UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT  OF

1934 OF

1934 |

For the fiscal year ended December 31, 2020

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-16465

Retractable Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Texas | 75-2599762 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 511 Lobo Lane | |

| Little Elm, Texas | 75068-5295 |

| (Address of principal executive offices) | (Zip Code) |

972-294-1010

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common | RVP | NYSE American LLC |

Securities registered pursuant to Section 12(g) of the Act:

Preferred Stock

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer x | Smaller reporting company x |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common equity held by non-affiliates as of June 30, 2020, was $121,416,123, assuming a closing price of $7.02 and outstanding shares held by non-affiliates of 17,295,744.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 12, 2021, there were 33,982,604 shares of our Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement filed on an even date herewith for the Annual Meeting of Shareholders to be held May 11, 2021 are incorporated by reference into Part III hereof.

RETRACTABLE TECHNOLOGIES, INC.

FORM 10-K

For the Fiscal Year Ended December 31, 2020

TABLE OF CONTENTS

i

PART I

FORWARD-LOOKING STATEMENT WARNING

Certain statements included by reference in this filing containing the words “could,” “may,” “believes,” “anticipates,” “intends,” “expects,” and similar such words constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Any forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the impact of COVID-19 on all facets of logistics and operations, as well as costs, our ability to complete capital improvements and ramp up domestic production in response to government agreements, potential tariffs, our ability to maintain liquidity, our maintenance of patent protection, our ability to maintain favorable third party manufacturing and supplier arrangements and relationships, foreign trade risk, our ability to access the market, production costs, the impact of larger market players, specifically Becton, Dickinson and Company ("BD"), in providing devices to the safety market, and other factors referenced in Item 1A. Risk Factors. Given these uncertainties, undue reliance should not be placed on forward-looking statements.

Item 1. Business.

DESCRIPTION OF BUSINESS

General Development of Business

Retractable Technologies, Inc. was incorporated in Texas in 1994. Our business is the manufacturing and marketing of safety medical products (predominately syringes) for the healthcare industry. Our syringes are used for vaccinations and our revenues for 2020 materially increased over prior years due to demand during the COVID-19 pandemic. Our principal customer was the U.S. government which purchased products representing 39.0% ($31.6 million) of our revenues in 2020. We have manufacturing facilities in Little Elm, Texas and use manufacturers in China as well. We are increasing our capacity for production at our U.S. manufacturing facility, funded in part by a grant by the U.S. government.

Description of Business

Our dominant revenue-generating products are our injection devices (syringes and needles). Such products are marketed under the VanishPoint®, Patient Safe®, and EasyPoint® brands. Other products which make up approximately 4.3% of our revenues include our blood collection devices and IV catheters. We have only one reporting segment. Most of our products incorporate a feature whereby our needles retract which is a safety feature designed to protect healthcare workers from needlestick injuries. Our VanishPoint® 1mL syringes meet the criteria set by pharmaceutical manufacturers for low dead space, which results in a reduction of wasted medication caused by residual medication remaining in the syringe after a dose has been administered. In some instances, the low dead space allows for additional doses to be obtained from a medication vial.

In 2020, the U.S. government was a significant customer due to efforts to vaccinate the U.S. population against COVID-19. On May 1, 2020, we received an order from the Department of Health and Human Services to supply certain automated safety syringes through May 2021 for $83.8 million (the “HHS Order”), plus $10 million in expedited freight costs. As of December 31, 2020, we recorded sales of $31.6 million under the 2020 HHS Order, representing 39.0% of our overall revenues for 2020. In February 2021, we received a new contract from the Department of Health and Human Services for additional safety syringes representing $54.2 million in expected revenues and reimbursable freight costs for a five-month base period of performance (February 15, 2021 to July 14, 2021) with additional renewal periods available at the option of the U.S. government.

During 2020, we also continued to provide products to our existing and new private healthcare customers. Our growth in sales in 2020 was predominantly driven by demand for syringes for COVID-19 vaccines and flu vaccines. Meeting demand for COVID-19 vaccines will continue to be our primary focus for the first half of 2021. As of December 31, 2020, our production and deliveries materially met or exceeded contract requirements despite the significant increase in demand.

1

Our goal is to become a leading provider of safety medical products. Our principal products were designed to protect healthcare workers, patients, and others from needlestick injuries, cross-contamination through reuse, and reduce disposal costs.

VanishPoint® syringe sales have historically comprised most of our sales. VanishPoint® syringe sales were 84.0%, 85.3%, and 84.0% of our revenues in 2018, 2019, and 2020. EasyPoint® products accounted for 11.8% of sales in 2020.

We currently have under development additional safety products that add to or build upon our current product line offering. Notwithstanding the foregoing, our primary focus over the last year has centered on providing existing products to meet demand related to COVID-19 vaccinations.

Our products are sold to and used by healthcare providers primarily in the U.S. (with 9.8% of revenues in 2020 generated from sales outside the U.S.).

In years not dominated by direct sales to the U.S. government, representatives of group purchasing organizations (“GPOs”) and purchasing representatives (rather than the end-users of the product) make the vast majority of decisions relating to the purchase of medical supplies. The GPOs and larger manufacturers often enter into contracts which can prohibit or limit entry in the marketplace by competitors.

We distribute our products throughout the U.S. through general line and specialty distributors. We also use international distributors. We have developed a national direct marketing network in order to market our products to health care customers and their purchaser representatives.

Sources and Availability of Raw Materials

Our product components, including needle adhesives and packaging materials, are purchased from various suppliers. There is no current scarcity of such materials or such suppliers.

Intellectual Property

Intellectual property rights, particularly patent rights, are material to our business. The patent rights are jointly owned by the Company and Thomas J. Shaw, our founder and CEO, and have varying expiration dates. Under the terms of an exclusive license agreement that has been in effect since 1995, the Company is exclusively licensed to use the patent rights held by Mr. Shaw, and Mr. Shaw generally receives a five percent (5%) royalty on gross sales of products subject to the license and he receives fifty percent (50%) of the royalties paid to the Company by certain sublicensees of the technology subject to the license.

Recent and expected modifications to our VanishPoint® syringes will effectively cause the modified VanishPoint® syringes products to have extended patent expiration dates. Following the expiration of patents related to the old design, competitors may attempt to copy aspects of such prior design, but not the current design. Patents related to recent modifications to the VanishPoint® syringes and core technology of the VanishPoint® syringes will expire during the years 2028 through 2032. Other patent applications covering inventions applicable to the VanishPoint® syringes are pending.

The Company has unexpired patents which relate to the EasyPoint® technology and other products as well.

The Company has registered the following trade names and trademarks for our products: VanishPoint®, EasyPoint®, Patient Safe®, VanishPoint® logos, RT and design, the VanishPoint® and design, the spot design and the Company slogans “The New Standard for Safety” ® and “We Make Safety Safe” ®.

2

Seasonality

Historically, unit sales have increased during the flu season. We cannot determine what percent of our increase in domestic sales (excluding the HHS Order) in the second half of 2020 were attributable to flu shots versus preparation for a COVID-19 vaccine.

Dependence on Customers

Although our business has historically derived significant percentages of its revenues from a few customers, we do not believe that the loss of any one of these customers would have a material adverse effect on our business.

Government Contracts

In 2020, we entered into a material contract with the U.S. government providing a significant grant and accepted the HHS Order under an existing contract for the sale of syringes. In February 2021, we and the Department of Health and Human Services entered into a new contract and it placed another material order with us for syringes. All such contracts may be terminated by the U.S. government but given current conditions with COVID-19, we do not believe termination (or renegotiation) is likely.

Government Approval and Government Regulations

The development, manufacture, marketing, sale, promotion, and distribution of our products are subject to government regulation by the U.S. Food and Drug Administration (FDA) and similar international regulatory agencies. Regulation by various international, federal and state agencies address the development and approval to market medical products, as well as approval and supervision of manufacturing, labeling, packaging, supply chains, distribution and record-keeping.

For all products manufactured for sale in the domestic market, we have given notice of intent to market to the FDA, and the devices were shown to be substantially equivalent to the predicate devices for the stated intended use. For all products manufactured for sale in the domestic market and foreign market, we hold a Quality Management System certification to ISO 13485:2016. Additionally, for all products manufactured for sale into the applicable countries, we hold a Quality Management System certification in compliance with the Medical Device Single Audit Program (MDSAP). For all products manufactured for sale into European Union countries, we hold a Full Quality Assurance System certification to Directive 93/42/EEC Annex II (excluding section 4). All of these certifications are issued by our notified body, BSI, and are reviewed annually.

Compliance with domestic and international laws and regulations may affect our business. Among other effects, health care regulations and significant changes thereto may substantially increase the time, difficulty, and costs incurred in developing, obtaining, and maintaining approval to market, and marketing newly developed and existing products. We expect this regulatory environment will continue to require effort and investment to ensure compliance. Failure to comply could delay the release of a new product or result in regulatory and enforcement actions, the seizure or recall of a product, the suspension or revocation of the authority necessary for a product’s production and sale, and other civil or criminal sanctions including fines and penalties.

The regulation of data privacy and security, and the protection of the confidentiality of certain personal information (including patient health information, financial information, and other sensitive personal information), is increasing. For example, the European Union, various other countries, and various U.S. states (e.g., California) have enacted stricter data protection laws that contain enhanced financial penalties for noncompliance. Similarly, the U.S. Department of Health and Human Services has issued rules governing the use, disclosure, and security of protected health information, and the FDA has issued further guidance concerning cybersecurity for medical devices. In addition, certain countries have issued or are considering “data localization” laws, which limit companies’ ability to transfer protected data across country borders. Failure to comply with data privacy and security laws and regulations can result in business disruption and enforcement actions, which could include civil or criminal penalties.

The sale of medical products is subject to laws and regulations pertaining to health care fraud and abuse, including state and federal anti-kickback, anti-self-referral, and false claims laws in the United States.

3

We will continue to comply with applicable regulations of all countries in which our products are registered for sale.

In a typical year, the cost of compliance with government regulations does not have a material effect on our capital expenditures, earnings, or competitive position (as measured against other U.S. entities). We believe that we do not incur material costs in connection with compliance with environmental laws.

Competitive Conditions

Major domestic competitors include BD and Medtronic Minimally Invasive Therapies (“Medtronic,” formerly known as Covidien). Terumo Medical Corp., Smiths Medical, and B Braun are additional competitors with smaller market shares. BD and Medtronic have controlling U.S. market share; greater financial resources; larger and more established sales, marketing, and distribution organizations; and greater market influence, including long-term and/or exclusive contracts. Additionally, BD may be able to use its resources to improve its products through research or acquisitions or develop new products which may compete with our products.

We compete primarily on the basis of healthcare worker and patient safety, product performance, and quality. We believe our competitive advantages include, but are not limited to, our leadership in quality and innovation. We believe our products continue to be the most effective safety devices in today’s market. Our VanishPoint® 1mL syringes meet the criteria set by pharmaceutical manufacturers for low dead space, which results in a reduction of wasted medication caused by residual medication remaining in the syringe after a dose has been administered. In some instances, the low dead space allows for additional doses to be obtained from a medication vial. Our syringe products include passive safety activation, require less disposal space, and are activated while in the patient, reducing exposure to the contaminated needle. Our price per unit is competitive or even lower than the competition once all the costs incurred during the life cycle of a syringe are considered. Such life cycle costs include disposal costs, testing and treatment costs for needlestick injuries, and treatment for contracted illnesses resulting from needlestick injuries.

EasyPoint® retractable needles offer unique safety benefits not found in other commercially available safety needles. Manually activated safety needles that compete with EasyPoint® must be removed from the patient, exposing the contaminated needle prior to activation of the manual safety mechanism. EasyPoint® needles allow for activation of the automated retraction mechanism while the needle is still in the patient, reducing exposure to the contaminated needle and effectively reducing the risk of needlestick injuries. EasyPoint® retractable needles are compatible with Luer-fitting syringes, including pre-filled syringes. In addition, EasyPoint® retractable needles may be activated with fluid in the syringe, making it applicable for aspiration procedures such as blood collection.

Employees

As of March 9, 2021, we had 182 employees. 178 of such employees were full time employees. We provide equal employment opportunities to all employees and applicants for employment without regard to race, color, religion, gender, national origin, age, disability, marital status, ancestry, veteran status, workers’ compensation status or any other characteristic protected by federal, state, or local law. We have adopted a policy of zero tolerance for any form of unlawful discrimination or retaliation.

Available Information

We make available, free of charge on our website (www.retractable.com), our Form 10-K Annual Report and Form 10-Q Quarterly Reports and Current Reports on Form 8-K (and any amendments to such reports) as soon as reasonably practical after such reports are filed.

Item 1A. Risk Factors.

You should carefully consider the following material risks facing us. If any of these risks occur, our business, results of operations, or financial condition could be materially affected.

4

We Are Challenged by Uncertainties in Obtaining and Enforcing Intellectual Property Rights

Our main competitive strength is our technology. We are dependent on patent rights, and if the patent rights are invalidated or circumvented, our business would be adversely affected. Patent protection is considered, in the aggregate, to be of material importance in the design, development, and marketing of our products.

VanishPoint® syringes comprised 84.0% of sales in 2020. When the patents of the VanishPoint® syringes and other products expire, we may experience a significant and rapid loss of sales, and our competitive position in the marketplace may weaken if other competitors use our technology. Such occurrences could have a material adverse effect on profitability.

We do not maintain patent or trademark protection in all foreign countries, but, where possible, have taken steps to protect our patents and trademarks in those countries where we market our products or where we believe other manufacturers are most likely to attempt to replicate our technology. Our lack of patent and trademark protection in certain foreign countries heightens the risk that our designs may be copied by a competitor in those countries.

We Are Vulnerable to New Technologies

Because we have a narrow focus on particular product lines and technology (currently, predominantly retractable needle products), we are vulnerable to the development of superior competing products and to changes in technology which could eliminate or reduce the need for our products. If a superior technology is created, the demand for our products could greatly diminish.

Our Competitors Have Greater Resources

Our competitors have greater financial resources, larger and more established sales and marketing and distribution organizations, and greater market influence, including long-term contracts. These competitors may be able to use these resources to improve their products through research and acquisitions or develop new products, which may compete more effectively with our products. If our competitors choose to use their resources to create products superior to ours, we may be unable to sell our products and our ability to continue operations would be weakened.

Operations May Be Affected by Foreign Trade Policy

We are subject to risks associated with foreign trade policy. In 2020, we used Chinese manufacturers to produce 85.2% of our products. We are currently working to expand our U.S. manufacturing facility, however.

In the event that we become unable to purchase such product from our Chinese manufacturers, we would need to find an alternate manufacturer for the blood collection set, IV catheter, Patient Safe® syringe, 0.5mL insulin syringe, 0.5mL autodisable syringe, and 2mL, 5mL, and 10mL syringes and we would increase domestic production for the 1mL and 3mL syringes. Even with increased domestic production, we may not be able to avoid a disruption in supply.

Trade protection measures, including tariffs, and/or changes to import or export requirements could materially adversely impact our operations. We cannot predict the impact of potential changes to U.S. foreign trade policy. Additionally, we derive 9.8% of our revenues from international sales. International sales, particularly in emerging market countries, are further subject to a variety of regulatory, economic, and political risks as well.

We Are Controlled by One Shareholder

Thomas J. Shaw, our President and Chief Executive Officer, has investment or voting power over a total of 46.1% of the outstanding Common Stock as of March 12, 2021. Mr. Shaw therefore has the ability to direct our operations and financial affairs and significant influence to elect members of our Board of Directors. His interests may not always coincide with the Company’s interests or the interests of other stockholders. This concentration of ownership, for example, may have the effect of delaying, deferring, or preventing a change in control, impeding a merger, consolidation, takeover, or other business combination involving us, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could materially adversely affect

5

the market price of our Common Stock. Mr. Shaw’s rights under the Technology License Agreement, as the owner of the technology we produce, present similar conflicts of interest.

Our Stock Has Recently Experienced Significant Price Fluctuation

Our stock price experienced significant fluctuation during 2020 and may continue to be unpredictable. Our stock price fluctuated in 2020 from a low price in January of $1.36 per share to a high in December of $15.79 per share. As of March 12, 2021, the stock price was $13.65 per share. We expect that the overall increase is connected with our recent orders from the Department of Health and Human Services and the Technology Investment Agreement, a contract with the U.S. government described in Item 2 of this report (“TIA”). We do not have assurance that the TIA will translate into increased sales of our products. Additionally, the products sold to the Department of Health and Human Services will be used in connection with administering a vaccine for COVID-19. We cannot predict our sales volumes if the country slows its immunization efforts.

Challenges from the Significant Orders

In 2020, the U.S. government was a significant customer representing 39.0% ($31.6 million) of our net sales. With additional 2021 deliveries under the HHS Order plus the new February 2021 contract from the U.S. government, the U.S. government will likely continue to be a materially significant customer in 2021. This presents unusual challenges to our business. Our 2021 performance under these orders will be somewhat dependent upon our timely completion of expansions to our facility and machinery, which we cannot guarantee will occur according to schedule. Moreover, in light of the government’s significant volume requirements, we may not be able to maintain our usual service levels to our existing customers. However, during 2020, we not only fulfilled obligations under the government’s order, but we also increased delivery volumes to existing customers.

We Face Inherent Product Liability Risks

As a manufacturer and provider of safety needle products, we face an inherent business risk of exposure to product liability claims. Additionally, our success depends on the quality, reliability, and safety of our products and defects in our products could damage our reputation. If a product liability claim is made and damages are in excess of our product liability coverage, our competitive position could be weakened by the amount of money we could be required to pay to compensate those injured by our products. In the event of a recall, we have recall insurance.

Our Business May Be Affected by Changes in the Health Care Regulatory Environment

In the U.S. and internationally, government authorities may enact changes in regulatory requirements, reform existing reimbursement programs, and/or make changes to patient access to health care, all of which could adversely affect the demand for our products and/or put downward pressure on our prices. Future healthcare rulemaking could affect our business. We cannot predict the timing or impact of any future rulemaking or changes in the law.

We May Experience Losses in Our Investment Account

Our investment portfolio is subject to market risk. As a result, the value and liquidity of our cash equivalents and marketable securities could fluctuate substantially. Likewise, our other income and expenses could vary materially depending on gains or losses realized on the sale or exchange of investments and other factors. Increased volatility in the financial markets and overall economic uncertainty could increase the risk that actual amounts realized on our investments may differ from the fair values currently assigned to them. Because 31.5% of our liquid assets are invested in the market, fluctuations in market values could have a material adverse impact on our business, financial condition, results of operations, or cash flows.

Health Crises Could Have an Adverse Effect on Our Business

Particularly during 2020, several states and local jurisdictions imposed, and others in the future may impose, “shelter-in-place” orders, quarantines, executive orders and similar government orders and restrictions for their residents to control the spread of COVID-19. Although our manufacturing facility has continued to operate during the 2020-2021 COVID-19 pandemic due to its status as an essential business, we continue to monitor the evolving

6

situation and cannot guarantee that the situation would be the same for any future pandemic. In the future, we may elect or be required to close temporarily which would result in a disruption in our activities and operations. Our supply chain, including transportation channels, may be impacted by any such restrictions as well. Any such disruption could impact our sales and operating results.

Widespread health crises also negatively affect economies which could affect demand for our products. With a new contract in place for 2021 sales directly to the U.S. government, our risk is somewhat mitigated for the 2021 year. However, in the event of a resurgence of this disease or in the case of any future pandemic, there is no guarantee that revenues from syringes needed for vaccines would offset the effects to our business of a global economic decline.

Health systems and other healthcare providers in our markets that provide procedures that use our products have suffered financially and operationally and may not be able to return to pre-pandemic levels of operations. Travel and import restrictions may also disrupt our ability to manufacture or distribute our devices. Any import or export or other cargo restrictions related to our products or the raw materials used to manufacture our products could restrict our ability to manufacture and ship products and harm our business, financial condition, and results of operations.

Our key personnel and other employees could still be affected by COVID-19 or any future pandemic, which could affect our ability to operate efficiently. In addition, the conduct of clinical trials and/or regulatory reviews of our new products may continue to be affected by the COVID-19 pandemic and would be affected in any future pandemic. Our sales and marketing personnel often rely on in-person and onsite access to healthcare providers which is currently restricted as hospitals are still not operating at pre-pandemic levels.

Disruption of Critical Information Systems or Material Breaches in the Security of Our Systems Could Harm Our Business, Customer Relations, and Financial Condition

Information technology helps us operate efficiently, interface with customers and suppliers, maintain financial accuracy and efficiency, and accurately produce our financial statements. If we do not allocate and effectively manage the resources necessary to build and sustain the proper technology infrastructure, we could be subject to transaction errors, processing inefficiencies, the loss of customers, business disruptions, or the loss of or damage to intellectual property through security breach. If our data management systems do not effectively collect, store, process, and report relevant data for the operation of our business, whether due to equipment malfunction or constraints, software deficiencies, or human error, our ability to effectively plan, forecast, and execute our business plan and comply with applicable laws and regulations will be impaired, perhaps materially. Any such impairment could materially and adversely affect our financial condition, results of operations, cash flows, and the timeliness with which we report our internal and external operating results. Third parties may attempt to fraudulently induce employees or customers into sensitive information, which may in turn be used to access our information technology systems. In addition, unauthorized persons may attempt to hack into our systems to obtain our confidential or proprietary information or confidential information we hold on behalf of third parties. If the unauthorized persons successfully hack into or interfere with our system, we may experience a negative impact to our business and reputation. We have programs in place to detect, contain, and respond to data security incidents, and we make ongoing improvements to our systems in order to minimize vulnerabilities, in accordance with industry and regulatory standards. However, we may not be able to anticipate and prevent these intrusions or mitigate them when and if they occur. We also rely on external vendors to supply and/or support certain aspects of our information technology systems. The systems of these external vendors may contain defects in design or manufacture or other problems that could unexpectedly compromise information security of our own systems, and we are dependent on these third parties to deploy appropriate security programs to protect their systems. It is possible for such vulnerabilities to remain undetected for an extended period, including several years or longer. The costs to us to eliminate or alleviate network security problems, bugs, viruses, worms, ransomware and other malicious software programs, and security vulnerabilities could be significant. Our efforts to address these problems may not be successful and could result in unexpected interruptions, delays, cessation of service, and harm to our business operations. Depending on the type of breach, we could also be exposed to a risk of loss or litigation and potential liability, which could have a material adverse impact on our business, financial condition, results of operations, or cash flows.

7

Illegal Distribution and Sale by Third Parties of Counterfeit Versions of Our Products Could Have A Negative Impact

Third parties may illegally distribute and sell counterfeit versions of our products which do not meet our rigorous manufacturing and testing standards. Our reputation and business could suffer harm as a result. In addition, diversion of products into other channels may result in reduced revenues.

We Are Subject to Various Risks Related To The PPP Loan.

Under our promissory note in favor of Independent Bank pursuant to the Paycheck Protection Program (the “PPP Loan”), we will be required to repay any portion of the outstanding principal that is not forgiven, along with accrued interest, and we cannot provide any assurance that we will be eligible for loan forgiveness or that any amount of the PPP Loan will ultimately be forgiven by the SBA. There can be no assurance that we will be eligible or able to take advantage of certain of the changes under the PPP Flexibility Act. The PPP Loan application required us to certify, among other things, that the current economic uncertainty made the PPP Loan request necessary to support our ongoing operations. While we made this certification in good faith after analyzing, among other things, our financial situation and access to alternative forms of capital, and believe that we satisfied all eligibility criteria for the PPP Loan and that our receipt of the PPP Loan is consistent with the broad objectives of the PPP of the CARES Act, the certification described above does not contain any objective criteria and is subject to interpretation. In addition, the SBA has stated that it is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification in good faith. The lack of clarity regarding loan eligibility under the Paycheck Protection Program has resulted in significant media coverage and controversy with respect to public companies applying for and receiving loans. If, despite our good faith belief that we satisfied all eligibility requirements for the PPP Loan, we are found to have been ineligible to receive the PPP Loan or in violation of any of the laws or governmental regulations that apply to us in connection with the PPP Loan, including the False Claims Act, we may be subject to administrative penalties and could be required to repay the PPP Loan. Our request for loan forgiveness remains subject to audit and review by governmental entities.

General Risk Factors

We face risk factors common to other U.S. businesses. We could be subject to complex and costly regulation. Our business could suffer if we or our suppliers encounter manufacturing problems or disruptions to transportation channels. We could be subject to risks associated with doing business outside of the U.S, including risks associated with global economic, regulatory, or political changes, or health crises. Current or worsening economic conditions may adversely affect our business and financial condition.

Item 1B. Unresolved Staff Comments.

Not applicable and none.

Item 2. Properties.

Our headquarters are located at 511 Lobo Lane, on 35 acres, which we own, overlooking Lake Lewisville in Little Elm, Texas. The headquarters are in good condition and houses our administrative offices and manufacturing facility. The manufacturing facility produced approximately 14.8% of the units that were manufactured in 2020. In the event that we become unable to purchase product from our Chinese manufacturers, we would need to find an alternate manufacturer for the blood collection set, IV catheter, Patient Safe® syringe, 0.5mL insulin syringe, 0.5mL autodisable syringe, and 2mL, 5mL, and 10mL syringes and we would increase domestic production for the 1mL and 3mL syringes. The 5mL and 10mL syringes are sold principally in the international market.

A loan in the original principal amount of approximately $4,210,000 is secured by our land and buildings. See Note 8 to our financial statements for more information.

In the opinion of Management, the property and equipment are suitable for their intended use and are adequately covered by an insurance policy.

8

Effective July 1, 2020, we entered into a Technology Investment Agreement (“TIA”) with the United States Government Department of Defense, U.S. Army Contracting Command-Aberdeen Proving Ground, Natick Contracting Division & Edgewood Contracting Division (ACC-APG, NCD & ECD) on behalf of the Biomedical Advanced Research and Development Authority (BARDA) for $53,664,286 in government funding for expanding our domestic production of needles and syringes. Pursuant to the terms of the TIA, we are expecting to make significant additions to our facilities which should allow us to increase domestic production. We have substantially completed construction of new controlled environment facilities and have begun construction of additional warehousing facilities which should be completed within the second quarter of 2021. The estimated cost of the controlled environment within existing properties is $6.4 million, and construction of the new warehouse is estimated to be $5.8 million. The cost of the controlled environment will be funded by the U.S. government under the TIA, while the cost of the new warehouse will be our financial obligation.

Item 3. Legal Proceedings.

Please refer to Note 10 to the financial statements for a complete description of all legal proceedings.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

MARKET INFORMATION

Our Common Stock has been listed on the NYSE American (or its predecessor entities) under the symbol “RVP” since May 4, 2001.

SHAREHOLDERS

As of March 12, 2021, there were 33,982,604 shares of Common Stock held by 184 shareholders of record, not including Cede & Co. participants or beneficial owners thereof.

DIVIDENDS

We have not ever declared or paid any dividends on the Common Stock. We have no current plans to pay any cash dividends on the Common Stock. Dividends on Common Stock cannot be paid so long as preferred dividends are unpaid. As of December 31, 2020, there was an aggregate of $5.0 million in preferred dividends in arrears. As of December 31, 2019, there was an aggregate of $12.3 million in preferred dividends in arrears.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information relating to our equity compensation plans as of December 31, 2020:

9

Equity Compensation Plan Information

| Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)) | ||||||||||

| Plan category | (a) | (b) | (c) | |||||||||

| Equity compensation plans approved by security holders | 199,450 | $2.05 | — | |||||||||

| Total | 199,450 | $2.05 | — | |||||||||

Stock Performance Graph

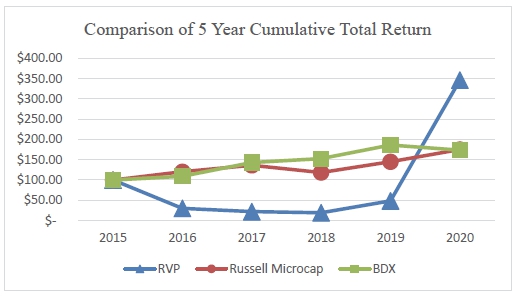

The following graph compares the cumulative total return for our Common Stock (RVP) from December 31, 2015 to December 31, 2020, to the total returns for the Russell Microcap® and Becton, Dickinson and Company (or “BDX”), a peer issuer. The graph assumes an investment of $100 in the aforementioned equities as of December 31, 2015, and that all dividends are reinvested.

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

In addition to the transactions disclosed previously in Item 2 of Part II of the Quarterly Reports on Form 10-Q, in October 2020, we purchased a total of 30,000 shares of Series IV Preferred Stock and 25,000 shares of Series V Preferred Stock from six shareholders in exchange for a total of $400,000 (of which $303,330 is to be paid over a three-year period beginning February 2021) and 110,000 shares of Common Stock. Such preferred shareholders agreed to waive all unpaid dividends in arrears associated with their Preferred Stock, which resulted in a waiver of a total of $757,759 in unpaid dividends in arrears.

In December 2020, we purchased a total of 20,000 shares of Series III Preferred Stock, 5,000 shares of Series IV Preferred Stock, and 9,000 shares of Series V Preferred Stock from five shareholders in exchange for a total of $286,000 and 34,000 shares of Common Stock. Such preferred shareholders agreed to waive all unpaid dividends in arrears associated with their Preferred Stock, which resulted in a wavier of a total of $592,892 in unpaid dividends.

We are relying on Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”) to exempt the foregoing transactions from the registration requirements of the Securities Act.

10

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

Purchases by affiliate(s) during 2020 were not repurchases by or on behalf of the issuer.

ISSUER PURCHASES OF EQUITY SECURITIES

| Period | Total Number of Shares |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs |

| December 31, 2020(1) | 14,300 | $7.50(2) | 14,300 | 0 |

(1) On November 24, 2020, we delivered to holders of Class B Series I Preferred Stock a Notice of Redemption notifying such preferred shareholders that, pursuant to the Certificate of Designation for the Series I Preferred Stock, we determined to redeem all Series I Preferred Stock. The redemption date was December 31, 2020. The redemption was publicly announced on Form 8-K on December 1, 2020.

(2) Not all Series I Preferred Shareholders have submitted adequate documentation to receive the redemption payments.

Item 6. Selected Financial Data.

Not required.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

FORWARD-LOOKING STATEMENT WARNING

Certain statements included by reference in this filing containing the words “could,” “may,” “believes,” “anticipates,” “intends,” “expects,” and similar such words constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Any forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the impact of COVID-19 on all facets of logistics and operations, as well as costs, our ability to complete capital improvements and ramp up domestic production in response to government agreements, potential tariffs, our ability to maintain liquidity, our maintenance of patent protection, our ability to maintain favorable third party manufacturing and supplier arrangements and relationships, foreign trade risk, our ability to access the market, production costs, the impact of larger market players, specifically Becton, Dickinson and Company ("BD"), in providing devices to the safety market, and other factors referenced in Item 1A. Risk Factors. Given these uncertainties, undue reliance should not be placed on forward-looking statements.

Overview

We have been manufacturing and marketing our products since 1997. VanishPoint® syringes comprised 84.0% of our sales in 2020. EasyPoint® products accounted for 11.8% of sales in 2020. We also manufacture and market a blood collection tube holder, IV safety catheter, and VanishPoint® Blood Collection Set.

Our products have been and continue to be distributed nationally and internationally through numerous distributors.

On May 1, 2020, we were awarded the HHS Order under an existing contract by the Department of Health and Human Services of the United States to supply automated retraction safety syringes for COVID-19 vaccination efforts, which order was in the amount of $83.8 million plus $10 million in expedited freight costs. As of December 31, 2020, we recorded sales of $31.6 million under the 2020 HHS Order, representing 39.0% of our overall revenues

11

for 2020, and we expect the remaining sales under the HHS Order in 2021. During 2020 and through March 2021, we have timely completed our delivery obligations under the HHS Order.

The Department of Health and Human Services awarded us another contract on February 12, 2021 to supply low dead space safety syringes for COVID-19 vaccination efforts. The base price for the contract and purchase order is $54,217,800 for the five-month base period of performance (February 15, 2021 to July 14, 2021). Such price includes both the fixed price for the products as well as cost reimbursement for freight. The terms of the contract allow for extensions at the option of the U.S. government for up to seven additional one-month periods. If all option periods are exercised, the value of the contract could increase by an additional $92,772,680, including the price of the products and freight reimbursement. For each period, the freight cost is estimated at approximately 25% of the overall price.

Effective July 1, 2020, we entered into the TIA with the United States Government Department of Defense, U.S. Army Contracting Command-Aberdeen Proving Ground, Natick Contracting Division & Edgewood Contracting Division (ACC-APG, NCD & ECD) on behalf of the Biomedical Advanced Research and Development Authority (BARDA) for $53,664,286 in government funding for expanding our domestic production of needles and syringes. Pursuant to the terms of the TIA, we are expecting to make significant additions to our facilities which should allow us to increase domestic production. Additionally, the TIA provides for reimbursement for equipment and supplies. As of early March 2021, we have negotiated contracts for the purchase of automated assembly equipment, molds, and molding equipment, as well as portions of auxiliary equipment, for approximately $42.1 million. As of March 2021, we have substantially completed construction of expanded facilities consisting of approximately 27,800 square feet of additional controlled environment within existing properties and we expect to complete approximately 55,000 square feet of new warehouse space within the second quarter of 2021. The estimated cost of the controlled environment within existing properties is $6.4 million. The increase from the original $6 million estimate is due to change orders and an expedited completion date in order to receive certain manufacturing equipment at an earlier date. The cost of the controlled environment will be funded by the U.S. government under the TIA, while the cost of the new warehouse will be our financial obligation.

Both of the abovementioned orders from the Department of Health and Human Services as well as the TIA from the U.S. government are material events particular to the COVID-19 pandemic and may not be indicative of future operations. While the addition of manufacturing equipment and facilities will greatly increase our production capacity, we cannot be assured that there will be increased demand for our products once orders from the U.S. government have been filled. If future orders are not placed by the U.S. government and orders from new and existing customers do not materialize, we would have significant excess productive capabilities.

On April 17, 2020, we entered into the PPP Loan in the principal amount of $1,363,000 in favor of Independent Bank pursuant to the Paycheck Protection Program (the “PPP”) of the Coronavirus Aid, Relief, and Economic Security Act, administered by the U.S. Small Business Administration (“SBA”). The PPP Loan’s original maturity date is April 17, 2022 and bears interest at a rate of 1.0% per annum. We have applied for forgiveness for the entirety of the loan granted under the PPP. We cannot be certain of the amount, if any, which may be forgiven.

As detailed in Note 4 to the financial statements, we held $8.1 million in debt and equity securities as of December 31, 2020, which represented 11.6% of our current assets. We continually monitor our invested balances.

During 2020, we hired 48 new full-time employees, predominantly as production line workers, and terminated several back office employees. We also moderately increased non-executive pay. The net effect of these actions caused a net increase of approximately $1.8 million in our operating expenses for 2020 as compared to 2019.

Historically, unit sales have increased during the flu season. We cannot determine what percent of our increase in domestic sales (excluding the HHS Order) in the second half of 2020 were attributable to flu shots versus preparation for a COVID-19 vaccine.

Product purchases from our Chinese manufacturers have enabled us to increase manufacturing capacity with little capital outlay and have provided a competitive manufacturing cost. In 2020, our Chinese manufacturers produced approximately 85.2% of our products. In the event that we become unable to purchase products from our Chinese manufacturers, we would need to find an alternate manufacturer for the blood collection set, IV catheter,

12

Patient Safe® syringe, 0.5mL insulin syringe, 0.5mL autodisable syringe, and 2mL, 5mL, and 10mL syringes and we would increase domestic production for the 1mL and 3mL syringes and EasyPoint® needles.

In 1995, we entered into a license agreement with Thomas J. Shaw for the exclusive right to manufacture, market, and distribute products utilizing his patented automated retraction technology and other patented technology. This technology is the subject of various patents and patent applications owned by Mr. Shaw. The license agreement generally provides for quarterly payments of a 5% royalty fee on gross sales of products subject to the license and he receives fifty percent (50%) of the royalties paid to the Company by certain sublicensees of the technology subject to the license.

With increased volumes, our manufacturing unit costs have generally tended to decline. Factors that could affect our unit costs include increases in costs by third party manufacturers, changing production volumes, costs of petroleum products, and transportation costs. Increases in such costs may not be recoverable through price increases of our products.

RESULTS OF OPERATIONS

The following discussion contains trend information and other forward-looking statements that involve a number of risks and uncertainties. Our actual future results could differ materially from our historical results of operations and those discussed in the forward-looking statements. All period references are to our fiscal years ended December 2020 and 2019. Dollar amounts have been rounded for ease of reading.

Comparison of Year Ended

December 31, 2020 and Year Ended December 31, 2019

Domestic sales, including sales to the U.S. government, accounted for 90.2% and 76.3% of the revenues in 2020 and 2019, respectively. Domestic revenues increased 131.4% principally due to increased volumes. Domestic unit sales increased 120.0%. Domestic unit sales were 85.9% of total unit sales for 2020. Domestic unit sales excluding the HHS Order rose approximately 36.4%. International revenues decreased 18.6% representing a return to normal levels after unusually high volumes in 2019. Our international orders may be subject to significant fluctuation over time. Overall unit sales increased 74.0%. Other than the Department of Health and Human Services, our increased sales are predominantly attributable to existing customers as well as several new smaller customers who do not operate as distributors. Our sales under the HHS Order were approximately $31.6 million in 2020 and we expect the remaining sales under the HHS Order in 2021, as well as orders of at least $54.2 million under the new February 2021 contract.

Cost of manufactured product increased 62.7% principally due to an increase in units sold. Royalty expense increased 58.7% due to increased gross sales. Gross profit margins increased from 33.8% in 2019 to 45.2% in 2020 principally due to an overall increase in sales.

Operating expenses increased 15.9% from the prior year due substantially to increased headcount and other employee-related expenses attributable to a larger volume of orders and the expansion activities required by the TIA.

Income from operations was $24.1 million in 2020 compared to income from operations of $3.0 million in 2019 due to the increase in net revenues and resulting gross profit.

Interest and other income increased $1.8 million for the year ended December 31, 2020 compared to the same period last year principally due unrealized gains from our investments.

For the year ended December 31, 2020, we recorded a provision for income taxes of $1,850,234. For a detailed description of the determination and components of calculating the provision, please refer to Note 11 of the financial statements.

During 2020, we engaged in private purchase agreements to purchase shares of outstanding preferred stock in exchange for cash consideration and the issuance of new common stock. We repurchased a total of 22,500 shares of Series III Class B Convertible Preferred Stock, 342,500 shares of Series IV Class B Convertible Preferred Stock,

13

and 34,000 shares of Series V Class B Convertible Preferred Stock. The aggregate cash consideration equaled $3,786,000, of which $482,670 was paid in 2020 with the remainder payable over a three-year period beginning in February 2021. The aggregate consideration was 754,000 shares of Common Stock. As a result of the transactions, $7,642,049 in unpaid dividends were waived by the shareholders, as measured from the effective date of the transactions. In connection with the transactions, the difference between the fair value of the consideration transferred to the preferred shareholders and the carrying amount of the preferred stock was added to net income available to common shareholders as a deemed capital contribution for the purpose of the calculation of earnings per share. As a result of the described transactions, a total of $2,975,708 was included in the calculation of Income (loss) applicable to common stockholders. Amounts payable as the result of our purchase of preferred stock also comprises a portion of the long-term liabilities set forth on our Balance Sheets. As further discussed in Note 9 of the financial statements, the long-term liabilities of $24,478,697 also includes amounts related to reimbursements from the U.S. government in connection with the TIA.

A comparison of the results of operations for the years ended December 31, 2019 and December 31, 2018 is omitted from this discussion. Such comparison was included in our Annual Report on Form 10-K filed with the SEC on March 30, 2020 in Item 7 of Part II thereof.

LIQUIDITY AND CAPITAL RESOURCES

Discussion of Statement of Cash Flow Items

Cash flow from operations was $19.0 million in 2020, principally due to our net income for the year. The increase in cash was offset by an increase in accounts receivable, largely driven by the HHS Order. There was also an increase in inventory. Additionally, we have recorded a deferred tax asset of $4,631,206 which is material to the adjustments to total cash flow from operations. The deferred tax asset represents amounts available to reduce income taxes payable on taxable income in future years. The determination and calculation of such asset is further discussed in Note 11 of the financial statements.

Cash used by investing activities was $19.3 million for the year ended December 31, 2020 due primarily to the purchase of property, plant and equipment, but offset by the net proceeds from the sales and purchases of debt and equity securities. The $21.0 million impact to cash from the purchase of such fixed assets reflects down payments on orders for certain assets detailed in this report in connection with the TIA.

Cash provided by financing activities was $12.0 million for the year ended December 31, 2020. This was primarily due to the proceeds from the PPP Loan, proceeds from the exercise of stock options, and proceeds from the government under the TIA for down payments on our orders for fixed assets.

Historical Sources of Liquidity

We have historically funded operations primarily from the proceeds from revenues, private placements, litigation settlements, and loans.

Internal Sources of Liquidity

Margins

The mix of domestic and international sales affects the average sales price of our products. Generally, the higher the ratio of domestic sales to international sales, the higher the average sales price will be. Some international sales of our products are shipped directly from China to the customer. The number of units produced by us versus manufactured in China can have a significant effect on the carrying costs of Inventory as well as Cost of sales. Additionally, the effect of an overall increase in units sold also has a positive effect on margins. We will continue to evaluate the appropriate mix of products manufactured domestically and those manufactured in China to achieve economic benefits as well as to maintain our domestic manufacturing capability.

14

Cash Requirements

We have sufficient cash reserves, received a PPP Loan, and have begun to realize income from operations. We also have access to our investments which may be liquidated in the event that we need to access the funds for operations.

Contracts with the U.S. Government

As discussed above, we were awarded a material delivery order by the Department of Health and Human Services of the United States in the total amount of approximately $83.8 million, plus certain expedited freight expenses. For the year ended December 31, 2020, our sales under this HHS Order were approximately $31.6 million and we expect such sales to increase each quarter through May 2021. In February 2021, we received a new contract from the Department of Health and Human Services for additional safety syringes representing $54.2 million in expected revenues and reimbursable freight costs for a five-month base period of performance (February 15, 2021 to July 14, 2021) with additional renewal periods available at the option of the U.S. government.

As discussed above, we entered into a TIA with the U.S. government for approximately $53.7 million in government funding for expanding our domestic production of needles and syringes. As of December 31, 2020, we have received approximately $10.7 million for down payments on the purchase of certain fixed assets. Pursuant to the terms of the TIA, we have begun making significant additions to our facilities which should allow us to increase domestic production. We have substantially completed construction of new controlled environment facilities and we have begun construction of warehousing facilities which are expected to be completed in the second quarter of 2021. While a portion of the planned construction will be funded by the U.S. government, we expect to fund the construction of the new warehouse and expect the cost to be approximately $5.8 million. Through December 31, 2020, have paid a total of approximately $320,000 in progress payments for the new warehouse.

Option Exercises

Stock options were exercised by our employees and directors during 2020, and, consequently, we received approximately $923 thousand to exercise such options.

External Sources of Liquidity

We recently received a PPP Loan, as described above, in the principal amount of $1,363,000. We have applied for forgiveness of this loan but we cannot be certain of the amount, if any, which may be forgiven.

It is unlikely we would choose to raise funds by the public sale of equity despite recent increases in the value of our stock. Our stock price increased materially during 2020 and during the first several months of 2021.

We consider our investment portfolio a source of liquidity as well. For example, in the third quarter of 2020, we liquidated approximately $4.0 million from our investment portfolio for operational needs. As of December 31, 2020, $8.1 million was invested in third party securities.

Capital Resources

Since the execution of the TIA on July 1, 2020, we have begun construction for significant expansion to our facilities. As of March 2021, we have substantially completed construction of expanded facilities consisting of approximately 27,800 square feet of additional controlled environment within existing properties and we expect to complete approximately 55,000 square feet of new warehouse space within the second quarter of 2021. The estimated cost of the controlled environment within existing properties is $6.4 million. The increase from the original $6 million estimate is due to change orders and an expedited completion date in order to receive certain manufacturing equipment at an earlier date. As of early March 2021, we have negotiated contracts for the purchase of automated assembly equipment, molds, and molding equipment, as well as portions of auxiliary equipment, for approximately $42.1 million. To fund the purchase of the automated assembly equipment, auxiliary equipment, and construction of the controlled environment, we are reimbursed by the U.S. government according to the terms in the TIA. The TIA also

15

allows us to request an advance of funds for larger purchases when necessary. The expenditures which are not reimbursable from the U.S. government under the TIA are funded with cash from operations.

OFF-BALANCE SHEET ARRANGEMENTS

None.

CONTRACTUAL OBLIGATIONS

Not applicable to smaller reporting companies.

CRITICAL ACCOUNTING ESTIMATES

We are responsible for developing estimates for amounts reported as assets and liabilities, and revenues and expenses in conformity with U.S. generally accepted accounting principles (“GAAP”). Those estimates require that we develop assumptions of future events based on past experience and expectations of economic factors. Among the more critical estimates management makes is the estimate for customer rebates. The amount reported as a contractual allowance for rebates involves examination of past historical trends related of our sales to customers and the related credits issued once contractual obligations of the customers have been met. The establishment of a liability for future claims of rebates against sales in the current period requires that we have an understanding of the relevant sales with respect to product categories, sales distribution channels, and the likelihood of contractual obligations being satisfied. We examine the results of estimates against actual results historically and use the determination to further develop our basis for assumptions in future periods, as well as the accuracy of past estimates.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Not applicable to smaller reporting companies.

16

Item 8. Financial Statements and Supplementary Data.

RETRACTABLE TECHNOLOGIES, INC.

FINANCIAL STATEMENTS AND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

DECEMBER 31, 2020, 2019, and 2018

F-1

RETRACTABLE TECHNOLOGIES, INC. INDEX TO FINANCIAL STATEMENTS | Page | ||

| Report of Independent Registered Public Accounting Firm | F-3 | ||

| Financial Statements: | |||

| Balance Sheets as of December 31, 2020 and 2019 | F-5 | ||

| Statements of Operations for the years ended December 31, 2020, 2019, and 2018 | F-6 | ||

| Statements of Changes in Stockholders’ Equity for the years ended December 31, 2020, 2019, and 2018 | F-7 | ||

| Statements of Cash Flows for the years ended December 31, 2020, 2019, and 2018 | F-9 | ||

| Notes to Financial Statements | F-10 | ||

| Financial Statement Schedule: | |||

| Schedule II: Schedule of Valuation and Qualifying Accounts for the years ended December 31, 2020, 2019, and 2018 | 18 |

F-2

Report of Independent Registered Public Accounting Firm

To the Stockholders and the Board of Directors of

Retractable Technologies, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Retractable Technologies, Inc. (the “Company”) as of December 31, 2020 and 2019, the related statements of operations, changes in stockholders’ equity, and cash flows for each of the three years in the period ended December 31, 2020, and the related notes and schedules (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2020 and 2019, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current period audit of the financial statements that was communicated or required to be communicated to the audit committee and that (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Revenue Recognition - Rebates

As described in Note 2 to the financial statements, the Company’s rebate accrual at December 31, 2020 is $3,435,352. The Company recognizes revenue when it has satisfied all performance obligations to the customer. Under certain contracts, revenue is recorded based on the sales price to distributors, less contractual pricing allowances. Contractual pricing allowances consist of: (i) rebates granted to distributors who provide tracking reports which show, among other things, the facility that purchased the products, and (ii) a provision for estimated contractual pricing allowances for products for which the Company has not received tracking reports. Once rebates are issued they are applied against the customer’s receivable balance.

F-3

We identified management’s estimates of rebates attributable to contractual pricing allowances, which are based on management’s evaluation of available internal and external data and for which the Company has not received tracking reports, as a critical audit matter. The Company’s evaluation uses internally developed assumptions, which involves a high degree of judgement. This leads to a high degree of auditor judgment and an increased extent of effort is required when performing audit procedures to evaluate the methodology and reasonableness of the estimates and assumptions.

The following are the most relevant procedures we performed to address this critical audit matter:

| · | We evaluated and tested the appropriateness of management’s process for estimating rebates, including: |

| o | Testing the completeness, accuracy, and relevance of the underlying data used in management’s estimate. |

| o | Obtaining management’s analysis and supporting documentation related to sales distribution, and testing whether sales distribution factors used in the calculation of rebates were supported by the analysis provided by management. |

| · | We developed an independent expectation of rebates based on historic trends in sales to distributors and credits issued and compared such expectation to the Company’s estimate, including testing the completeness and accuracy of the data used in the calculation, application of product categories and sales distribution channels determined by management and used in the calculation, and recalculation of the rebates. |

| · | We compared the year end rebate allowance to credits issued subsequent to year end and investigated variances between management’s estimate and actual results. |

/s/ Moss Adams LLP

Dallas, Texas

March 31, 2021

We have served as the Company’s auditor since 2016.

F-4

RETRACTABLE TECHNOLOGIES, INC.

BALANCE SHEETS

| December 31, | ||||||||

| 2020 | 2019 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 17,566,682 | $ | 5,934,749 | ||||

| Accounts receivable, net of allowance for doubtful accounts of $205,822 and $146,832 | 32,910,919 | 6,564,371 | ||||||

| Investments in debt and equity securities, at fair value | 8,081,833 | 7,771,660 | ||||||

| Inventories, net | 10,234,646 | 7,450,592 | ||||||

| Income taxes receivable | — | 50,392 | ||||||

| Other current assets | 684,317 | 635,201 | ||||||

| Total current assets | 69,478,397 | 28,406,965 | ||||||

| Property, plant, and equipment, net | 30,816,504 | 10,632,057 | ||||||

| Income taxes receivable | — | 50,393 | ||||||

| Deferred tax asset | 4,631,206 | — | ||||||

| Other assets | 44,567 | 88,315 | ||||||

| Total assets | $ | 104,970,674 | $ | 39,177,730 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 16,256,444 | $ | 5,007,604 | ||||

| Current portion of long-term debt | 1,030,763 | 260,939 | ||||||

| Accrued compensation | 826,762 | 607,339 | ||||||

| Dividends payable | 49,091 | 54,800 | ||||||

| Accrued royalties to shareholder | 1,973,781 | 921,445 | ||||||

| Other accrued liabilities | 3,398,904 | 1,387,149 | ||||||

| Income taxes payable | 4,365,770 | 17,944 | ||||||

| Total current liabilities | 27,901,515 | 8,257,220 | ||||||

| Other long-term liabilities | 24,478,697 | — | ||||||

| Long-term debt, net of current maturities | 2,710,337 | 2,378,055 | ||||||

| Total liabilities | 55,090,549 | 10,635,275 | ||||||

| Commitments and contingencies – See Note 10 | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred Stock, $1 par value: | ||||||||

| Class B; authorized: 5,000,000 shares | ||||||||

| Series I, Class B; outstanding: 0 and 96,000 shares at December 31, 2020 and 2019 | — | 96,000 | ||||||

| Series II, Class B; outstanding: 156,200 and 171,200 shares at December 31, 2020 and 2019 (liquidation preference of $1,952,500) | 156,200 | 171,200 | ||||||

| Series III, Class B; outstanding: 106,745 and 129,245 shares at December 31, 2020 and 2019 (liquidation preference of $1,334,313) | 106,745 | 129,245 | ||||||

| Series IV, Class B; outstanding: 0 and 342,500 shares at December 31, 2020 and 2019 | — | 342,500 | ||||||

| Series V, Class B; outstanding: 0 and 34,000 shares at December 31, 2020 and 2019 | — | 34,000 | ||||||

| Common Stock, no par value; authorized: 100,000,000 shares; outstanding: 33,957,204 and 32,674,954 shares at December 31, 2020 and 2019 | — | — | ||||||

| Additional paid-in capital | 59,285,401 | 61,660,744 | ||||||

| Accumulated deficit | (9,668,221 | ) | (33,891,234 | ) | ||||

| Total stockholders’ equity | 49,880,125 | 28,542,455 | ||||||

| Total liabilities and stockholders’ equity | $ | 104,970,674 | $ | 39,177,730 | ||||

See accompanying notes to financial statements

F-5

RETRACTABLE TECHNOLOGIES, INC.

STATEMENTS OF OPERATIONS

| Years Ended December 31, | ||||||||||||

| 2020 | 2019 | 2018 | ||||||||||

| Sales, net | $ | 81,862,453 | $ | 41,797,179 | $ | 33,274,702 | ||||||

| Cost of Sales | ||||||||||||

| Costs of manufactured product | 39,377,794 | 24,209,401 | 20,108,798 | |||||||||

| Royalty expense to shareholder | 5,476,306 | 3,449,822 | 2,944,102 | |||||||||

| Total cost of sales | 44,854,100 | 27,659,223 | 23,052,900 | |||||||||

| Gross profit | 37,008,353 | 14,137,956 | 10,221,802 | |||||||||

| Operating expenses: | ||||||||||||

| Sales and marketing | 4,061,904 | 4,217,863 | 4,404,441 | |||||||||

| Research and development | 574,527 | 516,095 | 621,365 | |||||||||

| General and administrative | 8,301,169 | 6,432,158 | 6,786,041 | |||||||||

| Total operating expenses | 12,937,600 | 11,166,116 | 11,811,847 | |||||||||

| Income from insurance proceeds | — | — | 260,514 | |||||||||

| Income (loss) from operations | 24,070,753 | 2,971,840 | (1,329,531 | ) | ||||||||

| Interest and other income | 2,262,758 | 351,166 | 153,460 | |||||||||

| Interest expense | (260,264 | ) | (166,897 | ) | (177,190 | ) | ||||||

| Income (loss) before income taxes | 26,073,247 | 3,156,109 | (1,353,261 | ) | ||||||||

| Provision (benefit) for income taxes | 1,850,234 | 7,875 | (13,318 | ) | ||||||||

| Net income (loss) | 24,223,013 | 3,148,234 | (1,339,943 | ) | ||||||||

| Preferred Stock dividend requirements | (573,868 | ) | (702,618 | ) | (704,996 | ) | ||||||

| Deemed contribution on extinguishment of preferred stock | 2,975,708 | — | — | |||||||||

| Income (loss) applicable to common stockholders | $ | 26,624,853 | $ | 2,445,616 | $ | (2,044,939 | ) | |||||

| Basic earnings (loss) per share | $ | 0.80 | $ | 0.07 | $ | (0.06 | ) | |||||

| Diluted earnings (loss) per share | $ | 0.80 | $ | 0.07 | $ | (0.06 | ) | |||||

| Weighted average common shares outstanding: | ||||||||||||

| Basic | 33,169,307 | 32,672,475 | 32,666,454 | |||||||||

| Diluted | 33,300,654 | 32,672,475 | 32,666,454 | |||||||||

See accompanying notes to financial statements

F-6

RETRACTABLE TECHNOLOGIES, INC.

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Series I Class B |

Series II Class B |

Series III Class B |