UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

Quarterly Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the Quarterly Period Ended June 30, 2017

Commission File Number: 1-13441

HEMISPHERX BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 52-0845822 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

1617 JFK Boulevard, Suite 500, Philadelphia, PA 19103

(Address of principal executive offices) (Zip Code)

(215) 988-0080

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| [ ] | Large accelerated filer | [ ] | Accelerated filer |

| [ ] | Non-accelerated filer | [X] | Smaller reporting company |

| [ ] | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

29,169,300 shares of common stock were outstanding as of August 1, 2017.

PART I - FINANCIAL INFORMATION

ITEM 1: Financial Statements

HEMISPHERX BIOPHARMA, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(in thousands, except for share and per share amounts)

| June 30,2017 | December 31, 2016 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,222 | $ | 2,408 | ||||

| Marketable securities | 1,989 | 3,460 | ||||||

| Accounts receivable | 98 | - | ||||||

| Assets held for sale | 764 | 764 | ||||||

| Prepaid expenses and other current assets | 607 | 309 | ||||||

| Total current assets | 4,680 | 6,941 | ||||||

| Property and equipment, net | 9,022 | 9,514 | ||||||

| Patent and trademark rights, net | 860 | 872 | ||||||

| Other assets | 1,546 | 1,546 | ||||||

| Total assets | $ | 16,108 | $ | 18,873 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 972 | $ | 887 | ||||

| Accrued expenses | 1,771 | 1,548 | ||||||

| Total current liabilities | 2,743 | 2,435 | ||||||

| Long- term debt | ||||||||

| Note payable | 517 | - | ||||||

| Redeemable warrants | 2,516 | 940 | ||||||

| Commitments and contingencies (Note 6) | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, par value $0.01 per share, authorized 5,000,000; issued and outstanding; none | — | — | ||||||

| Common stock, par value $0.001 per share, authorized 350,000,000 shares; issued and outstanding 28,957,668 and 24,202,921, respectively | 29 | 24 | ||||||

| Additional paid-in capital | 316,307 | 315,980 | ||||||

| Accumulated other comprehensive income (loss) | 18 | (5 | ) | |||||

| Accumulated deficit | (306,022 | ) | (300,501 | ) | ||||

| Total stockholders’ equity | 10,332 | 15,498 | ||||||

| Total liabilities and stockholders’ equity | $ | 16,108 | $ | 18,873 | ||||

See accompanying notes to consolidated financial statements.

| -2- |

HEMISPHERX BIOPHARMA, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive Loss

(in thousands, except share and per share data)

(Unaudited)

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenues: | ||||||||||||||||

| Clinical treatment programs - US | $ | 74 | $ | 15 | $ | 97 | $ | 54 | ||||||||

| Clinical treatment programs - Europe | 139 | — | 200 | — | ||||||||||||

| Total revenues | 213 | 15 | 297 | 54 | ||||||||||||

| Costs and expenses: | ||||||||||||||||

| Production costs | 218 | 290 | 488 | 558 | ||||||||||||

| Research and development | 1,106 | 900 | 2,497 | 1,902 | ||||||||||||

| General and administrative | 1,619 | 1,639 | 3,283 | 4,087 | ||||||||||||

| Total costs and expenses | 2,943 | 2,829 | 6,268 | 6,547 | ||||||||||||

| Operating loss | (2,730 | ) | (2,814 | ) | (5,971 | ) | (6,493 | ) | ||||||||

| Interest expense and other finance costs | (19 | ) | — | (19 | ) | — | ||||||||||

| Interest and other income/expense | 21 | 55 | 47 | 116 | ||||||||||||

| Redeemable warrants valuation adjustment | 529 | — | 923 | - | ||||||||||||

| Insurance proceeds from legal settlement, net | — | 1,436 | — | 1,436 | ||||||||||||

| Gain (Loss) on sales of short term marketable securities | 6 | 20 | 6 | (87 | ) | |||||||||||

| Gain from

sale of income tax net operating losses and research credits | — | — | — | 1,561 | ||||||||||||

| Net loss | (2,193 | ) | (1,303 | ) | (5,014 | ) | (3,467 | ) | ||||||||

| Other comprehensive income (loss): | ||||||||||||||||

| Reclassification adjustments for loss on sales of short term marketable securities included in net loss | (6 | ) | — | (6 | ) | 87 | ||||||||||

| Unrealized gain on marketable securities | 18 | 38 | 29 | 97 | ||||||||||||

| Net comprehensive loss | $ | (2,181 | ) | $ | (1,265 | ) | $ | (4,917 | ) | $ | (3,283 | ) | ||||

| Basic and diluted loss per share | $ | (0.08 | ) | $ | (0.06 | ) | $ | (0.19 | ) | $ | (0.16 | ) | ||||

| Weighted average shares outstanding, basic and diluted | 27,306,321 | 20,667,343 | 26,329,123 | 20,648,836 | ||||||||||||

See accompanying notes to consolidated financial statements.

| -3- |

HEMISPHERX BIOPHARMA, INC. AND SUBSIDIARIES

Consolidated Statement of Changes in Stockholders’ Equity

For the Six Months Ended June 30, 2017

(in thousands except share data)

(Unaudited)

| Common Stock Shares | Common

Stock $0.001 Par Value | Additional Paid-In Capital | Accumulated Other Compre- hensive Income (Loss) | Accumulated Deficit | Total

Stockholders’ Equity | |||||||||||||||||||

| Balance at December 31, 2016 | 24,202,921 | $ | 24 | $ | 315,980 | $ | (5 | ) | $ | (300,501 | ) | $ | 15,498 | |||||||||||

| Equity-based compensation | 38,681 | — | 101 | — | — | 101 | ||||||||||||||||||

| Redeemable warrants | — | — | (1,990 | ) | — | — | (1,990 | ) | ||||||||||||||||

| Deemed dividends | — | — | — | — | (507 | ) | (507 | ) | ||||||||||||||||

| Common stock issuance, net of costs | 4,516,205 | 5 | 2,110 | — | — | 2,115 | ||||||||||||||||||

| Stock issued for accounts payable | 199,861 | — | 106 | — | — | 106 | ||||||||||||||||||

| Net comprehensive income (loss) | — | — | — | 23 | (5,014 | ) | (4,991 | ) | ||||||||||||||||

| Balance at June 30, 2017 | 28,957,668 | $ | 29 | $ | 316,307 | $ | 18 | $ | (306,022 | ) | $ | 10,332 | ||||||||||||

See accompanying notes to consolidated financial statements.

| -4- |

HEMISPHERX BIOPHARMA, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the Six Months Ended June 30, 2017 and 2016

(in thousands)

(Unaudited)

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (5,014 | ) | $ | (3,467 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation of property and equipment | 504 | 576 | ||||||

| Redeemable warrants valuation adjustment | (923 | ) | — | |||||

| Amortization and abandonment of patent and trademark rights | 17 | 70 | ||||||

| Equity-based compensation | 101 | 238 | ||||||

| Realized gain(loss) on sale of marketable securities | (6 | ) | 87 | |||||

| Change in assets and liabilities: | ||||||||

| Escrow account for litigation settlement | — | (1,750 | ) | |||||

| Accounts receivable | (98 | ) | — | |||||

| Prepaid expenses and other current assets | (298 | ) | (43 | ) | ||||

| Accounts payable | 85 | 178 | ||||||

| Accrued expenses | 331 | 1,819 | ||||||

| Net cash used in operating activities | 5,301 | (2,292 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Sale of marketable securities | 1,500 | 1,918 | ||||||

| Purchase of property, equipment and construction in progress | (3 | ) | (160 | ) | ||||

| Lease deposit refund | — | 2 | ||||||

| Additions to patent and trademark rights | (14 | ) | (207 | ) | ||||

| Net cash provided by investing activities | 1,483 | 1,553 | ||||||

| Cash flows from financing activities: | ||||||||

| Payments on capital leases | — | (1 | ) | |||||

| Debt issuance costs | (89 | ) | — | |||||

| Proceeds from note payable | 606 | — | ||||||

| Proceeds from sale of stock, net of issuance costs | 2,115 | 163 | ||||||

| Net cash provided by financing activities | 2,632 | 162 | ||||||

| Net decrease in cash and cash equivalents | (1,186 | ) | (577 | ) | ||||

| Cash and cash equivalents at beginning of period | 2,408 | 2,115 | ||||||

| Cash and cash equivalents at end of period | $ | 1,222 | $ | 1,538 | ||||

| Supplemental disclosures of non-cash investing and financing cash flow information: | ||||||||

| Unrealized gain on marketable securities | $ | 29 | $ | 184 | ||||

| Insurance proceeds from legal settlement | — | $ | 3,536 | |||||

| Stock issued for accrued expenses | $ | 106 | $ | — | ||||

| Fair value of redeemable warrants granted | $ | 1,990 | $ | — | ||||

See accompanying notes to consolidated financial statements.

| -5- |

HEMISPHERX BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1: Basis of Presentation

The consolidated financial statements include the financial statements of Hemispherx Biopharma, Inc. and its wholly-owned subsidiaries (“Company”). The Company has two domestic subsidiaries: BioPro Corp. and BioAegean Corp., both of which are incorporated in Delaware and are dormant. The Company also has a foreign subsidiary, Hemispherx Biopharma Europe N.V./S.A., which was established in Belgium in 1998. All significant intercompany balances and transactions have been eliminated in consolidation.

The Company has incurred numerous years of substantial operating losses as it pursued its clinical and pre-clinical development activities and appropriate regulatory approval processes before any such products can be sold and marketed. As of June 30, 2017, our accumulated deficit was $304,581,000. The Company has not yet generated significant revenues from our products and may incur substantial losses in the future. The Company evaluated these conditions and events that may raise substantial doubt about the Company’s ability to continue as a going concern; however, the Company believes that it has alleviated the substantial doubt by implementing certain actions. The Company reexamined its fundamental priorities in terms of direction, corporate culture and its ability to fund operations. As a result, there were significant changes at the Company including the Company restructuring its executive management team, initiating the pursuit of international sales of clinical grade materials, and implementing a cost saving program which assisted the Company in gained efficiencies and eliminated redundancies within its workforce. In addition, the Company is in the process of selling an underutilized building adjacent to its New Jersey manufacturing facility site. Also, the Company is committed to a focused business plan oriented toward finding senior co-development partners with the capital and expertise needed to commercialize the many potential therapeutic aspects of our experimental drugs and our approved drug Alferon N. Lastly, the Company plans to access the public equity markets to raise further capital.

In the opinion of Management, all adjustments necessary for a fair presentation of such consolidated financial statements have been included. Such adjustments consist of normal recurring items. Interim results are not necessarily indicative of results for a full year.

The interim consolidated financial statements and notes thereto are presented as permitted by the Securities and Exchange Commission (“SEC”), and do not contain certain information which will be included in the Company’s annual consolidated financial statements and notes thereto.

These consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements for the years ended December 31, 2016 and 2015, contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016.

Note 2: Net Loss Per Share

Basic and diluted net loss per share is computed using the weighted average number of shares of common stock outstanding during the period. Equivalent common shares, consisting of stock options and warrants which amounted to 7,622,024 and 3,310,591 for the three months ended June 30, 2017 and 2016 , respectively; and 18,503,057 and 18,814,995 shares for the six months ended June 30, 2017 and 2016, respectively, are excluded from the calculation of diluted net loss per share since their effect is anti-dilutive.

Note 3: Equity-Based Compensation

The fair value of each option and equity warrant award is estimated on the date of grant using a Black-Scholes-Merton option pricing valuation model. Expected volatility is based on the historical volatility of the price of the Company’s stock. The risk-free interest rate is based on U.S. Treasury issues with a term equal to the expected life of the option and equity warrant. The Company uses historical data to estimate expected dividend yield, expected life and forfeiture rates. There were 669,619 and 185,417 options and equity warrants granted in the six months ended June 30, 2017 and 2016, respectively.

| -6- |

Stock option for employees’ activity during the six months ended June 30, 2017 is as follows:

Stock option activity for employees:

| Number of Options | Weighted

Average Exercise Price | Weighted

Average Remaining Contractual Term (Years) | Aggregate

Intrinsic Value | |||||||||||||

| Outstanding January 1, 2017 | 836,256 | $ | 16.82 | 4.47 | $ | — | ||||||||||

| Granted | 369,929 | 0.55 | — | — | ||||||||||||

| Forfeited | (6,715 | ) | 24.45 | — | — | |||||||||||

| Outstanding June 30, 2017 | 1,199,470 | $ | 11.76 | 5.85 | $ | — | ||||||||||

| Vested and expected to vest June 30, 2017 | 1,199,470 | $ | 11.76 | 5.85 | $ | — | ||||||||||

| Exercisable June 30, 2017 | 857,288 | $ | 15.24 | 3.53 | $ | — | ||||||||||

Unvested stock option activity for employees:

| Number of Options | Weighted

Average Exercise Price | Average

Remaining Contractual Term (Years) | Aggregate

Intrinsic Value | |||||||||||||

| Outstanding January 1, 2017 | 90,625 | $ | 1.72 | 9.33 | $ | — | ||||||||||

| Granted | 369,929 | 0.55 | — | — | ||||||||||||

| Vested | (118,373 | ) | 1.45 | — | — | |||||||||||

| Forfeited | — | — | — | — | ||||||||||||

| Outstanding June 30, 2017 | 342,181 | $ | 0.55 | 9.89 | $ | — | ||||||||||

Stock option activity for non-employees:

| Number of Options | Weighted

Average Exercise Price | Weighted

Average Remaining Contractual Term (Years) | Aggregate

Intrinsic Value | |||||||||||||

| Outstanding January 1, 2017 | 271,500 | $ | 10.41 | 4.66 | $ | — | ||||||||||

| Granted | 149,740 | 0.57 | — | — | ||||||||||||

| Exercised | — | — | — | — | ||||||||||||

| Forfeited | (5,590 | ) | 15.08 | — | — | |||||||||||

| Outstanding June 30, 2017 | 415,650 | $ | 6.80 | 6.26 | $ | — | ||||||||||

| Vested and expected to vest June 30, 2017 | 415,650 | $ | 6.80 | 6.26 | $ | — | ||||||||||

| Exercisable June 30, 2017 | 269,161 | $ | 10.17 | 4.17 | $ | — | ||||||||||

| -7- |

Unvested stock option activity for non-employees:

| Number of Options | Weighted

Average Exercise Price | Weighted

Average Remaining Contractual Term (Years) | Aggregate

Intrinsic Value | |||||||||||||

| Outstanding January 1, 2017 | 26,389 | $ | 1.65 | 8.61 | $ | — | ||||||||||

| Granted | 149,740 | 0.57 | — | — | ||||||||||||

| Vested | (26,862) | 1.46 | — | — | ||||||||||||

| Forfeited | (2,778 | ) | 1.56 | — | — | |||||||||||

| Outstanding June 30, 2017 | 146,489 | $ | 0.58 | 9.81 | $ | — | ||||||||||

The impact on the Company’s results of operations of recording equity-based compensation for the six months ended June 30, 2017 and 2016 was to increase costs and expenses by approximately $101,000 and $238,000, respectively, which decreased earnings per share by $0.01 for both June 30, 2017 and 2016, .

As of June 30, 2017 and 2016, respectively, there was $405,000 and $380,000 of unrecognized equity-based compensation cost related to options granted under the Equity Incentive Plan.

On January 26, 2016, the Board, based on the recommendation of its Compensation Committee, established two programs - the 2016 Senior Executive Deferred Cash Performance Award Plan for Dr. William A. Carter and Thomas K. Equels, the Company’s two primary executive officers, and the 2016 Voluntary Incentive Stock Award Plan for Company employees and Board members other than Dr. Carter and Mr. Equels. Both Plans include a Base Pay Supplement provision.

The Company maintains a record of the number of shares of stock represented by each Incentive Right issued out of the 2016 Voluntary Incentive Stock Award Plan. During the six months ended June 30, 2016, the Company granted rights of 123,100 incentive shares associated with the Plan and recorded $192,000 in equity-based compensation. There were no incentive shares issued during the six months ended June 30, 2017.

Note 4: Inventories

The Company uses the lower of first-in, first-out (“FIFO”) cost or market method of accounting for inventory.

| Inventories consist of the following: | (in thousands) | |||||||

| June 30,2017 | December 31,2016 | |||||||

| Inventory work-in-process, January 1 | $ | — | $ | 1,326 | ||||

| Production | — | — | ||||||

| Transfer to other assets | — | (1,326 | ) | |||||

| Spoilage | — | — | ||||||

| Inventory work-in-process, end of period | $ | — | $ | — | ||||

Commercial sales of Alferon® will not resume until new batches of commercial filled and finished product are produced and released by the FDA. The Company will continue the validation of Alferon® production and production of new Alferon® API inventory when funding becomes available. While the facility is approved by the FDA under the Biological License Application (“BLA”) for Alferon®, this status will need to be reaffirmed by an FDA pre-approval inspection. The Company will also need the FDA’s approval to release commercial product once it has submitted satisfactory stability and quality release data. Due to the Company extending the timeline of Alferon® production to an excess of one year, the Company reclassified Alferon® Work-In-Process inventory to other assets within the Company’s balance sheet.

| -8- |

Note 5: Marketable Securities

Marketable securities consist of mutual funds. For the six months ended June 30, 2017 and 2016, it was determined that none of the marketable securities had other-than-temporary impairments. At June 30, 2017 and December 31, 2016, all securities were classified as available for sale investments and were measured as Level 1 instruments of the fair value measurements standard.

Securities classified as available for sale consisted of:

June 30, 2017

(in thousands)

| Securities | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | Short-Term Investments | Long Term Investments | ||||||||||||||||||

| Mutual Funds | $ | 1,971 | $ | 18 | $ | — | $ | 1,989 | $ | 1,989 | $ | — | ||||||||||||

| Totals | $ | 1,971 | $ | 18 | $ | — | $ | 1,989 | $ | 1,989 | $ | — | ||||||||||||

December 31, 2016

(in thousands)

| Securities | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | Short-Term Investments | Long Term Investments | ||||||||||||||||||

| Mutual Funds | $ | 3,465 | $ | — | $ | (5 | ) | $ | 3,460 | $ | 3,460 | $ | — | |||||||||||

| Totals | $ | 3,465 | $ | — | $ | (5 | ) | $ | 3,460 | $ | 3,460 | $ | — | |||||||||||

Unrealized losses on investments

Investments with continuous unrealized losses for less than 12 months and 12 months or greater and their related fair values were as follows:

There were no investments in a loss position as of June 30, 2017.

December 31, 2016

(in thousands)

| Total | Less Than 12 Months | 12 Months or Greater | Totals | |||||||||||||||||||||||||

| Securities | Number

In Loss Position | Fair

Values | Unrealized

Losses | Fair

Values | Unrealized

Losses | Total

Fair Value | Total

Unrealized Losses | |||||||||||||||||||||

| Mutual Funds | 1 | $ | 1,853 | $ | (13 | ) | $ | - | $ | - | $ | 1,853 | $ | (13 | ) | |||||||||||||

| Totals | 1 | $ | 1,853 | $ | (13 | ) | $ | - | $ | - | $ | 1,853 | $ | (13 | ) | |||||||||||||

| -9- |

Note 6: Accrued Expenses

Accrued expenses consist of the following:

| (in thousands) | ||||||||

| June 30, 2017 | December 31, 2016 | |||||||

| Compensation | $ | 197 | $ | 297 | ||||

| Professional fees | 525 | 604 | ||||||

| Clinical trial expenses | 463 | 158 | ||||||

| Other expenses | 586 | 489 | ||||||

| $ | 1,771 | $ | 1,548 | |||||

Note 7: Property and Equipment

| (in thousands) | ||||||||

| June 30, 2017 | December 31, 2016 | |||||||

| Land, buildings and improvements | $ | 10,547 | $ | 10,530 | ||||

| Furniture, fixtures, and equipment | 5,625 | 5,630 | ||||||

| Total property and equipment | 16,172 | 16,160 | ||||||

| Less: accumulated depreciation and amortization | (7,150 | ) | (6,646 | ) | ||||

| Property and equipment, net | $ | 9,022 | $ | 9,514 | ||||

Property and equipment are recorded at cost. Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the respective assets, ranging from three to thirty-nine years. The Company also reclassified an underutilized building as an asset held for resale totaling $764,000 adjacent to its New Jersey manufacturing facility site that it is in the process of selling.

Note 8: Stockholders’ Equity

(a) Preferred Stock

The Company is authorized to issue 5,000,000 shares of $0.01 par value preferred stock with such designations, rights and preferences as may be determined by the Board of Directors. There were no Preferred Shares issued and outstanding as of June 30, 2017 and December 31, 2016.

(b) Common Stock

The Company’s stockholders approved an amendment to the Company’s corporate Charter at the Annual Shareholder Meeting held in Philadelphia, PA that concluded on December 8, 2011. This amendment increased the Company’s authorized shares from 200,000,000 to 350,000,000 with specific limitations and restrictions on the usage of 75,000,000 of the 150,000,000 newly authorized shares.

On September 16, 2015, the Company’s stockholders removed the limitations and restrictions on 67,000,000 shares. The Company’s stockholders approved up to an additional 60,000,000 shares for use in capital raising transactions and 7,000,000 shares for use in the Equity Plan of 2009. On August 29, 2016, the Company effected a 12 to 1 reverse stock split of the outstanding shares, in order to become compliant with the NYSE regulations. This did not affect the number of authorized shares.

| -10- |

On September 6, 2016, the Company entered into Securities Purchase Agreements with certain investors for the sale by the Company of 3,333,334 shares of its common stock at a purchase price of $1.50 per share and sold warrants to purchase 2,500,000 shares of Common Stock for aggregate net proceeds of $4,520,000 after deducting certain fees due to the placement agent and the Company’s transaction expenses. Subject to certain ownership limitations, the warrants are initially exercisable six-month after issuance at an exercise price equal to $2.00 per share of Common Stock, subject to adjustments as provided under the terms of the warrants. The warrants are exercisable for five years from the initial exercise date. On June 1, 2017, the exercise price of these warrants was changed to $0.50. As a result the warrant holders exercised these options and purchased 2,370,000 shares of company common stock. The Company realized net proceeds of $1,055,000 from this exercise. In conjunction with the foregoing, the Company issued 2,370,000 series A warrants with an exercise price of $0.60 per share, an initial exercise date of December 1, 2017 and expiring March 6, 2022 and 7,584,000 series B warrants with exercise price of $0.60, an initial exercise date December 1, 2017 per share and expiring March 1, 2018. The Company received net proceeds from the foregoing transaction of approximately $1,055,000, after deducting certain fees due to the placement agent and the Company’s transaction expenses. The net proceeds received by the Company from these offerings will be used for preparation for technology transfer opportunities, expenses related to Ampligen® manufacturing, working capital and general corporate purposes. Pursuant to an engagement agreement, the Company paid its placement agent an aggregate fee equal to 7% and 10.5 %, respectively, of the gross proceeds received by the Company from the sale of the securities in the offerings and granted to its placement agent or its designees warrants to purchase up to 5% of the aggregate number of shares sold in the transactions amounting to 166,667 and 107,759, respectively, unregistered warrants. The placement agent warrants have substantially the same terms as the investor warrants, except that the 166,667 placement agent warrants will expire September 1, 2021 and have an exercise price equal to $1.875 per share of common stock and the 107,759 placement agent warrants will expire June 1, 2022 and have an exercise price of $0.625.

On February 1, 2017, the Company entered into Securities Purchase Agreements (each, a “February Purchase Agreement”) with certain investors for the sale by us of 1,818,185 shares of its common stock at a purchase price of $0.55 per share. Concurrently with the sale of the common stock, pursuant to the February Purchase Agreement, the Company also sold unregistered warrants to purchase 1,363,639 shares of common stock for aggregate net proceeds of approximately $875,000. The warrants have an exercise price of $0.75 per share, are exercisable six months after issuance, and will expire five years from the initial exercise date. Pursuant to an engagement agreement, the Company paid its placement agent an aggregate fee equal to 7% of the gross proceeds received by the Company from the sale of the securities in the offering and granted to its placement agent or its designees warrants to purchase up to 5% of the aggregate number of shares sold in the transactions amounting to 90,910 unregistered warrants. The placement agent warrants have substantially the same terms as the investor warrants, except that the placement agent warrants will expire on February 1, 2022 and have an exercise price equal to $0.6875 per share of common stock

| -11- |

The common stock issued in the above referenced September 6, 2016 and February 1, 2017 offerings were offered and sold by the Company pursuant to an effective shelf registration statement on Form S-3, which was initially filed with the SEC on June 25, 2015 and subsequently declared effective on August 4, 2015 (Registration No. 333-205228) and the base prospectus dated as of August 4, 2015 contained therein. The Company filed a prospectus supplements related to these offerings with the SEC on September 1, 2016 and February 3, 2017, respectively, in connection with the sale of the common stock. The common stock issued pursuant to the above June 1, 2017 exercise of warrants were issued pursuant to an effective registration statement on Form S-1, which was initially filed with the SEC on May 4, 2017 as subsequently amended and declared effective on May 23, 2017 (Registration No. 333-217671) and the prospectus supplement filed with the SEC on May 23, 2017.

The Equity Incentive Plan of 2009, effective June 24, 2009, as amended and giving effect to the 12 to 1 reverse stock split, authorizes the grant of non-qualified and incentive stock options, stock appreciation rights, restricted stock and other stock awards. A maximum of 22,000,000 shares of common stock is reserved for potential issuance pursuant to awards under the Equity Incentive Plan of 2009. Unless sooner terminated, the Equity Incentive Plan of 2009 will continue in effect for a period of 10 years from its effective date. For the six months ended June 30, 2017, there were 669,619 options granted by the Company.

Note 9: Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents.

Note 10: Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2014-09 (ASU 2014-09), Revenue from Contracts with Customers. ASU 2014-09 will eliminate transaction- and industry-specific revenue recognition guidance under current U.S. GAAP and replace it with a principle based approach for determining revenue recognition. ASU 2014-09 will require that companies recognize revenue based on the value of transferred goods or services as they occur in the contract. ASU 2014-09 also will require additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. ASU 2014-09 is effective for reporting periods beginning after December 15, 2017, and early adoption is not permitted. Entities can transition to the standard either retrospectively or as a cumulative-effect adjustment as of the date of adoption. Upon the Company realizing operating revenues from the sale of commercialized product, the Company’s adoption of this guidance may have an impact on the Company’s financial statement presentation or disclosures.

In January 2016, the (“FASB”) has issued Accounting Standards Update (ASU) No. 2016-01, Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The new guidance is intended to improve the recognition and measurement of financial instruments. The new guidance is effective for public companies for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The new guidance permits early adoption of the own credit provision. The Company believes that the adoption of the guidance may have an impact on the Company’s financial statement presentation or disclosures.

In February 2016, the FASB issued ASU 2016-02 - Leases, which amends the existing accounting standards for lease accounting, including requiring lessees to recognize most leases on their balance sheets and making targeted changes to lessor accounting. ASU 2016-02 will be effective for annual reporting periods beginning after December 15, 2018, and early adoption of is permitted as of the standard’s issuance date. ASU 2016-02 allows a modified retrospective transition approach for all leases existing at, or entered into after, the date of initial application, with an option to use certain transition relief. The Company has not adopted ASU 2016-02 and believes such adoption may have an impact on the Company’s financial statement presentation or disclosures.

| -12- |

In August 2016, the FASB issued ASU 2016-15 - Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (a consensus of the Emerging Issues Task Force). The new guidance is intended to address the diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows under Topic 230, Statement of Cash Flows, and other Topics. The guidance addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice. The amendments apply to all entities, including both business entities and not-for-profit entities that are required to present a statement of cash flows under Topic 230. The amendments are effective for public business entities for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted, including adoption in an interim period. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. An entity that elects early adoption must adopt all of the amendments in the same period. The amendments in this Update should be applied using a retrospective transition method to each period presented. The Company believes that the adoption of the guidance may not have a material impact on the Company’s financial statement presentation or disclosures.

In 2017, the FASB also issued Accounting Standards Updates (“ASU”) 2017-01 through 2017-11. These updates did not have a significant impact on the financial statements.

Note 11: Funds Received from Sale of Income Tax Net Operating Losses

As of December 31, 2016, the Company has approximately $174,000,000 of federal net operating loss carryforwards (expiring in the years 2018 through 2036) available to offset future federal taxable income. The Company also has approximately $36,000,000 of Pennsylvania state net operating loss carryforwards (expiring in the years 2018 through 2033) and approximately $8,000,000 of New Jersey state net operating loss carryforwards (expiring in 2036) available to offset future state taxable income.

In January 2016, the Company effectively sold $16,000,000 of its New Jersey state net operating loss carryforward for the year 2014 for approximately $1,320,000, and also sold New Jersey research and development credits for $241,000. In December 2016, the Company effectively sold $14,000,000 of its New Jersey state net operating loss carryforward for the year 2015 for approximately $1,120,000, and also sold New Jersey research and development credits for $189,000. The utilization of certain state net operating loss carryforwards may be subject to annual limitations. With no tax due for the foreseeable future, the Company has determined that the accounting for interest or penalties related to the payment of tax is not necessary at this time.

Note 12: Fair Value

The Company is required under GAAP to disclose information about the fair value of all the Company’s financial instruments, whether or not these instruments are measured at fair value on the Company’s consolidated balance sheets.

The Company estimates that the fair values of cash and cash equivalents, other assets, accounts payable and accrued expenses approximate their carrying values due to the short-term maturities of these items. The Company also has certain warrants with a cash settlement feature in the unlikely occurrence of a Fundamental Transaction. The fair value of the redeemable warrants (“Warrants”) related to the Company’s August 2016,February 2017 and June 2017 common stock and warrant issuance, are calculated using a Monte Carlo Simulation. While the Monte Carlo Simulation is one of a number of possible pricing models, the Company has determined it to be industry accepted and fairly presented the fair value of the Warrants. As an additional factor to determine the fair value of the Put’s liability, the occurrence probability of a Fundamental Transaction event was factored into the valuation.

The Company recomputes the fair value of the Warrants at the issuance date and the end of each quarterly reporting period. Such value computation includes subjective input assumptions that are consistently applied each period. If the Company were to alter its assumptions or the numbers input based on such assumptions, the resulting fair value could be materially different.

| -13- |

The Company utilized the following assumptions to estimate the fair value of the August 2016 Warrants:

| June 30,2017 | December 31,2016 | |||||||

| Underlying price per share | $ | 0.50 | $0.69-$1.26 | |||||

| Exercise price per sharethe following assumptions to estimate the fair value of the August 2016 | $0.50-$1.88 | $1.88 - $2.00 | ||||||

| Risk-free interest rate | 1.75 | % | 1.86 | % | ||||

| Expected holding period | 4.2 | 4.70 | ||||||

| Expected volatility | 75 | % | 85 | % | ||||

| Expected dividend yield | - | - | ||||||

The Company utilized the following assumptions to estimate the fair value of the January 2017 Warrants:

| June 30,2017 | February 1,2017 | |||||||

| Underlying price per share | $ | 0.50 | $ | 0.64 | ||||

| Exercise price per share | $0.69-$0.75 | $0.69-$0.75 | ||||||

| Risk-free interest rate | 1.82 | % | 1.86%-1.93% | |||||

| Expected holding period | 4.6 | 5.00 | ||||||

| Expected volatility | 80 | % | 80%-85% | |||||

| Expected dividend yield | - | - | ||||||

The Company utilized the following assumptions to estimate the fair value of the June 2017 Warrants:

| June 30,2017 | June 1,2017 | |||||||

| Underlying price per share | $ | 0.50 | $ | 0.53 | ||||

| Exercise price per share | $0.60-$0.63 | $0.60-$0.63 | ||||||

| Risk-free interest rate | 1.17%-1.88% | 1.11%-1.76% | ||||||

| Expected holding period | .7-4.9 | .7-5 | ||||||

| Expected volatility | 80%-85% | 80 | % | |||||

| Expected dividend yield | - | - | ||||||

The significant assumptions using the Monte Carlo Simulation approach for valuation of the Warrants are:

| (i) | Risk-Free Interest Rate. The risk-free interest rates for the Warrants are based on U.S. Treasury constant maturities for periods commensurate with the remaining expected holding periods of the warrants. | |

| (ii) | Expected Holding Period. The expected holding period represents the period of time that the Warrants are expected to be outstanding until they are exercised. The Company utilizes the remaining contractual term of the Warrants at each valuation date as the expected holding period. | |

| (iii) | Expected Volatility. Expected stock volatility is based on daily observations of the Company’s historical stock values for a period commensurate with the remaining expected holding period on the last day of the period for which the computation is made. |

| -14- |

| (iv) | Expected Dividend Yield. Expected dividend yield is based on the Company’s anticipated dividend payments over the remaining expected holding period. As the Company has never issued dividends, the expected dividend yield is $-0- and this assumption will be continued in future calculations unless the Company changes its dividend policy. | |

| (v) | Expected Probability of a Fundamental Transaction. The possibility of the occurrence of a Fundamentals Transaction triggering a Put right is extremely remote. As discussed above, a Put right would only arise if a Fundamental Transaction 1) is an all cash transaction; (2) results in the Company going private; or (3) is a transaction involving a person or entity not traded on a national securities exchange. The Company believes such an occurrence is highly unlikely because: |

| a. | The Company only has one product that is FDA approved but which will not be available for commercial sale; | |

| b. | The Company may have to perform additional clinical trials for FDA approval of its flagship product; | |

| c. | Industry and market conditions continue to include a global market recession, adding risk to any transaction; | |

| d. | Available capital for a potential buyer in a cash transaction continues to be limited; | |

| e. | The nature of a life sciences company is heavily dependent on future funding and high fixed costs, including Research & Development; | |

| f. | The Company has minimal revenues streams which are insufficient to meet the funding needs for the cost of operations or construction at their manufacturing facility; and | |

| g. | The Company’s Rights Agreement and Executive Agreements make it less attractive to a potential buyer. |

With the above factors utilized in analysis of the likelihood of the Put’s potential Liability, the Company estimated the range of probabilities related to a Put right being triggered as:

| Range of Probability | Probability | |||

| Low | 0.5 | % | ||

| Medium | 1.0 | % | ||

| High | 5.0 | % | ||

The Monte Carlo Simulation has incorporated a 5.0% probability of a Fundamental Transaction to date for the life of the securities.

| (vi) | Expected Timing of Announcement of a Fundamental Transaction. As the Company has no specific expectation of a Fundamental Transaction, for reasons elucidated above, the Company utilized a discrete uniform probability distribution over the Expected Holding Period to model in the potential announcement of a Fundamental Transaction occurring during the Expected Holding Period. | |

| (vii) | Expected 100 Day Volatility at Announcement of a Fundamental Transaction. An estimate of future volatility is necessary as there is no mechanism for directly measuring future stock price movements. Daily observations of the Company’s historical stock values for the 100 days immediately prior to the Warrants’ grant dates, with a floor of 100%, were utilized as a proxy for the future volatility. | |

| (viii) | Expected Risk-Free Interest Rate at Announcement of a Fundamental Transaction. The Company utilized a risk-free interest rate corresponding to the forward U.S. Treasury rate for the period equal to the time between the date forecast for the public announcement of a Fundamental Transaction and the Warrant expiration date for each simulation. | |

| (ix) | Expected Time Between Announcement and Consummation of a Fundamental Transaction. The expected time between the announcement and the consummation of a Fundamental Transaction is based on the Company’s experience with the due diligence process performed by acquirers, and is estimated to be six months. The Monte Carlo Simulation approach incorporates this additional period to reflect the delay Warrant Holders would experience in receiving the proceeds of the Put. |

| -15- |

While the assumptions remain consistent from period to period (e.g., utilizing historical stock prices), the numbers input change from period to period (e.g., the actual historical prices input for the relevant period). The carrying amount and estimated fair value of the above Warrants was approximately $2,516,000 at June 30, 2017 and 940,000 at December 31, 2016.

The Company applies FASB ASC 820 (formerly Statement No. 157 Fair Value Measurements) that defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. The guidance does not impose any new requirements around which assets and liabilities are to be measured at fair value, and instead applies to asset and liability balances required or permitted to be measured at fair value under existing accounting pronouncements. The Company measures its warrant liability for those warrants with a cash settlement feature at fair value.

FASB ASC 820-10-35-37 (formerly SFAS No. 157) establishes a valuation hierarchy based on the transparency of inputs used in the valuation of an asset or liability. Classification is based on the lowest level of inputs that is significant to the fair value measurement. The valuation hierarchy contains three levels:

| ● | Level 1 – Quoted prices are available in active markets for identical assets or liabilities at the reporting date. Generally, this includes debt and equity securities that are traded in an active market. | |

| ● | Level 2 – Observable inputs other than Level 1 prices such as quote prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Generally, this includes debt and equity securities that are not traded in an active market. | |

| ● | Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or other valuation techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation. As of March, 2017, the Company has classified the warrants with cash settlement features as Level 3. Management evaluates a variety of inputs and then estimates fair value based on those inputs. As discussed above, the Company utilized the Monte Carlo Simulation Model in valuing these warrants. |

The table below presents the balances of assets and liabilities measured at fair value on a recurring basis by level within the hierarchy as:

| (in thousands) As of June 30, 2017 | ||||||||||||||||

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Assets: | ||||||||||||||||

| Marketable securities | $ | 1,989 | $ | 1,989 | $ | - | $ | - | ||||||||

| Liabilities: | ||||||||||||||||

| Redeemable warrants | $ | 2,516 | - | - | $ | 2,516 | ||||||||||

| (in thousands) As of December 31, 2016 | ||||||||||||||||

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Assets: | ||||||||||||||||

| Marketable Securities | $ | 3,460 | $ | 3,460 | $ | - | $ | - | ||||||||

| Liabilities: | ||||||||||||||||

| Redeemable warrants | $ | 940 | - | - | $ | 940 | ||||||||||

The changes in Level 3 Liabilities measured at fair value on a recurring basis are summarized as follows (in thousands):

| Balance at December 31, 2016 | $ | 940 | ||

| Issuance of warrants | 1,990 | |||

| Modification of warrants | 509 | |||

| Fair value adjustments | 923 | |||

| Balance at June 30, 2017 | $ | 2,516 |

| -16- |

Note 13: Note Payable

In May 2017, the Company entered into a mortgage and note payable agreement with a bridge funding company to obtain a two-year funding line of up to $4,000,000 secured by the property and assets located at 783 Jersey Ave., New Brunswick, New Jersey. Subject to the lender’s approval, the Company will be able to request up to $1,800,000 of the line in monthly advances during the loan term of 24 months. The Company will be able to request future advances in excess of $2,000,000 at the lender’s discretion and be payable in full upon maturity. The Company will pay interest on this note at a fixed rate of 12% per annum for the first 18 months and change to a rate equal to 800 basis points above the prime rate of interest during the remainder of the term; however, the interest rate will not be less than 12% for the entire term. The note will be interest only and payable monthly through the maturity. The Company is permitted to prepay the line without penalty commencing after six months. The balance on the note at June 30, 2017 is $517,000 ($606,000 less unamortized deferred finance costs of $89,000) .

Note 14: Subsequent Events

The Company evaluated subsequent events through the date of this filing and determined that no subsequent event constituted a matter that required adjustment to the financial statements for the six months ended June 30, 2017.

| -17- |

ITEM 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations

Special Note Regarding Forward-Looking Statements

Certain statements in this Report, including statements under “Item 1. Legal Proceedings” and “Item 1A. Risk Factors” in Part II, contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and are subject to risks, uncertainties and other important factors. We discuss many of these risks, uncertainties and other important factors in greater detail under “Item 1A. Risk Factors” in Part II in this Report. Because the risk factors referred to above and in our Annual Report on Form 10-K for our most recent fiscal year filed with the Securities and Exchange Commission could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, you should not place undue reliance on any such forward-looking statements.

Further, these forward-looking statements represent our estimates and assumptions only as of the date such forward-looking statements are made. You should carefully read this Report completely and with the understanding that our actual future results may be materially different from what we expect. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our business, results of operations and financial condition. Any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which will arise. We cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Any statements in this Report about our expectations, beliefs, plans, objectives, assumptions or future events or performance that are not historical facts are forward-looking statements. You can identify these forward-looking statements by the use of words or phrases such as “believe”, “may”, “could”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “seek”, “plan”, “expect”, “should”, or “would,” and similar expressions intended to identify forward-looking statements.

Among the factors that could cause actual results to differ materially from those indicated in the forward-looking statements are risks and uncertainties inherent in our business including, without limitation: our ability to adequately fund our projects, the potential therapeutic effect of our products, the possibility of obtaining regulatory approval, our ability to find senior co-development partners with the capital and expertise needed to commercialize our products and to enter into arrangements with them on commercially reasonable terms, our ability to manufacture and sell any products, our ability to enter into arrangements with third party vendors, market acceptance of our products, our ability to earn a profit from sales or licenses of any drugs, our ability to discover new drugs in the future, changing market conditions, changes in laws and regulations affecting our industry, and issues related to our New Brunswick, New Jersey facility. We have disclosed that in February 2013, we received a Complete Response from the U.S. Food and Drug Administration (the “FDA”) declining to approve our Ampligen® New Drug Application (“NDA”) for Chronic Fatigue Syndrome Treatment, sometimes referred to as myalgic encephalomyelitis/chronic fatigue syndrome (“ME/CFS”), stating that we should conduct at least one additional clinical trial, complete various nonclinical studies and perform a number of data analyses. Accordingly, the remaining steps to potentially gain FDA approval of the Ampligen® NDA, the final results of these and other ongoing activities could vary materially from our expectations and could adversely affect the chances for approval of the Ampligen® NDA. These activities and the ultimate outcomes are subject to a variety of risks and uncertainties, including but not limited to risks that (i) the FDA may ask for additional data, information or studies to be completed or provided; and (ii) the FDA may require additional work related to the commercial manufacturing process to be completed or may, in the course of the inspection of manufacturing facilities, identify issues to be resolved. With regard to our NDA for Ampligen® to treat ME/CFS, we noted above that there are additional steps which the FDA has advised Hemispherx to take in our seeking approval. The final results of these and other ongoing activities, and of the FDA review, could vary materially from Hemispherx’ expectations and could adversely affect the chances for approval of the Ampligen® NDA. Any failure to satisfy the FDA’s requirements could significantly delay, or preclude outright, approval of our drugs for commercial sale in the United States.

On August 18, 2016, we received approval of our NDA from Administracion Nacional de Medicamentos, Alimentos y Tecnologia Medica (“ANMAT”) for commercial sale of rintatolimod (U.S. tradename: Ampligen®) in the Argentine Republic for the treatment of severe ME/CFS. The product will be marketed by GP Pharm, our commercial partner in Latin America. We believe that this approval provides a platform for potential commercial sales in certain countries within the European Union under regulations that support cross-border pharmaceutical sales of licensed drugs. We and GP Pharm are now working to expand the approval of rintatolimod to additional countries with a focus on Latin America. In Europe, approval in a country with a stringent regulatory process in place, such as Argentina, should add further validation for the product as the Early Access Program as discussed below and underway in Europe. ANMAT approval is only an initial, but important, step in the overall successful commercialization of our product. There are a number of actions that must occur before we could be able to commence commercial sales in Argentina. Commercialization in Argentina will require, among other things, an appropriate reimbursement level, appropriate marketing strategies, completion of manufacturing preparations for launch (including possible requirements for approval of final manufacturing) and we most likely will need additional funds to manufacture product at a sufficient level for a commercial launch. There are no assurances as to whether or when such multiple subsequent steps will be successfully performed to result in an overall successful commercialization and product launch. Approval of rintatolimod for ME/CFS in the Argentine Republic does not in any way suggest that the Ampligen® NDA in the United States will obtain commercial approval.

| -18- |

On January 11, 2017, we announced that the EAP through our agreement with myTomorrows designed to enable access of Ampligen® to ME/CFS patients has been extended to pancreatic cancer patients beginning in the Netherlands. myTomorrows is our exclusive service provider in Europe and Turkey and will manage all EAP activities relating to the pancreatic cancer extension of the program.

On June 28, 2017, we signed an amendment to the EAP with myTomorrows. This amendment is for MyTomorrows to provide support services to Hemispherx with respect to the execution of the 511-Program (“511-Services”). The 511-Services shall be rendered for a period of 6 months to be renewed with additional 6 month periods with written mutual consent, or until termination of the 511-Program. The 511-Services shall be rendered free of charge.

Our overall objectives include plans to continue seeking approval for commercialization of Ampligen® in the United States and abroad as well as seeking to broaden commercial therapeutic indications of Alferon N Injection® presently approved in the United States and Argentina. We continue to pursue senior co-development partners with the capital and expertise needed to commercialize our products and to enter into arrangements with them on commercially reasonable terms. Our ability to commercialize our products, widen commercial therapeutic indications of Alferon N Injection® and/or capitalize on our collaborations with research laboratories to examine our products are subject to a number of significant risks and uncertainties including, but not limited to our ability to enter into more definitive agreements with some of the research laboratories and others that we are collaborating with, to fund and conduct additional testing and studies, whether or not such testing is successful or requires additional testing and meets the requirements of the FDA and comparable foreign regulatory agencies. We do not know when, if ever, our products will be generally available for commercial sale for any indication.

We outsource certain components of our manufacturing, quality control, marketing and distribution while maintaining control over the entire process through our quality assurance and regulatory groups. We cannot provide any guarantee that the facility or our contract manufacturer will necessarily pass an FDA pre-approval inspection for Alferon® manufacture.

The production of new Alferon® API inventory will not commence until the validation phase is complete. While the facility is approved by FDA under the Biological License Application (“BLA”) for Alferon®, this status will need to be reaffirmed by a successful Pre-Approval Inspection by the FDA prior to commercial sale of newly produced inventory product. If and when the Company obtains a reaffirmation of FDA BLA status and has begun production of new Alferon® API, it will need FDA approval as to the quality and stability of the final product to allow commercial sales to resume. We will need additional funds to finance the revalidation process in our facility to initiate commercial manufacturing, thereby readying ourselves for an FDA Pre-Approval Inspection. If we are unable to gain the necessary FDA approvals related to the manufacturing process and/or final product of new Alferon® inventory, our operations most likely will be materially and/or adversely affected. In light of these contingencies, there can be no assurances that the approved Alferon N Injection® product will be returned to production on a timely basis, if at all, or that if and when it is again made commercially available, it will return to prior sales levels.

Overview

General

Hemispherx Biopharma, Inc. and its subsidiaries (collectively, “Hemispherx”, “Company”, “we” or “us”) are a specialty pharmaceutical company headquartered in Philadelphia, Pennsylvania and engaged in the clinical development of new drug therapies based on natural immune system enhancing technologies for the treatment of viral and immune based disorders. We were first formed in 1966 and in the early 1970s were doing contract research for the National Institutes of Health. Since that time, we have established a strong foundation of laboratory, pre-clinical and clinical data with respect to the development of natural interferon and nucleic acids to enhance the natural antiviral defense system of the human body and to aid the development of therapeutic products for the treatment of certain chronic diseases. We have two domestic subsidiaries BioPro Corp., and BioAegean Corp., all of which are incorporated in Delaware and are dormant. Our foreign subsidiary is Hemispherx Biopharma Europe N.V./S.A. which was established in Belgium in 1998.

| -19- |

Our flagship products include Alferon N Injection® and the experimental therapeutic Ampligen®. Alferon N Injection® is approved for a category of STD infection, and Ampligen® represents an experimental RNA being developed for globally important viral diseases and disorders of the immune system. Hemispherx’ platform technology includes components for potential treatment of various severely debilitating and life threatening diseases.

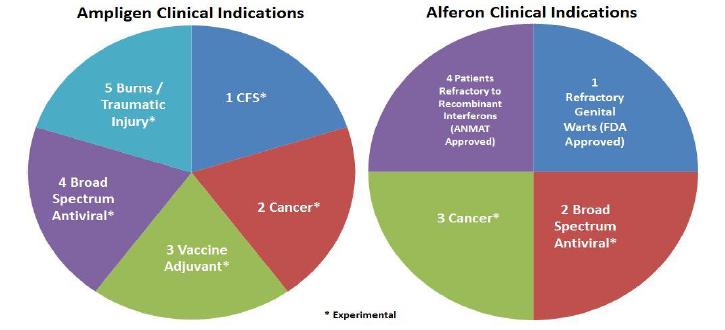

The below chart provides a summary of the clinical indications for both Ampligen® and Alferon® currently under development.

We own and operate a 30,000 sq. ft. facility in New Brunswick, NJ with the objective of producing Alferon® and Ampligen® upon FDA approval. As part of our objectives to achieve our commercial goals and increase stockholder value, we are in the process of selling an underutilized building adjacent to our New Jersey manufacturing facility site. We do not believe that the sale of this building will have an impact on the production of our products. In May 2017, we entered into a mortgage and note payable agreement with a bridge funding company to obtain a two-year funding line of up to $4,000,000 secured by our property and assets located at 783 Jersey Ave., New Brunswick, New Jersey. Subject to the lender’s approval, we will be able to request up to $1,800,000 of the line in monthly advances during the loan term of 24 months. We will be able to request future advances in excess of $2,000,000 at the lender’s discretion and be payable in full upon maturity. We will pay interest on this note at a fixed rate of 12% per annum for the first 18 months and change to a rate equal to 800 basis points above the prime rate of interest during the remainder of the term; however, the interest rate will not be less than 12% for the entire term. The note will be interest only and payable monthly through the maturity. We are permitted to prepay the line without penalty commencing after six months. The mortgage requires permission from the lender to amend our charter or by-laws; however, such permission cannot be unreasonably withheld. Please see “Manufacturing” section below.

On February 1, 2013, we received a Complete Response Letter (“CRL”) from the FDA declining to approve our NDA for Ampligen® for Chronic Fatigue Syndrome (“CFS”). Please see the discussion in “Our Products - Ampligen®” below for more detail.

We have taken significant actions to focus on our business and management and reserve capital so the Company can better achieve its commercial goals, including, but not limited to, a strict anti-nepotism policy, listing for sale underutilized assets, aggressively pursuing international sales of clinical grade materials, and implementing a strong financial austerity plan. We are committed to a focused business plan oriented toward finding senior co-development partners with the capital and expertise needed to commercialize the many potential therapeutic aspects of our experimental drugs and our approved drug Alferon® N.

Our principal executive office is located at One Penn Center, 1617 JFK Boulevard, Philadelphia, Pennsylvania 19103, and our telephone number is 215-988-0080.

| -20- |

OUR PRODUCTS

Our primary pharmaceutical product platform consists of our experimental compound, Ampligen®, and our FDA approved natural interferon product, Alferon N Injection. We are no longer pursuing development of liquid natural interferon for oral administration, Alferon LDO (Low Dose Oral).

Ampligen®

Ampligen® is approved for sale in Argentina and is an experimental drug currently undergoing clinical development for the treatment of CFS in the United States of America. As noted above and discussed below, the FDA in its CRL declined to approve our NDA for the treatment of CFS with Ampligen®. Over its developmental history, Ampligen® has received various designations, including Orphan Drug Product Designation (FDA), Treatment protocol (e.g., “Expanded Access” or “Compassionate” use authorization) with Cost Recovery Authorization (FDA) and “promising” clinical outcome recognition based on the evaluation of certain summary clinical reports (“AHRQ” or Agency for Healthcare Research and Quality). Ampligen® represents the first drug in the class of large (macromolecular) RNA (nucleic acid) molecules to apply for NDA review. Based on the results of published, peer reviewed pre-clinical studies and clinical trials, we believe that Ampligen® may have broad-spectrum anti-viral and anti-cancer properties.

We believe that nucleic acid compounds represent a potential new class of pharmaceutical products as they are designed to act at the molecular level for treatment of human diseases. There are two forms of nucleic acids, DNA and RNA. DNA is a group of naturally occurring molecules found in chromosomes, the cell’s genetic machinery. RNA is a group of naturally occurring informational molecules which orchestrate a cell’s behavior which, in turn, regulates the action of groups of cells, including the cells which compromise the body’s immune system. RNA directs the production of proteins and regulates certain cell activities including the activation of an otherwise dormant cellular defense against viruses and tumors. Our drug technology utilizes specifically-configured RNA. Our double-stranded RNA drug product, trademarked Ampligen®, is an experimental, unapproved drug, that would be administered intravenously. Ampligen® has been assigned the generic name rintatolimod by the United States Adopted Names Council (USANC) and has the chemical designation poly(I):poly(C12U).

Clinical trials of Ampligen® already conducted by us include studies of the potential treatment of CFS, Hepatitis B, HIV and cancer patients with renal cell carcinoma and malignant melanoma. All of these potential uses will require additional clinical trials to generate the safety and effectiveness data necessary to support regulatory approval.

On February 1, 2013, we received a CRL from the FDA declining to approve our NDA for Ampligen® for CFS. In its CRL, the FDA communicated that Hemispherx should conduct at least one additional clinical trial, complete various nonclinical studies and perform a number of data analyses. The additional clinical study should address, among other things, Ampligen®’s efficacy in treating CFS patients, be of sufficient size and duration to assess the safety of Ampligen® and be sufficient to determine appropriate dosing. The FDA set forth the reasons for this action and provided recommendations to address certain outstanding issues. The FDA stated that the submitted data does not provide substantial evidence of efficacy of Ampligen® for the treatment of CFS and that the data does not provide sufficient information to determine whether the product is safe for use in CFS due to the limited size of the safety database and multiple discrepancies within the submitted data. In addition to the safety and effectiveness issues recommended to be addressed in at least one additional clinical trial, the CRL states that Hemispherx should conduct complete rodent carcinogenicity studies in two species prior to approval and also conduct additional animal toxicology studies providing more comprehensive evaluation of Ampligen® fragments and degradation products. The CRL also requests evaluation of variation between lots of Ampligen® tested in the development process and recommends tighter control of the Ampligen® manufacturing process.

In response to the CRL, we continue to plan to avail ourselves of the opportunity for an “end-of-review” meeting with representatives of the Office of Drug Evaluation II which issued the CRL, in order to clarify and seek to narrow the outstanding issues regarding the further development of Ampligen® for the treatment of CFS.

FDA regulations provide a formal dispute resolution process to obtain review of any FDA decision, including a decision not to approve an NDA, by raising the matter with the supervisor of the FDA office that made the decision. The formal dispute resolution process exists to encourage open, prompt discussion of scientific (including medical) disputes and procedural (including administrative) disputes that arise during the drug development, new drug review, and post-marketing oversight processes of the FDA. Depending on the outcome of a number of initiatives in the CFS community, including the FDA’s Patient Focused Drug Development Initiatives, forthcoming drug guidance and other scientific initiatives by the Institute of Medicine, Center for Disease Control and National Institute of Health, we will continue to examine the opportunity for an “end-of-review” meeting. Depending on the results of these initiatives, we may request an “end-of-review” conference with the FDA as a precursor to a possible submission of a formal appeal to the Office of New Drugs within the FDA’s Center for Drug Evaluation and Research regarding the FDA’s decision. Please see “Risks Associated with Our Business” in Part I; Item 1A. Risk Factors below.

| -21- |

Until we undertake the end-of-review conference(s), or otherwise reach an agreement with the FDA regarding the design of a confirmatory study, we are unable to reasonably estimate the nature, costs, necessary efforts to obtain FDA clearance or anticipated completion dates of any additional clinical study or studies. Utilizing the industry norms for undertaking a Phase III clinical study, we estimate upon acceptance of the study’s design that it would take approximately 18 months to three years to complete a new well-controlled Ampligen® clinical study for resubmission to the FDA. Industry norms suggest that it will require three to six months to initiate the study, one to two years to accrue and test patients, three to six months to close-out the study and file the necessary documents with the FDA. The actual duration to complete the clinical study may be different based on the length of time it takes to design the study and obtain FDA’s acceptance of the design, the final design of an acceptable Phase III clinical study, availability of suitable participants and clinical sites along with other factors that could impact the implementation of the study, analysis of results or requirements of the FDA and/or other governmental organizations. We anticipate that the time and cost to undertake clinical trial(s), studies and data analysis are beyond our current financial resources without gaining access to additional funding. Please see “Part I; Item 1A, Risk Factors: “We may require additional financing which may not be available.”

In May 1997, the FDA authorized an open-label treatment protocol, (“AMP-511”), allowing patient access to Ampligen® for treatment in an open-label safety study under which severely debilitated CFS patients have the opportunity to be on Ampligen® to treat this very serious and chronic condition. The data collected from the AMP-511 protocol through a consortium group of clinical sites provide safety information regarding the use of Ampligen® in patients with CFS. . We are establishing an enlarged data base of clinical safety information which we believe will provide further documentation regarding the absence of autoimmune disease associated with Ampligen® treatment. We believe that continued efforts to understand existing data, and to advance the development of new data and information, will ultimately support our future filings for Ampligen® and/or the design of future clinical studies. In 2015, we engaged an independent certified public accountant to recalculate the cost per dose consistent with the current guidelines, utilizing the costs to produce a vial. In October 2016, the FDA granted our request to implement the new cost which was initiated during the quarter ended March 31, 2017. As of August 1, 2017, there are 18 patients participating in this open-label treatment protocol.

On July 12, 2012, we filed a new drug application for Ampligen® with the ANMAT (Administracion Nacional de Medicamentos, Alimentos y Tecnologia Medica), the agency responsible for the national regulation of drugs, foods and medical technology in Argentina, under the ANMAT’s Orphan Drug regulations. We believe that the approval of Ampligen® as an Orphan Drug may allow reimbursement by the Health Services Authority (SSS), the central health authority in Argentina for patients seeking treatment for CFS. On August 18, 2016, we received approval of our NDA from ANMAT for commercial sale of rintatolimod (U.S. tradename: Ampligen®) in the Argentine Republic for the treatment of ME/CFS. The product will be marketed by GP Pharm, our commercial partner in Latin America. There are a number of actions that must occur before we could be able to commence commercial sales in Argentina. Commercialization in Argentina will require, among other things, an appropriate reimbursement level, appropriate marketing strategies, completion of manufacturing preparations for launch (including possible requirements for approval of final manufacturing) and we most likely will need additional funds to manufacture product at a sufficient level for a commercial launch.

On January 11, 2017, we announced that the EAP through our agreement with myTomorrows designed to enable access of Ampligen® to ME/CFS patients has been extended to pancreatic cancer patients beginning in the Netherlands. myTomorrows is our exclusive service provider in Europe and Turkey and will manage all EAP activities relating to the pancreatic cancer extension of the program.

On June 28, 2017, we signed an amendment to the EAP with myTomorrows. This amendment is for MyTomorrows to provide support services to Hemispherx with respect to the execution of the 511-Program (“511-Services”). The 511-Services shall be rendered for a period of 6 months to be renewed with additional 6 month periods with written mutual consent, or until termination of the 511-Program. The 511-Services shall be rendered free of charge.

On April 18, 2017 we entered into a material transfer agreement with Sanofi Vaccine Technologies, France.

Alferon N Injection®

Alferon N Injection® is the registered trademark for our injectable formulation of natural alpha interferon, which was approved by the FDA in 1989 for the treatment of certain categories of genital warts. Alferon® is the only natural-source, multi-species alpha interferon currently approved for sale in the U.S. for the intralesional (within lesions) treatment of refractory (resistant to other treatment) or recurring external genital warts in patients 18 years of age or older. Certain types of human papilloma viruses (“HPV”) cause genital warts, a sexually transmitted disease (“STD”). The U.S. Centers for Disease Control and Prevention (“CDC”) estimates that “approximately twenty million Americans are currently infected with HPV with another six million becoming newly infected each year. HPV is so common that at least 50% of sexually active men and women get it at some point in their lives.” Although they do not usually result in death, genital warts commonly recur, causing significant morbidity and entail substantial health care costs.

| -22- |

Interferons are a group of proteins produced and secreted by cells to combat diseases. Researchers have identified four major classes of human interferon: alpha, beta, gamma and omega. Alferon® N Injection® contains a multi-species form of alpha interferon. The world-wide market for injectable alpha interferon-based products has experienced rapid growth and various alpha interferon injectable products are approved for many major medical uses worldwide. Alpha interferons are manufactured commercially in three ways: by genetic engineering, by cell culture, and from human white blood cells. All three of these types of alpha interferon are or were approved for commercial sale in the U.S. Our natural alpha interferon is produced from human white blood cells.