Exhibit 13.1

Dear Shareholders:

2015 was another successful year for your corporation. Net earnings (before preferred dividend) were $12,745,000. This was a 34% increase over 2014’s earnings of $9,528,000. This history of our continuing success from the depths of the recession is shown below in our earnings per share:

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Net earnings per share (basic) |

$ | 1.43 | $ | 0.99 | $ | 0.65 | $ | 0.57 | $ | 0.36 | ||||||||||

| Net earnings per share (diluted) |

$ | 1.17 | $ | 0.85 | $ | 0.64 | $ | 0.57 | $ | 0.36 | ||||||||||

The underlying driver of this success has been discipline. We have been and continue to be disciplined in our commitment to grow the company, to increase the value to the shareholders, to our business model, to our lending culture, and to our customers and community.

Growth will continue to come from new and existing markets and from acquisition. Contributing to our growth in 2015 was the successful completion of our Dayton acquisition and the opening of our loan production office in Mayfield Heights, Ohio. This follows our business model of supplementing our lending footprint with entry into active markets in Ohio where, with local skilled lenders, we can continue to add quality loans to our portfolio. The success can be seen in the total loan balances shown below:

| (In thousands) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Gross Loans |

$ | 1,001,527 | $ | 914,857 | $ | 861,241 | $ | 815,553 | $ | 785,268 | ||||||||||

Since 2011 we have enjoyed net loan growth of over $216,000,000 or about 28% - keeping in mind that we receive on average $21,800,000 each month in payments which needs to be put back to work. In addition to loan growth reflected in our numbers, in 2015 we sold $48,457,000 in one-to-four family real estate mortgages. We sell these loans to limit interest rate risk to the company and generate fee income.

To fund this loan growth we remain disciplined in our focus on low cost deposits. Our noninterest bearing deposits (checking accounts), have increased nicely to $300,615,000 or 28.6% of total deposits as of December 31, 2015. In addition, the majority of our $751,418,000 in interest bearing deposits are lower cost interest bearing checking and savings. Below is a recap of our deposit growth.

| (In thousands) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Noninterest bearing deposits |

$ | 300,615 | $ | 250,701 | $ | 234,976 | $ | 202,416 | $ | 189,382 | ||||||||||

| Interest bearing deposits |

751,418 | 718,217 | 707,499 | 723,973 | 711,864 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 1,052,033 | $ | 968,918 | $ | 942,475 | $ | 926,389 | $ | 901,246 | ||||||||||

In addition to maintaining a loyal base of retail deposit customers, we have been successful in securing commercial deposits with our commercial loan transactions. These noninterest-bearing deposits also bring the opportunity to provide cash management services which contribute to fee income for the company.

Our net interest income, shown below as a per share amount, is a result of taking deposits and making loans and investments. The numbers show the impact and necessity for growth. The increase of approximately 11.6% from 2014 to 2015 reflects the addition of the Dayton acquisition, the Mayfield Heights office, and organic growth in other offices. Reflected as a percentage, our interest margin was 3.96% for the year. At the end of September 2015, the interest margin of the average bank in the State of Ohio was 3.33%.

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Net interest income per share (basic) |

$ | 6.06 | $ | 5.43 | $ | 5.19 | $ | 5.26 | $ | 5.37 | ||||||||||

Our net interest income is supplemented with noninterest income. Noninterest income is comprised of a number of items, primarily service charges, wealth management fees, ATM fees, and tax refund processing. For 2015, we enjoyed a 1.7% increase in our noninterest income shown below as per share contribution. Fee income is harder to grow as consumers are very fee sensitive.

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Noninterest income per share (basic) |

$ | 1.83 | $ | 1.80 | $ | 1.56 | $ | 1.45 | $ | 1.29 | ||||||||||

From our total income consisting of net interest and noninterest income we pay the expense of operating the company. These noninterest expenses, as shown on a per share below basis, increased approximately 1.9% from 2014. Beginning in March 2015, expenses included the addition of the Dayton operation.

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Noninterest expense per share (basic) |

$ | 5.49 | $ | 5.39 | $ | 5.63 | $ | 4.94 | $ | 4.76 | ||||||||||

Our results can be readily seen in the growth in our net interest income per share from $5.43 to $6.06 (11.6%) compared to the growth in our expenses of $5.39 per share to $5.49 (1.9%) in 2015. As we discussed before, we have positioned the company to take advantage of the benefits of expanding with minimal impact to the expenses. A key measure of this in the banking industry is the efficiency ratio. In this ratio, the lower the number the better. Our number at the end of 2014 was 71.7%. At the end of 2015 it was 67.0%. The efficiency ratio of the average bank in the State of Ohio at the end of the third quarter 2015 was 72.7%. Again, growth of the company has generated both efficiency and profitability.

An expense not included in the noninterest expense category is the provision for loan loss. For 2015, this amount was $1,200,000. You can see from the below chart the continued decrease in this expense (expressed per share) as we move further away from the recession.

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Loan loss provision per share (basic) |

$ | 0.15 | $ | 0.19 | $ | 0.14 | $ | 0.83 | $ | 1.27 | ||||||||||

Other accomplishments for the year were our rebranding of the company, the filing of a securities shelf offering, and the successful changes in our articles of incorporation.

We completed the rebranding of the bank and holding company by last April. As you may recall, the United States and Ohio are prolific with Citizens banks. Adding to the confusion, our Urbana offices operated as Champaign Bank to avoid confusion with another Citizens in Urbana. Unifying our brand under the Civista name eliminated market confusion and brought consistency to our customers. This is important as we continue to grow our deposit and loan customer base.

The shelf filing completed earlier in the year is a process of placing on file the necessary documents with the U. S. Securities and Exchange Commission to allow a securities offering. This will simply speed the process should an opportunity present itself in the future that requires us to issue additional capital.

In November, we held our special shareholder meeting to consider two changes to the articles of incorporation – to eliminate preemptive rights and cumulative voting. The first issue received over 92% positive votes and the second issue over 88% positive votes. The board and management offer its sincere thank you for your support and trust shown by this turnout and vote.

Looking at our common stock performance, we have enjoyed continued improvement. The closing price on the last business day of year was:

| 2015 |

2014 | 2013 | 2012 | 2011 | ||||||||||||

| $12.83 |

$ | 10.28 | $ | 6.52 | $ | 5.25 | $ | 4.03 | ||||||||

While we have seen steady increases in the market’s view of our value, we continue to trade below the average Ohio publicly traded bank. We are trading at about 9 times earnings and the average Ohio bank about 13 times earnings. We firmly believe this company is at least equal to or better than the average, but the markets understand that for us to materially grow we will need additional common capital (stock) which could temporarily depress the value because more shares would be outstanding.

To reiterate earlier comments, we will consider adding to capital if it’s needed to support growth or to support an acquisition. We also don’t believe in growth for growth’s sake but in growth and acquisition that will show you a respectable return, both in dollars and time frame. Finally, when the time comes for increasing common equity, you, the existing shareholders, will be invited to participate.

In spite of the erratic markets and contradicting business news articles, we are optimistic on 2016. We continue to see nice loan opportunities and have a solid loan pipeline as we enter the year. Competition is strong, but we remain disciplined in our lending standards and pricing. Any institution can gather deposits and make loans. The long term success comes from how well this is accomplished. I believe our track record speaks for itself.

As always, please read your proxy and vote your shares in your company. I hope to see you at the annual meeting.

| Very truly yours, |

|

| James O. Miller |

| President & C.E.O. |

ANNUAL REPORT

CONTENTS

| Five –Year Selected Consolidated Financial Data |

1 | |||

| Common Stock and Shareholder Matters |

3 | |||

| General Development of Business |

3 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

4 | |||

| Quantitative and Qualitative Disclosures about Market Risk |

21 | |||

| Financial Statements |

||||

| Management’s Report on Internal Control over Financial Reporting |

24 | |||

| Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Statements |

25 | |||

| Report of Independent Registered Public Accounting Firm on Financial Statements |

26 | |||

| Consolidated Balance Sheets |

27 | |||

| Consolidated Statements of Operations |

28 | |||

| Consolidated Comprehensive Income Statements |

29 | |||

| Consolidated Statements of Changes in Shareholders’ Equity |

30 | |||

| Consolidated Statements of Cash Flow |

31 | |||

| Notes to Consolidated Financial Statements |

33 | |||

Five-Year Selected Consolidated Financial Data

(Amounts in thousands, except per share data)

| Year ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Statements of income: |

||||||||||||||||||||

| Total interest and dividend income |

$ | 50,701 | $ | 45,970 | $ | 44,881 | $ | 46,762 | $ | 48,861 | ||||||||||

| Total interest expense |

3,309 | 4,104 | 4,907 | 6,184 | 7,500 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

47,392 | 41,866 | 39,974 | 40,578 | 41,361 | |||||||||||||||

| Provision for loan losses |

1,200 | 1,500 | 1,100 | 6,400 | 9,800 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for loan losses |

46,192 | 40,366 | 38,874 | 34,178 | 31,561 | |||||||||||||||

| Security gains/(losses) |

(18 | ) | 113 | 204 | 40 | (8 | ) | |||||||||||||

| Other noninterest income |

14,296 | 13,761 | 11,858 | 11,160 | 9,979 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

14,278 | 13,874 | 12,062 | 11,200 | 9,971 | |||||||||||||||

| Total noninterest expense |

42,944 | 41,550 | 43,384 | 38,074 | 36,727 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before federal income taxes |

17,526 | 12,690 | 7,552 | 7,304 | 4,805 | |||||||||||||||

| Federal income tax expense |

4,781 | 3,162 | 1,373 | 1,725 | 847 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 12,745 | $ | 9,528 | $ | 6,179 | $ | 5,579 | $ | 3,958 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Preferred stock dividends and discount accretion |

1,577 | 1,873 | 1,159 | 1,193 | 1,176 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income available to common shareholders |

$ | 11,168 | $ | 7,655 | $ | 5,020 | $ | 4,386 | $ | 2,782 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Per common share earnings: |

||||||||||||||||||||

| Before preferred dividends (basic) |

$ | 1.63 | $ | 1.24 | $ | 0.80 | $ | 0.72 | $ | 0.51 | ||||||||||

| Before preferred dividends (diluted) |

1.17 | 0.87 | 0.79 | 0.72 | 0.51 | |||||||||||||||

| Available to common shareholders (basic) |

1.43 | 0.99 | 0.65 | 0.57 | 0.36 | |||||||||||||||

| Available to common shareholders (diluted) |

1.17 | 0.85 | 0.64 | 0.57 | 0.36 | |||||||||||||||

| Dividends |

0.20 | 0.19 | 0.15 | 0.12 | 0.03 | |||||||||||||||

| Book value |

13.12 | 12.04 | 10.65 | 10.48 | 10.30 | |||||||||||||||

| Average common shares outstanding: |

||||||||||||||||||||

| Basic |

7,822,369 | 7,707,917 | 7,707,917 | 7,707,917 | 7,707,917 | |||||||||||||||

| Diluted |

10,918,335 | 10,904,848 | 7,821,780 | 7,707,917 | 7,707,917 | |||||||||||||||

| Year-end balances: |

||||||||||||||||||||

| Loans, net |

$ | 987,166 | $ | 900,589 | $ | 844,713 | $ | 795,811 | $ | 764,011 | ||||||||||

| Securities |

209,701 | 210,491 | 215,037 | 219,528 | 220,021 | |||||||||||||||

| Total assets |

1,315,041 | 1,213,191 | 1,167,546 | 1,136,971 | 1,112,977 | |||||||||||||||

| Deposits |

1,052,033 | 968,918 | 942,475 | 926,389 | 901,246 | |||||||||||||||

| Borrowings |

125,667 | 116,240 | 87,206 | 92,907 | 98,751 | |||||||||||||||

| Shareholders’ equity |

125,173 | 115,909 | 128,376 | 103,980 | 102,528 | |||||||||||||||

| Average balances: |

||||||||||||||||||||

| Loans, net |

$ | 966,786 | $ | 858,532 | $ | 800,063 | $ | 759,105 | $ | 741,383 | ||||||||||

| Securities |

211,436 | 214,123 | 216,848 | 224,566 | 216,549 | |||||||||||||||

| Total assets |

1,336,645 | 1,234,406 | 1,172,819 | 1,127,989 | 1,124,553 | |||||||||||||||

| Deposits |

1,107,445 | 1,026,093 | 965,370 | 914,851 | 910,315 | |||||||||||||||

| Borrowings |

95,132 | 83,058 | 89,496 | 95,973 | 105,071 | |||||||||||||||

| Shareholders’ equity |

120,350 | 114,266 | 103,563 | 104,114 | 99,848 | |||||||||||||||

See accompanying notes to consolidated financial statements.

1

| Five-Year Selected Ratios | ||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Net interest margin |

3.96 | % | 3.79 | % | 3.79 | % | 3.98 | % | 4.00 | % | ||||||||||

| Return on average total assets |

0.95 | 0.77 | 0.53 | 0.49 | 0.35 | |||||||||||||||

| Return on average shareholders’ equity |

10.59 | 8.34 | 5.97 | 5.36 | 3.96 | |||||||||||||||

| Average shareholders’ equity as a percent of average total assets |

9.00 | 9.26 | 8.83 | 9.23 | 8.88 | |||||||||||||||

| Net loan charge-offs as a percent of average total loans |

0.11 | 0.43 | 0.53 | 1.01 | 1.35 | |||||||||||||||

| Allowance for loan losses as a percent of loans at year-end |

1.43 | 1.56 | 1.92 | 2.42 | 2.71 | |||||||||||||||

| Shareholders’ equity as a percent of total year-end assets |

9.52 | 9.55 | 11.00 | 9.15 | 9.21 | |||||||||||||||

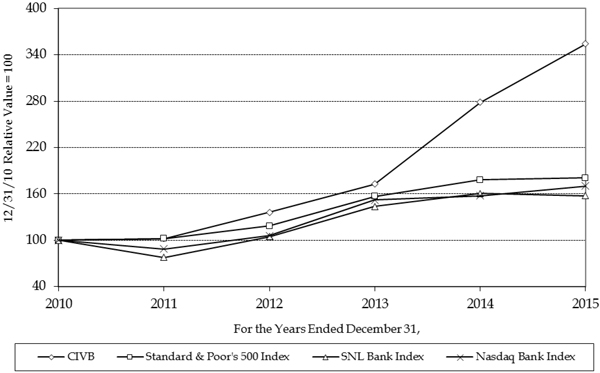

Stockholder Return Performance

Set forth below is a line graph comparing the five-year cumulative return of Civista Bancshares, Inc. (ticker symbol CIVB) common stock, based on an initial investment of $100 on December 31, 2010 and assuming reinvestment of dividends, with Standard & Poor’s 500 Index, the Nasdaq Bank Index and the SNL Bank Index. The comparative indices were obtained from SNL Securities.

A copy of the Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, will be furnished, free of charge, to shareholders, upon written request to the Secretary of Civista Bancshares, Inc., 100 East Water Street, Sandusky, Ohio 44870.

See accompanying notes to consolidated financial statements.

2

Common Stock and Shareholder Matters

The common shares of Civista Bancshares, Inc. (“CBI”) trade on The NASDAQ Capital Market under the symbol “CIVB”. As of February 19, 2016, there were 7,846,308 shares outstanding held by approximately 1,224 shareholders of record (not including the number of persons or entities holding stock in nominee or street name through various brokerage firms). Information below is the range of sales prices of our common shares for each quarter for the last two years based upon the closing prices of CBI common shares as reported on The NASDAQ Capital Market.

| 2015 | ||||||

| First Quarter |

Second Quarter | Third Quarter | Fourth Quarter | |||

| $10.04 to $11.54 | $10.11 to $11.47 | $9.68 to $10.93 | $9.81 to $13.65 | |||

| 2014 | ||||||

| First Quarter |

Second Quarter | Third Quarter | Fourth Quarter | |||

| $6.52 to $9.70 | $8.34 to $9.47 | $8.70 to $10.00 | $9.14 to $10.70 | |||

Dividends per share declared on common shares by CBI were as follows:

| 2015 | 2014 | |||||||

| First quarter |

$ | 0.05 | $ | 0.04 | ||||

| Second quarter |

0.05 | 0.05 | ||||||

| Third quarter |

0.05 | 0.05 | ||||||

| Fourth quarter |

0.05 | 0.05 | ||||||

|

|

|

|

|

|||||

| $ | 0.20 | $ | 0.19 | |||||

|

|

|

|

|

|||||

Information regarding potential restrictions on dividends paid can be found in Note 19 to the Consolidated Financial Statements.

On December 19, 2013, CBI completed a public offering of 1,000,000 depositary shares, each representing a 1/40th ownership interest in a Noncumulative Redeemable Convertible Perpetual Preferred Share, Series B (the “Series B Preferred Shares”), of CBI. The depositary shares trade on The NASDAQ Capital Market under the symbol “CIVBP.” The terms of the Series B Preferred Shares provide for the payment of quarterly dividends on the Series B Preferred Shares (and, therefore, the depositary shares) at the rate of 6.50% per annum of the liquidation preference of $1,000 per Series B Preferred Share (or $25.00 per depositary share). Dividends are noncumulative and are payable if, when and as declared by the board of directors. However, no dividends may be declared or paid on the common shares of CBI during any calendar quarter unless full dividends on the Series B Preferred Shares (and, therefore, the depositary shares) have been declared for that quarter and all dividends previously declared on the Series B Preferred Shares (and, therefore, the depositary shares) have been paid in full.

General Development of Business

(Amounts in thousands)

CBI was organized under the laws of the State of Ohio on February 19, 1987 and is a registered financial holding company under the Gramm-Leach-Bliley Financial Modernization Act of 1999, as amended. CBI and its subsidiaries are sometimes referred to together as the Company. The Company’s office is located at 100 East Water Street, Sandusky, Ohio. The Company had total consolidated assets of $1,315,041 at December 31, 2015.

See accompanying notes to consolidated financial statements.

3

CIVISTA BANK (“Civista”), owned by the Company since 1987, opened for business in 1884 as The Citizens National Bank. In 1898, Civista was reorganized under Ohio banking law and was known as The Citizens Bank and Trust Company. In 1908, Civista surrendered its trust charter and began operation as The Citizens Banking Company. The name Civista Bank was introduced during the first quarter of 2015 to solidify our dual Citizens/Champaign brand and distinguish ourselves from the many other Citizens’ Banks in existing and prospective markets. Civista maintains its main office at 100 East Water Street, Sandusky, Ohio and operates branch banking offices in the following Ohio communities: Sandusky (2), Norwalk (2), Berlin Heights, Huron, Port Clinton, Castalia, New Washington, Shelby (2), Willard, Greenwich, Plymouth, Shiloh, Akron, Dublin, Plain City, Russells Point, Urbana (2), West Liberty and Quincy. In January 2015, we added a loan production office in Mayfield Heights, Ohio and in March 2015 we acquired the three offices of TCNB Financial Corp. (“TCNB”) in Dayton, Ohio. Civista accounted for 99.8% of the Company’s consolidated assets at December 31, 2015.

FIRST CITIZENS INSURANCE AGENCY INC. (“FCIA”) was formed to allow the Company to participate in commission revenue generated through its third party insurance agreement. Assets of FCIA were less than one percent of the Company’s consolidated assets as of December 31, 2015.

WATER STREET PROPERTIES, INC. (“WSP”) was formed to hold properties repossessed by CBI subsidiaries. WSP accounted for less than one percent of the Company’s consolidated assets as of December 31, 2015.

FC REFUND SOLUTIONS, INC. (“FCRS”) was formed during 2012 and remained inactive for the periods presented.

FIRST CITIZENS INVESTMENTS, INC. (“FCI”) is wholly-owned by Civista and holds and manages its securities portfolio. The operations of FCI are located in Wilmington, Delaware.

FIRST CITIZENS CAPITAL LLC (“FCC”) is wholly-owned by Civista and holds inter-company debt that is eliminated in consolidation. The operations of FCC are located in Wilmington, Delaware.

Management’s Discussion and Analysis of Financial Condition and Results of Operations - As of December 31, 2015 and December 31, 2014 and for the Years Ended December 31, 2015, 2014 and 2013

(Amounts in thousands, except per share data)

General

The following paragraphs more fully discuss the significant highlights, changes and trends as they relate to the Company’s financial condition, results of operations, liquidity and capital resources as of December 31, 2015 and 2014, and during the three-year period ended December 31, 2015. This discussion should be read in conjunction with the Consolidated Financial Statements and Notes to the Consolidated Financial Statements, which are included elsewhere in this report.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), relating to such matters as financial condition, anticipated operating results, cash flows, business line results, credit quality expectations, prospects for new lines of business, economic trends (including interest rates) and similar matters. Forward-looking statements reflect our expectations, estimates or projections concerning future results or events. These statements are generally identified by the use of forward-looking words or phrases such as “believe,” “belief,” “expect,”

See accompanying notes to consolidated financial statements.

4

“anticipate,” “may,” “could,” “intend,” “intent,” “estimate,” “plan,” “foresee,” “likely,” “will,” “should” or other similar words or phrases. Forward-looking statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results, performance or achievements to differ materially from those expressed in or implied by the forward-looking statements. Factors that could cause actual results, performance or achievements to differ from results discussed in the forward-looking statements include, but are not limited to, changes in financial markets or national or local economic conditions; sustained weakness or deterioration in the real estate market; volatility and direction of market interest rates; credit risks of lending activities; changes in the allowance for loan losses; legislation or regulatory changes or actions; increases in FDIC insurance premiums and assessments; changes in tax laws; failure of or breach in our information and data processing systems; unforeseen litigation; increased competition in our market area; failures to manage growth and/or effectively integrate acquisitions; and other risks identified from time-to-time in the Company’s other public documents on file with the Securities and Exchange Commission.

The forward-looking statements included in this report are only made as of the date of this report, and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances, except as required by law.

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements, and the purpose of this section is to secure the use of the safe harbor provisions.

Financial Condition

At December 31, 2015, the Company’s total assets were $1,315,041, compared to $1,213,191 at December 31, 2014. The increase in assets is primarily the result of the acquisition of the TCNB offices in March. Other factors contributing to the change in assets are discussed in the following sections.

At $987,166, net loans increased from December 31, 2014 by 9.6%. The increase in net loans was spread across most segments and resulted primarily from the acquisition of net loans totaling $76,444 from TCNB. Real Estate Construction loans and Farm Real Estate loans declined in balance from December 31, 2014. Commercial & Agriculture loans increased $11,137, with a total of $13,799 of these loans being acquired as part of the TCNB acquisition. Commercial Real Estate – Owner Occupied loans increased $24,883, with a total of $23,029 of these loans being acquired as part of the TCNB acquisition. Commercial Real Estate - Non-Owner Occupied loans increased $39,773, with a total of $13,411 of these loans being acquired as part of the TCNB acquisition. Residential Real Estate loans increased $21,801, with a total of $17,541 of these loans being acquired as part of the TCNB acquisition. Real estate construction loans decreased $6,554, with a total of $3,863 of these loans being acquired as part of the TCNB acquisition. Farm Real Estate loans decreased $6,980, with a total of $397 of these loans being acquired as part of the TCNB acquisition. Consumer and other loans increased $2,610, with a total of $4,404 of these loans being acquired as part of the TCNB acquisition.

Securities available for sale decreased by $1,656, or 0.8%, from $197,905 at December 31, 2014 to $196,249 at December 31, 2015. U.S. Treasury securities and obligations of U.S. government agencies decreased $1,965, from $42,902 at December 31, 2014 to $40,937 at December 31, 2015. Obligations of states and political subdivisions available for sale increased $4,131 from 2014 to 2015. Mortgage-backed securities decreased by $3,869 to total $62,573 at December 31, 2015. The Company continues to utilize letters of credit from the Federal Home Loan Bank (FHLB) to replace maturing securities that were pledged for public entities. As of December 31, 2015, the Company was in compliance with all pledging requirements.

See accompanying notes to consolidated financial statements.

5

Mortgage-backed securities totaled $62,573 at December 31, 2015 and none were considered unusual or “high risk” securities as defined by regulatory authorities. Of this total, $50,599 consisted of pass-through securities issued by the Federal National Mortgage Association (“FNMA”), Federal Home Loan Mortgage Corporation (“FHLMC”), and Government National Mortgage Association (“GNMA”), and $11,975 was collateralized by mortgage-backed securities issued or guaranteed by FNMA, FHLMC, or GNMA. The average interest rate of the mortgage-backed portfolio at December 31, 2015 was 2.9%. The average maturity at December 31, 2015 was approximately 3.8 years. The Company has not invested in any derivative securities.

Securities available for sale had a fair value at December 31, 2015 of $196,249. This fair value includes unrealized gains of approximately $5,820 and unrealized losses of approximately $434. Net unrealized gains totaled $5,386 on December 31, 2015 compared to net unrealized gains of $5,653 on December 31, 2014. The change in unrealized gains is primarily due to changes in market interest rates. Note 3 to the Consolidated Financial Statements provides additional information on unrealized gains and losses.

Premises and equipment, net of accumulated depreciation, increased $2,544 from December 31, 2014 to December 31, 2015. The increase is attributed to the acquisition of TCNB assets of $1,738, consisting of branch offices and equipment within those branches. The Company has purchased the land and has plans to build a new branch office in Sandusky, Ohio in 2016. At December 31, 2015, construction in progress totaled $644. The remaining difference is attributed to new purchases of $1,355, offset by depreciation of $1,193.

Other assets increased $1,252 from December 31, 2014 to December 31, 2015. The increase is primarily the result of increases in the Company’s low income housing investment, bank owned life insurance, swap assets and deferred tax assets.

Year-end deposit balances totaled $1,052,033 in 2015 compared to $968,918 in 2014, an increase of $83,115, or 8.6%. Overall, the increase in deposits at December 31, 2015 compared to December 31, 2014 included increases in noninterest bearing demand deposits of $49,914, or 19.9%, statement and passbook savings accounts of $45,207, or 14.2%, offset in part by declines in interest bearing demand accounts of $3,085, or 1.7% and certificate of deposit accounts of $8,862, or 4.6%. A primary factor of the increase in deposits can be attributed to the acquisition of TCNB, which added $18,263 of noninterest-bearing deposits and $68,606 of interest-bearing deposits. Average deposit balances for 2015 were $1,107,445 compared to $1,026,093 for 2014, an increase of 7.9%. Noninterest bearing deposits averaged $340,360 for 2015, compared to $297,003 for 2014, increasing $43,357, or 14.6%. Savings, NOW, and MMDA accounts averaged $543,986 for 2015 compared to $501,408 for 2014. Average certificates of deposit decreased $4,583 to total an average balance of $223,099 for 2015.

Borrowings from the Federal Home Loan Bank (“FHLB”) of Cincinnati were $71,200 at December 31, 2015. The detail of these borrowings can be found in Note 10 and Note 11 to the Consolidated Financial Statements. The balance increased $6,000 from $65,200 at year-end 2014. The change in balance is mainly the result of a short term advance used as overnight funding to support loan growth offset by a matured advance. The advance matured on March 11, 2015, in the amount of $5,000. This advance had a term of eighty-four months with a fixed rate of 2.84%. The advance was not replaced.

Civista offers repurchase agreements in the form of sweep accounts to commercial checking account customers. These repurchase agreements totaled $25,040 at December 31, 2015 compared to $21,613 at December 31, 2014. U.S. Treasury securities and obligations of U.S. government agencies maintained under Civista’s control are pledged as collateral for the repurchase agreements. The detail related to these repurchase agreements can be found in Note 12 to the Consolidated Financial Statements

See accompanying notes to consolidated financial statements.

6

Total shareholders’ equity increased $9,264, or 8.0% during 2015 to $125,173. The change in shareholders’ equity resulted from net income of $12,745, offset by preferred dividends and common dividends of $1,577 and $1,562, respectively, and the decreased market value of securities available for sale, net of tax, of $176 and an increase in the Company’s pension liability, net of tax of $272. Additionally, $106 was recognized as stock-based compensation in connection with the grant of restricted common shares. For further explanation of these items, see Note 1, Note 15 and Note 16 to the Consolidated Financial Statements. The Company paid $0.20 per common share in dividends in 2015 compared to $0.19 per common share in dividends in 2014. Total outstanding common shares at December 31, 2015 were 7,843,578. Total outstanding common shares at December 31, 2014 were 7,707,917. The increase in common shares outstanding is the result of the conversion of 928 of the Company’s previously issued preferred shares into 118,678 common shares and the grant of 16,983 restricted common shares to certain officers under the Company’s 2014 Incentive Plan. The ratio of total shareholders’ equity to total assets was 9.5% and 9.6%, respectively, at December 31, 2015 and December 31, 2014.

Results of Operations

The operating results of the Company are affected by general economic conditions, the monetary and fiscal policies of federal agencies and the regulatory policies of agencies that regulate financial institutions. The Company’s cost of funds is influenced by interest rates on competing investments and general market rates of interest. Lending activities are influenced by the demand for real estate loans and other types of loans, which in turn is affected by the interest rates at which such loans are made, general economic conditions and the availability of funds for lending activities.

The Company’s net income primarily depends on its net interest income, which is the difference between the interest income earned on interest-earning assets, such as loans and securities, and interest expense incurred on interest-bearing liabilities, such as deposits and borrowings. The level of net interest income is dependent on the interest rate environment and the volume and composition of interest-earning assets and interest-bearing liabilities. Net income is also affected by provisions for loan losses, service charges, gains on the sale of assets, other income, noninterest expense and income taxes.

Comparison of Results of Operations for the Years Ended December 31, 2015 and December 31, 2014

Net Income

The Company’s net income for the year ended December 31, 2015 was $12,745, compared to $9,528 for the year ended December 31, 2014. The change in net income was the result of the items discussed in the following sections.

Net Interest Income

Net interest income for 2015 was $47,392, an increase of $5,526, or 13.2%, from 2014. Average earning assets increased 8.3% from 2014. Although market rates in 2015 remained at record lows, interest income increased $4,731, primarily due to increased loan volume. In addition, interest expense on interest-bearing liabilities decreased $795. The Company continually examines its rate structure to ensure that its interest rates are competitive and reflective of the current rate environment in which it competes. A change in the mix of deposits from certificates of deposit to non-maturing deposits also contributed to the decline in interest expense.

Total interest income increased $4,731, or 10.3%, from 2014. The increase was mainly a result of an increase in loan volume. Average loans increased $107,043 from 2014 to 2015. The yield on the Company’s loan portfolio declined 1 basis points from 2014. While the average balance of the securities portfolio for 2015 compared to 2014 decreased $2,687, this was primarily due to the Company not

See accompanying notes to consolidated financial statements.

7

replacing matured securities. Interest earned on the security portfolio, including bank stocks, decreased mainly due to decreases in yield. Average balances in interest-bearing deposits in other banks decreased in 2015 by $9,182.

Total interest expense decreased $795, or 19.4%, for 2015 compared to 2014. The decrease in interest expense can be attributed to declines in market rates and the corresponding repricing of deposits and other sources of funding. The total average balance of interest-bearing liabilities increased $50,069 while the average rate decreased 13 basis points in 2015. Average interest-bearing deposits increased $37,995 from 2014 to 2015. While average balances in interest-bearing deposits increased, the average balance in time deposits declined $4,583 and the rate on time deposits declined approximately 9 basis points, which caused interest expense on deposits to decrease by $205. Interest expense on FHLB borrowings decreased $573 due to a decline in rate of 203 basis points. The average balance in FHLB borrowings increased. The increase in FHLB borrowings is due to an increase in overnight borrowings, which are paying a low interest rate. The average balance in subordinated debentures did not change from 2014 to 2015, but the rate on these securities decreased 6 basis points, resulting in a decrease in interest expense of $17. Repurchase agreements increased $327 in average balance from 2014 to 2015.

Refer to “Distribution of Assets, Liabilities and Shareholders’ Equity; Interest Rates and Interest Differential” and “Changes in Interest Income and Interest Expense Resulting from Changes in Volume and Changes in Rate” on pages 14 through 16 for further analysis of the impact of changes in interest-bearing assets and liabilities on the Company’s net interest income.

Provision and Allowance for Loan Losses

The following table contains information relating to the provision for loan losses, activity in and analysis of the allowance for loan losses as of and for each of the three years in the period ended December 31.

| As of and for year | ||||||||||||

| ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Net loan charge-offs |

$ | 1,107 | $ | 3,760 | $ | 4,314 | ||||||

| Provision for loan losses charged to expense |

1,200 | 1,500 | 1,100 | |||||||||

| Net loan charge-offs as a percent of average outstanding loans |

0.11 | % | 0.43 | % | 0.53 | % | ||||||

| Allowance for loan losses |

$ | 14,361 | $ | 14,268 | $ | 16,528 | ||||||

| Allowance for loan losses as a percent of year-end outstanding loans |

1.43 | % | 1.56 | % | 1.92 | % | ||||||

| Impaired loans |

$ | 7,485 | $ | 11,149 | $ | 18,057 | ||||||

| Impaired loans as a percent of gross year-end loans (1) |

0.75 | % | 1.22 | % | 2.10 | % | ||||||

| Nonaccrual and 90 days or more past due loans |

$ | 9,890 | $ | 13,576 | $ | 20,459 | ||||||

| Nonaccrual and 90 days or more past due loans as a percent of gross year-end loans (1) |

0.99 | % | 1.48 | % | 2.38 | % | ||||||

| (1) | Nonperforming loans and impaired loans are defined differently. Some loans may be included in both categories, whereas other loans may only be included in one category. A loan is considered nonaccrual if it is maintained on a cash basis because of deterioration in the borrower’s financial condition, where payment in full of principal or interest is not expected and where the principal and interest have been in default for 90 days, unless the asset is both well-secured and in process of collection. A loan is considered impaired when it is probable that all of the interest and principal due will not be collected according to the terms of the original contractual agreement. |

See accompanying notes to consolidated financial statements.

8

The Company’s policy is to maintain the allowance for loan losses at a level sufficient to provide for probable losses incurred in the current portfolio. The Company provides for loan losses through regular provisions to the allowance for loan losses. The amount of the provision is affected by loan charge-offs, recoveries and changes in specific and general allocations required for the allowance for loan losses. Provisions for loan losses totaled $1,200, $1,500 and $1,100 in 2015, 2014 and 2013, respectively. Management believes the analysis of the allowance for loan losses supported a reserve of $14,361 at December 31, 2015.

The Company’s provision for loan losses decreased $300 during 2015. The decrease in provision for loan losses is related to the decrease in the specific reserve required for loans and a decrease in net charge-offs compared to a year ago. A number of factors impact the provisions for loan losses, such as the level of higher risk loans in the portfolio, changes in practices related to loans, changes in collateral values and other factors. We continue to actively manage this process and have provided to maintain the reserve at a level that assures adequate coverage ratios.

Efforts are continually made to analyze each segment of the loan portfolio and quantify risk to assure that reserves are appropriate for each segment and the overall portfolio. Management specifically evaluates loans that are impaired, which includes restructured loans, to estimate potential loss. This analysis includes a review of the loss migration calculation for all loan categories as well as fluctuations and trends in various risk factors that have occurred within the portfolios’ economic life cycle. The analysis also includes assessment of qualitative factors such as credit trends, unemployment trends, vacancy trends and loan growth. The composition and overall level of the loan portfolio and charge-off activity are also factors used to determine the amount of the allowance for loan losses.

Management analyzes each impaired commercial and commercial real estate loan with a balance of $350 or larger, on an individual basis and when it is in nonaccrual status or when an analysis of the borrower’s operating results and financial condition indicates that underlying cash flows are not adequate to meet its debt service requirements. In addition, loans held for sale and leases are excluded from consideration as impaired. Loans are generally moved to nonaccrual status when 90 days or more past due. Impaired loans or portions thereof, are charged-off when deemed uncollectible.

Noninterest Income

Noninterest income increased $404, or 2.9%, to $14,278 for the year ended December 31, 2015, from $13,874 for the comparable 2014 period. The increase was primarily due to increases in earnings on service charges of $451, gain on sale of loans of $447, ATM fees of $136 and gain on sale of other real estate owned of $155 which were partially offset by decreases in Trust fees of $307, tax refund processing fees of $324 and gain on sale of securities of $131.

Service charges increased primarily due to increases in business service charges and overdraft fees. Gain on sale of loans increased due to an increase in volume of loans sold, as well as an increase in the premium earned. ATM fee income increased due to increased interchange fees. Sales of other real estate owned resulted in recognized gains of $199 on the sale of 17 properties in 2015 compared to gains of $44 on the sale of 16 properties in 2014. The decrease in trust fee income is related to a general decrease in brokerage transactions. Tax refund processing fees decreased due to new fee structure in place during 2015. The new fee calls for a flat processing fee, whereas in 2014, the Company received a per transaction fee. Gain on the sale of securities decreased compared to the same period of 2014. Management, from time to time, will reposition the investment portfolio to match liquidity needs of the Company.

See accompanying notes to consolidated financial statements.

9

Noninterest Expense

Noninterest expense increased $1,394 or 3.4%, to $42,944 for the year ended December 31, 2015, from $41,550 for the comparable 2014 period. The increase was primarily due to increases in salaries, wages and benefits of $1,337, contracted data processing of $261 and professional services of $606 which were partially offset by decreases in, ATM expense of $132, marketing expense of $565 and repossession expense of $165.

Salaries, wages and benefits increased mainly due to an increase in salaries and 401(k) expenses. Salaries and related payroll taxes increased mainly due to annual pay increases and overtime related to the acquisition of TCNB, as well as the addition of TCNB employees. In 2015, the Company adopted a Safe Harbor 401(k) plan which increased the match paid to participants. Contracted data processing costs increased due to the cost of technology services and core processing costs related to the acquisition of TCNB. Professional services increased due to increased legal and audit fees relating to the acquisition of TCNB, increased recruiting expenses and increased legal expenses related to the Company’s filing of a Form S-3 shelf registration statement with the SEC and matters related to the Special Meeting of Shareholders held on November 4, 2015 for the purpose of voting to eliminate preemptive rights and cumulative voting in the election of directors, as well as the previously disclosed litigation related to a proposed sale of real estate that the Company owns near one of its branches. The decrease in ATM costs is due to vendor credits that began in the second quarter of 2015. Marketing costs decreased in 2015, as the Company incurred increased marketing expenses in 2014 as part of its rebranding effort. The decrease in repossession expense is the result of a general decrease in expenses related to repossessions.

Income Tax Expense

Federal income tax expense was $4,781 in 2015 compared to $3,162 in 2014. Federal income tax expense as a percentage of income was 27.3% in 2015 compared to 24.9% in 2014. A lower federal effective tax rate than the statutory rate of 34% is primarily due to tax-exempt interest income from state and municipal investments, municipal loans, income from BOLI and low income housing credits. Federal income tax expense increased in 2015 primarily due to an increase in pretax income, which also led to the increase in the effective tax rate in 2015.

Comparison of Results of Operations for the Years Ended December 31, 2014 and December 31, 2013

Net Income

The Company’s net income for the year ended December 31, 2014 was $9,528, compared to $6,179 for the year ended December 31, 2013. The change in net income was the result of the items discussed in the following sections.

Net Interest Income

Net interest income for 2014 was $41,866, an increase of $1,892, or 4.7%, from 2013. Average earning assets increased 4.7% from 2013. Although market rates in 2014 continued to decline, interest income increased $1,089, primarily due to increased loan volume. In addition, interest expense on interest-bearing liabilities decreased $803. The Company continually examines its rate structure to ensure that its interest rates are competitive and reflective of the current rate environment in which it competes. A change in the mix of deposits from certificates of deposit to non-maturing deposits also contributed to the decline in interest expense.

See accompanying notes to consolidated financial statements.

10

Total interest income increased $1,089, or 2.4%, from 2013. The increase was mainly a result of an increase in loan volume. Average loans increased $55,280 from 2013 to 2014. The yield on the Company’s loan portfolio declined 16 basis points from 2013. While the average balance of the securities portfolio for 2014 compared to 2013 decreased $2,725, this was primarily due to the Company not replacing matured securities. Interest earned on the security portfolio, including bank stocks, decreased mainly due to decreases in yield. Average balances in interest-bearing deposits in other banks decreased in 2014 by $1,780.

Total interest expense decreased $803, or 16.4%, for 2014 compared to 2013. The decrease in interest expense can be attributed to declines in market rates and the corresponding repricing of deposits and other sources of funding. The total average balance of interest-bearing liabilities decreased $9,126 while the average rate decreased 9 basis points in 2014. Average interest-bearing deposits decreased $2,688 from 2013 to 2014. The decrease in average interest-bearing deposits, mainly in time deposit accounts, coupled by a decline in rate on time deposits of approximately 13 basis points, caused interest expense on deposits to decrease by $496. Interest expense on FHLB borrowings decreased $343 due to a decrease in average balance of $5,462. The average balance in subordinated debentures did not change from 2013 to 2014, but the rate on these securities increased 13 basis points, resulting in an increase in interest expense of $37. Repurchase agreements decreased $990 in average balance from 2013 to 2014.

Refer to “Distribution of Assets, Liabilities and Shareholders’ Equity, Interest Rates and Interest Differential” and “Changes in Interest Income and Interest Expense Resulting from Changes in Volume and Changes in Rate” on pages 14 through 16 for further analysis of the impact of changes in interest-bearing assets and liabilities on the Company’s net interest income.

Provision and Allowance for Loan Losses

The following table contains information relating to the provision for loan losses, activity in and analysis of the allowance for loan losses as of and for each of the three years in the period ended December 31.

| As of and for year | ||||||||||||

| ended December 31, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Net loan charge-offs |

$ | 3,760 | $ | 4,314 | $ | 7,915 | ||||||

| Provision for loan losses charged to expense |

1,500 | 1,100 | 6,400 | |||||||||

| Net loan charge-offs as a percent of average outstanding loans |

0.43 | % | 0.53 | % | 1.01 | % | ||||||

| Allowance for loan losses |

$ | 14,268 | $ | 16,528 | $ | 19,742 | ||||||

| Allowance for loan losses as a percent of year-end outstanding loans |

1.56 | % | 1.92 | % | 2.42 | % | ||||||

| Impaired loans |

$ | 11,149 | $ | 18,057 | $ | 26,090 | ||||||

| Impaired loans as a percent of gross year-end loans (1) |

1.22 | % | 2.10 | % | 3.20 | % | ||||||

| Nonaccrual and 90 days or more past due loans |

$ | 13,576 | $ | 20,459 | $ | 29,935 | ||||||

| Nonaccrual and 90 days or more past due loans as a percent of gross year-end loans (1) |

1.48 | % | 2.38 | % | 3.67 | % | ||||||

| (1) | Nonperforming loans and impaired loans are defined differently. Some loans may be included in both categories, whereas other loans may only be included in one category. A loan is considered nonaccrual if it is maintained on a cash basis because of deterioration in the borrower’s financial condition, where payment in full of principal or interest is not expected and where the principal and interest have been in default for 90 days, unless the asset is both well-secured and in process of collection. A loan is considered impaired when it is probable that all of the interest and principal due will not be collected according to the terms of the original contractual agreement. |

See accompanying notes to consolidated financial statements.

11

The Company’s policy is to maintain the allowance for loan losses at a level sufficient to provide for probable losses incurred in the current portfolio. The Company provides for loan losses through regular provisions to the allowance for loan losses. The amount of the provision is affected by loan charge-offs, recoveries and changes in specific and general allocations required for the allowance for loan losses. Provisions for loan losses totaled $1,500, $1,100 and $6,400 in 2014, 2013 and 2012, respectively. Management believes the analysis of the allowance for loan losses supported a reserve of $14,268 at December 31, 2014.

The Company’s provision for loan losses increased $400 during 2014 to support the final resolutions in certain problem loans, coupled with solid loan growth of 6.2%. A number of factors impact the provisions for loan losses, such as the level of higher risk loans in the portfolio, changes in practices related to loans, changes in collateral values and other factors. We continue to actively manage this process and have provided to maintain the reserve at a level that assures adequate coverage ratios.

Efforts are continually made to analyze each segment of the loan portfolio and quantify risk to assure that reserves are appropriate for each segment and the overall portfolio. Management specifically evaluates loans that are impaired, which includes restructured loans, to estimate potential loss. This analysis includes a review of the loss migration calculation for all loan categories as well as fluctuations and trends in various risk factors that have occurred within the portfolios’ economic life cycle. The analysis also includes assessment of qualitative factors such as credit trends, unemployment trends, vacancy trends and loan growth. The composition and overall level of the loan portfolio and charge-off activity are also factors used to determine the amount of the allowance for loan losses.

Management analyzes each impaired commercial and commercial real estate loan with a balance of $350 or larger, on an individual basis and when it is in nonaccrual status or when an analysis of the borrower’s operating results and financial condition indicates that underlying cash flows are not adequate to meet its debt service requirements. In addition, loans held for sale and leases are excluded from consideration as impaired. Loans are generally moved to nonaccrual status when 90 days or more past due. Impaired loans or portions thereof, are charged-off when deemed uncollectible.

Noninterest Income

Noninterest income increased $1,812, or 15.0%, to $13,874 for the year ended December 31, 2014, from $12,062 for the comparable 2013 period. The increase was primarily due to increases in earnings on trust fees of $503 and tax refund processing fees of $1,894 which were partially offset by decreases in service charge income of $200, gain on sale of securities of $91, income on Bank Owned Life Insurance (BOLI) of $63 and other income of $183.

Trust fees increased due to both an increase in assets valuations as well as an increase in accounts. Tax refund processing fees primarily increased due to added volume from the addition of vendors to the tax processing program. The decrease in service charges was the result of a decrease in overdraft fees. The decrease in gain on sale of securities was due to a recovery of a security previously written off. This recovery was posted in 2013. The decrease in BOLI income is due to lower yields received in the current year. The decrease in other income was primarily the result of lower fees related to our customer derivative program and lower gains recognized on the sale of fixed assets.

Sales of other real estate owned resulted in recognized gains of $44 on the sale of 16 properties in 2014 compared to gains of $120 on the sale of 25 properties in 2013.

See accompanying notes to consolidated financial statements.

12

Noninterest Expense

Noninterest expense decreased $1,834, or 4.2%, to $41,550 for the year ended December 31, 2014, from $43,384 for the comparable 2013 period. The decrease was primarily due to decreases in salaries, wages and benefits of $2,465, FDIC assessment of $103, state franchise tax of $242, amortization of intangible assets of $77 and repossession expense of $291 which were partially offset by increases in contracted data processing of $233, professional services of $178, equipment expense of $148, ATM expense of $156 and marketing expense of $549.

Salaries, wages and benefits decreased primarily due to a decrease in pension costs. As of April 2014, the Company has frozen its pension plan. Several large pension disbursements were made in 2013, triggering settlement expense of $2,251. While the plan still exists, no new participants will be added and no additional benefits will accrue. FDIC assessments decreased due to a decrease in assessment rates. State franchise taxes decreased due to a change made by the State of Ohio. In 2014, the state replaced its corporate franchise tax with the financial institutions tax (FIT). The new tax is based on equity capital, whereas, the corporate franchise tax was based on net worth. In addition, the new law lowered tax rates. The decrease in amortization of intangible assets is the result of a decline in scheduled amortization of intangible assets associated with mergers. The decrease in repossession expense is the result of a general decrease in expenses related to repossessions. Contracted data processing increased due to increases in cost of technology services. Professional services increased primarily due to merger expenses and a general increase in consulting fees. Equipment expenses increased due to a change in the Company’s capitalization policy in 2014. ATM expense increased due to increased vendor charges. Marketing expenses increased as a result of our efforts to unify our marketing approach in order to improve the impact of marketing dollars spent.

Income Tax Expense

Federal income tax expense was $3,162 in 2014 compared to $1,373 in 2013. Federal income tax expense as a percentage of income was 24.9% in 2014 compared to 18.2% in 2013. A lower federal effective tax rate than the statutory rate of 34% is primarily due to tax-exempt interest income from state and municipal investments, municipal loans, income from BOLI and low income housing credits. Federal income tax expense increased in 2014 primarily due to an increase in pretax income, which also led to the increase in the effective tax rate in 2014.

See accompanying notes to consolidated financial statements.

13

Distribution of Assets, Liabilities and Shareholders’ Equity;

Interest Rates and Interest Differential

The following table sets forth, for the years ended December 31, 2015, 2014 and 2013, the distribution of assets, including interest amounts and average rates of major categories of interest-earning assets and interest-bearing liabilities (Amounts in thousands):

| 2015 | 2014 | 2013 | ||||||||||||||||||||||||||||||||||

| Average | Yield/ | Average | Yield/ | Average | Yield/ | |||||||||||||||||||||||||||||||

| balance | Interest | rate | balance | Interest | rate | balance | Interest | rate | ||||||||||||||||||||||||||||

| Assets |

||||||||||||||||||||||||||||||||||||

| Interest-earning assets: |

||||||||||||||||||||||||||||||||||||

| Loans (1)(2)(3)(5) |

$ | 981,475 | $ | 44,784 | 4.57 | % | $ | 874,432 | $ | 40,032 | 4.58 | % | $ | 819,152 | $ | 38,776 | 4.74 | % | ||||||||||||||||||

| Taxable securities (4) |

139,762 | 3,232 | 2.31 | % | 150,510 | 3,443 | 2.31 | % | 157,930 | 3,763 | 2.42 | % | ||||||||||||||||||||||||

| Non-taxable securities (4)(5) |

71,674 | 2,583 | 5.70 | % | 63,613 | 2,356 | 5.80 | % | 58,918 | 2,211 | 5.90 | % | ||||||||||||||||||||||||

| Interest-bearing deposits in other banks |

44,647 | 102 | 0.23 | % | 53,829 | 139 | 0.26 | % | 55,609 | 131 | 0.24 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest income assets |

1,237,558 | 50,701 | 4.23 | % | 1,142,384 | 45,970 | 4.15 | % | 1,091,609 | 44,881 | 4.24 | % | ||||||||||||||||||||||||

| Noninterest-earning assets: |

||||||||||||||||||||||||||||||||||||

| Cash and due from financial institutions |

34,616 | 35,784 | 25,203 | |||||||||||||||||||||||||||||||||

| Premises and equipment, net |

16,081 | 15,262 | 16,862 | |||||||||||||||||||||||||||||||||

| Accrued interest receivable |

4,476 | 4,242 | 4,288 | |||||||||||||||||||||||||||||||||

| Intangible assets |

28,568 | 24,122 | 24,464 | |||||||||||||||||||||||||||||||||

| Other assets |

10,181 | 9,133 | 10,626 | |||||||||||||||||||||||||||||||||

| Bank owned life insurance |

19,854 | 19,379 | 18,856 | |||||||||||||||||||||||||||||||||

| Less allowance for loan losses |

(14,689 | ) | (15,900 | ) | (19,089 | ) | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total |

$ | 1,336,645 | $ | 1,234,406 | $ | 1,172,819 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| (1) | For purposes of these computations, the daily average loan amounts outstanding are net of unearned income and include loans held for sale. |

| (2) | Included in loan interest income are loan fees of $542 in 2015, $387 in 2014 and $368 in 2013. |

| (3) | Non-accrual loans are included in loan totals and do not have a material impact on the analysis presented. |

| (4) | Average balance is computed using the carrying value of securities. The average yield has been computed using the historical amortized cost average balance for available-for-sale securities. |

| (5) | Interest yield is calculated using the tax-equivalent adjustment. |

See accompanying notes to consolidated financial statements.

14

Distribution of Assets, Liabilities and Shareholders’ Equity;

Interest Rates and Interest Differential (Continued)

The following table sets forth, for the years ended December 31, 2015, 2014 and 2013, the distribution of liabilities and shareholders’ equity, including interest amounts and average rates of major categories of interest-earning assets and interest-bearing liabilities (Amounts in thousands):

| 2015 | 2014 | 2013 | ||||||||||||||||||||||||||||||||||

| Liabilities and | Average | Yield/ | Average | Yield/ | Average | Yield/ | ||||||||||||||||||||||||||||||

| Shareholders’ Equity |

balance | Interest | rate | balance | Interest | rate | balance | Interest | rate | |||||||||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Savings and interest- bearing demand accounts |

$ | 543,986 | $ | 422 | 0.08 | % | $ | 501,408 | $ | 376 | 0.07 | % | $ | 485,054 | $ | 401 | 0.08 | % | ||||||||||||||||||

| Certificates of deposit |

223,099 | 1,665 | 0.75 | % | 227,682 | 1,916 | 0.84 | % | 246,724 | 2,387 | 0.97 | % | ||||||||||||||||||||||||

| Federal Home Loan Bank advances |

45,551 | 442 | 0.97 | % | 33,831 | 1,015 | 3.00 | % | 39,293 | 1,358 | 3.46 | % | ||||||||||||||||||||||||

| Securities sold under repurchase agreements |

20,086 | 20 | 0.10 | % | 19,759 | 20 | 0.10 | % | 20,749 | 21 | 0.10 | % | ||||||||||||||||||||||||

| Federal funds purchased |

68 | — | 0.00 | % | 41 | — | 0.00 | % | 27 | — | 0.00 | % | ||||||||||||||||||||||||

| Subordinated debentures |

29,427 | 760 | 2.58 | % | 29,427 | 777 | 2.64 | % | 29,427 | 740 | 2.51 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest- bearing liabilities |

862,217 | 3,309 | 0.38 | % | 812,148 | 4,104 | 0.51 | % | 821,274 | 4,907 | 0.60 | % | ||||||||||||||||||||||||

| Noninterest-bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Demand deposits |

340,360 | 297,003 | 233,592 | |||||||||||||||||||||||||||||||||

| Other liabilities |

13,718 | 10,989 | 14,390 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| 354,078 | 307,992 | 247,982 | ||||||||||||||||||||||||||||||||||

| Shareholders’ equity |

120,350 | 114,266 | 103,563 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total |

$ | 1,336,645 | $ | 1,234,406 | $ | 1,172,819 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest income and interest rate spread (1) |

$ | 47,392 | 3.84 | % | $ | 41,866 | 3.64 | % | $ | 39,974 | 3.64 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Net interest margin (2) |

3.96 | % | 3.79 | % | 3.79 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| (1) | Interest rate spread is calculated by subtracting the rate on average interest-bearing liabilities from the yield on average interest-earning assets. |

| (2) | Net interest margin is calculated by dividing tax-equivalent adjusted net interest income by average interest-earning assets. |

See accompanying notes to consolidated financial statements.

15

Changes in Interest Income and Interest Expense

Resulting from Changes in Volume and Changes in Rate

The following table sets forth, for the periods indicated, a summary of the changes in interest income and interest expense resulting from changes in volume and changes in rate (Amounts in thousands):

| Increase (decrease) due to: | ||||||||||||

| Volume(1) | Rate(1) | Net | ||||||||||

| 2015 compared to 2014 |

||||||||||||

| Interest income: |

||||||||||||

| Loans |

$ | 4,885 | $ | (133 | ) | $ | 4,752 | |||||

| Taxable securities |

(252 | ) | 41 | (211 | ) | |||||||

| Nontaxable securities |

304 | (77 | ) | 227 | ||||||||

| Interest-bearing deposits in other banks |

(22 | ) | (15 | ) | (37 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total interest income |

$ | 4,915 | $ | (184 | ) | $ | 4,731 | |||||

|

|

|

|

|

|

|

|||||||

| Interest expense: |

||||||||||||

| Savings and interest-bearing demand accounts |

$ | 33 | $ | 13 | $ | 46 | ||||||

| Certificates of deposit |

(38 | ) | (213 | ) | (251 | ) | ||||||

| Federal Home Loan Bank advances |

271 | (844 | ) | (573 | ) | |||||||

| Securities sold under repurchase agreements |

— | — | — | |||||||||

| Subordinated debentures |

— | (17 | ) | (17 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Total interest expense |

$ | 266 | $ | (1,061 | ) | $ | (795 | ) | ||||

|

|

|

|

|

|

|

|||||||

| Net interest income |

$ | 4,649 | $ | 877 | $ | 5,526 | ||||||

|

|

|

|

|

|

|

|||||||

| 2014 compared to 2013 |

||||||||||||

| Interest income: |

||||||||||||

| Loans |

$ | 2,562 | $ | (1,306 | ) | $ | 1,256 | |||||

| Taxable securities |

(176 | ) | (144 | ) | (320 | ) | ||||||

| Nontaxable securities |

273 | (128 | ) | 145 | ||||||||

| Interest-bearing deposits in other banks |

(4 | ) | 12 | 8 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total interest income |

$ | 2,655 | $ | (1,566 | ) | $ | 1,089 | |||||

|

|

|

|

|

|

|

|||||||

| Interest expense: |

||||||||||||

| Savings and interest-bearing demand accounts |

$ | 13 | $ | (38 | ) | $ | (25 | ) | ||||

| Certificates of deposit |

(175 | ) | (296 | ) | (471 | ) | ||||||

| Federal Home Loan Bank advances |

(176 | ) | (167 | ) | (343 | ) | ||||||

| Securities sold under repurchase agreements |

(1 | ) | — | (1 | ) | |||||||

| Subordinated debentures |

— | 37 | 37 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total interest expense |

$ | (339 | ) | $ | (464 | ) | $ | (803 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net interest income |

$ | 2,994 | $ | (1,102 | ) | $ | 1,892 | |||||

|

|

|

|

|

|

|

|||||||

| (1) | The change in interest income and interest expense due to changes in both volume and rate, which cannot be segregated, has been allocated proportionately to the change due to volume and the change due to rate. |

See accompanying notes to consolidated financial statements.

16

Liquidity and Capital Resources

Civista maintains a conservative liquidity position. All securities are classified as available for sale. At December 31, 2015, securities with maturities of one year or less, totaled $5,078, or 2.6%, of the total security portfolio. The available for sale portfolio helps to provide Civista with the ability to meet its funding needs. The Consolidated Statements of Cash Flows contained in the Consolidated Financial Statements detail the Company’s cash flows from operating activities resulting from net earnings.

Cash from operations for 2015 was $15,073. The primary additions to cash from operating activities are from changes in amortization of intangible assets, amortization of securities net of accretion, the provision for loan losses, depreciation and proceeds from sale of loans. The primary use of cash from operating activities is from loans originated for sale. Cash used for investing activities was $11,904 in 2015. Security and property and equipment purchases along with loans to customers and purchased loans were offset by security maturities. Cash from financing activities in 2015 totaled $2,534. A major source of cash for financing activities is short-term borrowings from the FHLB. In 2015, the Company borrowed additional funds from the FHLB in overnight funds of $11,000. The primary uses of cash in financing activities include payment of dividends, repayment of FHLB advances and a decrease in the net change in deposits. Cash and cash equivalents increased from $29,858 at December 31, 2014 to $35,561 at December 31, 2015.

Future loan demand of Civista can be funded by increases in deposit accounts, proceeds from payments on existing loans, the maturity of securities, the issuances of trust preferred obligations, and the sale of securities classified as available for sale. Additional sources of funds may also come from borrowing in the Federal Funds market and/or borrowing from the FHLB. As of December 31, 2015, Civista had total credit availability with the FHLB of $132,054 of which $71,200 was outstanding.

On a separate entity basis, CBI’s primary source of funds is dividends paid primarily by Civista. Generally, subject to applicable minimum capital requirements, Civista may declare a dividend without the approval of the Federal Reserve Bank of Cleveland and the State of Ohio Department of Commerce, Division of Financial Institutions, provided the total dividends in a calendar year do not exceed the total of its profits for that year combined with its retained profits for the two preceding years. At December 31, 2015, Civista was able to pay dividends to CBI without obtaining regulatory approval. During 2015, Civista paid dividends totaling $14,226 to CBI. This represented approximately 97 percent of Civista’s earnings for the year.

In addition to the restrictions placed on dividends by banking regulations, the Company is subject to restrictions on the payment of dividends as a result of the Company’s issuance of 1,000,000 depositary shares, each representing a 1/40th ownership interest in a Series B Preferred Share, of the Company on December 19, 2013. Under the terms of the Series B Preferred Shares, no dividends may be declared or paid on the common shares of the Company during any calendar quarter unless full dividends on the Series B Preferred Shares (and, therefore, the depositary shares) have been declared for that quarter and all dividends previously declared on the Series B Preferred Shares (and, therefore, the depositary shares) have been paid in full.

See accompanying notes to consolidated financial statements.

17

The Company manages its liquidity and capital through quarterly Asset/Liability Management Committee (ALCO) meetings. The ALCO discusses issues like those in the above paragraphs as well as others that will affect the future liquidity and capital position of the Company. The ALCO also examines interest rate risk and the effect that changes in rates will have on the Company. For more information about interest rate risk, please refer to the “Quantitative and Qualitative Disclosures about Market Risk” section.

Capital Adequacy

Shareholders’ equity totaled $125,173 at December 31, 2015 compared to $115,909 at December 31, 2014. The increase in shareholders’ equity resulted primarily from net income of $12,745, which was offset by dividends on preferred shares and common shares of $1,577 and $1,562, respectively.

During the first quarter of 2015, the Company adopted the new BASEL III regulatory capital framework as approved by the federal banking agencies. In addition to the existing regulatory capital rules, the final BASEL III rules also require the Company to now maintain minimum amounts and ratios of Common Equity Tier 1 (“CET1”) Capital to risk-weighted assets (as these terms are defined in the BASEL III rules). Under the BASEL III rules, the Company elected to opt-out of including accumulated other comprehensive income in regulatory capital. For December 31, 2014, the Company’s regulatory capital ratios were calculated under BASEL I rules because the BASEL III rules were not yet effective and, thus, the Common Equity Tier 1 Capital ratio was not required. All of the Company’s capital ratios exceeded the regulatory minimum guidelines as of December 31, 2015 and December 31, 2014 as identified in the following table:

| Total Risk Based Capital |

Tier I Risk Based Capital |

CET1 Risk Based Capital |

Leverage Ratio | |||||

| Company Ratios - December 31, 2015 |

14.0% | 12.7% | 7.6% | 10.0% | ||||

| Company Ratios - December 31, 2014 |

14.7% | 13.4% | N/A | 10.3% | ||||

| For Capital Adequacy Purposes |

8.0% | 6.0% | 4.5% | 4.0% | ||||

| To Be Well Capitalized Under Prompt |

||||||||

| Corrective Action Provisions |

10.0% | 8.0% | 6.5% | 5.0% |

Common equity for the CET1 risk-based capital ratio includes common stock (plus related surplus) and retained earnings, plus limited amounts of minority interests in the form of common stock, less the majority of certain regulatory deductions.

Tier 1 capital includes common equity as defined for the CET1 risk-based capital ratio, plus certain non-cumulative preferred stock and related surplus, cumulative preferred stock and related surplus and trust preferred securities that have been grandfathered (but which are not permitted going forward), and limited amounts of minority interests in the form of additional Tier 1 capital instruments, less certain deductions.

Tier 2 capital, which can be included in the total capital ratio, includes certain capital instruments (such as subordinated debt) and limited amounts of the allowance for loan and lease losses, subject to new eligibility criteria, less applicable deductions.

The deductions from CET1 capital include goodwill and other intangibles, certain deferred tax assets, mortgage-servicing assets above certain levels, gains on sale in connection with a securitization, investments in a banking organization’s own capital instruments and investments in the capital of unconsolidated financial institutions (above certain levels). The deductions phase in from 2015 through 2019.

See accompanying notes to consolidated financial statements.

18

Under applicable regulatory guidelines, capital is compared to the relative risk related to the balance sheet. To derive the risk included in the balance sheet, one of several risk weights is applied to different balance sheet and off-balance sheet assets, primarily based on the relative credit risk of the counterparty. The capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk weightings and other factors. Some of the risk weightings have been changed effective January 1, 2015.

The new regulatory capital rules and regulations also place restrictions on the payment of capital distributions, including dividends, and certain discretionary bonus payments to executive officers if the company does not hold a capital conservation buffer of greater than 2.5 percent composed of common equity tier 1 capital above its minimum risk-based capital requirements, or if its eligible retained income is negative in that quarter and its capital conservation buffer ratio was less than 2.5 percent at the beginning of the quarter. The capital conservation buffer phases in starting on January 1, 2016, at 0.625%. The implementation of Basel III is not expected to have a material impact on CBI’s or Civista’ capital ratios.

Effects of Inflation

The Company’s balance sheet is typical of financial institutions and reflects a net positive monetary position whereby monetary assets exceed monetary liabilities. Monetary assets and liabilities are those which can be converted to a fixed number of dollars and include cash assets, securities, loans, money market instruments, deposits and borrowed funds.