The notes are being issued by The Toronto-Dominion Bank (“TD”). There are important differences between the notes and a conventional debt security, including different investment

risks and certain additional costs. See “Risk Factors” beginning on page TS-7 of this term sheet, “Additional Risk Factors” beginning on page TS-9 of this term sheet and “Risk Factors” beginning on page PS-7 of product supplement EQUITY LIRN-1 and

page 1 of the prospectus.

The initial estimated value of the notes at the time the terms of the notes are set on the pricing date is expected to be between $9.094 and $9.394 per unit, which

is less than the public offering price listed below. See “Summary” on the following page, “Risk Factors” beginning on page TS-7 of this term sheet and “Structuring the Notes” on page TS-29 of this term sheet for additional information. The

actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy.

None of the U.S. Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these notes or passed upon the adequacy

or accuracy of this document, product supplement EQUITY LIRN-1 or the prospectus. Any representation to the contrary is a criminal offense.

|

Per Unit

|

Total

|

|

Public offering price(1)

|

$ 10.00

|

$

|

|

Underwriting discount(1)

|

$ 0.20

|

$

|

|

Proceeds, before expenses, to TD

|

$ 9.80

|

$

|

|

(1) |

For any purchase of 300,000 units or more in a single transaction by an individual investor or in combined transactions with the investor’s household in this offering, the public offering price and the underwriting discount will be $9.95

per unit and $0.15 per unit, respectively. See “Supplement to the Plan of Distribution (Conflicts of Interest)” below.

|

The notes:

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

BofA Securities

July , 2023

Summary

The Capped Notes with Absolute Return Buffer Linked to an International Equity Index Basket due July , 2025 (the “notes”) are our senior unsecured debt securities, Series E. The notes

are not guaranteed or insured by the CDIC, the FDIC or any other governmental agency, and are not, either directly or indirectly, an obligation of any third party. The notes are not bail-inable debt securities (as defined in the prospectus) under the

CDIC Act. The notes will rank equally with all of our other senior unsecured debt. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of TD. The notes

provide you a 1-to-1 return, subject to a cap, if the Ending Value of the Market Measure, which is the international equity index basket described below (the “Basket”), is greater than the Starting Value. If the Ending Value is equal to or less than

the Starting Value but greater than or equal to the Threshold Value, you will receive a positive return equal to the absolute value of the percentage decline in the Basket from the Starting Value to the Ending Value (e.g., if the negative return of

the Basket is -5%, you will receive a positive return of +5%). If the Ending Value is less than the Threshold Value, you will lose a portion, which could be significant, of the principal amount of your notes. Any payments on the notes will be

calculated based on the $10 principal amount per unit and will depend on the performance of the Basket, subject to our credit risk. See “Terms of the Notes” below.

The Basket will be comprised of the EURO STOXX 50® Index, the FTSE® 100 Index, the Nikkei Stock Average Index, the Swiss Market Index®, the S&P/ASX

200 Index, and the FTSE® China 50 Index (each a “Basket Component”). On the pricing date, the EURO STOXX 50® Index will be given an initial weight of 40.00%, each of the FTSE® 100 Index and the Nikkei Stock Average

Index will be given an initial weight of 20.00%, each of the Swiss Market Index® and the S&P/ASX 200 Index will be given an initial weight of 7.50% and the FTSE® China 50 Index will be given an initial weight of 5.00%. The

economic terms of the notes (including the Threshold Value) are based on our internal funding rate (which is our internal borrowing rate based on variables such as market benchmarks and our appetite for borrowing) and several factors, including

selling concessions, discounts, commissions or fees expected to be paid in connection with the offering of the notes, the estimated profit that we expect to earn in connection with structuring the notes, estimated costs which we may incur in

connection with the notes and the economic terms of certain related hedging arrangements as discussed further below and under “Structuring the Notes” on page TS-29.

On the cover page of this term sheet, we have provided the initial estimated value range for the notes. The initial estimated value of your notes on the pricing date will be less

than their public offering price. The range of initial estimated values was determined by reference to our internal pricing models, which take into account a number of variables, typically including expected volatility of the Market Measure, interest

rates (forecasted, current and historical rates), price-sensitivity analysis, time to maturity of the notes and our internal funding rate which take into account a number of variables and are based on a number of subjective assumptions, which are not

evaluated or verified on an independent basis and may or may not materialize. Because our internal funding rate generally represents a discount from the levels at which our benchmark debt securities trade in the secondary market, the use of an

internal funding rate for the notes rather than the levels at which our benchmark debt securities trade in the secondary market is expected, assuming all other economic terms are held constant, to increase the initial estimated value of the notes and

to have an adverse effect on the economic terms of the notes. For more information about the initial estimated value and the structuring of the notes, see the related discussion under “Risk Factors” and “Structuring the Notes” herein.

|

Terms of the Notes

|

|

Issuer:

|

|

The Toronto-Dominion Bank (“TD”)

|

|

Principal Amount:

|

|

$10.00 per unit

|

|

Term:

|

|

Approximately 2 years

|

|

Market Measure:

|

|

An international equity index basket comprised of the EURO STOXX 50® Index (Bloomberg symbol:

“SX5E”), the FTSE® 100 Index (Bloomberg symbol: “UKX”), the Nikkei Stock Average Index (Bloomberg symbol: “NKY”), the Swiss Market Index® (Bloomberg symbol: “SMI”), the S&P/ASX 200 Index (Bloomberg symbol:

“AS51”) and the FTSE® China 50 Index (Bloomberg symbol: “XIN0I”). Each Basket Component is a price return index.

|

|

Starting Value:

|

|

The Starting Value will be set to 100.00 on the pricing date.

|

|

Ending Value:

|

|

The average of the closing levels of the Market Measure on each calculation day occurring during the Maturity Valuation Period. The scheduled

calculation days are subject to postponement in the event of Market Disruption Events, as described beginning on page PS-27 of product supplement EQUITY LIRN-1.

|

|

Threshold Value:

|

|

[90.00% to 84.00%] of the Starting Value. The actual Threshold Value will be determined on the pricing date.

|

|

Participation

Rate:

|

|

100%

|

|

Capped Value:

|

|

$15.00 per unit, which represents a return of 50.00% over the principal amount.

|

|

Maturity Valuation

Period:

|

|

Five scheduled calculation days shortly before the maturity date.

|

|

Fees and

Charges:

|

|

The underwriting discount of $0.20 per unit listed on the cover page and the hedging related charge of $0.075 per unit described in “Structuring

the Notes” on page TS-29.

|

|

Calculation

Agents:

|

|

BofA Securities, Inc. (“BofAS”) and TD, acting jointly.

|

|

Redemption Amount Determination

|

|

Notwithstanding anything to the contrary in the accompanying product supplement, the Redemption Amount will be determined as set forth in this term

sheet.

On the maturity date, you will receive a cash payment per unit determined as follows:

|

|

|

The terms and risks of the notes are contained in this term sheet and in the following:

| ◾ |

Prospectus dated March 4, 2022:

|

These documents, including this term sheet (together, the “Note Prospectus”), have been filed as part of a registration statement with the SEC and may, without cost, be accessed on the SEC website as

indicated above or obtained from Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322.

Before you invest, you should read the Note Prospectus, including this term sheet, for information about us and this offering. Any prior or contemporaneous oral statements and any

other written materials you may have received are superseded by the Note Prospectus. Capitalized terms used but not defined in this term sheet have the meanings set forth in product supplement EQUITY LIRN-1. In the event of any conflict the following

hierarchy will govern: first, this term sheet; second, product supplement EQUITY LIRN-1; and last, the prospectus. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar

references are to TD.

To the extent the determination of the Redemption Amount and other terms described in this term sheet are inconsistent with those described in the accompanying product supplement,

prospectus supplement or prospectus, the determination of the Redemption Amount and other terms described in this term sheet shall control.

Investor Considerations

You may wish to consider an investment in the notes if:

| ◾ |

You anticipate that the value of the Basket will either increase moderately from the Starting Value to the Ending Value or decrease from the Starting Value to an Ending Value that is equal to or greater than the Threshold Value.

|

| ◾ |

You are willing to risk a substantial loss of principal if the value of the Basket decreases from the Starting Value to an Ending Value that is below the Threshold Value.

|

| ◾ |

You accept that the return on the notes will be capped.

|

| ◾ |

You are willing to forgo the interest payments that are paid on conventional interest bearing debt securities.

|

| ◾ |

You are willing to forgo dividends and other distributions on, and other benefits of owning, the stocks included in the Basket Components.

|

| ◾ |

You are willing to accept that a limited market or no market exists for sales of the notes prior to maturity, and understand that the market price for the notes in any secondary market may be adversely affected by various factors,

including, but not limited to, our actual and perceived creditworthiness, our internal funding rate and fees and charges on the notes, as described on page TS-2.

|

| ◾ |

You are willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Redemption Amount.

|

The notes may not be an appropriate investment for you if:

| ◾ |

You believe that the value of the Basket will decrease from the Starting Value to an Ending Value that is below the Threshold Value or that it will not increase sufficiently over the term of the notes to provide you with your desired

return.

|

| ◾ |

You seek 100% principal repayment or preservation of capital.

|

| ◾ |

You seek an uncapped return on your investment.

|

| ◾ |

You seek interest payments or other current income on your investment.

|

| ◾ |

You want to receive dividends or other distributions paid on the stocks included in the Basket Components.

|

| ◾ |

You seek an investment for which there will be a liquid secondary market.

|

| ◾ |

You are unwilling or are unable to take market risk on the notes or to accept the credit risk of TD as issuer of the notes.

|

We urge you to consult your investment, legal, tax, accounting and other advisors concerning an investment in the notes.

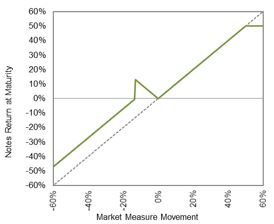

Hypothetical Payout Profile

The graph below is based on hypothetical numbers and values.

Capped Notes with Absolute Return Buffer

This graph reflects the returns on the notes, based on the Participation Rate of 100%, a Threshold Value of 87.00% of the Starting Value (the midpoint of the Threshold Value

range of [90.00% to 84.00%] of the Starting Value) and the Capped Value of $15.00 per unit. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct

investment in the stocks included in the Basket Components, excluding dividends.

This graph has been prepared for purposes of illustration only. See the below table for a further illustration of the range of hypothetical payments at maturity.

Hypothetical Payments at Maturity

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical

returns on the notes. They illustrate the calculation of the Redemption Amount and total rate of return based on a hypothetical Starting Value of 100.00, a hypothetical Threshold Value of 87.00, the Participation Rate of 100%, the Capped Value of

$15.00 per unit and a range of hypothetical Ending Values. The actual amount you receive and the resulting total rate of return will depend on the actual Threshold Value, Ending Value and whether you hold the notes to

maturity. The following examples do not take into account any tax consequences from investing in the notes.

For recent hypothetical values of the Basket, see “The Basket” section below. For recent actual levels of the Basket Components, see “The Basket Components” section below. Each

Basket Component is a price return index and as such the Ending Value will not include any income generated by dividends or other distributions paid on the stocks included in any of the Basket Components, which you would otherwise be entitled to

receive if you invested in those stocks directly. In addition, all payments on the notes are subject to issuer credit risk. If TD, as issuer, becomes unable to meet its obligations as they become due, you could lose some or all of your investment.

|

|

|

Percentage Change from the

Starting Value to the Ending

Value

|

|

Redemption Amount per

Unit

|

|

Total Rate of Return on the

Notes

|

|

0.00

|

|

-100.00%

|

|

$1.30

|

|

-87.00%

|

|

25.00

|

|

-75.00%

|

|

$3.80

|

|

-62.00%

|

|

50.00

|

|

-50.00%

|

|

$6.30

|

|

-37.00%

|

|

60.00

|

|

-40.00%

|

|

$7.30

|

|

-27.00%

|

|

70.00

|

|

-30.00%

|

|

$8.30

|

|

-17.00%

|

|

80.00

|

|

-20.00%

|

|

$9.30

|

|

-7.00%

|

|

87.00(1)

|

|

-13.00%

|

|

$11.30

|

|

13.00%

|

|

90.00

|

|

-10.00%

|

|

$11.00

|

|

10.00%

|

|

95.00

|

|

-5.00%

|

|

$10.50

|

|

5.00%

|

|

100.00(2)

|

|

0.00%

|

|

$10.00

|

|

0.00%

|

|

115.00

|

|

15.00%

|

|

$11.50

|

|

15.00%

|

|

130.00

|

|

30.00%

|

|

$13.00

|

|

30.00%

|

|

145.00

|

|

45.00%

|

|

$14.50

|

|

45.00%

|

|

150.00

|

|

50.00%

|

|

$15.00(3)

|

|

50.00%

|

|

160.00

|

|

60.00%

|

|

$15.00

|

|

50.00%

|

|

170.00

|

|

70.00%

|

|

$15.00

|

|

50.00%

|

|

180.00

|

|

80.00%

|

|

$15.00

|

|

50.00%

|

| (1) |

This is the hypothetical Threshold Value.

|

| (2) |

The Starting Value will be set to 100.00 on the pricing date.

|

| (3) |

Any positive return based on the appreciation of the Basket cannot exceed the return represented by the Capped Value.

|

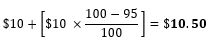

Redemption Amount Calculation Examples

|

Example 1

|

|

The Ending Value is 70.00, or 70.00% of the Starting Value:

|

|

Starting Value:

|

100.00

|

|

Threshold Value:

|

87.00

|

|

Ending Value:

|

70.00

|

|

|

Redemption Amount per unit

|

|

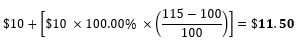

Example 2

|

The Ending Value is 95.00, or 95.00% of the Starting Value:

|

|

Starting Value:

|

100.00

|

| Threshold Value: |

87.00 |

|

Ending Value:

|

|

|

|

Redemption Amount per unit. Since the Ending Value is less than the Starting Value but equal to or greater than the Threshold Value, the Redemption Amount for the notes will be the principal

amount plus a positive return equal to the absolute value of the negative return of the Basket.

|

|

Example 3

|

|

The Ending Value is 115.00, or 115.00% of the Starting Value:

|

|

Starting Value:

|

100.00

|

|

Ending Value:

|

115.00

|

|

|

Redemption Amount per unit

|

|

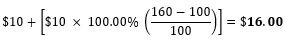

Example 4

|

The Ending Value is 160.00, or 160.00% of the Starting Value:

|

|

Starting Value:

|

100.00

|

|

Ending Value:

|

160.00

|

|

|

However, because any positive return based on the appreciation of the Basket cannot exceed the return represented by the Capped Value, the Redemption Amount will be $15.00 per unit

|

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should

carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-7 of product supplement EQUITY LIRN-1 and page 1 of the prospectus. We also urge you to consult your investment, legal,

tax, accounting and other advisors as to the risks entailed by an investment in the notes and the suitability of the notes in light of your particular circumstances before you invest in the notes.

Structure-Related Risks

|

◾ |

Depending on the performance of the Basket as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal.

|

|

◾ |

Any positive return on the notes is limited and may be less than a comparable investment directly in the stocks included in the Basket Components. The notes provide for a positive return if the value of the Basket increases or does not

decrease by more than [10.00% to 16.00%]. However, any positive return on the notes based on the appreciation of the Basket is limited to the return represented by the Capped Value and may be less than that of a comparable investment directly

in the stocks included in the Basket Components.

|

|

◾ |

Your potential for a positive return based on the depreciation of the Basket is limited by the Threshold Value and may be less than that of a comparable investment that takes a short position directly in the Basket Components (or the

stocks included in the Basket Components). In addition, the absolute value return feature applies only if the Ending Value is less than the Starting Value but greater than or equal to the Threshold Value. Because the Threshold Value will be

[90.00% to 84.00%] of the Starting Value, any positive return due to the depreciation of the Basket is limited to [10.00% to 16.00%] (the actual Threshold Value, and by extension, the cap on the positive return due to the depreciation of the

Basket, will be determined on the pricing date). Any decline in the Ending Value from the Starting Value by more than [10.00% to 16.00%] will result in a loss, rather than a positive return, on the notes. In contrast, for example, a short

position in the Basket Components (or the stocks included in the Basket Components) would allow you to receive the full benefit of any decrease in the level of the Basket Components (or the stocks included in the Basket Components).

|

|

◾ |

Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity

|

Market Measure-Related Risks

|

◾ |

Changes in the level of one or more of the Basket Components may be offset by changes in the levels of one or more of the other Basket Components. Due to the different initial Component Weights (as defined in “The Basket” section below),

changes in the levels of some Basket Components will have a more substantial impact on the value of the Basket than similar changes in the levels of the other Basket Components.

|

|

◾ |

An Index sponsor (as defined below) may adjust the relevant Basket Component in a way that may adversely affect its level and your interests, and has no obligation to consider your interests.

|

|

◾ |

You will have no rights of a holder of the securities included in the Basket Components or of a holder with a short position directly in the Basket Components (or of the securities included in the Basket Components) and you will not be

entitled to receive securities or dividends or other distributions by the issuers of the securities included in the Basket Components.

|

|

◾ |

While we, MLPF&S, BofAS, or our or their respective affiliates may from time to time own securities of companies included in the Basket Components, none of us, MLPF&S, BofAS, or our or their respective affiliates control any

company included in the Basket Components, and have not verified any disclosure made by any such company.

|

|

◾ |

Your return on the notes may be affected by factors affecting the international securities markets, specifically changes in the countries represented by the Basket Components. In addition, you will not obtain the benefit of any increase in

the value of the currencies in which the securities in the Basket Components trade against the U.S. dollar which you would have received if you had owned the securities in the Basket Components during the term of your notes, although the

value of the Basket may be adversely affected by the general exchange rate movements in the market.

|

Valuation- and Market-Related Risks

|

◾ |

The initial estimated value of your notes on the pricing date will be less than their public offering price. The difference between the public offering price of your notes and the initial estimated value of the notes reflects costs and

expected profits associated with selling and structuring the notes, as well as hedging our obligations under the notes (including, but not limited to, the hedging related charge, as further described under “Structuring the Notes” on page

TS-29). Because hedging our obligations entails risks and may be influenced by market forces beyond our control, this hedging may result in a profit that is more or less than expected, or a loss and the amount of any such profit or loss will

not be known until the maturity date.

|

|

◾ |

The initial estimated value of your notes is based on our internal funding rate. The internal funding rate used in the determination of the initial estimated value of the notes generally represents a discount from the credit spreads for

our conventional fixed-rate debt securities and the borrowing rate we would pay for our conventional fixed-rate debt securities. This discount is based on, among other things, our view of the funding value of the notes as well as the higher

issuance, operational and ongoing liability management costs of the notes in comparison to those costs for our conventional fixed-rate debt, as well as estimated financing

|

costs of any hedge positions (including, but not limited to, the hedging related charge, as further described under “Structuring the Notes” on page TS-29),

taking into account regulatory and internal requirements. If the interest rate implied by the credit spreads for our conventional fixed-rate debt securities, or the borrowing rate we would pay for our conventional fixed-rate debt securities were to

be used, we would expect the economic terms of the notes to be more favorable to you. Additionally, assuming all other economic terms are held constant, the use of an internal funding rate for the notes is expected to increase the initial estimated

value of the notes and have an adverse effect on the economic terms of the notes.

|

◾ |

The initial estimated value of the notes is based on our internal pricing models, which may prove to be inaccurate and may be different from the pricing models of other financial institutions, including BofAS and MLPF&S. The initial

estimated value of your notes when the terms of the notes are set on the pricing date is based on our internal pricing models, which take into account a number of variables, typically including the expected volatility of the Market Measure,

interest rates (forecasted, current and historical rates), price-sensitivity analysis, time to maturity of the notes and our internal funding rate, and are based on a number of subjective assumptions, which are not evaluated or verified on an

independent basis and may or may not materialize. Further, our pricing models may be different from other financial institutions’ pricing models, including those of BofAS and MLPF&S, and the methodologies used by us to estimate the value

of the notes may not be consistent with those of other financial institutions that may be purchasers or sellers of notes in any secondary market. As a result, the secondary market price of your notes, if any, may be materially less than the

initial estimated value of the notes determined by reference to our internal pricing models. In addition, market conditions and other relevant factors in the future may change and any assumptions may prove to be incorrect.

|

|

◾ |

The initial estimated value of your notes is not a prediction of the prices at which you may sell your notes in the secondary market, if any exists, and such secondary market prices, if any, will likely be less than the public offering

price of your notes, may be less than the initial estimated value of your notes and could result in a substantial loss to you. The initial estimated value of the notes will not be a prediction of the prices at which MLPF&S, BofAS, their

or our respective affiliates or third parties may be willing to purchase the notes from you in secondary market transactions (if they are willing to purchase, which they are not obligated to do). The price at which you may be able to sell

your notes in the secondary market at any time, if any, will be influenced by many factors that cannot be predicted, such as market conditions, and any bid and ask spread for similar sized trades, and may be substantially less than the

initial estimated value of the notes. Further, as secondary market prices of your notes take into account the levels at which our debt securities trade in the secondary market, and do not take into account our various costs and expected

profits associated with selling and structuring the notes, as well as hedging our obligations under the notes, secondary market prices of your notes will likely be less than the public offering price of your notes. As a result, the price at

which MLPF&S, BofAS, their or our respective affiliates or third parties may be willing to purchase the notes from you in secondary market transactions, if any, will likely be less than the price you paid for your notes, and any sale

prior to maturity could result in a substantial loss to you.

|

|

◾ |

A trading market is not expected to develop for the notes. None of us, any of our affiliates, MLPF&S or BofAS is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to

purchase your notes at any price in any secondary market.

|

Conflict-Related Risks

|

◾ |

Our business, hedging and trading activities, and those of MLPF&S, BofAS and our and their respective affiliates (including trades in shares of companies included in the Basket Components), and any hedging and trading activities we,

MLPF&S, BofAS or our or their respective affiliates engage in for our clients’ accounts, may affect the market value of, and return on, the notes and may create conflicts of interest with you.

|

|

◾ |

There may be potential conflicts of interest involving the calculation agents, one of which is us and one of which is BofAS, as the determinations made by the calculation agents may be discretionary and could adversely affect any payment

on the notes.

|

General Credit-Related Risks

|

◾ |

Payments on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of the notes. If we become unable to meet our financial obligations as they become due, you may

lose some or all of your investment.

|

Tax-Related Risks

|

◾ |

The U.S. federal income tax consequences of the notes are uncertain and, because of this uncertainty, there is a risk that the U.S. federal income tax consequences of the notes could differ materially and adversely from the treatment

described below in “Supplemental Discussion of U.S. Federal Income Tax Consequences”, as described further in product supplement EQUITY LIRN-1 under “Material U.S. Federal Income Tax Consequences — Alternative Treatments”. You should consult

your tax advisor as to the tax consequences of an investment in the notes and the potential alternative treatments.

|

|

◾ |

For a discussion of the Canadian federal income tax consequences of investing in the notes, please see the discussion in product supplement EQUITY LIRN-1 under “Supplemental Discussion of Canadian Tax Consequences” and under “Tax

Consequences – Canadian Taxation” in the accompanying prospectus. If you are not a Non-resident Holder (as that term is defined in the prospectus) for Canadian federal income tax purposes or if you acquire the notes in the secondary market,

you should consult your tax advisors as to the consequences of acquiring, holding and disposing of the notes and receiving the payments that might be due under the notes.

|

Additional Risk Factors

Additional Risk Factors Related to the Market Measure

Recent executive orders could adversely affect your investment in the notes.

Pursuant to an executive order issued by President Trump in November 2020, as amended in January 2021 and as further amended and partially superseded by an executive order issued

by President Biden in June 2021 (collectively, the “Executive Order”), U.S. persons are prohibited from engaging in transactions in publicly traded securities of certain companies that are determined to be linked to the People’s Republic of China

(the “PRC”) military, intelligence and security apparatus. The prohibition also covers any securities that are derivative of, or are designed to provide investment exposure to, such securities.

If the issuer of any of the component securities of the FTSE® China 50 Index is in the future designated as such a prohibited company, the value of such company may be

adversely affected, perhaps significantly, which would adversely affect the performance of the FTSE® China 50 Index. In addition, under these circumstances, FTSE Russell has publicly indicated that they expect to remove the securities of

any such prohibited company from the FTSE® China 50 Index. Any changes to the composition of the FTSE® China 50 Index in response to the Executive Order could adversely affect the performance of the FTSE® China 50

Index and, therefore, the market value of, and return on, the notes.

It is impossible to predict whether the securities of any particular company will become subject to the Executive Order or any similar executive action or other

legal restrictions. There is also no assurance that FTSE Russell would ultimately remove prohibited securities from the FTSE® China 50 Index. Although neither TD nor BofAS believe the notes to be subject to the Executive Order at this

time, it is possible that the Executive Order could be expanded or modified such that holding the notes or engaging in transactions relating to the notes could become restricted or prohibited. Any such restrictions or prohibitions may also cause the

value of the notes to be materially and adversely affected. You may suffer significant losses if you are forced to sell the notes prior to scheduled maturity or if you wish to sell the notes prior to scheduled maturity and are prohibited by law from

doing so.

Other Terms of the Notes

Closing Level

The “closing level” of a Basket Component will be its official closing level published by its Index sponsor (each as defined under “The Basket Components” herein) or any “successor index” (as defined in the product

supplement) on any Market Measure Business Day for such Basket Component, in each case as displayed on the relevant Bloomberg L.P. page or any successor page or service.

Market Measure Business Day

The following definition shall supersede and replace the definition of a “Market Measure Business Day” set forth in product supplement EQUITY LIRN-1:

A “Market Measure Business Day” means a day on which:

|

(A) |

each of the Eurex (as to the EURO STOXX 50® Index), the London Stock Exchange (as to the FTSE® 100 Index), the Tokyo Stock Exchange (as to the Nikkei Stock Average Index), the SIX Swiss Exchange (as to the Swiss

Market Index®), the Australian Stock Exchange (as to the S&P/ASX 200 Index) and the Stock Exchange of Hong Kong (as to the FTSE® China 50 Index) (or any successor to the foregoing exchanges) are open for trading;

and

|

|

(B) |

the Basket Components or any successors thereto are calculated and published.

|

The Basket

The Basket is designed to allow investors to participate in the percentage changes in the levels of the Basket Components from the Starting Value to the Ending Value of the Basket. The Basket

Components are described in the section “The Basket Components” below. Each Basket Component will be assigned an initial weight on the pricing date, as set forth in the table below.

For more information on the calculation of the value of the Basket, please see the section entitled “Description of LIRNs—Basket Market Measures” beginning on page PS-35 of product supplement EQUITY

LIRN-1.

If July 6, 2023 were the pricing date, for each Basket Component, the Initial Component Weight, the closing level, the hypothetical Component Ratio and the initial contribution to the Basket value

would be as follows:

|

Basket Component

|

|

Bloomberg

Symbol

|

|

Initial

Component

Weight

|

|

Closing

Level(1)(2)

|

|

Hypothetical

Component

Ratio(1)(3)

|

|

Initial Basket

Value

Contribution

|

|

EURO STOXX 50® Index

|

|

SX5E

|

|

40.00%

|

|

|

|

|

|

40.00

|

|

FTSE® 100 Index

|

|

UKX

|

|

20.00%

|

|

|

|

|

|

20.00

|

|

Nikkei Stock Average Index

|

|

NKY

|

|

20.00%

|

|

|

|

|

|

20.00

|

|

Swiss Market Index®

|

|

SMI

|

|

7.50%

|

|

|

|

|

|

7.50

|

|

S&P/ASX 200 Index

|

|

AS51

|

|

7.50%

|

|

|

|

|

|

7.50

|

|

FTSE® China 50 Index

|

|

XIN0I

|

|

5.00%

|

|

|

|

|

|

5.00

|

| |

|

|

|

|

|

|

|

Starting Value

|

|

100.00

|

|

(1) |

The actual closing level of each Basket Component and the resulting actual Component Ratios will be determined on the pricing date, subject to adjustment as more fully described in the section entitled “Description of LIRNs—Basket Market

Measures—Determination of the Component Ratio for Each Basket Component” beginning on page PS-35 of product supplement EQUITY LIRN-1 if a Market Disruption Event occurs on the pricing date as to any Basket Component.

|

|

(2) |

These were the closing levels of the Basket Components on July 6, 2023.

|

|

(3) |

Each hypothetical Component Ratio equals the Initial Component Weight of the relevant Basket Component (as a percentage) multiplied by 100.00, and then divided by the closing level of that Basket Component on July 6, 2023 and rounded to

eight decimal places.

|

The calculation agent will calculate the value of the Basket on each calculation day during the Maturity Valuation Period by summing the products of the closing level for each Basket Component on such calculation day

and the Component Ratio applicable to such Basket Component. If a Market Disruption Event occurs as to any Basket Component on any scheduled calculation day, the closing level of that Basket Component will be determined as more fully described

beginning on page PS-36 of product supplement EQUITY LIRN-1 in the section “Description of LIRNs—Basket Market Measures—Ending Value of the Basket”.

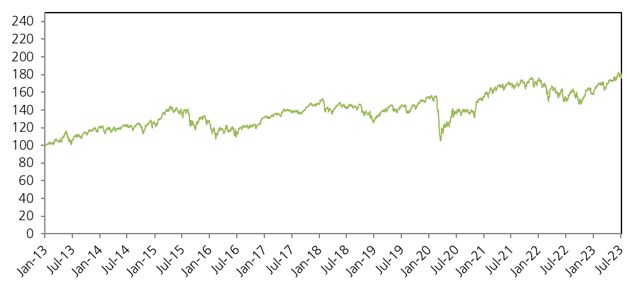

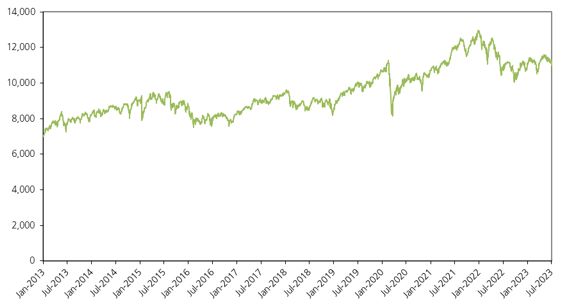

While actual historical information on the Basket will not exist before the pricing date, the following graph sets forth the hypothetical historical performance

of the Basket from January 1, 2013 through July 6, 2023. The graph is based upon actual daily historical levels of the Basket Components, hypothetical Component Ratios based on the closing levels of the Basket Components as of December 31, 2012, and

a Basket value of 100.00 as of that date. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may be. Any hypothetical historical upward or downward

trend in the value of the Basket during any period set forth below is not an indication that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

Hypothetical Historical Performance of the Basket

The Basket Components

All disclosures contained in this term sheet regarding the Basket Components, including, without limitation, their make-up, method of calculation, and changes in their components, have been derived

from publicly available sources. The information reflects the policies of, and is subject to change by each of STOXX Limited (“STOXX”) with respect to the EURO STOXX 50® Index (the “SX5E”), FTSE International Limited (“FTSE”) with respect

to the FTSE® 100 Index and the FTSE® China 50 Index (the “UKX” and the “XIN0I”, respectively), Nikkei Inc. (“Nikkei”) with respect to the Nikkei 225 Index (the “NKY”), S&P Dow Jones Indices LLC (“S&P”), a division of

S&P Global, with respect to the S&P/ASX 200 Index (the “AS51”) and the Geneva, Zurich, SIX Group Ltd., certain of its subsidiaries, and the Management Committee of the SIX Swiss Exchange (the “SIX Exchange”), with respect to the Swiss Market

Index® (the “SMI”) (STOXX, FTSE, Nikkei, S&P and Six Exchange together, the “Index sponsors”). The Index sponsors have no obligation to continue to publish, and may discontinue or suspend the publication of any Basket Component at any

time. The consequences of any Index sponsor discontinuing publication of a Basket Component are discussed in the section entitled “Description of LIRNs—Discontinuance of an Index” beginning on page PS-30 of product supplement EQUITY LIRN-1. None of

us, the calculation agent, MLPF&S, or BofAS accepts any responsibility for the calculation, maintenance or publication of any Basket Component or any successor index.

The EURO STOXX 50® Index

The SX5E is a capitalization-weighted index of 50 European blue-chip stocks in 11 Eurozone countries. Publication of the SX5E began on February 26, 1998, based on an initial index value of 1,000 at December 31, 1991.

The level of the SX5E is disseminated on, and additional information about the SX5E is published on, the STOXX website. Information contained in the STOXX website is not incorporated by reference in, and should not be considered a part of, this term

sheet.

Select information regarding top constituents, industry and/or sector weightings and country weightings may be made available by STOXX on its website.

Index Composition and Maintenance

For each of the 20 EURO STOXX regional supersector indices, the stocks are ranked in terms of free-float market capitalization. The largest stocks are added to the selection list until the coverage is close to, but

still less than, 60% of the free-float market capitalization of the corresponding supersector index. If the next highest-ranked stock brings the coverage closer to 60% in absolute terms, then it is also added to the selection list. All current stocks

in the SX5E are then added to the selection list. All of the stocks on the selection list are then ranked in terms of free-float market capitalization to produce the final index selection list. The largest 40 stocks on the selection list are

selected; the remaining 10 stocks are selected from the largest remaining current stocks ranked between 41 and 60; if the number of stocks selected is still below 50, then the largest remaining stocks are selected until there are 50 stocks. In

exceptional cases, STOXX’s management board can add stocks to and remove them from the selection list.

The SX5E components are subject to a capped maximum index weight of 10%, which is applied on a quarterly basis.

The composition of the SX5E is reviewed annually, based on the closing stock data on the last trading day in August. Changes in the composition of the SX5E are made to ensure that the SX5E includes the 50 market sector

leaders from within the SX5E.

The SX5E is subject to a “fast exit rule.” The SX5E components are monitored for any changes based on the monthly selection list ranking. A stock is deleted from the SX5E if: (a) it ranks 75 or below on the monthly

selection list and (b) it ranked 75 or below on the selection list of the previous month. The highest-ranked stock that is not an SX5E component will replace it. Changes will be implemented on the close of the fifth trading day of the month, and are

effective the next trading day.

The SX5E is also subject to a “fast entry rule.” All stocks on the latest selection lists and initial public offering (IPO) stocks are reviewed for a fast-track addition on a quarterly basis. A stock is added, if (a)

it qualifies for the latest STOXX blue-chip selection list generated at the end of February, May, August or November and (b) it ranks within the “lower buffer” (ranks 1-25) on this selection list.

The SX5E is also reviewed on an ongoing basis. Corporate actions (including initial public offerings, mergers and takeovers, spin-offs, delistings, and bankruptcy) that affect the SX5E composition are immediately

reviewed. Any changes are announced, implemented, and effective in line with the type of corporate action and the magnitude of the effect.

Index Calculation

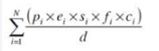

The SX5E is calculated with the “Laspeyres formula,” which measures the aggregate price changes in the component stocks against a fixed base quantity weight. The formula for calculating the SX5E value can be expressed

as follows:

Index = free float market capitalization of the Index at the time

divisor of the Index at the time

The “free float market capitalization of the Index” is equal to the sum of the products of the closing price, number of shares, free float factor, and weighting cap factor for the component company as of the time that

the SX5E is being calculated.

The SX5E is calculated using a divisor that helps to maintain the continuity of the SX5E’s value so that corporate actions do not artificially increase or decrease the level of the SX5E. The divisor of the SX5E is

adjusted to maintain the continuity of the SX5E’s values across changes due to corporate actions, such as cash dividends, rights offerings, stock dividends from treasury shares, repurchases of shares and self-tender, and spin-offs.

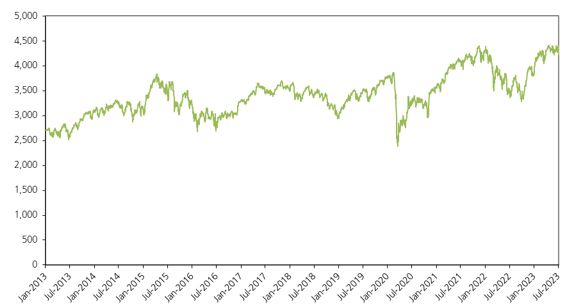

The following graph shows the daily historical performance of the SX5E in the period from January 1, 2013 through July 6, 2023. We obtained this historical data

from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On July 6, 2023, the closing level of the SX5E was 4,223.09.

Historical Performance of the EURO STOXX 50® Index

This historical data on the SX5E is not necessarily indicative of the future performance of the SX5E or what the value of the notes may be. Any historical upward or downward trend in

the level of the SX5E during any period set forth above is not an indication that the level of the SX5E is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the SX5E.

License Agreement

We have entered into a non-exclusive license agreement with STOXX Limited providing for the license to us and certain of our affiliated or subsidiary companies, in exchange for a fee, of the right to

use indices owned and published by STOXX Limited (including the SX5E) in connection with certain securities, including the notes offered hereby.

The license agreement between us and STOXX Limited requires that the following language be stated in this document:

STOXX Limited has no relationship to us, other than the licensing of the SX5E and the related trademarks for use in connection with the notes. STOXX Limited does not:

|

• |

sponsor, endorse, sell, or promote the notes;

|

|

• |

recommend that any person invest in the notes offered hereby or any other securities;

|

|

• |

have any responsibility or liability for or make any decisions about the timing, amount, or pricing of the notes;

|

|

• |

have any responsibility or liability for the administration, management, or marketing of the notes; or

|

|

• |

consider the needs of the notes or the holders of the notes in determining, composing, or calculating the SX5E, or have any obligation to do so.

|

STOXX Limited will not have any liability in connection with the notes. Specifically:

|

• |

STOXX Limited does not make any warranty, express or implied, and disclaims any and all warranty concerning:

|

|

• |

the results to be obtained by the notes, the holders of the notes or any other person in connection with the use of the SX5E and the data included in the SX5E;

|

|

• |

the accuracy or completeness of the SX5E and its data;

|

|

• |

the merchantability and the fitness for a particular purpose or use of the SX5E and its data;

|

|

• |

STOXX Limited will have no liability for any errors, omissions, or interruptions in the SX5E or its data; and

|

|

• |

Under no circumstances will STOXX Limited be liable for any lost profits or indirect, punitive, special, or consequential damages or losses, even if STOXX Limited knows that they might occur.

|

The licensing agreement between us and STOXX Limited is solely for their benefit and our benefit, and not for the benefit of the holders of the notes or any other third parties.

The FTSE® 100 Index

The UKX is a market-capitalization weighted index calculated, published and disseminated by FTSE, an independent company wholly owned by the London Stock Exchange Group (the “LSE”). The UKX is designed

to measure the composite performance of the 100 largest UK domiciled blue chip companies that pass screening for size and liquidity traded on the LSE. The UKX was launched on January 3, 1984 and has a base date of December 30, 1983. The UKX is

reported by Bloomberg under the ticker symbol “UKX.”

The UKX is calculated by (i) multiplying the per share price of each stock included in the UKX by the number of outstanding shares and by the free float factor applicable to such stock, (ii)

calculating the sum of all these products (such sum referred to hereinafter as the “FTSE Aggregate Market Value”) as of the starting date of the UKX and (iii) dividing the FTSE Aggregate Market Value by a divisor which represents the total issued

share capital of the UKX on the base date and which can be adjusted to allow changes in the issued share capital of individual underlying stocks (including the deletion and addition of stocks, the substitution of stocks, stock dividends and stock

splits) to be made without distorting the UKX. Because of such capitalization weighting, movements in share prices of companies with relatively larger market capitalization will have a greater effect on the level of the entire UKX than will movements

in share prices of companies with relatively smaller market capitalization.

The 100 stocks included in the UKX (the “FTSE 100 Index Underlying Stocks”) were selected from a reference group of stocks trading on the LSE which were selected by excluding certain stocks that have

low liquidity based on public float, accuracy and reliability of prices, size and number of trading days. The FTSE 100 Index Underlying Stocks were selected from this reference group by selecting 100 stocks with the largest market value. A list of

the issuers of the FTSE 100 Index Underlying Stocks is available from FTSE. The UKX is reviewed quarterly by the FTSE Europe/Middle East/Africa Regional Committee (the “Committee”) in order to maintain continuity in the level. The FTSE 100 Index

Underlying Stocks may be replaced, if necessary, in accordance with deletion/addition rules which provide generally for the removal and replacement of a stock from the UKX if such stock is delisted or its issuer is subject to a takeover offer that

has been declared unconditional or it has ceased to be a viable component of the UKX. To maintain continuity, a stock will be added at the quarterly review if it has risen to 90th place or above and a stock will be deleted if at the quarterly review

it has fallen to 111th place or below, in each case ranked on the basis of market value.

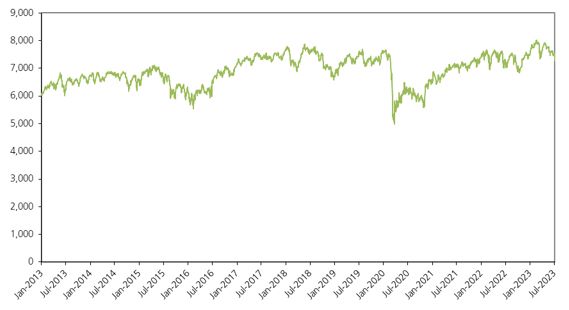

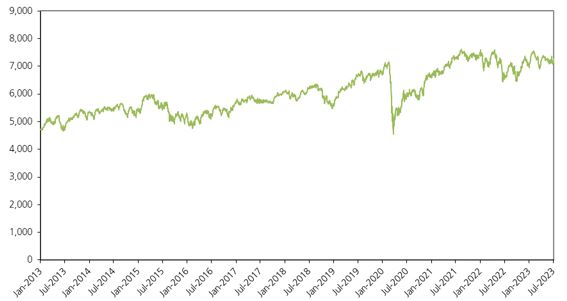

The following graph shows the daily historical performance of the UKX in the period from January 1, 2013 through July 6, 2023. We obtained this historical data

from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On July 6, 2023, the closing level of the UKX was 7,280.50.

Historical Performance of the FTSE® 100 Index

This historical data on the UKX is not necessarily indicative of the future performance of the UKX or what the value of the notes may be. Any historical upward or

downward trend in the level of the UKX during any period set forth above is not an indication that the level of the UKX is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the UKX.

License Agreement

We have entered into a non-exclusive license agreement with FTSE, whereby we and our affiliates and subsidiary companies, in exchange for a fee, will be permitted to use the UKX, which is owned and

published by FTSE, in connection with certain products, including the notes.

Neither FTSE nor the LSE makes any representation or warranty, express or implied, to the depositors of the notes or any member of the public regarding the advisability of investing in structured

products generally or in the notes particularly, or the ability of the UKX to track general stock market performance. FTSE and the LSE’s only relationship with the Issuer is the licensing of certain trademarks and trade names of FTSE, respectively,

without regard to the Issuer or the notes. FTSE and the LSE have no obligation to take the needs of the Issuer or the depositors of the notes into consideration in determining, composing or calculating the UKX. Neither FTSE nor the LSE is responsible

for and has not participated in the determination of the timing, price or quantity of the notes to be issued or in the determination or calculation of the amount due at maturity of the notes. Neither FTSE nor the LSE has any obligation or liability

in connection with the administration, marketing or trading of the notes.

The notes are not in any way sponsored, endorsed, sold or promoted by FTSE or the LSE, and neither FTSE nor the LSE makes any warranty or representation whatsoever, expressly or impliedly, either as to

the results to be obtained from the use of the UKX and/or the figure at which the said component stands at any particular time on any particular day or otherwise. The UKX is compiled and calculated by FTSE. However, neither FTSE nor the LSE shall be

liable (whether in negligence or otherwise) to any person for any error in the UKX and neither FTSE nor the LSE shall be under any obligation to advise any person of any error therein.

“FTSE®”, “FTSETM”, “FT-SE®” and “Footsie®” are trademarks of the London Stock Exchange Plc and The Financial Times Limited and are used by FTSE International Limited

under license. “All-World”, “All-Share” and “All-Small” are trademarks of FTSE International Limited.

The Nikkei Stock Average Index

The NKY is a stock index that measures the composite price performance of selected Japanese stocks. The NKY is based on 225 underlying stocks (the “Nikkei Underlying Stocks”) trading on the Tokyo Stock

Exchange (“TSE”), representing a broad cross-section of Japanese industries. All 225 Nikkei Underlying Stocks are stocks listed in the First Section of the TSE. Stocks listed in the First Section of the TSE are among the most actively traded stocks

on the TSE. Nikkei’s rules require that the 75 most liquid issues (one-third of the component count of the NKY) be included in the NKY. Nikkei first calculated and published the NKY in 1970; prior to 1970, the TSE calculated the NKY. The NKY is

reported by Bloomberg under the ticker symbol “NKY.”

The 225 companies included in the NKY are divided into six sector categories: Technology, Financials, Consumer Goods, Materials, Capital Goods/Others and Transportation and

Utilities. These six sector categories are further divided into 36 industrial classifications as follows:

|

◾ |

Technology — Pharmaceuticals, Electrical Machinery, Automobiles, Precision Machinery, Telecommunications;

|

|

◾ |

Financials — Banks, Miscellaneous Finance, Securities, Insurance;

|

|

◾ |

Consumer Goods — Marine Products, Food, Retail, Services;

|

|

◾ |

Materials — Mining, Textiles, Paper and Pulp, Chemicals, Oil, Rubber, Ceramics, Steel, Nonferrous Metals, Trading Houses;

|

|

◾ |

Capital Goods/Others — Construction, Machinery, Shipbuilding, Transportation Equipment, Miscellaneous Manufacturing, Real Estate; and

|

|

◾ |

Transportation and Utilities — Railroads and Buses, Trucking, Shipping, Airlines, Warehousing, Electric Power, Gas.

|

Calculation of the NKY

The NKY is a modified, price-weighted index (i.e., a Nikkei Underlying Stock’s weight in the NKY is based on its price per share rather than the total market

capitalization of the issuer) which is calculated by (i) multiplying the per share price of each Nikkei Underlying Stock by the corresponding weighting factor for such Nikkei Underlying Stock (a “Weight Factor”), (ii) calculating the sum of all these

products and (iii) dividing such sum by a divisor (the “Divisor”). The Divisor was initially set at 225 for the date of May 16, 1949 (the date on which the TSE was reopened after World War II) using historical numbers from that date. The Divisor is

subject to periodic adjustments as set forth below. Each Weight Factor is computed by dividing ¥50 by the presumed par value of the relevant Nikkei Underlying Stock, so that the share price of each Nikkei Underlying Stock when multiplied by its

Weight Factor corresponds to a share price based on a uniform par value of ¥50. The stock prices used in the calculation of the NKY are those reported by a primary market for the Nikkei Underlying Stocks (currently the TSE). The level of the NKY is

calculated once every 15 seconds during TSE trading hours.

In order to maintain continuity in the NKY in the event of certain changes due to non-market factors affecting the Nikkei Underlying Stocks, such as the addition or deletion of stocks, substitution of

stocks, stock splits or distributions of assets to stockholders, the Divisor used in calculating the NKY is adjusted in a manner designed to prevent any instantaneous change or discontinuity in the level of the NKY. Thereafter, the Divisor remains at

the new value until a further adjustment is necessary as the result of another change. As a result of such change affecting any Nikkei Underlying Stock, the Divisor is adjusted in such a way that the sum of all share prices immediately after the

change multiplied by the applicable Weight Factor and divided by the new Divisor (i.e., the level of the NKY immediately after such change) will equal the level of the NKY immediately prior to the change.

Standards for Listing and Maintenance

A Nikkei Underlying Stock may be deleted or added by Nikkei. Any stock becoming ineligible for listing in the First Section of the TSE due to any of the following reasons will be deleted from the

Nikkei Underlying Stocks: (i) bankruptcy of the issuer, (ii) merger of the issuer with, or acquisition of the issuer by, another company, (iii) delisting of such stock, (iv) transfer of such stock to the “Seiri-Meigara” because of excess debt of the

issuer or because of any other reason or (v) transfer of such stock to the Second Section. In addition, a component stock transferred to the “Kanri-Meigara” (posts for stocks under supervision) becomes a candidate for deletion. Nikkei Underlying

Stocks with relatively low liquidity, based on trading value and rate of price fluctuation over the past five years, may be deleted by Nikkei. Upon deletion of a stock from the Nikkei Underlying Stocks, Nikkei will select a replacement for such

deleted Nikkei Underlying Stock in accordance with certain criteria. In an exceptional case, a newly listed stock in the First Section of the TSE that is recognized by Nikkei to be representative of a market may be added to the Nikkei Underlying

Stocks. In such a case, an existing Nikkei Underlying Stock with low trading volume and deemed not to be representative of a market will be deleted by Nikkei.

A list of the issuers of the Nikkei Underlying Stocks constituting the NKY is published by Nikkei. Nikkei may delete, add or substitute any stock underlying the NKY.

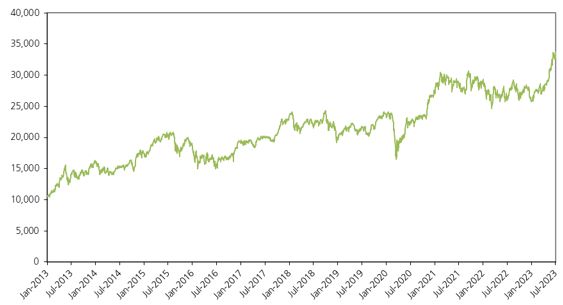

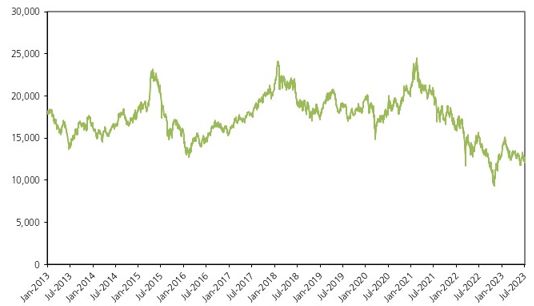

The following graph shows the daily historical performance of the NKY in the period from January 1, 2013 through July 6, 2023. We obtained this historical data

from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On July 6, 2023, the closing level of the NKY was 32,773.02.

Historical Performance of the Nikkei Stock Average Index

This historical data on the NKY is not necessarily indicative of the future performance of the NKY or what the value of the notes may be. Any historical upward or

downward trend in the level of the NKY during any period set forth above is not an indication that the level of the NKY is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the NKY.

License Agreement

TD is expected to enter into an agreement with Nikkei providing us with a non-exclusive license with the right to use the NKY in exchange for a fee. The NKY is the intellectual property of Nikkei.

“Nikkei,” “Nikkei Stock Average,” “Nikkei Average,” and “Nikkei 225” are the service marks of Nikkei. Nikkei reserves all the rights, including copyright, to the NKY.

The notes are not in any way sponsored, endorsed or promoted by Nikkei. Nikkei does not make any warranty or representation whatsoever, express or implied, either as to the results to be obtained as to

the use of the NKY or the figure as which the NKY stands at any particular day or otherwise. The NKY is compiled and calculated solely by Nikkei. However, Nikkei shall not be liable to any person for any error in the NKY and Nikkei shall not be under

any obligation to advise any person, including a purchaser or seller of the notes, of any error therein.

In addition, Nikkei gives no assurance regarding any modification or change in any methodology used in calculating the NKY and is under no obligation to continue the calculation, publication and

dissemination of the NKY.

The Swiss Market Index®

The Swiss Market Index® (Bloomberg ticker “SMI”):

|

◾ |

was first launched with a base level of 1,500 as of June 30, 1988; and

|

|

◾ |

is sponsored, calculated, published and disseminated by the SIX Exchange.

|

The SMI is a price return float-adjusted market capitalization-weighted index of the 20 largest stocks traded on the Swiss Stock Exchange. The Management Committee of SIX Swiss Exchange is supported by

an Index Commission (advisory board) in all index-related matters, notably in connection with changes to the SMI rules and adjustments, additions and exclusions outside of the established review and acceptance period. The Index Commission meets at

least twice annually.

Index Composition and Selection Criteria

The SMI is comprised of the 20 highest ranked stocks traded on the Swiss Stock Exchange that have a free float of 20% or more and that are not investment companies. The equity universe is largely Swiss

domestic companies; however, in some cases, foreign issuers with a primary listing on the Swiss Stock Exchange or investment companies that do not hold any shares of any other eligible company and that have a primary listing on the Swiss Stock

Exchange may be included.

The ranking of each security is determined by a combination of the following criteria:

|

◾ |

average free-float market capitalization (compared to the capitalization of the entire Swiss Stock Exchange index family), and

|

|

◾ |

cumulative on order book turnover (compared to the total turnover of the Swiss Stock Exchange index family).

|

Each of these two factors is assigned a 50% weighting in ranking the stocks eligible for the SMI.

The SMI is reconstituted annually after prior notice of at least two months on the third Friday in September after the close of trading.

The reconstitution is based on data from the previous July 1 through June 30. Provisional interim selection (ranking) lists are also published following the end of the third, fourth and first financial

quarters.

In order to reduce turnover, an index constituent will not be replaced unless it is ranked below 23 or, if it is ranked 21 or 22, if another share ranks 18 or higher. If a company has primary listings

on several exchanges and less than 50% of that company’s total turnover is generated on the Swiss Stock Exchange, it will not be included in the SMI unless it ranks at least 18 or better on the selection list on the basis of its turnover alone (i.e.,

without considering its free float).

Maintenance of the SMI

Constituent Changes. In the case of major market changes as a result of capital events such as mergers or new listings, the Management Committee of SIX Swiss

Exchange can decide at the request of the Index Commission that a security should be admitted to the SMI outside the annual review period as long as it clearly fulfills the criteria for inclusion. For the same reasons, a security can also be excluded

if the requirements for admission to the SMI are no longer fulfilled. As a general rule, extraordinary acceptances into the SMI take place after a three-month period on a quarterly basis after the close of trading on the third Friday of March, June,

September and December (for example, a security listed on or before the fifth trading day prior to the end of November cannot be included until the following March). An announced insolvency is deemed to be an extraordinary event and the security will

be removed from the SMI with five trading days’ prior notice if the circumstances permit such notice.

Number of Shares and Free Float. The securities included in the SMI are weighted according to their free float. This means that shares deemed to be in firm

hands are subtracted from the total market capitalization of that company. The free float is calculated on the basis of outstanding shares. Issued and outstanding equity capital is, as a rule, the total amount of equity capital that has been fully

subscribed and wholly or partially paid in and documented in the Commercial Register. Not counting as issued and outstanding equity capital are the approved capital and the conditional capital of a company. The free float is calculated on the basis

of listed shares only. If a company offers several different categories of listed participation rights, each is treated separately for purposes of index calculation.

Shares held deemed to be in firm hands are shareholdings that have been acquired by one person or a group of persons in companies domiciled in Switzerland and which, upon exceeding 5%, have been

reported to the SIX Exchange. Shares of persons and groups of persons who are subject to a shareholder agreement which is binding for more than 5% of the listed shares or who, according to publicly known facts, have a long-term interest in a company,

are also deemed to be in firm hands.

For the calculation of the number of shares in firm hands, the SIX Exchange may also use other sources than the reports submitted to it. In particular, the SIX Exchange may use data gained from issuer

surveys that it conducts itself.

In general, shares held by custodian nominees, trustee companies, investment funds, pension funds and investment companies are deemed free-floating regardless whether a report has been made to the SIX

Exchange. The SIX Exchange classifies at its own discretion persons and groups of persons who, because of their area of activity or the absence of important information, cannot be clearly assigned.

The free-float rule applies only to bearer shares and registered shares. Capital issued in the form of participation certificates and bonus certificates is taken into full account in calculating the

SMI because it does not confer voting rights.

The number of securities in the SMI and the free-float factors are adjusted after the close of trading on four adjustment dates per year, the third Friday of March, June, September and December. Such

changes are pre-announced at least one month before the adjustment date, although the Index sponsor reserves the right to take account of recent changes before the adjustment date in the actual adjustment, so the definite new securities are announced

five trading days before the adjustment date.

In order to avoid frequent slight changes to the weighting and to maintain the stability of the SMI, any extraordinary change of the total number of outstanding securities or the free float will only

result in an extraordinary adjustment if it exceeds 10% and 5% respectively and is in conjunction with a corporate action.

After a takeover, Six Exchange may, in exceptional cases, adjust the free float of a company upon publication of the end results after a five-day notification period or may exclude the security from

the relevant index family. When an insolvency has been announced, an extraordinary adjustment will be made and the affected security will be removed from the SMI after five trading days’ notice.

The Index sponsor reserves the right to make an extraordinary adjustment, in exceptional cases, without observing the notification period.

Calculation of the Index

The Index sponsor calculates the SMI using the “Laspeyres formula,” with a weighted arithmetic mean of a defined number of securities issues. The formula for calculating the index value can be

expressed as follows:

|

Index =

|

Free Float Market Capitalization of the index

Divisor

|

The “free float market capitalization of the index” is equal to the sum of the product of the last-paid price, the number of shares, the free-float factor and, if a foreign stock is included, the current CHF exchange

rate as of the time the index value is being calculated. The index value is calculated in real time and is updated whenever a trade is made in a component stock. Where any index component stock price is unavailable on any trading day, Six Exchange

will use the last reported price for such component stock. Only prices from the SIX Exchange’s electronic order book are used in calculating the SMI.

Divisor Value and Adjustments

The divisor is a technical number used to calculate the SMI and is adjusted to reflect changes in market capitalization due to corporate events, and is adjusted by Six Exchange to reflect corporate events, as described

in the SMI rules.

The following graph shows the daily historical performance of the SMI in the period from January 1, 2013 through July 6, 2023. We obtained this historical data

from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On July 6, 2023, the closing level of the SMI was 10,986.78.

Historical Performance of the Swiss Market Index®

This historical data on the SMI is not necessarily indicative of the future performance of the SMI or what the value of the notes may be. Any historical upward or downward trend in

the level of the SMI during any period set forth above is not an indication that the level of the SMI is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the SMI.

License Agreement

We have entered into a non-exclusive license agreement with SIX Swiss Exchange, whereby we and our affiliates and subsidiary companies, in exchange for a fee, will be permitted to use the SMI, which is

owned and published by SIX Swiss Exchange, in connection with certain products, including the notes.

These notes are not in any way sponsored, endorsed, sold or promoted by the SIX Swiss Exchange and the SIX Swiss Exchange makes no warranty or representation whatsoever, express or implied, either as

to the results to be obtained from the use of the SMI and/or the figure at which the SMI stands at any particular time on any particular day or otherwise. However, the SIX Swiss Exchange shall not be liable (whether in negligence or otherwise) to any

person for any error in the SMI and the SIX Swiss Exchange shall not be under any obligation to advise any person of any error therein.

SIX Group, SIX Swiss Exchange, SPI, Swiss Performance Index (SPI), SPI EXTRA, SPI ex SLI, SMI, Swiss Market Index (SMI), SMI MID (SMIM), SMI Expanded, SXI, SXI Real Estate, SXI Swiss Real Estate,

SXI Life Sciences, SXI Bio+Medtech, SLI, SLI Swiss Leader Index, SBI, SBI Swiss Bond Index, SAR, SAR SWISS AVERAGE RATE, SARON, SCR, SCR SWISS CURRENT RATE, SCRON, SAION, SCION, VSMI and SWX Immobilienfonds Index are trademarks that have been

registered in Switzerland and/or abroad by SIX Group Ltd respectively SIX Swiss Exchange. Their use is subject to a license.

The S&P/ASX 200 Index

The S&P/ASX 200 Index (Bloomberg ticker “AS51”):

|

◾ |

was first launched in 1979 by the Australian Securities Exchange and was acquired and re-launched by its current Index sponsor on April 3, 2000; and

|

|

◾ |

is sponsored, calculated, published and disseminated by S&P.

|

The AS51 includes 200 companies and covers approximately 80% of the Australian equity market by market capitalization. As discussed below, the AS51 is not limited solely to companies having their

primary operations or headquarters in Australia or to companies having their primary listing on the Australian Securities Exchange (the “ASX”). All ordinary and preferred shares (if such preferred shares are not of a fixed income nature) listed on

the ASX, including secondary listings, are eligible for the AS51. Hybrid stocks, bonds, warrants, preferred stock that provides a guaranteed fixed return and listed investment companies are not eligible for inclusion.

The AS51 is intended to provide exposure to the largest 200 eligible securities that are listed on the ASX by float-adjusted market capitalization. Constituent companies for the AS51 are chosen based

on market capitalization, public float and liquidity. All index-eligible securities that have their primary or secondary listing on the ASX are included in the initial selection of stocks from which the 200 index stocks may be selected.

The float-adjusted market capitalization of companies is determined based on the daily average market capitalization over the last six months. The security’s price history over the last six months, the

latest available shares on issue and the investable weight factor (the “IWF”), are the factors relevant to the calculation of daily average market capitalization. The IWF is a variable that is primarily used to determine the available float of a

security for ASX listed securities.

Number of Shares

When considering the index eligibility of securities for inclusion or promotion into S&P/ASX indices, the number of index securities under consideration is based upon the latest available ASX

quoted securities. For domestic securities (companies incorporated in Australia and traded on the ASX, companies incorporated overseas but exclusively listed on the ASX and companies incorporated overseas and traded on other markets but most of its

trading activity is on the ASX), this figure is purely based upon the latest available data from the ASX.

Foreign-domiciled securities may quote the total number of securities on the ASX that is representative of their global equity capital; whereas other foreign-domiciled securities may quote securities

on the ASX on a partial basis that represents their Australian equity capital. In order to overcome this inconsistency, S&P will quote the number of index securities that are represented by CHESS Depositary Interests (“CDIs”) for a foreign

entity. When CDIs are not issued, S&P will use the total securities held on the Australian register (CHESS and, where supplied, the issuer sponsored register). This quoted number for a foreign entity is representative of the Australian equity

capital, thereby allowing the AS51 to be increasingly reflective of the Australian market.

The number of CDIs or shares of a foreign entity quoted on the ASX can experience more volatility than is typically the case for ordinary shares on issue. Therefore, an average number on issue will be

applied over a six-month period.