FIDELITY COVINGTON TRUST

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer

St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston,

Massachusetts 02210

(Name and address of agent for service)

Registrant’s telephone number, including area code:

617-563-7000

Date of fiscal year end: July 31

Date of reporting period: July 31, 2020

| Item 1. |

Reports to Stockholders |

Fidelity® MSCI Communication Services Index

ETF

Fidelity® MSCI Consumer Discretionary Index

ETF

Fidelity® MSCI Consumer Staples Index

ETF

Fidelity® MSCI Energy Index

ETF

Fidelity® MSCI Financials Index

ETF

Fidelity® MSCI Health Care Index

ETF

Fidelity® MSCI Industrials Index

ETF

Fidelity® MSCI Information Technology Index

ETF

Fidelity® MSCI Materials Index

ETF

Fidelity® MSCI Real Estate Index

ETF

Fidelity® MSCI Utilities Index

ETF

Annual

Report

July 31,

2020

See

the inside front cover for important information

about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by

regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial

intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder

reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For

Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper

free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free

number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account

Type |

Website

|

Phone

Number |

| Brokerage,

Mutual Fund, or Annuity Contracts: |

fidelity.com/mailpreferences

|

1-800-343-3548

|

| Employer

Provided Retirement Accounts: |

netbenefits.fidelity.com/preferences

(choose ‘no’ under Required Disclosures to continue print) |

1-800-343-0860

|

To view a fund’s proxy voting guidelines and

proxy voting record for the period ended June, 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-FIDELITY to request a free copy

of the proxy voting guidelines.

The funds or

securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more

detailed description of the limited relationship MSCI has with Fidelity and any related funds.

Standard & Poor’s, S&P and S&P 500

are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the

property of their respective owners.

All other

marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

© 2020 FMR LLC. All Rights

reserved.

This

report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by

an effective prospectus.

A fund files its

complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N-PORT may be reviewed and

copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view

the most recent holdings listing on Fidelity’s web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO

BANK GUARANTEE

Neither the funds nor

Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new

coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the

World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following the end of this reporting

period, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including

travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and

– given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central

banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent

and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are "exogenous shocks" that can have significant adverse effects on mutual funds and their investments. Although

multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed

amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets

and our funds.

The S&P 500® index gained 11.96% for the 12 months ending July 31, 2020, in what was a bumpy ride for U.S. equity investors, marked by a steep but brief decline

due to the early-2020 outbreak and spread of the coronavirus, followed by a historic rebound. Declared a pandemic on March 11, the COVID-19 crisis and containment efforts caused broad contraction in economic activity, along with extreme uncertainty,

volatility and dislocation in financial markets. By mid-March, U.S. stocks entered bear-market territory less than a month after hitting an all-time high and extending the longest-running bull market in American history. Stocks slid in late

February, after a surge in COVID-19 cases outside China. The sudden downtrend continued in March (-12%), capping the index’s worst quarter since 2008. A historically rapid and expansive U.S. monetary/fiscal-policy response provided a partial

offset to the economic disruption and fueled a sharp uptrend. Aggressive support for financial markets by the U.S. Federal Reserve, plans for reopening the economy and improving infection data boosted stocks in April (+13%) and May (+5%). In June

and July, the index gained amid progress on potential treatments and signs of an early recovery in economic activity. For the full 12 months, growth stocks widely topped value, while large-caps handily bested smaller-caps. The information technology

sector (+39%) led the way, followed by consumer discretionary (+22%). In contrast, energy (-38%) fell hard along with the price of crude oil.

Fidelity® MSCI Communication Services Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Communication Services Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different

time periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Communication Services Index ETF – NAVA |

11.40%

|

10.41%

|

9.30%

|

| Fidelity

MSCI Communication Services Index ETF – Market PriceB |

11.26%

|

10.41%

|

9.28%

|

| MSCI

USA IMI Communication Services 25/50 IndexA |

11.54%

|

10.55%

|

9.37%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Communication Services Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This

information represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total

returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

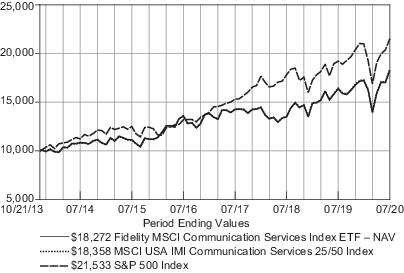

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Communication Services Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Communication

Services 25/50 Index and the S&P 500 Index performed over the same period.

Fidelity® MSCI Communication Services Index ETF

Management’s Discussion of Fund Performance

For the fiscal year ending July 31, 2020, the

exchange-traded fund's (ETF) net asset value gained 11.40%, roughly in line with the 11.54% advance of the MSCI USA IMI Communication Services 25/50 Index. The ETF's market price rose 11.26% over the same time frame, while the broad-market S&P

500® index added 11.96%. Communication services stocks delivered muted results for the first half of the 12-month period, then trailed the S&P

500® in a historically volatile March as the spread of coronavirus triggered a severe economic contraction. Communication services rebounded

strongly in April and May due to gains aided by market stimulus and performed well in July. Several companies that benefited from stay-at-home mandates and voluntary virus-containment efforts saw outsized stock advances. Interactive home

entertainment (+56%), comprising about 5% of the MSCI index, delivered the best returns by industry, as more consumers spent time at home. Video-game developer Activision Blizzard (+70%) added notable value. Wireless telecommunication services

(+24%), comprising about 3% of the MSCI index, also posted strong gains, mainly due to an advance by T-Mobile (+35%), which acquired competitor Sprint in early April. Interactive media & services (+24%) – the sector’s largest

subindustry, comprising about 46% of the MSCI index – also topped the MSCI index, led by index heavyweights Facebook (+30%) and Google-parent Alphabet (+21%). Conversely, broadcasting (-31%) and advertising (-24%), representing about 4% and 2%

of the MSCI index, respectively, delivered the weakest results, as advertising dollars continued to shift away from traditional print and television media to digital. Integrated telecommunication services, representing about 10% of the MSCI index,

also lagged the broader communication services sector.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Communication Services Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| Facebook,

Inc. Class A |

17.4

|

| Alphabet,

Inc. Class C |

11.0

|

| Alphabet,

Inc. Class A |

10.7

|

| Verizon

Communications, Inc. |

5.4

|

| Comcast

Corp. Class A |

4.5

|

| Netflix,

Inc. |

4.3

|

| The

Walt Disney Co. |

4.1

|

| AT&T,

Inc. |

4.1

|

| Charter

Communications, Inc. Class A |

3.3

|

| T-Mobile

US, Inc. |

3.0

|

| |

67.8

|

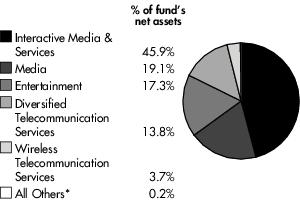

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Consumer Discretionary Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Consumer Discretionary Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different

time periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Consumer Discretionary Index ETF – NAVA |

25.26%

|

13.75%

|

14.28%

|

| Fidelity

MSCI Consumer Discretionary Index ETF – Market PriceB |

25.31%

|

13.74%

|

14.14%

|

| MSCI

USA IMI Consumer Discretionary IndexA |

25.20%

|

13.82%

|

14.38%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Consumer Discretionary Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This

information represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

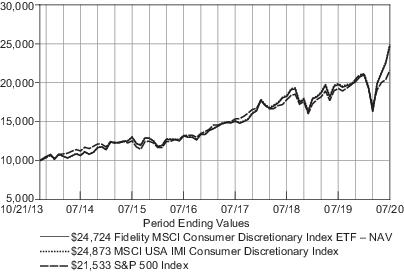

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Consumer Discretionary Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Consumer

Discretionary Index and the S&P 500 Index performed over the same period.

Fidelity® MSCI Consumer Discretionary Index ETF

Management’s Discussion of Fund Performance

For the fiscal year ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value rose 25.26%, roughly in line with the 25.20% return of the MSCI USA IMI Consumer Discretionary Index. The ETF’s market price gained 25.31% over the same time frame, while the broad-market

S&P 500® index returned 11.96%. Consumer discretionary stocks overcame concerns about global trade and recessionary fears during the first half

of the period. Specifically, in the first quarter of 2020 the global outbreak of a novel coronavirus and subsequent containment efforts caused broad-based contraction in economic activity, elevated volatility and dislocation in the financial

markets. By mid-March, the U.S. stock market entered bear-market territory less than a month after hitting an all-time high. Leisure travel stopped, and non-essential retailers were forced to close as states implemented social-distancing measures to

help stall the spread of the virus and the disease is causes, COVID-19. However, stocks rebounded from late March through July on aggressive support for the financial markets by the U.S. Federal Reserve and plans for reopening the economy, as well

as progress on potential treatments. Among the index’s industry components, automobile manufacturers (+110%) notched the strongest result the past 12 months. This was due to the strong performance of electric vehicle maker Tesla, which gained

490% as the company’s Model 3 reached record-breaking sales in China and the company produced four consecutive quarters of profit. Internet & direct market retail stocks (+60%), such as Amazon.com, benefited as the coronavirus pandemic

accelerated a broader shift to e-commerce spending. Homebuilding (+36%) was boosted by continued low interest rates and positive housing data, while home-improvement retailers (+33%) such as Home Depot (+28%) and Lowe’s (+50%) rallied as

consumers invested more money in their homes as they spent more time there amid the pandemic. Major laggards this year included department stores (-65%) and hotels, resorts & cruise lines (-43%), which suffered as non-essential businesses closed

and global travel virtually halted in an effort to contain the spread of COVID-19.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Consumer Discretionary Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| Amazon.com,

Inc. |

24.4

|

| The

Home Depot, Inc. |

8.0

|

| Tesla,

Inc. |

6.0

|

| McDonald's

Corp. |

4.3

|

| NIKE,

Inc. Class B |

3.7

|

| Lowe's

Cos., Inc. |

3.0

|

| Starbucks

Corp. |

2.6

|

| Booking

Holdings, Inc. |

2.3

|

| The

TJX Cos., Inc. |

2.1

|

| MercadoLibre,

Inc. |

1.8

|

| |

58.2

|

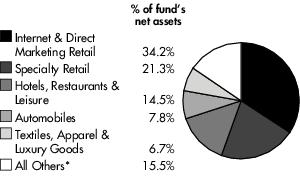

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Consumer Staples Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Consumer Staples Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time

periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Consumer Staples Index ETF – NAVA |

7.74%

|

7.06%

|

8.89%

|

| Fidelity

MSCI Consumer Staples Index ETF – Market PriceB |

7.65%

|

7.05%

|

8.68%

|

| MSCI

USA IMI Consumer Staples IndexA |

7.95%

|

7.21%

|

9.04%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Consumer Staples Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This

information represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

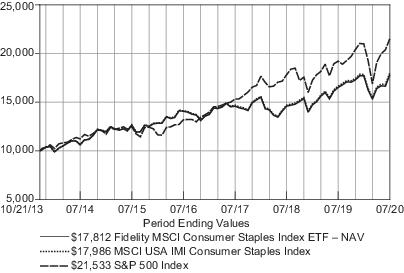

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Consumer Staples Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Consumer Staples Index

and the S&P 500 Index performed over the same period.

Fidelity® MSCI Consumer Staples Index ETF

Management’s Discussion of Fund Performance

For the fiscal year ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value returned 7.74%, trailing the 7.95% advance of the MSCI USA IMI Consumer Staples Index. The ETF’s market price gained 7.65% over the period, while the broad-based S&P 500® index returned 11.96%. Stocks were volatile, benefiting early on from continued economic expansion before plunging in the first quarter of 2020 when

the global outbreak of the coronavirus and the disease it causes, COVID-19, led to a shutdown of economies worldwide. The broader market subsequently rebounded in the second quarter on the back of government stimulus and encouraging news about

containment efforts to slow the spread of COVID-19. Within the MSCI sector index, household products (+16%) outperformed, helped by increased consumer demand. Standouts included Procter & Gamble (+15%), which represented about 15% of the index.

The hypermarkets & super centers segment (+20%) benefited as the COVID-19 crisis pushed more consumers to shop in bulk. Among standouts were Walmart and Costco Wholesale (+20% each). The packaged foods & meats group (+8%) also gained, as

growing consumer demand helped offset declining demand from restaurants, schools and sports venues that closed during the lockdowns. Conversely, weak on-premises sales held back the soft drinks (+2%) category, while continued regulatory headwinds

hindered the tobacco (-3%) segment. Individual disappointments included Coca-Cola (-7%), about 10% of the sector index, and Altria Group (-5%), another large index component.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Consumer Staples Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| The

Procter & Gamble Co. |

15.6

|

| The

Coca-Cola Co. |

9.3

|

| PepsiCo,

Inc. |

9.0

|

| Walmart,

Inc. |

8.8

|

| Costco

Wholesale Corp. |

6.9

|

| Philip

Morris International, Inc. |

4.7

|

| Mondelez

International, Inc. Class A |

3.9

|

| Altria

Group, Inc. |

3.8

|

| Colgate-Palmolive

Co. |

3.1

|

| Kimberly-Clark

Corp. |

2.6

|

| |

67.7

|

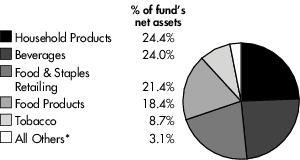

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Energy Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Energy Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods can

help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Energy Index ETF – NAVA |

-39.28%

|

-10.34%

|

-10.47%

|

| Fidelity

MSCI Energy Index ETF – Market PriceB |

-39.29%

|

-10.32%

|

-10.43%

|

| MSCI

USA IMI Energy IndexA |

-39.30%

|

-10.26%

|

-10.40%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Energy Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information

represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

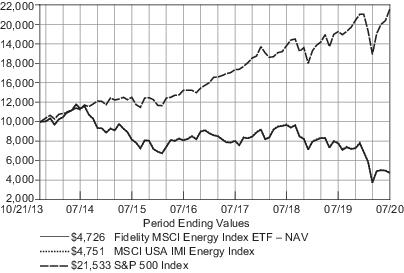

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Energy Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Energy Index and the S&P 500

Index performed over the same period.

Fidelity® MSCI Energy Index ETF

Management’s Discussion of Fund Performance

For the fiscal year ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value produced a return of -39.28%, about in line with the -39.30% result of the MSCI USA IMI Energy Index. The ETF’s market price was -39.29% for the period, whereas the broad-based S&P 500® index rose 11.96%. The energy sector was by far the worst-performing of the 11 major equity market sectors in the S& P 500® Index the past 12 months. In the first quarter of 2020, energy stocks were pressured by sharply lower global demand for crude oil and natural gas amid

the outbreak and global spread of a novel coronavirus and the disease it causes, COVID-19. Declared a pandemic on March 11, the COVID-19 crisis and containment efforts caused broad global economic contraction, along with elevated uncertainty,

volatility and dislocation in financial markets. Reduced demand for energy commodities resulted in lower pricing, which hindered the profitability and outlook for many energy companies. All industry groups within the sector experienced double-digit

declines during the period. Oil & gas equipment & services (-51%) was the biggest detractor, as demand for drilling equipment and services plummeted. Here, energy services firm Schlumberger (-52%) was a key driver of the portfolio’s

performance. The two largest industry segments – integrated oil & gas (-38%) and oil & gas exploration & production (-41%) stocks – also suffered from the sector’s weakened outlook. In the former category, Exxon Mobil

(-40%) had a significant negative influence on the industry’s performance, while E&P company EOG Resources (-44%) hurt the latter group. Holding up only moderately better than the sector benchmark were the oil & gas storage &

transportation (-32%) and oil & gas refining & marketing (-35%) groups. Among refining firms, Marathon Petroleum (-29%) and Valero Energy (-31%) contributed to the category’s performance this period.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Energy Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| Exxon

Mobil Corp. |

23.1

|

| Chevron

Corp. |

20.5

|

| ConocoPhillips

|

5.2

|

| Kinder

Morgan, Inc. |

3.7

|

| EOG

Resources, Inc. |

3.5

|

| Phillips

66 |

3.5

|

| Schlumberger

Ltd. |

3.3

|

| Marathon

Petroleum Corp. |

3.2

|

| The

Williams Cos., Inc. |

3.0

|

| Valero

Energy Corp. |

3.0

|

| |

72.0

|

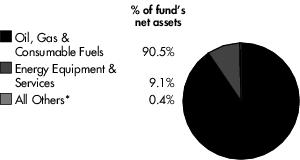

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Financials Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Financials Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods

can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Financials Index ETF – NAVA |

-14.78%

|

5.11%

|

6.97%

|

| Fidelity

MSCI Financials Index ETF – Market PriceB |

-14.84%

|

5.09%

|

7.00%

|

| MSCI

USA IMI Financials IndexA |

-14.66%

|

5.22%

|

7.09%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Financials Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information

represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

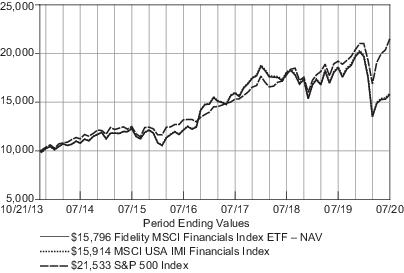

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Financials Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Financials Index and the

S&P 500 Index performed over the same period.

Fidelity® MSCI Financials Index ETF

Management’s Discussion of Fund Performance

For the 12 months ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value produced a return of -14.78%, versus the -14.66% return of the MSCI USA IMI Financials Index. The ETF’s market price returned -14.84% over the same period, while the broad-based S&P 500® index gained 11.96%. The COVID-19 pandemic brought with it lower interest rates and concerns about a possible surge in nonperforming loans, as

civilian unemployment reached levels not seen since the Great Depression. These conditions represented headwinds for the profitability of banks, which make up a large part of the financial services sector. Diversified banks, the largest group in the

MSCI index, returned about -24% during the period, while regional banks finished with a return of roughly -27%. Within the banking segment, Wells Fargo (-47%) was one of the weakest performers, as the company saw its path to a turnaround delayed by

the pandemic. US Bancorp (-33%) also weighed on the ETF’s return. JPMorgan Chase (-13%) and Bank of America (-17%) fared somewhat better. Outside of banks, other weak segments included mortgage REITs (-34%), multi-line insurance (-32%) and

consumer finance (-28%). Although most groups in the MSCI index recorded double-digit negative returns, one group posted a gain: asset management & custody banks (+5%). KKR (+36%), Blackrock (+27%) and T. Rowe Price Group (+26%) bolstered this

group’s performance.

The views expressed

above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund

Advisors (the ETF’s subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such

views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Financials Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| JPMorgan

Chase & Co. |

9.1

|

| Berkshire

Hathaway, Inc. Class B |

8.3

|

| Bank

of America Corp. |

6.0

|

| Citigroup,

Inc. |

3.2

|

| Wells

Fargo & Co. |

2.9

|

| BlackRock,

Inc. |

2.7

|

| S&P

Global, Inc. |

2.6

|

| The

Goldman Sachs Group, Inc. |

2.0

|

| American

Express Co. |

1.9

|

| CME

Group, Inc. |

1.8

|

| |

40.5

|

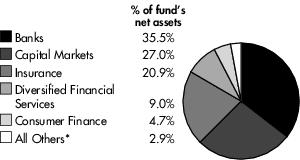

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Health Care Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Health Care Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods

can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Health Care Index ETF – NAVA |

19.69%

|

8.79%

|

13.28%

|

| Fidelity

MSCI Health Care Index ETF – Market PriceB |

19.60%

|

8.77%

|

13.15%

|

| MSCI

USA IMI Health Care IndexA |

19.80%

|

8.89%

|

13.41%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Health Care Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information

represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

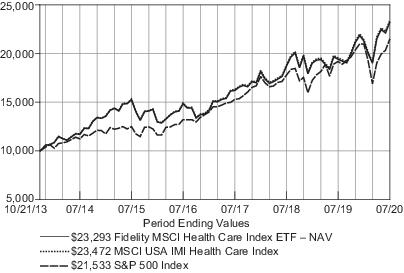

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Health Care Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Health Care Index and the

S&P 500 Index performed over the same period.

Fidelity® MSCI Health Care Index ETF

Management’s Discussion of Fund Performance

For the fiscal year ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value gained 19.69%, roughly in line with the 19.80% return of the MSCI USA IMI Health Care Index. The ETF’s market price gained 19.60% over the same time frame, while the broad-market S&P 500® index returned 11.96%. The sector benefited from higher demand late in period due to the anti-virus response. Secular trends, including an aging

population, also supported many health care companies, as did solid business fundamentals, continued innovation and accelerating growth. Most of the groups within the MSCI health care index produced double-digit gains this period, including two of

the largest industries: biotechnology and pharmaceuticals, which advanced 32% and 15%, respectively. These groups were beneficiaries of continued innovation and demand for life-saving drugs. As well, some biotech and pharma firms were at the

forefront of the development of testing and treatments for the novel coronavirus. Standouts from these categories included AbbVie (+50%), a leader in biologics, focused on auto-immune, infectious and cardiovascular diseases that benefited from

strong results for the its flagship arthritis treatment, Humira®, and the completion of its merger with Allergan in May. In addition, Amgen (+35%),

which saw strong growth and demand for Prolia®, its treatment for osteoporosis, also performed well. Health care technology (+41%) was another

strong-performing category, as health care providers increasingly turned to telemedicine companies, such as Teladoc Health, as the spread of the coronavirus escalated. Life science tools & services (+34%) also outpaced the broader sector, buoyed

by companies such as Thermo-Fisher Scientific, a laboratory instrument manufacturing company that benefited partly by sales of the firm’s COVID-19 tests. The only industry to decline during the past year was health care facilities (-8%). This

industry was negatively influenced by coronavirus outbreaks in nursing homes and long-term care facilities.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Health Care Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| Johnson

& Johnson |

8.1

|

| UnitedHealth

Group, Inc. |

6.1

|

| Pfizer,

Inc. |

4.5

|

| Merck

& Co., Inc. |

4.3

|

| Abbott

Laboratories |

3.7

|

| AbbVie,

Inc. |

3.5

|

| Thermo

Fisher Scientific, Inc. |

3.5

|

| Amgen,

Inc. |

3.0

|

| Bristol-Myers

Squibb Co. |

2.8

|

| Eli

Lilly & Co. |

2.7

|

| |

42.2

|

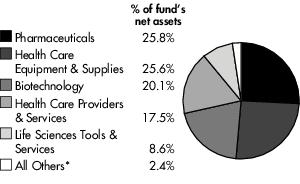

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Industrials Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Industrials Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods

can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Industrials Index ETF – NAVA |

-4.34%

|

7.99%

|

7.95%

|

| Fidelity

MSCI Industrials Index ETF – Market PriceB |

-4.47%

|

7.96%

|

7.76%

|

| MSCI

USA IMI Industrials IndexA |

-4.24%

|

8.10%

|

8.07%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Industrials Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information

represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

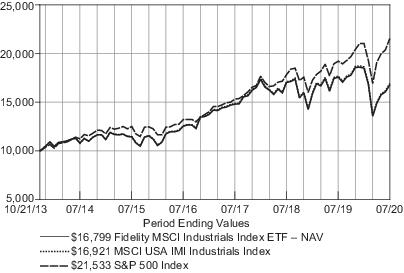

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Industrials Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Industrials Index and the

S&P 500 Index performed over the same period.

Fidelity® MSCI Industrials Index ETF

Management’s Discussion of Fund Performance

For the 12 months ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value returned -4.34%, versus the -4.24% result of the MSCI USA IMI Industrials Index. The ETF’s market price returned -4.47% over the same period, while the broad-based S&P 500® index gained 11.96%. Industrials stocks roughly kept pace with an advancing broader equity market from the beginning of the period through

mid-February. However, the sector notably lagged the S&P 500® thereafter because of the COVID-19 pandemic. Although it’s a relatively

small component of the MSCI index, airlines (-56%) was, by far, the weakest-performing group, as social distancing and sheltering at home reduced air travel to a fraction of what it had been. Delta Air Lines (-58%) and American Airlines Group (-63%)

were representative of the challenges faced by air carriers. Meanwhile, commercial aerospace stocks weighed down the aerospace & defense group (-24%). Index heavyweight Boeing (-53%) saw its value more than halved, as it simultaneously fought to

get its 737 MAX airliner back into production and struggled under the weight of the pandemic. Industrial conglomerates (-16%) also did relatively poorly, with General Electric (-42%) explaining a lot of the weakness. On the flip side, research &

consulting services (+20%), trading companies & distributors (+17%) and air freight & logistics (+15%) all outperformed. In the latter group, United Parcel Service (+23%) was a standout.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Industrials Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| Union

Pacific Corp. |

4.3

|

| Honeywell

International, Inc. |

3.9

|

| United

Parcel Service, Inc. Class B |

3.6

|

| Lockheed

Martin Corp. |

3.5

|

| 3M

Co. |

3.1

|

| Raytheon

Technologies Corp. |

3.1

|

| The

Boeing Co. |

3.1

|

| Caterpillar,

Inc. |

2.6

|

| Illinois

Tool Works, Inc. |

2.1

|

| CSX

Corp. |

2.0

|

| |

31.3

|

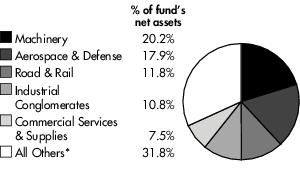

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Information Technology Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Information Technology Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different

time periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Information Technology Index ETF – NAVA |

36.99%

|

23.19%

|

21.55%

|

| Fidelity

MSCI Information Technology Index ETF – Market PriceB |

36.93%

|

23.17%

|

21.66%

|

| MSCI

USA IMI Information Technology IndexA |

37.13%

|

23.32%

|

21.67%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Information Technology Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This

information represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

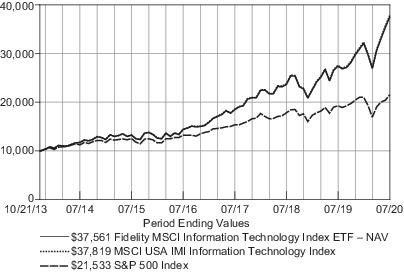

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Information Technology Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Information

Technology Index and the S&P 500 Index performed over the same period.

Fidelity® MSCI Information Technology Index ETF

Management’s Discussion of Fund Performance

For the fiscal year ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value gained 36.99%, roughly in line with the 37.13% advance of the MSCI USA IMI Information Technology Index. The ETF’s market price rose 36.93% over the same time frame, while the broad-market

S&P 500® index increased 11.96%. Information technology finished the trailing 12-month period with the strongest performance among the 11

S&P 500® sectors. The COVID-19 pandemic accelerated a number of trends that benefited technology stocks, such as the migration of consumers to

digital platforms, the shift of enterprises to cloud computing, and the growth in cashless transactions. Technology hardware, storage & peripherals (+89%) was, by far, the strongest group in the MSCI index, riding a strong gain from index

heavyweight Apple (+102%). Investors were optimistic about the company’s prospects for diversifying its business to rely more on services and wearables, and less on iPhones. Three other groups also stood out for their strong showings:

semiconductor equipment (+55%), systems software (+45%) and internet services & infrastructure (+43%). In systems software, the dominant influence was Microsoft (+52%), which saw healthy growth in both its Azure cloud business and its Office

productivity suite. Conversely, communications equipment (-10%) was one of the weaker index categories. Subdued capital spending on communications equipment, partly due to the pandemic, but also because of merger talks between telecom carriers

T-Mobile and Sprint – which officially joined forces on April 1 – was at work here. The IT consulting & other services group (+1%) and the data processing & outsourced services segment (+14%) also lagged the sector index.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Information Technology Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| Apple,

Inc. |

21.4

|

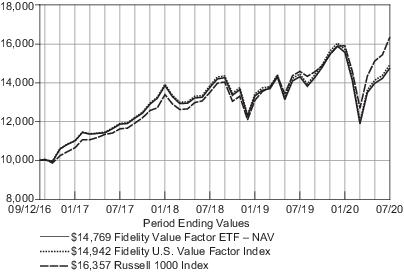

| Microsoft

Corp. |

17.0

|

| Visa,

Inc. Class A |

3.7

|

| Mastercard,

Inc. Class A |

3.2

|

| NVIDIA

Corp. |

3.0

|

| PayPal

Holdings, Inc. |

2.5

|

| Adobe,

Inc. |

2.5

|

| Intel

Corp. |

2.3

|

| Cisco

Systems, Inc. |

2.3

|

| Salesforce.com,

Inc. |

1.9

|

| |

59.8

|

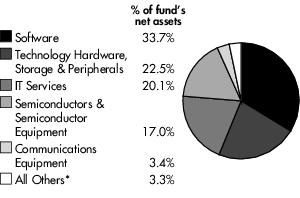

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

Fidelity® MSCI Materials Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Materials Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods

can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Materials Index ETF – NAVA |

3.28%

|

7.02%

|

6.17%

|

| Fidelity

MSCI Materials Index ETF – Market PriceB |

3.04%

|

7.00%

|

5.96%

|

| MSCI

USA IMI Materials IndexA |

3.38%

|

7.11%

|

6.25%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.98%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Materials Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information

represents returns as of the end of the fund’s fiscal period.

A

From October 21, 2013.

| B |

From October

24, 2013, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

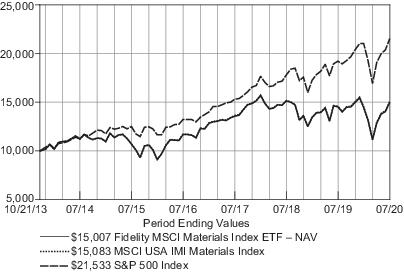

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Materials Index ETF – NAV on October 21, 2013, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Materials Index and the

S&P 500 Index performed over the same period.

Fidelity® MSCI Materials Index ETF

Management’s Discussion of Fund Performance

For the 12 months ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value advanced 3.28%, versus a 3.38% gain in the MSCI USA IMI Materials Index. The ETF’s market price rose 3.04% over the same period, while the broad-based S&P 500® index added 11.96%. Returns in the MSCI index by industry varied widely the past 12 months. Gold (+77%) advanced strongly, partly due to its defensive

nature, as well as negative real interest rates in the U.S., which tend to correlate with investor interest in precious metals. Among gold stocks, Newmont (+91%) stood out to the upside. The lone silver stock in the index, Hecla Mining (+206%), also

rose strongly. Elsewhere, forest products (+37%), industrial gases (+30%) and copper (+18%) all topped the MSCI index. Conversely, aluminum (-30%) struggled, partly because so much of this metal is used by commercial aerospace firms that faced

severe economic challenges due to the coronavirus pandemic. Alcoa (-41%), the largest aluminum player in the index, performed poorly. Other weak segments included paper products (-25%), steel (-22%) and commodity chemicals (-16%). Specialty

chemicals, by far the largest group in the index, recorded a return of -5%. Among the larger specialty chemicals firms in the MSCI index, Dupont de Nemours (-23%), Ecolab, (-6%) and PPG Industries (-6%) each lagged the industry return.

The views expressed above reflect those of the

portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or BlackRock Fund Advisors (the ETF’s

subadviser) or any other person in the BlackRock organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and BlackRock disclaim any responsibility to update such views. These views may not be

relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® MSCI Materials Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2020

| |

%

of fund's

net assets |

| Linde

PLC |

14.9

|

| Air

Products & Chemicals, Inc. |

7.2

|

| Newmont

Corp. |

6.3

|

| The

Sherwin-Williams Co. |

6.1

|

| Ecolab,

Inc. |

5.4

|

| DuPont

de Nemours, Inc. |

4.5

|

| Dow,

Inc. |

3.5

|

| PPG

Industries, Inc. |

2.9

|

| Ball

Corp. |

2.7

|

| Corteva,

Inc. |

2.4

|

| |

55.9

|

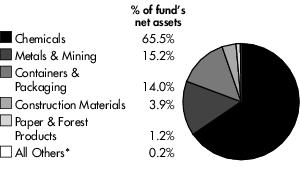

Industries as of July 31, 2020

* Includes

short-term investments and net other assets.

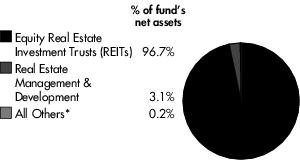

Fidelity® MSCI Real Estate Index ETF

Performance (Unaudited)

The information provided in the tables below shows

you the performance of Fidelity® MSCI Real Estate Index ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods

can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance

is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern

Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV –

the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance

data quoted. For month-end performance figures, please visit fidelity.com/etfs/sector-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal

value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended July 31, 2020

| Average

Annual Total Returns |

Past

1 Year |

Past

5 Years |

Life

of

fund |

| Fidelity

MSCI Real Estate Index ETF – NAVA |

-5.27%

|

5.65%

|

4.05%

|

| Fidelity

MSCI Real Estate Index ETF – Market PriceB |

-5.29%

|

5.64%

|

3.77%

|

| MSCI

USA IMI Real Estate IndexA |

-5.00%

|

5.79%

|

4.14%

|

| S&P

500 IndexA |

11.96%

|

11.49%

|

11.42%

|

Average annual total returns represent just that – the

average return on an annual basis for Fidelity® MSCI Real Estate Index ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information

represents returns as of the end of the fund’s fiscal period.

A

From February 2, 2015.

| B |

From February

5, 2015, date initially listed on the NYSE ARCA exchange. |

| *

|

Total returns

are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

$10,000 Over Life of Fund

Let’s say hypothetically that

$10,000 was invested in Fidelity MSCI Real Estate Index ETF – NAV on February 2, 2015, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the MSCI USA IMI Real Estate Index and the

S&P 500 Index performed over the same period.

Fidelity® MSCI Real Estate Index ETF

Management’s Discussion of Fund Performance

For the fiscal year ending July 31, 2020, the

exchange-traded fund’s (ETF) net asset value returned -5.27% compared with -5.00% for the MSCI USA IMI Real Estate Index. The ETF’s market price returned -5.29% over the same time frame, while the broad-market S&P 500® index rose 11.96%. In an often-challenging market environment for real estate securities, most groups within the MSCI sector index lost significant

ground. The weakest-performing categories tended to be those involving businesses that heavily depend on social interaction, which became severely limited in the COVID-19 pandemic. Hotel & resort and retail real estate investment trusts (REITs),

for example, were particularly poor performers, returning about -48% and -40%, respectively. By far, the biggest individual detractor was mall owner Simon Property Group (-59%). In March, Simon announced the temporary closure of all its retail U.S.

properties, a move the company would not begin to reverse until early May. Hotel REIT Host Hotels & Resorts (-36%) also significantly lagged the index. Several health care REITs also were meaningful detractors, led by Welltower (-32%) and Ventas

(-38%), both of which were hampered by worries about a potential oversupply of senior housing properties. Investor concern about the impact of COVID-19 on demand for senior-housing facilities also appeared to weigh on both stocks. Various apartment

REITs also struggled this period, most notably Equity Residential (-30%), AvalonBay Communities (-24%) and Essex Property Trust (-25%). On the positive side, meanwhile, were many real estate owners whose business models remained largely unaffected

by social distancing efforts. For example, industrial REITs were particularly strong performers, benefiting from growth in e-commerce and demand for specialized warehouse space. Prologis (+33%) and Duke Realty (+23%) were two particularly

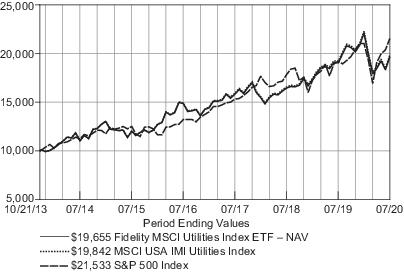

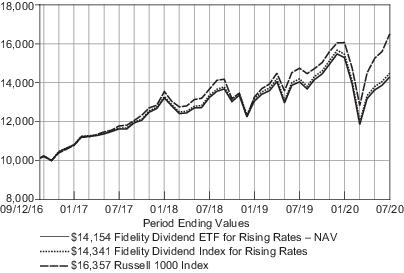

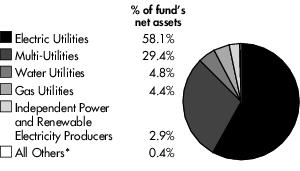

strong-performing firms in this category. Wireless communications tower operators, including American Tower (+24%), Crown Castle International (+28%) and SBA Communications (+27%), along with data-center operators Equinix (+58%), Digital Realty