QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the fiscal year ended December 31, 2011 | ||

OR |

||

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission file number 1-13758

| PORTUGAL TELECOM, SGPS, S.A. (Exact name of Registrant as specified in its charter) |

The Portuguese Republic (Jurisdiction of incorporation or organization) |

Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa, Portugal (Address of principal executive offices) |

Nuno Vieira, Investor Relations Director, Tel. +351 21 500 1701, Fax +351 21 500 0800 Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa, Portugal (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| American Depositary Shares, each representing one ordinary share, nominal value €0.03 per share | New York Stock Exchange | |

| Ordinary shares, nominal value €0.03 each | New York Stock Exchange* |

- *

- Not for trading but only in connection with the registration of American Depositary Shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary shares, nominal value €0.03 per share |

896,512,000 | |||

Class A shares, nominal value €0.03 per share |

500 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o (Note: None required of the registrant)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP o | International Financial Reporting Standards as issued by the International Accounting Standards Board ý | Other o |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

| |

Page | |||

|---|---|---|---|---|

CERTAIN DEFINED TERMS |

1 | |||

PRESENTATION OF FINANCIAL INFORMATION |

1 | |||

FORWARD-LOOKING STATEMENTS |

2 | |||

PART I |

3 | |||

ITEM 1—IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

3 | |||

ITEM 2—OFFER STATISTICS AND EXPECTED TIMETABLE |

3 | |||

ITEM 3—KEY INFORMATION |

3 | |||

ITEM 4—INFORMATION ON THE COMPANY |

28 | |||

ITEM 4A—UNRESOLVED STAFF COMMENTS |

102 | |||

ITEM 5—OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

102 | |||

ITEM 6—DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

144 | |||

ITEM 7—MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

165 | |||

ITEM 8—FINANCIAL INFORMATION |

170 | |||

ITEM 9—THE OFFER AND LISTING |

179 | |||

ITEM 10—ADDITIONAL INFORMATION |

180 | |||

ITEM 11—QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

201 | |||

ITEM 12—DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

210 | |||

PART II |

212 | |||

ITEM 13—DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

212 | |||

ITEM 14—MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

212 | |||

ITEM 15—CONTROLS AND PROCEDURES |

212 | |||

ITEM 16A—AUDIT COMMITTEE FINANCIAL EXPERT |

213 | |||

ITEM 16B—CODE OF ETHICS |

213 | |||

ITEM 16C—PRINCIPAL ACCOUNTANT FEES AND SERVICES |

214 | |||

ITEM 16D—EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

214 | |||

ITEM 16E—PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

214 | |||

ITEM 16F—CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT |

214 | |||

ITEM 16G—CORPORATE GOVERNANCE |

215 | |||

ITEM 16H—MINE SAFETY DISCLOSURE |

215 | |||

INDEX TO FINANCIAL STATEMENTS |

F-1 | |||

i

Unless the context otherwise requires, the terms "Portugal" refers to the Portuguese Republic, including the Madeira Islands and the Azores Islands; the term "EU" refers to the European Union; and the terms "United States" and "U.S." refer to the United States of America.

We use the term "Portugal Telecom" to refer to Portugal Telecom, SGPS S.A., and unless indicated otherwise, the terms "we," "our" or "us" refer to Portugal Telecom and its consolidated subsidiaries.

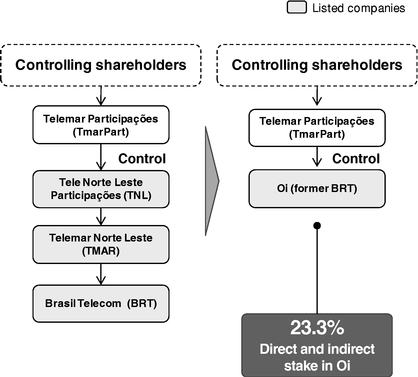

We use the term "Oi" to refer, collectively, to Telemar Participações S.A. ("TmarPart"), its subsidiary Telemar Norte Leste S.A. ("Telemar"), and its subsidiary Oi S.A., a Brazilian company. Before the corporate reorganization of Oi described in "Item 4—Information on the Company—Brazilian Operations (Oi)—Strategic Partnership with Oi," the Oi companies (the "Oi Companies") included TmarPart, its subsidiaries Valverde Participações S.A. ("Valverde"); Tele Norte Leste Participações S.A. ("TNL"), which merged with and into Oi S.A. (formerly known as Brasil Telecom S.A. ("Brasil Telecom")) as part of the corporate reorganization; Telemar; Coari Participações S.A. ("Coari"), which merged with and into Oi S.A. as part of the corporate reorganization; and Oi S.A. Following the corporate reorganization of Oi, the term "Oi Companies" refers to TmarPart, Valverde, Oi S.A. and Telemar.

References to "Euros," "EUR" or "€" are to the Euro. References herein to "U.S. dollars," "$" or "US$" are to United States dollars. References to "Real," "Reais" or "R$" are to Brazilian Reais.

PRESENTATION OF FINANCIAL INFORMATION

Preparation of Financial Statements in IFRS

Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as endorsed by the EU ("EU-IFRS"). EU-IFRS may differ from IFRS as issued by the International Accounting Standards Board ("IASB") if, at any point in time, new or amended reporting standards have not been endorsed by the EU. As of December 31, 2011, 2010 and 2009, there were no unendorsed standards effective as of and for the years ended December 31, 2011, 2010 and 2009, respectively, that affected our consolidated financial statements, and there was no difference between EU-IFRS and IFRS as issued by the IASB as applied by Portugal Telecom. Accordingly, our financial statements as of and for the years ended December 31, 2011, 2010 and 2009 were prepared in accordance with IFRS as issued by the IASB. IFRS comprise the accounting standards issued by the IASB and its predecessor body and interpretations issued by the International Financial Reporting Interpretations Committee ("IFRIC") and its predecessor body.

We publish our financial statements in Euro, the single EU currency adopted by certain participating member countries of the European Union, including Portugal, as of January 1, 1999. The Federal Reserve Bank of New York's noon buying rate in the City of New York for Euros was €0.7615 = US$1.00 on April 19, 2012, and the noon buying rate on that date for Reais was R$1.8846 = US$1.00. We are not representing that the Euro, US$ or R$ amounts shown herein could have been or could be converted at any particular rate or at all. See "Item 3—Key Information—Exchange Rates" for further information regarding the rates of exchange between Euros and U.S. dollars and between Reais and U.S. dollars.

Proportional Consolidation of Brazilian Operations

On March 28, 2011, we completed the acquisition of an economic interest of 25.3% in Oi (through a 25.6% economic interest in TmarPart and a 25.3% interest in Telemar Norte Leste S.A.). Since April 1, 2011, given our economic interest and our rights to participate in the management of TmarPart and Oi as described in "Item 4—Information on the Company—Brazilian Operations (Oi)—Strategic Partnership with Oi," we have proportionally consolidated 25.6% of TmarPart in our consolidated financial statements, which, in turn, fully consolidates TNL (which has now merged into Oi S.A.) and Telemar. Our economic interest in Oi decreased to 23.25% as a result of a corporate reorganization of

Oi that was completed on April 9, 2012. However, our economic interest in TmarPart remains at 25.6%, and we will continue to proportionally consolidate 25.6% of TmarPart in future periods.

Concurrently with our investment in Oi, we acquired a 16.2% economic interest in CTX Participações S.A. ("CTX"), the parent company of Contax Participações S.A. ("Contax Participações") and Contax S.A. ("Contax"), which provides contact center, business process outsourcing ("BPO") and IT services in Brazil and other countries in Latin America. Even before our investment in Contax, we provided call center and IT services in Brazil through our subsidiary Dedic, S.A. ("Dedic"), and Dedic's subsidiary GPTI—Tecnologias de Informação, S.A. ("GPTI") provided Information Technology/Information Systems ("IT/IS") services in Brazil. On June 30, 2011, we merged Dedic and GPTI into Contax, and our economic interest in Contax increased to 19.5%. We have proportionally consolidated the results of operations of Contax in our results of operations since April 1, 2011, and Contax's results of operations have included the results of operations of Dedic and GPTI since July 1, 2011.

Discontinued Operations

We provided mobile telecommunications services in Brazil through Vivo Participações S.A. ("Vivo") through September 2010. We held our participation in Vivo through our 50% interest in Brasilcel N.V., a joint venture with Telefónica, S.A. ("Telefónica"). On July 28, 2010, we reached an agreement with Telefónica for them to buy from us our 50% interest in Brasilcel N.V. We closed the transaction on September 27, 2010. Our consolidated statements of income and cash flows present Vivo under the caption "Discontinued Operations" for all periods presented, and our consolidated balance sheet as of December 31, 2010 and thereafter no longer includes the assets and liabilities related to Vivo.

This Form 20-F includes, and documents incorporated by reference herein and future public filings and oral and written statements by our management may include, statements that constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of our management and on information available to management at the time such statements were made. Forward-looking statements include, but are not limited to: (a) information concerning possible or assumed future results of our operations, earnings, industry conditions, demand and pricing for our services and other aspects of our business under "Item 4—Information on the Company," "Item 5—Operating and Financial Review and Prospects" and "Item 11—Quantitative and Qualitative Disclosures About Market Risk"; and (b) statements that are preceded by, followed by or include the words "believes," "expects," "anticipates," "intends," "is confident," "plans," "estimates," "may," "might," "could," "would," the negatives of such terms or similar expressions.

Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from our expectations. Many of the factors that will determine these results are beyond our ability to control or predict. We do not intend to review or revise any particular forward-looking statements referenced in this Form 20-F in light of future events or to provide reasons why actual results may differ. Investors are cautioned not to put undue reliance on any forward-looking statements.

Any of the following important factors, and any of those important factors described elsewhere in this or in other of our SEC filings, among other things, could cause our results to differ from any results that might be projected, forecasted or estimated by us in any such forward-looking statements:

- •

- material adverse changes in economic conditions in Portugal, Brazil or the other countries in which we have operations and investments;

2

- •

- the effects of intense competition in Portugal, Brazil and the other countries in which we have operations and

investments;

- •

- changes in telecommunications technology that could lead to obsolescence of our infrastruture;

- •

- the development and marketing of new products and services and market acceptance of such products and services;

- •

- risks and uncertainties related to national and supranational regulation; and

- •

- the adverse determination of disputes under litigation.

ITEM 1—IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

We are not required to provide the information called for by Item 1.

ITEM 2—OFFER STATISTICS AND EXPECTED TIMETABLE

We are not required to provide the information called for by Item 2.

Selected Consolidated Financial Data

The selected consolidated statement of financial position data as of December 31, 2009, 2010 and 2011 and the selected consolidated statement of income and cash flow data for each of the years ended December 31, 2009, 2010 and 2011 have been derived from our audited consolidated financial statements included herein prepared in accordance with IFRS. The selected consolidated statement of financial position data as of December 31, 2007 and 2008 and the selected consolidated statement of income and cash flow data for the years then ended have been derived from our consolidated financial statements prepared in accordance with IFRS included in our Annual Report for the year ended December 31, 2009.

The information set forth below is qualified by reference to, and should be read in conjunction with, our audited financial statements and the notes thereto and also "Item 5—Operating and Financial Review and Prospects" included in this Form 20-F.

Given the sale on September 27, 2010 of our interest in Vivo to Telefónica, the selected consolidated statement of income for Vivo is presented under the caption "Discontinued Operations" for all periods through the completion of the sale, and the selected consolidated statement of financial

3

position as of December 31, 2010 no longer includes the assets and liabilities related to Vivo, following the completion of the sale on September 27, 2010.

| |

Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||

| |

(EUR Millions) |

|||||||||||||||

Statement of Income Data(1): |

||||||||||||||||

Continuing operations |

||||||||||||||||

Revenues: |

||||||||||||||||

Services rendered |

3,530.0 | 3,503.4 | 3,492.0 | 3,516.0 | 5,859.3 | |||||||||||

Sales |

187.7 | 217.7 | 197.2 | 165.6 | 141.5 | |||||||||||

Other revenues |

32.8 | 40.1 | 44.3 | 60.6 | 146.1 | |||||||||||

Total revenues |

3,750.5 | 3,761.2 | 3,733.4 | 3,742.3 | 6,146.8 | |||||||||||

Costs, expenses losses and income: |

||||||||||||||||

Wages and salaries |

523.7 | 489.4 | 546.7 | 637.1 | 1,020.5 | |||||||||||

Direct costs |

478.9 | 520.8 | 522.4 | 547.6 | 1,012.3 | |||||||||||

Costs of products sold |

206.7 | 244.8 | 207.3 | 179.9 | 169.9 | |||||||||||

Marketing and publicity |

81.3 | 87.9 | 78.6 | 81.1 | 131.1 | |||||||||||

Supplies and external services |

695.1 | 695.6 | 733.3 | 724.5 | 1,281.4 | |||||||||||

Indirect taxes |

50.4 | 45.9 | 57.8 | 45.4 | 187.5 | |||||||||||

Provisions and adjustments |

19.1 | 29.0 | 30.5 | 35.0 | 156.3 | |||||||||||

Depreciation and amortization |

600.0 | 647.5 | 716.9 | 758.6 | 1,325.6 | |||||||||||

Net post retirement benefit costs (gains) |

(65.1 | ) | 44.8 | 89.6 | 38.2 | 58.5 | ||||||||||

Curtailment and settlement costs |

275.6 | 100.0 | 14.8 | 145.5 | 36.4 | |||||||||||

Gains on disposals of fixed assets, net |

(8.5 | ) | (18.3 | ) | (2.0 | ) | (5.5 | ) | (9.2 | ) | ||||||

Other costs, net |

42.7 | 22.6 | 45.6 | 141.2 | 32.6 | |||||||||||

Income before financial results and taxes |

850.6 | 851.3 | 691.9 | 413.8 | 744.0 | |||||||||||

Minus: Financial costs (gains), net |

(202.8 | ) | 32.4 | (200.7 | ) | 81.6 | 212.9 | |||||||||

Income before taxes |

1,053.3 | 818.9 | 892.6 | 332.2 | 531.1 | |||||||||||

Minus: Income taxes |

243.6 | 204.8 | 185.9 | 77.5 | 108.2 | |||||||||||

Net income from continuing operations |

809.8 | 614.1 | 706.7 | 254.6 | 422.9 | |||||||||||

Discontinued operations |

||||||||||||||||

Net income from discontinued operations |

24.0 | 81.7 | 82.5 | 5,565.4 | — | |||||||||||

Net income |

833.8 | 695.8 | 789.2 | 5,820.1 | 422.9 | |||||||||||

Attributable to non-controlling interests |

92.8 | 119.7 | 104.5 | 147.9 | 83.8 | |||||||||||

Attributable to equity holders of the parent |

740.9 | 576.1 | 684.7 | 5,672.2 | 339.1 | |||||||||||

Income before financial results and taxes per ordinary share, A share and ADS(2) |

0.83 | 0.95 | 0.77 | 0.46 | 0.83 | |||||||||||

Earnings per ordinary share, A share and ADS: |

||||||||||||||||

Basic(3) |

0.71 | 0.64 | 0.78 | 6.48 | 0.39 | |||||||||||

Diluted(4) |

0.67 | 0.62 | 0.76 | 6.06 | 0.39 | |||||||||||

Earnings per ordinary share, A share and ADS from continuing operations, net of non-controlling interests: |

||||||||||||||||

Basic(3) |

0.72 | 0.60 | 0.74 | 0.19 | 0.39 | |||||||||||

Diluted(4) |

0.69 | 0.59 | 0.72 | 0.19 | 0.39 | |||||||||||

Cash dividends per ordinary share, A share and ADS(5) |

0.575 | 0.575 | 0.575 | 2.30 | 0.65 | |||||||||||

Share capital |

30.8 | 26.9 | 26.9 | 26.9 | 26.9 | |||||||||||

- (1)

- As explained in Note 4 to our consolidated financial statements, we applied retrospectively, from January 1, 2009, the interpretation IFRIC 12, Service Concession Arrangements, which became effective as from January 1, 2010, following its approval by the European Commission as of March 25, 2009.

4

- (2)

- Based

on 1,025,800,000 ordinary and A shares issued as of December 31, 2007 and 896,512,500 ordinary and A shares issued as of December 31,

2008, 2009, 2010 and 2011.

- (3)

- The

weighted average number of shares for purposes of calculating basic earnings per share is computed based on the average ordinary and A shares issued and

the average number of shares held by Portugal Telecom.

- (4)

- The

weighted average number of shares for purposes of calculating diluted earnings per share is computed based on the average ordinary and A shares issued

and the average number of shares held by Portugal Telecom adjusted by the number of shares from the exchangeable bonds issued on August 28, 2007.

- (5)

- Cash dividends per ordinary share, A share and American Depositary Share ("ADS") for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were €0.575, €0.575, €0.575, €2.30 and €0.65, respectively. Cash dividends per ordinary share, A share and ADS for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were US$0.90, US$0.75, US$0.71, US$3.23 and US$0.85, respectively, using the exchange rate in effect on the date on which each dividend was paid (or, in the case of the dividends for the year ended December 31, 2011, using the exchange rate on April 19, 2011). See "Item 8—Financial Information—Distributions to Shareholders—Dividend Information." As mentioned in Note 23 to our audit consolidated financial statements, cash dividends for the year ended December 31, 2011 correspond to an ordinary dividend per share of €0.65, of which €0.215 was paid on January 4, 2012 as an advance over the profits relating to 2011, as approved by our Board of Directors on December 15, 2011, and the remaining €0.435 will be paid in 2012, as approved at our Annual Shareholders' Meeting held on April 27, 2012. Cash dividends for the year ended December 31, 2010 included (1) an extraordinary dividend per share of €1.65, of which €1.00 was paid in December 2010 and the remaining €0.65 was paid in 2011, as approved at our Annual Shareholders' Meeting held on May 6, 2011; and (2) an ordinary cash dividend of €0.65 per share also approved at the Annual Shareholders' Meeting.

| |

Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||

| |

(EUR Millions) |

|||||||||||||||

Cash Flow Data: |

||||||||||||||||

Cash flows from operating activities |

1,859.2 | 1,828.9 | 1,927.5 | 1,506.9 | 1,775.2 | |||||||||||

Cash flows from investing activities |

235.9 | (108.7 | ) | (597.8 | ) | 4,072.4 | (1,009.2 | ) | ||||||||

Cash flows from financing activities |

(1,953.6 | ) | (1,283.8 | ) | (997.3 | ) | (1,929.1 | ) | (540.3 | ) | ||||||

5

| |

Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||

| |

(EUR Millions) |

|||||||||||||||

Statement of Financial Position Data: |

||||||||||||||||

Current assets |

3,816.3 | 3,317.0 | 3,699.1 | 8,855.4 | 8,433.0 | |||||||||||

Investments in group companies |

538.1 | 613.2 | 597.2 | 361.5 | 533.4 | |||||||||||

Other investments |

27.2 | 21.1 | 16.9 | 17.7 | 22.9 | |||||||||||

Tangible assets |

3,585.4 | 4,621.5 | 4,843.9 | 3,874.6 | 6,228.6 | |||||||||||

Intangible assets |

3,383.1 | 3,486.2 | 4,074.3 | 1,111.7 | 5,424.1 | |||||||||||

Post retirement benefits |

134.1 | 1.6 | 67.6 | 1.9 | 13.6 | |||||||||||

Deferred tax assets |

992.2 | 1,032.7 | 1,019.5 | 653.1 | 1,220.9 | |||||||||||

Other non-current assets |

645.1 | 628.0 | 522.1 | 294.0 | 1,067.2 | |||||||||||

Total assets |

13,121.5 | 13,721.2 | 14,840.5 | 15,169.9 | 22,943.8 | |||||||||||

Current liabilities |

3,862.2 | 5,153.6 | 3,398.4 | 2,683.7 | 6,811.9 | |||||||||||

Medium and long term debt |

4,960.7 | 4,441.2 | 6,551.5 | 6,254.4 | 8,989.4 | |||||||||||

Accrued post retirement liability |

1,463.9 | 1,836.9 | 1,558.3 | 968.8 | 1,004.1 | |||||||||||

Deferred tax liabilities |

84.9 | 462.2 | 483.1 | 311.6 | 1,052.5 | |||||||||||

Other non-current liabilities |

666.2 | 631.1 | 461.7 | 342.3 | 1,343.2 | |||||||||||

Total liabilities |

11,037.9 | 12,525.0 | 12,453.0 | 10,560.8 | 19,201.0 | |||||||||||

Equity excluding non-controlling interests |

1,340.1 | 232.0 | 1,318.3 | 4,392.4 | 2,828.1 | |||||||||||

Non-controlling interests |

743.6 | 964.2 | 1,069.1 | 216.7 | 914.7 | |||||||||||

Total equity |

2,083.6 | 1,196.2 | 2,387.4 | 4,609.1 | 3,742.8 | |||||||||||

Total liabilities and shareholders' equity |

13,121.5 | 13,721.2 | 14,840.5 | 15,169.9 | 22,943.8 | |||||||||||

Number of ordinary shares |

1,025.8 | 896.5 | 896.5 | 896.5 | 896.5 | |||||||||||

Share capital(1) |

30.8 | 26.9 | 26.9 | 26.9 | 26.9 | |||||||||||

- (1)

- As of the dates indicated, we did not have any redeemable preferred stock.

6

Euro

The majority of our revenues, assets, liabilities and expenses are denominated in Euros. We have published our audited consolidated financial statements in Euros, and our shares trade in Euros on the regulated market Euronext Lisbon. Our financial results could be affected by exchange rate fluctuations in the Brazilian Real. See "Item 5—Operating and Financial Review and Prospects—Exchange Rate Exposure to the Brazilian Real."

Our dividends, when paid in cash, are denominated in Euros. As a result, exchange rate fluctuations have affected and will affect the U.S. dollar amounts received by holders of ADSs on conversion of such dividends by The Bank of New York, as the ADS depositary. The Bank of New York converts dividends it receives in foreign currency into U.S. dollars upon receipt, by sale or such other manner as it has determined and distributes such U.S. dollars to holders of ADSs, net of The Bank of New York's expenses of conversion, any applicable taxes and other governmental charges. Exchange rate fluctuations may also affect the U.S. dollar price of the ADSs on the New York Stock Exchange.

The following tables show, for the period and dates indicated, certain information regarding the U.S. dollar/Euro exchange rate. The information is based on the noon buying rate in the City of New York for cable transfers in Euro. On April 19, 2012, the Euro/U.S. dollar exchange rate was €0.7615 per US$1.00.

Year ended December 31,

|

Average Rate(1) | |||

|---|---|---|---|---|

| |

(EUR per US$1.00) |

|||

2007 |

0.7248 | |||

2008 |

0.6805 | |||

2009 |

0.7166 | |||

2010 |

0.7567 | |||

2011 |

0.7142 | |||

- (1)

- The average rate is calculated as the average of the noon buying rates on the last day of each month during the period.

Period

|

High | Low | |||||

|---|---|---|---|---|---|---|---|

| |

(EUR per US$1.00) |

||||||

October 2011 |

0,7530 | 0,7056 | |||||

November 2011 |

0,7551 | 0,7245 | |||||

December 2011 |

0,7736 | 0,7415 | |||||

January 2012 |

0,7885 | 0,7580 | |||||

February 2012 |

0,7641 | 0,7428 | |||||

March 2012 |

0.7678 | 0.7499 | |||||

April 2012 (through April 19, 2012) |

0.7655 | 0.7498 | |||||

None of the 27 member countries of the European Union has imposed any exchange controls on the Euro.

Brazilian Real

Although as of December 31, 2011, the majority of our revenues, assets and expenses are denominated in Euros, on March 28, 2011, we completed the acquisition of an economic interest of 25.3% in Oi. Oi records its financial position and results of operations in Brazilian Reais. Concurrently with our investment in Oi, we acquired an interest in Contax, which similarly records its financial

7

position and results of operations in Brazilian Reais. Consequently, exchange rate fluctuations between the Euro and the Brazilian Real affect our revenues, expenses, assets and liabilities.

The Brazilian government may impose temporary restrictions on the conversion of Reais into foreign currencies and on the remittance to foreign investors of proceeds from their investments in Brazil. Brazilian law permits the government to impose these restrictions whenever there is a serious imbalance in Brazil's balance of payments or reason to foresee a serious imbalance.

The following tables show, for the periods and date indicated, certain information regarding the Real/U.S. dollar exchange rate. On April 19, 2012, the Real/U.S. dollar exchange rate was R$1.8846 per US$1.00. The information is based on the noon buying rate in the City of New York for cable transfers in Brazilian Reais as certified for United States customs purposes by the Federal Reserve Bank of New York.

Year ended December 31,

|

Average Rate(1) | |||

|---|---|---|---|---|

| |

(R$ per US$1.00) |

|||

2007 |

1.929 | |||

2008 |

1.831 | |||

2009 |

1.987 | |||

2010 |

1.757 | |||

2011 |

1.668 | |||

- (1)

- The average rate is calculated as the average of the noon buying rates on the last day of each month during the period.

Period

|

High | Low | |||||

|---|---|---|---|---|---|---|---|

| |

(R$ per US$1.00) |

||||||

October 2011 |

1.8815 | 1.6916 | |||||

November 2011 |

1.8865 | 1.7355 | |||||

December 2011 |

1.8812 | 1.7841 | |||||

January 2012 |

1.8487 | 1.7392 | |||||

February 2012 |

1.7383 | 1.6997 | |||||

March 2012 |

1.8332 | 1.8263 | |||||

April 2012 (through April 19, 2012) |

1.8846 | 1.8218 | |||||

General Risks Relating to Our Company

The current economic and financial crisis has affected, and will likely continue to affect, demand for our products and services, our revenues and our profitability

The global economic and financial crisis, and the current economic recession in Portugal, have had, and are likely to continue to have, an adverse effect on the demand for our products and services and on our revenues and profitability. The year ended December 31, 2011 was a turbulent year in the global markets, dominated by the continuing eurozone debt crisis that began with the global financial crisis in 2007 and, by 2011, had developed into a severe sovereign debt crisis. During 2011, a number of eurozone countries came under severe financial pressure and their ability to raise, refinance and service their debt was put into question by markets, as demonstrated by the record high spreads during most of the year. Portugal, along with Greece and Ireland, was forced to seek support packages from the European Central Bank ("ECB") and the International Monetary Fund ("IMF") under strict conditions, while fear of contagion to other eurozone countries forced governments to reduce debt levels through austerity measures that, at least in the short term, were seen as the cause of slow growth for some countries and stagnation in others.

8

On April 6, 2011, Portugal announced that it would seek an economic rescue package from the European Union. In the following months, Portugal formally requested an economic rescue package from the European Union and the International Monetary Fund and negotiated the terms of that package. As a condition to receiving the economic rescue package, the Portuguese government implemented severe budget-cutting measures that have delayed Portugal's emergence from a recession and weakened consumer demand.

Despite a number of high profile summits and meetings the EU was unable to agree and implement a strong coherent policy response to the crisis, prompting fear of default or the exit from the euro of one or more members. Under pressure during most of 2011, EU members showed an increasing willingness to agree a structured common approach, but they also demonstrated divergent opinions on the way forward and on the measures to be taken. This resulted in the three major rating agencies either downgrading, or putting on the watch list for possible downgrade, a number of sovereign governments which intensified the pressure, even on the stronger eurozone countries. The ongoing sovereign debt crisis, slow economic growth, dearth of market financing for banks and private sector deleveraging severely affected the eurozone financial system, increasing the possibility of further economic stress in the region, including Portugal.

Against the backdrop of the eurozone crisis, the increased risk perception also led to consecutive downgrades of Portuguese sovereign debt by the rating agencies. In 2011, Portugal was downgraded (1) by 4 notches at Moody's, from A1 on December 21, 2010 to Ba2 on July 5, 2011; (2) by 3 notches at S&P from A- on November 30, 2011 to BBB- on December 5, 2011, and (3) by 6 notches at Fitch from A+ on December 23, 2010 to BB+ on November 24, 2011.

As one of Portugal's largest companies and one of its largest employers (and although a large portion of our business is conducted outside Portugal), Portugal Telecom's financial condition, revenues and profitability are closely linked to circumstances in the Portuguese economy. The recession in Portugal has had a direct effect on demand for our products and services, contributing to a decline in revenues in 2011 across most of the customer categories of our Portuguese telecommunications business.

In these and other ways, the global economic and financial crisis and its effect on the European and Portuguese economies has significantly affected, and could continue to significantly affect, our business, liquidity and financial performance.

Financial market conditions may adversely affect our ability to obtain financing, significantly increase our cost of debt and negatively impact the fair value of our assets and liabilities

Beginning in 2008, events in the global and European financial markets have increased the uncertainty and volatility of the financial markets, leading to a significant increase in execution and price risks in financing activities. Since the onset of the crisis, global financial markets and economic conditions have been severely disrupted and volatile and remain subject to significant vulnerabilities, such as the deterioration of fiscal balances and the rapid accumulation of public debt, continued deleveraging in the banking sector and limited supply of credit. At times during this period, credit markets and the debt and equity capital markets have been exceedingly distressed. In 2010 and 2011, the financial markets grew increasingly concerned about the ability of certain European countries, particularly Greece, Ireland and Portugal, but also others such as Spain and Italy, to finance their deficits and service growing debt burdens amidst difficult economic conditions. This loss of confidence has led to rescue measures for Greece, Ireland and Portugal by the EU and the IMF. These issues, along with the re-pricing of credit risk and the difficulties currently experienced by financial institutions, have made it difficult for companies to obtain financing, and we expect these difficulties to continue.

As a result of the disruptions in the credit markets, many lenders have increased interest rates, enacted tighter lending standards, required more restrictive terms (including higher collateral ratios for

9

advances, shorter maturities and smaller loan amounts) or refused to refinance existing debt at all or on terms similar to pre-crisis conditions. Changes in interest rates and exchange rates may also adversely affect the fair value of our assets and liabilities. If there is a negative impact on the fair values of our assets and liabilities, we could be required to record impairment charges.

Notwithstanding our international exposure and diversification and the fact that we believe we have liquidity to repay our debt through the end of 2013, the downgrades of Portugal's sovereign debt described in the preceding risk factor may have a significant effect on our costs of financing, particularly given the size and prominence of our company within the Portuguese economy. The recent events in Portugal and the other factors described above could adversely affect our ability to obtain future financing to fund our operations and capital needs and adversely impact the pricing terms that we are able to obtain in any new bank financing or issuance of debt securities and thereby negatively impact our liquidity.

Any future ratings downgrades may impair our ability to obtain financing and may significantly increase our cost of debt

The effects of the economic and financial crisis described above, or any adverse developments in our business, could lead to downgrades in our credit ratings. Any such downgrades are likely to adversely affect our ability to obtain future financing to fund our operations and capital needs. Any downgrade of our ratings could have even more significant effects on our ability to obtain financing and therefore on our liquidity. For example, the pricing conditions applicable to our commercial paper programs could be revised in the event our credit rating is changed. In addition, certain of our loan agreements, totaling €129 million as of December 31, 2011, contain provisions that require us to provide certain guarantees if our ratings decline below specified levels. Any failure to provide those guarantees could enable the lender to accelerate the loans. For further information on these covenants, please refer to "Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Indebtedness—Covenants."

Any worsening of the current economic and financial crisis may affect our liquidity and impact the creditworthiness of our company

In order to mitigate liquidity risks, we seek to maintain a liquidity position and an average maturity of debt that allows us to repay our short-term debt and our contractual obligations. As of December 31, 2011, the amount of available cash from our Portuguese operations (excluding cash from our international operations), plus the undrawn amount of our underwritten commercial paper lines (cash immediately available upon two or three days' notice) and our committed standby facilities available to our Portuguese operations amounted to €5,095 million, a reduction from €6,297 million as of December 31, 2010. This reduction reflects primarily the investments made in the acquisition of the interests in Oi and Contax and dividends paid during the year, which more than offset the impact of the third and last installment payment received from Telefónica for its purchase of Vivo and certain new financings obtained in 2011. The average maturity of our net debt in Portugal as of December 31, 2011 was 5.9 years.

We seek to manage our capital structure to ensure that our businesses will be able to continue as a going concern and maximize the return to shareholders. Our capital structure includes debt, cash and cash equivalents, short-term investments and equity attributable to equity holders of the parent, comprising issued capital, treasury shares, reserves and accumulated earnings. We periodically review our capital structure considering the risks associated with each of the above mentioned classes of the capital structure. We further discuss our liquidity and sources of funding in "Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources."

10

However, if economic and financial conditions in Portugal and in Europe generally were to worsen, if our cost of debt were to increase or if we were to encounter other difficulties in obtaining financing for the reasons described in the preceding three risk factors, our sources of funding, including our cash balances, operating cash inflows, funds from divestments, credit lines and cash flows obtained from financing operations, might not match our financing needs, including our operating and financing outflows, investments, shareholder remuneration and debt repayments. Any such event could have a material adverse effect on our financial position, liquidity and prospects.

If our customers' financial conditions decline, we will be exposed to increased credit and commercial risks

Due to continued adverse economic conditions, we may encounter increased difficulty collecting accounts receivable and could be exposed to risks associated with uncollectable accounts receivable. We regularly assess the creditworthiness of our customers and we set credit limits for our customers. Challenging economic conditions have impacted some of our customers' ability to pay their accounts receivable. Although our credit losses have historically been low and we have policies and procedures for managing customer finance credit risk, we may be unable to avoid future losses on our accounts receivable, which could materially adversely affect our results of operations and financial position.

We may not be able to pay our announced dividends

In connection with the sale of our interest in Vivo in September 2010, we announced an extraordinary dividend to our shareholders of €1.65 per share, of which we paid €1.00 per share on December 28, 2010. As approved at our General Shareholders' Meeting held on May 6, 2011, we paid the remaining €0.65 per share of this dividend, as well as an ordinary dividend of €0.65 per share with respect to the year ended December 31, 2010 on June 3, 2011. In 2011, we adopted a progressive dividend policy with the objective of raising the dividend per share every year between 3% and 5% for the period between 2012 and 2014. In addition, for the year ended December 31, 2011 onwards, we announced that our Board of Directors intended to approve the payment of interim ordinary dividends based on the financial performance of our company in order to allow for a smoother cash return to our shareholders throughout the year. As a result, on December 15, 2011, our Board of Directors announced an interim dividend of €0.215 per share, which was paid on January 4, 2012. This dividend was an advance payment on the profits of the year ended December 31, 2011 for our shareholders. On March 30, 2012, the Board of Directors announced a proposal approved at the General Shareholder's Meeting held on April 27, 2012 of a dividend of €0.65 per share, including the above-mentioned €0.215 dividend paid in January 2012. These cash dividend proposals are subject to market conditions, our financial condition, applicable law regarding the distribution of net income, including additional shareholder approvals, and other factors considered relevant by our Board of Directors at the time.

The payment of future dividends will depend on our ability to continue to generate cash flow in our businesses, which is dependent not only on our revenue stream but also on our ability to further streamline our operations and reduce our costs. In addition, significant volatility in the Real/Euro exchange rate may impair our ability to pay dividends.

If any of the conditions described above proves not to be the case or if any other circumstances (including any risks described in this "Risk Factors" section) impede our ability to generate cash and distributable reserves, shareholders may not receive the full remuneration we have announced, and the price of our ordinary shares and ADSs could be negatively affected.

We must continue to attract and retain highly qualified employees to remain competitive

We believe that our future success largely depends on our continued ability to hire, develop, motivate and retain qualified personnel needed to develop successful new products, support our existing product range and provide services to our customers. Competition for skilled personnel and

11

highly qualified managers in the telecommunications industry remains intense. We are continuously developing our corporate culture, remuneration, promotion and benefits policies as well as other measures aimed at empowering our employees and reducing employee turnover. However, we may not be successful in attracting and retaining employees with appropriate skills in the future, and failure in retention and recruiting could have a material adverse effect on our business.

Unfunded post retirement benefit obligations may put us at a disadvantage to our competitors and could adversely affect our financial performance

We have unfunded post retirement benefit obligations that may limit our future use and availability of capital and adversely affect our financial and operating results. Although in December 2010, we transferred to the Portuguese Government the post retirement benefits obligations relating to regulated pensions of Caixa Geral de Aposentações and Marconi, we retained all other obligations, including (1) salaries to suspended and pre-retired employees amounting to €782.5 million as of December 31, 2011, which we must pay monthly directly to the beneficiaries until their retirement age and (2) €474.1 million in obligations related to pension supplements and healthcare as of December 31, 2011, which are backed by plan assets with a market value of €344.7 million, resulting in unfunded obligations of €129.4 million.

Any decrease in the market value of our plan assets relating to our pension supplements and healthcare obligations could increase our unfunded position. Although there is in place an investment policy with capital preservation targets, in the current economic and financial crisis, in particular, the market value of our plan assets is volatile and poses a risk. In addition, our obligations to pay salaries to suspended and pre-retired employees are unfunded. The value of the obligations referred to above may also fluctuate, depending on demographic, financial, legal or regulatory factors that are beyond our control. Any significant increase in our unfunded obligations could adversely affect our ability to raise capital, require us to use cash flows that we would otherwise use for capital investments, implementing our strategy or other purposes and adversely affect perceptions of our overall financial strength, which could negatively affect the price of our ordinary shares and ADSs.

See "Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Post Retirement Obligations" for a description of our transfer of pension obligations to the Portuguese Government.

Risks Relating to Our Portuguese Operations

Competition from other mobile telephony and fixed line operators has reduced our revenues from our Portugese operations and could continue to adversely affect our revenues

As a result of the trend toward the use of mobile services instead of fixed telephone services, combined with the increase in competition from other operators, we have experienced, and may continue to experience, erosion of market share of both access lines and of outgoing domestic and international traffic. The number of active mobile telephone cards in Portugal has overtaken the number of wireline main lines. Mobile operators can bypass our international wireline network by interconnecting directly with fixed line and mobile networks either in our domestic network or abroad. Competition is also forcing down the prices of our fixed line voice services for long distance and international calls. Lowering our international call prices has caused a decline in our revenues from international fixed line voice services. The decrease in fixed line voice traffic and lower tariffs resulting from competition has significantly affected our overall revenues, and we expect these factors to continue to negatively affect our revenues. See "Item 4—Information on the Company—Competition—Competition Facing Our Portuguese Operations—Residential Services."

12

Increased competition in the Portuguese Pay-TV market may result in a decrease in our revenues

In 2008, we launched a nationwide Pay-TV service under the Meo brand, primarily using our fixed network (IPTV over ADSL2+ and fiber-to-the-home ("FTTH") and direct-to-home ("DTH") satellite technology). This service required us to make significant investments in our network in order to increase the bandwidth and offer a better service quality than our competitors. The main competitors in the market are Zon, Cabovisão, Optimus and Vodafone. Notwithstanding gains in our revenues and market share from Pay-TV services in recent years and the quality of our service, we have experienced pressure from our competitors to reduce monthly subscription fees. In addition, our efforts to build scale to enable us to negotiate better programming costs with our content suppliers, especially certain premium content owned by one of our competitors, may not prove successful. Our revenues from residential services and our financial position could be significantly affected if we are not successful in the Pay-TV business, which is becoming increasingly important as a retention tool of our fixed-line and broadband customers.

The broadband market in Portugal is highly competitive and may become more competitive in the future

Our competitors have been improving their commercial offers in broadband Internet, with most of them offering triple-play bundled packages (voice telephony, broadband Internet and Pay-TV subscription). We believe that with competition in Internet broadband access intensifying, and with the development of existing technologies such as broadband wireless access, mobile broadband through Universal Moblie Telecommunications System ("UMTS") and long-term evolution ("LTE") technology, as well as high speed broadband supported by the deployment of a fiber optic network, we may face additional pricing pressure on our services, which could result in the loss of revenues from both residential and enterprise customers.

Increased competition in the Portuguese mobile markets may result in decreased tariffs and loss of market share

We operate in the highly competitive Portuguese mobile telecommunications market. We believe that our existing mobile competitors, Vodafone and Optimus, will continue to market their services aggressively, and in most cases, those operators have similarly priced offers. After we launched our low-cost brand "Uzo," for example, Vodafone and Optimus quickly responded with similar products of their own. As another example, in 2010, we launched a tribal plan as a reaction to similar plans launched by our competitors, and that plan provides for lower revenue per user than many of our other plans. We believe that our ability to compete depends on our ability to differentiate our products based on services offered and quality, and we may not be successful in doing so.

We expect competition from VoIP-based operators also to place increasing price pressure on voice tariffs and lead to reductions in mobile voice traffic. Competition from companies providing wireless local-area network services ("WLAN"), which can deliver wireless data services more cheaply than mobile data services, such as through UMTS or LTE technology, in concentrated areas, may also affect the market and pricing for third and fourth generation services. See "Item 4—Information on the Company—Competition—Competition Facing Our Portuguese Operations—Personal Services."

Our ability to remain competitive depends on our ability to implement new technology, and any failure to do so could adversely affect our business

Companies in the telecommunications industry must adapt to rapid and significant technological changes that are usually difficult to anticipate. The Pay-TV, broadband internet and mobile telecommunications industries in particular have experienced rapid and significant technological development and frequent improvements in capacity, quality and data-transmission speed. Technological changes may render our equipment, services and technology obsolete or inefficient, which may

13

adversely affect our competitiveness or require us to increase our capital expenditures in order to maintain our competitive position. For example, we have made significant investments in recent years to develop our FTTH network for residential and enterprise customers, to connect our mobile network base stations and to develop our UMTS network for personal services customers. In 2011, we also upgraded some of our mobile network equipments for LTE services. We are investing significant amounts to construct our data center in Covilhã, Portugal to expand our ability to serve enterprise and other customers, and we launched LTE services in March 2012. We may not achieve the expected benefits of these investments in technology before more advanced technology is adopted by the market. Even if we adopt new technologies in a timely manner as they are developed, the cost of such technology may exceed the benefit to us, and we cannot assure you that we will be able to maintain our level of competitiveness.

Burdensome regulation in an open market may put us at a disadvantage to our competitors and could adversely affect our Portugese telecommunications business

The Portuguese electronic communications sector is fully open to competition. However, many regulatory restrictions and obligations are still imposed on us. In the previous round of market analysis, carried out in 2004-2006, Portugal Telecom was found by the Portuguese telecomunications regulator (Autoridade Nacional das Comunicações—"ANACOM") to have significant market power in all but one of the 16 markets analyzed and, consequently, is subject to regulatory restrictions and obligations. Not all of these obligations and restrictions have been imposed on other telecommunications operators and service providers. Pursuant to the European Relevant Markets Recommendation issued in 2007, which significantly reduced the number of markets subject to regulation, ANACOM is re-analyzing the retail and wholesale markets to identify which electronic communications operators and service providers it considers to have significant market power in those markets and determining the regulatory obligations that should be imposed on those operators and service providers.

ANACOM has re-analyzed certain of the markets defined under the European Relevant Market Recommendation and has found Portugal Telecom to have significant market power in some of those markets, including the wholesale market for call termination on individual public telephone networks provided at a fixed location, the market for call termination on individual mobile networks, the market for the provision of wholesale (physical) network infrastructure access and the wholesale leased lines terminal market. In certain cases, such as the wholesale broadband access market and the wholesale transit market, ANACOM has segmented the markets into "C" (competitive) and "NC" (non-competitive) segments and has found Portugal Telecom to have significant market power in the non-competitive segments. ANACOM has the power to impose remedies to increase competition in those markets. For example, ANACOM is proposing to introduce virtual access to fiber (an advanced bitstream offer) as a remedy in the wholesale (physical) network infrastructure access market in certain geographic areas. In addition, ANACOM has not completed its analysis of all the markets identified by the European Relevant Market Recommendation, and we expect that it will provide further analysis in the near future.

Remedies imposed by ANACOM may require us to provide services in certain markets or geographic regions or to make investments that we would otherwise not choose to make. In addition, we incur expenses to adapt our operations to constantly changing regulatory requirements and to ensure regulatory compliance. The substantial resources we must commit to fulfill our regulatory obligations could adversely affect our ability to compete. See "Item 4—Information on the Company—Regulation—Portugal" for more details on the regulatory requirements to which we are subject.

14

Reduced interconnection rates have negatively affected our revenues for our Portuguese telecommunications business and will continue to do so in 2012

In recent years, ANACOM has imposed price controls on interconnection rates for the termination of calls on mobile networks. These reductions have had a significant impact on interconnection revenues of our mobile subsidiary, TMN—Telecomunicações Móveis Nacionais, S.A. ("TMN"), and, consequently, on its earnings.

In April 2011, ANACOM held a consultation on the definition of a bottom-up long-run incremental cost ("LRIC") model to regulate mobile termination rates. In October 2011, ANACOM issued a new draft decision based on that cost model and proposed a new glide path according to which mobile termination rates in Portugal would decrease in four steps, reaching €0.0125 per minute by November 2012. In March 2012, ANACOM issued a final decision reducing mobile termination rates progressively to €0.0127 by December 2012. The reductions in mobile termination rates have had and will continue to have a negative effect on our cash flows and revenues.

ANACOM's price controls on fixed-to-mobile interconnection may also negatively affect our revenues from fixed line residential services because we are required to reflect the reduction in these interconnection charges in our retail prices for calls from our fixed line network. We expect that the reduction in interconnection charges will continue to have an impact on our revenues from fixed line residential services.

In addition, the lower interconnection rates have reduced revenues for our wholesale business, which records revenue from incoming calls transiting through our network that terminate on the networks of mobile operators. The prices we charge to international operators (and hence our revenues) also depend on the interconnection fees charged by mobile operators for international incoming calls terminating on their networks, and these fees have been decreasing. We expect that lower interconnection rates will continue to have a negative impact on our wholesale revenues.

In addition, in August 2008, ANACOM published a "reasoning" regarding mobile rates for originating calls, aimed at driving mobile operators to reducing their prices by the end of September 2008 to a level equal or close to the level of mobile termination rates. In the second half of 2008, the three mobile operators reduced their rates for originating calls but not to the extent desired by ANACOM. In February 2010, ANACOM chose to take the matter to the Portuguese national competition authority (the "Autoridade da Concorrência" or "AdC"). In January 2012, the Autoridade da Concorrência completed its analysis, finding origination rates to be excessive and stating that mobile operators must reduce their rates to the level of their costs by July 2012 or face the possibility of being sanctioned.

The European Commission's review of roaming charges may lead to a reduction in revenues from personal services

The European Commission has determined that roaming prices in Europe should be reduced and has published new regulations that have been in effect since 2007. These regulations set maximum roaming charges that may be charged in the wholesale market and the retail market. In 2008, the European Commission launched a consultation on roaming, proposing to carry over Regulation (EC) No. 717/2007, on roaming on mobile communications networks within the community (the "Roaming Regulation"), beyond 2010 and to extend it to data and Short Messaging Services ("SMS"), or text messaging. In 2009, Regulation (EC) No. 544/2009, amending the Roaming Regulation (the "New Roaming Regulation"), went into effect, limiting roaming charges. The New Roaming Regulation aimed to reduce roaming charges by up to 60%. In the wholesale market, a maximum roaming charge of €0.18 per minute currently applies. In the retail market, maximum roaming charges of €0.11 per minute (for received calls) and €0.35 per minute (for outgoing calls) currently apply.

15

The New Roaming Regulation is due to expire on June 30, 2012 and to be replaced by a third version, known as "Roaming III." The European Commission has proposed revisions to certain of those standards, including (1) a cap on retail data tariffs, proposed for July 2012, (2) introduction of an obligation for mobile operators to provide network access in order to allow roaming services, proposed for July 2012, and (3) the decoupling of roaming services from other services, while enabling a consumer to use the same number, proposed for July 2014. We expect the European Commission to make a final decision on these proposals in May 2012.

The New Roaming Regulation has had, and we expect Roaming III to have, an adverse effect on the revenues of our mobile business and on our results of operations.

The Portuguese government could terminate or fail to renew our fixed line concession, our licenses and our authorizations for data and mobile services

We provide a significant number of services under a concession granted to us by the Portuguese government and under licenses and authorizations granted to us by ANACOM. See "Item 4—Information on the Company—Regulation—Portugal—Summary of Our Concession and Existing Licenses and Authorizations." The Portuguese government can revoke our concession if it considers the revocation to be in the public interest. It can also terminate our concession at any time if we fail to comply with our obligations under the concession.

Our concession and Portuguese law impose obligations on us as a universal services provider. See "Item 4—Information on the Company—Regulation—Portugal—Universal Services Obligations." ANACOM recently completed a public consultation on the process for selecting a universal services provider and issued a final decision in February 2012, dividing universal services by three functions (telephone service, pay telephones, and directory and inquiry services) and further in three geographic regions. On April 12, 2012, the government launched a public consultation on proposed legislation to establish a compensation fund for universal service providers, after which the Portuguese government is expected shortly thereafter in 2012 to launch a tender for the designation of the universal service providers. The designation of the universal service providers and related renegotiation of our concession are explicit objectives set forth in the memorandum of understanding entered into by the Portuguese government, the IMF, the European Commission and the European Central Bank in the context of the financial support package provided to Portugal. Our rights and obligations as a universal service provider could be materially affected by the tender process, pursuant to which we could cease to be the universal service provider for certain services or in certain regions.

The Portuguese government can also terminate our mobile licenses under certain circumstances. Through TMN, we hold renewable license to provide GSM and UMTS mobile telephone services throughout Portugal, valid until 2016 and 2022, respectively. In January 2012, TMN was allocated the right to use frequencies to provide, among other technologies, LTE mobile telephone services throughout Portugal, and in March 2012, ANACOM issued a renewable licence to TMN, valid until 2027, with respect to the use of these frequencies. This license also unifies the previous GSM and UMTS licenses issued to TMN. If the Portuguese government were to terminate our license, we would not be able to conduct the activities authorized by the concession or the relevant licenses. This loss would eliminate an important source of our revenues.

Regulatory investigations and litigation may lead to fines or other penalties

We are regularly involved in litigation, regulatory inquiries and investigations involving our operations. ANACOM, the European Commission and the Autoridade da Concorrência regularly make inquiries and conduct investigations concerning our compliance with applicable laws and regulations. Current inquires by the Autoridade da Concorrência relate to alleged anti-competitive practices in the broadband internet, terrestrial television and public mobile telephone markets.

16

In addition, on January 19, 2011, the European Commission opened an investigation into an agreement between Telefónica and Portugal Telecom allegedly not to compete in the Iberian telecommunications markets. Portugal Telecom has developed various strategic partnerships with Telefónica in recent years. Although we do not believe the existence of these partnerships has impeded competition and ordinary activities of our company and Telefónica, our relationship with Telefónica is now subject to investigation. The European Commission has stated that the initiation of proceedings does not imply that the Commission has conclusive proof of an infringement but that the Commission will deal with the case as a matter of priority. On October 25, 2011, we were notified of a Statement of Objections sent by the European Commission to us and Telefonica on the matter. The Statement of Objections only covers alleged cooperation between the two companies after the Vivo transaction. In response to the Statement of Objections, we contested the allegations of the European Commission. The sending of a Statement of Objections does not prejudge the final outcome of the investigation. We cannot predict whether this investigation may lead to fines or other sanctions or whether it may have an adverse effect on our business.

These inquiries and investigations are described in "Item 8—Financial Information—Legal Proceedings." If we are found to be in violation of applicable laws and regulations in these or other regulatory inquiries, investigations, or litigation proceedings that are currently pending against us or that may be brought against us in the future, we may become subject to penalties, fines, damages or other sanctions. Any adverse outcome could have a material adverse effect on our operating results or cash flows.

Risks Related to Our Brazilian Operations

Our strategy of enhancing our operations in Brazil through our strategic partnerships with Oi and Contax may not be successful, and we do not have free access to cash flows from Oi and Contax

The successful implementation of our strategy for our mobile operations in Brazil depends on the development of our strategic partnership with Oi. On March 28, 2011, we completed the acquisition of a 25.3% economic interest in the Oi companies. For the year ended December 31, 2011, 47% of our revenues were generated in Brazil, and our strategic partnership with Oi represented the bulk of these revenues. As in any strategic partnership, it is possible that we, the other controlling shareholders and Oi will not agree on its strategy, operations or other matters. Any inability of Oi and us to operate Oi jointly could have a negative impact on Oi's operations, which could have a negative impact on our strategy in Brazil and could have a material adverse effect on our results of operations. In addition, we cannot be sure that Oi will be able to take advantage of its position in the Brazilian market to increase the scope and scale of its operations or that any anticipated benefits of the strategic partnership will be realized.

In addition, concurrently with our investment in Oi, we acquired a 16.2% economic interest in Contax, which provides among other contact center services in Brazil. Our economic interest in Contax increased to 19.5% in June 2011. Although the contribution of Contax to our consolidated revenues is not as significant as that of Oi, Contax remains an important part of our international telecommunications business. The types of risks described above that apply to our strategic partnership with Oi also apply to our strategic partnership with Contax.

In addition, because we hold joint control of Oi and Contax, we may not have free access to their cash flows. It will be necessary for us and other controlling shareholders of Oi and Contax to agree to approve any distributions from those companies. See "Item 4—Information on the Company—Our Businesses—Brazilian Operations (Oi)—Strategic Partnership with Oi" and "Item 4—Information on the Company—Our Businesses—Other International Operations—Other Brazilian Operations—Strategic Partnership with Contax."

17

We are exposed to Brazilian exchange rate and interest rate fluctuations

We are exposed to exchange rate fluctuation risks, mainly due to our significant investments in Brazil. On March 28, 2011, we completed the acquisition of an economic interest of 25.3% in Oi (through a 25.6% economic interest in TmarPart and a 25.3% interest in Telemar Norte Leste S.A.), Brazil's largest telecommunications group. We do not expect to hedge our economic exposure against exchange rate fluctuations. We are required to make adjustments to our equity on our balance sheet in response to fluctuations in the value of foreign currencies in which we have made investments. Devaluation of the Brazilian Real in the future could result in negative adjustments to our balance sheet, which could limit our ability to generate distributable reserves.

We are also exposed to interest rate fluctuation risks. We have entered into financial instruments to reduce the impact on our earnings of an increase in market interest rates, but these financial instruments may not prevent unexpected and material fluctuations of interest rates from having any material adverse effect on our earnings.

The Brazilian Central Bank's Monetary Policy Committee (Comitê de Política Monetária do Banco Central—COPOM) establishes the basic interest rate target for the Brazilian financial system by referring to the level of economic growth of the Brazilian economy, the level of inflation and other economic indicators. As of December 31, 2007, 2008, 2009, 2010 and 2011, the basic interest rate was 11.3%, 13.8%, 8.8%, 10.8% and 11%, respectively. Increases in interest rates may have a material adverse effect on Oi by increasing its interest expense on floating rate debt and increasing its financing costs.

Macroeconomic factors in Brazil could reduce expected returns on our Brazilian investments

A material portion of our business, prospects, financial condition and results of operations has been, and will continue to be, dependent on general economic conditions in Brazil. In particular, our growth depends on economic growth and its impact on demand for telecommunications and other related services. The major factors that could have a material adverse effect on our investments and results of operations in Brazil include:

Adverse political and economic conditions. The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy. The Brazilian government has utilized salary and price controls, currency devaluation, capital controls and limits on imports, among other things, as tools in its previous attempts to stabilize the Brazilian economy and control inflation. Changes in the Brazilian government's exchange control policy, or in general economic conditions in Brazil, could have a material adverse effect on the results of our operations in Brazil. Deterioration in economic and market conditions in other countries (mainly in other Latin American and emerging market countries) may adversely affect the Brazilian economy and our business.

Past political crises in Brazil have affected the confidence of investors and the public in general, as well as the development of the economy. Any future political crises could have an adverse impact on the Brazilian economy and on our business, financial condition and results of operations in Brazil.

Fluctuations in the Real and increases in interest rates. The Brazilian currency has historically experienced frequent fluctuations relative to the Euro and other currencies. In 2007, 2009 and 2010, the Real appreciated against the Euro by 8.3%, 29.2% and 13.2%, respectively, and in 2008 and 2011 the Real depreciated against the Euro by 20.0% and 8.5%, respectively. Any substantial negative reaction to the policies of the Brazilian government could have a negative impact, including devaluation. The devaluation of the Real could negatively affect the stability of the Brazilian economy and accordingly could negatively affect the profitability and results of our operations and our ability to distribute reserves. It would also increase costs associated with financing our operations in Brazil. In particular, a significant amount of Oi's financial liabilities are denominated in or indexed to foreign

18

currencies, primarily U.S. dollars, Japanese yen and euros. When the Real depreciates against foreign currencies, Oi incurs losses on its liabilities denominated in or indexed to foreign currencies, such as its U.S. dollar-denominated long-term debt and foreign currency loans, and it incurs gains on its monetary assets denominated in or indexed to foreign currencies, as the liabilities and assets are translated into Real. If significant depreciation of the Real were to occur when the value of such liabilities significantly exceeds the value of such assets, including any financial instruments entered into for hedging purposes, Oi could incur significant losses, even if the value of those assets and liabilities has not changed in their original currency. In addition, a significant depreciation in the Real could adversely affect Oi's ability to meet certain of our payment obligations. A failure to meet certain of Oi's payment obligations could trigger a default under certain financial covenants in its debt instruments, which could have a material adverse effect on Oi's business and results of operations. Additionally, Oi currently has currency swaps and non-deliverable forwards in place for a portion of its foreign currency debt. However, if the cost of currency swap instruments increases substantially, Oi may be unable to maintain its hedge positions, resulting in an increased foreign currency exposure, which could in turn lead to substantial foreign exchange losses.

In addition, a devaluation of the Real relative to the U.S. dollar may increase the costs of imported products and equipment. Our operations in Brazil rely on imported equipment, and, as a result of such devaluation, such equipment would be more expensive to purchase.

In response to the global economic and financial crisis, the Brazilian government increased the SELIC basic interest rate to 13.75% as of December 31, 2008. In 2009, Brazilian Central Bank reduced the SELIC rate to 8.75% as of December 31, 2009. Based on further economic developments, the Brazilian Central Bank increased the SELIC rate up to 10.75% as of December 31, 2010 and to 11% as of December 31, 2011. Most recently, the Brazilian Central Bank reduced the SELIC rate to 10.50% as of January 18, 2012 and to 9.00% as of April 18, 2012. However, Brazilian interest rates remain high, and any increase in interest rates could negatively affect our profitability and results of operations and would increase the costs associated with financing our operations in Brazil.

Inflation in Brazil. Brazil has historically experienced high rates of inflation. Inflation, as well as governmental measures put in place to combat inflation, have had a material adverse effect on the Brazilian economy. Inflationary pressures persist, and actions taken in an effort to curb inflation, coupled with public speculation about possible future governmental actions, have in the past contributed to economic uncertainty in Brazil and heightened volatility in the Brazilian securities market. According to the Broad Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo, or "IPCA"), published by the Brazilian Institute for Geography and Statistics (Instituto Brasileiro de Geografia e Estatística , or "IBGE"), the Brazilian consumer price inflation rates were 4.5% in 2007, 5.9% in 2008, 4.3% in 2009, 5.9% in 2010 and 6.5% in 2011.

Since 2006, Oi's telephone rates have been indexed to the Telecommunications Service Index (Índice de Serviços de Telecomunicações, or "IST"), which is a basket of national indexes that reflect the Brazilian telecommunications sector's operating costs. However, Brazilian monetary policy continues to use the IPCA as an inflation targeting system. The inflation target for 2012 is 4.5%. In recent years, Brazil has failed to meet its inflation target. According to the Brazilian monetary authority, the official inflation target was only met in one calendar year over the past three years. In 2009, the official target inflation rate of 4.50% was 4% higher than the actual inflation rate of 4.32%. However, in 2010 and 2011, Brazil's actual inflation rate was 5.91% and 6.50%, respectively, 31.3% and 44.4% higher than the 4.50% inflation target set for both calendar years. If inflation increases beyond the official 2012 target, basic interest rates may rise, causing direct effects on Oi's cost of debt and indirect effects on the demand for telecommunications goods and services. These effects are aggravated by the uncertainties historically observed in Brazil's economy.

19