UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrant ☒ Filed by a party other than the registrant ☐

Check the appropriate box:

| ☐ | Preliminary proxy statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive proxy statement |

| ☐ | Definitive additional materials |

| ☐ | Soliciting material pursuant to § 240.14a-12 |

BANNER CORPORATION

(Name of registrant as specified in its charter)

N/A

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of filing fee (Check all boxes that apply):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

2022

Proxy Statement

Dear

Shareholder:

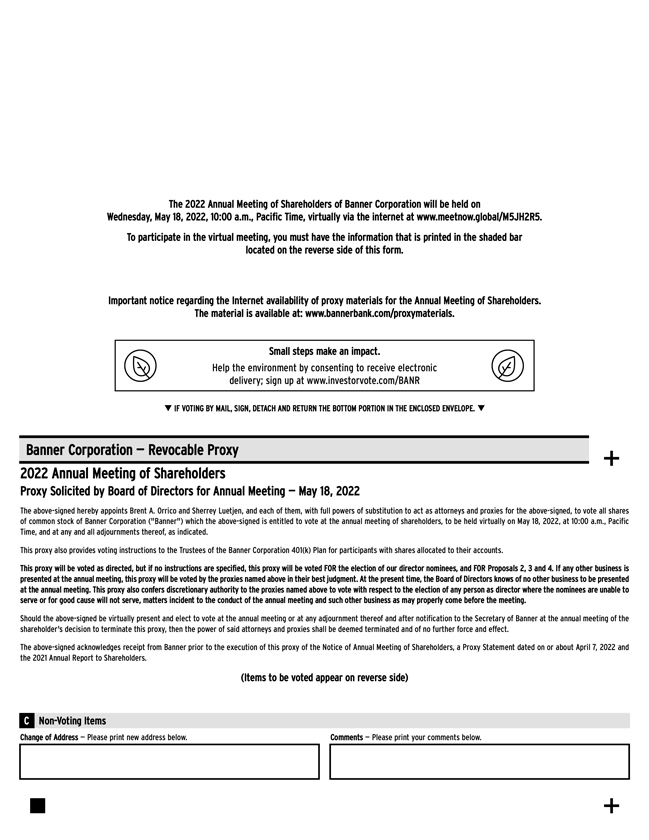

You are cordially invited to attend the annual meeting of shareholders of Banner Corporation, which will be held on Wednesday, May 18, 2022, at 10:00 a.m., Pacific Time. Due to continuing concerns regarding the novel coronavirus (COVID-19) pandemic and to protect the safety and well-being of our shareholders, directors and employees, our 2022 annual meeting of shareholders will be a virtual meeting conducted solely online via live webcast. There is no physical location for the annual meeting. The online meeting format will facilitate remote shareholder attendance and participation, including the ability to vote your shares electronically and submit questions during the meeting.

You can attend the meeting by visiting www.meetnow.global/M5JH2R5. To participate in the annual meeting, registered shareholders will need the control number included on their proxy card and all other shareholders will need to follow the instructions that accompanied their proxy materials.

The Notice of Annual Meeting of Shareholders and Proxy Statement describe the formal business to be transacted at the meeting. During the meeting, we will also report on our operations. Directors and officers of Banner Corporation, as well as a representative of Moss Adams LLP, our independent registered public accounting firm, will be available to respond to shareholder questions. We intend to answer questions pertinent to our business during a question and answer period following the formal meeting of shareholders.

It is important that your shares are represented at the meeting, whether or not you attend the meeting virtually and regardless of the number of shares you own. To make sure your shares are represented, we urge you to vote promptly. You may vote your shares via the Internet or a toll-free telephone number, or by completing and mailing the enclosed proxy card. If you attend the virtual meeting, you may vote your shares at that time even if you have previously submitted your proxy.

We hope you can attend the virtual meeting.

Sincerely,

Mark J. Grescovich

President and Chief Executive Officer

April 7, 2022

Notice of Annual Meeting of Shareholders

|

Date Wednesday, May 18, 2022 |

Time 10:00 a.m., Pacific Time |

Record Date March 10, 2022 | ||

|

Location Online at www.meetnow.global/M5JH2R5

Important notice regarding the availability of proxy materials for the annual meeting of shareholders Our Proxy Statement, proxy card and 2021 Annual Report to Shareholders are available at www.bannerbank.com/proxymaterials.

| ||||

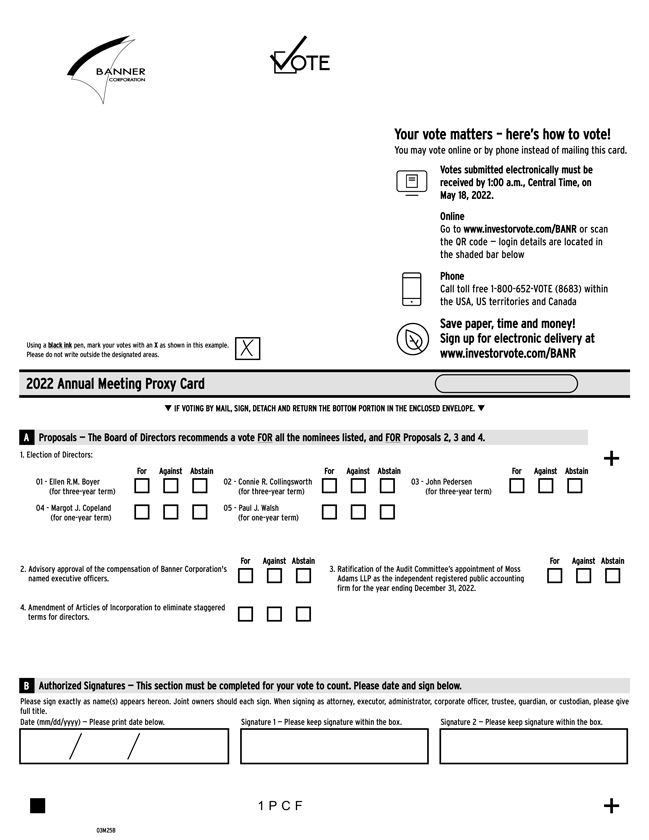

Items of Business

| Proposal 1. | Election of three directors to each serve for a three-year term and two directors to each serve for a one-year term. |

| Proposal 2. | Advisory (non-binding) approval of the compensation of our named executive officers as disclosed in this Proxy Statement. |

| Proposal 3. | Ratification of the Audit Committee’s appointment of Moss Adams LLP as our independent registered public accounting firm for 2022. |

| Proposal 4. | Amendment of Articles of Incorporation to eliminate staggered terms for directors. |

We will also consider and act upon such other matters as may properly come before the meeting or any adjournments or postponements thereof. As of the date of this notice, we are not aware of any other business to come before the annual meeting.

Your Vote is Important

To ensure your shares are represented at the meeting, please vote via the Internet or telephone, or sign, date and mail the enclosed proxy card which is solicited on behalf of the Board of Directors. The proxy will not be used if you attend and vote at the virtual annual meeting. Regardless of the number of shares you own, your vote is very important. Please act today.

Due to continuing concerns regarding the novel coronavirus (COVID-19) pandemic and to protect the safety and well-being of our shareholders, directors and employees, our 2022 annual meeting of shareholders will be a virtual meeting conducted solely online via live webcast. There is no physical location for the annual meeting. The online meeting format will facilitate remote shareholder attendance and participation, including the ability to vote your shares electronically and submit questions during the meeting. To participate in the annual meeting, registered shareholders will need the control number included on their proxy card and all other shareholders will need to follow the instructions that accompanied their proxy materials. Beneficial owners of shares held in street name must register in advance with Computershare no later than 5:00 p.m., Eastern Time, on May 13, 2022. (Late submissions will be processed to the extent feasible, but registration cannot be guaranteed in time for participation in the meeting.) To request registration, forward the proxy-granting email from your broker or email an image of your legal proxy to legalproxy@computershare.com, with a subject line of “Legal Proxy,” or mail your request to Computershare, Banner Corporation Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001. Computershare will confirm your registration by email and provide you with a unique control number necessary to participate fully in the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

SHERREY LUETJEN

Secretary, Banner Corporation

Walla Walla, Washington

April 7, 2022

|

IMPORTANT: Voting promptly will save us the expense of further requests for proxies in order to ensure a quorum. You may vote via the Internet or by telephone. Alternatively, a proxy card and self-addressed envelope are enclosed for your convenience. No postage is necessary if mailed in the United States.

|

Table

of Contents

Information about the Annual Meeting

PROXY STATEMENT

OF

BANNER CORPORATION

10 S. FIRST AVENUE

WALLA WALLA, WASHINGTON 99362

(509) 527-3636

The Board of Directors of Banner Corporation is using this Proxy Statement to solicit proxies from our shareholders for use at the 2022 annual meeting of shareholders. We are first mailing this Proxy Statement and the form of proxy to our shareholders on or about April 7, 2022.

The information provided in this Proxy Statement relates to Banner Corporation and its wholly-owned subsidiary, Banner Bank (collectively, the “Corporation”). Banner Corporation may also be referred to as “Banner” and Banner Bank may also be referred to as the “Bank.” References to “we,” “us” and “our” refer to Banner and, as the context requires, the Bank.

Information about the Annual Meeting

|

Date Wednesday, May 18, 2022 |

Time 10:00 a.m., Pacific Time |

Record Date March 10, 2022 | ||

|

Location Online at www.meetnow.global/M5JH2R5

Important notice regarding the availability of proxy materials for the annual meeting of shareholders Our Proxy Statement, proxy card and 2021 Annual Report to Shareholders are available at www.bannerbank.com/proxymaterials.

| ||||

| Matters to Be Considered at the Annual Meeting

At the meeting, you will be asked to consider and vote upon the following proposals:

Proposal 1. Election of three directors to each serve for a three-year term and two directors to each serve for a one-year term.

Proposal 2. Advisory (non-binding) approval of the compensation of our named executive officers as disclosed in this Proxy Statement.

Proposal 3. Ratification of the Audit Committee’s appointment of Moss Adams LLP as our independent registered public accounting firm for 2022.

Proposal 4. Amendment of Articles of Incorporation to eliminate staggered terms for directors.

We also will transact any other business that may properly come before the annual meeting. As of the date of this Proxy Statement, we are not aware of any other business to be presented for consideration at the annual meeting other than the matters described in this Proxy Statement. |

How to Vote:

To ensure that your shares are represented at the meeting, please take the time to submit your vote in one of the following ways:

| |||

|

Internet

Go to www.investorvote.com/BANR or scan the QR code on your proxy card

|

| |||

|

Telephone

Call 1 (800) 652-VOTE (8683) within the USA, US territories and Canada

|

| |||

|

Sign, date and mail the enclosed proxy card

|

| |||

| BANNER CORPORATION 2022 PROXY STATEMENT | 1 |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

Annual Meeting Frequently Asked Questions

| Q. | Who is Entitled to Vote? |

| A. | We have fixed the close of business on March 10, 2022 as the record date for shareholders entitled to notice of and to vote at our annual meeting. You are entitled to one vote for each share of Banner common stock you own, unless you acquired more than 10% of Banner’s outstanding common stock without prior Board approval. As provided in our Articles of Incorporation, for each vote in excess of 10% of the voting power of the outstanding shares of Banner’s voting stock, the record holders in the aggregate will be entitled to cast one-hundredth of a vote, and the aggregate power of these record holders will be allocated proportionately among these record holders. On March 10, 2022, there were 34,265,460 shares of Banner common stock outstanding and entitled to vote at the annual meeting. |

| Q. | How Do I Vote at the Annual Meeting? |

| A. | Proxies are solicited to provide all shareholders on the voting record date an opportunity to vote on matters scheduled for the annual meeting and described in these materials. You are a shareholder of record if your shares of Banner common stock are held in your name. The response to this question provides voting instructions only for shareholders of record. If you are a beneficial owner of Banner common stock held by a broker, bank or other nominee (i.e., in “street name”), please see the instructions in the following question and response. |

Shares of Banner common stock can only be voted if the shareholder is present virtually or by proxy at the annual meeting. To ensure your representation at the annual meeting, we recommend you vote by proxy even if you plan to attend the virtual annual meeting. You can always change your vote at the meeting if you are a shareholder of record.

Shareholders may vote by proxy via the Internet or a toll-free telephone number, or by mailing a proxy card. Instructions for voting are found on the proxy card. Shares of Banner common stock represented by properly executed proxies will be voted by the individuals named on the proxy card in accordance with the shareholder’s instructions. Where properly executed proxies are returned to us with no specific instruction as how to vote at the annual meeting, the persons named in the proxy will vote the shares FOR election of each of our director nominees, FOR advisory approval of the compensation of our named executive officers as disclosed in this Proxy Statement, FOR ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for 2022 and FOR amendment of the Articles of Incorporation to declassify the Board of Directors. If any other matters are properly presented at the annual meeting for action, the persons named in the enclosed proxy and acting thereunder will have the discretion to vote on these matters in accordance with their best judgment. We do not currently expect that any other matters will be properly presented for action at the annual meeting.

You may receive more than one proxy card depending on how your shares are held. For example, you may hold some of your shares individually, some jointly with your spouse or other party and some in trust for your children. In this case, you will receive three separate proxy cards to vote.

| 2 | BANNER CORPORATION 2022 PROXY STATEMENT |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

To ensure that your shares are represented at the meeting, please take the time to submit your vote in one of the following ways:

|

Internet

Go to www.investorvote.com/BANR or scan the QR code on your proxy card

|

| |

|

Telephone

Call 1 (800) 652-VOTE (8683) within the USA, US territories and Canada |

| |

|

Sign, date and mail the enclosed proxy card

|

|

| Q. | What if My Shares Are Held in Street Name? |

| A. | If you are the beneficial owner of shares held in “street name” by a broker, bank or other nominee (“nominee”), the nominee, as the record holder of the shares, is required to vote the shares in accordance with your instructions. If you do not give instructions to the nominee, the nominee may nevertheless vote the shares with respect to discretionary items, but will not be permitted to vote your shares with respect to non-discretionary items, pursuant to the rules governing brokers. In the case of non-discretionary items, the shares not voted will be treated as “broker non-votes.” The proposals to elect directors and amend the Articles of Incorporation, as well as the advisory vote on executive compensation, are considered non-discretionary items; therefore, you must provide instructions to the nominee in order to have your shares voted with respect to these proposals. |

If your shares are held in street name and you would like to fully participate in the annual meeting, you must register in advance. You may participate as a “Guest” without having a unique control number, but you will not have the option to vote your shares or ask questions at the virtual meeting. To fully participate in the meeting as a “Shareholder,” you must obtain a unique control number by registering in advance with Computershare and submitting proof of your proxy power (legal proxy) reflecting your Banner holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 13, 2022. (Late submissions will be processed to the extent feasible, but registration cannot be guaranteed in time for your participation in the meeting.) Requests for registration should be submitted as follows:

By email: Forward the proxy-granting email from your broker, or email an image of your legal proxy, to legalproxy@computershare.com. The subject line of your email should include “Legal Proxy.”

By mail:

Computershare

Banner Corporation Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

You will receive an email from Computershare confirming your registration and providing you with your unique control number needed to participate in the virtual annual meeting as a “Shareholder”

| BANNER CORPORATION 2022 PROXY STATEMENT | 3 |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

if you register by email or if you provide an email address when registering by mail. If you do not provide an email address when registering by mail, confirmation of your registration and your unique control number will be provided by mail.

| Q. | How Many Shares Must Be Present to Hold the Meeting? |

| A. | A quorum must be present at the meeting for any business to be conducted. The presence at the meeting, in person via the virtual meeting platform or by proxy, of at least a majority of the shares of Banner common stock entitled to vote at the annual meeting will constitute a quorum. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. |

| Q. | What if a Quorum Is Not Present at the Meeting? |

| A. | If a quorum is not present at the scheduled time of the meeting, a majority of the shareholders virtually present or represented by proxy may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given unless the meeting is adjourned for 120 days or more. An adjournment will have no effect on the business that may be conducted at the meeting. |

| Q. | Vote Required to Approve Proposal 1: Election of Directors |

| A. | Banner’s Amended and Restated Bylaws provide for the election of directors by a majority of the votes cast by shareholders in uncontested elections. Accordingly, in an uncontested election, the number of shares voted “for” a director nominee must exceed the number of shares voted “against” the nominee, in order for that nominee to be elected. The following are not considered votes cast: (1) a share whose ballot is marked as abstain; (2) a share otherwise present at the meeting but for which there is an abstention; and (3) a share otherwise present at the meeting as to which a shareholder of record gives no authority or direction. The term of any director who was a director at the time of the election but who does not receive a majority of votes cast in an election held under the majority vote standard will continue to serve as a director until terminated on the earliest to occur of: (1) 90 days after the date election results are determined; (2) the date the Board appoints a new director to fill the position; or (3) the date and time the director’s resignation is effective. |

Banner’s Amended and Restated Bylaws provide that an election is considered a contested election if there are shareholder nominees for director pursuant to the advance notice provision, and who are not withdrawn by the advance notice deadline set forth in Banner’s Articles of Incorporation. If the Board determines there is a contested election, the election of directors will be held under a plurality standard. Under the plurality standard, the nominees who receive the highest number of votes for the directorships for which they have been nominated will be elected.

Pursuant to our Articles of Incorporation, shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or against each nominee, or shareholders may abstain from voting. Abstentions and broker non-votes will have no effect on the outcome of the election. Our Board of Directors unanimously recommends that you vote FOR the election of each of our director nominees.

| Q. | Vote Required to Approve Proposal 2: Advisory Approval of Executive Compensation |

| A. | The advisory (non-binding) vote to approve the compensation of our named executive officers as disclosed in this Proxy Statement requires the affirmative vote of a majority of the votes cast, in |

| 4 | BANNER CORPORATION 2022 PROXY STATEMENT |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

| person via the virtual meeting platform or by proxy, at the annual meeting. Abstentions and broker non-votes will have no effect on the outcome of the proposal. Our Board of Directors unanimously recommends that you vote FOR approval of the compensation of our named executive officers. |

| Q. | Vote Required to Approve Proposal 3: Ratification of the Appointment of the Independent Registered Public Accounting Firm |

| A. | Ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 requires the affirmative vote of a majority of the votes cast, in person via the virtual meeting platform or by proxy, at the annual meeting. Abstentions will have no effect on the outcome of the proposal. Our Board of Directors unanimously recommends that you vote FOR the ratification of the appointment of the independent registered public accounting firm. |

| Q. | Vote Required to Approve Proposal 4: Amendment of Articles of Incorporation to Eliminate Staggered Terms for Directors |

| A. | The proposal to amend the Articles of Incorporation to eliminate staggered terms for directors and require the annual election of directors will require the affirmative vote of a majority of the votes entitled to be cast at the annual meeting. Abstentions and broker non-votes will have the same effect as a vote against the proposal. Our Board of Directors unanimously recommends that you vote FOR amendment of the Articles of Incorporation to eliminate staggered terms for directors and require the annual election of directors. |

| Q. | May I Revoke My Proxy? |

| A. | You may revoke your proxy before it is voted by: |

| • | Submitting a new proxy with a later date; |

| • | Notifying Banner’s Secretary in writing before the annual meeting that you have revoked your proxy; or |

| • | Voting at the virtual annual meeting. |

If you plan to attend the virtual annual meeting and vote during the meeting, you must join the meeting as a “Shareholder.” If you are a shareholder of record, you will need the control number on your proxy card. If you are the beneficial owner of shares held in “street name” by a broker, bank or other nominee, you will need to register in advance with Computershare by following the instructions in the question above titled, “What if My Shares Are Held in Street Name?”

| Q. | May I Ask A Question During the Virtual Meeting? |

| A. | Yes. There will be a question and answer session following the formal portion of the meeting, during which we will answer questions pertinent to our business as time allows. Questions of a similar nature may be grouped together and answered once to avoid repetition. The virtual meeting platform will allow shareholders to ask questions. To ask a question during the meeting, registered shareholders will need the control number included on their proxy card and all other shareholders will need to register in advance to obtain a unique control number as described in the Notice of Annual Meeting of Shareholders and in the question above titled, “What if My Shares Are Held in Street Name?” |

| BANNER CORPORATION 2022 PROXY STATEMENT | 5 |

Information about the Annual Meeting | Annual Meeting Frequently Asked Questions

| Q: | What if I Have Trouble Accessing the Annual Meeting Virtually? |

| A: | The virtual meeting platform is fully supported across Microsoft Edge, Firefox, Chrome and Safari browsers and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is not a supported browser. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. If you need further assistance, you may call 1-888-724-2416 (US) or 1-781-575-2748 (outside the US). |

| 6 | BANNER CORPORATION 2022 PROXY STATEMENT |

Security Ownership of Certain Beneficial Owners and Management

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of March 10, 2022, the voting record date, information regarding share ownership of:

| • | Those persons or entities (or groups of affiliated person or entities) known by management to beneficially own more than five percent of Banner’s common stock, other than directors and executive officers; |

| • | Each director and director nominee of Banner; |

| • | Each executive officer named in the Summary Compensation Table appearing under “Executive Compensation” below (known as “named executive officers”); and |

| • | All directors and executive officers of Banner and Banner Bank as a group. |

Persons and groups who beneficially own in excess of five percent of Banner’s common stock are required to file with the U.S. Securities and Exchange Commission (“SEC”), and provide copies to us, reports disclosing their ownership under the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”). To our knowledge, no other person or entity, other than those set forth below, beneficially owned more than five percent of the outstanding shares of Banner’s common stock as of the close of business on the voting record date.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In accordance with Rule 13d-3 of the Securities Exchange Act, a person is deemed to be the beneficial owner of any shares of common stock if that person has voting and/or investment power with respect to those shares. Therefore, the table below includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table may possess voting and/or investment power. In addition, in computing the number of shares beneficially owned by a person and the percentage ownership of that person, restricted share units that will vest within 60 days after the voting record date are included in the number of shares beneficially owned by the person and are deemed outstanding for the purpose of calculating the person’s percentage ownership. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. As of the voting record date, there were 34,265,460 shares of Banner common stock outstanding.

| BANNER CORPORATION 2022 PROXY STATEMENT | 7 |

Security Ownership of Certain Beneficial Owners and Management

| Name |

Number of Shares Beneficially |

Percent of Voting Shares Outstanding (%) |

||||||

| Beneficial Owners of More Than 5% |

| |||||||

| BlackRock, Inc. |

|

4,972,759 |

(2) |

|

14.51 |

| ||

| The Vanguard Group |

|

3,782,997 |

(3) |

|

11.04 |

| ||

| Dimensional Fund Advisors LP |

|

2,280,961 |

(4) |

|

6.66 |

| ||

| Directors |

| |||||||

| Ellen R.M. Boyer |

|

1,084 |

|

|

* |

| ||

| Connie R. Collingsworth |

|

8,059 |

(5) |

|

* |

| ||

| Margot J. Copeland |

|

— |

|

|

* |

| ||

| Roberto R. Herencia |

|

6,828 |

|

|

* |

| ||

| David A. Klaue |

|

117,353 |

|

|

* |

| ||

| John R. Layman |

|

26,051 |

(6) |

|

* |

| ||

| David I. Matson |

|

4,182 |

|

|

* |

| ||

| Brent A. Orrico |

|

47,956 |

(7) |

|

* |

| ||

| John Pedersen |

|

1,084 |

|

|

* |

| ||

| Kevin F. Riordan |

|

5,284 |

(8) |

|

* |

| ||

| Merline Saintil |

|

5,067 |

|

|

* |

| ||

| Terry Schwakopf |

|

4,416 |

|

|

* |

| ||

| Paul J. Walsh |

|

— |

|

|

* |

| ||

| Named Executive Officers |

| |||||||

| Mark J. Grescovich** |

|

120,404 |

|

|

* |

| ||

| Peter J. Conner |

|

24,084 |

|

|

* |

| ||

| Cynthia D. Purcell |

|

13,551 |

|

|

* |

| ||

| M. Kirk Quillin |

|

15,584 |

|

|

* |

| ||

| James P. G. McLean |

|

9,183 |

|

|

* |

| ||

| Judith A. Steiner |

|

8,294 |

|

|

* |

| ||

| All Executive Officers and Directors as a Group (29 persons) |

|

501,798 |

|

|

1.46 |

| ||

| * | Less than 1% of shares outstanding. |

| ** | Also a director of Banner. |

| (1) | Shares of restricted stock granted under the 2014 Omnibus Incentive Plan, as to which holders have voting but not investment power, are included as follows: Mr. Herencia, 1,174 shares and Mr. Riordan, 1,065 shares. Also includes the following number of restricted share units granted under the 2014 Omnibus Incentive Plan and the 2018 Omnibus Incentive Plan and vesting within 60 days of the voting record date: Ms. Boyer and Mr. Pedersen, 1,084 each; Ms. Collingsworth, 1,035; Mr. Klaue, Mr. Layman, Mr. Matson and Ms. Saintil, 936 each; Mr. Orrico, 1,391; Mr. Riordan, 49; Ms. Schwakopf, 1,050; Mr. Grescovich, 9,475; Mr. Conner, 3,564; Ms. Purcell, 3,224; Mr. Quillin, 1,710; and Mr. McLean, 1,587; and all executive officers and directors as a group, 39,647. |

| (2) | Based on a Schedule 13G/A dated January 27, 2022, which reports sole voting power over 4,879,881 shares and sole dispositive power over 4,972,759 shares. According to this filing the interest of iShares Core S&P Small-Cap ETF is more than 5% of Banner’s total outstanding stock. The address for BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

| (3) | Based on a Schedule 13G/A dated February 9, 2022, which reports shared voting power over 30,872 shares, sole dispositive power over 3,721,370 shares and shared dispositive power over 61,627 shares. The address for The Vanguard Group is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. |

| (4) | Based on a Schedule 13G/A dated February 8, 2022, which reports sole voting power over 2,236,260 shares and sole dispositive power over 2,280,961 shares. The address for Dimensional Fund Advisors is Building One, 6300 Bee Cave Road, Austin, Texas 78746. |

| 8 | BANNER CORPORATION 2022 PROXY STATEMENT |

Security Ownership of Certain Beneficial Owners and Management

| (5) | Includes 100 shares held jointly with her husband. |

| (6) | Includes 9,414 shares that have been pledged. |

| (7) | Includes 1,212 shares owned by companies controlled by Mr. Orrico, 2,453 shares owned by trusts directed by Mr. Orrico and 3,206 shares held jointly with his children. |

| (8) | Includes 885 restricted stock units that vest upon retirement from the Board. |

| BANNER CORPORATION 2022 PROXY STATEMENT | 9 |

Proposal 1 – Election of Directors

Proposal 1 – Election of Directors

Banner’s Board of Directors currently consists of 14 members and is divided into three classes. Directors David I. Matson and Brent A. Orrico will retire, and Director Merline Saintil will resign, effective as of the adjournment of the 2022 annual meeting of shareholders, at which time the Board will reduce its size to 11 members. Approximately one-third of the directors are elected annually to serve for a three-year period or until their respective successors are elected and qualified. The table below sets forth information regarding each continuing director of Banner and each nominee for director. The Corporate Governance/Nominating Committee of the Board of Directors selects nominees for election as directors. Each of our nominees currently serves as a Banner director and has consented to being named in this Proxy Statement and has agreed to serve if elected. To bolster the Board’s collective skills, the Board appointed Margot J. Copeland and Paul J. Walsh as directors at its February 2022 meeting and each has been nominated for election by shareholders.

If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority. At this time, we are not aware of any reason why a nominee might be unable to serve if elected.

The Board of Directors recommends a vote FOR the election of Ellen R.M. Boyer, Connie R. Collingsworth and John Pedersen, each for a three-year term, and FOR the election of Margot J. Copeland and Paul J. Walsh, each for a one-year term.

| Name |

Age as of December 31, 2021 |

Year First Elected or Appointed Director |

Term to Expire | |||||||||

| Board Nominees |

| |||||||||||

| Ellen R.M. Boyer |

|

61 |

|

|

2021 |

|

|

2025 |

(1) | |||

| Connie R. Collingsworth |

|

63 |

|

|

2013 |

|

|

2025 |

(1) | |||

| John Pedersen |

|

64 |

|

|

2021 |

|

|

2025 |

(1) | |||

| Margot J. Copeland |

|

70 |

|

|

2022 |

|

|

2023 |

(1) | |||

| Paul J. Walsh |

|

53 |

|

|

2022 |

|

|

2023 |

(1) | |||

| Directors Continuing in Office |

| |||||||||||

| Mark J. Grescovich |

|

57 |

|

|

2010 |

|

|

2023 |

| |||

| David A. Klaue |

|

68 |

|

|

2007 |

|

|

2023 |

| |||

| Roberto R. Herencia |

|

62 |

|

|

2016 |

|

|

2024 |

| |||

| John R. Layman |

|

63 |

|

|

2007 |

|

|

2024 |

| |||

| Kevin F. Riordan |

|

65 |

|

|

2018 |

|

|

2024 |

| |||

| Terry Schwakopf |

|

70 |

|

|

2018 |

|

|

2024 |

| |||

| (1) | Assuming election or re-election. |

Information Regarding Nominees for Election. Set forth below is the present principal occupation and other business experience during at least the last five years of each nominee for election, as well as a brief discussion of the particular experience, qualifications, attributes and skills that led the Board to conclude that the nominee should serve as a director of Banner.

| 10 | BANNER CORPORATION 2022 PROXY STATEMENT |

Proposal 1 – Election of Directors

| Ellen R.M. Boyer | ||||

|

Director Since: 2021 |

Committees: |

|||

| • Audit • Compensation and Human Capital

| ||||

| Key Qualifications: • Audit experience; qualifies as an audit committee financial expert • Certified Public Accountant (Active) • Experienced chief financial officer and chief operating officer • Acquisition and strategic planning expertise

Ellen R.M. Boyer is Chief Financial Officer of Logic20/20, a business and technology consulting firm headquartered in Seattle, Washington. Ms. Boyer has over 30 years of finance and operational experience in a variety of industries, including technology, financial services and healthcare. Prior to joining Logic20/20 in 2014, Ms. Boyer held chief financial officer and/or chief operating officer roles at several companies in the Seattle area beginning in 1997. Ms. Boyer was previously an Audit Senior Manager at PriceWaterhouseCoopers, where she worked for 12 years. Ms. Boyer has extensive experience in strategic planning, mergers and acquisitions, governance matters, organizational effectiveness, and audit and financial matters. Ms. Boyer graduated from Oregon State University with degrees in Accounting and Spanish and minors in Computer Science and Latin American Affairs. She maintains an active Certified Professional Accountant license. Ms. Boyer is active in her community and has served on several for-profit and not-for-profit boards, including Umpqua Holdings Corporation (Nasdaq: UMPQ) from 2014 through 2016 and Sterling Financial Corporation (now Umpqua) from 2007 through 2014. Ms. Boyer qualifies as an audit committee financial expert. This qualification, together with her deep financial expertise and strategic planning experience supported her nomination to the Board. | ||||

| Connie R. Collingsworth | ||||

|

Director Since: 2013 |

Committees: |

|||

| • Compensation and Human Capital • Corporate Governance/Nominating (Chair)

|

• Executive | |||

| Key Qualifications: • Risk management expertise • Acquisition, business expansion and complex investment experience • Organizational effectiveness and corporate governance best practices leadership • Unique insights regarding environmental, social and governance (ESG) issues; diversity, equity and inclusion; and corporate social responsibility

Connie R. Collingsworth serves as the Chief Operating Officer of the Bill & Melinda Gates Foundation in Seattle, Washington, where she manages the Foundation’s legal, information technology, human resources, security and other business operations units, and provides leadership in the areas of risk management, compliance and corporate governance. Since 2007, she has served on the Foundation’s Executive Leadership Team, which is responsible for the development and execution of Foundation-wide strategy and policy. Prior to joining the Foundation in 2002, Ms. Collingsworth was a partner of Preston Gates & Ellis, now K&L Gates, a leading Northwest law firm based in Seattle, where she served as lead attorney for a broad range of commercial transactions, mergers and acquisitions, and private equity financings. Ms. Collingsworth also serves on the Board of Directors of Premera Blue Cross, one | ||||

| BANNER CORPORATION 2022 PROXY STATEMENT | 11 |

Proposal 1 – Election of Directors

| of the largest health plan providers in the Pacific Northwest. She previously served on the Board of Directors of Women’s World Banking, a global non-profit devoted to giving low-income women access to the financial tools and resources essential to their security and prosperity. Ms. Collingsworth was honored as one of WomenInc. magazine’s 2019 Most Influential Corporate Directors. | ||||

| John Pedersen | ||||

|

Director Since: 2021 |

Committees: |

|||

| • Credit Risk • Risk

|

||||

| Key Qualifications: • Extensive bank leadership experience, including as a chief risk officer • Deep expertise in risk management • Acquisition and strategic planning expertise • Corporate governance best practices and organizational effectiveness expertise

John Pedersen was with City National Bank of Los Angeles, California from 2004, serving as Executive Vice President and Chief Risk Officer from 2006 until his retirement in 2019. He has over three decades of progressive commercial banking credit and risk management responsibilities and significant expertise in establishing and managing risk management functions within a regional bank setting. Mr. Pedersen is skilled in strategic planning, including turn-around and growth strategies. He has a thorough understanding of many aspects of banking, including retail, small business, commercial real estate, dealer banking, consumer lending, mortgage banking and middle market lending. Mr. Pedersen began his career in government and held staff and leadership positions with the Office of the Comptroller of the Currency and the Office of Thrift Supervision. After government service, Mr. Pedersen managed a wide range of risk management activities for several financial institutions, including First Interstate Bancorp, KeyCorp, Wachovia and Bank of the West. Active in the community, Mr. Pedersen is involved with various philanthropic organizations that facilitate the micro-financing of small business entrepreneurs domestically and abroad. Mr. Pedersen earned a Bachelor of Business Administration degree in finance and accounting from the University of Oklahoma. Mr. Pedersen’s deep risk management expertise and broad banking experience supported his nomination to the Board. | ||||

| Margot J. Copeland | ||||

|

Director Since: 2022 |

Committees: |

|||

| • Compensation and Human Capital • Credit Risk

| ||||

| Key Qualifications: • Extensive banking and executive leadership, philanthropic and community engagement experience • Corporate responsibility expertise, including in relation to diversity, equity and inclusion

Margot J. Copeland specializes in developing strategies in the areas of workforce development and management, leadership, diversity and inclusion, philanthropy, and community outreach and engagement. Ms. Copeland has over 20 years of experience, with her previous positions being at KeyBank (a subsidiary of KeyCorp (NYSE: KEY)) and its affiliate, KeyBank Foundation, in Cleveland, Ohio. At KeyBank, she was Executive Vice President and Director Corporate Philanthropy and Community Engagement from 2001 through 2019. During the same period, she served as Board Chair and Chief Executive Officer for KeyBank Foundation. As a corporate officer and leader of corporate philanthropy and civic engagement, Ms. Copeland was a member of KeyBank’s Corporate Social Responsibility | ||||

| 12 | BANNER CORPORATION 2022 PROXY STATEMENT |

Proposal 1 – Election of Directors

| Council, which focused on philanthropic investments, corporate citizenship, and regulatory and corporate strategy. She was also a member of the Diversity & Inclusion Council and she served as KeyBank’s Chief Diversity Officer from 2001 through 2013. Prior to joining KeyBank, Ms. Copeland served on the Advisory Board of US Bank (formerly Firstar) from 1998 through 2001. Ms. Copeland received a Master’s degree from The Ohio State University, a Bachelor of Science in Physics from Hampton University, Hampton, Virginia and an Honorary Doctorate of Humane Letters from Cuyahoga Community College, Cleveland, Ohio. With her vast experience in social responsibility and her long-tenured connection to banking, we believe that Ms. Copeland is an excellent addition to the Board of Directors. | ||||

| Paul J. Walsh | ||||

|

Director Since: 2022 |

Committees: |

|||

| • Audit • Risk

|

||||

| Key Qualifications: • Strong technology, information security, cybersecurity and digital expertise • Leadership and advisory board experience

Paul J. Walsh is currently Senior Vice President, Head of Digital, Engineering, and IT at Sony Interactive Entertainment (part of Sony Group Corp, NYSE: SONY) in Kirkland, Washington, which he joined in January 2022. He was an Executive-In-Residence with Adobe (NYSE: ADBE) in Kirkland, Washington, from 2021 to 2022. Mr. Walsh served as Senior Vice President and Global Chief Digital Officer with Lenovo (OTCM: LNVGF) in Kirkland, Washington, from 2018 to 2020. Prior to Lenovo, Mr. Walsh served as Senior Vice President, Platform Strategy & Innovation for Visa Inc. (NYSE: V) in Kirkland, Washington, from 2016 to 2018. Mr. Walsh previously served as the Global Chief Information Officer at Dell (NYSE: DELL) in Austin, Texas, from 2013 through 2015. Mr. Walsh is also an experienced advisory board member. Mr. Walsh received a Bachelor of Science, BSc Computer Science at Griffith College, Dublin, Ireland. He is a technology leader with more than 25 years of experience in both scale and scope with some of the most respected brands in the industry. With his advisory board experience and technical background, we believe Mr. Walsh is an important addition to the Board of Directors. | ||||

Information Regarding Incumbent Directors. Set forth below is the present principal occupation and other business experience during at least the last five years of each director continuing in office, as well as a brief discussion of the particular experience, qualifications, attributes and skills that led the Board to conclude that the director should serve on Banner’s Board of Directors.

| Roberto R. Herencia | ||||

|

Director Since: 2016 |

Committees: |

|||

| • Compensation and Human Capital (Chair) • Corporate Governance/Nominating

|

• Credit Risk (Chair) • Executive | |||

| Key Qualifications: • Extensive bank leadership experience, including as a director and chief executive officer • Acquisition and strategic planning expertise • Credit and risk management expertise | ||||

| BANNER CORPORATION 2022 PROXY STATEMENT | 13 |

Proposal 1 – Election of Directors

|

Roberto R. Herencia is President and Chief Executive Officer of BXM Holdings, a fund specializing in community bank investments. He is a director and Chairman of the Board of First BanCorp. (NYSE: FBP) and its subsidiary, FirstBank Puerto Rico, positions he has held since October 2011. He has been an independent director and the Chairman of the Board of Byline Bancorp (NYSE: BY) and its subsidiary bank, Byline Bank, since June 2013, and effective February 12, 2021 assumed the role of Chief Executive Officer of Byline Bancorp. Between 2009 and 2010, Mr. Herencia was President and Chief Executive Officer of Midwest Banc Holdings, Inc. and its subsidiary, Midwest Bank and Trust. Prior to that, he spent 17 years with Popular Inc. as its Executive Vice President and as President of Popular Inc.’s subsidiary, Banco Popular North America. Prior to joining Popular, Mr. Herencia spent 10 years with The First National Bank of Chicago (now J.P. Morgan Chase) in a variety of roles, including Deputy Senior Credit Officer and Head of the Emerging Markets Division. Mr. Herencia previously served on the US International Development Finance Corporation’s Board of Directors, to which he was appointed by President Obama in 2011. He graduated magna cum laude and received his Bachelor of Science in Business Administration degree in finance from Georgetown University and his Master of Business Administration degree from the Kellogg School of Management at Northwestern University. | ||||

| John R. Layman | ||||

|

Director Since: 2007 |

Committees: |

|||

| • Audit • Risk

|

||||

| Key Qualifications: • Extensive legal experience, including in mergers and acquisitions and complex litigation matters • Bank leadership and operational experience • Risk management expertise • Strategic planning experience

John R. Layman served as Co-Vice Chairman of the Board of Directors of F&M Bank until its acquisition by Banner Bank in May 2007. He is Managing Partner of Layman Law Firm, PLLP, with which he has been associated since 1983. His areas of practice include real estate development, commercial litigation, personal injury and product liability. He also has experience in securities litigation, fiduciary obligations, corporate governance and compliance and reporting requirements. | ||||

| Kevin F. Riordan | ||||

|

Director Since: 2018 |

Committees: |

|||

| • Audit (Chair) • Compensation and Human Capital

|

• Credit Risk • Executive | |||

| Key Qualifications: • Audit experience; qualifies as an audit committee financial expert • Risk management expertise • Corporate governance best practices and organizational effectiveness expertise

Kevin F. Riordan retired as a Banking & Capital Markets audit and client service Partner of PricewaterhouseCoopers LLP (PwC), a global professional services firm, in June 2014, having served in that capacity since 2000. Prior to joining PwC in 1994, Mr. Riordan served various banking and securities trading companies as both an independent auditor and senior financial/accounting executive. | ||||

| 14 | BANNER CORPORATION 2022 PROXY STATEMENT |

Proposal 1 – Election of Directors

| During his career at PwC, Mr. Riordan gained significant experience working with the boards and audit committees of publicly traded banking and lending institutions while managing major client relationships across multiple markets. In those roles, Mr. Riordan developed expertise in complex accounting, auditing and financial reporting matters. Mr. Riordan has been a Certified Public Accountant since 1983. His qualification as an audit committee financial expert was the primary reason for his nomination to the Board. | ||||

| Terry Schwakopf | ||||

|

Director Since: 2018 |

Committees: |

|||

| • Corporate Governance/Nominating • Executive

|

• Risk (Chair) | |||

| Key Qualifications: • Extensive bank regulatory supervision experience | ||||

| • Banking and fintech expertise • Risk management expertise

Terry Schwakopf is an Independent Senior Advisor to the banking practice of Deloitte & Touche, LLP. Prior to joining Deloitte in 2007, Ms. Schwakopf was Executive Vice President of the Federal Reserve Bank of San Francisco with overall responsibility for banking supervision. In that capacity, she oversaw the supervision of state member banks and bank and financial holding companies in the nine western states that comprise the San Francisco District. During her 23-year career with the Federal Reserve, she had a number of other responsibilities, including oversight of community affairs, public information, the corporate secretary’s function and communications. Before joining the Federal Reserve, she held positions in both the commercial banking and savings and loan industries and worked as a consultant to community banks. Ms. Schwakopf is a member of the advisory board of Blockchain Capital, a venture capital fund. She was on the Board of United Way of the Bay Area, and is actively involved in a number of international organizations and civic groups. Ms. Schwakopf previously served on the Boards of Directors of Bridge Bank and Bridge Capital Holdings, Nara Bank and Nara Bancorporation, and Rabobank, NA. She was a member of the accreditation cadre for the Conference of State Bank Supervisors and a board advisor for Solar Mosaic, a crowdfunding site for solar energy financing. Ms. Schwakopf was honored as one of WomenInc. magazine’s 2019 Most Influential Corporate Directors. | ||||

| Mark J. Grescovich | ||||

| President and CEO | ||||

|

Director Since: 2010 |

Committees: |

|||

| • Credit Risk • Executive

|

• Risk | |||

| Key Qualifications: • Extensive bank leadership experience • Acquisition and strategic planning expertise • Credit and risk management expertise

Mark J. Grescovich is President and Chief Executive Officer, and a director, of Banner Corporation and Banner Bank. Mr. Grescovich joined Banner Bank in April 2010 and became Chief Executive Officer in August 2010 following an extensive banking career specializing in finance, credit administration and risk | ||||

| BANNER CORPORATION 2022 PROXY STATEMENT | 15 |

Proposal 1 – Election of Directors

| management. Under his leadership, Banner has grown from $4.7 billion in assets in 2010 to more than $16 billion today through organic growth as well as selective acquisition. During that time, Mr. Grescovich has guided the expansion of Banner’s footprint to over 150 locations in four states. Prior to joining Banner, Mr. Grescovich was the Executive Vice President and Chief Corporate Banking Officer for Akron, Ohio-based FirstMerit Corporation and FirstMerit Bank N.A. He assumed responsibility for FirstMerit’s commercial and regional line of business in 2007, having served since 1994 in various commercial and corporate banking positions, including that of Chief Credit Officer. Prior to joining FirstMerit, Mr. Grescovich was a Managing Partner in corporate finance with Sequoia Financial Group, Inc. of Akron, Ohio, and a commercial and corporate lending officer and credit analyst with Society National Bank of Cleveland, Ohio. He has a Bachelor of Business Administration degree in finance from Miami University and a Master of Business Administration degree, also in finance, from The University of Akron. | ||||

| David A. Klaue | ||||

| Director Since: 2007 | Committees: | |||

| • Audit • Corporate Governance/Nominating

| ||||

| Key Qualifications: • Bank leadership experience • Acquisition, business expansion and strategic planning expertise • Extensive business operational experience • Organizational effectiveness expertise

David A. Klaue served as Chairman of the Board of Directors of F&M Bank until its acquisition by Banner Bank in May 2007. He is Chairman of the Board of Empire Lumber Co., a diversified wood products manufacturer with operations in Washington, Idaho and Montana, and of Park Ranch Land & Cattle Co., a cow/calf feeder and hay producer; he is also the Manager of EmpireAir, LLC, an air transportation company, and of Empire Investments, LLC, a real estate investment company. Mr. Klaue has been affiliated with these companies for more than 35 years. Additionally, he is a managing member in various other real estate investment, equipment and sales companies. Mr. Klaue’s career has afforded him expertise in banking, business, agricultural and real estate management. | ||||

Director Nomination Process. The Corporate Governance/Nominating Committee oversees the director nomination process. The Committee may consider both incumbent and new director nominees to nominate for election at each annual meeting of shareholders. The Committee also may recommend that the Board appoint new directors to serve until the next annual meeting of shareholders and then stand for election by shareholders. Only those nominations made by the Committee or properly presented by shareholders will be voted upon at the annual meeting.

In its deliberations for selecting candidates for nominees as director, the Committee seeks individuals of integrity, with a proven record of professional accomplishments and/or civic leadership, sound business judgment and practical wisdom, risk oversight skills, an ability to represent a broad spectrum of interests, an ability to work collaboratively with other directors and our executives, an inquiring and independent mind, who can function well as discussion leaders and consensus builders. The Committee also considers diversity characteristics (see “Board Diversity” below), the candidate’s knowledge of the banking business and whether the candidate would provide for adequate representation of our market area. Any nominee for director recommended by the Committee must be highly qualified in some or all of these areas.

| 16 | BANNER CORPORATION 2022 PROXY STATEMENT |

Proposal 1 – Election of Directors

In searching for qualified director candidates to fill vacancies on the Board, the Committee solicits its current Board of Directors for names of potentially qualified candidates. Additionally, the Committee may request that members of the Board of Directors pursue their own business contacts for the names of potentially qualified candidates. The Committee has also used an executive search and leadership consulting firm and other professional sources for qualified nominees, especially with respect to candidates with unique skill sets, such as a qualified financial expert. The Committee would then consider the potential pool of director candidates, select the candidate the Committee believes best meets the then-current needs of the Board, and conduct a thorough investigation of the proposed candidate’s background to ensure there is no past history that would cause the candidate not to be qualified to serve as a Banner director. The Committee will consider director candidates recommended by our shareholders. If a shareholder submits a proposed nominee, the Committee would consider the proposed nominee, along with any other proposed nominees recommended by members of the Board of Directors, in the same manner in which the Committee would evaluate its nominees for director. For a description of the proper procedure for shareholder nominations, see “Shareholder Proposals” in this Proxy Statement.

Board Diversity. Included among the attributes considered by the Corporate Governance/Nominating Committee in recommending director nominees is diversity by gender, race, ethnicity, national origin and/or age. Our Board believes that diversity, including differences in backgrounds, qualifications and personal characteristics, is important to the effectiveness of the Board’s oversight of Banner. The table below illustrates self-reported diversity characteristics for the individuals currently serving on our Board of Directors.

| Board Diversity Matrix (As of March 10, 2022) | ||||||||||||||||

| Board Size: |

||||||||||||||||

| Total Number of Directors |

14 | |||||||||||||||

| Gender: |

Male | Female | Non-Binary | |

Gender Undisclosed |

| ||||||||||

| 9 | 5 | — | — | |||||||||||||

| Number of directors who identify in any of the categories below: |

| |||||||||||||||

| African American or Black |

1 | 2 | — | — | ||||||||||||

| Alaskan Native or American Indian |

— | — | — | — | ||||||||||||

| Asian |

— | — | — | — | ||||||||||||

| Hispanic or Latinx |

1 | — | — | — | ||||||||||||

| Native Hawaiian or Pacific Islander |

— | — | — | — | ||||||||||||

| White |

8 | 3 | — | — | ||||||||||||

| Two or More Races or Ethnicities |

1 | — | — | — | ||||||||||||

| LGBTQ+ |

— | |||||||||||||||

| Undisclosed |

— | |||||||||||||||

| BANNER CORPORATION 2022 PROXY STATEMENT | 17 |

Proposal 1 – Election of Directors

Of our 14 current directors, 7 identify as having at least one diversity characteristic (i.e., female, non-binary, LGBTQ+ and/or race or ethnicity other than white).

| Gender Diversity |

Ethnic Diversity |

Overall Diversity |

||||||||||

| 36% |

29% |

50% |

||||||||||

|

5 of 14 directors |

4 of 14 directors |

|

7 of 14 directors have at least one diversity characteristic |

|||||||||

| 18 | BANNER CORPORATION 2022 PROXY STATEMENT |

Corporate Governance | Board of Directors

Our Board is committed to maintaining an effective corporate governance framework. Strong governance practices support long-term, sustainable value creation for our shareholders and provide a foundation for effective Board oversight. In January 2018, the Board of Directors adopted comprehensive corporate governance guidelines as a framework to assist the Board in fulfilling its responsibilities to shareholders. The guidelines, as amended from time to time, are available on our website at www.bannerbank.com and cover a wide range of topics including: Board composition; selection, tenure, evaluation and retirement of Board members; Board leadership; and director responsibilities. The Board’s Corporate Governance/Nominating Committee is responsible for initiatives to comply with the provisions contained in the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC adopted thereunder, and Nasdaq rules regarding corporate governance. The Committee evaluates and improves our corporate governance principles and policies from time to time, as deemed appropriate. Our governance framework is discussed in detail below.

Board of Directors

The Board of Directors conducts its business through Board meetings and through its committees. During the year ended December 31, 2021, the Board of Directors held 14 meetings. Each director attended more than 80% of the total meetings of the Board and committees on which that director served during this period.

Leadership Structure

The positions of Board Chair and of President and Chief Executive Officer are held separately by two individuals. This has been the case since 1995, when Banner was formed to become the holding company for Banner Bank. The Board believes this structure is appropriate for Banner because it provides the Board with capable leadership and independence from management. It also allows the President and Chief Executive Officer to focus on the day-to-day business of managing Banner, while the Chair leads the Board.

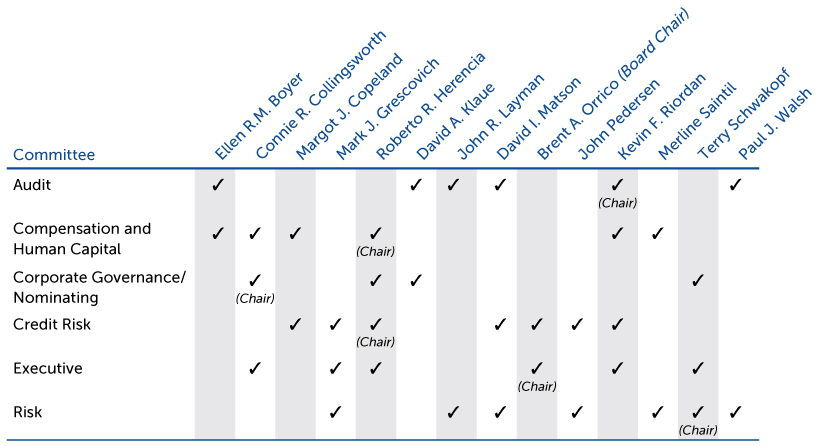

Committees and Committee Charters

The Board of Directors has standing Executive, Audit, Compensation and Human Capital, Corporate Governance/Nominating, Credit Risk, and Risk Committees. The Board has adopted written charters for each committee other than the Executive Committee. These charters are available on our website at https://investor.bannerbank.com/investor-relations/. Our directors’ current membership on these committees is reflected below.

| BANNER CORPORATION 2022 PROXY STATEMENT | 19 |

Corporate Governance | Committees and Committee Charters

Executive Committee. The Executive Committee acts for the Board of Directors when formal Board action is required between regular meetings. The Committee has the authority to exercise all powers of the full Board of Directors, except that it does not have the power to, among other things, declare dividends, authorize the issuance of stock, amend the Bylaws or approve any agreement of merger or consolidation other than mergers with Banner subsidiaries. The Executive Committee met three times during the year ended December 31, 2021.

Audit Committee. The Audit Committee oversees management’s fulfillment of its financial reporting responsibilities and maintenance of an appropriate internal control system. It also has the sole authority to appoint or replace our independent registered public accounting firm (“Independent Auditor”) and oversees the activities of our internal audit functions. The Audit Committee also assists the Board in fulfilling its oversight responsibilities relating to the quality and integrity of financial reports and other financial information provided by the Corporation and the Corporation’s systems of internal accounting and financial controls; the oversight and periodic evaluation of the Independent Auditor’s qualifications, independence and performance; the annual performance review and compensation of the Chief Audit Executive; the compliance by the Corporation with legal and regulatory requirements, including disclosure, controls and procedures with respect to financial reporting matters; and the oversight and review of external reporting and internal controls related to environmental, social and governance (ESG) activities.

The Corporation’s Independent Auditor routinely attends Audit Committee meetings and the Audit Committee regularly meets in executive session with the Corporation’s Independent Auditor. The Audit Committee also routinely meets in executive session with the Corporation’s Chief Audit Executive.

The Audit Committee believes it has fulfilled its responsibilities under its charter. The Committee met 14 times during the year ended December 31, 2021. Each member of the Audit Committee is “independent,” in accordance with the requirements for companies quoted on The Nasdaq Stock Market (“Nasdaq”). In addition, the Board of Directors has determined that Committee members Boyer, Matson and Riordan meet the definition of “audit committee financial expert,” as defined by the SEC.

| 20 | BANNER CORPORATION 2022 PROXY STATEMENT |

Corporate Governance | Committees and Committee Charters

Compensation and Human Capital Committee. The Compensation and Human Capital Committee sets compensation policies and levels for directors and executive officers and oversees all of our salary and incentive compensation programs. The Committee seeks to ensure that our compensation programs appropriately balance risk and reward. The Committee considers a wide variety of human capital management matters, including talent management and succession planning, diversity and inclusion initiatives and results, and pay equity reviews and results. The Committee also oversees environmental, social and governance (ESG) matters related to human capital resource management in coordination with the Corporate Governance/Nominating Committee.

The Committee believes it has fulfilled its responsibilities under its charter. The Compensation and Human Capital Committee met eight times during the year ended December 31, 2021. Each member of the Compensation and Human Capital Committee is “independent,” in accordance with the requirements for companies quoted on Nasdaq. In addition, each member of the Committee also qualifies as a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and as an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended.

The Committee meets, outside of the presence of Mr. Grescovich, to discuss his compensation and to make its associated recommendations to the full Board, which then votes on Mr. Grescovich’s compensation. Mr. Grescovich makes recommendations to the Committee regarding the compensation of all other executive officers. The Committee considers Mr. Grescovich’s recommendations and makes a recommendation to the full Board, which then votes on executive compensation.

Additional discussion regarding the Committee’s significant activities for fiscal year 2021 can be found in the “Compensation Discussion and Analysis” and “Executive Compensation” sections of this Proxy Statement.

Corporate Governance/Nominating Committee. The Corporate Governance/Nominating Committee assures that we maintain the highest standards and best practices in all critical areas relating to the management of the business of Banner. The Committee oversees the Board’s annual review of Board performance and reviews and recommends to the Board corporate governance guidelines. Additionally, the Committee reviews the Corporation’s environmental, social and governance (ESG) framework and initiatives and reviews policies and programs that relate to matters of corporate social responsibility. The Committee is also responsible for succession planning for the Board of Directors, including identifying needed skills and backgrounds, developing a list of nominees for board vacancies and selecting nominees for directors. The Committee also oversees our directors’ continuing education and ongoing training.

The Corporate Governance/Nominating Committee believes it has fulfilled its responsibilities under its charter. Each member of the Committee is “independent,” in accordance with the requirements for companies quoted on Nasdaq. The Committee met eight times during the year ended December 31, 2021.

Credit Risk Committee. The Credit Risk Committee was established in September 2020 and provides oversight of Banner’s credit risk structure and the processes established to identify, understand, measure, monitor and manage Banner’s credit risks. The Committee serves as the primary point of contact between the Board and the management-level committees dealing with credit risk management. The Committee is intended to enhance the Board’s oversight and understanding of credit risk management activities and the effectiveness thereof. Additional detail is provided below in “Board Involvement in the Risk Management Process.” The Credit Risk Committee met 11 times during the year ended December 31, 2021.

| BANNER CORPORATION 2022 PROXY STATEMENT | 21 |

Corporate Governance | Director Independence

Risk Committee. The Risk Committee provides oversight of our enterprise-wide risk structure and the processes established to identify, measure, monitor and manage our credit risk, market and liquidity risk, interest rate risk and operating risk, including technology, legal and compliance risk, and risks associated with the Corporation’s environmental, social and governance (ESG) program. The Committee is responsible for reviewing the Corporation’s progress on ESG risk management initiatives and activities, including climate change risk management relative to any stated ESG program goal. The Committee also reviews management’s strategies and policies for managing these risks and serves as the primary point of contact between the Board and senior management in assessing enterprise-wide risk management activities and effectiveness. Additional detail is provided below in “Board Involvement in the Risk Management Process.” The Risk Committee met 10 times during the year ended December 31, 2021.

Director Independence

Our common stock is listed on The Nasdaq Global Select Market. In accordance with Nasdaq rules, at least a majority of our directors must be independent directors. The Board has determined that 13 of our 14 directors are independent, as defined by Nasdaq. Ellen R.M. Boyer, Connie R. Collingsworth, Margot J. Copeland, Roberto R. Herencia, David A. Klaue, John R. Layman, David I. Matson, Brent A. Orrico, John Pedersen, Kevin F. Riordan, Merline Saintil, Terry Schwakopf and Paul J. Walsh are independent.

Director Tenure

The Corporate Governance/Nominating Committee seeks to select directors who will contribute to Banner’s corporate goals. The Committee recognizes the importance of Board refreshment as well as the value of Board tenure. As of the record date, March 10, 2022, four of Banner’s 13 non-management directors have served on the Board for less than four years, five have served for four to eight years and four have served for more than eight years.

| Director Independence

|

|

Non-Management Director Tenure | ||

| 93% |

| |||

|

13 of 14 Directors are Independent

|

||||

|

|

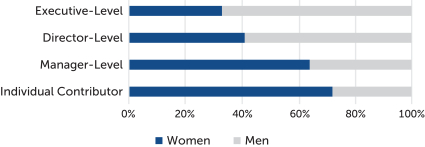

Diversity, Equity and Inclusion

Banner’s Board and management understand the importance of diversity and inclusion, including ensuring that all individuals are compensated equitably for similar work and have an equal opportunity to contribute and advance in the workplace. We are committed to creating a diverse and vibrant workplace that respects individuality, helps every person realize his or her full potential, and includes people with a broad range of experiences, backgrounds and skills that enable us to anticipate and meet the needs of our business and those of our clients. Additional details regarding our efforts in this area are included in the “Proposal 1 – Election of Directors – Board Diversity” and “Sustainability, Human Capital, and Social and Environmental Responsibility” sections of this Proxy Statement.

| 22 | BANNER CORPORATION 2022 PROXY STATEMENT |

Corporate Governance | Board Involvement in the Risk Management Process

Board Involvement in the Risk Management Process

The Board of Directors recognizes that effective risk management requires a high level of cooperation between the Board and senior management. Nonetheless, the Board has established and maintains its independence in overseeing the conduct of Banner, including the risk management process. The Board’s leadership structure takes into account its risk oversight function by the conduct of its business through Board meetings and through its committees, in particular the Audit, Corporate Governance/Nominating, Credit Risk and Risk Committees, as well as by the separation of the positions of Board Chair and President and Chief Executive Officer as described above.

Directors keep themselves informed of the activities and condition of Banner and of the risk environment in which it operates by regularly attending Board and assigned Committee meetings, and by review of meeting materials, auditor’s findings and recommendations, and supervisory communications. Directors stay abreast of general industry trends and any statutory and regulatory developments pertinent to Banner and the Bank by periodic briefings from senior management, counsel, auditors or other consultants, and by more formal director education. The Corporate Governance/Nominating Committee monitors and evaluates director training and information resources.

The Board oversees the conduct of Banner’s business and risk management functions by:

| • | Monitoring the selection, evaluation and retention of competent senior management; |

| • | Establishing, with senior management, Banner’s strategic business objectives, and adopting operating policies to support these objectives in a legal and sound manner; |

| • | Monitoring operations to ensure that they are controlled adequately and are in compliance with laws and policies; |

| • | Overseeing Banner’s business performance; and |

| • | Ensuring that the Bank helps to meet our communities’ credit needs. |

These responsibilities are governed by a complex framework of federal and state laws and regulations as well as regulatory guidelines applicable to the operation of Banner and the Bank.

The Board ensures that all significant risk-taking activities are covered by written policies that are communicated to appropriate employees. Specific policies cover material credit, market, liquidity, operational, legal and reputation risks. The policies are formulated to further Banner’s business plan in a manner consistent with safe and sound practices. The Board requires that all such policies be monitored by senior management to help ensure that they conform with changes in laws and regulations, economic conditions, and Banner’s and the Bank’s circumstances. The policies are implemented by senior management who develop and maintain procedures, including a system of internal controls, designed to foster sound practices, to comply with laws and regulations and to protect Banner against external crimes and internal fraud and abuse.

The Board’s policies also establish mechanisms for providing the Board with the information needed to monitor Banner’s operations. This includes senior management reports to the Board. These reports present information in a form meaningful to members of the Board, who recognize that the level of detail and frequency of individual senior management reports will vary with the nature of the risk under consideration and Banner’s and the Bank’s unique circumstances.

The Board enhanced its involvement in the risk management process in September 2010 by establishing a Risk Committee. The Risk Committee reviews management’s strategies and policies for

| BANNER CORPORATION 2022 PROXY STATEMENT | 23 |

Corporate Governance | Cybersecurity Risk Management

managing enterprise-wide risks and the processes established to identify, measure, monitor and manage those risks. The Risk Committee also serves as the primary point of contact between the Board and senior management in assessing enterprise-wide risk management activities and effectiveness. In 2020, when the COVID-19 pandemic triggered significant economic volatility and uncertainty, as well as acute impacts on certain industries, the Board further enhanced its risk management oversight through the establishment of the Credit Risk Committee. The Credit Risk Committee provides oversight regarding Banner’s credit risk structure and the processes established to identify, understand, measure, monitor and manage our credit risks. The establishment of the Credit Risk Committee allows for more focused oversight of credit risks by directors with relevant expertise, while simultaneously enabling the Risk Committee to devote its attention to other key enterprise risks, including cybersecurity, anti-money laundering, fraud, legal and regulatory risk. The Risk Committee receives regular reports from management in each of these key risk areas.

The Board has also established a mechanism for independent third-party review and testing of compliance with policies and procedures, applicable laws and regulations, and the accuracy of information provided by senior management. This is accomplished, for example, by the Chief Audit Executive reporting directly to the Audit Committee. In addition, an annual external audit is performed. The Audit Committee reviews the independent registered public accounting firm’s findings with senior management and monitors senior management’s efforts to resolve any identified issues and recommendations. The Audit Committee provides regular reports of its activities to the Board.

The Board also reviews reports of inspection and examination or other supervisory activity, and any other material correspondence received from Banner’s regulators. Findings and recommendations, if any, are carefully reviewed, and progress in addressing such matters is routinely monitored.

Cybersecurity Risk Management

The Board of Directors oversees our management of information and cybersecurity risks. We manage cybersecurity risks through our Information Security Program and related polices and standards, which are approved by the Board of Directors. The Board’s Risk Committee directly oversees information technology and cybersecurity activities and risks through the review of regular management reporting and discussions with senior management regarding the effectiveness of our Information Security Program. In connection with its review of these risks, the Risk Committee also reviews management’s plans to mitigate risk.

Our Information Security Program is based on each of the key principles:

CYBERSECURITY GOVERNANCE PRINCIPLES

| • | Ensure the confidentiality, integrity and availability of Banner data by means of comprehensive security policies, processes and technologies that allow for the proper protection of data and that facilitate secure, robust access |

| • | Continually maintain a scalable, secure and reliable production environment by means of advanced security processes and technologies to facilitate comprehensive attack identification, analysis and response |

| • | Design and maintain a secure digital environment to protect and enable Banner’s operations by implementing effective and secure technologies |

| • | Establish a mutual culture of security by creating a secure environment and a strong alliance with all employees in the practice of information security |

| • | Engage external expertise as part of the verification and ongoing testing of an effective cybersecurity program |

| 24 | BANNER CORPORATION 2022 PROXY STATEMENT |

Corporate Governance | Code of Ethics and Ethics Officer

Key components of our Information Security Program include: