|

Amendment No. 1 dated December 18, 2023† to the

Pricing Supplement dated December 15, 2023Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-262557

(To Product Supplement MLN-WF-1 dated August 31, 2022

and Prospectus dated March 4, 2022)

|

|

|

The Toronto-Dominion Bank

Senior Debt Securities, Series E

Equity Linked Securities

|

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Costco Wholesale Corporation, the common stock of Dollar General Corporation and the

common stock of Altria Group, Inc. due December 18, 2026

|

|

■ Linked to the lowest performing of the common stock of Costco Wholesale Corporation, the common stock of Dollar General Corporation and the common

stock of Altria Group, Inc. (each referred to as an “Underlying Stock”)

■ Unlike ordinary debt securities, the securities do not provide for fixed payments of interest, do not repay a fixed amount of principal at stated maturity and are subject to potential

automatic call prior to stated maturity upon the terms described below. Whether the securities pay a contingent coupon, whether the securities are automatically called prior to stated maturity and, if they are not automatically called,

whether you receive the face amount of your securities at stated maturity will depend, in each case, on the stock closing price of the lowest performing Underlying Stock on the relevant calculation day. The lowest performing Underlying

Stock on any calculation day is the Underlying Stock that has the lowest stock closing price on that calculation day as a percentage of its starting price

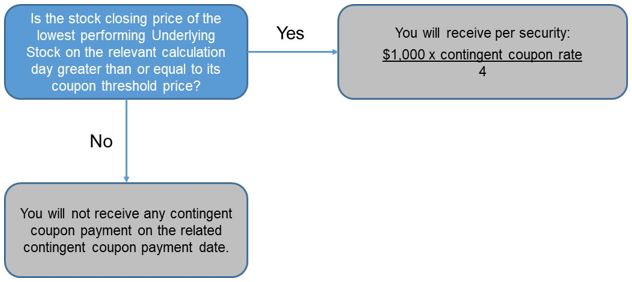

■ Contingent Coupon. The securities will pay a contingent coupon on a quarterly basis until the earlier of stated maturity or automatic call if, and only if, the stock closing price of the lowest performing Underlying Stock on the calculation day for that quarter is greater than or equal to its coupon threshold price. However, if the stock closing

price of the lowest performing Underlying Stock on a calculation day is less than its coupon threshold price, you will not receive any contingent coupon for the relevant quarter. If the stock closing price of the lowest performing

Underlying Stock is less than its coupon threshold price on every calculation day, you will not receive any contingent coupons throughout the entire term of the securities. The coupon threshold price for each Underlying Stock is equal to

70% of its starting price. The contingent coupon rate is 18.40% per annum

■ Automatic Call. If the stock closing price of the lowest performing Underlying Stock on any of the quarterly calculation days from June 2024 to

September 2026, inclusive, is greater than or equal to its starting price, the securities will be automatically called for the face amount plus a final contingent coupon payment

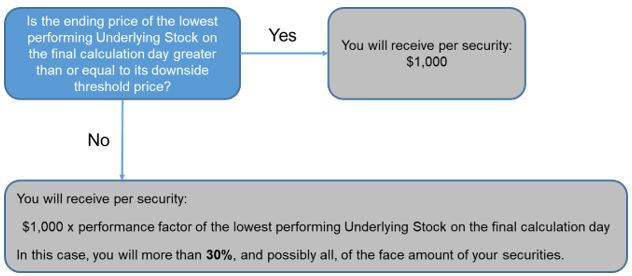

■ Potential Loss of Principal. If the securities are not automatically called prior to stated maturity, you will receive the face amount at stated

maturity if, and only if, the stock closing price of the lowest performing Underlying Stock on the final calculation day is greater than or equal to its downside threshold price. If the stock closing

price of the lowest performing Underlying Stock on the final calculation day is less than its downside threshold price, you will lose more than 30%, and possibly all, of the face amount of your securities. The downside threshold price for each Underlying Stock is equal to 70% of its starting price

■ If the securities are not automatically called prior to stated maturity, you will have full downside exposure to the lowest performing Underlying Stock from its starting price if its stock

closing price on the final calculation day is less than its downside threshold price, but you will not participate in any appreciation of any Underlying Stock and will not receive any dividends on any Underlying Stock

■ Your return on the securities will depend solely on the performance of the Underlying Stock that is the lowest performing Underlying Stock on each

calculation day. You will not benefit in any way from the performance of the better performing Underlying Stocks. Therefore, you will be adversely affected if any Underlying Stock performs poorly,

even if the other Underlying Stocks perform favorably

■ All payments on the securities are subject to the credit risk of The Toronto-Dominion Bank (the “Bank”)

■ No exchange listing; designed to be held to maturity

|

The estimated value of the securities at the time the terms of your securities were set on the pricing date was $949.60 per security, as discussed further under “Selected Risk

Considerations— Risks Relating to the Estimated Value of the Securities and Any Secondary Market” beginning on page P-13 and “Estimated Value of the Securities” herein. The estimated value is less than the original offering price of the securities.

The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk

Considerations” beginning on page P-11 herein and “Risk Factors” beginning on page PS-5 of the accompanying product supplement and on page 1 of the accompanying prospectus.

The securities are senior unsecured debt obligations of the Bank, and, accordingly, all payments are subject to credit risk. The securities are not insured by the Canada Deposit

Insurance Corporation pursuant to the Canada Deposit Insurance Corporation Act (the “CDIC Act”) or the U.S. Federal Deposit Insurance Corporation or any other governmental agency of Canada, the United States or any other jurisdiction.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this pricing supplement or the accompanying product supplement and prospectus. Any representation to the contrary is a criminal offense.

|

Original Offering Price

|

Agent Discount(1)

|

Proceeds to The Toronto-Dominion Bank

|

|

|

Per Security

|

$1,000.00

|

$23.25

|

$976.75

|

|

Total

|

$1,180,000.00

|

$27,435.00

|

$1,152,565.00

|

| (1) |

The Agents will receive a commission of $23.25 (2.325%) per security and will use all of that commission to allow selling concessions to other dealers in connection with the distribution of the securities. The

Agents may resell the securities to other securities dealers at the original offering price less a concession of $17.50 (1.75%) per security. Such securities dealers may include Wells Fargo Advisors (“WFA”, the trade name of the retail

brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC), an affiliate of Wells Fargo Securities, LLC (“Wells Fargo Securities”). The other dealers may forgo, in their sole discretion, some or

all of their selling concessions. In addition to the selling concession allowed to WFA, Wells Fargo Securities will pay $0.75 (0.075%) per security of the agent discount to WFA as a distribution expense fee for each security sold by WFA. The

Bank will reimburse TD Securities (USA) LLC (“TDS”) for certain expenses in connection with its role in the offer and sale of the securities, and the Bank will pay TDS a fee in connection with its role in the offer and sale of the securities.

In respect of certain securities sold in this offering, we will pay a fee of up to $2.50 per security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to

other securities dealers. See “Terms of the Securities—Agents” herein and “Supplemental Plan of Distribution (Conflicts of Interest) –Selling Restrictions” in the accompanying product supplement.

|

† This amended and restated pricing supplement amends, restates and supersedes the pricing supplement related hereto dated December 15, 2023 in its

entirety.

|

TD Securities (USA) LLC.

|

Wells Fargo Securities

|

|

Terms of the Securities

|

|

Issuer:

|

The Toronto-Dominion Bank (the “Bank”).

|

|

Market Measures:

|

The common stock of Costco Wholesale Corporation, the common stock of Dollar General Corporation and the common stock of Altria Group, Inc. (each

referred to as an “Underlying Stock,” and collectively as the “Underlying Stocks”). We refer to the issuer of each Underlying Stock as an “Underlying Stock Issuer” and collectively as the “Underlying Stock Issuers.”

|

|

Pricing Date:

|

December 15, 2023.

|

|

Issue Date:

|

December 20, 2023.

|

|

Original Offering

Price:

|

$1,000 per security.

|

|

Face Amount:

|

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000.

|

|

Contingent Coupon

Payment:

|

On each contingent coupon payment date, you will receive a contingent coupon payment at a per annum rate equal to the contingent coupon rate if, and only if, the stock closing price of the lowest performing Underlying Stock on the related calculation day is greater than or equal to its coupon threshold price. Each “contingent coupon payment,”

if any, will be calculated per security as follows: ($1,000 × contingent coupon rate)/4. Any contingent coupon payment will be rounded to the nearest cent, with one-half cent rounded upward.

If the stock closing price of the lowest performing Underlying Stock on any calculation day is less than its coupon threshold price,

you will not receive any contingent coupon payment on the related contingent coupon payment date. If the stock closing price of the lowest performing Underlying Stock is less than its coupon threshold price on all calculation days, you will

not receive any contingent coupon payments over the term of the securities.

|

|

Contingent Coupon

Payment Dates:

|

Quarterly, on the third business day following each calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events

and Postponement Provisions” below, if applicable); provided that the contingent coupon payment date with respect to the final calculation day will be the stated maturity date.

|

|

Contingent Coupon

Rate:

|

The “contingent coupon rate” is 18.40% per annum.

|

|

Automatic Call:

|

If the stock closing price of the lowest performing Underlying Stock on any of the calculation days from June 2024 to September 2026, inclusive, is

greater than or equal to its starting price, the securities will be automatically called, and on the related call settlement date you will be entitled to receive a cash payment per security in U.S. dollars equal to the face amount plus a

final contingent coupon payment. The securities will not be subject to automatic call until the second calculation day, which is approximately six months after the issue date.

If the securities are automatically called, they will cease to be outstanding on the related call settlement date and you will have no further rights

under the securities after such call settlement date. You will not receive any notice from us if the securities are automatically called.

|

|

Calculation Days:

|

Quarterly, on the 15th day of each March, June, September and December, commencing in March 2024 and ending in December 2026, each subject to postponement as

described below under “—Market Disruption Events and Postponement Provisions.” We refer to December 15, 2026 as the “final calculation day.”

|

P-2

|

Call Settlement Date:

|

Three business days after the applicable calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events and Postponement

Provisions” below, if applicable).

|

|

Stated Maturity Date:

|

December 18, 2026, subject to postponement. The securities are not subject to repayment at the option of any holder of the securities prior to the stated

maturity date.

|

|

Maturity Payment

Amount:

|

If the securities are not automatically called prior to the stated maturity date, you will be entitled to receive on the stated maturity date a cash

payment per security in U.S. dollars equal to the maturity payment amount (in addition to the final contingent coupon payment, if any). The “maturity payment amount” per security will equal:

• if the ending price of the lowest

performing Underlying Stock on the final calculation day is greater than or equal to its downside threshold price: $1,000; or

• if the ending price of the lowest

performing Underlying Stock on the final calculation day is less than its downside threshold price:

|

|

$1,000 × performance factor of the lowest performing Underlying Stock on the final calculation day

|

|

|

If the securities are not automatically called prior to stated maturity and the ending price of the lowest performing Underlying Stock

on the final calculation day is less than its downside threshold price, you will lose more than 30%, and possibly all, of the face amount of your securities at stated maturity.

Any return on the securities will be limited to the sum of your contingent coupon payments, if any. You will not participate in any

appreciation of any Underlying Stock, but you will have full downside exposure to the lowest performing Underlying Stock on the final calculation day if the ending price of that Underlying Stock is less than its downside threshold price.

|

|

|

Lowest Performing

Underlying Stock:

|

For any calculation day, the “lowest performing Underlying Stock” will be the Underlying Stock with the lowest performance factor on that

calculation day.

|

|

Performance Factor:

|

With respect to an Underlying Stock on any calculation day, its stock closing price on such calculation day divided by

its starting price (expressed as a percentage).

|

|

Stock Closing Price:

|

With respect to each Underlying Stock, stock closing price, closing price and adjustment factor has the meaning set forth under “General Terms of the

Securities—Certain Terms for Securities Linked to an Underlying Stock—Certain Definitions” in the accompanying product supplement.

|

|

Starting Price:

|

With respect to the common stock of Costco Wholesale Corporation: $658.82, its stock closing price on the pricing date.

With respect to the common stock of Dollar General Corporation: $129.98, its stock closing price on the pricing date.

With respect to the common stock of Altria Group, Inc.: $41.75, its stock closing price on the pricing date.

|

|

Ending Price:

|

The “ending price” of an Underlying Stock will be its stock closing price on the final calculation day.

|

|

Coupon Threshold

Price:

|

With respect to the common stock of Costco Wholesale Corporation: $461.174, which is equal to 70% of its starting price.

With respect to the common stock of Dollar General Corporation: $90.986, which is equal to 70% of its starting price.

With respect to the common stock of Altria Group, Inc.: $29.225, which is equal to 70% of its starting price.

|

|

Downside Threshold

Price:

|

With respect to the common stock of Costco Wholesale Corporation: $461.174, which is equal to 70% of its starting price.

With respect to the common stock of Dollar General Corporation: $90.986, which is equal to 70% of its starting price.

With respect to the common stock of Altria Group, Inc.: $29.225, which is equal to 70% of its starting price.

|

P-3

|

Market Disruption

Events and

Postponement

Provisions:

|

Each calculation day is subject to postponement due to non-trading days and the occurrence of a market disruption event. In addition, the stated maturity date will be postponed if the

final calculation day is postponed and will be adjusted for non-business days. For more information regarding adjustments to the calculation days and the stated maturity date, see “General Terms of the Securities—Consequences of a Market

Disruption Event; Postponement of a Calculation Day—Securities Linked to Multiple Market Measures” and “—Payment Dates” in the accompanying product supplement. For purposes of the accompanying product supplement, each call settlement date and

the stated maturity date is a “payment date.” In addition, for information regarding the circumstances that may result in a market disruption event, see “General Terms of the Securities—Certain Terms for Securities Linked to an Underlying

Stock—Market Disruption Events” in the accompanying product supplement.

|

|

Calculation Agent:

|

The Bank

|

|

U.S. Tax Treatment:

|

By purchasing the securities, you agree, in the absence of a statutory or regulatory change or an administrative determination or judicial ruling to the

contrary, to treat the securities, for U.S. federal income tax purposes, as prepaid derivative contracts with respect to the Market Measures with associated contingent coupons. Pursuant to this approach, any Contingent Coupon Payment that you

receive should be included in ordinary income at the time you receive the payment or when it accrues, depending on your regular method of accounting for U.S. federal income tax purposes. Based on certain factual representations received from

us, our special U.S. tax counsel, Fried, Frank, Harris, Shriver & Jacobson LLP, is of the opinion that it would be reasonable to treat the securities in the manner described above. However, because there is no authority that specifically

addresses the tax treatment of the securities, it is possible that your securities could alternatively be treated for tax purposes as a single contingent payment debt instrument, or pursuant to some other characterization, such that the

timing and character of your income from the securities could differ materially and adversely from the treatment described above, as described further under “Material U.S. Federal Income Tax Consequences” herein and in the product supplement.

An investment in the securities is not appropriate for non-U.S. holders, and we will not attempt to ascertain the tax consequences to non-U.S. holders of the purchase, ownership or disposition of the

securities.

|

|

Canadian Tax

Treatment:

|

Please see the discussion in the product supplement under “Supplemental Discussion of Canadian Tax Consequences,” which applies to the securities.

|

|

Agents:

|

TD Securities (USA) LLC. and Wells Fargo Securities, LLC.

The Agents will receive a commission of $23.25 (2.325%) per security and will use all of that commission to allow selling concessions to other dealers in

connection with the distribution of the securities. The Agents may resell the securities to other securities dealers at the original offering price less a concession of $17.50 (1.75%) per security. Such securities dealers may include WFA. In

addition to the selling concession allowed to WFA, Wells Fargo Securities will pay $0.75 (0.075%) per security of the agent discount to WFA as a distribution expense fee for each security sold by WFA.

In addition, in respect of certain securities sold in this offering, we will pay a fee of up to $2.50 per security to selected securities dealers in

consideration for marketing and other services in connection with the distribution of the securities to other securities dealers. We or one of our affiliates will also pay a fee to iCapital Markets LLC, who is acting as a dealer in connection

with the distribution of the securities.

The price at which you purchase the securities includes costs that the Bank, the Agents or their respective affiliates expect to incur and profits that

the Bank, the Agents or their respective affiliates expect to realize in connection with hedging activities related to the securities, as set forth above. These costs and profits will likely reduce the secondary market price, if any secondary

market develops, for the securities. As a result, you may experience an immediate and substantial decline in the market value of your securities on the pricing date. See “Selected Risk Considerations — Risks Relating To The Estimated Value Of

The Securities And Any Secondary Market — The Agent Discount, Offering Expenses and Certain Hedging Costs are Likely to Adversely Affect Secondary Market Prices” in this pricing supplement.

|

|

Listing:

|

The securities will not be listed 0r displayed on any securities exchange or electronic communications network

|

|

Canadian

Bail-in:

|

The securities are not bail-inable debt securities under the CDIC Act

|

|

Denominations:

|

$1,000 and any integral multiple of $1,000.

|

|

CUSIP / ISIN:

|

89115FHW4 / US89115FHW41

|

P-4

|

Additional Information about the Issuer and the Securities

|

You should read this pricing supplement together with product supplement MLN-WF-1 dated August 31, 2022 and the prospectus dated March 4, 2022 for additional information about the securities.

Information included in this pricing supplement supersedes information in the product supplement and prospectus to the extent it is different from that information. Certain defined terms used but not defined herein have the meanings set forth in the

product supplement or prospectus. In the event of any conflict, the following hierarchy will govern: first, this pricing supplement; second, the product supplement; and last, the prospectus. The

securities may vary from the terms described in the accompanying product supplement and prospectus in several important ways. You should read this pricing supplement, including the documents incorporated herein, carefully.

You may access the product supplement and prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filing for the relevant date on the SEC website):

| • |

Product Supplement MLN-WF-1 dated August 31, 2022:

|

| • |

Prospectus dated March 4, 2022:

|

Our Central Index Key, or CIK, on the SEC website is 0000947263. As used in this pricing supplement, the “Bank,” “we,” “us,” or “our” refers to The Toronto-Dominion Bank and its

subsidiaries.

We reserve the right to change the terms of, or reject any offer to purchase, the securities prior to their issuance. In the event of any changes to the terms of the securities, we will notify you and

you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes, in which case we may reject your offer to purchase.

This amended and restated pricing supplement amends, restates and supersedes the pricing supplement related hereto dated December 15, 2023 in

its entirety.

P-5

|

Estimated Value of the Securities

|

The final terms for the securities were determined on the pricing date, as indicated under “Terms of the Securities” herein, based on prevailing market conditions on the pricing

date, and are set forth in this pricing supplement.

The economic terms of the securities are based on our internal funding rate (which is our internal borrowing rate based on variables such as market benchmarks and our appetite for

borrowing), and several factors, including any sales commissions expected to be paid to TDS or another affiliate of ours, any selling concessions, discounts, commissions or fees expected to be allowed or paid to non-affiliated intermediaries, the

estimated profit that we or any of our affiliates expect to earn in connection with structuring the securities, estimated costs which we may incur in connection with the securities and an estimate of the difference between the amounts we pay to an

affiliate of Wells Fargo Securities and the amounts that an affiliate of Wells Fargo Securities pays to us in connection with hedging your securities as described further under “Terms of the Securities—Agents” herein and “Risk Factors—Risks Relating

To Hedging Activities And Conflicts Of Interest” in the accompanying product supplement. Because our internal funding rate generally represents a discount from the levels at which our benchmark debt securities trade in the secondary market, the use

of an internal funding rate for the securities rather than the levels at which our benchmark debt securities trade in the secondary market is expected to have had an adverse effect on the economic terms of the securities.

On the cover page of this pricing supplement, we have provided the estimated value for the securities. The estimated value was determined by reference to our internal pricing

models which take into account a number of variables and are based on a number of assumptions, which may or may not materialize, typically including volatility, interest rates (forecasted, current and historical rates), price-sensitivity analysis,

time to maturity of the securities, and our internal funding rate. For more information about the estimated value, see “Selected Risk Considerations — Risks Relating to the Estimated Value of the Securities and Any Secondary Market” herein. Because

our internal funding rate generally represents a discount from the levels at which our benchmark debt securities trade in the secondary market, the use of an internal funding rate for the securities rather than the levels at which our benchmark debt

securities trade in the secondary market is expected, assuming all other economic terms are held constant, to increase the estimated value of the securities. For more information see the discussion under “Selected Risk Considerations — Risks Relating

to the Estimated Value of the Securities and Any Secondary Market — The Estimated Value of Your Securities Is Based on Our Internal Funding Rate.”

Our estimated value of the securities is not a prediction of the price at which the securities may trade in the secondary market, nor will it be the price at which the Agents may

buy or sell the securities in the secondary market. Subject to normal market and funding conditions, the Agents or another affiliate of ours intends to offer to purchase the securities in the secondary market but it is not obligated to do so.

Assuming that all relevant factors remain constant after the pricing date, the price at which the Agents may initially buy or sell the securities in the secondary market, if any,

may exceed our estimated value on the pricing date for a temporary period expected to be approximately three months after the issue date because, in our discretion, we may elect to effectively reimburse to investors a portion of the estimated cost of

hedging our obligations under the securities and other costs in connection with the securities which we will no longer expect to incur over the term of the securities. We made such discretionary election and determined this temporary reimbursement

period on the basis of a number of factors, including the tenor of the securities and any agreement we may have with the distributors of the securities. The amount of our estimated costs which we effectively reimburse to investors in this way may not

be allocated ratably throughout the reimbursement period, and we may discontinue such reimbursement at any time or revise the duration of the reimbursement period after the issue date of the securities based on changes in market conditions and other

factors that cannot be predicted.

We urge you to read the “Selected Risk Considerations” in this pricing supplement.

P-6

|

Investor Considerations

|

The securities are not appropriate for all investors. The securities may be an appropriate investment for investors who:

| ■ |

seek an investment with contingent coupon payments at a rate of 18.40% per annum until the earlier of stated maturity or automatic call, if, and only if, the stock closing price of the lowest

performing Underlying Stock on the applicable calculation day is greater than or equal to 70% of its starting price;

|

| ■ |

understand that if the ending price of the lowest performing Underlying Stock on the final calculation day has declined by more than 30% from its starting price, they will be fully exposed to the decline in the lowest performing Underlying

Stock from its starting price and will lose more than 30%, and possibly all, of the face amount at stated maturity;

|

| ■ |

are willing to accept the risk that they may receive few or no contingent coupon payments over the term of the securities;

|

| ■ |

understand that the securities may be automatically called prior to stated maturity and that the term of the securities may be as short as approximately six months;

|

| ■ |

understand that the return on the securities will depend solely on the performance of the Underlying Stock that is the lowest performing Underlying Stock on each calculation day and that they will not benefit in any way from the

performance of the better performing Underlying Stocks;

|

| ■ |

understand that the securities are riskier than alternative investments linked to only one of the Underlying Stocks or linked to a basket composed of each Underlying Stock;

|

| ■ |

understand and are willing to accept the full downside risks of each Underlying Stock;

|

| ■ |

are willing to forgo participation in any appreciation of any Underlying Stock and dividends on any Underlying Stock; and

|

| ■ |

are willing to hold the securities until maturity.

|

The securities may not be an appropriate investment for investors who:

| ■ |

seek a liquid investment or are unable or unwilling to hold the securities to maturity;

|

| ■ |

require full payment of the face amount of the securities at stated maturity;

|

| ■ |

seek a security with a fixed term;

|

| ■ |

are unwilling to purchase securities with an estimated value as of the pricing date that is lower than the original offering price;

|

| ■ |

are unwilling to accept the risk that the stock closing price of the lowest performing Underlying Stock on the final calculation day may decline by more than 30% from its starting price;

|

| ■ |

seek certainty of current income over the term of the securities;

|

| ■ |

seek exposure to the upside performance of any or each Underlying Stock;

|

| ■ |

seek exposure to a basket composed of each Underlying Stock or a similar investment in which the overall return is based on a blend of the performances of the Underlying Stocks, rather than solely on the lowest performing Underlying Stock;

|

| ■ |

are unwilling to accept the risk of exposure to the Underlying Stocks;

|

| ■ |

are unwilling to accept the credit risk of the Bank; or

|

| ■ |

prefer the lower risk of conventional fixed income investments with comparable maturities issued by companies with comparable credit ratings.

|

The considerations identified above are not exhaustive. Whether or not the securities are an appropriate investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the appropriateness of an investment in the securities in light of your particular circumstances. You should also review carefully the “Selected Risk Considerations” herein and the “Risk Factors” in the accompanying product supplement for

risks related to an investment in the securities. For more information about the Underlying Stocks, please see the sections titled “The common stock of Costco Wholesale Corporation,” “The common stock of Dollar General Corporation” and “The

common stock of Altria Group, Inc.” below.

P-7

|

Determining Payment On A Contingent Coupon Payment Date and at Maturity

|

If the securities have not been previously automatically called, on each contingent coupon payment date, you will either receive a contingent coupon payment or you will not receive

a contingent coupon payment, depending on the stock closing price of the lowest performing Underlying Stock on the related calculation day.

Step 1: Determine which Underlying Stock is the lowest performing Underlying Stock on the relevant calculation day. The lowest performing Underlying Stock on

any calculation day is the Underlying Stock with the lowest performance factor on that calculation day. The performance factor of an Underlying Stock on a calculation day is its stock closing price on that calculation day as a percentage of its

starting price (i.e., its stock closing price on that calculation day divided by its starting price).

Step 2: Determine whether a contingent coupon is paid on the applicable contingent coupon payment date based on the stock closing price of the lowest

performing Underlying Stock on the relevant calculation day, as follows:

P-8

If the securities have not been automatically called prior to the stated maturity date, then at maturity you will receive (in addition to the final contingent coupon payment, if any) a cash payment

per security (the maturity payment amount) calculated as follows:

Step 1: Determine which Underlying Stock is the lowest performing Underlying Stock on the final calculation day. The lowest performing Underlying Stock on the

final calculation day is the Underlying Stock with the lowest performance factor on the final calculation day. The performance factor of an Underlying Stock on the final calculation day is its ending price as a percentage of its starting price (i.e.,

its ending price divided by its starting price).

Step 2: Calculate the maturity payment amount based on the ending price of the lowest performing Underlying Stock, as follows:

P-9

|

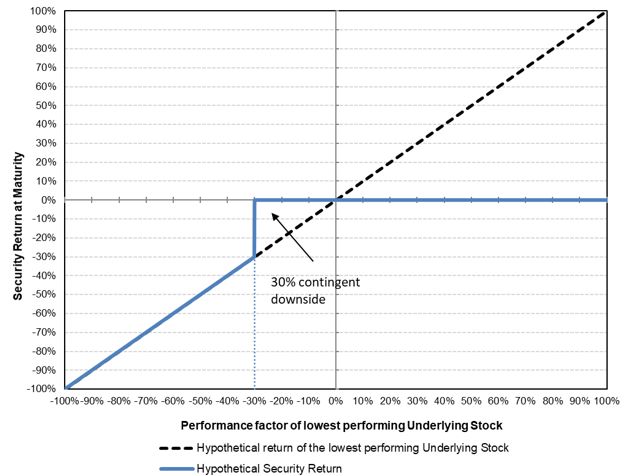

Hypothetical Payout Profile

|

The following profile illustrates the potential maturity payment amount on the securities (excluding the final contingent coupon payment, if any) for a range of hypothetical performances of the lowest

performing Underlying Stock on the final calculation day from its starting price to its ending price, assuming the securities have not been automatically called prior to the stated maturity date. As this profile illustrates, in no event will you have

a positive rate of return based solely on the maturity payment amount received at maturity; any positive return will be based solely on the contingent coupon payments, if any, received during the term of the securities. This graph has been prepared

for purposes of illustration only. Your actual return will depend on the actual ending price of the lowest performing Underlying Stock on the final calculation day and whether you hold your securities to stated maturity. The performance of the better

performing Underlying Stocks is not relevant to your return on the securities.

P-10

|

Selected Risk Considerations

|

The securities have complex features and investing in the securities will involve risks not associated with an investment in conventional debt securities. Some of the risks that apply to an investment

in the securities are summarized below, but we urge you to read the more detailed explanation of the risks relating to the securities generally in the “Risk Factors” section of the accompanying product supplement. You should reach an investment

decision only after you have carefully considered with your advisors the appropriateness of an investment in the securities in light of your particular circumstances.

Risks Relating To The Securities Generally

If The Securities Are Not Automatically Called Prior To Stated Maturity, You May Lose Some Or All Of The Face Amount Of Your Securities At Stated Maturity.

We will not repay you a fixed amount on the securities at stated maturity. If the securities are not automatically called prior to stated maturity, you will receive a maturity payment amount that will

be equal to or less than the face amount, depending on the ending price of the lowest performing Underlying Stock on the final calculation day.

If the ending price of the lowest performing Underlying Stock on the final calculation day is less than its downside threshold price, the maturity payment amount will be reduced by an amount equal to

the decline in the price of the lowest performing Underlying Stock from its starting price (expressed as a percentage of its starting price). The downside threshold price for each Underlying Stock is 70% of its starting price. For example, if the

securities are not automatically called and the lowest performing Underlying Stock on the final calculation day has declined by 30.1% from its starting price to its ending price, you will not receive any benefit of the contingent downside protection

feature and you will lose 30.1% of the face amount. As a result, you will not receive any protection if the price of the lowest performing Underlying Stock on the final calculation day declines significantly and you may lose some, and possibly all,

of the face amount at stated maturity, even if the price of the lowest performing Underlying Stock is greater than or equal to its starting price or its downside threshold price at certain times during the term of the securities.

Even if the ending price of the lowest performing Underlying Stock on the final calculation day is greater than its downside threshold price, the maturity payment amount will not exceed the face

amount, and your yield on the securities, taking into account any contingent coupon payments you may have received during the term of the securities, may be less than the yield you would earn if you bought a traditional interest-bearing debt security

of the Bank or another issuer with a similar credit rating.

The Securities Do Not Provide For Fixed Payments Of Interest And You May Receive No Coupon Payments On One Or More Contingent Coupon Payment Dates, Or Even Throughout The Entire Term

Of The Securities.

On each contingent coupon payment date you will receive a contingent coupon payment if, and only if, the stock closing price of the lowest performing Underlying

Stock on the related calculation day is greater than or equal to its coupon threshold price. The coupon threshold price for each Underlying Stock is 70% of its starting price. If the stock closing price of the lowest performing Underlying Stock on

any calculation day is less than its coupon threshold price, you will not receive any contingent coupon payment on the related contingent coupon payment date, and if the stock closing price of the lowest performing Underlying Stock is less than its

coupon threshold price on each calculation day over the term of the securities, you will not receive any contingent coupon payments over the entire term of the securities.

The Securities Are Subject To The Full Risks Of Each Underlying Stock And Will Be Negatively Affected If Any Underlying Stock Performs Poorly, Even If The Other Underlying Stocks

Perform Favorably.

You are subject to the full risks of each Underlying Stock. If any Underlying Stock performs poorly, you will be negatively affected, even if the other Underlying Stocks perform favorably. The

securities are not linked to a basket composed of the Underlying Stocks, where the better performance of some Underlying Stocks could offset the poor performance of others. Instead, you are subject to the full risks of whichever Underlying Stock is

the lowest performing Underlying Stock on each calculation day. As a result, the securities are riskier than an alternative investment linked to only one of the Underlying Stocks or linked to a basket composed of each Underlying Stock. You should not

invest in the securities unless you understand and are willing to accept the full downside risks of each Underlying Stock.

Your Return On The Securities Will Depend Solely On The Performance Of The Underlying Stock That Is The Lowest Performing Underlying Stock On Each Calculation Day, And You Will Not

Benefit In Any Way From The Performance Of The Better Performing Underlying Stocks.

Your return on the securities will depend solely on the performance of the Underlying Stock that is the lowest performing Underlying Stock on each calculation day. Although it is necessary for each

Underlying Stock to close above its respective coupon threshold price on the relevant calculation day in order for you to receive a contingent coupon payment and above its respective downside threshold price on the final calculation day for you to

receive the face amount of your securities at maturity, you will not benefit in any way from the performance of the better performing Underlying Stocks. The securities may underperform an alternative investment linked to a basket composed of the

Underlying Stocks, since in such case the performance of the better performing Underlying Stocks would be blended with the performance of the lowest performing Underlying Stock, resulting in a better return than the return of the lowest performing

Underlying Stock alone.

P-11

You Will Be Subject To Risks Resulting From The Relationship Among The Underlying Stocks.

It is preferable from your perspective for the Underlying Stocks to be correlated with each other so that their prices will tend to increase or decrease at similar times and by

similar magnitudes. By investing in the securities, you assume the risk that the Underlying Stocks will not exhibit this relationship. The less correlated the Underlying Stocks, the more likely it is that any one of the Underlying Stocks will be

performing poorly at any time over the term of the securities. All that is necessary for the securities to perform poorly is for one of the Underlying Stocks to perform poorly; the performance of the better performing Underlying Stocks is not

relevant to your return on the securities. It is impossible to predict what the relationship among the Underlying Stocks will be over the term of the securities. To the extent the Underlying Stocks operate in different industries or sectors of the

market, such industries and sectors may not perform similarly over the term of the securities.

You May Be Fully Exposed To The Decline In The Lowest Performing Underlying Stock On The Final Calculation Day From Its Starting Price, But Will Not Participate In Any Positive

Performance Of Any Underlying Stock.

Even though you will be fully exposed to a decline in the price of the lowest performing Underlying Stock on the final calculation day if its ending price is below its downside threshold price, you

will not participate in any increase in the price of any Underlying Stock over the term of the securities. Your maximum possible return on the securities will be limited to the sum of the contingent coupon payments you receive, if any. Consequently,

your return on the securities may be significantly less than the return you could achieve on an alternative investment that provides for participation in an increase in the price of any or each Underlying Stock.

Higher Contingent Coupon Rates Are Associated With Greater Risk.

The securities offer contingent coupon payments at a higher rate, if paid, than the fixed rate we would pay on conventional debt securities of the same maturity. These higher potential contingent

coupon payments are associated with greater levels of expected risk as of the pricing date as compared to conventional debt securities, including the risk that you may not receive a contingent coupon payment on one or more, or any, contingent coupon

payment dates and the risk that you may lose a substantial portion, and possibly all, of the face amount at maturity. The volatility of the Underlying Stocks and the correlation among the Underlying Stocks are important factors affecting this risk.

Volatility is a measurement of the size and frequency of daily fluctuations in the price of an Underlying Stock, typically observed over a specified period of time. Volatility can be measured in a variety of ways, including on a historical basis or

on an expected basis as implied by option prices in the market. Correlation is a measurement of the extent to which the prices of the Underlying Stocks tend to fluctuate at the same time, in the same direction and in similar magnitudes. Greater

expected volatility of the Underlying Stocks or lower expected correlation among the Underlying Stocks as of the pricing date may result in a higher contingent coupon rate, but it also represents a greater expected likelihood as of the pricing date

that the stock closing price of at least one Underlying Stock will be less than its coupon threshold price on one or more calculation days, such that you will not receive one or more, or any, contingent coupon payments during the term of the

securities, and that the stock closing price of at least one Underlying Stock will be less than its downside threshold price on the final calculation day such that you will lose a substantial portion, and possibly all, of the face amount at maturity.

In general, the higher the contingent coupon rate is relative to the fixed rate we would pay on conventional debt securities, the greater the expected risk that you will not receive one or more, or any, contingent coupon payments during the term of

the securities and that you will lose a substantial portion, and possibly all, of the face amount at maturity.

You Will Be Subject To Reinvestment Risk.

If your securities are automatically called, the term of the securities may be reduced to as short as approximately six months. There is no guarantee that you would be able to reinvest the proceeds

from an investment in the securities at a comparable return for a similar level of risk in the event the securities are automatically called prior to maturity.

Each Calculation Day (Including The Final Calculation Day) And The Related Call Settlement Date (Including The Stated Maturity Date) Is Subject To Market

Disruption Events And Postponements.

Each calculation day (including the final calculation day), and therefore the potential call settlement date and/or contingent coupon payment date (including the maturity date), is subject to

postponement in the case of a market disruption event or a non-trading day as described herein and in the accompanying product supplement.

Risks Relating To An Investment In the Bank’s Debt Securities, Including The Securities

Investors Are Subject To The Bank’s Credit Risk, And The Bank’s Credit Ratings And Credit Spreads May Adversely Affect The Market Value Of The Securities.

Although the return on the securities will be based on the performance of the lowest performing Underlying Stock, the payment of any amount due on the securities is subject to the Bank’s credit risk.

The securities are the Bank’s senior unsecured debt obligations. Investors are dependent on the Bank’s ability to pay all amounts due on the securities on each contingent coupon payment date, as well as the call settlement date or stated maturity

date and, therefore, investors are subject to the credit risk of the Bank and to changes in the market’s view of the Bank’s creditworthiness. Any decrease in the Bank’s credit ratings or increase in the credit spreads charged by the market for taking

the Bank’s credit risk is likely to adversely affect the market value of the securities. If the Bank becomes unable to meet its financial obligations as they become due, investors may not receive any amounts due under the terms of the securities.

P-12

Risks Relating To The Estimated Value Of The Securities And Any Secondary Market

The Estimated Value Of Your Securities Is Less Than The Original Offering Price Of Your Securities.

The estimated value of your securities is less than the original offering price of your securities. The difference between the original offering price of your securities and the estimated value of

the securities reflects costs and expected profits associated with selling and structuring the securities, as well as hedging our obligations under the securities. Because hedging our obligations entails risks and may be influenced by market forces

beyond our control, this hedging may result in a profit that is more or less than expected, or a loss.

The Estimated Value Of Your Securities Is Based On Our Internal Funding Rate.

The estimated value of your securities is determined by reference to our internal funding rate. The internal funding rate used in the determination of the estimated value of the securities generally

represents a discount from the credit spreads for our conventional, fixed-rate debt securities and the borrowing rate we would pay for our conventional, fixed-rate debt securities. This discount is based on, among other things, our view of the

funding value of the securities as well as the higher issuance, operational and ongoing liability management costs of the securities in comparison to those costs for our conventional, fixed-rate debt, as well as estimated financing costs of any hedge

positions, taking into account regulatory and internal requirements. If the interest rate implied by the credit spreads for our conventional, fixed-rate debt securities, or the borrowing rate we would pay for our conventional, fixed-rate debt

securities were to be used, we would expect the economic terms of the securities to be more favorable to you. Additionally, assuming all other economic terms are held constant, the use of an internal funding rate for the securities is expected to

increase the estimated value of the securities at any time.

The Estimated Value Of The Securities Is Based On Our Internal Pricing Models, Which May Prove To Be Inaccurate And May Be Different From The Pricing Models Of Other Financial

Institutions.

The estimated value of your securities is based on our internal pricing models, which take into account a number of variables, such as our internal funding rate on the pricing date, and are based on

a number of subjective assumptions, which are not evaluated or verified on an independent basis and may or may not materialize. Further, our pricing models may be different from other financial institutions’ pricing models and the methodologies used

by us to estimate the value of the securities may not be consistent with those of other financial institutions that may be purchasers or sellers of the securities in the secondary market. As a result, the secondary market price of your securities may

be materially less than the estimated value of the securities determined by reference to our internal pricing models. In addition, market conditions and other relevant factors in the future may change, and any assumptions may prove to be incorrect.

The Estimated Value Of Your Securities Is Not A Prediction Of The Prices At Which You May Sell Your Securities In The Secondary Market, If Any, And Such Secondary Market Prices,

If Any, Will Likely Be Less Than The Original Offering Price Of Your Securities And May Be Less Than The Estimated Value Of Your Securities.

The estimated value of the securities is not a prediction of the prices at which the Agents, other affiliates of ours or third parties may be willing to purchase the securities from you in secondary

market transactions (if they are willing to purchase, which they are not obligated to do). The price at which you may be able to sell your securities in the secondary market at any time, if any, may be based on pricing models that differ from our

pricing models and will be influenced by many factors that cannot be predicted, such as market conditions and any bid and ask spread for similar sized trades, and may be substantially less than our estimated value of the securities. Further, as

secondary market prices of your securities take into account the levels at which our debt securities trade in the secondary market and do not take into account our various costs and expected profits associated with selling and structuring the

securities, as well as hedging our obligations under the securities, secondary market prices of your securities will likely be less than the original offering price of your securities. As a result, the price at which the Agents, other affiliates of

ours or third parties may be willing to purchase the securities from you in secondary market transactions, if any, will likely be less than the price you paid for your securities, and any sale prior to the stated maturity date could result in a

substantial loss to you.

The Temporary Price At Which We May Initially Buy The Securities In The Secondary Market May Not Be Indicative Of Future Prices Of Your Securities.

Assuming that all relevant factors remain constant after the pricing date, the price at which the Agents may initially buy or sell the securities in the secondary market (if the Agents make a market

in the securities, which they are not obligated to do) may exceed the estimated value of the securities on the pricing date, as well as the secondary market value of the securities, for a temporary period after the pricing date of the securities, as

discussed further under “Estimated Value of the Securities”. The price at which the Agents may initially buy or sell the securities in the secondary market may not be indicative of future prices of your securities.

The Agent Discount, Offering Expenses And Certain Hedging Costs Are Likely To Adversely Affect Secondary Market Prices.

Assuming no changes in market conditions or any other relevant factors, the price, if any, at which you may be able to sell the securities will likely be less than the original offering price. The original offering

price includes, and any price quoted to you is likely to exclude, the underwriting discount paid in connection with the initial distribution, offering expenses as well as the cost of hedging our obligations under the securities. In addition, any such

price is also likely to reflect dealer discounts, mark-ups and other transaction costs, such as a discount to account for costs associated with establishing or unwinding any related hedge transaction. In addition, because an affiliate of Wells Fargo

Securities is to conduct hedging activities for us in connection with the securities, that affiliate may profit in connection with such hedging activities and such profit, if any, will be in addition to the compensation that the dealer receives for

the sale of the securities to you. You should be aware that the potential to earn fees in connection with hedging activities may create a further incentive for the dealer to sell the securities to you in addition to the compensation they would

receive for the sale of the securities.

P-13

There May Not Be An Active Trading Market For The Securities — Sales In The Secondary Market May Result In Significant Losses.

There may be little or no secondary market for the securities. The securities will not be listed or displayed on any securities exchange or any electronic communications network. The Agents and

their respective affiliates may make a market for the securities; however, they are not required to do so. The Agents and their respective affiliates may stop any market-making activities at any time. Even if a secondary market for the securities

develops, it may not provide significant liquidity or trade at prices advantageous to you. We expect that transaction costs in any secondary market would be high. As a result, the difference between bid and ask prices for your securities in any

secondary market could be substantial.

If you sell your securities before the stated maturity date, you may have to do so at a substantial discount from the principal amount irrespective of the price of the Underlying Stocks, and as a

result, you may suffer substantial losses.

If The Price Of Any Underlying Stocks Change, The Market Value Of Your Securities May Not Change In The Same Manner.

Your securities may trade quite differently from the performance of any of the Underlying Stocks. Changes in the price of any Underlying Stocks generally or the lowest performing Underlying Stock

specifically may not result in a comparable change in the market value of your securities. Even if the price of each Underlying Stock increases above its starting price during the term of the securities, the market value of your securities may not

increase by the same amount and could decline.

Risks Relating To The Underlying Stocks

Any Payments On The Securities And Whether The Securities Are Automatically Called Will Depend Upon The Performance Of The Underlying Stocks And Therefore The Securities Are Subject

To The Following Risks, Each As Discussed In More Detail In The Accompanying Product Supplement.

| • |

Investing In The Securities Is Not The Same As Investing In The Underlying Stocks. Investing in the securities is not equivalent to investing in any of the

Underlying Stocks. As an investor in the securities, your return will not reflect the return you would realize if you actually owned and held the Underlying Stocks for a period similar to the term of the securities because you will not

receive any dividend payments, distributions or any other payments paid on any Underlying Stock. As a holder of the securities, you will not have any voting rights or any other rights that holders of the Underlying Stocks would have.

|

| • |

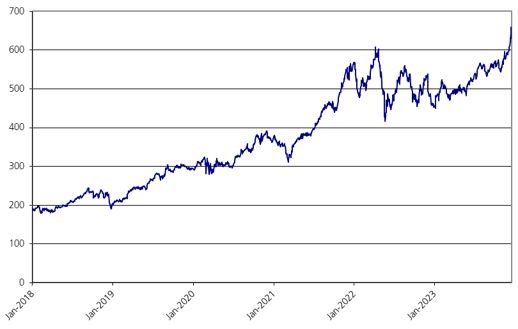

Historical Prices Of The Underlying Stocks Should Not Be Taken As An Indication Of The Future Performance Of The Underlying Stocks During The Term Of The Securities.

|

| • |

The Securities May Become Linked To The Common Stock Of A Company Other Than An Original Underlying Stock Issuer.

|

| • |

We, The Agents And Our Respective Affiliates Cannot Control Actions By An Underlying Stock Issuer.

|

| • |

We, The Agents And Our Respective Affiliates Have No Affiliation With Any Underlying Stock Issuer And Have Not Independently Verified Their Public Disclosure Of Information.

|

| • |

You Have Limited Anti-Dilution Protection.

|

P-14

Risks Relating To Hedging Activities And Conflicts of Interest

| • |

Trading And Business Activities By The Bank Or Its Affiliates May Adversely Affect The Market Value Of, And Any Amount Payable On, The Securities.

|

| • |

There Are Potential Conflicts Of Interest Between You And The Calculation Agent.

|

Risks Relating To Canadian And U.S. Federal Income Taxation

The Tax Consequences Of An Investment In The Securities Are Unclear.

Significant aspects of the U.S. federal income tax treatment of the securities are uncertain. You should read carefully the section entitled “Material U.S. Federal Income Tax Consequences” herein

and in the product supplement. You should consult your tax advisors as to the tax consequences of your investment in the securities.

For a discussion of the Canadian federal income tax consequences of investing in the securities, please see the discussion in the product supplement under “Supplemental

Discussion of Canadian Tax Consequences”. If you are not a Non-resident Holder (as that term is defined in the prospectus) for Canadian federal income tax purposes or if you acquire the securities in the secondary market, you should consult your

tax advisors as to the consequences of acquiring, holding and disposing of the securities and receiving the payments that might be due under the securities.

P-15

|

Hypothetical Returns

|

If the securities are automatically called:

If the securities are automatically called prior to stated maturity, you will receive the face amount of your securities plus a final contingent coupon payment on the call settlement date. In the

event the securities are automatically called, your total return on the securities will equal any contingent coupon payments received prior to the call settlement date and the contingent coupon payment received on the call settlement date.

If the securities are not automatically called:

If the securities are not automatically called prior to stated maturity, the following table illustrates, for a range of hypothetical performance factors of the lowest performing Underlying Stock on

the final calculation day, the hypothetical maturity payment amount payable at stated maturity per security (excluding the final contingent coupon payment, if any). The performance factor of the lowest performing Underlying Stock on the final

calculation day is its ending price expressed as a percentage of its starting price (i.e., its ending price divided by its starting price).

|

Hypothetical performance factor of

lowest performing Underlying Stock on

final calculation day

|

Hypothetical maturity payment amount

per security

|

|

175.00%

|

$1,000.00

|

|

160.00%

|

$1,000.00

|

|

150.00%

|

$1,000.00

|

|

140.00%

|

$1,000.00

|

|

130.00%

|

$1,000.00

|

|

120.00%

|

$1,000.00

|

|

110.00%

|

$1,000.00

|

|

100.00%

|

$1,000.00

|

|

90.00%

|

$1,000.00

|

|

80.00%

|

$1,000.00

|

|

70.00%

|

$1,000.00

|

|

69.00%

|

$690.00

|

|

60.00%

|

$600.00

|

|

50.00%

|

$500.00

|

|

40.00%

|

$400.00

|

|

30.00%

|

$300.00

|

|

25.00%

|

$250.00

|

|

0.00%

|

$0.00

|

The above figures do not take into account contingent coupon payments, if any, received during the term of the securities. As evidenced above, in no event will you have a positive rate of return based

solely on the maturity payment amount received at maturity; any positive return will be based solely on the contingent coupon payments, if any, received during the term of the securities.

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. If the securities are not automatically called prior to stated maturity, the actual amount you

will receive at stated maturity will depend on the actual ending price of the lowest performing Underlying Stock on the final calculation day. The performance of the better performing Underlying Stocks is not relevant to your return on the

securities.

P-16

|

Hypothetical Contingent Coupon Payments

|

Set forth below are examples that illustrate how to determine whether a contingent coupon payment will be paid and whether the securities will be automatically called, if applicable, on a contingent

coupon payment date prior to the stated maturity date. The examples do not reflect any specific contingent coupon payment date. The following examples assume that the securities are subject to automatic call on the applicable calculation day. The

securities will not be subject to automatic call until the second calculation day, which is approximately sixth months after the issue date. The following examples reflect the contingent coupon rate of 18.40% per annum and assume the hypothetical

starting price, coupon threshold price and stock closing prices for each Underlying Stock indicated in the examples. The terms used for purposes of these hypothetical examples do not represent any actual starting price or coupon threshold price. The

hypothetical starting price of $100.00 for each Underlying Stock has been chosen for illustrative purposes only and does not represent the actual starting price for any Underlying Stock. The actual starting price and coupon threshold price for each

Underlying Stock are set forth under “Terms of the Securities” above. For historical data regarding the actual closing prices of the Underlying Stocks, see the historical information provided herein. These examples are for purposes of illustration

only and the values used in the examples may have been rounded for ease of analysis.

Example 1. The stock closing price of the lowest performing Underlying Stock on the relevant calculation day is greater than or equal to its coupon threshold price and less than its

starting price. As a result, investors receive a contingent coupon payment on the applicable contingent coupon payment date and the securities are not automatically called.

|

The common

stock of Costco

Wholesale

Corporation

|

The common

stock of Dollar

General

Corporation

|

The common

stock of Altria

Group, Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical stock closing price on relevant calculation day:

|

$90.00

|

$95.00

|

$80.00

|

|

|

Hypothetical coupon threshold price:

|

$70.00

|

$70.00

|

$70.00

|

|

|

Performance factor (stock closing price on calculation day divided by starting price):

|

90.00%

|

95.00%

|

80.00%

|

Step 1: Determine which Underlying Stock is the lowest performing Underlying Stock on the relevant calculation day.

In this example, the common stock of Altria Group, Inc. has the lowest performance factor and is, therefore, the lowest performing Underlying Stock on the

relevant calculation day.

Step 2: Determine whether a contingent coupon payment will be paid and whether the securities will be automatically called on the applicable contingent

coupon payment date.

Since the hypothetical stock closing price of the lowest performing Underlying Stock on the relevant calculation day is greater than or equal to its coupon

threshold price, but less than its starting price, you would receive a contingent coupon payment on the applicable contingent coupon payment date and the securities would not be automatically called. The contingent coupon payment would be equal to

$46.00 per security, determined as follows: (i) $1,000 multiplied by 18.40% per annum divided by (ii) 4, rounded to the nearest cent.

Example 2. The stock closing price of the lowest performing Underlying Stock on the relevant calculation day is less than its coupon threshold price. As a result,

investors do not receive a contingent coupon payment on the applicable contingent coupon payment date and the securities are not automatically called.

|

The common

stock of Costco

Wholesale

Corporation

|

The common

stock of Dollar

General

Corporation

|

The common

stock of Altria

Group, Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical stock closing price on relevant calculation day:

|

$49.00

|

$125.00

|

$105.00

|

|

|

Hypothetical coupon threshold price:

|

$70.00

|

$70.00

|

$70.00

|

|

|

Performance factor (stock closing price on calculation day divided by starting price):

|

49.00%

|

125.00%

|

105.00%

|

Step 1: Determine which Underlying Stock is the lowest performing Underlying Stock on the relevant calculation day.

In this example, the common stock of Costco Wholesale Corporation has the lowest performance factor and is, therefore, the lowest performing Underlying Stock on

the relevant calculation day.

Step 2: Determine whether a contingent coupon payment will be paid and whether the securities will be automatically called on the applicable contingent

coupon payment date.

Since the hypothetical stock closing price of the lowest performing Underlying Stock on the relevant calculation day is less than its coupon threshold price, you would not receive

a contingent coupon payment on the applicable contingent coupon payment date.

P-17

In addition, the securities would not be automatically called, even though the stock closing prices of the better performing Underlying Stocks on the relevant calculation day

are greater than their starting prices. As this example illustrates, whether you receive a contingent coupon payment and whether the securities are automatically called on a contingent coupon payment date will depend solely on the stock closing price

of the lowest performing Underlying Stock on the relevant calculation day. The performance of the better performing Underlying Stocks is not relevant to your return on the securities.

Example 3. The stock closing price of the lowest performing Underlying Stock on the relevant calculation day is greater than or equal to its starting price. As a result, the

securities are automatically called on the applicable contingent coupon payment date for the face amount plus a final contingent coupon payment.

|

The common

stock of Costco

Wholesale

Corporation

|

The common

stock of Dollar

General

Corporation

|

The common

stock of Altria

Group, Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical stock closing price on relevant calculation day:

|

$115.00

|

$105.00

|

$130.00

|

|

|

Hypothetical coupon threshold price:

|

$70.00

|

$70.00

|

$70.00

|

|

|

Performance factor (stock closing price on calculation day divided by starting price):

|

115.00%

|

105.00%

|

130.00%

|

Step 1: Determine which Underlying Stock is the lowest performing Underlying Stock on the relevant calculation day.

In this example, the common stock of Dollar General Corporation has the lowest performance factor and is, therefore, the lowest performing Underlying Stock on the relevant

calculation day.

Step 2: Determine whether a contingent coupon payment will be paid and whether the securities will be automatically called on the applicable contingent coupon payment date.

Since the hypothetical stock closing price of the lowest performing Underlying Stock on the relevant calculation day is greater than or equal to its starting price, the securities

would be automatically called and you would receive the face amount plus a final contingent coupon payment on the applicable contingent coupon payment date, which is also referred to as the call settlement date. On the call settlement date, you would

receive $1,046.00 per security.

You will not receive any further payments after the call settlement date.

P-18

|

Hypothetical Payment at Stated Maturity

|

Set forth below are examples of calculations of the maturity payment amount payable at stated maturity, assuming that the securities have not been automatically called prior to stated maturity and

assuming the hypothetical starting price, coupon threshold price, downside threshold price and ending prices for each Underlying Stock indicated in the examples. The terms used for purposes of these hypothetical examples do not represent any actual

starting price, coupon threshold price or downside threshold price. The hypothetical starting price of $100.00 for each Underlying Stock has been chosen for illustrative purposes only and does not represent the actual starting price for any

Underlying Stock. The actual starting price, coupon threshold price and downside threshold price for each Underlying Stock are set forth under “Terms of the Securities” above. For historical data regarding the actual closing prices of the Underlying

Stocks, see the historical information provided herein. These examples are for purposes of illustration only and the values used in the examples may have been rounded for ease of analysis.

Example 1. The ending price of the lowest performing Underlying Stock on the final calculation day is greater than its starting price, the maturity payment amount is equal to the

face amount of your securities at maturity and you receive a final contingent coupon payment:

|

The common

stock of Costco

Wholesale

Corporation

|

The common

stock of Dollar

General

Corporation

|

The common

stock of Altria

Group, Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical ending price:

|

$145.00

|

$135.00

|

$125.00

|

|

|

Hypothetical coupon threshold price:

|

$70.00

|

$70.00

|

$70.00

|

|

|

Hypothetical downside threshold price:

|

$70.00

|

$70.00

|

$70.00

|

|

|

Performance factor (ending price divided by starting price):

|

145.00%

|

135.00%

|

125.00%

|

Step 1: Determine which Underlying Stock is the lowest performing Underlying Stock on the final calculation day.

In this example, the common stock of Altria Group, Inc. has the lowest performance factor and is, therefore, the lowest performing Underlying Stock on the final calculation day.

Step 2: Determine the maturity payment amount based on the ending price of the lowest performing Underlying Stock on the final calculation day.

Since the hypothetical ending price of the lowest performing Underlying Stock on the final calculation day is greater than its hypothetical downside threshold price, the maturity

payment amount would equal the face amount. Although the hypothetical ending price of the lowest performing Underlying Stock on the final calculation day is significantly greater than its hypothetical starting price in this scenario, the maturity

payment amount will not exceed the face amount.

In addition to any contingent coupon payments received during the term of the securities, on the stated maturity date you would receive $1,000 per security. In addition, because

the hypothetical ending price of the lowest performing Underlying Stock on the final calculation day is greater than its coupon threshold price, you would receive a final contingent coupon payment on the stated maturity date.

P-19

Example 2. The ending price of the lowest performing Underlying Stock on the final calculation day is less than its starting price but greater than its downside threshold price and its coupon

threshold price, the maturity payment amount is equal to the face amount of your securities at maturity and you receive a final contingent coupon payment:

|

The common

stock of Costco

Wholesale

Corporation

|

The common

stock of Dollar

General

Corporation

|

The common

stock of

Altria Group,

Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical ending price:

|

$80.00

|

$115.00

|

$110.00

|

|

|

Hypothetical coupon threshold price:

|

$70.00

|

$70.00

|

$70.00

|

|

|

Hypothetical downside threshold price:

|

$70.00

|

$70.00

|

$70.00

|

|

|

Performance factor (ending price divided by starting price):

|

80.00%

|

115.00%

|

110.00%

|

Step 1: Determine which Underlying Stock is the lowest performing Underlying Stock on the final calculation day.

In this example, the common stock of Costco Wholesale Corporation has the lowest performance factor and is, therefore, the lowest performing Underlying Stock on the final calculation

day.

Step 2: Determine the maturity payment amount based on the ending price of the lowest performing Underlying Stock on the final calculation day.

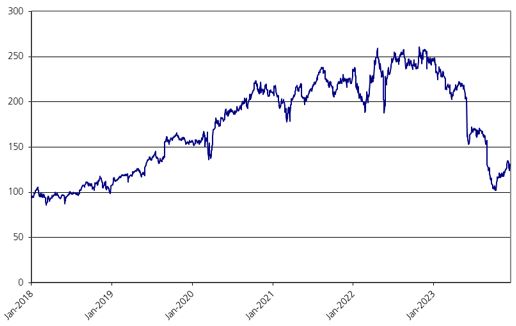

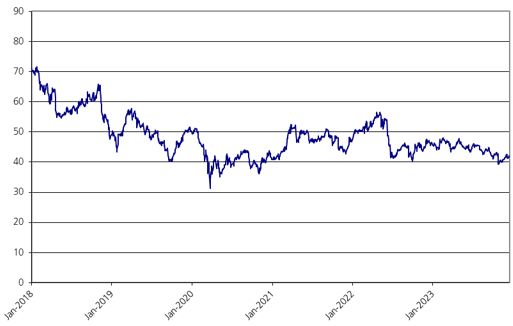

Since the hypothetical ending price of the lowest performing Underlying Stock on the final calculation day is less than its hypothetical starting price, but not by more than 30%, you