UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant’s telephone number, including area code: 617-563-7000

Date of fiscal year end: July 31

Date of reporting period: July 31, 2023

| Item 1. | Reports to Stockholders |

| Annual Report | 2 |

| 3 | Annual Report |

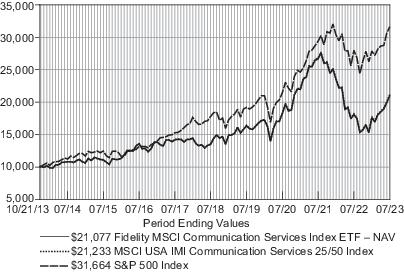

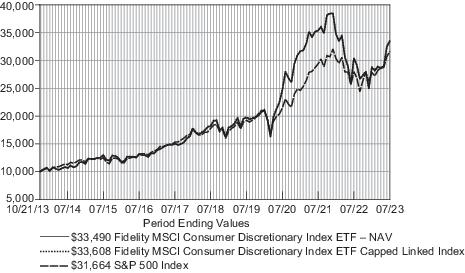

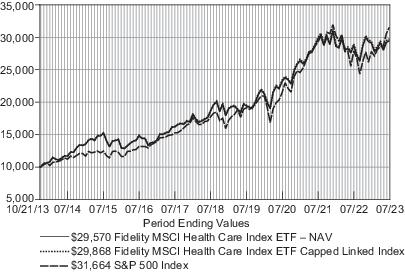

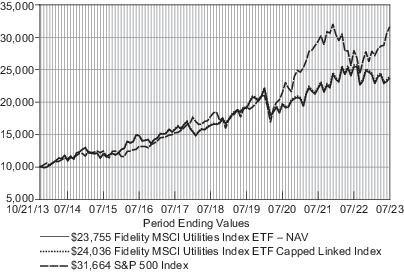

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| Annual Report | 4 |

| 5 | Annual Report |

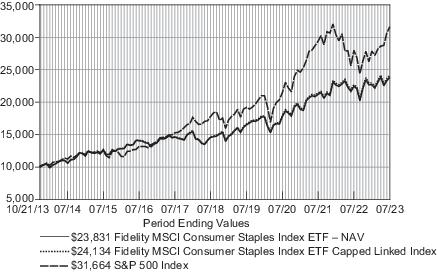

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| 7 | Annual Report |

| Annual Report | 8 |

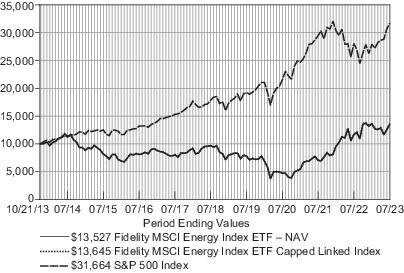

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| Annual Report | 10 |

| 11 | Annual Report |

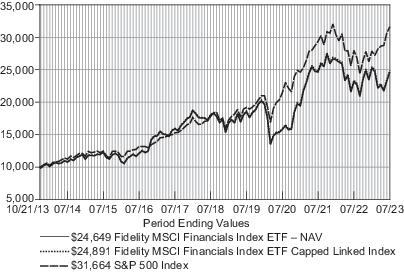

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| 13 | Annual Report |

| Annual Report | 14 |

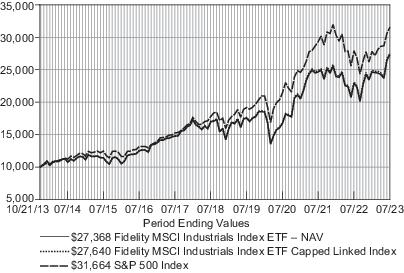

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| Annual Report | 16 |

| 17 | Annual Report |

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

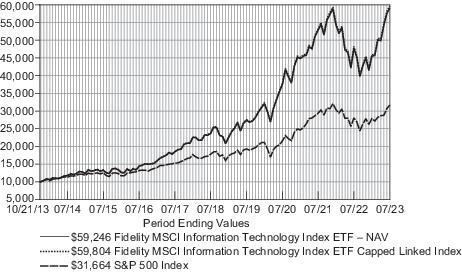

| 19 | Annual Report |

| Annual Report | 20 |

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| Annual Report | 22 |

| 23 | Annual Report |

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| 25 | Annual Report |

| Annual Report | 26 |

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| Annual Report | 28 |

| 29 | Annual Report |

| B | From February 5, 2015, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

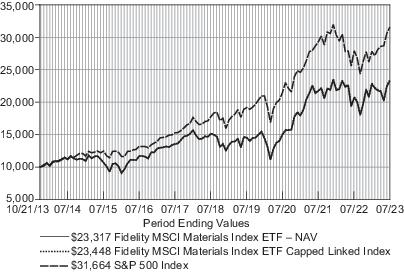

| 31 | Annual Report |

| Annual Report | 32 |

| B | From October 24, 2013, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

| Annual Report | 34 |

| 35 | Annual Report |

| 37 | Annual Report |

| Annual Report | 38 |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contract | |||||

| CME E-mini S&P Communication Service Select Sector Index Contracts (United States) | 12 | September 2023 | $1,086,000 | $50,173 | $50,173 |

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 796,355,557 | $ 796,355,557 | $ — | $ — | |||||

| Preferred Stocks | 1,290,967 | 1,290,967 | — | — | |||||

| Money Market Funds | 1,120,000 | 1,120,000 | — | — | |||||

| Total Investments in Securities: | $ 798,766,524 | $ 798,766,524 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 50,173 | $ 50,173 | $ — | $ — | |||||

| Total Assets | $ 50,173 | $ 50,173 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 50,173 | $ 50,173 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $50,173 | $0 | |

| Total Equity Risk | 50,173 | 0 | |

| Total Value of Derivatives | $50,173 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| 39 | Annual Report |

| Annual Report | 40 |

| Annual Report | 42 |

| Legend | ||

| (a) | Non-income producing. | |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. | |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini Consumer Discretionary Select Sector Index Contracts (United States) | 10 | September 2023 | 1,766,600 | $ 93,127 | $ 93,127 |

| CME E-mini Russell 2000 Index Contracts (United States) | 3 | September 2023 | 302,040 | 12,534 | 12,534 |

| Total Equity Index Contracts | $ 105,661 | ||||

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 1,293,690,688 | $ 1,293,690,688 | $ — | $ — | |||||

| Money Market Funds | 1,940,000 | 1,940,000 | — | — | |||||

| Total Investments in Securities: | $ 1,295,630,688 | $ 1,295,630,688 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 105,661 | $ 105,661 | $ — | $ — | |||||

| Total Assets | $ 105,661 | $ 105,661 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 105,661 | $ 105,661 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $105,661 | $0 | |

| Total Equity Risk | 105,661 | 0 | |

| Total Value of Derivatives | $105,661 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 44 |

| 45 | Annual Report |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini Consumer Staples Select Sector Index Contracts (United States) | 43 | September 2023 | 3,294,660 | $ 50,337 | $ 50,337 |

| CME E-mini Russell 2000 Index Contracts (United States) | 1 | September 2023 | 100,680 | 1,603 | 1,603 |

| Total Equity Index Contracts | $ 51,940 | ||||

| Annual Report | 46 |

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 1,235,712,607 | $ 1,235,712,607 | $ — | $ — | |||||

| Money Market Funds | 2,080,000 | 2,080,000 | — | — | |||||

| Total Investments in Securities: | $ 1,237,792,607 | $ 1,237,792,607 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 51,940 | $ 51,940 | $ — | $ — | |||||

| Total Assets | $ 51,940 | $ 51,940 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 51,940 | $ 51,940 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $51,940 | $0 | |

| Total Equity Risk | 51,940 | 0 | |

| Total Value of Derivatives | $51,940 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| 47 | Annual Report |

| Annual Report | 48 |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contract | |||||

| CME E-mini Energy Select Sector Index Contracts (United States) | 29 | September 2023 | $2,671,770 | $172,921 | $172,921 |

| 49 | Annual Report |

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 1,604,123,968 | $ 1,604,123,968 | $ — | $ — | |||||

| Money Market Funds | 2,130,000 | 2,130,000 | — | — | |||||

| Total Investments in Securities: | $ 1,606,253,968 | $ 1,606,253,968 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 172,921 | $ 172,921 | $ — | $ — | |||||

| Total Assets | $ 172,921 | $ 172,921 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 172,921 | $ 172,921 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $172,921 | $0 | |

| Total Equity Risk | 172,921 | 0 | |

| Total Value of Derivatives | $172,921 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 50 |

| 51 | Annual Report |

| Annual Report | 52 |

| Annual Report | 54 |

| Legend | ||

| (a) | Non-income producing. | |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. | |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini Financial Select Sector Index Contracts (United States) | 40 | September 2023 | 4,377,000 | $ 212,885 | $ 212,885 |

| CME E-mini Russell 2000 Index Contracts (United States) | 6 | September 2023 | 604,080 | 35,508 | 35,508 |

| Total Equity Index Contracts | $ 248,393 | ||||

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 1,425,880,473 | $ 1,425,880,473 | $ — | $ — | |||||

| Money Market Funds | 3,889,000 | 3,889,000 | — | — | |||||

| Total Investments in Securities: | $ 1,429,769,473 | $ 1,429,769,473 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 248,393 | $ 248,393 | $ — | $ — | |||||

| Total Assets | $ 248,393 | $ 248,393 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 248,393 | $ 248,393 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $248,393 | $0 | |

| Total Equity Risk | 248,393 | 0 | |

| Total Value of Derivatives | $248,393 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 56 |

| 57 | Annual Report |

| Annual Report | 58 |

| Annual Report | 60 |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini Health Care Select Sector Index Contracts (United States) | 57 | September 2023 | 7,761,690 | $ 162,123 | $ 162,123 |

| CME E-mini Russell 2000 Index Contracts (United States) | 7 | September 2023 | 704,760 | 44,153 | 44,153 |

| Total Equity Index Contracts | $ 206,276 | ||||

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 3,074,971,386 | $ 3,074,778,927 | $ 181,467 | $ 10,992 | |||||

| Money Market Funds | 4,424,000 | 4,424,000 | — | — | |||||

| Total Investments in Securities: | $ 3,079,395,386 | $ 3,079,202,927 | $ 181,467 | $ 10,992 | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 206,276 | $ 206,276 | $ — | $ — | |||||

| Total Assets | $ 206,276 | $ 206,276 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 206,276 | $ 206,276 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $206,276 | $0 | |

| Total Equity Risk | 206,276 | 0 | |

| Total Value of Derivatives | $206,276 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 62 |

| 63 | Annual Report |

| Annual Report | 64 |

| Annual Report | 66 |

| Legend | ||

| (a) | Non-income producing. | |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. | |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini Industrial Select Sector Index Contracts (United States) | 22 | September 2023 | 2,460,040 | $ 72,298 | $ 72,298 |

| CME E-mini Russell 2000 Index Contracts (United States) | 4 | September 2023 | 402,720 | 6,812 | 6,812 |

| Total Equity Index Contracts | $ 79,110 | ||||

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 798,106,235 | $ 798,106,235 | $ — | $ — | |||||

| Money Market Funds | 1,290,000 | 1,290,000 | — | — | |||||

| Total Investments in Securities: | $ 799,396,235 | $ 799,396,235 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 79,110 | $ 79,110 | $ — | $ — | |||||

| Total Assets | $ 79,110 | $ 79,110 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 79,110 | $ 79,110 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $79,110 | $0 | |

| Total Equity Risk | 79,110 | 0 | |

| Total Value of Derivatives | $79,110 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 68 |

| 69 | Annual Report |

| Annual Report | 70 |

| Annual Report | 72 |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini Russell 2000 Index Contracts (United States) | 5 | September 2023 | $ 503,400 | $ 24,197 | $ 24,197 |

| CME E-mini Technology Select Sector Index Contracts (United States) | 59 | September 2023 | 10,664,250 | 510,130 | 510,130 |

| Total Equity Index Contracts | $ 534,327 | ||||

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 7,499,663,295 | $ 7,499,663,295 | $ — | $ — | |||||

| Money Market Funds | 10,964,000 | 10,964,000 | — | — | |||||

| Total Investments in Securities: | $ 7,510,627,295 | $ 7,510,627,295 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 534,327 | $ 534,327 | $ — | $ — | |||||

| Total Assets | $ 534,327 | $ 534,327 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 534,327 | $ 534,327 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $534,327 | $0 | |

| Total Equity Risk | 534,327 | 0 | |

| Total Value of Derivatives | $534,327 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| 73 | Annual Report |

| Annual Report | 74 |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contract | |||||

| CME E-mini Materials Select Sector Index Contracts (United States) | 5 | September 2023 | $456,400 | $19,088 | $19,088 |

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 483,595,244 | $ 483,595,244 | $ — | $ — | |||||

| Money Market Funds | 889,000 | 889,000 | — | — | |||||

| Total Investments in Securities: | $ 484,484,244 | $ 484,484,244 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 19,088 | $ 19,088 | $ — | $ — | |||||

| Total Assets | $ 19,088 | $ 19,088 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 19,088 | $ 19,088 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $19,088 | $0 | |

| Total Equity Risk | 19,088 | 0 | |

| Total Value of Derivatives | $19,088 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 76 |

| 77 | Annual Report |

| Annual Report | 78 |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contract | |||||

| CME Dow Jones U.S. Real Estate Index Contracts (United States) | 62 | September 2023 | $2,113,580 | $39,006 | $39,006 |

| 79 | Annual Report |

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 1,027,127,079 | $ 1,027,127,079 | $ — | $ — | |||||

| Money Market Funds | 1,750,000 | 1,750,000 | — | — | |||||

| Total Investments in Securities: | $ 1,028,877,079 | $ 1,028,877,079 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 39,006 | $ 39,006 | $ — | $ — | |||||

| Total Assets | $ 39,006 | $ 39,006 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 39,006 | $ 39,006 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $39,006 | $0 | |

| Total Equity Risk | 39,006 | 0 | |

| Total Value of Derivatives | $39,006 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 80 |

| 81 | Annual Report |

| Futures Contracts | |||||

| Number

of contracts |

Expiration

Date |

Notional

Amount |

Value | Unrealized

Appreciation/ (Depreciation) | |

| Purchased | |||||

| Equity Index Contract | |||||

| CME E-mini S&P Utilities Select Sector Index Contracts (United States) | 75 | September 2023 | $5,099,250 | $43,080 | $43,080 |

| Description | Total | Level 1 | Level 2 | Level 3 | |||||

| Investments in Securities: | |||||||||

| Common Stocks | $ 1,896,431,477 | $ 1,896,431,477 | $ — | $ — | |||||

| Money Market Funds | 4,274,000 | 4,274,000 | — | — | |||||

| Total Investments in Securities: | $ 1,900,705,477 | $ 1,900,705,477 | $ — | $ — | |||||

| Derivative Instruments: | |||||||||

| Assets | |||||||||

| Futures Contracts | $ 43,080 | $ 43,080 | $ — | $ — | |||||

| Total Assets | $ 43,080 | $ 43,080 | $ — | $ — | |||||

| Total Derivative Instruments: | $ 43,080 | $ 43,080 | $ — | $ — | |||||

| Primary Risk/ Derivative Type | Value | ||

| Asset | Liabilities | ||

| Equity Risk | |||

| Futures Contracts(a) | $43,080 | $0 | |

| Total Equity Risk | 43,080 | 0 | |

| Total Value of Derivatives | $43,080 | $0 | |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

| Annual Report | 82 |

| Fidelity

MSCI Communication Services Index ETF |

Fidelity

MSCI Consumer Discretionary Index ETF |

Fidelity

MSCI Consumer Staples Index ETF |

Fidelity

MSCI Energy Index ETF | ||||

| Assets | |||||||

| Investments in securities, at value – See accompanying schedule | $ 798,766,524 | $ 1,295,630,688 | $ 1,237,792,607 | $ 1,606,253,968 | |||

| Segregated cash with brokers for derivative instruments | 60,000 | 113,600 | 124,450 | 210,250 | |||

| Cash | 108,115 | 34,758 | 41,020 | 16,783 | |||

| Receivable for investments sold | |||||||

| Regular delivery | — | — | — | 1,893,365 | |||

| Delayed delivery | — | — | — | 71,050 | |||

| Receivable for fund shares sold | 37,926 | 7,721 | — | — | |||

| Dividends receivable | 1,063,295 | 421,687 | 1,472,734 | 1,056,591 | |||

| Interest receivable | 3,880 | 8,118 | 9,060 | 9,120 | |||

| Receivable for daily variation margin on futures contracts | 1,006 | 14,761 | — | 79,952 | |||

| Other receivable | — | — | — | — | |||

| Total assets | 800,040,746 | 1,296,231,333 | 1,239,439,871 | 1,609,591,079 | |||

| Liabilities | |||||||

| Payable for investments purchased | 1,131,520 | — | — | 2,442,568 | |||

| Payable for fund shares redeemed | — | — | 20,861 | — | |||

| Accrued management fees | 53,732 | 88,888 | 86,718 | 106,992 | |||

| Payable for daily variation margin on futures contracts | — | — | 13,704 | — | |||

| Total liabilities | 1,185,252 | 88,888 | 121,283 | 2,549,560 | |||

| Net Assets | $798,855,494 | $1,296,142,445 | $1,239,318,588 | $1,607,041,519 | |||

| Net Assets consist of: | |||||||

| Paid in capital | $865,499,151 | $1,269,220,895 | $1,146,666,742 | $1,306,420,016 | |||

| Total accumulated earnings (loss) | (66,643,657) | 26,921,550 | 92,651,846 | 300,621,503 | |||

| Net Assets | $798,855,494 | $1,296,142,445 | $1,239,318,588 | $1,607,041,519 | |||

| Shares outstanding | 18,750,000 | 17,100,000 | 26,700,000 | 66,950,000 | |||

| Net Asset Value per share | $ 42.61 | $ 75.80 | $ 46.42 | $ 24.00 | |||

| Investments at cost | $794,304,919 | $1,189,234,449 | $1,106,838,772 | $1,133,811,831 |

| Annual Report | 84 |

| Fidelity

MSCI Financials Index ETF |

Fidelity

MSCI Health Care Index ETF |

Fidelity

MSCI Industrials Index ETF |

Fidelity

MSCI Information Technology Index ETF | ||||

| Assets | |||||||

| Investments in securities, at value – See accompanying schedule | $ 1,429,769,473 | $ 3,079,395,386 | $ 799,396,235 | $ 7,510,627,295 | |||

| Segregated cash with brokers for derivative instruments | 287,200 | 356,900 | 145,800 | 591,500 | |||

| Cash | 10,891 | 67,757 | 18,064 | 141,825 | |||

| Receivable for investments sold | |||||||

| Regular delivery | 3,452 | — | 1,253,183 | 12,596,541 | |||

| Delayed delivery | — | — | — | — | |||

| Receivable for fund shares sold | — | — | 19,771 | 83,507 | |||

| Dividends receivable | 1,119,738 | 4,241,493 | 382,169 | 1,233,620 | |||

| Interest receivable | 11,977 | 28,850 | 5,136 | 44,955 | |||

| Receivable for daily variation margin on futures contracts | 29,076 | — | — | 35,779 | |||

| Other receivable | — | — | — | — | |||

| Total assets | 1,431,231,807 | 3,084,090,386 | 801,220,358 | 7,525,355,022 | |||

| Liabilities | |||||||

| Payable for investments purchased | — | 40,510 | — | 12,825,879 | |||

| Payable for fund shares redeemed | 69,352 | 31,201 | — | — | |||

| Accrued management fees | 98,432 | 214,107 | 54,347 | 513,860 | |||

| Payable for daily variation margin on futures contracts | — | 50,080 | 60,385 | — | |||

| Total liabilities | 167,784 | 335,898 | 114,732 | 13,339,739 | |||

| Net Assets | $1,431,064,023 | $3,083,754,488 | $801,105,626 | $7,512,015,283 | |||

| Net Assets consist of: | |||||||

| Paid in capital | $1,441,336,826 | $2,589,810,234 | $715,606,178 | $4,661,816,227 | |||

| Total accumulated earnings (loss) | (10,272,803) | 493,944,254 | 85,499,448 | 2,850,199,056 | |||

| Net Assets | $1,431,064,023 | $3,083,754,488 | $801,105,626 | $7,512,015,283 | |||

| Shares outstanding | 28,700,000 | 48,350,000 | 13,650,000 | 55,900,000 | |||

| Net Asset Value per share | $ 49.86 | $ 63.78 | $ 58.69 | $ 134.38 | |||

| Investments at cost | $1,287,558,450 | $2,484,187,165 | $687,012,138 | $4,494,143,747 |

| 85 | Annual Report |

| Fidelity

MSCI Materials Index ETF |

Fidelity

MSCI Real Estate Index ETF |

Fidelity

MSCI Utilities Index ETF | |||

| Assets | |||||

| Investments in securities, at value – See accompanying schedule | $ 484,484,244 | $ 1,028,877,079 | $ 1,900,705,477 | ||

| Segregated cash with brokers for derivative instruments | 24,000 | 145,700 | 262,500 | ||

| Cash | 8,329 | 1,165 | 7,044 | ||

| Receivable for investments sold | |||||

| Regular delivery | — | — | — | ||

| Delayed delivery | — | — | — | ||

| Receivable for fund shares sold | — | — | — | ||

| Dividends receivable | 394,496 | 509,620 | 914,464 | ||

| Interest receivable | 4,040 | 5,613 | 14,126 | ||

| Receivable for daily variation margin on futures contracts | 47,377 | 14,066 | — | ||

| Other receivable | — | 57,806 | — | ||

| Total assets | 484,962,486 | 1,029,611,049 | 1,901,903,611 | ||

| Liabilities | |||||

| Payable for investments purchased | 827,427 | — | — | ||

| Payable for fund shares redeemed | — | — | 35,275 | ||

| Accrued management fees | 32,943 | 72,472 | 139,576 | ||

| Payable for daily variation margin on futures contracts | — | — | 33,062 | ||

| Total liabilities | 860,370 | 72,472 | 207,913 | ||

| Net Assets | $484,102,116 | $1,029,538,577 | $1,901,695,698 | ||

| Net Assets consist of: | |||||

| Paid in capital | $497,488,898 | $1,256,582,498 | $2,027,692,953 | ||

| Total accumulated earnings (loss) | (13,386,782) | (227,043,921) | (125,997,255) | ||

| Net Assets | $484,102,116 | $1,029,538,577 | $1,901,695,698 | ||

| Shares outstanding | 10,000,000 | 40,200,000 | 43,950,000 | ||

| Net Asset Value per share | $ 48.41 | $ 25.61 | $ 43.27 | ||

| Investments at cost | $480,161,079 | $1,169,978,556 | $1,985,646,257 |

| Annual Report | 86 |

| Fidelity

MSCI Communication Services Index ETF |

Fidelity

MSCI Consumer Discretionary Index ETF |

Fidelity

MSCI Consumer Staples Index ETF |

Fidelity

MSCI Energy Index ETF | ||||

| Investment Income | |||||||

| Dividends | $ 5,697,889 | $ 11,273,221 | $ 27,214,319 | $ 54,356,245 | |||

| Interest | 41,407 | 82,418 | 87,521 | 84,299 | |||

| Total income | 5,739,296 | 11,355,639 | 27,301,840 | 54,440,544 | |||

| Expenses | |||||||

| Management fees | 479,078 | 903,749 | 938,171 | 1,292,155 | |||

| Independent trustees' fees and expenses | 2,936 | 5,702 | 5,568 | 7,770 | |||

| Legal | — | 409 | — | — | |||

| Total expenses | 482,014 | 909,860 | 943,739 | 1,299,925 | |||

| Net investment income (loss) | 5,257,282 | 10,445,779 | 26,358,101 | 53,140,619 | |||

| Realized and Unrealized Gain (Loss) | |||||||

| Net realized gain (loss) on investment securities | (34,961,819) | (34,153,316) | (16,349,473) | (11,177,327) | |||

| Net realized gain (loss) on In-kind redemptions | 15,141,572 | 27,369,356 | 29,606,400 | 115,099,165 | |||

| Net realized gain (loss) on futures contracts | 225,804 | 204,845 | (6,865) | (516,772) | |||

| Net realized gain (loss) on foreign currency transactions | — | — | — | — | |||

| Total net realized gain (loss) | (19,594,443) | (6,579,115) | 13,250,062 | 103,405,066 | |||

| Change in net unrealized appreciation (depreciation) on investment securities | 118,643,490 | 109,237,053 | 32,472,307 | 60,096,331 | |||

| Change in net unrealized appreciation (depreciation) on futures contracts | 55,396 | (64,590) | (61,295) | 40,330 | |||

| Total change in net unrealized appreciation (depreciation) | 118,698,886 | 109,172,463 | 32,411,012 | 60,136,661 | |||

| Net gain (loss) | 99,104,443 | 102,593,348 | 45,661,074 | 163,541,727 | |||

| Net increase (decrease) in net assets resulting from operations | $104,361,725 | $113,039,127 | $ 72,019,175 | $216,682,346 |

| 87 | Annual Report |

| Fidelity

MSCI Financials Index ETF |

Fidelity

MSCI Health Care Index ETF |

Fidelity

MSCI Industrials Index ETF |

Fidelity

MSCI Information Technology Index ETF | ||||

| Investment Income | |||||||

| Dividends | $ 34,143,970 | $ 45,247,165 | $ 11,271,556 | $ 52,858,026 | |||

| Interest | 128,965 | 234,456 | 58,050 | 345,019 | |||

| Total income | 34,272,935 | 45,481,621 | 11,329,606 | 53,203,045 | |||

| Expenses | |||||||

| Management fees | 1,223,575 | 2,528,306 | 587,109 | 4,817,645 | |||

| Independent trustees' fees and expenses | 7,768 | 15,291 | 3,620 | 28,816 | |||

| Legal | — | — | — | — | |||

| Total expenses | 1,231,343 | 2,543,597 | 590,729 | 4,846,461 | |||

| Net investment income (loss) | 33,041,592 | 42,938,024 | 10,738,877 | 48,356,584 | |||

| Realized and Unrealized Gain (Loss) | |||||||

| Net realized gain (loss) on investment securities | (109,982,227) | (48,708,793) | (18,247,520) | (109,197,966) | |||

| Net realized gain (loss) on In-kind redemptions | 56,282,565 | 99,791,217 | 35,260,426 | 507,839,393 | |||

| Net realized gain (loss) on futures contracts | 444,116 | 350,855 | 123,260 | 2,814,659 | |||

| Net realized gain (loss) on foreign currency transactions | — | — | (16) | — | |||

| Total net realized gain (loss) | (53,255,546) | 51,433,279 | 17,136,150 | 401,456,086 | |||

| Change in net unrealized appreciation (depreciation) on investment securities | 106,816,933 | (12,074,209) | 97,407,499 | 944,915,424 | |||

| Change in net unrealized appreciation (depreciation) on futures contracts | 14,879 | (230,068) | (7,371) | 41,517 | |||

| Total change in net unrealized appreciation (depreciation) | 106,831,812 | (12,304,277) | 97,400,128 | 944,956,941 | |||

| Net gain (loss) | 53,576,266 | 39,129,002 | 114,536,278 | 1,346,413,027 | |||

| Net increase (decrease) in net assets resulting from operations | $ 86,617,858 | $ 82,067,026 | $125,275,155 | $1,394,769,611 |

| Annual Report | 88 |

| Fidelity

MSCI Materials Index ETF |

Fidelity

MSCI Real Estate Index ETF |

Fidelity

MSCI Utilities Index ETF | |||

| Investment Income | |||||

| Dividends | $ 8,608,060 | $ 37,036,440 | $ 62,469,490 | ||

| Interest | 36,710 | 71,186 | 157,097 | ||

| Total income | 8,644,770 | 37,107,626 | 62,626,587 | ||

| Expenses | |||||

| Management fees | 373,187 | 1,128,403 | 1,757,535 | ||

| Independent trustees' fees and expenses | 2,323 | 7,654 | 10,245 | ||

| Legal | — | — | — | ||

| Total expenses | 375,510 | 1,136,057 | 1,767,780 | ||

| Net investment income (loss) | 8,269,260 | 35,971,569 | 60,858,807 | ||

| Realized and Unrealized Gain (Loss) | |||||

| Net realized gain (loss) on investment securities | (5,418,072) | (40,677,292) | (11,624,223) | ||

| Net realized gain (loss) on In-kind redemptions | 9,988,163 | 47,537,324 | 56,229,170 | ||

| Net realized gain (loss) on futures contracts | 23,568 | (840,866) | (1,119,268) | ||

| Net realized gain (loss) on foreign currency transactions | — | — | — | ||

| Total net realized gain (loss) | 4,593,659 | 6,019,166 | 43,485,679 | ||

| Change in net unrealized appreciation (depreciation) on investment securities | 37,282,674 | (239,037,793) | (259,497,941) | ||

| Change in net unrealized appreciation (depreciation) on futures contracts | 49,332 | (122,395) | (194,422) | ||

| Total change in net unrealized appreciation (depreciation) | 37,332,006 | (239,160,188) | (259,692,363) | ||

| Net gain (loss) | 41,925,665 | (233,141,022) | (216,206,684) | ||

| Net increase (decrease) in net assets resulting from operations | $50,194,925 | $(197,169,453) | $(155,347,877) |

| 89 | Annual Report |

| Fidelity

MSCI Communication Services Index ETF |

Fidelity

MSCI Consumer Discretionary Index ETF | ||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2023 |

Year

ended July 31, 2022 | ||||

| Increase (Decrease) in Net Assets | |||||||

| Operations | |||||||

| Net investment income (loss) | $ 5,257,282 | $ 7,496,704 | $ 10,445,779 | $ 10,582,475 | |||

| Net realized gain (loss) | (19,594,443) | 64,340,202 | (6,579,115) | 221,091,762 | |||

| Change in net unrealized appreciation (depreciation) | 118,698,886 | (359,603,822) | 109,172,463 | (461,544,425) | |||

| Net increase (decrease) in net assets resulting from operations | 104,361,725 | (287,766,916) | 113,039,127 | (229,870,188) | |||

| Distributions to shareholders | (4,996,850) | (7,610,350) | (10,020,850) | (11,050,200) | |||

| Share transactions | |||||||

| Proceeds from sales of shares | 240,004,377 | 233,928,059 | 120,045,362 | 324,283,128 | |||

| Cost of shares redeemed | (101,759,290) | (293,680,545) | (101,937,235) | (539,877,842) | |||

| Net increase (decrease) in net assets resulting from share transactions | 138,245,087 | (59,752,486) | 18,108,127 | (215,594,714) | |||

| Total increase (decrease) in net assets | 237,609,962 | (355,129,752) | 121,126,404 | (456,515,102) | |||

| Net Assets | |||||||

| Beginning of year | 561,245,532 | 916,375,284 | 1,175,016,041 | 1,631,531,143 | |||

| End of year | $ 798,855,494 | $ 561,245,532 | $1,296,142,445 | $1,175,016,041 | |||

| Other Information | |||||||

| Shares | |||||||

| Sold | 6,600,000 | 5,400,000 | 1,800,000 | 3,800,000 | |||

| Redeemed | (3,050,000) | (6,900,000) | (1,600,000) | (6,950,000) | |||

| Net increase (decrease) | 3,550,000 | (1,500,000) | 200,000 | (3,150,000) | |||

| Annual Report | 90 |

| Fidelity

MSCI Consumer Staples Index ETF |

Fidelity

MSCI Energy Index ETF | ||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2023 |

Year

ended July 31, 2022 | ||||

| Increase (Decrease) in Net Assets | |||||||

| Operations | |||||||

| Net investment income (loss) | $ 26,358,101 | $ 21,398,163 | $ 53,140,619 | $ 44,453,478 | |||

| Net realized gain (loss) | 13,250,062 | 22,771,000 | 103,405,066 | 120,258,555 | |||

| Change in net unrealized appreciation (depreciation) | 32,411,012 | (5,042,927) | 60,136,661 | 405,661,825 | |||

| Net increase (decrease) in net assets resulting from operations | 72,019,175 | 39,126,236 | 216,682,346 | 570,373,858 | |||

| Distributions to shareholders | (26,225,300) | (21,252,450) | (55,155,850) | (46,175,650) | |||

| Share transactions | |||||||

| Proceeds from sales of shares | 256,003,524 | 324,193,400 | 199,400,543 | 387,541,369 | |||

| Cost of shares redeemed | (120,837,555) | (101,991,130) | (241,462,086) | (318,221,008) | |||

| Net increase (decrease) in net assets resulting from share transactions | 135,165,969 | 222,202,270 | (42,061,543) | 69,320,361 | |||

| Total increase (decrease) in net assets | 180,959,844 | 240,076,056 | 119,464,953 | 593,518,569 | |||

| Net Assets | |||||||

| Beginning of year | 1,058,358,744 | 818,282,688 | 1,487,576,566 | 894,057,997 | |||

| End of year | $1,239,318,588 | $1,058,358,744 | $1,607,041,519 | $1,487,576,566 | |||

| Other Information | |||||||

| Shares | |||||||

| Sold | 5,750,000 | 7,100,000 | 8,650,000 | 21,050,000 | |||

| Redeemed | (2,700,000) | (2,350,000) | (11,000,000) | (18,100,000) | |||

| Net increase (decrease) | 3,050,000 | 4,750,000 | (2,350,000) | 2,950,000 | |||

| 91 | Annual Report |

| Fidelity

MSCI Financials Index ETF |

Fidelity

MSCI Health Care Index ETF | ||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2023 |

Year

ended July 31, 2022 | ||||

| Increase (Decrease) in Net Assets | |||||||

| Operations | |||||||

| Net investment income (loss) | $ 33,041,592 | $ 35,229,668 | $ 42,938,024 | $ 36,342,043 | |||

| Net realized gain (loss) | (53,255,546) | 72,806,146 | 51,433,279 | 68,664,227 | |||

| Change in net unrealized appreciation (depreciation) | 106,831,812 | (226,108,984) | (12,304,277) | (208,929,300) | |||

| Net increase (decrease) in net assets resulting from operations | 86,617,858 | (118,073,170) | 82,067,026 | (103,923,030) | |||

| Distributions to shareholders | (33,588,200) | (36,480,350) | (42,324,300) | (37,227,200) | |||

| Share transactions | |||||||

| Proceeds from sales of shares | 87,310,214 | 276,240,117 | 305,561,085 | 455,404,706 | |||

| Cost of shares redeemed | (258,774,591) | (289,122,805) | (229,908,099) | (192,134,263) | |||

| Net increase (decrease) in net assets resulting from share transactions | (171,464,377) | (12,882,688) | 75,652,986 | 263,270,443 | |||

| Total increase (decrease) in net assets | (118,434,719) | (167,436,208) | 115,395,712 | 122,120,213 | |||

| Net Assets | |||||||

| Beginning of year | 1,549,498,742 | 1,716,934,950 | 2,968,358,776 | 2,846,238,563 | |||

| End of year | $1,431,064,023 | $1,549,498,742 | $3,083,754,488 | $2,968,358,776 | |||

| Other Information | |||||||

| Shares | |||||||

| Sold | 1,900,000 | 4,950,000 | 4,950,000 | 7,000,000 | |||

| Redeemed | (5,500,000) | (5,550,000) | (3,700,000) | (3,000,000) | |||

| Net increase (decrease) | (3,600,000) | (600,000) | 1,250,000 | 4,000,000 | |||

| Annual Report | 92 |

| Fidelity

MSCI Industrials Index ETF |

Fidelity

MSCI Information Technology Index ETF | ||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2023 |

Year

ended July 31, 2022 | ||||

| Increase (Decrease) in Net Assets | |||||||

| Operations | |||||||

| Net investment income (loss) | $ 10,738,877 | $ 10,433,633 | $ 48,356,584 | $ 44,263,520 | |||

| Net realized gain (loss) | 17,136,150 | 61,408,260 | 401,456,086 | 176,542,038 | |||

| Change in net unrealized appreciation (depreciation) | 97,400,128 | (138,691,000) | 944,956,941 | (866,361,731) | |||

| Net increase (decrease) in net assets resulting from operations | 125,275,155 | (66,849,107) | 1,394,769,611 | (645,556,173) | |||

| Distributions to shareholders | (10,658,050) | (10,491,650) | (47,990,200) | (46,200,150) | |||

| Share transactions | |||||||

| Proceeds from sales of shares | 100,904,162 | 101,356,059 | 1,618,758,979 | 554,048,203 | |||

| Cost of shares redeemed | (119,710,204) | (180,991,891) | (1,192,587,293) | (330,116,462) | |||

| Net increase (decrease) in net assets resulting from share transactions | (18,806,042) | (79,635,832) | 426,171,686 | 223,931,741 | |||

| Total increase (decrease) in net assets | 95,811,063 | (156,976,589) | 1,772,951,097 | (467,824,582) | |||

| Net Assets | |||||||

| Beginning of year | 705,294,563 | 862,271,152 | 5,739,064,186 | 6,206,888,768 | |||

| End of year | $ 801,105,626 | $ 705,294,563 | $ 7,512,015,283 | $5,739,064,186 | |||

| Other Information | |||||||

| Shares | |||||||

| Sold | 1,900,000 | 1,900,000 | 13,600,000 | 4,350,000 | |||

| Redeemed | (2,350,000) | (3,600,000) | (10,150,000) | (2,900,000) | |||

| Net increase (decrease) | (450,000) | (1,700,000) | 3,450,000 | 1,450,000 | |||

| 93 | Annual Report |

| Fidelity

MSCI Materials Index ETF |

Fidelity

MSCI Real Estate Index ETF | ||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2023 |

Year

ended July 31, 2022 | ||||

| Increase (Decrease) in Net Assets | |||||||

| Operations | |||||||

| Net investment income (loss) | $ 8,269,260 | $ 8,990,437 | $ 35,971,569 | $ 43,089,610 | |||

| Net realized gain (loss) | 4,593,659 | 38,061,774 | 6,019,166 | 99,966,618 | |||

| Change in net unrealized appreciation (depreciation) | 37,332,006 | (80,161,823) | (239,160,188) | (242,897,051) | |||

| Net increase (decrease) in net assets resulting from operations | 50,194,925 | (33,109,612) | (197,169,453) | (99,840,823) | |||

| Distributions to shareholders | (8,257,900) | (8,977,200) | (49,617,050) | (56,284,500) | |||

| Share transactions | |||||||

| Proceeds from sales of shares | 78,638,097 | 135,066,634 | 60,330,330 | 475,187,190 | |||

| Cost of shares redeemed | (86,290,107) | (187,299,301) | (556,592,493) | (331,089,835) | |||

| Net increase (decrease) in net assets resulting from share transactions | (7,652,010) | (52,232,667) | (496,262,163) | 144,097,355 | |||

| Total increase (decrease) in net assets | 34,285,015 | (94,319,479) | (743,048,666) | (12,027,968) | |||

| Net Assets | |||||||

| Beginning of year | 449,817,101 | 544,136,580 | 1,772,587,243 | 1,784,615,211 | |||

| End of year | $484,102,116 | $ 449,817,101 | $1,029,538,577 | $1,772,587,243 | |||

| Other Information | |||||||

| Shares | |||||||

| Sold | 1,750,000 | 2,750,000 | 2,300,000 | 14,750,000 | |||

| Redeemed | (2,000,000) | (4,100,000) | (22,150,000) | (10,900,000) | |||

| Net increase (decrease) | (250,000) | (1,350,000) | (19,850,000) | 3,850,000 | |||

| Annual Report | 94 |

| Fidelity

MSCI Utilities Index ETF | |||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 | ||

| Increase (Decrease) in Net Assets | |||

| Operations | |||

| Net investment income (loss) | $ 60,858,807 | $ 36,139,030 | |

| Net realized gain (loss) | 43,485,679 | 48,300,677 | |

| Change in net unrealized appreciation (depreciation) | (259,692,363) | 117,096,987 | |

| Net increase (decrease) in net assets resulting from operations | (155,347,877) | 201,536,694 | |

| Distributions to shareholders | (62,348,050) | (36,559,700) | |

| Share transactions | |||

| Proceeds from sales of shares | 400,446,151 | 1,236,559,491 | |

| Cost of shares redeemed | (476,126,894) | (282,756,360) | |

| Net increase (decrease) in net assets resulting from share transactions | (75,680,743) | 953,803,131 | |

| Total increase (decrease) in net assets | (293,376,670) | 1,118,780,125 | |

| Net Assets | |||

| Beginning of year | 2,195,072,368 | 1,076,292,243 | |

| End of year | $1,901,695,698 | $2,195,072,368 | |

| Other Information | |||

| Shares | |||

| Sold | 8,900,000 | 27,150,000 | |

| Redeemed | (10,950,000) | (6,400,000) | |

| Net increase (decrease) | (2,050,000) | 20,750,000 | |

| 95 | Annual Report |

| Fidelity

MSCI Communication Services Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 36.92 | $ 54.87 | $ 37.88 | $ 34.35 | $ 28.76 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.33 | 0.45 | 0.34 | 0.33 | 0.49 | ||||

| Net realized and unrealized gain (loss) | 5.67 | (17.95) | 16.96 | 3.52 | 5.59 | ||||

| Total from investment operations | 6.00 | (17.50) | 17.30 | 3.85 | 6.08 | ||||

| Distributions from net investment income | (0.31) | (0.45) | (0.31) | (0.32) | (0.49) | ||||

| Total distributions | (0.31) | (0.45) | (0.31) | (0.32) | (0.49) | ||||

| Net asset value, end of period | $ 42.61 | $ 36.92 | $ 54.87 | $ 37.88 | $ 34.35 | ||||

| Total ReturnC | 16.44% | (32.06)% | 45.81% | 11.40% | 21.33% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | .92% | .95% | .72% | .96% | 1.53% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $798,855 | $561,246 | $916,375 | $577,709 | $374,389 | ||||

| Portfolio turnover rateE,F | 18% | 21% | 13% | 23% | 82% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| Annual Report | 96 |

| Fidelity

MSCI Consumer Discretionary Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 69.53 | $ 81.37 | $ 57.25 | $ 46.25 | $ 43.32 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.63 | 0.55 | 0.42 | 0.50 | 0.51 | ||||

| Net realized and unrealized gain (loss) | 6.24 | (11.81) | 24.10 | 11.01 | 2.96 | ||||

| Total from investment operations | 6.87 | (11.26) | 24.52 | 11.51 | 3.47 | ||||

| Distributions from net investment income | (0.60) | (0.58) | (0.40) | (0.51) | (0.54) | ||||

| Total distributions | (0.60) | (0.58) | (0.40) | (0.51) | (0.54) | ||||

| Net asset value, end of period | $ 75.80 | $ 69.53 | $ 81.37 | $ 57.25 | $ 46.25 | ||||

| Total ReturnC | 10.04% | (13.89)% | 42.95% | 25.26% | 8.15% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | .96% | .71% | .58% | 1.06% | 1.18% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $1,296,142 | $1,175,016 | $1,631,531 | $881,589 | $728,457 | ||||

| Portfolio turnover rateE,F | 12% | 8% | 48% | 60% | 25% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| 97 | Annual Report |

| Fidelity

MSCI Consumer Staples Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 44.75 | $ 43.30 | $ 37.29 | $ 35.59 | $ 32.33 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 1.05 | 1.01 | 1.02 | 0.96 | 0.94 | ||||

| Net realized and unrealized gain (loss) | 1.66 | 1.45 | 6.01 | 1.70 | 3.23 | ||||

| Total from investment operations | 2.71 | 2.46 | 7.03 | 2.66 | 4.17 | ||||

| Distributions from net investment income | (1.04) | (1.01) | (1.02) | (0.96) | (0.91) | ||||

| Total distributions | (1.04) | (1.01) | (1.02) | (0.96) | (0.91) | ||||

| Net asset value, end of period | $ 46.42 | $ 44.75 | $ 43.30 | $ 37.29 | $ 35.59 | ||||

| Total ReturnC | 6.20% | 5.79% | 19.09% | 7.74% | 13.16% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 2.35% | 2.27% | 2.53% | 2.68% | 2.83% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $1,239,319 | $1,058,359 | $818,283 | $678,649 | $548,070 | ||||

| Portfolio turnover rateE,F | 9% | 8% | 20% | 34% | 30% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| Annual Report | 98 |

| Fidelity

MSCI Energy Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 21.47 | $ 13.47 | $ 9.47 | $ 16.79 | $ 21.50 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.78 | 0.65 | 0.49 | 0.51 | 0.54 | ||||

| Net realized and unrealized gain (loss) | 2.57 | 8.02 | 4.02 | (6.86) | (4.70) | ||||

| Total from investment operations | 3.35 | 8.67 | 4.51 | (6.35) | (4.16) | ||||

| Distributions from net investment income | (0.82) | (0.67) | (0.51) | (0.97) | (0.55) | ||||

| Total distributions | (0.82) | (0.67) | (0.51) | (0.97) | (0.55) | ||||

| Net asset value, end of period | $ 24.00 | $ 21.47 | $ 13.47 | $ 9.47 | $ 16.79 | ||||

| Total ReturnC | 16.10% | 65.70% | 48.79% | (39.28)% | (19.42)% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 3.44% | 3.59% | 4.11% | 4.18% | 2.92% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $1,607,042 | $1,487,577 | $894,058 | $449,325 | $467,628 | ||||

| Portfolio turnover rateE,F | 8% | 8% | 11% | 17% | 6% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| 99 | Annual Report |

| Fidelity

MSCI Financials Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 47.97 | $ 52.19 | $ 34.12 | $ 41.22 | $ 41.05 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 1.07 | 1.05 | 0.96 | 1.00 | 0.89 | ||||

| Net realized and unrealized gain (loss) | 1.91 | (4.19) | 18.00 | (7.09) | 0.18 | ||||

| Total from investment operations | 2.98 | (3.14) | 18.96 | (6.09) | 1.07 | ||||

| Distributions from net investment income | (1.09) | (1.08) | (0.89) | (1.01) | (0.90) | ||||

| Total distributions | (1.09) | (1.08) | (0.89) | (1.01) | (0.90) | ||||

| Net asset value, end of period | $ 49.86 | $ 47.97 | $ 52.19 | $ 34.12 | $ 41.22 | ||||

| Total ReturnC | 6.44% | (6.11)% | 56.15% | (14.78)% | 2.80% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 2.25% | 1.97% | 2.10% | 2.61% | 2.27% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $1,431,064 | $1,549,499 | $1,716,935 | $725,059 | $1,143,858 | ||||

| Portfolio turnover rateE,F | 28% | 6% | 4% | 6% | 5% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| Annual Report | 100 |

| Fidelity

MSCI Health Care Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 63.02 | $ 66.04 | $ 52.34 | $ 44.43 | $ 43.72 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.88 | 0.81 | 0.75 | 0.72 | 0.63 | ||||

| Net realized and unrealized gain (loss) | 0.76 | (3.00) | 13.74 | 7.88 | 1.01 | ||||

| Total from investment operations | 1.64 | (2.19) | 14.49 | 8.60 | 1.64 | ||||

| Distributions from net investment income | (0.88) | (0.83) | (0.79) | (0.69) | (0.93) | ||||

| Total distributions | (0.88) | (0.83) | (0.79) | (0.69) | (0.93) | ||||

| Net asset value, end of period | $ 63.78 | $ 63.02 | $ 66.04 | $ 52.34 | $ 44.43 | ||||

| Total ReturnC | 2.65% | (3.32)% | 27.91% | 19.69% | 3.84% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 1.42% | 1.27% | 1.28% | 1.52% | 1.43% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $3,083,754 | $2,968,359 | $2,846,239 | $2,015,266 | $1,557,252 | ||||

| Portfolio turnover rateE,F | 6% | 4% | 7% | 7% | 5% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| 101 | Annual Report |

| Fidelity

MSCI Industrials Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 50.02 | $ 54.57 | $ 37.55 | $ 40.04 | $ 39.51 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.79 | 0.68 | 0.61 | 0.69 | 0.70 | ||||

| Net realized and unrealized gain (loss) | 8.67 | (4.55) | 17.00 | (2.48) | 0.51 | ||||

| Total from investment operations | 9.46 | (3.87) | 17.61 | (1.79) | 1.21 | ||||

| Distributions from net investment income | (0.79) | (0.68) | (0.59) | (0.70) | (0.68) | ||||

| Total distributions | (0.79) | (0.68) | (0.59) | (0.70) | (0.68) | ||||

| Net asset value, end of period | $ 58.69 | $ 50.02 | $ 54.57 | $ 37.55 | $ 40.04 | ||||

| Total ReturnC | 19.17% | (7.10)% | 47.17% | (4.34)% | 3.23% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 1.53% | 1.29% | 1.24% | 1.80% | 1.84% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $801,106 | $705,295 | $862,271 | $347,297 | $454,471 | ||||

| Portfolio turnover rateE,F | 11% | 7% | 5% | 4% | 5% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| Annual Report | 102 |

| Fidelity

MSCI Information Technology Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 109.42 | $ 121.70 | $ 87.25 | $ 64.53 | $ 56.36 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.91 | 0.84 | 0.79 | 0.87 | 0.70 | ||||

| Net realized and unrealized gain (loss) | 24.95 | (12.24) | 34.45 | 22.70 | 8.17 | ||||

| Total from investment operations | 25.86 | (11.40) | 35.24 | 23.57 | 8.87 | ||||

| Distributions from net investment income | (0.90) | (0.88) | (0.79) | (0.85) | (0.70) | ||||

| Total distributions | (0.90) | (0.88) | (0.79) | (0.85) | (0.70) | ||||

| Net asset value, end of period | $ 134.38 | $ 109.42 | $ 121.70 | $ 87.25 | $ 64.53 | ||||

| Total ReturnC | 23.86% | (9.41)% | 40.57% | 36.99% | 15.94% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | .84% | .71% | .76% | 1.21% | 1.22% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $7,512,015 | $5,739,064 | $6,206,889 | $4,288,256 | $2,571,364 | ||||

| Portfolio turnover rateE,F | 14% | 5% | 3% | 5% | 18% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| 103 | Annual Report |

| Fidelity

MSCI Materials Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 43.88 | $ 46.91 | $ 32.90 | $ 32.63 | $ 34.70 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.82 | 0.83 | 0.71 | 0.65 | 0.65 | ||||

| Net realized and unrealized gain (loss) | 4.53 | (3.01) | 13.98 | 0.30 | (2.08) | ||||

| Total from investment operations | 5.35 | (2.18) | 14.69 | 0.95 | (1.43) | ||||

| Distributions from net investment income | (0.82) | (0.85) | (0.68) | (0.68) | (0.64) | ||||

| Total distributions | (0.82) | (0.85) | (0.68) | (0.68) | (0.64) | ||||

| Net asset value, end of period | $ 48.41 | $ 43.88 | $ 46.91 | $ 32.90 | $ 32.63 | ||||

| Total ReturnC | 12.41% | (4.68)% | 45.01% | 3.28% | (4.02)% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 1.85% | 1.77% | 1.66% | 2.08% | 2.05% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $484,102 | $449,817 | $544,137 | $164,486 | $199,043 | ||||

| Portfolio turnover rateE,F | 4% | 4% | 4% | 3% | 12% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| Annual Report | 104 |

| Fidelity

MSCI Real Estate Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 29.52 | $ 31.75 | $ 24.23 | $ 26.58 | $ 24.69 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 0.68 | 0.68 | 0.58 | 0.67 | 1.05 | ||||

| Net realized and unrealized gain (loss) | (3.63) | (2.01) | 7.83 | (2.13) | 2.08 | ||||

| Total from investment operations | (2.95) | (1.33) | 8.41 | (1.46) | 3.13 | ||||

| Distributions from net investment income | (0.96) | (0.90) | (0.89) | (0.68) | (1.24) | ||||

| Return of capital | — | — | — | (0.21) | — | ||||

| Total distributions | (0.96) | (0.90) | (0.89) | (0.89) | (1.24) | ||||

| Net asset value, end of period | $ 25.61 | $ 29.52 | $ 31.75 | $ 24.23 | $ 26.58 | ||||

| Total ReturnC | (9.85)% | (4.25)% | 35.58% | (5.27)% | 13.19% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 2.66% | 2.20% | 2.16% | 2.62% | 4.20% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $1,029,539 | $1,772,587 | $1,784,615 | $1,066,154 | $844,003 | ||||

| Portfolio turnover rateE,F | 9% | 11% | 8% | 9% | 10% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| 105 | Annual Report |

| Fidelity

MSCI Utilities Index ETF | |||||||||

| Year

ended July 31, 2023 |

Year

ended July 31, 2022 |

Year

ended July 31, 2021 |

Year

ended July 31, 2020 |

Year

ended July 31, 2019 | |||||

| Selected Per-Share Data | |||||||||

| Net asset value, beginning of period | $ 47.72 | $ 42.63 | $ 39.11 | $ 39.21 | $ 34.85 | ||||

| Income from Investment Operations | |||||||||

| Net investment income (loss)A,B | 1.29 | 1.19 | 1.21 | 1.23 | 1.16 | ||||

| Net realized and unrealized gain (loss) | (4.42) | 5.11 | 3.56 | (0.09) | 4.32 | ||||

| Total from investment operations | (3.13) | 6.30 | 4.77 | 1.14 | 5.48 | ||||

| Distributions from net investment income | (1.32) | (1.21) | (1.25) | (1.24) | (1.12) | ||||

| Total distributions | (1.32) | (1.21) | (1.25) | (1.24) | (1.12) | ||||

| Net asset value, end of period | $ 43.27 | $ 47.72 | $ 42.63 | $ 39.11 | $ 39.21 | ||||

| Total ReturnC | (6.63)% | 15.10% | 12.46% | 3.13% | 15.93% | ||||

| Ratios to Average Net AssetsA,D | |||||||||

| Expenses before reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of fee waivers, if any | .08% | .08% | .08% | .08% | .08% | ||||

| Expenses net of all reductions | .08% | .08% | .08% | .08% | .08% | ||||

| Net investment income (loss) | 2.89% | 2.66% | 2.96% | 3.06% | 3.11% | ||||

| Supplemental Data | |||||||||

| Net assets, end of period (000 omitted) | $1,901,696 | $2,195,072 | $1,076,292 | $844,807 | $733,190 | ||||

| Portfolio turnover rateE,F | 4% | 3% | 5% | 5% | 7% | ||||

| A | Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| E | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| F | Portfolio turnover rate excludes securities received or delivered in-kind. |

| Annual Report | 106 |

For the period ended July 31, 2023

| 107 | Annual Report |

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

| Annual Report | 108 |

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows for each Fund:

| Tax cost | Gross

unrealized appreciation |

Gross

unrealized depreciation |

Net

unrealized appreciation (depreciation) | |