|

PRELIMINARY PRICING SUPPLEMENT

Subject To Completion, dated December 14, 2023

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-262557

(To Product Supplement MLN-WF-1 dated August 31, 2022

and Prospectus dated March 4, 2022)

|

|

|

The Toronto-Dominion Bank

Senior Debt Securities, Series E

ETF Linked Securities

|

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares® 20+ Year Treasury Bond ETF due June 24, 2027

|

|

■ Linked to the iShares® 20+ Year Treasury Bond

ETF (the “Fund”)

■ Unlike ordinary debt securities, the securities do not pay interest or repay a fixed amount of

principal at maturity. Instead, the securities provide for a maturity payment amount that may be greater than, equal to or less than the face amount of the securities, depending on the performance of the Fund from its starting price to its

ending price. The maturity payment amount will reflect the following terms:

■ If the price of the Fund increases, you will receive the face amount plus a positive return

equal to at least 150% (to be determined on the pricing date) of the percentage increase in the price of the Fund from the starting price

■ If the price of the Fund decreases you will have full downside exposure to the decrease in

the price of the Fund from the starting price, and you will lose some, and possibly all, of the face amount of your securities

■ Investors may lose some, and possibly all, of the face amount

■ All payments on the securities are subject to the credit risk of The Toronto-Dominion Bank (the

“Bank”)

■ No periodic interest payments or dividends

■ No exchange listing; designed to be held to maturity

|

|

Original Offering Price

|

Agent Discount(1)

|

Proceeds to The Toronto-Dominion Bank

|

|

|

Per Security

|

$1,000.00

|

Up to $28.25

|

At least $971.75

|

|

Total

|

| (1) |

The Agents may receive a commission of up to $28.25 (2.825%) per security and may use a portion of that commission to allow selling concessions to other dealers in connection with the distribution of the

securities, or will offer the securities directly to investors. The Agents may resell the securities to other securities dealers at the original offering price less a concession not in excess of $22.50 (2.25%) per security. Such securities

dealers may include Wells Fargo Advisors (“WFA”, the trade name of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC), an affiliate of Wells Fargo Securities, LLC (“Wells

Fargo Securities”). The other dealers may forgo, in their sole discretion, some or all of their selling concessions. In addition to the selling concession allowed to WFA, Wells Fargo Securities may pay $0.75 (0.075%) per security of the

agent discount to WFA as a distribution expense fee for each security sold by WFA. The Bank will reimburse TD Securities (USA) LLC (“TDS”) for certain expenses in connection with its role in the offer and sale of the securities, and the

Bank will pay TDS a fee in connection with its role in the offer and sale of the securities. In respect of certain securities sold in this offering, we may pay a fee of up to $2.50 per security to selected securities dealers in

consideration for marketing and other services in connection with the distribution of the securities to other securities dealers. See “Terms of the Securities—Agents” herein and “Supplemental Plan of Distribution (Conflicts of Interest)

–Selling Restrictions” in the accompanying product supplement.

|

|

TD Securities (USA) LLC

|

Wells Fargo Securities

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Terms of the Securities

|

|

Issuer:

|

The Toronto-Dominion Bank (the “Bank”).

|

||

|

Market Measure:

|

iShares® 20+ Year Treasury Bond ETF (the “Fund”).

|

||

|

Fund Underlying

Index:

|

With respect to the Fund, the ICE® U.S. Treasury 20+ Year Bond Index

|

||

|

Pricing Date*:

|

December 20, 2023.

|

||

|

Issue Date*:

|

December 26, 2023.

|

||

|

Original Offering

Price:

|

$1,000 per security.

|

||

|

Face Amount:

|

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000.

|

||

|

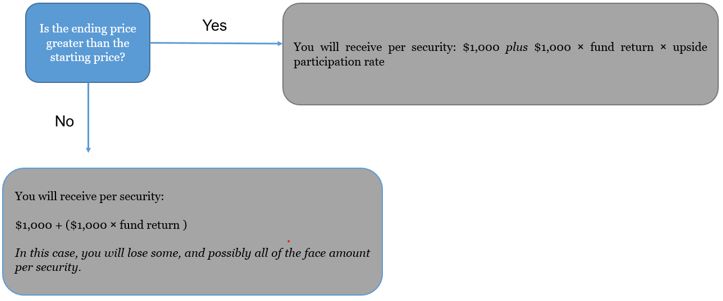

Maturity Payment

Amount:

|

On the stated maturity date, you will be entitled to receive a cash payment per security in U.S. dollars equal to the maturity payment amount. The “maturity

payment amount” per security will equal:

• if the ending price is greater than the starting price: $1,000 plus:

$1,000 × fund return × upside participation rate;

• if the ending price is less than or equal to the starting price:

$1,000 + ($1,000 × fund return)

|

||

|

If the ending price is less than the starting price, you will have full downside exposure to the decrease in the price of the Fund

from the starting price and will lose some, and possibly all, of the face amount of your securities at maturity.

|

|||

|

Stated Maturity

Date*:

|

June 24, 2027, subject to postponement. The securities are not subject to redemption by the Bank or repayment at the option of any holder of the

securities prior to the stated maturity date.

|

||

|

Starting Price:

|

$ , the fund closing price of the Fund on the pricing date.

|

||

|

Fund Closing Price:

|

The fund closing price, closing price and adjustment factor have the meanings set forth under “General Terms of the Securities—Certain Terms for

Securities Linked to a Fund—Certain Definitions” in the accompanying product supplement.

|

||

|

Ending Price:

|

The “ending price” will be the fund closing price of the Fund on the calculation day.

|

||

|

Upside Participation

Rate:

|

At least 150% (to be determined on the pricing date).

|

||

|

Fund Return:

|

The “fund return” is the percentage change from the starting price to the ending price, measured as follows:

ending price – starting price

starting price

|

||

|

Calculation Day*:

|

June 21, 2027, subject to postponement.

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Market Disruption

Events and

Postponement

Provisions:

|

The calculation day is subject to postponement due to non-trading days and the occurrence of a market disruption event. In addition, the stated maturity

date will be postponed if the calculation day is postponed and will be adjusted for non-business days.

For more information regarding adjustments to the calculation day and the stated maturity date, see “General Terms of the Securities—Consequences of a

Market Disruption Event; Postponement of a Calculation Day—Securities Linked to a Single Market Measure” and “—Payment Dates” in the accompanying product supplement. In addition, for information regarding the circumstances that may result

in a market disruption event, see “General Terms of the Securities—Certain Terms for Securities Linked to a Fund—Market Disruption Events” in the accompanying product supplement.

|

||

|

Calculation Agent:

|

The Bank

|

||

|

U.S. Tax Treatment:

|

By purchasing the securities, you agree, in the absence of a statutory or regulatory change or an administrative determination or judicial ruling to the

contrary, to treat the securities, for U.S. federal income tax purposes, as prepaid derivative contracts that are “open transactions” with respect to the Fund. Based on certain factual representations received from us, our special U.S. tax

counsel, Fried, Frank, Harris, Shriver & Jacobson LLP, is of the opinion that it would be reasonable to treat the securities in the manner described above. However, because there is no authority that specifically addresses the tax

treatment of the securities, it is possible that your securities could alternatively be treated for tax purposes as a single contingent payment debt instrument or pursuant to some other characterization, such that the timing and character

of your income from the securities could differ materially and adversely from the treatment described above, as described further under “Material U.S. Federal Income Tax Consequences” herein and in the product supplement. An investment in the securities is not appropriate for non-U.S. holders, and we will not attempt to ascertain the tax consequences to non-U.S. holders of the purchase, ownership or disposition of the securities.

|

||

|

Canadian Tax

Treatment:

|

Please see the discussion in the product supplement under “Supplemental Discussion of Canadian Tax Consequences,” which applies to the securities.

|

||

|

Agents:

|

TD Securities (USA) LLC and Wells Fargo Securities, LLC.

The Agents may receive a commission of up to $28.25 (2.825%) per security and may use a portion of that commission to allow selling concessions to other

dealers in connection with the distribution of the securities, or will offer the securities directly to investors. The Agents may resell the securities to other securities dealers at the original offering price less a concession not in

excess of $22.50 (2.25%) per security. Such securities dealers may include WFA. In addition to the selling concession allowed to WFA, Wells Fargo Securities may pay $0.75 (0.075%) per security of the agent discount to WFA as a distribution

expense fee for each security sold by WFA.

In addition, in respect of certain securities sold in this offering, we may pay a fee of up to $2.50 per security to selected securities dealers in

consideration for marketing and other services in connection with the distribution of the securities to other securities dealers.

The price at which you purchase the securities includes costs that the Bank, the Agents or their respective affiliates expect to incur and profits that

the Bank, the Agents or their respective affiliates expect to realize in connection with hedging activities related to the securities, as set forth above. These costs and profits will likely reduce the secondary market price, if any

secondary market develops, for the securities. As a result, you may experience an immediate and substantial decline in the market value of your securities on the pricing date. See “Selected Risk Considerations — Risks Relating To The

Estimated Value Of The Securities And Any Secondary Market — The Agent Discount, Offering Expenses And Certain Hedging Costs Are Likely To Adversely Affect Secondary Market Prices” in this pricing supplement.

|

||

|

Listing:

|

The securities will not be listed 0r displayed on any securities exchange or electronic communications network

|

||

|

Canadian Bail-in:

|

The securities are not bail-inable debt securities under the CDIC Act

|

||

|

Denominations:

|

$1,000 and any integral multiple of $1,000.

|

||

|

CUSIP / ISIN:

|

89115FKY6 / US89115FKY69

|

| * |

To the extent that we make any change to the expected pricing date or expected issue date, the calculation day and stated maturity date may also be changed in our discretion to ensure that the term of the

securities remains the same.

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Additional Information about the Issuer and the Securities

|

| • |

Product Supplement MLN-WF-1 dated August 31, 2022:

|

| • |

Prospectus dated March 4, 2022:

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Estimated Value of the Securities

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Investor Considerations

|

| ■ |

seek at least 150% (to be determined on the pricing date) exposure to the upside performance of the Fund if the ending price is greater than or equal to the starting price;

|

| ■ |

are willing to accept the risk that, if the ending price is less than the starting price, they will be fully exposed to the decrease of price of the Fund from the starting price and will lose some, and possibly all, of the face amount

per security at maturity;

|

| ■ |

are willing to forgo interest payments on the securities and dividends on the shares of the Fund and the securities held by the Fund; and

|

| ■ |

are willing to hold the securities until maturity.

|

| ■ |

seek a liquid investment or are unable or unwilling to hold the securities to maturity;

|

| ■ |

are unwilling to accept the risk that the ending price of the Fund may decrease from the starting price;

|

| ■ |

seek full return of the face amount of the securities at stated maturity;

|

| ■ |

are unwilling to purchase securities with an estimated value as of the pricing date that is lower than the original offering price and that may be as low as the lower estimated value set forth on the cover page;

|

| ■ |

seek current income;

|

| ■ |

are unwilling to accept the risk of exposure to the Fund;

|

| ■ |

seek exposure to the Fund but are unwilling to accept the risk/return trade-offs inherent in the maturity payment amount for the securities;

|

| ■ |

are unwilling to accept the credit risk of the Bank; or

|

| ■ |

prefer the lower risk of conventional fixed income investments with comparable maturities issued by companies with comparable credit ratings.

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Determining Payment at Stated Maturity

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Selected Risk Considerations

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

| • |

Investing In The Securities Is Not The Same As Investing In The Fund. Investing in the securities is not equivalent to investing in the Fund. As an investor in the securities, your return will not

reflect the return you would realize if you actually owned and held the securities held by the Fund for a period similar to the term of the securities because you will not receive any dividend payments, distributions or any other payments

paid on those securities. As a holder of the securities, you will not have any voting rights or any other rights that holders of the securities held by the Fund would have.

|

| • |

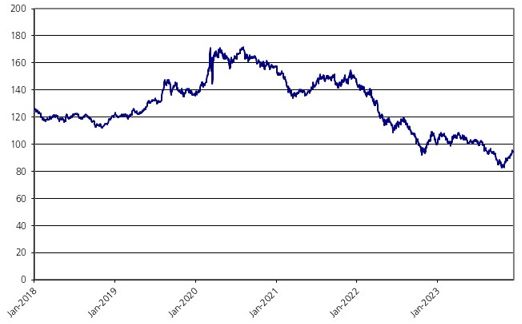

Historical Prices Of The Fund Should Not Be Taken As An Indication Of The Future Performance Of The Fund During The Term Of The Securities.

|

| • |

Changes That Affect A Fund Or Its Fund Underlying Index May Adversely Affect The Value Of The Securities And Any Payments On The Securities.

|

| • |

We, The Agents And Our Respective Affiliates Cannot Control Actions By Any Of The Unaffiliated Companies Whose Securities Are Included In The Fund Or Its Fund Underlying Index.

|

| • |

We And Our Affiliates And the Agents And Their Affiliates Have No Affiliation With Any Fund Sponsor Or Fund Underlying Index Sponsor And Have Not Independently Verified Their Public

Disclosure Of Information.

|

| • |

An Investment Linked To The Shares Of A Fund Is Different From An Investment Linked To Its Fund Underlying Index.

|

| • |

There Are Management and Liquidity Risks Associated With A Fund.

|

| • |

Anti-dilution Adjustments Relating To The Shares Of A Fund Do Not Address Every Event That Could Affect Such Shares.

|

| • |

economic performance, including any financial or economic crises and changes in the gross domestic product, the principal sectors, inflation, employment and labor, and prevailing prices and wages;

|

| • |

the monetary system, including the monetary policy, the exchange rate policy, the economic and tax policies, banking regulation, credit allocation and exchange controls;

|

| • |

the external sector, including the amount and types of foreign trade, the geographic distribution of trade, the balance of payments, and reserves and exchange rates;

|

| • |

public finance, including the budget process, any entry into or termination of any economic or monetary agreement or union, the prevailing accounting methodology, the measures of fiscal balance, revenues and expenditures, and any

government enterprise or privatization program; and

|

| • |

public debt, including external debt, debt service and the debt record.

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

| • |

sentiment regarding underlying strength in the U.S. economy and global economies;

|

| • |

expectations regarding the level of price inflation;

|

| • |

sentiment regarding credit quality in the U.S. and global credit markets;

|

| • |

central bank policies regarding interest rates; and

|

| • |

the performance of U.S. and foreign capital markets.

|

| • |

Trading And Business Activities By The Bank Or Its Affiliates May Adversely Affect The Market Value Of, And Any Amount Payable On, The Securities.

|

| • |

There Are Potential Conflicts Of Interest Between You And The Calculation Agent.

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

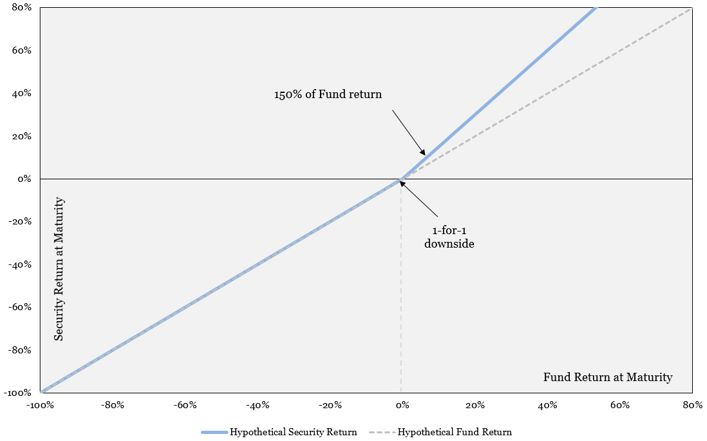

Hypothetical Examples and Returns

|

|

Upside Participation Rate:

|

150%

|

||

|

Hypothetical Starting Price:

|

$100.00

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Hypothetical

ending price

|

Hypothetical

fund return(1)

|

Hypothetical

maturity payment amount

per security

|

Hypothetical

pre-tax total

rate of return(2)

|

|

$200.00

|

100.00%

|

$2,500.00

|

150.00%

|

|

$175.00

|

75.00%

|

$2,125.00

|

112.50%

|

|

$150.00

|

50.00%

|

$1,750.00

|

75.00%

|

|

$140.00

|

40.00%

|

$1,600.00

|

60.00%

|

|

$130.00

|

30.00%

|

$1,450.00

|

45.00%

|

|

$120.00

|

20.00%

|

$1,300.00

|

30.00%

|

|

$110.00

|

10.00%

|

$1,150.00

|

15.00%

|

|

$105.00

|

5.00%

|

$1,075.00

|

7.50%

|

|

$100.00

|

0.00%

|

$1,000.00

|

0.00%

|

|

$95.00

|

-5.00%

|

$950.00

|

-5.00%

|

|

$90.00

|

-10.00%

|

$900.00

|

-10.00%

|

|

$80.00

|

-20.00%

|

$800.00

|

-20.00%

|

|

$70.00

|

-30.00%

|

$700.00

|

-30.00%

|

|

$60.00

|

-40.00%

|

$600.00

|

-40.00%

|

|

$50.00

|

-50.00%

|

$500.00

|

-50.00%

|

|

$25.00

|

-75.00%

|

$250.00

|

-75.00%

|

|

$0.00

|

-100.00%

|

$0.00

|

-100.00%

|

| (1) |

The fund return is equal to the percentage change from the starting price to the ending price (i.e., the ending price minus starting price, divided by

starting price).

|

| (2) |

The hypothetical pre-tax total rate of return is the number, expressed as a percentage, that results from comparing the maturity payment amount per security to the face amount of $1,000.

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

iShares® 20+ Year

Treasury Bond ETF

|

||

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$110.00

|

|

|

Hypothetical fund return

(ending price – starting price)/starting price:

|

10.00%

|

|

iShares® 20+ Year

Treasury Bond ETF

|

||

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$50.00

|

|

|

Hypothetical fund return

(ending price – starting price)/starting price:

|

-50.00%

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Information Regarding the Fund

|

|

The iShares® 20+ Year Treasury Bond ETF

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Market Linked Securities—Leveraged Upside Participation and 1-to-1 Downside Exposure

Principal at Risk Securities Linked to the iShares®

20+ Year Treasury Bond ETF due June 24, 2027

|

|

Material U.S. Federal Income Tax Consequences

|