nominee standing for election at the 2023 Annual Meeting, the Board Committees on which such director currently serves, if any, and the number of other U.S. public company boards they serve on.

| | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Independent | Committee Memberships | Other Public Company Boards |

| Andrew Michelmore (Chairman) | 70 | 2018 | Yes | Audit, Comp, G&N, HSS | — |

| Jarl Berntzen | 56 | 2006 | Yes | Audit, Comp, G&N, HSS | — |

| Jennifer Bush | 49 | 2021 | Yes | Audit, Comp, G&N, HSS | Cummins India, Ltd. |

| Jesse Gary | 43 | 2021 | No | HSS | N/A |

| Errol Glasser | 69 | 2014 | Yes | Audit, Comp, G&N, HSS | Regency Affiliates, Inc. |

| Wilhelm van Jaarsveld | 38 | 2017 | No | — | — |

| Tamla Olivier (new nominee) | 50 | N/A | Yes | N/A | — |

Performance Highlights

Century’s 2022 performance was impacted by the substantial volatility we experienced in both energy and commodity prices. During 2022 aluminum prices reached 30-year highs in the spring, only to reverse in the second half of the year as global inflation was met with rising interest rates and an energy crisis precipitated by the conflict in Ukraine. Despite the curtailment of our Hawesville facility due to historically high energy prices, the Company completed several key projects and initiatives to increase production capacity and add more value-added aluminum products to meet increasing demand in the U.S. and Europe.

The following are key performance highlights for 2022:

•Completed the Mt. Holly facility, increasing our production to 75% of total capacity

•Completed the initial phases of the U.S. casthouse debottlenecking programs, increasing capacity to produce value-added products by 20,000 tonnes.

•Continued progress on our low-carbon billet casthouse project at our Grundartangi smelter and is expected to start production in the first quarter of 2024.

•Produced strong year-end liquidity of $245 million

•Reduced workplace injuries by 10% compared to prior year levels

•Our Norðurál subsidiary named Environmental Company of the Year 2022 in Iceland

Corporate Governance 2022 Highlights

Century is committed to strong corporate governance practices, which we believe promote long-term value creation for our stockholders by strengthening Board and management accountability. Many of our corporate governance practices are a result of continued dialogue and collaboration with our various stakeholders, in an effort to continue to maximize the value delivered to our stockholders. Our key corporate governance practices are listed below and described in more detail below under “Corporate Governance.”

•Independent Board Chairman

•Regular meetings of the Independent Directors

•Fully independent Audit, Compensation and Governance & Nominating Committees

•100% director attendance at Board meetings in 2022 by all directors

•95% director attendance at Committee meetings in 2022

•Commitment to and emphasis on board diversity, including through the inclusion of the “Rooney Rule” in our Governance and Nominating Committee Charter

•Annual elections for all directors

•Annual Board and Committee self-evaluations

•Proactive shareholder outreach with regular board updates

•Stock ownership guidelines that apply to all executive officers and directors

•Policies prohibiting short sales, hedging, margin accounts and pledging of Century stock by employees, directors and officers

2022 Executive Compensation Highlights and Pay for Performance Alignment

Our compensation program is designed to (i) attract, retain and motivate talented executives, (ii) incentivize and reward our executives for achieving the Company’s short- and long-term performance goals and (iii) align management’s interests with long-term value creation for our stockholders, with a significant portion of executive compensation variable and at-risk. For more detail regarding our executive compensation program, including definitions for various of the defined terms used below, please see the “Executive Compensation” section of this Proxy Statement.

We believe the following aspects of our 2022 executive compensation program demonstrate our pay-for-performance orientation and our commitment to good governance:

•Setting target total compensation at competitive levels compared to our peers (and typically setting them below median levels for those executives new to their roles), while using annual and long-term incentive compensation to reward and motivate exceptional performance;

•Allocating a significant portion of each named executive officers’ (“NEO”) compensation to “at risk” compensation, the ultimate payouts or value of which are substantially dependent on the successful achievement of predetermined performance goals or linked to the value of our stock price (80% of 2022 target compensation was “at risk” for our CEO and on average 60% for our other NEOs);

•Linking payouts under a large portion of our long-term incentive awards to the Company’s TSR relative to our Industry Peer Group (75% of the 2022 target value of long-term incentive awards for our CEO and 67% on average for our other NEOs); and

•Linking payouts under our annual incentive awards to the achievement of pre-established financial, safety and operational performance targets (70% weighting) and individual performance criteria for each NEO (30% weighting).

We believe 2022 compensation outcomes for our NEOs were aligned with the overall performance of the Company in 2022 as evidenced by:

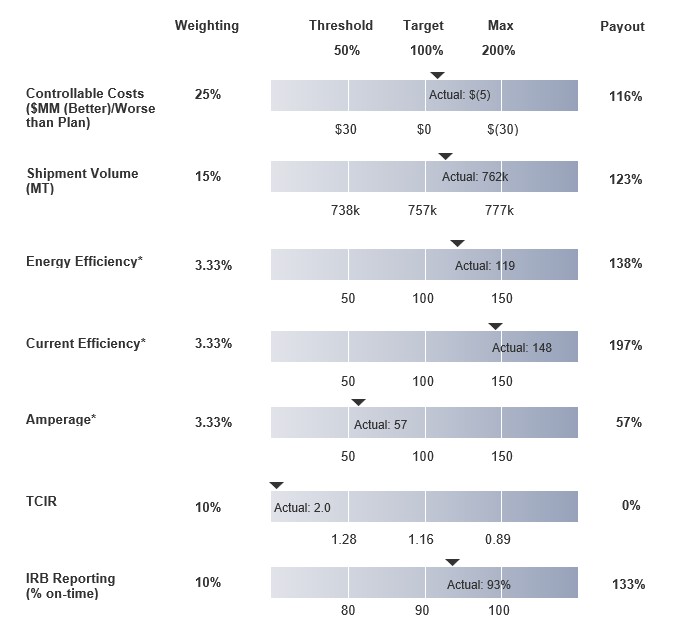

•Our 2022 Annual Incentive Plan (AIP) payout reflected:

oPayout at 116% of target under the financial and operational metrics of the plan reflecting strong operational performance and management execution; and

oPayout at 67% of target under the safety metrics of the plan, which reflected below threshold performance of the total case incident rate (TCIR) component.

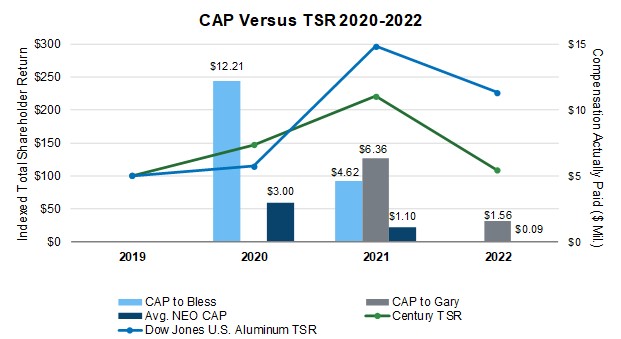

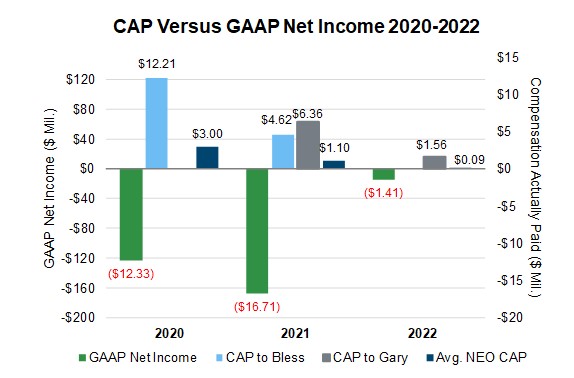

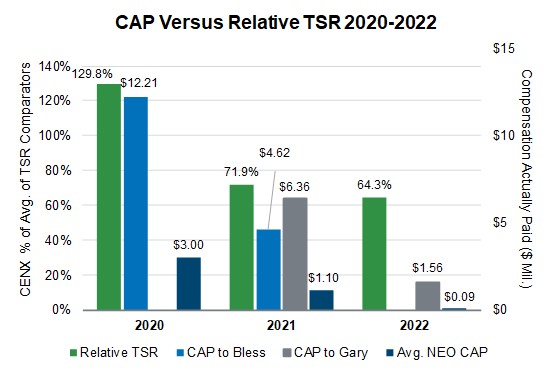

•The vesting of our 2020-2022 performance share units (“PSUs”) at 64.6% of target, reflecting below target relative TSR performance due, in part, to a challenging macro-economic climate and period of significant uncertainty for the global markets in which the Company operates.

The chart below illustrates the proportion of our CEO’s total target compensation that is variable and at risk, demonstrating the Committee’s commitment to performance-based and at-risk compensation, in line with our pay-for-performance philosophy.

| | | | | | | | | | | |

| Approximately 80% of our CEO’s 2022 targeted total compensation was variable and/or at-risk compensation, including 75% of long-term incentives in the form of PSUs. |

20% Base Salary | 20% AIP | 15% TVSUs | 45% PSUs |

| * Target Value Includes: Salary of $850,000; annual incentive of $850,000 and LTI grant of $2,507,500. Total Target Value: $4,207,500 |

Other Key Features of Our Executive Compensation Program

| | | | | | | | | | | |

| What We Do | What We Don’t Do |

| ● | We pay for performance with 80% of target 2022 compensation for our CEO “at risk” | ● | We do not have employment agreements with our officers, all of whom are at-will employees |

| ● | We annually consider an appropriate peer group to establish compensation and generally target executive compensation at or near the midpoint of our peers | ● | We do not allow executives to profit from short-term speculative swings in Company stock or engage in hedging or pledging of Company stock |

| ● | We maintain robust Company stock ownership guidelines for our executive officers and directors | ● | We do not allow for repricing of underwater stock options (including cash-outs) |

| ● | We have double-trigger equity vesting in the event of a change-in-control | ● | We do not pay dividend equivalents on unvested TVSUs |

| ● | We have adopted clawback policies for our executive incentive compensation | ● | We do not provide excise tax gross ups |

| ● | Our Compensation Committee retains an independent executive compensation consultant | | |

PROXY STATEMENT

Century Aluminum Company

1 South Wacker Drive

Suite 1000

Chicago, Illinois 60606

Our Board is soliciting proxies for the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) of Century Aluminum Company (“Century” or the “Company”). This proxy statement contains information about the items you will vote on at the 2023 Annual Meeting. Further information and instructions on how to vote online, or in the alternative, request a paper copy of these proxy materials and a proxy card, will be as set forth in the Notice of Internet Availability of Proxy Materials (“Notice”) as described below.

Notice of Availability of Proxy Materials

We are pleased to take advantage of the Securities and Exchange Commission (“SEC”‘) rules that permit public companies to furnish proxy materials to stockholders over the Internet. On or about April 21, 2023, we will begin mailing the Notice and making available to stockholders these proxy materials and the proxy card. The Notice contains instructions on how to vote online, or in the alternative, request a paper copy of the proxy materials and a proxy card. By furnishing a Notice and access to our proxy materials by the Internet, we are lowering the costs and reducing the environmental impact of the 2023 Annual Meeting. If you received a Notice by mail, you will not receive a paper copy of the proxy materials unless you request such materials by following the instructions contained on the Notice. Your vote is important no matter the extent of your holdings.

Questions and Answers

Q. When and where will the 2023 Annual Meeting be held?

A. The 2023 Annual Meeting is being held on June 5, 2023, at 8:30 a.m. Central Time, at Hyatt Place Chicago/Downtown – The Loop, 28 North Franklin Street, Chicago, Illinois 60606.

If you plan to attend the meeting, you will need an admission ticket. To obtain an admission ticket, please write to: Century Aluminum Company, 1 South Wacker Drive, Suite 1000, Chicago, Illinois 60606, Attention: Admission Ticket or email admissionticket@centuryaluminum.com. Please include a copy of your brokerage statement showing your ownership of Century stock as of the record date of April 6, 2023, or a legal proxy (which you can obtain from your broker, bank or other similar organization), and we will send you an admission ticket.

Q. Who is entitled to vote and how many votes do I have?

A. You may vote prior to or at the 2023 Annual Meeting if you owned shares of our common stock at the close of business on April 6, 2023. Each stockholder is entitled to one vote for each share of common stock held.

Q. How many shares are available to vote in the Annual Meeting?

A. On April 6, 2023, the record date for the 2023 Annual Meeting, there were 92,323,978 shares of Century common stock outstanding.

Q. What constitutes a quorum for the meeting?

A. The holders of a majority of the outstanding shares of Century’s common stock will constitute a quorum for the transaction of business at the 2023 Annual Meeting. Only shares of Century common stock that are present at the 2023 Annual Meeting, either in person or represented by proxy will be counted for purposes of determining whether a quorum exists at the meeting. Proxies properly received but marked with abstentions, as well as broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting for purposes of establishing quorum.

Q. How do I vote?

A. There are four ways that you can vote your shares:

Internet. The website for voting prior to the 2023 Annual Meeting is http://www.ProxyVote.com. To vote on the Internet, please follow the instructions provided in the Notice and have the Notice available when accessing the Internet. The voting system is available 24 hours a day, seven days a week. The deadline for voting online is 11:59 p.m. Eastern Time on Sunday, June 4, 2023. If you hold your shares in a Century 401(k) plan, the deadline for voting online is 11:59 p.m. Eastern Time on Wednesday, May 31, 2023.

Telephone. If you are located in the United States or Canada, you can vote your shares by calling 1-800-690-6903. This is a toll-free number available 24 hours a day, seven days a week. The deadline for voting by phone is 11:59 p.m. Eastern Time on Sunday, June 4, 2023. If you hold your shares in a Century 401(k) plan, the deadline for voting by phone is 11:59 p.m. Eastern Time on Wednesday, May 31, 2023.

Mail. To vote by mail, please follow the instructions on your Notice to request a paper copy of the proxy card and proxy materials, mark, sign and date your proxy card and return it in the postage-paid envelope provided with the proxy materials. If you mail your proxy card, we must receive it before 6:00 p.m. Eastern Time on Friday, June 2, 2023.

In Person. If you are the stockholder of record, you may vote by attending the 2023 Annual Meeting on Monday, June 5, 2023 at 8:30 a.m., Central Time, at Hyatt Place Chicago/Downtown – The Loop, 28 North Franklin Street, Chicago, Illinois 60606. If your shares are held in “street name” (i.e., you hold your shares in a brokerage account or through a bank or other nominee), you must obtain a copy of the legal proxy from your bank, broker or other holder of record that authorizes you to vote the shares that the record holder holds for you in its name. If you plan to attend the meeting, you will need an admission ticket. See above under “When and where will the 2023 Annual Meeting be held?” for information about how to obtain an admission ticket.

Q. What is the difference between holding shares as a stockholder of record and as a beneficial owner in “street name”?

A. Most of our stockholders hold their shares in “street name” through a bank, broker or other holder of record rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially in “street name.”

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Investor Services LLC, you are considered the stockholder of record of those shares. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the 2023 Annual Meeting.

Beneficial Owner. If your shares are held in a bank, broker or other holder of record, you are considered the beneficial owner of shares held in “street name.” The Notice is being forwarded to you by your bank, broker or other holder of record, who is considered to be the stockholder of record for those shares. As the beneficial owner, you have the right to direct your bank, broker or other holder of record on how to vote. Your bank, broker or other holder of record has provided a voting instruction card for you to use in directing it as to how to vote your shares.

Q How do I vote my shares that are held in a Century 401(k) plan?

A. If you participate in one of Century’s 401(k) plans, you must provide the trustee of the 401(k) plan with your voting instructions in advance of the meeting. You may do this by returning your voting instructions by mail, or submitting them by telephone or the Internet. You cannot vote shares held in a Century 401(k) plan in person at the 2023 Annual Meeting; only the plan trustee can directly vote your shares. The trustee will vote your shares as you have instructed. If the trustee does not receive your instructions, your shares will not be voted. To allow sufficient time for voting by the trustee, your voting instructions must be received before Wednesday, May 31, 2023.

Q. May I change my vote?

A. Yes. If you are the stockholder of record, you may revoke a proxy or change your voting instructions by:

● delivering a written notice of revocation or later-dated proxy to our Secretary at or before the taking of the vote at the 2023 Annual Meeting;

● changing your vote instructions via the Internet up to 11:59 p.m. Eastern Time on June 4, 2023;

● changing your vote instructions via the telephone up to 11:59 p.m. Eastern Time on June 4, 2023; or

● voting in person at the 2023 Annual Meeting.

If you hold your shares in one of Century’s 401(k) plans, notify the plan trustee in writing prior to May 31, 2023, that your voting instructions are revoked or should be changed.

If your shares are held in “street name,” you must follow the specific instructions provided to you to change or revoke any instructions that you may have already provided to your bank, broker or other holder of record.

Q. What are the voting requirements to elect the directors and to approve each of the proposals discussed in this proxy statement?

A. Directors are elected by a “plurality plus” voting standard, which means that the nominees that receive the highest number of votes cast “for” their election will be elected as directors, even if the nominees do not receive a majority of the votes cast; provided, however, that in uncontested elections any director nominee who receives a greater number of votes “withheld” than votes “for” must tender his or her resignation to the Board which shall then determine whether or not to accept or reject such resignation following a recommendation by the Governance and Nominating Committee of the Board. Abstentions and broker non-votes will not have an effect on the outcome of the vote on the election of directors.

Proposal No. 2 (ratification of independent registered public accounting firm) and Proposal No. 3 (advisory vote on the compensation of our named executive officers) each requires the affirmative vote of a majority of the shares of Century common stock present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions received on either proposal will have the same effect as a vote against such proposal, and broker non-votes will not have an effect on the outcome of either proposal.

Proposal No. 4, the advisory vote on frequency of future advisory votes on the compensation of our named executive officers, asks stockholders to express their preference for one of three choices: every year, every two years, or every three years. The option receiving the highest number of votes cast will be determined to be the preferred frequency. Abstentions and broker non-votes will have the same effect as not expressing a preference on this proposal.

Q. Why is it important to instruct my broker how to vote?

A. Under SEC rules, if you own shares in “street name” through a bank, broker or other holder of record and do not instruct your bank, broker or other holder of record how to vote, your bank, broker or other holder of record may not vote your shares on proposals determined to be “non-routine.” Of the proposals included in this proxy statement, only Proposal No. 2, the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, is considered to be “routine.” The other proposals are considered to be “non-routine” matters. Therefore, if you do not provide your bank, broker or other holder of record holding your shares in “street name” with voting instructions, your shares may be voted with respect to Proposal No. 2 but will not be counted as shares present and entitled to vote on the election of directors, the advisory vote on the compensation of our named executive officers, and the advisory vote on the frequency of the advisory vote on the compensation of our named executive officers and will have no effect on the outcome of such matters. Therefore, it is important that you provide voting instructions to your bank, broker or other holder of record.

Q. What is “householding”?

A. In addition to furnishing proxy materials over the Internet, the Company takes advantage of the SEC’s “householding” rules to reduce the delivery cost of materials. Under such rules, only one Notice or, if paper copies are requested, only one Proxy Statement and Annual Report on Form 10-K are delivered to multiple stockholders sharing an address unless the Company has received contrary instructions from one or more of the stockholders. If a stockholder sharing an address wishes to receive a separate Notice or copy of the proxy materials, he or she may so request by contacting Broadridge Householding Department by phone at 866-540-7095 or by mail to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717. A separate copy will be promptly provided following receipt of a stockholder’s request, and such stockholder will receive separate materials in the future. Any stockholder currently sharing an address with another stockholder but nonetheless receiving separate copies of the materials may request delivery of a single copy in the future by contacting Broadridge Householding Department at the number or address shown above.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board, upon the recommendation of the Governance and Nominating Committee, has nominated the following director nominees to stand for election to the Board for a one-year term: JARL BERNTZEN, JENNIFER BUSH, JESSE GARY, ERROL GLASSER, WILHELM VAN JAARSVELD, ANDREW MICHELMORE and TAMLA OLIVIER. Each of these nominees has indicated his or her willingness to serve if elected and the Board has no reason to believe that he or she will not be available to serve.

In addition to meeting the minimum qualifications set out by the Board, each of these nominees brings strong and unique backgrounds and skills to the Board, giving the Board, as a whole, competence and experience in a wide variety of areas, including board service, corporate governance, compensation, executive management, finance, metals and mining, operations, manufacturing, international business, health and safety, as well as sustainability and environmental and social responsibility.

Set forth below is background information for each nominee (as of the date of this proxy statement), including the qualifications, attributes or skills that led the Board to conclude that such person should be nominated to serve as a member of the Board.

| | |

| THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF MESSRS. BERNTZEN, GARY, GLASSER, VAN JAARSVELD AND MICHELMORE AND MSS. BUSH AND OLIVIER TO THE BOARD FOR A ONE-YEAR TERM EXPIRING IN 2024. |

| | | | | | | | | | | |

| DIRECTOR NOMINEES FOR ELECTION TO A TERM TO EXPIRE IN 2024 |

| | | |

| Name | Age | Business Experience and

Principal Occupation or Employment

During Past 5 Years; Other Directorships | Director Since |

| | | |

Jarl Berntzen | 56 | Mr. Berntzen has been a Managing Director in the Investment Banking Division of Oppenheimer & Co. since July 2020, where he serves as Head of Technology M&A. He was previously the Managing Director and Head of Technology & Business Services with G2 Capital Advisors, LLC from September 2019 to June 2020; Managing Director at Vaquero Capital LLC from June 2018 to April 2019; Senior Director, Cinema Strategic Initiatives at Dolby Laboratories, Inc. from October 2016 to October 2017.

Mr. Berntzen has extensive experience in mergers and acquisitions (“M&A”), financial restructurings and corporate development activities, having served in senior M&A advisory positions at several international investment banks and advisory firms, including more than 10 years with Goldman, Sachs & Co. Mr. Berntzen’s financial acumen and expertise, investment banking experience and international M&A experience provides insight to the Board when considering Century’s growth and development objectives. In addition, as a native of Norway, Mr. Berntzen provides international perspective and diversity to the Board. The Board has determined that Mr. Berntzen is an “audit committee financial expert” within the meaning of applicable SEC rules. | 2006 |

| | | |

Jennifer Bush | 49 | Ms. Bush has been with Cummins Inc. (NYSE: CMI) since 1997 and has been serving as the President, Cummins Power Systems Business, Vice President, Cummins, Inc. since August 2022. Ms. Bush previously served as Vice President, Cummins Sales and Service, North America from 2017 through 2022 and as President, Mid-South LLC and Cummins Southern Plains LLC from 2014 through 2017. Ms. Bush has served as a Director of Cummins India, Ltd. (NSE: CUMMINSIND.NS) since November 2022.

Ms. Bush brings 25 years of experience of global P&L, commercial and operational leadership in industrial businesses to the Board along with a strong commitment to health, safety, and sustainability. Ms. Bush’s strategic and operational acumen are an asset to Century as well as her strength as a leader who has embedded sustainability into her business strategy. Ms. Bush provides gender diversity to the Board. | 2021 |

| | | | | | | | | | | |

| | | |

Jesse Gary | 43 | Mr. Gary has served as Century’s President and Chief Executive Officer since July 2021. Prior to becoming President and CEO, Mr. Gary served as Century’s Chief Operating Officer from April 2019 through July 2021and Executive Vice President and General Counsel from February 2013 through July 2021.

Mr. Gary was elected to our Board of Directors in July 2021. Prior to joining Century, Mr. Gary practiced law at Wachtell, Lipton, Rosen & Katz in New York. Mr. Gary brings valuable leadership, risk-management, and strategy-development experience to the Board. Mr. Gary also has extensive knowledge of the aluminum industry and global market conditions and, as the only management representative on our Board, Mr. Gary provides a unique perspective in Board discussions about the business and strategic direction of the Company. The Board benefits from his business insights, operational expertise and knowledge of the Company and the markets it serves.

| 2021 |

| | | |

Errol Glasser | 69 | Mr. Glasser serves as a Partner and Co-Founder of Triangle Capital LLC since March 2005; Director of Regency Affiliates, Inc. (OTC Pink: RAFI) since 2002; Trustee of the Darrow School from September 2008 to February 2020.

Mr. Glasser adds to the Board extensive expertise in corporate development activities by virtue of his having served in the financial sector for over 40 years. The Board also benefits from Mr. Glasser’s substantial financial, accounting and investment knowledge and from his experiences serving on other boards and audit committees and as an advisor to other public and private companies. In addition, as a native of South Africa, Mr. Glasser provides international perspective and diversity to the Board. Mr. Glasser is a Chartered Accountant (SA) and the Board has determined that he is an “audit committee financial expert” within the meaning of applicable SEC rules.

| 2014 |

| | | | | | | | | | | |

| | | |

Wilhelm van Jaarsveld | 38 | Mr. van Jaarsveld has been an Asset and Investment Manager of the Aluminum and Alumina Department of Glencore plc since July 2017. Prior to this role, Mr. van Jaarsveld was an Asset Controller/Financial Analyst for Glencore plc from July 2012 to June 2017.

Mr. van Jaarsveld was appointed to the Board in December 2017 pursuant to the terms of the Standstill and Governance Agreement, dated July 7, 2008, between Century and Glencore plc which entitles Glencore plc to designate a nominee, reasonably acceptable to Century, to the Board. Mr. van Jaarsveld adds valuable expertise to our Board by virtue of his experience as Asset and Investment Manager of the Aluminum and Alumina Department at Glencore plc. In addition, as a Swiss resident and South African native, Mr. van Jaarsveld provides international diversity and perspective to the Board.

| 2017 |

| | | |

Andrew G. Michelmore (Chairman) | 70 | Mr. Michelmore served as the Executive Director and Chief Executive Officer of MMG Limited from December 2010 to February 2017; Chairman of the International Council on Mining and Metals from April 2016 to June 2017; Chairman of the Minerals Council of Australia since January 2023 and previously from June 2013 to June 2016; Chairman of the Council of Ormond College at the University of Melbourne from 2003 to 2020; Chairman of the Jean Hailes Foundation since 1996.

Mr. Michelmore rejoined the Board in September 2018 after previously serving on the Board from June 2010 through September 2015. Mr. Michelmore adds valuable metals and mining expertise to the Board by virtue of his experience as Chief Executive Officer of MMG Limited and previous experience as Chief Executive Officer of Zinifex, OZ Minerals, EN+ Group and WMC Resources. Mr. Michelmore also adds valuable engineering and international business experience to the Board by virtue of his positions as a Fellow of the Institution of Chemical Engineers and the Australian Academy of Technological Sciences and Engineering and a member of the Business Council of Australia. In addition, as an Australian citizen and having led and operated diversified metals and mining companies in several different countries, Mr. Michelmore provides international diversity and perspective to the Board. The Board has determined that Mr. Michelmore is an “audit committee financial expert” within the meaning of applicable SEC rules.

| 2018 |

| | | | | | | | | | | |

| | | |

Tamla A. Olivier | 50 | Ms. Olivier has served as the Senior Vice President and Chief Operating Officer of Pepco Holdings, Inc., a wholly owned subsidiary of Exelon Corporation (NASDAQ: EXC), since November 2021. Prior to this role, Ms. Olivier was the Senior Vice President and Chief Customer Officer of Baltimore Gas & Electric Company (“BGE”) from January 2020 to November 2021; and Senior Vice President of Constellation and President and CEO of BGE Home and Constellation Home from October 2016 to January 2020.

Prior to joining Constellation, Ms. Olivier held a series of leadership roles of increasing responsibility with T. Rowe Price, United Defense and Wells Fargo.

Ms. Olivier offers extensive experience as a seasoned executive in the utilities sector including direct, operational oversight of a substantial P&L business unit, as well as significant functional expertise in the areas of human resources, sustainability, safety and change management.

| — |

Board Diversity Matrix

Effective August 2021, Nasdaq adopted new listing standards that require Nasdaq-listed companies to disclose consistent, transparent diversity statistics regarding their boards of directors. The following matrix summarizes the gender and demographic diversity of our current Board nominees in accordance with Nasdaq prescribed categories and is based on the voluntary self-identification of each nominee:

| | | | | | | | | | | |

Board Diversity Matrix

(as of April 10, 2023) |

| Total Number of Director Nominees | 7 |

| Female | Male | Did Not Disclose Gender |

| Gender Identity | 2 | 4 | 1 |

| Demographic Background | | | |

| White | 1 | 4 | — |

| Black or African American | 1 | | |

| Did Not Disclose Demographic Background | 1 |

Non-Employee Director Compensation Program

Our non-employee director compensation program is designed to attract and retain talented director candidates. The Board and the Compensation Committee, with the assistance of the Compensation Committee’s independent executive compensation consultant, annually reviews the pay levels and structure of our directors’ compensation. Directors who are full-time salaried employees of Century are not compensated for their service on the Board. The Board believes that (i) compensation for independent directors should be a mix of cash and equity-based compensation and (ii) compensation for non-employee, non-independent, Board members should only be in cash in order to avoid indirectly increasing the beneficial ownership of any stockholder at whose direction a member of our Board serves. For 2022, Mr. van Jaarsveld waived his right to receive compensation of any kind.

Director Fees

The table below sets forth the components of compensation for our non-employee directors with respect to 2022 (such fees were waived by Mr. van Jaarsveld):

| | | | | |

| Annual Compensation Element | Amount |

| Annual Cash Retainer | $ 45,000 |

| Independent Chairman Annual Cash Retainer | 100,000 |

| Audit Committee Chair Annual Cash Retainer | 12,500 |

| Other Committee Chair Annual Cash Retainer | 10,000 |

Annual Equity Award(1) | 120,000 |

Board and Committee Meeting Fees(2) | 2,000 |

(1) The annual equity award is granted in the form of time-vested stock units (“TVSUs”) following the annual stockholders’ meeting or in connection with a new director appointment. Each TVSU vests on the earlier of (i) the one-year anniversary of its grant date or (ii) the next succeeding annual stockholder meeting. For any director who reaches the age of 65, his or her outstanding TVSU award will immediately vest pursuant to its terms. The dollar value of the annual equity award is converted into a number of TVSUs based on the thirty-day trailing average closing price of Century common stock.

(2) Each member of the Board is compensated $2,000 for each Board and Committee meeting attended, except that each of the Audit Committee Chair and Compensation Committee Chair receives $3,000 for each meeting of the Audit Committee and the Compensation Committee attended, respectively.

Any retainers due to the directors are paid on a quarterly basis together with any meeting fees incurred during the prior quarter. All directors are also reimbursed for their travel and other expenses incurred in attending Board and Board committee meetings, other than Mr. van Jaarsveld who also waived his right to receive expense reimbursement.

2022 Director Compensation

The following table sets forth the total compensation for each person who served as a non-employee director during the year ended December 31, 2022.

| | | | | | | | | | | |

| Name | Fees Earned or

Paid in Cash(a) | Stock Awards(b) | Total |

| Andrew Michelmore | $223,000 | $97,604 | $320,604 |

| Jarl Berntzen | 128,000 | 97,604 | 225,604 |

| Jennifer Bush | 119,000 | 97,604 | 216,604 |

| Errol Glasser | 133,500 | 97,604 | 231,104 |

Wilhelm van Jaarsveld(c) | — | — | — |

(a) Represents cash retainers and meeting fees earned by each non-employee director for 2022.

(b) These amounts represent the grant date fair value of the TVSUs awarded to each non-employee director computed in accordance with FASB Topic 718, which is calculated by multiplying the number of shares granted by the closing price of Century’s common stock on the date of grant. This calculation differs from how the Company calculates the amount of shares in each annual director equity award, which is based on the thirty-day trailing average closing price of the common stock of the Company. The closing price of Century’s common stock on June 13, 2022 (the date of grant for all directors) was $10.43. Mr. Glasser and Ms. Bush elected to defer the settlement of all TVSUs awarded to them in 2022 until their service on the Board has terminated.

(c) Mr. van Jaarsveld waived his right to receive compensation in connection with his service on the Board.

The following table sets forth as of December 31, 2022, the number of outstanding stock awards held by each non-employee director who served on our Board during 2022:

| | | | | | | | |

| Name | Number of Stock Awards Outstanding as of 12/31/2022(a) | Number of Deferred Stock Awards(b) |

| Andrew Michelmore | — | — |

| Jarl Berntzen | 9,358 | 107,786 |

| Jennifer Bush | 9,358 | — |

| Errol Glasser | — | 85,529 |

| Wilhelm van Jaarsveld | — | — |

(a) Represents unvested TVSUs as of December 31, 2022. All TVSUs granted to Messrs. Michelmore and Glasser immediately vest upon grant due to each of them having reached the age of 65.

(b) Represents vested TVSUs the settlement of which has been deferred until termination from service as a Director of the Company.

Non-Employee Director Stock Ownership Guidelines

Under our director stock ownership guidelines, each independent director is required to accumulate, within five years of election to the Board, 25,000 shares of our common stock (which was meant to approximate the value (at the time the guidelines were adopted in March 2019) of five times the annual cash retainer payable to independent directors). The guidelines of peer companies and, on a broader basis, industry practices, in place at the time the guidelines were adopted were considered in developing these guidelines. The director stock ownership guidelines continue to be based on a fixed number of shares to address the volatility inherent in the aluminum industry. As of the date of this proxy statement, each of our independent directors is in compliance with our director stock ownership guidelines.

CORPORATE GOVERNANCE

Board Information

The Board, which is responsible for the supervision of the overall business affairs of Century, establishes corporate policies, sets strategic direction and oversees management, which is responsible for Century’s day-to-day operations. The Board met eight times during 2022. There are no family relationships among any of our directors and executive officers.

Board Leadership and Independent Chairman

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure at any given time. The Company’s current Board leadership structure provides for an independent Chairman of the Board. The Board has not adopted a formal policy regarding whether the roles of the Chairman and Chief Executive Officer should be separate or combined, but recognizes the value to the Company of the separation of these positions and having an independent director serve as Chairman. We believe that this structure is appropriate for the Company because it allows our independent Chairman to lead the Board in its fundamental role of governing the Company and providing advice to management, while also providing for effective independent oversight and allowing our President and Chief Executive Officer to focus on the execution of our business strategy, growth and development. The Board evaluates whether this leadership structure is in the best interests of our stockholders on a regular basis.

Director Independence

Nasdaq Global Select Market (“Nasdaq”) rules require that a majority of the board of directors of listed companies be independent as defined by Nasdaq listing standards. The Board determined that each of Messrs. Michelmore, Berntzen and Glasser and Ms. Bush are, and during 2022 were, independent under the criteria established by Nasdaq for membership on the Board and that these directors are independent under applicable SEC rules and Nasdaq listing standards for service on the various committees of the Board on which they serve, in addition to meeting Institutional Shareholder Services’ (ISS) independence standards.

Led by our Chairman, our independent directors meet in executive session without the presence of management no fewer than four times each year. The Independent Directors met five times in 2022.

Board Composition and Diversity

Commitment to Diversity

Our Board is committed to maintaining a balance of skills, diversity, viewpoints and experiences on the Board. Our directors bring a range of attributes, viewpoints and experiences along with opinions and individual perspectives, all of which are reflective of the global industry in which we participate. The Board and our Governance and Nominating Committee believe that diversity is an important aspect in Board composition and considers diversity when evaluating any recommendations for nominations to the Board. Reflecting its commitment to diversity, the Governance and Nominating Committee’s Charter was amended in March 2021 to provide that any search for potential director candidates include qualified candidates who reflect diverse backgrounds, including diversity of gender, ethnicity and race. The Company is committed to having a Board that reflects diverse perspectives, including those based on gender and ethnicity.

In selecting a director nominee, the Governance and Nominating Committee takes into consideration each potential nominee’s diverse attributes and variety of experiences and viewpoints but does not make decisions to nominate a potential candidate solely on the basis of race, ethnicity, gender, national origin or sexual orientation. The Governance and Nominating Committee focuses on skills, education, experience and qualities that would complement the existing Board, recognizing our diverse global business structure. Our current directors come from diverse business backgrounds and are residents of or have nationalities associated with five different nations. The current directors also represent a range of ages: under 40 (14%), 40-49 (28%), 50-59 (29%) and 60 and over (29%).

Identification and Qualification of Director Nominees

The Governance and Nominating Committee solicits recommendations for potential Board nominees from a variety of sources, including directors, officers and other individuals with whom the Governance and Nominating Committee members are familiar, through its own research, and third-party consultants and search firms. The Governance and Nominating Committee also considers nominees recommended by stockholders who submit such recommendations in writing to our Corporate Secretary. The qualifications and standards that the Governance and Nominating Committee will apply in evaluating any recommendations for nomination to the Board include, but are not limited to:

•business or public company experience;

•a willingness and ability to make a sufficient time commitment to Century’s affairs to perform effectively the duties of a director, including regular attendance at Board and committee meetings;

•skills in finance, metals and mining and international business and knowledge about the global aluminum industry;

•personal qualities of leadership, character, judgment and integrity;

•attributes that contribute to the gender and racial diversity of the Board; and

•requirements relating to composition of the Board under applicable law and listing standards.

Board Committees and Meeting Attendance

To assist it in carrying out its duties, the Board has established various standing committees, including the committees set forth below denoting composition as of December 31, 2022:

| | | | | | | | | | | | | | |

| Name | Audit | Compensation | Governance & Nominating | Health, Safety & Sustainability |

| Andrew Michelmore | X | X | X* | X |

| Jarl Berntzen | X** | X* | X | X |

| Jennifer Bush | X | X | X | X* |

| Jesse Gary | | | | X |

| Errol Glasser | X* | X | X | X |

| Wilhelm van Jaarsveld | | | | |

*Committee Chair

**Committee Vice Chair

The Board designates the members of each committee and the committee chair annually based on the recommendations of the Governance and Nominating Committee. The Board has adopted written charters for each of these committees, which are available in the “Investors” section of our website, www.centuryaluminum.com, under the tab “Governance.” During 2022, each of our directors attended 100% of the meetings of the Board and 95% of the meetings of the Board committees on which each such director served. We encourage our directors to attend our annual meeting of stockholders. All of our directors attended our 2022 annual meeting of stockholders.

Audit Committee

The Audit Committee’s primary duties and responsibilities include:

•Overseeing the adequacy and effectiveness of the financial reporting process;

•Appointing and overseeing the engagement of the independent auditor, reviewing the scope and results of the independent audit with the independent auditor and managing and reviewing and approving all audit and non-audit services and fees;

•Overseeing the internal audit function, appointing the Company’s internal auditor and reviewing with management the adequacy and effectiveness of the Company’s system of internal controls;

•Overseeing the Company’s risk management, including reviewing with management, the internal auditor and to the extent appropriate, the independent auditor, our financial risk exposures and assessing the steps management has taken to monitor and control such exposures;

•Reviewing legal and regulatory matters with management that may have material financial impacts on the Company;

•Conducting or directing investigations of any allegations of material violations of securities laws, fiduciary duties or similar violations; and

•Reviewing and approving related party transactions pursuant to our Statement of Policy Regarding Related Party Transactions.

In 2022, the Audit Committee held eight meetings. The Board has determined that all current members of the Audit Committee are independent under the criteria established by Nasdaq and under SEC rules applicable to audit committee membership. The Board has also determined that three of the four members of the Audit Committee are “audit committee financial experts” within the meaning of applicable SEC rules.

The report of the Audit Committee is set forth below in the section titled “Audit Committee Report”.

Compensation Committee

The Compensation Committee’s primary duties and responsibilities include:

•Overseeing the administration of the compensation and benefit plans and policies of the Company, including incentive and equity-based plans and awards;

•Reviewing and approving the goals and objectives relevant to the compensation of the Chief Executive Officer, evaluating the performance of the Chief Executive Officer and determining the Chief Executive Officer’s compensation based on such evaluation;

•Reviewing with the Chief Executive Officer and approving the respective goals and objectives relevant to the compensation of the other executive officers and determining the compensation of the other executive officers following recommendations by the Chief Executive Officer based on the Chief Executive Officer’s evaluation of the performance of the other executive officers in light of their respective corporate and individual goals and objectives and in light of the Company’s most recent stockholder advisory vote on executive compensation;

•Reviewing with the Chief Executive Officer the non-executive management compensation and benefit policies of Century;

•Reviewing and recommending to the Board the compensation of our directors;

•Reviewing with the Chief Executive Officer the Company’s succession plans relating to the Chief Executive Officer and the other executive officers;

•Reviewing our executive compensation policies and practices to determine whether they encourage excessive risk-taking, reviewing and discussing the relationship between risk management policies and practices and compensation and evaluating compensation policies and practices that could mitigate any such risk; and

•Reviewing and discussing with management the Compensation Discussion and Analysis and recommending whether such report should be included in our annual report and proxy statement.

The Compensation Committee held five meetings in 2022. The Board has determined that all current members of the Compensation Committee are independent under the criteria established by Nasdaq and under SEC rules applicable to compensation committee membership. We refer you to the section of this proxy statement titled “Compensation Discussion and Analysis” for discussion of our Compensation Committee’s role in determining compensation for our executive officers.

Compensation Committee Interlocks and Insider Participation

At no time during 2022 nor as of the date of this proxy statement, has any member of our Compensation Committee been an officer or employee of our Company and none of our executive officers served as a member of the compensation committee of another entity, or as a director of another entity, one of whose executive officers served on our compensation committee or as one of our directors.

Governance and Nominating Committee

The Governance and Nominating Committee’s primary duties and responsibilities include:

•Identifying, recruiting and recommending candidates for election to the Board and its committees;

•Evaluating the size and composition of the Board;

•Recommending to the Board the number, identity and responsibilities of the Board committees;

•Reviewing, evaluating and making recommendations to the Board regarding our corporate governance practices and policies; and

•Overseeing the annual self-evaluation of the Board and of each Board committee.

In 2022, the Governance and Nominating Committee held four meetings. The Board has determined that all members of the Governance and Nominating Committee are independent under the criteria established by Nasdaq and applicable SEC rules.

Health, Safety and Sustainability Committee

The Health, Safety and Sustainability Committee’s primary duties and responsibilities include:

•Reviewing the Company’s goals, policies and programs relative to health, safety and sustainability;

•Monitoring the Company’s performance on health, social responsibility, safety and sustainability matters and reviewing such performance with management;

•Reviewing with management the Company’s compliance with laws, rules, regulations and standards of corporate conduct relating to health, safety, social responsibility and sustainability matters; and

•Monitoring the Company’s potential risks and liabilities as they relate to health, safety, social responsibility and sustainability and the adequacy of the Company’s policies and practices to manage these risks and liabilities.

•The Health, Safety and Sustainability Committee held four meetings in 2022.

Board Oversight of Risk Management

Management of risk is the direct responsibility of our Chief Executive Officer and our management team. Our Board as a whole and through its committees oversees management’s attention to risk by regularly reviewing with management the risks inherent to our business and to our business strategy, their potential impacts on us, and our risk management decisions, practices and activities (both short-term and long-term).

The Company has implemented a comprehensive risk management process overseen by the Executive Director of Internal Audit to aggregate, monitor, measure, and manage risk. The risk management process is designed to enable the Board to establish a mutual understanding with management of the effectiveness of the Company’s risk management practices and capabilities, to review the Company’s risk exposure, and to elevate certain key risks for discussion at the Board level. The Executive Director of Internal Audit reports directly to the Audit Committee and regularly updates the Audit Committee on the Company’s risk management process. The Chair of the Audit Committee then reports to the full Board on the risks associated with the Company’s operations. The Board also relies on the Chief Executive Officer and other executive officers of the Company to supervise day-to-day risk management and to bring material risks to the Board’s attention. The Chief Executive Officer and our other executive officers report directly to the Board and certain Board committees, as appropriate. Directors may also from time to time rely on the advice of our outside advisors and auditors, provided they have a reasonable basis for such reliance.

While the Board has primary responsibility for overseeing risk management, the Board also delegates certain oversight responsibilities to its Board committees. The Audit Committee provides risk oversight with respect to the Company’s financial statements, the Company’s compliance with legal and regulatory requirements and corporate policies and controls related to the financial statements, the independent auditor’s selection, retention, qualifications, objectivity and independence, and the performance of the Company’s internal audit function. The Compensation Committee reviews and reports on risks related to our compensation policies and practices. The Governance and Nominating Committee considers risks related to director nominations, corporate governance matters, succession planning and oversees the appropriate allocation of responsibility for risk oversight among the committees of the Board. The Health, Safety and Sustainability Committee provides oversight of risks relating to Century’s policies and management systems with respect to health, safety, social responsibility and sustainability matters. The Board regularly receives detailed reports from its committees regarding risk oversight in their areas of responsibility.

The Board as a whole also oversees the Company’s cybersecurity risks. Our Chief Information Officer updates the Board periodically regarding the actions management is taking to mitigate the Company’s cybersecurity risks and enhance the Company’s cybersecurity protection. Management routinely evaluates the Company’s existing security processes, procedures and systems in order to determine whether additional enhancements are needed to further reduce the likelihood and impact of a future cybersecurity event. Some of the Company’s current safeguards include multi-factor authentication for remote access to systems; performing email phishing test campaigns; strengthened email spam filtering; further restricted internet firewall rules; revoking memory stick and external hard drive use; requiring timely application of security and software patches on servers; antivirus endpoint protection upgrades; performing 24-hour/7-day a week network monitoring; improving our backup and recovery strategy; and updating our cyber incident response plan, among others.

Corporate Governance Guidelines and Code of Ethics

The Board has adopted Corporate Governance Guidelines, which are designed to assist the Board in performing its duties to the Company and its stockholders. These guidelines provide general guidance to the Board with a view to continuing a strong and effective working relationship between the Board and management. The goal of these guidelines is to reflect current governance practices for the Board and to enhance the ability of the Board and management to guide the Company in its continuing growth and success. Our Corporate Governance Guidelines may be amended by the Board at any time.

The Board has also adopted a Code of Ethics that applies to all of our directors, officers and other employees. The Code of Ethics sets forth guidelines for deterring wrong-doing and promoting the highest standards of honest and ethical behavior and integrity in carrying out the Company’s business activities.

Copies of our Corporate Governance Guidelines and our Code of Ethics are available on our website at www.centuryaluminum.com and to any stockholder who requests them. If and when they occur, we will disclose any amendments to or waivers of our Code of Ethics on behalf of our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions on our website at www.centuryaluminum.com.

Related Party Transaction Policy

The Company has a written policy and written procedures for the review, approval and monitoring of transactions involving Century or its subsidiaries and “related parties.” For the purposes of the policy, “related parties” include executive officers, directors and director nominees and any of their respective immediate family members, as well as stockholders owning five percent or greater of our outstanding stock and their immediate family members. A copy of the Company’s Statement of Policy Regarding Related Party Transactions is available in the Investor section of the Company’s website, www.centuryaluminum.com, under the tab “Governance.”

The Company’s Statement of Policy Regarding Related Party Transactions applies, subject to certain specific exclusions, to any transaction, arrangement or relationship or any series of similar transactions, arrangements or relationships in which Century or any of its subsidiaries was or is to be a participant and where any related party had or will have a direct or indirect interest. Pursuant to the policy, the Audit Committee is responsible for reviewing related party transactions. However, all transactions with Glencore plc or its affiliates (together, “Glencore”) and any other transaction the Audit Committee Chair determines is material to the Company are reviewed by the independent directors, acting as a separate body of our Board. Based on its consideration of all relevant facts and circumstances, whether the transaction is on terms that are fair and reasonable to the Company and whether the transaction is in the business interests of the Company, the Audit Committee or independent directors, as the case may be, will decide whether or not to approve or ratify such transaction. If a related party transaction is submitted for approval after the commencement of the transaction, the Audit Committee or independent directors, as the case may be, will evaluate all options available, including the ratification, rescission or termination of such transaction, if appropriate. The policy defines certain ordinary course, non-material transactions with Glencore that are pre-approved by the independent directors. The Audit Committee receives quarterly reports of all pre-approved transactions.

Transactions with Related Parties in 2022

Please see page 56 for a description of related party transactions in 2022.

Health, Safety and Sustainability