EXHIBIT 2.7

CONTENTS

| 2003 ANNUAL REPORT | 1

|

| Board of Directors 1 |

Chairman | Carlo Buora * (E) 4 | ||

| Deputy Chairman | Gianni Mion ** 5 | |||

| CEO | Marco De Benedetti *** (E) | |||

| Directors | Carlo Bertazzo | |||

| Lorenzo Caprio (I) 6 | ||||

| Oscar Carlos Cristianci 7 | ||||

| Enzo Grilli (I) | ||||

| Attilio Leonardo Lentati (I) | ||||

| Gioacchino Paolo Maria Ligresti (I) 8 | ||||

| Giuseppe Lucchini 9 | ||||

| Gaetano Miccichè 10 | ||||

| Enrico Parazzini 11 | ||||

| Paolo Savona (I) | ||||

| Mauro Sentinelli **** (E) 12 | ||||

| Rodolfo Zich | ||||

| Secretary to the Board | Antonio Sanna | |||

| Remuneration |

Chairman | Enzo Grilli | ||

| Committee ***** |

||||

| Committee Members | Attilio Leonardo Lentati 13 | |||

| Rodolfo Zich | ||||

| Internal Control |

Chairman | Paolo Savona | ||

| Committee ****** |

||||

| Committee Members | Lorenzo Caprio 14 | |||

| Attilio Leonardo Lentati | ||||

| Board of Statutory |

Chairman | Pietro Adonnino | ||

| Auditors 2 |

||||

| Statutory Auditors | Enrico Laghi | |||

| Gianfranco Zanda | ||||

| Alternate Auditors | Alfredo Malguzzi | |||

| Antonio Mastrapasqua | ||||

| General Manager |

Mauro Sentinelli | |||

| Common representative of savings shareholders | Carlo Pasteris 15 | |||

| External Auditors 3 |

Reconta Ernst & Young | |||

| 1 | Appointed by the Shareholders’ Meeting of December 14, 2001. |

| 2 | Appointed by the Shareholders’ Meeting of April 12, 2002. |

| 3 | Appointed by the Shareholders’ Meeting of April 11, 2001. |

| 4 | Post assigned by the Board of Directors’ meeting of September 4, 2002. |

| 5 | Post assigned by the Board of Directors’ meeting of September 4, 2002. |

| 6 | Appointed by the Shareholders’ Meeting of April 14, 2003. |

| 7 | Appointed by the Shareholders’ Meeting of December 11, 2002. |

| 8 | Appointed by co-option by the Board of Directors on May 5, 2003. |

| 9 | Appointed by the Shareholders’ Meeting of April 14, 2003. |

| 10 | Appointed by the Shareholders’ Meeting of December 11, 2002. |

| 11 | Appointed by the Shareholders’ Meeting of December 11, 2002. |

| 12 | Appointed by the Shareholders’ Meeting of April 12, 2002. |

| 13 | Appointed by the Board of Directors’ meeting of April 12, 2002. |

| 14 | Appointed by the Board of Directors’ meeting of May 5, 2003. |

| 15 | Appointed by the Special Category Meeting of April 11, 2002. |

| * | Vested with the power of legal representation and signature in dealings with third parties and before the court; conducts own activities as part of the powers granted by the Board of Directors during the meeting held on September 4, 2002, in observance of applicable legal restrictions on matters that cannot be delegated by the Board of Directors, the reservations set aside for the Board, and the principles and limitations set forth by the company’s Code of Corporate Governance. |

| ** | Vested with the power of legal representation and signature in dealings with third parties and before the court, in case of absence or impediment of the Chairman, as decided by the Board of Directors during the meeting held on September 4, 2002. |

| *** | Vested with the power of legal representation and signature in dealings with third parties and before the court; conducts own activities as part of the powers granted by the Board of Directors during the meeting held on December 14, 2001, in observance of applicable legal restrictions on matters that cannot be delegated by the Board of Directors, the reservations set aside for the Board, and the principles and limitations set forth by the company’s Code of Corporate Governance. |

| **** | Vested with specific powers pertaining to business operations, conferred on him by the Board of Directors on December 14, 2001. |

| ***** | The new Self-Regulatory Code, approved by the Board of Directors on September 1, 2003, establishes that the Remuneration Committee, composed of Non-executive Directors, submits proposals to the Board regarding the compensation paid to CEOs and persons who hold certain positions, generally entailing that part of the overall remuneration to said parties is linked to the financial results achieved by the Company and by the Group, as well as the achievement of specific objectives that have been set. Based on the indications of the Director delegated for this purpose, the Committee also draws up proposals to determine the criteria for remunerating the Company’s top management and establish any stock option plans or the allotment of shares. |

| ****** | The new Self-Regulatory Code, approved by the Board of Directors on September 1, 2003, establishes that the Internal Control Committee must be composed of Independent Directors whose role is to act as consultants and submit proposals. The Chairman of the Board of Statutory Auditors or another Statutory Auditor designated by said Chairman also participates in the works of the Committee. Specifically, the Internal Control Committee assists the Board in performing the tasks set forth in Article 11.2 of the Code of Corporate Governance (which confirms that “the Board defines the guidelines of the internal control system and verifies its correct operation, with reference to the management of corporate risks”). It evaluates the work plan prepared by the persons responsible for internal control and receives their periodic reports. With the administrative management of the Company and the auditors, it evaluates the adequacy of the accounting principles that are used and their uniformity for the purposes of drawing up the consolidated financial statements. It evaluates proposals submitted by the external auditors in order to be assigned to this job, as well as the audit work plan and the results set out in the report and letter of suggestions. It reports to the Board at least once every six months, at the time the annual and half-year financial statements are approved, in order to detail the activities that have been carried out and the adequacy of the internal control work. It also carries out additional tasks that may be assigned to it by the Board of Directors, particularly with regard to relations with the external auditors. The Committee also monitors the observance and periodic update of the rules of corporate governance. |

| (E): | Executive Director |

| (I): | Independent Director |

| 2003 ANNUAL REPORT | 2

|

Shareholders,

2003 was a year of sluggish growth for Italy as a whole and it is only now that the very first signs of macroeconomic recovery are being felt, although market confidence in an upturn and future expansion remains subdued. In particular, the Italian economy is still held back by the drop in investments and exports due to the strength of the Euro.

In stark contrast with this overall scenario, the telecommunications sector featured a significant growth rate, displaying an anti-cyclical tendency when compared to the context of reference, especially in the current phase of consolidation of the industry.

In this scenario TIM continues to reinforce its leading position within the Italian wireless telecommunications sector, with about 26.1 million connections at the end of 2003 and very encouraging results in terms of profitability, efficiency and value creation, a ROI (Return on Investment) of 52% up 16.2 percentage points since the end of 2002.

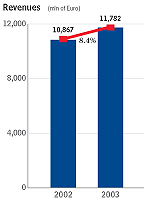

The main results attained in 2003 basically consisted in maintaining profit margins high, in a climate of significant growth: since the end of 2002, the TIM Group’s revenues grew by 8.4% while the gross operating profit rose by 9.2%; in the case of TIM SpA, the gross operating profit increased by 11.2% over figures for 2002.

With a positive net financial position of Euro 0.9 billion at the Group level and Euro 1.4 billion for TIM SpA alone, even after financing technical investments amounting to Euro 2.0 billion for the Group and distributing dividends in the amount of Euro 0.4 billion, TIM confirmed its leading position in terms of profitability.

The Company’s financial resources serve, on the one hand, to compensate its shareholders through the distribution of a dividend for the year that ensures a very significant payout, and on the other, to finance industrial investments directed at consolidating the TIM brand as a hallmark of state-of-the-art technology and innovation worldwide.

These results are the outcome of the high level of professionalism of TIM’s human capital, constant commitment in investment strategy, and the high placement of the technological frontier. This is demonstrated by the fact that TIM was the first carrier in Italy and in Europe to conduct solid testing of EDGE, a technology that makes it possible to anticipate and expand new-generation mobile services more rapidly. At the same time, TIM laid the groundwork for a new business cycle that is bound to be marked by the widespread use of UMTS technology and the mushrooming of the new services that UMTS makes possible.

At the international level, 2003 saw the further consolidation of the Company’s portfolio and the focusing of financial and managerial resources on Latin America and the Mediterranean Basin, aimed at allowing the Company to attain an international dimension capable of generating synergies and economies of scale. TIM’s main

| 2003 ANNUAL REPORT | 3

|

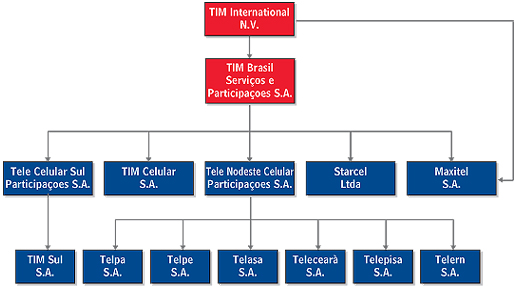

success in 2003 consisted in the commercial launching of GSM in Brazil, that attracted 2.7 million lines by the end of the year.

Special mention must also be made of the Pan-European alliance between TIM, T-Mobile International, Telefonica Moviles and Orange that was set up with a view to improving the voice, data and wireless Internet service offerings to international customers, through a joint international presence, initially targeted at the European countries in which the various companies already operate, and to be later extended worldwide.

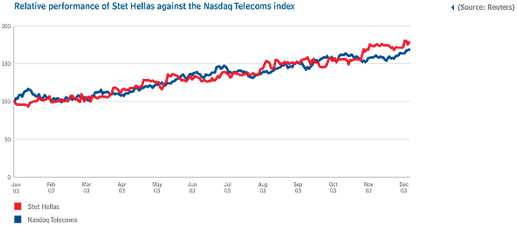

Further progress was achieved in increasing integration with subsidiaries, especially through the brand harmonization process that was recently completed with the re-branding of the Greek trade name Telestet as TIM. As a result, the subsidiary Stet Hellas can now reinforce its corporate image and offer better products and services, by exploiting the leverage acquired through the brand recognition of the TIM trade mark as well as the Group’s technological know-how.

In 2004, TIM intends to continue its efforts towards the development of innovation, especially so as to maintain its reputation as an ICT pioneer in Italy, and extend the same throughout Europe and in Latin America. TIM’s efforts in this direction will continue to be oriented towards the implementation of new technologies, especially UMTS that has marked a turning point for the market and for which TIM has been preparing for quite some time. The challenge in 2004 consists in being ready to take full advantage of the new horizons opened by third generation technology and, above all, to offer customers a range of new wireless services (from multimedia messaging, to video calls and wireless office applications) but in a transparent manner in light of the technology used, while ensuring the levels of quality and customer satisfaction that have always served as the hallmark of excellence of TIM’s services.

At the international level, the Company aims at continuing consolidation and integration with subsidiaries, with a view to exploiting in foreign markets, the results and know-how generated in Italy.

The greatest challenge for 2004 will be to expand market share in Brazil, to become the country’s second largest carrier.

TIM will remain firmly committed to the creation of value over time, in the interest of its Shareholders and customers, and to proactively contributing to the commitment that the Telecom Italia Group has always had towards the development of Italy.

| The Chairman | The CEO | |||

| Carlo Buora | Marco De Benedetti | |||

|

| |||

| 2003 ANNUAL REPORT | 4

|

YEAR 2003

| • | Growth in consolidated revenues driven by Italy and Brazil, despite the currency effect: |

| • | consolidated revenues Euro 11,782 million, +8.4% compared to 2002; |

| • | growth in revenues at equalized exchange rates, +12.6% compared to the previous period; |

| • | revenues in Italy of Euro 9,469 million, +6.2% compared to 2002 (pro forma without Blu). |

| • | Strong growth in margins, benefiting also from cancellation of the contribution for telecommunications activities; the negative effect of the exchange rate and the start up of operations in Brazil have influenced consolidated results: |

| • | consolidated GOP was Euro 5,502 million, +9.2% compared to 2002; ratio of GOP to revenues was 46.7%, as compared to 46.4% in the previous period; |

| • | growth in GOP at equalized exchange rates, +10.2% compared to 2002; |

| • | GOP for Italy Euro 5,035 million, +11.2% compared to 2002 (pro forma without Blu); ratio of GOP to revenues 53.2% compared to 50.8% in 2002 (pro forma without Blu). |

| • | Growth in operating income and profitability, despite the Brazilian start up: |

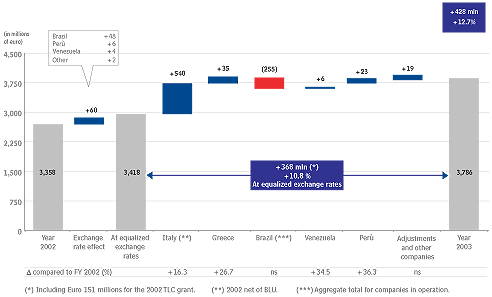

| • | consolidated operating income Euro 3,786 million, +12.7% compared to 2002; profitability (operating income to revenues) 32.1%, compared to 30.9% in 2002; |

| • | at equalized exchanges, the growth in operating income was 10.8%; |

| • | operating income for TIM Italia Euro 3,863 million, +16.3% compared to 2002 (pro forma without Blu); profitability (operating income to revenues) 40.8%, compared to 37.3% in 2002 (pro forma without Blu). |

| • | Consolidated income before extraordinary items and taxes Euro 3,790 million, up 26.9% compared to 2002. |

| • | Acknowledgment of the sentence handed down by the Court of Justice of the European Communities: |

| • | following the sentence handed down by the Court of Justice of the European Communities regarding the illegitimacy of the contribution for telecommunications activities, in 2003 TIM reversed provisions allocated in 2003 and posted windfall gains of Euro 543 million for the payable amount matured through December 31, 2002. This had a positive effect on the Statement of Income for a total of Euro 334 million net of taxes. |

| • | Other extraordinary operations: |

| • | in 2003, TIM International adjusted the book value of equity investments in TIM Perù and in Digitel. TIM International also made provisions to reserves for risks and charges with regard to subsidiaries (maintained in the consolidated report), for the sum of Euro 59 million. TIM adjusted its equity investment in TIM International for a total of Euro 618 million, whereas on a consolidated basis a partial writedown was taken on Digitel’s goodwill for Euro 132 million. Considering the fiscal aspects induced by the writedown taken by TIM, the net effect on a consolidated basis was a positive one of approximately Euro 14 million. |

| • | Consolidated net income for 2003 pertaining to Parent Company TIM was Euro 2,342 million (Euro 1,165 million in 2002). Excluding the effect of non-recurrent operations posted in the two periods being compared, income rose by 41.7%. |

| • | Net financial position was positive by Euro 934 million, up Euro 2,856 million compared to the 2002 year-end value, thanks to the high free operating cash flow generated during the period (+27.8%, from Euro 2,932 million to Euro 3,746 million in 2003). |

| 2003 ANNUAL REPORT | 5

|

| • | Mobile lines: 44.5 million (+13.8% compared to December 31, 2002); GSM start up customers in Brazil amounted to 2,469,000 at December 31, 2003 (293,000 at December 31, 2002). |

New products and services:

| • | Launch of “MOBILE TV”: TV on cellular phones. TIM has made television mobile by being the first operator in the world to launch the “MOBILE TV” service. Currently in its early testing phase, it permits access to the programs of four TV broadcasting partners, LA7, MTV, CFN/CNBC and Coming Soon Television. The service was free of charge until the end of 2003. |

| • | Launch of “Chiama Ora”, the new service that, if a TIM number is turned off or is out of range, sends an SMS as soon as the called number is available again. |

| • | Launch of “TIM Click”, the service allowing users to print out photos taken with MMS handsets or to turn them into postcards to send around the world. |

| • | Launch of “Non rimanere senza parole”: an SMS message advises customers when their credit balance drops below Euro 2.58, and a recharge within 48 hours earns the customer 48 free SMS; |

| • | Agreement with Banca Intesa to launch a new service that will allow over 7.5 million Banca Intesa customers to use their cell phones to access Mobile Banking services with both SMS and MMS technology; |

| • | Agreement with Lega Calcio: the agreement between TIM and the Italian Soccer League has been extended until June 30, 2006 with the A Series, B Series, Supercoppa di Lega and TIM CUP tournaments, the Italian Spring Championship and the Spring TIM CUP; |

| • | Launch of “WLAN” (Wireless Local Area Network), a service targeting the corporate market. With it, the SIM card in mobile telephones can be connected with W-LAN networks and all the services typical WI-FI technology can be used through the WLAN coverage implemented by TIM with company headquarters and public WI-FI hotspots, which will be available and enabled for the TIM solution. |

| • | agreement with RAI Radio televisione Italiana: TIM and RAI concluded an agreement that will allow customers to watch RAI programmes and content on TIM’s mobile handsets. |

Alliance between TIM, Telefonica Moviles, T-Mobile International and Orange

On April 7, 2003, TIM entered into an alliance with Telefónica Móviles and T-Mobile International aimed at extending to the customers of all the partners, a unique offer of high quality products and services in all the countries in which any one of the partners operates, so as to reinforce their combined competitive edge on international markets. On June 24, the competitor Orange, joined the alliance.

On August 1, 2003, the first results of the alliance involving all four partners was concretized in the form of a cooperation agreement signed between TIM, Telefonica Moviles, T-Mobile and Orange. The agreement lays the groundwork for the development of broad-ranging collaboration and highlights the joint commitment to providing a “seamless” experience to all customers within the geographical area in which the partners operate.

The new alliance that was initially launched in Europe within the area of reference of the four wireless telephony operators, is targeted at over 170 million customers in fifteen countries; the objective is to extend the project to include all the activities of the partner companies worldwide, setting up one of the largest wireless telecommunications communities in the world, capable of instant interaction, anytime, anywhere.

The very first products and services on offer will extend roaming facilities to customers using prepaid cards in a much larger number of countries than currently possible, without sacrificing habitual services, such as voicemail and assistance, even during trips overseas.

This cooperation will soon be extended to other areas of business, involving, for instance the development of infrastructure and cell phones, with a view to expanding the range of products on offer.

| 2003 ANNUAL REPORT | 6

|

ECONOMIC AND FINANCIAL HIGHLIGHTS OF THE TIM GROUP

|

|

|

| 2003 |

2002 |

2001 | |||||

| Economic and Financial Highlights (in millions of Euro) |

|||||||

| Sales and service revenues |

11,782 | 10,867 | 10,250 | ||||

| Gross operating profit |

5,502 | 5,039 | 4,760 | ||||

| Operating income before amortization of consolidation differences |

3,885 | 3,458 | 3,292 | ||||

| Operating income |

3,786 | 3,358 | 3,136 | ||||

| Income before taxes |

4,207 | 1,117 | 1,946 | ||||

| Net income/(loss) for the period pertaining to the Parent Company before amortization of consolidation differences |

2,441 | 1,265 | 1,106 | ||||

| Net income/(loss) of Parent Company and minority interests |

2,456 | 1,169 | 998 | ||||

| Net income/(loss) of Parent Company |

2,342 | 1,165 | 950 | ||||

| Operating Free Cash Flow 1 |

3,746 | 2,932 | 2,293 | ||||

| Investments: |

|||||||

| - Industrial |

1,957 | 1,715 | 3,151 | ||||

| - Consolidation differences |

7 | 196 | 31 | ||||

| - Financial |

53 | 448 | 1,972 | ||||

| Balance Sheet Highlights (in millions of Euro) |

|||||||

| Total assets |

14,773 | 14,211 | 17,036 | ||||

| Net invested capital |

6,869 | 7,701 | 11,034 | ||||

| Shareholders’ equity |

|||||||

| - Parent Company |

7,295 | 5,409 | 8,804 | ||||

| - Minority interests |

508 | 370 | 698 | ||||

| Net financial debt/(net liquid assets) |

(934 | ) | 1,922 | 1,532 | |||

| Income and Financial Indexes (%) |

|||||||

| Gross operating profit/Revenues |

46.7 | 46.4 | 46.4 | ||||

| Operating income/Revenues (ROS) |

32.1 | 30.9 | 30.6 | ||||

| Net income/Average shareholders’ equity (ROE) |

36.2 | 15.3 | 10.0 | ||||

| Operating income/Average invested capital (ROI) |

52.0 | 35.8 | 30.1 | ||||

| Free cash flow/Revenues |

31.8 | 27.0 | 22.4 | ||||

| Debt Ratio (Net financial debt/Net invested capital) |

(13.6 | ) | 25.0 | 13.9 | |||

| Personnel |

|||||||

| Personnel (Group figure at December 31, 2003 - No.) |

18,888 | 18,702 | 16,721 | ||||

| Personnel (Group average - No.) |

17,535 | 16,184 | 15,104 | ||||

| Revenues/personnel (Group average, in thousands of Euro) |

672 | 671 | 679 | ||||

| (1) | Calculated as follows: Operating Income + Depreciation and amortization + Industrial investments – Variation in operating working capital. |

| 2003 ANNUAL REPORT | 7

|

HIGHLIGHTS OF TIM GROUP COMPANIES

During the year, the Group operated based on the subdivision of companies, as outlined below:

| ITALY |

BRAZIL |

PERU |

VENEZUELA |

GREECE |

||||||||||||||||||

| (in millions of Euro) |

TIM S.p.A.(*) |

TIM BRASIL GROUP (***) |

TIM PERÙ |

DIGITEL |

STET HELLAS |

Sub- total |

Other activities and eliminations (***) |

Conso- lidated total | ||||||||||||||

| Revenues |

2003 | 9,469 | 1,271 | 128 | 148 | 805 | 11,821 | (39 | ) | 11,782 | ||||||||||||

| 2002 | 8,915 | 1,029 | 93 | 177 | 689 | 10,903 | (36 | ) | 10,867 | |||||||||||||

| Gross operating profit |

2003 | 5,035 | 150 | 6 | 45 | 287 | 5,523 | (21 | ) | 5,502 | ||||||||||||

| 2002 | 4,510 | 270 | (29 | ) | 35 | 255 | 5,041 | (2 | ) | 5,039 | ||||||||||||

| Operating income |

2003 | 3,983 | (195 | ) | (32 | ) | (10 | ) | 166 | 3,912 | (126 | ) | 3,786 | |||||||||

| 2002 | 3,427 | (16 | ) | (61 | ) | (20 | ) | 131 | 3,461 | (103 | ) | 3,358 | ||||||||||

| Industrial investments (**) |

2003 | 1,178 | 576 | 38 | 22 | 138 | 1,952 | 5 | 1,957 | |||||||||||||

| 2002 | 1,066 | 378 | 72 | 87 | 104 | 1,707 | 8 | 1,715 | ||||||||||||||

| Personnel (no.) |

12.31.2003 | 10,023 | 5,985 | 565 | 847 | 1,359 | 18,779 | 109 | 18,888 | |||||||||||||

| 12.31.2002 | 10,261 | 5,556 | 555 | 936 | 1,386 | 18,694 | 8 | 18,702 |

| (*) | Data according to Group accounting principles. |

| (**) | Goodwill not included. |

| (***) | In 2003, the stake held by Brazilian companies in Blah! was transferred to TIM International. TIM Brasil’s Consolidated Financial Statements for 2003 do not include Blah!’s data. No 2002 pro forma consolidated accounts have been drawn up for the TIM Brasil Group as its values are not significant. |

| 2003 ANNUAL REPORT | 8

|

TIM S.P.A.: RECONCILIATION BETWEEN PERIOD-END FIGURES OF TIM S.P.A. AND PERIOD-END FIGURES BASED ON GROUP PRINCIPLES

TIM S.p.A. manages several differences between the statutory financial statements and the financial statements prepared based on the Group’s accounting principles for consolidation purposes. These differences stem mainly from fiscal aspects.

| (in millions of Euro) |

TIM S.p.A. |

UMTS License |

IAS 17 |

BLU |

TIM S.p.A. Group principles | |||||||||

| Financial Year 2003 |

Revenues | 9,469 | 9,469 | |||||||||||

| Gross operating profit | 5,035 | 5,035 | ||||||||||||

| Operating income | 3,863 | 121 | (1 | ) | 3,983 | |||||||||

| Industrial investments | 1,194 | (16 | ) | 1,178 | ||||||||||

| Financial Year 2002 |

Revenues | 9,022 | (107 | ) | 8,915 | |||||||||

| Gross operating profit | 4,404 | 6 | 100 | 4,510 | ||||||||||

| Operating income | 3,153 | 121 | 4 | 149 | 3,427 | |||||||||

| Industrial investments | 1,697 | (631 | ) | 1,066 |

The UMTS license was amortized in the financial statements of TIM S.p.A. to avoid jeopardizing the tax deductibility of this amortization; according to the accounting principle adopted by the Group, this amortization would go into effect starting in the period in which commercial service is started up.

For the assets utilized through financial leasing – specifically, leased real estate – in its statutory report TIM posted charges for the accrued installments, as envisaged by tax regulations, whereas for the consolidated report it applied International Accounting Principle No. 17. In 2003, the asset to which this principle was applied was redeemed and then resold.

In TIM’s 2003 Annual Report, the redemption value is part of the investments for the period, whereas for the purposes of the consolidated economic and equity situation, the investment was adjusted, because the asset is posted as already being part of the Group capital.

Lastly, it must be noted that the 2002 Annual Report of TIM S.p.A. included the values of Blu S.p.A., incorporated with accounting and fiscal efficacy as of January 1, 2002. For the purposes of the Group’s consolidated report, the operation of Blu was consolidated effective as of the acquisition date (October 7, 2002).

| 2003 ANNUAL REPORT | 9

|

OPERATING HIGHLIGHTS OF THE TIM GROUP

| 2003 |

2002 | |||

| TIM lines in Italy (in thousands) |

26,0276 | 25,302 | ||

| TIM Group foreign lines (in thousands) |

18,438 | 13,809 | ||

| Total TIM Group lines (Italy + foreign, in thousands) (*) |

44,514 | 39,111 | ||

| ARPU (euro/line/month) |

28.2 | 28.0 | ||

| GSM coverage in Italy (% of the population) |

99.8 | 99.8 | ||

| E-TACS coverage in Italy (% of the population) |

97.9 | 398.0 | ||

| Traffic (TIM S.p.A., millions of minutes) |

38,420 | 36,432 |

| (*) | The figures for foreign lines include the ones for affiliate Aria-Is TIM and subsidiary Radiomobil. |

| 2003 ANNUAL REPORT | 10

|

| SHARES | ||

| Share capital |

Euro 513,964,432.74 | |

| Ordinary shares |

8,434,004,716 at Euro 0.06 each | |

| Savings shares |

132,069,163 at Euro 0.06 each | |

| Stock market capitalization (based on the price average for December 2003) |

Euro 37,276 million | |

| Ratio of TIM shares |

||

| - on the Mibtel index |

||

| - TIM - ordinary |

8.60% (at 12/31/2003) | |

| - TIM - savings |

0.12% (at 12/31/2003) | |

| - on the DJ Stoxx TLC 2 |

||

| - TIM - ordinary |

4.22% (at 12/31/2003) | |

| (2) | The index is calculated on a geographical basis including all European countries. |

SHAREHOLDERS

Shareholders of TIM S.p.A. Stock Ledger 12.31.2003

(Ordinary Shares)

| 2003 ANNUAL REPORT | 11

|

STOCK PERFORMANCE OF THE TIM GROUP

Italy

Performance of TIM S.p.A.

| 2003 ANNUAL REPORT | 12

|

EUROPE

Performance of Stet Hellas

SOUTH AMERICA

BRAZIL

Performance of Tele Celular Sul Participaçoes

| 2003 ANNUAL REPORT | 13

|

Performance of Tele Nordeste Celular Participaçoes

| 2003 ANNUAL REPORT | 14

|

PERFORMANCE OF THE MAIN EUROPEAN MOBILE TLC SECURITIES

FINANCIAL INDICATORS

TIM S.p.A.

| 12.31.2003 |

12.31.2002 |

|||||

| Prices (December average) |

||||||

| - Ordinary |

4.353 | 4.621 | ||||

| - Savings |

4.232 | 4.133 | ||||

| Dividend per share |

||||||

| - Ordinary |

0.2567 | 0.2342 | ||||

| - Savings |

0.2687 | 0.2462 | ||||

| Market to Book Value |

4.162 | 5.610 | ||||

| Dividend Yield |

||||||

| - Ordinary |

5.9 | % | 5.4 | % | ||

| - Savings |

6.3 | % | 6.1 | % |

TIM Group

| 12.31.2003 |

12.31.2002 | |||

| Net income/(Loss) per ordinary share |

0.273 | 0.136 | ||

| Operating Free Cash Flow per share |

0.437 | 0.342 | ||

| Shareholders’ equity per share |

0.852 | 0.632 |

| 2003 ANNUAL REPORT | 15

|

TIM ORGANIZATIONAL CHART AS OF MARCH 22, 2004

| (1) | Elisabetta RIPA directly answers to the CEO as Head of Staff and Mobile Business Development. |

| (2) | The Managing Committee is made up of the CEO, the General Manager, the Head of Finance & Control and the Head of Human Resources. |

| (3) | The Special Project function - entrusted to Elis BONTEMPELLI - answers to the CEO. |

| (4) | The Security function - entrusted to Adamo BOVE - answers to the CEO. |

| 2003 ANNUAL REPORT | 16

|

INTERNATIONAL PRESENCE AS OF DECEMBER 31, 2003

| 2003 ANNUAL REPORT | 17

|

ECONOMIC AND FINANCIAL PERFORMANCE OF THE TIM GROUP

The following is a summary of the economic and financial performance of the TIM Group.

MANAGEMENT OF OPERATIONS

Sales and service revenues in 2003 amounted to Euro 11,782 million (Euro 10,867 million in 2002), a growth of 8.4%; net of the negative exchange-rate effect on South American subsidiaries, this item increased by 12.6%. At equalized exchange rates, all companies present positive growth rates.

The revenues of TIM Celular (a Brazilian company working exclusively with GSM technology and currently in the startup phase) totaled Euro 362 million.

Raw materials and outside services in 2003 amounted to Euro 5,660 million (Euro 5,210 million in the same period of 2002). Compared to the previous period, this increase is referable mainly to the startup of GSM service in Brazil and to cost dynamics due to the increase in sales volume. Raw materials and outside services in 2003 were influenced by the non-existence of charges for the telecommunications contribution (pursuant to Art. 20 of Law 448/98), following the sentence handed down on September 18, 2003 by the Court of Justice of the European Communities concerning the illegitimacy of this contribution. In FY 2002, these charges amounted to Euro 151 million.

| 2003 ANNUAL REPORT | 18

|

Labor costs amounted to Euro 622 million (Euro 620 million in 2002). The ratio of these costs to revenues (5.3%) decreased compared to 2002 (5.7%).

At December 31, 2003, personnel numbered 18,888 employees (18,702 at December 31, 2002), categorized as follows:

| 12.31.2003 |

12.31.2002 |

Absolute change |

|||||

| Italy |

10,023 | 10,261 | (238 | ) | |||

| Abroad |

8,865 | 8,441 | 424 | ||||

| Total Staff |

18,888 | 18,702 | 186 | ||||

Gross operating profit for FY 2003 was Euro 5,502 million (Euro 5,039 million in FY 2002), reflecting a 9.2% increase compared to the previous period; at equalized exchange rates, the increase in GOP was 10.2%. The improvement stems from the positive performance of existing business, which can absorb the higher costs arising from the startup of GSM service in Brazil, and the aforesaid acknowledgement of the sentence of the Court of Justice of the European Communities.

GOP for TIM Celular shows a negative change that, at equalized exchange rates, totals Euro 131 million with respect to the previous period.

Depreciation and amortization for the period, amounting to Euro 1,542 million (Euro 1,512 million in FY 2002), refer to:

| (in millions of Euro) |

Financial Year 2003 |

Financial Year 2002 |

Absolute change |

||||

| Intangible assets |

596 | 611 | (15 | ) | |||

| of which consolidation differences |

99 | 100 | (1 | ) | |||

| Fixed assets |

946 | 901 | 45 | ||||

| Total depreciation and amortization |

1,542 | 1,512 | 30 | ||||

It must be noted that, starting with the report for the first half of 2003, for certain categories of intangible assets, TIM S.p.A. modified the method for calculating the amortization allowance, aligning the starting date for calculating amortization with the date the asset actually went into operation. This modification led to a decrease in the amortization allowance for intangible assets in the amount of approximately Euro 106 million.

| 2003 ANNUAL REPORT | 19

|

Other valuation adjustments in 2003 amounted to Euro 138 million and refer essentially to write-downs of trade account receivables to their estimated realizable value. These refer specifically to:

| • | TIM S.p.A. (Euro 66 million); |

| • | TIM Brasil Group (Euro 61 million); |

| • | Stet Hellas (Euro 7 million). |

Provisions to reserves for risks and charges for 2003, amounting to Euro 21 million, decreased by Euro 42 million compared to 2002 and refer mainly to provisions of Euro 15 million by TIM S.p.A. and of Euro 3 million by Stet Hellas.

Net other income (expense) in 2003 was negative at Euro -15 million (Euro -13 million in 2002).

Operating income for 2003 was Euro 3,786 million (Euro 3,358 million in 2002) and shows a 12.7% increase compared to last year. The impact of the devaluation of exchange rates was positive: at equalized exchange rates, the growth in operating income amounted to 10.8%. This increase in operating income stems both from the positive performance of existing operations (Italy, Greece, Peru, Brazilian companies operating with TDMA technology) that offset the higher costs for the GSM startup in Brazil, and from the non-existence of the telecommunications contribution.

The operating income of TIM Celular, at equalized exchange rates and compared to the previous period, dropped by Euro 273 million.

The ratio of operating income to total revenues increased, going from 30.9% in FY 2002 to 32.1% in FY 2003.

Net investment and financial income (expense) and value adjustments are listed below:

| (in millions of Euro) |

Financial Year 2003 |

Financial Year 2002 |

Absolute change |

||||||

| Financial income |

290 | 808 | (518 | ) | |||||

| Financial expenses |

(282 | ) | (1,018 | ) | 736 | ||||

| Net financial income (expense) from subsidiaries |

(4 | ) | (162 | ) | 158 | ||||

| Total |

4 | (372 | ) | 376 | |||||

| 2003 ANNUAL REPORT | 20

|

In 2003, income before extraordinary items and taxes was Euro 3,790 million (Euro 2,986 million in 2002), reflecting a 26.9% increase compared to last year, with a ratio to revenues increasing from 27.5% in 2002 to 32.2% in 2003.

Net extraordinary income and expense for 2003 was positive at Euro 417 million (Euro –1,869 million in 2002). This change is due chiefly to the following events:

| • | in FY 2002 gains were posted for disposals in Bouygues Telecom, Mobilkom Austria and Auna totaling Euro 845 million. Extraordinary write-downs were posted for Aria-Is TIM (Turkey) and Digitel (Venezuela) for a total of Euro 1,566 million, extraordinary provisions were made to the reserve for risks and charges in relation to Aria-Is TIM for Euro 850 million, and extraordinary write-downs were taken for plant and machinery by several Brazilian subsidiaries for Euro 142 million and for the consolidation difference in relation to Blu (Euro 103 million), for a negative net figure for non-recurrent items of Euro 1,816 million; |

| • | in 2003, non-existent assets were posted for Euro 543 million, due to the non-existence of liabilities accrued at December 31, 2002 for the telecommunications contribution. In addition, another partial write-down was taken on Digitel’s goodwill for Euro 132 million, considering the continuing difficult macroeconomic picture in which the company operates. Furthermore, provisions were made to a fund for risks pertaining the Digitel litigation, for an amount of Euro 59 million. The balance of non-recurrent items is thus positive at Euro 352 million. |

Corporate income tax amounted to Euro 1,751 million in FY 2003, reflecting an increase of Euro 1,803 million over the previous year, primarily as a result of the TIM S.p.A.’s greater tax burden arising from the increase in the Company’s pre-tax result, due to the divergent trend of non-recurrent items. It must further be borne in mind that in 2002 the Company benefited from the favorable tax effects resulting from the merger of Blu S.p.A.

As a result, the Parent Company’s overall tax burden increased from Euro -255 million to Euro 1,530 million.

The Group’s consolidated net income for 2003 amounted to Euro 2,456 million.

Consolidated net income for the Parent Company amounted to Euro 2,342 million and Minority interests amounted to Euro 114 million.

In 2002, the Group posted a net income of Euro 1,169 million and Minority interests of less than Euro 4 million. Net income for FY 2002 included Euro 845 million in extraordinary income from the gains on transfers of stakes in Mobilkom Austria, Bouygues Telecom and Auna; write-downs and provisions totaling Euro 2,661 million, and charges related to Blu’s operations for Q4 of Euro 21 million. Net of the correlated tax aspects, these non-recurrent elements had a negative effect totaling Euro 242 million. Net income for FY 2003, without considering the specified extraordinary operations and their relevant tax effect, is approximately Euro 1,994 million.

The increase in normalized net income would thus be 49.4% inclusive of minority interests and 41.7% net of these interests.

| 2003 ANNUAL REPORT | 21

|

Lastly, it must be noted that in FY 2003 no adjustments were made for affiliate Aria-Is TIM, whose value was written down in full in the 2002 Financial Statements, in which specific reserves for risks were established.

MANAGEMENT OF ASSETS AND LIABILITIES

Intangible assets, fixed assets and long-term investments, amounting to Euro 9,276 million, decreased by Euro 85 million compared to the figure at December 31, 2002.

In detail:

| • | intangible assets amounted to Euro 5,250 million (Euro 5,225 million at December 31, 2002). The change is due mainly to Euro 720 million in investments made during the period, amortization expense totaling Euro 596 million, write-down of Digitel goodwill amounting to Euro 132 million, and the effect of negative currency translation differences due to the variation in foreign-exchange rates, amounting to Euro 39 million; |

| • | fixed assets amounted to Euro 3,908 million (Euro 3,756 million at December 31, 2002). The variation is due mainly to Euro 1,244 million in investments made during the period, depreciation and write-downs totaling Euro 946 million, divestments amounting to Euro 40 million, and the effect of negative currency translation differences amounting to Euro 64 million; |

| • | long-term investments amounted to Euro 118 million (Euro 380 million at December 31, 2002). The decrease was due essentially to the write-down (using reserves for future risks and charges established in 2002) of receivables from affiliate Aria-Is TIM, totaling Euro 279 million. At the end of 2003, as part of the merger process of the Turkish affiliate, the TIM Group acquired the loans that Telecom Italia Finance issued to Aria-Is TIM (for Euro 250 million). These loans were guaranteed by sureties provided by the TIM Group, fully allocated to the reserves for future risks and charges. The acquisition was carried out with the partial use of financial assets from Telecom Italia Finance. |

| 2003 ANNUAL REPORT | 22

|

Investments totaled Euro 2,017 million (Euro 2,359 million in 2002) and are categorized as follows:

| (in millions of Euro) |

Financial Year 2003 |

Financial Year 2002 |

Absolute change |

||||

| Industrial investments |

1,957 | 1,715 | 242 | ||||

| Consolidation differences |

7 | 196 | (189 | ) | |||

| Financial investments |

53 | 448 | (395 | ) | |||

| Total investments |

2,017 | 2,359 | (342 | ) | |||

In 2003, investment activities were concentrated in the technological area, in order to bolster the network and develop value-added services, mainly in Italy (Euro 1,178 million) and Brazil (Euro 576 million).

Working capital showed a negative balance of Euro 2,407 million (negative for Euro 1,660 million at December 31, 2002).

The difference of Euro 747 million is mainly due to:

| • | the decrease in other assets for Euro 535 million, due mainly to TIM S.p.A. and attributed to the offset of tax credits against the amount due for current taxes; in 2002, this generated a net tax credit of Euro 482 million, whereas at the end of 2003 this item reflected a payable balance; |

| • | an Euro 99 million increase in trade accounts payable, dropping from Euro 2,614 million at the end of 2002 to Euro 2,713 million at December 31, 2003, attributable mainly to the Parent Company TIM S.p.A.; |

| • | an increase in other liabilities amounting to Euro 354 million, also attributable mainly to TIM S.p.A., referable essentially to the elimination of the liability for the telecommunications contribution accruing on December 31, 2002, which was offset by the increase in VAT payables; |

| • | an Euro 82 million decrease in assets for advance taxes, net of the tax reserves; |

| • | a decrease in reserve for risks and charges amounting to Euro 296 million, referable mainly to the use (Euro 279 million) of part of the reserves for future risks and charges established in 2002 for Aria-Is TIM. |

Shareholders’ equity amounted to Euro 7,803 million (Euro 5,779 million at December 31, 2002), of which Euro 7,295 million (Euro 5,409 million at December 31, 2002) attributable to TIM and Euro 508 million (Euro 370 million at December 31, 2002) attributable to minority interests.

| (in millions of Euro) |

Financial Year 2003 |

Financial Year 2002 |

||||

| At beginning of year |

5,779 | 9,502 | ||||

| Net income for the year of Parent Company and minority interests |

2,456 | 1,169 | ||||

| Dividends paid to minority interests by: |

(429 | ) | (3,617 | ) | ||

| TIM S.p.A. |

(410 | ) | (3,605 | ) | ||

| Other companies (Tele Nordeste Celular, Tele Celular Sul, Stet Hellas) |

(19 | ) | (12 | ) | ||

| Net exchange difference for conversion and other changes |

(3 | ) | (1,275 | ) | ||

| At end of year |

7,803 | 5,779 |

The change of Euro 2,024 million was influenced mainly by the consolidated income for the period.

| 2003 ANNUAL REPORT | 23

|

At December 31, 2003, the Group presented positive financial position of Euro 934 million (with respect to net borrowings of Euro 1,922 million at December 31, 2002), for a change of Euro 2,856 million as compared to December 31, 2002, mainly due to the high cash flow generated during the period.

Free operating cash flow amounted to Euro 3,746 million (after financing industrial investments worth Euro 1,957 million), up 27.8% compared to 2002 (Euro 2,932 million, after technical investments of Euro 1,715 million), for a ratio to turnover of 31.8% (27% in 2002).

The composition of gross financial debt (which does not include Euro 2 million in short-term net financial accruals and deferrals) is analyzed in the following chart:

| (in millions of Euro) |

12.31.2003 |

12.31.2002 | ||||||||||||||

| Euro |

% |

Currency |

% |

Total |

% |

Total |

% | |||||||||

| Medium/long-term debt |

208 | 68 | 377 | 71 | 585 | 69 | 807 | 32 | ||||||||

| Short-term borrowings |

100 | 32 | 157 | 29 | 257 | 31 | 1,712 | 68 | ||||||||

| Total |

308 | 100 | 534 | 100 | 842 | 100 | 2,519 | 100 | ||||||||

TIM S.P.A.

The year 2003 closed with a net income of Euro 2,322 million, influenced by two non-recurrent operations, one positive and the other negative. One was related to non-existent assets of Euro 543 million, originated in Q3 due to the non-existence of the liability allocated through December 31, 2002 for charges for the telecommunications contribution. The other one involves the write-down taken on the book value of the holding company TIM International N.V. for Euro 618 million, due to an update in the evaluations of the equity investments it holds. Net of correlated tax effects, the impact on 2003 income was negative at Euro 79 million.

Sales and service revenues amounted to Euro 9,469 million. Growth, as measured versus FY 2002 pro forma (excluding accounting effects of the merger by incorporation of Blu, which took place in December 2002 and was retroactive to January 1, 2002 for accounting and tax purposes), was 6.2%. Also contributing to this item was the growth in revenues from traffic (+3.7% compared to pro forma 2002) and in revenues from VAS (+36.7% compared to 2002, net of the effects of the incorporation of Blu).

| 2003 ANNUAL REPORT | 24

|

Gross operating profit, amounting to Euro 5,035 million, rose by 11.2% compared to pro forma 2002. This growth was influenced by the non-existence of the contribution of telecommunications, which in FY 2002 pro forma amounted to Euro 151 million.

Operating income, which was Euro 3,863 million, rose by 16.3% compared to pro forma 2002. This growth was influenced not only by the above-mentioned item referring to the telecommunications contribution, but also by the change in the amortization method used for several types of intangible assets, which led to amortization that was lower by approximately Euro 106 million.

Net financial position was positive at Euro 1,418 million, showing an improvement of Euro 2,910 million for the year, thanks to the high level of free operating cash flow, totaling Euro 4,201 million.

MARKET OUTLOOK AND STRATEGIC GUIDELINES

Market outlook: mobile telecommunications and TIM’s positioning

After the strong crisis period that followed the downsizing of the “new economy” and the uncertainty caused by the world political situation, the international economic scenario is starting to show signs of recovery.

During recent years, despite a slowdown in the leading world economies, the incidence of overall expenditure in TLC on GDP continued to grow. The mobile sector in particular, together with the Internet, posted the highest levels of growth, and the number of mobile lines worldwide exceeded the levels set in 2001.

Market growth will also continue in the coming years, but at rates that are probably lower compared to the past, and with significant differences among the various regions around the world. Western Europe, and Italy in particular, represent markets that are close to the saturation point (approximately 80% penetration in Europe, more than 90% in Italy), whereas in several developing areas like Southeast Asia and Latin America the markets are still extremely appealing (compared to last year, penetration and growth are approximately 20% in South America, while in Asia penetration is about 13% and growth is approximately 30%).

Voice traffic continues to represent the core business for mobile telephone services and it contributes to financing the development of VAS, whose weight is growing progressively (revenues from VAS is about 11% of service revenues for TIM S.p.A. in 2003). Mobile operators must not only defend their roles as carriers but must also increasingly affirm their positions along the entire chain of value, becoming VAS providers in a position to contribute to defining standards that will allow new applications to be launched.

In this arena, TIM is one of the major operators on the world market:

| • | it is the Italian leader with over 26 million lines at December 31, 2003 and a market share of 46%; |

| • | it is the leading mobile telephony European group in terms of profitability, the generation of cash flow and financial stability; |

| • | it is the third leading Brazilian operator with over 8 million lines, a market share of 18% at December 31, 2003 and a widespread national presence. |

To defend and reinforce its position, a strategy must be defined that can face the different challenges that are arising:

| • | defending the voice business; |

| • | developing a new generation of GPRS/EDGE/UMTS “Mobile Data”; |

| • | developing GSM in Brazil and becoming the second operator on the market; |

| • | completing the start up phase of several subsidiaries. |

| 2003 ANNUAL REPORT | 25

|

The main strategic levers to achieve these objectives are:

| • | Centrality of the customer, to be achieved through caring and offer segmentation, a focus on high-consumption customers, leadership in acquisitions; |

| • | Premium positioning, to maintain through to development of a consistent on-net community and high-quality service; |

| • | Innovation and technological leadership (characteristics traditionally associated with TIM’s image) to be promoted by developing the GPRS/EDGE/UMTS data networks and innovative VAS, maintaining constant quality in network and IT services, gradual replacement of TDMA with GSM by several subsidiaries; |

| • | Profitability and cash flow, to be achieved by preserving the efficiency and effectiveness levels on network, IT and back office, monitoring investments and working capital, and establishing a far-sighted policy of capital allocation, |

| • | Global positioning, through partnerships/alliances with other major mobile groups that can stimulate significant economies of scale, international roaming services and R&D activities; |

| • | Multinational approach, based on a unified Plug & Play strategy, the creation of a group culture and growing integration between TIM Italia and subsidiaries; |

| • | Excellence in human resources by recruiting, developing and maintaining “valuable” human resources, selecting methods to improve their flexibility and the process of internal innovation. |

TIM’s capacity to use these levers correctly will allow it to pursue its fundamental mission:

“Generating value for Stakeholders, through leadership in traditional mobile services and the development of innovative services in Italy and around the world”.

| 2003 ANNUAL REPORT | 26

|

HIGHLIGHTS OF THE QUARTERLY PERFORMANCE OF THE TIM GROUP

| 2003 |

2002 (*) |

|||||||||||||||||||||||||||||

| (in millions of Euro) |

Q1 |

Q2 |

Q3 |

Q4 |

Year |

Q1 |

Q2 |

Q3 |

Q4 |

Year |

||||||||||||||||||||

| Revenues |

2,616 | 2,918 | 3,101 | 3,147 | 11,782 | 2,498 | 2,687 | 2,825 | 2,857 | 10,867 | ||||||||||||||||||||

| % change on the same quarter of previous year |

4.7 | % | 8.6 | % | 9.8 | % | 10.2 | % | 4.3 | % | 6.0 | % | 8.6 | % | 5.1 | % | ||||||||||||||

| Gross operating profit |

1,262 | 1,362 | 1,533 | 1,345 | 5,502 | 1,221 | 1,267 | 1,415 | 1,136 | 5,039 | ||||||||||||||||||||

| % change on the same quarter of previous year |

3.4 | % | 7.5 | % | 8.3 | % | 18.4 | % | 3.7 | % | 5.7 | % | 12.6 | % | 0.8 | % | ||||||||||||||

| % GOP/Revenues |

48.2 | % | 46.7 | % | 49.4 | % | 42.7 | % | 46.7 | % | 48.9 | % | 47.2 | % | 50.1 | % | 39.8 | % | 46.4 | % | ||||||||||

| Operating income before amortization of consolidation differences |

922 | 955 | 1,144 | 864 | 3,885 | 858 | 877 | 1,053 | 670 | 3,458 | ||||||||||||||||||||

| % change on the same quarter of previous year |

7.5 | % | 8.9 | % | 8.6 | % | 29.0 | % | 0.7 | % | 2.6 | % | 14.0 | % | 1.4 | % | ||||||||||||||

| % Op. income before amortization of consol. differences/ Revenues |

35.2 | % | 32.7 | % | 36.9 | % | 27.5 | % | 33.0 | % | 34.3 | % | 32.6 | % | 37.3 | % | 23.5 | % | 31.8 | % | ||||||||||

| Operating income |

897 | 929 | 1,118 | 842 | 3,786 | 831 | 853 | 1,029 | 645 | 3,358 | ||||||||||||||||||||

| % change on the same quarter of previous year |

7.9 | % | 8.9 | % | 8.6 | % | 30.5 | % | 1.8 | % | 6.5 | % | 13.8 | % | 4.9 | % | ||||||||||||||

| % Operating income/ Revenues |

34.3 | % | 31.8 | % | 36.1 | % | 26.8 | % | 32.1 | % | 33.3 | % | 31.7 | % | 36.4 | % | 22.6 | % | 30.9 | % | ||||||||||

| (*) | It is noted that Q3 and Q4 benefited from the annulment of the contribution for TLC activities that affected the first two quarters of 2003. In comparable terms, in the four quarters of 2003 the GOP/Revenues and Operating income/Revenues ratios would have been as follows: |

| 2003 |

|||||||||||||||

| Q1 |

Q2 |

Q3 |

Q4 |

Year |

|||||||||||

| % GOP/Revenues |

49.4 | % | 47.7 | % | 49.4 | % | 40.9 | % | 46.7 | % | |||||

| % Operating income before amortization of consolidation differences |

36.4 | % | 33.8 | % | 36.9 | % | 25.6 | % | 33.0 | % | |||||

| % Operating income/ Revenues |

35.4 | % | 32.9 | % | 36.1 | % | 24.9 | % | 32.1 | % | |||||

| 2003 ANNUAL REPORT | 27

|

TIM GROUP

CONSOLIDATED STATEMENT OF INCOME

| Financial (a) |

Financial (b) |

Changes (a)-(b) |

||||||||||

| (in millions of Euro) |

absolute |

% |

||||||||||

| A. Sales and service revenues |

11,782 | 10,867 | 915 | 8.4 | ||||||||

| Increases in capitalized internal construction costs |

2 | 1 | 1 | °°° | ||||||||

| Operating grants |

0 | 1 | (1 | ) | °°° | |||||||

| B. Standard production value |

11,784 | 10,869 | 915 | 8.4 | ||||||||

| Raw materials and outside services (*) |

(5,660 | ) | (5,210 | ) | (450 | ) | 8.6 | |||||

| C. Value added |

6,124 | 5,659 | 465 | 8.2 | ||||||||

| Labor costs (*) |

(622 | ) | (620 | ) | (2 | ) | 0.3 | |||||

| D. Gross operating profit |

5,502 | 5,039 | 463 | 9.2 | ||||||||

| Amortization and depreciation of other intangibles and fixed assets |

(1,443 | ) | (1,412 | ) | (31 | ) | 2.2 | |||||

| Other valuation adjustments |

(138 | ) | (93 | ) | (45 | ) | 48.4 | |||||

| Provisions to reserves for risks and charges |

(21 | ) | (63 | ) | 42 | (66.7 | ) | |||||

| Net other income (expense) |

(15 | ) | (13 | ) | (2 | ) | 15.4 | |||||

| E. Operating income before amortization of consolidation differences |

3,885 | 3,458 | 427 | 12.3 | ||||||||

| Amortization of consolidation differences |

(99 | ) | (100 | ) | 1 | (1.0 | ) | |||||

| F. Operating income |

3,786 | 3,358 | 428 | 12.7 | ||||||||

| Net financing (**) |

8 | (210 | ) | 218 | °°° | |||||||

| Net investments |

(4 | ) | (162 | ) | 158 | (97.5 | ) | |||||

| G. Income (loss) before extraordinary items and taxes |

3,790 | 2,986 | 804 | 26.9 | ||||||||

| Net extraordinary income (expense) |

417 | (1,869 | ) | 2,286 | °°° | |||||||

| H. Income before taxes |

4,207 | 1,117 | 3,090 | °°° | ||||||||

| Income taxes |

(1,751 | ) | 52 | (1,803 | ) | °°° | ||||||

| I. Net income for the year of the Parent Company and minority interests |

2,456 | 1,169 | 1,287 | °°° | ||||||||

| (Income) loss for the year of minority interests |

(114 | ) | (4 | ) | (110 | ) | °°° | |||||

| L. Net income (loss) of the Parent Company |

2,342 | 1,165 | 1,177 | °°° | ||||||||

| (*) | Net of relevant recuperated costs. |

| (**) | Including value adjustments to financial assets other than equity investments. |

| 2003 ANNUAL REPORT | 28

|

CONSOLIDATED BALANCE SHEET

| 12.31.2003 (a) |

12.31.2002 (b) |

Changes (a)-(b) |

||||||||||||

| (in millions of Euro) |

absolute |

% |

||||||||||||

| A. Net intangibles, fixed assets and long-term investments |

||||||||||||||

| Intangible assets: |

||||||||||||||

| - consolidation differences |

734 | 957 | (223 | ) | (23.3 | ) | ||||||||

| - other intangible assets |

4,516 | 4,268 | 248 | 5.8 | ||||||||||

| Fixed assets |

3,908 | 3,756 | 152 | 4.0 | ||||||||||

| Long-term investments: |

||||||||||||||

| - equity investments and advances on future capital contributions |

12 | 16 | (4 | ) | (25.0 | ) | ||||||||

| - other |

106 | 364 | (258 | ) | (70.9 | ) | ||||||||

| 9,276 | 9,361 | (85 | ) | (0.9 | ) | |||||||||

| B. Working capital |

||||||||||||||

| Inventories |

97 | 104 | (7 | ) | (6.7 | ) | ||||||||

| Net trade accounts receivable |

1,997 | 1,967 | 30 | 1.5 | ||||||||||

| Other assets |

492 | 1,027 | (535 | ) | (52.1 | ) | ||||||||

| Trade accounts payable |

(2,713 | ) | (2,614 | ) | (99 | ) | 3.8 | |||||||

| Other liabilities |

(1,941 | ) | (1,587 | ) | (354 | ) | 22.3 | |||||||

| Reserve for employee termination indemnities, retirement payments and similar obligations |

(95 | ) | (98 | ) | 3 | (3.1 | ) | |||||||

| Advance taxes payments, net of the tax reserves |

1,020 | 1,102 | (82 | ) | (7.4 | ) | ||||||||

| Other reserves for risks and charges |

(1,256 | ) | (1,552 | ) | 296 | (19.1 | ) | |||||||

| Capital grants and/or contributions to infrastructure |

(8 | ) | (9 | ) | 1 | (11.1 | ) | |||||||

| (2,407 | ) | (1,660 | ) | (747 | ) | 45.0 | ||||||||

| C. Net invested capital |

(A+B) | 6,869 | 7,701 | (832 | ) | (10.8 | ) | |||||||

| Financed by: |

||||||||||||||

| D. Shareholders’ equity |

||||||||||||||

| of Parent Company |

7,295 | 5,409 | 1,886 | 34.9 | ||||||||||

| of minority interests |

508 | 370 | 138 | 37.3 | ||||||||||

| 7,803 | 5,779 | 2,024 | 35.0 | |||||||||||

| E. Medium/long-term debt |

585 | 807 | (222 | ) | (27.5 | ) | ||||||||

| F. Net short-term borrowings |

||||||||||||||

| (net short-term liquid assets) |

||||||||||||||

| Short-term borrowings |

257 | 1,712 | (1,455 | ) | (85.0 | ) | ||||||||

| Liquid assets and short-term financial assets |

(1,778 | ) | (594 | ) | (1,184 | ) | °°° | |||||||

| Short-term financial accruals and deferrals, net |

2 | (3 | ) | 5 | °°° | |||||||||

| (1,519 | ) | 1,115 | (2,634 | ) | °°° | |||||||||

| Consolidated net financial debt/ (net liquid assets) |

(E+F) | (934 | ) | 1,922 | (2,856 | ) | °°° | |||||||

| G. Net financial funding |

(D+E+F)=C | 6,869 | 7,701 | (832 | ) | (10.8 | ) | |||||||

| 2003 ANNUAL REPORT | 29

|

| CONSOLIDATED STATEMENT OF CASH FLOWS

|

||||||||||||||

| (in millions of Euro) |

Financial (a) |

Financial Year 2002 (b) |

Absolute (a) - (b) |

|||||||||||

| A. |

(Net borrowings at the beginning of the year) | (1,922 | ) | (1,532 | ) | (390 | ) | |||||||

| Operating income for the year | 3,786 | 3,358 | 428 | |||||||||||

| Amortization and depreciation of intangibles and fixed assets | 1,542 | 1,512 | 30 | |||||||||||

| Investments in intangibles and fixed assets (1) | (1,957 | ) | (1,715 | ) | (242 | ) | ||||||||

| Proceeds from ordinary divestments of intangibles | ||||||||||||||

| and fixed assets | 6 | 90 | (84 | ) | ||||||||||

| Change in operating working capital and other changes | 369 | (313 | ) | 682 | ||||||||||

| B. |

Operating free cash flow | 3,746 | 2,932 | 814 | ||||||||||

| Long-term investments and consolidation differences (1) | (60 | ) | (644 | ) | 584 | |||||||||

| Proceeds from sale, or redemption value, of other intangibles, fixed assets and long-term investments | 58 | 1,827 | (1,769 | ) | ||||||||||

| Change in non-operating working capital and other changes | (459 | ) | (888 | ) | 429 | |||||||||

| C. |

(461 | ) | 295 | (756 | ) | |||||||||

| D. |

Net cash flows before distribution of dividends/ reserves and contributions by shareholders | (B+C | ) | 3,285 | 3,227 | 58 | ||||||||

| E. |

Distribution of dividends/reserves | (429 | ) | (3,617 | ) | 3,188 | ||||||||

| F. |

Contributions by shareholders | — | — | — | ||||||||||

| G. |

Change in net borrowings | (D+E+F | ) | 2,856 | (390 | ) | 3,246 | |||||||

| H. |

(Net borrowings)/net liquid assets at the end of the year | (A+G | ) | 934 | (1,922 | ) | 2,856 | |||||||

The change in net financial borrowings is as follows:

| (in millions of Euro) |

Financial Year 2003 |

Financial Year 2002 |

||||

| Increase (decrease) in medium/long-term debt |

(222 | ) | (603 | ) | ||

| Increase (decrease) in net short-term borrowings |

(2,634 | ) | 993 | |||

| Total |

(2,856 | ) | 390 | |||

| (1) Total capital requirements for investments are broken down as follows: |

||||||

| (in millions of Euro) |

Financial Year 2003 |

Financial Year 2002 |

||||

| Industrial investments: |

||||||

| - consolidation differences |

713 | 640 | ||||

| - other intangible assets |

1,244 | 1,075 | ||||

| - fixed assets |

7 | 196 | ||||

| Long-term investments |

53 | 448 | ||||

| Capital requirements for investments |

2,017 | 2,359 | ||||

| 2003 ANNUAL REPORT | 30

|

ECONOMIC AND FINANCIAL PERFORMANCE OF TIM S.P.A.

MANAGEMENT OF OPERATIONS

In FY 2003, the Parent Company TIM S.p.A. posted sales and service revenues of Euro 9,469 million, 75% of which composed of income from traffic (Euro 7,099 million), up 2.6% (3.7% net of the effects of the merger by incorporation of Blu S.p.A., which took place in December 2002 and became effective, for accounting and tax purposes on January 1, 2002) and 10.9% from VAS income (Euro 1,028 million). Over the past 12 months, there was a 5% growth in total revenues. Compared to the figures for pro forma 2002, which excludes revenues incorporated as part of the merger with Blu S.p.A., the increase in sales and service revenues in 2003 is equivalent to 6.2% (+ Euro 554 million).

In 2003, revenues from outgoing traffic continue to represent the most significant component of revenue, not only in absolute terms (amounting to Euro 4,257 million), but also in terms of an increase compared to last year (+4.1%).

Income from VAS increased by 33.2% over the past twelve months (36.7% excluding the effects of the Blu merger), rising to Euro 1,028 million in 2003. The ratio to service revenues alone was 11.4%.

Raw materials and outside services amounted to Euro 3,998 million (Euro 4,144 million in 2002). The trend in this item was influenced by the effects of the sentence handed down on September 18, 2003 by the Court of Justice of the European Communities, confirming the illegitimacy of the institutive regulations on the contribution for the performance of TLC activities (Art. 20 of Law 448/98). Thus, there is no longer an obligation to allocate this contribution in the Statement of Income. The relevant cost, which continued to be posted in the previous quarters, was estimated at Euro 59 million for H1 2003 and at Euro 29 million for the first three months of the year. The expense earmarked for this item in FY 2002 was Euro 154 million, of which Euro 3 million pertaining to Blu S.p.A.

Excluding the effects of the merger, raw materials and outside services would have amounted to Euro 3,972 million and the increase for the past twelve months would have been Euro 26 million (+0.7%).

Gross operating profit for the period was Euro 5,035 million, showing a 14.3% improvement compared to 2002 (Euro 4,404 million). The ratio to total revenues was 53.2%, as opposed to 48.8% for the previous period.

The growth in gross operating profit compared to the value for pro forma 2002 was Euro 506 million in terms of absolute value, or 11.2%.

Operating income was Euro 3,863 million, versus Euro 3,153 million in 2002 (+22.5%). The ratio to total revenues was 40.8%.

| 2003 ANNUAL REPORT | 31

|

It must be noted that starting with the report for the first half of 2003, for certain categories of intangible assets the method for calculating the relevant amortization allowance was modified, aligning the starting date for calculating amortization with the date the asset actually went into operation. This refinement, which was made in order to improve the comprehension and comparability of the figures, led to a reduction of approximately Euro 106 million in the amortization allowance for intangible assets.

Excluding the effects of the merger with Blu, the increase in operating income would have totaled 16.3%.

Net income (expense) from equity investments (negative for Euro -4 million) refers to the write-down of the carrying value of affiliate Edotel S.p.A.

Net extraordinary income and expense, negative at Euro 8 million, was influenced by the following events:

| • | non-existent assets of Euro 543 million generated in Q3 following the non-applicability of the liability provision allocated through December 31, 2002 to meet expenses for the TLC contribution; |

| • | the write-down, entered in the accounts for Euro 618 million, of the book value of subsidiary TIM International N.V. |

The effect of the two operations on taxes for the period can be estimated, respectively, as a liability of approximately Euro 209 million and a benefit of approximately Euro 205 million.

Net income for the period amounted to Euro 2,322 million, or 24.5% of total revenues. The significant increase compared to the value posted at the end of 2002 can be attributed not only to the improvement in the Company’s operating performance and to the extraordinary operations illustrated above, but also to the write-down in the book value of TIM International in 2002, for the amount of Euro 2,952 million (Euro 1,889 million net of tax effects).

TIM’s personnel at December 31, 2003 numbered 10,023 employees; compared to the workforce at the end of the last period (10,261 employees), this reflects a decrease of 238.

TIM S.p.A. R&D costs for 2003 amounted to approximately Euro 47 million.

For better comparability of data, as a basis of comparison with last year the Statement of Income of TIM S.p.A. has been listed net of the effects of the incorporation of Blu.

MANAGEMENT OF ASSETS AND LIABILITIES

At December 31, 2003 the net intangibles, fixed assets and long-term investments of TIM S.p.A. totaled Euro 9,161 million, reflecting a decrease of Euro 17 million compared to the end of last year.

Plant and machinery totaled Euro 5,052 million (Euro 4,984 million at December 31, 2002); investments in fixed assets amounted to Euro 632 million, while those in intangible assets were Euro 562 million.

With regard to long-term investments it must be noted – in addition to the comments detailing the write-down of the Dutch holding company – that during the period advances were made on future capital contributions for a total of Euro 537 million, nearly all of which in favor of TIM International. In December, following the capital increase passed by the subsidiary, part of these advances were reclassified (Euro 416 million) as an increase of the equity investment entered under the assets on the Balance Sheet.

The residual value of the advances on future capital contributions thus totaled Euro 121 million at December 31, 2003.

| 2003 ANNUAL REPORT | 32

|

Working capital showed a negative balance of Euro 1,622 million (at December 31, 2002 this figure had a negative balance of Euro 641 million). The components showing the most significant variations were Other assets (Euro 293 million, down Euro 569 million due mainly to the trend in net current taxes, which showed a credit at the end of 2002 and a liability for 2003) and Other liabilities (Euro 1,720 million, influenced not only by the steep increase in VAT liabilities but also to the write-off of the amount payable for telecommunications activities).

Shareholders’ equity at December 31, 2003 was Euro 8,957 million. This item was influenced by the additional dividend portion passed when the 2002 Annual Report was approved (of which Euro 263 million drawn from net income and Euro 147 million from share premium reserve), and it has increased as a result of net income for the period. The aggregate change over the past twelve months is thus a positive figure of Euro 1,912 million.

Year-end net financial position is positive with a figure of Euro 1,418 million, whereas at December 31, 2002 it was negative at Euro 1,492 million.

The overall cash flow generated by operations amounted to Euro 2,910 million and it thus financed all the investments for the year, worth Euro 1,737 million, as well as the above-mentioned payment of dividends.

The cash flow was also generated by the change in non-operating working capital, which underwent a negative variation totaling Euro 343 million. This movement is due mainly to tax management (that absorbed resources amounting to Euro 303 million).

Free operating cash flow, or the cash flow generated by operations alone, amounted to Euro 4,201 million.

It must be pointed out that at December 31, 2003, TIM held 897,835 of its own ordinary shares of a par value of Euro 0.06 each, representing 0.01% of the Company’s share capital. These shares have been carried as assets in the Balance Sheet, to the amount of about Euro 4 million; as required under applicable regulations, an unavailable reserve fund of the same amount has been carried under net equity.

| 2003 ANNUAL REPORT | 33

|

TIM S.p.A.

| STATEMENT OF INCOME | |||||||||||||||||||||||

| Financial Year 2003 |

Financial Year 2002 |

Financial Year 2002 Pro forma |

Changes (a) - (b) |

Changes (a) - (c) |

|||||||||||||||||||

| (in millions of Euro) |

(a) |

(b) |

(c) |

absolute |

% |

absolute |

% |

||||||||||||||||

| A. |

Sales and service revenues | 9,469 | 9,022 | 8,915 | 447 | 5.0 | 554 | 6.2 | |||||||||||||||

| Operating grants | 0 | 0 | 0 | 0 | — | 0 | — | ||||||||||||||||

| B. |

Standard production value | 9,469 | 9,022 | 8,915 | 447 | 5.0 | 554 | 6.2 | |||||||||||||||

| Raw materials and outside services (*) | (3,998 | ) | (4,144 | ) | (3,972 | ) | 146 | (3.5 | ) | (26 | ) | 0.7 | |||||||||||

| C. |

Value added | 5,471 | 4,878 | 4,943 | 593 | 12.2 | 528 | 10.7 | |||||||||||||||

| Labor costs (*) | (436 | ) | (474 | ) | (414 | ) | 38 | (8.0 | ) | (22 | ) | 5.3 | |||||||||||

| D. |

Gross operating profit | 5,035 | 4,404 | 4,529 | 631 | 14.3 | 506 | 11.2 | |||||||||||||||

| Amortization and depreciation | (1,083 | ) | (1,153 | ) | (1,112 | ) | 70 | (6.1 | ) | 29 | (2.6 | ) | |||||||||||

| Other valuation adjustments | (66 | ) | (51 | ) | (47 | ) | (15 | ) | 29.4 | (19 | ) | 40.4 | |||||||||||

| Provisions to reserves for risks and charges | (15 | ) | (38 | ) | (38 | ) | 23 | (60.5 | ) | 23 | (60.5 | ) | |||||||||||

| Net other income (expense) | (8 | ) | (9 | ) | (9 | ) | 1 | (11.1 | ) | 1 | (11.1 | ) | |||||||||||

| E. |

Operating income | 3,863 | 3,153 | 3,323 | 710 | 22.5 | 540 | 16.3 | |||||||||||||||

| Net financing (**) | 1 | (16 | ) | (15 | ) | 17 | °°° | 16 | °°° | ||||||||||||||

| Net investments | (4 | ) | 0 | 0 | (4 | ) | — | (4 | ) | — | |||||||||||||

| F. |

Income (loss) before extraordinary items and taxes | 3,860 | 3,137 | 3,308 | 723 | 23.0 | 552 | 16.7 | |||||||||||||||

| Net extraordinary income (expense) | (8 | ) | (3,128 | ) | (3,121 | ) | 3,120 | (99.7 | ) | 3,113 | (99.7 | ) | |||||||||||

| G. |

Income before taxes | 3,852 | 9 | 187 | 3,843 | °°° | 3,665 | °°° | |||||||||||||||

| Income taxes | (1,530 | ) | 255 | (1,785 | ) | °°° | |||||||||||||||||

| H. |

Net income (loss) | 2.322 | 264 | 2.058 | °°° | ||||||||||||||||||

| (*) | Net of relevant recuperated costs. |

| (**) | Including value adjustments to financial assets other than equity investments. |

| 2003 ANNUAL REPORT | 34

|

| BALANCE SHEET |

|||||||||||||||||

| 12.31.2003 |

12.31.2002 |

Changes (a)-(b) |

|||||||||||||||

| (in millions of Euro) |

(a) |

(b) |

absolute |

% |

|||||||||||||

| A. |

Net intangibles, fixed assets and long-term investments | ||||||||||||||||

| Intangible assets | 2,944 | 2,809 | 135 | 4.8 | |||||||||||||

| Fixed assets | 2,108 | 2,175 | (67 | ) | (3.1 | ) | |||||||||||

| Long-term investments: | |||||||||||||||||

| - equity investments and advances on future capital contributions | 4,088 | 4,174 | (86 | ) | (2.1 | ) | |||||||||||

| - other | 21 | 20 | 1 | 5.0 | |||||||||||||

| 9,161 | 9,178 | (17 | ) | (0.2 | ) | ||||||||||||

| B. |

Working capital | ||||||||||||||||

| Inventories | 20 | 36 | (16 | ) | (44.4 | ) | |||||||||||

| Net trade accounts receivable | 1,583 | 1,692 | (109 | ) | (6.4 | ) | |||||||||||

| Other assets | 293 | 862 | (569 | ) | (66.0 | ) | |||||||||||

| Trade accounts payable | (2,081 | ) | (2,044 | ) | (37 | ) | 1.8 | ||||||||||

| Other liabilities | (1,720 | ) | (1,412 | ) | (308 | ) | 21.8 | ||||||||||

| Reserve for employee termination indemnities, retirement payments and similar obligations | (90 | ) | (84 | ) | (6 | ) | 7.1 | ||||||||||

| Advance taxes payments, net of the tax reserves | 1,039 | 1,047 | (8 | ) | (0.8 | ) | |||||||||||

| Other reserves for risks and charges | (658 | ) | (729 | ) | 71 | (9.7 | ) | ||||||||||

| Capital grants and/or contributions to infrastructure | (8 | ) | (9 | ) | 1 | (11.1 | ) | ||||||||||

| (1,622 | ) | (641 | ) | (981 | ) | °°° | |||||||||||

| C. |

Net invested capital | (A+B | ) | 7,539 | 8,537 | (998 | ) | (11.7 | ) | ||||||||

| Financed by: | |||||||||||||||||

| D. |

Shareholder’s equity | ||||||||||||||||

| Share capital | 514 | 514 | — | — | |||||||||||||

| Reserves and retained earnings | 6,121 | 6,267 | (146 | ) | (2.3 | ) | |||||||||||

| Net income (loss) | 2,322 | 264 | 2,058 | °°° | |||||||||||||

| 8,957 | 7,045 | 1,912 | 27.1 | ||||||||||||||

| E. |

Medium/long-term debt | — | — | — | — | ||||||||||||

| F. |

Net short-term borrowings (net short-term liquid assets) | ||||||||||||||||

| Short-term borrowings | 27 | 1,620 | (1,593 | ) | (98.3 | ) | |||||||||||

| Liquid assets and short-term financial assets | (1,444 | ) | (129 | ) | (1,315 | ) | °°° | ||||||||||

| Short-term financial accruals and deferrals, net | (1 | ) | 1 | (2 | ) | °°° | |||||||||||

| (1,418 | ) | 1,492 | (2,910 | ) | °°° | ||||||||||||

| Net financial debt/ (net liquid assets) | (E+F | ) | (1,418 | ) | 1,492 | (2,910 | ) | °°° | |||||||||

| G. |

Net financial funding | (D+E+F | )=C | 7,539 | 8,537 | (998 | ) | (11.7 | ) | ||||||||

| 2003 ANNUAL REPORT | 35

|

CASH FLOWS STATEMENT

| (in millions of Euro) |

Financial (a) |

Financial (b) |

Absolute change (a) - (b) |

|||||||||||

| A. |

(Net borrowings)/net liquid assets at the beginning of the year |

(1,492 | ) | 458 | (1,950 | ) | ||||||||

| Operating income for the year |

3,863 | 3,153 | 710 | |||||||||||

| Amortization and depreciation of intangibles and fixed assets |

1,083 | 1,153 | (70 | ) | ||||||||||

| Investments in intangibles and fixed assets (1) |

(1,194 | ) | (1,697 | ) | 503 | |||||||||

| Proceeds from ordinary divestments of intangibles and fixed assets |

32 | 80 | (48 | ) | ||||||||||

| Change in operating working capital and other changes |

417 | (36 | ) | 453 | ||||||||||

| B. |

Operating free cash flow |

4,201 | 2,653 | 1,548 | ||||||||||

| Long-term investments (1) |

(543 | ) | (777 | ) | 234 | |||||||||

| Proceeds from sale, or redemption value, of other intangibles, fixed assets and long-term investments |

5 | 285 | (280 | ) | ||||||||||

| Change in non-operating working capital and other changes |

(343 | ) | (560 | ) | 217 | |||||||||

| C. |

(881 | ) | (1,052 | ) | 171 | |||||||||

| D. |

Net cash flows before distribution of dividends/ reserves and contributions by shareholders |

(B+C | ) | 3,320 | 1,601 | 1,719 | ||||||||

| E. |

Distribution of dividends/reserves |

(410 | ) | (3,605 | ) | 3,195 | ||||||||

| F. |

Contributions by shareholders (2) |

— | 54 | (54 | ) | |||||||||

| G. |

Change in net borrowings |

(D+E+F | ) | 2,910 | (1,950 | ) | 4,860 | |||||||

| H. |

(Net borrowings)/net liquid assets at the end of the year |

(A+G | ) | 1,418 | (1,492 | ) | 2,910 | |||||||

The change in net financial borrowings is as follows:

| (in millions of Euro) |

Financial Year 2003 |

Financial Year 2002 |

||||

| Increase (decrease) in medium/long-term debt |

— | (117 | ) | |||

| Increase (decrease) in net short-term borrowings |

(2,910 | ) | 2,067 | |||

| Total |

(2,910 | ) | 1,950 | |||