pool-2023123100009458412023FYfalseP1Y00009458412023-01-012023-12-3100009458412023-06-30iso4217:USD00009458412024-02-20xbrli:shares00009458412023-12-31pool:distribution_center0000945841pool:NccMember2023-01-012023-12-31xbrli:pure0000945841pool:NccMember2023-12-31iso4217:USDxbrli:shares00009458412022-01-012022-12-3100009458412021-01-012021-12-3100009458412022-12-3100009458412021-12-3100009458412020-12-310000945841us-gaap:CommonStockMember2020-12-310000945841us-gaap:AdditionalPaidInCapitalMember2020-12-310000945841us-gaap:RetainedEarningsMember2020-12-310000945841us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000945841us-gaap:CommonStockMember2021-01-012021-12-310000945841us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000945841us-gaap:RetainedEarningsMember2021-01-012021-12-310000945841us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000945841us-gaap:CommonStockMember2021-12-310000945841us-gaap:AdditionalPaidInCapitalMember2021-12-310000945841us-gaap:RetainedEarningsMember2021-12-310000945841us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000945841us-gaap:CommonStockMember2022-01-012022-12-310000945841us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000945841us-gaap:RetainedEarningsMember2022-01-012022-12-310000945841us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000945841us-gaap:CommonStockMember2022-12-310000945841us-gaap:AdditionalPaidInCapitalMember2022-12-310000945841us-gaap:RetainedEarningsMember2022-12-310000945841us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000945841us-gaap:CommonStockMember2023-01-012023-12-310000945841us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000945841us-gaap:RetainedEarningsMember2023-01-012023-12-310000945841us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000945841us-gaap:CommonStockMember2023-12-310000945841us-gaap:AdditionalPaidInCapitalMember2023-12-310000945841us-gaap:RetainedEarningsMember2023-12-310000945841us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000945841us-gaap:ShippingAndHandlingMember2023-01-012023-12-310000945841us-gaap:ShippingAndHandlingMember2022-01-012022-12-310000945841us-gaap:ShippingAndHandlingMember2021-01-012021-12-310000945841us-gaap:AllowanceForCreditLossMember2022-12-310000945841us-gaap:AllowanceForCreditLossMember2021-12-310000945841us-gaap:AllowanceForCreditLossMember2020-12-310000945841us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310000945841us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310000945841us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000945841us-gaap:AllowanceForCreditLossMember2023-12-310000945841us-gaap:InventoryValuationReserveMember2022-12-310000945841us-gaap:InventoryValuationReserveMember2021-12-310000945841us-gaap:InventoryValuationReserveMember2020-12-310000945841us-gaap:InventoryValuationReserveMember2023-01-012023-12-310000945841us-gaap:InventoryValuationReserveMember2022-01-012022-12-310000945841us-gaap:InventoryValuationReserveMember2021-01-012021-12-310000945841us-gaap:InventoryValuationReserveMember2023-12-310000945841us-gaap:BuildingMember2023-12-310000945841srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-12-310000945841us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-310000945841srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2023-12-310000945841us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2023-12-310000945841srt:MinimumMemberus-gaap:VehiclesMember2023-12-310000945841us-gaap:VehiclesMembersrt:MaximumMember2023-12-310000945841srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-12-310000945841us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-12-310000945841srt:MinimumMemberus-gaap:ComputerEquipmentMember2023-12-310000945841srt:MaximumMemberus-gaap:ComputerEquipmentMember2023-12-310000945841us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000945841us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000945841us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-310000945841us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-12-310000945841country:PTpool:A.C.SolucoesParaPiscinasLda.Member2023-12-012023-12-310000945841stpr:ALpool:PioneerPoolProductsInc.Member2023-06-012023-06-300000945841pool:RecreationSupplyCompanyMemberstpr:ND2023-05-012023-05-310000945841pool:ProWaterIrrigationLandscapeSupplyInc.Memberstpr:AZ2023-03-012023-03-310000945841stpr:WVpool:TriStatePoolDistributorsMember2022-04-012022-04-300000945841pool:PorpoisePoolPatioIncMember2021-12-162021-12-160000945841pool:PorpoisePoolPatioIncMember2023-09-300000945841pool:PorpoisePoolPatioIncMember2021-12-160000945841stpr:FLpool:PorpoisePoolPatioIncMember2021-12-162021-12-160000945841stpr:FLpool:WingateSupplyIncMember2021-12-012021-12-310000945841stpr:FLpool:VakPakBuildersSupplyIncMember2021-06-012021-06-300000945841pool:PoolSourceLLCMemberstpr:TN2021-04-012021-04-3000009458412023-09-300000945841us-gaap:TradeNamesMember2023-12-310000945841us-gaap:TradeNamesMember2022-12-310000945841us-gaap:TrademarksAndTradeNamesMember2023-12-310000945841us-gaap:TrademarksAndTradeNamesMember2022-12-310000945841pool:NptTradenameMember2023-12-310000945841pool:NptTradenameMember2022-12-310000945841us-gaap:NoncompeteAgreementsMember2023-12-310000945841us-gaap:NoncompeteAgreementsMember2022-12-310000945841us-gaap:CustomerRelationshipsMember2023-12-310000945841us-gaap:CustomerRelationshipsMember2022-12-310000945841us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310000945841us-gaap:CustomerRelatedIntangibleAssetsMember2022-12-310000945841us-gaap:RevolvingCreditFacilityMember2023-12-310000945841us-gaap:RevolvingCreditFacilityMember2022-12-310000945841us-gaap:LineOfCreditMember2023-12-310000945841us-gaap:LineOfCreditMember2022-12-310000945841pool:TermLoanUnderCreditFacilityMember2023-12-310000945841pool:TermLoanUnderCreditFacilityMember2022-12-310000945841pool:TermFacilityMember2023-12-310000945841pool:TermFacilityMember2022-12-310000945841us-gaap:SecuredDebtMember2023-12-310000945841us-gaap:SecuredDebtMember2022-12-310000945841pool:LineOfCreditIncludingTermLoanMember2023-12-310000945841us-gaap:LineOfCreditMember2017-09-290000945841pool:LineOfCreditAccountsSecuritizationMember2021-09-270000945841pool:LineOfCreditAccountsSecuritizationMember2023-06-300000945841pool:SwinglineCommitmentMember2023-06-300000945841pool:EuroComittmentMember2023-06-300000945841pool:CADCommitmentMember2023-06-300000945841pool:FederalFundsRateMember2023-01-012023-12-310000945841us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310000945841pool:CanadianDealerOfferedRateMember2023-01-012023-12-310000945841us-gaap:BaseRateMember2023-01-012023-12-310000945841pool:TermFacilityMember2023-06-012023-06-300000945841us-gaap:PrimeRateMemberpool:TermFacilityMember2023-01-012023-12-310000945841us-gaap:EurodollarMemberpool:TermFacilityMember2023-01-012023-12-310000945841us-gaap:BaseRateMemberpool:TermFacilityMember2023-01-012023-12-310000945841us-gaap:SecuredDebtMember2023-01-012023-12-310000945841pool:CommercialPaperMarketVariableRateMember2023-01-012023-12-310000945841pool:MaximumAverageTotalLeverageRatioMember2021-11-012021-12-310000945841pool:MinimumFixedChargeCoverageRatioMember2021-11-012021-12-31iso4217:AUD0000945841us-gaap:BankOverdraftsMember2023-12-31iso4217:EUR0000945841pool:InterestRateSwap1Member2023-01-012023-12-310000945841pool:InterestRateSwap1Member2020-02-050000945841pool:InterestRateSwap2Member2023-01-012023-12-310000945841pool:InterestRateSwap2Member2020-03-090000945841pool:ForwardstartingInterestRateSwapAgreementsMember2023-01-012023-12-310000945841pool:ForwardstartingInterestRateSwap1Member2023-01-012023-12-310000945841pool:ForwardstartingInterestRateSwap1Member2020-03-090000945841pool:FormerInterestRateSwap1Member2022-01-012022-09-290000945841pool:FormerInterestRateSwap1Member2019-05-070000945841pool:FormerInterestRateSwap2Member2022-01-012022-09-290000945841pool:FormerInterestRateSwap2Member2019-07-250000945841pool:Ltip2007Member2023-12-310000945841us-gaap:RestrictedStockMember2023-12-310000945841us-gaap:RestrictedStockMember2023-01-012023-12-310000945841srt:MinimumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310000945841srt:MaximumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310000945841us-gaap:EmployeeStockOptionMember2022-12-310000945841us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000945841us-gaap:EmployeeStockOptionMember2023-12-310000945841pool:ExercisePriceRange1Member2023-01-012023-12-310000945841pool:ExercisePriceRange1Member2023-12-310000945841pool:ExercisePriceRange2Member2023-01-012023-12-310000945841pool:ExercisePriceRange2Member2023-12-310000945841pool:ExercisePriceRange3Member2023-01-012023-12-310000945841pool:ExercisePriceRange3Member2023-12-310000945841us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000945841us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000945841pool:OptionsMember2023-01-012023-12-310000945841us-gaap:RestrictedStockMember2022-12-310000945841us-gaap:RestrictedStockMember2022-01-012022-12-310000945841us-gaap:RestrictedStockMember2021-01-012021-12-310000945841pool:RestrictedMember2023-01-012023-12-310000945841pool:EmployeestockpurchaseplanMember2023-12-310000945841us-gaap:EmployeeStockMember2023-01-012023-12-310000945841us-gaap:EmployeeStockMember2022-01-012022-12-310000945841us-gaap:EmployeeStockMember2021-01-012021-12-310000945841us-gaap:EmployeeStockMember2023-07-310000945841srt:SubsidiariesMember2023-12-310000945841srt:SubsidiariesMember2022-12-310000945841pool:NccMember2022-01-012022-12-310000945841pool:NccMember2021-01-012021-12-310000945841us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000945841us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000945841us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-3100009458412023-01-012023-03-3100009458412023-04-012023-06-3000009458412023-07-012023-09-3000009458412023-10-012023-12-3100009458412022-01-012022-03-3100009458412022-04-012022-06-3000009458412022-07-012022-09-3000009458412022-10-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-26640

| | | | | | | | | | | |

| POOL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | |

| Delaware | | 36-3943363 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

| 109 Northpark Boulevard, | | |

| Covington, | Louisiana | | 70433-5001 |

| (Address of principal executive offices) | | (Zip Code) |

(985) 892-5521

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | POOL | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | o | | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant based on the closing sales price of the registrant’s common stock as of June 30, 2023 was $14,212,954,827.

As of February 20, 2024, there were 38,376,151 shares of common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement for the 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

| | | | | | | | |

| POOL CORPORATION | |

| | |

| TABLE OF CONTENTS | |

| | | |

| | | Page |

| PART I. | |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II. | |

| | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| PART III. | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV. | |

| | | |

| Item 15. | | |

| Item 16. | | |

| | | |

| |

| | |

PART I.

Item 1. Business

General

Pool Corporation (the Company, which may also be referred to as we, us or our), a member of the S&P 500 Index, is the world’s largest wholesale distributor of swimming pool supplies, equipment and related leisure products and is one of the leading distributors of irrigation and landscape maintenance products in the United States.

Our industry is highly fragmented, and as such, we believe we add considerable value to the industry by purchasing products from a large number of manufacturers and then efficiently distributing the products to our customer base on conditions that are more favorable than our customers could obtain on their own.

As of December 31, 2023, we operated 439 sales centers in North America, Europe and Australia through our five distribution networks:

•SCP Distributors (SCP);

•Superior Pool Products (Superior);

•Horizon Distributors (Horizon);

•National Pool Tile (NPT); and

•Sun Wholesale Supply (Sun Wholesale).

Our Industry

We believe that the swimming pool industry will continue to grow with the increased penetration of new pools into households with the discretionary income and physical capacity to install a swimming pool. We believe significant growth opportunities also reside with pool remodel and pool equipment replacement activities due to the aging of the installed base of swimming pools, technological advancements and the development of environmentally sustainable, energy-efficient and more aesthetically attractive products. The desire for consumers to enhance their outdoor living spaces with hardscapes, lighting and other outdoor living-related products provides us with additional future growth opportunities in this area.

Over the past several years, favorable demographic and socioeconomic trends have positively impacted our industry, and we believe these trends will continue over the long term. These favorable trends include the following:

•long-term growth in housing units in warmer climate markets due to the population migration toward the southern United States, where use of the outdoor home environment is more prevalent and extends longer throughout the year;

•increased homeowner spending on outdoor living spaces for relaxation and entertainment;

•consumers bundling the purchase of a swimming pool and other products, with new irrigation systems, landscaping and improvements to outdoor living spaces often being key components to both pool installations and remodels;

•consumers using more automation and control products, higher quality materials and other pool features that add to our sales opportunities over time;

•consumers increasing focus on environmentally sustainable, energy-efficient products; and

•remote and hybrid work trends as homeowners seek to create attractive areas in their backyards as an extension of their home space.

We estimate about 60% of consumer spending in the pool industry is for maintenance and minor repair of existing swimming pools. Maintaining a safe and consistent water chemistry and the related upkeep and repair of swimming pool equipment, such as pumps, heaters, filters and safety equipment, creates non-discretionary demand for pool chemicals, equipment and other related parts and supplies. We also believe cosmetic considerations such as a pool’s appearance and the overall look of backyard environments create ongoing demand for other maintenance-related goods and certain discretionary products that we supply.

Consistent growth of the installed base of in-ground swimming pools and the recurring nature of the maintenance and repair market has helped maintain a relatively consistent rate of industry growth. This characteristic has helped cushion the negative impact on revenues in periods when unfavorable economic conditions and softness in the housing market adversely impacted consumer discretionary spending, including pool construction and major replacement and renovation activities.

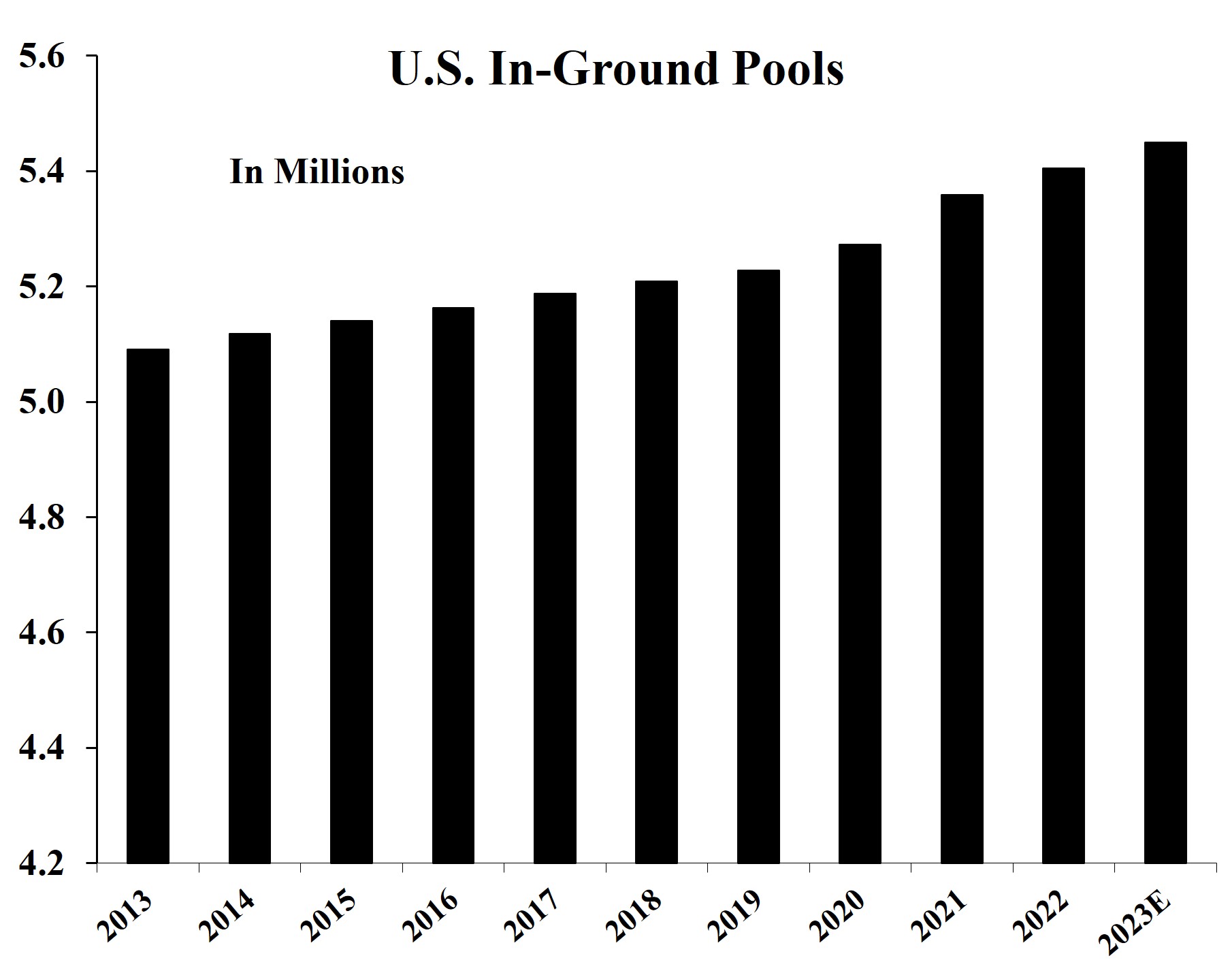

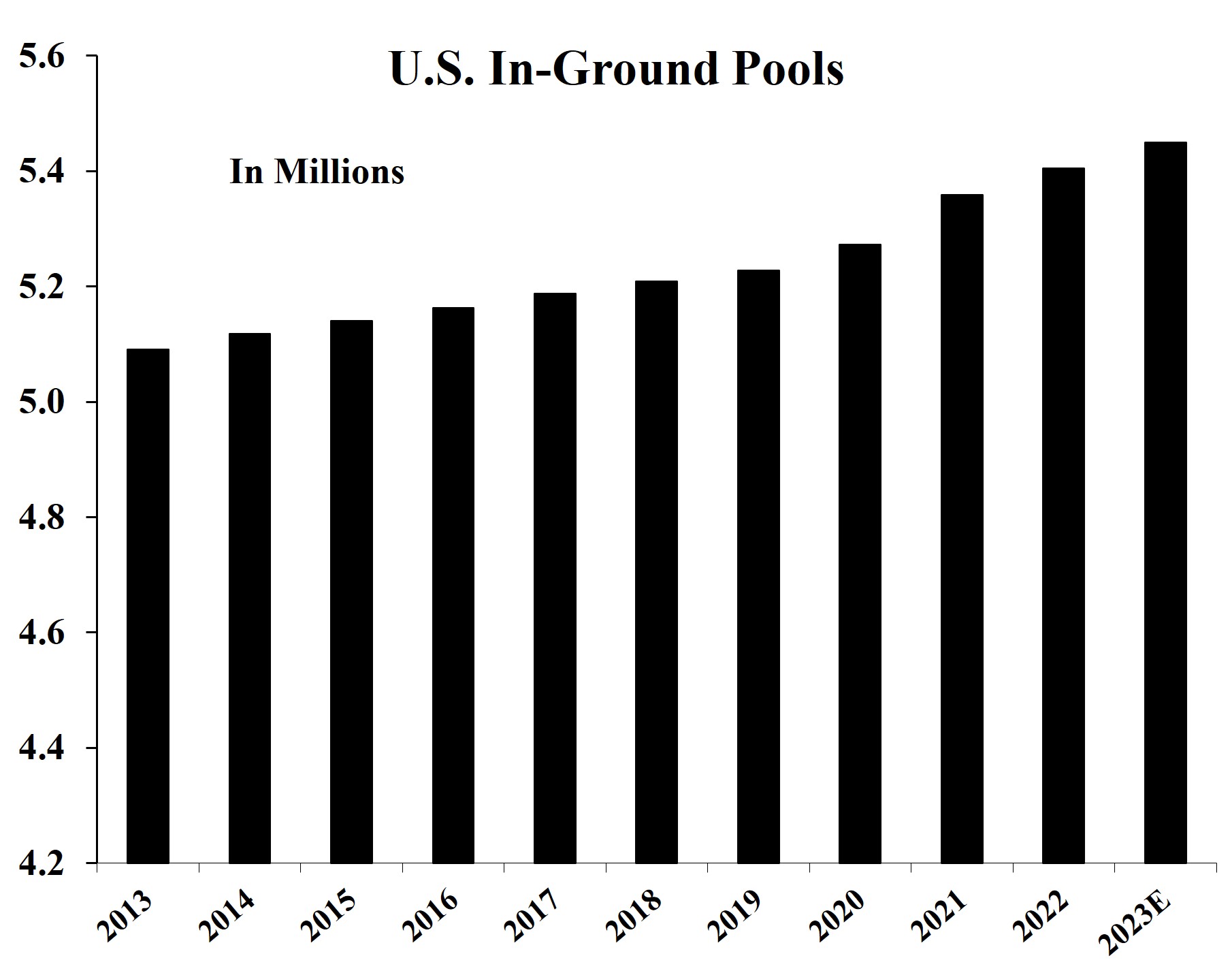

The following table reflects growth in the domestic installed base of in-ground swimming pools over the past 11 years (based on Company estimates and information from 2022 P.K. Data, Inc. reports):

The swimming pool remodel, renovation and upgrade market currently accounts for an estimated 21% to 23% of consumer spending in the pool industry. The activity in this market, which includes major swimming pool remodeling and upgrading, is driven by the aging of the installed base of pools and availability of enhanced feature products such as swimming pool automated controls, variable speed pumps, robotic cleaners and LED pool and hot tub lighting. Many new homeowners with existing pools transform older pools into a modern backyard oasis through upgraded features, finishes and equipment. Among other factors such as the southern population migration and housing shortage trends, the timing of these types of expenditures is more sensitive to economic factors including home values, single-family home sales and consumer confidence that impact consumer spending compared to the maintenance and minor repair market.

We estimate that new swimming pool construction comprises approximately 17% to 18% of consumer spending in the pool industry. The demand for new pools is driven by the perceived benefits of pool ownership including enhanced property value, relaxation, entertainment, family activity, exercise and convenience. The industry competes for new pool sales against other discretionary consumer purchases such as kitchen and bathroom remodeling, boats, motorcycles, recreational vehicles and vacations. The industry is also affected by other factors including, but not limited to, consumer preferences or attitudes toward pool and related outdoor living products for aesthetic, environmental, safety or other reasons.

The irrigation and landscape maintenance industry shares many characteristics with the pool industry, and we believe that it exhibits similar long-term growth rates. Irrigation system installations often occur in tandem with new single-family home construction making them more susceptible to economic variables that drive new home sales. However, the landscape industry offers similar maintenance-related growth opportunities as the swimming pool industry. Product offerings such as chemicals and fertilizers, power equipment and related repair and maintenance services offer recurring revenue streams in an industry otherwise closely tied to the new housing market. The irrigation and landscape maintenance products distribution business serves both residential and commercial markets, with the majority of sales related to the residential market. Within the United States market, we believe that residential and commercial irrigation products account for approximately 30% to 35% of total spending in the industry, with the remaining 65% to 70% of spending related to landscape maintenance products, power equipment, hardscapes and specialty outdoor products and accessories.

Economic Environment

Certain trends in the housing market, the availability of consumer credit and general economic conditions (as commonly measured by Gross Domestic Product or GDP) affect our industry, particularly new pool and irrigation system starts as well as the timing and extent of pool remodels, equipment replacements, landscaping projects and outdoor living space renovations. Consumers typically spend more on new pools, new irrigation systems, renovations and replacement when general economic conditions are strong.

We believe that over the long term, home value appreciation and single-family housing turnover correlate with demand for new pool construction, with higher rates of home appreciation and turnover having a positive impact on new pool installations over time. While most new swimming pools are installed in existing homes, there has also been a correlation of new pool construction activity to new home construction activities over time. We also believe that homeowners’ discretionary spending capacity, availability of consumer credit and favorable borrowing rates are critical factors enabling the purchase of new swimming pools and irrigation systems. Similar to other discretionary purchases, replacement and renovation activities are more heavily impacted by economic factors such as consumer confidence, GDP and employment levels. Contractor labor availability has also become an issue in recent years, limiting our customers’ ability to fully meet consumer construction and renovation demand. While existing home turnover slowed in 2023 driven by higher interest rates and homeowners taking advantage of their existing lower rate mortgages, new home construction grew versus a decline in new pool construction, creating more available backyards for swimming pools when economic conditions stabilize.

Over the past decade, consumers’ investments in their homes, including backyard renovations, have flourished. In recent years, steady increases in home values, lack of affordable new homes and increased mortgage rates have prompted homeowners to stay in their homes longer and upgrade their home environments, including their backyards. Many families have spent more time at home and sought opportunities to create or expand home-based outdoor living and entertainment spaces. These outdoor investment trends, which were particularly heightened during 2020 through 2022, resulted in an increase in new pool construction and greater expenditures for maintenance and remodeling products. In 2023, we estimate that new in-ground pool construction units decreased 23% to approximately 75,000 units from 98,000 units in 2022 as new construction activities declined following significant growth in 2021 and 2020. Our estimate of the new in-ground pool units added in 2023 is consistent with the 78,000 pools added in 2019. We expect that consumers will continue to invest in outdoor living spaces as they consider backyards an extension of their home space. We believe that we are well positioned to benefit from the inherent long-term growth opportunities in our industry fueled by favorable population migration trends, strong housing demand dynamics and product developments and technological advancements as consumers focus on more environmentally sustainable and energy-efficient products.

Historically, annual price inflation averaged 1% to 2% in our industry. We generally pass industry price increases through our supply chain and may make strategic volume inventory purchases ahead of vendor price increases in order to obtain favorable pricing. During 2021 and 2022, supply chain interruptions, production shutdowns and weather-related events resulted in increased inflation as higher costs to produce and transport finished products were passed through to consumers. Our results in 2022 benefited from extraordinary inflationary product cost increases of approximately 10% following a benefit of 7% to 8% in 2021. In 2023, inflationary product cost increases moderated and benefited our sales by approximately 3% to 4%. We believe that results in 2024 will be impacted by inflationary product cost increases of approximately 2% to 3%.

Business Strategy and Growth Strategy

Our mission is to provide exceptional value to our customers and suppliers, creating exceptional return to our shareholders, while providing exceptional opportunities to our employees. Our core strategies are as follows:

•to promote the growth of our industry;

•to promote the growth of our customers’ businesses; and

•to continuously strive to operate more effectively.

We promote the growth of our industry through various advertising and promotional programs intended to raise consumer awareness of the benefits and affordability of pool ownership, the ease of pool maintenance and the many ways in which a pool and the surrounding spaces may be enjoyed beyond swimming. These programs include digital and media advertising, industry-oriented website development such as www.swimmingpool.com®, www.hottubs.com® and www.nptpool.com®, social media platforms and other digital marketing initiatives, including our NPT® Backyard mobile app. We use these programs as tools to educate consumers and lead prospective pool owners to our customers. We also promote the growth of our industry by offering a growing selection of energy-efficient and environmentally preferred products, which support sustainability and can help pool owners save energy, water, time and money. Our environmentally friendly technology products include variable speed pumps, LED pool and hot tub lights and high-efficiency heat pumps. Our Horizon sales centers offer organic fertilizers, organic pesticides, and irrigation and drainage products that reduce water usage and soil erosion, allowing our customers and homeowners to have less of an impact on freshwater reserves.

We promote the growth of our customers’ businesses by offering the broadest product assortment through the largest number of conveniently located market-based sales centers and through comprehensive support programs that include promotional tools and marketing support to help our customers generate increased sales. We provide in depth product training that allows our customers to expand the scope of their product offerings. We also provide uniquely tailored advertising programs that include such features as digital marketing, customer lead generation, personalized websites, brochures, direct mail, marketing campaigns and business development training. As a customer service, we also provide certain customers assistance with all aspects of their business, including site selection, store layout and design, product merchandising, comprehensive product offering selections and efficient ordering and inventory management processes. In addition to these programs, we feature consumer showrooms in over 100 of our sales centers and host our annual Retail Summit to educate our customers about product offerings and the overall industry. We also function as a day-to-day resource by offering product and market expertise to serve our customers’ unique needs.

In addition to our efforts aimed at promoting industry and customer growth, we strive to operate more effectively by continuously focusing on improvements in our operations, which we define as capacity creation. We create capacity with business to business development tools and execution aimed at ensuring best-in-class service and value creation for our customers and suppliers. In particular, our Pool360 and Horizon 24/7 internet and mobile platforms help our customers be more productive by allowing them to digitally receive pricing and product availability information, and enter orders, while leveraging our customer service staff resources, particularly during peak business periods. These tools offer real-time integration into our enterprise resource planning system, creating efficiencies in our business processes and also provide our customers graphical catalog presentation in the same platform. Our BlueStreak mobile ordering platform enables our sales associates to process orders faster, often eliminating the need for customers to get out of their vehicles. We are focused on efficiency at our sales centers and warehouses through order processing speed at the counter, intentional showroom layouts, sales center merchandising, bin replenishment and velocity slotting. Velocity slotting uses technology to identify fast moving, high velocity items, which are then color-coded and placed in an easily accessible location to create efficiencies for both our employees and customers.

We believe that ongoing investments in digital transformation and technology help us provide best-in-class service to our customers by improving the customer experience, enhancing our existing customer relationships and expanding our customer base. To that end, a part of our growth strategy includes investing in technology that allows us to better serve our customers and using this information to make better data-driven decisions for our business. We recently launched Pool360 WaterTest and are in the process of rolling out Pool360 PoolService under our Pool360 platform of technologies. Pool360 WaterTest is a professional water testing software available to our retail customers that works with our complete line of proprietary brand pool and hot tub chemicals. Our Pool360 PoolService app is a mobile tool that allows pool professionals to better manage their service business and improve their customers’ experience. We believe these tools allow us to support and grow our retail and service customer base. Going forward, we plan to continue to grow our suite of Pool360 technologies with additional resources for our customers.

We have grown our distribution networks through new sales center openings, acquisitions and the expansion of existing sales centers depending on our market presence and capacity. For additional information regarding our new sales center openings, acquisitions and closures/consolidations, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Item 8, Note 2 of “Notes to Consolidated Financial Statements,” included in this Form 10-K.

We plan to continue to make strategic acquisitions and open new sales centers to further penetrate existing markets and expand into both new geographic markets and new product categories. We believe that our high customer service levels and expanded product offerings have enabled us to gain market share historically. Going forward, we expect to continue to realize sales growth through market share gains and continued expansion of our product offerings with a focus on our proprietary and exclusive brand products.

Customers and Products

We serve roughly 125,000 customers. No single customer accounted for 10% or more of our sales in 2023. Most of our customers are small, family-owned businesses with relatively limited capital resources. Most of these businesses provide labor and technical services to the end consumer and operate as independent contractors and specialty retailers employing no more than ten employees (in many cases, working alone or with a limited crew). These customers also buy products from other distributors, mass merchants, home stores and certain specialty and internet retailers.

We provide extended payment terms to qualified customers for sales under pre-season early buy programs, which typically occur during the fourth and first quarters. The extended terms usually require payments in equal installments during the second quarter of each year. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Estimates - Allowance for Doubtful Accounts” for additional information.

We sell our products primarily to the following types of customers:

•swimming pool remodelers and builders;

•specialty retailers that sell swimming pool supplies, including independently owned and operated Pinch A Penny franchise stores;

•swimming pool repair and service businesses;

•irrigation construction and landscape maintenance contractors; and

•commercial pool operators and pool contractors who build, remodel or service large commercial installations such as hotels, universities and community recreational facilities.

We conduct our operations through 439 sales centers in North America, Europe and Australia. Our primary markets, with the highest concentration of swimming pools, are California, Texas, Florida and Arizona, collectively representing approximately 54% of our 2023 net sales. In 2023, we generated approximately 95% of our sales in North America (including Canada and Mexico), 4% in Europe and 1% in Australia. While we continue to expand both domestically and internationally, we expect this geographic mix to be similar over the next few years. References to product line and product category data throughout this Form 10-K generally reflect data related to the North American swimming pool market, as it is more readily available for analysis and represents the largest component of our operations.

Our goal is to be a trusted resource for both industry professionals, retailers and consumers in the outdoor living industry. We use local sales and marketing personnel to promote the growth of our business and develop and strengthen our customers’ businesses. Our sales and marketing personnel focus on developing customer training programs and promotional activities, creating and enhancing sales management tools and providing product and market expertise. Our local sales personnel work from our sales centers as trusted resources for our customers and are charged with understanding and meeting our customers’ specific needs. Our sales center personnel help educate our customers on a variety of topics including the newest, most innovative products and solutions that can elevate their businesses.

We offer our customers more than 200,000 manufacturer and proprietary and exclusive brand products. We believe that our selection of pool equipment, supplies, chemicals, replacement parts, irrigation and related products and other pool construction and recreational products is the most comprehensive in the industry. We sell the following types of products:

•maintenance products, such as chemicals, supplies and pool accessories;

•repair and replacement parts for pool equipment, such as cleaners, filters, heaters, pumps and lights;

•building materials, such as concrete, plumbing and electrical components, both functional and decorative pool surfaces, decking materials, tile, hardscapes and natural stone, used for pool installations and remodeling;

•pool equipment and components for new pool construction and the remodeling and replacement of existing pools;

•irrigation and related products, including irrigation system components and professional turf care equipment and supplies;

•commercial pool products, including American Society of Material Engineers heaters, safety equipment, commercial decking equipment and commercial pumps and filters;

•fiberglass pools and hot tubs and packaged pool kits including walls, liners, braces and coping for in-ground and above-ground pools; and

•other pool construction and recreational products, which consist of a number of product categories and include discretionary recreational and related outdoor living products, such as grills and components for outdoor kitchens.

We currently have over 650 product lines and approximately 50 product categories. Based on our 2023 product classifications, sales for our pool and hot tub chemicals product category represented approximately 14% of total net sales for 2023, 13% of total net sales in 2022 and 9% of total net sales in 2021. The increase in pool and hot tub chemicals as a percentage of our total net sales from 2021 to 2022 was driven primarily by our December 2021 acquisition of Porpoise Pool & Patio and its chemical re-packaging plant, combined with inflation and improved supply over the prior year. No other product categories accounted for 10% or more of total net sales in any of the last three fiscal years.

We continue to identify new related product categories, and we typically introduce new categories each year in select markets. We then evaluate the performance in these markets and focus on those product categories that we believe exhibit the best long-term growth potential. We expect to realize continued sales growth for these types of product offerings by expanding the number of locations that offer these products, increasing the number of products offered at certain locations and continuing a modest broadening of these product offerings on a company-wide basis.

New product technology provides opportunities not only for improved energy-efficiency but also expanded control and convenience in enjoying leisure activities. We offer a growing selection of energy-efficient and environmentally preferred products, which support sustainability and can help pool owners save energy, water, time and money. Major equipment manufacturers have developed and will continue to develop more retrofit kits that allow homeowners to interact with their pools or hot tubs through their smartphones. Also, robotic cleaners offer consumers a more efficient option for maintaining their swimming pools. We see each of these developments as significant growth opportunities.

Over the last several years, we have increased our product offerings and service abilities related to commercial swimming pools. We consider the commercial market to be a key growth opportunity as we focus more attention on providing products to customers who operate and service large commercial installations such as hotels, condominiums, apartment complexes, universities and community recreational facilities. We continue to leverage our existing sales center networks and customer and vendor relationships to grow this market.

In 2023, the sale of maintenance and minor repair products (non-discretionary) accounted for approximately 62% of our sales, while approximately 24% of our sales were derived from partially discretionary products used in the remodel, renovation, upgrade of pools and approximately 14% of our sales were derived from discretionary products used in the construction and installation (equipment, materials, plumbing, electrical, etc.) of swimming pools. These components may vary from year to year.

Operating Strategy

We distribute swimming pool supplies, equipment and related leisure products domestically through our SCP and Superior sales center networks and internationally through our SCP network. We adopted the strategy of operating two distinct distribution networks within the U.S. swimming pool market primarily to offer our customers a choice of distinctive product selections, locations and service personnel. We distribute irrigation, landscape maintenance and related products through our Horizon network.

Swimming pool tile, decking materials and interior pool surfacing products are distributed through our NPT network, as well as through SCP and Superior networks. Our NPT network primarily serves the swimming pool market with our market-leading brand of pool tile and composite pool finish products but also provides some overlap with the irrigation and landscape industry as we offer NPT hardscapes and other outdoor living products. As more consumers create and enhance outdoor living areas and invest more in their outdoor environment, we believe we can focus our resources to address such demand by leveraging our existing pool and irrigation and landscape maintenance customer base. We feel the development of our NPT network is a natural extension of our distribution model. In addition to our 21 standalone NPT sales centers, we currently have over 100 SCP and Superior sales centers that feature consumer showrooms where landscape and swimming pool contractors, as well as homeowners, can view and select pool components including pool tile, decking materials and interior pool finishes in various styles and grades, and serve as stocking locations for our NPT brand products. We also offer virtual tools for homeowners to select and design their pool and outdoor environments, collaborating with their chosen contractors to install these products. Our NPT® Backyard mobile app and www.nptpool.com® allow our customers to virtually design, customize and view a pool in their own backyard within seconds. We believe our showrooms, local stocking of products and virtual support provide us with a competitive advantage in these categories. Given the more discretionary nature of these products, this business is more sensitive to external market factors compared to our business overall.

Sun Wholesale Supply, which we acquired in December 2021, distributes swimming pool supplies, equipment and related leisure products, primarily servicing independently owned and operated Pinch A Penny, Inc. franchise locations. Since December 2021, we have expanded Pinch A Penny franchise operations through additional locations of Pinch A Penny franchised stores and expect to continue these expansion initiatives. Sun Wholesale Supply also owns and operates a specialty chemical re-packaging plant providing pool chemical products to the Pinch A Penny franchised store network and a portion of the chemical products sold through our SCP and Superior sales centers.

We evaluate our sales centers based on their performance relative to predetermined standards that include both financial and operational measures. Our corporate support groups provide our field operations with various services, such as developing and coordinating customer and vendor related programs, services from our real estate support function to find appropriate locations for our sales centers, human resources support, information systems support, support from our logistics and fleet teams, accounting and financial analysis support and expert resources to help them achieve their goals. We believe our incentive programs and feedback tools, along with the competitive nature of our sales center network, stimulate and enhance employee performance.

Distribution

Our sales centers are located within population centers near customer concentrations, typically in industrial, commercial or mixed-use zones. Customers may pick up products at any sales center location, or we may deliver products to their premises or job sites via our trucks or third-party carriers. For additional information on our sales centers, see Item 2, “Properties,” of this Form 10-K.

Our sales centers maintain well-stocked inventories to meet our customers’ immediate needs. We utilize warehouse management technology to optimize receiving, inventory control, picking, packing and shipping functions. For additional information regarding our inventory management, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Estimates - Inventory Obsolescence,” of this Form 10-K.

We also operate four centralized shipping locations (CSLs) in the United States that redistribute products we purchase in bulk quantities to our sales centers or, in some cases, directly to customers. Our CSLs are regional locations that carry a wide range of outdoor living products.

Purchasing and Suppliers

We believe we enjoy good relationships with our suppliers, who generally offer competitive pricing, return policies and promotional allowances. It is customary in our industry for certain manufacturers to manage their shipments by offering seasonal terms to qualifying purchasers such as Pool Corporation, which are referred to as early buy purchases. These early buy purchases typically allow us to place orders in the fall at a modest discount, take delivery of product during the off-season months and pay for these purchases in the spring or early summer. Due to vendor backlogs resulting in product availability constraints, these early buy opportunities were generally not available in 2021 or 2020. Although early buy opportunities were re-established in 2022, they were not widely utilized until 2023 due to higher stocking levels in 2022.

Our preferred vendor program encourages our distribution networks to stock and sell products from a smaller number of vendors offering the best overall terms and service to optimize profitability and shareholder return. We also work closely with our vendors to develop programs and services to better meet the needs of our customers and to concentrate our inventory investments. These practices, together with a more comprehensive service offering, have positively impacted our selling margins and our returns on inventory investments. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Estimates - Vendor Programs,” for additional information.

We regularly evaluate supplier relationships and consider alternate sourcing to ensure competitive cost, service and quality standards. Our largest suppliers include Pentair plc, Hayward Pool Products, Inc. and Zodiac Pool Systems, Inc., which accounted for approximately 19%, 10% and 10%, respectively, of the cost of products we sold in 2023.

Competition

We are the largest wholesale distributor of swimming pool and related backyard products (based on industry knowledge and available data) and one of the only national wholesale distributors focused on the swimming pool industry in the United States. We are also one of the leading distributors of irrigation and landscape maintenance products in the United States. We face intense competition from many regional and local distributors in our markets and from three national wholesale distributors of irrigation and landscape supplies. We also face competition, both directly and indirectly, from mass market retailers (both store-based and internet) and large pool supply retailers who primarily buy directly from manufacturers.

Some geographic markets we serve, particularly the four largest and higher pool density markets of California, Texas, Florida and Arizona, have a greater concentration of competition than others. Barriers to entry in our industry are relatively low. We believe that the principal competitive factors in swimming pool and irrigation and landscape supply distribution are:

•the breadth and availability of products offered;

•the quality and level of customer service, including ease of ordering and speed of product delivery;

•the breadth and depth of sales and marketing programs;

•consistency and stability of business relationships with customers and suppliers;

•competitive product pricing; and

•geographic proximity to the customer.

Environmental, Social and Governance (ESG)

Environmental

We are committed to sustainable business practices, which includes offering eco-friendly products to our customers, closely monitoring our sourcing activities, and being good stewards within the communities we serve. We are taking steps to reduce our carbon footprint and to improve product choices that allow pool and homeowners to reduce their environmental impact. We are also installing more energy-efficient systems throughout our sales center network. We continually strive to ensure success in our business while protecting resources for future generations. Our sustainability goals include the reduction of greenhouse gases and other harmful air emissions, water conservation, energy conservation and carbon footprint minimization. We also endeavor to handle, distribute, transport and dispose of all products in a responsible manner, particularly the chemicals and fertilizers that we sell.

Social - Human Capital Management

We employed approximately 6,000 people at December 31, 2023 and approximately 90% of our employees were located in the U.S. Given the seasonal nature of our business, our peak employment period is the summer season and, depending on expected sales levels, we add 100 to 200 employees to our work force to meet seasonal demand. We believe that we have good relations with our employees. None of our employees are currently covered under any collective bargaining agreements.

Our goal is to be an Employer of Choice by focusing on the engagement, development, retention, and health and well‑being of our employees. We believe that our success is a direct result of the contributions and commitment of our employees. We provide competitive pay and benefits, training and continuing education, and professional development and promotional opportunities to engage and reward our team. We have established a set of standard operating procedures to optimize our human capital management function, including recruitment and employee relations policies, training practices and operational instructions. We focus on the following factors in implementing and developing our human capital strategy:

•employee health, safety and wellness;

•diversity, equity and inclusion;

•employee growth and development; and

•employee compensation and benefits.

Employee Health, Safety and Wellness

Our commitment to the health, safety and wellness of our employees ranks at the top of our core operating priorities. Our ultimate goal is to send every employee home each night in the same condition in which they came to work that morning. We aim to achieve zero serious injuries through continued investment in, and focus on, our core safety programs and injury-reduction initiatives. This effort begins immediately with new employees and is reinforced each day through a focus on training, safety awareness, risk identification and other essential safety protocols. We closely monitor overall workers’ compensation and auto claims, OSHA recordable incidents, Department of Transportation compliance and other internally established safety prevention elements in an effort to make every workday safe.

Diversity, Equity and Inclusion (DEI)

We are committed to fostering a diverse, equitable and inclusive workplace that represents the communities in which we work and live. We believe that diversity drives innovation and delivers the best solutions to complex problems. Our culture is one where differences are welcomed, valued and respected.

We are committed to expanding the diversity of our workforce through the hiring, retention and advancement of underrepresented populations. To achieve this, our approach to DEI is as follows:

•Diversity: Recruit, develop and retain a diverse workforce and provide developmental opportunities for career advancement for all employees;

•Equity: Ensure that our policies, practices and procedures are fair and enable equal employment opportunity for prospective candidates and employees; and

•Inclusion: Communicate that we, as an Employer of Choice, are committed to DEI with action-oriented programs that produce results and employee engagement.

Our DEI efforts are focused on expanding content in core employee development programs and improving our ability to recruit and hire first-class diverse talent. To create connection and community, we have established a Women’s Interactive Network (WIN) and diversity mentoring program to cultivate the growth and development of our female and diverse employees. We also support our employees with training and development opportunities, which includes content aimed at creating and sustaining an inclusive environment.

Employee Growth and Development

We strive to be an Employer of Choice by investing in our employees. Our goal is to attract, develop and retain a talented team of diverse people inspired by our mission to provide exceptional value to our customers and suppliers and create exceptional return to our shareholders, while providing exceptional opportunities for our employees. Our success depends on our employees understanding how their work contributes to the company’s overall strategy.

When our employees succeed, the company succeeds. To help our employees achieve success in their roles, we emphasize continuous training and career development opportunities. These opportunities include annual performance reviews, succession planning, promotion and advancement opportunities, ongoing training in safety and security protocols, updates on new products and service offerings and deployment of technologies. We also provide a series of managerial training to our field and departmental leaders. This coursework covers topics such as leading with inclusion, recruitment best practices, effective communications, leading and empowering others and managing employee performance.

We also provide an entry level training program to prepare Manager Trainees (MITs) for sales and operations management opportunities and build our pipeline for field leadership. Our MITs are hosted at either our state-of-the-art EDGEucation Center or in a virtual classroom. They gain valuable experience during their training program through field-based interaction with customers and operating management. Our program includes interaction with subject matter experts, hands-on projects and role play to provide MITs with practical industry knowledge, leadership skills and the tools necessary to succeed within our organization.

Our employees are also involved in a multitude of volunteer efforts that positively impact our communities through support of charitable organizations. We have donated over $3 million through our partnerships with YMCAs across the country to provide free water safety lessons and lifeguard training in underserved communities. Our donations have funded safety around water swimming lessons and lifeguard training scholarships from coast to coast. Our local employees and partners have also donated their time and energy to make these events a success.

Employee Compensation and Benefits

We strive to provide market-competitive compensation, benefits and services to our employees. Our performance-based compensation philosophy rewards each employee’s individual contributions regardless of gender, race or ethnicity. Our total compensation package includes cash compensation (base salary and performance-based incentive or bonus payments), company contributions toward additional benefits (such as health and disability plans), retirement plans with a company match and paid time off. We also offer the opportunity to become a shareholder through equity grants for management and our employee stock purchase plan. Our employees can take advantage of a range of benefits, including healthcare and wellness programs, tuition reimbursement for eligible employees and multi-year scholarships to their dependents, and financial wellness programs to help provide education and tools to assist in improving, maintaining and capitalizing on our employees’ financial future. We closely monitor employee turnover and conduct exit interviews to gain relevant information and adapt our engagement and retention strategy as appropriate.

Governance

Our employees, managers and officers conduct our business under the direction of our CEO and the oversight of our Board of Directors (our Board) to enhance our long-term value for our stockholders. The core responsibility of our Board is to exercise its fiduciary duty to act in the best interests of our company and our stockholders. In exercising this obligation, our Board and committees perform a number of specific functions, including risk assessment, review and oversight. While management is responsible for the day-to-day management of risk, our Board is responsible for oversight of our risk management programs, ensuring that an appropriate culture of risk management exists within the company, and assisting management in addressing specific risks, such as strategic risks, financial risks, cybersecurity risks, regulatory risks and operational risks.

Seasonality and Weather

Our business is seasonal. In general, sales and operating income are highest during the second and third quarters, which represent the peak months of swimming pool use, pool and irrigation installation and remodeling and repair activities. Sales are lower during the first and fourth quarters. In 2023, we generated approximately 60% of our net sales and 70% of our operating income in the second and third quarters of the year.

We typically experience a build-up of product inventories and accounts payable during the winter months in anticipation of the peak selling season. Excluding borrowings to finance acquisitions, dividend payments and share repurchases, our peak borrowing usually occurs during the late spring and summer, primarily because extended terms offered by certain of our suppliers are typically payable during the second quarter of each year, while our peak accounts receivable collections typically occur in June, July and August.

We expect that our quarterly results of operations will continue to fluctuate depending on the timing and amount of revenue contributed by new and acquired sales centers. Based on our peak summer selling season, we generally open new sales centers and close or consolidate sales centers, when warranted, either in the first quarter before the peak selling season begins or in the fourth quarter after the peak selling season ends.

Weather is one of the principal external factors affecting our business. The table below presents some of the possible effects resulting from various weather conditions.

| | | | | | | | |

| Weather | | Possible Effects |

| Hot and dry | • | Increased purchases of chemicals and supplies |

| | | for existing swimming pools |

| | • | Increased purchases of above-ground pools and |

| | | irrigation and lawn care products |

| | |

| Unseasonably cool weather or extraordinary amounts | • | Fewer pool and irrigation and landscaping |

| of rain | | installations |

| • | Decreased purchases of chemicals and supplies |

| • | Decreased purchases of impulse items such as |

| | | above-ground pools and accessories |

| | |

| Unseasonably early warming trends in spring/late cooling | • | A longer pool and landscape season, thus positively |

| trends in fall | | impacting our sales |

| (primarily in the northern half of the U.S. and Canada) | | |

| | |

| Unseasonably late warming trends in spring/early cooling | • | A shorter pool and landscape season, thus negatively |

| trends in fall | | impacting our sales |

| (primarily in the northern half of the U.S. and Canada) | | |

For discussion regarding the effects seasonality and weather had on our results of operations in 2023 and 2022, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Seasonality and Quarterly Fluctuations,” of this Form 10-K.

Government Regulations

Our business is subject to a wide variety of regulations, principally under local fire codes and international, federal, state and local environmental and health and safety requirements, including regulation by the Environmental Protection Agency, the Consumer Product Safety Commission, the Department of Transportation, the Occupational Safety and Health Administration, the National Fire Protection Agency and the International Maritime Organization. Most of these requirements govern the packaging, labeling, handling, transportation, storage and sale of chemicals and fertilizers. We store certain types of chemicals and/or fertilizers at each of our sales centers and the storage of these items is strictly regulated by local fire codes. In addition, we sell algaecides and pest control products that are regulated as pesticides under the Federal Insecticide, Fungicide and Rodenticide Act and various state pesticide laws. These laws primarily relate to labeling, annual registration and licensing.

Intellectual Property

We maintain both domestic and foreign registered trademarks and patents, primarily for our proprietary and exclusive brand products that are important to our current and future business operations. We also own rights to numerous internet domain names.

Geographic Areas

The table below presents net sales by geographic region, with international sales translated into U.S. dollars at prevailing exchange rates, for the past three fiscal years (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2023 | | 2022 | | 2021 |

| United States | | $ | 5,126,308 | | | $ | 5,674,909 | | | $ | 4,749,459 | |

| International | | 415,287 | | | 504,818 | | | 546,125 | |

| | | $ | 5,541,595 | | | $ | 6,179,727 | | | $ | 5,295,584 | |

The table below presents net property and equipment by geographic region, with international property and equipment balances translated into U.S. dollars at prevailing exchange rates, for the past three fiscal year ends (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, |

| | | 2023 | | 2022 | | 2021 |

| United States | | $ | 215,109 | | | $ | 185,117 | | | $ | 171,408 | |

| International | | 8,820 | | | 8,592 | | | 7,600 | |

| | | $ | 223,929 | | | $ | 193,709 | | | $ | 179,008 | |

Website Access and Additional Information

Our website is www.poolcorp.com. Our website and other websites mentioned in this Form 10-K are for information only and the contents of such websites are not incorporated in, or otherwise to be regarded as part of, this Form 10-K.

Our periodic reports, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on our website at www.poolcorp.com as soon as reasonably practicable after we electronically file such reports with, or furnish them to, the Securities and Exchange Commission (SEC).

We regularly evaluate the possibility of acquiring additional companies, and at any given time may be engaged in discussions or negotiations regarding these transactions. We generally do not announce our acquisitions until they are completed, unless it is required by regulatory or other rules to announce when a definitive agreement is reached.

Investors should also be aware that while we may answer questions raised by securities analysts, it is against our policy to disclose any material non-public information or other confidential information. Accordingly, investors should not assume that we agree with any statement or report issued by an analyst with respect to our past or projected performance. To the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not our responsibility.

Unless otherwise indicated, information contained in this report and other documents filed by us under the federal securities laws concerning our views and expectations regarding the industries in which we operate are based on estimates made by us using data from industry sources and making assumptions based on our industry knowledge and experience. We have not independently verified data from industry or other third-party sources and cannot guarantee its accuracy or completeness.

In this annual report and other of our public disclosures, we estimate the impact that favorable or unfavorable weather had on our operating results. In connection with these estimates, we make several assumptions and rely on various third-party sources. It is possible that others assessing the same data could reach conclusions that differ from ours.

Item 1A. Risk Factors

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

This report contains forward-looking information that involves risks and uncertainties. Our forward-looking statements express our current expectations or forecasts of possible future results or events, including projections of earnings and other financial performance measures, statements of management’s expectations regarding our strategic, operational and capital allocation plans and objectives, management’s views on industry, economic, competitive, technological and regulatory conditions and other forecasts of trends and other matters. Forward-looking statements speak only as of the date of this filing, and we undertake no obligation to publicly update or revise such statements to reflect new circumstances or unanticipated events as they occur. You can identify these statements by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate,” “estimate,” “expect,” “intend,” “believe,” “will,” “outlook,” “project,” “may,” “can,” “plan,” “target,” “potential,” “should” and other words and expressions of similar meaning.

No assurance can be given that the expected results in any forward-looking statement will be achieved, and actual results may differ materially due to one or more factors, including the risks described below in this Item 1A, below in Item 7 of this Form 10-K and elsewhere in this Form 10-K. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act.

Risk Factors

Investing in our securities involves multiple risks and uncertainties. Certain factors that may affect our business and could cause actual results to differ materially from those expressed in any forward-looking statement are described below. Investors should carefully consider the risks described below in addition to the other information set forth in this Annual Report on Form 10-K. The risks discussed below are not the only risks we face. Other risks or uncertainties not presently known to us, or that we currently believe are immaterial, may materially affect our business if they occur. Moreover, new risks emerge from time to time. Further, our business may also be affected by additional factors that generally apply to all companies operating in the U.S. and globally, which we have not included below.

Risks Relating to Macroeconomic Conditions or Events

The demand for our products may be adversely affected by unfavorable economic conditions and changes in consumer discretionary spending.

Demand for our products is subject to fluctuations and is difficult to predict, often due to factors outside of our control. Consumer discretionary spending significantly affects our sales and is impacted by a variety of factors, including general economic conditions, the residential housing market, unemployment rates, wage levels, interest rate fluctuations, inflation, disposable income levels, consumer confidence and access to credit. In economic downturns or recessions, the demand for swimming pool, irrigation, landscape and related outdoor living products typically declines, often corresponding with declines in discretionary consumer spending, the growth rate of pool eligible households and swimming pool construction. Currently over 86% of our net sales are derived from sales of maintenance, repair, replacement and renovation products necessary to maintain existing swimming pools. However, the growth in this portion of our business depends on the expansion of the installed pool base, which could also be adversely affected by decreases in construction activities, similar to the trends experienced this past year. A weak economy may also cause consumers to defer discretionary replacement and renovation activity. Even in generally favorable economic conditions, severe or prolonged downturns in the housing market could have a material adverse impact on our financial performance. Such downturns expose us to certain additional risks, including but not limited to the risk of customer closures or bankruptcies, which could shrink our potential customer base and inhibit our ability to collect on those customers’ receivables.

We believe that homeowners’ access to consumer credit at attractive interest rates is a critical factor enabling the purchase of new pools, irrigation systems and outdoor living products. Unfavorable economic conditions or a downturn in the housing market could result in a significant tightening of credit markets, which can limit the ability of consumers to access financing for new swimming pools and irrigation systems.

During 2022 and 2023, interest and inflation rates were higher than the three years prior to 2022, economic uncertainties increased, and consumer credit tightened, which led to a slowdown in new pool permits (signaling a decline in new construction projects). During 2023, the heightened demand for our products during the pandemic moderated as consumers applied less disposable income to pools and other home improvements. These economic events reduced our revenues in 2023 and are expected to similarly impact our revenues in 2024.

Discretionary spending is often adversely affected during times of economic, social or political uncertainty, whether caused by health threats, man-made or natural disasters, or other similar events discussed below in this item 1A. These events could create uncertainties that negatively impact our business in ways that we cannot presently predict.

Changes in our customer base could also impact us. Our business could be adversely impacted if (i) consolidation of our customers leads to changes in purchasing habits, (ii) more people choose to live in urban settings or (iii) more homeowners bypass our customers by directly procuring their own supplies or undertaking their own improvement projects.

An outbreak of disease or similar public health threat, such as the recent COVID-19 pandemic, could adversely impact our business and results of operations.

An outbreak of disease or similar public health threat, such as the recent COVID-19 pandemic and its negative impact on the worldwide economy, could have an adverse impact on our workforce, supply chain or operations. Although our revenues increased during the COVID-19 pandemic that began in early 2020, we cannot assure you that our revenues would increase in the event of a future public health emergency. New variants of COVID-19 could continue to cause outbreaks and uncertainties, and any future epidemics, pandemics or similar public health crises could adversely impact our business and results of operations.

Other catastrophic events or societal unrest could adversely impact our operations.

Terrorist attacks, wars, rioting, labor strife, civil disturbances, societal unrest or political instability could negatively impact us directly by interfering with our ability to operate or indirectly by depressing macroeconomic conditions. Our customers could also encounter hardships that negatively impact their ability to make timely payments to us or to continue doing business with us.

Risks Relating to Our Business and Industry

We are susceptible to adverse weather conditions, which could intensify as a result of climate change.

Given the nature of our business, weather is one of the principal external factors affecting our business and the effect of seasonality has a significant impact on our results. In 2023, we generated approximately 60% of our net sales and 70% of our operating income in the second and third quarters of the year. These quarters represent the peak months of swimming pool use, pool and irrigation installation and remodeling and repair activities. Unfavorable weather during these quarters in our largest geographic regions can significantly affect our results. Unseasonably late warming trends in the spring or early cooling trends in the fall can shorten the length of the pool season. Also, unseasonably cool weather or excessive rainfall during the peak season can have an adverse impact on demand due to decreased swimming pool use, installation and maintenance, as well as decreased irrigation installations. While warmer weather conditions generally impact our sales favorably, global warming trends and other significant climate changes can create more variability in the short term or lead to other unfavorable weather conditions that could adversely impact our sales or operations. Drought conditions or water management initiatives may lead to government-imposed water use restrictions. Such restrictions could result in decreased pool and irrigation system installations which could negatively impact our sales.

Certain extreme weather events and natural disasters, such as hurricanes, tornadoes, earthquakes, tropical storms, floods, drought and wildfires, may adversely impact us in several ways, including interfering with our ability to deliver our products and services, interfering with our receipt of supplies from our vendors, reducing demand for our products and services, and damaging our facilities. We have experienced short-term impacts on our sales due to closures from weather events in recent years, including Hurricane Ian in Florida in 2022. Although these events have not had any material lasting impacts on our business or resulted in any material permanent operational challenges, similar events could adversely affect our business in the future. The areas in which we operate, including California, Florida, Texas and other coastal areas, have experienced recent natural disasters or present increased risks of adverse weather or natural disasters. The physical effects of climate change may increase the frequency or severity of natural disasters and other extreme weather events in the future, which would increase our exposure to these risks.

For additional discussion regarding seasonality and weather, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Seasonality and Quarterly Fluctuations,” of this Form 10-K.

Our distribution business is highly dependent on our ability to maintain favorable and stable relationships with suppliers.

As a distribution company, maintaining favorable relationships with our suppliers is critical to our success. We believe that we add considerable value to the swimming pool and irrigation supply chains by purchasing products from a large number of manufacturers and distributing the products to a highly fragmented customer base on conditions that are more favorable than these customers could obtain on their own. We believe that we currently enjoy good relationships with our suppliers, who generally offer us competitive pricing, return policies and promotional allowances. However, any failure to maintain favorable relationships with our suppliers could have an adverse effect on our business.

Our largest suppliers are Pentair plc, Hayward Pool Products, Inc. and Zodiac Pool Systems, Inc., which accounted for approximately 19%, 10% and 10%, respectively, of the costs of products we sold in 2023. A decision by our largest suppliers, acting individually or in concert, to sell their products directly to retailers or other end users of their products, bypassing distribution companies like ours, would have an adverse effect on our business. Additionally, if our suppliers experience difficulties or disruptions in their operations, if there is any material interruption in our supply chain (such as the interruptions caused by the COVID-19 pandemic and exacerbated by the war in Ukraine) or if we lose a single significant supplier due to financial failure or a decision to sell exclusively to retailers or end-use consumers, we may experience increased supply costs or delays in establishing replacement supply sources that meet our quality and control standards, which may affect our profitability.

Failure to achieve and maintain a high level of product and service quality and safety could damage our reputation, expose us to litigation and negatively impact our financial performance.