Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-12719

GOODRICH PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 76-0466193 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 801 Louisiana, Suite 700 Houston, Texas |

77002 | |

| (Address of principal executive offices) | (Zip Code) | |

(713) 780-9494 (Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Common Stock, par value $0.20 per share |

New York Stock Exchange | |

| (Title of Class) | (Name of Exchange) | |

Securities Registered Pursuant to Section 12(g) of the Act:

Series B Preferred Stock, $1.00 par value

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Small reporting company ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

The aggregate market value of Common Stock, par value $0.20 per share (Common Stock), held by non-affiliates (based upon the closing sales price on the New York Stock Exchange on June 30, 2012, the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $359.7 million. The number of shares of the registrant’s common stock outstanding as of February 18, 2013 was 36,759,232.

Documents Incorporated By Reference:

Portions of Goodrich Petroleum Corporation’s definitive Proxy Statement, which will be filed with the Securities and Exchange Commission within 120 days of December 31, 2012, are incorporated by reference in Part III of this Form 10-K.

Table of Contents

GOODRICH PETROLEUM CORPORATION

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED

December 31, 2012

2

Table of Contents

PART I

Items 1. and 2. Business and Properties

General

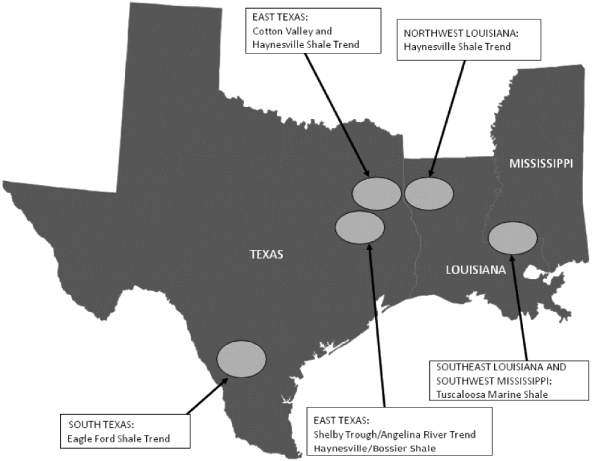

Goodrich Petroleum Corporation, a Delaware corporation (together with its subsidiary, “we,” “our,” or “the Company”) formed in 1995, is an independent oil and natural gas company engaged in the exploration, development and production of oil and natural gas on properties primarily in (i) South Texas, which includes the Eagle Ford Shale Trend, (ii) Northwest Louisiana and East Texas, which includes the Haynesville Shale and Cotton Valley Taylor Sand and (iii) Southwest Mississippi and Southeast Louisiana which includes the Tuscaloosa Marine Shale. In the current depressed natural gas price environment, we are concentrating the vast majority of our development efforts on existing leased acreage within formations that are prospective for oil. In addition, we continue to aggressively pursue the evaluation and acquisition of prospective acreage and oil and natural gas drilling opportunities outside of our existing leased acreage. We own working interests in 392 producing oil and natural gas wells located in 32 fields in eight states. At December 31, 2012, we had estimated proved reserves of approximately 333.1 Bcfe, comprised of 254.0 Bcf of natural gas, 5.1 MMBbls of natural gas liquids (NGLs) and 8.1 MMBbls of oil and condensate.

We operate as one segment as each of our operating areas have similar economic characteristics and each meet the criteria for aggregation as defined by accounting standards related to disclosures about segments of an enterprise.

Available Information

Our principal executive offices are located at 801 Louisiana Street, Suite 700, Houston, Texas 77002.

Our website address is http://www.goodrichpetroleum.com. We make available, free of charge through the Investor Relations portion of our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). Reports of beneficial ownership filed pursuant to Section 16(a) of the Exchange Act are also available on our website. Information contained on our website is not part of this report.

We file or furnish annual, quarterly and current reports, proxy statements and other documents with the SEC under the Exchange Act. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

3

Table of Contents

GLOSSARY OF CERTAIN OIL AND NATURAL GAS TERMS

As used herein, the following terms have specific meanings as set forth below:

| Bbls | Barrels of crude oil or other liquid hydrocarbons | |

| Bcf | Billion cubic feet | |

| Bcfe | Billion cubic feet equivalent | |

| MBbls | Thousand barrels of crude oil or other liquid hydrocarbons | |

| Mcf | Thousand cubic feet of natural gas | |

| Mcfe | Thousand cubic feet equivalent | |

| MMBbls | Million barrels of crude oil or other liquid hydrocarbons | |

| MMBtu | Million British thermal units | |

| Mmcf | Million cubic feet of natural gas | |

| Mmcfe | Million cubic feet equivalent | |

| MMBoe | Million barrels of crude oil or other liquid hydrocarbons equivalent | |

| NGL | Natural gas liquids | |

| SEC | United States Securities and Exchange Commission | |

| U.S. | United States |

Crude oil and other liquid hydrocarbons are converted into cubic feet of natural gas equivalent based on six Mcf of natural gas to one barrel of crude oil or other liquid hydrocarbons.

Development well is a well drilled within the proved area of an oil or natural gas field to the depth of a stratigraphic horizon known to be productive.

Dry hole is an exploratory, development or extension well that proves to be incapable of producing either oil or natural gas in sufficient quantities to justify completion as an oil or natural gas well.

Economically producible as it relates to a resource, means a resource that generates revenue that exceeds, or is reasonably expected to exceed, the costs of the operation. The value of the products that generate revenue shall be determined at the terminal point of oil-and-natural gas producing activities.

Estimated ultimate recovery is the sum of reserves remaining as of a given date and cumulative production as of that date.

Exploratory well is a well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or natural gas in another reservoir. Generally, an exploratory well is any well that is not a development well, a service well or a stratigraphic test well.

Farm-in or farm-out is an agreement whereby the owner of a working interest in an oil and natural gas lease or license assigns the working interest or a portion thereof to another party who desires to drill on the leased or licensed acreage. Generally, the assignee is required to drill one or more wells to earn its interest in the acreage. The assignor (the “farmor”) usually retains a royalty or reversionary interest in the lease. The interest received by an assignee is a “farm-in,” while the interest transferred by the assignor is a “farm-out.”

Field is an area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature or stratigraphic condition. The SEC provides a complete definition of field in Rule 4-10 (a) (15).

PV-10 is the pre-tax present value, discounted at 10% per year, of estimated future net revenues from the production of proved reserves, computed by applying the 12-month average price for the year and holding that price constant throughout the productive life of the reserves (except for consideration of price changes to the extent provided by contractual arrangements), and deducting the estimated future costs to be incurred in

4

Table of Contents

developing, producing and abandoning the proved reserves (computed based on current costs and assuming continuation of existing economic conditions). PV-10 is not a Generally Accepted Accounting Principles (“GAAP”) financial measure.

Productive well is an exploratory, development or extension well that is not a dry well.

Proved reserves are those quantities of oil and natural gas which, by analysis of geosciences and engineering data can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulation prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. As used in this definition, “existing economic conditions” include prices and costs at which economic producibility from a reservoir is to be determined. The prices shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based on future reconditions. The SEC provides a complete definition of proved reserves in Rule 4-10 (a) (22) of Regulation S-X.

Developed oil and natural gas reserves are proved reserves that can be expected to be recovered through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared with the cost of a new well or through installed extraction equipment and infrastructure operational at the time of the reserves estimates if the extraction is by means not involving a well.

Reasonable certainty means a high degree of confidence that the quantities will be recovered, if deterministic methods are used. If probabilistic methods are used, there should be at least a 90 percent probability that the quantities actually recovered will equal or exceed the estimate. A high degree of confidence exists if the quantity is much more likely to be achieved than not, and, as changes due to increased availability of geosciences (geological, geophysical, and geochemical), engineering, and economic data are made to estimated ultimate recovery with time, reasonably certain estimated ultimate recovery is much more likely to increase or remain constant than to decrease. The deterministic method of estimating reserves or resources uses a single value for each parameter (from the geosciences, engineering, or economic data) in the reserves calculation. The probabilistic method of estimation of reserves or resources uses the full range of values that could reasonably occur for each unknown parameter (from the geosciences and engineering data) to generate a full range of possible outcomes and their associated probabilities of occurrence.

Reserves are estimated remaining quantities of oil and natural gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and natural gas or related substances to market, and all permits and financing required to implement the project.

Undeveloped reserves are proved reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time. Under no circumstances shall estimates for undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, or by other evidence using reliable technology establishing reasonable certainty.

5

Table of Contents

Working interest is the operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and a share of production.

Workover is a series of operations on a producing well to restore or increase production.

Gross well or acre is a well or acre in which the registrant owns a working interest. The number of gross wells is the total number of wells in which the registrant owns a working interest.

Net well or acre is deemed to exist when the sum of fractional ownership working interests in gross wells or acres equals one. The number of net wells or acres is the sum of the fractional working interests owned in gross wells or acres expressed as whole numbers and fractions of whole numbers.

6

Table of Contents

Oil and Natural Gas Operations and Properties

Overview. As of December 31, 2012, nearly all of our proved oil and natural gas reserves were located in Louisiana, Texas and Mississippi. We spent substantially all of our 2012 capital expenditures of $250.7 million in these areas, with $173.5 million, or 69%, spent on the Eagle Ford Shale Trend, $48.7 million, or 19%, on the Tuscaloosa Marine Shale and $26.8 million, or 11%, spent on the Haynesville Shale Trend. Our total capital expenditures, including accrued costs for services performed during 2012, consist of $221.3 million for drilling and completion costs, $22.3 million for leasehold acquisitions, $5.7 million for facilities, infrastructure and equipment and $1.4 million for geological and geophysical costs.

The table below details our acreage positions, average working interest and producing wells as of December 31, 2012.

| Field or Area |

Acreage As of December 31, 2012 |

Average Working Interest |

Producing Wells at December 31, 2012 |

|||||||||||||

| Gross | Net | |||||||||||||||

| Eagle Ford Shale Trend |

53,515 | 38,582 | 72 | % | 51 | |||||||||||

| Cotton Valley Taylor Sand |

43,185 | 38,339 | 93 | % | 5 | |||||||||||

| Haynesville Shale Trend |

122,555 | 78,860 | 46 | % | 78 | |||||||||||

| Tuscaloosa Marine Shale |

158,214 | 134,244 | 84 | % | 2 | |||||||||||

| Other |

32,029 | 6,831 | 39 | % | 256 | |||||||||||

7

Table of Contents

Eagle Ford Shale Trend

As of December 31, 2012, we have acquired or farmed-in leases totaling approximately 53,500 gross (38,600 net) lease acres. In 2010 we began development and production activity in the Eagle Ford Shale and Buda Lime formations (“Eagle Ford Shale Trend”) in La Salle and Frio Counties located in South Texas. During 2012, we drilled 33 gross (22 net) oil wells.

Tuscaloosa Marine Shale

As of December 31, 2012, we have acquired approximately 158,200 gross (134,200 net) lease acres in the Tuscaloosa Marine Shale Trend, an emerging oil shale play in East Feliciana, West Feliciana, St. Helena, Concordia and Washington parishes in Southeast Louisiana and Wilkinson, Pike and Amite Counties in Southwest Mississippi. During 2012, we conducted drilling operations on six gross (two net) and added to production two gross (0.5 net) Tuscaloosa Marine Shale wells. One gross (0.8 net) drilling well resulted in a mechanical failure in which operations have been suspended.

Haynesville Shale Trend

As of December 31, 2012, we have acquired or farmed-in leases totaling approximately 122,600 gross (78,900 net) acres in the Haynesville Shale. During 2012, we drilled and completed six gross (three net) successful Haynesville Shale wells. Our Haynesville Shale drilling activities are located in five primary leasehold areas in East Texas and Northwest Louisiana.

In December 2010, we sold a significant amount of our shallow rights in fields in East Texas and Northwest Louisiana, but retained ownership of all the deep rights including the Haynesville and Bossier Shale formations. The sale resulted in net proceeds of $64.9 million, after normal closing adjustments.

Cotton Valley Taylor Sand

As of December 31, 2012, we have acquired or farmed-in leases totaling approximately 43,200 gross (38,300 net) lease acres in the Cotton Valley Taylor Sand Trend. During 2012, we drilled and completed one gross (0.5 net) well, with a 100% success rate.

Other

As of December 31, 2012, we maintained ownership interests in acreage and/or wells in several additional fields including: the Midway field in San Patricio County, Texas and the Garfield Unit in Kalkaska County, Michigan.

On September 28, 2012, we closed the sale of certain non-core natural gas properties in the South Henderson field in the Cotton Valley Taylor Sand Trend to Memorial Resource Development, L.L.C. The total consideration paid for these assets was $95 million and we recognized a gain on the sale of assets of $44.0 million. The sale was effective as of July 1, 2012.

See “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K for additional information on our recent operations and plans for 2013 in the Haynesville Shale, Eagle Ford Shale and Tuscaloosa Marine Shale Trends.

8

Table of Contents

Oil and Natural Gas Reserves

The following tables set forth summary information with respect to our proved reserves as of December 31, 2012 and 2011, as estimated by Netherland, Sewell & Associates, Inc. (“NSAI”), our independent reserve engineers. A copy of their summary reserve report for 2012 is included as an exhibit to this Annual Report on Form 10-K. For additional information see Supplemental Information “Oil and Natural Gas Producing Activities (Unaudited)” to our consolidated financial statements in Part II Item 8 of this Annual Report on Form 10-K.

| Proved Reserves at December 31, 2012 | ||||||||||||||||

| Developed Producing |

Developed Non-Producing |

Undeveloped | Total | |||||||||||||

| (dollars in thousands) | ||||||||||||||||

| Net Proved Reserves: |

||||||||||||||||

| Oil (MBbls) (1) |

3,549 | 1,058 | 3,453 | 8,060 | ||||||||||||

| NGL (MBbls) (5) (6) |

1,674 | 166 | 3,289 | 5,129 | ||||||||||||

| Natural Gas (Mmcf) |

100,949 | 18,722 | 134,310 | 253,981 | ||||||||||||

| Natural Gas Equivalent (Mmcfe) (2) |

132,284 | 26,068 | 174,764 | 333,116 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Estimated Future Net Cash Flows |

$ | 675,529 | ||||||||||||||

|

|

|

|||||||||||||||

| PV-10 (3) |

$ | 359,094 | ||||||||||||||

| Discounted Future Income Taxes |

(1,645 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Standardized Measure of Discounted Net Cash Flows (3) |

$ | 357,449 | ||||||||||||||

|

|

|

|||||||||||||||

| Proved Reserves at December 31, 2011 | ||||||||||||||||

| Developed Producing |

Developed Non-Producing |

Undeveloped | Total | |||||||||||||

| (dollars in thousands) | ||||||||||||||||

| Net Proved Reserves: |

||||||||||||||||

| Oil (MBbls) (1) |

2,329 | 222 | 3,151 | 5,702 | ||||||||||||

| NGL (MBbls) (4) (6) |

3,854 | 127 | 3,833 | 7,814 | ||||||||||||

| Natural Gas (Mmcf) (4) |

152,066 | 17,277 | 239,364 | 408,707 | ||||||||||||

| Natural Gas Equivalent (Mmcfe) (2) |

189,161 | 19,377 | 281,267 | 489,805 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Estimated Future Net Cash Flows |

$ | 1,049,967 | ||||||||||||||

|

|

|

|||||||||||||||

| PV-10 (3) |

$ | 452,009 | ||||||||||||||

| Discounted Future Income Taxes |

(4,039 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Standardized Measure of Discounted Net Cash Flows (3) |

$ | 447,970 | ||||||||||||||

|

|

|

|||||||||||||||

| (1) | Includes condensate. |

| (2) | Based on ratio of six Mcf of natural gas per Bbl of oil and per Bbl of NGLs. |

| (3) | PV-10 represents the discounted future net cash flows attributable to our proved oil and natural gas reserves before income tax, discounted at 10%. PV-10 of our total year-end proved reserves is considered a non-GAAP financial measure as defined by the SEC. We believe that the presentation of the PV-10 is relevant and useful to our investors because it presents the discounted future net cash flows attributable to our proved reserves before taking into account future corporate income taxes and our current tax structure. We further believe investors and creditors use our PV-10 as a basis for comparison of the relative size and value of our reserves to other companies. Our standardized measure of discounted future net cash flows of proved reserves, or standardized measure, as of December 31, 2012 was $357.4 million. See the reconciliation of our PV-10 to the standardized measure of discounted future net cash flows in the table above. |

| (4) | Reserves were recast for 2011 to break out NGLs from our natural gas in our Eagle Ford Shale Trend, West Brachfield, South Henderson, Minden and Beckville fields. |

9

Table of Contents

| (5) | NGL reserves for 2012 include our Eagle Ford Shale Trend, West Brachfield, Minden and Beckville fields but not South Henderson as it was sold in September 2012. |

| (6) | Our production and sales volumes are accounted for and disclosed based on the wet gas stream at the point of sale. We report no NGL production, as NGLs are processed after the point of sale. However, we share and receive the pricing benefit of the revenue stream of the gas through the processing. We believe that presenting NGLs separately from natural gas and oil in our reserve report provides more information for our investors. The presentation of NGLs as a separate commodity more accurately presents to investors our economic interest in those NGLs separated, produced and sold from the wet gas streams (which we realize through our sharing in the revenue stream attributable to the processed NGLs). These commodities have separate pricing that is monitored in the marketplace. |

The following table presents our reserves by targeted geologic formation in Mmcfe.

| December 31, 2012 | ||||||||||||||||

| Area |

Proved Developed |

Proved Undeveloped |

Proved Reserves |

% of Total |

||||||||||||

| Haynesville Shale Trend |

84,231 | 65,812 | 150,043 | 45 | % | |||||||||||

| Cotton Valley Taylor Sand Trend |

8,609 | 87,989 | 96,598 | 29 | % | |||||||||||

| Eagle Ford Shale Trend |

30,991 | 20,434 | 51,425 | 16 | % | |||||||||||

| Tuscaloosa Marine Shale Trend |

516 | 529 | 1,045 | — | ||||||||||||

| Other |

34,005 | — | 34,005 | 10 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

158,352 | 174,764 | 333,116 | 100 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Reserve engineering is a subjective process of estimating underground accumulations of crude oil, condensate and natural gas that cannot be measured in an exact manner, and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. The quantities of oil and natural gas that are ultimately recovered, production and operating costs, the amount and timing of future development expenditures and future oil and natural gas sales prices may differ from those assumed in these estimates. Therefore, the PV-10 amounts shown above should not be construed as the current market value of the oil and natural gas reserves attributable to our properties.

In accordance with the guidelines of the SEC, our independent reserve engineers’ estimates of future net revenues from our estimated proved reserves, and the PV-10 and standardized measure thereof, were determined to be economically producible under existing economic conditions, which requires the use of the 12-month average price for each product, calculated as the unweighted arithmetic average of the first-day-of-the-month price for the period of January 2012 through December 2012, except where such guidelines permit alternate treatment, including the use of fixed and determinable contractual price escalations. For reserves at December 31, 2012, the average twelve month prices used were $2.76 per MMBtu of natural gas and $91.21 per Bbl of crude oil/condensate. These prices do not include the impact of hedging transactions, nor do they include the adjustments that are made for applicable transportation and quality differentials, and price differentials between natural gas liquids and oil, which are deducted from or added to the index prices on a well by well basis in estimating our proved reserves and related future net revenues.

Our proved reserve information as of December 31, 2012 included in this Annual Report on Form 10-K was estimated by our independent petroleum consultant, NSAI, in accordance with petroleum engineering and evaluation principles and definitions and guidelines set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Natural Gas Reserve Information promulgated by the Society of Petroleum Engineers. The technical persons responsible for preparing the reserves estimates presented herein meet the requirements regarding qualifications, independence, objectivity and confidentiality set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Natural Gas Reserves Information promulgated by the Society of Petroleum Engineers.

10

Table of Contents

Our principal engineer has over 30 years of experience in the oil and natural gas industry, including over 25 years as a reserve evaluator, trainer or manager. Further professional qualifications of our principal engineer include a degree in petroleum engineering, extensive internal and external reserve training, and experience in asset evaluation and management. In addition, the principal engineer is an active participant in professional industry groups and has been a member of the Society of Petroleum Engineers for over 30 years.

Our estimates of proved reserves are made by NSAI, as our independent petroleum engineers. Our internal professional staff works closely with our external engineers to ensure the integrity, accuracy and timeliness of data that is furnished to them for their reserve estimation process. In addition, other pertinent data such as seismic information, geologic maps, well logs, production tests, material balance calculations, well performance data, operating procedures and relevant economic criteria is provided to them. We make available all information requested, including our pertinent personnel, to the external engineers as part of their evaluation of our reserves.

We consider providing independent fully engineered third-party estimate of reserves from a nationally reputable petroleum engineering firm, such as NSAI, to be the best control in ensuring compliance with Rule 4-10 of Regulation S-X for reserve estimates.

While we have no formal committee specifically designated to review reserves reporting and the reserves estimation process, a preliminary copy of the NSAI reserve report is reviewed by our senior management with representatives of NSAI and our internal technical staff. Additionally, our senior management reviews and approves any internally estimated significant changes to our proved reserves semi-annually.

Proved reserves are those quantities of oil and natural gas, which, by analysis of geosciences and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations. The term “reasonable certainty” implies a high degree of confidence that the quantities of oil and/or natural gas actually recovered will equal or exceed the estimate. To achieve reasonable certainty, NSAI employed technologies that have been demonstrated to yield results with consistency and repeatability. The technologies and economic data used in the estimation of our proved reserves include, but are not limited to, well logs, geologic maps, available downhole and production data, seismic data and well test data.

Our total proved reserves at December 31, 2012, as estimated by NSAI, were 333.1 Bcfe, consisting of 254.0 Bcf of natural gas, 5.1 MMBbls of NGLs and 8.1 MMBbls of oil and condensate. In 2012 we added approximately 2.1 Bcfe related to the Haynesville Shale Trend and Cotton Valley Taylor Sand Trend, 29.1 Bcfe related to the Eagle Ford Shale Trend and 1.2 Bcfe in other areas. We had negative revisions of approximately 120.8 Bcfe, sale of minerals of 36.1 Bcfe and produced 32.2 Bcfe in 2012. The vast majority of our negative revisions related to the loss of proved undeveloped natural gas reserves reflecting low natural gas prices for the year ended December 31, 2012 at an average Henry Hub spot price of $2.76 per MMBtu.

Our proved undeveloped reserves at December 31, 2012 were 174.8 Bcfe or 52% of our total proved reserves, consisting of 134.3 Bcf of natural gas, 3.3 MMBbls of NGLs and 3.5 MMBbls of oil and condensate. In 2012 we added approximately 14.0 Bcfe related to the Eagle Ford Shale Trend and 0.5 Bcfe related to the Tuscaloosa Marine Shale Trend. We had negative revisions of 103.7 Bcfe and we developed approximately 17.4 Bcfe, or 6% of our total proved undeveloped reserves booked as of December 31, 2011 through the drilling of 16 gross (10 net) development wells at an aggregate capital cost of approximately $73.2 million. Of the proved undeveloped reserves in our December 31, 2012 reserve report, none have remained undeveloped for more than five years since the date of initial booking as proved undeveloped reserves and none are scheduled for commencement of development on a date more than five years from the date the reserves were initially booked as proved undeveloped.

11

Table of Contents

Productive Wells

The following table sets forth the number of productive wells in which we maintain ownership interests as of December 31, 2012:

| Oil | Natural Gas | Total | ||||||||||||||||||||||

| Gross (1) | Net (2) | Gross (1) | Net (2) | Gross (1) | Net (2) | |||||||||||||||||||

| South Texas |

51 | 34 | — | — | 51 | 34 | ||||||||||||||||||

| East Texas |

1 | — | 207 | 194 | 208 | 194 | ||||||||||||||||||

| Northwest Louisiana |

— | — | 105 | 44 | 105 | 44 | ||||||||||||||||||

| Other |

14 | 4 | 14 | — | 28 | 4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Productive Wells |

66 | 38 | 326 | 238 | 392 | 276 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Royalty and overriding interest wells that have immaterial values are excluded from the above table. As of December 31, 2012, only three wells with royalty-only and overriding interests-only are included. |

| (2) | Net working interest. |

Productive wells consist of producing wells and wells capable of production, including natural gas wells awaiting pipeline connections. A gross well is a well in which we maintain an ownership interest, while a net well is deemed to exist when the sum of the fractional working interests owned by us equals one. Wells that are completed in more than one producing horizon are counted as one well. Of the gross wells reported above, 51 wells had completions in multiple producing horizons.

Acreage

The following table summarizes our gross and net developed and undeveloped acreage under lease as of December 31, 2012. Acreage in which our interest is limited to a royalty or overriding royalty interest is excluded from the table.

| Developed | Undeveloped | Total | ||||||||||||||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||||||||||||||

| South Texas |

14,199 | 10,460 | 39,316 | 28,123 | 53,515 | 38,583 | ||||||||||||||||||

| East Texas |

80,556 | 50,832 | 32,471 | 22,948 | 113,027 | 73,780 | ||||||||||||||||||

| Northwest Louisiana |

38,412 | 22,167 | 3,025 | 1,752 | 41,437 | 23,919 | ||||||||||||||||||

| Southeast Louisiana |

— | — | 72,050 | 71,880 | 72,050 | 71,880 | ||||||||||||||||||

| Southwest Mississippi |

490 | 387 | 85,674 | 61,977 | 86,164 | 62,364 | ||||||||||||||||||

| Other |

2,135 | 227 | 9 | 9 | 2,144 | 236 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

135,792 | 84,073 | 232,545 | 186,689 | 368,337 | 270,762 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Undeveloped acreage is considered to be those lease acres on which wells have not been drilled or completed to the extent that would permit the production of commercial quantities of natural gas or oil, regardless of whether or not such acreage contains proved reserves. As is customary in the oil and natural gas industry, we can retain our interest in undeveloped acreage by drilling activity that establishes commercial production sufficient to maintain the leases or by payment of delay rentals during the remaining primary term of such a lease. The oil and natural gas leases in which we have an interest are for varying primary terms; however, most of our developed lease acreage is beyond the primary term and is held so long as natural gas or oil is produced.

Lease Expirations

Our undeveloped lease acreage, excluding optioned acreage, will expire during the next four years, unless the leases are converted into producing units or extended prior to lease expiration.

12

Table of Contents

The following table sets forth the lease expirations as of December 31, 2012:

| Year |

Net Acreage |

|||

| 2013 |

10,847 | |||

| 2014 |

38,252 | |||

| 2015 |

14,008 | |||

| 2016 |

6,119 | |||

Operator Activities

We operate a majority of our producing properties by value, and will generally seek to become the operator of record on properties we drill or acquire. Chesapeake Energy Corporation (“Chesapeake”) continues to operate our jointly-owned Northwest Louisiana acreage in the Haynesville Shale.

Drilling Activities

The following table sets forth our drilling activities for the last three years. As denoted in the following table, “gross” wells refer to wells in which a working interest is owned, while a “net” well is deemed to exist when the sum of the fractional working interests we own in gross wells equals one.

| Year Ended December 31, | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | ||||||||||||||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||||||||||||||

| Development Wells: |

||||||||||||||||||||||||

| Productive |

40 | 25.3 | 46 | 24.1 | 44 | 18.9 | ||||||||||||||||||

| Non-Productive |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

40 | 25.3 | 46 | 24.1 | 44 | 18.9 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Exploratory Wells: |

||||||||||||||||||||||||

| Productive |

5 | 1.0 | 1 | 0.7 | 3 | 2.3 | ||||||||||||||||||

| Non-Productive |

1 | 0.8 | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

6 | 1.8 | 1 | 0.7 | 3 | 2.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Wells: |

||||||||||||||||||||||||

| Productive |

45 | 26.3 | 47 | 24.8 | 47 | 21.2 | ||||||||||||||||||

| Non-Productive |

1 | 0.8 | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

46 | 27.1 | 47 | 24.8 | 47 | 21.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

At December 31, 2012, we had 20 gross (10 net) development wells and two gross (0.6 net) exploration wells in progress of being drilled or completed.

13

Table of Contents

Net Production, Unit Prices and Costs

The following table presents certain information with respect to oil and natural gas production attributable to our interests in all of our properties (including each of the two fields which have attributed more than 15% of our total proved reserves as of December 31, 2012), the revenue derived from the sale of such production, average sales prices received and average production costs during each of the years in the three-year period ended December 31, 2012.

| Sales Volumes | Average Sales Prices (1) | Average Production Cost (2) Per Mcfe |

||||||||||||||||||||||||||

| Natural Gas Mmcf |

Oil & Condensate MBbls |

Total Mmcfe |

Natural Gas Mcf |

Oil & Condensate Per Bbl |

Total Per Mcfe |

|||||||||||||||||||||||

| For Year 2012 |

||||||||||||||||||||||||||||

| Haynesville Shale Trend |

15,395 | 1 | 15,401 | $ | 2.20 | $ | 97.28 | $ | 2.20 | $ | 0.27 | |||||||||||||||||

| Cotton Valley Taylor Sand |

3,715 | 68 | 4,123 | 4.27 | 99.92 | 5.66 | 0.33 | |||||||||||||||||||||

| Eagle Ford Shale Trend |

1,142 | 960 | 6,902 | 4.26 | 100.01 | 14.64 | 0.81 | |||||||||||||||||||||

| Other |

4,592 | 66 | 4,989 | 3.78 | 98.43 | 4.79 | 2.75 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

24,844 | 1,095 | 31,415 | $ | 2.86 | $ | 99.91 | $ | 5.75 | $ | 0.83 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| For Year 2011 |

||||||||||||||||||||||||||||

| Haynesville Shale Trend |

24,753 | 1 | 24,760 | $ | 3.57 | $ | 94.80 | $ | 3.57 | $ | 0.18 | |||||||||||||||||

| Cotton Valley Taylor Sand |

5,008 | 104 | 5,634 | 4.43 | 93.38 | 5.74 | 0.21 | |||||||||||||||||||||

| Eagle Ford Shale Trend |

838 | 464 | 3,624 | 5.16 | 90.22 | 12.89 | 0.76 | |||||||||||||||||||||

| Other |

5,568 | 75 | 6,011 | 4.80 | 94.60 | 5.69 | 2.11 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

36,167 | 644 | 40,029 | $ | 3.92 | $ | 91.34 | $ | 5.01 | $ | 0.54 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| For Year 2010 |

||||||||||||||||||||||||||||

| Haynesville Shale Trend |

17,295 | 1 | 17,300 | $ | 3.83 | $ | 64.00 | $ | 3.83 | $ | 0.15 | |||||||||||||||||

| Cotton Valley Taylor Sand |

2,386 | 24 | 2,529 | 4.38 | 62.17 | 4.72 | 0.16 | |||||||||||||||||||||

| Eagle Ford Shale Trend |

131 | 39 | 368 | 3.53 | 68.26 | 8.49 | 0.62 | |||||||||||||||||||||

| Other |

13,003 | 86 | 13,519 | 4.56 | 84.53 | 4.93 | 1.70 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

32,815 | 150 | 33,716 | $ | 4.16 | $ | 76.59 | $ | 4.39 | $ | 0.78 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Excludes the impact of commodity derivatives. |

| (2) | Excludes ad valorem and severance taxes. |

In addition, three of our fields, the Bethany Longstreet, Beckville and the Eagle Ford Shale Trend fields each account for more than 15% of our estimated proved reserves as of December 31, 2012. The table below provides production volume data for each of the fields for the years presented:

| Sales volumes | ||||||||||||

| Natural Gas | Oil & Condensate | Total | ||||||||||

| (Mmcf) | (MBbls) | (Mmcfe) | ||||||||||

| For Year 2012 |

||||||||||||

| Bethany Longstreet |

8,852 | — | 8,852 | |||||||||

| Beckville |

3,208 | 21 | 3,337 | |||||||||

| Eagle Ford Shale Trend |

1,142 | 960 | 6,902 | |||||||||

| For Year 2011 |

||||||||||||

| Bethany Longstreet |

14,962 | — | 14,962 | |||||||||

| Beckville |

4,372 | 30 | 4,551 | |||||||||

| Eagle Ford Shale Trend |

838 | 464 | 3,624 | |||||||||

| For Year 2010 |

||||||||||||

| Bethany Longstreet |

10,398 | 2 | 10,412 | |||||||||

| Beckville |

6,259 | 37 | 6,483 | |||||||||

| Eagle Ford Shale Trend |

131 | 39 | 368 | |||||||||

14

Table of Contents

For a discussion of comparative changes in our sales volumes, revenues and operating expenses for the three years ended December 31, 2012, see Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Results of Operations.”

Oil and Natural Gas Marketing and Major Customers

Marketing. Our natural gas production is sold under spot or market-sensitive contracts to various natural gas purchasers on short-term contracts. Our oil production is sold to various purchasers under short-term rollover agreements based on current market prices.

Customers. Due to the nature of the industry, we sell our oil and natural gas production to a limited number of purchasers and, accordingly, amounts receivable from such purchasers could be significant. Revenues from the largest of these sources as a percent of oil and natural gas revenues for the year ended December 31, 2012 were as follows:

| 2012 | ||||

| BP Energy Company |

34 | % | ||

| Flint Hill Resources, LLC |

15 | % | ||

| OGO Marketing LLC |

5 | % | ||

Competition

The oil and natural gas industry is highly competitive. Major and independent oil and natural gas companies, drilling and production acquisition programs and individual producers and operators are active bidders for desirable oil and natural gas properties, as well as the equipment and labor required to operate those properties. Many competitors have financial resources substantially greater than ours, and staffs and facilities substantially larger than us.

Employees

At February 18, 2013, we had 112 full-time employees in our two administrative offices and two field offices, none of whom is represented by any labor union. We regularly use the services of independent consultants and contractors to perform various professional services, particularly in the areas of construction, design, well-site supervision, permitting and environmental assessment. Independent contractors usually perform field and on-site production operation services for us, including gauging, maintenance, dispatching, inspection, and well testing.

Regulations

The availability of a ready market for any oil and natural gas production depends upon numerous factors beyond our control. These factors include regulation of oil and natural gas production, federal and state regulations governing environmental quality and pollution control, state limits on allowable rates of production by a well or proration unit, the amount of oil and natural gas available for sale, the availability of adequate pipeline and other transportation and processing facilities and the marketing of competitive fuels. For example, a productive natural gas well may be “shut-in” because of an oversupply of natural gas or the lack of an available natural gas pipeline in the areas in which we may conduct operations. State and federal regulations generally are intended to prevent waste of oil and natural gas, protect rights to produce oil and natural gas between owners in a common reservoir, control the amount of oil and natural gas produced by assigning allowable rates of production and control contamination of the environment. Pipelines are subject to the jurisdiction of various federal, state and local agencies as well.

15

Table of Contents

Environmental and Occupational Health and Safety Matters

General

Our operations are subject to stringent and complex federal, regional, state and local laws and regulations governing occupational health and safety, the discharge of materials into the environment or otherwise relating to environmental protection. Compliance with these laws and regulations may require the acquisition of permits before drilling or other related activity commences, restrict the type, quantities and concentration of various substances that can be released into the environment in connection with drilling and production activities, limit or prohibit drilling and production activities on certain lands lying within wilderness, wetlands and other protected areas, impose specific health and safety criteria addressing worker protection, and impose substantial liabilities for pollution arising from drilling and production operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations, and the issuance of injunctions that may limit or prohibit some or all of our operations.

These laws and regulations may also restrict the rate of oil and natural gas production below the rate that would otherwise be possible. The regulatory burden on the oil and natural gas industry increases the cost of doing business in the industry and consequently affects profitability. Additionally, the trend in environmental regulation has been to place more restrictions and limitations on activities that may affect the environment, and, any changes in environmental laws and regulations that result in more stringent and costly well construction, drilling, waste management or completion activities or waste handling, storage, transport, disposal or remediation requirements could have a material adverse effect on our business. While we believe that we are in substantial compliance with current applicable federal and state environmental laws and regulations and that continued compliance with existing requirements will not have a material adverse impact on our operations or financial condition, there is no assurance that we will be able to remain in compliance in the future with such existing or any new laws and regulations or that such future compliance will not have a material adverse effect on our business and operating results.

The following is a summary of the more significant existing environmental laws to which our business operations are subject and with which compliance may have a material adverse effect on our capital expenditures, earnings or competitive position.

Hazardous Substances and Wastes

The Comprehensive Environmental Response, Compensation, and Liability Act, as amended (“CERCLA”), also known as the “Superfund” law, and analogous state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to have contributed to the release of a “hazardous substance” into the environment. These persons include the owner or operator of the disposal site or sites where the release occurred, and companies that disposed or arranged for the disposal of hazardous substances released at the site. Under CERCLA, these persons may be subject to joint and several, strict liabilities for remediation costs at the site, natural resource damages and for the costs of certain health studies. Additionally, it is not uncommon for neighboring landowners and other third parties to file tort claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. We generate materials in the course of our operations that are regulated as hazardous substances.

We also may incur liability under the Resource Conservation and Recovery Act, as amended (“RCRA”), and comparable state statutes that impose stringent requirements related to the handling and disposal of non-hazardous and hazardous solid wastes. While there exists an exclusion under RCRA from the definition of hazardous wastes for drilling fluids, produced waters and certain other wastes generated in the exploration, development or production of oil and natural gas, efforts have been made from time to time to remove this exclusion such that those wastes would be regulated as hazardous wastes and therefore subject to more rigorous RCRA standards. Notwithstanding the continued effectiveness of this RCRA exclusion, these exploration, development and production wastes remain subject to regulation by the EPA and state environmental agencies as non-hazardous “solid” wastes.

16

Table of Contents

We currently own or lease, and in the past have owned or leased, properties that have been used for oil and natural gas exploration and production for many years. Although we believe that we have utilized operating and waste disposal practices that were standard in the industry at the time, hazardous substances, wastes and petroleum hydrocarbons may have been released on or under the properties owned or leased by us, or on or under other locations where such substances have been taken for recycling or disposal. In addition, some of our properties have been operated by third parties whose treatment and disposal of hazardous substances, wastes and petroleum hydrocarbons were not under our control. These properties and the substances disposed or released on them may be subject to CERCLA, RCRA, and analogous state laws. Under such laws, we could be required to remove previously disposed substances and wastes, remediate contaminated property, or perform remedial plugging or pit closure operations to prevent future contamination.

Water Discharges and Subsurface Injections

The federal Water Pollution Control Act, as amended, (“Clean Water Act”), and analogous state laws, impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into state and federal waters. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by EPA or an analogous state agency. Spill prevention, control and countermeasure (“SPCC”) plan requirements imposed under the Clean Water Act require appropriate containment berms and similar structures to help prevent the contamination of navigable waters in the event of a petroleum hydrocarbon tank spill, rupture or leak. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. The Clean Water Act also prohibits the discharge of dredge and fill material in regulated waters, including wetlands, unless authorized by permit. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations. In addition, the Oil Pollution Act of 1990, as amended (“OPA”), imposes a variety of requirements related to the prevention of oil spills into navigable waters.

The disposal of oil and natural gas wastes into underground injection wells are subject to the federal Safe Drinking Water Act, as amended (“SDWA”), and analogous state laws. Under Part C of the SDWA, the EPA established the Underground Injection Control Program, which establishes requirements for permitting, testing, monitoring, recordkeeping and reporting of injection well activities as well as a prohibition against the migration of fluid containing any contaminants into underground sources of drinking water. State programs may have analogous permitting and operational requirements. Any leakage from the subsurface portions of the injection wells may cause degradation of freshwater, potentially resulting in cancellation of operations of a well, issuance of fines and penalties from governmental agencies, incurrence of expenditures for remediation of the affected resource, and imposition of liability by third parties for property damages and personal injury.

Hydraulic Fracturing

Hydraulic fracturing is an important and common practice that is used to stimulate production of natural gas and/or oil from dense subsurface rock formations. The hydraulic fracturing process involves the injection of water, sand, and chemicals under pressure into targeted subsurface formations to fracture the surrounding rock and stimulate production. We routinely use hydraulic fracturing techniques in our drilling and completion programs. Hydraulic fracturing typically is regulated by state oil and natural gas commissions, but the EPA has asserted federal regulatory authority pursuant to the SDWA over certain hydraulic fracturing activities involving the use of diesel fuels and published draft permitting guidance in May 2012 addressing the performance of such activities using diesel fuels. In November 2011, the EPA announced its intent to develop and issue regulations under the Toxic Substances Control Act to require companies to disclose information regarding the chemicals used in hydraulic fracturing and the agency currently plans to issue a Notice of Proposed Rulemaking that would seek public input on the design and scope of such disclosure regulations. In addition, congress has from time to time considered legislation to provide for federal regulation of hydraulic fracturing under the SDWA and to

17

Table of Contents

require disclosure of the chemicals used in the hydraulic fracturing process. At the state level, some states, including Louisiana and Texas, where we operate, have adopted, and other states are considering adopting legal requirements that could impose more stringent permitting, public disclosure or well construction requirements on hydraulic fracturing activities. Local government also may seek to adopt ordinances within their jurisdictions regulating the time, place and manner of drilling activities in general or hydraulic fracturing activities in particular. We believe that we follow applicable standard industry practices and legal requirements for groundwater protection in our hydraulic fracturing activities. Nevertheless, if new or more stringent federal, state, or local legal restrictions relating to the hydraulic fracturing process are adopted in areas where we operate, we could incur potentially significant added costs to comply with such requirements, experience delays or curtailment in the pursuit of exploration, development, or production activities, and perhaps even be precluded from drilling wells.

In addition, certain governmental reviews have been conducted or are underway that focus on environmental aspects of hydraulic fracturing practices. The White House Council on Environmental Quality is coordinating an administration-wide review of hydraulic fracturing practices. The EPA has commenced a study of the potential environmental effects of hydraulic fracturing on drinking water and groundwater, with a first progress report outlining work currently underway by the agency released on December 21, 2012 and a final report drawing conclusions about the potential impacts of hydraulic fracturing on drinking water resources expected to be available for public comment and peer review by 2014. Moreover, the EPA has announced that it will develop effluent limitations for the treatment and discharge of wastewater resulting from hydraulic fracturing activities by 2014. Other governmental agencies, including the U.S. Department of Energy and the U.S. Department of the Interior, have evaluated or are evaluating various other aspects of hydraulic fracturing. These ongoing or proposed studies, depending on their degree of pursuit and any meaningful results obtained, could spur initiatives to further regulate hydraulic fracturing under the SDWA or other regulatory mechanisms.

Air Emissions

The federal Clean Air Act, as amended (“CAA”), and comparable state laws, regulate emissions of various air pollutants from many sources in the United States, including crude oil and natural gas production activities through air emissions standards, construction and operating programs and the imposition of other compliance regulations. These laws and any implementing regulations may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with stringent air permit requirements, or utilize specific equipment or technologies to control emissions of certain pollutants. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with air permits or other requirements of the Clean Air Act and associated state laws and regulations. Over the next several years, we may be required to incur certain capital expenditures for air pollution control equipment or other air emissions-related issues. For example, on August 16, 2012, the EPA published final rules under the CAA that subject oil and natural gas production, processing, transmission and storage operations to regulation under the New Source Performance Standards (“NSPS”) and National Emission Standards for Hazardous Air Pollutants (“NESHAP”) programs. With regards to production activities, these final rules require, among other things, the reduction of volatile organic compound emissions from three subcategories of fractured and refractured gas wells for which well completion operations are conducted: wildcat (exploratory) and delineation gas wells; low reservoir pressure non-wildcat and non-delineation gas wells; and all “other” fractured and refractured gas wells. All three subcategories of wells must route flow back emissions to a gathering line or be captured and combusted using a combustion device such as a flare after October 15, 2012. However, the “other” wells must use reduced emission completions, also known as “green completions,” with or without combustion devices, after January 1, 2015. These regulations also establish specific new requirements regarding emissions from production-related wet seal and reciprocating compressors, effective October 15, 2012 and from pneumatic controllers and storage vessels, effective October 15, 2013. Compliance with these requirements could increase our costs of development and production, which costs could be significant

18

Table of Contents

Climate Change Based on findings by the EPA in December 2009 that emissions of carbon dioxide, methane, and other greenhouse gases (“GHGs”) present an endangerment to public health and the environment because emissions of such gases are contributing to the warming of the earth’s atmosphere and other climatic changes, the EPA has adopted regulations under existing provisions of the CAA. The EPA has adopted rules requiring the monitoring and reporting of GHG emissions from specified sources in the United States on an annual basis, including, among others, certain onshore and offshore oil and natural gas production facilities, which include certain of our operations. We are monitoring GHG emissions from our operations in accordance with the GHG emissions reporting rule and believe that our monitoring activities are in substantial compliance with applicable reporting obligations.

While Congress has from time to time considered legislation to reduce emissions of GHGs that require reporting of GHGs or otherwise limit emissions of GHGs from our equipment and operations could require us to incur costs to monitor and report on GHG emissions or reduce emissions of GHGs associated with our operations or could adversely affect demand for the oil and natural gas that we produce. Finally, it should be noted that some scientists have concluded that increasing concentrations of GHGs in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, floods and other climatic events; if any such effects were to occur, they could have an adverse effect on our exploration and production interests and operations.

Endangered Species

The federal Endangered Species Act, as amended (“ESA”), and analogous state laws restrict activities that could have an adverse effect on threatened or endangered species or their habitats. Some of our operations may be located in or near areas that are designated as habitat for endangered or threatened species. In these areas, we may be obligated to develop and implement plans to avoid potential adverse impacts to protected species, and we may be prohibited from conducting operations in certain locations or during certain seasons, such as breeding and nesting seasons, when our operations could have an adverse effect on the species. It is also possible that a federal or state agency could order a complete halt to our activities in certain locations if it is determined that such activities may have a serious adverse effect on a protected species. Moreover, as a result of a settlement approved by the U.S. District Court for the District of Columbia in September 2011, the U.S. Fish and Wildlife Service is required to make a determination on listing more than 250 species as endangered or threatened under the ESA before the completion of the agency’s 2017 fiscal year. The presence of protected species or the designation of previously unidentified endangered or threatened species could impair our ability to timely complete well drilling and development and could cause us to incur additional costs or become subject to operating restrictions or bans in the affected areas.

Employee Health and Safety

We are also subject to the requirements of the federal Occupational Safety and Health Act, as amended, (“OSHA”), and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard, the Emergency Planning and Community Right-to-Know Act, as amended, and implementing regulations and similar state statutes and regulations require that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local governmental authorities and citizens. We believe that we are in substantial compliance with all applicable laws relating to worker health and safety.

Other Laws and Regulations

State statutes and regulations require permits for drilling operations, drilling bonds and reports concerning operations. In addition, there are state statutes, rules and regulations governing conservation matters, including the unitization or pooling of oil and natural gas properties, establishment of maximum rates of production from oil and natural gas wells and the spacing, plugging and abandonment of such wells. Such statutes and regulations may limit the rate at which oil and natural gas could otherwise be produced from our properties and may restrict the number of wells that may be drilled on a particular lease or in a particular field.

19

Table of Contents

| Item 1A. | Risk Factors |

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

The Company has made in this report, and may from time to time otherwise make in other public filings, press releases and discussions with Company management, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 concerning the Company’s operations, economic performance and financial condition. These forward-looking statements include information concerning future production and reserves, schedules, plans, timing of development, contributions from oil and natural gas properties, marketing and midstream activities, and also include those statements accompanied by or that otherwise include the words “may,” “could,” “believes,” “expects,” “anticipates,” “intends,” “estimates,” “projects,” “predicts,” “target,” “goal,” “plans,” “objective,” “potential,” “should,” or similar expressions or variations on such expressions that convey the uncertainty of future events or outcomes. For such statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company has based these forward-looking statements on its current expectations and assumptions about future events. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments as well as other factors it believes are appropriate under the circumstances. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. These forward-looking statements speak only as of the date of this report, or if earlier, as of the date they were made; the Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

These forward-looking statements involve risk and uncertainties. Important factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, the following risk and uncertainties:

| • | planned capital expenditures; |

| • | future drilling activity; |

| • | our financial condition; |

| • | business strategy including the our ability to successfully transition to more liquids-focused operations; |

| • | the market prices of oil and natural gas; |

| • | uncertainties about the estimated quantities of oil and natural gas reserves; |

| • | financial market conditions and availability of capital; |

| • | production; |

| • | hedging arrangements; |

| • | future cash flows and borrowings; |

| • | litigation matters; |

| • | pursuit of potential future acquisition opportunities; |

| • | sources of funding for exploration and development; |

| • | general economic conditions, either nationally or in the jurisdictions in which we are doing business; |

| • | legislative or regulatory changes, including retroactive royalty or production tax regimes, hydraulic-fracturing regulation, drilling and permitting regulations, derivatives reform, changes in state and federal corporate taxes, environmental regulation, environmental risks and liability under federal, state and foreign and local environmental laws and regulations; |

20

Table of Contents

| • | the creditworthiness of our financial counterparties and operation partners; |

| • | the securities, capital or credit markets; |

| • | our ability to repay our debt; and |

| • | other factors discussed below and elsewhere in this Annual Report on Form 10-K and in our other public filings, press releases and discussions with our management. |

Our actual production, revenues and expenditures related to our reserves are likely to differ from our estimates of proved reserves. We may experience production that is less than estimated and drilling costs that are greater than estimated in our reserve report. These differences may be material.

The proved oil and natural gas reserve information included in this report are estimates. These estimates are based on reports prepared by NSAI, our independent reserve engineers, and were calculated using the unweighted average of first-day-of-the-month oil and natural gas prices in 2012. These prices will change and may be lower at the time of production than those prices that prevailed during 2012. Reservoir engineering is a subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact manner. Estimates of economically recoverable oil and natural gas reserves and of future net cash flows necessarily depend upon a number of variable factors and assumptions, including:

| • | historical production from the area compared with production from other similar producing wells; |

| • | the assumed effects of regulations by governmental agencies; |

| • | assumptions concerning future oil and natural gas prices; and |

| • | assumptions concerning future operating costs, severance and excise taxes, development costs and workover and remedial costs. |

Because all reserve estimates are to some degree subjective, each of the following items may differ materially from those assumed in estimating proved reserves:

| • | the quantities of oil and natural gas that are ultimately recovered; |

| • | the production and operating costs incurred; |

| • | the amount and timing of future development expenditures; and |

| • | future oil and natural gas sales prices. |

Furthermore, different reserve engineers may make different estimates of reserves and cash flows based on the same available data. Our actual production, revenues and expenditures with respect to reserves will likely be different from estimates and the differences may be material. The discounted future net cash flows included in this document should not be considered as the current market value of the estimated oil and natural gas reserves attributable to our properties. As required by the SEC, the standardized measure of discounted future net cash flows from proved reserves are generally based on 12-month average prices and costs as of the date of the estimate, while actual future prices and costs may be materially higher or lower. Actual future net cash flows also will be affected by factors such as:

| • | the amount and timing of actual production; |

| • | supply and demand for oil and natural gas; |

| • | increases or decreases in consumption; and |

| • | changes in governmental regulations or taxation. |

In addition, the 10% discount factor, which is required by the SEC to be used to calculate discounted future net cash flows for reporting purposes, and which we use in calculating our PV-10, is not necessarily the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and natural gas industry in general.

21

Table of Contents

Our operations are subject to governmental risks that may impact our operations.

Our operations have been, and at times in the future may be, affected by political developments and are subject to complex federal, state, tribal, local and other laws and regulations such as restrictions on production, permitting and changes in taxes, deductions, royalties and other amounts payable to governments or governmental agencies or price gathering-rate controls. In order to conduct our operations in compliance with these laws and regulations, we must obtain and maintain numerous permits, approvals and certificates from various federal, state, tribal and local governmental authorities. We may incur substantial costs in order to maintain compliance with these existing laws and regulations. In addition, our costs of compliance may increase if existing laws, including tax laws, and regulations are revised or reinterpreted, or if new laws and regulations become applicable to our operations.

Our operations are subject to environmental and occupational health and safety laws and regulations that may expose us to significant costs and liabilities.

Our oil and natural gas exploration and production operations are subject to stringent and complex federal, regional, state and local laws and regulations governing the discharge of materials into the environment, health and safety aspects of our operations, or otherwise relating to environmental protection. These laws and regulations may impose numerous obligations applicable to our operations including the acquisition of permits, including drilling permits, before conducting regulated activities; the restriction of types, quantities and concentration of materials that can be released into the environment; limit or prohibit drilling activities on certain lands lying within wilderness, wetlands and other protected areas, the application of specific health and safety criteria addressing worker protection; and the imposition of substantial liabilities for pollution resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of sanctions, including administrative, civil or criminal penalties, the imposition of investigatory or remedial obligations, and the issuance of orders limiting or prohibiting some or all of our operations.

There is inherent risk of incurring significant environmental costs and liabilities in the performance of our operations as a result of our handling of petroleum hydrocarbons and wastes, because of air emissions and wastewater discharges related to our operations, and as a result of historical industry operations and waste disposal practices. Under certain environmental laws and regulations, we could be subject to strict, joint and several liabilities for the removal or remediation of previously released materials or property contamination. Private parties, including the owners of properties upon which our wells are drilled and facilities where our petroleum hydrocarbons or wastes are taken for reclamation or disposal, also may have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property or natural resource damages. Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly well drilling, construction, completion or water management activities, or waste control, handling, storage, transport, disposal or cleanup requirements could require us to make significant expenditures to attain and maintain compliance and may otherwise have a material adverse effect on our own results of operations, competitive position or financial condition. We may not be able to recover some or any of these costs from insurance.