UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTE FROM OUR CHAIR |

||

“As we begin this new chapter at LS&Co., we are confident we have the right leadership and strategies in place — coupled with the feedback and engagement of our shareholders — to further drive sustained profitable growth and continue to demonstrate the strength and resilience of our company and brands.” | ||

2023 was a pivotal year for Levi Strauss & Co. (“LS&Co.”), as the company carried out a successful CEO succession plan that resulted in Michelle Gass, a proven and distinguished business leader, being named CEO of LS&Co. as of January 2024. We applaud Chip Bergh for an impressive 12+ year tenure as chief executive officer, and we’re honored to have Michelle guide the company through this next chapter of growth.

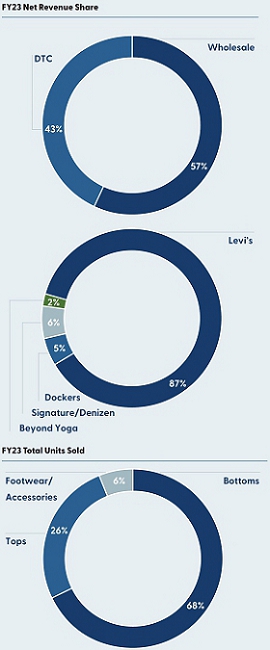

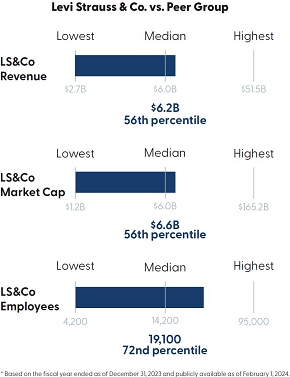

LS&Co.’s strategic growth areas of being direct-to-consumer (DTC) first and brand-led and focusing on diversifying our portfolio are working. While the company and industry at large faced headwinds in wholesale and a volatile macroeconomic and geopolitical environment, LS&Co. delivered $6.2 billion in total net revenue for 2023, with global DTC up 13% for the full year. We also returned $199 million in capital to shareholders, primarily in dividends, which were up 9% from the previous year.

There was a lot to be proud of within our brand portfolio. The Levi’s® brand continues to hold the top spot in the global denim marketplace and sits firmly in the center of culture, with new collaborations and partnerships strengthening connections with consumers and the next generation of shoppers. In May, we celebrated the 150th anniversary of the iconic Levi’s® 501® jean and saw 501® sales grow 11% for the full year, with our total Levi’s® brands revenue growing to $5.4 billion last year. In 2023, we continued to expand our brick-and-mortar presence across our portfolio and geographies, including Beyond Yoga®, which opened six stores and expanded outside of Southern California.

We have a lot to be excited about as we head into 2024. We welcomed veteran retailer and proven brand builder Nancy Green as the new CEO of Beyond Yoga® and last year added new faces to our executive leadership team, including Natalie MacLennan as the new CEO of Dockers®, Dawn Vitale as our chief merchant officer for the Levi’s® brand, Kenny Mitchell as our new chief marketing officer for the Levi’s® brand and Jason Gowans as LS&Co.’s first chief digital officer. At the Board level, Pat Pineda retired from distinguished service to LS&Co. in December 2023, and earlier this year, the Board welcomed Dave Marberger to its ranks.

As we begin this new chapter at LS&Co., we are confident we have the right leadership and strategies in place — coupled with the feedback and engagement of our shareholders — to further drive sustained profitable growth and continue to demonstrate the strength and resilience of our company and brands. And as we move forward, we will do so without losing sight of our deep-rooted values, because as LS&Co. has seen time and time again, not only is it the right thing to do, it’s also good for business.

We look forward to delivering a strong, profitable year in 2024 — for both the company and all of you.

ROBERT A. ECKERT

Board Chair

We intend to mail the Proxy Availability Notice on or about March 14, 2024 to all shareholders of record entitled to vote at the annual meeting. We expect that this proxy statement and the other proxy materials will be available to shareholders on or about March 14, 2024.

| 2024 PROXY STATEMENT | 3 |

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS |

| PROPOSALS | BOARD VOTE RECOMMENDATION |

FOR FURTHER DETAILS | |||

| 1. | Election of Class II Directors | “FOR” each director nominee | Page 11 | ||

| 2. | Advisory Vote on Executive Compensation | “FOR” | Page 34 | ||

| 3. | Ratification of Selection of Independent Registered Public Accounting Firm | “FOR” | Page 70 | ||

| 4. | Corporate Financial Sustainability Report | “AGAINST” | Page 72 | ||

Shareholders will also conduct any other business properly brought before the annual meeting or any adjournment or postponement thereof. A list of shareholders of record will be available for inspection by shareholders of record during normal business hours for 10 days prior to the annual meeting for any legally valid purpose at our corporate headquarters at 1155 Battery Street, San Francisco, CA 94111. Whether or not you expect to attend the annual meeting, you are urged to vote by proxy as promptly as possible to ensure your vote is counted. You may vote over the telephone, through the internet or by using the proxy card that you request as instructed in the Proxy Availability Notice. Even if you have voted by proxy, you may still vote at the annual meeting, as your proxy is revocable at your option. Note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from that record holder. See the Proxy Availability Notice for more information.

By Order of the Board of Directors,

NANCI PRADO

Corporate Secretary

A live webcast of the annual meeting will be available at www.virtualshareholdermeeting.com/LEVI2024. To access the webcast, go to this website and follow the instructions provided. The webcast will be recorded and available for replay at this website through May 24, 2024. Electronic entry to the meeting will begin at 10:15 a.m., Pacific Time.

To attend and vote during the annual meeting visit www.virtualshareholdermeeting.com/LEVI2024 and enter the 16-digit control number included in your Proxy Availability Notice, voting instruction form or proxy card.

If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/LEVI2024.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 24, 2024

The notice of annual meeting, proxy statement and annual report to shareholders are available free of charge at www.proxyvote.com.

|

DATE

AND TIME April 24, 2024 (Wednesday) 10:30 a.m. (Pacific Time) |

|

LOCATION

www.virtualshareholdermeeting.com/ LEVI2024 |

|

WHO CAN VOTE |

| HOW TO VOTE | ||

|

INTERNET | |

| • | Visit www.proxyvote.com to vote online (you will need the voter control number from your proxy card or the Proxy Availability Notice) | |

| • | Your vote must be received by 8:59 p.m., Pacific Time, on April 23, 2024 | |

|

TELEPHONE | |

| • | Call 1-800-690-6903 and follow the recorded instructions (you will need the voter control number from your proxy card) | |

| • | Your vote must be received by 8:59 p.m., Pacific Time, on April 23, 2024 | |

|

||

| • | Complete, sign, date and return the proxy card that may be delivered | |

| • | Your proxy card must be mailed by April 15, 2024 | |

|

AT THE VIRTUAL MEETING See “Attendance at the Meeting” | |

|

QR CODE Scan this QR code to vote with your mobile device | |

| 4 | LEVI STRAUSS & CO. |

TABLE OF CONTENTS |

| 2024 PROXY STATEMENT | 5 |

PERFORMANCE HIGHLIGHTS |

|

||

|

$6.2 billion FY23 net revenue

| |

|

~$199 million FY23 capital return to shareholders in dividends and share buybacks

| |

|

Leading with our Brand* $5.4 billion in Levi’s® brand revenue — the highest in several decades

| |

|

Prioritizing our Direct to Consumer Business* 43% total global DTC business accounted for 43% of our total net revenue

| |

|

Diversifying Across Geographies, Categories, Genders & Channels* 56% international business accounted for 56% of our total net revenue | |

| * We encourage you to review our Annual Report on Form 10-K for the year ended November 26, 2023. | ||

| 6 | LEVI STRAUSS & CO. |

PROXY STATEMENT SUMMARY |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find further information in this proxy statement.

|

||||||

| 1 |

ELECTION OF CLASS II DIRECTORSThe Board recommends a vote FOR each director nominee.

See page 11. |

|||||

| DIRECTOR | COMMITTEE MEMBERSHIP | |||||||||||

| NAME AND PRINCIPAL OCCUPATION | AGE | SINCE | AC | CHCC | FC | NGCCC | ||||||

|

|

|

DAVID A. FRIEDMAN Retired; Senior Principal, Emeritus Chief Executive Officer and Chair of the Board, Forell/Elsesser Engineers |

70 | 2018 |  |

| |||||

|

YAEL GARTEN Former Director, AI/ML Data Science and Engineering, Apple |

45 | 2020 |  |

| |||||||

|

JENNY MING Chief Executive Officer and Director, Rothy’s, Inc. |

68 | 2014 |  |

| |||||||

|

JOSHUA E. PRIME Co-President, Argonaut Securities Company. |

46 | 2019 |  |

|

|||||||

|

|

|

TROY M. ALSTEAD Founder and President, Table 47 and Ocean5 |

60 | 2012 | C |  |

|||||

|

CHARLES (“CHIP”) V. BERGH(1) Executive Vice Chair of the Board of Directors, Levi Strauss & Co. |

66 | 2012 | |||||||||

|

ROBERT A. ECKERT Operating Partner, FFL Partners, LLC |

69 | 2010 |  |

C | |||||||

|

MICHELLE GASS President and Chief Executive Officer, Levi Strauss & Co. |

56 | 2023 | |||||||||

|

DAVID MARBERGER(2) Executive Vice President and CFO, Conagra Brands. |

59 | 2024 |  |

|

|||||||

|

|

JILL BERAUD Retired; Former Chief Executive Officer, Ippolita |

63 | 2013 |  |

C | ||||||

|

SPENCER C. FLEISCHER Chairman, FFL Partners, LLC |

70 | 2013 | C |  |

|||||||

|

CHRISTOPHER J. MCCORMICK Retired; Former President and Chief Executive Officer, L.L. Bean, Inc. |

68 | 2016 |  |

| |||||||

|

ELLIOTT RODGERS Executive Vice President and Chief Operations Officer, Foot Locker, Inc. |

48 | 2020 |  |

| |||||||

| AC | Audit Committee | CHCC | Compensation and Human Capital Committee |  |

Member |  |

Independent | |||||||||

| FC | Finance Committee | NGCCC | Nominating, Governance and Corporate Citizenship Committee | C | Chair |

| (1) | Mr. Bergh is expected to retire from our Board of Directors as of April 26, 2024. Upon his retirement, the number of members serving on our Board of Directors will decrease from 13 to 12. |

| (2) | Mr. Marberger joined the Board of Directors on January 9, 2024, replacing Ms. Patricia Salas Pineda, who retired from our Board of Directors in December 2023. |

| 2024 PROXY STATEMENT | 7 |

SKILLS & EXPERIENCE

| • | Independent Board Chair |

| • | Majority of independent directors |

| • | Diverse Board |

| • | Committee membership limited to independent directors |

| • | Executive sessions of non-employee directors of Board and committees |

| • | Director and officer stock ownership requirements |

| • | No poison pill |

| (1) | Mr. Bergh is expected to retire from our Board of Directors as of April 26, 2024. Upon his retirement, the number of members serving on our Board of Directors will decrease from 13 to 12. |

| 8 | LEVI STRAUSS & CO. |

|

||||||

| 2 |

ADVISORY VOTE ON EXECUTIVE COMPENSATIONThe Board recommends a vote FOR this proposal.

See page 34. |

|||||

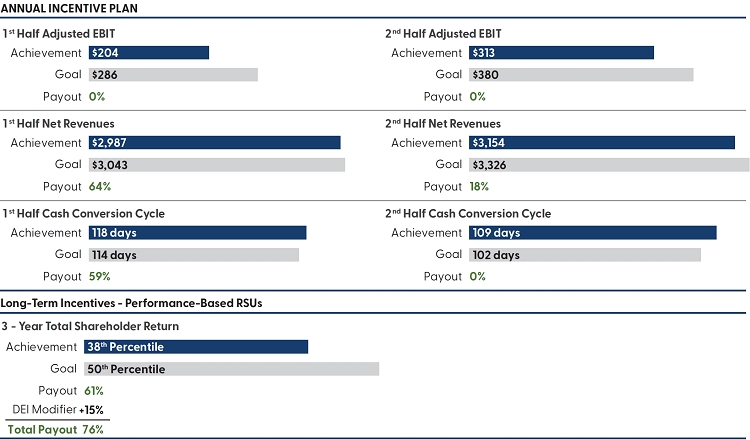

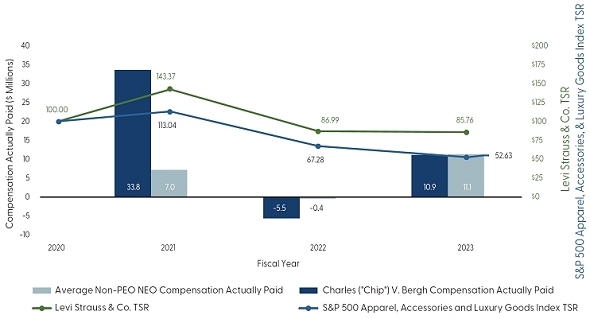

Overall, 2023 was a solid year for Levi Strauss & Co. Despite headwinds in wholesale, persistent inflation and a turbulent macroeconomic and geopolitical environment, the company generated $6.2B in total net revenues — flat to fiscal year 2022 on both a reported and constant-currency basis.* Additionally, the company returned approximately $199 million in capital to shareholders, including dividends of $191 million, which were up 9% from the previous year.

| * | We encourage you to review our Annual Report on Form 10-K for the year ended November 26, 2023. |

| 2024 PROXY STATEMENT | 9 |

|

PRACTICES WE ENGAGE IN |  |

PRACTICES WE DO NOT ENGAGE IN | ||||||

|

| ||||||||

|

||||||

| 3 |

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMThe Board recommends a vote FOR this proposal.

See page 70. |

|||||

|

||||||

| 4 |

CORPORATE FINANCIAL SUSTAINABILITY REPORTThe Board recommends a vote AGAINST this proposal.

See page 72. |

|||||

| 10 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE |

PROPOSAL 1 |

|||

ELECTION OF CLASS II DIRECTORS |

|||

Our Board of Directors currently has 13 members(1) and is divided into three classes, with directors elected for overlapping three-year terms. There are four Class II directors whose term of office expires in fiscal year 2024: David A. Friedman, Yael Garten, Jenny Ming and Joshua E. Prime. Our Board of Directors has recommended that each of these directors be re-elected as Class II directors to serve until the 2027 annual meeting of shareholders and until their successors are duly elected and qualified or, if sooner, until their death, resignation or removal.

A biography of each nominee and a discussion of his or her specific experience, qualifications, attributes and skills that led the Nominating, Governance and Corporate Citizenship Committee and our Board of Directors to recommend him or her as a nominee for Class II director is set forth in this proxy statement under “Board of Directors—Nominees for Election as Class II Directors.”

Directors are elected by a plurality of the votes of the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the four nominees receiving the most FOR votes will be elected as Class II directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, FOR the election of the four nominees recommended by our Board of Directors and named in this proxy statement. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by us. Each nominee has agreed to serve as a Class II director if elected. We have no reason to believe that any nominee will be unable to serve. |

|||

| Our Board of Directors unanimously recommends a vote “FOR” all of the named nominees. | |||

Our Board of Directors currently has 13 members. Our current Board of Directors is divided into three classes with directors elected for overlapping three-year terms:

| • | The current term for directors in Class II (David A. Friedman, Yael Garten, Jenny Ming and Joshua E. Prime) will end at the 2024 annual meeting of shareholders; |

| • | The term for directors in Class III (Troy M. Alstead, Charles (“Chip”) V. Bergh(1), Robert A. Eckert, Michelle Gass and David Marberger) will end at the 2025 annual meeting of shareholders; and |

| • | The term for directors in Class I (Jill Beraud, Spencer C. Fleischer, Christopher J. McCormick and Elliott Rodgers) will end at the 2026 annual meeting of shareholders. |

At each annual meeting of shareholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election and until their successors are duly elected and qualified or, if sooner, their death, resignation or removal. We expect that additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Our corporate governance guidelines provide that directors are expected to attend our annual meetings of shareholders. All of our then-serving directors attended the 2023 annual meeting of shareholders.

| (1) | Mr. Bergh is expected to retire from our Board of Directors on April 26, 2024. Upon his retirement, the number of members serving on our Board of Directors will decrease from 13 to 12. |

| 2024 PROXY STATEMENT | 11 |

The following is a brief biography of each nominee for Class II director and a discussion of his or her specific experience, qualifications, attributes or skills that led the Nominating, Governance and Corporate Citizenship Committee and our Board of Directors to recommend him or her as a nominee for Class II director.

|

DAVID A. FRIEDMAN |

|

|

CAREER HIGHLIGHTS: • Retired Senior Principal, Emeritus Chief Executive Officer and past-Chair of the Board, and past President and Chief Executive Officer of Forell/Elsesser Engineers, with over 40 years of professional practice in structural and earthquake engineering. • President and member of the Board of Directors for the Earthquake Engineering Research Institute, which disseminates lessons learned from earthquakes around the world, and served on its post-earthquake reconnaissance teams in Kobe, Japan in 1995 and Wenchuan, China in 2008. • Involved in many institutional, academic, philanthropic and not-for-profit boards, including the San Francisco Planning and Urban Research Association, the University of California, Berkeley Foundation, the Jewish Home and Senior Living Foundation, Jewish Senior Living Group and GeoHazards International. • A licensed structural engineer in California, Nevada and British Columbia.

KEY QUALIFICATIONS: Mr. Friedman was selected to join our Board of Directors due to his broad professional experience, as well as his extensive background with our company arising from his familial connection to our founder. | ||

|

Retired; Former Senior Principal, Emeritus Chief Executive Officer and past-Chair of the Board, Forell/Elsesser Engineers

AGE: 70

DIRECTOR SINCE: 2018

COMMITTEES: Compensation and Human Capital Committee, Nominating, Governance and Corporate Citizenship Committee |

||

|

YAEL GARTEN |

|

|

CAREER HIGHLIGHTS: • Director, AI/ML Data Science and Engineering, Apple, Inc. from August 2017 through June 2023. • Worked at LinkedIn Corporation in a number of positions from October 2011 to August 2017, including as Director of Data Science from October 2015 to August 2017. • Research Scientist and Text Mining Lead at Stanford University School of Medicine before joining LinkedIn. • Serves on the Board of Directors of Fiverr International Ltd.

KEY QUALIFICATIONS: Dr. Garten was selected to join our Board of Directors for her expertise in data science, artificial intelligence and machine learning, and converting data into actionable product and business strategy. She has applied this expertise across products and services with massive global user bases. | ||

Former Director, AI/ML Data Science and Engineering, Apple

AGE: 45

DIRECTOR SINCE: 2020

COMMITTEES: Audit Committee, Nominating, Governance and Corporate Citizenship Committee |

||

| 12 | LEVI STRAUSS & CO. |

|

JENNY MING |

|

|

CAREER HIGHLIGHTS: • Chief Executive Officer of Rothy’s, Inc., a manufacturer of shoes, handbags and accessories, since January 2024 and a member of the Rothy’s, Inc. Board of Directors since June 2022. • President and Chief Executive Officer of Charlotte Russe Inc., a fast-fashion specialty retailer of apparel and accessories catering to young women, from October 2009 to February 2019. In February 2019, Charlotte Russe Inc. filed a voluntary petition under Chapter 11 of the U.S. Bankruptcy Code. • Was a member of Gap Inc.’s executive team that launched Old Navy, a $7 billion brand in Gap Inc.’s portfolio. Served as its first President from March 1999 to October 2006, where she oversaw all aspects of Old Navy and its 900 retail clothing stores in the United States and Canada. • Joined Gap Inc. in 1986, serving in various executive capacities at its San Francisco headquarters. • Serves on the Board of Directors of Kendra Scott, LLC, and Kaiser Hospital Health Plan. Former director of Affirm Holdings, Inc. and Poshmark, Inc.

KEY QUALIFICATIONS: Ms. Ming was selected to join our Board of Directors due to her extensive operational and retail leadership experience in the apparel industry. | ||

Chief Executive Officer and Director, Rothy’s, Inc.

AGE: 68

DIRECTOR SINCE: 2014

COMMITTEES: Nominating, Governance and Corporate Citizenship Committee, Compensation and Human Capital Committee |

||

|

JOSHUA E. PRIME |

|

CAREER HIGHLIGHTS: • Co-President, Argonaut Securities Company • Partner, Idea Generation and Research, at Indaba Capital Management, L.P., where he served from its founding in 2010 until 2024. • Manager of retail strategy for the Americas Region of Levi Strauss & Co. from 2007 to 2009. • Served as an analyst in merger arbitrage, special situations and credit at Farallon Capital Management, L.L.C. from 1999 to 2005.

KEY QUALIFICATIONS: Mr. Prime was selected to join our Board of Directors due to his broad professional experience, including with our company, and his extensive background with the company arising from his familial connection to our founder. | ||

|

Co-President, Argonaut Securities Company

AGE: 46

DIRECTOR SINCE: 2019

COMMITTEES: Audit Committee, Finance Committee |

||

| 2024 PROXY STATEMENT | 13 |

The following is a brief biography of each director whose term will continue after the annual meeting.

|

TROY M. ALSTEAD |

|

|

CAREER HIGHLIGHTS: • Founder and President of Table 47, Ocean5, a restaurant and social concept, and The Cup Coffee Lounge. • Retired from Starbucks Corporation in February 2016 after 24 years with the company, having most recently served as Chief Operating Officer. • Held the positions of Group President, Chief Financial Officer and Chief Administrative Officer of Starbucks. • Spent a decade in Starbucks international business, including roles as Senior Leader of Starbucks International, President of Europe, Middle East and Africa headquartered in Amsterdam and Chief Operating Officer of Starbucks Greater China headquartered in Shanghai. • Currently serves as a director of Harley-Davidson, Inc., Array Technologies, Inc., and OYO Global.

KEY QUALIFICATIONS: Mr. Alstead brings to our Board of Directors his broad financial and business perspective developed over many years in the global consumer goods industry. | ||

Founder and President, Table 47, Ocean5, and The Cup Coffee Lounge

AGE: 60

DIRECTOR SINCE: 2012

COMMITTEES: Audit Committee (Chair), Compensation and Human Capital Committee |

||

|

JILL BERAUD |

|

|

CAREER HIGHLIGHTS: • Retired Chief Executive Officer of Ippolita, a privately held luxury jewelry company with distribution in high-end department stores, flagship and ecommerce, from October 2015 until September 2018. • Executive Vice President for Tiffany & Co., with responsibility for its Global Retail Operations and E-Commerce with oversight of strategic store development and real estate from October 2014 until June 2015. • Served as Chief Executive Officer for Living Proof, Inc., a privately held company that uses advanced medical and materials technologies to create hair care and skin care products for women from December 2011 to October 2014. • Served as President of Starbucks/Lipton Joint Ventures and Chief Marketing Officer of PepsiCo Americas Beverages from July 2009 to June 2011, and PepsiCo’s Global Chief Marketing Officer from December 2008 to July 2009. • Spent 13 years at Limited Brands in various roles, including Chief Marketing Officer of Victoria’s Secret and Executive Vice President of Marketing for its broader portfolio of specialty brands, including Bath & Body Works, C.O. Bigelow, Express, Henri Bendel and Limited Stores. • Director of Revance Therapeutics, Inc. and Chair of the Board for the Fashion for Good BV.

KEY QUALIFICATIONS: Ms. Beraud was selected to join our Board of Directors due to her extensive marketing, social media and consumer branding experience, as well as her extensive managerial and operational knowledge in the apparel and other consumer goods industries. | ||

|

Retired; Former Chief Executive Officer, Ippolita

AGE: 63

DIRECTOR SINCE: 2013

COMMITTEES: |

||

| 14 | LEVI STRAUSS & CO. |

|

CHARLES (“CHIP”) V. BERGH |

|

|

CAREER HIGHLIGHTS: • Executive Vice Chair of our Board of Directors; President and Chief Executive Officer of Levi Strauss & Co. from September 2011 until January 2024. • Joined LS&Co. after a distinguished career at Procter & Gamble. His last assignment was leading the Gillette integration following P&G’s $57 billion acquisition of that business and running the Gillette Blades & Razors business and the entire Male Grooming portfolio of P&G. • Twenty-eight-year career at P&G included roles of increasing scope and complexity and included a six-year assignment as Regional President of Southeast Asia, India and Australia. • Currently serves as the non-executive Chairman of HP Inc. • Previously served on the Board of Directors for VF Corporation, the Singapore Economic Development Board and was a member of the US ASEAN Business Council, Singapore.

KEY QUALIFICATIONS: Mr. Bergh’s position as our Executive Vice Chair of the Board of Directors and former President and Chief Executive Officer and his past experience as a leader of large, global consumer brands make him well suited to be a member of our Board of Directors.

Mr. Bergh is expected to retire from our Board of Directors on April 26, 2024 and will step down from the Board on that date. | ||

Executive Vice Chair of the Board of Directors, Levi Strauss & Co.

AGE: 66

DIRECTOR SINCE: 2011

COMMITTEES: None |

||

|

ROBERT A. ECKERT |

|

CAREER HIGHLIGHTS: • Chair of our Board of Directors, a position he has held since 2021. • Operating Partner of FFL Partners, LLC, a private equity firm, since September 2014. • Chairman Emeritus of Mattel, Inc., a role he has held since January 2013. • Chairman and Chief Executive Officer of Mattel from May 2000 until December 2011, and he continued to serve as its Chairman until December 2012. • Previously worked for Kraft Foods, Inc. for 23 years, and served as President and Chief Executive Officer from October 1997 until May 2000. • Group Vice President of Kraft Foods from 1995 to 1997, and President of the Oscar Mayer foods division of Kraft Foods from 1993 to 1995. • Currently a director of Uber Technologies, Inc., Amgen, Inc., Eyemart Express Holdings, LLC and Quinn Group Inc. Previously served on the Board of Directors for McDonald’s Corporation.

KEY QUALIFICATIONS: Mr. Eckert was selected to join our Board of Directors due to his experience as a senior executive engaged with the dynamics of building global consumer brands through high performance expectations, integrity and decisiveness in driving businesses to successful results. | ||

Operating Partner, FFL Partners, LLC

AGE: 69

DIRECTOR SINCE: 2010

COMMITTEES: Nominating, Governance and Corporate Citizenship Committee (Chair), Compensation and Human Capital Committee |

||

| 2024 PROXY STATEMENT | 15 |

|

SPENCER C. FLEISCHER |

|

CAREER HIGHLIGHTS: • Current Chairman and former Managing Partner of FFL Partners, LLC, a private equity firm. • Spent 19 years at Morgan Stanley & Company as an investment banker and senior leader, leading business units in Asia, Europe and the United States, before co-founding FFL Partners, LLC in 1997. • Currently serves as a director of The Clorox Company and Americans for Oxford, Inc.

KEY QUALIFICATIONS: Mr. Fleischer was selected to join our Board of Directors due to his broad financial and international business perspectives developed over many years in the private equity and investment banking industries. | ||

Chairman, FFL Partners, LLC

AGE: 70

DIRECTOR SINCE: 2013

COMMITTEES: Compensation and Human Capital Committee (Chair), Finance Committee |

||

|

MICHELLE GASS |

|

CAREER HIGHLIGHTS: • President, Chief Executive Officer of Levi Strauss & Co. since January 2024 and a Director since 2023. • Previously served as President of Levi Strauss & Co. from January 2023 to January 2024. • Previously Chief Executive Officer of Kohl’s Corporation from May 2018 until December 2022 where she led the company’s effort to become a leading omnichannel retailer while acquiring and elevating notable national brand partnerships, including the long-term partnership with Sephora. Held positions of Chief Merchandising and Customer Officer and Chief Customer Officer at Kohl’s prior to becoming Chief Executive Officer. • Served in a variety of leadership roles at Starbucks Corporation across marketing, global strategy, and merchandising for more than 16 years, including President, Starbucks Europe, Middle East and Africa and Executive Vice President, Marketing and Category. • Served in product development and brand management roles at Procter and Gamble before joining Starbucks. • Serves on the Board of Directors of PepsiCo, Inc. Previously served on the Board of Directors of Kohl’s Corporation.

KEY QUALIFICATIONS: Ms. Gass’ position as our President and Chief Executive Officer and her deep retail and omni-channel experience combined with her track record of building brands and meaningful innovation make her well suited to serve as a member of our Board of Directors. | ||

President and Chief Executive Officer, Levi Strauss & Co.

AGE: 56

DIRECTOR SINCE: 2023

COMMITTEES: None |

||

| 16 | LEVI STRAUSS & CO. |

|

DAVID MARBERGER |

|

CAREER HIGHLIGHTS: • Executive Vice President and Chief Financial Officer at Conagra Brands, Inc, a branded food company, since 2016. • Chief Financial Officer at Prestige Brands, a provider of over-the-counter health care products with a portfolio of over 80 brands. • Chief Financial Officer of Godiva Chocolatier for seven years, where he was responsible for the finance, accounting, audit, tax and IT functions, in addition to overseeing Godiva’s worldwide strategic planning process. • Chief Financial Officer of Tasty Baking Company. • Held finance roles with increasing responsibility at Campbell Soup Company.

KEY QUALIFICATIONS: Mr. Marberger was selected to join our Board of Directors due to his extensive experience overseeing financial functions, investor relations, information technology and mergers and acquisitions and his work with leading brands. Mr. Marberger was appointed on January 9, 2024 to fill the seat vacated by Ms. Patricia Salas Pineda. | ||

Executive Vice President and CFO of Conagra Brands, Inc.

AGE: 59

DIRECTOR SINCE: 2024

COMMITTEES: Audit Committee and Finance Committee |

||

|

CHRISTOPHER J. McCORMICK |

|

|

CAREER HIGHLIGHTS: • Served as President and Chief Executive Officer of L.L. Bean, Inc. from 2001 until 2016. • Senior Vice President and Chief Marketing Officer of L.L. Bean from 2000 to 2001. • Joined L.L. Bean in 1983, previously serving in a number of senior and executive level positions in advertising and marketing. • Director of Big Lots!, Inc. and a former director of Sun Life Financial, Inc.

KEY QUALIFICATIONS: Mr. McCormick brings to our Board of Directors his deep channel knowledge and ecommerce and direct marketing experience. | ||

Retired; Former President and Chief Executive Officer, L.L. Bean, Inc

AGE: 68

DIRECTOR SINCE: 2016

COMMITTEES: Audit Committee, Nominating, Governance and Corporate Citizenship Committee |

||

| 2024 PROXY STATEMENT | 17 |

|

ELLIOTT RODGERS |

|

|

CAREER HIGHLIGHTS: • Executive Vice President and Chief Operations Officer at Foot Locker, Inc. since December 2022. • Chief People Officer at project44, a supply chain visibility platform from October 2021 to December 2022 • Previously was Chief Information Officer and Chief Supply Chain Officer of Ulta Beauty. Joined Ulta Beauty in 2013 and served in a number of senior positions where he led distribution, transportation, supplier operations, sales and operations planning, and supply chain strategy. • Led the transformation of Ulta Beauty’s supply chain in support of its strategic imperatives. • Held operational leadership roles spanning retail, financial services, and logistics at Target, Citibank and the United States Army. • Served in various assignments as an Army Officer, including leading logistics support operations for humanitarian service missions.

KEY QUALIFICATIONS: Mr. Rodgers was selected to join our Board of Directors due to his broad professional experience and his extensive operational, technology and retail leadership experience. | ||

Executive Vice President and Chief Operations Officer, Foot Locker, Inc.

AGE: 48

DIRECTOR SINCE: 2020

COMMITTEES: Finance Committee, Nominating, Governance and Corporate Citizenship Committee |

||

| 18 | LEVI STRAUSS & CO. |

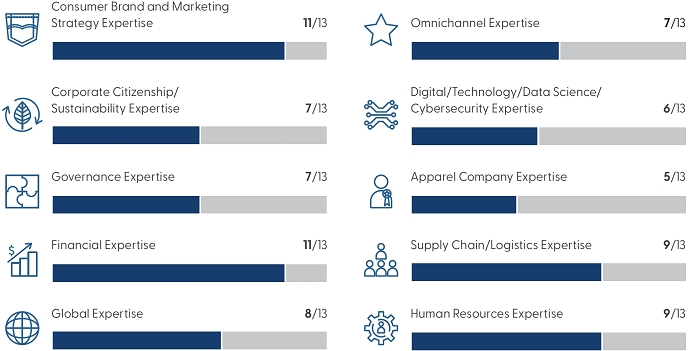

The table below summarizes the key qualifications, skills and attributes that our Board has determined are most relevant to service on our Board. A mark next to a qualification or skill indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not mean the director does not possess that qualification or skill. Our directors’ biographies describe each director’s background and relevant experience in more detail.

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

Consumer Brand and Marketing Strategy |  |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

Corporate Citizenship / Sustainability |  |

|

|

|

|

|

|

||||||||||||||||||||

|

Governance |  |

|

|

|

|

|

|

||||||||||||||||||||

|

Financial |  |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Global |  |

|

|

|

|

|

|

|

|||||||||||||||||||

|

Omnichannel |  |

|

|

|

|

|

| ||||||||||||||||||||

|

Digital / Technology / Artificial Intelligence / Cybersecurity |  |

|

|

|

|

| |||||||||||||||||||||

|

Apparel |  |

|

|

|

|

||||||||||||||||||||||

|

Supply Chain / Logistics |  |

|

|

|

|

|

|

|

| ||||||||||||||||||

|

Human Resources |  |

|

|

|

|

|

|

|

| ||||||||||||||||||

|

Gender Diversity Individuals who self-identify as female. |

|

|

|

|

|||||||||||||||||||||||

|

Racial Diversity Individuals who self-identify as Black, African American, Hispanic, Latinx, Asian, Pacific Islander, Native American, Native Hawaiian, two or more races or ethnicities or Alaskan Native. |

|

|

| 2024 PROXY STATEMENT | 19 |

The Nominating, Governance and Corporate Citizenship Committee believes that candidates for director should have certain minimum qualifications, including the highest personal integrity and ethics and the ability to read and understand basic financial statements. The Nominating, Governance and Corporate Citizenship Committee also will consider factors such as whether a director nominee possesses business and other relevant expertise to offer advice and guidance to management, has sufficient time to devote to the affairs of the Company, demonstrates excellence and a record of accomplishment in his or her field, has the ability to exercise sound business judgment and has the independence of mind and strength of character to rigorously represent the long-term interests of our shareholders. However, from time to time, the Board may change the criteria for Board membership at its discretion. Candidates for director nominees are reviewed in the context of the current composition of the Board, our operating requirements and the long-term interests of shareholders. In conducting this assessment, the Board considers diversity (including, among other things, race, ethnicity, cultural background, gender, geography, sexual orientation and areas of expertise), age, skills, integrity, strength of character, judgment and other factors that it deems appropriate to maintain a balance of knowledge, experience and capability on the Board.

The Nominating, Governance and Corporate Citizenship Committee will consider director candidates recommended by shareholders. The Nominating, Governance and Corporate Citizenship Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a shareholder. Shareholders who wish to recommend individuals for consideration by the Nominating, Governance and Corporate Citizenship Committee to become nominees for election to our Board of Directors may do so by delivering a written recommendation to the Nominating, Governance and Corporate Citizenship Committee at 1155 Battery Street, San Francisco, CA 94111 in accordance with the procedures set forth in our bylaws. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

As required by New York Stock Exchange (“NYSE”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. Our Board of Directors consults with counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of independent, including those set forth in applicable NYSE listing standards, as in effect from time to time. In addition, the charters of the committees of our Board of Directors prohibit members from having any relationship that would interfere with the exercise of their independence from management and our company. The fact that a Board member may own capital stock in the Company is not, by itself, considered an interference with independence under these charters.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and our company, senior management and our independent auditors, our Board of Directors has affirmatively determined that all of our directors are independent, with the exception of Mr. Bergh and Ms. Gass, who serve as executive officers.

Each of Mr. Friedman and Mr. Prime, either directly or by marriage, is a descendant of the family of our founder, Levi Strauss.

| 20 | LEVI STRAUSS & CO. |

The Board of Directors believes that, at this time, it is in the best interests of the company and its shareholders to separate the Chair of the Board and Chief Executive Officer roles and for our Chair to be independent. Currently, Mr. Eckert serves as our independent Chair of the Board. The principal duty of the Chair is to lead and oversee the Board. In the event of a non-independent Chair, the Board may also nominate a person to serve as a lead independent director for election by the independent directors.

Our corporate governance guidelines are available under the “Governance” tab of our website at investors.levistrauss.com.

Our Board of Directors seeks members who are committed to the values of our company and are, by reason of their character, judgment, knowledge and experience, capable of contributing to the effective governance of our company.

In reaching this determination, our Board of Directors considers, among other things, each candidate’s:

| • | business and other relevant expertise to offer advice and guidance to management; |

| • | sufficient time to devote to the affairs of the Company; |

| • | excellence and a record of accomplishment in his or her field; |

| • | the ability to exercise sound business judgment; and |

| • | the commitment, independence of mind and strength of character to rigorously represent the long-term interests of our shareholders. |

Our Board of Directors also considers diversity (including, among other things, race, ethnicity, cultural background, gender, geography, sexual orientation and areas of expertise), age, skills, integrity, strength of character, judgment and other factors that it deems appropriate to maintain a balance of knowledge, experience and capability on the Board. The Board is committed to actively seeking out diverse candidates, including qualified women and individuals from minority and other backgrounds described above, to include in the pool from which nominees for the Board are selected. The Nominating, Governance and Corporate Citizenship Committee assesses the effectiveness of these efforts by examining the overall composition of the Board, assessing how individual director candidates, including incumbent directors, can contribute to the overall success of the Board, and reviewing individual, committee and Board evaluation results.

For incumbent directors whose terms of office are set to expire, the Board reviews those directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence.

Our corporate governance guidelines provide that all directors are subject to a mandatory retirement age of 72, unless waived by our Board of Directors in its discretion.

| 2024 PROXY STATEMENT | 21 |

Our Board of Directors has established four standing committees: an Audit Committee, a Compensation and Human Capital Committee, a Finance Committee and a Nominating, Governance and Corporate Citizenship Committee, each of which has the composition and responsibilities described below. From time to time, our Board of Directors may establish other committees to facilitate the management of our business. Below is a high-level description of each committee of our Board of Directors. More detailed information on the standing committees, including their written charters, is available under the “Governance” tab of our website at investors.levistrauss.com.

| MEMBERS: |

Joshua E. Prime |

Christopher J. McCormick |

David Marberger |

Yael |

Troy M. Alstead | |||

| AUDIT COMMITTEE | ||||||||

| MEETINGS IN FISCAL YEAR 2023: 6 |

||||||||

PRIMARY RESPONSIBILITIES: • Provides assistance to our Board of Directors in its oversight of the integrity of our financial statements and disclosures related to environment, health and safety, corporate citizenship, public policy and community involvement (“ESG”), accounting and financial reporting processes, systems of internal control over financial reporting and compliance with legal and regulatory requirements. • Meets with our management regularly to discuss our critical accounting policies, internal controls over financial reporting and our financial reports to the public. • Meets with our independent registered public accounting firm and with our financial personnel and internal auditors regarding these matters. • Examines the qualifications, selection, independence and performance of our independent registered public accounting firm, and the performance, design and implementation of the internal audit function. • Has sole and direct authority to engage, appoint, evaluate and replace our independent auditor. Both our independent registered public accounting firm and our internal auditors regularly meet privately with, and have unrestricted access to, the Audit Committee. • Evaluates risk and policies for risk management and assessment, including material litigation instituted against the Company and resolution of any ethics issues. Our Board of Directors has determined that each member of the Audit Committee satisfies the independence requirements for Audit Committee members of the U.S. Securities and Exchange Commission (“SEC”) and under the listing standards of the NYSE and Rule 10A-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), and meets the financial literacy requirements under the rules and regulations of the NYSE and the SEC. Each of Mr. Alstead and Mr. Marberger has been determined to be an “audit committee financial expert,” as defined by SEC rules, based on their professional qualifications and experience described above in their biography in “Continuing Directors.”

The Audit Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. This charter is available under the “Governance” tab of our website at investors.levistrauss.com. |

| 22 | LEVI STRAUSS & CO. |

| MEMBERS: |

Jenny |

David A. |

Robert A. |

Jill |

Troy M. |

Spencer C. | |||

| COMPENSATION AND HUMAN CAPITAL COMMITTEE | |||||||||

| MEETINGS IN FISCAL YEAR 2023: 4 |

|||||||||

PRIMARY RESPONSIBILITIES: • Provides assistance to our Board of Directors in its oversight of our compensation, benefits and human resources programs and of CEO and senior management performance, composition and compensation. • Reviews our compensation and benefits objectives and performance against those objectives, reviews market conditions and practices and our strategy and processes for making compensation decisions and annually determines and approves (or, in the case of our CEO, recommends to our Board of Directors) the annual and long-term compensation for our executive officers, including our long-term incentive compensation plans. • Reviews our short- and long-term succession planning process for all our senior executives, including our CEO. • Reviews with management our Compensation Discussion and Analysis and considers whether to recommend that it be included in our SEC filings. • Reviews our policies and strategies relating to culture, recruiting, retention, career development and progression, talent planning and diversity and inclusion. • Reviews the compensation and benefits of our non-employee directors. Our Board of Directors has determined that each member of the Compensation and Human Capital Committee is a non-employee member of our Board of Directors as defined in Rule 16b-3 under the Exchange Act and an outside director as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The composition of the Compensation and Human Capital Committee meets the requirements for independence under the current listing standards of the NYSE and current SEC rules and regulations.

The Compensation and Human Capital Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. Under this charter, the Compensation and Human Capital Committee may, in its discretion, delegate its duties to a subcommittee. This charter is available under the “Governance” tab of our website at investors.levistrauss.com.

The specific determinations of the Compensation and Human Capital Committee with respect to executive compensation for fiscal year 2023 are described in greater detail under “Compensation Discussion and Analysis.” |

| 2024 PROXY STATEMENT | 23 |

| MEMBERS: |

Elliott |

Joshua E. |

David |

Spencer C. |

Jill Beraud | |||

| FINANCE COMMITTEE | ||||||||

| MEETINGS IN FISCAL 2023: 6 |

||||||||

PRIMARY RESPONSIBILITIES: • Provides assistance to our Board of Directors in its oversight of our financing strategies and execution, financial condition, capital structure, equity and debt financings, capital expenditures, cash management, banking activities and relationships, investments, credit arrangements, financial transactions and planning, shareholder financial matters, real estate transactions and relationships with shareholders, creditors and other members of the financial community. • Reviews and makes recommendations to the Board regarding dividends, stock repurchases and other sources of shareholder liquidity. Evaluates and approves mergers, acquisitions, disposals, joint ventures, partnerships and investment opportunities. • Reviews capital structure and returns from various aspects of operations. The Finance Committee operates under a written charter, which is available under the “Governance” tab of our website at investors.levistrauss.com. |

| MEMBERS: |

Elliott |

Jenny |

Christopher J. |

Yael |

David A. |

Robert A. | |||

| NOMINATING, GOVERNANCE AND CORPORATE CITIZENSHIP COMMITTEE | |||||||||

| MEETINGS IN 2023: 5 |

|||||||||

PRIMARY RESPONSIBILITIES: • Responsible for identifying qualified candidates for, and making recommendations regarding the size, structure, composition and functioning of, our Board of Directors in light of, among other factors, directors’ skills, experience, diversity, independence and availability of service. • Responsible for overseeing our corporate governance matters, reporting and making recommendations to our Board of Directors concerning corporate governance matters, developing and recommending to the Board corporate governance guidelines applicable to the Company and reviewing the performance of the Chair of our Board of Directors and our CEO. • Reviews periodically the self-evaluations of the Board and its committees and makes recommendations concerning the structure and membership of the other committees. • Assists our Board of Directors with oversight and review of corporate citizenship and sustainability matters which may have a significant impact on us. • Reviews the composition of our Board in light of directors’ integrity, strength of character, judgment, skills, experience, diversity (including, among other things, race, ethnicity, cultural background, age, gender, sexual orientation and areas of expertise), independence and availability of service to the Company, and recommends nominees for each annual election of directors and to fill any vacancies on our Board. The composition of the Nominating, Governance and Corporate Citizenship Committee meets the requirements for independence under the current listing standards of the NYSE and current SEC rules and regulations.

The Nominating, Governance and Corporate Citizenship Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. This charter is available under the “Governance” tab of our website at investors.levistrauss.com. |

| 24 | LEVI STRAUSS & CO. |

Our Board of Directors met five times during the last fiscal year. Each director attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

In accordance with our corporate governance guidelines and applicable NYSE listing standards, executive sessions of non-management directors are scheduled for every meeting of our Board of Directors and at such other times as our non-management directors see fit. All executive sessions of non-management directors are presided over by the Chair of our Board of Directors. In the absence of the Chair of our Board of Directors, the participating non-management directors will select a director to preside over an executive session.

| OVERSIGHT OF STRATEGY | OVERSIGHT OF RISK | SUCCESSION PLANNING |

The Board provides unique insights into the strategic issues facing the company. The Board and its committees provide guidance and oversight to management with respect to our business strategy throughout the year. As part of its oversight of business strategy, the Board:

• Reviews our annual and long-term strategic and financial plans; • Receives regular reports from the various business leads regarding our performance, risks facing the business and our competitive position; • Reviews and assesses our results and competitive position; and • Discusses external factors affecting the company. |

As described below, the Board of Directors has ultimate responsibility for risk oversight under our risk management framework. The Board oversees policies and procedures for assessing and managing risk, while management is responsible for assessing and managing our exposures to risk on a day-to-day basis. The Board executes its duty both directly and through its committees, as outlined more fully below. | Our leadership team is an important element in our future success.

• Our Chair leads the Board in CEO succession planning. • As disclosed in January 2024, Michelle Gass assumed the role of Chief Executive Officer in January 2024. • Through its Compensation and Human Capital Committee, the Board also oversees succession planning for other leadership roles, including executive officers and key members of senior management.

|

| 2024 PROXY STATEMENT | 25 |

Management is responsible for the day-to-day management of the risks facing our company, while our Board of Directors—as a whole and through its committees—has responsibility for the oversight of risk management.

| BOARD OVERSIGHT | |||||||||

Responsible for the oversight of risk management as a whole and through its committees(1). | |||||||||

|

|||||||||

| AUDIT COMMITTEE | COMPENSATION AND HUMAN CAPITAL COMMITTEE |

FINANCE COMMITTEE |

NOMINATING, GOVERNANCE AND CORPORATE CITIZENSHIP COMMITTEE | ||||||

|

• Reviews our major financial risk and enterprise exposures, risks related to ESG and the steps management has taken to monitor and control such exposures, along with management and the independent registered public accounting firm. • At each meeting, reviews the risks related to the company’s information technology use and protection, including but not limited to data governance, privacy, IT risks, compliance, cybersecurity and significant legislative and regulatory developments that could materially impact the Company. |

• Reviews the risks arising from our compensation policies and practices applicable to all employees and to evaluate policies and practices that could mitigate any such risk. • Consults with its compensation consultant, Semler Brossy, on such matters. • Reviews the development, implementation and effectiveness of policies and strategies relating to human capital, including but not limited to those regarding culture, recruiting, retention, career development and progression, talent planning and diversity and inclusion.

|

• Reviews the risks associated with our capital structure, investment policies, financing needs, long-term financing strategy, banking relationships, credit rating agency relationships and compliance with credit agreement and bond indenture covenants. | • Reviews the risks associated with our corporate citizenship and sustainability initiatives, and reviews with management our corporate governance policies. | ||||||

|

|||||||||

| MANAGEMENT OVERSIGHT | ||

| • | Responsible for the day-to-day management of the risks facing our company. | |

| • | Engages our Board of Directors in discussions concerning risk periodically and, as needed, addresses the topic as part of the annual planning discussions where our Board of Directors and management review key risks to our plans and strategies and the mitigation plans for those risks. | |

| (1) | More detailed information on the standing committees, including their written charters, is available under the “Governance” tab of our website at investors.levistrauss.com. |

| (2) | Semler Brossy provided no services to LS&Co. other than those in support of the Compensation and Human Capital Committee. |

| 26 | LEVI STRAUSS & CO. |

During our 170 years of business, we have built a platform to drive meaningful social change and environmental action. Over the years we have taken stands on issues such as gun violence prevention, equitable access to the polls, the rights of LGBTQIA+ people and many other issues that are important to our business, our customers and the communities we serve. The Levi Strauss Foundation—a separately run charitable foundation, with its own distinct board of directors (11 of the 12 members of the Foundation’s board of directors are not members of the company’s board of directors), which makes charitable grants at its own discretion and to which the company contributes funds—and the company underpin these efforts with grantmaking support to organizations working for lasting changes on these and other important issues.

We review with the Nominating, Governance and Corporate Citizenship Committee the issues on which we are contemplating taking a stand and with the full Board of Directors where appropriate. The Board of Directors and the Nominating, Governance and Corporate Citizenship Committee also approve on an annual basis the Company’s annual donation to the Levi Strauss Foundation. In determining which issues to support, we seek issues that directly affect our business and our people and discuss the business, and sometimes moral, case for taking action. We also take into consideration and discuss with the Nominating, Governance and Corporate Citizenship Committee and, as appropriate, the Board, among other things, the potential impact on our business, customers, employees and communities in which we do business, risks related to taking a stand, measures to address and mitigate such risks and how best to communicate our stance on such issues.

We intend to continue advocating for social change and encouraging others to do the same wherever we see opportunities to contribute to a more just, safe and inclusive society.

We have adopted a Worldwide Code of Business Conduct, applicable to all of our directors and employees (including our President and CEO, Chief Financial Officer, Controller and other senior financial employees). The Worldwide Code of Business Conduct covers a number of topics, including: accounting practices and financial communications; conflicts of interest; confidentiality; corporate opportunities; insider trading; and compliance with laws. The Worldwide Code of Business Conduct is available under the “Governance” tab of our website at investors.levistrauss.com. If we grant a waiver of the Worldwide Code of Business Conduct to one of our officers, we will disclose this waiver on our website.

The Board and the Nominating, Governance and Corporate Citizenship Committee oversee the company’s shareholder engagement practices. We engage with shareholders on issues related to corporate governance, executive compensation and composition, sustainability, company performance and other areas of focus for shareholders. Our engagement with shareholders helps us better understand our shareholders’ priorities and perspectives. We take insights from this feedback into consideration and share them with our Board as we review and evolve our practices and disclosures.

Over the years, our Board of Directors and management have had a rich dialogue with shareholders about important issues, and we have in place an effective process that has ensured that various shareholder inputs are heard by our Board of Directors and management.

Our Board of Directors has adopted a formal process by which shareholders may communicate with our Board of Directors or any of its members. Shareholders who wish to communicate with our Board of Directors or an individual director may do so by sending written communications addressed to Levi Strauss & Co., Attn: Corporate Secretary, 1155 Battery Street, San Francisco, CA 94111. Written communications may be submitted anonymously or confidentially and may, at the discretion of the person submitting the communication, indicate whether the person is a shareholder or other interested party. All communications will be compiled by the Corporate Secretary and reviewed to determine whether it is appropriate for presentation to our Board of Directors or such individual director. Communications determined by the Corporate Secretary to be appropriate for presentation to the Board of Directors or such individual director will be submitted to the Board of Directors or such individual director on a periodic basis.

| 2024 PROXY STATEMENT | 27 |

Any interested person may communicate directly with our non-management or independent directors as a group. Persons interested in communicating directly with our non-management or independent directors regarding their concerns or issues may do so by addressing correspondence to a particular director, or to the independent or non-management directors generally, in care of Levi Strauss & Co. at 1155 Battery Street, San Francisco, CA 94111. If no particular director is named, letters will be forwarded, depending upon the subject matter, to the relevant committee chair.

We have a written policy concerning the review and approval of related party transactions. Potential related party transactions are identified through an internal review process that includes a review of director and officer questionnaires and a review of any payments made in connection with transactions in which related persons may have had a direct or indirect material interest. Any business transactions or commercial relationships between us and any of our directors or shareholders, any of their immediate family members or any related person (as defined in Item 404 of Regulation S-K), are reviewed by the Nominating, Governance and Corporate Citizenship Committee and must be approved by at least a majority of the disinterested members of our Board of Directors. Business transactions or commercial relationships between us and our named executive officers (“NEOs”) who are not directors, or any of their immediate family members, requires approval from our CEO with reporting to the Audit Committee. Our NEOs are disclosed under “Compensation Discussion and Analysis.”

During fiscal year 2023, there have been no transactions to which we have been a participant in which the amount involved exceeded or will exceed $120,000, and in which any of our then directors, executive officers or holders of more than 5% of Class A and Class B common stock on a combined basis at the time of such transaction, or any members of their immediate family, had or will have a direct or indirect material interest, other than as noted below.

In connection with our initial public offering in 2019, we entered into a registration rights agreement with certain holders of our capital stock, including Mr. Friedman, Mr. Prime, Mimi L. Haas, Margaret E. Haas, Robert D. Haas, the Peter E. Haas Jr. Family Fund, Bradley J. Haas, Daniel S. Haas and Jennifer C. Haas. Pursuant to the registration rights agreement, holders of more than 80% of our Class B common stock have certain contractual rights with respect to the registration under the Securities Act of 1933, as amended (the “Securities Act”) of the shares of Class A common stock issuable upon conversion of their Class B common stock (“registrable securities”).

| • | “Piggyback” Registration Rights. If we intend to register any of our securities for public sale, the holders of any then-outstanding registrable securities will be entitled to notice of, and will have the right to include their registrable securities in, such registration. These “piggyback” registration rights will be subject to specified conditions and limitations, including the right of the underwriters of any underwritten offering to limit the number of registrable securities to be included in such offering (but in no case below 50% of the total number of securities included in such offering). |

| • | Registration on Form S-3. If we are eligible to file a registration statement on Form S-3, the holders of any then-outstanding registrable securities will have the right to demand that we file registration statements on Form S-3. This right to have registrable securities registered on Form S-3 will be subject to specified conditions and limitations. |

| • | Expenses of Registration. Subject to specified conditions and limitations, we will pay all expenses relating to any registration made pursuant to the registration rights agreement, other than underwriting discounts, selling commissions, certain stock transfer taxes and certain fees and disbursements of counsel to such holders. |

| • | Termination of Registration Rights. The registration rights of any particular holder of registrable securities will not be available when such holder is able to sell all of his, her or its registrable securities during a 90-day period pursuant to Rule 144 or other similar exemption from registration under the Securities Act. |

We have entered into indemnification agreements with each of our directors and executive officers. As permitted by our certificate of incorporation and bylaws, the indemnification agreements require us to indemnify our directors and executive officers to the fullest extent permitted by Delaware law.

Ms. Gass (our President and CEO), Ms. Layney (our Executive Vice President and Chief Human Resources Officer) and Mr. David Jedrzejek (our Senior Vice President and General Counsel) are members of the Board of Directors of the Levi Strauss Foundation, which is not one of our consolidated entities. Mr. Jedrzejek also serves as a Vice President of the Levi Strauss Foundation. Mr. Bergh served as a member of the Board of Directors of the Levi Strauss Foundation until January 29, 2024. We donated $11.3 million and recognized $2.2 million in expenses related to the Levi Strauss Foundation in fiscal year 2023.

| 28 | LEVI STRAUSS & CO. |

NON-EMPLOYEE DIRECTOR COMPENSATION DURING FISCAL YEAR 2023 |

We provide compensation to our non-employee directors for the time and effort necessary to serve as a member of our Board of Directors. In addition, our non-employee directors are entitled to reimbursement of direct expenses incurred in connection with attending meetings of our Board of Directors or committees thereof.

Compensation for members of our Board of Directors is reviewed by the Compensation and Human Capital Committee and approved by our Board of Directors. The Compensation and Human Capital Committee consults regularly with its compensation consultant, Semler Brossy, which informs it of market trends and conditions, comments on market data relative to the non-employee directors’ current compensation, and provides perspective on other companies’ non-employee director compensation practices.

In fiscal year 2023, director compensation consisted of an annual retainer paid in cash and equity compensation in the form of restricted stock units. The Chair of our Board of Directors also received additional cash and equity retainers and chairs of the committees of our Board of Directors received additional cash retainers, as described below.

In fiscal year 2023, each non-employee director received compensation consisting of an annual cash retainer fee and was eligible to participate in the provisions of our Deferred Compensation Plan that apply to directors. In fiscal year 2023, Spencer C. Fleischer and Elliott Rodgers participated in our Deferred Compensation Plan.

The annual retainer for our non-employee directors is at the rate of $100,000 per fiscal year.

In fiscal year 2023, each non-employee director also received an annual equity award in the form of restricted stock units (“RSUs”) which are granted under our 2019 Equity Incentive Plan (the “2019 EIP”). The annual equity award value in the form of RSUs granted under our 2019 EIP was $155,000. Our non-employee directors have target stock ownership guidelines of five times their annual retainer, or $500,000, of equity ownership within five years of joining the Board of Directors.

The RSUs are generally granted to continuing directors at the close of business on the date of each annual meeting of the company’s shareholders and vest in full upon the earlier of (i) the day before the next annual meeting of shareholders or (ii) the one-year anniversary of the date of grant. In addition, each director’s initial RSU grant includes a deferral delivery feature, under which the director will not receive the vested awards until six months following the cessation of service on our Board of Directors.

Under the terms of our 2016 Equity Incentive Plan (the “2016 EIP”) and 2019 EIP, recipients of RSUs receive additional grants as a dividend equivalent when our Board of Directors declares a dividend to all shareholders. Dividend equivalents are subject to all the terms and conditions, including vesting, of the underlying RSU Award Agreement to which they relate.

In addition to the compensation described above, chairs of the committees of our Board of Directors receive an additional retainer fee in the amount of $25,000 for the Audit Committee, $20,000 for the Compensation and Human Capital Committee, and $15,000 for each of the Finance Committee and the Nominating, Governance and Corporate Citizenship Committee.

For fiscal year 2023, Mr. Eckert was the Chair of our Board of Directors and Chair of our Nominating, Governance and Corporate Citizenship Committee. The Chair of our Board of Directors is entitled to receive an additional annual retainer in the amount of $200,000, 50% of which is paid in cash and 50% of which is paid in the form of RSUs. The Chair of our Board of Directors may also receive the additional retainers earned by chairs of the committees of our Board of Directors, if applicable. Mr. Eckert earned an additional retainer for his role as Chair of our Nominating, Governance and Corporate Citizenship Committee.

| 2024 PROXY STATEMENT | 29 |

In determining the Chair’s compensation, our Board of Directors reviewed compensation data and market trends as advised by, its compensation consultant, Semler Brossy. The Board of Directors also took into account the Chair’s additional role and responsibilities in interacting with our family shareholders over time.

| TYPE OF COMPENSATION | AMOUNT ($) | |

| Annual Cash Retainer | 100,000 | |

| Additional Annual Cash Retainer for Board Chair | 100,000 | |

| Additional Annual Cash Retainer for Committee Chairs | ||

| Audit | 25,000 | |

| Compensation and Human Capital | 20,000 | |

| Finance | 15,000 | |

| Nominating, Governance and Corporate Citizenship | 15,000 | |

| Annual Equity Award | 155,000 | |

| Additional Annual Equity Award for Board Chair | 100,000 |

The following table sets forth information regarding the compensation earned for service on our Board of Directors during fiscal year 2023 by our non-employee directors. Mr. Bergh and Ms. Gass did not receive any additional compensation for their service on our Board of Directors during fiscal year 2023. Their compensation as NEOs are set forth in the “Summary Compensation Table.”

| NAME | FEES EARNED OR PAID IN CASH |

STOCK AWARDS(1) |

ALL OTHER COMPENSATION(2) |

TOTAL | ||||

| Troy M. Alstead | 125,000 | 154,995 | 10,542 | 290,537 | ||||

| Jill Beraud | 115,000 | 154,995 | 7,515 | 277,510 | ||||

| Robert A. Eckert(3) | 215,000 | 254,999 | 25,694 | 495,693 | ||||

| Spencer Fleischer(4) | 120,000 | 154,995 | 18,260 | 293,255 | ||||

| David A. Friedman(5) | 100,000 | 154,995 | 17,717 | 272,712 | ||||

| Yael Garten (6) | 100,000 | 154,995 | 9,386 | 264,381 | ||||

| Christopher J. McCormick | 100,000 | 154,995 | 13,633 | 268,628 | ||||

| Jenny Ming | 100,000 | 154,995 | 19,309 | 274,305 | ||||

| Patricia Salas Pineda | 100,000 | 154,995 | 24,976 | 279,971 | ||||

| Joshua E. Prime(7) | 100,000 | 154,995 | 17,389 | 272,384 | ||||

| Elliott Rodgers (8) | 100,000 | 154,995 | 15,591 | 270,586 |

| (1) | These amounts reflect the aggregate grant date fair value of RSUs granted under the 2019 EIP in fiscal year 2023 computed in accordance with FASB ASC 718. See the notes to our audited consolidated financial statements included in our Annual Report on Form 10-K for fiscal year 2023 for the relevant assumptions used to determine these awards. The following table shows as of November 26, 2023, the aggregate number of outstanding RSUs held by each person who was a director in fiscal year 2023, which number includes any RSUs that were vested but deferred and RSUs that were not vested as of such date: |

| 30 | LEVI STRAUSS & CO. |

| NAME | AGGREGATE OUTSTANDING RSUs | ||

| Troy M. Alstead | 54,511 | ||

| Jill Beraud | 23,951 | ||

| Robert A. Eckert | 60,206 | ||

| Spencer Fleischer | 36,217 | ||

| David A. Friedman | 19,856 | ||

| Yael Garten | 14,078 | ||

| Christopher J. McCormick | 16,174 | ||

| Jenny Ming | 53,996 | ||

| Patricia Salas Pineda | 71,985 | ||

| Joshua E. Prime | 18,086 | ||

| Elliott Rodgers | 15,254 |

| (2) | This column includes the aggregate grant date fair value of dividend equivalents provided to each director in fiscal year 2023 in the following amounts: |

| NAME | FAIR VALUE OF DIVIDEND EQUIVALENT RSUS GRANTED | ||

| Troy M. Alstead | 10,542 | ||

| Jill Beraud | 7,515 | ||

| Robert A. Eckert | 18,194 | ||

| Spencer Fleischer | 10,760 | ||

| David A. Friedman | 10,217 | ||

| Yael Garten | 8,121 | ||

| Christopher J. McCormick | 13,633 | ||

| Jenny Ming | 19,309 | ||

| Patricia Salas Pineda | 24,976 | ||

| Joshua E. Prime | 9,889 | ||

| Elliott Rodgers | 8,091 |

| (3) | Mr. Eckert’s amount in the “All Other Compensation” column includes charitable matches of $7,500. |

| (4) | Mr. Fleischer’s amount in the “All Other Compensation” column includes charitable matches of $7,500. |

| (5) | Mr. Friedman’s amount in the “All Other Compensation” column includes charitable matches of $7,500. |

| (6) | Ms. Garten’s amount in the “All Other Compensation” column includes charitable matches of $1,265. |

| (7) | Mr. Prime’s amount in the “All Other Compensation” column includes charitable matches of $7,500. |

| (8) | Mr. Rodgers’ amount in the “All Other Compensation” column includes charitable matches of $7,500. |

| 2024 PROXY STATEMENT | 31 |

EXECUTIVE OFFICERS |

The following is a brief biography of each of our executive officers as of January 25, 2024, the date we filed our Annual Report on Form 10-K for the fiscal year ending November 26, 2023, except for Mr. Bergh and Ms. Gass, whose biographies are set forth under “Continuing Board of Directors” above.

| NAME | AGE | POSITION |

| Charles (“Chip”) V. Bergh | 66 | President, Chief Executive Officer and Director |

| Michelle Gass | 56 | President and Director |

| David Jedrzejek | 56 | Senior Vice President and General Counsel |

| Tracy Layney | 50 | Executive Vice President and Chief Human Resources Officer |

| Elizabeth O’Neill | 52 | Executive Vice President and Chief Operations Officer |

| Harmit Singh | 60 | Executive Vice President and Chief Financial and Growth Officer |

|

||||

| DAVID JEDRZEJEK | ||||

| David Jedrzejek currently serves as our Senior Vice President and General Counsel. He leads the global legal department in supporting our businesses operating in over 110 countries. He is responsible for all aspects of legal, ethics and compliance, enterprise resilience and governance, in addition to acting as counselor to the board of directors and executive leadership. Mr. Jedrzejek is a member of the company’s executive leadership team. Mr. Jedrzejek also oversees the Levi Strauss Foundation, whose mission is to bring pioneering social change. He previously served as the company’s Deputy General Counsel from February 2023 to June 2023. Mr. Jedrzejek served as our Chief Counsel, Commercial from June 2021 to February 2023 and Chief Counsel, Finance, Governance and Compliance from November 2015 to June 2021. Prior to joining the company, Mr. Jedrzejek served as Associate General Counsel at Gap, Inc. and was previously an attorney at Wilson, Sonsini, Goodrich & Rosati, P.C. and Pillsbury Winthrop Shaw Pittman LLP. | ||||

|

Senior Vice President and General Counsel |

||||

|

||||

| TRACY LAYNEY | ||||