|

Pricing Supplement dated October 18, 2023

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-262557

(To Product Supplement MLN-WF-1 dated August 31, 2022

and Prospectus dated March 4, 2022)

|

|

|

The Toronto-Dominion Bank

Senior Debt Securities, Series E

Equity Linked Securities

|

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and

Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of

Amazon.com, Inc., the common stock of The Walt Disney Company and the common stock of

Netflix, Inc. due October 22, 2026

|

|

|

■ Linked to the lowest performing of the common stock of Amazon.com, Inc., the common stock of The Walt Disney Company and the common stock of

Netflix, Inc. (each referred to as an “Underlying Stock”)

■ Unlike ordinary debt securities, the securities do not provide for fixed payments of interest, do not repay a fixed amount of principal at stated maturity and are subject to potential

automatic call prior to stated maturity upon the terms described below. Whether the securities pay a contingent coupon, whether the securities are automatically called prior to stated maturity and, if they are not automatically called,

whether you receive the face amount of your securities at stated maturity will depend, in each case, on the stock closing price of the lowest performing Underlying Stock on the relevant calculation day. The lowest performing Underlying

Stock on any calculation day is the Underlying Stock that has the lowest stock closing price on that calculation day as a percentage of its starting price

■ Contingent Coupon. The securities will pay a contingent coupon on a quarterly basis until the earlier of stated maturity or automatic call if, and only if, the stock closing price of the lowest performing Underlying Stock on the calculation day for that quarter is greater than or equal to its coupon threshold price. However, if the stock closing

price of the lowest performing Underlying Stock on a calculation day is less than its coupon threshold price, you will not receive any contingent coupon for the relevant quarter. If the stock closing price of the lowest performing

Underlying Stock is less than its coupon threshold price on every calculation day, you will not receive any contingent coupons throughout the entire term of the securities. The coupon threshold price for each Underlying Stock is equal to

60% of its starting price. The contingent coupon rate is 17.25% per annum

■ Automatic Call. If the stock closing price of the lowest performing Underlying Stock on any of the quarterly calculation days from April 2024 to July

2026, inclusive, is greater than or equal to its starting price, the securities will be automatically called for the face amount plus a final contingent coupon payment

■ Potential Loss of Principal. If the securities are not automatically called prior to stated maturity, you will receive the face amount at stated

maturity if, and only if, the stock closing price of the lowest performing Underlying Stock on the final calculation day is greater than or equal to its downside threshold price. If the stock closing

price of the lowest performing Underlying Stock on the final calculation day is less than its downside threshold price, you will lose more than 40%, and possibly all, of the face amount of your securities. The downside threshold price for each Underlying Stock is equal to 60% of its starting price

■ If the securities are not automatically called prior to stated maturity, you will have full downside exposure to the lowest performing Underlying Stock from its starting price if its stock

closing price on the final calculation day is less than its downside threshold price, but you will not participate in any appreciation of any Underlying Stock and will not receive any dividends on any Underlying Stock

■ Your return on the securities will depend solely on the performance of the Underlying Stock that is the lowest performing Underlying Stock on each

calculation day. You will not benefit in any way from the performance of the better performing Underlying Stocks. Therefore, you will be adversely affected if any Underlying Stock performs poorly,

even if the other Underlying Stocks perform favorably

■ All payments on the securities are subject to the credit risk of The Toronto-Dominion Bank (the “Bank”)

■ No exchange listing; designed to be held to maturity

|

|

|

Original Offering Price

|

Agent Discount(1)

|

Proceeds to The Toronto-Dominion Bank

|

|

|

Per Security

|

$1,000.00

|

$23.25

|

$976.75

|

|

Total

|

$1,085,000.00

|

$25,226.25

|

$1,059,773.75

|

| (1) |

The Agents will receive a commission of $23.25 (2.325%) per security and will use all of that commission to allow selling concessions to other dealers in connection with the distribution of the securities. The

Agents may resell the securities to other securities dealers at the original offering price less a concession of $17.50 (1.75%) per security. Such securities dealers may include Wells Fargo Advisors (“WFA”, the trade name of the retail

brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC), an affiliate of Wells Fargo Securities, LLC (“Wells Fargo Securities”). The other dealers may forgo, in their sole discretion, some or

all of their selling concessions. In addition to the selling concession allowed to WFA, Wells Fargo Securities will pay $0.75 (0.075%) per security of the agent discount to WFA as a distribution expense fee for each security sold by WFA. The

Bank will reimburse TD Securities (USA) LLC (“TDS”) for certain expenses in connection with its role in the offer and sale of the securities, and the Bank will pay TDS a fee in connection with its role in the offer and sale of the securities.

In respect of certain securities sold in this offering, we will pay a fee of up to $2.00 per security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to

other securities dealers. See “Terms of the Securities—Agents” herein and “Supplemental Plan of Distribution (Conflicts of Interest) –Selling Restrictions” in the accompanying product supplement.

|

|

TD Securities (USA) LLC.

|

Wells Fargo Securities

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Terms of the Securities

|

|

Issuer:

|

The Toronto-Dominion Bank (the “Bank”).

|

||

|

Market Measures:

|

The common stock of Amazon.com, Inc., the common stock of The Walt Disney Company and the common stock of Netflix, Inc. (each referred to as an “Underlying Stock,”

and collectively as the “Underlying Stocks”). We refer to the issuer of each Underlying Stock as an “Underlying Stock Issuer” and collectively as the “Underlying Stock Issuers.”

|

||

|

Pricing Date:

|

October 18, 2023.

|

||

|

Issue Date:

|

October 23, 2023.

|

||

|

Original Offering

Price:

|

$1,000 per security.

|

||

|

Face Amount:

|

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000.

|

||

|

Contingent Coupon

Payment:

|

On each contingent coupon payment date, you will receive a contingent coupon payment at a per annum rate equal to the contingent coupon rate if, and only if, the stock closing price of the lowest performing Underlying Stock on the related calculation day is greater than or equal to its coupon threshold price. Each “contingent coupon payment,” if any, will be

calculated per security as follows: ($1,000 × contingent coupon rate)/4. Any contingent coupon payment will be rounded to the nearest cent, with one-half cent rounded upward.

If the stock closing price of the lowest performing Underlying Stock on any calculation day is less than its coupon threshold price, you will not receive

any contingent coupon payment on the related contingent coupon payment date. If the stock closing price of the lowest performing Underlying Stock is less than its coupon threshold price on all calculation days, you will not receive any

contingent coupon payments over the term of the securities.

|

||

|

Contingent Coupon

Payment Dates:

|

Quarterly, on the third business day following each calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events and Postponement

Provisions” below, if applicable); provided that the contingent coupon payment date with respect to the final calculation day will be the stated maturity date.

|

||

|

Contingent Coupon

Rate:

|

The “contingent coupon rate” is 17.25% per annum.

|

||

|

Automatic Call:

|

If the stock closing price of the lowest performing Underlying Stock on any of the calculation days from April 2024 to July 2026, inclusive, is greater than or equal to its

starting price, the securities will be automatically called, and on the related call settlement date you will be entitled to receive a cash payment per security in U.S. dollars equal to the face amount plus a final contingent coupon payment.

The securities will not be subject to automatic call until the second calculation day, which is approximately six months after the issue date.

If the securities are automatically called, they will cease to be outstanding on the related call settlement date and you will have no further rights under the securities

after such call settlement date. You will not receive any notice from us if the securities are automatically called.

|

||

|

Calculation Days:

|

Quarterly, on the 18th day of each January, April, July and October, commencing in January 2024 and ending in October 2026, each subject to postponement as

described below under “—Market Disruption Events and Postponement Provisions.” We refer to the calculation day scheduled to occur in October 2026 (October 19, 2026) as the “final calculation day.”

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Call Settlement Date:

|

Three business days after the applicable calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events and Postponement Provisions”

below, if applicable).

|

||

|

Stated Maturity Date:

|

October 22, 2026, subject to postponement. The securities are not subject to repayment at the option of any holder of the securities prior to the stated maturity date.

|

||

|

Maturity Payment

Amount:

|

If the securities are not automatically called prior to the stated maturity date, you will be entitled to receive on the stated maturity date a cash payment per security in

U.S. dollars equal to the maturity payment amount (in addition to the final contingent coupon payment, if any). The “maturity payment amount” per security will equal:

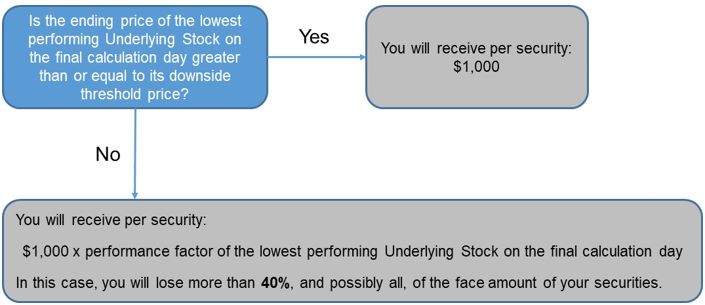

• if the ending price of the lowest performing Underlying Stock on

the final calculation day is greater than or equal to its downside threshold price: $1,000; or

• if the ending price of the lowest performing Underlying Stock on

the final calculation day is less than its downside threshold price:

|

||

|

$1,000 × performance factor of the lowest performing Underlying Stock on the final calculation day

|

|||

|

If the securities are not automatically called prior to stated maturity and the ending price of the lowest performing Underlying Stock on the final

calculation day is less than its downside threshold price, you will lose more than 40%, and possibly all, of the face amount of your securities at stated maturity.

Any return on the securities will be limited to the sum of your contingent coupon payments, if any. You will not participate in any appreciation of any

Underlying Stock, but you will have full downside exposure to the lowest performing Underlying Stock on the final calculation day if the ending price of that Underlying Stock is less than its downside threshold price.

|

|||

|

Lowest Performing

Underlying Stock:

|

For any calculation day, the “lowest performing Underlying Stock” will be the Underlying Stock with the lowest performance factor on that calculation day.

|

||

|

Performance Factor:

|

With respect to an Underlying Stock on any calculation day, its stock closing price on such calculation day divided by its starting

price (expressed as a percentage).

|

||

|

Stock Closing Price:

|

With respect to each Underlying Stock, stock closing price, closing price and adjustment factor has the meaning set forth under “General Terms of the Securities—Certain

Terms for Securities Linked to an Underlying Stock—Certain Definitions” in the accompanying product supplement.

|

||

|

Starting Price:

|

With respect to the common stock of Amazon.com, Inc.: $128.13, its stock closing price on the pricing date.

With respect to the common stock of The Walt Disney Company: $84.68, its stock closing price on the pricing date.

With respect to the common stock of Netflix, Inc.: $346.19, its stock closing price on the pricing date.

|

||

|

Ending Price:

|

The “ending price” of an Underlying Stock will be its stock closing price on the final calculation day.

|

||

|

Coupon Threshold

Price:

|

With respect to the common stock of Amazon.com, Inc.: $76.878, which is equal to 60% of its starting price.

With respect to the common stock of The Walt Disney Company: $50.808, which is equal to 60% of its starting price.

With respect to the common stock of Netflix, Inc.: $207.714, which is equal to 60% of its starting price.

|

||

|

Downside Threshold

Price:

|

With respect to the common stock of Amazon.com, Inc.: $76.878, which is equal to 60% of its starting price.

With respect to the common stock of The Walt Disney Company: $50.808, which is equal to 60% of its starting price.

With respect to the common stock of Netflix, Inc.: $207.714, which is equal to 60% of its starting price.

|

||

|

Market Disruption

Events and

Postponement

Provisions:

|

Each calculation day is subject to postponement due to non-trading days and the occurrence of a market disruption event. In addition, the stated maturity date will be

postponed if the final calculation day is postponed and will be adjusted for non-business days. For more information regarding adjustments to the calculation days and the stated maturity date, see “General Terms of the Securities—Consequences

of a Market Disruption Event; Postponement of a Calculation Day—Securities Linked to Multiple Market Measures” and “—Payment Dates” in the accompanying product supplement. For purposes of the accompanying product supplement, each call

settlement date and the stated maturity date is a “payment date.” In addition, for information regarding the circumstances that may result in a market disruption event, see “General Terms of the Securities—Certain Terms for Securities Linked

to an Underlying Stock—Market Disruption Events” in the accompanying product supplement.

|

||

|

Calculation Agent:

|

The Bank

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

U.S. Tax Treatment:

|

By purchasing the securities, you agree, in the absence of a statutory or regulatory change or an administrative determination or judicial ruling to the contrary, to treat

the securities, for U.S. federal income tax purposes, as prepaid derivative contracts with respect to the Market Measures with associated contingent coupons. Pursuant to this approach, any Contingent Coupon Payment that you receive should be

included in ordinary income at the time you receive the payment or when it accrues, depending on your regular method of accounting for U.S. federal income tax purposes. Based on certain factual representations received from us, our special

U.S. tax counsel, Fried, Frank, Harris, Shriver & Jacobson LLP, is of the opinion that it would be reasonable to treat the securities in the manner described above. However, because there is no authority that specifically addresses the

tax treatment of the securities, it is possible that your securities could alternatively be treated for tax purposes as a single contingent payment debt instrument, or pursuant to some other characterization, such that the timing and

character of your income from the securities could differ materially and adversely from the treatment described above, as described further under “Material U.S. Federal Income Tax Consequences” herein and in the product supplement. An investment in the securities is not appropriate for non-U.S. holders, and we will not attempt to ascertain the tax consequences to non-U.S. holders of the purchase, ownership or disposition of the securities.

|

||

|

Canadian Tax

Treatment:

|

Please see the discussion in the product supplement under “Supplemental Discussion of Canadian Tax Consequences,” which applies to the securities.

|

||

|

Agents:

|

TD Securities (USA) LLC. and Wells Fargo Securities, LLC.

The Agents will receive a commission of $23.25 (2.325%) per security and will use all of that commission to allow selling concessions to other dealers in connection with the

distribution of the securities. The Agents may resell the securities to other securities dealers at the original offering price less a concession of $17.50 (1.75%) per security. Such securities dealers may include WFA. In addition to the

selling concession allowed to WFA, Wells Fargo Securities will pay $0.75 (0.075%) per security of the agent discount to WFA as a distribution expense fee for each security sold by WFA.

In addition, in respect of certain securities sold in this offering, we will pay a fee of up to $2.00 per security to selected securities dealers in consideration for

marketing and other services in connection with the distribution of the securities to other securities dealers.

The price at which you purchase the securities includes costs that the Bank, the Agents or their respective affiliates expect to incur and profits that the Bank, the Agents

or their respective affiliates expect to realize in connection with hedging activities related to the securities, as set forth above. These costs and profits will likely reduce the secondary market price, if any secondary market develops, for

the securities. As a result, you may experience an immediate and substantial decline in the market value of your securities on the pricing date. See “Selected Risk Considerations — Risks Relating To The Estimated Value Of The Securities And

Any Secondary Market — The Agent Discount, Offering Expenses and Certain Hedging Costs are Likely to Adversely Affect Secondary Market Prices” in this pricing supplement.

|

||

|

Listing:

|

The securities will not be listed 0r displayed on any securities exchange or electronic communications network

|

||

|

Canadian

Bail-in:

|

The securities are not bail-inable debt securities under the CDIC Act

|

||

|

Denominations:

|

$1,000 and any integral multiple of $1,000.

|

||

|

CUSIP / ISIN:

|

89115FDK4 / US89115FDK49

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Additional Information about the Issuer and the Securities

|

| • |

Product Supplement MLN-WF-1 dated August 31, 2022:

|

| • |

Prospectus dated March 4, 2022:

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Estimated Value of the Securities

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Investor Considerations

|

| ■ |

seek an investment with contingent coupon payments at a rate of 17.25% per annum until the earlier of stated maturity or automatic call, if, and only if, the stock closing price of the lowest

performing Underlying Stock on the applicable calculation day is greater than or equal to 60% of its starting price;

|

| ■ |

understand that if the ending price of the lowest performing Underlying Stock on the final calculation day has declined by more than 40% from its starting price, they will be fully exposed to the decline in the lowest performing Underlying

Stock from its starting price and will lose more than 40%, and possibly all, of the face amount at stated maturity;

|

| ■ |

are willing to accept the risk that they may receive few or no contingent coupon payments over the term of the securities;

|

| ■ |

understand that the securities may be automatically called prior to stated maturity and that the term of the securities may be as short as approximately six months;

|

| ■ |

understand that the return on the securities will depend solely on the performance of the Underlying Stock that is the lowest performing Underlying Stock on each calculation day and that they will not benefit in any way from the

performance of the better performing Underlying Stocks;

|

| ■ |

understand that the securities are riskier than alternative investments linked to only one of the Underlying Stocks or linked to a basket composed of each Underlying Stock;

|

| ■ |

understand and are willing to accept the full downside risks of each Underlying Stock;

|

| ■ |

are willing to forgo participation in any appreciation of any Underlying Stock and dividends on any Underlying Stock; and

|

| ■ |

are willing to hold the securities until maturity.

|

| ■ |

seek a liquid investment or are unable or unwilling to hold the securities to maturity;

|

| ■ |

require full payment of the face amount of the securities at stated maturity;

|

| ■ |

seek a security with a fixed term;

|

| ■ |

are unwilling to purchase securities with an estimated value as of the pricing date that is lower than the original offering price;

|

| ■ |

are unwilling to accept the risk that the stock closing price of the lowest performing Underlying Stock on the final calculation day may decline by more than 40% from its starting price;

|

| ■ |

seek certainty of current income over the term of the securities;

|

| ■ |

seek exposure to the upside performance of any or each Underlying Stock;

|

| ■ |

seek exposure to a basket composed of each Underlying Stock or a similar investment in which the overall return is based on a blend of the performances of the Underlying Stocks, rather than solely on the lowest performing Underlying Stock;

|

| ■ |

are unwilling to accept the risk of exposure to the Underlying Stocks;

|

| ■ |

are unwilling to accept the credit risk of the Bank; or

|

| ■ |

prefer the lower risk of conventional fixed income investments with comparable maturities issued by companies with comparable credit ratings.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Determining Payment On A Contingent Coupon Payment Date and at Maturity

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Hypothetical Payout Profile

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Selected Risk Considerations

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

| • |

Investing In The Securities Is Not The Same As Investing In The Underlying Stocks. Investing in the securities is not equivalent to investing in any of the Underlying

Stocks. As an investor in the securities, your return will not reflect the return you would realize if you actually owned and held the Underlying Stocks for a period similar to the term of the securities because you will not receive any

dividend payments, distributions or any other payments paid on any Underlying Stock. As a holder of the securities, you will not have any voting rights or any other rights that holders of the Underlying Stocks would have.

|

| • |

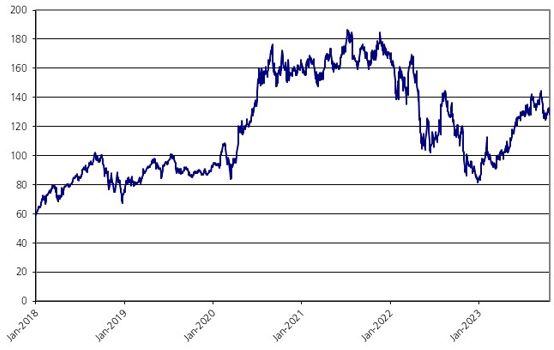

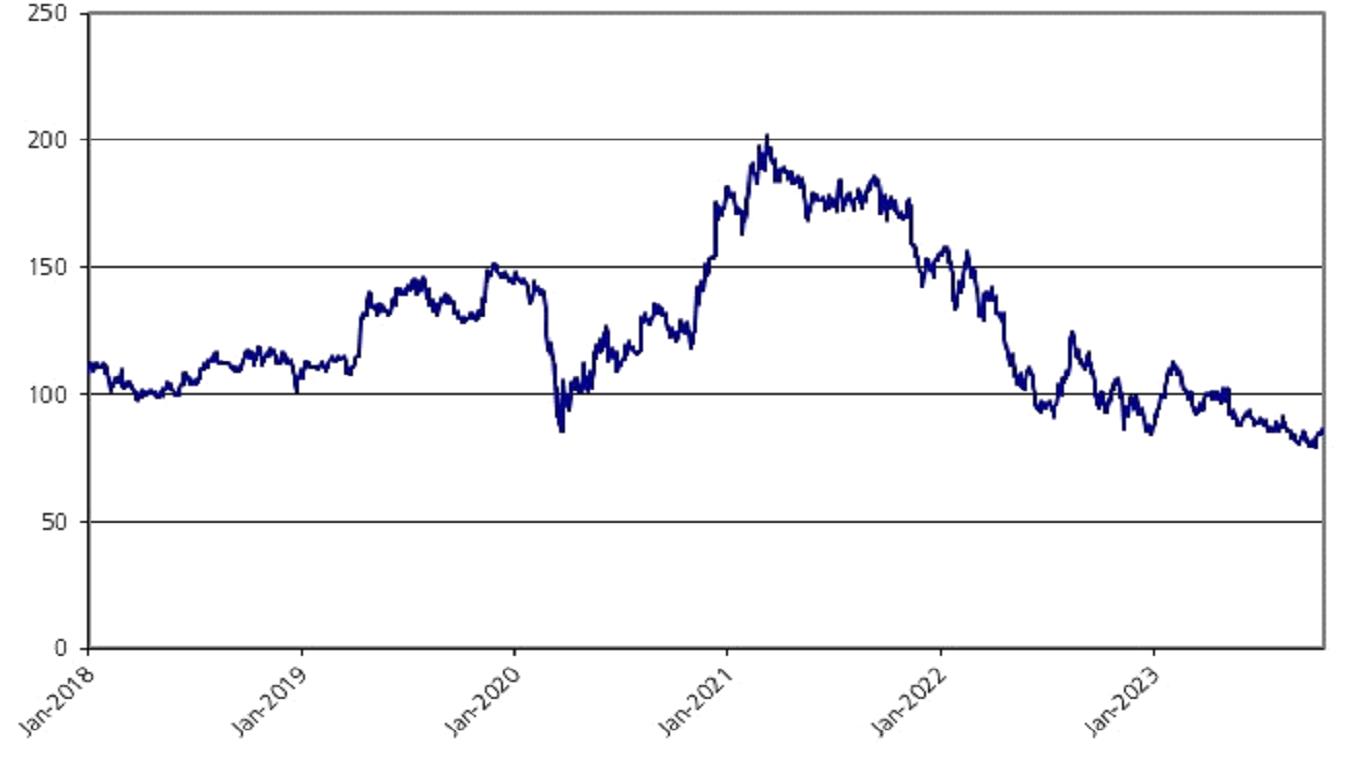

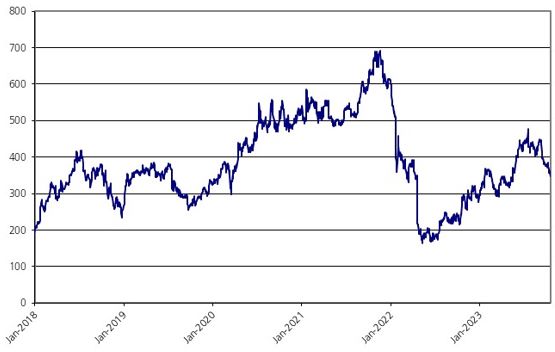

Historical Prices Of The Underlying Stocks Should Not Be Taken As An Indication Of The Future Performance Of The Underlying Stocks During The Term Of The Securities.

|

| • |

The Securities May Become Linked To The Common Stock Of A Company Other Than An Original Underlying Stock Issuer.

|

| • |

We, The Agents And Our Respective Affiliates Cannot Control Actions By An Underlying Stock Issuer.

|

| • |

We, The Agents And Our Respective Affiliates Have No Affiliation With Any Underlying Stock Issuer And Have Not Independently Verified Their Public Disclosure Of Information.

|

| • |

You Have Limited Anti-Dilution Protection.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

| • |

Trading And Business Activities By The Bank Or Its Affiliates May Adversely Affect The Market Value Of, And Any Amount Payable On, The Securities.

|

| • |

There Are Potential Conflicts Of Interest Between You And The Calculation Agent.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Hypothetical Returns

|

|

Hypothetical performance factor of

lowest performing Underlying Stock on

final calculation day

|

Hypothetical maturity payment amount

per security

|

|

175.00%

|

$1,000.00

|

|

160.00%

|

$1,000.00

|

|

150.00%

|

$1,000.00

|

|

140.00%

|

$1,000.00

|

|

130.00%

|

$1,000.00

|

|

120.00%

|

$1,000.00

|

|

110.00%

|

$1,000.00

|

|

100.00%

|

$1,000.00

|

|

90.00%

|

$1,000.00

|

|

80.00%

|

$1,000.00

|

|

70.00%

|

$1,000.00

|

|

60.00%

|

$1,000.00

|

|

59.00%

|

$590.00

|

|

50.00%

|

$500.00

|

|

40.00%

|

$400.00

|

|

30.00%

|

$300.00

|

|

25.00%

|

$250.00

|

|

0.00%

|

$0.00

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Hypothetical Contingent Coupon Payments

|

|

The common

stock of

Amazon.com,

Inc.

|

The common

stock of The

Walt Disney

Company

|

The common

stock of Netflix,

Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical stock closing price on relevant calculation day:

|

$90.00

|

$95.00

|

$80.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Performance factor (stock closing price on calculation day divided by starting price):

|

90.00%

|

95.00%

|

80.00%

|

|

The common

stock of

Amazon.com,

Inc.

|

The common

stock of The

Walt Disney

Company

|

The common

stock of Netflix,

Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical stock closing price on relevant calculation day:

|

$49.00

|

$125.00

|

$105.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Performance factor (stock closing price on calculation day divided by starting price):

|

49.00%

|

125.00%

|

105.00%

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

The common

stock of

Amazon.com,

Inc.

|

The common

stock of The

Walt Disney

Company

|

The common

stock of Netflix,

Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical stock closing price on relevant calculation day:

|

$115.00

|

$105.00

|

$130.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Performance factor (stock closing price on calculation day divided by starting price):

|

115.00%

|

105.00%

|

130.00%

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Hypothetical Payment at Stated Maturity

|

|

The common

stock of

Amazon.com,

Inc.

|

The common

stock of The

Walt Disney

Company

|

The common

stock of Netflix,

Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical ending price:

|

$145.00

|

$135.00

|

$125.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Hypothetical downside threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Performance factor (ending price divided by starting price):

|

145.00%

|

135.00%

|

125.00%

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

The common

stock of

Amazon.com,

Inc.

|

The common

stock of The

Walt Disney

Company

|

The common

stock of

Netflix, Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical ending price:

|

$80.00

|

$115.00

|

$110.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Hypothetical downside threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Performance factor (ending price divided by starting price):

|

80.00%

|

115.00%

|

110.00%

|

|

The common

stock of

Amazon.com,

Inc.

|

The common

stock of The

Walt Disney

Company

|

The common

stock of

Netflix, Inc.

|

||

|

Hypothetical starting price:

|

$100.00

|

$100.00

|

$100.00

|

|

|

Hypothetical ending price:

|

$120.00

|

$45.00

|

$90.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Hypothetical downside threshold price:

|

$60.00

|

$60.00

|

$60.00

|

|

|

Performance factor (ending price divided by starting price):

|

120.00%

|

45.00%

|

90.00%

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Information Regarding The Market Measures

|

|

The common stock of Amazon.com, Inc.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

The common stock of The Walt Disney Company

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

The common stock of Netflix, Inc.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Material U.S. Federal Income Tax Consequences

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the common stock of Amazon.com, Inc., the

common stock of The Walt Disney Company and the common stock of Netflix, Inc. due October 22, 2026

|

|

Validity of the Securities

|