UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12

Pool Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No Fee Required

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1. | Title of each class of securities to which transaction applies: |

2. | Aggregate number of securities to which transaction applies: |

3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11. (Set forth the amount on which the filing fee is calculated and state how it was determined): |

4. | Proposed maximum aggregate value of transaction: |

5. | Total Fee Paid: |

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1. | Amount Previously Paid: |

2. | Form, Schedule or Registration Statement No: |

3. | Filing Party: |

4. | Date Filed: |

POOL CORPORATION

_____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2016 annual meeting of stockholders (the Annual Meeting) of Pool Corporation (the Company, we, us or our) will be held on Wednesday, May 4, 2016, at 9:00 a.m., Central Time, at our corporate headquarters, located at 109 Northpark Boulevard, Covington, Louisiana 70433.

At the Annual Meeting, you will be asked to:

1. | elect eight directors, each to serve a one-year term or until their successors have been elected and qualified; |

2. | ratify the retention of Ernst & Young LLP, certified public accountants, as our independent registered public accounting firm for the 2016 fiscal year; |

3. | cast a non-binding advisory vote to approve the compensation of our named executive officers as disclosed in the attached Proxy Statement (the say-on-pay vote); |

4. | reapprove the Pool Corporation Strategic Plan Incentive Program; |

5. | approve the Pool Corporation Amended and Restated 2007 Long-Term Incentive Plan; |

6. | approve the Pool Corporation Executive Officer Annual Incentive Plan; |

7. | approve the Pool Corporation Amended and Restated Employee Stock Purchase Plan; and |

8. | consider any other business which may properly arise at the Annual Meeting. |

The accompanying Proxy Statement describes the matters being voted on and contains other information relating to Pool Corporation.

The Board of Directors has set March 16, 2016 as the record date for the Annual Meeting. This means that only record owners of the Company’s common stock at the close of business on that date are entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement of the Annual Meeting.

By Order of the Board of Directors,

Jennifer M. Neil

Corporate Secretary

Covington, Louisiana

March 30, 2016

We urge each stockholder to promptly sign and return the enclosed proxy card or if applicable, to use telephone or internet voting. See “Frequently Asked Questions Regarding Attendance and Voting” for information about voting by telephone or internet.

POOL CORPORATION

TABLE OF CONTENTS

Page | |

POOL CORPORATION

109 Northpark Boulevard

Covington, Louisiana 70433

PROXY STATEMENT

Frequently Asked Questions Regarding Attendance and Voting

Q: Why am I receiving these materials?

A: The Board of Directors (the Board) of Pool Corporation (the Company, we, us or our) is providing these proxy materials to you in connection with its solicitation of proxies for use at the 2016 annual meeting of our stockholders (the Annual Meeting). Stockholders at the close of business on March 16, 2016, the record date, are entitled to vote at the Annual Meeting.

Q: Who may vote?

A: With respect to the election of directors, each stockholder is entitled to one vote for every share of common stock, $0.001 par value (Common Stock) owned on the record date for each position to be filled. For all other matters, each stockholder is entitled to one vote on each matter presented for each share of our Common Stock owned on the record date. On March 16, 2016, there were approximately 42,024,738 shares of our Common Stock outstanding. This Proxy Statement is being mailed to stockholders on or about March 30, 2016.

Q: When and where will the Annual Meeting be held?

A: The Annual Meeting will be held on Wednesday, May 4, 2016, at 9:00 a.m., Central Time, at our corporate headquarters, located at 109 Northpark Boulevard, Covington, Louisiana 70433.

Q: How can I obtain directions to the Annual Meeting?

A: To obtain directions to the Annual Meeting, please contact Investor Relations at (985) 892-5521.

Q: What proposals will be voted upon at the Annual Meeting?

A: At the Annual Meeting, you will be asked to:

(1) | elect eight directors to the Board of Directors, each to serve a one-year term or until their successors have been elected and qualified; |

(2) | ratify the retention of Ernst &Young LLP as our independent registered public accounting firm for the 2016 fiscal year; |

(3) | cast a non-binding advisory vote to approve the compensation of our named executive officers as disclosed in this Proxy Statement (the say-on-pay vote); |

(4) | reapprove the Pool Corporation Strategic Plan Incentive Program; |

(5) | approve the Pool Corporation Amended and Restated 2007 Long-Term Incentive Plan; |

(6) | approve the Pool Corporation Executive Officer Annual Incentive Plan; and |

(7) | approve the Pool Corporation Amended and Restated Employee Stock Purchase Plan. |

The Board does not know of any additional matters to be presented at our Annual Meeting other than those described in this Proxy Statement.

Q: What are the Board’s voting recommendations?

A: The Board unanimously recommends that you vote your shares FOR each of the seven proposals described above.

1

Q: How do I vote?

A: If you are a holder of record (that is, if your shares are registered in your own name with our transfer agent), you may vote using the enclosed proxy card. You can also vote by telephone or the internet. Voting instructions are provided on the proxy card included in the proxy materials.

If you are a street name holder (that is, if you hold your shares through a bank, broker or other holder of record), you must vote in accordance with the voting instruction form provided by your bank, broker or other holder of record. The availability of telephone or internet voting will depend upon the voting process of your bank, broker or other holder of record.

If you come to the Annual Meeting, you can, of course, vote in person. If you are a street name holder and wish to vote at the meeting, you must first obtain a proxy from your bank, broker or other holder of record authorizing you to vote.

Q: How many votes must be represented to hold the Annual Meeting?

A: In order to carry on the business of the Annual Meeting, a quorum must be present. This means at least a majority of the outstanding shares eligible to vote must be represented at the Annual Meeting, either by proxy or in person. If you submit your proxy instructions or if you attend the Annual Meeting in person, your shares will be counted for the purpose of determining a quorum, even if you abstain from voting on some or all matters introduced at the Annual Meeting. Also, if you hold your shares in street name, your shares will be counted in determining a quorum if your broker, bank or other holder of record votes your shares on any matter.

Q: Could other matters be decided at the Annual Meeting?

A: We are not aware of any matters to be presented other than those described in this Proxy Statement. By signing and returning a proxy card, however, you will give to the persons named as proxies discretionary voting authority with respect to any other matter that may properly come before the Annual Meeting, and they intend to vote on any such matter in accordance with their best judgment.

Q: What if I do not indicate my voting instructions for one or more of the matters on my proxy card?

A: If you execute and return your proxy but do not give voting instructions, your shares will be voted as recommended by the Board. This means that unless your proxy is otherwise marked, properly executed proxies will be voted FOR the election of each of the director nominees, and FOR each of the other proposals.

Q: What happens if I do not return my proxy? What is discretionary voting authority, and what is a broker non-vote?

A: If you are a holder of record and do not return a proxy, your shares will not be voted.

If you are a street name holder and do not provide voting instructions to your broker, your shares may be voted on any matter on which your broker has discretionary authority to vote. Under the rules of the New York Stock Exchange (NYSE), brokers generally have discretionary authority to vote on “routine” matters but not on “non-routine” matters. A “broker non-vote” occurs when a broker holding shares for a street name holder returns a valid proxy, but does not vote on a particular proposal because it does not have discretionary authority to vote on the matter and has not received voting instructions from the stockholder for whom it is holding shares. Broker non‑votes will be treated as present for purposes of determining the existence of a quorum at the Annual Meeting.

The ratification of the appointment of the independent registered public accounting firm is considered a routine matter; the remaining proposals listed in this Proxy Statement are classified as non-routine matters under the NYSE rules. Therefore, if you are a street name holder and do not provide voting instructions to your broker, your broker may only cast a vote with regard to the ratification of the appointment of the independent registered public accounting firm.

2

Q: What is the vote required, and how will my vote be counted, to elect the director nominees and to approve each of the other proposals discussed in this proxy statement?

Proposal | Voting Options | Vote Required to Adopt the Proposal | Effect of Abstentions | Effect of Broker Non-Votes | ||||

No. 1 - Election of eight director nominees | For, against or abstain on each director nominee | Affirmative vote of a majority of the votes cast | N/A | No effect | ||||

No. 2 - Ratification of the appointment of our independent registered public accounting firm | For, against or abstain | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote | Treated as votes against | N/A | ||||

No. 3 - Approval, on an advisory basis, of the compensation of our executive officers | For, against, or abstain | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote | Treated as votes against | No effect | ||||

No. 4 - Reapproval of the Company’s Strategic Plan Incentive Program | For, against, or abstain | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote | Treated as votes against | No effect | ||||

No. 5 - Approval of the Company’s Amended and Restated 2007 Long‑Term Incentive Plan | For, against, or abstain | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote | Treated as votes against | No effect | ||||

No. 6 - Approval of the Company’s Executive Officer Annual Incentive Plan | For, against, or abstain | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote | Treated as votes against | No effect | ||||

No. 7 - Approval of the Company’s Amended and Restated Employee Stock Purchase Plan | For, against, or abstain | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote | Treated as votes against | No effect | ||||

In uncontested elections, our directors are elected by the affirmative vote of the holders of a majority of the shares of our Common Stock voted. In contested elections (where the number of nominees exceeds the number of directors to be elected), our directors are elected by a plurality of shares of our Common Stock voted. Under our Bylaws, all other matters require the affirmative vote of the holders of a majority of the shares of our Common Stock present in person or by proxy and entitled to vote, except as otherwise provided by statute, our Certificate of Incorporation or our Bylaws.

3

Q: Can I change or revoke my proxy?

A: Yes. To change or revoke your proxy at any time before the shares are voted at the Annual Meeting, you must either:

a) | mail (i) a new proxy card with a later date or (ii) a written revocation addressed to: |

Pool Corporation

Jennifer M. Neil, Corporate Secretary

109 Northpark Boulevard

Covington, LA 70433-5001

or

b) | attend the Annual Meeting and vote in person. |

Q: Who will pay the expenses incurred in connection with the solicitation of my vote?

A: We pay the cost of preparing proxy materials and soliciting your vote. We will, upon request, reimburse brokers and other nominees for the cost of mailing materials to beneficial owners. Some of our employees, who will receive no additional compensation, may solicit proxies by telephone, facsimile or electronic mail. We also pay all Annual Meeting expenses.

Q: What happens if the Annual Meeting is postponed or adjourned?

A: Unless a new record date is fixed, your proxy will still be good and may be voted at the postponed or adjourned Annual Meeting. You will still be able to change or revoke your proxy at any time until it is voted.

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on May 4, 2016:

The Company’s Proxy Statement and Annual Report to Stockholders for the fiscal year ended December 31, 2015 are available at http://ir.poolcorp.com/Proxy.

4

ELECTION OF DIRECTORS

(Proposal 1)

(Proposal 1)

General

Our Bylaws provide that the size of our Board may be increased or decreased from time to time by resolution of the Board. On October 28, 2015, James J. Gaffney and George T. Haymaker, Jr. notified the Board that they each intended to retire at the end of their terms, and as such, did not intend to stand for re-election at our 2016 Annual Meeting. At that time, the Board increased its size from eight members to ten members and, upon the recommendation of the Nominating and Corporate Governance Committee, appointed Timothy M. Graven and David G. Whalen.

The Board has nominated eight of our current directors to serve a one-year term and currently intends to reduce its size to eight members following the Annual Meeting. Other than Messrs. Graven and Whalen, each of the nominees was previously elected a director of the Company by our stockholders, and each has indicated his intention to serve if elected. However, if any director nominee is unable or unwilling to take office at the Annual Meeting, your proxy may be voted in favor of another person or other persons nominated by the Board. Once elected, each director will hold office until his successor has been elected and qualified or until the director’s earlier resignation or removal.

In December 2012, the Board amended our Bylaws to implement a majority voting standard in uncontested director elections. As a result of this amendment, if the number of shares voted for any sitting director does not exceed the number of votes withheld with respect to that director, that director must submit a letter to the Board offering to resign. The Board, after considering the recommendation of the Nominating and Corporate Governance Committee, must make a decision whether to accept, reject or take other action with respect to the resignation within 90 days from certification of the election results.

Information about our Director Nominees

Below is biographical information about each of our director nominees including information regarding his tenure as a director, his business experience and qualifications, his education and other company directorships. The summaries are not comprehensive, but describe the primary experiences, attributes and skills that led the Nominating and Corporate Governance Committee and our Board to determine that these individuals should serve as directors of our Company. In addition to the qualifications referred to below, we believe each individual has a reputation for integrity, honesty, and high ethical standards and has demonstrated sound business judgment.

Wilson B. Sexton (79)

Chairman and director since: 1993

Business experience: Our chief executive officer (CEO) from 1999 to 2001.

Other directorships: Director of Houston Wire and Cable Company, a wholesale distributor of electrical wire and cable, and serves on its audit and compensation committees; previously a director of Beacon Roofing Supply, Inc., a wholesale distributor of roofing and complementary building products.

Other qualifications: Bachelor of Business Administration, Southern Methodist University; Certified Public Accountant; among other qualifications, Mr. Sexton brings to the Board strong financial acumen along with extensive managerial experience and industry knowledge.

Areas of experience include:

▪ | Industry knowledge |

▪ | Operations |

▪ | Strategic planning |

▪ | Distribution |

▪ | International operations |

5

Andrew W. Code (57)

Director since: 1993

Business experience: A founding partner in Promus Capital, a wealth management, private equity, alternative investments and multi-family office with over $900 million under management; a founding partner of CHS Capital, a Chicago-based private equity firm since 1988, with five funds totaling over $2.7 billion in assets under management and having purchased over 300 companies with total revenue exceeding $15 billion.

Other directorships: Serves as a member of various private, profit and non-profit boards of directors, including the boards of directors of the University of Iowa Foundation, where he serves as chair of the investment committee, Resource Land Holdings, Creation Investments, CAPX Partners, LaSalle Capital, Quality Control Corporation, Boat House Holdings and ProSteel Security Products; previously a director of ARC Document Solutions (ARC), a leading reprographics company providing document management services to the architectural, engineering and construction industry and The Hillman Companies, Inc., a distributor of hardware items, key duplication and engraving equipment.

Other qualifications: Bachelor of Arts and Master of Business Administration, University of Iowa; among other qualifications, Mr. Code brings to the Board extensive financial expertise, many years of senior leadership and business development experience, and significant acquisition and initial public offering experience.

Areas of experience include:

▪ | Finance |

▪ | Mergers and acquisitions |

▪ | Strategic opportunities |

▪ | Management |

▪ | Compensation |

Timothy M. Graven (64)

Director since: October 28, 2015

Business experience: Co-founder and managing member of Triad Investment Company, LLC, a private investment company, since 1994; president, chief operating officer and director of Steel Technologies, Inc., a former NASDAQ‑listed steel processing company, from 1990-1994, as well as serving in various positions including executive vice president, chief financial officer, vice president finance and corporate controller from 1979-1990.

Other directorships: Previously a director of Performance Food Group Company (PFG), a foodservice distribution company, from 1993-2008, serving on its audit, compensation, and corporate governance committees; director of Processing Technologies, Inc., a joint venture of LTV Steel, Mitsui Steel Development Company and Steel Technologies, Inc. from 1988‑1994; and director of Soltec, Inc., a Kentucky manufacturing company, from 1988-1992.

Other qualifications: Bachelor of Science, Murray State University; Certified Public Accountant; among other qualifications, Mr. Graven brings to the Board broad leadership and corporate governance experience as well as comprehensive experience in financial and risk management matters.

Areas of experience include:

▪ | Finance |

▪ | Management |

▪ | Compensation |

▪ | Corporate governance |

▪ | Audit |

6

Manuel J. Perez de la Mesa (59)

Director and chief executive officer since: 2001

Business experience: Our president since 1999 and our chief operating officer from 1999-2001; previous general, financial and operations management experience with Watsco, Inc. from 1994 to 1999, Fresh Del Monte Produce B.V. from 1987 to 1994, International Business Machines Corp. from 1982 to 1987, and Sea‑Land Service Inc./R.J. Reynolds, Inc. from 1977 to 1982.

Other directorships: Director of ARC and serves on its compensation and audit committees; director of Patriot Holdings LLC.

Other qualifications: Bachelor of Business Administration, Florida International University; Master of Business Administration, St. John’s University; among other qualifications, Mr. Perez de la Mesa brings to the Board extensive management experience, over 15 years of industry knowledge, a broad strategic vision for the Company, and a strong financial acumen.

Areas of experience include:

▪ | Management |

▪ | Strategic planning |

▪ | International operations |

▪ | Finance |

▪ | Industry knowledge |

Harlan F. Seymour (66)

Director since: 2003

Business experience: From 2000 to present, conducts personal investments in both public and private companies and business advisory services through HFS LLC, particularly in the area of strategic planning services for companies in a wide variety of industries; previously served as executive vice president of Envoy Corporation, a publicly traded provider of EDI and transaction processing services for the healthcare market, from 1997 to 1999 when it merged with Quintiles Transnational; previous general, financial and operations management experience with Jefferson Capital Partners from 1996 to 1997, Trigon Blue Cross Blue Shield from 1994 to 1996, and First Financial Management Corporation from 1983 to 1994, serving from 1990 to 1994 as president and CEO of its subsidiary, First Health Services Corporation and previously as senior vice president, corporate development.

Other directorships: Serves as a member of various private boards of directors, including Rx Innovation, a company that provides technology solutions to pharmacies and utilizes pharmacy transactions data to improve patient outcomes and the advisory board of Calvert Street Capital Partners, a private equity firm; previously a director of Envoy Corporation and chairman of ACI Worldwide, Inc. (ACI), a global provider of software for electronic payments and electronic commerce.

Other qualifications: Bachelor of Arts, University of Missouri; Master of Business Administration, Keller Graduate School of Management; among other qualifications, Mr. Seymour brings to the Board senior leadership experience, information technology knowledge, strategic planning, operating and acquisition expertise.

Areas of experience include:

▪ | Strategic planning |

▪ | Business development |

▪ | Operations |

▪ | Information technology |

▪ | Finance |

7

Robert C. Sledd (63)

Director since: 1996

Business experience: Managing partner of Pinnacle Ventures, LLC, a venture capital firm, and Sledd Properties, LLC, an investment company, from 2001 to present; previously CEO of PFG from 1987 to 2001 and from 2004 to 2006.

Other directorships: Director of Owens and Minor, Inc., a distributor of medical and surgical supplies, chairs its compensation and benefits committee, and serves on its governance and nominating committee and its executive committee; director of Universal Corporation, a leaf tobacco merchant and processor, and serves on its audit, finance and pension investment committees; chairman of PFG from 1995 to 2008 and director from 1987 to 2008.

Other qualifications: Bachelor of Science, Business Administration, University of Tennessee; among other qualifications, Mr. Sledd brings to the Board executive leadership experience, including his past service as a CEO of a public company, along with extensive strategic planning, brand marketing experience and financial expertise.

Areas of experience include:

▪ | Finance |

▪ | Operations |

▪ | Marketing |

▪ | Business development |

▪ | Strategic planning |

John E. Stokely (63)

Director since: 2000

Business experience: Our lead independent director; from 1996 to 1999, president, CEO and chairman of Richfood Holdings, Inc., a regional Fortune 500 wholesale food distributor and operator of retail grocery stores prior to its acquisition by SuperValu Inc.

Other directorships: Director of Malibu Boats, Inc., a manufacturer of performance sports boats, and serves on its audit committee and nominating and governance committee; previously a director of O’Charley’s Inc., a national restaurant chain, Nash Finch Company, a wholesale food distributor, PFG, Imperial Sugar Company, and ACI.

Other qualifications: Bachelor of Arts, University of Tennessee; among other qualifications, Mr. Stokely brings to the Board experience in providing strategic, financial, and risk management advice to companies engaged in a variety of industries, unique strategic insight, distribution and retail expertise and extensive senior leadership experience; additionally, Mr. Stokely’s previous experience as CEO of Richfood Holdings, Inc. afforded him with significant acquisition experience.

Areas of experience include:

▪ | Finance |

▪ | Management |

▪ | Operations |

▪ | Corporate governance |

▪ | Distribution |

8

David G. Whalen (58)

Director since: October 28, 2015

Business experience: President and CEO of A.T. Cross Company (subsequently Costa Inc.) from 1999-2014, a global manufacturer of personal accessories including writing instruments under the Cross brand name and premium sunglasses under the Costa brand name; general, marketing, acquisition, operations and international management experience with Bausch & Lomb, Inc. from 1991-1999 serving in various positions including corporate vice president, president North American eyewear division and president Europe, Middle East, Africa division; general, marketing, strategic and finance experience with G. Heileman Brewing Company from 1989-1991 serving as vice president business development and with Booz Allen Hamilton as a marketing associate from 1986-1988.

Other directorships: Director of Phoenix Footwear Group, Inc.; and director of Bowrail Corp., the parent company of JN Phillips Auto Glass; previously director of A.T. Cross Company

Other qualifications: Bachelor of Arts, with Honors, Trinity College; Master of Business Administration, University of Chicago; among other qualifications, Mr. Whalen brings to the Board background in implementing marketing, operations and finance strategies for global companies engaged in a variety of industries, distribution and retail expertise and extensive senior leadership experience in the United States and abroad. Additionally, Mr. Whalen’s previous success engineering a major restructuring as well as identifying and integrating a number of acquisitions afford him with unique strategic and operational insight.

Areas of experience include:

▪ | Management |

▪ | Marketing |

▪ | Finance |

▪ | Mergers and acquisitions |

▪ | International operations |

▪ | Strategic planning |

The Board of Directors unanimously recommends that our stockholders vote FOR the election of each of the director nominees.

Our Nominating and Corporate Governance Committee recommended to our full Board of Directors the foregoing nominees, and our Board has nominated them for election by our stockholders. At least annually, our Nominating and Corporate Governance Committee evaluates the effectiveness of the operation of our Board and Board committees and reviews the appropriateness of the composition and size of our Board and Board committees. In considering potential nominees, our Nominating and Corporate Governance Committee looks for persons with the highest personal and professional ethics, integrity and values, who can commit themselves to representing the long-term interests of our stockholders. Nominees must also have an inquisitive and objective perspective, practical wisdom and mature judgment. Nominees must be willing to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serving on our Board for an extended period of time.

In reviewing the composition of our Board and potential nominees, our Nominating and Corporate Governance Committee also considers the director independence and committee requirements of The NASDAQ Stock Market LLC (NASDAQ) listing rules and all legal requirements. Our Board seeks independent directors with a broad diversity of experience, professions, skills, geographic representation and backgrounds that will enhance the quality of the Board’s deliberations and decisions. Our Nominating and Corporate Governance Committee does not assign specific weights to particular criterion and no particular criterion is necessarily applicable to all prospective nominees. Prospective nominees are not discriminated against on the basis of age, race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

Our Nominating and Corporate Governance Committee and Board believe the nominees fulfill the criteria described above. In addition, the Board has determined that three-fourths of the nominees (including all committee members) are independent under NASDAQ listing rules. All five current members of our Audit Committee are “audit committee financial experts,” as defined by SEC rules. In addition to these attributes, each of the nominees has a strong and unique background and experience which led our Nominating and Corporate Governance Committee and Board to conclude that he should serve as a director of our Company. These qualifications are described individually for each nominee above.

9

Our Company has grown rapidly through internal growth and acquisitions to become the world’s largest wholesale distributor of swimming pool supplies, equipment and related leisure products and one of the top three distributors of irrigation and landscape products in the United States. We currently operate in 39 states, one U.S. territory and 11 foreign countries. Accordingly, our nominees have experience in a variety of areas important to our Company, such as managing and overseeing large public and private companies, corporate governance and executive compensation, strategic planning, mergers and acquisitions, financing growing businesses, international operations, information technology and marketing, and experience in our industry. Our Nominating and Corporate Governance Committee and Board believe that these nominees together provide us with the range and depth of experience and capabilities needed to oversee the management of our Company.

Director Independence

To be considered independent under the listing rules of NASDAQ, directors must be free from any relationship with management or the Company, which, in the opinion of the Board, would interfere with the exercise of independent judgment. The Board has determined that eight of our ten current directors - Messrs. Code, Gaffney, Graven, Haymaker, Seymour, Sledd, Stokely and Whalen - meet the definition of an independent director as defined by NASDAQ listing rules. The Board’s independent directors regularly meet in executive session (without management present) at each Board and committee meeting.

Board Leadership Structure and Lead Independent Director

The positions of Chief Executive Officer (CEO) and Chairman of the Board (Chairman) are presently held by two different individuals, and the Board continues to believe that this is the most appropriate leadership structure for our Company. The principal responsibility of the CEO is to manage the business. The principal responsibilities of the Chairman are to manage the operations of the Board and its committees and provide counsel to the CEO on behalf of the Board.

However, because our Chairman is not considered an independent director, our Board has elected a Lead Independent Director. Mr. Stokely currently serves as the Board’s Lead Independent Director. Our Lead Independent Director’s responsibilities include the following:

▪ | assign tasks to the Board’s committees; |

▪ | determine the appropriate schedule of Board meetings after consultation with our CEO, Chairman, and other Board members; |

▪ | consult with our CEO, Chairman and other Board members on the agenda of the Board; |

▪ | assess the quality, quantity, and timeliness of the flow of information from management to the Board; |

▪ | direct the retention of consultants who report directly to the Board; |

▪ | coordinate with the Chairman of the Nominating and Corporate Governance Committee to oversee compliance with and implementation of corporate governance policies; |

▪ | coordinate, develop the agenda for, and moderate executive sessions of the Board’s independent directors; |

▪ | assist the Chairman of the Compensation Committee in his evaluation of our CEO’s performance; and |

▪ | perform such other functions as the Board may direct. |

Director Attendance at Meetings

Our Board held seven meetings in the 2015 fiscal year. As stated in our Corporate Governance Guidelines, we expect directors to attend Board meetings and meetings of the Board committees on which they serve. In the 2015 fiscal year, each of our incumbent directors attended 75% or more of the total number of Board meetings and meetings of the Board committees on which he served.

We encourage each member of our Board to attend the annual meeting and all of our directors then in office attended the 2015 annual meeting.

Board’s Role in Risk Oversight and Assessment

Our employees, managers and officers conduct our business under the direction of our CEO and the oversight of our Board to enhance our long-term value for our stockholders. The core responsibility of our Board is to exercise its fiduciary duty to act in the best interest of our Company and our stockholders. In discharging this obligation, our Board and committees perform a number of specific functions, including risk assessment, review and oversight. While management is responsible for the day-to-day management of risk, our Board is responsible for oversight of our risk management programs, ensuring that an appropriate culture of risk management exists within the Company and assisting management in addressing specific risks, such as strategic risks, financial risks, regulatory risks and operational risks.

Our Board’s goal is to have systems and processes in place to bring to its attention the material risks facing our Company and to permit the Board to effectively oversee the management of these risks. As reflected in our Code of Business Conduct and Ethics, our

10

Board seeks to establish a “tone at the top” communicating our Board’s strong commitment to ethical behavior and compliance with the law. In furtherance of these goals, our Board regularly includes agenda items at its meetings relating to its risk oversight obligations and meets with various members of management on a range of topics, including corporate governance and regulatory obligations, disaster recovery and business continuity planning, succession planning, safety and risk management, insurance, and operations. Our Board also sets and regularly reviews quantitative and qualitative authority levels for management. Further, our Board oversees the strategic direction of our Company, and in doing so considers the potential rewards and risks of our Company’s business opportunities and challenges, and monitors the development and management of risks that may impact our strategic goals.

While risk oversight is a full Board responsibility, we also empower our various Board committees to address risk oversight in their respective areas and regularly report on their activities to our full Board. For example, our Strategic Planning Committee routinely reviews with management external and internal risks that may impact our strategic goals and our Compensation Committee assesses risks related to compensation. Our Audit Committee regularly reviews our disclosure controls and procedures and internal control over financial reporting, our Code of Business Conduct and Ethics, and other legal and regulatory matters affecting our Company, including compliance policies. Our Audit Committee also discusses our major financial risk exposures and steps management has taken to monitor and control such exposures, including our risk assessment and risk management policies. Our Director of Internal Audit reports to and regularly meets in executive session with our Audit Committee.

Compensation-Related Risk

Our Compensation Committee assesses risks associated with our compensation policies and practices. We do not believe that our compensation policies or practices are reasonably likely to have a material adverse effect on our Company. While risk taking is a necessary part of growing a business, our compensation philosophy is focused on aligning compensation with the long-term interests of our stockholders as opposed to rewarding short-term management decisions that could pose long-term risks. For example:

▪ | our annual cash incentive programs are capped for all members of senior management, including our Named Executive Officers; |

▪ | our Share Ownership Guidelines require our Named Executive Officers to hold Company stock; |

▪ | we maintain a clawback policy for executive compensation; |

▪ | our Insider Trading Policy prohibits hedging, pledging or monetization transactions involving our stock; and |

▪ | our equity-based long-term incentive compensation cliff vests over a period of three to five years for all management recipients, including our Named Executive Officers. |

Moreover, equity awards are granted annually, so executives always have unvested awards that could significantly decrease in value if our business is not managed for the long-term.

Access to Management and Employees

Directors have full and unrestricted access to our management and employees. Additionally, key members of management attend Board meetings from time to time to present information about the results, plans and operations within their areas of responsibility.

Communications with the Board

Stockholders and other interested parties may communicate with the members of our Board by mail addressed to the full Board, a specific member of the Board or to a particular committee of the Board at 109 Northpark Boulevard, Covington, Louisiana 70433. Communications are distributed to the Board, or to a specific member of the Board, as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board has requested that certain items that are unrelated to the duties and responsibilities of the Board be excluded, such as junk mail, mass mailings, resumes and other forms of job inquiries and business solicitations or advertisements. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable may be excluded.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our employees, officers (including our principal executive officer, principal financial officer and principal accounting officer) and directors. Our Code of Business Conduct and Ethics is posted on our website at www.poolcorp.com and can also be obtained free of charge by sending a request to our Corporate Secretary at 109 Northpark Boulevard, Covington, Louisiana 70433. As permitted by SEC and NASDAQ rules, we intend to satisfy the disclosure requirement regarding an amendment to, or a waiver from, a provision of our Code of Business Conduct and Ethics by posting such information on our website.

11

Board Committees

Board committees work on key issues in greater detail than would be possible at full Board meetings. The Board has appointed four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Strategic Planning Committee. Each of these Board committees is comprised entirely of independent directors and operates under a written charter, which sets forth the committees’ authorities and responsibilities. The charters are posted on our website at www.poolcorp.com under the “Governance” link in the “Investors” section.

The following table shows the membership of each of our Board committees during the 2015 fiscal year and the number of meetings each committee held during that year.

Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Strategic Planning Committee | |

Andrew W. Code | ü | |||

James J. Gaffney | ü | Chair | ||

George T. Haymaker, Jr. | Chair | ü | ||

Harlan F. Seymour | ü | ü | Chair | |

Robert C. Sledd | ü | ü | ||

John E. Stokely | Chair | ü | ||

No. of Meetings in 2015 | 8 | 5 | 3 | 2 |

In 2016, Mr. Graven was appointed to the Audit Committee and the Nominating and Corporate Governance Committee, and Mr. Whalen was appointed to the Audit Committee and the Strategic Planning Committee. Additionally, Mr. Seymour stepped down from the Audit Committee and was appointed to the Compensation Committee.

The following sections briefly describe our Board committees and outline certain of their principal functions. These descriptions are qualified in their entirety by the full text of the Board committee charters.

Audit Committee

The Audit Committee assists the Board in monitoring:

▪ | management’s process for ensuring the integrity of our financial statements; |

▪ | the independent registered public accounting firm’s qualifications and independence; |

▪ | the performance of our internal audit function and independent registered public accounting firm; |

▪ | information technology security and risk, including cyber security; and |

▪ | management’s process for ensuring our compliance with legal and regulatory requirements. |

The Board has determined that each Audit Committee member meets the requirements for independence, experience and expertise, including financial literacy, as set forth in the applicable SEC and NASDAQ rules. The Board has further determined that Messrs. Stokely, Gaffney, Graven, Sledd and Whalen are “audit committee financial experts” as defined in the SEC rules.

Compensation Committee

Our Compensation Committee is responsible for oversight of our executive compensation and makes recommendations to our entire Board with respect to director compensation, incentive compensation plans for senior management and equity-based plans for all employees. All members of the Compensation Committee are independent based on the applicable definition of independence for compensation committee members in NASDAQ listing standards, Rule 16b-3 of the Exchange Act, as amended, and Internal Revenue Code Section 162(m). The Compensation Committee’s specific responsibilities and duties are outlined in detail in our Compensation Committee Charter. The Compensation Committee has full and final authority in connection with the administration of our stock plans and, in its sole discretion, may grant options and make awards of shares under such plans.

The Compensation Committee has the authority to engage the services of outside advisers, experts and others. Specifically, the Compensation Committee may periodically retain compensation consultants to review the overall structure and design of our compensation programs and their suitability in meeting our compensation objectives. In addition, when changes to specific compensation programs are considered, the Compensation Committee may use an outside consultant to review the design and suitability of that specific program.

12

In 2015, the Compensation Committee engaged Lyons, Benenson & Company Inc. (Lyons), a compensation consultant, to conduct a review of non‑employee director and chairman compensation. Lyons reported directly to the Compensation Committee Chairman and was advised by the Compensation Committee to compare our director compensation program against our peer group. Also in 2015, in an effort to continue to ensure that our executive compensation properly aligns with the interests of our stockholders and remains comparable with the market, the Compensation Committee engaged Lyons to review our 2016 executive compensation program and peer group composition. As required by SEC and NASDAQ rules, the Compensation Committee has assessed the independence of Lyons, determined that Lyons is independent from management and concluded that Lyons’ work did not raise any conflict of interest.

For more information regarding the processes used by the Compensation Committee to determine executive compensation, see the section titled “Compensation Discussion and Analysis” below.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s primary purpose is to provide oversight on a broad range of issues surrounding the composition of the Board, including:

▪ | identifying qualified individuals to be considered for nomination as a director; |

▪ | recommending to the Board director nominees for the next annual meeting of stockholders; |

▪ | assisting the Board in committee member selection; |

▪ | evaluating the overall effectiveness of the Board and committees of the Board; and |

▪ | reviewing and considering corporate governance practices. |

The Nominating and Corporate Governance Committee has the authority to recommend to the Board candidates for Board membership. Stockholders may also make recommendations for director nominations by sending a letter to the Nominating and Corporate Governance Committee in care of our Corporate Secretary at 109 Northpark Boulevard, Covington, Louisiana 70433. Stockholders making nominations must also comply with the notice procedures set forth in our Bylaws. The Nominating and Corporate Governance Committee evaluates such candidates in the same manner as other candidates.

Strategic Planning Committee

The Strategic Planning Committee assists senior management in the analysis and preparation of our strategic plan, and then reports and makes recommendations regarding our strategic plan to the Board. Our strategic planning process involves defining the Company’s strategy and making decisions on allocating resources, including capital and people, to pursue this strategy. Our strategic plan, which we update and review with the Board periodically, incorporates specific goals for growth and business development over the next three to five years.

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, George T. Haymaker, Jr., Andrew W. Code, and Robert C. Sledd served on the Compensation Committee and none of them served at any time as officers or employees of the Company or any of its subsidiaries. None of our executive officers served in the last fiscal year as a member of the board of directors or compensation committee of another entity, one of whose executive officers served as a member of our Board or Compensation Committee.

13

Information about our Executive Officers

The following table presents, as of March 16, 2016, certain information about our current executive officers (other than Mr. Perez de la Mesa, our President and Chief Executive Officer, whose biographical information appears under “Election of Directors”). We expect that each of these officers will remain in his or her current position following the Annual Meeting.

Name and age | Positions and recent business experience | |

A. David Cook (60) | Group Vice President § Group Vice President since 2007 § Vice President from 1997 to 2007 § Director of National Sales Development of our principal operating subsidiary from 1993 to 1997 | |

Mark W. Joslin (56) | Senior Vice President, Chief Financial Officer § Vice President, Chief Financial Officer since 2004 § Vice President of Corporate Development of Eastman Chemical Company (Eastman) from 2002 to 2004 § Vice President and Controller of Eastman from 1999 to 2002 | |

Kenneth G. St. Romain (53) | Group Vice President § Group Vice President since 2007 § General Manager from 2001 to 2007 § Regional Manager from 1987 to 2001 | |

Jennifer M. Neil (42) | Corporate Secretary, General Counsel § Corporate Secretary since 2005 § General Counsel since 2003 | |

Melanie M. Housey Hart (43) | Corporate Controller, Chief Accounting Officer § Chief Accounting Officer since 2008 § Corporate Controller since 2007 § Senior Director of Corporate Accounting from 2006 to 2007 § Senior Manager at Ernst & Young LLP from 2001 to 2006 | |

14

PRINCIPAL STOCKHOLDERS

In accordance with Rule 13d-3 under the Exchange Act, the table below sets forth, as of March 16, 2016, certain information regarding beneficial ownership of Common Stock by (i) each of our directors, (ii) each of the executive officers listed in the Summary Compensation Table included in “Executive Compensation” (Named Executive Officers), (iii) all of our directors and executive officers as a group and (iv) each stockholder known by us to be the beneficial owner of more than 5% of our outstanding Common Stock. Based on information furnished to us by such stockholders, unless otherwise indicated, all shares indicated as beneficially owned are held with sole voting and investment power. On February 26, 2015, the Board adopted a policy that prohibits executive officers and directors from pledging the Company’s Common Stock as collateral for a loan, including through the use of traditional margin accounts with a broker.

Name of Beneficial Owner | Number of Shares Beneficially Owned | (1) | Percentage of Outstanding Common Stock | |

Directors | ||||

Wilson B. Sexton | 389,107 | (2) | * | |

Andrew W. Code | 112,846 | (3) | * | |

James J. Gaffney | 42,466 | * | ||

Timothy M. Graven | 1,000 | * | ||

George T. Haymaker, Jr. | 4,141 | * | ||

Manuel J. Perez de la Mesa | 1,646,243 | (4) | 4% | |

Harlan F. Seymour | 43,255 | (5) | * | |

Robert C. Sledd | 47,616 | (6) | * | |

John E. Stokely | 28,397 | * | ||

David G. Whalen | 1,000 | * | ||

Named Executive Officers (7) | ||||

A. David Cook | 191,906 | (8) | * | |

Mark W. Joslin | 214,359 | (9) | * | |

Jennifer M. Neil | 20,796 | (10) | * | |

Stephen C. Nelson | 208,737 | (11) | * | |

Kenneth G. St. Romain | 372,117 | (12) | * | |

All executive officers and directors as a group (16 persons) | 3,346,151 | (13) | 8% | |

Greater than 5% Beneficial Owners | ||||

BlackRock, Inc. | 3,994,946 | (14) | 9% | |

Neuberger Berman Group LLC | 2,956,411 | (15) | 7% | |

The Vanguard Group, Inc. | 3,130,964 | (16) | 7% | |

_______________

* Less than one percent.

(1) | Includes shares of unvested restricted stock for executive officers and directors as these shares convey the right to vote and receive dividends. |

(2) | Includes (i) 19,929 shares that may be acquired upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016, all of which are held by a trust for which Mr. Sexton serves as trustee; (ii) 34,079 shares held directly by a charitable foundation over which Mr. Sexton has voting and investment power with respect to such shares; and (iii) 327,090 shares held by a trust for which Mr. Sexton serves as trustee. |

(3) | Includes 80,000 shares held by a family trust for which Mr. Code serves as co‑trustee and 30,000 held directly by a charitable foundation of which Mr. Code is a director and president (although neither Mr. Code nor any members of his immediate family have a pecuniary interest in such shares). |

(4) | Includes (i) 757,500 shares that Mr. Perez de la Mesa has the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016; (ii) 5,000 shares beneficially |

15

owned by Mr. Perez de la Mesa’s wife; (iii) 187,232 shares held by a trust for which Mr. Perez de la Mesa serves as a trustee; and (iv) 666,000 shares held in three irrevocable trusts for the benefit of Mr. Perez de la Mesa’s adult children.

(5) | Includes 14,118 shares that Mr. Seymour has the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016. |

(6) | Includes 21,662 shares that Mr. Sledd has the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016. |

(7) | Information regarding shares beneficially owned by Mr. Perez de la Mesa, our Chief Executive Officer, who is a Named Executive Officer in addition to Ms. Neil and Messrs. Cook, Joslin, Nelson and St. Romain, appears above under the caption “Directors.” |

(8) | Includes 96,000 shares that Mr. Cook has the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016. |

(9) | Includes 94,000 shares that Mr. Joslin has the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016. |

(10) | Includes 2,000 shares that Ms. Neil has the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016. |

(11) | Includes (i) 147,625 shares that Mr. Nelson has the right to acquire upon exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016; (ii) 400 shares that Mr. Nelson’s adult daughter has the right to acquire upon exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016; (iii) 815 shares held by Mr. Nelson’s adult daughter; (iv) 84 shares held by Mr. Nelson’s grandson; and(v) 5,218 shares held by a family trust, over which Mr. Nelson serves as a co-trustee and of which his wife is a beneficiary. |

(12) | Includes 248,500 shares that Mr. St. Romain has the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016. |

(13) | Includes 1,416,209 shares that such persons have the right to acquire upon the exercise of presently exercisable options or the exercise of options which will become exercisable on or before May 15, 2016. Also includes 1,265,540 shares held in family trusts, 64,079 shares held in charitable foundations and 6,299 shares held by family members of such persons. |

(14) | Based upon such holder’s Schedule 13G/A filed with the SEC on January 22, 2016. BlackRock, Inc. has sole voting power over 3,897,992 shares and sole dispositive power with respect to all shares. The business address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

(15) | Based upon such holder’s Schedule 13G/A filed with the SEC on February 10, 2016. Neuberger Berman Group LLC (Neuberger) has shared voting power and shared dispositive power with Neuberger Berman Investment Advisers LLC with respect to all shares. Neuberger Berman Equity Funds has shared voting and dispositive power with respect to 2,506,608 shares. The business address of Neuberger is 605 Third Avenue, New York, New York 10158. |

(16) | Based upon such holder’s Schedule 13G/A filed with the SEC on February 10, 2016. The Vanguard Group, Inc. (Vanguard), an investment advisor, has sole voting power over 95,302 shares, sole dispositive power over 3,035,862 shares and shared dispositive power over 92,602 shares beneficially owned by its wholly‑owned subsidiary, Vanguard Fiduciary Trust Company. Vanguard Investments Australia, Ltd, a wholly-owned subsidiary of Vanguard is the beneficial owner of 5,200 shares. The business address of Vanguard is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. |

16

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis section of the proxy statement (the CD&A) describes and analyzes our executive compensation philosophy and program in the context of the compensation paid during the last fiscal year to our named executive officers (collectively, our Named Executive Officers or NEOs). This list includes our Chief Executive Officer (CEO), Chief Financial Officer (CFO) and our next three most highly-compensated executives as of December 31, 2015. Additionally, under applicable SEC rules, our NEOs for fiscal 2015 include Mr. Nelson, our former Vice President, who retired in June 2015.

For fiscal 2015, our Named Executive Officers were:

▪ | Manuel J. Perez de la Mesa, President, Chief Executive Officer and Director; |

▪ | Mark W. Joslin, Senior Vice President and Chief Financial Officer; |

▪ | A. David Cook, Group Vice President; |

▪ | Kenneth G. St. Romain, Group Vice President; |

▪ | Jennifer M. Neil, Corporate Secretary and General Counsel; and |

▪ | Stephen C. Nelson, former Vice President (retired June 30, 2015). |

In this CD&A, we first provide an Executive Summary of our actions and highlights from 2015. We next explain the principles that guide our Compensation Committee’s executive compensation decisions, our Compensation Philosophy and Objectives. We then describe the Compensation Committee’s Process of Setting Compensation, including any supporting role played by the NEOs themselves. Finally, we discuss in detail each of the Components of Compensation, which includes, for each component, a design overview as well as the actual results yielded for each NEO in 2015.

Executive Summary

Our Company is the world’s largest wholesale distributor of swimming pool supplies, equipment and related leisure products, with approximately 100,000 wholesale customers around the world. We operate 336 locations worldwide with approximately 3,800 employees. For more information about our business, please see Item 1, “Business,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

Over the past five years, the pool industry has continued to show signs of recovery, mostly due to the gradual improvement in remodeling and replacement activity. Our base business sales growth has rebounded since 2010, reflecting increased spending on consumer discretionary expenditures and higher replacement activities. Improvements in general external market factors in the United States including consumer confidence, employment, housing, consumer access to credit and economic expansion, largely complements our base business growth, which has been spurred by strong operational execution and market share gains. We feel these positive external trends have promoted increased consumer spending on products that enhance swimming pools and outdoor living spaces, such as building materials and energy-efficient equipment.

Overview of Fiscal 2015

Our Company’s financial and operational accomplishments for fiscal 2015 included the following:

▪ | Sales growth of 5% to a record $2.36 billion; |

▪ | Operating income improvement of 14%, or $27.3 million; |

▪ | 2015 diluted EPS up 19% to a record $2.90; and |

▪ | Net cash provided by operating activities that was 114% of net income. |

We had a record-setting year in 2015, topped off with favorable, warmer weather in the fourth quarter, which contributed to record fourth quarter sales and our first profitable fourth quarter ever. Annual sales benefited from increased consumer spending on discretionary products, particularly related to replacement and remodel activity as pool owners are investing to upgrade existing pools and outdoor systems that increase energy efficiency and incorporate more technologically advanced products. Execution of our business plans, a continued gradual recovery of demand for discretionary replacement and remodel products and increased market share were the primary contributors to our sales growth in 2015.

17

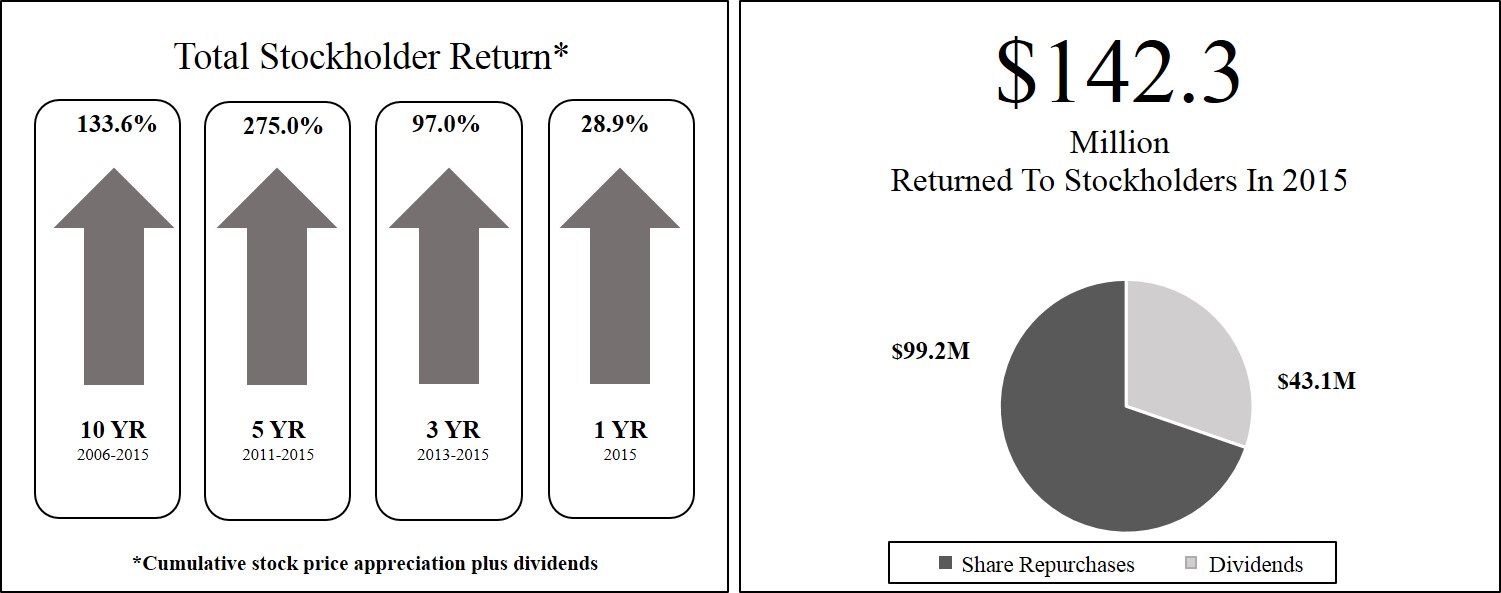

Return to Stockholders

We have delivered consistent positive returns to stockholders over time, and in 2015 we continued our long history of increasing dividends and conducting share repurchases.

2015 Executive Compensation Program Highlights

▪ | Our executive compensation program is designed and implemented by the Compensation Committee, which strives to incorporate compensation “best practices” into our program design. The following summary highlights our commitment to executive compensation practices that align the interests of our executives and stockholders: |

What we do: | What we don’t do: | |||

ü | Our executive pay is predominantly performance-based and not guaranteed. | û | We do not provide excessive perquisites to our executives. | |

ü | All of our variable compensation plans have caps on plan formulas. | û | Directors and NEOs are prohibited from pledging their shares of company stock. | |

ü | Our equity plans contain “double trigger” change of control vesting provisions. | û | Our equity plans prohibit the repricing of underwater stock options. | |

ü | We benchmark pay relative to the market and review the peer group used for market benchmarking on an annual basis. | û | We do not have any related party transactions. | |

ü | We maintain share ownership guidelines. | û | We do not provide any cash change of control payments to our executive officers. | |

ü | We maintain executive compensation clawback provisions. | û | We do not provide excise tax gross-ups. | |

ü | The Compensation Committee, like all of our Board committees, is comprised solely of independent directors. | |||

ü | Our Compensation Committee retains its own independent compensation consultant. | |||

ü | Beginning in 2016, restricted stock awards include performance-based vesting criteria. | |||

18

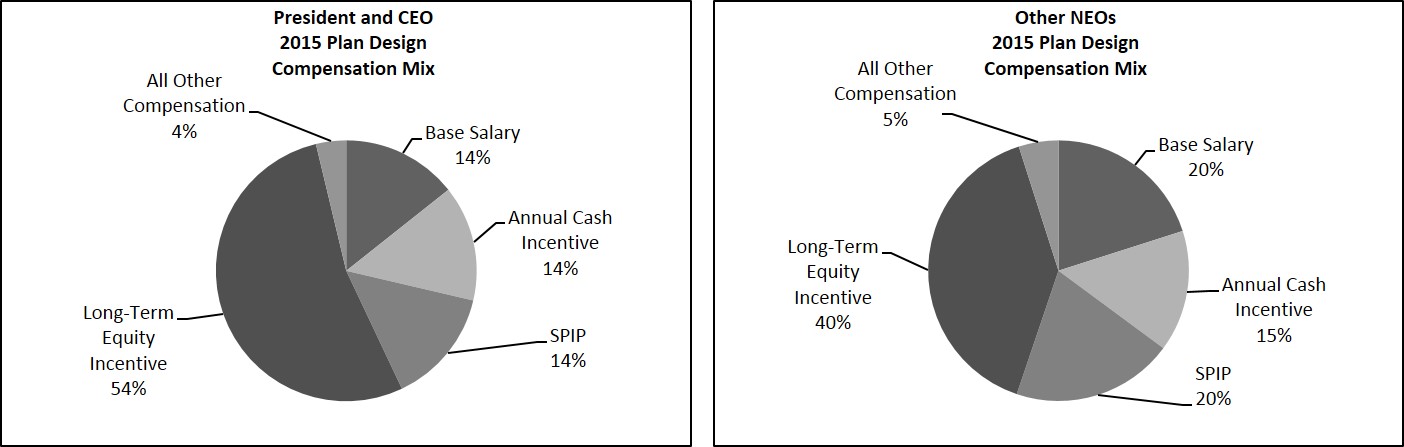

▪ | A majority of each NEO’s target compensation has been and continues to be at-risk. The charts below show the 2015 plan design, or target, compensation mix by component: |

▪ | The Compensation Committee approved only a marginal increase in base salaries for each NEO (less than 3% on average), consistent with its long-standing policy of placing greater emphasis on the performance-based components of compensation. |

▪ | The Compensation Committee approved the same annual cash performance potential as the prior year for each NEO, with plan design targeted at 100% of base salary for our CEO and 75% of base salary for our other NEOs. Actual 2015 annual cash performance awards were 125% of base salary for our CEO and averaged 96% of base salary for our other NEOs based primarily on our attainment of the target level of the diluted earnings per share (EPS) component of the annual performance award. |

▪ | The Compensation Committee continued to emphasize the importance of our long-term growth by providing substantial pay‑for‑performance compensation opportunities through the medium-term Strategic Plan Incentive Program (SPIP) and long-term equity components. For the 2015 SPIP grant, which is based on the EPS growth in the three-year cumulative period from 2015 to 2017, the Compensation Committee established the diluted earnings per share baseline at $2.44, which was our 2014 diluted EPS. The minimum threshold to qualify for an incentive is $3.25 (representing 10% compounded annual growth) and the maximum threshold is $4.22 (representing 20% compounded annual growth). The Compensation Committee believes that while the targets are aggressive, they are reasonable and provide both a fair reward and strong upside potential for our executives. Actual 2015 cash payments under the SPIP were 123% of base salary (out of a possible 200% for maximum performance) for our NEOs as the Company’s 2015 diluted EPS of $2.90 fell around the middle of the 2013 SPIP grant (2013-2015 performance years) performance range of $2.46 - $3.20. |

▪ | Beginning with grants in 2015, our equity awards are subject to “double trigger” accelerated vesting upon a change of control; this means our unvested equity awards accelerate only if there is both a change of control and a diminution of an NEO’s compensation or responsibilities, or a relocation. |

▪ | The Compensation Committee determined the 2015 equity grants for all NEOs based on total compensation targets approximating the peer group median for total compensation. |

▪ | With regard to our CEO’s 2015 compensation in particular, the Compensation Committee kept the same compensation plan design intact with a very modest salary increase (2.2%), the same annual cash performance program potential, as well as the same medium-term SPIP and long-term equity components. The annual performance award continued to use EPS as the principal factor (140% of salary maximum potential), complemented with cash flow from operations (30% of salary maximum potential), and other specific objectives (30% of salary maximum potential). Mr. Perez de la Mesa’s equity grant of stock options and restricted shares had an estimated grant date fair value of $2,007,188 and cliff vests 50% after three years and 50% after five years. |

Results Compared to Peers

Our total compensation is designed to target or approximate the peer median for total compensation (sometimes referred to as compensation by design) and ultimately varies depending on our performance. Our peer group is comprised of public companies primarily engaged in distribution,with similar size as reflected in both revenues and market capitalization. See “Process of Setting Compensation - Establishment of Peer Group” for further information on our peer group.

19

For perspective, the table below presents compounded annual growth rates (CAGR) for our EPS and stock price performance as well as our total stockholder return (TSR) performance compared to our peer group median as of December 31, 2015. In addition to our peer group, we believe that our performance should also be measured against the S&P MidCap 400 Index because (a) it is comprised of more similar-sized public companies that represent the most likely alternative investments for investors and (b) we have no direct public company peers given the niche nature of our industry. Given that our compensation philosophy stresses the long-term growth of stockholder value, we believe that longer-term performance data provides the most appropriate comparisons.

POOL Corporation | |||||||||||||||||

Adjusted (1) Diluted EPS CAGR | Stock Price CAGR | TSR CAGR | Peer Group Median TSR (2) CAGR | S&P MidCap 400 Index CAGR (3) | |||||||||||||

1-year | 18.9 | % | 27.3 | % | 28.9 | % | (9.3 | )% | (3.7 | )% | |||||||

3-year | 16.2 | % | 24.0 | % | 25.4 | % | 5.5 | % | 11.1 | % | |||||||

5-year | 20.3 | % | 29.1 | % | 30.3 | % | 9.5 | % | 9.0 | % | |||||||

10-year | 7.3 | % | 8.1 | % | 8.9 | % | 6.8 | % | 6.4 | % | |||||||

(1) | The 3-year CAGR is based on adjusted 2012 diluted EPS, which excludes a non-cash goodwill impairment charge of $6.9 million, or $0.14 per diluted share. |

(2) | We calculated TSR based on changes in the market price of each company’s common stock plus dividends paid during the respective periods, if applicable, using information from company financial statements and various financial websites including www.nasdaq.com. In calculating TSR, we used stock-split adjusted amounts for both historical market prices and dividends paid. |

(3) | As reported by NASDAQ. |

As reflected in the table below, 2015 actual total compensation for our NEOs was 14% higher than the peer group median amount. This difference largely reflects our performance over the one-and three-year time frames during which our total stockholder return CAGR was 28.9% and 25.4% compared to our peer group median total stockholder return CAGR of (9.3)% and 5.5%, respectively. Moreover, our stock price CAGR also exceeds that of the S&P MidCap 400 Index for all periods presented above. As such, our higher-than-peer pay was based on our exceptional performance and, as discussed in the footnote below, the fact that the peer group compensation data used in our comparison is generally a year or more old.

Total Compensation Above (Below) Peer Group Medians (1) | ||||||

Position | 2015 Actual | 2015 Plan Design | ||||

CEO | (4 | )% | (18 | )% | ||

All Other NEOs (2) | 31 | % | 13 | % | ||

Total NEOs (2) | 14 | % | (1 | )% | ||

(1) | Our Compensation Committee set our compensation plan design for the year in February 2015. At this time, peer group compensation data for 2014 was not available. Therefore, the peer group median amounts used for comparison in the above table were calculated primarily using 2013 compensation data. |

(2) | We included Ms. Neil’s compensation amounts but excluded Mr. Nelson’s compensation amounts in these calculations. We feel this methodology provides the most appropriate comparisons to the peer group medians as Mr. Nelson was only employed for half of the year. |

The actual amounts in the table above reflect the reported amounts per the Summary Compensation Table, except for the value of stock options. For both our stock options and our peer group’s stock options, rather than use the estimated grant date fair values as reported in the proxy statements, we estimated stock option values by multiplying the number of stock options awarded by 40% of the stock’s closing price on the grant date. We believe this eliminates potential differences related to fair value assumptions for expected term, volatility and dividend yield, thus improving the comparability to our peer group.

20

After review of all existing programs, consideration of current market and competitive conditions, and alignment with our overall compensation objectives and philosophy, we believe that the total compensation program for our executives is appropriately focused on increasing value for stockholders and enhancing corporate performance. We believe that a significant part of our executive pay is properly tied to stock appreciation or stockholder value through stock options, restricted stock awards and incentive performance measures.

Results of 2015 Say-on-Pay Vote

At our 2015 annual meeting of stockholders in May, our stockholders approved our executive compensation by 98.2% (excluding broker non-votes). Because our NEO compensation is principally established in February of each year, the results of the 2015 say‑on‑pay vote were not taken into consideration in setting the 2015 executive officer compensation. However, the Compensation Committee did consider the strong support we received on the 2014 say-on-pay vote, which was approved by 99.2% (excluding broker non-votes). Our Compensation Committee is mindful of the strong support our stockholders expressed and as a result continues to believe that our general approach to and design of executive compensation properly align the interests of our stockholders and our performance. Going forward, the Compensation Committee will continue to review stockholder advisory votes on executive compensation and take them into consideration when making future executive compensation decisions.

Compensation Philosophy and Objectives

We believe our employees are our most important asset. The primary objectives of our compensation program are to attract, motivate, reward and retain talented executives who are critical to our success. The overriding principle of our executive compensation philosophy is that compensation must be linked to continuous improvements in corporate performance and sustained increases in stockholder value. We believe that a substantial portion of executive compensation should be at-risk based on performance and that the majority of the at-risk compensation opportunity should be predicated on medium- and long-term rather than short-term results. We strive to develop our executives’ capabilities and focus them on achieving superior long-term returns for our stockholders, while assuring that our programs do not lead to unnecessary risk taking.

Our executive compensation philosophy applies to all employees, with increasingly greater proportions of total compensation being at-risk as an employee’s responsibility increases. While we place great value on long-term performance and the congruent improvement in stockholder value, we seek to balance the relationship between total stockholder return and short-term and long-term compensation in order to complement our annual and long-term business objectives and encourage the fulfillment of those objectives through executive performance.

In pursuing these objectives, we seek to design and maintain a program that will accomplish the following:

• | align total compensation by design to our peer group median total compensation; |

• | vary compensation with our performance in achieving financial and non-financial objectives; |

• | tie compensation to individual and group performance; |

• | closely align incentive compensation with stockholders’ interests; and |

• | promote equity ownership by executives through long-term performance compensation. |

While we have not established specific target percentages of total compensation for short-term and long-term compensation, we do take into consideration the individual components in relation to the total opportunity we seek to provide. Under our program, our performance impacts both short-term and long-term compensation, as superior performance will result in additional annual compensation through our annual cash performance program and additional long-term compensation, consisting of the increased value of our equity grants and through our medium-term SPIP. Our goal is for the portion of compensation that is at-risk (both short-term and long-term) to constitute a substantial and meaningful portion of total compensation and for sustained long-term growth to result in the greatest compensation opportunities.

21

Process of Setting Compensation

Our Compensation Committee is responsible for oversight of our executive compensation. The Compensation Committee approves compensation plans for senior management and equity-based plans for all employees. In its evaluation of executive compensation, the Compensation Committee considers many factors, including the Company’s overall performance; each individual executive’s role and responsibilities, performance, tenure, and experience; internal pay equity; and peer group performance.

The Compensation Committee normally meets in February of each year to set executive compensation plans for that fiscal year. To do this, it uses the most current data available for peer group compensation, although this data is generally a year or more old.

Role of Management

The Compensation Committee also relies upon data, analysis and recommendations from our CEO. Our Company’s management assists the Compensation Committee with developing the peer group analysis. While the CEO provides recommendations with respect to potential senior management compensation and the Compensation Committee reviews such recommendations, the Compensation Committee ultimately uses its collective judgment to determine senior management compensation. The CEO does not provide recommendations for his own compensation as the Compensation Committee independently determines and approves his compensation. Although the CEO attends Compensation Committee meetings at which executive compensation matters are considered, he is not present when the Compensation Committee deliberates or votes on his compensation.

Role of Compensation Consultant

Our Compensation Committee periodically engages a compensation consultant to review and comment upon director and executive compensation. In 2015, the Compensation Committee engaged Lyons, Benenson & Company Inc. (Lyons) to conduct a review of non‑employee director and chairman compensation. Lyons reported directly to the Compensation Committee Chairman and was advised by the Compensation Committee to compare our director compensation program against our peer group. Also in 2015, in an effort to continue to ensure that our executive compensation properly aligns with the interests of our stockholders and remains comparable with the market, the Compensation Committee engaged Lyons to review our 2016 executive compensation program and peer group composition.

Establishment of Peer Group