UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2018

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

For the transition period from _________________ to _________________

Commission File Number: 000-33155

COATES INTERNATIONAL, LTD.

(Exact name of registrant as specified in its charter)

| Nevada | 22-2925432 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

2100 Highway 34, Wall Township, New Jersey 07719

(Address of principal executive offices) (Zip Code)

(732) 449-7717

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Non-accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.)

Yes ☐ No ☒

As of November 8, 2018, the Registrant had 915,268,263 shares of its common stock, par value $0.0001 per share issued and outstanding.

COATES INTERNATIONAL, LTD.

QUARTERLY REPORT ON FORM 10-Q

CONTENTS

SEPTEMBER 30, 2018

| Page | ||

| PART 1 – FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements: | 1 |

| Balance Sheets | 1 | |

| Statements of Operations | 2 | |

| Condensed Statements of Cash Flows | 3 | |

| Notes to Financial Statements | 4-23 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24-33 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 33 |

| Item 4. | Controls and Procedures | 33 |

| PART II – OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 34 |

| Item 1A. | Risk Factors | 34 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 34 |

| Item 3. | Defaults Upon Senior Securities | 35 |

| Item 4. | Mine Safety Disclosures | 35 |

| Item 5. | Other Information | 35 |

| Item 6. | Exhibits | 35 |

| SIGNATURES | 36 | |

i

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

Coates International, Ltd.

Balance Sheets

| September 30, 2018 | December 31, 2017 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash | $ | 17,726 | $ | 6,807 | ||||

| Inventory | 102,164 | 103,610 | ||||||

| Other current assets | 50,799 | 608 | ||||||

| Total Current Assets | 170,689 | 111,025 | ||||||

| Property, plant and equipment, net | 2,004,553 | 2,031,684 | ||||||

| Deferred licensing costs, net | 30,669 | 33,882 | ||||||

| Total Assets | $ | 2,205,911 | $ | 2,176,591 | ||||

| Liabilities and Stockholders’ Deficiency | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 2,806,192 | $ | 2,544,002 | ||||

| Deferred compensation payable | 1,892,211 | 1,621,322 | ||||||

| Promissory notes to related parties | 1,437,445 | 1,472,409 | ||||||

| Derivative liability related to convertible promissory notes | 311,047 | 358,996 | ||||||

| Deposit on sale of property | 200,000 | - | ||||||

| Convertible promissory notes, net of unamortized discount | 159,172 | 96,816 | ||||||

| Unearned revenues | 150,595 | 150,595 | ||||||

| Current portion of mortgage loan payable | 60,000 | 1,273,158 | ||||||

| Sublicense deposits | 19,200 | 60,725 | ||||||

| Total Current Liabilities | 7,035,862 | 7,578,024 | ||||||

| Non-current portion of mortgage loan payable | 1,180,490 | - | ||||||

| Non-current portion of sublicense deposits | 635,100 | 607,975 | ||||||

| Total Liabilities | 8,851,452 | 8,185,999 | ||||||

| Commitments and Contingencies | - | - | ||||||

| Stockholders’ Deficiency | ||||||||

| Preferred stock, $0.001 par value, 100,000,000 and 350,000,shares authorized at September 30, 2018 and December 31, 2017, respectively: | ||||||||

| Series A Preferred Stock, 1,000,000 and 5,000 shares designated, 15,620 and 3,601 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | 16 | 4 | ||||||

| Series B Convertible Preferred Stock, 10,000,000 and 345,000 shares designated, 3,261,396 and 228,471 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | 3,261 | 228 | ||||||

| Common Stock, $0.0001 par value, 2,400,000,000 and 120,000,000 shares authorized, 577,968,318 and 36,943,242 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | 57,797 | 3,694 | ||||||

| Additional paid-in capital | 71,341,235 | 67,699,876 | ||||||

| Accumulated deficit | (78,047,850 | ) | (73,713,210 | ) | ||||

| Total Stockholders’ Deficiency | (6,645,541 | ) | (6,009,408 | ) | ||||

| Total Liabilities and Stockholders’ Deficiency | $ | 2,205,911 | $ | 2,176,591 | ||||

The accompanying notes are an integral part of these financial statements.

| -1- |

Coates International, Ltd.

Statements of Operations

(Unaudited)

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Sublicensing fee revenue | $ | 4,800 | $ | 4,800 | $ | 14,400 | $ | 14,400 | ||||||||

| Total Revenues | 4,800 | 4,800 | 14,400 | 14,400 | ||||||||||||

| Expenses: | ||||||||||||||||

| Research and development costs | 99,435 | - | 194,680 | 196,598 | ||||||||||||

| Stock-based compensation expense | 819,483 | 1,715,597 | 2,702,916 | 4,927,152 | ||||||||||||

| Compensation and benefits | 45,492 | 156,171 | 226,328 | 382,098 | ||||||||||||

| General and administrative expenses | 147,283 | 101,977 | 433,764 | 245,087 | ||||||||||||

| Depreciation and amortization | 11,342 | 12,249 | 32,351 | 36,746 | ||||||||||||

| Total Operating Expenses | 1,123,035 | 1,985,994 | 3,590,039 | 5,787,681 | ||||||||||||

| Loss from Operations | (1,118,235 | ) | (1,981,194 | ) | (3,575,639 | ) | (5,773,281 | ) | ||||||||

| Other Expenses: | ||||||||||||||||

| Decrease (increase) in estimated fair value of embedded derivative liabilities | 44,491 | (118,570 | ) | 49,406 | (281,957 | ) | ||||||||||

| Loss on conversion of convertible notes | (40,492 | ) | (84,625 | ) | (69,078 | ) | (245,372 | ) | ||||||||

| Interest expense, net | (211,882 | ) | (266,064 | ) | (739,329 | ) | (969,447 | ) | ||||||||

| Total other expenses | (207,883 | ) | (469,259 | ) | (759,001 | ) | (1,496,776 | ) | ||||||||

| Loss Before Income Taxes | (1,326,118 | ) | (2,450,453 | ) | (4,334,640 | ) | (7,270,057 | ) | ||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| Net Loss | $ | (1,326,118 | ) | $ | (2,450,453 | ) | $ | (4,334,640 | ) | $ | (7,270,057 | ) | ||||

| Basic net loss per share | $ | (0.01 | ) | $ | (0.09 | ) | $ | (0.04 | ) | $ | (0.35 | ) | ||||

| Basic weighted average shares outstanding | 245,993,739 | 26,990,814 | 116,958,625 | 20,816,989 | ||||||||||||

| Diluted net loss per share | $ | (0.01 | ) | $ | (0.09 | ) | $ | (0.04 | ) | $ | (0.35 | ) | ||||

| Diluted weighted average shares outstanding | 245,993,739 | 26,990,814 | 116,958,625 | 20,816,989 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| -2- |

Coates International Ltd.

Condensed Statements of Cash Flows

(Unaudited)

| For the Nine Months Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| Net Cash Used in Operating Activities | $ | (483,317 | ) | $ | (663,268 | ) | ||

| Net Cash Used in Investing Activities | - | - | ||||||

| Cash Flows Provided by Financing Activities: | ||||||||

| Issuance of convertible promissory notes | 374,200 | 723,300 | ||||||

| Deposit received on sale of property | 200,000 | - | ||||||

| Issuance of promissory notes to related parties | 68,230 | 60,340 | ||||||

| Issuance of common stock under equity purchase agreements | - | 42,944 | ||||||

| Issuance of promissory note | - | 30,000 | ||||||

| Repayment of promissory notes and accrued interest to related parties | (103,194 | ) | (122,000 | ) | ||||

| Repayment of mortgage loan | (45,000 | ) | (45,000 | ) | ||||

| Repayment of promissory notes | - | (30,000 | ) | |||||

| Net Cash Provided by Financing Activities | 494,236 | 659,584 | ||||||

| Net Increase (Decrease) in Cash | 10,919 | (3,684 | ) | |||||

| Cash, beginning of period | 6,807 | 9,163 | ||||||

| Cash, end of period | $ | 17,726 | $ | 5,479 | ||||

| Supplemental Disclosure of Cash Flow Information: | ||||||||

| Cash paid during the period for interest | $ | 81,084 | $ | 135,960 | ||||

| Supplemental Disclosure of Non-cash Financing Activities: | ||||||||

| Conversion of convertible promissory notes | $ | 420,503 | $ | 449,614 | ||||

The accompanying notes are an integral part of these financial statements.

| -3- |

Coates International, Ltd.

Notes to Financial Statements

September 30, 2018

(All amounts rounded to thousands of dollars)

(Unaudited)

1. THE COMPANY AND BASIS OF PRESENTATION

Nature of Organization

Coates International, Ltd. (the “Company” or “CIL”) has acquired the exclusive licensing rights to the patented Coates spherical rotary valve (“CSRV®”) system technology in North America, Central America and South America (the “CSRV® License”). The CSRV® system technology has been developed over a period of more than 20 years by the Company’s founder George J. Coates, President and Chief Executive Officer, and his son Gregory G. Coates. The CSRV® system technology is adaptable for use in piston-driven internal combustion engines of many types and has been patented in the United States and numerous countries throughout the world. The Company is endeavoring to raise working capital to commence production of hydrogen gas and natural gas powered CSRV® industrial electric power generator sets (“Gen Sets”) and is also seeking to enter into sublicense agreements with third party, original equipment manufacturers (“OEM’s”) which provide for licensing fees. George J. Coates is also continuing with research and development of a hydrogen reactor to harvest Hydrogen Gas from water with the intent to power the Company’s products, including large industrial Gen Sets. George J. Coates, owner of the hydrogen reactor technology, has committed to license this technology to the Company to manufacture Hydrogen Gas powered products, once the related patent protection is in place.

Management believes the CSRV® engines provide the following advantages as compared to conventional internal combustion engines designed with “poppet valves”:

| ● | Improved fuel efficiency |

| ● | Lower levels of harmful emissions |

| ● | Adaptability to numerous types of engine fuels |

| ● | Longer engine life |

| ● | Longer intervals between engine servicing |

The CSRV® system technology is designed to replace the intake and exhaust conventional “poppet valves” currently used in almost all piston-driven, automotive, truck, motorcycle, marine and electric power generator engines, among others. Unlike conventional valves which protrude into the engine combustion chamber, the CSRV® system technology utilizes spherical valves that rotate in a cavity formed between a two-piece cylinder head. The CSRV® system technology utilizes significantly fewer moving parts than conventional poppet valve assemblies. As a result of these design improvements, management believes that engines incorporating the CSRV® system technology (“CSRV® Engines”) will last significantly longer and will require less lubrication over the life of the engine, as compared to conventional engines. In addition, CSRV® Engines can be designed with larger openings into the engine cylinder than with conventional valves so that more fuel and air can be inducted into, and expelled from the cylinder in a shorter period of time. Larger valve openings permit higher revolutions-per-minute (RPM’s) and permit higher compression ratios with lower combustion chamber temperatures, allowing the Coates Engine® to produce more power than equivalent conventional engines. The extent to which CSRV® Engines operating with the CSRV® system technology achieve (i) higher RPM’s, (ii) greater volumetric efficiency and (iii) higher thermal efficiency than conventional engines, is a function of the engine design and application.

| -4- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

Basis of Presentation

The accompanying condensed financial statements include the accounts of the Company. In the opinion of the Company’s management, the condensed consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation. The preparation of these condensed consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in these condensed consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. Certain prior period amounts in the condensed financial statements have been reclassified to conform to the current period’s presentation.

These condensed financial statements and accompanying notes should be read in conjunction with the Company’s annual financial statements and the notes thereto included in its Annual Report on Form 10-K for the year ended December 31, 2017 and the Company’s quarterly financial statements and the notes thereto included in its Quarterly Reports.

Since the Company’s inception, the Company has been responsible for the development costs of the CSRV® technology in order to optimize the value of the licensing rights and has incurred related operational costs, the bulk of which have been funded primarily through cash generated from licensing fees, sales of stock, short term convertible promissory notes, capital contributions, loans made by George J. Coates, Bernadette Coates, his spouse, Gregory G. Coates and certain directors, fees received from research and development of prototype models and a small number of CSRV® engine generator sales. The Company has incurred substantial cumulative losses from operations since its inception. Losses from operations are expected to continue until the CSRV® Engines® are successfully introduced into the marketplace, enabling the Company to generate substantial sales and/or receive substantial licensing revenues. These losses from operations were primarily related to research and development of the Company’s intellectual property rights, patent filing and maintenance costs and general and administrative expenses. The Company has also reported substantial non-cash expenses for stock-based compensation, remeasurement of the estimated fair value of embedded derivative liabilities related to convertible promissory notes issued and interest expense and losses on conversion of convertible promissory notes.

As shown in the accompanying financial statements, the Company has incurred recurring losses from operations and, as of September 30, 2018, had a stockholders’ deficiency of ($6,646,000). In addition, the recent trading price range of the Company’s common stock at a fraction of a penny has introduced additional difficulty to the Company’s challenge to secure needed additional working capital. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management has instituted a cost control program intended to restrict variable costs to only those expenses that are necessary to complete its activities related to entering the production phase of operations, develop additional commercially feasible applications of the CSRV® system technology, seek additional sources of working capital and cover general and administrative costs in support of such activities. The Company has been actively undertaking efforts to secure new sources of working capital. This could include the balance due at closing consisting of cash proceeds of $1,100,000, less closing costs, if the contingent sale of a portion of the land owned by the Company is consummated, as more fully discussed in Note 9. At September 30, 2018, the Company had negative working capital of ($6,865,000) compared with negative working capital of ($7,467,000) at the end of 2017.

The Company continues to actively seek out new sources of working capital; however, there can be no assurance that it will be successful in these efforts. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Reverse Stock Split

The Company effected a one-for-200 reverse stock split of all of its outstanding shares of common stock, Series A Preferred Stock, Series B Convertible Preferred Stock, common stock warrants and stock options as of the close of trading on December 1, 2017. All prior year balances of shares of capital stock, warrants and stock options outstanding and all presentations and disclosures of transactions in shares of capital stock, warrants and stock options have been restated on a pro forma basis as if the reverse stock split had occurred prior to January 1, 2017. Such restatements include calculations regarding the Company’s weighted average shares outstanding and loss per share.

| -5- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

Inventory

Inventory consists of raw materials. Inventory is stated at the lower of cost or net realizable value. Inventory is accounted for on the first-in, first-out method.

Use of Estimates

The preparation of the Company’s financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These significant estimates include determining the fair value of convertible promissory notes containing embedded derivatives and variable conversion rates, determining a value for shares of Series A Preferred Stock and Series B Convertible Preferred Stock issued, assigning useful lives to the Company’s property, plant and equipment, determining an appropriate amount to reserve for obsolete and slow moving inventory, estimating a valuation allowance for deferred tax assets, assigning expected lives to, and estimating the rate of forfeitures of, stock options granted and selecting a trading price volatility factor for the Company’s common stock in order to estimate the fair value of the Company’s stock options on the date of grant or other appropriate measurement date. Actual results could differ from those estimates.

2. CONCENTRATIONS OF CREDIT AND BUSINESS RISK

The Company maintains cash balances with one financial institution. Monies on deposit are fully insured by the Federal Deposit Insurance Corporation.

The Company’s operations are devoted to the development, application, licensing and marketing of the CSRV® system technology which was invented by George J. Coates, the Company’s founder, Chairman, Chief Executive Officer, President and controlling stockholder. Development efforts have been conducted continuously during this time. From July 1982 through May 1993, seven U.S. patents as well as a number of foreign patents were issued with respect to the CSRV® system technology. Since inception of the Company in 1988, all aspects of the business have been completely dependent upon the activities of George J. Coates. The loss of George J. Coates’ availability or service due to death, incapacity or otherwise would have a material adverse effect on the Company’s business and operations. The Company does not presently have any key-man life insurance in force for Mr. Coates.

3. FAIR VALUE OF FINANCIAL INSTRUMENTS

Cash, Other Assets, Accounts Payable and Accrued Liabilities and Other Liabilities

With the exception of convertible promissory notes, the carrying amount of these items approximates their fair value because of the short term maturity of these instruments. The convertible promissory notes are reported at their estimated fair value, determined as described in more detail in Note 14.

Limitations

Fair value estimates are made at a specific point in time, based on relevant market information and information about the financial instrument. These estimates are subjective in nature and involve uncertainties and matters of significant judgment and therefore cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

| -6- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

4. LICENSING AGREEMENT AND DEFERRED LICENSING COSTS

The Company holds a manufacturing, use, lease and sale license from George J. Coates and Gregory G. Coates for the CSRV® system technology in the territory defined as the Western Hemisphere (the “License Agreement”). Under the License Agreement, George J. Coates and Gregory G. Coates granted to the Company an exclusive, perpetual, royalty-free, fully paid-up license to the patented intellectual property that specifically relates to an internal combustion engine that incorporates the CSRV® system technology (the “CSRV® Engine”) and that is currently owned or controlled by them (the “CSRV® Intellectual Property”), plus any CSRV® Intellectual Property that is developed by them during their employment with the Company. In the event of insolvency or bankruptcy of the Company, the licensed rights would terminate and ownership would revert back to George J. Coates and Gregory G. Coates.

Under the License Agreement, George J. Coates and Gregory G. Coates agreed that they will not grant any Western Hemisphere licenses to any other party with respect to the CSRV® Intellectual Property.

At September 30, 2018 and December 31, 2017, deferred licensing costs, comprised of expenditures for patent costs incurred pursuant to the CSRV® licensing agreement, net of accumulated amortization, amounted to $31,000 and $34,000, respectively. Amortization expense for the three months ended September 30, 2018 and 2017 amounted to $1,000 and $1,000, respectively. Amortization expense for the nine months ended September 30, 2018 and 2017 amounted to $3,000 and $3,000, respectively.

5. AGREEMENT ASSIGNED TO ALMONT ENERGY, INC.

In 2010, Almont Energy Inc. (“Almont”), a privately held, independent third-party entity based in Alberta, Canada became the assignee of a sublicense which covers the use of the CSRV® system technology in the territory of Canada in the oil and gas industry (the “Canadian License”). This sublicense is currently inactive because the parties have not fulfilled their obligations thereunder due to the Company’s delay in starting up production and delivery of CSRV® products to Almont. The parties mutually agreed to consider the basis on which the license could be reactivated at such time that the Company is successful in starting up its manufacturing operations.

In prior years, the Company received a non-refundable $300,000 deposit on the Canadian License. As the Company continues to be desirous of commencing shipments of its CSRV® products to Almont under the sublicense at such time that it is able to start up production operations, it has continued to amortize this deposit into income over the period until expiration of the last CSRV® system technology patent in force. At September 30, 2018, amortization of the unamortized balance is as follows:

| Year Ending | Amount | |||

| 2018 | 5,000 | |||

| 2019 | 19,000 | |||

| 2020 | 19,000 | |||

| 2021 | 19,000 | |||

| Thereafter | 94,000 | |||

| $ | 156,000 | |||

At September 30, 2018 and December 31, 2017, the unamortized balance of this license deposit was $156,000 and $170,000, respectively. The current portion of $19,000 is included in sublicense deposits under current liabilities and the remainder of the balance is included in non-current sublicense deposits on the accompanying balance sheets at September 30, 2018 and December 31, 2017, respectively. For the three months ended September 30, 2018 and 2017, amortization of the license deposit which was recorded as sublicensing fee revenue amounted to $5,000 and $5,000, respectively. For the nine months ended September 30, 2018 and 2017, amortization of the license deposit which was recorded as sublicensing fee revenue amounted to $14,000 and $14,000, respectively.

| -7- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

6. NON-EXCLUSIVE DISTRIBUTION SUBLICENSE WITH RENOWN POWER DEVELOPMENT, LTD.

In February 2015, the Company granted a non-exclusive distribution sublicense to Renown Power Development, Ltd., a China-based sales and distribution company (“Renown”) covering the territory defined as the Western Hemisphere. Under this sublicense, Renown will be permitted to sell, lease and distribute CSRV® products. Renown intends to source CSRV® products from Coates Power, Ltd., a China-based company formed for the purpose of manufacturing CSRV® products (“Coates Power”). Coates Power has not been able to commence operations due to ongoing delays in obtaining necessary support and approval from the Chinese government in spite of continuing efforts by Renown to do so on its behalf. This has been and continues to be a long, arduous process because the government is addressing this at a very slow pace. As of September 30, 2018, the Company has only received an initial non-refundable deposit of $500,000. Until Coates Power can begin production of CSRV® products for Renown, the Company will not receive any further monies from its sublicense with Renown.

At this time, as the Company’s intellectual property rights only cover the territory of North America, it does not have any rights to enter into a manufacturing and sale license agreement with Coates Power. These rights are currently held by George J. Coates, Gregory G. Coates and The Coates Trust, a trust controlled by George J. Coates. Coates Power and Renown are controlled and managed by Mr. James Pang, the Company’s liaison agent in China.

The Company received a $131,000 cash deposit with an order from Coates Power to produce two Gen Sets. This amount is included in Unearned Revenues in the accompanying balance sheets at September 30, 2018 and December 31, 2017. The Company intends to build and ship these two generators at such time that Coates Power is able to commence production in accordance with the manufacturing license agreement and there is sufficient working capital for this purpose.

7. OTHER CURRENT ASSETS

Other current assets at September 30, 2018 and December 31, 2017 amounted to $51,000 and $1,000, respectively. The balance at September 30, 2018, included $48,000 for inventory billed, but not received.

8. INVENTORY

Inventory consisted of the following:

| September 30, 2018 | December 31, 2017 | |||||||

| Raw materials | $ | 102,000 | $ | 104,000 | ||||

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment at cost, less accumulated depreciation, consisted of the following:

| September 30, 2018 | December 31, 2017 | |||||||

| Land | $ | 540,015 | $ | 1,235,000 | ||||

| Land held for sale under contract | 695,000 | - | ||||||

| Building | 964,000 | 964,000 | ||||||

| Building improvements | 83,000 | 83,000 | ||||||

| Machinery and equipment | 689,000 | 689,000 | ||||||

| Furniture and fixtures | 57,000 | 57,000 | ||||||

| 3,028,000 | 3,028,000 | |||||||

| Less: Accumulated depreciation | (1,024,000 | ) | (996,000 | ) | ||||

| Total | $ | 2,004,000 | $ | 2,032,000 | ||||

| -8- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

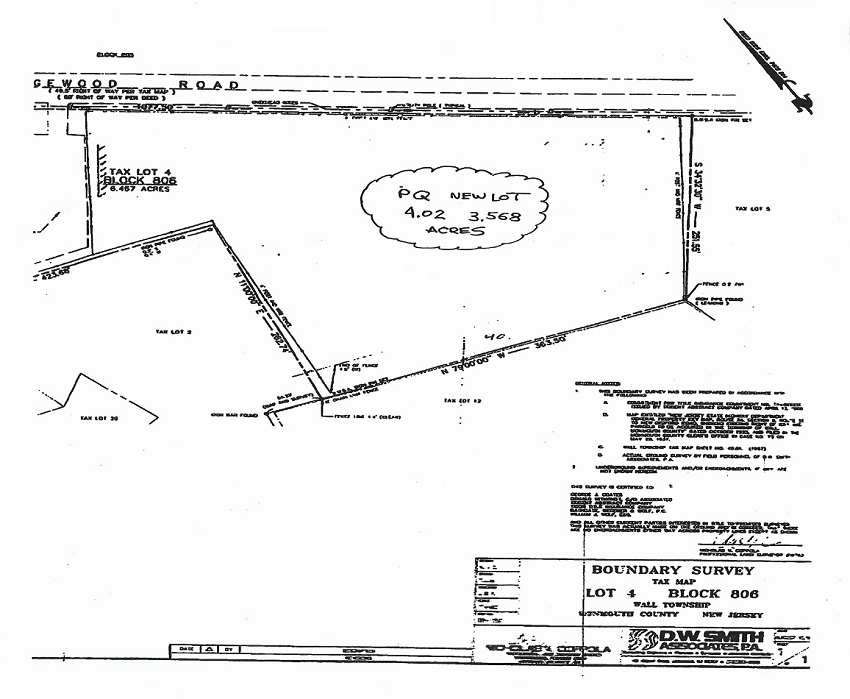

In August 2018, the Company entered into a contract to sell a 3.6-acre parcel of undeveloped land that is part of the 6.4 total acres of land comprising its headquarters facility in New Jersey. The sales price for this parcel is $1,300,000 and the sale is subject to successfully obtaining a zoning variance and subdivision of the land into two land parcels (the “Sale Contingencies”). The Company received a $200,000 refundable deposit. The balance of the sales price is payable at closing of title. Concurrently with execution of the contract, the Company executed a $200,000 mortgage note payable to the purchaser which has been placed in escrow for the benefit of the purchaser in the event that the requisite Sale Contingencies are not satisfied within 120 days, unless this period is extended by the purchaser. The 120-day period may be extended up to four times at the option of the purchaser, each such extension for 30 additional days. During the period that the mortgage loan is held in escrow, it will not be interest-bearing, nor will a lien be recorded on the land parcel. If the Sale Contingencies are not satisfied within the contractual times frame, including any extensions, then the sales contract would be cancelled. The Company then has the option of returning the $200,000 deposit, in which case, the mortgage loan would be cancelled. If the deposit is not returned by the Company, then the mortgage loan would be released from escrow and the related lien on the property would be recorded. From this point forward, the mortgage loan would bear interest at the rate of 7.5% per annum and be payable in quarterly installments over a five-year period.

Depreciation expense amounted to $10,000 and $11,000 for the three months ended September 30, 2018 and 2017, respectively. Depreciation expense amounted to $28,000 and $33,000 for the nine months ended September 30, 2018 and 2017, respectively.

10. MORTGAGE LOAN PAYABLE

The Company has a mortgage loan on the land and building that serves as its headquarters and research and development facility which bears interest at the rate of 7.5% per annum, and matures in July 2023. In July 2018, the Company entered into a 5-year mortgage extension agreement with the existing lender and paid the lender $12,000 in financing related costs which were added to the outstanding balance of the mortgage loan. Interest expense for the three months ended September 30, 2018 and 2017 amounted to $24,000 and $25,000, respectively. Interest expense for the nine months ended September 30, 2018 and 2017 amounted to $72,000 and $75,000, respectively. The loan requires monthly payments of interest, plus $5,000 which is being applied to the principal balance. The remaining principal balance at September 30, 2018 and December 31, 2017 was $1,240,000 and $1,273,000, respectively. The mortgage loan may be prepaid in whole, or, in part, at any time without penalty.

The loan is collateralized by a security interest in all of the Company’s assets, the pledge of 25,000 shares of common stock of the Company owned by George J. Coates, which were deposited into escrow for the benefit of the lender and the personal guarantee of George J. Coates. The Company is not permitted to create or permit any secondary mortgage liens or similar liens on the property or improvements thereon without prior consent of the lender.

11. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

Accounts payable and accrued liabilities are as follows:

| September 30, 2018 | December 31, 2017 | |||||||

| Legal and professional fees | $ | 1,528,000 | $ | 1,427,000 | ||||

| Accrued interest expense | 622,000 | 582,000 | ||||||

| General and administrative expenses | 542,000 | 420,000 | ||||||

| Research and development costs | 115,000 | 115,000 | ||||||

| Total | $ | 2,807,000 | $ | 2,544,000 | ||||

| -9- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

12. PROMISSORY NOTES TO RELATED PARTIES

Promissory Notes Issued to George J. Coates

During the nine months ended September 30, 2018 and 2017, the Company issued, in a series of transactions, promissory notes to George J. Coates and received cash proceeds of $55,000 and $24,000, respectively and repaid promissory notes to George J. Coates in the aggregate principal amount of $50,000 and $23,000, respectively. Interest expense for the three months ended September 30, 2018 and 2017 amounted to $17,000 and $13,000, respectively. Interest expense for the nine months ended September 30, 2018 and 2017 amounted to $44,000 and $38,000, respectively.

The promissory notes are payable on demand and provide for interest at the rate of 17% per annum, compounded monthly. At September 30, 2018, the outstanding principal balance was $25,000 and the balance of unpaid accrued interest was $362,000.

Promissory Note Issued to Gregory G. Coates

The Company has a non-interest bearing promissory note due to Gregory G. Coates which is payable on demand. Interest is being imputed on this promissory note at the rate of 10% per annum. During the nine months ended September 30, 2018 and 2017, the Company, partially repaid $31,000 and $20,000, respectively of this promissory note. Imputed interest expense for the three months ended September 30, 2018 and 2017, amounted to $35,000 and $36,000, respectively. Imputed interest expense for the nine months ended September 30, 2018 and 2017, amounted to $105,000 and $107,000, respectively. At September 30, 2018, the outstanding principal balance was $1,387,000.

Promissory Notes Issued to Bernadette Coates

During the nine months ended September 30, 2018 and 2017, the Company issued promissory notes to Bernadette Coates, spouse of George J. Coates and received cash proceeds of $14,000 and $36,000, respectively. The Company repaid promissory notes to Bernadette Coates in the principal amount of $17,000 and $31,000, respectively. The promissory notes are payable on demand and provide for interest at the rate of 17% per annum, compounded monthly. Interest expense for the three months ended September 30, 2018 and 2017, amounted to $6,000 and $4,000, respectively. Interest expense for the nine months ended September 30, 2018 and 2017, amounted to $18,000 and $11,000, respectively. At September 30, 2018, the outstanding principal balance was $25,000 and the balance of unpaid accrued interest was $113,000.

Promissory Note Issued to Employee

The Company issued promissory notes to an employee in 2016, aggregating $5,000, which were payable on demand and provided for interest at the rate of 17% per annum, compounded monthly. In February 2018, these notes were repaid in full along with accrued interest thereon of $1,000.

The aggregate amount of unpaid accrued interest on all promissory notes to related parties amounting to $475,000 is included in accounts payable and accrued liabilities in the accompanying balance sheet at September 30, 2018.

13. PROMISSORY NOTE

In March 2017, the Company issued a $25,000 promissory note with a maturity date of May 13, 2017. Interest was payable upon maturity in the form of 50,000 shares of unregistered, restricted shares of the Company’s common stock. In addition, the Company agreed to extend warrants held by the lender to purchase 54,199 shares of common stock that were scheduled to expire in 2017 for an additional five years and modify the exercise price to $0.03 per share. On May 5, 2017, the Company prepaid the note in full and issued 43,443 shares of its common stock representing the prorated number of shares for interest on the note, as a result of the prepayment. Interest expense of $4,000 was recorded for issuance of these shares based on the closing trading price on the date of issuance.

| -10- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

14. CONVERTIBLE PROMISSORY NOTES AND EMBEDDED DERIVATIVE LIABILITY

From time to time, the Company issues convertible promissory notes, the proceeds of which are used for general working capital purposes. At September 30, 2018, there was $193,000 principal amount of convertible promissory notes outstanding. During the nine months ended September 30, 2018 and 2017, $410,000 and $778,000 of convertible promissory notes were issued, respectively. Outstanding notes may be converted into unregistered shares of the Company’s common stock at a discount ranging from 30% to 39% of the defined trading price of the common stock on the date of conversion. The defined trading prices are based on the trading price of the stock during a defined period ranging from ten to twenty-five trading days immediately preceding the date of conversion. The conversion rate discount establishes a beneficial conversion feature (“BCF”) or unamortized discount, which is required to be valued and accreted to interest expense over the six-month period until the conversion of the notes into restricted shares of common stock is permitted. In addition, the conversion formula meets the conditions that require accounting for convertible notes as derivative liability instruments. The effective interest rate on the outstanding convertible notes at September 30, 2018 ranged from 85% to 147%. The unamortized discount on the outstanding convertible notes at September 30, 2018 and December 31, 2017 amounted to $34,000 and $82,000, respectively.

The convertible notes generally become convertible, in whole, or in part, beginning on the six-month anniversary of the issuance date and may be prepaid at the option of the Company, with a prepayment penalty ranging from 15% to 50% of the principal amount of the convertible note at any time prior to becoming eligible for conversion.

One convertible promissory note with an aggregate outstanding balance of $8,000 is convertible in monthly installments in an amount determined by the noteholder, plus accrued interest. The Company may elect, at its option to repay each monthly installment in whole, or in part, in cash, without penalty. The amount of each installment not paid in cash is converted into shares of the Company’s common stock. This convertible note also requires that the conversion price be remeasured 23 trading days after the conversion shares are originally delivered. If the remeasured conversion price is lower, then the Company is required to issue additional conversion shares to the noteholder.

In accordance with GAAP, the estimated fair value of the embedded derivative liability related to the convertible notes is required to be remeasured at each balance sheet date. The fair value measurement accounting standard establishes a valuation hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used, when available. Observable inputs are inputs market participants would use in valuing the asset or liability developed based on independent market data sources. Unobservable inputs are inputs that reflect the Company’s assumptions about the factors market participants would use in valuing the asset or liability developed based upon the best information available. The valuation hierarchy is composed of three categories, which are as follows:

| ● | Level 1 – Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| ● | Level 2 – Inputs include quoted prices in active markets for similar assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. |

| ● | Level 3 – Inputs to the fair value measurement are unobservable inputs or valuation techniques. |

| -11- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

The estimated fair value of the embedded derivative liabilities related to promissory notes outstanding was measured as the aggregate estimated fair value, based on Level 2 inputs, which included quoted daily yield curve rates of treasury securities with comparable maturities and, because the actual volatility rate on the Company’s common stock is not available, a conservative estimated volatility rate of 200%.

The embedded derivative liability arises because, based on historical trading patterns of the Company’s stock, the formula for determining the Conversion Rate is expected to result in a different Conversion Rate than the closing price of the stock on the actual date of conversion (hereinafter referred to as the “Variable Conversion Rate Differential”). The estimated fair values of the derivative liabilities have been calculated based on a Black-Scholes option pricing model.

The following table presents the Company’s fair value hierarchy of financial assets and liabilities measured at fair value at:

| September 30, 2018 | December 31, 2017 | |||||||

| Level 1 Inputs | $ | - | $ | - | ||||

| Level 2 Inputs | 311,000 | 359,000 | ||||||

| Level 3 Inputs | - | - | ||||||

| Total | $ | 311,000 | $ | 359,000 | ||||

In a series of transactions, during the nine months ended September 30, 2018, convertible promissory notes with an aggregate principal balance of $421,000, including accrued interest thereon were converted into 532,055,076 unregistered shares of common stock. The Company incurred a loss on these conversions amounting to $69,000 for the nine months ended September 30, 2018.

In a series of transactions, during the nine months ended September 30, 2017, convertible promissory notes with an aggregate principal balance of $604,000, including accrued interest thereon were converted into 14,810,763 unregistered shares of common stock. The Company incurred a loss on these conversions amounting to $245,000 for the nine months ended September 30, 2017.

At September 30, 2018, the Company had reserved 1,015,452,881 shares of its unissued common stock for conversion of convertible promissory notes.

The Company made the private placement of these securities in reliance upon Section 4(2) of the Securities Act of 1933, as amended (the “Act”), Rule 506 of Regulation D, and the rules and regulations promulgated thereunder, and/or upon any other exemption from the registration requirements of the Act, as applicable.

15. CAPITAL STOCK

Common Stock

The Company’s common stock is traded on OTC Pink Sheets. Investors can find real-time quotes and market information for the Company at www.otcmarkets.com market system under the ticker symbol COTE. The Company is authorized to issue up to 2,400,000,000 shares of common stock, par value, $0.0001 per share (the “common stock”). At September 30, 2018 and December 31, 2017, there were 577,968,318 and 36,943,242 shares of common stock issued and outstanding, respectively.

Reverse Stock Split

At the close of trading in the Company’s common stock on December 1, 2017, a 1:200 reverse stock split of all of the Company’s shares of common stock, shares of preferred stock, common stock warrants and stock options became effective. Shareholders were paid cash-in-lieu of any fractional shares that would have resulted in connection with the reverse stock split. The reverse stock split was approved by the board of directors and George J. Coates, the majority stockholder by means of a written consent. For purposes of presenting the accompanying financial statements as of September 30, 2018 and December 31, 2017 and for the nine months ended September 30, 2018, all balances, transactions and calculations were restated on a pro forma basis as if the reverse stock split occurred prior to the beginning of the year ended December 31, 2017.

| -12- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

Certificate of Validation

On April 2, 2018, the Company filed a certificate of validation with the state of Delaware which had retroactive effect to the close of trading in the Corporation’s common stock on December 1, 2017, in order to:

| (i) | cure certain technical, procedural defects related to the 1:200 reverse stock split, which became effective at the close of trading on December 1, 2017, |

| (ii) | clarify that the reverse stock split effected a 1:200 reduction in the number of the Corporation’s authorized shares of common stock, from 12,000,000,000 to 60,000,000, with retroactive effect to the close of trading on December 1, 2017, |

| (iii) | clarify that the reverse stock split effected 1:200 reduction in the number of authorized shares of the Corporation’s preferred stock, from 100,000,000 to 500,000 with retroactive effect to the close of trading on December 1, 2017; and, |

| (iv) | concurrently therewith, further amend the Corporation’s Amended Certificate of Articles of Incorporation with the State of Delaware to increase the number of the Corporation’s authorized shares of common stock, par value $0.0001 from 60,000,000 to 120,000,000 and reduce the number of authorized shares of the Corporation’s preferred stock, par value $0.001 from 500,000 to 350,000. |

The above corporate action was authorized by the board of directors on February 28, 2018, and by means of obtaining the written consent of George J. Coates, the sole majority stockholder, was approved by the shareholders on March 1, 2018.

Certificate of Conversion and Certificate of Designation

On May 9, 2018, the Company filed a Certificate of Conversion and a Certificate of Designation which caused the following corporate actions to become effective:

| (i) | The Corporation’s State of Domicile was converted from the State of Delaware to the State of Nevada. |

| (ii) | The number of authorized shares of capital stock of the Company was increased to: |

| a. | 2,400,000,000 shares of common stock, par value $0.0001 per share |

| b. | 100,000,000 shares of preferred stock, par value $0.001 per share |

| (iii) | The series and number of shares of preferred stock designated from the 100,000,000 shares of preferred stock authorized, was increased to: |

| a. | 1,000,000 shares of Series A Preferred Stock, $0.001 per share |

| b. | 10,000,000 shares of Series B Convertible Preferred Stock, $0.001 per share |

| -13- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

Section 3(a)10 Exempt Securities Transaction

On March 19, 2018, the Company entered into a Settlement Agreement and Stipulation (the “Settlement Agreement”) with Livingston Asset Management LLC, a Florida limited liability company (“LAM”), pursuant to which the Company agreed to issue common stock to LAM in exchange for the settlement of $69,000 (the “Settlement Amount”) of past-due obligations and accounts payable of the Company. LAM purchased the obligations and accounts payable from certain vendors of the Company as described below.

On April 2, 2018, the Circuit Court of Baltimore County, Maryland (the “Court”), entered an order (the “LAM Order”) approving, among other things, the fairness of the terms and conditions of an exchange in reliance upon an exemption from registration provided for in Section 3(a)(10) of the Securities Act of 1933, as amended (the “Securities Act”), in accordance with a stipulation of settlement, pursuant to the Settlement Agreement between the Company and LAM. Pursuant to the court order, LAM commenced an action against the Company to recover an aggregate of $69,000 of past-due obligations and accounts payable of the Company, which LAM had purchased from certain vendors of the Company pursuant to the terms of separate claim purchase agreements between LAM and each of such vendors (the “LAM Assigned Accounts”). The LAM Assigned Accounts relate to certain accounting services provided to the Company and a supplier invoice. The Settlement Agreement became effective and binding upon the Company and LAM upon execution of the Order by the Court on April 2, 2018.

Pursuant to the terms of the Settlement Agreement approved by the LAM Order, on April 2, 2018, the Registrant agreed to issue shares to LAM (the “LAM Settlement Shares”) of the Registrant’s common stock at a 30% discount from the selling price of the settlement shares sold by LAM, as defined in the settlement agreement. The Settlement Agreement provides that the LAM Settlement Shares will be issued in one or more tranches, as necessary, sufficient to satisfy the settlement amount through the issuance of freely trading securities issued in reliance upon an exemption provided for in Section 3(a)(10) of the Securities Act. The parties reasonably estimate that the fair market value of the LAM Settlement Shares to be received by LAM is equal to approximately $99,000. Additional tranche requests shall be made as requested by LAM until the LAM Settlement Amount is paid in full.

The Settlement Agreement provides that in no event shall the number of shares of common stock issued to LAM or its designee in connection with the Settlement Agreement, when aggregated with all other shares of common stock then beneficially owned by LAM and its affiliates (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations thereunder), result in the beneficial ownership by LAM and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and the rules and regulations thereunder) at any time of more than 9.99% of the Common Stock.

The Company is required to reserve a sufficient number of shares of its common stock to provide for issuances thereof, upon full satisfaction of the Settlement Amount.

The following common stock transactions occurred during the nine months ended September 30, 2018:

| ● | In a series of transactions, convertible promissory notes with an aggregate principal balance of $421,000, including accrued interest thereon were converted into 532,055,076 unregistered shares of common stock. |

| ● | In a series of transactions, the Company issued 8,970,000 shares of its common stock to LAM to be sold in the open market in reliance upon an exemption provided for in Section 3(a)(10) of the Securities Act. Proceeds from the sales are to be used to satisfy past-due obligations of the Company previously assigned to LAM. During the nine months ended September 30, 2018, Lam has paid $40,000 of the Settlement Amount of the Company’s past due obligations in accordance with the Settlement Agreement. |

| -14- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

The following common stock transactions occurred during the nine months ended September 30, 2017:

| ● | In a series of transactions, convertible promissory notes with an aggregate principal balance of $604,000, including accrued interest thereon were converted into 14,810,763 unregistered shares of common stock. |

| ● | Barry C. Kaye converted 6.86 shares of Series B Convertible Preferred Stock (“Series B”) into 6,860 unregistered, restricted shares of the Company’s common stock. |

| ● | The Company issued 43,443 shares of common stock in payment of interest on a $25,000 promissory note as more fully discussed in Note 13. |

Preferred Stock and anti-dilution rights

The Company is authorized to issue 100,000,000 shares of preferred stock, par value, $0.001 per share (the “Preferred Stock”). The Company may issue any class of the Preferred Stock in any series. The board is authorized to establish and designate series, and to fix the number of shares included in each such series and the relative rights, preferences and limitations as between series, provided that, if the stated dividends and amounts payable on liquidation are not paid in full, the shares of all series of the same class shall share ratably in the payment of dividends including accumulations, if any, in accordance with the sums which would be payable on such shares if all dividends were declared and paid in full and in any distribution of assets other than by way of dividends in accordance with the sums which would be payable on such distribution if all sums payable were discharged in full. Shares of each such series when issued, shall be designated to distinguish the shares of each series from shares of all other series.

There are two series of Preferred Stock that have been designated to date from the total 100,000,000 authorized shares of Preferred Stock. These are as follows:

| ● | Series A Preferred Stock, par value $0.001 per share (“Series A”), 1,000,000 and 50,000 shares designated, 15,620 and 3,601 shares issued and outstanding as of September 30, 2018 and December 31, 2017, respectively. Shares of Series A entitle the holder to 10,000 votes per share on all matters brought before the shareholders for a vote. These shares are not entitled to receive dividends or share in distributions of capital and have no liquidation preference. All outstanding shares of Series A are owned by George J. Coates, which entitle him to 152,620,000 votes in addition to his voting rights from the shares of common stock and the shares of Series B he holds. |

The Company may issue additional shares of Series A Preferred Stock to Mr. Coates if deemed necessary to provide anti-dilution protection and maintain his ownership percentage of eligible votes.

Issuances of shares of Series A to George J. Coates do not have any effect on the share of dividends or liquidation value of the holders of the Company’s common stock. However, the voting rights of the holders of the Company’s common stock are diluted with each issuance.

During the nine months ended September 30, 2018 and 2017, the Company issued 12,019 and 3,351 shares, respectively, of Series A Preferred Stock to George J. Coates representing anti-dilution shares to maintain Mr. Coates’ percentage of eligible votes at 85.7%.

| ● | Series B Convertible Preferred Stock, par value $0.001 per share, 10,000,000 and 345,000 shares designated and 3,261,396 and 228,471 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively. Shares of Series B do not earn any dividends and may be converted at the option of the holder at any time beginning on the second annual anniversary date after the date of issuance into 1,000 unregistered shares of the Company’s common stock. Holders of the Series B are entitled to one thousand votes per share held on all matters brought before the shareholders for a vote. |

In the event that either (i) the Company enters into an underwriting agreement for a secondary public offering of securities, or (ii) a change in control of the Company is consummated representing 50% more of the then outstanding shares of Company’s common stock, plus the number of shares of common stock into which any convertible preferred stock is convertible, regardless of whether or not such shares are otherwise eligible for conversion, then the Series B may be immediately converted at the option of the holder into restricted shares of the Company’s common stock.

| -15- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

The Company provides anti-dilution protection for certain of its key employees. For each new share of common stock issued by the Company to non-Coates family members in the future, additional shares of Series B will be issued to maintain their fixed ownership percentage of the Company. The fixed ownership percentage is adjusted for acquisitions and dispositions of common stock, not related to conversions of Series B Convertible Preferred Stock, by these key employees. At September 30, 2018, the fixed ownership percentages were as follows:

| 1. | George J. Coates – 80.63% |

| 2. | Gregory G. Coates – 6.10% |

| 3. | Barry C. Kaye – 0.048% |

These anti-dilution provisions do not apply to new shares of common stock issued in connection with exercises of employee stock options, a secondary public offering of the Company’s securities or a merger or acquisition.

The following presents by year, the number of shares of Series B held and the year that they become eligible for conversion into shares of common stock, as of September 30, 2018.

| Total | 2018 | 2019 | 2020 | |||||||||||||

| George J. Coates | 3,015,159 | 74,506 | 136,599 | 2,804,054 | ||||||||||||

| Gregory G. Coates | 228,384 | 5,484 | 10,646 | 212,254 | ||||||||||||

| Barry C. Kaye | 17,853 | 413 | 823 | 16,617 | ||||||||||||

| Total | 3,261,396 | 80,403 | 148,068 | 3,032,925 | ||||||||||||

For the nine months ended September 30, 2018, 2,804,054, 212,254 and 16,617 shares of Series B were issued to George J. Coates, Gregory G. Coates and Barry C. Kaye, respectively, having an estimated fair value of $1,221,000, $92,000 and $7,000, respectively. These amounts were included in stock-based compensation expense in the accompanying statements of operations for the nine months ended September 30, 2018.

For the nine months ended September 30, 2017, 92,031, 7,270 and 570 shares of Series B were issued to George J. Coates, Gregory G. Coates and Barry C. Kaye, respectively, having an estimated fair value of $4,511,000, $370,000 and $29,000, respectively. These amounts were included in stock-based compensation expense in the accompanying statements of operations for the nine months ended September 30, 2017.

During the nine months ended September 30, 2017, Barry C. Kaye converted 6.86 shares of Series B into 6,860 unregistered, restricted shares of the Company’s common stock.

In the event that all of the 3,261,396 shares of Series B outstanding at September 30, 2018 were converted, once the conversion restrictions lapse, an additional 3,261,396,000 new restricted shares of common stock would be issued. On a pro forma basis, based on the number of shares of common stock outstanding at September 30, 2018, this would dilute the ownership percentage of non-affiliated stockholders from 99.4% to 12.8%.

To the extent that additional shares of Series B are issued under the anti-dilution plan, the non-affiliated stockholders’ percentage ownership of the Company would be further diluted.

| -16- |

Coates International, Ltd.

Notes to Financial Statements - (Continued)

16. LOSS PER SHARE

At September 30, 2018, there were stock warrants outstanding to purchase 731,736 shares of common stock at exercise prices ranging from $0.10 to $13.50 per share, vested stock options outstanding to acquire 62,351 shares of common stock at exercise prices ranging from $5.60 to $88.00 per share and $125,000 of convertible promissory notes outstanding eligible for conversion, which on a pro forma basis assuming all such promissory notes, eligible for conversion, were converted into shares of common stock using the contractual conversion price determined as of the close of trading on the last trading in September 2018, would have been convertible into 459,433,619 shares of common stock.

At September 30, 2017, there were stock warrants outstanding to purchase 751,725 shares of common stock at exercise prices ranging from $0.10 to $13.50 per share, vested stock options outstanding to acquire 62,351 shares of common stock at exercise prices ranging from $5.60 to $88.00 per share. None of the convertible promissory notes outstanding were eligible for conversion.

For the three and nine-month periods ended September 30, 2018 and 2017, none of the potentially issuable shares of common stock were assumed to be converted because the Company incurred a net loss in those periods and the effect of including them in the calculation of earnings per share would have been anti-dilutive.

17. STOCK OPTIONS

The Company’s 2006 Stock Option and Incentive Plan (the “Stock Plan”) was adopted by the Company’s board in October 2006. In September 2007, the Stock Plan, by consent of George J. Coates, majority shareholder, was adopted by our shareholders. The Stock Plan provides for the grant of stock-based awards to employees, officers and directors of, and consultants or advisors to, the Company and its subsidiaries, if any. Under the Stock Plan, the Company may grant options that are intended to qualify as incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (“ISO’s”), options not intended to qualify as incentive stock options (“non-statutory options”), restricted stock and other stock-based awards. ISO’s may be granted only to employees of the Company. All of the shares of common stock authorized under the Stock Plan have been granted and no further grants may be awarded thereunder.

The Company established a 2014 Stock Option and Incentive Plan (the “2014 Stock Plan”) which was adopted by the Company’s board on May 30, 2014. On March 2, 2015, the 2014 Stock Plan, by consent of George J. Coates, majority shareholder, was adopted by our shareholders. The 2014 Stock Plan provides for the grant of stock-based awards to employees, officers and directors of, and consultants or advisors to, the Company and its subsidiaries, if any. Under the 2014 Stock Plan, the Company may grant ISO’s, non-statutory options, restricted stock and other stock-based awards. ISO’s may be granted only to employees of the Company. A total of 250,000 shares of common stock may be issued upon the exercise of options or other awards granted under the 2014 Stock Plan. The maximum number of shares with respect to which awards may be granted during any one year to any employee under the 2014 Stock Plan shall not exceed 25% of the 250,000 shares of common stock covered by the 2014 Stock Plan. At September 30, 2018, none of the shares of common stock authorized under the 2014 Stock Plan had been granted as stock options or awards.

The Stock Plan and the 2014 Stock Plan (the “Stock Plans”) are administered by the board and the Compensation Committee. Subject to the provisions of the Stock Plans, the board and the Compensation Committee each has the authority to select the persons to whom awards are granted and determine the terms of each award, including the number of shares of common stock subject to the award. Payment of the exercise price of an award may be made in cash, in a “cashless exercise” through a broker, or if the applicable stock option agreement permits, shares of common stock, or by any other method approved by the board or Compensation Committee. Unless otherwise permitted by the Company, awards are not assignable or transferable except by will or the laws of descent and distribution.

| -17- |

Coates

International, Ltd.

Notes to Financial Statements - (Continued)

Upon the consummation of an acquisition of the business of the Company, by merger or otherwise, the board shall, as to outstanding awards (on the same basis or on different bases as the board shall specify), make appropriate provision for the continuation of such awards by the Company or the assumption of such awards by the surviving or acquiring entity and by substituting on an equitable basis for the shares then subject to such awards either (a) the consideration payable with respect to the outstanding shares of common stock in connection with the acquisition, (b) shares of stock of the surviving or acquiring corporation, or (c) such other securities or other consideration as the board deems appropriate, the fair market value of which (as determined by the board in its sole discretion) shall not materially differ from the fair market value of the shares of common stock subject to such awards immediately preceding the acquisition. In addition to, or in lieu of the foregoing, with respect to outstanding stock options, the board may, on the same basis or on different bases as the board shall specify, upon written notice to the affected optionees, provide that one or more options then outstanding must be exercised, in whole or in part, within a specified number of days of the date of such notice, at the end of which period such options shall terminate, or provide that one or more options then outstanding, in whole or in part, shall be terminated in exchange for a cash payment equal to the excess of the fair market value (as determined by the board in its sole discretion) for the shares subject to such stock options over the exercise price thereof. Unless otherwise determined by the board (on the same basis or on different bases as the board shall specify), any repurchase rights or other rights of the Company that relate to a stock option or other award shall continue to apply to consideration, including cash, that has been substituted, assumed or amended for a stock option or other award pursuant to these provisions. The Company may hold in escrow all or any portion of any such consideration in order to effectuate any continuing restrictions.

The board may at any time provide that any stock options shall become immediately exercisable in full or in part, that any restricted stock awards shall be free of some or all restrictions, or that any other stock-based awards may become exercisable in full or in part or free of some or all restrictions or conditions, or otherwise realizable in full or in part, as the case may be.

The board or Compensation Committee may, in its sole discretion, amend, modify or terminate any award granted or made under the Stock Plan, so long as such amendment, modification or termination would not materially and adversely affect the participant.

During the nine months ended September 30, 2018 and 2017, no stock options were granted. There were no unvested stock options outstanding at September 30, 2018.

During the nine months ended September 30, 2018 and 2017, the Company did not incur any stock-based compensation expense related to employee stock options. At September 30, 2018, all stock-based compensation expense related to outstanding stock options had been fully recognized.

Details of the stock options outstanding under the Company’s Stock Option Plans are as follows:

| Exercise

Price Per Share | Number

Outstanding | Weighted Average Remaining Contractual Life | Number Exercisable | Weighted

Average Exercise Price | Weighted

Average Fair Value Per Stock Option at Date of Grant | |||||||||||||||||

| Balance, 9/30/18 | $5.60 – $88.00 | 62,500 | 8 | 62,500 | $ | 36.34 | $ | 33.84 | ||||||||||||||

No stock options were exercised, forfeited or expired during the nine months ended September 30, 2018 and 2017.

| -18- |

Coates

International, Ltd.

Notes to Financial Statements - (Continued)

The weighted average fair value of the Company’s stock options was estimated using the Black-Scholes option pricing model which requires highly subjective assumptions including the expected stock price volatility. These assumptions were as follows:

| ● | Historical stock price volatility | 139% - 325% | |

| ● | Risk-free interest rate | 0.21% - 4.64% | |

| ● | Expected life (in years) | 4 | |

| ● | Dividend yield | $0.00 |

The valuation assumptions were determined as follows:

| ● | Historical stock price volatility: The Company utilized the volatility in the trading of its common stock computed for the 12 months of trading immediately preceding the date of grant. |

| ● | Risk-free interest rate: The Company bases the risk-free interest rate on the interest rate payable on U.S. Treasury securities in effect at the time of the grant for a period that is commensurate with the assumed expected option life. |

| ● | Expected life: The expected life of the options represents the period of time options are expected to be outstanding. The Company has very limited historical data on which to base this estimate. Accordingly, the Company estimated the expected life based on its assumption that the executives will be subject to frequent blackout periods during the time that the stock options will be exercisable and based on the Company’s expectation that it will complete its research and development phase and commence its initial production phase. The vesting period of these options was also considered in the determination of the expected life of each stock option grant. |

| ● | No expected dividends. |

18. INCOME TAXES

Deferred income taxes are determined using the liability method for the temporary differences between the financial reporting basis and income tax basis of the Company’s assets and liabilities. Deferred income taxes are measured based on the tax rates expected to be in effect when the temporary differences are included in the Company’s tax return. Deferred tax assets and liabilities are recognized based on anticipated future tax consequences attributable to differences between financial statement carrying amounts of assets and liabilities and their respective tax bases.

Deferred tax assets increased by $235,000 and $701,000 for the three months ended September 30, 2018 and 2017, respectively. Deferred tax assets increased by $940,000 and $2,151,000 for the nine months ended September 30, 2018 and 2017, respectively. These amounts were fully offset by a corresponding increase in the tax valuation allowance resulting in no net change in deferred tax assets, respectively, during these periods.

No liability for unrecognized tax benefits was required to be reported at September 30, 2018 and December 31, 2017. Based on the Company’s evaluation, it has concluded that there are no significant uncertain tax positions requiring recognition in the Company’s financial statements. The Company’s evaluation was performed for tax years ended 2015 through 2017, the only periods subject to examination. The Company believes that its income tax positions and deductions will be sustained on audit and does not anticipate that adjustments, if any, will result in a material change to its financial position. For the nine months ended September 30, 2018 and 2017, there were no penalties or interest related to the Company’s income tax returns.

At September 30, 2018, the Company had available, $21,139,000 of net operating loss carryforwards which may be used to reduce future federal taxable income, expiring between 2018 and 2038 and $10,757,000 of net operating loss carryforwards which may be used to reduce future state taxable income, expiring between 2029 and 2038.

| -19- |

Coates

International, Ltd.

Notes to Financial Statements - (Continued)

19. RELATED PARTY TRANSACTIONS

Licensing Agreement for CSRV® System Technology

The Company’s intellectual property rights for the CSRV® System Technology are derived from the licensing agreement with George J. Coates and Gregory G. Coates, as more fully discussed in Note 4. The Company pays for all costs of new patent filings and patent maintenance on intellectual properties licensed to it by George J. Coates and Gregory G. Coates.

Non-Exclusive distribution sublicense to Renown Power Development, Ltd.

The Company has granted a non-exclusive distribution sublicense to Renown, as more fully discussed in Note 6. Renown is controlled by James Pang, the Company’s exclusive liaison agent in China.

Issuances and Repayments of Promissory Notes to Related Parties

Issuances and repayments of promissory notes to related parties during the nine months ended September 30, 2018 and 2017, are discussed in detail in Note 12.

Promissory notes issued to George J. Coates and Bernadette Coates are payable on demand and provide for interest at the rate of 17% per annum, compounded monthly. The promissory note issued to Gregory G. Coates is non-interest bearing, however, the Company imputes interest at a rate of 10% per annum, which has been charged to interest expense in the accompanying statements of operations.

Stock Options

Stock options previously granted to related parties, all of which are fully vested are more fully discussed in Note 17.

Issuances and Conversions of Preferred Stock

Shares of Series A Preferred Stock awarded to George J. Coates during the nine months ended September 30, 2018 and 2017, are discussed in detail in Note 15.

Shares of Series B Convertible Preferred Stock awarded to George J. Coates, Gregory G. Coates and Barry C. Kaye and shares converted during the nine months ended September 30, 2018 and 2017, are discussed in detail in Note 15.

Personal Guaranty and Stock Pledge

In connection with the Company’s mortgage loan on the Company’s headquarters facility, George J. Coates has pledged certain of his shares of common stock of the Company to the extent required by the lender and provided a personal guaranty as additional collateral.

Compensation and Benefits Paid

The approximate amount of compensation and benefits, all of which were approved by the board, paid to George J. Coates and Gregory G. Coates, exclusive of stock-based compensation for unregistered, restricted shares of Preferred Stock awarded to George J. Coates and Gregory G. Coates is summarized as follows:

| For

the nine months ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| George J. Coates (a) (b) | $ | 13,000 | $ | 22,000 | ||||

| Gregory G. Coates (c) (d) | 71,000 | 34,000 | ||||||

| (a) | For the nine months ended September 30, 2018 and 2017, George J. Coates earned additional base compensation of $188,000 and $178,000, respectively, payment of which is being deferred until the Company has sufficient working capital. The total amount of deferred compensation included in the accompanying balance sheets at September 30, 2018 and December 31, 2017, was $1,408,000 and $1,221,000, respectively. |

| -20- |

Coates

International, Ltd.

Notes to Financial Statements - (Continued)

| (b) | During the nine months ended September 30, 2018 and 2017, George J. Coates was awarded Series A Preferred Stock and Series B Converted Preferred Stock for anti-dilution. The details are presented in Note 15. |

| (c) | For the nine months ended September 30, 2018 and 2017, Gregory G. Coates earned additional base compensation of $56,000 and $91,000, respectively, payment of which is being deferred until the Company has sufficient working capital. The total amount of deferred compensation included in the accompanying balance sheets at September 30, 2018 and December 31, 2017, was $199,000 and $180,000, respectively. |

| (d) | During the nine months ended September 30, 2018 and 2017, Gregory G. Coates was awarded Series B Converted Preferred Stock for anti-dilution. The details are presented in Note 15. |

The Company had been deferring base compensation for Bernadette Coates, who retired in 2016, until it has sufficient working capital. The total amount of deferred compensation included in the accompanying balance sheets at September 30, 2018 and December 31, 2017, was $242,000.

During the nine months ended September 30, 2018 and 2017, Barry C. Kaye, Treasurer and Chief Financial Officer was paid compensation of $50,000 and $53,000, respectively. For the nine months ended September 30, 2018 and 2017, Mr. Kaye earned compensation of $91,000 and $85,000, respectively, which was not paid and is being deferred until the Company has sufficient working capital to remit payment to him. During the nine months ended September 30, 2018 and 2017, interest accrued on Mr. Kaye’s deferred compensation, at the rate of 17% per annum, compounded monthly, amounted to $58,000 and $43,000, respectively. At September 30, 2018, the total amount of Mr. Kaye’s unpaid, deferred compensation, including accrued interest thereon, was $517,000. This amount is included in accounts payable and accrued liabilities in the accompanying balance sheet at September 30, 2018. During the nine months ended September 30, 2018 and 2017, Barry C. Kaye was awarded Series B Convertible Preferred Stock for anti-dilution. The details are presented in Note 15.

At September 30, 2018 the Company owed deferred compensation to an employee in the amount of $45,000, payment of which is being deferred until the Company has sufficient working capital. This amount is included in deferred compensation in the accompanying balance sheet at September 30, 2018.

Agreements with a Director

The Company is a party to two agreements with The Whitworth Group, an entity controlled by Richard Whitworth, a member of the Company’s board of directors. One agreement provides for the payment of fees, plus reasonable out-of-pocket expenses incurred, to The Whitworth Group upon a successful debt or equity capital raise from a lender and/or investor identified by The Whitworth Group and not previously known by the Company, as follows:

| ● | 6% of the first million dollars received at closing |