ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

☒ |

Smaller reporting company |

|||||

Emerging growth company |

||||||

| As of June 30, 2020 | $ |

| As of February 4, 2021 | Common Stock, $0.01 par value per share |

Page No. |

||||||

Cover Page |

||||||

Explanatory Note |

||||||

Document Table of Contents |

||||||

Part III |

||||||

Item 10 |

Directors, Executive Officers and Corporate Governance | 1 | ||||

Item 11 |

Executive Compensation | 5 | ||||

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 26 | ||||

Item 13 |

Certain Relationships and Related Transactions, and Director Independence | 28 | ||||

Item 14 |

Principal Accounting Fees and Services | 29 | ||||

Part IV |

||||||

Item 15 |

Exhibits and Financial Statement Schedules | 30 | ||||

| 34 | ||||||

| Name |

Age as of April 28, 2021 |

Position | ||

| Ronald Woll |

53 | Interim President and CEO, Executive Vice President and Chief Operating Officer | ||

| David L. Roland |

59 | Senior Vice President, General Counsel and Secretary | ||

| Scott L. Kornblau |

49 | Senior Vice President and Chief Financial Officer | ||

| Dominic A. Savarino |

51 | Vice President and Chief Accounting & Tax Officer |

| Class I Directors |

Class II Directors |

Class III Directors | ||

| John H. Hollowell | Neal P. Goldman | Raj Iyer | ||

| Patrick Carey Lowe | Ane Launy | |||

| Adam C. Peakes |

| Name |

Director Class |

Position |

Age as of April 28, 2021 |

Director Since | ||||

| John H. Hollowell |

I | Director |

63 | 2021 | ||||

| Patrick Carey Lowe |

I | Director |

62 | 2021 | ||||

| Adam C. Peakes |

I | Director |

48 | 2021 | ||||

| Neal P. Goldman |

II | Director |

51 | 2021 | ||||

| Ane Launy |

II | Director |

34 | 2021 | ||||

| Raj Iyer |

III | Chairman of the Board |

49 | 2021 |

| Director |

Audit Committee |

Compensation Committee |

Nominating, Governance & Sustainability Committee | |||

| Neal P. Goldman |

* | Chair | * | |||

| John H. Hollowell |

* | Chair | ||||

| Ane Launy |

* | * | ||||

| Patrick Carey Lowe |

* | |||||

| Adam C. Peakes |

Chair |

| Name |

Title | |

| Marc Edwards |

Former President and CEO (principal executive officer) | |

| Ronald Woll |

Interim President and CEO, Executive Vice President and Chief Operating Officer | |

| Scott L. Kornblau |

Senior Vice President and CFO (principal financial officer) | |

| David L. Roland |

Senior Vice President, General Counsel and Secretary | |

| Dominic A. Savarino |

Vice President and Chief Accounting & Tax Officer |

| • | The payout of a pro rata portion of outstanding unvested cash incentive awards, based on completed service and performance achieved as of April 1, 2020 and conditioned on the employee agreeing not to voluntarily leave the company within the next year, which enabled us to terminate our 2018 and 2019 long-term incentive award programs early while aligning, retaining and rewarding our key employees for actual results achieved through April 1, 2020. |

| • | Adoption of a key employee retention plan (or KERP) and a non-executive incentive plan (or NEIP) providing quarterly incentive opportunities for the year-long period from April 1, 2020 through March 31, 2021, for certain non-executive key employees whose continued dedication and performance was critical to the Company’s operation and success. The KERP and NEIP were approved by the Bankruptcy Court in May 2020. No awards were made to any of the named executive officers during 2020 under the KERP or the NEIP. |

| • | Adoption of a key employee incentive plan (or KEIP) covering nine executive-level key employees, including the named executive officers, providing quarterly performance-based incentive opportunities for the year-long period from April 1, 2020 through March 31, 2021. The KEIP was approved by the Bankruptcy Court in June 2020. |

| Named Executive Officer |

Total KEIP Payments Assuming Achievement of Target Performance Levels ($) |

|||

| Marc Edwards |

5,000,000 | |||

| Ronald Woll |

1,360,940 | |||

| Scott L. Kornblau |

567,500 | |||

| David L. Roland |

602,800 | |||

| Dominic A. Savarino |

525,000 | |||

| • | Attract and retain highly qualified and productive executives by striving to provide total compensation generally consistent with compensation paid by other companies in the energy industry (although we did not benchmark our compensation for 2020 to any particular group of companies); |

| • | Motivate our executives to achieve strong financial and operational performance for our stakeholders; |

| • | Structure compensation to create meaningful links between company and individual performance and financial rewards; and |

| • | Limit corporate perquisites. |

| Named Executive Officer |

Total KEIP Payments Assuming Achievement of Target Performance Levels ($) |

|||

| Marc Edwards |

5,000,000 | |||

| Ronald Woll |

1,360,940 | |||

| Scott L. Kornblau |

567,500 | |||

| David L. Roland |

602,800 | |||

| Dominic A. Savarino |

525,000 | |||

Q2 2020 Performance |

Q3 2020 Performance |

|||||||||||||||||||||||||||||||

| Performance Metric |

Threshold |

Target |

Maximum |

Actual |

Threshold |

Target |

Maximum |

Actual |

||||||||||||||||||||||||

| Rig Efficiency |

91 | % | 94 | % | 97 | % | 99.6 | % | 91 | % | 94 | % | 97 | % | 98.2 | % | ||||||||||||||||

| LTI Safety |

2 | 1 | 0 | 0 | 2 | 1 | 0 | 0 | ||||||||||||||||||||||||

| Cost Reduction |

8 | % | 18 | % | 29 | % | 27.5 | % | 14 | % | 25 | % | 36 | % | 44.3 | % | ||||||||||||||||

Q4 2020 Performance |

Q1 2021 Performance |

|||||||||||||||||||||||||||||||

| Performance Metric |

Threshold |

Target |

Maximum |

Actual |

Threshold |

Target |

Maximum |

Actual |

||||||||||||||||||||||||

| Rig Efficiency |

91 | % | 94 | % | 97 | % | 99.8 | % | 91 | % | 94 | % | 97 | % | 98.8 | % | ||||||||||||||||

| LTI Safety |

2 | 1 | 0 | 2 | 2 | 1 | 0 | 2 | ||||||||||||||||||||||||

| Cost Reduction |

18 | % | 29 | % | 39 | % | 44.1 | % | 21 | % | 31 | % | 40 | % | 45.7 | % | ||||||||||||||||

| Executive |

2018 Retention Payment ($) |

2019 Retention Payment ($) |

2020 Retention Payment ($) |

|||||||||

| Marc Edwards |

1,500,000 | 1,500,000 | — | |||||||||

| Ronald Woll |

750,000 | 750,000 | 750,000 | |||||||||

| Named Executive Officer |

Payment for Early Vesting of Portion of 2018 and 2019 Cash Incentive Awards ($) |

|||

| Marc Edwards |

1,750,000 | |||

| Ronald Woll |

260,833 | |||

| Scott L. Kornblau |

140,208 | |||

| David L. Roland |

160,000 | |||

| Dominic A. Savarino |

136,500 | |||

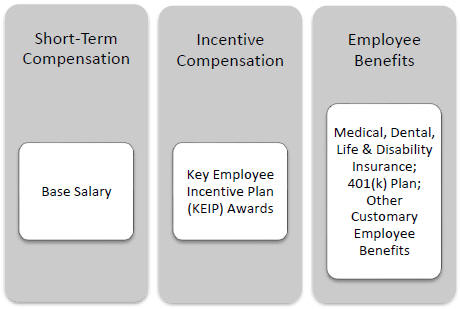

| • | Our 2020 compensation program consisted of both fixed and variable compensation. The fixed (or salary) portion was designed to provide a steady income regardless of our financial performance, in part so that executives do not focus exclusively on short-term financial performance to the detriment of other important business metrics and objectives. The variable (KEIP awards) portion of compensation was designed to reward key employees only if we achieve exceptional corporate performance. We believe that the variable elements of compensation are a sufficient percentage of overall compensation to motivate executives to produce positive corporate results, while the fixed element is also sufficient such that executives are not encouraged to take unnecessary or excessive risks. |

| • | Our 2020 compensation program was reviewed and approved not only by our Compensation Committee and Board of Directors, but our principal stakeholders and the Bankruptcy Court also reviewed our 2020 KEIP, including performance metrics. |

| • | The performance metrics used in the KEIP are measures the Compensation Committee believes represent key value driving indicators for our business operations over the KEIP performance period. Moreover, the committee set ranges for these measures designed to encourage success without encouraging excessive risk taking to achieve short-term results. In addition, the overall maximum annual cash incentive award for each participating named executive officer cannot exceed 150% of the executive’s target KEIP award, no matter how much the company’s performance exceeds the ranges established in the KEIP. |

| • | We have strict internal controls over the measurement and calculation of the performance metrics used in determining the executives’ KEIP awards, designed to prevent the metrics from being susceptible to manipulation by any employee, including our executives. In addition, 20% of each earned KEIP payment was withheld from KEIP participants until we emerged from our chapter 11 reorganization, which occurred after the completion of the KEIP performance period. |

| • | We maintain a policy that prohibits our named executive officers from engaging in any pledging, hedging or short sale transactions related to our stock or our other equity securities. |

| • | Except as otherwise provided in the applicable award agreements, full vesting of all long-term incentive awards with respect to which the applicable performance goals have been achieved and which are subject only to the condition of continued employment and pro-rata vesting of long-term incentive awards outstanding and subject to the achievement of performance goals at the date of termination, subject to and based upon the achievement of the applicable performance goals; and |

| • | Pro rata payment of the annual bonus as if there has been achievement of 100% of the specified performance target. |

| • | A pro-rata annual bonus for the year in which the termination occurs, based on actual performance for such year; |

| • | Separation payments of $208,333 per month through the end of the then-scheduled term of the employment agreement, but in any event not less than 12 and not more than 24 such payments; |

| • | Except as otherwise provided in the applicable award agreements, full vesting of any long-term incentive awards with respect to which the applicable performance goals have been achieved or are not required and which are subject only to the condition of continued employment and continued eligibility for vesting of long-term incentive awards outstanding and subject to the achievement of performance goals at the date of termination, subject to and based upon the achievement of the applicable performance goals; |

| • | Continued participation for him and his dependents in our group medical plan for 24 months; and |

| • | Customary outplacement services commensurate with his position, not to exceed 12 months or $25,000. |

| • | A lump sum cash severance payment equal to $6,000,000; and |

| • | Continued participation for him and his dependents in our group medical plan for 24 months. |

| THE COMPENSATION COMMITTEE (1) |

| Anatol Feygin, Former Chair |

| Paul G. Gaffney II, Former Member |

| Peter McTeague, Former Member |

| Neal P. Goldman, Chair |

| John H. Hollowell |

| Ane Launy |

| (1) | Messrs. Feygin, Gaffney and McTeague served as the members of the Compensation Committee until they resigned from our Board effective upon our emergence from chapter 11 reorganization on April 23, 2021. Messrs. Goldman and Hollowell and Ms. Launy were appointed to our Board pursuant to our Joint Plan, which became effective on April 23, 2021, and were also appointed to the Compensation Committee effective as of such date. The Compensation Discussion and Analysis included in this report was reviewed by the Compensation Committee and recommended to the Board of Directors prior to the appointment of the post-emergence Compensation Committee members, and accordingly Messrs. Feygin, Gaffney and McTeague performed the activities described in this Compensation Committee Report regarding the Compensation Discussion and Analysis included in this report, and Messrs. Goldman and Hollowell and Ms. Launy did not perform such activities. |

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Marc Edwards |

2020 | 1,000,000 | 291,667 | — | 5,758,333 | 27,198 | 7,077,198 | |||||||||||||||||||||

| President and CEO |

2019 | 1,000,000 | 1,500,000 | 1,738,403 | 1,500,000 | 65,640 | 5,804,043 | |||||||||||||||||||||

| 2018 | 1,000,000 | 1,500,000 | 1,669,349 | 1,500,000 | 62,734 | 5,732,083 | ||||||||||||||||||||||

| Ronald Woll |

2020 | 515,630 | 830,417 | — | 1,350,826 | 22,991 | 2,719,864 | |||||||||||||||||||||

| Executive Vice President and Chief Operating Officer |

2019 | 515,630 | 750,000 | 360,101 | 360,900 | 34,810 | 2,021,441 | |||||||||||||||||||||

| 2018 | 435,435 | 750,000 | 286,178 | 261,300 | 30,660 | 1,763,573 | ||||||||||||||||||||||

| Scott L. Kornblau |

2020 | 427,330 | 52,500 | — | 575,758 | 21,336 | 1,076,924 | |||||||||||||||||||||

| Senior Vice President and CFO |

2019 | 410,000 | — | 161,420 | 205,000 | 27,522 | 803,942 | |||||||||||||||||||||

| 2018 | 424,850 | — | 165,646 | 205,000 | 22,274 | 817,770 | ||||||||||||||||||||||

| David L. Roland |

2020 | 405,600 | 46,667 | — | 631,741 | 21,780 | 1,105,788 | |||||||||||||||||||||

| Senior Vice President, General Counsel and Secretary |

2019 | 405,600 | — | 198,681 | 202,800 | 28,095 | 835,176 | |||||||||||||||||||||

| 2018 | 405,600 | — | 190,790 | 202,800 | 28,065 | 827,255 | ||||||||||||||||||||||

| Dominic A. Savarino |

2020 | 391,477 | 35,000 | — | 536,500 | 20,942 | 983,919 | |||||||||||||||||||||

| Vice President and Chief Accounting & Tax Officer |

||||||||||||||||||||||||||||

| Name |

Accelerated Time-Vesting Cash Incentive Payment ($) |

|||

| Marc Edwards |

291,667 | |||

| Ronald Woll |

80,417 | |||

| Name |

Target Grant Date Value of Performance-Vesting RSUs ($) |

Performance- Vesting RSUs Granted (#) |

Grant Date Value of Time-Vesting RSUs ($) |

Time-Vesting RSUs Granted (#) |

||||||||||||

| Marc Edwards |

875,000 | 82,860 | 875,000 | 82,860 | ||||||||||||

| Ronald Woll |

181,250 | 17,164 | 181,250 | 17,164 | ||||||||||||

| Scott L. Kornblau |

81,250 | 7,694 | 81,250 | 7,694 | ||||||||||||

| David L. Roland |

100,000 | 9,470 | 100,000 | 9,470 | ||||||||||||

| Name |

Target Grant Date Value of Performance-Vesting RSUs ($) |

Performance- Vesting RSUs Granted (#) |

Grant Date Value of Time-Vesting RSUs ($) |

Time-Vesting RSUs Granted (#) |

||||||||||||

| Marc Edwards |

1,750,000 | 115,207 | — | — | ||||||||||||

| Ronald Woll |

180,000 | 11,850 | 120,000 | 7,900 | ||||||||||||

| Scott L. Kornblau |

97,500 | 5,624 | 65,000 | 3,750 | ||||||||||||

| David L. Roland |

120,000 | 7,900 | 80,000 | 5,267 | ||||||||||||

Maximum Number of Performance-Vesting RSUs that Could Vest (#) |

Grant-Date Value of Maximum Number of Performance-Vesting RSUs that Could Vest ($) |

|||||||||||||||

| Name |

2019 |

2018 |

2019 |

2018 |

||||||||||||

| Marc Edwards |

110,204 | 153,225 | 1,156,040 | 2,220,230 | ||||||||||||

| Ronald Woll |

22,828 | 15,761 | 239,466 | 228,377 | ||||||||||||

| Scott L. Kornblau |

10,233 | 7,479 | 107,344 | 132,159 | ||||||||||||

| David L. Roland |

12,595 | 10,507 | 132,122 | 152,246 | ||||||||||||

| Name |

Accelerated Performance-Vesting Cash Incentive Payment ($) | |

| Marc Edwards |

1,458,333 | |

| Ronald Woll |

180,417 | |

| Scott L. Kornblau |

87,708 | |

| David L. Roland |

113,333 | |

| Dominic A. Savarino |

85,000 |

| Name |

2020 Cash Payments Awarded and Earned under KEIP ($) |

|||

| Marc Edwards |

4,300,000 | |||

| Ronald Woll |

1,170,410 | |||

| Scott L. Kornblau |

488,050 | |||

| David L. Roland |

518,408 | |||

| Dominic A. Savarino |

451,500 | |||

| Name |

Retirement Plan Matching ($) |

Insurance ($) |

SERP ($) |

Total ($) |

||||||||||||

| Marc Edwards |

14,250 | 7,886 | 5,062 | 27,198 | ||||||||||||

| Ronald Woll |

14,250 | 7,886 | 855 | 22,991 | ||||||||||||

| Scott L. Kornblau |

14,250 | 6,922 | 164 | 21,336 | ||||||||||||

| David L. Roland |

14,250 | 6,861 | 669 | 21,780 | ||||||||||||

| Dominic A. Savarino |

14,322 | 6,439 | 181 | 20,942 | ||||||||||||

| Name |

Registrant Contributions in 2020 ($) |

Aggregate Earnings in 2020 ($)(1) |

Aggregate Balance at December 31, 2020 ($)(2) |

|||||||||

| Marc Edwards |

— | 5,062 | 282,428 | |||||||||

| Ronald Woll |

— | 855 | 47,690 | |||||||||

| Scott L. Kornblau |

— | 164 | 9,158 | |||||||||

| David L. Roland |

— | 669 | 37,321 | |||||||||

| Dominic A. Savarino |

— | 181 | 10,113 | |||||||||

| (1) | These amounts represent interest earned on contributions under our SERP. These amounts are also included in the “ All Other Compensation 2020 Summary Compensation Table SERP 2020 All Other Compensation Table 10-year U.S. Treasury Securities to current year and deferred contributions. |

| (2) | These amounts represent the aggregate balance as of December 31, 2020 for each of the named executive officers pursuant to our SERP. The deferred balances related to our SERP were reported in the Summary Compensation Table in each contribution year. |

Estimated Future Payouts Under Non-Equity IncentivePlan Awards ($) (2) |

||||||||||||||||||||

| Name and Type of Award (1) |

Grant Date |

Action Date |

Threshold |

Target |

Maximum |

|||||||||||||||

| Marc Edwards |

||||||||||||||||||||

| KEIP |

06/25/20 | 04/21/20 | 2,500,000 | 5,000,000 | 7,500,000 | |||||||||||||||

| Ronald Woll |

||||||||||||||||||||

| KEIP |

06/25/20 | 04/21/20 | 680,460 | 1,360,920 | 2,041,380 | |||||||||||||||

| Scott L. Kornblau |

||||||||||||||||||||

| KEIP |

06/25/20 | 04/21/20 | 283,750 | 567,500 | 851,250 | |||||||||||||||

| David L. Roland |

||||||||||||||||||||

| KEIP |

06/25/20 | 04/21/20 | 301,400 | 602,800 | 904,200 | |||||||||||||||

| Dominic A. Savarino |

||||||||||||||||||||

| KEIP |

06/25/20 | 04/21/20 | 262,500 | 525,000 | 787,500 | |||||||||||||||

| (1) | All incentive plan awards granted in 2020 were cash incentive awards pursuant to the KEIP. See “ Compensation Discussion and Analysis - Key Employee Incentive Plan |

| (2) | These amounts represent threshold, target and maximum awards, as applicable, under the cash incentive awards granted in 2020 pursuant to our KEIP. Each of the named executive officers was eligible to earn a performance-driven cash incentive payment following the completion of each of the second, third and fourth calendar quarters of 2020 and the first calendar quarter of 2021, depending upon the extent to which the KEIP’s performance goals had been achieved for each such quarter. The KEIP payout amount for each of these quarters was determined based upon the level of achievement of the following three performance metrics: (i) average contracted rig efficiency, weighted 40%; (ii) lost time incidents, weighted 20%; and (iii) reduction in total consolidated overhead expenses, weighted 40%. The amount of the KEIP payment, if payable, would range from 50% (at threshold level) to 150% (at stretch level) of the target value of a participant’s incentive payment. If the threshold performance level for any given metric was not achieved, no KEIP payment would be earned for that metric for that quarter. In addition to performance being measured for each quarter, the KEIP contained a catch-up provision, which provided that performance goals would also be measured cumulatively at the end of the second, third and fourth quarters of the plan, taking into account each such quarter and all preceding quarters. To the extent performance was not achieved at the stretch level for any preceding quarter, a KEIP participant would be eligible to earn an additional “catch-up” payment for the prior quarters; provided, that in no event would the “catch-up” payment be greater than the cumulative quarterly plan payments assuming maximum level of performance for such period. The KEIP provided that 80% of the KEIP payments earned based on quarterly performance would be paid in cash on a quarterly basis after each applicable quarter, and the remaining 20% of the award amount would be held back and paid in cash to participants upon our emergence from our chapter 11 reorganization. The KEIP originally provided for the withheld payments to be subject to the satisfaction of certain emergence timing criteria, but after we filed our proposed Joint Plan with the Bankruptcy Court in January 2021, our principal creditors agreed that the withheld payments would be paid in full upon our emergence from our chapter 11 reorganization. In order to earn a KEIP payment for any quarter, a KEIP participant must have been employed by us through the payment date. A KEIP participant whose employment terminates due to death or disability, by us without “cause” or by a KEIP participant for “good reason” (as such terms are defined in the KEIP) prior to the end of the applicable quarter would be entitled to a pro-rata portion of his KEIP payment that would otherwise have been earned for the quarter based on the percentage of the quarter the participant was employed by us. |

SARs Awards |

RSU Awards |

|||||||||||||||

| Name |

Number of Shares Acquired on Exercise (#) |

Value Realized on Exercise ($) |

Number of Shares Acquired on Vesting (#) |

Value Realized on Vesting ($)(1) |

||||||||||||

| Marc Edwards |

— | — | 220,681 | 838,588 | ||||||||||||

| Ronald Woll |

— | — | 34,215 | 104,567 | ||||||||||||

| Scott L. Kornblau |

— | — | 6,920 | 18,182 | ||||||||||||

| David L. Roland |

— | — | 19,027 | 57,425 | ||||||||||||

| Dominic A. Savarino |

— | — | 1,975 | 3,140 | ||||||||||||

| (1) | The values realized upon vesting of RSU awards contained in the table are based on the market value of our common stock on the date of vesting. |

| Marc Edwards Executive Benefits & Payments |

Termination for Good Reason or Without Cause ($) |

Termination for Death or Disability ($) |

Termination for Cause ($) |

Other Voluntary Termination ($) |

Change in Control ($) |

|||||||||||||||

| Cash Severance |

5,000,000 | — | — | — | 12,000,000 | |||||||||||||||

| Cash Incentive |

1,500,000 | 1,500,000 | — | — | 1,500,000 | |||||||||||||||

| Insurance Continuation |

40,800 | — | — | — | 40,800 | |||||||||||||||

| Outplacement Services |

25,000 | — | — | — | 25,000 | |||||||||||||||

| KEIP Payment |

1,250,000 | 1,250,000 | — | — | — | |||||||||||||||

| SERP |

282,428 | 282,428 | 282,428 | 282,428 | 282,428 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

8,098,228 | 3,032,428 | 282,428 | 282,428 | 13,848,228 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Ronald Woll Executive Benefits & Payments |

Termination for Good Reason or Without Cause ($) |

Termination for Death or Disability ($) |

Termination for Cause ($) |

Other Voluntary Termination ($) |

||||||||||||||||

| KEIP Payment |

340,235 | 340,235 | — | — | ||||||||||||||||

| SERP |

47,690 | 47,690 | 47,690 | 47,690 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total |

387,925 | 387,925 | 47,690 | 47,690 | ||||||||||||||||

| Scott L. Kornblau Executive Benefits & Payments |

Termination for Good Reason or Without Cause ($) |

Termination for Death or Disability ($) |

Termination for Cause ($) |

Other Voluntary Termination ($) |

||||||||||||||||

| KEIP Payment |

141,875 | 141,875 | — | — | ||||||||||||||||

| SERP |

9,158 | 9,158 | 9,158 | 9,158 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total |

151,033 | 151,033 | 9,158 | 9,158 | ||||||||||||||||

| David L. Roland Executive Benefits & Payments |

Termination for Good Reason or Without Cause ($) |

Termination for Death or Disability ($) |

Termination for Cause ($) |

Other Voluntary Termination ($) |

||||||||||||||||

| KEIP Payment |

150,700 | 150,700 | — | — | ||||||||||||||||

| SERP |

37,321 | 37,321 | 37,321 | 37,321 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total |

188,021 | 188,021 | 37,321 | 37,321 | ||||||||||||||||

| Dominic A. Savarino Executive Benefits & Payments |

Termination for Good Reason or Without Cause ($) |

Termination for Death or Disability ($) |

Termination for Cause ($) |

Other Voluntary Termination ($) |

||||||||||||||||

| KEIP Payment |

131,250 | 131,250 | — | — | ||||||||||||||||

| SERP |

10,113 | 10,113 | 10,113 | 10,113 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total |

141,363 | 141,363 | 10,113 | 10,113 | ||||||||||||||||

| • | the annual total compensation of the employee identified at median of our company (other than our CEO) was $125,538; and |

| • | the annual total compensation of Mr. Edwards, as reflected in the 2020 Summary Compensation Table |

| • | We identified our median-compensated employee from all full-time, part-time and temporary workers (with the exception of our employees in Singapore as described below) who were included as employees on our payroll records as of December 31, 2020, based on actual base salary, overtime and bonuses paid for calendar year 2020. We believe the use of such cash compensation for all employees is a consistently-applied compensation measure because we do not widely distribute equity awards to employees. |

| • | We determined that, as of December 31, 2020, our employee population for purposes of this pay ratio calculation consisted of approximately 1,651 individuals globally. As permitted by SEC rules, when identifying our median employee for purposes of the pay ratio calculation, we excluded the compensation of our three employees based in Singapore. |

| • | Compensation for newly-hired employees who worked less than a full year was annualized. The pay for employees based outside of the U.S. was converted to U.S. dollars using the average of the exchange rates in effect on each of January 1, 2020 and December 31, 2020. We did not make any cost of living adjustments in identifying the median employee. The median employee from our analysis had anomalous compensation characteristics and was substituted with a similarly-situated employee with a materially equivalent compensation level. |

| • | After identifying the median employee based on total cash compensation, we calculated annual total compensation for such employee using the same methodology we use for our named executive officers as set forth in the 2020 Summary Compensation Table |

| • | other services provided to our company by the firm; |

| • | the amount of fees to be paid by us as a percentage of the firm’s total revenues; |

| • | policies or procedures maintained by the firm designed to prevent a conflict of interest; |

| • | business or personal relationships between the individual consultants involved in the engagement and any committee member; |

| • | our common stock owned by the individual consultants involved in the engagement; and |

| • | business or personal relationships between our executive officers and the firm or the individual consultants involved in the engagement. |

| • | None of our executive officers served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Compensation Committee; |

| • | None of our executive officers served as a director of another entity, one of whose executive officers served on our Compensation Committee; and |

| • | None of our executive officers served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Board of Directors. |

| • | Annual cash retainer of $150,000, paid in quarterly installments in advance; |

| • | Annual cash retainer for the Chair of the Audit Committee of $25,000; |

| • | Annual cash retainers for the Chair of the Compensation Committee and the Lead Director of $10,000; and |

| • | Non-employee directors receive a grant of immediately-vested RSUs each quarter with a grant date value of $12,500. |

| • | Annual cash retainer of $200,000, paid in quarterly installments in advance; |

| • | Annual cash retainer for the Chair of the Audit Committee of $25,000; and |

| • | Annual cash retainers for the Chair of the Compensation Committee and the Lead Director of $10,000. |

| Name(1) |

Fees Earned or Paid in Cash ($) |

Option Awards ($)(2) |

All Other Compensation ($) |

Total ($) |

||||||||||||

| Anatol Feygin |

161,000 | 6,638 | — | 167,638 | ||||||||||||

| Paul G. Gaffney II |

166,000 | 6,638 | — | 172,638 | ||||||||||||

| Edward Grebow |

44,970 | 6,638 | — | 51,608 | ||||||||||||

| Alan H. Howard |

177,723 | — | — | 177,723 | ||||||||||||

| Peter McTeague |

150,648 | — | — | 150,648 | ||||||||||||

| Kenneth I. Siegel |

— | 6,638 | — | 6,638 | ||||||||||||

| Clifford M. Sobel |

— | 6,638 | — | 6,638 | ||||||||||||

| Andrew H. Tisch |

— | 6,638 | — | 6,638 | ||||||||||||

| James S. Tisch |

— | 6,638 | — | 6,638 | ||||||||||||

| (1) | Messrs. Grebow, Sobel and A. Tisch served as directors until our 2020 annual meeting of stockholders held in May 2020. Messrs. Howard and McTeague were elected to the Board in March 2020. Our current directors who were appointed to the Board upon our emergence from chapter 11 reorganization in April 2021 and did not serve in 2020 are not included in this table. Marc Edwards, our former President and CEO, is not included in this table because he was an employee of our company during 2020, and therefore received no compensation for his service as director. The compensation received by Mr. Edwards as an employee of the company during 2020 is shown in the 2020 Summary Compensation Table |

| (2) | These amounts represent the aggregate grant date fair value of awards of SARs granted pursuant to our Equity Plan for the year ended December 31, 2020, computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of dollar amounts of these awards are included in Note 6, Stock-Based Compensation |

| Name |

Unexercised Option Awards(#) |

|||

| Anatol Feygin |

3,000 | |||

| Paul G. Gaffney II |

35,000 | |||

| Alan H. Howard |

— | |||

| Peter McTeague |

— | |||

| Kenneth I. Siegel |

24,000 | |||

| James S. Tisch |

225,500 | |||

| Title of Class |

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class |

|||||||

| Common Stock |

Loews Corporation | 73,119,047 | (1) | 53.1 | % | |||||

| 667 Madison Avenue | ||||||||||

New York, NY 10065-8087 |

||||||||||

| Common Stock |

Contrarius Investment Management Limited |

13,255,994 | (2) | 9.6 | % | |||||

| 2 Bond Street | ||||||||||

| St. Helier, Jersey JE2 3NP | ||||||||||

| Channel Islands | ||||||||||

| (1) | This information is based on a Schedule 13D/A (Amendment No. 3) filed with the SEC on March 23, 2020 by Loews Corporation (which we refer to as Loews), which reported that Loews had sole investment power and sole voting power over the shares. |

| (2) | This information is based on a Schedule 13G/A (Amendment No. 1) filed with the SEC on February 12, 2021 by Contrarius Investment Management Limited and Contrarius Investment Management (Bermuda) Limited, which reported that Contrarius Investment Management Limited had shared voting power over 13,255,994 shares and shared dispositive power over 13,255,994 shares, and Contrarius Investment Management (Bermuda) Limited had shared voting power over 13,255,994 shares and shared dispositive power over 13,255,994 shares. The address for Contrarius Investment Management (Bermuda) Limited is Waterloo House, 100 Pitts Bay Road, Pembroke HM 08, Bermuda. |

| Name of Beneficial Owner |

Shares of Our Common Stock |

Shares of Loews Common Stock |

% of Loews Common Stock |

|||||||||

| Raj Iyer |

— | — | * | |||||||||

| Neal P. Goldman |

— | |

— |

|

* | |||||||

| John H. Hollowell |

— | — | * | |||||||||

| Ane Launy |

— | — | * | |||||||||

| Patrick Carey Lowe |

— | — | * | |||||||||

| Adam C. Peakes |

— | — | * | |||||||||

| Ronald Woll |

— | — | * | |||||||||

| Scott L. Kornblau |

— | — | * | |||||||||

| David L. Roland (1) |

810 | — | * | |||||||||

| Dominic A. Savarino |

— | — | * | |||||||||

| Marc Edwards |

— | — | * | |||||||||

| All Directors and Executive Officers as a Group (10 persons, comprised of those listed above other than Marc Edwards) |

810 | — | * | |||||||||

| * | Less than 1% of the Loews Common Stock. |

| (1) | The number of shares of our common stock 810 shares held by virtue of Mr. Roland’s investment in our common stock pursuant to our Retirement Plan. |

| Plan Category |

Number of securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (1) (a) |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights ($)(2) (b) |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) |

|||||||||

| Equity compensation plans approved by stockholders |

11,000 | 43.84 | 5,299,853 | |||||||||

| Equity compensation plans not approved by stockholders |

— |

— |

— |

|||||||||

| Total |

11,000 | 43.84 | 5,299.853 | |||||||||

| (1) | As of December 31, 2020, there were no SARs outstanding under our Equity Plan with an exercise price less than $0.17, which was the closing price per share on December 31, 2020, as quoted on the OTC Pink Open Market. |

| (2) | The weighted-average exercise price does not take into account RSUs because RSUs do not have an exercise price. |

| (1) | any of the following relationships existed during the past three years: |

| (i) | the director is our employee or has received more than $120,000 per year in direct compensation from us, other than director and committee fees and pension or other forms of deferred compensation for prior service; |

| (ii) | the director provided significant advisory or consultancy services to us or is affiliated with a company or firm that has provided significant advisory or consultancy services to us (annual revenue of the greater of 2% of the other company’s consolidated gross revenues or $1 million is considered significant for this purpose); |

| (iii) | the director has been a significant customer or supplier of ours or has been affiliated with a company or firm that is a significant customer or supplier of ours (annual revenue of the greater of 2% of the other company’s consolidated gross revenues or $1 million is considered significant for this purpose); |

| (iv) | the director has been employed by or affiliated with an internal or external auditor that within the past three years provided services to us; or |

| (v) | the director has been employed by another company where any of our current executives serve on that company’s compensation committee; |

| (2) | the director’s spouse, parent, sibling, child, mother- or father-in-law, son- or daughter-in-law sister-in-law, |

| (3) | the director has any other relationships with us or with any member of our senior management that our Board of Directors determines to be material. |

2020 |

2019 |

|||||||

| Audit Fees (1) |

$ | 1,875,000 | $ | 2,113,700 | ||||

| Audit-Related Fees |

— | — | ||||||

| Tax Fees (2) |

22,000 | — | ||||||

| All Other Fees (3) |

4,000 | 4,000 | ||||||

| |

|

|

|

|||||

| Total |

$ | 1,901,000 | $ | 2,117,700 | ||||

| (1) | Audit Fees include the aggregate fees and expenses for the audit of our annual financial statements and internal control over financial reporting, reviews of our quarterly financial statements, various statutory audits of our foreign subsidiaries and aggregate fees and expenses associated with the consent for our Registration Statement on Form S-3 filed with the SEC in March 2018. |

| (2) | Tax fees include aggregate fees and expenses related to tax consultations with respect to tax disputes outside the scope of the annual audit of our financial statements. |

| (3) | All Other Fees include fees and expenses for a subscription to an accounting research tool. |

| (a) | Index to Financial Statements and Financial Statement Schedules |

| (1) Financial Statements | Page | |

| Report of Independent Registered Public Accounting Firm |

53 of the Original Filing | |

| Consolidated Balance Sheets |

57 of the Original Filing | |

| Consolidated Statements of Operations |

58 of the Original Filing | |

| Consolidated Statements of Comprehensive Income or Loss |

59 of the Original Filing | |

| Consolidated Statements of Stockholders’ Equity |

60 of the Original Filing | |

| Consolidated Statements of Cash Flows |

61 of the Original Filing | |

| Notes to Consolidated Financial Statements |

62 of the Original Filing | |

| (b) | Exhibits |

| Exhibit No. |

Description | |

| 104* | The cover page of this Annual Report on Form 10-K/A (Amendment No. 1) for the fiscal year ended December 31, 2020, formatted in Inline XBRL. | |

| * | Filed or furnished herewith. |

| + | Management contracts or compensatory plans or arrangements. |

| DIAMOND OFFSHORE DRILLING, INC. | ||

| By: |

/s/ SCOTT KORNBLAU | |

| Scott Kornblau | ||

| Chief Financial Officer | ||