UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended December 31, 2012

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from to

Commission file number: 000-26408

WAYSIDE TECHNOLOGY GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

13-3136104 |

|

(State or other jurisdiction of incorporation) |

|

(IRS Employer Identification Number) |

|

1157 Shrewsbury Avenue, Shrewsbury, New Jersey |

|

07702 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (732) 389-8950

Securities registered pursuant to section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, par value $0.01 per share |

|

The NASDAQ Global Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or other information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

|

Large accelerated filer o |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the Common Stock held by non-affiliates of the Registrant computed by reference to the closing sale price for the Registrant’s Common Stock as of June 29, 2012, which was the last business day of the Registrant’s most recently completed second fiscal quarter, as reported on The NASDAQ Global Market, was approximately $45,412,747 (In determining the market value of the Common Stock held by any non-affiliates, shares of Common Stock of the Registrant beneficially owned by directors, officers and holders of more than 10% of the outstanding shares of Common Stock of the Registrant have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes).

The number of shares outstanding of the Registrant’s Common Stock as of February 07, 2013 was 4,753,558 shares.

Documents Incorporated by Reference: Portions of the Registrant’s definitive Proxy Statement for its 2013 Annual Meeting of Stockholders to be filed on or before April 30, 2013 are incorporated by reference into Part III of this Report.

PART I

Item 1 Business

General

Wayside Technology Group, Inc. and Subsidiaries (the “Company,” “us,” “we,” or “our”) is an information technology (“IT”) channel company. We resell computer software and hardware developed by others and provide technical services directly to customers in the United States and Canada. We also distribute software through resellers indirectly to customers worldwide. We offer an extensive line of products from leading publishers of software and tools for virtualization, networking, software development, database modeling, security, and other technically sophisticated domains.

Wayside Technology Group, Inc. was incorporated in Delaware in 1982. Our Common Stock is listed on The NASDAQ Global Market under the symbol “WSTG”. Our main web site address is www.waysidetechnology.com, and the other web sites maintained by our business include www.lifeboatdistribution.com, and www.techxtend.com. Reference to these “uniform resource locators” or “URLs” is made as an inactive textual reference for informational purposes only. Information on our web sites should not be considered filed with the Securities and Exchange Commission, and is not, and should not be deemed to be, a part of this report.

The Company operates through two reportable operating segments. The “Lifeboat Distribution” segment distributes technical software to corporate resellers, value added resellers (VARs), consultants and systems integrators primarily in the United States and Canada. The “TechXtend” segment is a value-added reseller of software, hardware and services for corporations, government organizations and academic institutions in the United States and Canada. For each of our segments, sales from unaffiliated customers, income and total assets, among other financial information, is presented in Note 10 in the Notes to our Consolidated Financial Statements.

Competition

The software market is highly competitive. Pricing is very aggressive in both software distribution and reselling. The Company expects pricing pressure to continue. The Company faces competition from a wide variety of sources. In the Lifeboat Distribution segment, we compete against much larger broad-line distributors, as well as specialty distributors and, in some cases, the direct sales teams of the vendors we represent also sell directly to the end-customers. In the TechXtend segment, we also compete against vendors who sell directly to customers, as well as software resellers, superstores, e-commerce vendors, and other direct marketers of software products. In both segments, some of our competitors are significantly larger and have substantially greater resources than the Company. Many of our competitors compete principally on the basis of price, product availability, customer service and technical support.

There can be no assurance that the Company can compete effectively against existing competitors or new competitors that may enter the market or that it can generate profit margins which represent a fair return to the Company. In addition, price is an important competitive factor in the personal computer software market and there can be no assurance that the Company will not be subject to increased price competition. An increase in the amount of competition faced by the Company, or its failure to compete effectively against its competitors, could have a material adverse effect on the Company’s business, financial condition and results of operations.

The Company competes to attract prospective buyers and in sourcing new products from software developers and publishers, as well as in marketing its current product line to its customers. The Company believes that its ability to offer software developers and IT professionals a wide selection of products at reasonable prices with prompt delivery and high customer service levels, along with its good relationships with vendors and suppliers, allows it to compete effectively in acquiring prospective buyers and marketing its current product line to its customers. The Company competes to gain distribution rights for new products primarily on the basis of its reputation and its relationships with software publishers.

The market for developer and infrastructure software products is characterized by rapid changes in technology, user requirements, and customer specifications. The manner in which software products are distributed and sold is changing, and new methods of distribution and sale may emerge or expand. Software developers and publishers have sold, and may intensify their efforts to sell, their products directly to end-users. The continuing evolution of the Internet as a platform in which to conduct e-commerce business transactions has both lowered the barriers for competition and broadened customer access to products and information, increasing competition and reducing prices. From time to time, certain software developers and publishers have instituted programs for the direct sale of large order quantities of software to certain major corporate accounts. These types of programs may continue to be developed and used by various developers and publishers. While Microsoft and other vendors currently sell new releases or upgrades directly to end users, they have not, however, attempted to completely bypass the reseller channel. There can be no assurances, that software developers and publishers will continue using resellers to the same extent they currently do. Future efforts by software developers and publishers to bypass third- party sales channels could materially and adversely affect the Company’s business operations and financial conditions.

In addition, resellers and publishers may attempt to increase the volume of software products distributed electronically through ESD (Electronic Software Distribution) technology, through subscription services, and through on-line shopping services. Any of these competitive programs, if successful, could have a material adverse effect on the Company’s business, results of operations and financial condition. For a description of additional risks relating to competition in our industry, please refer to “Item 1.A. Risk Factors”: “We rely on our suppliers for product availability, marketing funds, purchasing incentives and competitive products to sell”, and “The IT products and services industry is intensely competitive and actions of competitors, including manufacturers of products we sell, can negatively affect our business”.

Products

The Company offers a wide variety of products from a broad range of publishers and manufacturers, such as Acronis, CA Technologies, DataCore, Datawatch, Dell, Flexera Software, GFI, Hewlett Packard, Infragistics, Intel Software, Lenovo, Microsoft, Mindjet, Quest Software, SolarWinds, Sophos, StorageCraft Technology, TechSmith, Veeam, Vision Solutions and VMware. On a continuous basis, we screen new products for inclusion in our catalogs and web sites based on their features, quality, price, profit margins and warranties, as well as on current sales trends. Since the Company predominantly sells software, sales of hardware and peripherals represented only 4% of our overall net sales in each of 2012, 2011 and 2010.

Marketing and Distribution

We market products through creative marketing communications, including our web sites, local and on-line seminars, print and electronic catalogs. We also use direct e-mail and printed material to introduce new products and upgrades, to cross-sell products to current customers, and to educate and inform existing and potential customers. We believe that our blend of electronic and traditional marketing and selling programs are important marketing vehicles for software publishers and manufacturers. These programs provide a cost-effective and service-oriented means to market and sell and fulfill software products and meet the needs of users.

The Company had three customers that accounted for more than 10% of total sales for 2012. For the year ended December 31, 2012, Software House International, CDW Corporation, and Insight accounted for 13.4%, 12.4% and 11.1%, respectively, of consolidated net sales and, as of December 31, 2012, 12.0%, 9.6%, and 8.3%, respectively, of total net accounts receivable. For the year ended December 31, 2011, CDW Corporation, Insight and Software House International accounted for 14.0%, 11.0% and 10.5%, respectively, of consolidated net sales. For the year ended December 31, 2010, CDW Corporation accounted for 15.8% of consolidated net sales. Our top five customers accounted for 44%, 42%, and 44% of consolidated net sales in 2012, 2011 and 2010, respectively. The Company generally ships products within 48 hours of confirming a customer’s order. This allows for minimum backlog in the business.

Sales in Canada represented 7% of our consolidated revenues in each of 2012, 2011 and 2010. For geographic financial information, please refer to Note 10 in the Notes to our Consolidated Financial Statements.

Customer Support

We believe that providing a high level of customer service is necessary to compete effectively and is essential to continued sales and revenue growth. Our account representatives assist our customers with all aspects of purchasing decisions, process products ordered and respond to customer inquiries on order status, product pricing and availability. The account representatives are trained to answer all basic questions about the features and functionality of products. To deal with technical issues, we maintain an in-house technical support staff.

Purchasing and Fulfillment

The Company’s success is dependent, in part, upon the ability of its suppliers to develop and market products that meet the changing requirements of the marketplace. The Company believes it enjoys good relationships with its vendors. The Company and its principal vendors have cooperated frequently in product introductions and in other marketing programs. As is customary in the industry, the Company has no long-term supply contracts with any of its suppliers. Substantially all of the Company’s contracts with its vendors are terminable upon 30 days’ notice or less. Moreover, the manner in which software products are distributed and sold is changing, and new methods of distribution and sale may emerge or expand. Software publishers have sold, and may intensify their efforts to sell, their products directly to end-users. The Company’s business and results of operations may be adversely affected if the terms and conditions of the Company’s authorizations with its vendors were to be significantly modified or if certain products become unavailable to the Company.

We believe that effective purchasing from a diverse vendor base is a key element of our business strategy. For the year ended December 31, 2012, Dell/Quest Software was the only individual vendor from whom our purchases exceeded 10% of our total purchases and accounted for 13.4% of our total purchases. For the year ended December 31, 2011, Veeam and Quest accounted for 12.6% and 11.2%, respectively, of our total purchases. For the year ended December 31, 2010, Quest was the only individual vendor from whom our purchases exceeded 10% of our total purchases and represented 11.2% of our total purchases. The loss of a key vendor or group of vendors could disrupt our product availability and otherwise have an adverse effect on the Company.

In 2012, the Company purchased approximately 91% of its products directly from manufacturers and publishers and the balance from multiple distributors, as compared to 90% in 2011 and 2010. Most suppliers or distributors will “drop ship” products directly to the customers, which reduces physical handling by the Company. Inventory management techniques, such as “drop shipping” allow the Company to offer a greater range of products without increased inventory requirements or associated risk.

Inventory levels may vary from period to period, due in part to increases or decreases in sales levels, the Company’s practice of making large-volume purchases when it deems the terms of such purchases to be attractive, and the addition of new suppliers and products. Moreover, the Company’s order fulfillment and inventory control systems allow the Company to order certain products just in time for next day shipping. The Company promotes the use of electronic data interchange (“EDI”) with its suppliers, which helps reduce overhead and the use of paper in the ordering process. Although brand names and individual products are important to our business, we believe that competitive sources of supply are available for substantially all of the product categories we carry.

The Company operates distribution facilities in Shrewsbury, New Jersey and Mississauga, Canada.

Management Information Systems

The Company operates management information systems on Windows 2003 and Windows 2008 platforms that allow for centralized management of key functions, including inventory, accounts receivable, purchasing, sales and distribution. We are dependent on the accuracy and proper utilization of our information technology systems, including our telephone, web sites, e-mail and fax systems.

The management information systems allow the Company to monitor sales trends, provide real-time product availability and order status information, track direct marketing campaign performance and to make marketing event driven purchasing decisions. In addition to the main system, the Company has systems of networked personal computers, as well as microcomputer-based desktop publishing systems, which facilitate data sharing and provide an automated office environment.

The Company recognizes the need to continually upgrade its management information systems to most effectively manage its operations and customer database. In that regard, the Company anticipates that it will, from time to time, require software and hardware upgrades for its present management information systems.

Trademarks

The Company conducts its business under the various trademarks and service marks of Programmer’s Paradise, the “Island Man” cartoon character logo, TechXtend, and Lifeboat Distribution. The Company protects these trademarks and service marks and believes that they have significant value to us and are important factors in our marketing programs.

Employees

As of December 31, 2012, Wayside Technology Group, Inc. and its subsidiaries had 118 full-time employees and 2 part-time employees. The Company is not a party to any collective bargaining agreements with its employees, has experienced no work stoppages and considers its relationships with its employees to be satisfactory.

Executive Officers of the Company

Set forth below are the name, age, present title, principal occupation and certain biographical information for our executive officers as of February 1, 2013, all of whom have been appointed by and serve at the discretion of the Board of Directors of the Company (the “Board of Directors”).

|

Name |

|

Age |

|

Position |

|

Simon F. Nynens |

|

41 |

|

Chairman, President and Chief Executive Officer |

|

Thomas J. Flaherty |

|

45 |

|

Vice President and Chief Financial Officer |

|

Vito Legrottaglie |

|

48 |

|

VP of Operations and Information Systems |

|

Daniel T. Jamieson |

|

55 |

|

VP and General Manager — Lifeboat Distribution |

|

Richard J. Bevis |

|

63 |

|

Vice President of Marketing |

|

Shawn J. Giordano |

|

43 |

|

Vice President of Sales-TechXtend |

Simon F. Nynens was appointed President and Chief Executive Officer in January 2006. Mr. Nynens also serves on the Board of Directors and was named Chairman in June 2006. He previously held the position of Executive Vice President and Chief Financial Officer (June 2004 - January 2006) and Vice President and Chief Financial Officer (January 2002 - June 2004). Prior to January 2002, Mr. Nynens served as the Vice President and Chief Operating Officer of the Company’s European operations.

Thomas J. Flaherty was appointed as Vice President and Chief Financial Officer in August 2012. He most recently served as Vice President of Finance of StemCyte, Inc. from 2008 to 2012. Before that, from 2004 to 2008, Mr. Flaherty served as Corporate Controller & US Division Controller at VPIsystems, Inc., an international enterprise class software company. Prior to joining VPIsystems, Inc., from 1997 to 2004, he served as Chief Financial Officer and founder of Bike-Time, LLC and GeeWhiz Toys, LLC. Mr. Flaherty also was employed by Centennial Communications Corp. and Ernst & Young, LLP. In addition, Mr. Flaherty is a Certified Public Accountant.

Vito Legrottaglie was appointed to the position of Vice President of Operations and Information Systems in April 2007. He previously held the position of Vice President of Information Systems since June 2003. Mr. Legrottaglie had previously served as Vice President of Information Systems from 1999 to 2000 and had been with the Company since 1996. Mr. Legrottaglie has also held the positions of Chief Technology Officer at Swell Commerce Incorporated, Vice President of Operations for The Wine Enthusiast Companies and Director of Information Systems at Barnes & Noble.

Daniel T. Jamieson was appointed Vice President and General Manager of Lifeboat Distribution in April 2003. Prior to that, and since 1992, Mr. Jamieson held various sales and marketing management positions within the Company.

Richard J. Bevis was appointed Vice President Marketing in July 2007. Prior to joining Wayside Technology Group, Inc., Mr. Bevis worked for Covance Inc., a drug development service company, as Senior Director Marketing Communication from 2003 to 2007. He also held the position of Vice President of Corporate Communications for Eyretel, PLC. from 2002 to 2003.

Shawn J. Giordano was appointed Vice President of Sales - TechXtend in August 2008. Mr. Giordano joined Wayside Technology Group, Inc. in November 2007 as Senior Director of Sales for Programmer’s Paradise and TechXtend. Prior to joining Wayside Technology Group, Inc., he worked for CA, Inc. (Computer Associates), a business consulting and software development company, from 2000 to 2007, most recently as Director of Channel Sales. Mr. Giordano began his career at Microwarehouse, Inc., and in over eight years with that company, progressed through positions of increasing responsibility in sales, marketing, and management.

Available Information

Under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is required to file annual, quarterly and current reports, proxy and information statements and other information with the SEC. You may read and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. The SEC maintains a web site at

http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The Company files electronically with the SEC. The Company makes available, free of charge, through its internet web site, its reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, as soon as reasonably practicable after they are filed with the SEC. The following address for the Company’s web site includes a hyperlink to those reports under “Financials/SEC Filings”: http://www.waysidetechnology.com.

In January 2004, we adopted a Code of Ethical Conduct. The full text of the Code of Ethical Conduct, which applies to all employees, officers and directors of the Company, including our Chief Executive Officer, Chief Financial Officer and Controller, is available at our web site, http://www.waysidetechnology.com, under “Corporate Governance.” The Company intends to disclose any amendment to, or waiver from, a provision of the Code of Ethical Conduct that applies to its Chief Executive Officer, Chief Financial Officer or Controller on its web site under “Investor Information.”

Reference to the “uniform resource locators” or “URLs” contained in this section is made as an inactive textual reference for informational purposes only. Information on our web sites should not be considered filed with the Securities and Exchange Commission, and is not, and should not be deemed to be part of this report.

Item 1A. Risk Factors

Investors should carefully consider the risk factors set forth below as well as the other information contained in this report. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. Additional risks and uncertainties not currently known to us or those currently viewed by us to be immaterial may also materially and adversely affect our business, financial condition or results of operations.

Changes in the information technology industry and/or economic environment may reduce demand for the products and services we sell. Our results of operations are influenced by a variety of factors, including the condition of the IT industry, general economic conditions, shifts in demand for, or availability of, computer products and software and IT services and industry introductions of new products, upgrades or methods of distribution. The information technology products industry is characterized by abrupt changes in technology, rapid changes in customer preferences, short product life cycles and evolving industry standards. Net sales can be dependent on demand for specific product categories, and any change in demand for or supply of such products could have a material adverse effect on our net sales, and/or cause us to record write-downs of obsolete inventory, if we fail to react in a timely manner to such changes.

We rely on our suppliers for product availability, marketing funds, purchasing incentives and competitive products to sell. We acquire products for resale both directly from manufacturers and indirectly from distributors. The loss of a supplier could cause a disruption in the availability of products. Additionally, there is no assurance that as manufacturers continue to or increasingly sell directly to end users and through the distribution channel, that they will not limit or curtail the availability of their products to resellers like us. For example, resellers and publishers may attempt to increase the volume of software products distributed electronically through ESD (Electronic Software Distribution) technology, through subscription services, and through on-line shopping services, and correspondingly, decrease the volume of products sold through us. Our inability to obtain a sufficient quantity of products, or an allocation of products from a manufacturer in a way that favors one of our competitors, or competing distribution channels, relative to us, could cause us to be unable to fill clients’ orders in a timely manner, or at all, which could have a material adverse effect on our business, results of operations and financial condition. We also rely on our suppliers to provide funds for us to market their products, including through our catalogs and on-line marketing efforts, and to provide purchasing incentives to us. If any of the suppliers that have

historically provided these benefits to us decides to reduce such benefits, our expenses would increase, adversely affecting our results of operations.

General economic weakness may reduce our revenues and profits. The ongoing effects of the general economic downturn continues to cause some of our current and potential customers to delay or reduce technology purchases, resulting in longer sales cycles, slower adoption of new technologies and increased price competition. We may, therefore, experience a greater decline in demand for the products we sell, resulting in increased competition and pressure to reduce the cost of operations. Any benefits from cost reductions may take longer to realize and may not fully mitigate the impact of the reduced demand. In addition, weak financial and credit markets heighten the risk of customer bankruptcies and create a corresponding delay in collecting receivables from those customers and may also affect our vendors’ ability to supply products, which could disrupt our operations. The realization of any or all of these risks could have a material adverse effect on our business, results of operations and financial condition.

We Depend on Having Creditworthy Customers to Avoid an Adverse Impact to Our Operating Results and Financial Condition. We require sufficient amounts of debt and equity capital to fund our transactions as we provide larger extended payment terms to certain of our customers. If the credit quality of our customer base materially decreases, or if we experience a material increase in our credit losses, we may find it difficult to continue to obtain the required capital for our business, and our operating results and financial condition may be harmed. In addition to the impact on our ability to attract capital, a material increase in our delinquency and default experience would itself have a material adverse effect on our business, operating results and financial condition. Furthermore, if any of our customers to whom we provide larger extended payment terms go elsewhere for financing, such loss of financing revenue could have a material adverse effect on our business, operating results and financial condition.

The IT products and services industry is intensely competitive and actions of competitors, including manufacturers of products we sell, can negatively affect our business. Competition has been based primarily on price, product availability, speed of delivery, credit availability and quality and breadth of product lines and, increasingly, also is based on the ability to tailor specific solutions to client needs. We compete with manufacturers, including manufacturers of products we sell, as well as a large number and wide variety of marketers and resellers of IT products and services. In addition, manufacturers are increasing the volume of software products they distribute electronically directly to end-users and in the future will likely pay lower referral fees for sales of certain software licensing agreements sold by us. Generally, pricing is very aggressive in the industry, and we expect pricing pressures to continue. There can be no assurance that we will be able to negotiate prices as favorable as those negotiated by our competitors or that we will be able to offset the effects of price reductions with an increase in the number of clients, higher net sales, cost reductions, or greater sales of services, which service sales typically at higher gross margins, or otherwise. Price reductions by our competitors that we either cannot or choose not to match could result in an erosion of our market share and/or reduced sales or, to the extent we match such reductions, could result in reduced operating margins, any of which could have a material adverse effect on our business, results of operations and financial condition.

Disruptions in our information technology and voice and data networks could affect our ability to service our clients and cause us to incur additional expenses. We believe that our success to date has been, and future results of operations likely will be, dependent in large part upon our ability to provide prompt and efficient service to clients. Our ability to provide such services is dependent largely on the accuracy, quality and utilization of the information generated by our IT systems, which affect our ability to manage our sales, client service, distribution, inventories and accounting systems and the reliability of our voice and data networks.

Failure to adequately maintain the security of our electronic and other confidential information could materially adversely affect our financial condition and results of operations. We are dependent upon automated information technology processes. Privacy, security, and compliance concerns have

continued to increase as technology has evolved to facilitate commerce and as cross-border commerce increases. As part of our normal business activities, we collect and store certain confidential information, including personal information of employees and information about partners and clients which may be entitled to protection under a number of regulatory regimes. In the course of normal and customary business practice, we may share some of this information with vendors who assist us with certain aspects of our business. Moreover, the success of our operations depends upon the secure transmission of confidential and personal data over public networks, including the use of cashless payments. Any failure on the part of us or our vendors to maintain the security of data we are required to protect, including via the penetration of our network security and the misappropriation of confidential and personal information, could result in business disruption, damage to our reputation, financial obligations to third parties, fines, penalties, regulatory proceedings and private litigation with potentially large costs, and also result in deterioration in our employees’, partners’ and clients’ confidence in us and other competitive disadvantages, and thus could have a material adverse impact on our business, financial condition and results of operations.

We depend on certain key personnel. Our future success will be largely dependent on the efforts of key management personnel. We also believe that our future success will be largely dependent on our continued ability to attract and retain highly qualified management, sales, service and technical personnel. We cannot assure you that we will be able to attract and retain such personnel. Further, we make a significant investment in the training of our sales account executives. Our inability to retain such personnel or to train them either rapidly enough to meet our expanding needs or in an effective manner for quickly changing market conditions could cause a decrease in the overall quality and efficiency of our sales staff, which could have a material adverse effect on our business, results of operations and financial condition.

Risks Related to Our Common Stock. The exercise of outstanding options or any other issuance of shares by us may dilute your ownership of our Common Stock. Our Common Stock is thinly traded. As a result of the thin trading market for our stock, its market price may fluctuate significantly more than the stock market as a whole or of the stock prices of similar companies. Without a larger float, our common stock will be less liquid than the stock of companies with broader public ownership, and, as a result, the trading prices for our Common Stock may be more volatile. Among other things, trading of a relatively small volume of our Common Stock may have a greater impact on the trading price of our stock than would be the case if our public float were larger.

Our common stock is listed on The NASDAQ Global Market, and we therefore are subject to continued listing requirements, including requirements with respect to the market value and number of publicly-held shares, number of stockholders, minimum bid price, number of market makers and either (i) stockholders’ equity or (ii) total market value of stock, total assets and total revenues. If we fail to satisfy one or more of the requirements, we may be delisted from The NASDAQ Global Market. If we do not qualify for listing on The NASDAQ Capital Market, and if we are not able to list our common stock on another exchange, our common stock could be quoted on the OTC Bulletin Board or on the “pink sheets”. As a result, we could face significant adverse consequences including, among others, a limited availability of market quotations for our securities and a decreased ability to issue additional securities or obtain additional financing in the future.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

The Company leases 18,000 square feet of space in Shrewsbury, New Jersey for its corporate headquarters and warehouse under a lease expiring in February 2016. Total annual rent expense for these premises is approximately $225,000. Additionally, the Company leases approximately 3,700 square

feet of office and warehouse space in Mississauga, Canada, under a lease which expires November 30, 2013. Total annual rent expense for these premises is approximately $30,000. The Company also leases office space in Almere, Netherlands under a lease which expires October 31, 2013, at an annual rent of approximately $12,000. We believe that each of the properties is in good operating condition and such properties are adequate for the operation of the Company’s business as currently conducted.

Item 3. Legal Proceedings

There are no material legal proceedings to which the Company or any of its subsidiaries is a party or of which any of their property is the subject.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Shares of our Common Stock, par value $0.01, trade on The NASDAQ Global Market under the symbol “WSTG”. Following is the range of low and high sales prices for our Common Stock as reported on The NASDAQ Global Market.

|

|

|

High |

|

Low |

| ||

|

2012: |

|

|

|

|

| ||

|

First Quarter |

|

$ |

14.40 |

|

$ |

11.70 |

|

|

Second Quarter |

|

$ |

17.00 |

|

$ |

12.05 |

|

|

Third Quarter |

|

$ |

12.97 |

|

$ |

12.15 |

|

|

Fourth Quarter |

|

$ |

12.90 |

|

$ |

10.81 |

|

|

|

|

|

|

|

| ||

|

2011: |

|

|

|

|

| ||

|

First Quarter |

|

$ |

15.35 |

|

$ |

11.27 |

|

|

Second Quarter |

|

$ |

15.30 |

|

$ |

13.06 |

|

|

Third Quarter |

|

$ |

13.88 |

|

$ |

10.00 |

|

|

Fourth Quarter |

|

$ |

12.55 |

|

$ |

9.51 |

|

In each of 2012 and 2011, we declared quarterly dividends totaling $0.64 per share, respectively, on our Common Stock. There can be no assurance that we will continue to pay comparable cash dividends in the future.

During 2012, the Company granted a total of 92,000 shares of restricted stock to employees and a member of the Board of Directors. These shares vest over 20 equal quarterly installments. A total of 3,525 shares of restricted common stock were forfeited as a result of employees terminating employment with the Company.

During 2011, the Company granted a total of 15,000 shares of restricted stock to employees. These shares vest over 20 equal quarterly installments. A total of 8,375 shares of restricted common stock were forfeited as a result of employees terminating employment with the Company.

The share issuances in all of the above transactions were not registered under the Securities Act of 1933, as amended (the “Securities Act”). The issuances were exempt from registration pursuant to Section 4(2) of the Securities Act and/or Regulation D thereunder, as they were transactions by the issuer that did not involve public offerings of securities and/or involved issuances to accredited investors.

As of February 06, 2013 there were approximately 31 record holders of our Common Stock. This figure does not include an estimate of the number of beneficial holders whose shares are held of record by brokerage firms and clearing agencies.

During the fourth quarter of 2012, we repurchased shares of our Common Stock as follows:

|

|

|

Total Number |

|

Average |

|

Total |

|

Average |

|

Maximum |

| ||

|

Period |

|

Purchased |

|

(2) |

|

Programs |

|

(3) |

|

(4) (5) |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

October 1- October 31, 2012 |

|

— |

|

— |

|

— |

|

— |

|

374,719 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

November 1- November 30, 2012 |

|

17,617 |

(1) |

$ |

12.45 |

|

8,937 |

|

$ |

12.30 |

|

365,782 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

December 1 - December 31, 2012 |

|

23,304 |

|

$ |

11.16 |

|

23,304 |

|

$ |

11.16 |

|

342,478 |

|

|

Total |

|

40,921 |

|

$ |

11.72 |

|

32,241 |

|

$ |

11.48 |

|

342,478 |

|

(1) Includes 8,680 shares surrendered to the Company by employees to satisfy individual tax withholding obligations upon vesting of previously issued shares of Restricted Stock. These shares are not included in the Common Stock repurchase program referred to in footnote (4) below.

(2) Average price paid per share reflects the closing price of the Company’s Common Stock on the business date the shares were surrendered by the employee stockholder to satisfy individual tax withholding obligations upon vesting of Restricted Stock or the price of the Common Stock paid on the open market purchase, as applicable.

(3) Average price paid per share reflects the price of the Company’s Common Stock purchased on the open market.

(4) On July 31, 2008, the Company approved the increase of its Common Stock repurchase program by 500,000 shares. The Company expects to purchase shares of its Common Stock from time to time in the market or otherwise subject to market conditions. The Common Stock repurchase program does not have an expiration date.

(5) On October 23, 2012, the Board of Directors approved, and on October 29, 2012, the Company entered into a written purchase plan intended to comply with the requirements of Rule 10b5-1 under the Exchange Act, as amended (the “Plan”). Purchases involving shares of the Company’s Common Stock under the Plan commenced October 29, 2012, and the Plan is intended to be in effect until October 29, 2014. Pursuant to the Plan, the Company’s broker shall effect purchases of up to an aggregate of 350,000 shares of Common Stock.

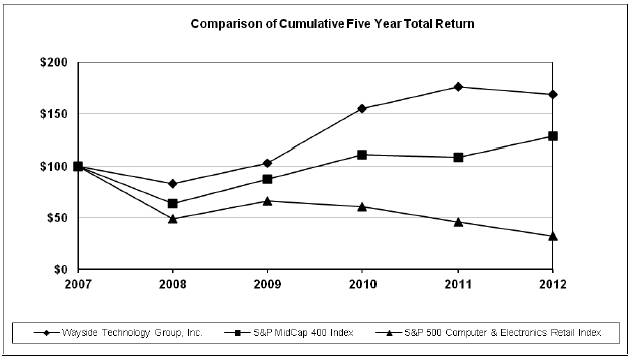

STOCK PRICE PERFORMANCE GRAPH

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return on the Company’s Common Stock with the cumulative total return of the S&P Midcap 400 Index and the S&P 500 Computer and Electronics Retail Index for the period commencing December 31, 2007 and ending December 31, 2012, assuming $100 was invested on December 31, 2007 and the reinvestment of dividends.

|

|

|

Base |

|

INDEXED RETURNS |

| ||||||||

|

|

|

Period |

|

Years Ending |

| ||||||||

|

Company / Index |

|

Dec07 |

|

Dec08 |

|

Dec09 |

|

Dec10 |

|

Dec11 |

|

Dec12 |

|

|

Wayside Technology Group, Inc. |

|

100 |

|

83.58 |

|

102.89 |

|

155.34 |

|

176.59 |

|

168.96 |

|

|

S&P MidCap 400 Index |

|

100 |

|

63.77 |

|

87.61 |

|

110.94 |

|

109.02 |

|

128.51 |

|

|

S&P 500 Computer & Electronics Retail Index |

|

100 |

|

49.24 |

|

66.58 |

|

61.17 |

|

46.22 |

|

32.61 |

|

Item 6. Selected Financial Data

The following tables set forth, for the periods indicated, selected consolidated financial and other data for Wayside Technology Group, Inc. and its Subsidiaries. You should read the selected consolidated financial and other data below in conjunction with our consolidated financial statements and the related notes and with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Form 10-K.

Year Ended December 31,

(Amounts in thousands, except per share data)

|

|

|

2012 |

|

2011 |

|

2010 |

|

2009 |

|

2008 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Consolidated Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net sales |

|

$ |

297,057 |

|

$ |

250,169 |

|

$ |

206,730 |

|

$ |

146,384 |

|

$ |

174,025 |

|

|

Cost of sales |

|

273,165 |

|

226,928 |

|

186,720 |

|

130,791 |

|

157,228 |

| |||||

|

Gross profit |

|

23,892 |

|

23,241 |

|

20,010 |

|

15,593 |

|

16,797 |

| |||||

|

Selling, general and administrative expenses |

|

15,377 |

|

14,623 |

|

13,207 |

|

11,319 |

|

12,207 |

| |||||

|

Income from operations |

|

8,515 |

|

8,618 |

|

6,803 |

|

4,274 |

|

4,590 |

| |||||

|

Other income, net |

|

574 |

|

369 |

|

407 |

|

521 |

|

744 |

| |||||

|

Income before income taxes |

|

9,089 |

|

8,987 |

|

7,210 |

|

4,795 |

|

5,334 |

| |||||

|

Income tax provision |

|

3,600 |

|

3,448 |

|

2,789 |

|

1,928 |

|

2,168 |

| |||||

|

Net income |

|

$ |

5,489 |

|

$ |

5,539 |

|

$ |

4,421 |

|

$ |

2,867 |

|

$ |

3,166 |

|

|

Net income per common share: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic |

|

$ |

1.23 |

|

$ |

1.26 |

|

$ |

1.01 |

|

$ |

0.65 |

|

$ |

0.72 |

|

|

Diluted |

|

$ |

1.19 |

|

$ |

1.20 |

|

$ |

0.98 |

|

$ |

0.65 |

|

$ |

0.71 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic |

|

4,476 |

|

4,412 |

|

4,386 |

|

4,399 |

|

4,414 |

| |||||

|

Diluted |

|

4,628 |

|

4,606 |

|

4,500 |

|

4,427 |

|

4,461 |

| |||||

|

|

|

December 31, |

| |||||||||||||

|

|

|

2012 |

|

2011 |

|

2010 |

|

2009 |

|

2008 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Cash and cash equivalents |

|

$ |

9,835 |

|

$ |

9,202 |

|

$ |

10,955 |

|

$ |

8,560 |

|

$ |

9,349 |

|

|

Marketable securities |

|

4,411 |

|

5,375 |

|

4,528 |

|

7,571 |

|

9,367 |

| |||||

|

Working capital |

|

19,592 |

|

19,337 |

|

19,033 |

|

16,583 |

|

14,806 |

| |||||

|

Total assets |

|

91,445 |

|

74,861 |

|

68,683 |

|

53,667 |

|

47,485 |

| |||||

|

Total stockholders’ equity |

|

32,125 |

|

28,934 |

|

26,679 |

|

24,359 |

|

23,884 |

| |||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following management’s discussion and analysis of the Company’s financial condition and results of operations should be read in conjunction with the Company’s Consolidated Financial Statements and the Notes thereto. This discussion and analysis contains, in addition to historical information, forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and uncertainties, including those set forth under the heading “Risk Factors” and elsewhere in this report.

Overview

The Company is organized into two reportable operating segments. The “Lifeboat Distribution” segment distributes technical software to corporate resellers, value added resellers (VARs), consultants and systems integrators primarily in the United States and Canada. The “TechXtend” segment is a value-added reseller of software, hardware and services for corporations, government organizations and academic institutions in the United States and Canada.

We offer an extensive line of products from leading publishers of software and tools for virtualization, networking, software development, database modeling, security, and other technically sophisticated domains as well as computer hardware. We market these products through direct sales, our

catalogs, direct mail programs, advertisements in trade magazines, as well as through Internet and e-mail promotions.

Forward-looking Statements

This report includes “forward-looking statements” within the meaning of Section 21E of the Exchange Act. Statements in this report regarding future events or conditions, including but not limited to statements regarding industry prospects and the Company’s expected financial position, business and financing plans, are forward-looking statements.

Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. We strongly urge current and prospective investors to carefully consider the cautionary statements and risks contained in this report, particularly the risks described under “Item 1A. Risk Factors” above. Such risks include, but are not limited to, the continued acceptance of the Company’s distribution channel by vendors and customers, the timely availability and acceptance of new products, contribution of key vendor relationships and support programs, as well as factors that affect the software industry generally.

The Company operates in a rapidly changing business, and new risk factors emerge from time to time. Management cannot predict every risk factor, nor can it assess the impact, if any, of all such risk factors on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those projected in any forward-looking statements.

Accordingly, forward-looking statements should not be relied upon as a prediction of actual results and readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The statements concerning future sales, future gross profit margin and future selling and administrative expenses are forward looking statements involving certain risks and uncertainties such as availability of products, product mix, pricing pressures, market conditions and other factors, which could result in a fluctuation of sales below recent experience.

Stock Volatility. The technology sector of the United States stock markets has experienced substantial volatility in recent periods. Numerous conditions which impact the technology sector or the stock market in general or the Company in particular, whether or not such events relate to or reflect upon the Company’s operating performance, could adversely affect the market price of the Company’s Common Stock. Furthermore, fluctuations in the Company’s operating results, announcements regarding litigation, the loss of a significant vendor, increased competition, reduced vendor incentives and trade credit, higher postage and operating expenses, and other developments, could have a significant impact on the market price of the Company’s Common Stock.

Financial Overview

Net sales totaled $297.1 million in 2012 as compared to $250.2 million in 2011, representing a 19% increase. Gross profit increased by $0.7 million in 2012 as compared to 2011. Selling, general and administrative (“SG&A”) expenses increased by $0.8 million in 2012 as compared to 2011. Income from operations amounted to $8.5 million in 2012 as compared to $8.6 million in 2011, representing a decrease of $0.1 million as compared to 2011. This decrease resulted primarily from the increase in sales, offset in part by competitive pricing pressure and lower rebate attainment which lowered gross

profit margin percentage and increased SG&A expenses. Our income before income taxes increased by $0.1 million to $9.1 million in 2012 compared to $9.0 million in 2011. We reported a net income of $5.5 million for each of 2012 and 2011.

The Company’s sales, gross profit and results of operations have fluctuated and are expected to continue to fluctuate on a quarterly basis as a result of a number of factors, including but not limited to: the condition of the software industry in general, shifts in demand for software products, pricing, industry shipments of new software products or upgrades, the timing of new merchandise and catalog offerings, fluctuations in response rates, fluctuations in merchandise returns, adverse weather conditions that affect response, distribution or shipping, shifts in the timing of holidays and changes in the Company’s product offerings. The Company’s operating expenditures are based on sales forecasts. If sales do not meet expectations in any given quarter, operating results may be materially adversely affected.

Results of Operations

The following table sets forth for the years indicated the percentage of net sales represented by selected items reflected in the Company’s Consolidated Statements of Earnings. The year-to-year comparison of financial results is not necessarily indicative of future results:

|

|

|

Years ended December 31, |

| ||||

|

|

|

2012 |

|

2011 |

|

2010 |

|

|

Net sales |

|

100.0 |

% |

100.0 |

% |

100.0 |

% |

|

Cost of sales |

|

92.0 |

|

90.7 |

|

90.3 |

|

|

Gross profit |

|

8.0 |

|

9.3 |

|

9.7 |

|

|

Selling, general and administrative expenses |

|

5.1 |

|

5.9 |

|

6.4 |

|

|

Income from operations |

|

2.9 |

|

3.4 |

|

3.3 |

|

|

Other income |

|

0.2 |

|

0.2 |

|

0.2 |

|

|

Income before income taxes |

|

3.1 |

|

3.6 |

|

3.5 |

|

|

Income tax provision |

|

1.2 |

|

1.4 |

|

1.4 |

|

|

Net income |

|

1.9 |

% |

2.2 |

% |

2.1 |

% |

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011

Net Sales

Net sales for 2012 increased 19%, or $46.9 million to $297.1 million in 2012 compared to $250.2 million in 2011. Total sales for our Lifeboat Distribution segment in 2012 were $217.3 million compared to $192.7 million in 2011, representing a 13% increase. Total sales for the TechXtend segment in 2012 amounted to $79.7 million, compared to $57.4 million in 2011, representing a 39% increase.

The increase in net sales for our Lifeboat Distribution segment was mainly a result of the strengthening of our account penetration, our continued focus on the expanding virtual infrastructure-centric business and the addition of several key product lines. The 39% increase in sales in the TechXtend division was primarily due to an increase in larger extended payment term transactions, solution focus selling and higher average order sizes in 2012.

Gross Profit

Gross Profit for 2012 was $23.9 million compared to $23.2 million in 2011, a 3% increase. Total gross profit for our Lifeboat Distribution segment was $15.8 million compared to $16.8 million in 2011, representing a 6% decrease. The decrease in gross profit for the Lifeboat Distribution segment

was due to lower vendor rebate attainment and competitive pricing pressure within this segment. Total gross profit for our TechXtend segment was $8.1 million compared to $6.4 million in 2011, representing a 25% increase. The increase in gross profit for the TechXtend segment was the result of increased sales volume offset in part by a lower gross margin in 2012 as compared to 2011 and lower vendor rebates. Vendor rebates and discounts for 2012 amounted to $1.8 million compared to $2.9 million for 2011. Vendor rebates are dependent on reaching certain targets set by our vendors. Vendors have been periodically substantially increasing their target revenues for rebate eligibility. Therefore, despite our increasing revenue, vendor rebates have declined.

Gross profit margin (gross profit as a percentage of net sales) for 2012 was 8.0% compared to 9.3% in 2011. Gross profit margin for our Lifeboat Distribution segment in 2012 was 7.3% compared to 8.7% in 2011. Gross profit margin for our TechXtend segment in 2012 was 10.1% compared to 11.2% in 2011.

The increase in gross profit dollars and the decrease in gross profit margins were primarily caused by the sales growth within our Lifeboat Distribution and TechXtend segments, offset in part, by continued pressure on discounts and rebates earned and competitive pricing pressure in both segments, and, in part, by our having won several large bids, including transactions on extended payment terms, based on aggressive pricing which we plan to continue.

The Company monitors gross profits and gross profit margins carefully. Price competition in our market intensified further in 2012, with competitors lowering their prices significantly and the Company responding immediately. Although our sales volume increased substantially as a result, gross margins, as well as the rebates and discounts that are material elements of the Company’s overall profitability, were negatively impacted during the year ended December 31, 2012. We anticipate that margins, as well as discounts and rebates, will continue to be affected by this current trend.

Selling, General and Administrative Expenses

Total selling, general and administrative (“SG&A”) expenses for 2012 were $15.4 million compared to $14.6 million in 2011, representing an increase of $0.8 million. This increase is primarily the result of an increase in sales commissions for our TechXtend segment due to our growth in this segment, the addition of employees in sales, finance and operations to support business growth and higher professional fees. As a result of the increase in net sales, SG&A expenses declined as a percentage of net sales to 5.2% in 2012, compared to 5.9% in 2011.

Direct selling costs (a component of SG&A) for 2012 were $8.1 million compared to $7.8 million in 2011. Total direct selling costs for our Lifeboat Distribution segment for 2012 were $4.5 million compared to $4.7 million in 2011, mainly due to lower commission and bonus expense compared to the prior year. Total direct selling costs for our TechXtend segment for 2012 were $3.6 million compared to $3.1 million in 2011. The increase in the TechXtend segment was due to higher commission, salaries and bonus expense resulting from growth in the segment.

The Company expects that its SG&A expenses, as a percentage of net sales, may vary depending on changes in sales volume, as well as the levels of continuing investments in key growth initiatives. We plan to continue to expand our investment in information technology and marketing, while monitoring our sales and remaining general and administrative expenses closely.

Income Taxes

For the year ended December 31, 2012, the Company recorded a provision for income taxes of $3.6 million which consists of a provision of $2.8 million for U.S. federal income taxes, as well as a $0.5 million provision for state and local taxes, a $0.2 million provision for foreign taxes, and a deferred tax expense of $0.1 million.

As of December 31, 2012, the Company had a U.S. deferred tax asset of approximately $0.5 million.

For the year ended December 31, 2011, the Company recorded a provision for income taxes of $3.4 million which consists of a provision of $2.4 million for U.S. federal income taxes, as well as a $0.5 million provision for state and local taxes, a $0.3 million provision for foreign taxes, and a deferred tax expense of $0.3 million.

As of December 31, 2011, the Company had a U.S. deferred tax asset of approximately $0.6 million.

Year Ended December 31, 2011 Compared to Year Ended December 31, 2010

Net Sales

Net sales for 2011 increased 21%, or $43.4 million to $250.1 million compared to $206.7 million in 2010. Total sales for our Lifeboat Distribution segment in 2011 were $192.7 million compared to $149.1 million in 2010, representing a 29% increase. Total sales for the TechXtend segment in 2011 amounted to $57.4 million, compared to $57.6 million in 2010.

The increase in net sales for our Lifeboat Distribution segment was mainly a result of our continued focus on the expanding virtual infrastructure-centric business, the addition of several key product lines, and the strengthening of our account penetration.

Gross Profit

Gross Profit for 2011 was $23.2 million compared to $20.0 million in 2010, a 16% increase. Total gross profit for our Lifeboat Distribution segment was $16.8 million compared to $13.7 million in 2010, representing a 23% increase. Total gross profit for our TechXtend segment was $6.4 million compared to $6.3 million in 2010, representing a 2% increase. Vendor rebates and discounts for 2011 amounted to $2.9 million compared to $2.7 million for 2010. Vendor rebates are dependent on reaching certain targets set by our vendors.

Gross profit margin (gross profit as a percentage of net sales) for 2011 was 9.3% compared to 9.7% in 2010. Gross profit margin for our Lifeboat Distribution segment in 2011 was 8.7% compared to 9.2% in 2010. Gross profit margin for our TechXtend segment in 2011 was 11.2% compared to 11.0% in 2010.

The increase in gross profit dollars and the decrease in gross profit margin was primarily caused by the aggressive sales growth within our Lifeboat Distribution segment, offset in part, by continued pressure on discounts and rebates earned and competitive pricing pressure in both segments, and, in part, by our having won several large bids based on aggressive pricing, which we plan to continue to do.

Selling, General and Administrative Expenses

Total SG&A expenses for 2011 were $14.6 million compared to $13.2 million in 2010. As a percentage of net sales, SG&A expenses for 2011 and 2010 were 5.9% and 6.4%, respectively. This dollar increase was primarily the result of higher employee and employee-related costs (salaries, commissions, bonus accruals, benefits and travel and entertainment) of $1.1 million and increased credit card processing fees of $0.2 million due to increased sales volume.

Direct selling costs (a component of SG&A) for 2011 were $7.8 million compared to $6.9 million in 2010. Total direct selling costs for our Lifeboat Distribution segment for 2011 were $4.7 million compared to $3.9 million in the same period in 2010, mainly due to increased employee related

costs to manage and reward our growth in this segment. Total direct selling costs for our TechXtend segment for 2011 were $3.0 million compared to $2.9 million in the same period in 2010.

The Company expects that its SG&A expenses, as a percentage of net sales, may vary depending on changes in sales volume, as well as the levels of continuing investments in key growth initiatives. We plan to continue to expand our investment in information technology and marketing, while monitoring our sales and remaining general and administrative expenses closely.

Income Taxes

For the year ended December 31, 2011, the Company recorded a provision for income taxes of $3.4 million which consists of a provision of $2.4 million for U.S. federal income taxes, as well as a $0.5 million provision for state and local taxes, a $0.3 million provision for foreign taxes, and a deferred tax expense of $0.3 million.

As of December 31, 2011, the Company had a U.S. deferred tax asset of approximately $0.6 million.

For the year ended December 31, 2010, the Company recorded a provision for income taxes of $2.8 million which consists of a provision of $1.8 million for U.S. federal income taxes, as well as a $0.5 million provision for state and local taxes, a $0.2 million provision for Canadian taxes, and a deferred tax expense of $0.3 million.

As of December 31, 2010, the Company had a U.S. deferred tax asset of approximately $0.9 million.

The effective tax rate for the year ended December 31, 2010, was impacted by a benefit of $78 thousand related to the reversal of the Company’s liability related to uncertain tax positions.

Recently Adopted Accounting Pronouncements

In June 2011, the Financial Accounting Standards Board, “FASB” issued ASU 2011-05, “Presentation of Comprehensive Income”, an amendment to FASB ASC Topic 220, “Comprehensive Income”. The update gives companies the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. The amendments in the update do not change the items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income. The ASU is effective for the Company for fiscal years, and interim periods within those years, beginning after December 15, 2011. In December 2011, the FASB issued ASU 2011-12 “Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items out of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05.” This update stated that the specific requirement to present items that are reclassified from other comprehensive income to net income alongside their respective components of net income and other comprehensive income will be deferred. In February 2013, the FASB issued ASU 2013-02 “Reporting of Amounts Reclassified out of Accumulated Other Comprehensive Income”. This update requires companies to present the effects on the line items of net income of significant reclassifications out of accumulated other comprehensive income if the amount being reclassified is required under U.S. generally accepted accounting principles (“GAAP”) to be reclassified in its entirety to net income in the same reporting period. ASU 2013-02 is effective prospectively for the Company for fiscal years, and interim periods within those years, beginning after

December 15, 2012. The Company does not expect the adoption of the amended guidance to have a significant impact on its consolidated financial statements.

Liquidity and Capital Resources

Our cash and cash equivalents increased by $0.6 million to $9.8 million at December 31, 2012 from $9.2 million at December 31, 2011. Net cash provided by operating activities amounted to $3.4 million, net cash provided by investing activities amounted to $0.8 million, and net cash used in financing activities amounted to $3.5 million.

Net cash provided by operating activities in 2012 was $3.4 million. In 2012, cash was mainly provided by $7.2 million from net income net of non-cash charges, a $13.4 million increase in accounts payable and accrued expenses, and a $0.7 million decrease in prepaid expenses and other current assets, offset in part by a $17.5 million increase in accounts receivable, and an increase in inventory of $0.5 million. The increase in accounts receivable relates primarily to our increased sales during the month of December 2012 and the year ended December 31, 2012, as well as an increase in larger extended payment term transactions during 2012, compared to the comparable periods in 2011. The increase in accounts payable is primarily due to our increased net sales during the month of December 2012 and the year ended December 31, 2012, as compared to the comparable periods in 2011 and our normal cycle of payments.

In 2012, cash provided by investing activities was $0.8 million. This resulted primarily from net sales of $1.0 million in marketable securities. These securities are highly rated and highly liquid. These securities are classified as available-for-sale securities in accordance with ASC Topic 320 “Investments in Debt and Equity Securities”, and as a result, unrealized gains and losses are reported as part of accumulated other comprehensive income. This was partially offset by $0.2 million for the purchase of equipment and leasehold improvements.

Net cash used in financing activities in 2012 of $3.5 million consisted of $3.0 million of dividend payments on our Common Stock and $1.1 million for the purchases of treasury shares of our Common Stock offset by the tax benefit from share based compensation of $0.2 million and the exercise of stock options of $0.4 million.

In 2008, the Board of Directors authorized the purchase of 500,000 shares of our Common Stock. In 2002, the Board of Directors authorized the purchase of 1,490,000 shares of our Common Stock. In October 1999, the Company was authorized by the Board of Directors to buy back 521,013 shares of our Common Stock in both open market and private transactions, as conditions warrant. A total of 2,168,535 shares of the Company’s stock had been bought back as of December 31, 2012 leaving a balance of 342,478 shares of Common Stock that the Company is authorized to buy back in the future.

On October 23, 2012, the Board of Directors approved, and on October 29, 2012, the Company entered into a written purchase plan intended to comply with the requirements of Rule 10b5-1 under the Exchange Act, as amended (the “Plan”). Purchases involving shares of the Company’s Common Stock under the Plan commenced October 29, 2012, and the Plan is intended to be in effect until October 29, 2014. Pursuant to the Plan, the Company’s broker shall effect purchases of up to an aggregate of 350,000 shares of Common Stock.

We intend to hold the repurchased shares in treasury for general corporate purposes, including issuances under various stock plans. As of December 31, 2012, we held 543,627 shares of our Common Stock in treasury at an average cost of $9.88 per share. As of December 31, 2011, we held 604,622 shares of our Common Stock in treasury at an average cost of $8.25 per share.

The Company’s current and anticipated use of its cash and cash equivalents is, and will continue to be, to fund working capital, operational expenditures, the stock repurchase program and dividends, if any, declared by the Board of Directors.

The Company believes that the cash flows from operations and funds held in cash and cash equivalents will be sufficient to fund the Company’s working capital and cash requirements for at least the next 12 months. In addition, subsequent to December 31, 2012, on January 4, 2013, the Company has entered into a $10,000,000 revolving credit facility (the “Credit Facility”) with Citibank, N.A. pursuant to a Business Loan Agreement, Promissory Note, Commercial Security Agreements and Commercial Pledge Agreement. The Credit Facility, which will be used for business and working capital purposes, including financing of larger extended payment terms sales transactions which are becoming a more significant portion of the Company’s net sales. The Credit Facility matures on January 4, 2016. (see Note 12 Subsequent Events in the Notes to our Consolidated Financial Statements).

Contractual Obligations as of December 31, 2012

(Amounts in thousands)

|

Payment due by Period |

|

Total |

|

Less than 1 year |

|

1-3 years |

|

4-5 years |

|

After 5 years |

| |||

|

Long-term debt obligations |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||

|

Capital Lease obligations |

|

$ |

56 |

|

$ |

56 |

|

— |

|

— |

|

|

| |

|

Operating Leases obligations (1) |

|

$ |

736 |

|

$ |

255 |

|

$ |

481 |

|

— |

|

— |

|

|

Purchase Obligations |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||

|

Other Long term Obligations reflected on the Company’s Balance Sheet under GAAP |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||

|

Total Contractual Obligations |

|

$ |

792 |

|

$ |

311 |

|

$ |

481 |

|

— |

|

— |

|

(1) Operating leases relate primarily to the lease of the space used for our operations in Shrewsbury, New Jersey, Mississauga, Canada and Almere, Netherlands. The commitments for operating leases include the minimum rent payments.

As of December 31, 2012, the Company is not committed by lines of credit or standby letters of credit, and has no standby repurchase obligations or other commercial commitments (see Note 12 Subsequent Events in the Notes to our Consolidated Financial Statements).

Foreign Exchange

The Company’s Canadian business is subject to changes in demand or pricing resulting from fluctuations in currency exchange rates or other factors. We are subject to fluctuations primarily in the Canadian Dollar-to-U.S. Dollar exchange rate.

Off-Balance Sheet Arrangements

As of December 31, 2012, we did not have any off-balance sheet arrangements, as defined in Item 303 (a)(4)(ii) of SEC Regulation S-K.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of the Company’s financial condition and results of operations are based upon the Company’s consolidated financial statements that have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of

contingent assets and liabilities. The Company recognizes revenue from the sale of software and hardware for microcomputers, servers and networks upon shipment or upon electronic delivery of the product. The Company expenses the advertising costs associated with producing its catalogs. The costs of these catalogs are expensed in the same month the catalogs are mailed.

On an on-going basis, the Company evaluates its estimates, including those related to product returns, bad debts, inventories, investments, intangible assets, income taxes, stock-based compensation, contingencies and litigation.

The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

The Company believes the following critical accounting policies used in the preparation of its consolidated financial statements affect its more significant judgments and estimates.

The Company maintains allowances for doubtful accounts for estimated losses resulting from the inability of its customers to make required payments. If the financial condition of the Company’s customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances may be required.

The Company writes down its inventory for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated market value based upon assumptions about future demand and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-offs may be required.