Filed Pursuant to Rule 433

Registration Statement No. 333-262557

Registration Statement No. 333-262557

|

ACCELERATED RETURN NOTES® (ARNs®)

|

|

ARNs® Linked to the Russell 2000® Index

|

|||

|

Issuer

|

The Toronto-Dominion Bank (“TD”)

|

||

|

Principal

Amount

|

$10.00 per unit

|

||

|

Term

|

Approximately 14 months

|

||

|

Market Measure

|

The Russell 2000® Index (Bloomberg symbol: “RTY”)

|

||

|

Payout Profile at

Maturity

|

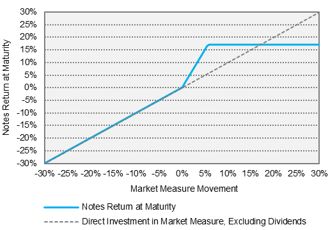

• 3-to-1 upside exposure to increases in the Market Measure, subject to the Capped Value

• 1-to-1 downside exposure to decreases in the Market Measure, with up to 100.00% of your principal at risk

|

||

|

Capped Value

|

[$11.50 to $11.90] per unit, an [15.00% to 19.00%] return over the principal amount, to be determined on the pricing date.

|

||

|

Investment

Considerations

|

This investment is designed for investors who anticipate that the Market Measure will increase moderately over the term of the notes, and are willing to accept a capped return, take full downside risk and

forgo interim interest payments.

|

||

|

Preliminary

Offering

Documents

|

|||

|

Exchange Listing

|

No

|

||

You should read the relevant Preliminary Offering Documents before you invest. Click on the Preliminary Offering Documents hyperlink above or call your

Financial Advisor for a hard copy.

Risk factors

Please see the Preliminary Offering Documents for a description of certain risks related to this investment, including, but not limited to, the following:

| • |

Depending on the performance of the Market Measure as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal.

|

| • |

Payments on the notes are subject to the credit risk of TD, and actual or perceived changes in the creditworthiness of TD are expected to affect the value of the notes. If TD becomes unable to meet its

financial obligations as they become due, you may lose some or all of your investment.

|

| • |

Your investment return is limited to the return represented by the Capped Value and may be less than a comparable investment directly in the stocks included in the Market Measure.

|

| • |

The initial estimated value of the notes on the pricing date will be less than their public offering price.

|

| • |

The initial estimated value of your notes is not a prediction of the prices at which you may sell your notes in the secondary market, if any exists, and such secondary market prices, if any, will likely be

less than the public offering price of your notes, may be less than the initial estimated value of your notes and could result in a substantial loss to you.

|

| • |

You will have no rights of a holder of the securities represented by the Market Measure, and you will not be entitled to receive securities or dividends or other distributions by the issuers of those

securities.

|

| • |

The notes are subject to risks associated with small-size capitalization companies.

|

The final terms of the notes will be set on the pricing date within the given range. Please see the Preliminary Offering Documents for complete product disclosure, including

related risks and tax disclosure.

The graph above and the table below reflect the hypothetical return on the notes, based on the terms contained in the table to the left (using the

mid-point for any range(s)). The graph and table have been prepared for purposes of illustration only and do not take into account any tax consequences from investing in the notes.

|

Hypothetical

Percentage Change

from the Starting Value

to the Ending Value

|

Hypothetical

Redemption Amount

per Unit

|

Hypothetical Total Rate of

Return on the Notes

|

|

-100.00%

|

$0.00

|

-100.00%

|

|

-50.00%

|

$5.00

|

-50.00%

|

|

-30.00%

|

$7.00

|

-30.00%

|

|

-20.00%

|

$8.00

|

-20.00%

|

|

-10.00%

|

$9.00

|

-10.00%

|

|

-5.00%

|

$9.50

|

-5.00%

|

|

-3.00%

|

$9.70

|

-3.00%

|

|

0.00%

|

$10.00

|

0.00%

|

|

2.00%

|

$10.60

|

6.00%

|

|

5.00%

|

$11.50

|

15.00%

|

|

5.67%

|

$11.70(1)

|

17.00%

|

|

10.00%

|

$11.70

|

17.00%

|

|

20.00%

|

$11.70

|

17.00%

|

|

30.00%

|

$11.70

|

17.00%

|

|

40.00%

|

$11.70

|

17.00%

|

|

50.00%

|

$11.70

|

17.00%

|

|

100.00%

|

$11.70

|

17.00%

|

|

|

(1)

|

The Redemption Amount per unit cannot exceed the hypothetical Capped Value.

|

|

|

TD has filed a registration statement (including a product supplement and a prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this term sheet relates. Before you invest, you should read the

Note Prospectus, including this term sheet, and the other documents that TD has filed with the SEC, for more complete information about TD and this offering. You may get these documents without cost by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, TD, any agent, or any dealer participating in this offering will arrange to send you these documents if you so request by calling MLPF&S or BofAS toll-free at 1-800-294-1322.