cenx-202203310000949157false2022Q112/310.053354700009491572022-01-012022-03-3100009491572022-04-28xbrli:sharesiso4217:USD00009491572021-01-012021-03-31iso4217:USDxbrli:shares00009491572022-03-3100009491572021-12-3100009491572020-12-3100009491572021-03-310000949157us-gaap:PreferredStockMember2021-12-310000949157us-gaap:CommonStockMember2021-12-310000949157us-gaap:AdditionalPaidInCapitalMember2021-12-310000949157us-gaap:TreasuryStockMember2021-12-310000949157us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000949157us-gaap:RetainedEarningsMember2021-12-310000949157us-gaap:RetainedEarningsMember2022-01-012022-03-310000949157us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000949157us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000949157us-gaap:PreferredStockMember2022-03-310000949157us-gaap:CommonStockMember2022-03-310000949157us-gaap:AdditionalPaidInCapitalMember2022-03-310000949157us-gaap:TreasuryStockMember2022-03-310000949157us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000949157us-gaap:RetainedEarningsMember2022-03-310000949157us-gaap:PreferredStockMember2020-12-310000949157us-gaap:CommonStockMember2020-12-310000949157us-gaap:AdditionalPaidInCapitalMember2020-12-310000949157us-gaap:TreasuryStockMember2020-12-310000949157us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000949157us-gaap:RetainedEarningsMember2020-12-310000949157us-gaap:RetainedEarningsMember2021-01-012021-03-310000949157us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310000949157us-gaap:PreferredStockMember2021-01-012021-03-310000949157us-gaap:CommonStockMember2021-01-012021-03-310000949157us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310000949157us-gaap:PreferredStockMember2021-03-310000949157us-gaap:CommonStockMember2021-03-310000949157us-gaap:AdditionalPaidInCapitalMember2021-03-310000949157us-gaap:TreasuryStockMember2021-03-310000949157us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310000949157us-gaap:RetainedEarningsMember2021-03-310000949157cenx:GlencoreMember2022-03-31xbrli:pure0000949157us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercenx:GlencoreMember2022-01-012022-03-310000949157us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercenx:GlencoreMember2021-01-012021-03-310000949157cenx:GlencoreMember2022-01-012022-03-310000949157cenx:GlencoreMember2021-01-012021-03-310000949157country:US2022-01-012022-03-310000949157country:US2021-01-012021-03-310000949157country:IS2022-01-012022-03-310000949157country:IS2021-01-012021-03-310000949157us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-03-310000949157us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-03-310000949157us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-03-310000949157us-gaap:FairValueMeasurementsRecurringMember2022-03-310000949157us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000949157us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000949157us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000949157us-gaap:FairValueMeasurementsRecurringMember2021-12-310000949157cenx:FixedtoVariableLondonMetalsExchangeSwapMember2022-03-310000949157us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMembercenx:FixedtoVariableLondonMetalsExchangeSwapMember2022-03-310000949157cenx:FixedtoVariableLondonMetalsExchangeSwapMember2021-12-310000949157us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMembercenx:FixedtoVariableLondonMetalsExchangeSwapMember2021-12-310000949157cenx:FXSwapMember2022-03-310000949157cenx:FXSwapMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMember2022-03-310000949157cenx:FXSwapMember2021-12-310000949157cenx:FXSwapMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMember2021-12-310000949157cenx:NordpoolPowerPriceSwapMember2022-03-310000949157cenx:NordpoolPowerPriceSwapMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMember2022-03-310000949157cenx:NordpoolPowerPriceSwapMember2021-12-310000949157cenx:NordpoolPowerPriceSwapMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMember2021-12-310000949157cenx:ContingentObligationMember2022-03-310000949157srt:MinimumMemberus-gaap:FairValueInputsLevel3Membercenx:ContingentObligationMember2022-01-012022-03-31utr:MT0000949157us-gaap:FairValueInputsLevel3Membercenx:ContingentObligationMembersrt:MaximumMember2022-01-012022-03-310000949157cenx:ContingentObligationMember2021-12-310000949157srt:MinimumMemberus-gaap:FairValueInputsLevel3Membercenx:ContingentObligationMember2021-01-012021-12-310000949157us-gaap:FairValueInputsLevel3Membercenx:ContingentObligationMembersrt:MaximumMember2021-01-012021-12-310000949157cenx:NordpoolPowerPriceSwapMember2022-01-012022-03-310000949157cenx:FixedtoVariableLondonMetalsExchangeSwapMember2022-01-012022-03-310000949157cenx:FXSwapMember2022-01-012022-03-310000949157cenx:FixedtoVariableLondonMetalsExchangeSwapMember2020-12-310000949157cenx:FXSwapMember2020-12-310000949157cenx:FixedtoVariableLondonMetalsExchangeSwapMember2021-01-012021-03-310000949157cenx:FXSwapMember2021-01-012021-03-310000949157cenx:FixedtoVariableLondonMetalsExchangeSwapMember2021-03-310000949157cenx:FXSwapMember2021-03-310000949157us-gaap:StockCompensationPlanMember2022-01-012022-03-310000949157us-gaap:StockCompensationPlanMember2021-01-012021-03-310000949157us-gaap:ConvertiblePreferredStockMember2022-01-012022-03-310000949157us-gaap:ConvertiblePreferredStockMember2021-01-012021-03-3100009491572018-12-310000949157us-gaap:ConvertiblePreferredStockMember2022-03-310000949157us-gaap:ConvertiblePreferredStockMember2021-12-310000949157us-gaap:TreasuryStockMember2021-12-310000949157us-gaap:CommonStockMember2021-12-310000949157us-gaap:ConvertiblePreferredStockMember2022-01-012022-03-310000949157us-gaap:TreasuryStockMember2022-01-012022-03-310000949157us-gaap:CommonStockMember2022-01-012022-03-310000949157us-gaap:TreasuryStockMember2022-03-310000949157us-gaap:CommonStockMember2022-03-310000949157us-gaap:ConvertiblePreferredStockMember2020-12-310000949157us-gaap:TreasuryStockMember2020-12-310000949157us-gaap:CommonStockMember2020-12-310000949157us-gaap:ConvertiblePreferredStockMember2021-01-012021-03-310000949157us-gaap:TreasuryStockMember2021-01-012021-03-310000949157us-gaap:CommonStockMember2021-01-012021-03-310000949157us-gaap:ConvertiblePreferredStockMember2021-03-310000949157us-gaap:TreasuryStockMember2021-03-310000949157us-gaap:CommonStockMember2021-03-3100009491572011-12-3100009491572015-01-012015-03-3100009491572011-01-012022-03-3100009491572015-04-012022-03-310000949157cenx:IndustrialRevenueBondsVariableMember2022-03-310000949157cenx:IndustrialRevenueBondsVariableMember2021-12-310000949157us-gaap:RevolvingCreditFacilityMemberus-gaap:DomesticLineOfCreditMember2022-03-310000949157us-gaap:RevolvingCreditFacilityMemberus-gaap:DomesticLineOfCreditMember2021-12-310000949157us-gaap:ForeignLineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-03-310000949157us-gaap:ForeignLineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-12-310000949157us-gaap:ForeignLineOfCreditMembercenx:CasthouseFacilityMember2022-03-310000949157us-gaap:ForeignLineOfCreditMembercenx:CasthouseFacilityMember2021-12-310000949157cenx:SeniorSecuredNotes75Memberus-gaap:SeniorNotesMember2022-03-310000949157cenx:SeniorSecuredNotes75Memberus-gaap:SeniorNotesMember2021-12-310000949157cenx:SeniorConvertibleNotes275Memberus-gaap:SeniorNotesMember2022-03-310000949157cenx:SeniorConvertibleNotes275Memberus-gaap:SeniorNotesMember2021-12-310000949157cenx:SeniorSecuredNotes75Memberus-gaap:SeniorNotesMember2021-04-140000949157cenx:SeniorSecuredNotes75Memberus-gaap:SeniorNotesMember2021-04-142021-04-140000949157us-gaap:FairValueInputsLevel2Membercenx:SeniorSecuredNotes75Memberus-gaap:SeniorNotesMember2022-03-310000949157cenx:ConvertibleSeniorNoteMemberus-gaap:SeniorNotesMember2021-04-090000949157cenx:ConvertibleSeniorNoteMemberus-gaap:SeniorNotesMember2021-04-092021-04-090000949157cenx:ConvertibleSeniorNoteMemberus-gaap:SeniorNotesMember2022-01-012022-03-310000949157us-gaap:FairValueInputsLevel2Membercenx:ConvertibleSeniorNoteMemberus-gaap:SeniorNotesMember2022-03-310000949157us-gaap:LetterOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-03-310000949157cenx:CasthouseFacilityMember2021-11-022021-11-020000949157cenx:CasthouseFacilityMember2021-11-020000949157cenx:CasthouseFacilityMember2022-03-310000949157cenx:RavenswoodRetireeMedicalBenefitsChangesMember2017-08-182017-08-180000949157cenx:RavenswoodRetireeMedicalBenefitsChangesMember2017-09-012017-09-300000949157cenx:RavenswoodRetireeMedicalBenefitsChangesMember2018-03-310000949157cenx:RavenswoodRetireeMedicalBenefitsChangesMember2022-01-012022-03-310000949157us-gaap:OtherCurrentLiabilitiesMembercenx:RavenswoodRetireeMedicalBenefitsChangesMember2022-01-012022-03-310000949157us-gaap:OtherLiabilitiesMembercenx:RavenswoodRetireeMedicalBenefitsChangesMember2022-01-012022-03-310000949157cenx:PensionBenefitGuaranteeCorporationMember2013-01-012013-12-310000949157cenx:PensionBenefitGuaranteeCorporationMember2021-01-012021-03-310000949157cenx:PensionBenefitGuaranteeCorporationMember2022-01-012022-03-310000949157cenx:PensionBenefitGuaranteeCorporationMember2021-10-010000949157cenx:PensionBenefitGuaranteeCorporationMember2021-10-012021-10-010000949157cenx:HawesvilleMember2022-01-012022-03-310000949157cenx:SebreeMember2022-01-012022-03-310000949157cenx:SanteeCooperMember2021-04-012021-04-010000949157cenx:SanteeCooperMember2021-04-010000949157cenx:GrundartangiHSLandsvirkjunandORMember2022-03-31utr:MW0000949157cenx:GrundartangiLandsvirkjunMember2021-07-310000949157cenx:GrundartangiLandsvirkjunMember2022-03-31cenx:Labor_Union0000949157country:NL2022-03-310000949157us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-03-310000949157us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000949157us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-03-310000949157us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310000949157us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-03-310000949157us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-03-310000949157us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310000949157us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310000949157us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310000949157us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-03-310000949157us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-310000949157us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-03-310000949157us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-03-310000949157us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310000949157us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-03-310000949157us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-03-310000949157us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-03-310000949157us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-03-310000949157us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-03-310000949157us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-03-31utr:t0000949157cenx:MidwestPremiumMWPMember2022-01-012022-03-310000949157cenx:FixedtoFloatingSwapMember2022-01-012022-03-310000949157cenx:NordpoolPowerPriceSwapMembercenx:GrundartangiMember2022-01-012022-03-31utr:MWhiso4217:EUR0000949157cenx:IndianaHubPowerPriceSwapsMember2022-01-012022-03-310000949157us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2022-03-310000949157us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2021-12-310000949157us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-03-310000949157us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-12-310000949157us-gaap:NondesignatedMember2022-03-310000949157us-gaap:NondesignatedMember2021-12-310000949157us-gaap:CommodityContractMembercenx:GlencoreMember2022-03-310000949157us-gaap:CommodityContractMembercenx:GlencoreMember2021-12-310000949157us-gaap:CommodityContractMember2022-01-012022-03-310000949157us-gaap:CommodityContractMember2021-01-012021-03-310000949157us-gaap:ForeignExchangeContractMember2022-01-012022-03-310000949157us-gaap:ForeignExchangeContractMember2021-01-012021-03-310000949157us-gaap:CommodityContractMembercenx:GlencoreMember2022-01-012022-03-310000949157us-gaap:CommodityContractMembercenx:GlencoreMember2021-01-012021-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______.

Commission file number 001-34474

Century Aluminum Company

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware | 13-3070826 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| One South Wacker Drive | 60606 |

| Suite 1000 | (Zip Code) |

| Chicago | |

| Illinois | |

| (Address of principal executive offices) | |

Registrant’s telephone number, including area code: (312) 696-3101

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: |

| Common Stock, $0.01 par value per share | CENX | Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

The registrant had 91,231,611 shares of common stock outstanding at April 28, 2022.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

| | | | | | | | | | | | | | | |

| CENTURY ALUMINUM COMPANY |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in millions, except per share amounts) |

| (Unaudited) |

| Three months ended March 31, | | |

| 2022 | | 2021 | | | | |

| NET SALES: | | | | | | | |

| Related parties | $ | 433.1 | | | $ | 268.3 | | | | | |

| Other customers | 320.5 | | | 175.7 | | | | | |

| Total net sales | 753.6 | | | 444.0 | | | | | |

| Cost of goods sold | 660.4 | | | 464.7 | | | | | |

| Gross profit (loss) | 93.2 | | | (20.7) | | | | | |

| Selling, general and administrative expenses | 11.7 | | | 16.1 | | | | | |

| Other operating expense - net | 0.2 | | | 0.1 | | | | | |

| Operating income (loss) | 81.3 | | | (36.9) | | | | | |

| Interest expense – Hawesville term loan | — | | | (0.3) | | | | | |

| Interest expense | (7.3) | | | (9.0) | | | | | |

| Interest income | 0.1 | | | 0.1 | | | | | |

| Net loss on forward and derivative contracts | (56.7) | | | (98.1) | | | | | |

| | | | | | | |

| Other income - net | 2.0 | | | 1.9 | | | | | |

| Income (loss) before income taxes | 19.4 | | | (142.3) | | | | | |

| Income tax (expense) benefit | (1.7) | | | 2.3 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income (loss) | $ | 17.7 | | | $ | (140.0) | | | | | |

| Less: net income (loss) allocated to participating securities | 1.1 | | | — | | | | | |

| Net income (loss) allocated to common stockholders | $ | 16.6 | | | $ | (140.0) | | | | | |

| | | | | | | |

| INCOME (LOSS) PER COMMON SHARE: | | | | | | | |

| Basic | $ | 0.18 | | | $ | (1.55) | | | | | |

| Diluted | 0.18 | | | (1.55) | | | | | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | | | | | | | |

| Basic | 91.2 | | | 90.1 | | | | | |

| Diluted | 97.1 | | | 90.1 | | | | | |

See condensed notes to consolidated financial statements

| | | | | | | | | | | | | | | | | |

CENTURY ALUMINUM COMPANY |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) |

(in millions) |

(Unaudited) |

| Three months ended March 31, | | |

| 2022 | | 2021 | | | | |

| Comprehensive income (loss): | | | | | | | |

| Net income (loss) | $ | 17.7 | | | $ | (140.0) | | | | | |

| Other comprehensive income before income tax effect: | | | | | | | |

| Net income (loss) on foreign currency cash flow hedges reclassified as income | 0.0 | | | (0.0) | | | | |

| Defined benefit plans and other postretirement benefits: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Amortization of prior service benefit (cost) during the period | (0.4) | | | (0.8) | | | | | |

| Amortization of net gain (loss) during the period | 1.1 | | | 2.1 | | | | | |

| Other comprehensive income (loss) before income tax effect | 0.7 | | | 1.3 | | | | | |

| Income tax effect | (0.1) | | | (0.0) | | | | |

| Other comprehensive income (loss) | 0.6 | | | 1.3 | | | | | |

| Total comprehensive income (loss) | $ | 18.3 | | | $ | (138.7) | | | | | |

| | | | | | | |

See condensed notes to consolidated financial statements

| | | | | | | | | | | |

| CENTURY ALUMINUM COMPANY |

| CONSOLIDATED BALANCE SHEETS |

| (in millions) |

| (Unaudited) |

| March 31, 2022 | | December 31, 2021 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 26.6 | | | $ | 29.0 | |

| Restricted cash | 21.6 | | | 11.7 | |

| Accounts receivable - net | 127.7 | | | 80.6 | |

| Due from affiliates | 18.6 | | | 8.3 | |

| Inventories | 426.5 | | | 425.6 | |

| Derivative assets | 73.3 | | | 34.8 | |

| Prepaid and other current assets | 34.2 | | | 28.2 | |

| Total current assets | 728.5 | | | 618.2 | |

| Property, plant and equipment - net | 893.3 | | | 892.5 | |

| Other assets | 66.9 | | | 59.2 | |

| | | |

| TOTAL | $ | 1,688.7 | | | $ | 1,569.9 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| LIABILITIES: | | | |

| Accounts payable, trade | $ | 202.8 | | | $ | 186.5 | |

| Interest payable | 9.4 | | | — | |

| Due to affiliates | 88.3 | | | 65.8 | |

| Accrued and other current liabilities | 63.0 | | | 62.7 | |

| Derivative liabilities | 122.2 | | | 102.1 | |

| Accrued employee benefits costs | 10.2 | | | 8.9 | |

| U.S. revolving credit facility | 35.3 | | | 63.6 | |

| Iceland revolving credit facility | 35.0 | | | 50.0 | |

| Industrial revenue bonds | 7.8 | | | 7.8 | |

| Total current liabilities | 574.0 | | | 547.4 | |

| Senior notes payable | 246.0 | | | 245.8 | |

| Convertible senior notes payable | 84.1 | | | 84.0 | |

| Grundartangi casthouse debt facility | 39.4 | | | — | |

| Accrued pension benefits costs - less current portion | 26.0 | | | 28.6 | |

| Accrued postretirement benefits costs - less current portion | 92.6 | | | 93.3 | |

| Other liabilities | 51.0 | | | 46.3 | |

| Leases - right of use liabilities | 22.4 | | | 22.9 | |

| Due to affiliates - less current portion | 52.9 | | | 21.9 | |

| Deferred taxes | 60.5 | | | 58.7 | |

| Total noncurrent liabilities | 674.9 | | | 601.5 | |

| COMMITMENTS AND CONTINGENCIES (NOTE 10) | — | | | — | |

| SHAREHOLDERS’ EQUITY: | | | |

| 0.0 | | | 0.0 | |

| 1.0 | | | 1.0 | |

| Additional paid-in capital | 2,536.0 | | | 2,535.5 | |

| Treasury stock, at cost | (86.3) | | | (86.3) | |

| Accumulated other comprehensive loss | (81.7) | | | (82.3) | |

| Accumulated deficit | (1,929.2) | | | (1,946.9) | |

| Total shareholders’ equity | 439.8 | | | 421.0 | |

| TOTAL | $ | 1,688.7 | | | $ | 1,569.9 | |

See condensed notes to consolidated financial statements

| | | | | | | | | | | |

| CENTURY ALUMINUM COMPANY |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (in millions) |

| (Unaudited) |

| Three Months Ended March 31, |

| 2022 | | 2021 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | |

|

| Net income (loss) | $ | 17.7 | | | $ | (140.0) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Unrealized (gain) loss on derivative instruments | 35.5 | | | 94.4 | |

| Depreciation and amortization | 19.4 | | | 20.9 | |

| | | |

| Deferred tax provision (benefit) | 1.3 | | | (3.1) | |

| Other non-cash items - net | (1.7) | | | 6.3 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable - net | (47.1) | | | (6.4) | |

| Due from affiliates | (10.3) | | | (12.2) | |

| Inventories | (0.9) | | | (11.8) | |

| Prepaid and other current assets | (4.2) | | | (3.1) | |

| Accounts payable, trade | 31.6 | | (4.9) | |

| Due to affiliates | (1.2) | | | 7.0 | |

| Accrued and other current liabilities | 1.6 | | | 3.8 | |

| | | |

| Other - net | (4.3) | | | (0.7) | |

| Net cash provided by (used in) operating activities | 37.4 | | | (49.8) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchase of property, plant and equipment | (26.0) | | | (7.4) | |

| Proceeds from sales of property, plant & equipment | 0.0 | | — | |

| Net cash used in investing activities | (26.0) | | | (7.4) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| Repayments on Hawesville term loan | — | | | (5.0) | |

| Borrowings under revolving credit facilities | 264.1 | | | 197.6 | |

| Repayments under revolving credit facilities | (307.4) | | | (192.2) | |

| Debt issuance costs | (0.6) | | | — | |

| | | |

| | | |

| Borrowings under Grundartangi casthouse debt facility | 40.0 | | | — | |

| Net cash provided by (used in) financing activities | (3.9) | | | 0.4 | |

| CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | 7.5 | | | (56.8) | |

| Cash, cash equivalents and restricted cash, beginning of period | 40.7 | | | 84.3 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 48.2 | | | $ | 27.5 | |

| | | |

| Supplemental Cash Flow Information: | | | |

| Cash paid for: | | | |

| Interest | $ | 1.2 | | | $ | 16.1 | |

| Taxes | 0.5 | | | — | |

| Non-cash investing activities: | | | |

| Capital expenditures | 4.2 | | | 1.8 | |

| Capitalized interest | 1.0 | | | — | |

See condensed notes to consolidated financial statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CENTURY ALUMINUM COMPANY |

| CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY |

| (in millions) |

| (Unaudited) |

| | Preferred stock | | Common stock | | Additional paid-in capital | | Treasury stock, at cost | | Accumulated other comprehensive loss | | Accumulated

deficit | | Total shareholders’ equity |

| Three Months Ended March 31, 2022 | | | | | | | | | | | | | | |

| Balance, December 31, 2021 | | $ | 0.0 | | | $ | 1.0 | | | $ | 2,535.5 | | | $ | (86.3) | | | $ | (82.3) | | | $ | (1,946.9) | | | $ | 421.0 | |

| Net income (loss) | | — | | | — | | | — | | | — | | | — | | | 17.7 | | | 17.7 | |

| Other comprehensive income (loss) | | — | | | — | | | — | | | — | | | 0.6 | | | — | | | 0.6 | |

| Share-based compensation | | — | | | — | | | 0.5 | | | — | | | — | | | — | | | 0.5 | |

| | | | | | | | | | | | | | |

| Balance, March 31, 2022 | | $ | 0.0 | | | $ | 1.0 | | | $ | 2,536.0 | | | $ | (86.3) | | | $ | (81.7) | | | $ | (1,929.2) | | | $ | 439.8 | |

| | | | | | | | | | | | | | |

Three Months Ended

March 31, 2021 | | | | | | | | | | | | | | |

| Balance, December 31, 2020 | | $ | 0.0 | | | $ | 1.0 | | | $ | 2,530.0 | | | $ | (86.3) | | | $ | (118.8) | | | $ | (1,779.8) | | | $ | 546.1 | |

| Net income (loss) | | — | | | — | | | — | | | — | | | — | | | (140.0) | | | (140.0) | |

| Other comprehensive income (loss) | | — | | | — | | | — | | | — | | | 1.3 | | | — | | | 1.3 | |

| Share-based compensation | | 0.0 | | | 0.0 | | | 0.9 | | | — | | | — | | | — | | | 0.9 | |

| Conversion of preferred stock to common stock | | 0.0 | | | 0.0 | | | 0.0 | | | — | | | — | | | — | | | 0.0 |

| Balance, March 31, 2021 | | $ | 0.0 | | | $ | 1.0 | | | $ | 2,530.9 | | | $ | (86.3) | | | $ | (117.5) | | | $ | (1,919.8) | | | $ | 408.3 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements

Three months ended March 31, 2022 and 2021

(amounts in millions, except share and per share amounts)

(Unaudited)

1.General

The accompanying unaudited interim consolidated financial statements of Century Aluminum Company should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2021. In management’s opinion, the unaudited interim consolidated financial statements reflect all adjustments, which are of a normal and recurring nature, that are necessary for a fair presentation of financial results for the interim periods presented. Operating results for the first three months of 2022 are not necessarily indicative of the results that may be expected for the year ending December 31, 2022. Throughout this Form 10-Q, and unless expressly stated otherwise or as the context otherwise requires, "Century Aluminum," "Century," the "Company," "we," "us," "our" and "ours" refer to Century Aluminum Company and its consolidated subsidiaries.

2.Related Party Transactions

The significant related party transactions occurring during the three months ended March 31, 2022 and 2021 are described below. We believe all of our transactions with related parties are at prices that approximate market.

Glencore Ownership

As of March 31, 2022, Glencore plc and its affiliates (together "Glencore") beneficially owned 42.9% of Century’s outstanding common stock (46.4% on a fully-diluted basis assuming the conversion of all of the Series A Convertible Preferred Stock) and all of our outstanding Series A Convertible Preferred Stock. See Note 6. Shareholders' Equity for a description of our outstanding Series A Convertible Preferred Stock. Century and Glencore enter into various transactions from time to time such as the purchase and sale of primary aluminum, purchase and sale of alumina and other raw materials, tolling agreements as well as forward financial contracts and borrowing and other debt transactions. Sales to Glencore

For the three months ended March 31, 2022 and 2021, we derived approximately 57% and 60%, respectively, of our consolidated net sales from Glencore.

Glencore purchases aluminum produced at our U.S. smelters at prices based on the London Metal Exchange (the "LME") plus the Midwest regional delivery premium plus any additional market-based product premiums. Glencore purchases aluminum produced at our Grundartangi, Iceland smelter at prices primarily based on the LME plus the European Duty Paid premium plus any additional market-based product premiums.

We have entered into agreements with Glencore pursuant to which we sell certain amounts of alumina at market-based prices. For the three months ended March 31, 2022 and 2021, we recorded no revenue related to alumina sales to Glencore.

Purchases from Glencore

We purchase a portion of our alumina and certain other raw material requirements from Glencore. Alumina purchases from Glencore during the three months ended March 31, 2022 were priced based on published alumina and aluminum indices as well as fixed prices.

Financial Contracts with Glencore

We have certain financial contracts with Glencore. See Note 13. Derivatives regarding these forward financial sales contracts. Summary

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

A summary of the aforementioned significant related party transactions is as follows:

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2022 | | | | |

| | 2022 | | 2021 | | | | | | | | |

| Net sales to Glencore | $ | 433.1 | | | $ | 268.3 | | | | | | | | | |

Purchases from Glencore(1) | 54.5 | | | 72.3 | | | | | | | | | |

(1) Includes settlements of financial contract positions.

3.Revenue

We disaggregate our revenue by geographical region as follows:

| | | | | | | | | | | | | | | | | | |

| Net Sales | | Three Months Ended March 31, | | |

| | 2022 | | 2021 | | | | |

| United States | | $ | 506.1 | | | $ | 276.2 | | | | | |

| Iceland | | 247.5 | | | 167.8 | | | | | |

| Total | | $ | 753.6 | | | $ | 444.0 | | | | | |

4.Fair Value Measurements

We measure certain of our assets and liabilities at fair value. Fair value represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

In general, reporting entities should apply valuation techniques to measure fair value that maximize the use of observable inputs and minimize the use of unobservable inputs. Observable inputs are developed using market data and reflect assumptions that market participants would use when pricing the asset or liability. Unobservable inputs are developed using the best information available about the assumptions that market participants would use when pricing the asset or liability.

The fair value hierarchy provides transparency regarding the inputs we use to measure fair value. We categorize each fair value measurement in its entirety into the following three levels, based on the lowest level input that is significant to the entire measurement:

•Level 1 Inputs - quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity can access at the measurement date.

•Level 2 Inputs - inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

•Level 3 Inputs - significant unobservable inputs for the asset or liability.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Recurring Fair Value Measurements | | As of March 31, 2022 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| ASSETS: | | | | | | | | |

| Cash equivalents | | $ | 10.9 | | | $ | — | | | $ | — | | | $ | 10.9 | |

Trust assets (1) | | 1.5 | | | — | | | — | | | 1.5 | |

| | | | | | | | |

| Derivative instruments | | — | | | 84.7 | | | — | | | 84.7 | |

| TOTAL | | $ | 12.4 | | | $ | 84.7 | | | $ | — | | | $ | 97.1 | |

| | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Contingent obligation – net | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Derivative instruments | | — | | | 206.8 | | | 16.7 | | | 223.5 | |

| TOTAL | | $ | — | | | $ | 206.8 | | | $ | 16.7 | | | $ | 223.5 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Recurring Fair Value Measurements | | As of December 31, 2021 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| ASSETS: | | | | | | | | |

| Cash equivalents | | $ | 14.2 | | | $ | — | | | $ | — | | | $ | 14.2 | |

Trust assets (1) | | 0.1 | | — | | | — | | | 0.1 |

| Derivative instruments | | — | | | 42.6 | | | 0.2 | | | 42.8 | |

| TOTAL | | $ | 14.3 | | | $ | 42.6 | | | $ | 0.2 | | | $ | 57.1 | |

| | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Contingent obligation – net | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Derivative instruments | | — | | | 140.9 | | | 5.3 | | 146.2 | |

| TOTAL | | $ | — | | | $ | 140.9 | | | 5.3 | | $ | 146.2 | |

| | | | | | | | |

(1) Trust assets are currently invested in money market funds. These trust assets are held to fund the non-qualified supplemental executive pension benefit obligations for certain of our officers.

The following section describes the valuation techniques and inputs for fair value measurements categorized within Level 2 or Level 3 of the fair value hierarchy:

| | | | | | | | | | | | | | |

| Level 2 Fair Value Measurements: |

| Asset / Liability | | Valuation Techniques | | Inputs |

| LME forward financial sales contracts | | Discounted cash flows | | Quoted LME forward market |

| Midwest Premium ("MWP") forward financial sales contracts | | Discounted cash flows | | Quoted MWP forward market |

| Fixed for floating swaps | | Discounted cash flows | | Quoted LME forward market, quoted MWP forward market |

| Nord Pool power price swaps | | Discounted cash flows | | Quoted Nord Pool forward market |

| Indiana Hub power price swaps | | Discounted cash flows | | Quoted Indiana Hub forward market |

| FX swaps | | Discounted cash flows | | Euro/USD forward exchange rate |

When valuing Level 3 assets and liabilities, we use certain significant unobservable inputs. Management incorporates various inputs and assumptions including forward commodity prices, commodity price volatility and macroeconomic

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

conditions, including interest rates and discount rates. Our estimates of significant unobservable inputs are ultimately based on our estimates of risks that market participants would consider when valuing our assets and liabilities.

The following table presents the inputs for fair value measurements categorized within Level 3 of the fair value hierarchy, along with information regarding significant unobservable inputs used to value Level 3 assets and liabilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Level 3 Fair Value Measurements: | | As of March 31, 2022 | | As of December 31, 2021 |

| Asset / Liability | | Valuation Technique | | Observable Inputs | | Significant Unobservable Input | | Fair Value | | Value/Range of Unobservable Input | | Fair Value | | Value/Range of Unobservable Input |

| LME forward financial sales contracts | | Discounted cash flows | | Quoted LME forward market | | Discount rate net (1) | | $ | (16.7) | | | 8.58% | | $ | (5.1) | | | 8.58% |

| FX Swaps | | Discounted cash flows | | Euro/USD forward exchange rate | | Discount rate net (1) | | $ | — | | | 8.58% | | $ | (0.2) | | | 8.58% |

| Nord Pool Swaps | | Discounted cash flows | | Quoted Nord Pool forward market | | Discount rate net (1) | | $ | — | | | 8.58% | | $ | 0.2 | | | 8.58% |

| Contingent Obligation | | Discounted cash flows | | Quoted LME forward market | | Expected monthly Hawesville production level (2) | | $ | — | | | 14,000 - 16,000 MT/month | | $ | — | | | 14,000 - 15,000 MT/month |

(1) Represents risk adjusted discount rate.

(2) Represents management's estimate of expected monthly Hawesville production levels through the term of the agreement in December 2028.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

The following table presents the fair value reconciliation of Level 3 assets and liabilities measured at fair value on a recurring basis.

| | | | | | | | | | | | | | | | | | | | | | | | |

For the three months ended March 31, 2022 | | Level 3 Assets | | Level 3 Liabilities | | | |

| | Nord Pool | | LME forward financial sales contracts | | FX Swaps | | | |

Balance as of December 31, 2021 | | | $ | 0.2 | | | $ | (5.1) | | | $ | (0.2) | | | | |

| Total realized/unrealized gains (losses) | | | | | | | | | | |

Included in Net Income (1) | | | — | | | (9.1) | | | — | | | | |

| Purchases, sales, settlements | | | | | | | | | | |

| Purchases | | | — | | | — | | | — | | | | |

| Sales | | | — | | | — | | | — | | | | |

| Settlements | | | — | | | — | | | — | | | | |

Transfers into Level 3 (2) | | | — | | | (2.5) | | | — | | | | |

Transfers out of Level 3 (3) | | | (0.2) | | | (0.0) | | 0.2 | | | | |

Balance as of March 31, 2022 | | | $ | — | | | $ | (16.7) | | | $ | — | | | | |

| | | | | | | | | | |

Change in unrealized gains (losses) (1) | | | $ | — | | | $ | (9.1) | | | $ | — | | | | |

(1) Gains and losses are presented in the Consolidated Statement of Operations within the line item "Net gain (loss) on forward and derivative contracts."

(2) Transfers into Level 3 due to contracts with applied discount rate entered into during the first quarter of 2022.

(3) Transfers out of Level 3 due to period of time remaining in derivative contract. | | | | | | | | | | | | | | |

| | Level 3 Liabilities |

For the three months ended March 31, 2021 | | LME forward financial sales contracts | | FX Swaps |

Balance as of January 1, 2021 | | $ | 2.9 | | | $ | 0.1 | |

| Total realized/unrealized gains (losses) | | | | |

Included in net income (loss) (1) | | (8.7) | | | — | |

| Purchases, sales, settlements | | | | |

| Purchases | | — | | | — | |

| Sales | | — | | | — | |

| Settlements | | — | | | — | |

Transfers into Level 3 (2) | | (0.7) | | | (0.2) | |

Transfers out of Level 3(3) | | 0.5 | | | (0.1) | |

Balance as of March 31, 2021 | | (6.0) | | | $ | (0.2) | |

| | | | |

Change in unrealized gains (losses) (1) | | $ | (8.7) | | | $ | — | |

(1) Gains and losses are presented in the Consolidated Statement of Operations within the line item "Net gain (loss) on forward and derivative contracts."

(2) Transfers into Level 3 due to contracts with applied discount rate entered into during the first quarter of 2021.

(3) Transfers out of Level 3 due to period of time remaining in derivative contract.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

5. Earnings (Loss) Per Share

Basic earnings (loss) per share ("EPS") amounts are calculated by dividing net income (loss) allocated to common stockholders by the weighted average number of common shares outstanding during the period. Diluted EPS amounts assume the issuance of common stock for all potentially dilutive securities.

The following table shows the basic and diluted earnings (loss) per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended March 31, |

| 2022 | | 2021 |

| Net Income (Loss) | | Shares (in millions) | | Per Share | | Net Income (Loss) | | Shares (in millions) | | Per Share |

| Net income (loss) | $ | 17.7 | | | | | | | $(140.0) | | | | |

| Less: net income allocated to participating securities | 1.1 | | | | | | | — | | | | | |

| Basic EPS: | | | | | | | | | | | |

| Net income (loss) allocated to common stockholders | $ | 16.6 | | | 91.2 | | | $ | 0.18 | | | $ | (140.0) | | | 90.1 | | | $ | (1.55) | |

Effect of Dilutive Securities(1): | | | | | | | | | | | |

| Share-based compensation | — | | | 1.1 | | | | | — | | | — | | | |

| Convertible senior notes | 0.7 | | | 4.8 | | | | | — | | | — | | | |

| Diluted EPS: | | | | | | | | | | | |

| Net income (loss) allocated to common stockholders with assumed conversion | $ | 17.3 | | | 97.1 | | | $ | 0.18 | | | $ | (140.0) | | | 90.1 | | | $ | (1.55) | |

| | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | | | |

Securities excluded from the calculation of diluted EPS (in millions)(1): | 2022 | | 2021 | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Share-based compensation | 0.7 | | | 2.2 | | | | | | | | | |

| Convertible preferred shares | 5.9 | | | 6.4 | | | | | | | | | |

(1) In periods when we report a net loss, all share-based compensation awards, convertible preferred shares and convertible senior notes are excluded from the calculation of diluted weighted average shares outstanding because of their anti-dilutive effect on earnings (loss) per share.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

6.Shareholders’ Equity

Common Stock

As of March 31, 2022 and December 31, 2021, we had 195,000,000 shares of common stock, $0.01 par value per share, authorized under our Restated Certificate of Incorporation, of which 98,418,132 shares were issued and 91,231,611 shares were outstanding at March 31, 2022 and December 31, 2021.

The rights, preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of our preferred stock which are currently outstanding, including our Series A Convertible Preferred Stock, or which we may designate and issue in the future.

Preferred Stock

As of March 31, 2022 and December 31, 2021, we had 5,000,000 shares of preferred stock, $0.01 par value per share, authorized under our Restated Certificate of Incorporation. Our Board of Directors may issue preferred stock in one or more series and determine for each series the dividend rights, conversion rights, voting rights, redemption rights, liquidating preferences, sinking fund terms and the number of shares constituting that series, as well as the designation thereof. Depending upon the terms of preferred stock established by our Board of Directors, any or all of the preferred stock could have preference over the common stock with respect to dividends and other distributions and upon the liquidation of Century. In addition, issuance of any shares of preferred stock with voting powers may dilute the voting power of the outstanding common stock.

Series A Convertible Preferred Stock

Shares Authorized and Outstanding. In 2008, we issued 160,000 shares of our Series A Convertible Preferred Stock. Glencore holds all of the issued and outstanding Series A Convertible Preferred Stock. At March 31, 2022 and December 31, 2021, there were 58,542 shares of Series A Convertible Preferred Stock outstanding.

The issuance of common stock under our stock incentive programs, debt exchange transactions and any stock offering that excludes Glencore participation triggers anti-dilution provisions of the preferred stock agreement and results in the automatic conversion of Series A Convertible Preferred Stock shares into shares of common stock. The conversion ratio of preferred to common shares is 100 shares of common stock for each share of preferred stock.

The Common and Preferred Stock table below contains additional information about preferred stock conversions during the three months ended March 31, 2022 and March 31, 2021.

| | | | | | | | | | | | | | | | | |

| Preferred stock | | Common stock |

| Common and Preferred Stock Activity (in shares): | Series A Convertible | | Treasury | | Outstanding |

Beginning balance as of December 31, 2021 | 58,542 | | | 7,186,521 | | | 91,231,611 | |

| Conversion of convertible preferred stock | — | | | — | | | — | |

| Issuance for share-based compensation plans | — | | | — | | | — | |

Ending balance as of March 31, 2022 | 58,542 | | | 7,186,521 | | | 91,231,611 | |

| | | | | |

Beginning balance as of December 31, 2020 | 63,589 | | | 7,186,521 | | | 90,055,797 | |

| | | | | |

| Conversion of convertible preferred stock | (137) | | | — | | | 13,697 | |

| Issuance for share-based compensation plans | — | | | — | | | 18,220 | |

Ending balance as of March 31, 2021 | 63,452 | | | 7,186,521 | | | 90,087,714 | |

Stock Repurchase Program

In 2011, our Board of Directors authorized a $60.0 million common stock repurchase program and during the first quarter of 2015, our Board of Directors increased the size of the program by $70.0 million. Under the program, Century is authorized to repurchase up to $130.0 million of our outstanding shares of common stock, from time to time, on the open market at prevailing market prices, in block trades or otherwise. The timing and amount of any shares repurchased will be determined by

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

our management based on its evaluation of market conditions, the trading price of our common stock and other factors. The stock repurchase program may be suspended or discontinued at any time.

Shares of common stock repurchased are recorded at cost as treasury stock and result in a reduction of shareholders’ equity in the consolidated balance sheets. From time to time, treasury shares may be reissued as contributions to our employee benefit plans and for the conversion of convertible preferred stock. When shares are reissued, we use an average cost method for determining cost. The difference between the cost of the shares and the reissuance price is added to or deducted from additional paid-in capital.

We have repurchased 7,186,521 shares of common stock under the program for an aggregate purchase price of $86.3 million. We have made no repurchases since April 2015 and we have $43.7 million remaining under the repurchase program authorization as of March 31, 2022.

7. Income Taxes

We recorded an income tax expense of $1.7 million and an income tax benefit of $2.3 million for the three months ended March 31, 2022 and 2021, respectively. The change is primarily due to improved operational results from both U.S. and foreign operations during the current quarter.

Our income tax benefit or expense is based on an annual effective tax rate forecast, including estimates and assumptions that could change during the year. The application of the accounting requirements for income taxes in interim periods, after consideration of our valuation allowance, causes a significant variation in the typical relationship between income tax expense/benefit and pre-tax accounting income/loss.

As of March 31, 2022, all of Century's U.S. and certain foreign deferred tax assets, net of deferred tax liabilities, continue to be subject to a valuation allowance.

8. Inventories

Inventories consist of the following:

| | | | | | | | | | | |

| March 31, 2022 | | December 31, 2021 |

| Raw materials | $ | 127.1 | | | $ | 132.9 | |

| Work-in-process | 69.6 | | | 76.1 | |

| Finished goods | 43.9 | | | 43.9 | |

| Operating and other supplies | 185.9 | | | 172.7 | |

| Total inventories | $ | 426.5 | | | $ | 425.6 | |

Inventories are stated at the lower of cost or Net Realizable Value ("NRV") using the first-in, first-out or the weighted average cost method.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

9.Debt

| | | | | | | | | | | |

| March 31, 2022 | | December 31, 2021 |

| Debt classified as current liabilities: | | | |

Hancock County industrial revenue bonds ("IRBs") due April 1, 2028, interest payable quarterly (variable interest rates (not to exceed 4%)) (1) | $ | 7.8 | | | $ | 7.8 | |

U.S. Revolving Credit Facility(2) | 35.3 | | | 63.6 | |

Iceland Revolving Credit Facility (3) | 35.0 | | | 50.0 | |

| Debt classified as non-current liabilities: | | | |

Grundartangi casthouse facility, net of financing fees of $0.6 million at March 31, 2022(4) | 39.4 | | | — | |

7.5% senior secured notes due April 1, 2028, net of financing fees of $4.0 million at March 31, 2022, interest payable semiannually | 246.0 | | | 245.8 | |

2.75% convertible senior notes due May 1, 2028, net of financing fees of $2.2 million at March 31, 2022, interest payable semiannually | 84.1 | | | 84.0 | |

| | | |

| Total | $ | 447.6 | | | $ | 451.2 | |

(1) The IRBs are classified as current liabilities because they are remarketed weekly and could be required to be repaid upon demand if there is a failed remarketing. The IRBs interest rate at March 31, 2022 was 0.64%.

(2) We have elected to incur interest at a base rate plus applicable margin as defined within the agreement. The interest rate at March 31, 2022 was 4.25%.

(3) We have elected to incur interest at LIBOR plus applicable margin as defined within the agreement. The interest rate at March 31, 2022 was 3.51%.

(4) We incur interest at a base rate plus applicable margin as defined within the agreement. The interest rate at March 31, 2022 was 3.64%.

7.5% Senior Secured Notes due 2028

In April 2021, we issued $250.0 million in aggregate principal amount of 7.5% senior secured notes due April 1, 2028 (the "2028 Notes"). We received proceeds of $245.2 million, after payment of certain financing fees and related expenses. The 2028 Notes bear interest semi-annually in arrears on April 1 and October 1 of each year, which began on October 1, 2021, at a rate of 7.5% per annum in cash. The 2028 Notes are senior secured obligations of Century, ranking equally in right of payment with all existing and future senior indebtedness of Century, but effectively senior to unsecured debt to the extent of the value of collateral.

As of March 31, 2022, the total estimated fair value of the 2028 Notes was $262.6 million. Although we use quoted market prices for identical debt instruments, the markets on which they trade are not considered to be active and are therefore considered Level 2 fair value measurements.

Convertible Notes due 2028

In April 2021, we completed a private offering of $86.3 million aggregate principal amount of convertible senior notes due May 1, 2028 unless earlier converted, repurchased, or redeemed (the "Convertible Notes"). The Convertible Notes were issued at a price of 100% of their aggregate principal amount. We received proceeds of $83.7 million, after payment of certain financing fees and related expenses. The Convertible Notes bear interest semi-annually in arrears on May 1 and November 1 of each year, which began on November 1, 2021, at a rate of 2.75% per annum in cash.

The initial conversion rate for the Convertible Notes is 53.3547 shares of the Company's common stock per $1,000 principal amount of Convertible Notes, which is equivalent to an initial conversion price of approximately $18.74 per share of the Company's common stock. The conversion rate and conversion price are subject to customary adjustments under certain circumstances in accordance with the terms of the indenture. As of March 31, 2022, the conversion rate remains unchanged.

The Convertible Notes are the Company’s senior unsecured obligations and rank senior in right of payment to any of the Company’s indebtedness that is expressly subordinated in right of payment to the Convertible Notes; equal in right of payment to any of the Company’s unsecured indebtedness that is not so subordinated; effectively junior in right of payment to any of the

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

Company’s senior secured indebtedness to the extent of the value of the assets securing such indebtedness; and structurally junior to all indebtedness and other liabilities (including trade payables) of the Company’s subsidiaries.

As of March 31, 2022, the if-converted value of the Convertible Notes exceeded the outstanding principal amount by $34.8 million.

As of March 31, 2022, the total estimated fair value of the Convertible Notes was $137.8 million. Although we use quoted market prices for identical debt instruments, the markets on which they trade are not considered to be active and are therefore considered Level 2 fair value measurements.

U.S. Revolving Credit Facility

We and certain of our direct and indirect domestic subsidiaries (the "Borrowers") have a senior secured revolving credit facility with a syndicate of lenders (as amended from time to time, the "U.S. revolving credit facility"). The U.S. revolving credit facility provides for borrowings of up to $220.0 million in the aggregate, including up to $110.0 million under a letter of credit sub-facility. The U.S. revolving credit facility matures on May 16, 2023.

Any letters of credit issued and outstanding under the U.S. revolving credit facility reduce our borrowing availability on a dollar-for-dollar basis. At March 31, 2022, there were $35.3 million in outstanding borrowings and $102.1 million of outstanding letters of credit issued under our U.S. revolving credit facility. Principal payments, if any, are due upon maturity of the U.S. revolving credit facility and may be prepaid without penalty.

| | | | | |

| Status of our U.S. revolving credit facility: | March 31, 2022 |

| Credit facility maximum amount | $ | 220.0 | |

| Borrowing availability | 220.0 | |

| Outstanding letters of credit issued | 102.1 | |

| Outstanding borrowings | 35.3 | |

| Borrowing availability, net of outstanding letters of credit and borrowings | 82.7 | |

Iceland Revolving Credit Facility

Our wholly-owned subsidiary, Nordural Grundartangi ehf ("Grundartangi"), has entered into a $80.0 million revolving credit facility agreement with Landsbankinn hf., dated November 2013, as amended (the "Iceland revolving credit facility"). Under the terms of the Iceland revolving credit facility, when Grundartangi borrows funds it will designate a repayment date, which may be any date prior to the maturity of the Iceland revolving credit facility. At March 31, 2022, there were $35.0 million in outstanding borrowings under our Iceland revolving credit facility. The Iceland revolving credit facility has a term through November 2024.

| | | | | |

| Status of our Iceland revolving credit facility: | March 31, 2022 |

| Credit facility maximum amount | $ | 80.0 | |

| Borrowing availability | 80.0 | |

| Outstanding letters of credit issued | — | |

| Outstanding borrowings | 35.0 | |

| Borrowing availability, net of borrowings | 45.0 | |

Grundartangi Casthouse Facility

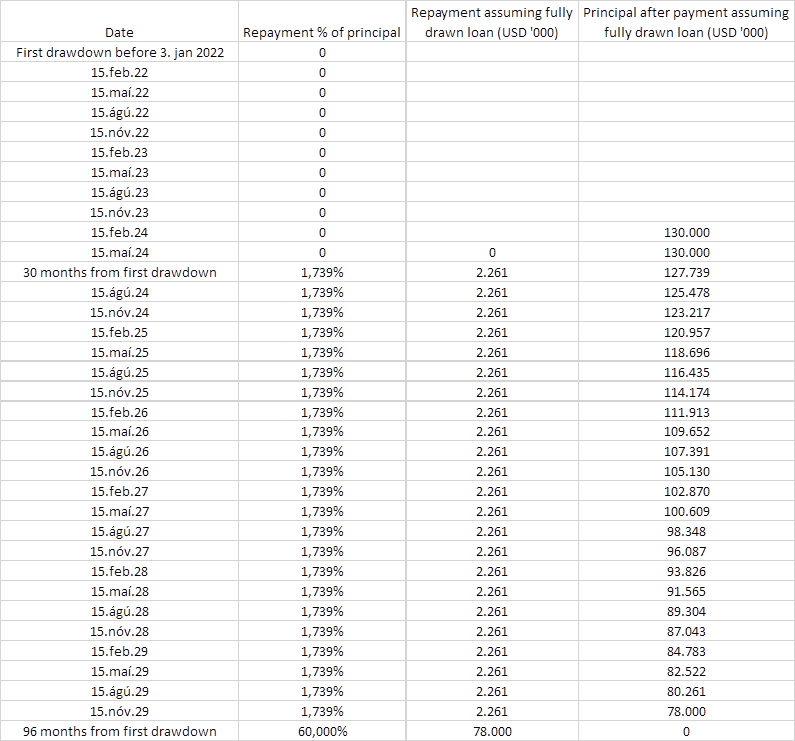

Our wholly-owned subsidiary, Grundartangi, has entered into an eight-year Term Facility Agreement with Arion Bank hf, dated November 2021, as amended (the "Casthouse Facility") to provide for borrowings up to $130.0 million associated with construction of the new billet casthouse at Grundartangi (the"casthouse project"). Under the Casthouse Facility, repayments of principal amounts will be made in equal quarterly installments equal to 1.739% of the principal amount, the first payment occurring in July 2024, with the remaining 60% of the principal amount to be paid no later than the termination date in December 2029. As of March 31, 2022, there were $40.0 million in outstanding borrowings under this Casthouse Facility.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

10.Commitments and Contingencies

We have pending against us or may be subject to various lawsuits, claims and proceedings related primarily to employment, commercial, stockholder, environmental, safety and health matters and are involved in other matters that may give rise to contingent liabilities. While the results of such matters and claims cannot be predicted with certainty, we believe that the ultimate outcome of any such matters and claims will not have a material adverse impact on our financial condition, results of operations or liquidity. However, because of the nature and inherent uncertainties of litigation and estimating liabilities, should the resolution or outcome of these actions be unfavorable, our business, financial condition, results of operations and liquidity could be materially and adversely affected.

In evaluating whether to accrue for losses associated with legal or environmental contingencies, it is our policy to take into consideration factors such as the facts and circumstances asserted, our historical experience with contingencies of a similar nature, the likelihood of our prevailing and the severity of any potential loss. For some matters, no accrual is established because we have assessed our risk of loss to be remote. Where the risk of loss is probable and the amount of the loss can be reasonably estimated, we record an accrual, either on an individual basis or with respect to a group of matters involving similar claims, based on the factors set forth above. While we regularly review the status of, and our estimates of potential liability associated with, contingencies to determine the adequacy of any associated accruals and related disclosures, the ultimate amount of loss may differ from our estimates.

Legal Contingencies

Ravenswood Retiree Medical Benefits

In November 2009, Century Aluminum of West Virginia ("CAWV") filed a class action complaint for declaratory judgment against the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union ("USW"), the USW’s local and certain CAWV retirees, individually and as class representatives ("CAWV Retirees"), seeking a declaration of CAWV’s rights to modify/terminate retiree medical benefits. Later in November 2009, the USW and representatives of a retiree class filed a separate suit against CAWV, Century Aluminum Company, Century Aluminum Master Welfare Benefit Plan, and various John Does with respect to the foregoing. On August 18, 2017, the District Court for the Southern District of West Virginia approved a settlement agreement in respect of these actions, pursuant to which, CAWV agreed to make payments into a trust for the benefit of the CAWV Retirees in the aggregate amount of $23.0 million over the course of ten years. Upon approval of the settlement, we paid $5.0 million to the aforementioned trust in September 2017 and recognized a gain of $5.5 million to arrive at the then-net present value of $12.5 million. CAWV has agreed to pay the remaining amounts under the settlement agreement in annual increments of $2.0 million for nine years. As of March 31, 2022, $2.0 million was recorded in other current liabilities and $6.3 million was recorded in other liabilities.

PBGC Settlement

In 2013, we entered into a settlement agreement with the Pension Benefit Guarantee Corporation (the "PBGC") regarding an alleged "cessation of operations" at our Ravenswood facility (the "PBGC Settlement Agreement"). Pursuant to the terms of the PBGC Settlement Agreement, we agreed to make additional contributions (above any minimum required contributions) to our defined benefit pension plans totaling approximately $17.4 million. Under certain circumstances, in periods of lower primary aluminum prices relative to our cost of operations, we were able to defer one or more of these payments, provided that we provide the PBGC with acceptable security for such deferred payments. We did not make any contributions for the three month periods ended March 31, 2022, or 2021. We historically elected to defer certain payments under the PBGC Settlement Agreement and provided the PBGC with the appropriate security. In October 2021, we amended the PBGC Settlement Agreement such that we removed the deferral mechanism and agreed to contribute approximately $2.4 million per year to our defined benefit pension plans for a total of approximately $9.6 million, over the next four years beginning on November 30, 2022 and ending on November 30, 2025, subject to acceleration if certain terms and conditions are met in such amendment.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

Power Commitments and Contingencies

Hawesville

Hawesville has a power supply arrangement with Kenergy and EDF Trading North America, LLC (“EDF") which provides market-based power to the Hawesville smelter. Under this arrangement, the power companies purchase power on the open market and pass it through to Hawesville at Midcontinent Independent System Operator ("MISO") pricing plus transmission and other costs. The power supply arrangement with Kenergy has an effective term through December 2023. The arrangement with EDF to act as our market participant with MISO has an effective term through May 2023. Each of these agreements provide for automatic extension on a year-to-year basis unless a one year notice is given.

Sebree

Sebree has a power supply arrangement with Kenergy and EDF which provides market-based power to the Sebree smelter. Similar to the arrangement at Hawesville, the power companies purchase power on the open market and pass it through to Sebree at MISO pricing plus transmission and other costs. The power supply arrangement with Kenergy has an effective term through December 2023. The arrangement with EDF to act as our market participant with MISO has an effective term through May 2023. Each of these agreements provides for automatic extension on a year-to-year basis unless a one year notice is given.

Mt. Holly

Century Aluminum of South Carolina, Inc. has a power supply agreement with Santee Cooper that has an effective term from April 1, 2021 and runs through December 2023. Under this power supply agreement, 100% of Mt. Holly’s electrical power requirements are supplied from Santee Cooper’s generation at cost of service based rates. The contract is expected to provide sufficient energy to allow Mt. Holly to increase its production to 75% of full production capacity.

Grundartangi

Grundartangi has power purchase agreements for approximately 545 MW with HS Orka hf ("HS"), Landsvirkjun and Orkuveita Reykjavikur ("OR") to provide power to its Grundartangi smelter. These power purchase agreements expire on various dates from 2026 through 2036 (subject to extension). The power purchase agreements with HS and OR provide power at LME-based variable rates for the duration of these agreements. In July 2021, Grundartangi reached an agreement with Landsvirkjun for an extension of its existing 161 MW power contract that would have expired in December 2023. Under the terms of the extension, Landsvirkjun will continue to supply power to Grundartangi from January 1, 2024 through December 31, 2026 and will increase the existing contract from 161 MW to 182 MW over time to provide the necessary flexibility to support the most recent capacity creep requirements and future growth opportunities for value-added products at the Grundartangi plant, including the Grundartangi casthouse project. Under the terms of this extension, the majority of power supplied by Landsvirkjun will be priced at rates linked to the Nord Pool power market through December 2023 and a small portion of power at a fixed price. Thereafter, beginning January 1, 2024 through December 31, 2026 this agreement provides for only fixed rates. Grundartangi also has a 25 MW power purchase agreement with Landsvirkjun at LME-based variable rates.

Other Commitments and Contingencies

Labor Commitments

The bargaining unit employees at our Grundartangi, Vlissingen, Hawesville and Sebree facilities are represented by labor unions, representing approximately 63% of our total workforce.

Approximately 86% of Grundartangi’s work force is represented by five labor unions, governed by a labor agreement that establishes wages and work rules for covered employees. This agreement is effective through December 31, 2024.

100% of Vlissingen's work force is represented by the Federation for the Metal and Electrical Industry ("FME"), a Netherlands' employers' organization for companies in the metal, electronics, electrical engineering and plastic sectors. The FME negotiates working conditions with trade unions on behalf of its members, which, when agreed upon, are then applicable to all employees of Vlissingen. The current labor agreement is effective through November 30, 2022.

Approximately 55% of our U.S. based work force is represented by USW. The labor agreement for Hawesville employees is effective through April 1, 2026. Century Sebree's labor agreement with the USW for its employees is effective through October 28, 2023. Mt. Holly employees are not represented by a labor union.

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

Contingent obligations

We have a contingent obligation in connection with the "unwind" of a contractual arrangement between Century Aluminum of Kentucky ("CAKY"), Big Rivers Electric Corporation and a third party and the execution in July 2009 of a long-term cost-based power contract with Kenergy, a member of a cooperative of Big Rivers. This contingent obligation consists of the aggregate payments made to Big Rivers by the third party on CAKY’s behalf in excess of the agreed upon base amount under the long-term cost-based power contract with Kenergy. As of March 31, 2022, the principal and accrued interest for the contingent obligation was $28.4 million, which was fully offset by a derivative asset. We may be required to make installment payments for the contingent obligation in the future. These payments are contingent based on the LME price of primary aluminum and the level of Hawesville’s operations. As of March 31, 2022, the LME forward market prices exceeded the threshold for payment, however, based on the current level of Hawesville's operations, we believe that we will not be required to make payments on the contingent obligation during the term of the agreement, which expires in 2028. There can be no assurance that circumstances will not change thus accelerating the timing of such payments.

11.Components of Accumulated Other Comprehensive Loss

| | | | | | | | | | | |

| Components of AOCL: | March 31, 2022 | | December 31, 2021 |

Defined benefit plan liabilities | $ | (86.0) | | | $ | (86.7) | |

| | | |

Unrealized gain (loss) on financial instruments | 1.9 | | | 1.9 | |

Other comprehensive loss before income tax effect | (84.1) | | | (84.8) | |

Income tax effect (1) | 2.4 | | | 2.5 | |

Accumulated other comprehensive loss | $ | (81.7) | | | $ | (82.3) | |

(1) The allocation of the income tax effect to the components of other comprehensive loss is as follows:

| | | | | | | | | | | |

| March 31, 2022 | | December 31, 2021 |

| Defined benefit plan liabilities | $ | 2.8 | | | $ | 2.9 | |

| | | |

| Unrealized loss on financial instruments | (0.4) | | | (0.4) | |

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

The following table summarizes the changes in the accumulated balances for each component of AOCL:

| | | | | | | | | | | | | | | | | |

| Defined benefit plan and other postretirement liabilities | | Unrealized gain (loss) on financial instruments | | Total, net of tax |

| Balance, January 1, 2022 | $ | (84.0) | | | $ | 1.7 | | | $ | (82.3) | |

| Net amount reclassified to net income (loss) | 0.6 | | | 0.0 | | | 0.6 | |

Balance, March 31, 2022 | $ | (83.4) | | | $ | 1.7 | | | $ | (81.7) | |

| | | | | |

| Balance, January 1, 2021 | $ | (120.6) | | | $ | 1.8 | | | $ | (118.8) | |

| Net amount reclassified to net income | 1.3 | | | 0.0 | | | 1.3 | |

Balance, March 31, 2021 | $ | (119.3) | | | $ | 1.8 | | | $ | (117.5) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Reclassifications out of AOCL were included in the consolidated statements of operations as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended March 31, | | | | |

| AOCL Components | | Location | | 2022 | | 2021 | | | | | | | | |

| Defined benefit plan and other postretirement liabilities | | Cost of goods sold | | $ | 0.4 | | | $ | 0.8 | | | | | | | | | |

| | Selling, general and administrative expenses | | 0.1 | | | 0.2 | | | | | | | | | |

| | Other operating expense, net | | 0.2 | | | 0.4 | | | | | | | | | |

| | Income tax effect | | (0.1) | | | (0.1) | | | | | | | | | |

| | Net of tax | | $ | 0.6 | | | $ | 1.3 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Unrealized loss on financial instruments | | Cost of goods sold | | $ | 0.0 | | | $ | 0.0 | | | | | | | | | |

| | Income tax effect | | 0.0 | | | 0.0 | | | | | | | | | |

| | Net of tax | | $ | 0.0 | | | $ | 0.0 | | | | | | | | | |

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

12. Components of Net Periodic Benefit Cost

| | | | | | | | | | | | | | | | | | | |

| Pension Benefits |

| Three months ended March 31, | | | | |

| 2022 | | 2021 | | | | | | | | |

| Service cost | $ | 1.1 | | | $ | 1.4 | | | | | | | | | |

| Interest cost | 2.5 | | | 2.4 | | | | | | | | | |

| Expected return on plan assets | (5.8) | | | (5.5) | | | | | | | | | |

| Amortization of prior service costs | 0.0 | | | 0.0 | | | | | | | | |

| Amortization of net loss | 0.7 | | | 1.5 | | | | | | | | | |

| Net periodic benefit cost | $ | (1.5) | | | $ | (0.2) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other Postretirement Benefits |

| Three months ended March 31, | | | | |

| 2022 | | 2021 | | | | | | | | |

| Service cost | $ | 0.1 | | | $ | 0.1 | | | | | | | | | |

| Interest cost | 0.7 | | | 0.6 | | | | | | | | | |

| Amortization of prior service cost | (0.5) | | | (0.8) | | | | | | | | | |

| Amortization of net loss | 0.5 | | | 0.6 | | | | | | | | | |

| Net periodic benefit cost | $ | 0.8 | | | $ | 0.5 | | | | | | | | | |

13. Derivatives

As of March 31, 2022, we had an open position of 118,341 tonnes related to LME forward financial sales contracts to fix the forward LME aluminum price. These contracts are expected to settle monthly through December 2024. We also had an open position of 152,250 tonnes related to MWP forward financial sales contracts to fix the forward MWP price. These contracts are expected to settle monthly through December 2022. We have also entered into financial contracts with various counterparties to offset fixed price sales arrangements with certain of our customers ("fixed for floating swaps") to remain exposed to the LME and MWP aluminum prices. As of March 31, 2022, we had 4,816 tonnes related to fixed for floating swaps that will settle monthly through November 2022.

We have entered into financial contracts to hedge a portion of Grundartangi's exposure to the Nord Pool power market (“Nord Pool power price swaps”). As of March 31, 2022, we had an open position of 1,755,100 MWh related to the Nord Pool power price swaps. The Nord Pool power price swaps are expected to settle monthly through December 2023. Because the Nord Pool power price swaps are settled in Euros, we have entered into financial contracts to hedge the risk of fluctuations associated with the Euro ("FX swaps"). As of March 31, 2022, we had an open position related to the FX swaps of €48.3 million that will settle monthly through December 2023.

We have entered into financial contracts to fix a portion of our exposure to the Indiana Hub power market at our Kentucky plants ("Indiana Hub power price swaps"). As of March 31, 2022, we had an open position of 307,200 MWh. The Indiana Hub power price swaps are expected to settle monthly through December 2023.

Our agreements with derivative counterparties contain certain provisions requiring collateral to be posted in the event the market value of our position exceeds the margin threshold limit of our master agreement with the counterparty. As of March 31, 2022, and December 31, 2021, the Company had recorded restricted cash of $18.5 million and $8.6 million, respectively, as collateral related to open derivative contracts under the master arrangements with our counterparties.

The following table sets forth the Company's derivative assets and liabilities that were accounted for at fair value and not designated as cash flow hedges as of March 31, 2022 and December 31, 2021, respectively:

CENTURY ALUMINUM COMPANY

Condensed Notes to the Consolidated Financial Statements (continued)

(amounts in millions, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | |

| | Asset Fair Value |

| March 31, 2022 | | December 31, 2021 |

Commodity contracts (1) | $ | 84.7 | | | $ | 42.9 | |

Foreign exchange contracts (2) | — | | | — | |

| Total | $ | 84.7 | | | $ | 42.9 | |

| | | |

| | | | | | | | | | | |

| | Liability Fair Value |

| March 31, 2022 | | December 31, 2021 |

Commodity contracts (1) | $ | 220.0 | | | $ | 143.3 | |

Foreign exchange contracts (2) | 3.5 | | | 2.9 | |

| Total | $ | 223.5 | | | $ | 146.2 | |

| | | |

(1) Commodity contracts reflect our outstanding LME forward financial sales contracts, MWP forward financial sales contracts, fixed for floating swaps, Nord Pool power price swaps, and Indiana Hub power price swaps. At March 31, 2022, $37.9 million of Due to affiliates and $52.9 million of Due to affiliates - less current portion was related to commodity contract liabilities with Glencore. At December 31, 2021, $17.1 million of Due to affiliates, and $21.9 million of Due to affiliates - less current portion was related to commodity contract assets and liabilities with Glencore.

(2) Foreign exchange contracts reflect our outstanding FX swaps.

The following table summarizes the net (loss) gain on forward and derivative contracts:

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| 2022 | | 2021 | | | | |

Commodity contracts(1) | $ | (56.0) | | | $ | (96.0) | | | | | |

| Foreign exchange contracts | (1.0) | | | (2.1) | | | | | |

| Total | $ | (57.0) | | | $ | (98.1) | | | | | |

(1) For the three months ended March 31, 2022 and 2021, there were $58.9 million and $20.3 million of the net losses, respectively, with Glencore.

FORWARD-LOOKING STATEMENTS