| 1 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 19 | ||||

| Financial Statements |

||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

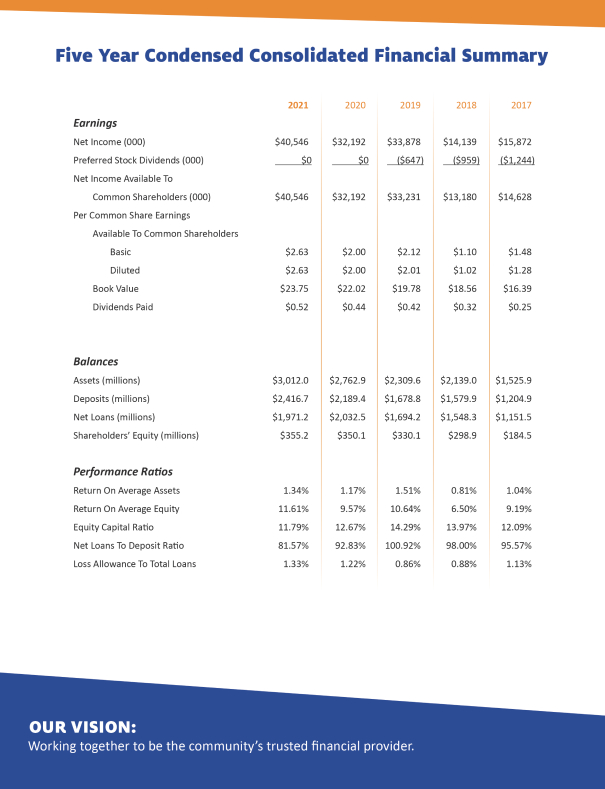

Year ended December 31, |

||||||||||||||||||||

2021 |

2020 |

2019 |

2018 |

2017 |

||||||||||||||||

| Statements of income: |

||||||||||||||||||||

| Total interest and dividend income |

$ | 101,742 | $ | 99,865 | $ | 98,054 | $ | 73,677 | $ | 58,594 | ||||||||||

| Total interest expense |

6,317 | 10,138 | 12,954 | 7,570 | 4,092 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

95,425 | 89,727 | 85,100 | 66,107 | 54,502 | |||||||||||||||

| Provision for loan losses |

830 | 10,112 | 1,035 | 780 | — | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for loan losses |

94,595 | 79,615 | 84,065 | 65,327 | 54,502 | |||||||||||||||

| Net gain (loss) on sale of securities |

1,786 | 94 | 32 | (413 | ) | 12 | ||||||||||||||

| Other noninterest income |

29,666 | 28,088 | 22,411 | 18,544 | 16,322 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

31,452 | 28,182 | 22,443 | 18,131 | 16,334 | |||||||||||||||

| Total noninterest expense |

78,484 | 70,665 | 66,947 | 66,679 | 48,604 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before federal income taxes |

47,563 | 37,132 | 39,561 | 16,779 | 22,232 | |||||||||||||||

| Federal income tax expense |

7,017 | 4,940 | 5,683 | 2,640 | 6,360 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 40,546 | $ | 32,192 | $ | 33,878 | $ | 14,139 | $ | 15,872 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Preferred stock dividends and discount accretion |

— | — | 647 | 959 | 1,244 | |||||||||||||||

| Allocation of earnings and dividends to participating securities |

173 | 98 | 87 | — | — | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income available to common shareholders |

$ | 40,373 | $ | 32,094 | $ | 33,144 | $ | 13,180 | $ | 14,628 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Per common share: |

||||||||||||||||||||

| Net income available to common shareholders (basic) |

2.63 | 2.00 | 2.12 | 1.10 | 1.48 | |||||||||||||||

| Net income available to common shareholders (diluted) |

2.63 | 2.00 | 2.01 | 1.02 | 1.28 | |||||||||||||||

| Dividends declared |

0.52 | 0.44 | 0.42 | 0.32 | 0.25 | |||||||||||||||

| Book value |

23.75 | 22.02 | 19.78 | 18.56 | 16.39 | |||||||||||||||

| Average common shares outstanding: |

||||||||||||||||||||

| Basic |

15,353,215 | 16,080,863 | 15,612,868 | 11,971,786 | 9,906,856 | |||||||||||||||

| Diluted |

15,343,215 | 16,080,863 | 16,851,740 | 13,855,706 | 12,352,616 | |||||||||||||||

| Year-end balances: |

||||||||||||||||||||

| Loans, net |

$ | 1,971,238 | $ | 2,032,474 | $ | 1,694,203 | $ | 1,548,262 | $ | 1,151,527 | ||||||||||

| Securities |

577,957 | 384,887 | 379,970 | 368,385 | 245,309 | |||||||||||||||

| Total assets |

3,011,983 | 2,762,918 | 2,309,557 | 2,138,954 | 1,525,857 | |||||||||||||||

| Deposits |

2,416,701 | 2,189,398 | 1,678,764 | 1,579,893 | 1,204,923 | |||||||||||||||

| Borrowings |

203,308 | 183,341 | 274,601 | 245,226 | 123,082 | |||||||||||||||

| Shareholders’ equity |

355,212 | 350,108 | 330,126 | 298,898 | 184,461 | |||||||||||||||

| Average balances: |

||||||||||||||||||||

| Loans, net |

$ | 2,026,907 | $ | 1,953,472 | $ | 1,598,991 | $ | 1,261,568 | $ | 1,095,956 | ||||||||||

| Securities |

450,599 | 386,703 | 372,886 | 273,998 | 234,249 | |||||||||||||||

| Total assets |

3,032,382 | 2,754,708 | 2,241,111 | 1,742,823 | 1,526,387 | |||||||||||||||

| Deposits |

2,422,938 | 2,078,454 | 1,689,801 | 1,341,860 | 1,236,663 | |||||||||||||||

| Borrowings |

156,206 | 288,551 | 208,932 | 167,752 | 101,880 | |||||||||||||||

| Shareholders’ equity |

349,203 | 336,461 | 318,306 | 217,371 | 172,763 | |||||||||||||||

Year ended December 31, |

||||||||||||||||||||

2021 |

2020 |

2019 |

2018 |

2017 |

||||||||||||||||

| Net interest margin (1) |

3.47 | % | 3.70 | % | 4.31 | % | 4.21 | % | 4.01 | % | ||||||||||

| Return on average total assets |

1.34 | 1.17 | 1.51 | 0.81 | 1.04 | |||||||||||||||

| Return on average shareholders’ equity |

11.61 | 9.57 | 10.64 | 6.50 | 9.19 | |||||||||||||||

| Dividend payout ratio |

19.77 | 22.00 | 19.81 | 29.09 | 16.89 | |||||||||||||||

| Average shareholders’ equity as a percent of average total assets |

11.52 | 12.21 | 14.20 | 12.47 | 11.32 | |||||||||||||||

| Net loan charge-offs (recoveries) as a percent of average total loans |

(0.04 | ) | (0.01 | ) | (0.00 | ) | 0.02 | 0.02 | ||||||||||||

| Allowance for loan losses as a percent of loans at year-end |

1.33 | 1.22 | 0.86 | 0.88 | 1.13 | |||||||||||||||

| Shareholders’ equity as a percent of total year-end assets |

11.79 | 12.67 | 14.29 | 13.97 | 12.09 | |||||||||||||||

| (1) | Calculated on a tax-equivalent basis using an effective tax rate of 21% for 2021, 2020, 2019 and 2018 and 35% for 2017. |

As of and for year ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Net loan charge-offs (recoveries) |

$ | (783 | ) | $ | (149 | ) | $ | (53 | ) | |||

| Provision for loan losses charged to expense |

830 | 10,112 | 1,035 | |||||||||

| Net loan charge-offs (recoveries) as a percent of average outstanding loans |

(0.04 | )% | (0.01 | )% | (0.00 | )% | ||||||

| Allowance for loan losses |

$ | 26,641 | $ | 25,028 | $ | 14,767 | ||||||

| Allowance for loan losses as a percent of year-end outstanding loans |

1.33 | % | 1.22 | % | 0.86 | % | ||||||

| Impaired loans, excluding purchase credit impaired loans (PCI) |

$ | 1,222 | $ | 2,666 | $ | 3,597 | ||||||

| Impaired loans as a percent of gross year-end loans (1) |

0.06 | % | 0.13 | % | 0.21 | % | ||||||

| Nonaccrual and 90 days or more past due loans, excluding PCI |

$ | 3,673 | $ | 5,125 | $ | 5,599 | ||||||

| Nonaccrual and 90 days or more past due loans, excluding PCI as a percent of gross year-end loans (1) |

0.18 | % | 0.25 | % | 0.33 | % | ||||||

| (1) | Nonaccrual loans and impaired loans are defined differently. Some loans may be included in both categories, whereas other loans may only be included in one category. A loan is considered nonaccrual if it is maintained on a cash basis because of deterioration in the borrower’s financial condition, where payment in full of principal or interest is not expected and where the principal and interest have been in default for 90 days, unless the asset is both well-secured and in process of collection. A loan is considered impaired when it is probable that all of the interest and principal due will not be collected according to the terms of the original contractual agreement. |

2021 |

2020 |

2019 |

||||||||||||||||||||||||||||||||||

| Assets |

Average balance |

Interest |

Yield/ rate |

Average balance |

Interest |

Yield/ rate |

Average balance |

Interest |

Yield/ rate |

|||||||||||||||||||||||||||

| Interest-earning assets: |

||||||||||||||||||||||||||||||||||||

| Loans (1)(2)(3)(5) |

$ | 2,026,907 | $ | 89,570 | 4.42 | % | $ | 1,953,472 | $ | 87,777 | 4.49 | % | $ | 1,612,975 | $ | 84,972 | 5.27 | % | ||||||||||||||||||

| Taxable securities (4) |

232,813 | 5,473 | 2.41 | % | 183,721 | 5,359 | 3.03 | % | 200,074 | 6,584 | 3.35 | % | ||||||||||||||||||||||||

| Non-taxable securities (4)(5) |

217,786 | 6,250 | 3.96 | % | 202,982 | 6,123 | 4.15 | % | 172,812 | 5,647 | 4.36 | % | ||||||||||||||||||||||||

| Interest-bearing deposits in other banks |

347,573 | 449 | 0.13 | % | 155,960 | 606 | 0.39 | % | 38,359 | 851 | 2.22 | % | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest earning assets |

2,825,079 | 101,742 | 3.69 | % | 2,496,135 | 99,865 | 4.10 | % | 2,024,220 | 98,054 | 4.95 | % | ||||||||||||||||||||||||

| Noninterest-earning assets: |

||||||||||||||||||||||||||||||||||||

| Cash and due from financial institutions |

35,404 | 77,848 | 47,472 | |||||||||||||||||||||||||||||||||

| Premises and equipment, net |

22,617 | 22,831 | 21,946 | |||||||||||||||||||||||||||||||||

| Accrued interest receivable |

8,010 | 9,043 | 7,088 | |||||||||||||||||||||||||||||||||

| Intangible assets |

84,747 | 84,953 | 85,744 | |||||||||||||||||||||||||||||||||

| Other assets |

36,456 | 37,675 | 24,273 | |||||||||||||||||||||||||||||||||

| Bank owned life insurance |

46,435 | 45,454 | 44,352 | |||||||||||||||||||||||||||||||||

| Less allowance for loan losses |

(26,366 | ) | (19,231 | ) | (13,984 | ) | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total |

$ | 3,032,382 | $ | 2,754,708 | $ | 2,241,111 | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| (1) | For purposes of these computations, the daily average loan amounts outstanding are net of unearned income and include loans held for sale. |

| (2) | Included in loan interest income are loan fees of $1,661 in 2021, $1,025 in 2020 and $1,227 in 2019. |

| (3) | Non-accrual loans are included in loan totals and do not have a material impact on the analysis presented. |

| (4) | Average balance is computed using the carrying value of securities. The average yield has been computed using the historical amortized cost average balance for available for sale securities. |

| (5) | Yield/Rate is calculated using the tax-equivalent adjustment of 21% for 2020, 2019 and 2018. |

2021 |

2020 |

2019 |

||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders’ Equity |

Average balance |

Interest |

Yield/ rate |

Average balance |

Interest |

Yield/ rate |

Average balance |

Interest |

Yield/ rate |

|||||||||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Savings and interest-bearing demand accounts |

$ | 1,315,220 | $ | 1,219 | 0.09 | % | $ | 1,050,544 | $ | 1,813 | 0.17 | % | $ | 869,340 | $ | 2,871 | 0.33 | % | ||||||||||||||||||

| Certificates of deposit |

265,294 | 2,956 | 1.11 | % | 288,262 | 5,068 | 1.76 | % | 269,823 | 5,186 | 1.92 | % | ||||||||||||||||||||||||

| Short-term Federal Home Loan Bank advances |

— | — | — | 8,151 | 134 | 1.64 | % | 112,088 | 2,600 | 2.32 | % | |||||||||||||||||||||||||

| Long-term Federal Home Loan Bank advances |

94,041 | 1,163 | 1.24 | % | 125,000 | 1,798 | 1.44 | % | 48,959 | 852 | 1.74 | % | ||||||||||||||||||||||||

| Other borrowings |

— | — | — | 101,295 | 354 | 0.35 | % | — | — | — | ||||||||||||||||||||||||||

| Securities sold under repurchase agreements |

26,165 | 23 | 0.09 | % | 24,390 | 25 | 0.10 | % | 18,321 | 19 | 0.10 | % | ||||||||||||||||||||||||

| Federal funds purchased |

137 | 1 | 0.73 | % | 288 | 1 | 0.35 | % | 137 | 3 | 2.19 | % | ||||||||||||||||||||||||

| Subordinated debentures |

35,863 | 955 | 2.66 | % | 29,427 | 945 | 3.21 | % | 29,427 | 1,423 | 4.84 | % | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-bearing liabilities |

1,736,720 | 6,317 | 0.36 | % | 1,627,357 | 10,138 | 0.62 | % | 1,348,095 | 12,954 | 0.96 | % | ||||||||||||||||||||||||

| Noninterest-bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Demand deposits |

907,591 | 739,648 | 550,638 | |||||||||||||||||||||||||||||||||

| Other liabilities |

38,868 | 51,242 | 24,072 | |||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| 946,459 | 790,890 | 574,710 | ||||||||||||||||||||||||||||||||||

| Shareholders’ equity |

349,203 | 336,461 | 318,306 | |||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total |

$ | 3,032,382 | $ | 2,754,708 | $ | 2,241,111 | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest income and interest rate spread (1) |

$ | 95,425 | 3.33 | % | $ | 89,727 | 3.48 | % | $ | 85,100 | 3.99 | % | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Net interest margin (2) |

3.47 | % | 3.70 | % | 4.31 | % | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| (1) | Interest rate spread is calculated by subtracting the rate on average interest-bearing liabilities from the yield on average interest-earning assets. |

| (2) | Net interest margin is calculated by dividing tax-equivalent adjusted net interest income by average interest-earning assets. |

Increase (decrease) due to: |

||||||||||||

Volume (1) |

Rate (1) |

Net |

||||||||||

| 2021 compared to 2020 |

||||||||||||

| Interest income: |

||||||||||||

| Loans |

$ | 3,262 | $ | (1,469 | ) | $ | 1,793 | |||||

| Taxable securities |

1,360 | (1,246 | ) | 114 | ||||||||

| Nontaxable securities |

439 | (312 | ) | 127 | ||||||||

| Interest-bearing deposits in other banks |

422 | (579 | ) | (157 | ) | |||||||

| |

|

|

|

|

|

|||||||

| Total interest income |

$ | 5,483 | $ | (3,606 | ) | $ | 1,877 | |||||

| |

|

|

|

|

|

|||||||

| Interest expense: |

||||||||||||

| Savings and interest-bearing demand accounts |

$ | 382 | $ | (976 | ) | $ | (594 | ) | ||||

| Certificates of deposit |

(377 | ) | (1,735 | ) | (2,112 | ) | ||||||

| Short-term Federal Home Loan Bank advances |

(134 | ) | — | (134 | ) | |||||||

| Long-term Federal Home Loan Bank advances |

(405 | ) | (230 | ) | (635 | ) | ||||||

| Securities sold under repurchase agreements |

2 | (4 | ) | (2 | ) | |||||||

| Federal funds purchased |

(1 | ) | 1 | — | ||||||||

| Other borrowings |

(354 | ) | — | (354 | ) | |||||||

| Subordinated debentures |

187 | (177 | ) | 10 | ||||||||

| |

|

|

|

|

|

|||||||

| Total interest expense |

$ | (700 | ) | $ | (3,121 | ) | $ | (3,821 | ) | |||

| |

|

|

|

|

|

|||||||

| Net interest income |

$ | 6,183 | $ | (485 | ) | $ | 5,698 | |||||

| |

|

|

|

|

|

|||||||

| 2020 compared to 2019 |

||||||||||||

| Interest income: |

||||||||||||

| Loans |

$ | 16,383 | $ | (13,578 | ) | $ | 2,805 | |||||

| Taxable securities |

(633 | ) | (592 | ) | (1,225 | ) | ||||||

| Nontaxable securities |

761 | (285 | ) | 476 | ||||||||

| Interest-bearing deposits in other banks |

913 | (1,158 | ) | (245 | ) | |||||||

| |

|

|

|

|

|

|||||||

| Total interest income |

$ | 17,424 | $ | (15,613 | ) | $ | 1,811 | |||||

| |

|

|

|

|

|

|||||||

| Interest expense: |

||||||||||||

| Savings and interest-bearing demand accounts |

$ | 512 | $ | (1,570 | ) | $ | (1,058 | ) | ||||

| Certificates of deposit |

341 | (459 | ) | (118 | ) | |||||||

| Short-term Federal Home Loan Bank advances |

(1,877 | ) | (589 | ) | (2,466 | ) | ||||||

| Long-term Federal Home Loan Bank advances |

1,117 | (171 | ) | 946 | ||||||||

| Securities sold under repurchase agreements |

6 | — | 6 | |||||||||

| Federal funds purchased |

2 | (4 | ) | (2 | ) | |||||||

| Other borrowings |

354 | — | 354 | |||||||||

| Subordinated debentures |

— | (478 | ) | (478 | ) | |||||||

| |

|

|

|

|

|

|||||||

| Total interest expense |

$ | 455 | $ | (3,271 | ) | $ | (2,816 | ) | ||||

| |

|

|

|

|

|

|||||||

| Net interest income |

$ | 16,969 | $ | (12,342 | ) | $ | 4,627 | |||||

| |

|

|

|

|

|

|||||||

| (1) | The change in interest income and interest expense due to changes in both volume and rate, which cannot be segregated, has been allocated proportionately to the change due to volume and the change due to rate. |

Total Risk Based Capital |

Tier I Risk Based Capital |

CET1 Risk Based Capital |

Leverage Ratio |

|||||||||||||

| Company Ratios—December 31, 2021 |

19.2 | % | 14.3 | % | 12.9 | % | 10.2 | % | ||||||||

| Company Ratios—December 31, 2020 |

16.0 | % | 14.7 | % | 13.2 | % | 10.8 | % | ||||||||

| For Capital Adequacy Purposes |

8.0 | % | 6.0 | % | 4.5 | % | 4.0 | % | ||||||||

| To Be Well Capitalized Under Prompt Corrective Action Provisions |

10.0 | % | 8.0 | % | 6.5 | % | 5.0 | % | ||||||||

| Contractual Obligations |

One year or less |

One to three years |

Three to five years |

Over five years |

Total |

|||||||||||||||

| Deposits without a stated maturity |

$ | 2,170,253 | $ | — | $ | — | $ | — | $ | 2,170,253 | ||||||||||

| Certificates of deposit and IRAs |

174,022 | 64,005 | 7,425 | 996 | 246,448 | |||||||||||||||

| FHLB advances, securities sold under agreements to repurchase and U.S. Treasury interest-bearing demand note |

— | — | — | 75,000 | 75,000 | |||||||||||||||

| Subordinated debentures (1) |

— | — | — | 102,813 | 102,813 | |||||||||||||||

| Operating leases |

569 | 613 | 417 | 491 | 2,090 | |||||||||||||||

| (1) | The subordinated debentures consist of $2,000, $2,500, $5,000, $7,500, and $12,500 debentures. |

December 31, 2021 |

December 31, 2020 |

|||||||||||||||||||||||

| Change in Rates |

Dollar Amount |

Dollar Change |

Percent Change |

Dollar Amount |

Dollar Change |

Percent Change |

||||||||||||||||||

| +200bp |

$ | 531,385 | $ | 44,276 | 9 | % | $ | 515,754 | $ | 44,930 | 10 | % | ||||||||||||

| +100bp |

521,707 | 34,598 | 7 | % | 503,010 | 32,186 | 7 | % | ||||||||||||||||

| Base |

487,109 | — | — | 470,824 | — | — | ||||||||||||||||||

| -100bp |

495,963 | 8,854 | 2 | % | 501,686 | 30,862 | 7 | % | ||||||||||||||||

| -200bp |

548,326 | 61,217 | 13 | % | 527,360 | 56,536 | 12 | % | ||||||||||||||||

|

| |||

| Dennis G. Shaffer |

Todd A. Michel | |||

| President and Chief Executive Officer |

Senior Vice President, Controller | |||

| Sandusky, Ohio |

||||

| March 15, 2022 |

||||

| • | Evaluated and tested the design and operating effectiveness of related controls over the reliability and accuracy of data used to calculate and estimate various components of the ALL including: |

○ |

Classification of loans by segment |

○ |

Historical loss data and loss rates |

○ |

Establishment of qualitative adjustments |

○ |

Grading and risk classification |

○ |

Establishment of specific reserves on impaired loans |

| • | Testing the clerical and computational accuracy of the formulas and information utilized within the ALL model. |

| • | Evaluating the qualitative and environmental adjustment to the historical loss rates, including assessing the basis for the adjustments and the reasonableness of the significant assumptions. |

| • | Evaluating the relevance and reliability of data and assumptions. |

| • | Testing of the loan review function and the accuracy of how loan grades are determined. Specifically, evaluating the appropriateness of loan grades and to assess the reasonableness of specific impairments on loans. |

| • | Evaluating the overall reasonableness of qualitative factors and the appropriateness of their direction and magnitude and the Company’s support for the direction and magnitude compared to previous years. |

| • | Evaluating credit quality indicators such as trends in delinquencies, nonaccruals, and charge-offs. |

| • | Evaluating the accuracy and completeness of disclosures in the consolidated financial statements. |

2021 |

2020 |

|||||||

| ASSETS |

||||||||

| Cash and due from financial institutions |

$ | |

$ | |

||||

| Restricted cash |

||||||||

| |

|

|

|

|||||

| Cash and cash equivalents |

||||||||

| Investments in time deposits |

|

|

|

|

|

|

|

|

| Securities available for sale |

||||||||

| Equity securities |

||||||||

| Loans held for sale |

||||||||

| Loans, net of allowance of $ |

||||||||

| Other securities |

||||||||

| Premises and equipment, net |

||||||||

| Accrued interest receivable |

||||||||

| Goodwill |

||||||||

| Other intangible assets |

||||||||

| Bank owned life insurance |

||||||||

| Swap assets |

||||||||

| Other assets |

||||||||

| |

|

|

|

|||||

| Total assets |

$ | $ | ||||||

| |

|

|

|

|||||

| LIABILITIES |

||||||||

| Deposits |

||||||||

| Noninterest-bearing |

$ | $ | ||||||

| Interest-bearing |

||||||||

| |

|

|

|

|||||

| Total deposits |

||||||||

| Long-term Federal Home Loan Bank advances |

||||||||

| Securities sold under agreements to repurchase |

||||||||

| Subordinated debentures |

||||||||

| Swap liabilities |

||||||||

| Accrued expenses and other liabilities |

||||||||

| |

|

|

|

|||||

| Total liabilities |

||||||||

| |

|

|

|

|||||

| SHAREHOLDERS’ EQUITY |

||||||||

| Common stock, |

||||||||

| Accumulated earnings |

||||||||

| Treasury stock, |

( |

) | ( |

) | ||||

| Accumulated other comprehensive income |

||||||||

| |

|

|

|

|||||

| Total shareholders’ equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | $ | ||||||

| |

|

|

|

|

|

|

|

|

2021 |

2020 |

2019 |

||||||||||

| Interest and dividend income |

||||||||||||

| Loans, including fees |

$ | |

$ | |

$ | |

||||||

| Taxable securities |

||||||||||||

| Tax-exempt securities |

||||||||||||

| Federal funds sold and other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total interest and dividend income |

||||||||||||

| |

|

|

|

|

|

|||||||

| Interest expense |

||||||||||||

| Deposits |

||||||||||||

| Federal Home Loan Bank advances |

||||||||||||

| Subordinated debentures |

||||||||||||

| Securities sold under agreements to repurchase and other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total interest expense |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net interest income |

||||||||||||

| Provision for loan losses |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net interest income after provision for loan losses |

||||||||||||

| |

|

|

|

|

|

|||||||

| Noninterest income |

||||||||||||

| Service charges |

||||||||||||

| Net gain on sale of securities |

||||||||||||

| Net gain (loss) on equity securities |

( |

) | ||||||||||

| Net gain on sale of loans |

||||||||||||

| ATM/Interchange fees |

||||||||||||

| Wealth management fees |

||||||||||||

| Bank owned life insurance |

||||||||||||

| Tax refund processing fees |

||||||||||||

| Computer center item processing fees |

||||||||||||

| Swap fees |

||||||||||||

| Other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total noninterest income |

||||||||||||

| |

|

|

|

|

|

|||||||

| Noninterest expense |

||||||||||||

| Compensation expense |

||||||||||||

| Net occupancy expense |

||||||||||||

| Equipment expense |

||||||||||||

| Contracted data processing |

||||||||||||

| FDIC Assessment |

||||||||||||

| State franchise tax |

||||||||||||

| Professional services |

||||||||||||

| Amortization of intangible assets |

||||||||||||

| ATM/Interchange expense |

||||||||||||

| Marketing expense |

||||||||||||

| Software maintenance expenses |

||||||||||||

| Other operating expenses |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total noninterest expense |

||||||||||||

| |

|

|

|

|

|

|||||||

| Income before income taxes |

||||||||||||

| Income taxes |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net income |

||||||||||||

| Preferred stock dividends |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net income available to common shareholders |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Earnings per common share, basic |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Earnings per common share, diluted |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

| Net income |

$ | |

$ | |

$ | |

||||||

| Other comprehensive income (loss): |

||||||||||||

| Unrealized holding gains (loss) on available for sale securities |

( |

) | ||||||||||

| Tax effect |

( |

) | ( |

) | ||||||||

| Reclassification of gains recognized in net income |

( |

) | ( |

) | ( |

) | ||||||

| Tax effect |

— | |||||||||||

| Pension liability adjustment |

( |

) | ( |

) | ||||||||

| Tax effect |

( |

) | ||||||||||

| Reclassification of actuatial gain (loss) recognized in net income |

||||||||||||

| Tax effect |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Total other comprehensive income (loss) |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Comprehensive income |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

Preferred Shares |

Common Shares |

Accumulated Earnings |

Treasury Stock |

Accumulated Other Comprehensive Income (Loss) |

Total Shareholders’ Equity |

|||||||||||||||||||||||||||

Shares |

Amount |

Shares |

Amount |

|||||||||||||||||||||||||||||

| Balance, December 31, 2018 |

$ | $ | $ | $ | ( |

) | $ | ( |

) | $ | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

||||||||||||||||||||||||||||||||

| Other comprehensive income |

||||||||||||||||||||||||||||||||

| Conversion of Series B preferred shares to common shares |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||

| Stock-based compensation |

||||||||||||||||||||||||||||||||

| Common share dividends ($ |

( |

) | ( |

) | ||||||||||||||||||||||||||||

| Preferred share dividends ($ |

( |

) | ( |

) | ||||||||||||||||||||||||||||

| Repurchase of common stock |

( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance, December 31, 2019 |

— | $ | — | $ | $ | $ | ( |

) | $ | $ | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

||||||||||||||||||||||||||||||||

| Other comprehensive loss |

||||||||||||||||||||||||||||||||

| Stock-based compensation |

||||||||||||||||||||||||||||||||

| Common share dividends ($ |

( |

) | ( |

) | ||||||||||||||||||||||||||||

| Repurchase of common stock |

( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance, December 31, 2020 |

— | $ | — | $ | $ | $ | ( |

) | $ | $ | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

||||||||||||||||||||||||||||||||

| Other comprehensive income |

( |

) | ( |

) | ||||||||||||||||||||||||||||

| Stock-based compensation |

||||||||||||||||||||||||||||||||

| Common share dividends ($ |

( |

) | ( |

) | ||||||||||||||||||||||||||||

| Repurchase of common stock |

( |

) | — | ( |

) | ( |

) | |||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance, December 31, 2021 |

— | $ | — | $ | $ | $ | ( |

) | $ | $ | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Cash flows from operating activities: |

||||||||||||

| Net income |

$ | |

$ | |

$ | |

||||||

| Adjustments to reconcile net income to net cash from operating activities |

||||||||||||

| Time deposits amortizatio n |

|

|

|

|

|

|

|

|

|

|

— |

|

| Security amortization, net |

||||||||||||

| Depreciation |

||||||||||||

| Amortization of core deposit intangible |

||||||||||||

| Amortization of net deferred loan fees |

( |

) | ( |

) | ( |

) | ||||||

| Net gain on sale of securities |

( |

) | ( |

) | ( |

) | ||||||

| Net (gain) loss on equity securities |

( |

) | ( |

) | ||||||||

| Provision for loan losses |

||||||||||||

| Loans originated for sale |

( |

) | ( |

) | ( |

) | ||||||

| Proceeds from sale of loans |

||||||||||||

| Net gain on sale of loans |

( |

) | ( |

) | ( |

) | ||||||

| Increase in cash surrender value of bank owned life insurance |

( |

) | ( |

) | ( |

) | ||||||

| Share-based compensation |

||||||||||||

| Deferred taxes |

( |

) | ||||||||||

| Change in: |

||||||||||||

| Accrued interest payable |

( |

) | ||||||||||

| Accrued interest receivable |

( |

) | ( |

) | ||||||||

| Other, net |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Net cash from operating activities |

||||||||||||

| |

|

|

|

|

|

|||||||

| Cash flows used for investing activities : |

|

|

|

|

|

|

|

|

|

|

|

|

| Investments in time securities |

|

|

|

|

|

|

|

|

|

|

|

|

| Maturities |

|

|

|

|

|

|

|

|

|

|

— |

|

| Purchase s |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

| Securities available for sale |

|

|

|

|

|

|

|

|

|

|

|

|

| Maturities, prepayments and calls |

||||||||||||

| Sales |

||||||||||||

| Purchases |

( |

) | ( |

) | ( |

) | ||||||

| Purchases of other securities |

— | ( |

) | — | ||||||||

| Redemption of other securities |

— | |||||||||||

| Redemption of equity securities |

— | — | ||||||||||

| Purchases of bank owned life insurance |

— | — | ( |

) | ||||||||

| Proceeds from bank owned life insurance |

— | — | ||||||||||

| Net change in loans |

( |

) | ( |

) | ||||||||

| Proceeds from sale of OREO properties |

— | — | ||||||||||

| Premises and equipment purchases |

( |

) | ( |

) | ( |

) | ||||||

| Disposal of premises and equipment |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net cash used for investing activities |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

| Cash flows from financing activities: |

||||||||||||

| Increase in deposits |

||||||||||||

| Net change in short-term FHLB advances |

— | ( |

) | ( |

) | |||||||

| Repayment of long-term FHLB advances |

( |

) | — | ( |

) | |||||||

| Proceeds from long-term FHLB advances |

— | — | ||||||||||

| Repayment of other borrowings |

— | ( |

) | — | ||||||||

| Proceeds from other borrowings |

— | — | ||||||||||

| Proceeds from subordinated debentures |

— | — | ||||||||||

| Increase (decrease) in securities sold under repurchase agreements |

( |

) | ( |

) | ||||||||

| Cash payment for redemption of series B preferred stock |

— | — | ( |

) | ||||||||

| Repurchase of common stock |

( |

) | ( |

) | ( |

) | ||||||

| Cash paid on fractional shares on preferred stock conversion |

— | — | ( |

) | ||||||||

| Cash dividends paid |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Net cash from financing activities |

||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Increase in cash and due from financial institutions |

||||||||||||

| Cash and cash equivalents at beginning of year |

||||||||||||

| |

|

|

|

|

|

|||||||

| Cash and cash equivalents at end of year |

$ | |

$ | |

$ | |

||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information: |

||||||||||||

| Interest paid |

$ | $ | $ | |||||||||

| Income taxes paid |

||||||||||||

| Transfer of loans from portfolio to other real estate owned |

— | |||||||||||

| Transfer of premises to held-for-sale |

— | — | ||||||||||

| Securities purchased not settled |

— | |||||||||||

| Conversion of preferred stock to common stock |

— | — | ||||||||||

Amortized Cost |

Gross Unrealized Gains |

Gross Unrealized Losses |

Fair Value |

|||||||||||||

| 2021 |

||||||||||||||||

| U.S. Treasury securities and obligations of U.S. government agencies |

$ | $ | $ | ( |

) | $ | ||||||||||

| Obligations of states and political subdivisions |

( |

) | ||||||||||||||

| Mortgage-back securities in government sponsored entities |

( |

) | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total debt securities |

$ | |

$ | |

$ | ( |

) | $ | |

|||||||

| |

|

|

|

|

|

|

|

|||||||||

Amortized Cost |

Gross Unrealized Gains |

Gross Unrealized Losses |

Fair Value |

|||||||||||||

| 2020 |

||||||||||||||||

| U.S. Treasury securities and obligations of U.S. government agencies |

$ | $ | $ | ( |

) | $ | ||||||||||

| Obligations of states and political subdivisions |

( |

) | ||||||||||||||

| Mortgage-back securities in government sponsored entities |

( |

) | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total debt securities |

$ | $ | $ | ( |

) | $ | |

|||||||||

| |

|

|

|

|

|

|

|

|||||||||

Available for sale |

||||||||

Amortized Cost |

Fair Value |

|||||||

| Due in one year or less |

$ | $ | ||||||

| Due from one to five years |

||||||||

| Due from five to ten years |

||||||||

| Due after ten years |

||||||||

| Mortgage-backed securities in government sponsored entities |

||||||||

| |

|

|

|

|||||

| Total securities available for sale |

$ | |

$ | |

||||

| |

|

|

|

|||||

2021 |

2020 |

2019 |

||||||||||

| Sale proceeds |

$ | |

$ | |

$ | |

||||||

| Gross realized gains |

||||||||||||

| Gross realized losses |

||||||||||||

| Gains from securities called or settled by the issuer |

||||||||||||

| 2021 |

12 Months or less |

More than 12 months |

Total |

|||||||||||||||||||||

| Description of Securities |

Fair Value |

Unrealized Loss |

Fair Value |

Unrealized Loss |

Fair Value |

Unrealized Loss |

||||||||||||||||||

| U.S. Treasury securities and obligations of U.S. government agencies |

$ | $ | ( |

) | $ | |

$ | ( |

) | $ | $ | ( |

) | |||||||||||

| Obligations of states and political subdivisions |

( |

) | — | — | ( |

) | ||||||||||||||||||

| Mortgage-backed securities in gov’t sponsored entities |

( |

) | ( |

) | ( |

) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total temporarily impaired |

$ | $ | ( |

) | $ | $ | ( |

) | $ | $ | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 2020 |

12 Months or less |

More than 12 months |

Total |

|||||||||||||||||||||

| Description of Securities |

Fair Value |

Unrealized Loss |

Fair Value |

Unrealized Loss |

Fair Value |

Unrealized Loss |

||||||||||||||||||

| U.S. Treasury securities and obligations of U.S. government agencies |

$ | $ | ( |

) | $ | |

$ | ( |

) | $ | $ | ( |

) | |||||||||||

| Obligations of states and political subdivisions |

( |

) | — | — | ( |

) | ||||||||||||||||||

| Mortgage-backed securities in gov’t sponsored entities |

( |

) | — | — | ( |

) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total temporarily impaired |

$ | |

$ | ( |

) | $ | $ | ( |

) | $ | $ | ( |

) | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| • | The length of time and the extent to which fair value has been below cost; |

| • | The severity of impairment; |

| • | The cause of the impairment and the financial condition and near-term prospects of the issuer; |

| • | If the Company intends to sell the investment; |

| • | If it’s more-likely-than-not the Company will be required to sell the investment before recovering its amortized cost basis; and |

| • | If the Company does not expect to recover the investment’s entire amortized cost basis (even if the Company does not intend to sell the investment). |

| • | Identification and evaluation of investments that have indications of impairment; |

| • | Analysis of individual investments that have fair values less than amortized cost, including consideration of length of time each investment has been in unrealized loss position and the expected recovery period; |

| • | Evaluation of factors or triggers that could cause individual investments to qualify as having other-than-temporary impairment; and |

| • | Documentation of these analyses, as required by policy. |

2021 |

2020 |

|||||||

| Net gains (losses) recognized on equity securities during the year |

$ | $ | ( |

) | ||||

| Less: Net gains realized on the sale of equity securities during the period |

— | |||||||

| |

|

|

|

|||||

| Unrealized gains (losses) recognized in equity securities held at December 31 |

$ | |

$ | ( |

) | |||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

| Commercial & Agriculture |

$ | $ | ||||||

| Commercial Real Estate - owner occupied |

||||||||

| Commercial Real Estate - non-owner occupied |

||||||||

| Residential Real Estate |

||||||||

| Real Estate Construction |

||||||||

| Farm Real Estate |

||||||||

| Consumer and Other |

||||||||

| |

|

|

|

|||||

| Total Loans |

||||||||

| Allowance for loan losses |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net loans |

$ | $ | ||||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

| Balance - Beginning of year |

$ | $ | ||||||

| New loans and advances |

||||||||

| Repayments |

( |

) | ( |

) | ||||

| Effect of changes to related parties |

||||||||

| |

|

|

|

|||||

| Balance - End of year |

$ | |

$ | |

||||

| |

|

|

|

|||||

| • | Changes in lending policies and procedures |

| • | Changes in experience and depth of lending and management staff |

| • | Changes in quality of credit review system |

| • | Changes in the nature and volume of the loan portfolio |

| • | Changes in past due, classified and nonaccrual loans and TDRs |

| • | Changes in economic and business conditions |

| • | Changes in competition or legal and regulatory requirements |

| • | Changes in concentrations within the loan portfolio |

| • | Changes in the underlying collateral for collateral dependent loans |

December 31, 2021 |

Beginning balance |

Charge-offs |

Recoveries |

Provision (Credit) |

Ending Balance |

|||||||||||||||

| Commercial & Agriculture |

$ | $ | ( |

) | $ | $ | ( |

) | $ | |

||||||||||

| Commercial Real Estate: |

||||||||||||||||||||

| Owner Occupied |

— | |||||||||||||||||||

| Non-Owner Occupied |

— | |||||||||||||||||||

| Residential Real Estate |

( |

) | ( |

) | ||||||||||||||||

| Real Estate Construction |

— | ( |

) | |||||||||||||||||

| Farm Real Estate |

— | ( |

) | |||||||||||||||||

| Consumer and Other |

( |

) | ( |

) | ||||||||||||||||

| Unallocated |

— | — | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | |

$ | ( |

) | $ | |

$ | |

$ | |

|||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

December 31, 2020 |

Beginning balance |

Charge-offs |

Recoveries |

Provision (Credit) |

Ending Balance |

|||||||||||||||

| Commercial & Agriculture |

$ | $ | ( |

) | $ | $ | $ | |||||||||||||

| Commercial Real Estate: |

||||||||||||||||||||

| Owner Occupied |

( |

) | ||||||||||||||||||

| Non-Owner Occupied |

— | |||||||||||||||||||

| Residential Real Estate |

( |

) | ||||||||||||||||||

| Real Estate Construction |

— | |||||||||||||||||||

| Farm Real Estate |

— | ( |

||||||||||||||||||

| Consumer and Other |

( |

) | ( |

|||||||||||||||||

| Unallocated |

— | — | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | |

$ | ( |

) | $ | |

$ | |

$ | |

|||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

December 31, 2019 |

Beginning balance |

Charge-offs |

Recoveries |

Provision (Credit) |

Ending Balance |

|||||||||||||||

Commercial & Agriculture |

$ | $ | ( |

) | $ | $ | $ | |||||||||||||

Commercial Real Estate: |

||||||||||||||||||||

Owner Occupied |

( |

) | ||||||||||||||||||

Non-Owner Occupied |

— | |||||||||||||||||||

Residential Real Estate |

( |

) | ||||||||||||||||||

Real Estate Construction |

( |

) | ||||||||||||||||||

Farm Real Estate |

— | ( |

) | |||||||||||||||||

Consumer and Other |

( |

) | ||||||||||||||||||

Unallocated |

— | — | ( |

) | — | |||||||||||||||

Total |

$ | |

$ | ( |

) | $ | |

$ | |

$ | |

|||||||||

December 31, 2021 |

Loans acquired with credit deterioration |

Loans individually evaluated for impairment |

Loans collectively evaluated for impairment |

Total |

||||||||||||

Allowance for loan losses: |

||||||||||||||||

Commercial & Agriculture |

$ | — | $ | — | $ | $ | ||||||||||

Commercial Real Estate: |

||||||||||||||||

Owner Occupied |

— | |||||||||||||||

Non-Owner Occupied |

— | — | ||||||||||||||

Residential Real Estate |

— | |||||||||||||||

Real Estate Construction |

— | — | ||||||||||||||

Farm Real Estate |

— | — | ||||||||||||||

Consumer and Other |

— | — | ||||||||||||||

Unallocated |

— | — | ||||||||||||||

Total |

$ | — | $ | $ | $ | |||||||||||

Outstanding loan balances: |

||||||||||||||||

Commercial & Agriculture |

$ | — | $ | — | $ | $ | ||||||||||

Commercial Real Estate: |

||||||||||||||||

Owner Occupied |

— | |||||||||||||||

Non-Owner Occupied |

— | — | ||||||||||||||

Residential Real Estate |

||||||||||||||||

Real Estate Construction |

— | — | ||||||||||||||

Farm Real Estate |

— | |||||||||||||||

Consumer and Other |

— | — | ||||||||||||||

Total |

$ | |

$ | |

$ | $ | ||||||||||

December 31, 2020 |

Loans acquired with credit deterioration |

Loans individually evaluated for impairment |

Loans collectively evaluated for impairment |

Total |

||||||||||||

Allowance for loan losses: |

||||||||||||||||

Commercial & Agriculture |

$ | — | $ | $ | $ | |||||||||||

Commercial Real Estate: |

||||||||||||||||

Owner Occupied |

— | |||||||||||||||

Non-Owner Occupied |

— | — | ||||||||||||||

Residential Real Estate |

— | |||||||||||||||

Real Estate Construction |

— | — | ||||||||||||||

Farm Real Estate |

— | — | ||||||||||||||

Consumer and Other |

— | — | ||||||||||||||

Unallocated |

— | — | ||||||||||||||

Total |

$ | — | $ | $ | $ | |||||||||||

Outstanding loan balances: |

||||||||||||||||

Commercial & Agriculture |

$ | — | $ | $ | $ | |||||||||||

Commercial Real Estate: |

||||||||||||||||

Owner Occupied |

— | |||||||||||||||

Non-Owner Occupied |

— | |||||||||||||||

Residential Real Estate |

||||||||||||||||

Real Estate Construction |

— | — | ||||||||||||||

Farm Real Estate |

— | |||||||||||||||

Consumer and Other |

— | — | ||||||||||||||

Total |

$ | |

$ | |

$ | $ | ||||||||||

• |

Pass – loans which are protected by the current net worth and paying capacity of the obligor or by the value of the underlying collateral. |

• |

Special Mention – loans where a potential weakness or risk exists, which could cause a more serious problem if not corrected. |

• |

Substandard – loans that have a well-defined weakness based on objective evidence and are characterized by the distinct possibility that Civista will sustain some loss if the deficiencies are not corrected. |

• |

Doubtful – loans classified as doubtful have all the weaknesses inherent in a substandard asset. In addition, these weaknesses make collection or liquidation in full highly questionable and improbable, based on existing circumstances. |

• |

Loss – loans classified as a loss are considered uncollectible, or of such value that continuance as an asset is not warranted. |

• |

Unrated – Generally, Residential Real Estate, Real Estate Construction and Consumer and Other loans are not risk-graded, except when collateral is used for a business purpose. |

December 31, 2021 |

Pass |

Special Mention |

Substandard |

Doubtful |

Ending Balance |

|||||||||||||||

Commercial & Agriculture |

$ |

$ |

$ |

$ |

— |

$ |

||||||||||||||

Commercial Real Estate: |

||||||||||||||||||||

Owner Occupied |

— |

|||||||||||||||||||

Non-Owner Occupied |

— |

|||||||||||||||||||

Residential Real Estate |

— |

|||||||||||||||||||

Real Estate Construction |

— |

|||||||||||||||||||

Farm Real Estate |

— |

|||||||||||||||||||

Consumer and Other |

— |

— |

||||||||||||||||||

Total |

$ |

$ |

$ |

$ |

— |

$ |

||||||||||||||

December 31, 2020 |

Pass |

Special Mention |

Substandard |

Doubtful |

Ending Balance |

|||||||||||||||

Commercial & Agriculture |

$ |

$ |

$ |

$ |

— |

$ |

||||||||||||||

Commercial Real Estate: |

||||||||||||||||||||

Owner Occupied |

— |

|||||||||||||||||||

Non-Owner Occupied |

— |

|||||||||||||||||||

Residential Real Estate |

— |

|||||||||||||||||||

Real Estate Construction |

— |

|||||||||||||||||||

Farm Real Estate |

— |

|||||||||||||||||||

Consumer and Other |

— |

— |

||||||||||||||||||

Total |

$ |

$ |

$ |

$ |

— |

$ |

||||||||||||||

December 31, 2021 |

Residential Real Estate |

Real Estate Construction |

Consumer and Other |

Total |

||||||||||||

Performing |

$ | $ | $ | $ | ||||||||||||

Nonperforming |

— | — | — | — | ||||||||||||

Total |

$ | $ | $ | $ | ||||||||||||

December 31, 2020 |

Residential Real Estate |

Real Estate Construction |

Consumer and Other |

Total |

||||||||||||

Performing |

$ | $ | $ | $ | ||||||||||||

Nonperforming |

— | — | — | — | ||||||||||||

Total |

$ | $ | $ | $ | ||||||||||||

December 31, 2021 |

30-59 Days Past Due |

60-89 Days Past Due |

90 Days or Greater |

Total Past Due |

Current |

Purchased Credit- Impaired Loans |

Total Loans |

Past Due 90 Days and Accruing |

||||||||||||||||||||||||

Commercial & Agriculture |

$ | $ | $ | $ | $ | $ | — | $ | $ | — | ||||||||||||||||||||||

Commercial Real Estate: |

||||||||||||||||||||||||||||||||

Owner Occupied |

— | — | — | — | ||||||||||||||||||||||||||||

Non-Owner Occupied |

— | — | — | — | ||||||||||||||||||||||||||||

Residential Real Estate |

— | |||||||||||||||||||||||||||||||

Real Estate Construction |

— | — | — | — | — | — | ||||||||||||||||||||||||||

Farm Real Estate |

— | — | — | — | — | — | ||||||||||||||||||||||||||

Consumer and Other |

— | — | — | |||||||||||||||||||||||||||||

Total |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |||||||||||||||||

December 31, 2020 |

30-59 Days Past Due |

60-89 Days Past Due |

90 Days or Greater |

Total Past Due |

Current |

Purchased Credit- Impaired Loans |

Total Loans |

Past Due 90 Days and Accruing |

||||||||||||||||||||||||

Commercial & Agriculture |

$ | $ | $ | $ | $ | $ | — | $ | $ | — | ||||||||||||||||||||||

Commercial Real Estate: |

||||||||||||||||||||||||||||||||

Owner Occupied |

— | — | — | |||||||||||||||||||||||||||||

Non-Owner Occupied |

— | — | — | — | ||||||||||||||||||||||||||||

Residential Real Estate |

— | |||||||||||||||||||||||||||||||

Real Estate Construction |

— | — | — | — | — | — | ||||||||||||||||||||||||||

Farm Real Estate |

— | — | — | — | ||||||||||||||||||||||||||||

Consumer and Other |

— | — | ||||||||||||||||||||||||||||||

Total |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | — | ||||||||||||||||

2021 |

2020 |

|||||||

Commercial & Agriculture |

$ |

$ |

||||||

Commercial Real Estate: |

||||||||

Owner Occupied |

||||||||

Non-Owner Occupied |

||||||||

Residential Real Estate |

||||||||

Real Estate Construction |

||||||||

Farm Real Estate |

— |

|||||||

Consumer and Other |

||||||||

Total |

$ |

$ |

||||||

Type of Loan |

Number of Loans |

Balance | Percent of Loans Outstanding 1 |

|||||||||

| (In thousands) | ||||||||||||

Commercial & Agriculture |

$ | % | ||||||||||

Commercial Real Estate: |

||||||||||||

Non-Owner Occupied |

% | |||||||||||

Total |

$ | % | ||||||||||

1 excluding PPP loans |

||||||||||||

For the Twelve Month Period Ended December 31, 2019 |

||||||||||||

Number of Contracts |

Pre- Modification Outstanding Recorded Investment |

Post- Modification Outstanding Recorded Investment |

||||||||||

Commercial & Agriculture |

— |

$ |

— |

$ |

— |

|||||||

Commercial Real Estate: |

||||||||||||

Owner Occupied |

— |

— |

— |

|||||||||

Non-Owner Occupied |

||||||||||||

Residential Real Estate |

— |

— |

— |

|||||||||

Real Estate Construction |

— |

— |

— |

|||||||||

Farm Real Estate |

— |

— |

— |

|||||||||

Consumer and Other |

— |

— |

— |

|||||||||

Total Loan Modifications |

$ |

$ |

||||||||||

December 31, 2021 |

December 31, 2020 |

|||||||||||||||||||||||

Recorded Investment |

Unpaid Principal Balance |

Related Allowance |

Recorded Investment |

Unpaid Principal Balance |

Related Allowance |

|||||||||||||||||||

With no related allowance recorded: |

||||||||||||||||||||||||

Commercial Real Estate: |

||||||||||||||||||||||||

Owner Occupied |

$ | — | $ | — | $ | |

$ | |

||||||||||||||||

Non-Owner Occupied |

— | — | ||||||||||||||||||||||

Residential Real Estate |

||||||||||||||||||||||||

Farm Real Estate |

||||||||||||||||||||||||

Total |

||||||||||||||||||||||||

With an allowance recorded: |

||||||||||||||||||||||||

Commercial & Agriculture |

— | — | $ | — | $ | |||||||||||||||||||

Commercial Real Estate: |

||||||||||||||||||||||||

Owner Occupied |

||||||||||||||||||||||||

Residential Real Estate |

||||||||||||||||||||||||

Total |

||||||||||||||||||||||||

Total: |

||||||||||||||||||||||||

Commercial & Agriculture |

— | — | — | |||||||||||||||||||||

Commercial Real Estate: |

||||||||||||||||||||||||

Owner Occupied |

||||||||||||||||||||||||

Non-Owner Occupied |

— | — | — | — | ||||||||||||||||||||

Residential Real Estate |

||||||||||||||||||||||||

Farm Real Estate |

— | — | ||||||||||||||||||||||

Total |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

||||||||||||

For the year ended: |

December 31, 2021 |

December 31, 2020 |

||||||||||||||

Average Recorded Investment |

Interest Income Recognized |

Average Recorded Investment |

Interest Income Recognized |

|||||||||||||

Commercial & Agriculture |

$ | $ | — | $ | $ | |||||||||||

Commercial Real Estate: |

||||||||||||||||

Owner Occupied |

||||||||||||||||

Non-Owner Occupied |

||||||||||||||||

Residential Real Estate |

||||||||||||||||

Farm Real Estate |

||||||||||||||||

Total |

$ | |

$ | |

$ | |

$ | |

||||||||

For the year ended: |

December 31, 2019 |

|||||||

Average Recorded Investment |

Interest Income Recognized |

|||||||

Commercial & Agriculture |

$ | $ | ||||||

Commercial Real Estate: |

||||||||

Owner Occupied |

||||||||

Non-Owner Occupied |

||||||||

Residential Real Estate |

||||||||

Farm Real Estate |

||||||||

Total |

$ | |

$ | |

||||

At December 31, 2021 |

At December 31, 2020 |

|||||||

(In Thousands) |

(In Thousands) |

|||||||

| Balance at beginning of period |

$ | |

$ | |

||||

| Acquisition of PCI loans |

||||||||

| Accretion |

( |

) | ( |

) | ||||

| Transfers from non-accretable to accretable |

||||||||

| |

|

|

|

|||||

| Balance at end of period |

$ | $ | ||||||

| |

|

|

|

|||||

At December 31, 2021 |

At December 31, 2020 |

|||||||

Acquired Loans with Specific Evidence of Deterioration of Credit Quality (ASC 310-30) |

Acquired Loans with Specific Evidence of Deterioration of Credit Quality (ASC 310-30) |

|||||||

(In Thousands) |

||||||||

| Outstanding balance |

$ | |

$ | |

||||

| Carrying amount |

||||||||

Before Tax |

Tax Effect |

Net of Tax |

||||||||||

Year Ended December 31, 2021 |

||||||||||||

| Net unrealized Gains (Losses) on Investment Securities: |

||||||||||||

| Other comprehensive income (loss) before reclassifications |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

| Amounts reclassified from accumulated other comprehensive income (loss) |

( |

) | ( |

) | ||||||||

| Net Unrealized Gains (Losses) on Investment Securities |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Defined Benefit Plans: |

||||||||||||

| Other comprehensive income (loss) before reclassifications |

||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Defined Benefit Plans, Net |

||||||||||||

| |

|

|

|

|

|

|||||||

| Other Comprehensive Income |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

| |

|

|

|

|

|

|||||||

Year Ended December 31, 2020 |

||||||||||||

| Net unrealized Gains (Losses) on Investment Securities: |

||||||||||||

| Other comprehensive income (loss) before reclassifications |

$ | |

$ | |

$ | |

||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

( |

) | ( |

) | ( |

) | ||||||

| Net Unrealized Gains on Investment Securities |

||||||||||||

| |

|

|

|

|

|

|||||||

| Defined Benefit Plans: |

||||||||||||

| Other comprehensive income (loss) before reclassifications |

( |

) | ( |

) | ( |

) | ||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Defined Benefit Plans, Net |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Other Comprehensive Income |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, 2019 |

||||||||||||

| Net unrealized Gains (Losses) on Investment Securities: |

||||||||||||

| Other comprehensive income (loss) before reclassifications |

$ | $ | $ | |||||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

( |

) | ( |

) | ( |

) | ||||||

| Net Unrealized Losses on Investment Securities |

||||||||||||

| |

|

|

|

|

|

|||||||

| Defined Benefit Plans: |

||||||||||||

| Other comprehensive income (loss) before reclassifications |

( |

) | ( |

) | ( |

) | ||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Defined Benefit Plans, Net |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Other Comprehensive Loss |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

For the Year Ended December 31, 2021 |

For the Year Ended December 31, 2020 |

For the Year Ended December 31, 2019 |

||||||||||||||||||||||||||||||||||

Unrealized Gains and Losses on Available for Sale Securities |

Defined Benefit Pension Items |

Total |

Unrealized Gains and Losses on Available for Sale Securities |

Defined Benefit Pension Items |

Total |

Unrealized Gains and Losses on Available for Sale Securities |

Defined Benefit Pension Items |

Total |

||||||||||||||||||||||||||||

| Beginning balance |

$ | $ | ( |

) | $ | $ | $ | ( |

) | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Other comprehensive income (loss) before reclassifications |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net current-period other comprehensive income (loss) |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Ending balance |

$ | $ | ( |

) | $ | $ | $ | ( |

) | $ | $ | $ | ( |

) | $ | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Amount Reclassified from Accumulated Other Comprehensive Loss (a) |

||||||||||||||

For the year ended December 31, |

||||||||||||||

| Details about Accumulated Other Comprehensive Income (Loss) Components |

2021 |

2020 |

2019 |

Affected Line Item in the Statement Where Net Income is Presented | ||||||||||

| Unrealized gains (losses) on available |

$ | $ | $ | Net gain on sale of securities | ||||||||||

| Tax effect |

— | ( |

) | ( |

) | Income taxes | ||||||||

| |

|

|

|

|

|

|||||||||

| Amortization of defined benefit pension items |

||||||||||||||

| Actuarial losses |

( |

)(b) | ( |

)(b) | ( |

)(b) | Other operating expenses | |||||||

| Tax effect |

|

|

|

Income taxes | ||||||||||

| |

|

|

|

|

|

|||||||||

| ( |

) | ( |

) | ( |

) | |||||||||

| Total reclassifications for the period |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||||

| |

|

|

|

|

|

|||||||||

| (a) | Amounts in parentheses indicate expenses and other amounts indicate income. |

(b) |

These accumulated other comprehensive income (loss) components are included in the computation of net periodic pension cost. |

| At December 31, | ||||||||

2021 |

2020 |

|||||||

| Land and improvements |

$ | $ | ||||||

| Buildings and improvements |

||||||||

| Furniture and equipment |

||||||||

| |

|

|

|

|||||

| Total |

||||||||

| Accumulated depreciation |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Premises and equipment, net |

$ | |

$ | |

||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||||||||||||||||||

Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

|||||||||||||||||||

| Core deposit intangible assets(1): |

||||||||||||||||||||||||

| Core deposit intangibles |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total core deposit intangible assets |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Excludes fully amortized core deposit intangible assets |

2021 |

2020 |

|||||||

| Mortgage Servicing Rights: |

||||||||

| Beginning of year |

$ | |

$ | |

||||

| Additions |

||||||||

| Disposals |

— | — | ||||||

| Amortized to expense |

||||||||

| Other Charges |

— | — | ||||||

| Change in valuation allowance |

( |

) | ||||||

| |

|

|

|

|||||

| End of year |

$ | $ | ||||||

| |

|

|

|

|||||

| Valuation allowance: |

||||||||

| Beginning of year |

$ | $ | ||||||

| Additions expensed |

||||||||

| Reductions credited to operations |

( |

) | ( |

) | ||||

| Direct write-offs |

— | — | ||||||

| |

|

|

|

|||||

| End of year |

$ | — | $ | |||||

| |

|

|

|

|||||

MSRs |

Core deposit intangibles |

Total |

||||||||||

| 2022 |

$ | $ | $ | |||||||||

| 2023 |

||||||||||||

| 2024 |

||||||||||||

| 2025 |

||||||||||||

| 2026 |

||||||||||||

| Thereafter |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | |

$ | |

$ | |

|||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

|||||||

| Demand |

$ | $ | ||||||

| Savings and Money markets |

||||||||

| Certificates of Deposit: |

||||||||

| $250 and over |

||||||||

| Other |

||||||||

| Individual Retirement Accounts |

||||||||

| |

|

|

|

|||||

| Total |

$ | $ | ||||||

| |

|

|

|

|||||

| 2022 |

$ | |||

| 2023 |

||||

| 2024 |

||||

| 2025 |

||||

| 2026 |

||||

| Thereafter |

||||

| |

|

|||

| Total |

$ | |

||

| |

|

At December 31, 2021 |

At December 31, 2020 |

|||||||||||||||

Federal Funds Purchased |

Short-term Borrowings |

Federal Funds Purchased |

Short-term Borrowings |

|||||||||||||

| Outstanding balance at year end |

$ | — | $ | — | $ | — | $ | — | ||||||||

| Maximum indebtedness during the year |

— | |||||||||||||||

| Average balance during the year |

— | |||||||||||||||

| Average rate paid during the year |

% | — | % | % | ||||||||||||

| Interest rate on year end balance |

— | — | — | — | ||||||||||||

At December 31, 2019 |

||||||||

Federal Funds Purchased |

Short-term Borrowings |

|||||||

| Outstanding balance at year end |

$ | — | $ | |||||

| Maximum indebtedness during the year |

||||||||

| Average balance during the year |

||||||||

| Average rate paid during the year |

% | % | ||||||

| Interest rate on year end balance |

— | % | ||||||

| 2029 |

$ | |||

| |

|

|||

| Total |

$ | |||

| |

|

December 31, 2021 |

December 31, 2020 |

|||||||

| Securities pledged for repurchase agreements: |

||||||||

| U.S. Treasury securities |

$ | $ | ||||||

| Obligations of U.S. government agencies |

||||||||

| |

|

|

|

|||||

| Total securities pledged |

$ | |

$ | |

||||

| |

|

|

|

|||||

| Gross amount of recognized liabilities for repurchase agreements |

$ | $ | ||||||

| |

|

|

|

|||||

| Amounts related to agreements not included in offsetting disclosures above |

$ | $ | ||||||

| |

|

|

|

|||||

2021 |

2020 |

2019 |

||||||||||

| Outstanding balance at year end |

$ | $ | $ | |||||||||

| Average balance during the year |

||||||||||||

| Average interest rate during the year |

% | % | % | |||||||||

| Maximum month-end balance during the year |

$ | |

$ | |

$ | |

||||||

| Weighted average interest rate at year end |

% | % | % | |||||||||

2021 |

2020 |

2019 |

||||||||||

| Current |

$ | $ | $ | |||||||||

| State |

||||||||||||

| Deferred |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Income taxes |

$ | |

$ | |

$ | |

||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

| Income taxes computed at the statutory federal tax rate |

$ | $ | $ | |||||||||

| Add (subtract) tax effect of: |

||||||||||||

| Nontaxable interest income, net of nondeductible interest expense |

( |

) | ( |

) | ( |

) | ||||||

| Low income housing tax credit |

( |

) | ( |

) | ( |

) | ||||||

| Cash surrender value of BOLI |

( |

) | ( |

) | ( |

) | ||||||

| Change in tax position BOLI |

— | — | ( |

) | ||||||||

| Other |

( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|||||||

| Income tax expense |

$ | |

$ | |

$ | |

||||||

| |

|

|