2024

Proxy Statement

| ☐ | Preliminary proxy statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive proxy statement |

| ☐ | Definitive additional materials |

| ☐ | Soliciting material pursuant to § 240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

2024

Proxy Statement

Dear

Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Banner Corporation, which will be held on Wednesday, May 22, 2024, at 10:00 a.m., Pacific Time. Our 2024 annual meeting of shareholders will be a virtual meeting conducted solely online via live webcast. There is no physical location for the annual meeting. The online meeting format will facilitate remote shareholder attendance and participation, including the ability to vote your shares electronically and submit questions during the meeting.

You can attend the meeting by visiting https://meetnow.global/MULJV4V. To participate in the annual meeting, registered shareholders will need the control number included on their proxy card and all other shareholders will need to follow the instructions that accompanied their proxy materials.

The Notice of Annual Meeting of Shareholders and Proxy Statement describe the formal business to be transacted at the meeting. Directors and officers of Banner Corporation, as well as a representative of Moss Adams LLP, our independent registered public accounting firm, will be available to respond to shareholder questions. We intend to answer questions pertinent to our business immediately following the formal meeting of shareholders.

It is important that your shares are represented at the meeting, whether or not you attend the meeting virtually and regardless of the number of shares you own. To make sure your shares are represented, we urge you to vote promptly. You may vote your shares via the Internet or a toll-free telephone number, or by completing and mailing your proxy card. If you attend the virtual meeting as a shareholder, you may vote your shares at that time even if you have previously submitted your proxy.

We hope you can attend the virtual meeting.

Sincerely,

Mark J. Grescovich

President and Chief Executive Officer

April 9, 2024

Notice of Annual Meeting

of Shareholders

|

Date Wednesday, May 22, 2024 |

Time 10:00 a.m., Pacific Time |

Record Date March 21, 2024 | ||

|

Location Online at https://meetnow.global/MULJV4V

Important notice regarding the availability of proxy materials for the annual meeting of shareholders The accompanying Proxy Statement and proxy card were either made available to you online or mailed to you beginning on or about April 9, 2024. Our Proxy Statement, proxy card and 2023 Annual Report to Shareholders are available at www.bannerbank.com/proxymaterials.

| ||||

Items of Business

| Proposal 1. | Election of eight directors to each serve for a one-year term. |

| Proposal 2. | Advisory (non-binding) approval of the compensation of our named executive officers as disclosed in this Proxy Statement. |

| Proposal 3. | Ratification of the Audit Committee’s appointment of Moss Adams LLP as our independent registered public accounting firm for 2024. |

We will also consider and act upon such other matters as may properly come before the meeting or any adjournments or postponements thereof. As of the date of this notice, we are not aware of any other business to come before the annual meeting.

Your Vote is Important

To ensure your shares are represented at the meeting, please vote via the Internet or telephone, or sign, date and mail your proxy card which is solicited on behalf of the Board of Directors. The proxy will not be used if you attend and vote at the virtual annual meeting. Regardless of the number of shares you own, your vote is very important. Please act today.

Our 2024 annual meeting of shareholders will be a virtual meeting conducted solely online via live webcast. There is no physical location for the annual meeting. The online meeting format will facilitate remote shareholder attendance and participation, including the ability to vote your shares electronically and submit questions during the meeting. To participate in the annual meeting, registered shareholders will need the control number included on their proxy card and all other shareholders will need to follow the instructions that accompanied their proxy materials. Beneficial owners of shares held in street name must register in advance with Computershare no later than 5:00 p.m., Eastern Time, on May 17, 2024. (Late submissions will be processed to the extent feasible, but registration cannot be guaranteed in time for participation in the meeting.) To request registration, forward the proxy-granting email from your broker or email an image of your legal proxy to legalproxy@computershare.com, with a subject line of “Legal Proxy,” or mail your request to Computershare, Banner Corporation Legal Proxy, P.O. Box 43006, Providence, RI 02940-3006. Computershare will confirm your registration by email and provide you with a unique control number necessary to participate fully in the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

SHERREY LUETJEN

Secretary, Banner Corporation

Walla Walla, Washington

April 9, 2024

|

IMPORTANT: Voting promptly will save us the expense of further requests for proxies in order to ensure a quorum. You may vote via the Internet or by telephone or by submitting your proxy card by mail.

|

Table

of Contents

Information about the Annual Meeting

PROXY STATEMENT

OF

BANNER CORPORATION

10 S. FIRST AVENUE

WALLA WALLA, WASHINGTON 99362

(509) 527-3636

The Board of Directors of Banner Corporation is using this Proxy Statement to solicit proxies from our shareholders for use at the 2024 annual meeting of shareholders. The information provided in this Proxy Statement relates to Banner Corporation and its wholly-owned subsidiary, Banner Bank (collectively, the “Corporation”). Banner Corporation may also be referred to as “Banner” and Banner Bank may also be referred to as the “Bank.” References to “we,” “us” and “our” refer to Banner and, as the context requires, the Bank.

Internet Availability of Proxy Materials

Under rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our shareholders primarily via the internet, instead of mailing printed copies of those materials to each shareholder. On or about April 9, 2024, we expect to send our shareholders a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) containing instructions on how to access our proxy materials, including our Proxy Statement and our 2023 Annual Report to Shareholders. The Notice of Internet Availability also provides instructions on how to vote by telephone or by Internet and includes instructions on how to receive a paper copy of the proxy materials by mail. If you prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability.

Information about the Annual Meeting

|

Date Wednesday, May 22, 2024 |

Time 10:00 a.m., Pacific Time |

Record Date March 21, 2024 | ||

|

Location Online at https://meetnow.global/MULJV4V

Proxy materials for the annual meeting of shareholders Our Proxy Statement, proxy card and 2023 Annual Report to Shareholders are available at www.bannerbank.com/proxymaterials.

| ||||

| Matters to Be Considered at the Annual Meeting

At the meeting, you will be asked to consider and vote upon the following proposals:

Proposal 1. Election of eight directors to each serve for a one-year term.

Proposal 2. Advisory (non-binding) approval of the compensation of our named executive officers as disclosed in this Proxy Statement.

Proposal 3. Ratification of the Audit Committee’s appointment of Moss Adams LLP as our independent registered public accounting firm for 2024.

We also will transact any other business that may properly come before the annual meeting. As of the date of this Proxy Statement, we are not aware of any other business to be presented for consideration at the annual meeting other than the matters described in this Proxy Statement. |

How to Vote:

To ensure that your shares are represented at the meeting, please take the time to submit your vote in one of the following ways:

| |||

|

Internet

Go to www.investorvote.com/BANR or scan the QR code on your proxy card

|

| |||

|

Telephone

Call 1 (800) 652-VOTE (8683) within the USA, US territories and Canada

|

| |||

|

Sign, date and mail the proxy card

|

| |||

| BANNER CORPORATION 2024 PROXY STATEMENT | 1 |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

Annual Meeting Frequently Asked Questions

| Q. | Who is Entitled to Vote? |

| A. | We have fixed the close of business on March 21, 2024 as the record date for shareholders entitled to notice of and to vote at our annual meeting. You are entitled to one vote for each share of Banner common stock you own, unless you acquired more than 10% of Banner’s outstanding common stock without prior Board approval. As provided in our Restated Articles of Incorporation, for each vote in excess of 10% of the voting power of the outstanding shares of Banner’s voting stock, the record holders in the aggregate will be entitled to cast one-hundredth of a vote, and the aggregate power of these record holders will be allocated proportionately among these record holders. On March 21, 2024, there were 34,369,886 shares of Banner common stock outstanding and entitled to vote at the annual meeting. |

| Q. | How Do I Vote at the Annual Meeting? |

| A. | Proxies are solicited to provide all shareholders on the voting record date an opportunity to vote on matters scheduled for the annual meeting and described in these materials. You are a shareholder of record if your shares of Banner common stock are held in your name. This section provides voting instructions only for shareholders of record. If you are a beneficial owner of Banner common stock held by a broker, bank or other nominee (i.e., in “street name”), please see the instructions in the following question and response. |

Shares of Banner common stock can only be voted if the shareholder is present virtually or by proxy at the annual meeting. To ensure your representation at the annual meeting, we recommend you vote by proxy even if you plan to attend the virtual annual meeting. You can always change your vote at the meeting if you are a shareholder of record.

Shareholders may vote by proxy via the Internet or a toll-free telephone number, or by mailing a proxy card. Instructions for voting are found on the proxy card. Shares of Banner common stock represented by properly executed proxies will be voted by the individuals named on the proxy card in accordance with the shareholder’s instructions. Where properly executed proxies are returned to us with no specific instruction as how to vote at the annual meeting, the persons named in the proxy will vote the shares FOR election of each of our director nominees, FOR advisory approval of the compensation of our named executive officers as disclosed in this Proxy Statement, and FOR ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for 2024. If any other matters are properly presented at the annual meeting for action, the persons named in the proxy and acting thereunder will have the discretion to vote on these matters in accordance with their best judgment. We do not currently expect that any other matters will be properly presented for action at the annual meeting.

You may receive more than one proxy card depending on how your shares are held. For example, you may hold some of your shares individually, some jointly with your spouse or other party and some in trust for your children. In this case, you will receive three separate proxy cards to vote.

| 2 | BANNER CORPORATION 2024 PROXY STATEMENT |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

To ensure that your shares are represented at the meeting, please take the time to submit your vote in one of the following ways:

|

Internet

Go to www.investorvote.com/BANR or scan the QR code on your proxy card

|

| |

|

Telephone

Call 1 (800) 652-VOTE (8683) within the USA, US territories and Canada |

| |

|

Sign, date and mail the proxy card

|

|

| Q. | What if My Shares Are Held in Street Name? |

| A. | If you are the beneficial owner of shares held in “street name” by a broker, bank or other nominee (“nominee”), the nominee, as the record holder of the shares, is required to vote the shares in accordance with your instructions. If you do not give instructions to the nominee, the nominee may nevertheless vote the shares with respect to discretionary items, but will not be permitted to vote your shares with respect to non-discretionary items, pursuant to the rules governing brokers. In the case of non-discretionary items, the shares not voted will be treated as “broker non-votes.” The proposal to elect directors and the advisory vote on executive compensation are considered non-discretionary items; therefore, you must provide instructions to the nominee in order to have your shares voted with respect to these proposals. |

If your shares are held in street name and you would like to fully participate in the annual meeting, you must register in advance. You may participate as a “Guest” without having a unique control number, but you will not have the option to vote your shares or ask questions at the virtual meeting. To fully participate in the meeting as a “Shareholder,” you must obtain a unique control number by registering in advance with Computershare and submitting proof of your proxy power (legal proxy) reflecting your Banner holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 17, 2024. (Late submissions will be processed to the extent feasible, but registration cannot be guaranteed in time for your participation in the meeting.) Requests for registration should be submitted as follows:

By email: Forward the proxy-granting email from your broker, or email an image of your legal proxy, to legalproxy@computershare.com. The subject line of your email should include “Legal Proxy.”

By mail:

Computershare

Banner Corporation Legal Proxy

P.O. Box 43006

Providence, RI 02940-3006

You will receive an email from Computershare confirming your registration and providing you with your unique control number needed to participate in the virtual annual meeting as a “Shareholder”

| BANNER CORPORATION 2024 PROXY STATEMENT | 3 |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

if you register by email or if you provide an email address when registering by mail. If you do not provide an email address when registering by mail, confirmation of your registration and your unique control number will be provided by mail.

| Q. | How Many Shares Must Be Present to Hold the Meeting? |

| A. | A quorum must be present at the meeting for any business to be conducted. The presence at the meeting, in person via the virtual meeting platform or by proxy, of at least a majority of the shares of Banner common stock entitled to vote at the annual meeting will constitute a quorum. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. |

| Q. | What if a Quorum Is Not Present at the Meeting? |

| A. | If a quorum is not present at the scheduled time of the meeting, a majority of the shareholders virtually present or represented by proxy may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given unless the meeting is adjourned for 120 days or more. An adjournment will have no effect on the business that may be conducted at the meeting. |

| Q. | Vote Required to Approve Proposal 1: Election of Directors |

| A. | Banner’s Amended and Restated Bylaws provide for the election of directors by a majority of the votes cast by shareholders in uncontested elections. Accordingly, in an uncontested election, the number of shares voted “for” a director nominee must exceed the number of shares voted “against” the nominee, in order for that nominee to be elected. The following are not considered votes cast: (1) a share otherwise present at the meeting but for which there is an abstention; and (2) a share otherwise present at the meeting as to which a shareholder of record gives no authority or direction. The term of any director who was a director at the time of the election but who does not receive a majority of votes cast in an election held under the majority vote standard will continue to serve as a director until terminated on the earliest to occur of: (1) 90 days after the date election results are determined; (2) the date the Board appoints a new director to fill the position; or (3) the date and time the director’s resignation is effective. |

Banner’s Amended and Restated Bylaws provide that an election is considered a contested election if there are shareholder nominees for director pursuant to the advance notice provision, and who are not withdrawn by the advance notice deadline set forth in Banner’s Restated Articles of Incorporation. If the Board determines there is a contested election, the election of directors will be held under a plurality standard. Under the plurality standard, the nominees who receive the highest number of votes for the directorships for which they have been nominated will be elected.

Pursuant to our Restated Articles of Incorporation, shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or against each nominee, or shareholders may abstain from voting. Abstentions and broker non-votes will have no effect on the outcome of the election. Our Board of Directors unanimously recommends that you vote FOR the election of each of our director nominees.

| Q. | Vote Required to Approve Proposal 2: Advisory Approval of Executive Compensation |

| A. | The advisory (non-binding) vote to approve the compensation of our named executive officers as disclosed in this Proxy Statement requires the affirmative vote of a majority of the votes cast, in person via the virtual meeting platform or by proxy, at the annual meeting. Abstentions and broker |

| 4 | BANNER CORPORATION 2024 PROXY STATEMENT |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

| non-votes will have no effect on the outcome of the proposal. Our Board of Directors unanimously recommends that you vote FOR approval of the compensation of our named executive officers. |

| Q. | Vote Required to Approve Proposal 3: Ratification of the Appointment of the Independent Registered Public Accounting Firm |

| A. | Ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 requires the affirmative vote of a majority of the votes cast, in person via the virtual meeting platform or by proxy, at the annual meeting. Abstentions will have no effect on the outcome of the proposal. Our Board of Directors unanimously recommends that you vote FOR the ratification of the appointment of the independent registered public accounting firm. |

| Q. | May I Revoke My Proxy? |

| A. | You may revoke your proxy before it is voted by: |

| • | Submitting a new proxy with a later date; |

| • | Notifying Banner’s Secretary in writing before the annual meeting that you have revoked your proxy; or |

| • | Voting at the virtual annual meeting. |

If you plan to attend the virtual annual meeting and vote during the meeting, you must join the meeting as a “Shareholder.” If you are a shareholder of record, you will need the control number on your proxy card. If you are the beneficial owner of shares held in “street name” by a broker, bank or other nominee, you will need to register in advance with Computershare by following the instructions in the question above titled, “What if My Shares Are Held in Street Name?”

| Q. | May I Ask A Question During the Virtual Meeting? |

| A. | Yes. There will be a question and answer session following the formal portion of the meeting, during which we will answer questions pertinent to our business as time allows. Questions of a similar nature may be grouped together and answered once to avoid repetition. The virtual meeting platform will allow shareholders to ask questions, provided the shareholder is logged into the meeting as a “shareholder.” Shareholders entering the virtual meeting as “guests” will not be able to ask questions. To ask a question during the meeting, registered shareholders will need the control number included on their proxy card and all other shareholders will need to register in advance to obtain a unique control number as described in the Notice of Annual Meeting of Shareholders and in the question above titled, “What if My Shares Are Held in Street Name?” |

| Q: | What if I Have Trouble Accessing the Annual Meeting Virtually? |

| A: | The virtual meeting platform is fully supported across Microsoft Edge, Firefox, Chrome and Safari browsers and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is not a supported browser. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. If you need further assistance, you may call 1-888-724-2416 (US) or 1-781-575-2748 (outside the US). |

| BANNER CORPORATION 2024 PROXY STATEMENT | 5 |

Security Ownership of Certain Beneficial Owners and Management

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of March 21, 2024, the voting record date, information regarding share ownership of:

| • | Those persons or entities (or groups of affiliated person or entities) known by management to beneficially own more than five percent of Banner’s common stock, other than directors and executive officers; |

| • | Each director and director nominee of Banner; |

| • | Each executive officer named in the Summary Compensation Table appearing under “Executive Compensation” below (known as “named executive officers”); and |

| • | All directors and executive officers of Banner and Banner Bank as a group. |

Persons and groups who beneficially own in excess of five percent of Banner’s common stock are required to file with the U.S. Securities and Exchange Commission (“SEC”), and provide copies to us, reports disclosing their ownership under the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”). To our knowledge, no other person or entity, other than those set forth below, beneficially owned more than five percent of the outstanding shares of Banner’s common stock as of the close of business on the voting record date.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In accordance with Rule 13d-3 of the Securities Exchange Act, a person is deemed to be the beneficial owner of any shares of common stock if that person has voting and/or investment power with respect to those shares. Therefore, the table below includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table may possess voting and/or investment power. In addition, in computing the number of shares beneficially owned by a person and the percentage ownership of that person, restricted share units that will vest within 60 days after the voting record date are included in the number of shares beneficially owned by the person and are deemed outstanding for the purpose of calculating the person’s percentage ownership. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. As of the voting record date, there were 34,369,886 shares of Banner common stock outstanding.

| 6 | BANNER CORPORATION 2024 PROXY STATEMENT |

Security Ownership of Certain Beneficial Owners and Management

| Name |

Number of Shares Beneficially |

Percent of Voting Shares Outstanding (%) | ||||||||

| Beneficial Owners of More Than 5% |

| |||||||||

| BlackRock, Inc. |

|

4,951,813 |

(2) |

|

14.41 |

|||||

| The Vanguard Group |

|

4,187,837 |

(3) |

|

12.18 |

|||||

| Dimensional Fund Advisors LP |

|

2,257,929 |

(4) |

|

6.57 |

|||||

| State Street Corporation |

|

1,779,867 |

(5) |

|

5.18 |

|||||

| Directors |

| |||||||||

| Ellen R.M. Boyer |

|

3,666 |

|

* |

||||||

| Connie R. Collingsworth |

|

10,604 |

(6) |

|

* |

|||||

| Margot J. Copeland |

|

2,448 |

|

* |

||||||

| Roberto R. Herencia |

|

13,491 |

|

* |

||||||

| David A. Klaue |

|

127,836 |

|

* |

||||||

| John R. Layman |

|

32,355 |

(7) |

|

* |

|||||

| John Pedersen |

|

4,829 |

|

* |

||||||

| Kevin F. Riordan |

|

8,233 |

|

* |

||||||

| Terry S. Schwakopf |

|

6,834 |

|

* |

||||||

| Paul J. Walsh |

|

2,448 |

|

* |

||||||

| Named Executive Officers |

| |||||||||

| Mark J. Grescovich** |

|

157,977 |

|

* |

||||||

| Robert G. Butterfield |

|

5,260 |

|

* |

||||||

| Cynthia D. Purcell |

|

22,579 |

|

* |

||||||

| James M. Costa |

|

4,588 |

|

* |

||||||

| James P. G. McLean |

|

11,430 |

|

* |

||||||

| Peter J. Conner |

|

36,662 |

|

|

| |||||

| All Executive Officers and Directors as a Group (25 persons) |

|

|

|

|

1.60 |

|||||

| * | Less than 1% of shares outstanding. |

| ** | Also a director of Banner. |

| (1) | Shares of restricted stock granted under the 2014 Omnibus Incentive Plan, as to which holders have voting but not investment power, are included as follows: Mr. Herencia, 2,091 shares; Ms. Boyer, 1,441 shares; and Ms. Copeland, 1,277 shares. Also includes the following number of restricted share units granted under the 2014 Omnibus Incentive Plan and the 2018 Omnibus Incentive Plan and vesting within 60 days of the voting record date: Ms. Collingsworth, 1,432; Mr. Klaue, Mr. Layman, Ms. Schwakopf and Mr. Walsh, 1,277 each; Mr. Pedersen, 1,604; Mr. Riordan, 1,495; Mr. Grescovich, 7,635; Mr. Butterfield, 1,756; Ms. Purcell, 2,874; Mr. Costa, 2,772; Mr. McLean, 1,532; and Mr. Conner, 3,088; and all executive officers and directors as a group, 46,154. |

| (2) | Based on a Schedule 13G/A dated January 23, 2024, which reports sole voting power over 4,866,443 shares and sole dispositive power over 4,951,813 shares. According to this filing, the interest of iShares Core S&P Small-Cap ETF is more than 5% of Banner’s total outstanding stock. The address for BlackRock, Inc. is 50 Hudson Yards, New York, New York 10001. |

| (3) | Based on a Schedule 13G/A dated February 13, 2024, which reports shared voting power over 24,178 shares, sole dispositive power over 4,127,983 shares and shared dispositive power over 59,854 shares. The address for The Vanguard Group is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. |

| (4) | Based on a Schedule 13G/A dated February 14, 2024, which reports sole voting power over 2,221,328 shares and sole dispositive power over 2,257,929 shares. The address for Dimensional Fund Advisors LP is Building One, 6300 Bee Cave Road, Austin, Texas 78746. |

| (5) | Based on a Schedule 13G dated January 24, 2024, which reports shared voting power over 225,047 shares and shared dispositive power over 1,779,867 shares. The address for State Street Corporation is State Street Financial Center, 1 Congress Street, Suite 1, Boston, Massachusetts 02114-2016. |

| (6) | Includes 100 shares held jointly with her husband. |

| (7) | Includes 9,414 shares that have been pledged. |

| BANNER CORPORATION 2024 PROXY STATEMENT | 7 |

Proposal 1 – Election of Directors

Proposal 1 – Election of Directors

Banner’s Board of Directors currently consists of 11 members. In prior years, approximately one-third of the directors were elected annually to serve for a three-year period or until their respective successors are elected and qualified. However, at the 2022 annual meeting, Banner’s shareholders approved an amendment to our Articles of Incorporation to eliminate staggered terms for directors and provide for the annual election of all directors. Accordingly, each director will be elected annually upon expiration of the director’s term, beginning with directors whose terms expired at the 2023 annual meeting of shareholders, with all directors being subject to annual elections beginning with the 2025 annual meeting of shareholders. The table below sets forth information regarding each continuing director of Banner and each nominee for director. The Corporate Governance/Nominating Committee of the Board of Directors selects nominees for election as directors. Each of our nominees currently serves as a Banner director and has consented to being named in this Proxy Statement and has agreed to serve if elected.

If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority. At this time, we are not aware of any reason why a nominee might be unable to serve if elected.

The Board of Directors recommends a vote FOR the election of Margot J. Copeland, Mark J. Grescovich, Roberto R. Herencia, David A. Klaue, John R. Layman, Kevin F. Riordan, Terry S. Schwakopf and Paul J. Walsh, each for a one-year term.

| Name |

Age as of December 31, 2023 |

Year First Elected or Appointed Director |

Term to Expire | |||

| Board Nominees | ||||||

| Margot J. Copeland |

72 |

2022 |

2025 (1) | |||

| Mark J. Grescovich |

59 |

2010 |

2025 (1) | |||

| Roberto R. Herencia |

64 |

2016 |

2025 (1) | |||

| David A. Klaue |

70 |

2007 |

2025 (1) | |||

| John R. Layman |

65 |

2007 |

2025 (1) | |||

| Kevin F. Riordan |

67 |

2018 |

2025 (1) | |||

| Terry S. Schwakopf |

72 |

2018 |

2025 (1) | |||

| Paul J. Walsh |

55 |

2022 |

2025 (1) | |||

| Directors Continuing in Office | ||||||

| Ellen R.M. Boyer |

63 |

2021 |

2025 | |||

| Connie R. Collingsworth |

65 |

2013 |

2025 | |||

| John Pedersen |

66 |

2021 |

2025 | |||

| (1) | Assuming re-election. |

Information Regarding Nominees for Election. Set forth below is the present principal occupation and other business experience during at least the last five years of each nominee for election, as well as a brief discussion of the particular experience, qualifications, attributes and skills that led the Board to conclude that the nominee should serve as a director of Banner.

| 8 | BANNER CORPORATION 2024 PROXY STATEMENT |

Proposal 1 – Election of Directors

| Margot J. Copeland | ||||

|

Director Since: 2022 |

Committees: |

|||

| • Compensation and Human Capital • Credit Risk

| ||||

| Key Qualifications: • Extensive banking and executive leadership, philanthropic and community engagement experience • Corporate responsibility expertise, including in relation to diversity, equity and inclusion

Margot J. Copeland specializes in developing strategies in the areas of workforce development and management, leadership, diversity and inclusion, philanthropy, and community outreach and engagement. Ms. Copeland has over 20 years of experience, with her previous positions being at KeyBank (a subsidiary of KeyCorp (NYSE: KEY)) and its affiliate, KeyBank Foundation, in Cleveland, Ohio. At KeyBank, she was Executive Vice President and Director Corporate Philanthropy and Community Engagement from 2001 through 2019. During the same period, she served as Board Chair and Chief Executive Officer for KeyBank Foundation. As a corporate officer and leader of corporate philanthropy and civic engagement, Ms. Copeland was a member of KeyBank’s Corporate Social Responsibility Council, which focused on philanthropic investments, corporate citizenship, and regulatory and corporate strategy. She was also a member of the Diversity & Inclusion Council and she served as KeyBank’s Chief Diversity Officer from 2001 through 2013. Prior to joining KeyBank, Ms. Copeland served on the Advisory Board of US Bank (formerly Firstar) from 1998 through 2001. Ms. Copeland is actively involved in her community, having served on a number of advisory boards and boards of directors for educational institutions, health care systems, community organizations and other nonprofit entities. She currently serves on the Board of Trustees for The Cleveland Clinic and the Board of Directors for AARP, among others. Ms. Copeland received a Master’s degree from The Ohio State University, a Bachelor of Science in Physics from Hampton University, Hampton, Virginia and an Honorary Doctorate of Humane Letters from Cuyahoga Community College, Cleveland, Ohio. With her vast experience in social responsibility and her long-tenured connection to banking, the directors believe that Ms. Copeland should continue to serve on the Board of Directors. | ||||

| Mark J. Grescovich | ||||

|

President and CEO | ||||

|

Director Since: 2010 |

Committees: |

|||

| • Credit Risk • Executive

|

• Risk | |||

| Key Qualifications: • Extensive bank leadership experience • Acquisition and strategic planning expertise • Credit and risk management expertise

Mark J. Grescovich is President and Chief Executive Officer, and a director, of Banner Corporation and Banner Bank. Mr. Grescovich joined Banner Bank in April 2010 and became Chief Executive Officer in August 2010 following an extensive banking career specializing in finance, credit administration and risk management. Under his leadership, Banner has grown from $4.7 billion in assets in 2010 to more than $15 billion through organic growth as well as selective acquisition. During that time, Mr. Grescovich has guided the expansion of Banner’s footprint to over 135 locations in four states. Prior to joining Banner, Mr. Grescovich was the Executive Vice President and Chief Corporate Banking Officer for Akron, Ohio-based FirstMerit Corporation and FirstMerit Bank N.A. He assumed responsibility for FirstMerit’s commercial and regional line of business in 2007, having served since 1994 in various commercial and | ||||

| BANNER CORPORATION 2024 PROXY STATEMENT | 9 |

Proposal 1 – Election of Directors

| corporate banking positions, including that of Chief Credit Officer. Prior to joining FirstMerit, Mr. Grescovich was a Managing Partner in corporate finance with Sequoia Financial Group, Inc. of Akron, Ohio, and a commercial and corporate lending officer and credit analyst with Society National Bank of Cleveland, Ohio. He has a Bachelor of Business Administration degree in finance from Miami University and a Master of Business Administration degree, also in finance, from The University of Akron. | ||||

| Roberto R. Herencia | ||||

|

Board Chair Director Since: 2016 |

Committees: |

|||

| • Compensation and Human Capital • Corporate Governance/Nominating

|

• Credit Risk • Executive (Chair) | |||

| Key Qualifications: • Extensive bank leadership experience, including as a director and chief executive officer • Acquisition and strategic planning expertise • Credit and risk management expertise

Roberto R. Herencia is President and Chief Executive Officer of BXM Holdings, a fund specializing in community bank investments. He is a director and Chairman of the Board of First BanCorp. (NYSE: FBP) and its subsidiary, FirstBank Puerto Rico, positions he has held since October 2011. He has been an independent director and the Chairman of the Board of Byline Bancorp (NYSE: BY) and its subsidiary bank, Byline Bank, since June 2013, and effective February 12, 2021, he assumed the role of Chief Executive Officer of Byline Bancorp. Between 2009 and 2010, Mr. Herencia was President and Chief Executive Officer of Midwest Banc Holdings, Inc. and its subsidiary, Midwest Bank and Trust. Prior to that, he spent 17 years with Popular Inc. as its Executive Vice President and as President of Popular Inc.’s subsidiary, Banco Popular North America. Prior to joining Popular, Mr. Herencia spent 10 years with The First National Bank of Chicago (now J.P. Morgan Chase) in a variety of roles, including Deputy Senior Credit Officer and Head of the Emerging Markets Division. Mr. Herencia previously served on the US International Development Finance Corporation’s Board of Directors, to which he was appointed by President Obama in 2011. He graduated magna cum laude and received his Bachelor of Science in Business Administration degree in finance from Georgetown University and his Master of Business Administration degree from the Kellogg School of Management at Northwestern University. Based on these qualifications, the directors believe that Mr. Herencia should continue to serve on the Board of Directors. | ||||

| David A. Klaue | ||||

|

Director Since: 2007 |

Committees: |

|||

| • Audit • Corporate Governance/Nominating

| ||||

| Key Qualifications: • Bank leadership experience • Acquisition, business expansion and strategic planning expertise • Extensive business operational experience • Organizational effectiveness expertise

David A. Klaue served as Chairman of the Board of Directors of F&M Bank until its acquisition by Banner Bank in May 2007. He is Chairman of the Board of Empire Lumber Co., a diversified wood products manufacturer with operations in Washington, Idaho and Montana, and of Park Ranch Land & Cattle Co., | ||||

| 10 | BANNER CORPORATION 2024 PROXY STATEMENT |

Proposal 1 – Election of Directors

| a cow/calf feeder and hay producer; he is also the Manager of Empire Investments, LLC, a real estate investment company. Mr. Klaue has been affiliated with these companies for more than 35 years. Additionally, he is a managing member in various other real estate investment, equipment and sales companies. Mr. Klaue’s career has afforded him expertise in banking, business, and agricultural and real estate management. Based on these qualifications, the directors believe that Mr. Klaue should continue to serve on the Board of Directors. | ||||

| John R. Layman | ||||

|

Director Since: 2007 |

Committees: |

|||

| • Audit • Risk

|

||||

| Key Qualifications: • Extensive legal experience, including in mergers and acquisitions and complex litigation matters • Bank leadership and operational experience • Risk management expertise • Strategic planning experience

John R. Layman served as Co-Vice Chairman of the Board of Directors of F&M Bank until its acquisition by Banner Bank in May 2007. He is Managing Partner of Layman Law Firm, PLLP, with which he has been associated since 1983. His areas of practice include real estate development, commercial litigation, personal injury and product liability. He also has experience in securities litigation, fiduciary obligations, corporate governance and compliance and reporting requirements. Based on these qualifications, the directors believe that Mr. Layman should continue to serve on the Board of Directors. | ||||

| Kevin F. Riordan | ||||

|

Director Since: 2018 |

Committees: |

|||

| • Audit (Chair) • Compensation and Human Capital

|

• Credit Risk • Executive | |||

| Key Qualifications: • Audit experience; qualifies as an audit committee financial expert • Risk management expertise • Corporate governance best practices and organizational effectiveness expertise

Kevin F. Riordan retired as a Banking & Capital Markets audit and client service Partner of PricewaterhouseCoopers LLP (PwC), a global professional services firm, in June 2014, having served in that capacity since 2000. Prior to joining PwC in 1994, Mr. Riordan served various banking and securities trading companies as both an independent auditor and senior financial/accounting executive. During his career at PwC, Mr. Riordan gained significant experience working with the boards and audit committees of publicly traded banking and lending institutions while managing major client relationships across multiple markets. In those roles, Mr. Riordan developed expertise in complex accounting, auditing and financial reporting matters. He has been a Certified Public Accountant since 1983. Mr. Riordan’s qualification as an audit committee financial expert was the primary reason for his nomination to the Board. The directors believe that this qualification, together with his experience with banking entities and financial reporting matters, support Mr. Riordan’s continued service on the Board of Directors. | ||||

| BANNER CORPORATION 2024 PROXY STATEMENT | 11 |

Proposal 1 – Election of Directors

| Terry S. Schwakopf | ||||

|

Director Since: 2018 |

Committees: |

|||

| • Corporate Governance/Nominating • Risk

| ||||

| Key Qualifications: • Extensive bank regulatory supervision experience • Banking and fintech expertise • Risk management expertise

Terry S. Schwakopf is an Independent Senior Advisor to the banking practice of Deloitte & Touche, LLP. Prior to joining Deloitte in 2007, Ms. Schwakopf was Executive Vice President of the Federal Reserve Bank of San Francisco with overall responsibility for banking supervision. In that capacity, she oversaw the supervision of state member banks and bank and financial holding companies in the nine western states that comprise the San Francisco District. During her 23-year career with the Federal Reserve, she had a number of other responsibilities, including oversight of community affairs, public information, the corporate secretary’s function and communications. Before joining the Federal Reserve, she held positions in both the commercial banking and savings and loan industries and worked as a consultant to community banks. Ms. Schwakopf serves on the Board of Directors of IDB Bank and is a member of the Advisory Board of Blockchain Capital, a venture capital fund. She was on the Board of United Way of the Bay Area and is actively involved in a number of international organizations and civic groups. Ms. Schwakopf previously served on the Boards of Directors of Bridge Bank and Bridge Capital Holdings, Nara Bank and Nara Bancorporation, and Rabobank, NA. She was a member of the accreditation cadre for the Conference of State Bank Supervisors and a board advisor for Solar Mosaic, a crowdfunding site for solar energy financing. Ms. Schwakopf was honored as one of WomenInc. magazine’s 2019 Most Influential Corporate Directors. Based on these qualifications, the directors believe that Ms. Schwakopf should continue to serve on the Board of Directors. | ||||

| Paul J. Walsh | ||||

|

Director Since: 2022 |

Committees: |

|||

| • Audit • Risk

|

||||

| Key Qualifications: • Strong technology, information security, cybersecurity and digital expertise • Leadership and advisory board experience

Paul J. Walsh is currently Senior Vice President, Head of Digital, Engineering, and IT at Sony Interactive Entertainment (part of Sony Group Corp, NYSE: SONY) in Kirkland, Washington, which he joined in January 2022. He was an Executive-In-Residence with Adobe (NYSE: ADBE) in Kirkland, Washington, from 2021 to 2022. Mr. Walsh served as Senior Vice President and Global Chief Digital Officer with Lenovo (OTCM: LNVGF) in Kirkland, Washington, from 2018 to 2020. Prior to Lenovo, Mr. Walsh served as Senior Vice President, Platform Strategy & Innovation for Visa Inc. (NYSE: V) in Kirkland, Washington, from 2016 to 2018. Mr. Walsh previously served as the Global Chief Information Officer at Dell (NYSE: DELL) in Austin, Texas, from 2013 through 2015. Mr. Walsh is also an experienced advisory board member. Mr. Walsh received a Bachelor of Science, BSc Computer Science at Griffith College, Dublin, Ireland. He is a technology leader with more than 25 years of experience in both scale and scope with some of the most respected brands in the industry. With his advisory board experience and technical background, the directors believe Mr. Walsh should continue to serve on the Board of Directors. | ||||

| 12 | BANNER CORPORATION 2024 PROXY STATEMENT |

Proposal 1 – Election of Directors

Information Regarding Incumbent Directors. Set forth below is the present principal occupation and other business experience during at least the last five years of each director continuing in office, as well as a brief discussion of the particular experience, qualifications, attributes and skills that led the Board to conclude that the director should serve on Banner’s Board of Directors.

| Ellen R.M. Boyer | ||||

|

Director Since: 2021 |

Committees: |

|||

| • Audit • Compensation and Human Capital (Chair)

|

• Executive | |||

| Key Qualifications: • Audit experience; qualifies as an audit committee financial expert • Certified Public Accountant (Active) • Experienced chief financial officer and chief operating officer • Acquisition and strategic planning expertise

Ellen R.M. Boyer was Chief Financial Officer of Logic20/20, a business and technology consulting firm headquartered in Seattle, Washington, until her retirement in early April 2024. Ms. Boyer has over 30 years of finance and operational experience in a variety of industries, including technology, financial services and healthcare. Prior to joining Logic20/20 in 2014, Ms. Boyer held chief financial officer and/or chief operating officer roles at several companies in the Seattle area beginning in 1997. Ms. Boyer was previously an Audit Senior Manager at PriceWaterhouseCoopers, where she worked for 12 years. Ms. Boyer has extensive experience in strategic planning, mergers and acquisitions, governance matters, organizational effectiveness, and audit and financial matters. Ms. Boyer graduated from Oregon State University with degrees in Accounting and Spanish and minors in Computer Science and Latin American Affairs. She maintains an active Certified Professional Accountant license. Ms. Boyer is active in her community and has served on several for-profit and not-for-profit boards, including Umpqua Holdings Corporation (now Columbia Banking System, Inc. (Nasdaq: COLB)) from 2014 through 2016 and Sterling Financial Corporation (subsequently Umpqua and now Columbia) from 2007 through 2014. Ms. Boyer qualifies as an audit committee financial expert. This qualification, together with her deep financial expertise and strategic planning experience, adds value to the Board and the directors believe that Ms. Boyer should continue to serve on the Board of Directors. | ||||

| Connie R. Collingsworth | ||||

|

Director Since: 2013 |

Committees: |

|||

| • Compensation and Human Capital • Corporate Governance/Nominating (Chair)

|

• Executive | |||

| Key Qualifications: • Risk management expertise • Acquisition, business expansion and complex investment experience • Organizational effectiveness and corporate governance best practices leadership • Unique insights regarding environmental, social and governance (“ESG”) issues; diversity, equity and inclusion; and corporate social responsibility | ||||

| BANNER CORPORATION 2024 PROXY STATEMENT | 13 |

Proposal 1 – Election of Directors

|

Connie R. Collingsworth served as the Chief Operating Officer of the Bill & Melinda Gates Foundation in Seattle, Washington, where she managed the Foundation’s legal, information technology, human resources, security and other business operations units, and provided leadership in the areas of risk management, compliance and corporate governance. From 2007 to 2023, she served on the Foundation’s Executive Leadership Team, which is responsible for the development and execution of Foundation-wide strategy and policy. Prior to joining the Foundation in 2002, Ms. Collingsworth was a partner of Preston Gates & Ellis, now K&L Gates, which has grown from a leading Northwest law firm based in Seattle to one of the largest law firms in the world. She currently serves on the Board of Directors of Axxes Capital and the boards of several advisory and charitable organizations. Ms. Collingsworth previously served on the Board of Directors of Premera Blue Cross, one of the largest health plan providers in the Pacific Northwest, and on the Board of Directors of Women’s World Banking, a global non-profit devoted to giving low-income women access to the financial tools and resources essential to their security and prosperity. Ms. Collingsworth was honored as one of WomenInc. magazine’s 2019 Most Influential Corporate Directors. Based on these qualifications, the directors believe that Ms. Collingsworth should continue to serve on the Board of Directors. | ||||

| John Pedersen | ||||

|

Director Since: 2021 |

Committees: |

|||

| • Audit • Executive

|

• Credit Risk (Chair) • Risk (Chair) | |||

| Key Qualifications: • Extensive bank leadership experience, including as a chief risk officer • Deep expertise in risk management • Acquisition and strategic planning expertise • Corporate governance best practices and organizational effectiveness expertise

John Pedersen was with City National Bank of Los Angeles, California from 2004, serving as Executive Vice President and Chief Risk Officer from 2006 until his retirement in 2019. He has over three decades of progressive commercial banking credit and risk management responsibilities and significant expertise in establishing and managing risk management functions within a regional bank setting. Mr. Pedersen is skilled in strategic planning, including turn-around and growth strategies. He has a thorough understanding of many aspects of banking, including retail, small business, commercial real estate, dealer banking, consumer lending, mortgage banking and middle market lending. Mr. Pedersen began his career in government and held staff and leadership positions with the Office of the Comptroller of the Currency and the Office of Thrift Supervision. After government service, Mr. Pedersen managed a wide range of risk management activities for several financial institutions, including First Interstate Bancorp, KeyCorp, Wachovia and Bank of the West. Active in the community, Mr. Pedersen is involved with various philanthropic organizations that facilitate the micro-financing of small business entrepreneurs domestically and abroad. Mr. Pedersen earned a Bachelor of Business Administration degree in finance and accounting from the University of Oklahoma. Mr. Pedersen’s deep risk management expertise and broad banking experience add value to the Board and the directors believe that Mr. Pedersen should continue to serve on the Board of Directors. | ||||

Director Nomination Process. The Corporate Governance/Nominating Committee oversees the director nomination process. The Committee may consider both incumbent and new director nominees to nominate for election at each annual meeting of shareholders and may recommend that

| 14 | BANNER CORPORATION 2024 PROXY STATEMENT |

Proposal 1 – Election of Directors

the Board appoint new directors to serve until the next annual meeting of shareholders. Only those nominations made by the Committee or properly presented by shareholders will be voted upon at the annual meeting.

In its deliberations for selecting candidates for nominees as director, the Committee seeks individuals of integrity, with a proven record of professional accomplishments and/or civic leadership, sound business judgment and practical wisdom, risk oversight skills, an ability to represent a broad spectrum of interests, an ability to work collaboratively with other directors and our executives, an inquiring and independent mind, who can function well as discussion leaders and consensus builders. The

Committee also considers diversity characteristics (see “Board Diversity” below), the candidate’s knowledge of the banking business and whether the candidate would provide adequate representation of our market area. Any nominee for director recommended by the Committee must be highly qualified in some or all of these areas.

In searching for qualified director candidates to fill vacancies on the Board, the Committee solicits its current Board of Directors for names of potentially qualified candidates. Additionally, the Committee may request that members of the Board of Directors pursue their own business contacts for the names of potentially qualified candidates. The Committee has also used an executive search and leadership consulting firm and other professional sources for qualified nominees, especially with respect to candidates with unique skill sets, such as a qualified financial expert. The Committee would then consider the potential pool of director candidates, select the candidate the Committee believes best meets the then-current needs of the Board, and conduct a thorough investigation of the proposed candidate’s background to ensure there is nothing that would cause the candidate not to be qualified to serve as a Banner director. The Committee will consider director candidates recommended by our shareholders. If a shareholder submits a proposed nominee, the Committee would consider the proposed nominee, along with any other proposed nominees recommended by members of the Board of Directors, in the same manner in which the Committee would evaluate its nominees for director. For a description of the proper procedure for shareholder nominations, see “Shareholder Proposals” in this Proxy Statement.

Director Commitments. In accordance with our Corporate Governance Guidelines, our Board believes that in addition to directors possessing the skills and judgment to perform their functions, they should devote sufficient time and attention necessary to fulfill their duties and responsibilities as directors. The Corporate Governance/Nominating Committee considers whether directors and nominees for director have sufficient time and attention to devote to Board duties, including whether a director serves on an excessive number of boards. Our Board believes that each of our directors, including each of our director nominees, has demonstrated the ability to devote sufficient time and attention to board duties and to fulfill the responsibilities required of directors.

In addition to serving as our Board’s Chairman, Roberto Herencia serves as Chief Executive Officer and Executive Chair of Byline Bancorp (NYSE: BY) and Chairman of First BanCorp (NYSE: FBP). Our Board strongly believes that Chairman Herencia’s other board and professional commitments do not impede his ability to devote sufficient time and attention to his duties as Chairman of Banner’s Board, as demonstrated by the following:

| • | Chairman Herencia is a highly engaged and high performing director, as evidenced by his impeccable record of meeting preparation and attendance. In the past two years, Chairman Herencia has participated in 100% of Board meetings and 100% of the meetings of the Board committees of which he has been a member. His perfect attendance record is evidence of his |

| BANNER CORPORATION 2024 PROXY STATEMENT | 15 |

Proposal 1 – Election of Directors

| commitment and engagement with the Corporation. His commitment has been unwavering even in relation to unanticipated circumstances such as the significant banking industry events in the spring of 2023, which received the focused attention of our directors including Chairman Herencia. |

| • | Chairman Herencia actively participates in the discussions at the Board and committee meetings, including providing valuable and constructive feedback from a strategic, financial, risk and reputational perspective. Chairman Herencia’s insightful questions and comments contribute significantly to discussions, as well as the decision-making process, in which he is actively involved. |

| • | Chairman Herencia appropriately engages with management and other directors outside of the Board and committee meetings. |

| • | Chairman Herencia has vast experience in the financial industry, including overseeing and managing a bank through a financial crisis, and he possesses significant expertise in mergers and acquisitions, including integration activities. |

| • | Chairman Herencia’s experience with other boards of directors of public companies that are also financial institutions provides him with additional insights and experience that enhance his value to our Board. |

| • | Chairman Herencia has assured our Board that he continues to be committed to serving our Board and devoting the time and attention that his duties and responsibilities require. |

Board Diversity. Included among the attributes considered by the Corporate Governance/Nominating Committee in recommending director nominees is diversity by gender, race, ethnicity, national origin and/or age. Our Board believes that diversity, including differences in backgrounds, qualifications and personal characteristics, is important to the effectiveness of the Board’s oversight of Banner. The table below illustrates self-reported diversity characteristics for the individuals serving on our Board of Directors as of the voting record date.

| Board Diversity Matrix (As of March 21, 2024) | ||||||||||||||||

| Board Size: |

||||||||||||||||

| Total Number of Directors |

11 | |||||||||||||||

| Gender: |

Male | Female | Non-Binary | |

Gender Undisclosed |

|||||||||||

| 7 | 4 | — | — | |||||||||||||

| Number of directors who identify in any of the categories below: |

| |||||||||||||||

| African American or Black |

1 | 1 | — | — | ||||||||||||

| Alaskan Native or American Indian |

— | — | — | — | ||||||||||||

| Asian |

— | — | — | — | ||||||||||||

| Hispanic or Latinx |

1 | — | — | — | ||||||||||||

| Native Hawaiian or Pacific Islander |

— | — | — | — | ||||||||||||

| White |

6 | 3 | — | — | ||||||||||||

| Two or More Races or Ethnicities |

1 | — | — | — | ||||||||||||

| LGBTQ+ |

— | |||||||||||||||

| Undisclosed |

— | |||||||||||||||

| 16 | BANNER CORPORATION 2024 PROXY STATEMENT |

Proposal 1 | The Right Skills for our Board

Of our 11 directors, 6 identify as having at least one diversity characteristic (i.e., female, non-binary, LGBTQ+ and/or race or ethnicity other than white).

| Gender Diversity |

Ethnic Diversity |

Overall Diversity |

||||||||||

| 36% |

27% |

55% |

||||||||||

| 4 of 11 directors |

3 of 11 directors |

|

6 of 11 directors have at least one diversity characteristic |

|||||||||

The Right Skills for our Board

As a part of the Board evaluation and director selection processes, the Corporate Governance/Nominating Committee (“Governance Committee”) maintains a Director Attributes Matrix (described further in the “Director Selection Process” section of this Proxy Statement). The Governance Committee and the Board believe that the director nominees for 2024, together with the continuing directors, provide Banner with the right mix of skills and experience necessary for a highly functioning board. The chart below summarizes the number of Banner’s directors who consider themselves to be skilled in each primary category; the descriptions below each category heading are illustrative of the types of experience that generally would be considered in determining whether a given director is skilled in that particular area, and should not be read to imply that every listed example or title is represented on the Board.

| BANNER CORPORATION 2024 PROXY STATEMENT | 17 |

Proposal 1 | The Right Skills for our Board

Total Directors and Director Nominees with Particular Qualifications and Experience

(out of 11 total Directors and Nominees)

| 5 |

Financial Expertise/Audit Committee Financial Expert | |

| Independent auditors/certified public accountants, chief financial officers, chief accounting officers, senior professionals overseeing capital management activities, or otherwise qualified as an “audit committee financial expert.” | ||

| 11 |

Leadership | |

| Experience as a business line leader or C-suite professional, or otherwise demonstrating advanced leadership expertise. | ||

| 8 |

Mergers & Acquisitions (M&A) | |

| C-suite professionals or senior leaders directly involved in M&A (e.g., chief executive officers, chief financial officers, chief operating officers, general counsels, operational heads), M&A attorneys, accountants with direct M&A experience, investment bankers. | ||

| 8 |

Risk Management | |

| Chief risk officers and senior professionals with experience in compliance, fraud prevention, or enterprise risk management; senior level internal audit professionals; attorneys or other professionals with relevant risk management expertise. | ||

| 6 |

Human Capital Management/Executive Compensation | |

| Chief human resources officers or other senior human resources professionals, employment attorneys, prior experience as a compensation committee member or consultant to compensation committees. | ||

| 3 |

Communications/Marketing | |

| Experience as a public relations officer, senior marketing professional, head of customer relations, community engagement leader, media professional (including social media), or similar role. | ||

| 8 |

Strategic Planning | |

| Senior leaders who have led or actively participated in the development of numerous strategic plans. | ||

| 7 |

Financial Industry Experience | |

| Management experience in traditional banking (commercial/retail), investment banking, wealth management, securities/investment management or fintech. | ||

| 5 |

Legal/Regulatory | |

| Attorneys, chief risk officers, bank regulatory agency staff, lobbyists, legislators/legislative aides with experience in a highly regulated industry such as financial services. | ||

| 5 |

Organizational Effectiveness/Continuous Improvement | |

| Experienced professionals who are LEAN or Six Sigma certified, continuous improvement professionals, or executives with significant experience implementing continuous improvement approaches. | ||

| 8 |

Public Company Governance/Corporate Governance Best Practices | |

| Experienced chief executive officers, chief financial officers, general counsels, corporate secretaries, other governance specialists, or investor relations professionals at a publicly-traded company, prior experience as a governance committee member or professional advising governance committees. | ||

| 11 |

Prior Board Experience/Interaction | |

| Experience as a board member or advisory board member of a publicly-traded company, private company, or non-profit organization, or executives regularly interacting with boards. | ||

| 1 | Information Technology/Cybersecurity | |

| Senior management experience at technology/ cybersecurity companies, in IT/cybersecurity roles outside of technology companies, or in relevant fintech organizations. | ||

| 11 |

Geographic Representation | |

| Knowledge of or experience in a specific geographic area or market in which Banner and its subsidiaries operate. | ||

| 18 | BANNER CORPORATION 2024 PROXY STATEMENT |

Corporate Governance | Board of Directors

Corporate Governance

Our Board is committed to maintaining an effective corporate governance framework. Strong governance practices support long-term, sustainable value creation for our shareholders and provide a foundation for effective Board oversight. The Board of Directors has maintained comprehensive corporate governance guidelines since January 2018 to provide a framework to assist the Board in fulfilling its responsibilities to shareholders. The guidelines, as amended from time to time, are available on our website at https://investor.bannerbank.com and cover a wide range of topics including: Board composition; selection, tenure, evaluation and retirement of Board members; Board leadership; and director responsibilities. The Board’s Corporate Governance/Nominating Committee is responsible for initiatives to comply with the governance-related provisions contained in the Sarbanes-Oxley Act of 2002 and the rules and regulations of the SEC adopted thereunder, as well as Nasdaq rules regarding corporate governance. The Committee evaluates and improves our corporate governance principles and policies from time to time, as deemed appropriate. Our governance framework is discussed in detail below.

Board of Directors

The Board of Directors conducts its business through Board meetings and through its committees. During the year ended December 31, 2023, the Board of Directors held 14 meetings. Each director attended more than 75% of the total meetings of the Board and committees on which that director served during this period.

Leadership Structure

The positions of Board Chair and of President and Chief Executive Officer are held separately by two individuals. This has been the case since 1995, when Banner was formed to become the holding company for Banner Bank. The Board believes this structure is appropriate for Banner because it provides the Board with capable leadership and independence from management. It also allows the President and Chief Executive Officer to focus on the day-to-day business of managing Banner, while the Chair leads the Board.

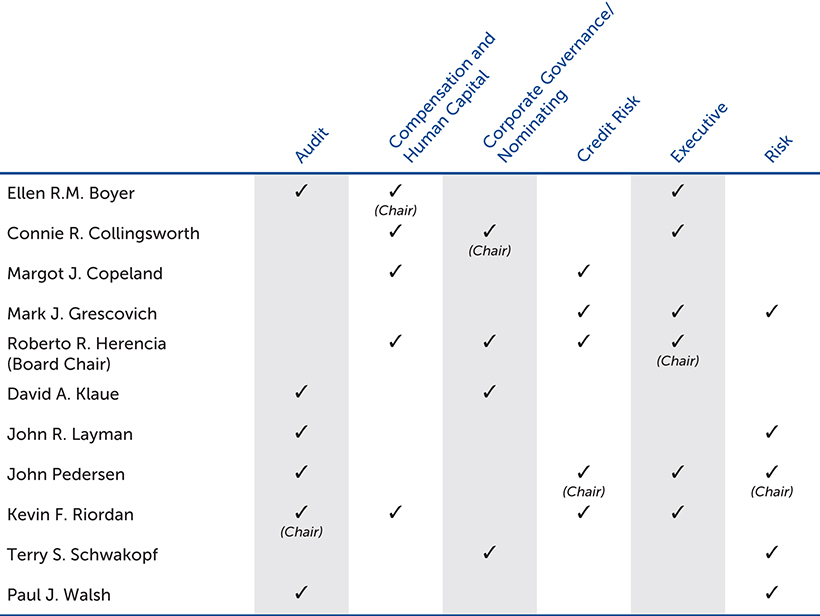

Committees and Committee Charters

The Board of Directors has established standing Executive, Audit, Compensation and Human Capital, Corporate Governance/Nominating, Credit Risk, and Risk Committees. The Board has adopted written charters for each committee other than the Executive Committee. These charters are available on our website at https://investor.bannerbank.com. Our directors’ current membership on these committees is reflected below.

| BANNER CORPORATION 2024 PROXY STATEMENT | 19 |

Corporate Governance | Committees and Committee Charters

Executive Committee. The Executive Committee acts for the Board of Directors when formal Board action is required between regular meetings. The Committee has the authority to exercise all powers of the full Board of Directors, except that it does not have the power to, among other things, declare dividends, authorize the issuance of stock, amend the Bylaws or approve any agreement of merger or consolidation other than mergers with Banner subsidiaries. The Executive Committee did not meet during the year ended December 31, 2023.

Audit Committee. The Audit Committee oversees management’s fulfillment of its financial reporting responsibilities and maintenance of an appropriate internal control system. It also has the sole authority to appoint or replace our independent registered public accounting firm (“Independent Auditor”) and oversees the activities of our internal audit functions. The Audit Committee also assists the Board in fulfilling its oversight responsibilities relating to the quality and integrity of financial reports and other financial information provided by the Corporation and the Corporation’s systems of internal accounting and financial controls; the oversight and periodic evaluation of the Independent Auditor’s qualifications, independence and performance; the annual performance review and compensation of the Chief Audit Executive; the compliance by the Corporation with legal and regulatory requirements, including disclosure controls and procedures with respect to financial reporting matters; review of controls governing relevant cybersecurity incident and risk disclosures; coordination with the Corporation’s Compensation and Human Capital Committee regarding any application of the Corporation’s Compensation Recovery Policy; and the oversight and review of external reporting and internal controls related to ESG activities.

The Corporation’s Independent Auditor routinely attends Audit Committee meetings and the Audit Committee regularly meets in executive session with the Corporation’s Independent Auditor. The Audit Committee also routinely meets in executive session with the Corporation’s Chief Audit Executive.

| 20 | BANNER CORPORATION 2024 PROXY STATEMENT |

Corporate Governance | Committees and Committee Charters

The Audit Committee believes it has fulfilled its responsibilities under its charter. The Committee met eight times during the year ended December 31, 2023. Each member of the Audit Committee is “independent,” in accordance with the requirements for companies quoted on The Nasdaq Stock Market (“Nasdaq”). In addition, the Board of Directors has determined that Committee members Boyer and Riordan meet the definition of “audit committee financial expert,” as defined by the SEC.

Compensation and Human Capital Committee. The Compensation and Human Capital Committee sets compensation policies and levels for directors and executive officers and oversees all of our salary and incentive compensation programs. The Committee seeks to ensure that our compensation programs appropriately balance risk and reward. The Committee considers a wide variety of human capital management matters, including talent management and succession planning, diversity and inclusion initiatives and results, and pay equity reviews and results. The Committee also oversees ESG matters related to human capital resource management in coordination with the Corporate Governance/Nominating Committee; and oversees and administers the Corporation’s Compensation Recovery Policy.

The Committee believes it has fulfilled its responsibilities under its charter. The Compensation and Human Capital Committee met seven times during the year ended December 31, 2023. Each member of the Compensation and Human Capital Committee is “independent,” in accordance with the requirements for companies quoted on Nasdaq. In addition, each member of the Committee also qualifies as a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended.

The Committee meets, outside of the presence of Mr. Grescovich, to discuss his compensation and to make its associated recommendations to the full Board, which then votes on Mr. Grescovich’s compensation. Mr. Grescovich makes recommendations to the Committee regarding the compensation of all other executive officers. The Committee considers Mr. Grescovich’s recommendations and makes a recommendation to the full Board, which then votes on executive compensation.

Additional discussion regarding the Committee’s significant activities for fiscal year 2023 can be found in the “Compensation Discussion and Analysis” and “Executive Compensation” sections of this Proxy Statement.

Corporate Governance/Nominating Committee. The Corporate Governance/Nominating Committee oversees the Corporation’s efforts to maintain the highest standards and best practices in all critical areas relating to the management of the business of Banner. The Committee oversees the Board’s annual review of Board performance and reviews and recommends to the Board corporate governance guidelines. Additionally, the Committee reviews the Corporation’s ESG framework and initiatives and reviews policies and programs that relate to matters of corporate social responsibility. The Committee is also responsible for succession planning for the Board of Directors, including identifying needed skills and backgrounds (including cybersecurity experience), developing a list of nominees for board vacancies and selecting nominees for directors. The Committee also oversees our directors’ continuing education and ongoing training.

The Corporate Governance/Nominating Committee believes it has fulfilled its responsibilities under its charter. Each member of the Committee is “independent,” in accordance with the requirements for companies listed on Nasdaq. The Committee met six times during the year ended December 31, 2023.

Credit Risk Committee. The Credit Risk Committee provides oversight of Banner’s credit risk structure and the processes established to identify, understand, measure, monitor and manage Banner’s credit

| BANNER CORPORATION 2024 PROXY STATEMENT | 21 |

Corporate Governance | Director Independence

risks. The Committee serves as the primary point of contact between the Board and the management-level committees dealing with credit risk management. The Committee is intended to enhance the Board’s oversight and understanding of credit risk management activities and the effectiveness thereof. Additional detail is provided below in “Board Involvement in the Risk Management Process.” The Credit Risk Committee met four times during the year ended December 31, 2023.

Risk Committee. The Risk Committee provides oversight of our enterprise-wide risk structure and the processes established to identify, measure, monitor and manage our capital risk, market/price risk, liquidity risk, interest rate risk, operational risk, technology risk (including cybersecurity), legal and compliance risk, people risk, reputation risk, and strategic risk, as well as risks associated with the Corporation’s ESG program. The Committee is responsible for reviewing the Corporation’s progress on ESG risk management initiatives and activities, including climate change risk management relative to any stated ESG program goal. The Committee also reviews management’s strategies and policies for managing these risks and serves as the primary point of contact between the Board and senior management in assessing enterprise-wide risk management activities and effectiveness. Additional detail is provided below in “Board Involvement in the Risk Management Process.” The Risk Committee met seven times during the year ended December 31, 2023.

Director Independence

Our common stock is listed on The Nasdaq Global Select Market. In accordance with Nasdaq rules, at least a majority of our directors must be independent directors. The Board has determined that 10 of our 11 directors are independent, as defined by Nasdaq. Ellen R.M. Boyer, Connie R. Collingsworth, Margot J. Copeland, Roberto R. Herencia, David A. Klaue, John R. Layman, John Pedersen, Kevin F. Riordan, Terry S. Schwakopf and Paul J. Walsh are independent.

Director Tenure

The Corporate Governance/Nominating Committee seeks to select directors who will contribute to Banner’s corporate goals. The Committee recognizes the importance of Board refreshment as well as the value of Board tenure. As of the record date, March 21, 2024, four of Banner’s 10 non-management directors have served on the Board for less than four years, three have served for four to eight years and three have served for more than eight years.

| Director Independence

|

|

Non-Management Director Tenure | ||

| 91% |

| |||

|

10 of 11 Directors are Independent

|

||||

|

|

||||

Diversity, Equity and Inclusion

Banner’s Board and management understand the importance of diversity and inclusion, including ensuring that all individuals are compensated equitably for similar work and have an equal opportunity to contribute and advance in the workplace. We are committed to creating a diverse and vibrant

| 22 | BANNER CORPORATION 2024 PROXY STATEMENT |

Corporate Governance | Board Involvement in the Risk Management Process

workplace that respects individuality, helps every person realize their full potential, and includes people with a broad range of experiences, backgrounds and skills that enable us to anticipate and meet the needs of our business and those of our clients. Additional details regarding our efforts in this area are included in the “Proposal 1 – Election of Directors – Board Diversity” and “Environmental, Social, and Governance: Supporting Stakeholder Value” sections of this Proxy Statement.

Board Involvement in the Risk Management Process