UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 01-35525

SMITH MICRO SOFTWARE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0029027 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

| 51 Columbia, Aliso Viejo, CA | 92656 | |

| (Address of principal executive offices) | (Zip Code) | |

|

Registrant’s telephone number, including area code: (949) 362-5800

| ||

| Common Stock, $.001 par value (Title of each class) |

The NASDAQ Stock Market LLC (NASDAQ Global Market) | |

| (Name of each exchange on which registered) | ||

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $.001 par value

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES[ ] NO [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [X]

Indicate by check mark if whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] |

Accelerated filer [ ] | |||

|

Non-accelerated filer [X] (Do not check if a smaller reporting company) |

Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES[ ] NO [X]

As of June 30, 2013, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the common stock of the registrant held by non-affiliates was $34,675,588 based upon the closing sale price of such stock as reported on the Nasdaq Global Market on that date. For purposes of such calculation, only executive officers, board members, and beneficial owners of more than 10% of the registrant’s outstanding common stock are deemed to be affiliates.

As of February 18, 2014, there were 38,609,318 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2014 Annual Meeting of Stockholders to be filed under the Securities Exchange Act of 1934 are incorporated by reference in Part III of this report.

SMITH MICRO SOFTWARE, INC.

2013 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

2

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

In this document, the terms “Smith Micro,” “Company,” “we,” “us,” and “our” refer to Smith Micro Software, Inc. and, where appropriate, its subsidiaries.

This report contains forward-looking statements regarding Smith Micro which include, but are not limited to, statements concerning projected revenues, expenses, gross profit and income, the competitive factors affecting our business, market acceptance of products, customer concentration, the success and timing of new product introductions and the protection of our intellectual property. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs, and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “estimates,” “should,” “may,” “will” and variations of these words or similar expressions are intended to identify forward-looking statements. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. Such factors include, but are not limited to, the following:

| • | changes in demand for our products from our key customers and their end-users; |

| • | our business and stock price may decline further which could cause an additional impairment of long-lived assets or restructuring charges resulting in a material adverse effect on our financial condition and results of operations; |

| • | our ability to successfully execute our business and restructuring plan and control costs and expenses; |

| • | we risk being delisted from NASDAQ if our stock trades below $1.00 per share for 30 straight business days; |

| • | our quarterly revenues and operating results are difficult to predict and could fall below analyst or investor expectations, which could cause the price of our common stock to fall; |

| • | the pace at which the market for new products develop; |

| • | the intensity of the competition and our ability to successfully compete; |

| • | our ability to hire and retain key personnel; |

| • | the availability of third party intellectual property and licenses which may not be on commercially reasonable terms, or not at all; |

| • | our ability to protect our intellectual property and our ability to not infringe on the rights of others; |

| • | the ongoing uncertainty and volatility in U.S. and worldwide economic conditions may adversely affect our operating results; |

| • | our ability to raise additional capital through the issuance of additional equity or convertible debt securities or by borrowing money, in order to meet our capital needs; |

| • | security and privacy breaches in our systems may damage client relations and inhibit our ability to grow; |

| • | interruptions or delays in the services we provide from our data center hosting facilities could harm our business; and |

| • | those additional factors which are listed under the section “1A. Risk Factors” beginning on page 10 of this report. |

The forward-looking statements contained in this report are made on the basis of the views and assumptions of management regarding future events and business performance as of the date this report is filed with the Securities and Exchange Commission (the “SEC”). We do not undertake any obligation to update these statements to reflect events or circumstances occurring after the date this report is filed.

3

PART I

General

Smith Micro Software, Inc. provides software and services that simplify, secure and enhance the mobile experience. The Company’s portfolio of wireless solutions includes a wide range of client and server applications that manage devices, communications and network connectivity for end-users as well as Machine-to-Machine (“M2M”) endpoints. Our primary customers are the world’s leading wireless service providers, mobile device and chipset manufacturers, and enterprise businesses. In addition to our wireless and mobility software, Smith Micro offers personal productivity, graphics and animation products distributed through a variety of consumer channels worldwide.

With a 30-year history of technology innovation, leadership in industry standards, and extensive commercial deployment experience, Smith Micro continues to evolve its portfolio and business models to capitalize on new market opportunities. Over the past three decades, the Company has developed deep expertise in embedded software for networked devices, policy-based management platforms, and highly-scalable mobile applications and hosted services. For network operators and organizations struggling to reduce costs and complexity in the fragmented, rapidly evolving mobile market, Smith Micro offers proven solutions that increase reliability, security, and efficiency while accelerating time to market for mobile products and services.

The proliferation of mobile broadband technology continues to provide new opportunities for Smith Micro on a global scale. Today, Smith Micro’s mission is to help our customers thrive in a connected world with software solutions that:

1. Simplify wireless connectivity to reduce support costs and increase accessibility;

2. Optimize network and device resources for maximum performance and efficiency;

3. Enable a safe, productive mobile environment that meets enterprise and governmental standards for security, control and regulatory compliance; and

4. Engage and grow high-value relationships with end customers using mobile devices.

The Company was incorporated in California in November 1983, and reincorporated in Delaware in June 1995. Our principal executive offices are located at 51 Columbia, Aliso Viejo, California 92656. Our telephone number is (949) 362-5800. Our website address is www.smithmicro.com. Our NASDAQ symbol is SMSI, and we make our SEC filings available on the Investor Relations page of our website. Information contained on our website is not part of this Annual Report on Form 10-K.

Business Segments

Our operations are organized into two business segments: Wireless and Productivity & Graphics. We do not separately allocate operating expenses, nor do we allocate specific assets to these groups. Therefore, segment information reported includes only revenues and cost of revenues. See Note 6 of Notes to Consolidated Financial Statements for financial information related to our business segments and geographical information.

4

Wireless

Rapid advancements in wireless technology, including higher speed networks, intelligent connected devices and an abundance of digital content and mobile applications, are fueling the mobile broadband market. The demand for pervasive connectivity is largely driven by the insatiable consumer desire to access information and digital entertainment - anytime, anywhere - from smartphones, tablets, laptop computers, e-readers, gaming devices and more. Further, the ability to instrument devices with meters, diagnostics and operational controls has led to an exploding M2M wireless market across a broad range of vertical industries. While the benefits and opportunities associated with increased mobility are plenty, so are the challenges of this highly dynamic environment:

| • | Wireless data services are being adopted at such a fast pace that global wireless networks cannot support them without significant investments to increase capacity and performance. |

| • | Operators are being marginalized by over-the-top applications and social networks as they struggle to supplement declining voice and messaging revenues with new data services. |

| • | Device and module makers face increasing pressure to differentiate their platforms and accelerate time to market while burdened by network certification requirements that differ for each wireless carrier. |

| • | Commercial and public sector organizations are challenged to mobilize their operations and provide their work forces with wireless access to critical information without sufficient tools to manage security, performance and costs. |

| • | End users must adapt to a variety of mobile platforms, a deluge of mobile apps, and unreliable connection methods while learning to understand and manage costs of consuming data. |

To address these challenges, Smith Micro has developed a robust software portfolio comprised of three product families that help our customers connect, control and capitalize on the mobile internet:

QuickLink® – connection management applications and software components that help users and devices access 3G, 4G and Wi-Fi networks, easily and securely.

NetWise® – policy-based control solutions for intelligently managing data traffic, network authentication, user entitlement to wireless services, and device behavior.

CommSuite® – a premium services platform that allows operators and enterprises to deliver and monetize advanced voice, video and messaging applications.

Our flagship QuickLink connectivity solutions have been shipped on more than 100 million devices worldwide. This patented technology allows mobile users to easily connect a tablet, laptop or other wireless device to cellular or Wi-Fi networks. Many of the world’s largest mobile network operators, including AT&T, Bell Canada, Bouygues, Orange, Sprint, T-Mobile, Verizon Wireless, and Vodafone, have offered QuickLink as a white-label connection management application to their subscribers. QuickLink components are embedded by leading chipset manufacturers and module makers to ensure that connectivity is consistent across device types. QuickLink is also used by enterprises and public sector organizations with mobile workforces to provide enhanced security and configurability over public and private wireless networks.

5

NetWise is a policy-driven platform for managing data and devices over heterogeneous networks. Using an intelligent device client NetWise provides visibility and control over 3G, 4G and Wi-Fi network connections to ensure the best possible quality of experience for end users. NetWise helps operators reduce congested networks and helps enterprises reduce escalating telecom budgets through discovery, authentication and seamless offload of data to Wi-Fi networks. NetWise also provides remote device and user access management to ensure secure, compliant access to networked systems and information.

With the CommSuite premium services platform, operators can drive new revenues and better compete with over-the-top (“OTT”) applications by offering innovative new messaging features, such as Voice-to-Text, Avatar messaging, Videomail, live Videocasting, and more. CommSuite services are offered stand-alone or can be bundled with existing voicemail and messaging systems, including Rich Communication Services (“RCS”). The CommSuite gateway provides application management and supports flexible business models, such as monthly subscription, content-driven purchases, and “freemium” ad-sponsored plans, by integrating with operator billing/provisioning systems and advertising mediation engines. For enterprises, CommSuite offers increased productivity through a single client application for accessing mobile and office voice messages, as well as secure, adaptive streaming of mobile video, including rights-managed content (like on-demand movies), closed-circuit video, and more.

Beyond the advanced features within each product family, the expertise to integrate technologies across the entire portfolio is an advantage that Smith Micro uniquely brings to its customers. For example, CommSuite Videomail can be managed by NetWise data policies to ensure that video traffic is restricted to Wi-Fi or 4G networks. Using technology and experience acquired over 30 years, Smith Micro continues to deliver new solutions to meet new market challenges.

Productivity & Graphics

The Productivity & Graphics group focuses on developing a variety of software for the consumer, prosumer, and professional markets. Our solutions span compression, graphics and utilities. This group also republishes and markets third party software titles that complement our existing line of products. All of these products are available through direct sales on the Smith Micro websites (smithmicro.com, mysmithmicro.com and contentparadise.com), on affiliate websites, direct through customer service order desks, on-line resellers and through traditional retail outlets.

The group’s primary product offering is its line of graphic titles, in particular Poser®, Anime Studio®, Manga Studio® and MotionArtist™. These products are aimed at digital artists of all skill levels helping them to produce professional level animations, comics, and other 2D and 3D art. Poser is the industry leading tool for 3D human figure design and animation. Anime Studio is used by both hobbyists and professional artists working for high-end animation studios like Disney, and Manga Studio is at the top of the market for comic illustration software, used by famous graphic novelists such as Dave Gibbons, the author of the Watchmen. The group is focused on pursuing adjacent markets to these graphic arts, as well as new platforms for the existing titles, such as iOS.

The secondary product line is StuffIt®, driven by its patented and patent-pending image compression, with a focus on our innovative “lossless” JPEG compression technology. StuffIt provides superior lossless compression, encryption and archiving. We have enhanced this industry-leading product’s feature set with new, online file transfer capabilities.

6

Products and Services

Our primary products consist of the following:

| Product Groups | Products | Description | ||

| QuickLink® Mobile | Connection management application to control, customize and automate wireless connections from PCs and Macs to WWAN and WLAN/Wi-Fi networks | |||

| QuickLink® Mobility | Mobile VPN and connection manager targeted to enterprises with mobile workforces and the public sector | |||

| QuickLink® Hotspot QuickLink® Zero | An application that optimizes the user-experience with billing integration, automated diagnostics, and usage metering for mobile hotspot features on smartphones and mobile broadband devices | |||

| QuickLink® MiTile | Connection manager for Microsoft Windows 8 devices | |||

| QuickLink® MBIM Drivers | Customizable drivers that support the Mobile Broadband Interface Model (MBIM) standard for connecting USB devices to a variety of operating systems | |||

| NetWise® Director | Intelligent traffic management for data offload and seamless, secure network transitions between 3G/4G/Wi-Fi; provides application controls, user entitlement, and automated authentication | |||

| NetWise® I/O | A toolkit for testing client/server interoperability using the ANDSF networking standard. | |||

| NetWise® SmartSpot | Wi-Fi discoverability, promotion and automated authentication | |||

| NetWise® DM Suite | Device Management platform for mobile device provisioning and configuration | |||

| NetWise® FOTA | Lightweight device agent and deployment server for updating Firmware Over The Air (FOTA) | |||

| CommSuite® PTT | A push-to-talk (PTT) data service that uses a mobile Internet connection to send and receive “walkie-talkie” style calls | |||

| CommSuite® VVM | Visual Voicemail (VVM) delivered directly to a mobile phone app and managed like email | |||

| CommSuite® VTT | Voice-to-Text (VTT) transcription of voicemail and voice SMS messages | |||

| CommSuite® Avatarmail | Talking Avatars that use voice, wallpapers, stickers and photos to communicate | |||

| CommSuite® VIDIO | Adaptive streaming of video content to support mobile viewing across laptops, tablets, phones, TVs, and more | |||

| CommSuite® Videocast and Videomail | Delivery of live or pre-recorded video messages captured on mobile devices and available via web link with no client application required | |||

| Productivity & Graphics |

Poser® | A solution for creating 3D character art and animations | ||

| Anime Studio® | An animation tool for professionals and digital artists | |||

| Manga Studio® | A solution for creating manga and comic art | |||

| MotionArtist ™ | A solution for creating interactive presentations | |||

| ScatterShow™ | Creates interactive slide shows from photo albums on mobile devices | |||

| StuffIt Deluxe® | Patented, lossless compression solution for documents and media |

7

Marketing and Sales Strategy

Because of our broad product portfolio and deep device integration experience, we are able to leverage technologies across a wide range of platforms and operating systems to quickly bring to market innovative solutions that meet the evolving needs of our customers. We continue to offer flexible, performance-based business models that align with our customers’ needs to create new revenue opportunities and differentiate their products and services among their competitors.

Our sales strategy is as follows:

Leverage Carrier and OEM Relationships. We continue to capitalize on our strong relationships with the world’s leading wireless carriers and mobile device manufacturers. Our carrier customers serve as our primary distribution channel, providing access to hundreds of millions of end-users around the world, and also providing market feedback for future product offerings.

Focus on High-Growth Markets. We continue to focus on wireless connectivity and communications solutions taking advantage of enhanced 4G networks developed by wireless carriers and an increasing availability of rich media and multi-media enabled smartphones, tablets, eReaders and other emerging cellular and Wi-Fi devices.

Expand our Customer Base. In addition to introducing new products to current customers, we are growing our domestic and international business through sales to new carriers and device manufacturers, as well as increased penetration of the enterprise market, with particular focus on public safety, education, and vertical markets utilizing M2M technologies.

Selectively Pursue Partnerships and Acquisitions of Complementary Products and Services. We continue to pursue partnerships and acquisition opportunities that will enhance our portfolio, help us enter complementary markets, and extend our geographic reach. We will leverage partnerships with technology providers and systems integrators to further our penetration into new markets and deliver more comprehensive solutions to our customers.

Revenues to two customers (Sprint and Verizon Wireless) and their respective affiliates in the Wireless business segment accounted for 53.1% and 13.0%, respectively, of the Company’s total revenues for the fiscal year 2013. Revenues to FastSpring in the Productivity & Graphics business segment accounted for 11.4% of the Company’s total revenues for the fiscal year 2013. In 2012, our two largest customers (Sprint and Verizon Wireless) accounted for 40.7% and 20.5%, respectively, of our total revenues. In 2011, our three largest customers (Sprint, Verizon Wireless and AT&T) accounted for 24.8%, 18.4% and 11.7%, respectively, of our total revenues. Our major customers could reduce their orders of our products in favor of a competitor’s product or for any other reason. The loss of any of our major customers or decisions by a significant customer to substantially reduce purchases could have a material adverse effect on our business.

Customer Service and Technical Support

We provide technical support and customer service through our online knowledge base, via email, live chat and by telephone. OEM customers generally provide their own primary customer support functions and rely on us for support to their own technical support personnel.

8

Product Development

The software industry, particularly the wireless market, is characterized by rapid and frequent changes in technology and user needs. We work closely with industry groups and customers, both current and potential, to help us anticipate changes in technology and determine future customer needs. Software functionality depends upon the capabilities of the hardware. Accordingly, we maintain engineering relationships with various hardware manufacturers and we develop our software in tandem with their product development. Our engineering relationships with manufacturers, as well as with our major customers, are central to our product development efforts. We remain focused on the development and expansion of our technology, particularly in the wireless space. Research and development expenditures amounted to $21.3 million, $24.8 million, and $41.7 million for the years ended December 31, 2013, 2012 and 2011, respectively.

Manufacturing

Although we primarily deliver our software via electronic downloads, we do deliver our software in several other forms. We offer a package or kit that may include CD-ROMs and certain other documentation or marketing material. We also permit selected OEM customers to duplicate our products on their own CD-ROMs, USB devices, or embedded devices, and pay a royalty based on usage. Some OEM business requires that we provide a CD, which includes a soft copy of a user guide. Finally, we grant licenses to certain OEM customers that enable those customers to preload a copy of our software onto a personal computer. With the enterprise sales program, we offer site licenses under which a corporate user is allowed to distribute copies of the software to users within their corporate sites.

Our product development group produces a product master for each product that is then duplicated and packaged into products by the manufacturing organization. All product components are purchased by our personnel in our Aliso Viejo, California facility. Our manufacturing is subcontracted to outside vendors and includes the replication of CD-ROMs and the printing of documentation materials. Assembly of the final package is completed by our Aliso Viejo, California facility.

Competition

The markets in which we operate are highly competitive and subject to rapid changes in technology. These conditions create new opportunities for Smith Micro, as well as for our historical connection management competitors, and we expect new competitors to enter the market. We also believe that competition from established and emerging software companies will continue to intensify as the emerging mobile, wireless and Internet markets evolve. We compete with other software vendors for new customer contracts, as well as in our efforts to acquire technology and qualified personnel.

We believe that the principal competitive factors affecting the mobile software market include domain expertise, product features, usability, quality, price, customer service and effective sales and marketing efforts. Although we believe that our products currently compete favorably with respect to these factors, there can be no assurance that we can maintain our competitive position against current and potential competitors. We also believe that the market for our software products has been and will continue to be characterized by significant price competition. A material reduction in the price of our products could negatively affect our profitability.

Many existing and potential carrier and OEM customers have the resources to develop products that compete directly with our products. These customers may discontinue the purchase of our products. Our future performance is substantially dependent upon the extent to which existing carrier and OEM customers elect to purchase software from us rather than design and develop their own software.

9

Proprietary Rights and Licenses

Our success and ability to compete is dependent upon our software code base, our programming methodologies and other intellectual properties. To protect our proprietary technology and intellectual property, we rely on a combination of trade secrets, nondisclosure agreements, patents, copyright and trademark law that may afford only limited protection. As of December 31, 2013, we owned 79 issued U.S. patents and have 29 U.S. patent applications that are currently pending. These patents are intended to provide generalized protection of our intellectual property technology base and we will continue to apply for various patents and trademarks in the future as we deem necessary to protect our intellectual property technology base.

We seek to avoid unauthorized use and disclosure of our proprietary intellectual property by requiring employees and consultants with access to our proprietary information to execute confidentiality agreements with us and by restricting access to our source code. The deterrent steps that we have taken to protect our proprietary technology may not be adequate to deter misappropriation of our proprietary information or prevent the successful assertion of any adverse claim against us relating to software or intellectual property utilized by us. In addition, we may not be able to detect unauthorized use of our intellectual property rights or take effective steps to enforce those rights.

In selling our products, we primarily rely on “shrink wrap” licenses that are not signed by licensees and may be unenforceable under the laws of certain jurisdictions. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the United States. Accordingly, the means we currently use to protect and enforce all of our proprietary rights and intellectual property rights may not be adequate. Moreover, our competitors may independently develop competitive technology similar to ours. We also license technology on a non-exclusive basis from several companies for inclusion in our products and anticipate that we will continue to do so in the future. If we are unable to continue to license these technologies or to license other necessary technologies for inclusion in our products, or such third party technologies become subject to claims directed to or against the third party technologies used by us, or if we experience substantial increases in royalty payments under these third party licenses, our business could be materially and adversely affected.

Employees

As of December 31, 2013, we had a total of 241 employees within the following departments: 143 in engineering, 52 in sales and marketing, 22 in operations and customer support and 24 in management and administration. We are not subject to any collective bargaining agreement and we believe that our relationships with our employees are good.

Our future operating results are highly uncertain. Before deciding to invest in our common stock or to maintain or increase your investment, you should carefully consider the risks described below, in addition to the other information contained in this report and in our other filings with the SEC, including our reports on Forms 10-K, 10-Q and 8-K. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. If any of these risks actually occur, that could seriously harm our business, financial condition or results of operations. In that event, the market price for our common stock could decline and you may lose all or part of your investment.

10

We derive a significant portion of our revenues from sales of a small number of products to Sprint and Verizon Wireless, so our revenues and operating results are highly vulnerable to shifts in demand and may continue to decline.

In our Wireless business segment, we sell primarily to large carriers and original equipment manufacturers (“OEMs”), so there are a limited number of actual and potential customers for our products, resulting in customer concentration for sales of our products and services. For the year ended December 31, 2013, sales to Sprint and Verizon Wireless comprised 53.1% and 13.0% of our total revenues, respectively. Because of our customer concentration, these carriers and other large customers may have significant pricing power over us, and any material decrease in sales to any of them would materially affect our revenues and profitability. Additionally, carriers and OEMs are not the end-users of our products. If any of their efforts to market products and services incorporating our software are unsuccessful in the marketplace, our revenues and profitability could be adversely affected.

On July 10, 2013, Softbank and Sprint Nextel completed a merger which could further intensify the competitive pressures that we face. Furthermore, the uncertainties created by this merger could cause it to delay or cancel planned purchases of our products and services, particularly if there are proposed changes or uncertainties in the future management, product offerings and technical specifications of Sprint and its product portfolio.

We also derive a significant portion of our revenues from a few vertical markets, such as wireless carriers and handset manufacturers. In order to sustain and grow our business, we must continue to sell our software products into these vertical markets. Shifts in the dynamics of these vertical markets, such as new product introductions by our competitors, could materially harm our results of operations, financial condition and prospects. To increase our sales outside our core vertical markets, for example to large enterprises, requires us to devote time and resources to hire and train sales employees familiar with those industries. Even if we are successful in hiring and training sales teams, customers in other vertical markets may not need or sufficiently value our current products or new product introductions.

We announced a restructuring plan in July 2013 and we may take additional restructuring actions in the future that would result in additional charges, which would have a negative impact on our results of operations in the period the action is taken.

On July 25, 2013, the Board of Directors approved a new restructuring plan which was implemented primarily during the fiscal quarter ending September 30, 2013. This restructuring plan involved changes in management structure in order to streamline the organization, facility consolidations/closures, and headcount reductions that amounted to approximately 26% of the Company’s worldwide workforce. This resulted in one-time restructuring charges of approximately $5.6 million that was recorded in the three month period ended September 30, 2013. If the demand for our legacy and new products does not increase, we may need to take additional restructuring actions in future quarters, although we currently do not have any intention to do so. If future restructuring actions are taken, this could have a material adverse effect on our financial condition and results of operations in the period that the action is taken.

Our restructuring plan includes organizational changes and facility closures and consolidations, which could have a negative impact on our operations and customers.

Our recently announced restructuring plan involves a transfer of significant duties and responsibilities from employees who are being terminated and facilities which are being closed or consolidated. Such duties and responsibilities will be transferred to employees and facilities which we are retaining. If the transfer of duties and responsibilities, including underlying product knowledge and expertise of our existing product lines, is not executed successfully and seamlessly, this could adversely affect our levels of customer service and satisfaction, which could adversely affect our business and future revenues. In addition, the restructuring may cause us future difficulties in hiring and retaining highly skilled employees, particularly in competitive specialties.

11

If we fail to meet the requirements for continued listing on the NASDAQ Global Market, our common stock would likely be delisted from trading on the NASDAQ Global Market, which could adversely affect the liquidity of our common stock and cause our trading price to decline.

Our common stock is currently listed for quotation on the NASDAQ Global Market. We are required to meet specified financial requirements in order to maintain our listing on the NASDAQ Global Market. One such requirement is that we maintain a minimum closing bid price of at least $1.00 per share for our common stock. NASDAQ notified the Company on November 7, 2013 that the bid price of the Company’s common stock had closed below the minimum $1.00 per share requirement over the previous 30 consecutive business days and, as a result, the Company was not in compliance with Listing Rule 5450(a)(1). On November 25, 2013, NASDAQ notified the Company that the closing bid price of its common stock had been at $1.00 per share or greater for at least 10 consecutive business days. Accordingly, NASDAQ confirmed to the Company that it had regained compliance with the minimum bid price rule and the matter was now closed.

Our common stock price could again fall below the $1.00 per share threshold for 30 consecutive business days, in which case we would receive another deficiency letter. If we fail to satisfy the NASDAQ Global Market’s continued listing requirements, our common stock would likely be delisted from the NASDAQ Global Market, in which case our stock may trade on the NASDAQ Capital Market for a period of time, or our stock may trade on the OTC Bulletin Board. Any potential delisting of our common stock from the NASDAQ Global Market would likely result in decreased liquidity and increased volatility of our common stock, and could cause our trading price to decline.

Our quarterly revenues and operating results are difficult to predict and could fall below analyst or investor expectations, which could cause the price of our common stock to fall.

Our quarterly revenues and operating results have fluctuated significantly in the past and may continue to vary from quarter to quarter due to a number of factors, many of which are not within our control. If our operating results do not meet the expectations of securities analysts or investors, our stock price may decline. Fluctuations in our operating results may be due to a number of factors, including the following:

| • | the gain or loss of a key customer; |

| • | the size and timing of orders from and shipments to our major customers; |

| • | the size and timing of any product return requests; |

| • | our ability to maintain or increase gross margins; |

| • | variations in our sales channels or the mix of our product sales; |

| • | our ability to anticipate market needs and to identify, develop, complete, introduce, market and produce new products and technologies in a timely manner to address those needs; |

| • | the availability and pricing of competing products and technologies and the resulting effect on sales and pricing of our products; |

| • | acquisitions; |

| • | the effect of new and emerging technologies; |

| • | the timing of acceptance of new mobile services by users of our customers’ services; |

| • | deferrals of orders by our customers in anticipation of new products, applications, product enhancements or operating systems; and |

| • | general economic and market conditions. |

We have difficulty predicting the volume and timing of orders. In any given quarter, our sales have involved, and we expect will continue to involve, large financial commitments from a relatively small number of customers. As a result, the cancellation or deferral of even a small number of orders would

12

reduce our revenues, which would adversely affect our quarterly financial performance. Also, we have often booked a large amount of our sales in the last month of the quarter and often in the last week of that month. Accordingly, delays in the closing of sales near the end of a quarter could cause quarterly revenues to fall substantially short of anticipated levels. Significant sales may also occur earlier than expected, which could cause operating results for later quarters to compare unfavorably with operating results from earlier quarters.

Future orders may come from new customers, or from existing customers for new products. The sales cycles may be greater than what we have experienced in the past, increasing the difficulty to predict quarterly revenues.

Because we sell primarily to large carriers and OEM customers, we have no direct relationship with most end-users of our products. This indirect relationship delays feedback and blurs signals of change in the quick-to-evolve wireless ecosystem, and is one of the reasons we have difficulty predicting demand.

A large portion of our operating expenses, including rent, depreciation and amortization, is fixed and difficult to reduce or change. Accordingly, if our total revenue does not meet our expectations, we may not be able to adjust our expenses quickly enough to compensate for the shortfall in revenue. In that event, our business, financial condition and results of operations would be materially and adversely affected.

Due to all of the foregoing factors, and the other risks discussed in this report, you should not rely on quarter-to-quarter comparisons of our operating results as an indication of future performance.

We may have further impairments of long-lived assets if our business does not improve and our stock price declines which could cause a material adverse effect on our financial condition and results of operations.

The Company assesses potential impairment to its long-lived assets as required by FASB ASC Topic No. 360, Property, Plant, and Equipment, when there is evidence that events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. An impairment loss is recognized when the carrying amount of the long-lived assets exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. Any required impairment loss is measured as the amount by which the carrying amount of a long-lived asset exceeds its fair value and is recorded as a reduction in the carrying value of the related asset and a charge to operating results.

For the year ended December 31, 2013, we recorded a charge for impairment of long-lived assets of $1.0 million as a result of our 2013 restructuring. For the year ended December 31, 2011, we recorded a charge for impairment of long-lived assets of $18.7 million ($13.4 million on intangible assets and $5.3 million on fixed assets) due, in part, to continued declines in our revenues and profitability and our continued depressed stock price. In future years, we may be required to take further charges for impairment of equipment and improvements, which could have a material adverse effect on our financial condition and results of operations.

Technology and customer needs change rapidly in our market, which could render our products obsolete and negatively affect our business, financial condition and results of operations.

Our success depends on our ability to anticipate and adapt to changes in technology and industry standards. We will also need to continue to develop and introduce new and enhanced products to meet our target markets’ changing demands, keep up with evolving industry standards, including changes in the Microsoft, Google and Apple operating systems with which our products are designed to be compatible, and to promote those products successfully. The communications and utilities software markets in which we operate are characterized by rapid technological change, changing customer needs, frequent new product introductions, evolving industry standards and short product life cycles. In addition, the technology we market, which has been sold as software in the past, can be integrated at the chipset level by the leading mobile chipset manufacturers. Any of these factors could render our existing products obsolete and unmarketable. In addition, new products and product enhancements can require long development and

13

testing periods as a result of the complexities inherent in today’s computing environments and the performance demanded by customers and called for by evolving wireless networking technologies. If our target markets do not develop as we anticipate, our products do not gain widespread acceptance in these markets, or we are unable to develop new versions of our software products that can operate on future wireless networks and PC and mobile device operating systems and interoperate with other popular applications, our business, financial condition and results of operations could be materially and adversely affected.

Competition within our target markets is intense and includes numerous established competitors and new entrants, which could negatively affect our revenues and results of operations.

We operate in markets that are extremely competitive and subject to rapid changes in technology. Because there are low barriers to entry into the software markets in which we participate and may participate in the future, we expect significant competition to continue from both established and emerging software companies in the future, both domestic and international. In fact, our growth opportunities in new product markets could be limited to the extent established and emerging software companies enter or have entered those markets. Furthermore, our existing and potential OEM customers may acquire or develop products that compete directly with our products.

Many of our other current and prospective competitors have significantly greater financial, marketing, service, support, technical and other resources than we do. As a result, they may be able to adapt more quickly than we can to new or emerging technologies and changes in customer requirements or to devote greater resources to the promotion and sale of their products. Announcements of competing products by competitors could result in the cancellation of orders by customers in anticipation of the introduction of such new products. In addition, some of our competitors are currently making complementary products that are sold separately. Such competitors could decide to enhance their competitive position by bundling their products to attract customers seeking integrated, cost-effective software applications. Some competitors have a retail emphasis and offer OEM products with a reduced set of features. The opportunity for retail upgrade sales may induce these and other competitors to make OEM products available at their own cost or even at a loss. We also expect competition to increase as a result of software industry consolidations, which may lead to the creation of additional large and well-financed competitors. Increased competition is likely to result in price reductions, fewer customer orders, reduced margins and loss of market share.

We are entering new, emerging markets in which we have limited experience; if these markets do not develop or we are unable to otherwise succeed in them, our revenues will suffer and the price of our common stock will likely decline.

Our recent and planned product introductions to support new higher speed networking and 4G technologies have allowed us to enter new markets. A viable market for these products may not develop or be sustainable, and we may face intense competition in these markets. In addition, our success in these markets depends on our carrier customers’ ability to successfully introduce new mobile services enabled by our products and our ability to broaden our carrier customer base, which we believe will be difficult and time-consuming. If the expected benefits from entering new markets do not materialize, our revenues will suffer and the price of our common stock would likely decline. In addition, to the extent we enter new markets through acquisitions of companies or technologies, our financial condition could be harmed or our stockholders could suffer dilution without a corresponding benefit to our company if we do not realize expected benefits of entering such new markets.

14

If the adoption of and investments in new technologies and services grows more slowly than anticipated in our product planning and development, our operating results, financial condition and prospects may be negatively affected.

If the adoption of and investments in new networking and 4G technologies and services does not grow or grows more slowly than anticipated, we will not obtain the anticipated returns from our planning and development investments. For example, our Enterprise products allow our customers to update mobile devices from a home office and incorporate technology that provides a mechanism to allow for efficient firmware updates for mobile devices. In addition, we have introduced new high-speed networking and 4G products, but the pace of the market introduction of such technologies is uncertain. Future sales and any future profits from these and related products are substantially dependent upon the acceptance and use of these new technologies, and on the continued adoption and use of mobile data services by end-users.

Many of our customers and other communications service providers have made and continue to make major investments in next generation networks that are intended to support more complex applications. If communications service providers delay their deployment of networks or fail to deploy such networks successfully, demand for our products could decline, which would adversely affect our revenues. Also, to the extent we devote substantial resources and incur significant expenses to enable our products to be interoperable with new networks that have failed or have been delayed or not deployed, our operating results, financial condition and prospects may be negatively affected.

If we are unable to retain key personnel, the loss of their services could materially and adversely affect our business, financial condition and results of operations.

Our future performance depends in significant part upon the continued service of our senior management and other key technical and consulting personnel. We do not have employment agreements with our key employees that govern the length of their service. The loss of the services of our key employees would materially and adversely affect our business, financial condition and results of operations. Our future success also depends on our ability to continue to attract, retain and motivate qualified personnel, particularly highly skilled engineers involved in the ongoing research and development required to develop and enhance our products. Competition for these employees remains high and employee retention is a common problem in our industry. Our inability to attract and retain the highly trained technical personnel that are essential to our product development, marketing, service and support teams may limit the rate at which we can generate revenue, develop new products or product enhancements and generally would have an adverse effect on our business, financial condition and results of operations.

We rely directly and indirectly on third-party intellectual property and licenses, which may not be available on commercially reasonable terms or at all.

Many of the Company’s products and services include third-party intellectual property, which requires licenses from those third parties directly to us or to unrelated companies which provide us with sublicenses and/or execution of services for the operation of our business. These products and services include our wireless suite of products as well as our productivity and graphics products. The Company has historically been able to obtain such licenses on reasonable terms. There is however no assurance that in the future the necessary licenses could be obtained on acceptable terms or at all. If the Company or our third party service providers are unable to obtain or renew critical licenses on reasonable terms, we may be forced to terminate or curtail our products and services which rely on such intellectual property and our financial condition and operating results may be materially adversely affected.

If we fail to continue to establish and maintain strategic relationships with mobile device manufacturers, wireless carriers and network infrastructure manufacturers, market acceptance of our products and our profitability may suffer.

Most of our strategic relationships with mobile device manufacturers are not subject to written contract, but rather are in the form of informal working relationships. We believe these relationships are valuable to our success. In particular, these relationships provide us with insights into product development and emerging technologies, which allows us to keep abreast of, or anticipate, market trends and helps us serve our current and prospective customers. Because these relationships are not typically governed by written agreements, there is no obligation for many of our partners to continue working with us. If we are unable to maintain our existing strategic relationships with mobile device manufacturers or if we fail to enter into additional strategic relationships or the parties with whom we have strategic relationships favor one of our

15

competitors, our ability to provide products that meet our current and prospective customers’ needs could be compromised and our reputation and future revenue prospects could suffer. For example, if our software does not function well with a popular mobile device because we have not maintained a relationship with its manufacturer, carriers seeking to provide that device to their respective customers could choose a competitor’s software over ours or develop their own. Even if we succeed in establishing these relationships, they may not result in additional customers or revenues.

Our growth depends in part on our customers’ ability and willingness to promote services and attract and retain new customers or achieve other goals outside of our control.

We sell our products for use on handheld devices primarily through our carrier customers. Losing the support of these customers may limit our ability to compete in existing and potential markets and could negatively affect our revenues. In addition, the success of these customers and their ability and willingness to market services supported by our products is critical to our future success. Our ability to generate revenues from sales of our software is also constrained by our carrier customers’ ability to attract and retain customers. We have no input into or influence upon their marketing efforts and sales and customer retention activities. If our large carrier customers fail to maintain or grow demand for their services, revenues or revenue growth from our products designed for use on mobile devices will decline and our results of operations will suffer.

The ongoing uncertainty and volatility in U.S. and worldwide economic conditions may adversely affect our operating results.

Our operations and performance depend significantly on economic conditions in the United States and worldwide. The U.S. and global economic outlook remains uncertain. A general weakening of, and related decline of confidence in, the U.S. and global economies or the curtailment in government or corporate spending could make it difficult for current or potential wireless carrier and OEM customers and their end users to accurately forecast and plan future business activities and capital expenditures, which could cause them to slow spending on our products and services. These and other economic factors could adversely affect demand for our products and services and our financial condition and operating results, and may require us to record additional charges related to restructuring costs and/or the impairment of long-lived assets.

Acquisitions of companies or technologies may disrupt our business and divert management attention and cause our current operations to suffer.

We have historically made targeted acquisitions of smaller companies with important technology and expect to continue to do so in the future. As part of any acquisition, we will be required to assimilate the operations, products and personnel of the acquired businesses and train, retain and motivate key personnel from the acquired businesses. We may not be able to maintain uniform standards, controls, procedures and policies if we fail in these efforts. Similarly, acquisitions may cause disruptions in our operations and divert management’s attention from our company’s day-to-day operations, which could impair our relationships with our current employees, customers and strategic partners. Acquisitions may also subject us to liabilities and risks that are not known or identifiable at the time of the acquisition.

We may also have to incur debt or issue equity securities in order to finance future acquisitions. Our financial condition could be harmed to the extent we incur substantial debt or use significant amounts of our cash resources in acquisitions. The issuance of equity securities for any acquisition could be substantially dilutive to our existing stockholders. In addition, we expect our profitability could be adversely affected because of acquisition-related accounting costs, write offs, amortization expenses, and charges related to acquired intangible assets. In consummating acquisitions, we are also subject to risks of entering geographic and business markets in which we have had limited or no prior experience. If we are unable to fully integrate acquired businesses, products or technologies within existing operations, we may not receive the intended benefits of acquisitions.

16

Our operating income or loss may continue to change due to shifts in our sales mix and increased spending on our research and development.

Our operating income or loss can change quarter to quarter and year to year due to a change in our sales mix and the timing of our continued investments in research and development and infrastructure. We continue to invest in research and development which is the lifeline of our technology portfolio. The timing of these additional expenses can vary significantly quarter to quarter and even from year to year.

Our products may contain undetected software defects, which could negatively affect our revenues.

Our software products are complex and may contain undetected defects. In the past, we have discovered software defects in certain of our products and have experienced delayed or lost revenues during the period it took to correct these problems. Although we and our OEM customers test our products, it is possible that errors may be found or occur in our new or existing products after we have commenced commercial shipment of those products. Defects, whether actual or perceived, could result in adverse publicity, loss of revenues, product returns, a delay in market acceptance of our products, loss of competitive position or claims against us by customers. Any such problems could be costly to remedy and could cause interruptions, delays, or cessation of our product sales, which could cause us to lose existing or prospective customers and could negatively affect our results of operations. In addition, some of our software contains open source components that are licensed under the GNU General Public License and similar open source licenses. These components may contain undetected defects or incompatibilities, may cause us to lose control over the development of portions of our software code, and may expose us to claims of infringement if these components are, or incorporate, infringing materials, the licenses are not enforceable or are modified to become incompatible with other open source licenses, or exposure to misappropriation claims if these components include unauthorized materials from a third party.

Regulations affecting our customers and us and future regulations, to which they or we may become subject to, may harm our business.

Certain of our customers in the communications industry are subject to regulation by the Federal Communications Commission, which could have an indirect effect on our business. In addition, the United States telecommunications industry has been subject to continuing deregulation since 1984. We cannot predict when, or upon what terms and conditions, further regulation or deregulation might occur or the effect regulation or deregulation may have on demand for our products from customers in the communications industry. Demand for our products may be indirectly affected by regulations imposed upon potential users of those products, which may increase our costs and expenses.

We may be unable to adequately protect our intellectual property and other proprietary rights, which could negatively impact our revenues.

Our success is dependent upon our software code base, our programming methodologies and other intellectual properties and proprietary rights. In order to protect our proprietary technology, we rely on a combination of trade secrets, nondisclosure agreements, patents, and copyright and trademark law. We currently own U.S. trademark registrations for certain of our trademarks and U.S. patents for certain of our technologies. However, these measures afford us only limited protection. Furthermore, we rely primarily on “shrink wrap” licenses that are not signed by the end user and, therefore, may be unenforceable under the laws of certain jurisdictions. Accordingly, it is possible that third parties may copy or otherwise obtain our rights without our authorization. It is also possible that third parties may independently develop technologies similar to ours. It may be difficult for us to detect unauthorized use of our intellectual property and proprietary rights.

We may be subject to claims of intellectual property infringement as the number of trademarks, patents, copyrights and other intellectual property rights asserted by companies in our industry grows and the coverage of these patents and other rights and the functionality of software products increasingly overlap. From time to time, we have received communications from third parties asserting that our trade name or features, content, or trademarks of certain of our products infringe upon intellectual property rights held by

17

such third parties. We have also received correspondence from third parties separately asserting that our products may infringe on certain patents held by each of the parties. Although we are not aware that any of our products infringe on the proprietary rights of others, third parties may claim infringement by us with respect to our current or future products. Additionally, our customer agreements require that we indemnify our customers for infringement claims made by third parties involving our intellectual property embedded in their products. Infringement claims, whether with or without merit, could result in time-consuming and costly litigation, divert the attention of our management, cause product shipment delays or require us to enter into royalty or licensing agreements with third parties. If we are required to enter into royalty or licensing agreements, they may not be on terms that are acceptable to us. Unfavorable royalty or licensing agreements could seriously impair our ability to market our products.

We may raise additional capital through the issuance of additional equity or convertible debt securities or by borrowing money, in order to meet our capital needs. Additional funds may not be available on terms acceptable to us to allow us to meet our capital needs.

We believe that the cash and cash equivalents and short-term investments on hand and the cash we expect to generate from operations will be sufficient to meet our capital needs for at least the next twelve months. However, it is possible that we may need or choose to obtain additional financing to fund our activities in the future. We could raise these funds by selling more stock to the public or to selected investors, or by borrowing money. We may not be able to obtain additional funds on favorable terms, or at all. If adequate funds are not available, we may be required to curtail our operations or other business activities significantly or to obtain funds through arrangements with strategic partners or others that may require us to relinquish rights to certain technologies or potential markets.

In addition, we may file with the SEC a shelf registration statement to sell from time to time additional shares of our common stock in one or more offerings in amounts, at prices and on the terms that we will determine at the time of offering. If we raise additional funds by issuing additional equity or convertible debt securities (whether in a public offering or private placement), the ownership percentages of existing stockholders would be reduced. In addition, the equity or debt securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock. We currently have no established line of credit or other business borrowing facility in place.

It is possible that our future capital requirements may vary materially from those now planned. The amount of capital that we will need in the future will depend on many factors, including:

| • | the market acceptance of our products; |

| • | the levels of promotion and advertising that will be required to launch our products and achieve and maintain a competitive position in the marketplace; |

| • | our business, product, capital expenditure and research and development plans and product and technology roadmaps; |

| • | the levels of inventory and accounts receivable that we maintain; |

| • | capital improvements to new and existing facilities; |

| • | our ability to meet our headcount hiring commitment to the state of Pennsylvania; |

| • | technological advances; |

| • | our competitors’ response to our products; and |

| • | our relationships with suppliers and customers. |

In addition, we may raise additional capital to accommodate planned growth, hiring, infrastructure and facility needs or to consummate acquisitions of other businesses, products or technologies.

18

Our business, financial condition and operating results could be adversely affected as a result of legal, business and economic risks specific to international operations.

In recent years, our revenues derived from sales to customers outside the U.S. have not been material. Our revenues derived from such sales can vary from quarter to quarter and from year to year. We also frequently ship products to our domestic customers’ international manufacturing divisions and subcontractors. In the future, we may expand these international business activities. International operations are subject to many inherent risks, including:

| • | general political, social and economic instability; |

| • | trade restrictions; |

| • | the imposition of governmental controls; |

| • | exposure to different legal standards, particularly with respect to intellectual property; |

| • | burdens of complying with a variety of foreign laws; |

| • | import and export license requirements and restrictions of the United States and any other country in which we operate; |

| • | unexpected changes in regulatory requirements; |

| • | foreign technical standards; |

| • | changes in tariffs; |

| • | difficulties in staffing and managing international operations; |

| • | difficulties in securing and servicing international customers; |

| • | difficulties in collecting receivables from foreign entities; |

| • | fluctuations in currency exchange rates and any imposition of currency exchange controls; and |

| • | potentially adverse tax consequences. |

These conditions may increase our cost of doing business. Moreover, as our customers are adversely affected by these conditions, our business with them may be disrupted and our results of operations could be adversely affected.

Security and privacy breaches may harm our business.

The uninterrupted operation of our hosted solutions and the confidentiality and security of third-party information is critical to our business. Any failures in our security and privacy measures could have a material adverse effect on our financial position and results of operations. If we are unable to protect, or our customers perceive that we are unable to protect, the security and privacy of our electronic information, our growth could be materially adversely affected. A security or privacy breach may:

| • | cause our customer to lose confidence in our solutions; |

| • | harm our reputation; |

| • | expose us to liability; and |

| • | increase our expense from potential remediation costs. |

While we believe we use proven applications designed for data security and integrity to process electronic transactions, there can be no assurance that our use of these applications will be sufficient to address changing market conditions or the security and privacy concerns of existing and potential customers. In addition, our customers and end users may use our products and services in a manner which violates security or data privacy laws in one or more jurisdictions. Any significant or high profile data privacy breaches or violations of data privacy laws, whether directly through our hosted solutions or by third parties using our products and services, could result in the loss of business and reputation, litigation against us and regulatory investigations and penalties that could adversely affect our operating results and financial condition.

19

Interruptions or delays in service from data center hosting facilities could impair the delivery of our service and harm our business.

We currently serve our customers from data center hosting facilities. Any damage to, or failure of, our systems generally could result in interruptions in our service. Interruptions in our service may reduce our revenue, cause us to issue credits or pay penalties, cause customers to terminate their on-demand services and adversely affect our renewal rates and our ability to attract new customers.

We may have exposure to additional tax liabilities.

As a multinational corporation, we are subject to income taxes as well as sales, use and other non-income based taxes, in both the United States and various foreign jurisdictions. Significant judgment is required in determining our worldwide provision for income taxes, sales and use taxes, and other tax liabilities. Changes in tax laws or tax rulings may have a significantly adverse impact on our effective tax rate.

We are also subject to non-income based taxes, such as payroll, sales, use, value-added, net worth, property and goods and services taxes, in both the United States and various foreign jurisdictions. We are regularly under audit by tax authorities with respect to these non-income based taxes and may have exposure to additional non-income based tax liabilities. An increasing number of states have considered or adopted laws that attempt to impose obligations on out-of-state retailers to collect sales and use taxes on their behalf. A successful assertion by one or more states or foreign countries requiring us to collect sales and use taxes where we do not do so could result in substantial tax liabilities, including for past sales, as well as penalties and interest.

Although we believe that our income and non-income based tax estimates are reasonable, there is no assurance that our provisions for taxes are correct, or that the final determination of tax audits or tax disputes will not be different from what is reflected in our historical income tax provisions and accruals. If we are required to pay substantially more taxes in the future or for prior periods, our operating results and financial condition could be adversely affected

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate headquarters, including our principal administrative, sales and marketing, customer support and research and development facility, is located in Aliso Viejo, California, where we currently lease and occupy approximately 52,700 square feet of space pursuant to leases that expire on May 31, 2016 and January 31, 2022. We lease approximately 55,600 square feet in Pittsburgh, Pennsylvania under a lease that expires December 31, 2021. We lease approximately 16,000 square feet in Sunnyvale, California under a lease that expires February 28, 2015. We lease approximately 15,300 square feet in Watsonville, California under a lease that expires September 30, 2018. Internationally, we lease space in Belgrade, Serbia that expires December 30, 2016.

20

The Company is and may become involved in various legal proceedings arising from its business activities. While management does not believe the ultimate disposition of these matters will have a material adverse impact on the Company’s consolidated results of operations, cash flows or financial position, litigation is inherently unpredictable, and depending on the nature and timing of these proceedings, an unfavorable resolution could materially affect the Company’s future consolidated results of operations, cash flows or financial position in a particular period.

Item 4. MINE SAFETY DISCLOSURES

Not Applicable.

21

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is traded on the NASDAQ Global Market under the symbol “SMSI.” The high and low sale prices for our common stock as reported by NASDAQ are set forth below for the periods indicated.

| High | Low | |||||||

| YEAR ENDED DECEMBER 31, 2013: |

||||||||

| First Quarter |

$ | 1.78 | $ | 1.26 | ||||

| Second Quarter |

1.49 | 1.06 | ||||||

| Third Quarter |

1.31 | 0.88 | ||||||

| Fourth Quarter |

1.57 | 0.79 | ||||||

| YEAR ENDED DECEMBER 31, 2012: |

||||||||

| First Quarter |

$ | 2.87 | $ | 1.14 | ||||

| Second Quarter |

2.37 | 1.46 | ||||||

| Third Quarter |

2.16 | 1.49 | ||||||

| Fourth Quarter |

1.89 | 1.10 | ||||||

On February 18, 2014, the closing sale price for our common stock as reported by NASDAQ was $1.79.

For information regarding Securities Authorized for Issuance under Equity Compensation Plans, please refer to Item 12.

Stock Performance Graph

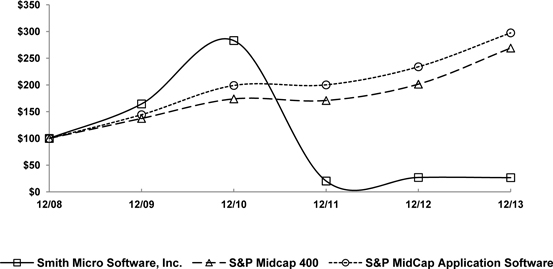

The following graph and information compares the cumulative total stockholder return on our common stock against the cumulative total return of the S&P Midcap 400 Index and the S&P Midcap Applications Software Index (Peer Group) for the same period.

The graph covers the period from December 31, 2008 through December 31, 2013. The graph assumes that $100 was invested in our common stock on December 31, 2008, and in each index, and that all dividends were reinvested. No cash dividends have been declared on our common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

22

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Smith Micro Software, Inc., the S&P Midcap 400 Index, and S&P MidCap Application

Software

*$100 invested on 12/31/08 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

Copyright© 2014 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

| 12/08 | 12/09 | 12/10 | 12/11 | 12/12 | 12/13 | |||||||||||||||||||

| Smith Micro Software, Inc. |

100.00 | 164.57 | 283.09 | 20.32 | 26.98 | 26.62 | ||||||||||||||||||

| S&P Midcap 400 |

100.00 | 137.38 | 173.98 | 170.96 | 201.53 | 269.04 | ||||||||||||||||||

| S&P MidCap Application Software |

100.00 | 144.42 | 199.15 | 200.22 | 234.09 | 297.54 | ||||||||||||||||||

Holders

As of February 18, 2014, there were approximately 161 holders of record of our common stock based on information provided by our transfer agent.

23

Dividends

We have never paid any cash dividends on our common stock and we have no current plans to do so.

Recent Sales of Unregistered Securities

None.

Purchases of Equity Securities by the Company

The table set forth below shows all purchases of securities by us during the fiscal year 2013:

| ISSUER PURCHASES OF EQUITY SECURITIES | ||||||||||||||||||

| Period | Total |

Average Paid per |

Total Number of as Part of |

Maximum of Shares (or |

||||||||||||||

| Jan. 1-31, 2013 |

- | - | - | 4,625,000 | ||||||||||||||

| Feb. 1-28, 2013 |

- | - | - | 4,625,000 | ||||||||||||||

| Mar. 1-31. 2013 |

5,122 | $ | 1.45 | - | 4,625,000 | |||||||||||||

| Apr. 1-30, 2013 |

- | - | - | 4,625,000 | ||||||||||||||

| May 1-31, 2013 |

- | - | - | 4,625,000 | ||||||||||||||

| Jun. 1-30, 2013 |

29,681 | $ | 1.38 | - | 4,625,000 | |||||||||||||

| July 1-31, 2013 |

- | - | - | 4,625,000 | ||||||||||||||

| Aug. 1-31, 2013 |

- | - | - | 4,625,000 | ||||||||||||||

| Sep. 1-30, 2013 |

29,296 | $ | 1.13 | - | 4,625,000 | |||||||||||||

| Oct. 1-31, 2013 |

- | - | - | 4,625,000 | (b) | |||||||||||||

| Nov. 1-30, 2013 |

- | - | - | - | ||||||||||||||

| Dec. 1-31, 2013 |

32,131 | $ | 1.04 | - | - | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

96,230 | (a) | - | - | ||||||||||||||

24

The above table includes:

(a) Acquisition of stock by the Company as payment of withholding taxes in connection with the vesting of restricted stock awards, in an aggregate amount of 96,230 shares during the periods set forth in the table. All of the shares were cancelled when they were acquired.