|

Pricing Supplement dated July 31, 2023

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-262557

(To Product Supplement MLN-WF-1 dated August 31, 2022

and Prospectus dated March 4, 2022)

|

|

|

The Toronto-Dominion Bank

Senior Debt Securities, Series E

ETF Linked Securities

|

|

|

Market Linked Securities—Upside Participation

to a Cap with Contingent Absolute Return and Fixed Percentage Buffered

Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

■

Linked to the VanEck® Gold Miners ETF (the “Fund”)

■ Unlike ordinary debt securities, the securities do not pay interest or repay a fixed amount of principal at maturity. Instead, the securities provide for a maturity

payment amount that may be greater than, equal to or less than the face amount of the securities, depending on the performance of the Fund from its starting price to its ending price. The maturity payment amount will reflect the following

terms:

■ If the price of the Fund increases, you will receive the face amount plus a positive return equal to 100% of the percentage increase in the price of the Fund from the

starting price, subject to a maximum return at maturity of 36.00% of the face amount. As a result of the maximum return, the maximum maturity payment amount will be $1,360.00

■ If the price of the Fund decreases but the decrease is not more than the buffer amount of 20%, you will receive the face amount plus a positive return equal to the absolute value of the percentage decline in the price of the Fund from the starting price, which will effectively be capped at a positive return of 20%

■ If the price of the Fund decreases by more than the buffer amount of 20%, you will receive less than the face amount and have 1-to-1 downside exposure to the decrease

in the price of the Fund in excess of the buffer amount

■ Investors may lose up to 80% of the face amount

■ All payments on the securities are subject to the credit risk of The Toronto-Dominion Bank (the “Bank”)

■ No periodic interest payments or dividends

■ No exchange listing; designed to be held to maturity

|

The estimated value of the securities at the time the terms of your securities were set on the pricing

date is $956.70 per security, as discussed further under “Selected Risk Considerations— Risks Relating to the Estimated Value of the Securities and Any Secondary Market” beginning on page P-9 and “Estimated Value of the Securities” herein. The

estimated value is less than the original offering price of the securities.

The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See

“Selected Risk Considerations” beginning on page P-8 herein and “Risk Factors” beginning on page PS-6 of the accompanying product supplement and on page 1 of the accompanying prospectus.

The securities are senior unsecured debt obligations of the Bank, and, accordingly, all payments are subject to credit risk. The securities are not insured by

the Canada Deposit Insurance Corporation pursuant to the Canada Deposit Insurance Corporation Act (the “CDIC Act”) or the U.S. Federal Deposit Insurance Corporation or any other governmental agency of Canada, the United States or any other

jurisdiction.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of

these securities or passed upon the accuracy or adequacy of this pricing supplement or the accompanying product supplement and prospectus. Any representation to the contrary is a criminal offense.

|

Original Offering Price

|

Agent Discount(1)

|

Proceeds to The Toronto-Dominion Bank

|

|

|

Per Security

|

$1,000.00

|

$25.70

|

$974.30

|

|

Total

|

$1,376,000.00

|

$35,363.20

|

$1,340,636.80

|

| (1) |

The Agents will receive a commission of $25.70 (2.57%) per security and will use all of that commission to allow selling concessions to other dealers in connection with the distribution of

the securities. The Agents may resell the securities to other securities dealers at the original offering price less a concession of $20.00 (2.00%) per security. Such securities dealers may include Wells Fargo Advisors (“WFA”, the trade

name of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC), an affiliate of Wells Fargo Securities, LLC (“Wells Fargo Securities”). The other dealers may forgo, in their sole

discretion, some or all of their selling concessions. In addition to the selling concession allowed to WFA, Wells Fargo Securities will pay $0.75 (0.075%) per security of the agent discount to WFA as a distribution expense fee for each

security sold by WFA. The Bank will reimburse TD Securities (USA) LLC (“TDS”) for certain expenses in connection with its role in the offer and sale of the securities, and the Bank will pay TDS a fee in connection with its role in the offer

and sale of the securities. In respect of certain securities sold in this offering, we will pay a fee of up to $1.00 per security to selected securities dealers in consideration for marketing and other services in connection with the

distribution of the securities to other securities dealers. See “Terms of the Securities—Agents” herein and “Supplemental Plan of Distribution (Conflicts of Interest) –Selling Restrictions” in the accompanying product supplement.

|

|

TD Securities (USA) LLC.

|

Wells Fargo Securities

|

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Terms of the Securities

|

|

Issuer:

|

The Toronto-Dominion Bank (the “Bank”).

|

|

Market Measure:

|

VanEck® Gold Miners ETF (the “Fund”).

|

|

Fund Underlying

Index:

|

With respect to the VanEck® Gold Miners ETF, NYSE® Arca Gold Miners Index®

|

|

Pricing Date:

|

July 31, 2023.

|

|

Issue Date:

|

August 3, 2023.

|

|

Original Offering

Price:

|

$1,000 per security.

|

|

Face Amount:

|

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000.

|

|

Maturity Payment

Amount:

|

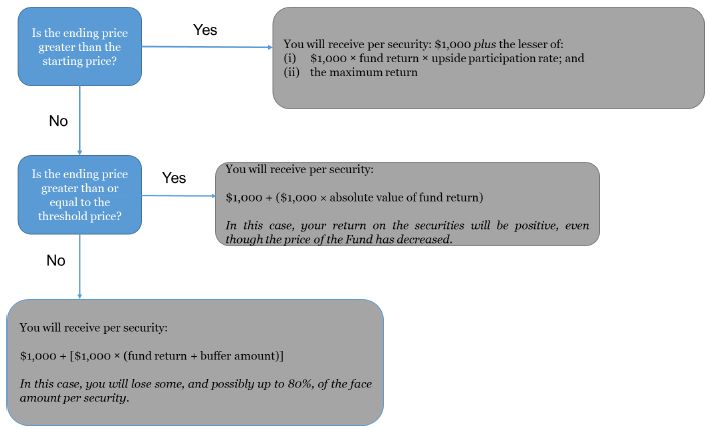

On the stated maturity date, you will be entitled to receive a cash payment per security in U.S. dollars equal to

the maturity payment amount. The “maturity payment amount” per security will equal:

• if the ending price is greater than the starting price: $1,000 plus the lesser of:

(i) $1,000 × fund return × upside participation rate; and

(ii) the maximum return;

• if the ending price is less than or equal to the starting price, but greater than or equal to the threshold price:

$1,000 + ($1,000 × absolute value of fund return); or

• if the ending price is less than the threshold price:

$1,000 + [$1,000 × (fund return + buffer amount)]

|

|

If the ending price is less than the threshold price, you will have 1-to-1 downside exposure

to the decrease in the price of the Fund in excess of the buffer amount and will lose some, and possibly up to 80%, of the face amount of your securities at maturity.

|

|

|

Stated Maturity

Date:

|

August 4, 2025, subject to postponement. The securities are not subject to redemption by the Bank or repayment at

the option of any holder of the securities prior to the stated maturity date.

|

|

Starting Price:

|

$31.41, the fund closing price of the Fund on the pricing date.

|

|

Fund Closing Price:

|

The fund closing price, closing price and adjustment factor have the meanings set forth under “General Terms of

the Securities—Certain Terms for Securities Linked to a Fund—Certain Definitions” in the accompanying product supplement.

|

|

Ending Price:

|

The “ending price” will be the fund closing

price of the Fund on the calculation day.

|

|

Maximum Return:

|

The “maximum return” is 36.00% of the face

amount per security ($360.00 per security). As a result of the maximum return, the maximum maturity payment amount is $1,360.00 per security.

|

|

Threshold Price:

|

$25.128, which is equal to 80% of the starting price.

|

|

Buffer Amount:

|

20%.

|

|

Upside Participation

Rate:

|

100%.

|

|

Fund Return:

|

The “fund return” is the percentage change from

the starting price to the ending price, measured as follows:

ending price – starting price

starting price

For example, if the fund return is equal to -5%, the absolute value of the fund return would be +5%.

|

P-2

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Calculation Day:

|

July 28, 2025, subject to postponement.

|

|

Market Disruption

Events and

Postponement

Provisions:

|

The calculation day is subject to postponement due to non-trading days and the occurrence of a market disruption

event. In addition, the stated maturity date will be postponed if the calculation day is postponed and will be adjusted for non-business days.

For more information regarding adjustments to the calculation day and the stated maturity date, see “General

Terms of the Securities—Consequences of a Market Disruption Event; Postponement of a Calculation Day—Securities Linked to a Single Market Measure” and “—Payment Dates” in the accompanying product supplement. In addition, for information

regarding the circumstances that may result in a market disruption event, see “General Terms of the Securities—Certain Terms for Securities Linked to a Fund—Market Disruption Events” in the accompanying product supplement.

|

|

Calculation Agent:

|

The Bank

|

|

U.S. Tax Treatment:

|

By purchasing the securities, you agree, in the absence of a statutory or regulatory change or an administrative

determination or judicial ruling to the contrary, to treat the securities, for U.S. federal income tax purposes, as prepaid derivative contracts that are “open transactions” with respect to the Fund. Based on certain factual representations

received from us, our special U.S. tax counsel, Fried, Frank, Harris, Shriver & Jacobson LLP, is of the opinion that it would be reasonable to treat the securities in the manner described above. However, because there is no authority

that specifically addresses the tax treatment of the securities, it is possible that your securities could alternatively be treated for tax purposes as a single contingent payment debt instrument or pursuant to some other characterization,

such that the timing and character of your income from the securities could differ materially and adversely from the treatment described above, as described further under “Material U.S. Federal Income Tax Consequences” herein and in the

product supplement. An investment in the securities is not appropriate for non-U.S. holders, and we will not attempt to ascertain the tax consequences to non-U.S.

holders of the purchase, ownership or disposition of the securities.

|

|

Canadian Tax

Treatment:

|

Please see the discussion in the product supplement under “Supplemental Discussion of Canadian Tax Consequences,”

which applies to the securities.

|

|

Agents:

|

TD Securities (USA) LLC. and Wells Fargo Securities, LLC.

The Agents will receive a commission of $25.70 (2.57%) per security and will use all of that commission to allow

selling concessions to other dealers in connection with the distribution of the securities. The Agents may resell the securities to other securities dealers at the original offering price less a concession of $20.00 (2.00%) per security.

Such securities dealers may include WFA. In addition to the selling concession allowed to WFA, Wells Fargo Securities will pay $0.75 (0.075%) per security of the agent discount to WFA as a distribution expense fee for each security sold by

WFA.

In addition, in respect of certain securities sold in this offering, we will pay a fee of up to $1.00 per

security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to other securities dealers.

The price at which you purchase the securities includes costs that the Bank, the Agents or their respective

affiliates expect to incur and profits that the Bank, the Agents or their respective affiliates expect to realize in connection with hedging activities related to the securities, as set forth above. These costs and profits will likely

reduce the secondary market price, if any secondary market develops, for the securities. As a result, you may experience an immediate and substantial decline in the market value of your securities on the pricing date. See “Selected Risk

Considerations — Risks Relating To The Estimated Value Of The Securities And Any Secondary Market — The Agent Discount, Offering Expenses And Certain Hedging Costs Are Likely To Adversely Affect Secondary Market Prices” in this pricing

supplement.

|

|

Listing:

|

The securities will not be listed 0r displayed on any securities exchange or electronic communications network

|

|

Canadian Bail-in:

|

The securities are not bail-inable debt securities under the CDIC Act

|

|

Denominations:

|

$1,000 and any integral multiple of $1,000.

|

|

CUSIP / ISIN:

|

89115F2X8 / US89115F2X82

|

P-3

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Additional Information about the Issuer and the Securities

|

You should read this pricing supplement together with product supplement MLN-WF-1 dated August 31, 2022 and the prospectus dated March 4, 2022 for additional

information about the securities. Information included in this pricing supplement supersedes information in the product supplement and prospectus to the extent it is different from that information. Certain defined terms used but not defined herein

have the meanings set forth in the product supplement or prospectus. In the event of any conflict, the following hierarchy will govern: first, this pricing supplement; second, the product supplement; and last, the prospectus. The securities may vary from the terms described in the accompanying product supplement and prospectus in several important ways. You should read this pricing

supplement, including the documents incorporated herein, carefully.

You may access the product supplement and prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filing for the

relevant date on the SEC website):

| • |

Product Supplement MLN-WF-1 dated August 31, 2022:

|

| • |

Prospectus dated March 4, 2022:

|

Our Central Index Key, or CIK, on the SEC website is 0000947263. As used in this pricing supplement, the “Bank,” “we,” “us,” or “our” refers to

The Toronto-Dominion Bank and its subsidiaries.

We reserve the right to change the terms of, or reject any offer to purchase, the securities prior to their issuance. In the event of any changes to the terms

of the securities, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes, in which case we may reject your offer to purchase.

P-4

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Estimated Value of the Securities

|

The final terms for the securities were determined on the pricing date, as indicated under “Terms of the Securities”

herein, based on prevailing market conditions on the pricing date, and are set forth in this pricing supplement.

The economic terms of the securities are based on our internal funding rate (which is our internal borrowing rate based

on variables such as market benchmarks and our appetite for borrowing), and several factors, including any sales commissions expected to be paid to TDS or another affiliate of ours, any selling concessions, discounts, commissions or fees expected

to be allowed or paid to non-affiliated intermediaries, the estimated profit that we or any of our affiliates expect to earn in connection with structuring the securities, estimated costs which we may incur in connection with the securities and an

estimate of the difference between the amounts we pay to an affiliate of Wells Fargo Securities and the amounts that an affiliate of Wells Fargo Securities pays to us in connection with hedging your securities as described further under “Terms of

the Securities—Agents” herein and “Risk Factors—Risks Relating To Hedging Activities And Conflicts Of Interest” in the accompanying product supplement. Because our internal funding rate generally represents a discount from the levels at which our

benchmark debt securities trade in the secondary market, the use of an internal funding rate for the securities rather than the levels at which our benchmark debt securities trade in the secondary market is expected to have had an adverse effect on

the economic terms of the securities.

On the cover page of this pricing supplement, we have provided the estimated value for the securities. The estimated

value was determined by reference to our internal pricing models which take into account a number of variables and are based on a number of assumptions, which may or may not materialize, typically including volatility, interest rates (forecasted,

current and historical rates), price-sensitivity analysis, time to maturity of the securities, and our internal funding rate. For more information about the estimated value, see “Selected Risk Considerations — Risks Relating To The Estimated Value

Of The Securities And Any Secondary Market” herein. Because our internal funding rate generally represents a discount from the levels at which our benchmark debt securities trade in the secondary market, the use of an internal funding rate for the

securities rather than the levels at which our benchmark debt securities trade in the secondary market is expected, assuming all other economic terms are held constant, to increase the estimated value of the securities. For more information see the

discussion under “Selected Risk Considerations — Risks Relating To The Estimated Value Of The Securities And Any Secondary Market — The Estimated Value Of Your Securities Is Based On Our Internal Funding Rate.”

Our estimated value of the securities is not a prediction of the price at which the securities may trade in the

secondary market, nor will it be the price at which the Agents may buy or sell the securities in the secondary market. Subject to normal market and funding conditions, the Agents or another affiliate of ours intends to offer to purchase the

securities in the secondary market but it is not obligated to do so.

Assuming that all relevant factors remain constant after the pricing date, the price at which the Agents may initially

buy or sell the securities in the secondary market, if any, may exceed our estimated value on the pricing date for a temporary period expected to be approximately three months after the issue date because, in our discretion, we may elect to

effectively reimburse to investors a portion of the estimated cost of hedging our obligations under the securities and other costs in connection with the securities which we will no longer expect to incur over the term of the securities. We made

such discretionary election and determined this temporary reimbursement period on the basis of a number of factors, including the tenor of the securities and any agreement we may have with the distributors of the securities. The amount of our

estimated costs which we effectively reimburse to investors in this way may not be allocated ratably throughout the reimbursement period, and we may discontinue such reimbursement at any time or revise the duration of the reimbursement period after

the issue date of the securities based on changes in market conditions and other factors that cannot be predicted.

We urge you to read the “Selected Risk Considerations” in this pricing supplement.

P-5

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Investor Considerations

|

The securities are not appropriate for all investors. The securities may be an appropriate investment for investors who:

| ◾ |

seek 100% exposure to the upside performance of the Fund if the ending price is greater than the starting price, subject to the maximum return at maturity of 36.00% of the face amount;

|

| ◾ |

understand that any positive return based on the decrease in the price of the Fund will be limited to 20%, and that any decrease in the price of the Fund by more than 20% will result in a loss,

rather than a positive return, on the securities;

|

| ◾ |

desire to limit downside exposure to the Fund through the buffer amount;

|

| ◾ |

are willing to accept the risk that, if the ending price is less than the starting price by more than the buffer amount, they will lose some, and possibly up to 80%, of the face amount per

security at maturity;

|

| ◾ |

are willing to forgo interest payments on the securities and dividends on the shares of the Fund and the securities held by the Fund; and

|

| ◾ |

are willing to hold the securities until maturity.

|

The securities may not be an appropriate investment for investors who:

| ◾ |

seek a liquid investment or are unable or unwilling to hold the securities to maturity;

|

| ◾ |

are unwilling to accept the risk that the ending price of the Fund may decrease from the starting price by more than the buffer amount;

|

| ◾ |

seek uncapped exposure to the upside performance of the Fund;

|

| ◾ |

seek full return of the face amount of the securities at stated maturity;

|

| ◾ |

are unwilling to purchase securities with an estimated value as of the pricing date that is lower than the original offering price;

|

| ◾ |

seek current income;

|

| ◾ |

are unwilling to accept the risk of exposure to the Fund;

|

| ◾ |

seek exposure to the Fund but are unwilling to accept the risk/return trade-offs inherent in the maturity payment amount for the securities;

|

| ◾ |

are unwilling to accept the credit risk of the Bank; or

|

| ◾ |

prefer the lower risk of conventional fixed income investments with comparable maturities issued by companies with comparable credit ratings.

|

The considerations identified above are not exhaustive. Whether or not the securities are

an appropriate investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal,

tax, accounting and other advisors have carefully considered the appropriateness of an investment in the securities in light of your particular circumstances. You

should also review carefully the “Selected Risk Considerations” herein and the “Risk Factors” in the accompanying product supplement for risks related to an investment in the securities. For more information about the Fund, please see the section

titled “Information Regarding the Fund” below.

P-6

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Determining Payment at Stated Maturity

|

On the stated maturity date, you will receive a cash payment per security (the maturity payment amount) calculated as follows:

P-7

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Selected Risk Considerations

|

The securities have complex features and investing in the securities will involve risks not associated with an investment in conventional debt securities. Some of

the risks that apply to an investment in the securities are summarized below, but we urge you to read the more detailed explanation of the risks relating to the securities generally in the “Risk Factors” section of the accompanying product

supplement. You should reach an investment decision only after you have carefully considered with your advisors the appropriateness of an investment in the securities in light of your particular circumstances.

Risks Relating To The Securities Generally

If The Ending Price Is Less Than The Threshold Price, You Will Lose Some, And Possibly Up To 80%, Of The Face Amount Of Your Securities At

Maturity.

We will not repay you a fixed amount on the securities on the stated maturity date. The maturity payment amount will depend on the direction of and percentage

change in the ending price of the Fund relative to the starting price and the other terms of the securities. Because the price of the Fund will be subject to market fluctuations, the maturity payment amount may be more or less, and possibly

significantly less, than the face amount of your securities.

If the ending price is less than the threshold price, the maturity payment amount will be less than the face amount and you will have 1-to-1 downside exposure to

the decrease in the price of the Fund in excess of the buffer amount, resulting in a loss of 1% of the face amount for every 1% decline in the Fund in excess of the buffer amount. The threshold price is 80% of the starting price. As a result, if

the ending price is less than the threshold price, you will lose some, and possibly up to 80%, of the face amount per security at maturity. This is the case even if the price of the Fund is greater than or equal to the starting price or the

threshold price at certain times during the term of the securities.

Even if the ending price is greater than the starting price, the maturity payment amount may only be slightly greater than the face amount, and your yield on the

securities may be less than the yield you would earn if you bought a traditional interest-bearing debt security of the Bank or another issuer with a similar credit rating with the same stated maturity date.

No Periodic Interest Will Be Paid On The Securities.

No periodic payments of interest will be made on the securities. However, if the agreed-upon tax treatment is successfully challenged by the Internal Revenue

Service (the “IRS”), you may be required to recognize taxable income over the term of the securities. You should review the section of this pricing supplement entitled “Material U.S.

Federal Income Tax Consequences”.

Your Return Will Be Limited To The Maximum Return And May Be Lower Than The Return On A Direct Investment In The Fund.

The opportunity to participate in the possible increases in the price of the Fund through an investment in the securities will be limited because any positive

return on the securities will not exceed the maximum return. Therefore, your return on the securities may be lower than the return on a direct investment in the Fund. Furthermore, the effect of the upside participation rate will be progressively

reduced for all ending prices exceeding the ending price at which the maximum return is reached.

Any Positive Return Based On The Depreciation Of The Fund Is Effectively Capped.

Any positive return based on the depreciation of the Fund will be capped at 20% because the contingent absolute return feature is only operative if the ending

price of the Fund does not decline by more than 20% from the starting price. Any depreciation of the Fund from the starting price to the ending price by more than 20% will result in a loss, rather than a positive return, on the securities.

The Return On Your Securities May Change Significantly Despite Only A Small Change In The Price Of The Fund.

If the ending price is less than the threshold price, you will receive less than the face amount of your securities and you will lose some, and possibly up to

80%of the face amount per security. This means that while a decrease in the ending price to the threshold price will result in a positive return equal to the absolute value of the percentage decline in the price of the Fund from the starting price,

a decrease in the ending price to less than the threshold price will result in a loss of a 1% of the face amount of the securities for each 1% decline in the Fund in excess of the buffer amount despite only a small change in the price of the Fund.

P-8

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

Risks Relating To An Investment In the Bank’s Debt Securities, Including The Securities

Investors Are Subject To The Bank’s Credit Risk, And The Bank’s Credit Ratings And Credit Spreads May Adversely Affect The Market Value Of The

Securities.

Although the return on the securities will be based on the performance of the Fund, the payment of any amount due on the securities is

subject to the Bank’s credit risk. The securities are the Bank’s senior unsecured debt obligations. Investors are dependent on the Bank’s ability to pay all amounts due on the securities on the stated maturity date and, therefore, investors are

subject to the credit risk of the Bank and to changes in the market’s view of the Bank’s creditworthiness. Any decrease in the Bank’s credit ratings or increase in the credit spreads charged by the market for taking the Bank’s credit risk is likely

to adversely affect the market value of the securities. If the Bank becomes unable to meet its financial obligations as they become due, investors may not receive any amounts due under the terms of the securities.

Risks Relating To The Estimated Value Of The Securities And Any Secondary Market

The Estimated Value Of Your Securities Is Less Than The Original Offering Price Of Your Securities.

The estimated value of your securities is less than the original offering price of your securities. The difference between the original offering price of your

securities and the estimated value of the securities reflects costs and expected profits associated with selling and structuring the securities, as well as hedging our obligations under the securities. Because hedging our obligations entails risks

and may be influenced by market forces beyond our control, this hedging may result in a profit that is more or less than expected, or a loss.

The Estimated Value Of Your Securities Is Based On Our Internal Funding Rate.

The estimated value of your securities is determined by reference to our internal funding rate. The internal funding rate used in the determination of the

estimated value of the securities generally represents a discount from the credit spreads for our conventional, fixed-rate debt securities and the borrowing rate we would pay for our conventional, fixed-rate debt securities. This discount is based

on, among other things, our view of the funding value of the securities as well as the higher issuance, operational and ongoing liability management costs of the securities in comparison to those costs for our conventional, fixed-rate debt, as well

as estimated financing costs of any hedge positions, taking into account regulatory and internal requirements. If the interest rate implied by the credit spreads for our conventional, fixed-rate debt securities, or the borrowing rate we would pay

for our conventional, fixed-rate debt securities were to be used, we would expect the economic terms of the securities to be more favorable to you. Additionally, assuming all other economic terms are held constant, the use of an internal funding

rate for the securities is expected to increase the estimated value of the securities at any time.

The Estimated Value Of The Securities Is Based On Our Internal Pricing Models, Which May Prove To Be Inaccurate And May Be Different From The

Pricing Models Of Other Financial Institutions.

The estimated value of your securities is based on our internal pricing models, which take into account a number of variables, such as our internal funding rate

on the pricing date, and are based on a number of subjective assumptions, which are not evaluated or verified on an independent basis and may or may not materialize. Further, our pricing models may be different from other financial institutions’

pricing models and the methodologies used by us to estimate the value of the securities may not be consistent with those of other financial institutions that may be purchasers or sellers of the securities in the secondary market. As a result, the

secondary market price of your securities may be materially less than the estimated value of the securities determined by reference to our internal pricing models. In addition, market conditions and other relevant factors in the future may change,

and any assumptions may prove to be incorrect.

The Estimated Value Of Your Securities Is Not A Prediction Of The Prices At Which You May Sell Your Securities In The Secondary Market, If

Any, And Such Secondary Market Prices, If Any, Will Likely Be Less Than The Original Offering Price Of Your Securities And May Be Less Than The Estimated Value Of Your Securities.

The estimated value of the securities is not a prediction of the prices at which the Agents, other affiliates of ours or third parties may be willing to

purchase the securities from you in secondary market transactions (if they are willing to purchase, which they are not obligated to do). The price at which you may be able to sell your securities in the secondary market at any time, if any, may be

based on pricing models that differ from our pricing models and will be influenced by many factors that cannot be predicted, such as market conditions and any bid and ask spread for similar sized trades, and may be substantially less than our

estimated value of the securities. Further, as secondary market prices of your securities take into account the levels at which our debt securities trade in the secondary market and do not take into account our various costs and expected profits

associated with selling and structuring the securities, as well as hedging our obligations under the securities, secondary market prices of your securities will likely be less than the original offering price of your securities. As a result, the

price at which the Agents, other affiliates of ours or third parties may be willing to purchase the securities from you in secondary market transactions, if any, will likely be less than the price you paid for your securities, and any sale prior to

the stated maturity date could result in a substantial loss to you.

The Temporary Price At Which We May Initially Buy The Securities In The Secondary Market May Not Be Indicative Of Future Prices Of Your

Securities.

Assuming that all relevant factors remain constant after the pricing date, the price at which the Agents may initially buy or sell the securities in the secondary market (if the

Agents make a market in the securities, which they are not obligated to do) may exceed the estimated value of the securities on the pricing date, as well as the secondary market value of the securities, for a temporary period after

P-9

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

the pricing date of the securities, as discussed further under “Estimated Value of the Securities”. The price at which the Agents may initially buy or sell the

securities in the secondary market may not be indicative of future prices of your securities.

The Agent Discount, Offering Expenses And Certain Hedging Costs Are Likely To Adversely Affect Secondary Market Prices.

Assuming no changes in market conditions or any other relevant factors, the price, if any, at which you may be able to sell the securities will likely be less

than the original offering price. The original offering price includes, and any price quoted to you is likely to exclude, the underwriting discount paid in connection with the initial distribution, offering expenses as well as the cost of hedging

our obligations under the securities. In addition, any such price is also likely to reflect dealer discounts, mark-ups and other transaction costs, such as a discount to account for costs associated with establishing or unwinding any related hedge

transaction. In addition, because an affiliate of Wells Fargo Securities is to conduct hedging activities for us in connection with the securities, that affiliate may profit in connection with such hedging activities and such profit, if any, will

be in addition to the compensation that the dealer receives for the sale of the securities to you. You should be aware that the potential to earn fees in connection with hedging activities may create a further incentive for the dealer to sell the

securities to you in addition to the compensation they would receive for the sale of the securities.

There May Not Be An Active Trading Market For The Securities — Sales In The Secondary Market May Result In Significant Losses.

There may be little or no secondary market for the securities. The securities will not be listed or displayed on any securities exchange or any electronic

communications network. The Agents and their respective affiliates may make a market for the securities; however, they are not required to do so. The Agents and their respective affiliates may stop any market-making activities at any time. Even if

a secondary market for the securities develops, it may not provide significant liquidity or trade at prices advantageous to you. We expect that transaction costs in any secondary market would be high. As a result, the difference between bid and ask

prices for your securities in any secondary market could be substantial.

If you sell your securities before the stated maturity date, you may have to do so at a substantial discount from the principal amount irrespective of the price

of the Fund, and as a result, you may suffer substantial losses.

If The Price Of The Fund Changes, The Market Value Of Your Securities May Not Change In The Same Manner.

Your securities may trade quite differently from the performance of the Fund. Changes in the price of the Fund may not result in a comparable change in the market

value of your securities. Even if the price of the Fund increases above its starting price during the term of the securities, the market value of your securities may not increase by the same amount and could decline.

Risks Relating To The Fund

The Maturity Payment Amount Will Depend Upon The Performance Of The Fund And Therefore The Securities Are Subject To The Following Risks,

Each As Discussed In More Detail In The Accompanying Product Supplement.

| • |

Investing In The Securities Is Not The Same As Investing In The Fund. Investing in the securities is not equivalent

to investing in the Fund. As an investor in the securities, your return will not reflect the return you would realize if you actually owned and held the securities held by the Fund for a period similar to the term of the securities because

you will not receive any dividend payments, distributions or any other payments paid on those securities. As a holder of the securities, you will not have any voting rights or any other rights that holders of the securities held by the Fund

would have.

|

| • |

Historical Prices Of The Fund Should Not Be Taken As An Indication Of The Future Performance Of The Fund During The Term Of The Securities.

|

| • |

Changes That Affect A Fund Or Its Fund Underlying Index May Adversely Affect The Value Of The Securities And Any Payments On The Securities.

|

| • |

We, The Agents And Our Respective Affiliates Cannot Control Actions By Any Of The Unaffiliated Companies Whose Securities Are Included In The Fund Or Its Fund Underlying

Index.

|

| • |

We And Our Affiliates And the Agents And Their Affiliates Have No Affiliation With Any Fund Sponsor Or Fund Underlying Index Sponsor And Have Not

Independently Verified Their Public Disclosure Of Information.

|

| • |

An Investment Linked To The Shares Of A Fund Is Different From An Investment Linked To Its Fund Underlying Index.

|

| • |

There Are Management and Liquidity Risks Associated With A Fund.

|

| • |

Anti-dilution Adjustments Relating To The Shares Of A Fund Do Not Address Every Event That Could Affect Such Shares.

|

The Holdings Of The Fund Are Concentrated In The Gold And Silver Mining Industries.

P-10

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

All or substantially all of the equity securities held by the Fund are issued by gold or silver mining companies. An investment in the securities will be

exposed to risks in the gold and silver mining industries. As a result of being linked to a single industry or sector, the securities may have increased volatility as the share price of the Fund may be more susceptible to factors that affect that

industry or sector. Competitive pressures may have a significant effect on the financial condition of companies in these industries.

In addition, these companies are highly dependent on the price of gold or silver, as applicable. These prices fluctuate widely and may be affected by numerous

factors. Factors affecting gold prices include economic factors, including, among other things, the structure of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and confidence

in, the U.S. dollar (the currency in which the price of gold is generally quoted), interest rates and gold borrowing and lending rates, and global or regional economic, financial, political, regulatory, judicial or other events. Gold prices may

also be affected by industry factors such as industrial and jewelry demand, lending, sales and purchases of gold by the official sector, including central banks and other governmental agencies and multilateral institutions which hold gold, levels

of gold production and production costs, and short-term changes in supply and demand because of trading activities in the gold market. Factors affecting silver prices include general economic trends, technical developments, substitution issues and

regulation, as well as specific factors including industrial and jewelry demand, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar (the currency in which the price of silver is generally quoted) and other

currencies, interest rates, central bank sales, forward sales by producers, global or regional political or economic events, and production costs and disruptions in major silver producing countries such as Mexico and Peru. The supply of silver

consists of a combination of new mine production and existing stocks of bullion and fabricated silver held by governments, public and private financial institutions, industrial organizations and private individuals. In addition, the price of silver

has on occasion been subject to very rapid short-term changes due to speculative activities. From time to time, above-ground inventories of silver may also influence the market.

The Securities Are Subject To Exchange Rate Risk

Because securities held by the Fund are traded in currencies other than U.S. dollars, and the securities are denominated in U.S. dollars, the amount payable on

the securities at maturity may be exposed to fluctuations in the exchange rate between the U.S. dollar and each of the currencies in which those securities are denominated. These changes in exchange rates may reflect changes in various non-U.S.

economies that in turn may affect the payment on the securities at maturity. An investor’s net exposure will depend on the extent to which the currencies in which the relevant securities are denominated either strengthen or weaken against the U.S.

dollar and the relative weight of each security.

The Price Of The Fund May Be Disproportionately Affected By The Performance Of A Small Number Of Stocks.

As of the date of this document, more than forty percent of the Fund was invested in only six stocks. As a result, a decline in the prices of one or more of

these stocks, including as a result of events negatively affecting one or more of these companies, may have the effect of significantly lowering the price of the Fund even if none of the other stocks held by the Fund are affected by such events.

Risks Relating To Hedging Activities And Conflicts Of Interest

| • |

Trading And Business Activities By The Bank Or Its Affiliates May Adversely Affect The Market Value Of, And Any Amount Payable On, The Securities.

|

| • |

There Are Potential Conflicts Of Interest Between You And The Calculation Agent.

|

Risks Relating To Canadian And U.S. Federal Income Taxation

The Tax Consequences Of An Investment In The Securities Are Unclear.

Significant aspects of the U.S. federal income tax treatment of the securities are uncertain. You should read carefully the section entitled “Material U.S.

Federal Income Tax Consequences” herein and in the product supplement. You should consult your tax advisors as to the tax consequences of your investment in the securities. An investment in the securities is not appropriate for non-U.S. holders,

and we will not attempt to ascertain the tax consequences to non-U.S. holders of the purchase, ownership or disposition of the securities.

For a discussion of the Canadian federal income tax consequences of investing in the securities, please see the discussion in the

product supplement under “Supplemental Discussion of Canadian Tax Consequences”. If you are not a Non-resident Holder (as that term is defined in the prospectus) for Canadian federal income tax purposes or if you acquire the securities in the

secondary market, you should consult your tax advisors as to the consequences of acquiring, holding and disposing of the securities and receiving the payments that might be due under the securities.

P-11

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Hypothetical Examples and Returns

|

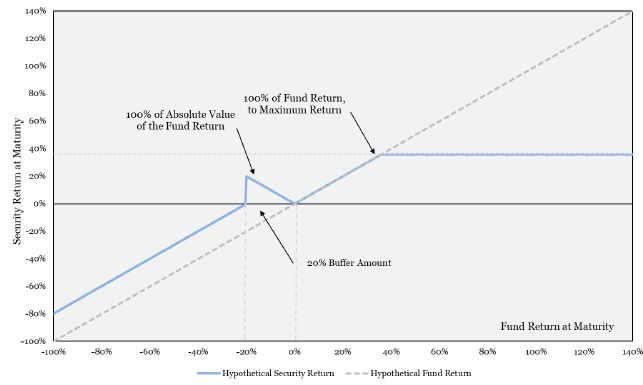

The payout profile, return table and examples below illustrate the maturity payment amount for a $1,000 face amount security on a hypothetical

offering of securities under various scenarios, with the assumptions set forth in the table below. The terms used for purposes of these hypothetical examples do not represent the actual starting price or threshold price. The hypothetical starting

price of $100.00 has been chosen for illustrative purposes only and does not represent the actual starting price. The actual starting price and threshold price were determined on the pricing date and are set forth under “Terms of the Securities”

above. For historical data regarding the actual closing prices of the Fund, see the historical information set forth herein. The payout profile, return table and examples below assume that an investor purchases the securities for $1,000 per

security. These examples are for purposes of illustration only and the values used in the examples may have been rounded for ease of analysis.

|

Upside Participation Rate:

|

100%

|

||

|

Maximum Return:

|

36.00% or $360.00 per security

|

||

|

Hypothetical Starting Price:

|

$100.00

|

||

|

Hypothetical Threshold Price:

|

$80.00 (80% of the hypothetical starting price)

|

||

|

Buffer Amount:

|

20%

|

Hypothetical Payout Profile

P-12

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

Hypothetical Returns

|

Hypothetical

ending price

|

Hypothetical

fund return(1)

|

Maturity payment amount

per security

|

Pre-tax total

rate of return(2)

|

|

$200.00

|

100.00%

|

$1,360.00

|

36.00%

|

|

$175.00

|

75.00%

|

$1,360.00

|

36.00%

|

|

$150.00

|

50.00%

|

$1,360.00

|

36.00%

|

|

$140.00

|

40.00%

|

$1,360.00

|

36.00%

|

|

$136.00

|

36.00%

|

$1,360.00

|

36.00%

|

|

$130.00

|

30.00%

|

$1,300.00

|

30.00%

|

|

$120.00

|

20.00%

|

$1,200.00

|

20.00%

|

|

$110.00

|

10.00%

|

$1,100.00

|

10.00%

|

|

$105.00

|

5.00%

|

$1,050.00

|

5.00%

|

|

$100.00

|

0.00%

|

$1,000.00

|

0.00%

|

|

$97.50

|

-2.50%

|

$1,025.00

|

2.50%

|

|

$95.00

|

-5.00%

|

$1,050.00

|

5.00%

|

|

$90.00

|

-10.00%

|

$1,100.00

|

10.00%

|

|

$80.00

|

-20.00%

|

$1,200.00

|

20.00%

|

|

$79.00

|

-21.00%

|

$990.00

|

-1.00%

|

|

$70.00

|

-30.00%

|

$900.00

|

-10.00%

|

|

$60.00

|

-40.00%

|

$800.00

|

-20.00%

|

|

$50.00

|

-50.00%

|

$700.00

|

-30.00%

|

|

$25.00

|

-75.00%

|

$450.00

|

-55.00%

|

|

$0.00

|

-100.00%

|

$200.00

|

-80.00%

|

| (1) |

The fund return is equal to the percentage change from the starting price to the ending price (i.e., the ending price minus

starting price, divided by starting price).

|

| (2) |

The hypothetical pre-tax total rate of return is the number, expressed as a percentage, that results from comparing the maturity payment amount per security to the face

amount of $1,000.

|

P-13

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

Hypothetical Examples

Example 1. Maturity payment amount is greater than the face amount and reflects a return that is less than the maximum

return:

|

VanEck® Gold Miners

ETF

|

||

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$110.00

|

|

|

Hypothetical threshold price:

|

$80.00

|

|

|

Hypothetical fund return

(ending price – starting price)/starting price:

|

10.00%

|

Because the hypothetical ending price is greater than the hypothetical starting price, the maturity payment amount per security would be equal to

the face amount of $1,000 plus a positive return equal to the lesser of:

(i) $1,000 × fund return × upside participation rate

$1,000 × 10.00% × 100.00%

= $100.00; and

(ii) the maximum return of $360.00

On the stated maturity date you would receive $1,100.00 per security.

Example 2. Maturity payment amount is greater than the face amount and reflects a return equal to the maximum return:

|

VanEck® Gold Miners

ETF

|

||

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$150.00

|

|

|

Hypothetical threshold price:

|

$80.00

|

|

|

Hypothetical fund return

(ending price – starting price)/starting price:

|

50.00%

|

Because the hypothetical ending price is greater than the hypothetical starting price, the maturity payment amount per security would be equal to

the face amount of $1,000 plus a positive return equal to the lesser of:

(i) $1,000 × fund return × upside participation rate

$1,000 × 50.00% × 100.00%

= $1,500.00; and

(ii) the maximum return of $360.00

On the stated maturity date you would receive $1,360.00 per security, which is the maximum maturity payment amount.

P-14

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

Example 3. Maturity payment amount is greater than the face amount and reflects a return equal to the absolute value of the

fund return:

|

VanEck® Gold Miners

ETF

|

||

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$90.00

|

|

|

Hypothetical threshold price:

|

$80.00

|

|

|

Hypothetical fund return

(ending price – starting price)/starting price:

|

-10.00%

|

Because the hypothetical ending price is less than the hypothetical starting price but is not less than the hypothetical

threshold price, you will receive a positive return on the securities equal to the absolute value of the fund return, even though the fund return is negative. You will receive a maturity payment amount equal to:

$1,000 + ($1,000 × absolute value of fund return)

$1,000 + ($1,000 × 10.00%)

= $1,100.00;

On the stated maturity date, you would receive $1,100.00 per security.

Example 4. Maturity payment amount is less than the face amount:

|

VanEck® Gold Miners

ETF

|

||

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$50.00

|

|

|

Hypothetical threshold price:

|

$80.00

|

|

|

Hypothetical fund return

(ending price – starting price)/starting price:

|

-50.00%

|

Because the hypothetical ending price is less than the hypothetical starting price by more than the buffer amount, you would lose a portion of

the face amount of your securities and receive the maturity payment amount equal to:

$1,000 + [$1,000 × (fund return + buffer amount)]

$1,000 + [ $1,000 × (-50.00% + 20%)]

= $700.00

On the stated maturity date you would receive $700.00 per security.

P-15

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Information Regarding the Fund

|

All disclosures contained in this document regarding the Fund, including, without limitation, its make-up, method of

calculation, and changes in any securities held by the Fund, have been derived from publicly available sources. The information reflects the policies of, and is subject to change by, Van Eck Associates Corporation (the “Investment Adviser”). The

Investment Adviser, which owns the copyright and all other rights to the Fund, has no obligation to continue to publish, and may discontinue publication of, the Fund. None of the websites referenced in the Fund description below, or any materials

included in those websites, are incorporated by reference into this document or any document incorporated herein by reference. We have not independently verified the accuracy or completeness of reports filed by an Investment Adviser with the SEC,

information published by it on its website or in any other format, information about it obtained from any other source or the information provided below.

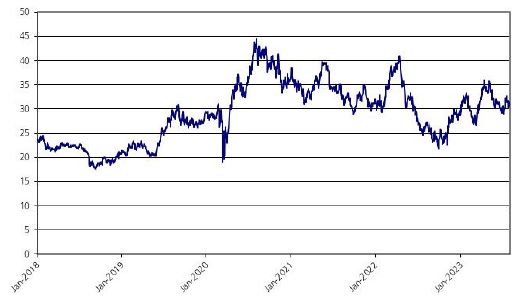

The graph below sets forth the information relating to the historical performance of the Fund. The graph below shows the

daily historical closing prices of the Fund for the periods specified. We obtained the information regarding the historical performance of the Fund in the graph below from Bloomberg Professional® service (“Bloomberg”). The closing prices

may be adjusted by Bloomberg for corporate actions such as stock splits, public offerings, mergers and acquisitions, spin-offs, delistings and bankruptcy.

We have not independently verified the accuracy or completeness of the information obtained from Bloomberg. The

historical performance of the Fund should not be taken as an indication of its future performance, and no assurance can be given as to the ending price of the Fund. We cannot give you any assurance that the performance of the Fund will result in

any positive return on your initial investment.

The Fund is registered under the Securities Act of 1933, the Investment Company Act of 1940, each as amended, and/or the

Exchange Act. Companies with securities registered with the SEC are required to file financial and other information specified by the SEC periodically. Information filed by the Investment Adviser with the SEC can be reviewed electronically through

a website maintained by the SEC. The address of the SEC’s website is http://www.sec.gov. Information filed with the SEC by the Fund can be located by reference to its SEC file number provided below.

|

The VanEck® Gold Miners ETF

|

We have derived all information contained herein regarding the VanEck® Gold Miners ETF (the “GDX Fund”) and the Fund Underlying

Index, as defined below, from publicly available information. Such information reflects the policies of, and is subject to changes by, the GDX Fund’s investment adviser, Van Eck Associates Corporation (“Van Eck” or the “Investment Adviser”) and the

Underlying Index Sponsor of the Fund Underlying Index, as defined below.

The GDX Fund is one of the separate investment portfolios that constitute the VanEck® ETF Trust (“VanEck Trust”). The GDX Fund

seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the NYSE® Arca Gold Miners Index® (the “Fund Underlying Index”). The Fund Underlying Index is

designed to measure the performance of highly capitalized companies in the gold mining industry. The Fund Underlying Index consists of securities of selected companies which are involved in the mining for gold and silver ore and are listed for

trading and electronically quoted on a major stock market that is accessible by foreign investors. The weight of companies whose revenues are more significantly exposed to silver mining will not exceed 20% of the Fund Underlying Index at rebalance.

The Fund Underlying Index is calculated, maintained and published by, ICE Data Indices, LLC (the “Underlying Index Sponsor”). The Underlying Index Sponsor is under no obligation to continue to publish, and may discontinue or suspend the publication

of, the Fund Underlying Index at any time.

Select information regarding the GDX Fund’s expense ratio and its top constituents, country, industry and/or sector weightings may be made

available on the GDX Fund’s website. Expenses of the GDX Fund reduce the net asset value of the assets held by the GDX Fund and, therefore, reduce the value of the shares of the GDX Fund.

The GDX Fund, using a “passive” or indexing investment approach, attempts to approximate the investment performance of the Fund Underlying

Index by investing in a portfolio of securities that generally replicates the Fund Underlying Index. The GDX Fund normally invests at least 80% of its total assets in securities that comprise the Fund Underlying Index and normally invests at least

80% of its total assets in common stocks and depositary receipts of companies involved in the gold mining industry. The GDX Fund may concentrate its investments in a particular industry or group of industries to the extent that the Fund Underlying

Index concentrates in an industry or group of industries. The GDX Fund may or may not hold all of the securities that are included in the Fund Underlying Index.

Shares of the GDX Fund are listed on the NYSE Arca under the ticker symbol “GDX”.

Information from outside sources including, but not limited to the prospectus related to the GDX Fund and any other website referenced in this

section, is not incorporated by reference in, and should not be considered part of, this document or any document incorporated herein by reference. We have not undertaken an independent review or due diligence of any publicly available information

with respect to the GDX Fund or the Fund Underlying Index.

Information filed by VanEck Trust with the SEC, including the prospectus for the GDX Fund, can be found by reference to its SEC file numbers:

333-123257 and 811-10325 or its CIK Code: 0001137360.

P-16

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

The Fund Underlying Index

We have derived all information contained in this pricing supplement regarding the Fund Underlying Index, including, without limitation, its

make-up, method of calculation and changes in its components, from publicly available information and information supplied by the Underlying Index Sponsor. The Underlying Index Sponsor is responsible for the day-to-day management of the Fund

Underlying Index, including retaining primary responsibility for all aspects of the Fund Underlying Index determination process, including implementing appropriate governance and oversight. The NYSE Arca has no obligation to continue to publish,

and may discontinue the publication of, the Fund Underlying Index.

The Fund Underlying Index includes common stocks, ADRs and GDRs of selected companies that are involved primarily in mining for gold or silver

and that are listed for trading and electronically quoted on a major stock market that is accessible by foreign investors. Generally, this will include exchanges in most developed markets and major emerging markets, and will include companies that

are cross-listed, e.g., both U.S. and Canadian listings. The Underlying Index Sponsor will use its discretion to avoid exchanges and markets that are considered “frontier” in nature or have major restrictions to foreign ownership. The Fund

Underlying Index includes companies that derive at least 50% of their revenues from gold mining and related activities (40% for companies already in the Fund Underlying Index). Also, the Fund Underlying Index maintains exposure to companies with a

significant revenue exposure to silver mining in addition to gold mining, which will not exceed 20% of the Fund Underlying Index weight at each rebalance.

Only companies with market capitalizations greater than $750 million, an average daily volume of at least 50,000 shares over the past three

months and an average daily value traded of at least $1 million over the past three months are eligible for inclusion in the Fund Underlying Index. For companies already in the Fund Underlying Index, the market capitalization requirement is greater

than $450 million, the average daily volume requirement is at least 30,000 shares over the past three months and the average daily value traded requirement is at least $600,000 over the past three months. The Underlying Index Sponsor has the

discretion to not include all companies that meet the minimum criteria for inclusion.

Only one listing is permitted per company and the listing representing the company’s ordinary shares is generally used. If an ADR, GDR, or

U.S. cross-listing is available for a given stock and it satisfies the minimum liquidity requirements, that ADR, GDR, or U.S. cross-listing will be used instead of the locally listed ordinary share. If multiple share classes are available for a

particular listing line, the shares outstanding for each class will be added up and be attributed to the most liquid class.

Calculation of the Fund Underlying Index.

The Fund Underlying Index is calculated by NYSE Arca on a net total return basis. A net total return index measures the period to period

change in the value of its components due to changes in the valuation (price in U.S. dollars) of those components plus (by means of an adjustment to the divisor) any income produced by those components net of dividend withholding taxes. As the

index level is expressed in U.S. dollars, the Fund Underlying Index converts non-U.S. currencies into U.S. dollars using currency exchange rates. The calculation is based on the current modified market capitalization divided by a divisor. The

divisor was determined on the initial capitalization base of the Fund Underlying Index and the base level and may be adjusted as a result of corporate actions and composition changes, as described below.

Fund Underlying Index Maintenance

The Fund Underlying Index is reviewed quarterly. The general aim of the quarterly rebalance of the Fund Underlying Index is to ensure that the

selection and weightings of the components continues to reflect as closely as possible the Fund Underlying Index's objective of measuring the performance of highly capitalized companies in the gold mining industry. The Underlying Index Sponsor

reserves the right to, at any time, change the number of stocks comprising the Fund Underlying Index by adding or deleting one or more stocks, or replacing one or more stocks contained in the Fund Underlying Index with one or more substitute stocks

of its choice, if in the Underlying Index Sponsor's discretion such addition, deletion or substitution is necessary or appropriate to maintain the quality and/or character of the index. The rebalances become effective at the open of the first

trading after the third Friday of March, June, September and December.

Components will be removed from the Fund Underlying Index during the quarterly review if (1) the market capitalization is less than $450

million, or (2) the average daily volume for the previous three months is less than 30,000 shares and the average daily value traded for the previous three months is less than $600,000.

At the time of the quarterly rebalance, the component security quantities will be modified to conform to the following asset diversification

requirements:

| (1) |

the weight of any single component security may not account for more than 20% of the total value of the Fund Underlying Index;

|

| (2) |

the component securities are split into two subgroups – large and small, which are ranked by market capitalization weight in the Fund Underlying Index. Large securities are

defined as having a starting index weight greater than or equal to 5%. Small securities are defined as having a starting index weight below 5%; and

|

| (3) |

the final aggregate weight of those component securities which individually represent more than 4.5% of the total value of the Fund Underlying Index may not account for

more than 45% of the total index value.

|

The weights of the components securities (taking into account expected component changes and share adjustments) are modified in accordance

with the Fund Underlying Index’s diversification rules.

Diversification Rule 1: If any component stock exceeds 20% of the

total value of the Fund Underlying Index, then all stocks greater than 20% of the Fund Underlying Index are reduced to represent 20% of the value of the Fund Underlying Index. The aggregate amount by

P-17

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

which all component stocks are reduced is redistributed proportionately across the remaining stocks that represent less than 20% of the index

value. After this redistribution, if any other stock then exceeds 20%, the stock is set to 20% of the index value and the redistribution is repeated.

Diversification Rule 2: If the components with a starting index

weight of 5% or greater exceeds 45% of the total value of the Fund Underlying Index (after any adjustments for Diversification Rule 1), the components are sorted into two groups, large are components with a starting index weight of 5% or greater

and small are components with a weight of under 5%. The large group will represent in the aggregate 45% and the small group will represent 55% in the aggregate of the final index weight. This will be adjusted through the following process: The

weight of each of the large stocks will be scaled down proportionately (with a floor of 5%) so that the aggregate weight of the large components will be reduced to represent 45% of the Fund Underlying Index. If any large component stock falls below

a weight equal to the product of 5% and the proportion by which the stocks were scaled down following this distribution, then the weight of the stock is set equal to 5% and the components with weights greater than 5% will be reduced

proportionately. The weight of each of the small components will be scaled up proportionately from the redistribution of the large components. If any small component stock exceeds a weight equal to the product of 4.5% and the proportion by which

the stocks were scaled down following this distribution, then the weight of the stock is set equal to 4.5%. The redistribution of weight to the remaining stocks is repeated until the entire amount has been redistributed.

The inclusion of new companies in the Fund Underlying Index will typically only occur during the quarterly reconstitutions or rebalances,

although there could be exceptions based on a specific corporate action affecting a current constituent. The inclusion of the new company at the quarterly rebalances/reconstitutions will be announced at least six trading days before the effective

date of the actual inclusion. Components would be removed from the Fund Underlying Index as a result of periodic corporate actions as well as the results of the quarterly rebalances/reconstitutions. All removals in the quarterly

rebalances/reconstitutions will be announced at least six trading days before the effective date of the removal. The new composition of the Fund Underlying Index, including the companies to be a part of the index and their corresponding new index

shares, will be announced at least six trading days before the effective date.

In case of an event that could affect one or more constituents, the Underlying Index Sponsor will inform the market about the intended

treatment of the event in the Fund Underlying Index shortly after the firm details have become available and have been confirmed. When possible, the corporate action will be announced, even if not all information is known, at least one trading day

before the effective date of the action. Once the corporate action has been effectuated, the Underlying Index Sponsor will confirm the changes in a separate announcement.

Changes to the index methodology will be announced by the Underlying Index Sponsor. Generally, the Underlying Index Sponsor shall announce

rule changes prior to them being implemented.

Historical Information

We obtained the closing prices of the VanEck® Gold Miners ETF in the graph below from Bloomberg, without independent verification.

The following graph sets forth daily closing prices of the VanEck® Gold Miners ETF for the period from January 1, 2018 to July 31, 2023. The closing

price on July 31, 2023 was $31.41. The historical performance of the VanEck® Gold Miners ETF should not be taken as an indication of the future performance of the VanEck® Gold Miners ETF, and no assurance can be given as to

the closing price of the VanEck® Gold Miners ETF on any day during the term of the securities. We cannot give you any assurance that the performance of the VanEck® Gold Miners ETF will result in any positive return on your

initial investment.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

P-18

|

Market Linked Securities—Upside Participation to a Cap with Contingent

Absolute Return and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the VanEck® Gold Miners ETF due August 4, 2025

|

|

Material U.S. Federal Income Tax Consequences

|

You should carefully review the section entitled “Material U.S. Federal Income Tax Consequences” in the accompanying product supplement. The

following discussion, when read in combination with that section, constitutes the full opinion of our special U.S. tax counsel, Fried, Frank, Harris, Shriver & Jacobson, LLP, regarding the material U.S. federal income tax consequences of owning

and disposing of the securities.

Due to the absence of statutory provisions, regulations, published rulings or judicial decisions addressing the characterization for U.S. federal income tax

purposes of securities with terms that are substantially the same as the securities, no assurance can be given that the IRS or a court will agree with the tax treatment described herein. Pursuant to the terms of the securities, the Bank and you

agree, in the absence of a statutory or regulatory change or an administrative determination or judicial ruling to the contrary, to characterize the securities as prepaid derivative contracts that are “open transactions” with respect to the Fund.

If the securities are so treated, upon the taxable disposition (including cash settlement) of your securities, you generally should recognize gain or loss equal to the difference between the amount realized on such taxable disposition and your tax

basis in the securities. Subject to the discussion in the accompanying product supplement regarding Section 1260 of the Code, such gain or loss should be long-term capital gain or loss if you have held your securities for more than one year

(otherwise, short-term capital gain or loss). The U.S. Treasury Department and the IRS have requested comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar financial instruments and