UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The Hanover Insurance Group® Notice of Annual Meeting and Proxy Statement ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 9, 2023

THE HANOVER INSURANCE GROUP, INC.

440 Lincoln Street

Worcester, Massachusetts 01653

|

Letter to our Shareholders from Cynthia L. Egan, Chair of our Board, and |

March 24, 2023

TO OUR FELLOW SHAREHOLDERS:

You are cordially invited to attend the Annual Meeting of Shareholders of The Hanover Insurance Group, Inc. to be held on Tuesday, May 9, 2023, at 9:00 a.m. Eastern time, at the Company’s headquarters in Worcester, Massachusetts.

The accompanying Notice and Proxy Statement describe in detail the matters to be acted on at the Annual Meeting. This Proxy Statement also describes the corporate governance policies and practices that guide the Board’s oversight of the Company’s business, risks, conduct, and environmental, social and governance considerations for the long-term benefit of our stakeholders. The Board, on behalf of our shareholders, is actively engaged in the governance, audit, compensation and other matters addressed in this Proxy Statement.

Your vote is important to us. We hope you will vote as soon as possible. Please review the instructions concerning each of your voting options described in this Proxy Statement. Your cooperation will assure that your shares are voted and will also greatly assist us in preparing for the Annual Meeting.

On behalf of the Board of Directors, the executive leadership team and all our employees, we would like to thank you for your investment and continued support of The Hanover Insurance Group.

Sincerely,

|

|

|

|

|

|

|

Cynthia L. Egan Chair of the Board of Directors and Independent Presiding Director |

John C. Roche President, Chief Executive Officer and Director |

THE HANOVER INSURANCE GROUP, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 9, 2023

To the Shareholders of The Hanover Insurance Group, Inc.:

Set forth below are details regarding the 2023 Annual Meeting of Shareholders of The Hanover Insurance Group, Inc.:

LOCATION: Our principal executive office and corporate headquarters, 440 Lincoln Street, Worcester, Massachusetts 01653

DATE AND TIME: Tuesday, May 9, 2023, at 9:00 a.m. Eastern time

ITEMS OF BUSINESS: 1. The election of three individuals to the Board of Directors; 2. Approval of the 2023 Employee Stock Purchase Plan; 3. The advisory approval of the Company's executive compensation; 4. Advisory vote on the frequency of holding an advisory vote on executive compensation; 5. The ratification of the appointment of PricewaterhouseCoopers LLP to serve as the Company's independent, registered public accounting firm for 2023; and 6. Such other business as may properly come before the Annual Meeting or any adjournment thereof.

RECORD DATE: The Board of Directors has fixed March 17, 2023 as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

By Order of the Board of Directors,

CHARLES F. CRONIN

Senior Vice President and Secretary

Worcester, Massachusetts

March 24, 2023

Your vote is important. Whether or not you plan to attend the Annual Meeting, you are requested to vote your shares. Please follow the voting instructions set forth in the Proxy Statement. If you attend the Annual Meeting and desire to withdraw your proxy and vote at the meeting, you may do so.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, you are requested to vote your shares. Please follow the voting instructions set forth in the Proxy Statement. If you attend the Annual Meeting and desire to withdraw your proxy and vote at the meeting, you may do so.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 9, 2023: The Proxy Statement and Annual Report to Shareholders are available at www.proxydocs.com/THG.

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

This summary highlights some of the important information contained elsewhere in our Proxy Statement. It does not contain all of the information you should consider. We encourage you to read the entire Proxy Statement before voting.

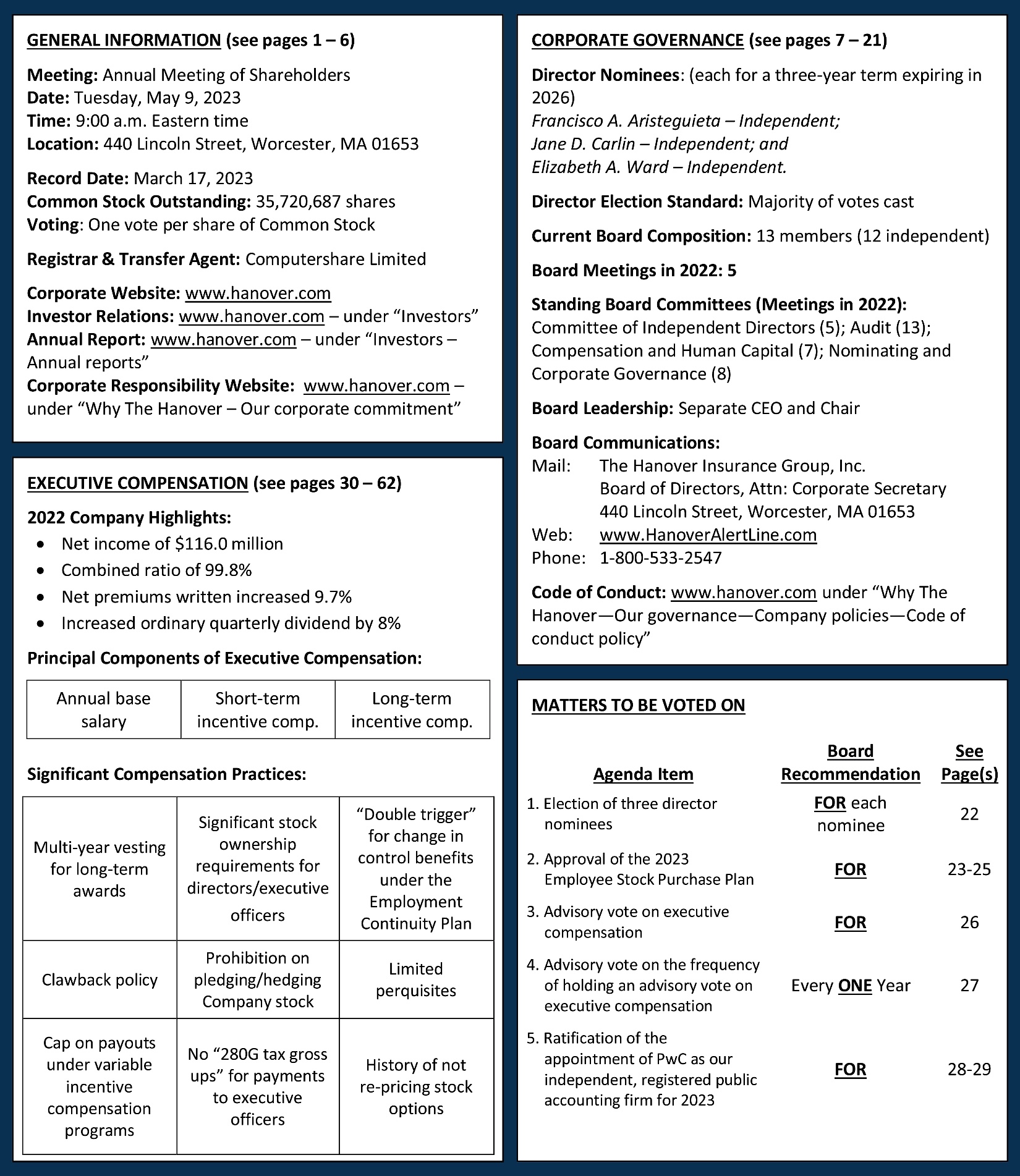

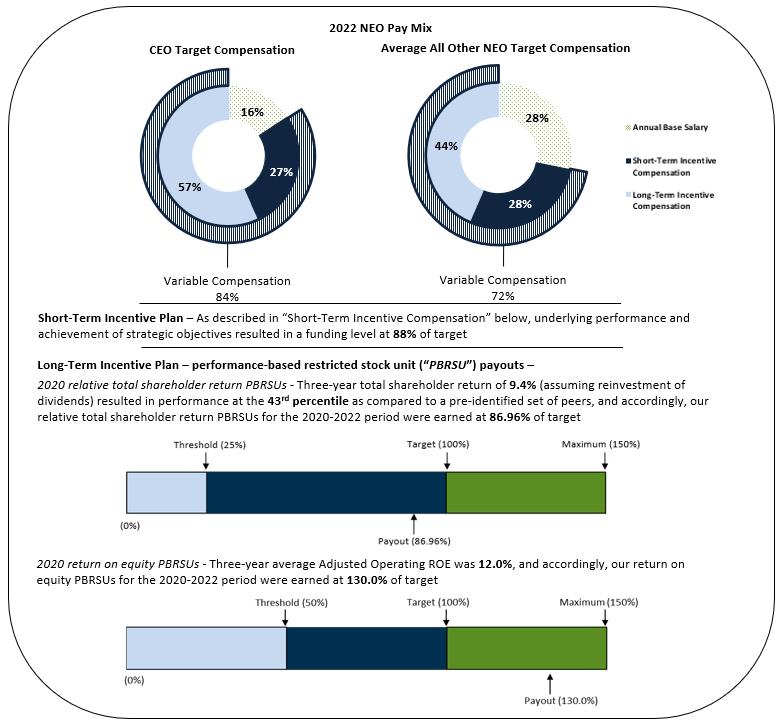

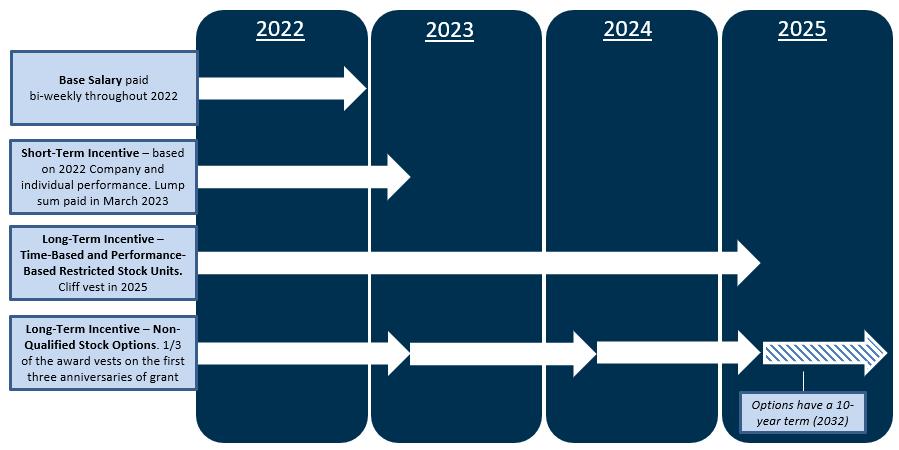

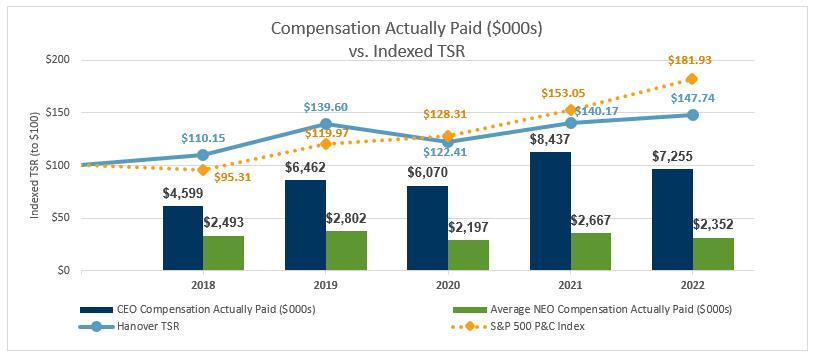

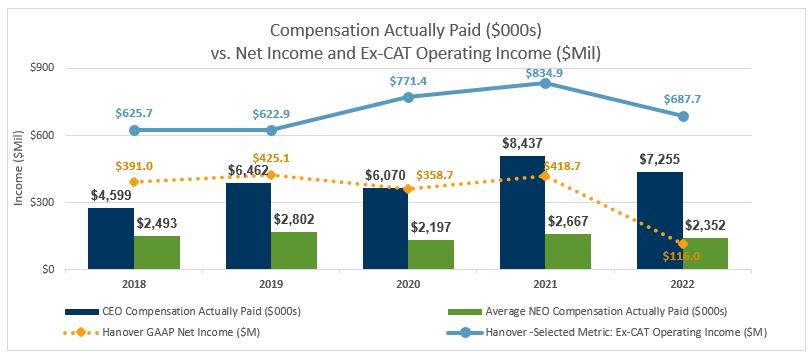

GENERAL INFORMATION (see pages 1 – 6) Meeting: Annual Meeting of Shareholders Date: Tuesday, May 9, 2023 Time: 9:00 a.m. Eastern time Location: 440 Lincoln Street, Worcester, MA 01653 Record Date: March 17, 2023 Common Stock Outstanding: 35,720,687 shares Voting: One vote per share of Common Stock Registrar & Transfer Agent: Computershare Limited Corporate Website: www.hanover.com Investor Relations: www.hanover.com – under “Investors” Annual Report: www.hanover.com – under “Investors – Annual reports” Corporate Responsibility Website: www.hanover.com – under “Why The Hanover – Our corporate commitment” EXECUTIVE COMPENSATION (see pages 30 – 62) 2022 Company Highlights: Net income of $116.0 million Combined ratio of 99.8% Net premiums written increased 9.7% Increased ordinary quarterly dividend by 8% Principal Components of Executive Compensation: Annual base salary Short-term incentive comp. Long-term incentive comp. Significant Compensation Practices: Multi-year vesting for long-term awards Significant stock ownership requirements for directors/executive officers “Double trigger” for change in control benefits under the Employment Continuity Plan Clawback policy Prohibition on pledging/hedging Company stock Limited perquisites Cap on payouts under variable incentive compensation programs No “280G tax gross ups” for payments to executive officers History of not re-pricing stock options CORPORATE GOVERNANCE (see pages 7 – 21) Director Nominees: (each for a three-year term expiring in 2026) Francisco A. Aristeguieta – Independent; Jane D. Carlin – Independent; and Elizabeth A. Ward – Independent. Director Election Standard: Majority of votes cast Current Board Composition: 13 members (12 independent) Board Meetings in 2022: 5 Standing Board Committees (Meetings in 2022): Committee of Independent Directors (5); Audit (13); Compensation and Human Capital (7); Nominating and Corporate Governance (8) Board Leadership: Separate CEO and Chair Board Communications: Mail: The Hanover Insurance Group, Inc. Board of Directors, Attn: Corporate Secretary 440 Lincoln Street, Worcester, MA 01653 Web: www.HanoverAlertLine.com Phone: 1-800-533-2547 Code of Conduct: www.hanover.com under “Why The Hanover—Our governance—Company policies—Code of conduct policy” MATTERS TO BE VOTED ON Agenda Item Board Recommendation See Page(s) 1. Election of three director nominees FOR each nominee 22 2. Approval of the 2023 Employee Stock Purchase Plan FOR 23-25 3. Advisory vote on executive compensation FOR 26 4. Advisory vote on the frequency of holding an advisory vote on executive compensation Every ONE Year 27 5. Ratification of the appointment of PwC as our independent, registered public accounting firm for 2023 FOR 28-29

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT i

PROXY STATEMENT

We have made these proxy materials available to you on or about March 24, 2023 via the Internet or, at your request, forwarded paper copies by mail, in connection with the solicitation of proxies by the Board of Directors (the “Board”) of The Hanover Insurance Group, Inc. (“THG” or the “Company”) for use at our Annual Meeting of Shareholders to be held on May 9, 2023 (the “Annual Meeting” or “Meeting”). In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), we have provided access to our proxy materials over the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail, you will not receive a paper copy of the proxy materials unless you request one. The Notice instructs you how to access the proxy materials via the Internet. The Notice also instructs you how to vote your shares via the Internet. If you received a Notice by mail and would like to receive a paper copy of our proxy materials, please follow the instructions included in the Notice.

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND THE ANNUAL MEETING

What is included in these proxy materials? These proxy materials include our Proxy Statement for the Annual Meeting and our Annual Report to Shareholders for the fiscal year ended December 31, 2022 (the “Annual Report”), including our financial statements and the report of PricewaterhouseCoopers LLP (“PwC”) thereon. The Annual Report is neither a part of this Proxy Statement nor incorporated herein by reference. If you requested a paper copy of these materials by mail, these materials also include the proxy card for submitting your vote prior to the Annual Meeting.

What is the purpose of the Annual Meeting? At the Annual Meeting, shareholders will act on the following matters:

|

|

• |

election of three directors; |

|

|

• |

approval of The Hanover Insurance Group 2023 Employee Stock Purchase Plan (the “2023 ESPP”); |

|

|

• |

advisory approval of the Company’s executive compensation; |

|

|

• |

advisory vote on the frequency of holding an advisory vote on executive compensation; and |

|

|

• |

ratification of the appointment of PwC to serve as the Company’s independent, registered public accounting firm for 2023. |

Any other business that properly comes before the Annual Meeting also will be considered. In addition, management and the Board will respond to questions from shareholders.

Who is entitled to vote at the Annual Meeting? Only shareholders of record at the close of business on March 17, 2023 (the “Record Date”) are entitled to vote at the Meeting.

What are the voting rights of the holders of the Company’s common stock? Each share of THG’s common stock, par value $0.01 per share (the “Common Stock”), entitles its holder to one vote.

Who is soliciting my vote? The Board is soliciting your vote at the Annual Meeting. Proxies also may be solicited on the Board’s behalf by directors, officers or employees of the Company, in person or by telephone, mail, the Internet, or electronic or facsimile transmission. The Company will pay the cost of soliciting proxies on the Board’s behalf, including reimbursing banks, brokerage firms and others for the reasonable expenses incurred by them for forwarding proxy material on behalf of the Board to beneficial owners of Common Stock.

How does the Board recommend that I vote? Our Board recommends you vote your shares “FOR” the election of each Board nominee, for every “ONE” year for the frequency of holding advisory votes on executive compensation, and “FOR” each of the other proposals specifically identified in this Proxy Statement for action at the Annual Meeting.

How many shares are entitled to vote at the Annual Meeting? As of the Record Date, 35,720,687 shares of Common Stock were issued, outstanding and entitled to be voted.

How many shares must be present to hold the Annual Meeting? A majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting must be present either in person or by proxy to constitute a quorum. Abstentions will be treated as present at the Annual Meeting for the purpose of determining a quorum and, because brokers have the discretionary authority to vote on one proposal (the ratification of auditors), broker non-votes also will be treated as present at the Annual Meeting for the purpose of determining a quorum. A “broker non-vote” occurs when a broker holding shares for a beneficial owner returns a proxy but does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner. Banks and brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on any matter specifically identified for action at the Annual Meeting other than the ratification of the appointment of PwC to serve as the Company’s independent, registered public accounting firm for 2023.

How do I vote? You may either attend and vote at the Annual Meeting, or vote by proxy without attending the Meeting.

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 1

How do I vote by proxy? If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name,” and such brokerage firm or nominee will forward the Notice and/or a printed copy of the proxy materials to you, together with voting instructions. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote.

If you are a registered shareholder (that is, if you hold stock certificates directly in your name), you may vote via the Internet in accordance with the instructions set forth in the Notice. If you have requested a paper copy of the proxy materials, you may vote by mail, via the Internet, or via the toll-free number in accordance with the instructions set forth on the proxy card. The shares of Common Stock represented by your proxy will be voted as you directed or, if the proxy card is signed, dated and returned without instructions, in accordance with the Board’s recommendations as set forth in this Proxy Statement.

The proxy also confers discretionary authority with respect to any other proposals that may properly be brought before the Annual Meeting. As of the date of this Proxy Statement, neither the Board nor management is aware of any other matters to be presented for action at the Annual Meeting. However, if any other matters properly come before the Annual Meeting, then the proxies solicited hereby will be voted in accordance with the recommendations of the Board.

Can I change my vote after I submit my proxy? Yes. Any registered shareholder giving a proxy may revoke it at any time before it is exercised by delivering written notice thereof to the Company’s Corporate Secretary, The Hanover Insurance Group, Inc., 440 Lincoln Street, Worcester, MA 01653. If you are a beneficial owner of shares held in street name, you may revoke or change your voting instructions prior to the Meeting by timely instructing your broker, trustee or nominee. Any shareholder of record attending the Annual Meeting may vote in person at the Meeting regardless of whether the shareholder previously delivered a proxy. Shares held beneficially in street name may be voted in person at the Meeting only if you obtain and bring to the Meeting a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. Attendance at the Annual Meeting by a shareholder who has submitted a proxy, however, does not in itself revoke a submitted proxy.

What vote is required to approve each item, and how are abstentions and broker non-votes treated?

|

|

|

|

|

Proposal |

Vote Required |

Effect of Broker Non-Votes and Abstentions |

|

1. Election of a director nominee |

The affirmative vote of a majority of the votes properly cast (in person or by proxy). For purposes of electing directors, “the affirmative vote of a majority of the votes cast” means that the number of votes cast “for” a director must exceed the number of votes cast “against” that director. |

Broker non-votes and abstentions, because they are not votes cast, are not counted for this proposal and will have no effect on the outcome. |

|

2. Approval of the 2023 ESPP |

The affirmative vote of a majority of the votes properly cast (in person or by proxy). |

Broker non-votes and abstentions, because they are not votes cast, are not counted for this proposal and will have no effect on the outcome. |

|

3. Advisory vote on executive compensation |

The affirmative vote of a majority of the votes properly cast (in person or by proxy). |

Broker non-votes and abstentions, because they are not votes cast, are not counted for this proposal and will have no effect on the outcome. |

|

4. Advisory vote on the frequency of holding an advisory vote on executive compensation |

The affirmative vote of a majority of the votes properly cast (in person or by proxy). If none of the three frequency options receives the vote of the holders of a majority of the votes properly cast, we will consider the frequency option (one year, two years or three years) receiving the highest number of votes cast by shareholders to be the frequency that has been recommended by shareholders. |

Broker non-votes and abstentions, because they are not votes cast, are not counted for this proposal and will have no effect on the outcome. |

|

5. Ratification of the appointment of PwC to serve as the Company’s independent, registered public accounting firm for 2023 |

The affirmative vote of a majority of the votes properly cast (in person or by proxy). |

Abstentions, because they are not votes cast, will not be counted and will have no effect on the outcome. However, banks and brokers that have not received voting instructions from their clients may vote their clients’ shares on this proposal. |

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 2

What happens if a director nominee is not elected at the Annual Meeting? If a nominee who is currently serving as a director is not re-elected at the Annual Meeting, then, under Delaware law, the director would continue to serve on the Board as a “holdover director.” However, under our by-laws, any director who is nominated but fails to be re-elected is required to promptly tender his or her resignation to the Board, effective at the end of his or her current term. The Nominating and Corporate Governance Committee (the “NCGC”) will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. In making their determinations, the NCGC and the Board may consider any factors deemed relevant. The Board will act on the NCGC’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. The director who tenders his or her resignation will not vote on the NCGC’s recommendation or the Board’s decision.

How do participants in The Hanover Insurance Group Employee Stock Purchase Plan (the “ESPP”) vote their shares? ESPP participants who retain their issued shares are considered to hold such shares in “street name” in a brokerage account. Such shares may be voted like other “street name” holders. The brokerage firm or nominee will forward ESPP participants the Notice and/or a printed copy of the proxy materials, together with voting instructions. ESPP participants’ voting instructions are kept confidential by the administrator of the ESPP.

Who can attend the Annual Meeting? The Meeting is open to all THG shareholders of record as of the Record Date and to invited guests of the Board. Individuals who hold shares in “street name” may be required to provide proof of their share ownership as of the Record Date.

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 3

COMPANY STOCK OWNERSHIP

Stock Ownership by the Company’s Directors and Executive Officers

The following table sets forth information regarding the number of shares of Common Stock beneficially owned as of March 10, 2023 by (i) each director of THG, (ii) the named executive officers (the “NEOs”) in the Summary Compensation Table appearing later in this Proxy Statement, and (iii) all current directors and executive officers of THG, as a group. This information has been furnished by the persons listed in the table.

|

|

|

|

|

|

Name of Beneficial Owner |

Shares Beneficially Owned† |

|

Percent of Class |

|

|

|

|

|

|

Francisco A. Aristeguieta |

868 |

|

* |

|

Kevin J. Bradicich |

5,907 |

|

* |

|

Theodore H. Bunting, Jr. |

2,846 |

|

* |

|

Jane D. Carlin |

— (1) |

|

* |

|

J. Paul Condrin III |

2,167 (2) |

|

* |

|

Cynthia L. Egan |

10,394 |

|

* |

|

Jeffrey M. Farber |

139,178 (3) |

|

* |

|

Martin P. Hughes |

4,843 |

|

* |

|

Dennis F. Kerrigan |

17,022 (4) |

|

* |

|

Wendell J. Knox |

31,202 (5) |

|

* |

|

Kathleen S. Lane |

1,884 (6) |

|

* |

|

Richard W. Lavey |

127,786 (7) |

|

* |

|

Joseph R. Ramrath |

29,645 (2) |

|

* |

|

John C. Roche |

369,870 (8) |

|

1.0% |

|

Bryan J. Salvatore |

78,848 (9) |

|

* |

|

Harriett “Tee” Taggart |

14,577 (2) |

|

* |

|

Elizabeth A. Ward |

798 |

|

* |

|

Current directors and executive officers, as a group (20 persons) |

857,663 (10) |

|

2.4% |

|

† |

As to shares listed in this column, each person has sole voting and investment power, except as indicated in other footnotes to this table. Some directors have deferred receipt of certain stock grants from the Company. Deferred shares are held in a rabbi trust (the “Rabbi Trust”) by the trustee, Principal Trust Company. As of March 10, 2023, the Rabbi Trust held 11,268 shares of Common Stock pursuant to deferrals by directors. In accordance with regulations prescribed by the SEC, and even though such director has a direct economic interest in such deferred shares, shares held in the Rabbi Trust are not included in the amounts set forth in this column. These shares may be voted by the trustee of the Rabbi Trust, but not by the individuals on whose behalf the shares are held in the Rabbi Trust. For information regarding specific deferrals, please refer to the footnotes below. |

|

* |

Less than 1%. |

|

(1) |

Excludes 5,929 shares held by the Rabbi Trust, the receipt of which Ms. Carlin has deferred. |

|

(2) |

Shares voting and investment power with spouse. |

|

(3) |

Includes 64,751 shares underlying options exercisable within 60 days of March 10, 2023. Mr. Farber shares voting and investment power with his wife with respect to 7,500 shares. |

|

(4) |

Includes 14,435 shares underlying options exercisable within 60 days of March 10, 2023. |

|

(5) |

Excludes 1,926 shares held by the Rabbi Trust, the receipt of which Mr. Knox has deferred. |

|

(6) |

Excludes 3,413 shares held by the Rabbi Trust, the receipt of which Ms. Lane has deferred. |

|

(7) |

Includes 100,605 shares underlying options exercisable within 60 days of March 10, 2023. |

|

(8) |

Includes 293,898 shares underlying options exercisable within 60 days of March 10, 2023 and 7,652 shares held by his spouse. |

|

(9) |

Includes 63,068 shares underlying options exercisable within 60 days of March 10, 2023. |

|

(10) |

Includes 552,970 shares underlying options exercisable within 60 days of March 10, 2023. Excludes 11,268 shares held by the Rabbi Trust. See footnotes 1-9 above. |

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 4

Stock Ownership Guidelines for Named Executive Officers and Directors

Named Executive Officers

Within 18 months of becoming subject to our stock ownership guidelines, each NEO, and each of our other executive officers should achieve an ownership level in our Common Stock with a value equal to one times his or her base salary. Within three years of becoming subject to these guidelines, each NEO (as well as each executive officer) should achieve and maintain an ownership level with a value equal to at least two to four times his or her base salary (four to six times base salary for the CEO). The guidelines credit shares held outright by the officer and by immediate family members residing in the same household, whether held individually or jointly by the officer or the immediate family member, unvested restricted stock, restricted stock units, performance-based restricted stock units (measured at target), shares held in estate planning vehicles of the officer, and any shares that have been earned but the payment of which has been deferred. Regardless of their vesting status, shares subject to unexercised stock options are not counted when determining ownership under the guidelines. For these purposes, shares are valued based upon the then-current market value, or if higher, the value on the date of acquisition.

Each of our current NEOs is in compliance with the guidelines. Set forth below is a table that indicates, as of March 10, 2023, each current NEO’s share ownership as a multiple of his current base salary rate. Such figures are calculated in accordance with our stock ownership guidelines, and the multiple presented below has been determined based upon the current market value ($129.61 per share, the closing price of our Common Stock on March 10, 2023), or if higher, the value of the shares on the date of acquisition.

|

|

|

|

|

|

|

|

NEO |

Year Hired |

|

Number of Shares Counted under Stock Ownership Guidelines |

|

Ownership Level as a Multiple of Base Salary |

|

|

|

|

|

|

|

|

John C. Roche |

2006 |

|

145,763 |

|

17.6 |

|

Jeffrey M. Farber |

2016 |

|

103,609 |

|

18.5 |

|

Richard W. Lavey |

2004 |

|

42,316 |

|

8.3 |

|

Bryan J. Salvatore |

2017 |

|

29,332 |

|

6.2 |

|

Dennis F. Kerrigan |

2020 |

|

12,348 |

|

2.9 |

Board of Directors

Within four years from the date of first being elected to the Board, each non-employee director should achieve an ownership level in our Common Stock with a value equal to four times the value of the regular annual stock retainer paid to directors for service on the Board. This requirement can be satisfied by purchases in the open market or by holding grants received from the Company (including share grants that the director has elected to defer under Company-sponsored deferred compensation programs). The guidelines credit directors for shares held outright by the director and by his or her immediate family members residing in the same household, whether held individually or jointly by the director or the immediate family member, and shares held in estate planning vehicles of the director. For these purposes, shares are valued based upon the then-current market value, or if higher, the value on the date of acquisition.

Each of our non-employee directors is in compliance with our stock ownership guidelines or is expected to become compliant within the prescribed time following his or her initial election to the Board. Set forth below is a table that indicates, as of March 10, 2023, each director’s share ownership as a multiple of the value of the current annual stock retainer ($135,000). Such figures are calculated in accordance with our stock ownership guidelines, and the multiple presented below has been determined based upon the current market value ($129.61 per share, the closing price of our Common Stock on March 10, 2023), or if higher, the value of the shares on the date of acquisition.

|

|

|

|

|

|

|

|

Non-Employee Director |

Year First Elected to Board |

|

Number of Shares Counted under Stock Ownership Guidelines |

|

Ownership Level as a Multiple of the Value of the Annual Stock Retainer |

|

|

|

|

|

|

|

|

Francisco A. Aristeguieta |

2022 |

|

868 |

|

0.9 |

|

Kevin J. Bradicich |

2018 |

|

5,907 |

|

5.8 |

|

Theodore H. Bunting, Jr. |

2020 |

|

2,846 |

|

2.9 |

|

Jane D. Carlin |

2016 |

|

5,929 |

|

5.7 |

|

J. Paul Condrin III |

2021 |

|

2,167 |

|

2.2 |

|

Cynthia L. Egan |

2015 |

|

10,394 |

|

10.1 |

|

Martin P. Hughes |

2020 |

|

4,843 |

|

4.8 |

|

Wendell J. Knox |

1999 |

|

33,128 |

|

32.0 |

|

Kathleen S. Lane |

2018 |

|

5,297 |

|

5.2 |

|

Joseph R. Ramrath |

2004 |

|

29,645 |

|

28.6 |

|

Harriett “Tee” Taggart |

2009 |

|

14,577 |

|

14.1 |

|

Elizabeth A. Ward |

2022 |

|

798 |

|

0.8 |

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 5

Largest Owners of the Company’s Stock

The following table lists the only persons who, to the best of the Company’s knowledge, are “beneficial owners” (as defined by SEC regulations) of more than five percent of the issued and outstanding shares of Common Stock as of March 10, 2023.

|

|

|

|

|

|

Name and Address of Beneficial Owner |

Shares Beneficially Owned |

|

Percent of Class |

|

|

|

|

|

|

The Vanguard Group |

3,712,029 (1) |

|

10.4% |

|

100 Vanguard Blvd. |

|

|

|

|

Malvern, PA 19355 |

|

|

|

|

BlackRock, Inc. |

3,337,724 (2) |

|

9.3% |

|

55 East 52nd Street |

|

|

|

|

New York, NY 10055 |

|

|

|

|

(1) |

Based on a Schedule 13G/A filed on February 9, 2023 by The Vanguard Group that reported sole voting power with respect to zero shares, sole dispositive power with respect to 3,663,590 shares, shared voting power with respect to 13,374 shares and shared dispositive power with respect to 48,439 shares as of December 30, 2022. |

|

(2) |

Based on a Schedule 13G/A filed on January 24, 2023 by BlackRock, Inc. that reported sole voting power with respect to 3,245,883 shares and sole dispositive power with respect to 3,337,724 shares as of December 31, 2022. The 13G/A also reported that its subsidiary, BlackRock Fund Advisors, beneficially owned five percent or greater of the Company’s Common Stock as of December 31, 2022. |

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 6

CORPORATE GOVERNANCE

The Board has long been focused on and committed to responsible and effective corporate governance in order to promote sustainable, long-term shareholder value. The following section: (i) identifies our continuing directors and director nominees, highlights their qualifications, and provides a snapshot of Board expertise, diversity and tenure on an aggregate basis; (ii) describes the Board’s independence from management and its leadership structure; (iii) outlines the standing Board committees and their oversight responsibilities; and (iv) highlights other key aspects of our corporate governance, including the Board’s oversight of key environmental, social and governance (“ESG”) topics.

The Board has adopted Corporate Governance Guidelines that can be found on the Company’s website at www.hanover.com under “Why The Hanover - Our governance - Corporate governance guidelines.” For a printed copy of the guidelines, shareholders should contact the Company’s Corporate Secretary, The Hanover Insurance Group, Inc., 440 Lincoln Street, Worcester, MA 01653. Information on our website is not part of, or incorporated into, this Proxy Statement.

There are three nominees for election to the Board this year. Mr. Aristeguieta and Mses. Carlin and Ward are each being nominated to serve for a three-year term expiring in 2026. Ms. Carlin has served as a director since 2016. Mr. Aristeguieta, who was elected to the Board in June 2022, and Ms. Ward who was elected to the Board in July 2022, were each identified as potential director candidates and presented to the NCGC and the Board by a third-party recruiting firm, which was engaged by the NCGC to assist the NCGC in (i) identifying director candidates that meet the Company’s Director Qualifications set forth below, (ii) coordinating interviews with those qualified candidates selected by the NCGC for further consideration, and (iii) completing the due diligence work of the NCGC, as needed. Once identified as candidates, the NCGC evaluated Mr. Aristeguieta and Ms. Ward following the process described below under “Consideration of Director Nominees” on page 17 and recommended that each be elected to the Board.

Mr. Knox and Ms. Taggart have, or will have by the Annual Meeting, reached the mandatory retirement age under the Company’s director retirement policy and, in accordance with the policy, will retire from the Board at the Annual Meeting. The Board has voted to reduce the size of the Board to 11 members, effective immediately following the Annual Meeting and the retirement of Mr. Knox and Ms. Taggart.

Information regarding the business experience and qualifications of each nominee and continuing director is provided below. Following the individual director descriptions, we have provided the current key competencies, diversity profile of the Board on an aggregate basis, and Board tenure and refreshment in the section titled “Board Profile and Diversity” beginning on page 11. For a description of the skill set that the Board seeks in a director and how the individual and collective director qualifications set forth below tie to the Board’s expectations, see “Director Qualifications” on page 17.

Director Nominees

|

Francisco A. Aristeguieta

Age: 57 Director since 2022 |

Mr. Aristeguieta currently serves as special advisor for State Street Corporation, a provider of financial services to institutional investors worldwide. Mr. Aristeguieta served as Chief Executive Officer of State Street Institutional Services from 2020 to May 2022 and served as Executive Vice President and Chief Executive Officer of State Street International Business from 2019 to 2020. Before joining State Street in 2019, Mr. Aristeguieta was Chief Executive Officer of Citigroup Asia Pacific, an international investment banking and financial services provider, from 2015 to 2019. Prior to that role, he served as Chief Executive Officer of Citigroup Latin America from 2013 to 2015 and before that he led Citigroup’s Global Transaction Services Group in Latin America and served as vice chairman on the board of directors of Banco de Chile. We believe Mr. Aristeguieta’s qualifications to serve on our Board include his many years of senior leadership and management experience in the financial services industry. Mr. Aristeguieta is a member of the Compensation and Human Capital Committee. If re-elected, Mr. Aristeguieta’s term will expire in 2026. |

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 7

|

Jane D. Carlin

Age: 67 Director since 2016 |

Ms. Carlin has provided advisory and consultancy services to financial services companies since 2012. Prior to that, Ms. Carlin served in senior roles with leading companies, including Morgan Stanley Group Inc. and Credit Suisse Group AG. At Morgan Stanley, she held a number of leadership positions, most recently, as managing director, global head of financial holding company governance and assurance, from 2006 to 2012, and previously from 1987 to 2003, when she served as managing director and deputy general counsel. From 2003 to 2006, Ms. Carlin was managing director and global head of bank operational risk oversight at Credit Suisse. In 2010, Ms. Carlin was appointed by the U.S. Treasury Department as chair of the Financial Services Sector Coordinating Council for Critical Infrastructure Protection and Homeland Security (“FSSCC”) and served in that role until 2012. Prior to that, from 2009 to 2010, she served as vice chair of the FSSCC and as chair of its Cyber Security Committee. Ms. Carlin serves as a trustee of iShares Trust and iShares U.S. ETF Trust. Ms. Carlin also served as a director of PHH Corporation, a publicly traded provider of end-to-end mortgage solutions, from 2012 until its acquisition by Ocwen Financial Corporation in 2018. We believe Ms. Carlin’s qualifications to serve on our Board include her many years of management experience in compliance, risk oversight, and cybersecurity in the financial services industry, and her experience on the boards of other publicly traded companies. Ms. Carlin is Chair of the Audit Committee. If re-elected, Ms. Carlin’s term will expire in 2026. |

|

Elizabeth A. Ward

Age: 58 Director since 2022 |

Ms. Ward has served as Chief Financial Officer of Massachusetts Mutual Life Insurance Company (“MassMutual”), a mutual life insurance company, since 2016. She previously served as Executive Vice President and Chief Actuary of MassMutual from 2015 to 2019, and as Chief Enterprise Risk Officer from 2007 to 2016. Prior to joining MassMutual affiliate, Babson Capital Management, in 2001, Ms. Ward worked in investment portfolio management and actuarial roles at American Skandia Life Assurance Company, Charter Oak Capital Management and Aeltus Investment Management, a subsidiary of Aetna Life & Casualty Company. Ms. Ward currently serves as a member of the Board of Managers of Barings LLC, a registered investment company and subsidiary of MassMutual, and previously served on the Board of Directors of MML Investment Advisors, LLC (2013-2021) and MML Investors Services, LLC (2012-2021), each registered investment companies and subsidiaries of MassMutual. Ms. Ward also serves as a member of the Board of Trustees of The University of Rochester. We believe Ms. Ward’s qualifications to serve on our Board include her decades of management experience in finance and accounting, actuarial science, risk management and investment management in the life insurance industry, including many years of senior management experience. Ms. Ward is a member of the Audit Committee. If re-elected, Ms. Ward’s term will expire in 2026. |

Directors Continuing in Office

|

Kevin J. Bradicich

Age: 65 Director since 2018 |

Mr. Bradicich served as Senior Partner at McKinsey & Company, Inc. until his retirement in 2017. Mr. Bradicich began his career at McKinsey in 1983 and also held the titles of Manager, Principal and Director while with the firm. He spent the last 25 years at McKinsey focused on serving insurance company clients. While at McKinsey, Mr. Bradicich was a core member of the firm’s Global Insurance Practice’s leadership group. During his career, he also led the firm’s North American Property and Casualty Insurance Practice and helped lead the Practice’s and the firm’s people processes. We believe Mr. Bradicich’s qualifications to serve on our Board include his experience as a Senior Partner at McKinsey, including his 25 years of experience focused on advising boards and senior executives at global insurance company clients on all aspects of their business. Mr. Bradicich is a member of the Nominating and Corporate Governance Committee. Mr. Bradicich’s term expires in 2025. |

|

|

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 8

|

Theodore H.

Age: 64 Director since 2020 |

Mr. Bunting most recently served as group president, utility operations at Entergy Corporation, an integrated energy company, from 2012 until his retirement in 2017. Before that, he was senior vice president and chief accounting officer at Entergy from 2007 to 2012, and chief financial officer of several subsidiaries from 2000 to 2007. He held other management positions of increasing responsibility in accounting and operations at Entergy since joining the company in 1983. Mr. Bunting is also a director of Unum Group, a publicly traded insurance company providing group long-term disability insurance, employee benefits, individual disability insurance and special risk reinsurance, and of NiSource Inc., a publicly traded natural gas utility company. From 2020 until its acquisition by MasTec in 2022, Mr. Bunting also served as a director of Infrastructure and Energy Alternatives, Inc., a publicly traded infrastructure construction company. We believe Mr. Bunting’s qualifications to serve on our Board include his extensive accounting and operations experience, his many years of management experience while with Entergy, and his experience on the boards of other publicly traded companies. Mr. Bunting is a member of the Audit Committee. Mr. Bunting’s term expires in 2025. |

|

|

|

J. Paul Condrin III

Age: 61 Director since 2021 |

Mr. Condrin served as Executive Vice President and President, Commercial Insurance for Liberty Mutual Insurance from 2012 until his retirement in 2018. During his 29 years at Liberty Mutual, Mr. Condrin served in other senior roles, including as President of three additional strategic business units, Corporate CFO and Corporate Comptroller. Mr. Condrin began his career at KPMG, where he specialized in serving insurance companies and higher education institutions. Mr. Condrin is also Chair of the Board of Trustees of Bentley University. Mr. Condrin has served on the Bentley Board of Trustees since 2013 and served as Interim President from June 2020 to May 2021. We believe Mr. Condrin’s qualifications to serve on our Board include his many decades of extensive experience in and knowledge of the insurance industry, including his many years of senior management experience. Mr. Condrin is Chair of the Compensation and Human Capital Committee. Mr. Condrin’s term expires in 2024. |

|

|

|

Cynthia L. Egan

Age: 67 Director since 2015 |

From 2007 until her retirement in 2012, Ms. Egan was President, Retirement Plan Services for T. Rowe Price Group, a global investment management organization. From 1989 to 2007, Ms. Egan held progressively senior positions with Fidelity Investments, a multinational financial services corporation, serving as Executive Vice President, Head of Fidelity Institutional Services Company, President of the Fidelity Charitable Gift Fund, and Executive Vice President of Fidelity Management Research Co. From 2014 to 2015, she was an advisor to the U.S. Department of Treasury specializing in retirement security. Ms. Egan began her professional career at the Board of Governors of the Federal Reserve and prior to joining Fidelity, worked at KPMG Peat Marwick and Bankers Trust Company. Ms. Egan is also a director of UNUM Group, a publicly traded insurance company providing group long-term disability insurance, employee benefits, individual disability insurance and special risk reinsurance; Vice Chair and Lead Independent Director of Huntsman Corporation, a publicly traded global manufacturer and marketer of differentiated and specialty chemicals; and a director of the BlackRock Fixed Income Funds Complex, a fund complex comprised of 101 mutual funds. Ms. Egan also serves as Chair of the Board of Visitors of the University of Maryland School of Medicine. We believe Ms. Egan’s qualifications to serve on our Board include her many years of management experience in the financial services industry at Fidelity and T. Rowe Price and her experience on other public company boards of directors. Ms. Egan is Chair of the Board, the Independent Presiding Director and a member of the Compensation and Human Capital Committee. Ms. Egan’s term expires in 2024. |

|

|

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 9

|

Martin P. Hughes

Age: 74 Director since 2020 |

Mr. Hughes serves as non-executive Chair of the Board of Directors of HUB International Limited (“HUB”), a privately held insurance brokerage firm providing an array of property, casualty, risk management, life and health, employee benefits, investment, and wealth management products and services across North America. Mr. Hughes previously served as Chair and CEO of HUB from 1999 to 2018, including while it was a publicly traded, New York Stock Exchange-listed company, before its sale to private investors. In addition, Mr. Hughes was Executive Chair of HUB from 2018 to January 2020. He joined Mack and Parker, Inc., an independent insurance agency (now a part of HUB), in 1973, where he served as President from 1990 to 1999, and as Chair from 1999 to 2001. Mr. Hughes has also served as chair of both the Council of Insurance Agents & Brokers, an association of the top commercial insurance and employee benefits intermediaries, as well as Assurex Global, a leading worldwide insurance services organization. We believe Mr. Hughes’s qualifications to serve on our Board include his over 40 years of experience in the insurance brokerage industry, his knowledge of both the property and casualty insurance industry and the agency and brokerage sales channel, his prior service as chief executive officer of a public company, and his many years of management and transactional experience in the insurance industry. Mr. Hughes is a member of the Audit Committee. Mr. Hughes’s term expires in 2024. |

|

|

|

Kathleen S. Lane

Age: 65 Director since 2018 |

Ms. Lane served as Executive Vice President and Chief Information Officer at The TJX Companies, Inc. from 2008 to 2013. Prior to joining TJX, Ms. Lane was Group Chief Information Officer at National Grid plc from 2006 to 2008. In addition, she served as Chief Information Officer at the Gillette Company, GE Oil & Gas, and GE Vendor Financial Services. Ms. Lane also served as Director, Technology Services of Pepsi Cola International and began her career at The Procter & Gamble Company. Ms. Lane previously served as a director of Bob Evans Farms, Inc., a publicly traded operator of over 500 restaurants and a producer and distributer of food products, from 2014 to 2018, and as a director of Armstrong Flooring, Inc., a publicly traded leading global producer of flooring products, from 2016 to 2022. We believe Ms. Lane’s qualifications to serve on our Board include her many years of executive and management experience as a Chief Information Officer at leading companies and her experience on other public company boards of directors. Ms. Lane is a member of the Nominating and Corporate Governance Committee. Ms. Lane’s term expires in 2024. |

|

|

|

Joseph R. Ramrath

Age: 66 Director since 2004 |

Mr. Ramrath is Senior Managing Director of Colchester Partners LLC, an investment banking and strategic advisory firm that he cofounded in 2002. Mr. Ramrath was Executive Vice President and Chief Legal Officer of the United Asset Management division of Old Mutual plc, an international financial services firm headquartered in London, England, from 2000 to 2002. Prior to that, he was Senior Vice President, General Counsel and Secretary of United Asset Management Corporation from 1996 until its acquisition by Old Mutual in 2000. Earlier in his career, Mr. Ramrath was a partner at Hill & Barlow, a Boston law firm, and a certified public accountant with Arthur Andersen & Co. We believe Mr. Ramrath’s qualifications to serve on our Board include his accounting, financial and legal background, his experience as a member of management and on the board of directors with other public companies, as well as his years of experience as an advisor to investment advisory companies. Mr. Ramrath is Chair of the Nominating and Corporate Governance Committee. Mr. Ramrath’s term expires in 2025. |

|

|

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 10

|

John C. Roche

Age: 59 Director since 2017 |

Mr. Roche has been President and Chief Executive Officer of the Company since November 2017. Prior to that, he led the Company’s personal and commercial lines businesses as Executive Vice President and President, Hanover Agency Markets. Since joining the Company in 2006, Mr. Roche has served in several senior leadership positions, including, President, Business Insurance; Vice President, Field Operations, Marketing and Distribution; and Vice President, Commercial Lines Underwriting and Product Management. Prior to joining the Company, he served in senior roles at the St. Paul Travelers Companies. He began his career at Fireman’s Fund and Atlantic Mutual, where he held a number of underwriting and management positions. We believe Mr. Roche’s qualifications to serve on our Board include his more than 30 years of experience in the property and casualty insurance industry, his management experience leading significant business units both at the Company and at St. Paul Travelers, and his detailed understanding of the Company and its business. Mr. Roche’s term expires in 2025. |

|

|

Board Profile and Diversity

The Board believes diversity among its members provides the Company a depth and breadth of insight, perspective and experience that are important to effective corporate governance and in addressing the complex challenges that the Company faces. To this end, the Board seeks members who represent a broad array of experiences and expertise in the context of the evolving needs of the Board.

The NCGC maintains a comprehensive skills and experience matrix for evaluating the background and skill set of the Board on both an individual director and collective basis. The matrix details key competencies, demographic information, and outside public company board, committee, committee chair and CEO experience. The NCGC tracks each director’s level of current and developing expertise across the key competencies in order for the Board to ensure that it can effectively oversee the long-term success of the Company and to align with the Company’s goal of being a premier property and casualty insurance company in the independent agency channel.

On a collective basis, the Board has expertise in the following categories of key competencies:

|

|

✓ |

property & casualty insurance (beyond service on our Board) |

|

|

✓ |

financial services |

|

|

✓ |

mergers, acquisitions, and strategic business combinations |

|

|

✓ |

finance / accounting |

|

|

✓ |

investments / portfolio management |

|

|

✓ |

technology |

|

|

✓ |

operations |

|

|

✓ |

marketing and distribution |

|

|

✓ |

governance |

|

|

✓ |

two sub-categories of property & casualty, one for underwriting and one for distribution |

|

|

✓ |

capital markets |

|

|

✓ |

risk management |

|

|

✓ |

information security |

|

|

✓ |

artificial intelligence / big data |

|

|

✓ |

legal / regulatory |

|

|

✓ |

investor relations |

|

|

✓ |

corporate strategy |

|

|

✓ |

human resources / human capital management |

|

|

✓ |

ESG |

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 11

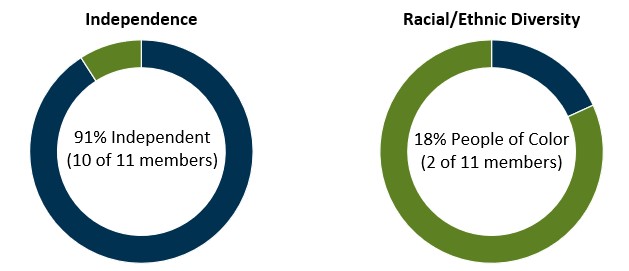

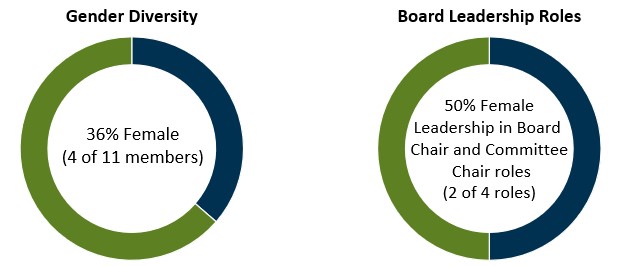

On a collective basis, the demographic profile of all director nominees and directors continuing in office after the Annual Meeting is reflected below.

Independence 91% Independent (10 of 11 members) Racial/Ethnic Diversity 18% People of Color (2 of 11 members)

Gender Diversity 36% Female (4 of 11 members) Board Leadership Roles 50% Female Leadership in Board Chair and Committee Chair roles (2 of 4 roles)

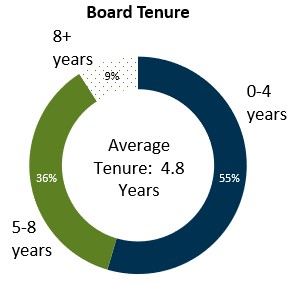

The Board recognizes the importance of Board refreshment to provide fresh ideas and perspectives and strives to balance refreshment with the benefits of tenure, namely Company Board experience and continuity. Since the beginning of 2021 we have added three new directors, and three directors retired from the Board after reaching mandatory retirement age under our Board retirement policy (including the two directors who will retire effective at the Annual Meeting). For purposes of providing a current snapshot of the Board, all director nominees and directors continuing in office after the Annual Meeting are included in the Board tenure profile below.

Board Tenure 8+ years 9 Average Tenure: 4.8 years 55% 0-4 years 5-8 years 36%

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 12

Director Independence

Under the New York Stock Exchange (“NYSE”) listing standards, a member of the Board only qualifies as “independent” if the Board affirmatively determines the director has no material relationship with the Company (either directly, or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Company’s Corporate Governance Guidelines include standards to assist the Board in determining whether a director has a material relationship with the Company. The standards conform to the standards established by the NYSE.

Mr. Hughes serves as non-executive chairman of HUB, and he is a former executive and employee of HUB. We conduct regular business activities with HUB. Most significantly, HUB is one of the Company’s appointed agents, placing both commercial lines and personal lines business with us. The Board and the NCGC examined these relationships again in 2023, as well as those of an immediate family member of Mr. Hughes who is a HUB executive, in light of the independence standards adopted by the NYSE and our Corporate Governance Guidelines and concluded that Mr. Hughes is independent under these standards. This conclusion was supported by the fact that the commission amounts paid to HUB did not exceed the relevant objective thresholds set forth in the applicable independence standards, Mr. Hughes is no longer an executive or employee of HUB, and because neither Mr. Hughes nor his family member are directly or indirectly involved in any transactions with the Company or any of its subsidiaries, nor will either of their compensation be directly or indirectly impacted by such transactions.

After review by and following the recommendation of the NCGC, the Board determined that every director is independent under the applicable standards, with the exception of Mr. Roche, who is the President and Chief Executive Officer of the Company.

There are no family relationships among any of the directors, director nominees or executive officers of the Company.

Related-Person Transactions

The Board has established a written procedure for the review, approval and/or ratification of “transactions with related persons” (as such term is defined by the SEC, provided that the dollar threshold for review and approval in our policy is $100,000, which is more stringent than the $120,000 threshold established by the SEC). Pursuant to such policy, any related-person transaction must be presented to the Audit Committee for review, and the Audit Committee may approve, ratify or reject the transaction. In the event management determines that it is impractical to convene an Audit Committee meeting to consummate a particular transaction, the Chair of the Audit Committee (or the Independent Presiding Director, in the event the Chair of the Audit Committee or any of her immediate family members is the “related person”) has the authority to approve the transaction. The Chair of the Audit Committee, or Independent Presiding Director, as applicable, shall report to the Audit Committee at its next meeting any approval under this policy pursuant to this delegated authority. No member of the Audit Committee may participate in any approval or ratification of a transaction with respect to which such member or any of his or her immediate family members is the related person. In preparing the Company’s SEC filings and in determining whether a transaction is subject to this policy, the Company’s General Counsel is entitled to make the determination of whether a particular relationship constitutes a material interest by a related person. In evaluating a transaction with a related person, the Audit Committee shall consider all relevant facts and circumstances available to it and shall approve or ratify only those transactions that are in, or not inconsistent with, the best interests of the Company and its shareholders, as it determines in good faith.

The Related Person Transaction Policy can be found on the Company’s website at www.hanover.com under “Why The Hanover—Our governance—Company policies—Related person transaction policy.” For a printed copy of the policy, shareholders should contact the Company’s Corporate Secretary.

Board Leadership Structure

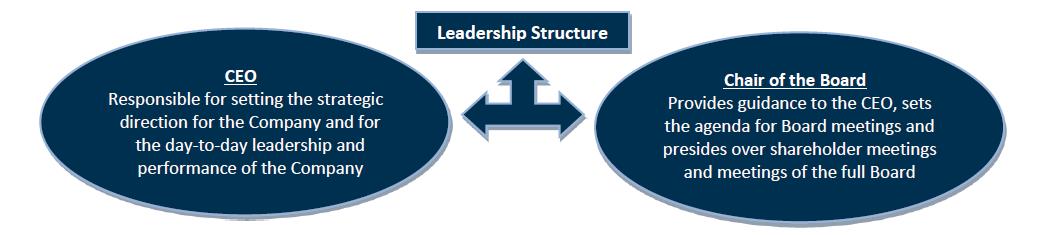

We separate the roles of CEO and Chair of the Board in recognition of the differences between the two positions.

CEO Responsible for setting the strategic direction for the Company and for the day-to-day leadership and performance of the Company Leadership Structure Chair of the Board Provides guidance to the CEO, sets the agenda for Board meetings and presides over shareholder meetings and meetings of the full Board

Additionally, we believe that separating the roles and having an independent Chair of the Board is consistent with corporate governance best practices and better supports effective management oversight and risk management. We have separated these roles since 2002. While we believe these goals can be achieved without necessarily separating the CEO and Chair designations, we also take into consideration Ms. Egan’s demonstrated skill in leading our Board and counseling management.

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 13

Ms. Egan’s duties as Chair of the Board are determined by the Board and include presiding over Board and shareholder meetings and over executive sessions of non-management directors (including the Committee of Independent Directors). The Chair of the Board may also be appointed to any committee of the Board.

It is the Board’s practice that in advance of regularly scheduled Board and committee meetings, the Chair of the Board, each Board committee chair, and the CEO convene to discuss and set the agendas for the respective meetings, based principally on a review of an annual topical calendar, prior discussions among directors and current topics of interest or concern. It is Ms. Egan's practice to speak with each director following regularly scheduled Board meetings and to have other regular discussions with directors as she deems appropriate, to solicit ongoing feedback and reinforce inclusiveness and engagement. She also typically meets individually with the CEO, Chief Financial Officer, and General Counsel of the Company following each Board meeting and as she otherwise deems appropriate.

The Board generally convenes in executive session (i.e., with no members of management present) in connection with regularly scheduled Board meetings and at other times as deemed appropriate. In addition, the Board regularly meets with the CEO with no other members of management present. Directors have regular access to other members of senior management.

Board Meetings and Attendance

During 2022, there were five meetings of the full Board of Directors. In addition to formal Board and committee meetings held throughout the year, directors routinely engage in communications and interactions and convene informal telephonic or in-person meetings for discussion or planning purposes. The Board routinely convenes meetings at its headquarters in Worcester, Massachusetts, and periodically convenes meetings at other locations. In addition, Board and committee meetings are also held virtually through the use of videoconferencing technology.

For meetings held in 2022, all of the incumbent directors attended at least 75% of the Board meetings and meetings of committees of which they were members. In addition, as provided in the Company’s Corporate Governance Guidelines, all continuing directors and director nominees are expected to attend the Annual Meeting. All the directors serving at the time were present at last year’s virtual annual meeting.

Board Committees

The standing committees of the Board consist of the Committee of Independent Directors (the “CID”), the Audit Committee, the Compensation and Human Capital Committee (the “C&HCC”), and the NCGC. Each committee is composed solely of directors determined by the Board to be independent. The responsibilities of each of the committees are set forth in their charters, which are reviewed annually. Committee charters are available on the Company’s website, www.hanover.com, under “Why The Hanover—Our governance—Committee charters.” For a printed copy of any committee charter, shareholders should contact the Company’s Corporate Secretary.

The current members of the committees of the Board are:

|

|

|

|

|

|

|

|

|

|

Board Committees |

|||

|

Director |

Independent |

Committee of Independent Directors |

Audit Committee |

Compensation and Human Capital Committee |

Nominating and Corporate Governance Committee |

|

|

|

|

|

|

|

|

Francisco A. Aristeguieta |

✓ |

✓ |

|

✓ |

|

|

Kevin J. Bradicich |

✓ |

✓ |

|

|

✓ |

|

Theodore H. Bunting, Jr. |

✓ |

✓ |

✓ |

|

|

|

Jane D. Carlin |

✓ |

✓ |

✓ (Chair) |

|

|

|

J. Paul Condrin III |

✓ |

✓ |

|

✓ (Chair) |

|

|

Cynthia L. Egan (Board Chair) |

✓ |

✓ |

|

✓ |

|

|

Martin P. Hughes |

✓ |

✓ |

✓ |

|

|

|

Wendell J. Knox |

✓ |

✓ |

|

✓ |

|

|

Kathleen S. Lane |

✓ |

✓ |

|

|

✓ |

|

Joseph R. Ramrath |

✓ |

✓ |

|

|

✓ (Chair) |

|

Harriett “Tee” Taggart |

✓ |

✓ |

✓ |

|

|

|

Elizabeth A. Ward |

✓ |

✓ |

✓ |

|

|

|

Number of meetings held in 2022† |

|

5 |

13 |

7 |

8 |

|

(Chair) |

Denotes the Chair of the applicable committee |

|

† |

Does not include informal meetings held by the committees throughout the year |

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 14

Committee of Independent Directors

The CID, consisting of all the independent members of the Board, discharges such responsibilities as are referred to it from time to time by the Board or one of the Board’s other committees. In particular, the CID is responsible for reviewing and approving the recommendations of the C&HCC and the NCGC, as applicable, with respect to establishing performance criteria (goals and objectives) for our CEO, evaluating the CEO’s performance and approving CEO compensation. In addition to meeting the independence requirements under the NYSE regulations, each committee member participating in approving the CEO’s compensation must also meet the independence requirements under Section 16 (“Section 16”) of the Securities Exchange Act of 1934 (the “Exchange Act”). The independent members of the Board typically meet in executive session at every scheduled Board meeting and from time-to-time meet informally. Topics of discussion at executive sessions include, among other things: the Company’s strategy, annual business plan and progress; key risks and challenges facing the Company; leadership development and succession; and other matters addressed during regular Board sessions with management.

Audit Committee

The Board has made a determination that the members of the Audit Committee satisfy the requirements of the NYSE as to independence, financial literacy and experience, and satisfy the independence requirements of the Sarbanes-Oxley Act of 2002. Accordingly, the Audit Committee is independent from management. The Board has determined that Messrs. Bunting and Hughes and Ms. Ward are Audit Committee financial experts and Mses. Carlin and Taggart are financially literate, in each case as defined by SEC regulations. The Audit Committee is, among other things, responsible for the selection and engagement, compensation, retention, evaluation, oversight and, when deemed appropriate, termination of the Company’s independent, registered public accounting firm. The Audit Committee annually evaluates the performance of the Company’s independent, registered public accounting firm, and determines whether to reengage it or consider other audit firms. Some of the factors considered by the Audit Committee in deciding whether to retain PwC, the Company’s independent, registered public accounting firm, include:

|

|

• |

PwC’s technical expertise and capabilities with respect to audit and non-audit services; |

|

|

• |

PwC’s depth of knowledge of the Company’s operations and businesses, accounting policies and practices, and internal control over financial reporting, and PwC’s tenure as independent auditor, including the relative benefits compared to any concerns that may be associated with a longer tenure; |

|

|

• |

PwC’s independence and processes for maintaining its independence; |

|

|

• |

the quality and candor of PwC’s communications with the Audit Committee and management; and |

|

|

• |

the appropriateness of PwC’s fees relative to the scope and efficiency of the audit and non-audit services provided. |

The Audit Committee also has oversight responsibility for the Company’s General Auditor and must approve matters related to the General Auditor’s employment and compensation. The Audit Committee generally meets in executive session separately with representatives of PwC, the Chief Financial Officer and the General Auditor, and by themselves, following regularly scheduled committee meetings. The Audit Committee also meets from time to time in executive sessions with the Company’s Chief Actuary, Chief Risk Officer and General Counsel.

The Audit Committee reviews and discusses the Company’s financial statements and earnings press releases with management and PwC prior to their release. Among its other responsibilities, as set forth in its charter, the Audit Committee reviews the arrangements for and the results of the auditor’s examination of the Company’s books and records, auditors’ compensation, internal accounting control procedures, and activities and recommendations of the Company’s internal auditors, as well as any reports relating to the integrity of our financial statements, internal financial controls or auditing matters that are reported on our anonymous Alertline. The Audit Committee also reviews the Company’s significant accounting policies, the effect of regulatory and accounting initiatives, control systems, reserving practices, information security and disaster recovery programs, compliance with legal and regulatory requirements, outstanding major litigation (if applicable), major enterprise risks, management’s approach to managing and mitigating the Company’s exposure to data security and privacy risk, and the Company’s efforts associated with cybersecurity, as well as the resources of PwC dedicated to or otherwise supporting the Company’s audit. As noted above, the Audit Committee is also responsible for reviewing related-person transactions and assisting the Board in assessing the adequacy of the Company’s enterprise risk management program. The Audit Committee receives periodic reports regarding developments in the regulatory environment and relevant legislative reforms.

Compensation and Human Capital Committee

The C&HCC has oversight responsibility with respect to compensation matters involving directors and executive officers of THG and makes compensation decisions regarding our executive officers (other than the CEO). In conjunction with the Chair of the Board and the NCGC, the C&HCC annually reviews the CEO’s performance and other relevant external factors and makes a recommendation to the CID for the CEO’s annual compensation. It also provides general oversight of the Company’s compensation structure, including compensation plans and benefits programs applicable to all employees, and oversees a risk-based analysis of the Company’s incentive arrangements. Except to the extent reviewed by the Board, the C&HCC is also tasked with periodically reviewing the Company’s strategies, policies, practices and experience relating to recruiting and retention, personnel practices,

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 15

succession planning, corporate culture and human capital development, including policies and practices relating to inclusion, diversity and equity (“IDE”).

In addition to meeting the independence requirements under the NYSE regulations, each committee member must meet the independence requirements under Section 16. Each of the members of the C&HCC satisfies the independence requirements of the NYSE listing standards and applicable SEC requirements. The C&HCC may delegate any of its responsibilities to a subcommittee comprised of one or more of its members.

Use of Independent Outside Compensation Consultant

Through May of 2022, the C&HCC engaged Frederic W. Cook & Co., Inc. (“F.W. Cook”) as its independent compensation consultant. Subsequently, the C&HCC elected to engage Compensation Advisory Partners LLC (“CAP”) as its independent compensation consultant.

During 2022, a representative of F.W. Cook or CAP, as applicable:

|

|

• |

regularly attended, either in person, telephonically or via video conference, C&HCC meetings; |

|

|

• |

periodically participated in executive sessions of the C&HCC, at which no members of management were present; |

|

|

• |

provided relevant market and comparative data and information; |

|

|

• |

provided advice regarding compensation trends and developments; |

|

|

• |

assisted in the review and design of our director and executive compensation programs; and |

|

|

• |

provided advice with respect to compensation decisions relating to our executive officers and directors. |

Additionally, for 2022, F.W. Cook reviewed and provided comments regarding the executive compensation disclosure in the 2022 Proxy Statement and provided input to the C&HCC and to management regarding the selection of peer companies against which to evaluate compensation levels and practices.

F.W. Cook and CAP were selected by, and report to, the C&HCC. Neither F.W. Cook nor CAP were engaged by the Company for any other purpose, and the C&HCC reviewed all compensation payable to these firms.

Pursuant to its charter, the C&HCC may select its outside compensation consultant only after taking into consideration factors relevant to that consultant’s independence, including such factors required to be considered under the listing standards of the NYSE. The C&HCC reviewed such factors as it deemed appropriate, including all such factors required by the NYSE listing standards, and is satisfied as to both F.W. Cook’s and CAP’s independence from the Company and its management.

Nominating and Corporate Governance Committee

The NCGC advises and makes recommendations to the Board on all matters concerning directorship and corporate governance practices and the selection of candidates as nominees for election as directors. The NCGC coordinates and oversees the Board’s evaluation of the individual directors who are eligible for re-nomination and election at each annual meeting of shareholders. The committee recommended this year’s candidates for election and, in consultation with the Chair of the Board, recommends Board member committee assignments to the full Board. The NCGC is responsible for facilitating the Board’s annual review of the performance of the CEO. The NCGC also monitors the Company’s corporate citizenship, charitable giving, sustainability and ESG efforts, as well as shareholder advocacy matters.

Director Evaluation Process

The NCGC leads an annual review of the Board that examines, at the Board level and at each committee level, overall effectiveness across multiple evaluation areas, including: governance processes; whether the Board and the committees are maintaining the proper level of oversight; Board composition and function; meeting content, structure and preparation; and management’s interaction with the Board. The NCGC facilitates discussion of the results of the assessment annually among the Board and each Board committee, with the Chair leading the process for the full Board and each committee chair leading the process for their own committee. Our evaluation process encompasses an examination of the Board as a whole, each Board committee, and each individual director whose term is expiring at the next annual meeting, to determine if that director should be re-nominated for another term. Evaluations of individual directors who are up for re-nomination include a peer review questionnaire that is completed by each of the other directors and reviewed by the Board Chair and NCGC Chair or, in instances where one of these chairs is the subject of an evaluation, by the other chair and another member of the NCGC. The NCGC considers the feedback in its assessment of individual member contributions when making its nomination recommendations to the full Board, who then make final determinations regarding Board-nominated candidates. In addition to the formal director evaluation process, the Chair solicits informal feedback from directors during her follow-up calls to each director after the conclusion of every regularly scheduled Board meeting. The Board leverages a third-party platform to facilitate, streamline and provide anonymity to the review process, with a view toward facilitating candor and encouraging constructive insight.

THE HANOVER INSURANCE GROUP 2023 PROXY STATEMENT 16

Consideration of Director Nominees

The NCGC may identify candidates for nomination to the Board through several sources, including recommendations of non-management directors, shareholders, the CEO, other executive officers, an outside search firm or other resources. Committee members review the backgrounds of candidates in light of the current needs of the Board and the key competencies discussed above, interview qualified candidates, conduct inquiries with references and review available information pertaining to the candidate’s qualifications and background.

Director Qualifications

Members of the Board and nominees for election should possess high personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company and its shareholders, employees, agents, customers and local communities. To maintain a majority of independent directors on the Board, as required by our Corporate Governance Guidelines, the NCGC and the Board have a strong preference that nominees meet our independence standards. Board members and nominees should demonstrate initiative, be participatory and contribute a perspective based on practical experience and mature judgment. The Board seeks members who represent a broad array of experiences and expertise in the context of the evolving needs of the Board. While we do not have a policy in this regard, when evaluating a candidate for Board membership, the NCGC and the Board also take into consideration factors such as diversity of race, gender, ethnicity and age. In addition, without the approval of the NCGC, nominees who are CEOs (or others with similar responsibilities) should serve on no more than two other public company boards, and other nominees should serve on no more than three other public company boards. All directors and nominees for election are in compliance with this policy.

As described above under “Board Profile and Diversity” starting on page 11, the NCGC maintains a comprehensive skills and experience matrix for evaluating the background and skill set of the Board on both an individual director and collective basis. The Board seeks director candidates whose skills, experience, and expertise can augment the key competencies the NCGC and the Board have identified.

Shareholder Nominees