10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-26640

POOL CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 36-3943363 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

109 Northpark Boulevard, Covington, Louisiana | 70433-5001 |

(Address of principal executive offices) | (Zip Code) |

985-892-5521

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of each class | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer x | Accelerated filer ¨ |

| |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant based on the closing sales price of the registrant’s common stock as of June 30, 2015 was $2,869,059,459.

As of February 22, 2016, there were 42,040,969 shares of common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement to be mailed to stockholders on or about March 30, 2016 for the

Annual Meeting to be held on May 4, 2016, are incorporated by reference in Part III of this Form 10-K.

POOL CORPORATION

TABLE OF CONTENTS

|

| | |

| | |

| | Page |

PART I. | |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| |

PART II. | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| |

PART III. | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| |

PART IV. | |

| | |

Item 15. | | |

| | |

| | |

| | |

PART I.

Item 1. Business

General

Pool Corporation (the Company, which may be referred to as we, us or our) is the world’s largest wholesale distributor of swimming pool supplies, equipment and related leisure products and is one of the top three distributors of irrigation and landscape products in the United States. The Company was incorporated in the State of Delaware in 1993 and has grown from a regional distributor to a multi-national, multi-network distribution company.

Our industry is highly fragmented, and as such, we add considerable value to the industry by purchasing products from a large number of manufacturers and then distributing the products to our customer base on conditions that are more favorable than our customers could obtain on their own.

As of December 31, 2015, we operated 336 sales centers in North America, Europe, South America and Australia through our four distribution networks:

| |

• | Superior Pool Products (Superior); |

| |

• | Horizon Distributors (Horizon); and |

| |

• | National Pool Tile (NPT). |

Beginning in 2014, we identified NPT as a separate distribution network. Through this network, we sell specialized products under the NPT brand including tile, decking materials and interior pool finishes, as well as hardscape and natural stone products. Please refer to our “Business Strategy and Growth” section below for more detailed information regarding the development of our NPT distribution network.

Superior and Horizon are both wholly owned subsidiaries of SCP, which is wholly owned by Pool Corporation.

Our Industry

We believe that the swimming pool industry is relatively young, with room for continued growth from the increased penetration of new pools. Of the approximately 80 million homes in the United States that have the economic capacity and the yard space to have a swimming pool, approximately 11% currently have a pool. Significant growth opportunities also reside with pool remodel and pool equipment replacement activities due to the aging of the installed base of swimming pools, technological advancements and the development of energy-efficient products. The irrigation and landscape industry shares many characteristics with the pool industry, and we believe that it will realize long-term growth rates similar to the pool industry. As irrigation system installations and landscaping often occur in tandem with new single-family home construction, we believe the continued recovery in the housing industry also offers significant opportunities for the irrigation and landscape industry.

Favorable demographic and socioeconomic trends have positively impacted our industry and we believe these trends will continue to do so in the long term. These favorable trends include the following:

| |

• | long-term growth in housing units in warmer markets due to the population migration toward the southern United States, which contributes to the growing installed base of pools that homeowners must maintain; |

| |

• | increased homeowner spending on outdoor living spaces for relaxation and entertainment; |

| |

• | consumers bundling the purchase of a swimming pool and other products, with new irrigation systems and landscaping often being key components to both pool installations and remodels; and |

| |

• | consumers using more automation and control products, higher quality materials and other pool features that add to our sales opportunities over time. |

Approximately 60% of consumer spending in the pool industry is for maintenance and minor repair of existing swimming pools. Maintaining proper chemical balance and the related upkeep and repair of swimming pool equipment, such as pumps, heaters, filters and safety equipment, creates a non-discretionary demand for pool chemicals, equipment and other related parts and supplies. We also believe cosmetic considerations such as a pool’s appearance and the overall look of backyard environments create an ongoing demand for other maintenance-related goods and certain discretionary products.

We believe that the recurring nature of the maintenance and repair market has historically helped maintain a relatively consistent rate of industry growth. This characteristic, along with relatively consistent inflationary price increases of 1% to 2% on average passed on by manufacturers and distributors, has helped cushion the negative impact on revenues in periods when unfavorable economic conditions and softness in the housing market adversely impacted pool construction and major replacement and refurbishment activities.

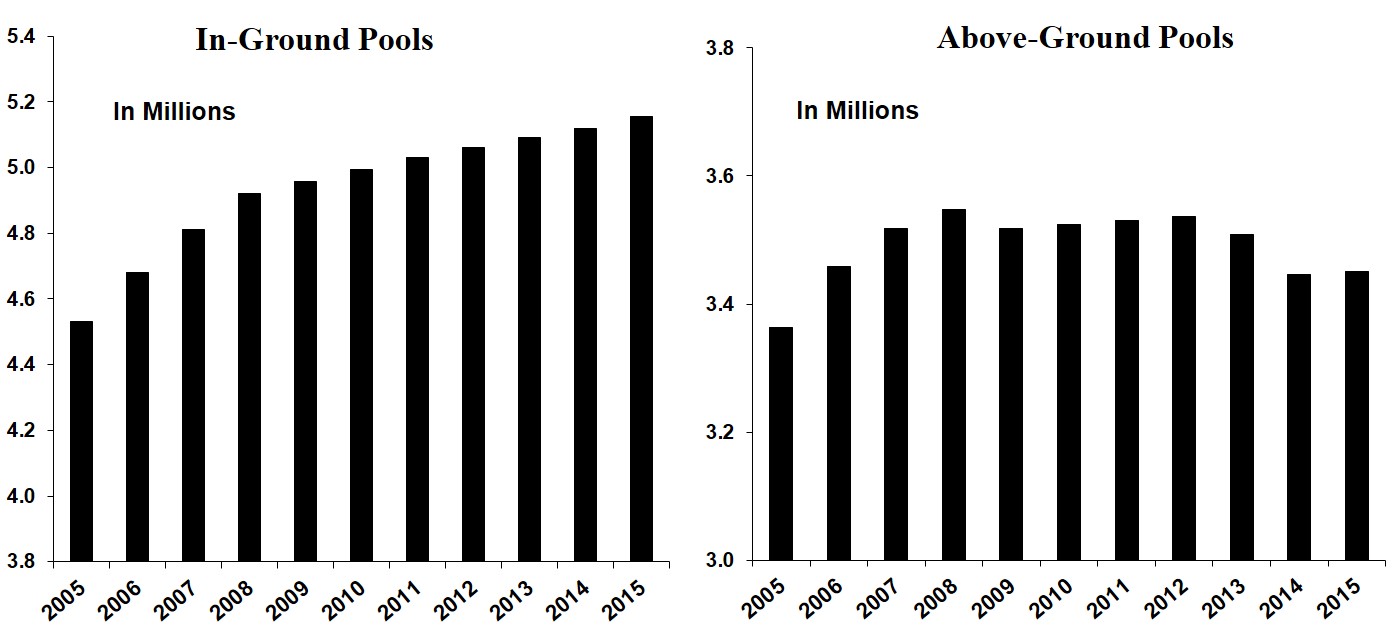

The following tables reflect growth in the domestic installed base of in-ground and above-ground swimming pools over the past 11 years (based on Company estimates and information from 2014 P.K. Data, Inc. reports):

The replacement and refurbishment market currently accounts for close to 30% of consumer spending in the pool industry. The activity in this market, which includes major swimming pool remodeling, is based on the aging of the installed base of pools. The timing of these types of expenditures is more sensitive to economic factors that impact consumer spending compared to the maintenance and minor repair market.

New swimming pool construction comprises the bulk of the remaining consumer spending in the pool industry. The demand for new pools is driven by the perceived benefits of pool ownership including relaxation, entertainment, family activity, exercise and convenience. The industry competes for new pool sales against other discretionary consumer purchases such as kitchen and bathroom remodeling, boats, motorcycles, recreational vehicles and vacations. The industry is also affected by other factors including, but not limited to, consumer preferences or attitudes toward pool and landscape products for aesthetic, environmental, safety or other reasons.

The irrigation and landscape distribution business is split between residential and commercial markets, with the majority of sales related to the residential market. Irrigation and landscape maintenance activities account for approximately 40% of total spending in the irrigation industry, with the remaining 60% of spending related to irrigation construction and other discretionary related products. As such, our irrigation business is more heavily weighted toward new construction activities and the sale of discretionary related products compared to our pool business and is therefore more sensitive to economic factors that impact consumer spending. Our irrigation and landscape business has recently benefited from the continued recovery of single-family home construction as irrigation system installations and landscaping projects typically correlate with, but lag, new home construction.

Certain trends in the housing market, the availability of consumer credit and general economic conditions (as commonly measured by Gross Domestic Product or GDP) affect our industry, particularly new pool and irrigation system starts as well as the timing and extent of pool refurbishments and equipment replacement. We believe that over the long term, housing turnover and single‑family home value appreciation may correlate with demand for new pool construction, with higher rates of home turnover and appreciation having a positive impact on new pool starts over time. We also believe that homeowners’ access to consumer credit is a critical factor enabling the purchase of new swimming pools and irrigation systems. Similar to other discretionary purchases, replacement and refurbishment activities are more heavily impacted by economic factors such as consumer confidence, GDP and employment.

The economic downturn between 2007 and 2009 had a significant impact on our industry, driving an approximate 80% reduction in new pool construction in the United States compared to peak levels in 2005 and also contributing to more than a 30% decline in replacement and refurbishment activities. While we estimate that new pool construction has increased from a low of roughly 45,000 new units in 2009 to approximately 65,000 new units in 2015, construction levels are still down approximately 70% compared to peak levels in 2005 and down approximately 60% from what we consider normal levels.

Over the past five years, the pool industry has continued to show signs of recovery, mostly due to the gradual improvement in remodeling and replacement activity. The rebound in our base business sales growth since 2010 reflects increased consumer discretionary spending and higher replacement activities. Improvements in general external market factors in the United States including consumer confidence, employment, housing, access to consumer credit and economic expansion, largely supports our base business growth. For each year from 2010 to 2015, we estimate the industry grew from 3% to 4%, with the exception of 2013, when we believe industry growth dipped temporarily to approximately 1% to 2% primarily due to the impact of adverse weather on seasonal markets. While unseasonably cool temperatures impacted the industry in 2014, the impact was not quite as widespread, nor as severe. In 2015 excessive precipitation impacted our industry in the second quarter; however a mild fall and delayed winter alleviated any contraction in industry growth rates.

Going forward, we believe there is potential for a significant sales recovery due to the build-up of deferred replacement and remodeling activity and our expectation for new pool and irrigation construction levels to gradually normalize. Additionally, we believe favorable demographics from an aging population and southern migration are ideal for increased residential investment, especially in outdoor lifestyle products. We expect that market conditions in the United States will continue to improve, enabling further recovery of replacement, remodeling and new construction activity to normalized levels over the next 4 to 7 years. We expect that the industry will realize an annual growth rate of approximately 3% to 6% over this time period. As economic trends indicate that consumer spending has been slowly recovering and that residential construction activities will likely continue to gradually improve, we believe that we are well positioned to take advantage of both the eventual market recovery and the inherent long-term growth opportunities in our industry.

Our industry is seasonal and weather is one of the principal external factors that affect our business. Peak industry activity occurs during the warmest months of the year, typically April through September. Unseasonable warming or cooling trends can accelerate or delay the start or end of the pool and landscape season, impacting our maintenance and repair sales. These impacts at the shoulders of the season are generally more pronounced in northern markets in the United States and Canada. Weather also impacts our sales of construction and installation products to the extent that above average precipitation, late spring thaws in northern markets and other extreme weather conditions delay, interrupt or cancel current or planned construction and installation activities.

Business Strategy and Growth

Our mission is to provide exceptional value to our customers and suppliers, in order to provide exceptional return to our shareholders while providing exceptional opportunities to our employees. Our three core strategies are as follows:

| |

• | to promote the growth of our industry; |

| |

• | to promote the growth of our customers’ businesses; and |

| |

• | to continuously strive to operate more effectively. |

We promote the growth of our industry through various advertising and promotional programs intended to raise consumer awareness of the benefits and affordability of pool ownership, the ease of pool maintenance and the many ways in which a pool and the surrounding spaces may be enjoyed beyond swimming. These programs include media advertising, industry-oriented website development such as www.swimmingpool.com®, public relations campaigns and other online marketing initiatives including social media. We use these programs as tools to educate consumers and lead prospective pool owners to our customers.

We promote the growth of our customers’ businesses by offering comprehensive support programs that include promotional tools and marketing support to help our customers generate increased sales. Our uniquely tailored programs include such features as customer lead generation, personalized websites, brochures, direct mail, marketing campaigns and business development training. As a customer service, we also provide certain retail store customers assistance with all aspects of their business including site selection, store layout and design, product merchandising, business management system implementation, comprehensive product offering selections and efficient ordering and inventory management processes. In addition to these programs, we feature consumer showrooms in over 80 of our sales centers and host our annual Retail Summit to educate our customers about product offerings and the overall industry. We also act as a day to day resource by offering product and market expertise to serve our customers’ unique needs.

In addition to our efforts aimed at industry and customer growth, we strive to operate more effectively by continuously focusing on improvements in our operations such as product sourcing, procurement and logistics initiatives, adoption of enhanced business practices and improved working capital management. Other key internal growth initiatives include the continued expansion of both our product offerings (as described in the “Customers and Products” section below) and our distribution networks.

Beginning in early 2000, we significantly increased the breadth of our product offerings outside our traditional pool distribution business. These complementary products included building materials used for pool construction, installations and remodeling, such as concrete and pool surfacing and decking materials. With our March 2008 acquisition of National Pool Tile Group, Inc., we added a market leading brand of pool tile and composite pool finish products, and gained a position in a wider market. Over the last five years, to increase operating efficiency, we consolidated and repositioned NPT standalone sales centers and established NPT showcases within certain existing sales centers. In addition to our 15 standalone NPT sales centers, we currently have over 80 SCP and Superior sales centers that feature consumer showrooms where swimming pool dealers and homeowners can view and select pool components including tile, decking materials and interior pool finishes in various styles and grades, and serve as stocking locations for our NPT branded products.

We feel the growth opportunities for the NPT network closely align with those of our other networks, as we see continued opportunity to expand under the NPT name both organically and through acquisitions. We also expect potential expansion of the network by broadening our product range and sourcing capabilities. As more consumers create and enhance outdoor living areas and continue to invest in their outdoor environment, we believe we can focus our resources to address such demand, while leveraging our existing pool and irrigation/landscape customer base. We feel the development of our NPT network is a natural extension of our distribution model. While we are currently enjoying an expanding economy and improving housing market, which help fuel demand for these products, this business is more sensitive to these external market factors compared to our business overall.

We have grown our distribution networks through new sales center openings, acquisitions and the expansion of existing sales centers. Given the more stabilized external environment, we have increased our focus on new sales center openings complemented by strategic acquisitions and consolidations, depending on our market presence. Since the beginning of 2013, we have opened 8 new sales centers (net of sales center consolidations), with 4 new sales centers in 2015. We expect to open between 5 and 7 new sales centers in 2016. Since the beginning of 2013, we have completed 9 acquisitions consisting of 16 sales centers (net of sales center consolidations within one year of acquisition). The acquired locations in 2015 include 2 sales centers added to our SCP network, 2 sales centers added to our Superior network and 3 sales centers added to our NPT network. We plan to continue to make strategic acquisitions and open new sales centers to further penetrate existing markets and expand into both new geographic markets and new product categories. For additional discussion of our recent acquisitions, see Note 2 of “Notes to Consolidated Financial Statements,” included in Item 8 of this Form 10-K.

We believe that our high customer service levels and expanded product offerings have enabled us to gain market share historically, including the period between 2007 and 2009 when our industry contracted. Going forward, we expect to realize sales growth higher than the industry average due to further increases in market share and continued expansion of our product offerings.

We estimate that price inflation has averaged 1% to 2% annually in our industry over the past 10 years. We generally pass industry price increases through the supply chain and make strategic volume inventory purchases ahead of vendor price increases. We estimate that annual price inflation was consistent with the ten-year average between 2013 and 2015. We anticipate price inflation will vary some by product lines, but will approximate the ten-year average overall in 2016.

Customers and Products

We serve over 100,000 customers. In 2015, sales to our largest 100 customers collectively accounted for just under 10% of our total sales. We estimate that sales to our largest 1,000 customers represented approximately 25% of our total sales in 2015. Notably, 98% of our customers are small, family-owned businesses with relatively limited capital resources. These core customers generated a large majority of our sales in 2015. Most of these businesses provide labor and technical services to the end consumer and operate as independent contractors employing no more than ten employees (in many cases, working alone or with a limited crew). These customers also buy from other distributors, mass merchants, home stores, and specialty and internet retailers.

We sell our products primarily to the following types of customers:

| |

• | swimming pool remodelers and builders; |

| |

• | specialty retailers that sell swimming pool supplies; |

| |

• | swimming pool repair and service businesses; |

| |

• | landscape construction and maintenance contractors; and |

| |

• | municipal, golf course and other commercial customers. |

We conduct our operations through 336 sales centers in North America, Europe, South America and Australia. Our primary markets, with the highest concentration of swimming pools, are California, Florida, Texas and Arizona, collectively representing approximately 53% of our 2015 net sales. In 2015, we generated approximately 94% of our sales in North America, 5% in Europe and less than 1% in South America and Australia combined.

We use a combination of local and international sales and marketing personnel to promote the growth of our business and develop and strengthen our customers’ businesses. Our sales and marketing personnel focus on developing customer programs and promotional activities, creating and enhancing sales management tools and providing product and market expertise. Our local sales personnel work from our sales centers and are charged with understanding and meeting our customers’ specific needs.

We offer our customers more than 160,000 national brand and Pool Corporation branded products. We believe that our selection of pool equipment, supplies, chemicals, replacement parts, irrigation and landscape products and other pool construction and recreational products is the most comprehensive in the industry. The products we sell can be categorized as follows:

| |

• | maintenance products such as chemicals, supplies and pool accessories; |

| |

• | repair and replacement parts for pool equipment, such as cleaners, filters, heaters, pumps and lights; |

| |

• | packaged pool kits including walls, liners, braces and coping for in-ground and above-ground pools; |

| |

• | pool equipment and components for new pool construction and the remodeling of existing pools; |

| |

• | irrigation and landscape products, including irrigation system components and professional lawn care equipment and supplies; |

| |

• | building materials, such as concrete, plumbing and electrical components, both functional and decorative pool surfaces, decking materials, tile, hardscapes and natural stone, used for pool installations and remodeling; |

| |

• | commercial products, including ASME heaters, safety equipment, and commercial pumps and filters; and |

| |

• | other pool construction and recreational products, which consist of a number of product categories and include discretionary recreational and related outdoor lifestyle products that enhance consumers’ use and enjoyment of outdoor living spaces, such as spas, grills and components for outdoor kitchens. |

We track and monitor the majority of our sales at the product level to provide support for sales and marketing efforts and for consideration in incentive plan programs. We currently have over 500 product lines and over 50 product categories. Based on our 2015 product classifications, sales for our pool and spa chemicals product category as a percentage of total net sales was 13% in 2015, 13% in 2014 and 14% in 2013. In 2015 and 2014 chemical sales increased by 5% and 3%, respectively, with little benefit from pricing inflation. No other product category accounted for 10% or more of total net sales in any of the last three fiscal years.

We categorize our maintenance, repair and replacement products into the following two groupings:

| |

• | maintenance and minor repair (non-discretionary); and |

| |

• | major refurbishment and replacement (partially discretionary). |

In 2015, the sale of maintenance and minor repair products accounted for approximately 60% of our sales and gross profits while approximately 40% of our sales and gross profits were derived from the refurbishment, replacement, construction and installation (equipment, materials, plumbing, electrical, etc.) of swimming pools. These components reflect a shift back toward more sales of major refurbishment and replacement products due to an ongoing recovery of these activities since levels reached a low point in 2009. Between 2005 and early 2010, sales of maintenance and minor repair products had increased to approximately 70% of our sales and gross profits due to the significant declines in new pool construction. Prior to this industry downturn, just over 50% of our total sales and gross profits were related to maintenance and minor repair products.

Discretionary demand for products related to pool construction and remodeling has been an important factor in our historical base business sales growth. While sales of these products declined between 2007 and 2009, we realized sales growth from 2010 to 2015 due to our ongoing expansion of these product offerings and the steady improvement in new construction, remodeling and economic trends. However, new pool construction remains approximately 70% below peak levels reached in 2005 and approximately 60% below what we believe to be normal levels. We continue to identify new related product categories and we typically introduce new categories each year in select markets. We then evaluate the performance in these test markets and focus on those product categories that we believe exhibit the best long-term growth potential. We expect to realize continued sales growth for these types of product offerings by expanding the number of locations that offer these products, increasing the number of products offered at certain locations and continuing a modest broadening of these product offerings on a company-wide basis.

In recent years we have experienced product and customer mix changes, including a shift in consumer spending to higher value, lower margin products such as variable speed pumps, high efficiency heaters, LED lighting and irrigation and landscape equipment, which positively contribute to our sales and gross profit growth but negatively impact our gross margin. We expect continued demand for these products, but believe our efforts in various pricing and sourcing initiatives and our expansion of building materials and commercial product offerings will help offset these gross margin declines and lead to somewhat flat gross margin trends over the next few years.

Operating Strategy

We distribute swimming pool supplies, equipment and related leisure products domestically through our SCP and Superior networks and internationally through our SCP network. We distribute irrigation and landscape products through our Horizon network and hardscapes, tile, decking materials and interior pool finish products through our NPT network. We adopted the strategy of operating two distinct distribution networks within the U.S. swimming pool market primarily for two reasons:

| |

• | to offer our customers a choice of distinctive product selections, locations and service personnel; and |

| |

• | to increase the level of customer service and operational efficiency provided by the sales centers in each network by promoting healthy competition between the two networks. |

We evaluate our sales centers based upon their performance relative to predetermined standards that include both financial and operational measures. Our corporate support groups provide our field operations with various services, such as developing and coordinating customer and vendor related programs, information systems support and expert resources to help them achieve their goals. We believe our incentive programs and feedback tools, along with the competitive nature of our internal networks, stimulate and enhance employee performance.

Distribution

Our sales centers are located within population centers near customer concentrations, typically in industrial, commercial or mixed‑use zones. Customers may pick up products at any sales center location, or we may deliver products to their premises or job sites via our trucks or third party carriers.

Our sales centers maintain well-stocked inventories to meet our customers’ immediate needs. We utilize warehouse management technology to optimize receiving, inventory control, picking, packing and shipping functions.

We also operate four centralized shipping locations (CSLs) that redistribute products we purchase in bulk quantities to our sales centers or in some cases, directly to customers. Our CSLs are regional locations that carry a wide range of traditional swimming pool, irrigation and related construction products.

Purchasing and Suppliers

We enjoy good relationships with our suppliers, who generally offer competitive pricing, return policies and promotional allowances. It is customary in our industry for certain manufacturers to offer seasonal terms to qualifying purchasers such as Pool Corporation. These terms typically allow us to place orders in the fall prior to any seasonal price increases, take delivery of product during the off-season months and pay for these purchases in the spring or early summer.

Our preferred vendor program encourages our distribution networks to stock and sell products from a smaller number of vendors to optimize profitability and shareholder return. We also work closely with our vendors to develop programs and services to better meet the needs of our customers and to concentrate our inventory investments. These practices, together with a more comprehensive service offering, have positively impacted our selling margins and our returns on inventory investments.

We regularly evaluate supplier relationships and consider alternate sourcing to assure competitive cost, service and quality standards. Our largest suppliers include Pentair Water Pool and Spa, Inc., Hayward Pool Products, Inc. and Zodiac Pool Systems, Inc., which accounted for approximately 20%, 10% and 8%, respectively, of the cost of products we sold in 2015.

Competition

Based on industry knowledge and available data, management believes we are the largest wholesale distributor of swimming pool and related backyard products and the only truly national wholesale distributor focused on the swimming pool industry in the United States. We are also one of the top three distributors of irrigation and landscape products in the United States. We face intense competition from many regional and local distributors in our markets and from one national wholesale distributor of irrigation and landscape products. We also face competition, both directly and indirectly, from mass-market retailers and large pool supply retailers (both store-based and internet) who buy directly from manufacturers.

Some geographic markets we serve, particularly the four largest and higher pool density markets of California, Florida, Texas and Arizona, have a greater concentration of competition than others. Barriers to entry in our industry are relatively low. We believe that the principal competitive factors in swimming pool and landscape supply distribution are:

| |

• | the breadth and availability of products offered; |

| |

• | the quality and level of customer service; |

| |

• | the breadth and depth of sales and marketing programs; |

| |

• | consistency and stability of business relationships with customers and suppliers; |

| |

• | competitive product pricing; and |

| |

• | access to commercial credit to finance business working capital. |

We believe that we generally compete favorably with respect to each of these factors.

Seasonality and Weather

For a discussion regarding seasonality and weather, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Seasonality and Quarterly Fluctuations,” of this Form 10-K.

Environmental, Health and Safety Regulations

Our business is subject to regulation under local fire codes and international, federal, state and local environmental and health and safety requirements, including regulation by the Environmental Protection Agency, the Consumer Product Safety Commission, the Department of Transportation, the Occupational Safety and Health Administration, the National Fire Protection Agency and the International Maritime Organization. Most of these requirements govern the packaging, labeling, handling, transportation, storage and sale of chemicals and fertilizers. We store certain types of chemicals and/or fertilizers at each of our sales centers and the storage of these items is strictly regulated by local fire codes. In addition, we sell algaecides and pest control products that are regulated as pesticides under the Federal Insecticide, Fungicide and Rodenticide Act and various state pesticide laws. These laws primarily relate to labeling, annual registration and licensing.

Employees

We employed approximately 3,800 people at December 31, 2015. Given the seasonal nature of our business, our peak employment period is the summer and, depending on expected sales levels, we add 200 to 500 employees to our work force to meet seasonal demand.

Intellectual Property

We maintain both domestic and foreign registered trademarks and patents, primarily for our Pool Corporation and Pool Systems Pty. Ltd. (PSL) branded products that are important to our current and future business operations. We also own rights to numerous internet domain names.

Geographic Areas

The table below presents net sales by geographic region, with international sales translated into U.S. dollars at prevailing exchange rates for the past three fiscal years (in thousands):

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2015 | | 2014 | | 2013 |

United States | | $ | 2,168,802 |

| | $ | 2,037,001 |

| | $ | 1,895,226 |

|

International | | 194,337 |

| | 209,561 |

| | 184,474 |

|

| | $ | 2,363,139 |

| | $ | 2,246,562 |

| | $ | 2,079,700 |

|

The table below presents net property and equipment by geographic region, with international property and equipment balances translated into U.S. dollars at prevailing exchange rates for the past three fiscal years (in thousands):

|

| | | | | | | | | | | | |

| | December 31, |

| | 2015 | | 2014 | | 2013 |

United States | | $ | 65,885 |

| | $ | 51,027 |

| | $ | 48,294 |

|

International | | 3,969 |

| | 5,448 |

| | 4,034 |

|

| | $ | 69,854 |

| | $ | 56,475 |

| | $ | 52,328 |

|

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on our website at www.poolcorp.com as soon as reasonably practical after we electronically file such reports with, or furnish them to, the Securities and Exchange Commission (SEC).

Additionally, we have adopted a Code of Business Conduct and Ethics (the Code) that applies to all of our employees, officers and directors, and is available on our website at www.poolcorp.com. Any substantive amendments to the Code, or any waivers granted to any directors or executive officers, including our principal executive officer, principal financial officer, or principal accounting officer and controller, will be disclosed on our website and remain there for at least 12 months.

Item 1A. Risk Factors

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

Our disclosure and analysis in this report contains forward-looking information that involves risks and uncertainties. Our forward‑looking statements express our current expectations or forecasts of possible future results or events, including projections of earnings and other financial performance measures, statements of management’s expectations regarding our plans and objectives and industry, general economic and other forecasts of trends and other matters. Forward-looking statements speak only as of the date of this filing, and we undertake no obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur. You can identify these statements by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate,” “estimate,” “expect,” “believe,” “will likely result,” “outlook,” “project,” “should” and other words and expressions of similar meaning. No assurance can be given that the results in any forward-looking statements will be achieved and actual results could be affected by one or more factors, which could cause them to differ materially. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act.

Risk Factors

Certain factors that may affect our business and could cause actual results to differ materially from those expressed in any forward‑looking statements include the following:

The demand for our swimming pool, irrigation and related outdoor lifestyle products has been and may continue to be adversely affected by unfavorable economic conditions.

Consumer discretionary spending affects our sales and is impacted by factors outside of our control, including general economic conditions, disposable income levels, consumer confidence and access to credit. In economic downturns, the demand for swimming pool, irrigation and related outdoor lifestyle products may decline, often corresponding with declines in discretionary consumer spending, the growth rate of pool eligible households and swimming pool construction. Maintenance products and repair and certain replacement equipment, which are required to maintain existing swimming pools, currently account for approximately 90% of net sales and gross profits related to our swimming pool business; however the growth of this portion of our business depends on the expansion of the installed pool base and could also be adversely affected by decreases in construction activities, similar to the trends between late 2006 and early 2010. A weak economy may also cause consumers to defer discretionary replacement and refurbish activity. Even in generally favorable economic conditions, severe and/or prolonged downturns in the housing market could have a material adverse impact on our financial performance. Such downturns expose us to certain additional risks, including but not limited to the risk of customer closures or bankruptcies, which could shrink our potential customer base and inhibit our ability to collect on those customers’ receivables.

We believe that homeowners’ access to consumer credit is a critical factor enabling the purchase of new pools and irrigation systems. Between late 2006 and early 2010, the unfavorable economic conditions and downturn in the housing market resulted in significant tightening of credit markets, which limited the ability of consumers to access financing for new swimming pools and irrigation systems. Although we have seen improvement since 2010, if these trends worsen, many consumers will likely not be able to obtain financing for pool, irrigation and related outdoor projects, which could negatively impact our sales of construction-related products.

We are susceptible to adverse weather conditions.

Weather is one of the principal external factors affecting our business. For example, unseasonably late warming trends in the spring or early cooling trends in the fall can shorten the length of the pool season. Also, unseasonably cool weather or extraordinary rainfall during the peak season can decrease swimming pool use, installation and maintenance, as well as landscape installations and maintenance. These weather conditions adversely affect sales of our products. While warmer weather conditions favorably impact our sales, global warming trends and other significant climate changes can create more variability in the short term or lead to other unfavorable weather conditions that could adversely impact our sales or operations. Drought conditions or water management initiatives may lead to municipal ordinances related to water use restrictions, which could result in decreased pool and irrigation system installations and negatively impact our sales. For a discussion regarding seasonality and weather, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Seasonality and Quarterly Fluctuations,” of this Form 10-K.

Our distribution business is highly dependent on our ability to maintain favorable relationships with suppliers.

As a distribution company, maintaining favorable relationships with our suppliers is critical to our success. We believe that we add considerable value to the swimming pool and irrigation and landscape supply chains by purchasing products from a large number of manufacturers and distributing the products to a highly fragmented customer base on conditions that are more favorable than these customers could obtain on their own. We believe that we currently enjoy good relationships with our suppliers, who generally offer us competitive pricing, return policies and promotional allowances. However, our inability to maintain favorable relationships with our suppliers could have an adverse effect on our business.

Our largest suppliers are Pentair Water Pool and Spa, Inc., Hayward Pool Products, Inc. and Zodiac Pool Systems, Inc., which accounted for approximately 20%, 10% and 8%, respectively, of the costs of products we sold in 2015. A decision by several suppliers, acting in concert, to sell their products directly to retailers or other end users of their products, bypassing distribution companies like ours, would have an adverse effect on our business. Additionally, the loss of a single significant supplier due to financial failure or a decision to sell exclusively to retailers or end-use consumers could also adversely affect our business. We dedicate considerable resources to promote the benefits and affordability of pool ownership, which we believe significantly benefits our swimming pool customers and suppliers.

We face intense competition both from within our industry and from other leisure product alternatives.

We face competition from both inside and outside of our industry. Within our industry, we directly compete against various regional and local distributors and indirectly, against mass market retailers, large pool or landscape supply retailers and internet retailers as they compete against our customers for the business of pool owners and other end-use customers. Outside of our industry, we compete indirectly with alternative suppliers of big ticket consumer discretionary products, such as boat and motor home distributors, and with other companies who rely on discretionary homeowner expenditures, such as home remodelers. New competitors may emerge as there are low barriers to entry in our industry. Given the density and demand for pool products, some geographic markets that we serve also tend to have a higher concentration of competitors than others, particularly California, Florida, Texas and Arizona. These states encompass our four largest markets and represented approximately 53% of our net sales in 2015.

More aggressive competition by store- and internet-based mass merchants and large pool or landscape supply retailers could adversely affect our sales.

Mass market retailers today carry a limited range of, and devote a limited amount of shelf space to, merchandise and products targeted to our industry. Historically, mass market retailers have generally expanded by adding new stores and product breadth, but their product offering of pool and landscape related products has remained relatively constant. Should store- and internet-based mass market retailers increase their focus on the pool or professional landscape industries, or increase the breadth of their pool and landscape related product offerings, they may become a more significant competitor for our direct customers and end-use consumers which could have an adverse impact on our business. We may face additional competitive pressures if large pool or landscape supply retailers look to expand their customer base to compete more directly within the distribution channel.

We depend on key personnel.

We consider our employees to be the foundation for our growth and success. As such, our future success depends in large part on our ability to attract, retain and motivate qualified personnel. This includes succession planning related to our executive officers and key management personnel. If we are unable to attract and retain key personnel, our operating results could be adversely affected.

Past growth may not be indicative of future growth.

Historically, we have experienced substantial sales growth through organic market share gains, new sales center openings and acquisitions that have increased our size, scope and geographic distribution. Since the beginning of 2013, we have opened 8 new sales centers (net of sales center consolidations) and we have completed 9 acquisitions consisting of 16 sales centers (net of sales center consolidations within one year of acquisition). While we contemplate continued growth through internal expansion and acquisitions, no assurance can be made as to our ability to:

| |

• | generate sufficient cash flows to support expansion plans and general operating activities; |

| |

• | identify appropriate acquisition candidates; |

| |

• | maintain favorable supplier arrangements and relationships; and |

| |

• | identify and divest assets which do not continue to create value consistent with our objectives. |

If we do not manage these potential difficulties successfully, our operating results could be adversely affected.

Our business is highly seasonal.

In 2015, we generated approximately 63% of our net sales and 90% of our operating income in the second and third quarters of the year. These quarters represent the peak months of both swimming pool use, installation, remodeling and repair, and landscape installations and maintenance. Our sales are substantially lower during the first and fourth quarters of the year, when we may incur net losses.

The nature of our business subjects us to compliance with environmental, health, transportation and safety regulations.

We are subject to regulation under federal, state, local and international environmental, health, transportation and safety requirements, which govern such things as packaging, labeling, handling, transportation, storage and sale of chemicals and fertilizers. For example, we sell algaecides and pest control products that are regulated as pesticides under the Federal Insecticide, Fungicide and Rodenticide Act and various state pesticide laws. These laws primarily relate to labeling, annual registration and licensing.

Management has processes in place to facilitate and support our compliance with these requirements. However failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties or the imposition of injunctive relief. Moreover, compliance with such laws and regulations in the future could prove to be costly. Although we presently do not expect to incur any capital or other expenditures relating to regulatory matters in amounts that may be material to us, we may be required to make such expenditures in the future. These laws and regulations have changed substantially and rapidly over the last 25 years and we anticipate that there will be continuing changes.

The clear trend in environmental, health, transportation and safety regulations is to place more restrictions and limitations on activities that impact the environment, such as the use and handling of chemical substances. Increasingly, strict restrictions and limitations have resulted in higher operating costs for us and it is possible that the costs of compliance with such laws and regulations will continue to increase. We will attempt to anticipate future regulatory requirements that might be imposed and we will plan accordingly to remain in compliance with changing regulations and to minimize the costs of such compliance.

We store chemicals, fertilizers and other combustible materials that involve fire, safety and casualty risks.

We store chemicals and fertilizers, including certain combustible, oxidizing compounds, at our sales centers. A fire, explosion or flood affecting one of our facilities could give rise to fire, safety and casualty losses and related liability claims. We maintain what we believe is prudent insurance protection. However, we cannot guarantee that our insurance coverage will be adequate to cover future claims that may arise or that we will be able to maintain adequate insurance in the future at rates we consider reasonable. Successful claims for which we are not fully insured may adversely affect our working capital and profitability. In addition, changes in the insurance industry have generally led to higher insurance costs and decreased availability of coverage.

We conduct business internationally, which exposes us to additional risks.

Our international operations, which accounted for 8% of our total net sales in 2015, expose us to certain additional risks, including:

| |

• | difficulty in staffing international subsidiary operations; |

| |

• | different political and regulatory conditions; |

| |

• | adverse tax consequences; and |

| |

• | dependence on other economies. |

For foreign sourced products, we may be subject to certain trade restrictions that would prevent us from obtaining products and there is also a greater risk that we may not be able to access products in a timely and efficient manner. Fluctuations in other factors relating to international trade, such as tariffs, transportation costs and inflation are additional risks for our international operations.

We depend on a global network of suppliers to source our products. Product quality or safety concerns could negatively impact our sales and expose us to legal claims.

We rely on manufacturers and other suppliers to provide us with the products we sell and distribute. As we increase the number of Pool Corporation and PSL branded products we distribute, our exposure to potential liability claims may increase. The risk of claims may also be greater with respect to products manufactured by third-party suppliers outside the United States, particularly in China. Uncertainties with respect to foreign legal systems may adversely affect us in resolving claims arising from our foreign sourced products. Even if we are successful in defending any claim relating to the products we distribute, claims of this nature could negatively impact customer confidence in our products and our company.

We rely on information technology systems to support our business operations. Any disturbance or breach of our technological infrastructure could adversely affect our financial condition and results of operations. Additionally, failure to maintain the security of confidential information could damage our reputation and expose us to litigation.

Information technology supports several aspects of our business, including among others, product sourcing, pricing, customer service, transaction processing, financial reporting, collections and cost management. Our ability to operate effectively on a day to day basis depends on a solid technological infrastructure, which is inherently susceptible to internal and external threats. We are vulnerable to interruption by fire, natural disaster, power loss, telecommunication failures, internet failures, security breaches and other catastrophic events. Exposure to various types of cyber-attacks such as malware, computer viruses, worms, or other malicious acts, as well as human error, could also potentially disrupt our operations or result in a significant interruption in the delivery of our goods and services. Advances in computer and software capabilities, encryption technology and other discoveries increase the complexity of our technological environment, including how each interact with our various software platforms, and may delay or hinder our ability to process transactions and compromise the integrity of our data.

We have designed numerous procedures and protocols to mitigate these risks. We continually invest in information technology security and update our business continuity plan. However, the failure to maintain security over and prevent unauthorized access to our data, our customers’ personal information, including credit card information, or data belonging to our suppliers, could put us at a competitive disadvantage, result in damage to our reputation and subject us to potential litigation, liability, fines and penalties, resulting in a possible material adverse impact on our financial condition and results of operations.

A terrorist attack or the threat of a terrorist attack could have a material adverse effect on our business.

Discretionary spending on leisure product offerings such as ours is generally adversely affected during times of economic or political uncertainty. The potential for terrorist attacks, the national and international responses to terrorist attacks, and other acts of war or hostility could create these types of uncertainties and negatively impact our business for the short or long term in ways that cannot presently be predicted.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We lease the Pool Corporation corporate offices, which consist of approximately 54,800 square feet of office space in Covington, Louisiana, from an entity in which we have a 50% ownership interest. We own three sales center facilities in Florida and one in Texas. We lease all of our other properties and the majority of our leases have three to seven year terms.

As of December 31, 2015, we had 12 leases with remaining terms longer than seven years that expire between 2023 and 2027. Most of our leases contain renewal options, some of which involve rent increases. In addition to minimum rental payments, which are set at competitive rates, certain leases require reimbursement for taxes, maintenance and insurance.

Our sales centers range in size from approximately 2,000 square feet to 60,000 square feet and generally consist of warehouse, counter, display and office space. Our centralized shipping locations (CSLs) range in size from approximately 103,000 square feet to 185,000 square feet.

We believe that our facilities are well maintained, suitable for our business and occupy sufficient space to meet our operating needs. As part of our normal business, we regularly evaluate sales center performance and site suitability and may relocate a sales center or consolidate two locations if a sales center is redundant in a market, underperforming or otherwise deemed unsuitable. We do not believe that any single lease is material to our operations.

The table below summarizes the changes in our sales centers during the year ended December 31, 2015:

|

| | | | | | | | | | | | | | | |

Network | | 12/31/14 | | New Locations | | Consolidated Locations (2) | | Acquired Locations (3) | | 12/31/15 |

SCP | | 157 |

| | 3 |

| | (1 | ) | | 2 |

| | 161 |

|

Superior | | 64 |

| | — |

| | (1 | ) | | 2 |

| | 65 |

|

Horizon | | 60 |

| | 1 |

| | (1 | ) | | — |

| | 60 |

|

NPT (1) | | 12 |

| | — |

| | — |

| | 3 |

| | 15 |

|

Total Domestic | | 293 |

| | 4 |

| | (3 | ) | | 7 |

| | 301 |

|

SCP International | | 35 |

| | — |

| | — |

| | — |

| | 35 |

|

Total | | 328 |

| | 4 |

| | (3 | ) | | 7 |

| | 336 |

|

| |

(1) | In 2014, we identified NPT as a separate network. In addition to the stand-alone NPT sales centers, there are over 80 SCP and Superior locations that have consumer showrooms and serve as stocking locations that feature NPT brand tile and composite finish products. |

| |

(2) | Consolidated sales centers are those locations where we expect to transfer the majority of the existing business to our nearby sales center locations. |

| |

(3) | We acquired six sales centers through three acquisitions completed in the United States in 2015. One of the acquired locations in our NPT network reflects a sales center from an acquisition completed on December 31, 2014 that is included in our 2015 count versus in our 2014 count, as there were no sales attributable to Pool Corporation from this acquisition in fiscal 2014. |

The table below identifies the number of sales centers in each state, territory or country by distribution network as of December 31, 2015:

|

| | | | | | | | | | | | | | | |

Location | | SCP | | Superior | | Horizon | | NPT | | Total |

United States | | | | | | | | | | |

California | | 24 |

| | 20 |

| | 17 |

| | 5 |

| | 66 |

|

Florida | | 32 |

| | 6 |

| | 4 |

| | 1 |

| | 43 |

|

Texas | | 20 |

| | 5 |

| | 10 |

| | 4 |

| | 39 |

|

Arizona | | 6 |

| | 6 |

| | 11 |

| | 2 |

| | 25 |

|

Georgia | | 6 |

| | 2 |

| | — |

| | 1 |

| | 9 |

|

Nevada | | 2 |

| | 3 |

| | 3 |

| | — |

| | 8 |

|

Tennessee | | 5 |

| | 3 |

| | — |

| | — |

| | 8 |

|

New Jersey | | 4 |

| | 3 |

| | — |

| | — |

| | 7 |

|

Washington | | 1 |

| | — |

| | 6 |

| | — |

| | 7 |

|

Alabama | | 4 |

| | 2 |

| | — |

| | — |

| | 6 |

|

New York | | 6 |

| | — |

| | — |

| | — |

| | 6 |

|

Louisiana | | 5 |

| | — |

| | — |

| | — |

| | 5 |

|

Missouri | | 3 |

| | 1 |

| | — |

| | 1 |

| | 5 |

|

Pennsylvania | | 3 |

| | 1 |

| | — |

| | 1 |

| | 5 |

|

Colorado | | 1 |

| | 1 |

| | 2 |

| | — |

| | 4 |

|

Illinois | | 3 |

| | 1 |

| | — |

| | — |

| | 4 |

|

Indiana | | 2 |

| | 2 |

| | — |

| | — |

| | 4 |

|

North Carolina | | 3 |

| | 1 |

| | — |

| | — |

| | 4 |

|

Ohio | | 2 |

| | 2 |

| | — |

| | — |

| | 4 |

|

Oregon | | 1 |

| | — |

| | 3 |

| | — |

| | 4 |

|

South Carolina | | 3 |

| | 1 |

| | — |

| | — |

| | 4 |

|

Virginia | | 2 |

| | 1 |

| | 1 |

| | — |

| | 4 |

|

Idaho | | 1 |

| | — |

| | 2 |

| | — |

| | 3 |

|

Oklahoma | | 2 |

| | 1 |

| | — |

| | — |

| | 3 |

|

Arkansas | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Connecticut | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Kansas | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Maryland | | 1 |

| | — |

| | 1 |

| | — |

| | 2 |

|

Massachusetts | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Michigan | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Minnesota | | 1 |

| | 1 |

| | — |

| | — |

| | 2 |

|

Mississippi | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Hawaii | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Iowa | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Kentucky | | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

Nebraska | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

New Mexico | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Puerto Rico | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Utah | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Wisconsin | | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

Total United States | | 161 |

| | 65 |

| | 60 |

| | 15 |

| | 301 |

|

International | | | | | | | | | | |

Canada | | 15 |

| | — |

| | — |

| | — |

| | 15 |

|

France | | 5 |

| | — |

| | — |

| | — |

| | 5 |

|

Australia | | 3 |

| | — |

| | — |

| | — |

| | 3 |

|

Mexico | | 3 |

| | — |

| | — |

| | — |

| | 3 |

|

Portugal | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

United Kingdom | | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Belgium | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Colombia | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Germany | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Italy | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Spain | | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Total International | | 35 |

| | — |

| | — |

| | — |

| | 35 |

|

Total | | 196 |

| | 65 |

| | 60 |

| | 15 |

| | 336 |

|

Item 3. Legal Proceedings

From time to time, we are subject to various claims and litigation arising in the ordinary course of business, including product liability, personal injury, commercial, contract and employment matters. Litigation can be expensive and disruptive to normal business operations.

As previously disclosed, a number of purported anti-trust class action suits were filed against us in various United States District Courts in 2012. The cases were transferred and consolidated before the Judicial Panel for Multidistrict Litigation, MDL Docket No. 2328, and are presently pending in the Eastern District of Louisiana. The plaintiffs include indirect purchaser plaintiffs, purporting to represent indirect purchasers of swimming pool products in Arizona, California, Florida and Missouri, and direct purchaser plaintiffs, who are current or former customers. The plaintiffs also named three additional defendants: Hayward Industries, Inc., Pentair Water Pool and Spa, Inc. and Zodiac Pool Systems, Inc. The plaintiffs seek unspecified compensatory and enhanced damages, interest, costs and fees and other equitable relief. The Court gave final approval of a class action settlement between Hayward Industries, Inc., Pentair Water Pool and Spa, Inc. and Zodiac Pool Systems, Inc. and the direct purchaser plaintiffs. The Court also gave final approval of class action settlements between the indirect purchaser plaintiffs and each of Hayward Industries, Inc., Zodiac Pool Systems, Inc. and Pentair Water Pool and Spa, Inc. On January 27, 2016, the Court granted summary judgment in our favor on the direct purchasers’ horizontal conspiracy claim. We continue to defend ourselves in this matter.

While the outcome of any litigation is inherently unpredictable, based on currently available facts we do not believe that the ultimate resolution of this matter or other claims and litigation not discussed above will have a material adverse impact on our financial condition, results of operations or cash flows. Our view of these matters may change in the future as the litigation and related events unfold.

Item 4. Mine Safety Disclosures

Not applicable.

PART II.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NASDAQ Global Select Market under the symbol “POOL.” On February 17, 2016, there were approximately 30,025 holders of record of our common stock. The table below sets forth the high and low closing sales prices of our common stock as well as dividends declared per common share for each quarter during the last two fiscal years.

|

| | | | | | | | | | | | |

| | High | | Low | | Dividends Declared |

Fiscal 2015 | | | | | | |

First Quarter | | $ | 70.43 |

| | $ | 62.21 |

| | $ | 0.22 |

|

Second Quarter | | 71.80 |

| | 64.89 |

| | 0.26 |

|

Third Quarter | | 72.80 |

| | 66.14 |

| | 0.26 |

|

Fourth Quarter | | 84.16 |

| | 72.63 |

| | 0.26 |

|

| | | | | | |

Fiscal 2014 | | | | | | |

First Quarter | | $ | 61.74 |

| | $ | 52.68 |

| | $ | 0.19 |

|

Second Quarter | | 62.42 |

| | 56.56 |

| | 0.22 |

|

Third Quarter | | 57.53 |

| | 53.92 |

| | 0.22 |

|

Fourth Quarter | | 64.09 |

| | 53.34 |

| | 0.22 |

|

We initiated quarterly dividend payments to our shareholders in the second quarter of 2004 and we have continued payments in each subsequent quarter. Our Board of Directors (our Board) has increased the dividend amount ten times including in the fourth quarter of 2004, annually in the second quarters of 2005 through 2008 and in the second quarters of 2011 through 2015. Future dividend payments will be at the discretion of our Board, after considering various factors, including our earnings, capital requirements, financial position, contractual restrictions and other relevant business considerations. For a description of restrictions on dividends in our Credit Facility and Receivables Facility, see Note 5 of “Notes to Consolidated Financial Statements,” included in Item 8 of this Form 10-K. We cannot assure shareholders or potential investors that dividends will be declared or paid any time in the future if our Board determines that there is a better use of our funds.

Stock Performance Graph

The information included under the caption “Stock Performance Graph” in this Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 (the 1934 Act) or to the liabilities of Section 18 of the 1934 Act, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the 1934 Act, except to the extent we specifically incorporate it by reference into such a filing.

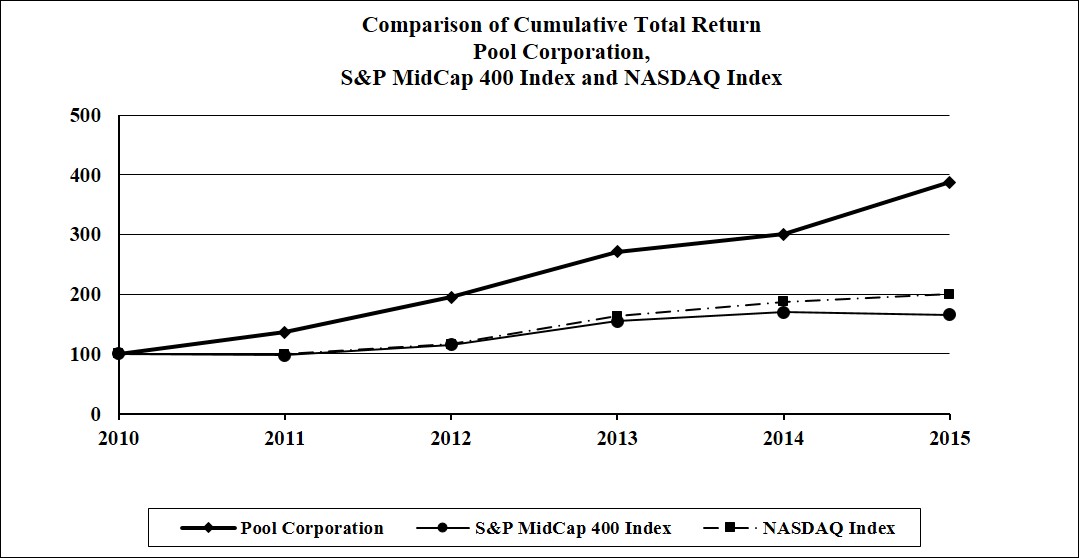

The following graph compares the total stockholder return on our common stock for the last five fiscal years with the total return on the S&P MidCap 400 Index and the NASDAQ Index for the same period, in each case assuming the investment of $100 on December 31, 2010 and the reinvestment of all dividends. We believe the S&P MidCap 400 Index includes companies with market capitalizations comparable to ours. Additionally, we chose the S&P MidCap 400 Index for comparison, as opposed to an industry index, because we do not believe that we can reasonably identify a peer group or a published industry or line-of-business index that contains companies in a similar line of business.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Base Period | | Indexed Returns Years Ending |

Company / Index | | 12/31/10 | | 12/31/11 | | 12/31/12 | | 12/31/13 | | 12/31/14 | | 12/31/15 |

Pool Corporation | | $ | 100.00 |

| | $ | 136.23 |

| | $ | 194.61 |

| | $ | 271.14 |

| | $ | 300.17 |

| | $ | 387.59 |

|

S&P MidCap 400 Index | | 100.00 |

| | 98.27 |

| | 115.83 |

| | 154.64 |

| | 169.74 |

| | 166.05 |

|

NASDAQ Index | | 100.00 |

| | 99.17 |

| | 116.48 |

| | 163.21 |

| | 187.27 |

| | 200.31 |

|

Purchases of Equity Securities

The table below summarizes the repurchases of our common stock in the fourth quarter of 2015.

|

| | | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased (1) | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plan (2) | | Maximum Approximate Dollar Value of Shares That May Yet be Purchased Under the Plan (3) |

October 1 – October 31, 2015 | | 38,681 |

| | $ | 75.35 |

| | 25,265 |

| | $ | 78,159,421 |

|

November 1 – November 30, 2015 | | 3,700 |

| | $ | 79.39 |

| | 3,700 |

| | $ | 77,865,671 |

|

December 1 – December 31, 2015 | | 70,707 |

| | $ | 80.65 |

| | 70,707 |

| | $ | 72,162,798 |

|

Total | | 113,088 |

| | $ | 78.80 |

| | 99,672 |

| | |

|

| |

(1) | These shares may include shares of our common stock surrendered to us by employees in order to satisfy minimum tax withholding obligations in connection with certain exercises of employee stock options and/or the exercise price of such options granted under our share-based compensation plans. There were 13,416 shares surrendered for this purpose in the fourth quarter of 2015. |

| |

(2) | In May 2015, our Board authorized an additional $100.0 million under our existing share repurchase program. This program allows for the repurchase of shares of our common stock in the open market at prevailing market prices or in privately negotiated transactions. On February 25, 2016, when $14.3 million remained under the May 2015 share repurchase authorization, our Board authorized an additional $150.0 million under our existing share repurchase program. This increased our total authorized amount to $164.3 million. |

| |

(3) | In 2015, we purchased a total of $92.4 million, or 1,346,958 shares, in the open market at an average price of $68.57 per share. |

Item 6. Selected Financial Data

The table below sets forth selected financial data from the Consolidated Financial Statements. You should read this information in conjunction with the discussions in Item 7 of this Form 10-K and with the Consolidated Financial Statements and accompanying Notes in Item 8 of this Form 10-K.

|

| | | | | | | | | | | | | | | | | | | | |

(in thousands, except per share data) | | Year Ended December 31, |

| | 2015 | | 2014 | | 2013 | | 2012 (1) | | 2011 |

Statement of Income Data | | | | | | | | | | |

Net sales | | $ | 2,363,139 |

| | $ | 2,246,562 |

| | $ | 2,079,700 |

| | 1,953,974 |

| | 1,793,318 |

|

Operating income | | 216,222 |

| | 188,870 |

| | 165,486 |

| | 144,869 |

| | 125,067 |

|

Net income attributable to Pool Corporation | | 128,275 |

| | 110,692 |

| | 97,330 |

| | 81,972 |

| | 71,993 |

|

Earnings per share: | | | | | | |

| | |

| | |

|

Basic | | $ | 2.98 |

| | $ | 2.50 |

| | $ | 2.10 |

| | $ | 1.75 |

| | $ | 1.49 |

|

Diluted | | $ | 2.90 |

| | $ | 2.44 |

| | $ | 2.05 |

| | $ | 1.71 |

| | $ | 1.47 |

|

Cash dividends declared per common share | | $ | 1.00 |

| | $ | 0.85 |

| | $ | 0.73 |

| | 0.62 |

| | $ | 0.55 |

|

| | | | | | | | | | |

Balance Sheet Data | | | | |

| | |

| | |

| | |

|

Working capital (2) | | $ | 356,899 |

| | $ | 345,305 |

| | $ | 313,843 |

| | $ | 295,100 |

| | $ | 305,467 |

|

Total assets (2) | | 936,031 |

| | 892,937 |

| | 823,761 |

| | 780,576 |

| | 770,902 |

|

Total long-term debt, including current portion | | 329,715 |

| | 320,838 |

| | 246,418 |

| | 230,882 |

| | 247,300 |

|

Stockholders’ equity | | 255,743 |

| | 244,352 |

| | 286,182 |

| | 281,623 |

| | 279,746 |

|

| | | | | | | | | | |

Other | | | | | | |

| | |

| | |

|

Base business sales growth (3) | | 5 | % | | 7 | % | | 6 | % | | 7 | % | | 10 | % |

Number of sales centers | | 336 |

| | 328 |

| | 321 |

| | 312 | | 298 |

|

| |

(1) | In 2012, operating income, net income attributable to Pool Corporation and earnings per share amounts were significantly impacted by a $6.9 million non-cash goodwill impairment charge related to our United Kingdom reporting unit. The impact of this impairment charge on earnings was $0.14 per diluted share. |

| |

(2) | The 2011 working capital and total assets amounts have been adjusted to reclassify our deferred tax balances and our deferred tax valuation allowances between current and non-current line items to reflect net presentation. The 2011 total assets balance also reflects a change in the presentation of deferred service charge income. |

| |

(3) | For a discussion regarding our calculation of base business sales, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - RESULTS OF OPERATIONS,” of this Form 10-K. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

For a discussion of our base business calculations, see the RESULTS OF OPERATIONS section below.

2015 FINANCIAL OVERVIEW

Financial Results

We had a record-setting year in 2015 topped off with favorable warmer weather in the fourth quarter, which contributed to record fourth quarter sales and our first profitable fourth quarter ever. We grew annual sales by 5% over 2014, despite an almost 2% negative impact from foreign currency fluctuations. Strict margin discipline and expense management enabled us to expand our operating margin by more than 70 basis points.

Net sales for the year ended December 31, 2015 increased 5% compared to 2014. Base business sales also increased 5%. Annual sales benefited from increased consumer spending on discretionary products, particularly related to replacement and remodel activity. Pool owners are investing to upgrade existing pools and outdoor systems to increase energy efficiency and incorporate more technologically advanced products. Record warm temperatures through much of the fourth quarter extended the pool season well into November and December in many markets, which spurred greater sales in both our building materials and equipment product categories.

Gross profit for the year ended December 31, 2015 increased 5% over 2014. Gross profit as a percentage of net sales (gross margin) remained constant at 28.6% for both 2015 and 2014.

Selling and administrative expenses (operating expenses) for 2015 increased just 1% from 2014. Increases in performance-based incentive compensation and technology related expenses were offset by tight expense controls and an approximate 2% favorable impact on operating expenses from the stronger U.S. dollar relative to foreign currencies.

Operating income for the year improved 14% over 2014. Operating income as a percentage of net sales (operating margin) increased to 9.1% in 2015 compared to 8.4% in 2014.

Net income attributable to Pool Corporation increased 16% compared to 2014, while earnings per share was up 19% to a record $2.90 per diluted share.