Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-02658

STEWART INFORMATION SERVICES CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 74-1677330 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1980 Post Oak Blvd., Houston TX | 77056 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (713) 625-8100

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $1 par value | New York Stock Exchange | |

| (Title of each class of stock) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | þ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the Common Stock (based upon the closing sales price of the Common Stock of Stewart Information Services Corporation, as reported by the NYSE on June 30, 2012) held by non-affiliates of the Registrant was approximately $280,935,000.

At March 1, 2013, the following shares of each of the registrant’s classes of stock were outstanding:

| Common, $1 par value |

20,045,307 | |||

| Class B Common, $1 par value |

1,050,012 |

Documents Incorporated by Reference

Portions of the definitive proxy statement (the Proxy Statement), relating to the annual meeting of the registrant’s stockholders to be held May 3, 2013, are incorporated by reference in Part III of this document.

Table of Contents

FORM 10-K ANNUAL REPORT

YEAR ENDED DECEMBER 31, 2012

| Item |

Page | |||||

| 1. | 1 | |||||

| 1A. | 6 | |||||

| 1B. | 9 | |||||

| 2. | 9 | |||||

| 3. | 10 | |||||

| 4. | 10 | |||||

| 5. | 10 | |||||

| 6. | 12 | |||||

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

13 | ||||

| 7A. | 27 | |||||

| 8. | 27 | |||||

| 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

28 | ||||

| 9A. | 28 | |||||

| 9B. | 28 | |||||

| 10. | 29 | |||||

| 11. | 29 | |||||

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

29 | ||||

| 13. | Certain Relationships and Related Transactions, and Director Independence |

30 | ||||

| 14. | 30 | |||||

| 15. | 30 | |||||

| 31 | ||||||

As used in this report, “we,” “us,” “our,” the “Company” and “Stewart” mean Stewart Information Services Corporation and our subsidiaries, unless the context indicates otherwise.

Table of Contents

We are a Delaware corporation formed in 1970. We and our predecessors have been engaged in the title business since 1893.

Stewart Information Services Corporation (NYSE-STC) is a customer-focused, global title insurance and real estate services company offering products and services through our direct operations, network of approved agencies and other companies within the Stewart family. Stewart provides these services to homebuyers and sellers; residential and commercial real estate professionals; mortgage lenders and servicers; title agencies and real estate attorneys; home builders; and United States and foreign governments. Stewart also provides loan origination and servicing support; loan review services; loss mitigation; REO asset management; home and personal insurance services; and technology to streamline the real estate process.

Our international division delivers products and services protecting and promoting private land ownership worldwide. Currently, our primary international operations are in Canada, the United Kingdom, Central Europe, Central America and Australia.

We report our business in three segments: title insurance and related services, mortgage services and corporate. The financial information related to these segments is discussed in Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 20 to our audited consolidated financial statements.

Title Insurance Services

Title insurance and related services (title segment) include the functions of searching, examining, closing and insuring the condition of the title to real property. The title segment also includes certain ancillary services provided for tax-deferred exchanges and home and personal insurance services.

Examination and closing. The purpose of a title examination is to ascertain the ownership of the property being transferred, debts that are owed on it and the scope of the title policy coverage. This involves searching for and examining documents such as deeds, mortgages, wills, divorce decrees, court judgments, liens, paving assessments and tax records.

At the closing or “settlement” of a sale transaction, the seller executes and delivers a deed to the new owner. The buyer typically signs new mortgage documents. Closing funds are then disbursed to the seller, the prior lender, real estate brokers, the title company and others. The documents are then recorded in the public records. A title insurance policy is generally issued to both the new lender and the owner.

Title insurance policies. Lenders in the United States generally require title insurance as a condition to making a loan on real estate, including securitized lending. This is to assure lenders of the priority of their lien position. The purchasers of the property want insurance to protect against claims that may arise against the title to the property. The face amount of the policy is normally the purchase price or the amount of the related loan.

1

Table of Contents

Title insurance is substantially different from other types of insurance. Fire, auto, health and life insurance protect against future losses and events. In contrast, title insurance insures against losses from past events and seeks to protect the public by eliminating covered risks through the examination and settlement process. In essence, a title insurance policy provides a warranty to the policyholder that the title to the property is free from defects that might impair ownership rights. Most other forms of insurance provide protection for a limited period of time and, hence the policy must be periodically renewed. Title insurance, however, is issued for a one-time premium and the policy provides protection for as long as the owner owns the property or has liability in connection with the property. Also, a title insurance policy does not have a finite contract term, whereas most other lines of insurance have a definite beginning and ending date for coverage. Although a title insurance policy provides protection as long as the owner owns the property being covered, the title insurance company generally does not have information about which policies are still effective. Most other lines of insurance receive periodic premium payments and policy renewals thereby allowing the insurance company to know which policies are effective.

Investments in debt securities. Our title insurance underwriters maintain investments in accordance with certain statutory requirements for the funding of statutory premium reserves and state deposits. We have established policies and procedures to minimize our exposure to changes in the fair values of our investments. These policies include retaining an investment advisory firm, emphasizing credit quality, managing portfolio duration, maintaining or increasing investment income and actively monitoring profile and security mix based upon market conditions.

Losses. Losses on policies occur when a title defect is not discovered during the examination and settlement process. Reasons for losses include forgeries, misrepresentations, unrecorded or undiscovered liens, the failure to pay off existing liens, mortgage lending fraud, mishandling or defalcation of settlement funds, issuance by title agencies of unauthorized coverage and defending insureds when covered claims are filed against their interest in the property.

Some claimants seek damages in excess of policy limits. Those claims are based on various legal theories. We vigorously defend against spurious claims and provide protection for covered claims up to policy limits. We have from time-to-time incurred losses in excess of policy limits.

Experience shows that most policy claims and claim payments are made in the first six years after the policy has been issued, although claims can also be incurred and paid many years later. By their nature, claims are often complex, vary greatly in dollar amounts and are affected by economic and market conditions and the legal environment existing at the time claims are processed.

Our liability for estimated title losses comprises both known claims and our estimate of claims that may be reported in the future. The amount of our loss reserve represents the aggregate future payments (net of recoveries) that we expect to incur on policy and escrow losses and in costs to settle claims. In accordance with industry practice, these amounts have not been discounted to their present values.

Estimating future title loss payments is challenging because of the complex nature of title claims, the length of time over which claims are paid, the significantly varying dollar amounts of individual claims and other factors. Estimated provisions for current year policy losses are charged to income in the same year the related premium revenues are recognized. The amounts provided for policy losses are based on reported claims, historical loss payment experience, title industry averages and the current legal and economic environment. Actual loss payment experience relating to policies issued in previous years, including the impact of large losses, is the primary reason for increases or decreases in our loss provision.

Amounts shown as our estimated liability for future loss payments are continually reviewed by us for reasonableness and adjusted as appropriate. We have consistently followed the same basic method of estimating and recording our loss reserves for more than 10 years. As part of our process, we also obtain input from third-party actuaries regarding our methodology and resulting reserve calculations. While we are responsible for determining our loss reserves, we utilize this actuarial input to assess the overall reasonableness of our reserve estimation.

2

Table of Contents

Factors affecting revenues. Title insurance revenues are closely related to the level of activity in the real estate markets we serve and the prices at which real estate sales are made. Real estate sales are directly affected by the availability and cost of money to finance purchases. Other factors include consumer confidence and demand by buyers. These factors may override the seasonal nature of the title business. Generally, our first quarter is the least active and our third and fourth quarters are the most active in terms of title insurance revenues.

Selected information from the U.S. Department of Housing and Urban Development and National Association of Realtors® for the U.S. real estate industry follows (2012 figures are preliminary and subject to revision):

| 2012 | 2011 | 2010 | ||||||||||

| New home sales – in millions |

0.37 | 0.30 | 0.32 | |||||||||

| Existing home sales – in millions |

4.65 | 4.26 | 4.19 | |||||||||

| Existing home sales – median sales price in $ thousands |

176.6 | 166.1 | 172.9 | |||||||||

Customers. The primary sources of title insurance business are attorneys, builders, developers, home buyers and home sellers, lenders and real estate brokers and agents. No one customer was responsible for as much as 10% or more of our consolidated revenues in any of the last three years. Titles insured include residential and commercial properties, undeveloped acreage, farms, ranches, wind and solar power installations and water rights.

Service, location, financial strength, size and related factors affect customer acceptance. Increasing market share is accomplished primarily by providing superior service. The parties to a closing are concerned with personal schedules and the interest and other costs associated with any delays in the settlement. The rates charged to customers are regulated, to varying degrees, in many states.

The financial strength and stability of the title underwriter are important factors in maintaining and increasing our agency network. We are rated as investment grade by the title industry’s leading rating companies. Our principal underwriter, Stewart Title Guaranty Company (Guaranty) is currently rated “A” by Demotech, Inc., BBB+ by Fitch, B++ by A. M. Best and B- by Kroll Bond Rating Agency.

Market share. Title insurance statistics are compiled quarterly by the title industry’s national trade association. Based on 2012 unconsolidated statutory net premiums written through September 30, 2012, Guaranty is one of the leading title insurers in the United States.

Our principal competitors are Fidelity National Financial, Inc. (which includes Fidelity National Title Insurance Company, Chicago Title Insurance Company, Commonwealth Land Title Insurance Company, and Alamo Title Insurance), Old Republic Title Insurance Group, which includes Old Republic National Title Insurance Company, and The First American Corporation, which includes First American Title Insurance Company. Like most title insurers, we also compete with abstractors, attorneys who issue title opinions and attorney-owned title insurance funds. A number of homebuilders, financial institutions, real estate brokers and others own or control title insurance agencies, some of which issue policies underwritten by Guaranty.

3

Table of Contents

Title insurance revenues by geographic location. The approximate amounts and percentages of our consolidated title operating revenues were:

| Amounts ($ millions) | Percentages | |||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Texas |

299 | 247 | 244 | 17 | 16 | 16 | ||||||||||||||||||

| California |

204 | 181 | 203 | 12 | 12 | 13 | ||||||||||||||||||

| New York |

190 | 165 | 136 | 11 | 11 | 9 | ||||||||||||||||||

| International |

117 | 109 | 98 | 7 | 7 | 6 | ||||||||||||||||||

| Florida |

71 | 58 | 71 | 4 | 4 | 5 | ||||||||||||||||||

| All others |

845 | 745 | 788 | 49 | 50 | 51 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 1,726 | 1,505 | 1,540 | 100 | 100 | 100 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Regulations. Title insurance companies are subject to comprehensive state regulations covering premium rates, agency licensing, policy forms, trade practices, reserve requirements, investments and the transfer of funds between an insurer and its parent or its subsidiaries and any similar related party transactions. Kickbacks and similar practices are prohibited by most state and federal laws.

Mortgage Services

Our mortgage services segment includes a diverse group of products and services provided to multiple markets. These services are provided principally through our Stewart Lender Services (SLS), PropertyInfo® Corporation and Stewart Government Services businesses.

SLS offers origination support, loss mitigation, default, and post-closing services to residential mortgage lenders, servicers and investors. Loss mitigation products include loan modification, loan review, loan default and REO asset recovery services. SLS also offers outsourcing solutions for post-closing and servicing support to lenders.

PropertyInfo® Corporation offers technology that a title business requires. PropertyInfo® offers a production system, AIM+™, along with web-based search tools designed to increase the processing speed of title examinations by connecting all aspects of the title examination process to proprietary title information databases and to public land and court record information sources.

Factors affecting revenues. As in the title segment, mortgage services revenues, particularly those generated by lender services, are closely related to the level of activity in the real estate market, including the volume of foreclosure or other distressed property activity. Revenues related to many services are generated on a project basis.

Companies that compete with our mortgage services companies vary across a wide range of industries. In the mortgage-related products and services area, competitors include the major title insurance underwriters mentioned under “Title – Market share” as well as other real estate technology and business process outsourcing providers. In some cases the competitor may be the customer itself. For example, certain services offered by SLS can be, or historically have been, performed by internal departments of large mortgage lenders.

Customers. Customers for our mortgage services products and services primarily include mortgage lenders and servicers, mortgage brokers, mortgage investors and government entities.

Many of the services and products offered by our mortgage services segment are used by professionals and intermediaries who have been retained to assist consumers with the sale, purchase, mortgage, transfer, recording and servicing of real estate-related transactions. To that end, timely and accurate services are critical to our customers since these factors directly affect the service they provide to their customers. Financial strength, marketplace presence and reputation as a technology innovator are important factors in attracting new business.

4

Table of Contents

Corporate

The corporate segment consists of the expenses of the parent holding company and certain other corporate overhead expenses not allocated to the lines of business. We periodically review our allocation models and may make adjustments to the amounts charged to the business units as deemed appropriate. Underwriter investment income is recorded in the corporate segment.

General

Internal Technology. Our internally developed title production technology, is increasing productivity in our core title business, while reducing the time involved in the real estate closing process for lenders, real estate professionals and consumers.

Trademarks. We have developed numerous automated products and processes that are crucial to both our title and mortgage services segments. These systems automate most facets of the real estate transaction. Among these trademarked products and processes are AIM+™, E-Title®, PropertyInfo®, SureClose®, TitleSearch®, eClosingRoomTM and Virtual Underwriter®. We consider these trademarks, which are perpetual in duration, to be important to our business.

Employees. As of December 31, 2012, we employed approximately 6,300 people. We consider our relationship with our employees to be good.

Available information. We file annual, quarterly and other reports and information with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934, as amended (Exchange Act). You may read and copy any material that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain additional information about the Public Reference Room by calling the SEC at (800) SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and other information statements, and other information regarding issuers that file electronically with the SEC.

We also make available upon written request, free of charge, or through our Internet site (www.stewart.com), our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Code of Ethics and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Transfer agent. Our transfer agent is Computershare, which is located at 250 Royall St., Canton, MA, 02021. Its phone number is (888) 478-2392 and website is www.computershare.com.

CEO and CFO Certifications. The CEO and CFO certifications required under Section 302 of the Sarbanes-Oxley Act are filed as exhibits to our 2012 Form 10-K. Stewart Information Services Corporation submitted a Section 12(a) CEO Certification to the New York Stock Exchange in 2012.

5

Table of Contents

You should consider the following risk factors, as well as the other information presented in this report and our other filings with the SEC, in evaluating our business and any investment in Stewart. These risks could materially and adversely affect our business, financial condition and results of operations. In that event, the trading price of our Common Stock could decline materially.

Adverse changes in the levels of real estate activity reduce our revenues.

Our financial condition and results of operations are affected by changes in economic conditions, particularly mortgage interest rates, credit availability, real estate prices and consumer confidence. Our revenues and earnings have fluctuated in the past and we expect them to fluctuate in the future.

The demand for our title insurance-related and mortgage services offerings depends in large part on the volume of residential and commercial real estate transactions. The volume of these transactions historically has been influenced by such factors as mortgage interest rates, availability of financing and the overall state of the economy. Typically, when interest rates are increasing or when the economy is experiencing a downturn, real estate activity declines. As a result, the title insurance industry tends to experience decreased revenues and earnings. Increases in interest rates also may have an adverse impact on our bond portfolio and the amount of interest we pay on our floating-rate bank debt.

Our revenues and results of operations have been and could continue to be adversely affected as a result of the decline in home prices, real estate activity and the availability of financing alternatives. In addition, continued weakness or further adverse changes in the level of real estate activity could have a material adverse effect on our consolidated financial condition or results of operations.

Our claims experience may require us to increase our provision for title losses or to record additional reserves, either of which would adversely affect our earnings.

Estimating future loss payments is difficult, and our assumptions about future losses may prove inaccurate. Provisions for policy losses on policies written within a given year are charged to income in the same year the related premium revenues are recognized. The amounts provided are based on reported claims, historical loss payment experience, title industry averages and the current legal and economic environment. Losses that are higher than anticipated are an indication that total losses for a given policy year may be higher than originally calculated. Changes in the total estimated future loss for prior policy years are recorded in the period in which the estimate changes. Claims are often complex and involve uncertainties as to the dollar amount and timing of individual payments. Claims are often paid many years after a policy is issued. From time-to-time, we experience large losses, including losses from independent agency defalcations, from title policies that have been issued or worsening loss payment experience, any of which may require us to increase our title loss reserves. These events are unpredictable and adversely affect our earnings. Provisions for strengthening policy loss reserves were $4.8 million for the year ended 2010.

6

Table of Contents

Competition in the title insurance industry affects our revenues.

Competition in the title insurance industry is intense, particularly with respect to price, service and expertise. Larger commercial customers and mortgage originators also look to the size and financial strength of the title insurer. Although we are one of the leading title insurance underwriters based on market share, Fidelity National Financial, Inc. and The First American Corporation each has substantially greater revenues than we do. Their holding companies have significantly greater capital than we do. Although we are not aware of any current initiatives to reduce regulatory barriers to entering our industry, any such reduction could result in new competitors, including financial institutions, entering the title insurance business. Competition among the major title insurance companies and any new entrants could lower our premium and fee revenues. From time-to-time, new entrants enter the marketplace with alternative products to traditional title insurance, although many of these alternative products have been disallowed by title insurance regulators. These alternative products, if permitted by regulators, could adversely affect our revenues and earnings.

Availability of credit may reduce our liquidity and negatively impact our ability to fund operating losses or initiatives.

As a result of our past history of operating losses, we may not be able to obtain, on acceptable terms, the financing necessary to fund our operations or initiatives. However, we expect that cash flows from operations and cash available from our underwriters, subject to regulatory restrictions, will be sufficient to fund our operations, pay our claims and fund initiatives. To the extent that these funds are not sufficient, we may be required to borrow funds on less favorable terms or seek funding from the equity market, which may be on terms that are dilutive to existing shareholders.

A downgrade of our underwriters by rating agencies may reduce our revenues.

Ratings are a significant component in determining the competitiveness of insurance companies. Our principal underwriter, Guaranty is currently rated “A” by Demotech, Inc., BBB+ by Fitch, B++ by A. M. Best and B- by Kroll Bond Rating Agency. Guaranty has historically been highly rated by the rating agencies that cover us. These ratings are not credit ratings. Instead, the ratings are based on quantitative, and in some cases qualitative, information and reflect the conclusions of the rating agencies with respect to our financial strength, results of operations and ability to pay policyholder claims. Our ratings are subject to continual review by the rating agencies and we cannot be assured that our current ratings will be maintained. If our ratings are downgraded from current levels by the rating agencies, our ability to retain existing customers and develop new customer relationships may be negatively impacted, which could result in an adverse impact on our results of operations.

Our insurance subsidiaries must comply with extensive government regulations. These regulations could adversely affect our ability to increase our revenues and operating results.

The Consumer Financial Protection Bureau (CFPB) is charged with protecting consumers by enforcing Federal consumer protective laws and regulations. The CFPB is an independent unit inside, and funded by, the United States Federal Reserve System. Its jurisdiction includes banks, credit unions, securities firms, payday lenders, mortgage servicing operations, foreclosure relief services, debt collectors and other financial companies. The nature and extent of these regulations include, but are not limited to:

| • | conducting rule-making, supervision, and enforcement for Federal consumer protection laws; |

| • | restricting unfair, deceptive, or abusive acts or practices; |

| • | taking consumer complaints; |

| • | promoting financial education; |

| • | researching consumer behavior; |

| • | monitoring financial markets for new risks to consumers; and |

| • | enforcing laws that outlaw discrimination and other unfair treatment in consumer finance. |

7

Table of Contents

Governmental authorities regulate our insurance subsidiaries in the various states and international jurisdictions in which we do business. These regulations generally are intended for the protection of policyholders rather than stockholders. The nature and extent of these regulations vary from jurisdiction to jurisdiction, but typically involve:

| • | approving or setting of insurance premium rates; |

| • | standards of solvency and minimum amounts of statutory capital and surplus that must be maintained; |

| • | limitations on types and amounts of investments; |

| • | establishing reserves, including statutory premium reserves, for losses and loss adjustment expenses; |

| • | regulating underwriting and marketing practices; |

| • | regulating dividend payments and other transactions among affiliates; |

| • | prior approval for the acquisition and control of an insurance company or of any company controlling an insurance company; |

| • | licensing of insurers, agencies and, in certain states, escrow officers; |

| • | regulation of reinsurance; |

| • | restrictions on the size of risks that may be insured by a single company; |

| • | deposits of securities for the benefit of policyholders; |

| • | approval of policy forms; |

| • | methods of accounting; and |

| • | filing of annual and other reports with respect to financial condition and other matters. |

These regulations may impede or impose burdensome conditions on rate increases or other actions that we might want to take to enhance our operating results.

We may also be subject to additional federal regulations prescribed by legislation such as the Dodd-Frank Act or by regulations issued by the Department of Labor.

Changes in regulations may adversely affect us. In addition, state regulators perform periodic examinations of insurance companies, which could result in increased compliance or litigation expenses.

Rapid changes in our industry require secure, timely and cost-effective technological responses. Our earnings may be adversely affected if we are unable to effectively use technology to address regulatory changes and increase productivity.

We believe that our future success depends on our ability to anticipate technological changes and to offer products and services that meet evolving standards on a timely and cost-effective basis. To do so, requires a flexible technology architecture which can continuously comply with changing regulations, improve productivity, reduce risk and enhance the customer experience. Our earnings could also be adversely affected by unanticipated downtime in our technology although we have never experienced such. We also maintain insurance coverage to mitigate our risk of loss from the unintended disclosure of personal data.

We rely on dividends from our insurance underwriting subsidiaries.

We are a holding company and our principal assets are our insurance underwriting subsidiaries. Consequently, we may depend on receiving sufficient dividends from our insurance subsidiaries to meet our debt service obligations and to pay our operating expenses and dividends to our stockholders. The insurance statutes and regulations of some states require us to maintain a minimum amount of statutory capital and restrict the amount of dividends that our insurance subsidiaries may pay to us. Guaranty is a wholly owned subsidiary of Stewart and the principal source of our cash flow. In this regard, the ability of Guaranty to pay dividends to us is dependent on the approval of the Texas Insurance Commissioner. As of December 31, 2012, under Texas insurance law, Guaranty could pay dividends or make distributions of up to $85.8 million in 2013 after approval of the Texas Insurance Commissioner. However, Guaranty voluntarily restricts dividends to us so that it can grow its statutory surplus, maintain liquidity at competitive levels and maintain its high ratings. Guaranty did not pay a dividend in any of the three years ended December 31, 2012 and does not anticipate paying a dividend in 2013.

8

Table of Contents

Risks include claims by large classes of claimants.

We are periodically involved in litigation arising in the ordinary course of business. In addition, we are currently, and have been in the past, subject to claims and litigation from large classes of claimants seeking substantial damages not arising in the ordinary course of business. Material pending legal proceedings, if any, not in the ordinary course of business, are disclosed in Item 3—Legal Proceedings included elsewhere in this report. To date, the impact of the outcome of these proceedings has not been material to our consolidated financial condition or results of operations. However, an unfavorable outcome in any litigation, claim or investigation against us could have an adverse effect on our consolidated financial condition or results of operations.

Anti-takeover provisions in our certificate of incorporation and by-laws may make a takeover of us difficult. This may reduce the opportunity for our stockholders to obtain a takeover premium for their shares of our Common Stock.

Our certificate of incorporation and by-laws, as well as Delaware corporation law and the insurance laws of various states, all contain provisions that could have the effect of discouraging a prospective acquirer from making a tender offer for our shares, or that may otherwise delay, defer or prevent a change in control of Stewart.

The holders of our Class B Common Stock have the right to elect four of our nine directors. Pursuant to our by-laws, the vote of six directors is required to constitute an act by the Board of Directors. Accordingly, the affirmative vote of at least one of the directors elected by the holders of the Class B Common Stock is required for any action to be taken by the Board of Directors. The foregoing provision of our by-laws may not be amended or repealed without the affirmative vote of at least a majority of the outstanding shares of each class of our capital stock, voting as separate classes.

The voting rights of the holders of our Class B Common Stock may have the effect of rendering more difficult or discouraging unsolicited tender offers, merger proposals, proxy contests or other takeover proposals to acquire control of Stewart.

Item 1B. Unresolved Staff Comments

None.

We lease under a non-cancelable operating lease expiring in 2016 approximately 242,000 square feet in an office building in Houston, Texas, which is used for our corporate offices and for offices of several of our subsidiaries. In addition, we lease offices at approximately 495 additional locations that are used for branch offices, production, administrative and technology centers. These additional locations include significant leased facilities in Austin, Los Angeles, New York, Dallas, Toronto, San Diego and Denver.

Our leases expire from 2013 through 2021 and have an average term of four years, although our typical lease term ranges from three to five years. We believe we will not have any difficulty obtaining renewals of leases as they expire or, alternatively, leasing comparable properties. The aggregate annual rent expense under all leases was approximately $39.1 million in 2012.

We also own several office buildings located in Arizona, Colorado, New York and Texas. These owned properties are not material to our consolidated financial condition. We consider all buildings and equipment that we own or lease to be well maintained, adequately insured and generally sufficient for our purposes.

9

Table of Contents

See discussion of legal proceedings in Note 19 to the Consolidated Financial Statements included in Item 15 of Part IV of this Report, which is incorporated by reference into this Part I, Item 3 of this Annual Report on Form 10-K for the year ended December 31, 2012.

Item 4. Mine Safety Disclosures

None.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issue Purchases of Equity Securities

Our Common Stock is listed on the New York Stock Exchange (NYSE) under the symbol “STC”. The following table sets forth the high and low sales prices of our Common Stock for each fiscal period indicated, as reported by the NYSE.

| High | Low | |||||||

| 2012: |

||||||||

| First quarter |

$ | 14.27 | $ | 11.54 | ||||

| Second quarter |

16.28 | 12.99 | ||||||

| Third quarter |

20.85 | 13.19 | ||||||

| Fourth quarter |

28.35 | 19.95 | ||||||

| 2011: |

||||||||

| First quarter |

$ | 12.74 | $ | 10.00 | ||||

| Second quarter |

11.13 | 9.25 | ||||||

| Third quarter |

11.02 | 8.31 | ||||||

| Fourth quarter |

12.16 | 8.13 | ||||||

As of March 1, 2013, the number of stockholders of record was approximately 6,400 and the price of one share of our Common Stock was $23.64.

The Board of Directors declared an annual cash dividend of $0.10 and $0.05 per share payable December 28, 2012 and December 29, 2011, respectively, to Common stockholders of record on December 14, 2012 and December 15, 2011, respectively. Our certificate of incorporation provides that no cash dividends may be paid on our Class B Common Stock.

We had a book value per share of $29.91 and $24.01 at December 31, 2012 and 2011, respectively. As of December 31, 2012, book value per share was based on approximately $580.4 million in stockholders’ equity and 19,403,765 shares of Common and Class B Common Stock outstanding, excluding the effects of possible conversion of senior convertible notes into common shares. As of December 31, 2011, book value per share was based on approximately $463.5 million in stockholders’ equity and 19,303,844 shares of Common and Class B Common Stock outstanding, excluding the effects of possible conversion of senior convertible notes into common shares.

10

Table of Contents

Performance graph

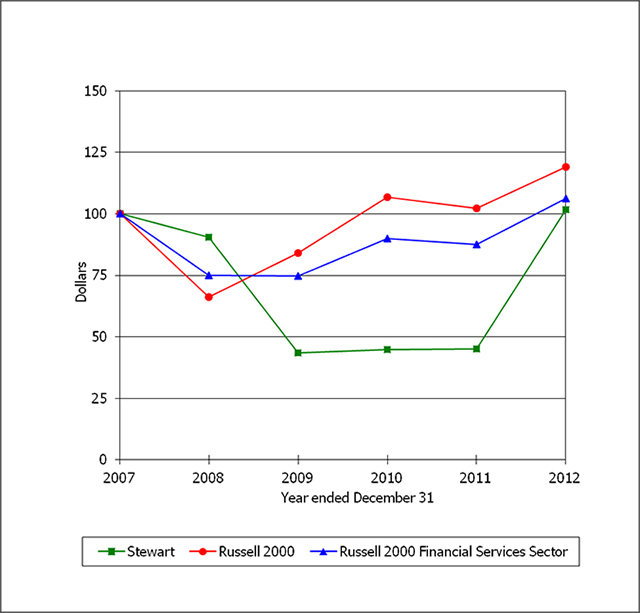

The following graph compares the yearly percentage change in our cumulative total stockholder return on Common Stock with the cumulative total return of the Russell 2000 Index and the Russell 2000 Financial Services Sector Index for the five years ended December 31, 2012. The graph assumes that the value of the investment in our Common Stock and each index was $100 at December 31, 2007 and that all dividends were reinvested.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||||||

| Stewart |

100.00 | 90.42 | 43.61 | 44.77 | 45.04 | 101.79 | ||||||||||||||||||

| Russell 2000 |

100.00 | 66.21 | 84.20 | 106.81 | 102.35 | 119.04 | ||||||||||||||||||

| Russell 2000 Financial Services Sector |

100.00 | 74.88 | 74.82 | 90.06 | 87.46 | 106.39 | ||||||||||||||||||

The performance graph above and the related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

11

Table of Contents

Item 6. Selected Financial Data

The following table sets forth selected consolidated financial data, which were derived from our consolidated financial statements and should be read in conjunction with our audited consolidated financial statements, including the Notes thereto, beginning on page F-1 of this Report. See also Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations.

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| ($ millions, except share and per share data) | ||||||||||||||||||||

| Total revenues |

1,910.4 | 1,634.9 | 1,672.4 | 1,707.3 | 1,555.3 | |||||||||||||||

| Title operating revenues |

1,726.2 | 1,505.0 | 1,540.5 | 1,610.0 | 1,507.2 | |||||||||||||||

| Mortgage services revenues |

162.8 | 112.1 | 91.7 | 69.1 | 47.2 | |||||||||||||||

| Investment income |

13.8 | 15.5 | 18.4 | 20.8 | 29.1 | |||||||||||||||

| Investment gains (losses) |

7.6 | 2.3 | 21.8 | 7.4 | (28.2 | ) | ||||||||||||||

| Title loss provisions |

140.0 | 142.1 | 148.4 | 182.8 | 169.4 | |||||||||||||||

| % title operating revenues |

8.1 | 9.4 | 9.6 | 11.3 | 11.2 | |||||||||||||||

| Pretax earnings (loss)(1) |

89.3 | 18.0 | 2.9 | (62.2 | ) | (237.5 | ) | |||||||||||||

| Net earnings (loss) attributable to Stewart |

109.2 | 2.3 | (12.6 | ) | (51.0 | ) | (247.5 | ) | ||||||||||||

| Cash provided (used) by operations |

120.5 | 23.4 | 41.2 | (17.0 | ) | (104.8 | ) | |||||||||||||

| Total assets |

1,291.2 | 1,156.1 | 1,141.2 | 1,369.2 | 1,448.4 | |||||||||||||||

| Long-term debt |

71.2 | 76.2 | 71.2 | 67.8 | 71.3 | |||||||||||||||

| Stockholders’ equity |

580.4 | 463.5 | 448.3 | 462.1 | 501.2 | |||||||||||||||

| Per share data: |

||||||||||||||||||||

| Average shares – dilutive (millions) |

24.4 | 19.1 | 18.3 | 18.2 | 18.1 | |||||||||||||||

| Basic earnings (loss) attributable to Stewart |

5.66 | 0.12 | (0.69 | ) | (2.80 | ) | (13.68 | ) | ||||||||||||

| Diluted earnings (loss) attributable to Stewart |

4.61 | 0.12 | (0.69 | ) | (2.80 | ) | (13.68 | ) | ||||||||||||

| Cash dividends |

0.10 | 0.05 | 0.05 | 0.05 | 0.10 | |||||||||||||||

| Stockholders’ equity |

29.91 | 24.01 | 24.40 | 25.34 | 27.63 | |||||||||||||||

| Market price: |

||||||||||||||||||||

| High |

28.35 | 12.74 | 14.93 | 23.75 | 36.42 | |||||||||||||||

| Low |

11.54 | 8.13 | 7.80 | 8.45 | 5.67 | |||||||||||||||

| Year end |

26.00 | 11.55 | 11.53 | 11.28 | 23.49 | |||||||||||||||

| (1) | Pretax figures are before noncontrolling interests |

12

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

MANAGEMENT’S OVERVIEW

For the year ended December 31, 2012, net earnings attributable to Stewart of $109.2 million, or $4.61 per diluted share, represent an improvement of $106.8 million over the same period in 2011. Our strong operating results in 2012 allowed us to release in the fourth quarter $36.6 million ($1.50 per diluted share) of a tax asset valuation allowance (originally established in 2008), representing that portion of the allowance that had not been previously utilized to offset taxable income. The remaining valuation allowance of $12.1 million relates primarily to foreign tax credit carryforwards.

Total revenues in 2012 were $1.9 billion, an increase of 16.9 percent from $1.6 billion in 2011. Revenues from our title segment operations increased 14.6 percent, to $1.7 billion in 2012. Revenues from services provided by our mortgage services segment increased 44.0 percent to $178.0 million in 2012 from $123.6 million in 2011.

Cash provided by operations improved substantially in 2012 to $120.5 million compared to $23.4 million in 2011.

Mortgage services pretax earnings increased 45.7 percent to $48.6 million in 2012 compared to $33.4 million in 2011. The offerings in our mortgage services segment continue to expand, with new projects within the broad category of servicing support helping drive the increase in revenues over the last two quarters. As the real estate market recovers, the distressed servicing projects naturally retrench, and new service offerings have been introduced which allow our customers to outsource various other aspects of their servicing operations to us. Our focus is on providing mortgage process outsourcing services which are high-quality, flexible, and responsive. We expect these service offerings to be more sustainable over market cycles.

2012 title losses as a percentage of title revenues declined to 8.1 percent from 9.4 percent in 2011. Title losses, including adjustments to certain large claims in both periods, decreased 1.5 percent on the 14.7 percent increase in title operating revenues when compared to 2011. Our overall loss experience continued to improve relative to prior year periods and was in line with our actuarial expectations, which allowed us to maintain the lower loss provisioning rate adopted effective with policies issued in the third quarter 2012. Cash claim payments decreased 7.7 percent compared to 2011. Losses incurred on known claims decreased 12.2 percent compared to 2011. The decline in cash claim payments and losses incurred on known claims continues a trend noted for several quarters.

13

Table of Contents

CRITICAL ACCOUNTING ESTIMATES

Actual results can differ from our accounting estimates. While we do not anticipate significant changes in our estimates, there is a risk that such changes could have a material impact on our consolidated financial condition or results of operations for future periods.

Title loss reserves

Our most critical accounting estimate is providing for title loss reserves. Our liability for estimated title losses as of December 31, 2012 comprises both known claims ($137.9 million) and our estimate of claims that may be reported in the future ($382.5 million). The amount of the reserve represents the aggregate, non-discounted future payments (net of recoveries) that we expect to incur on policy and escrow losses and in costs to settle claims.

Provisions for title losses, as a percentage of title operating revenues, were 8.1%, 9.4% and 9.6% for the years ended December 31, 2012, 2011 and 2010, respectively. Actual loss payment experience, including the impact of large losses, is the primary reason for increases or decreases in our loss provision. A change of 100 basis points in this percentage, a reasonably likely scenario based on our historical loss experience, would have increased or decreased our provision for title losses and pretax operating results approximately $17.3 million for the year ended December 31, 2012.

Our method for recording the reserves for title losses on both an interim and annual basis begins with the calculation of our current loss provision rate, which is applied to our current premium revenues resulting in a title loss expense for the period. This loss provision rate is set to provide for losses on current year policies and is determined using moving average ratios of recent actual policy loss payment experience (net of recoveries) to premium revenues.

At each quarter end, our recorded reserve for title losses begins with the prior period’s reserve balance for claim losses, adds the current period provision to that balance and subtracts actual paid claims, resulting in an amount that our management compares to its actuarially-based calculation of the ending reserve balance necessary to provide for future title losses. The actuarially-based calculation is a paid loss development calculation where loss development factors are selected based on company data and input from our third-party actuaries. We also obtain input from third-party actuaries in the form of a reserve analysis utilizing generally accepted actuarial methods. While we are responsible for determining our loss reserves, we utilize this actuarial input to assess the overall reasonableness of our reserve estimation. If our recorded reserve amount is within a reasonable range (+/- 4.0%) of our actuarially-based reserve calculation and the actuary’s point estimate, but not at the point estimate, our management assesses the major factors contributing to the different reserve estimates in order to determine the overall reasonableness of our recorded reserve, as well as the position of the recorded reserves relative to the point estimate and the estimated range of reserves. The major factors considered can change from period to period and include items such as current trends in the real estate industry (which management can assess although there is a time lag in the development of this data for use by the actuary), the size and types of claims reported and changes in our claims management process. If the recorded amount is not within a reasonable range of our third-party actuary’s point estimate, we will adjust the recorded reserves in the current period and reassess the provision rate on a prospective basis. Once our reserve for title losses is recorded, it is reduced in future periods as a result of claims payments and may be increased or reduced by revisions to our estimate of the overall level of required reserves.

Large claims (those exceeding $1.0 million on a single claim), including large title losses due to independent agency defalcations, are analyzed and reserved for separately due to the higher dollar amount of loss, lower volume of claims reported and sporadic reporting of such claims. Large title losses due to independent agency defalcations typically occur when the independent agency misappropriates funds from escrow accounts under its control. Such losses are usually discovered when the independent agency fails to pay off an outstanding mortgage loan at closing (or immediately thereafter) from the proceeds of the new loan. Once the previous lender determines that its loan has not been paid off timely, it will file a claim against the title insurer. It is at this point that the title insurance underwriter is alerted to the potential theft and begins its investigation. As is industry practice, these claims are considered a

14

Table of Contents

claim on the newly issued title insurance policy since such policy insures the holder (in this case, the new lender) that all previous liens on the property have been satisfied. Accordingly, these claim payments are charged to policy loss expense. These incurred losses are typically more severe in terms of dollar value compared with traditional title policy claims since the independent agency is often able, over time, to conceal misappropriation of escrow funds relating to more than one transaction through the constant volume of funds moving through its escrow accounts. As long as new funds continue to flow into escrow accounts, an independent agency can mask one or more defalcations. In declining real estate markets, lower transaction volumes result in a lower incoming volume of funds, making it more difficult to cover up the misappropriation with incoming funds. Thus, when the defalcation is discovered, it often relates to several transactions. In addition, the overall decline in an independent agency’s revenues, profits and cash flows increases the agency’s incentive to improperly utilize the escrow funds from real estate transactions.

Internal controls relating to independent agencies include, but are not limited to, pre-signing and periodic audits, site visits and reconciliations of policy inventories and premiums. The audits and site visits cover examination of the escrow account bank reconciliations and an examination of a sample of closed transactions. In some instances, the scope of our review is limited by attorney agencies that cite client confidentiality. Certain states have mandated annual reviews of all agencies by their underwriter. We also determine whether our independent agencies have appropriate internal controls as defined by the American Land Title Association and us. However, even with adequate internal controls in place, their effectiveness can be circumvented by collusion or improper override of the controls by management at the independent agencies. To aid in the selection of independent agencies to review, we have developed an agency risk model that aggregates data from different areas to identify possible problems. This is not a guarantee that all independent agencies with deficiencies will be identified. In addition, we are typically not the only underwriter for which an independent agency issues policies, and independent agencies may not always provide complete financial records for our review.

Due to the inherent uncertainty in predicting future title policy losses, significant judgment is required by both our management and our third party actuaries in estimating reserves. As a consequence, our ultimate liability may be materially greater or less than current reserves and/or our third party actuary’s calculated estimate.

Agency revenues

We recognize revenues on title insurance policies written by independent agencies (agencies) when the policies are reported to us. In addition, where reasonable estimates can be made, we accrue for revenues on policies issued but not reported until after period end. We believe that reasonable estimates can be made when recent and consistent policy issuance information is available. Our estimates are based on historical reporting patterns and other information about our agencies. We also consider current trends in our direct operations and in the title industry. In this accrual, we are not estimating future transactions; we are estimating revenues on policies that have already been issued by agencies but not yet reported to or received by us. We have consistently followed the same basic method of estimating unreported policy revenues for more than 10 years.

Our accruals for revenues on unreported policies from agencies were not material to our consolidated assets or stockholders’ equity as of December 31, 2012 and 2011. The differences between the amounts our agencies have subsequently reported to us compared to our estimated accruals are substantially offset by any differences arising from prior years’ accruals and have been immaterial to consolidated assets and stockholders’ equity during each of the three prior years. We believe our process provides the most reliable estimate of the unreported revenues on policies and appropriately reflects the trends in agency policy activity.

15

Table of Contents

Goodwill and other long-lived assets

Our evaluation of goodwill is normally completed annually in the third quarter using June 30 balances, but an evaluation may also be made whenever events may indicate impairment. This evaluation is based on a combination of a discounted cash flow analysis (DCF) and market approaches that incorporate market multiples of comparable companies and our own market capitalization. The DCF model utilizes historical and projected operating results and cash flows, initially driven by estimates of changes in future revenue levels, and risk-adjusted discount rates. Our projected operating results are primarily driven by anticipated mortgage originations, which we obtain from projections by industry experts. Fluctuations in revenues, followed by our ability to appropriately adjust our employee count and other operating expenses, or large and unanticipated adjustments to title loss reserves, are the primary reasons for increases or decreases in our projected operating results. Our market-based valuation methodologies utilize (i) market multiples of earnings and/or other operating metrics of comparable companies and (ii) our market capitalization and a control premium based on market data and factors specific to our ownership and corporate governance structure (such as our Class B Common Stock). To the extent that our future operating results are below our projections, or in the event of adverse market conditions, an interim review for impairment may be required, which may result in an impairment of goodwill.

We evaluate goodwill based on five reporting units (direct operations, agency operations, international operations, mortgage services and corporate). Goodwill is assigned to these reporting units at the time the goodwill is initially recorded. Once assigned to a reporting unit, the goodwill is pooled and no longer attributable to a specific acquisition. All activities within a reporting unit are available to support the carrying value of the goodwill.

We also evaluate the carrying values of title plants and other long-lived assets when events occur that may indicate impairment. The process of determining impairment for our goodwill and other long-lived assets relies on projections of future cash flows, operating results, discount rates and overall market conditions, including our market capitalization. Uncertainties exist in these projections and they are subject to changes relating to factors such as interest rates and overall real estate and financial market conditions, our market capitalization and overall stock market performance. Actual market conditions and operating results may vary materially from our projections.

Based on these evaluations, we estimate and expense to current operations any loss in value of these assets. As part of our process, we have an option to assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If we decide not to use a qualitative assessment or if we fail the qualitative assessment, then we obtain input from third-party appraisers regarding the fair value of our reporting units. While we are responsible for assessing whether an impairment of goodwill exists, we utilize the input from third-party appraisers to assess the overall reasonableness of our conclusions. We utilized a qualitative assessment for our annual goodwill impairment test and, based on our analysis, determined it was not more-likely-than-not that the fair value of our reporting units were less than their carrying amounts as of June 30, 2012. There were no impairment charges for goodwill or material impairment charges for other long-lived assets during the three years ended December 31, 2012.

Operations. Our business has three main operating segments: title insurance and related services, mortgage services and corporate.

Our primary business is title insurance and settlement-related services. We close transactions and issue title policies on homes, commercial and other real properties located in all 50 states, the District of Columbia and international markets through policy-issuing offices and agencies. We also provide loan origination and servicing support; loan review services; loss mitigation; REO asset management; home and personal insurance services; and technology to streamline the real estate process.

16

Table of Contents

Factors affecting revenues. The principal factors that contribute to changes in operating revenues for our title and mortgage services segments include:

| • | mortgage interest rates; |

| • | availability of mortgage loans; |

| • | ability of potential purchasers to qualify for loans; |

| • | inventory of existing homes available for sale; |

| • | ratio of purchase transactions compared with refinance transactions; |

| • | ratio of closed orders to open orders; |

| • | home prices; |

| • | volume of distressed property transactions; |

| • | consumer confidence; |

| • | demand by buyers; |

| • | number of households; |

| • | premium rates; |

| • | market share; |

| • | opening of new offices and acquisitions; |

| • | number of commercial transactions, which typically yield higher premiums; |

| • | government or regulatory initiatives, including tax incentives; and |

| • | number of REO and foreclosed properties and related debt. |

To the extent inflation causes increases in the prices of homes and other real estate, premium revenues are also increased. Conversely, falling home prices cause premium revenues to decline. Premiums are determined in part by the insured values of the transactions we handle. These factors may override the seasonal nature of the title insurance business. Historically, our first quarter is the least active and our third and fourth quarters are the most active in terms of title insurance revenues.

Industry data. Published mortgage interest rates and other selected residential data for the years ended December 31, 2012, 2011 and 2010 follow (amounts shown for 2012 are preliminary and subject to revision). The amounts below may not relate directly to or provide accurate data for forecasting our operating revenues or order counts.

Our statements on home sales, mortgage interest rates and loan activity are based on published industry data from sources including Fannie Mae, the National Association of Realtors®, the Mortgage Bankers Association and Freddie Mac.

| 2012 | 2011 | 2010 | ||||||||||

| Mortgage interest rates (30-year, fixed-rate) – % |

||||||||||||

| Averages for the year |

3.66 | 4.46 | 4.69 | |||||||||

| First quarter |

3.92 | 4.85 | 5.00 | |||||||||

| Second quarter |

3.80 | 4.66 | 4.91 | |||||||||

| Third quarter |

3.55 | 4.31 | 4.45 | |||||||||

| Fourth quarter |

3.36 | 4.01 | 4.41 | |||||||||

| Mortgage originations – $ billions |

1,921 | 1,496 | 1,701 | |||||||||

| Refinancings – % of originations |

73.0 | 65.7 | 67.9 | |||||||||

| New home sales – in millions |

0.37 | 0.30 | 0.32 | |||||||||

| Existing home sales – in millions |

4.65 | 4.26 | 4.19 | |||||||||

| Existing home sales – median sales price in $ thousands |

176.6 | 166.1 | 172.9 | |||||||||

The real estate market experienced increasing home prices in 2012 and is expected to provide an increasing contribution to GDP in 2013 and in coming years. Recent data indicate that the housing recovery has transitioned to a faster upward track, boosted by an improving labor market and low mortgage rates. Overall, home sales, home prices, and home building activity as well as homebuilder confidence appear to be on the upswing, having risen to multi-year highs during 2012.

17

Table of Contents

Trends and order counts. For the three years ended December 31, 2012, mortgage interest rates (30-year, fixed-rate) have fluctuated from a monthly high of 5.1% in April 2010 to a monthly low of 3.4% in November 2012. In 2012, total mortgage originations and refinancing mortgage originations increased 28.4% and 43.0%, respectively. During 2012, sales of new homes and existing homes increased 19.9% and 9.2%, respectively. In 2011, sales of new homes decreased 5.9%, while sales of existing homes increased 1.7%.

As a result of the above trends, our direct order levels increased from 2011 to 2012 and decreased from 2010 to 2011, which is consistent with the U.S. real estate market during those same periods.

The number of direct title orders opened follows:

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

| First quarter |

103 | 84 | 97 | |||||||||

| Second quarter |

111 | 91 | 106 | |||||||||

| Third quarter |

112 | 101 | 117 | |||||||||

| Fourth quarter |

104 | 90 | 95 | |||||||||

|

|

|

|

|

|

|

|||||||

| 430 | 366 | 415 | ||||||||||

|

|

|

|

|

|

|

|||||||

The number of direct title orders closed follows:

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

| First quarter |

71 | 62 | 61 | |||||||||

| Second quarter |

79 | 67 | 77 | |||||||||

| Third quarter |

81 | 69 | 75 | |||||||||

| Fourth quarter |

85 | 73 | 80 | |||||||||

|

|

|

|

|

|

|

|||||||

| 316 | 271 | 293 | ||||||||||

|

|

|

|

|

|

|

|||||||

RESULTS OF OPERATIONS

A comparison of our results of operations for 2012 with 2011 and 2011 with 2010 follows. Factors contributing to fluctuations in results of operations are presented in the order of their monetary significance, and we have quantified, when necessary, significant changes. Results from our mortgage services and corporate segments are included in year-to-year discussions and, when relevant, are discussed separately.

Title revenues. Revenues from direct title operations increased $91.0 million, or 14.5%, in 2012 and increased $1.1 million, or 0.2%, in 2011. The largest revenue increases in 2012 were in Texas, Utah, Colorado and Washington, partially offset by decreases in Nevada and Georgia. The largest revenue increases in 2011 were in California and Florida, partially offset by decreases in Maryland and Arizona. Revenues from commercial and other large transactions increased $8.5 million to $111.5 million in 2012 and increased $10.3 million to $103.0 million in 2011.

Direct orders closed increased 16.7%, while the average revenue per file closed (including large commercial policies) decreased 2.3% in 2012 compared to 2011 due to an increase in residential refinancing closings in the same periods. Direct operating revenues, excluding large commercial policies, increased 15.3%, while the average revenue per closing decreased 1.2% in 2012 compared to 2011. On average, refinance premium rates are 60% of the title premium revenue of a similarly priced sale transaction. In 2011 direct orders closed decreased 7.7%, while the average revenue per file closed (including large commercial policies) increased 8.7%

18

Table of Contents

compared to 2010 due to a decrease in residential refinancing closings in the same periods. Direct operating revenues, excluding large commercial policies, decreased 1.5%, while the average revenue per closing decreased 6.7% in 2011 compared to 2010.

Revenues from independent agencies increased $130.2 million, or 14.8%, in 2012 and decreased $37.4 million, or 4.1%, in 2011. The largest increases in revenues from independent agencies in 2012 were in New York, Texas, California and Pennsylvania, partially offset by decreases in Illinois, Maryland, and Minnesota. The largest increases in revenues from independent agencies in 2011 were in New York, Illinois, Michigan, and Minnesota, partially offset by decreases in California, Florida, New Jersey, and Utah. Revenues from independent agencies net of amounts retained by those agencies increased 16.3% in 2012 and declined 4.9% in 2011.

Title revenues by geographic location. The approximate amounts and percentages of consolidated title operating revenues for the last three years were as follows:

| Amounts ($ millions) | Percentages | |||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Texas |

299 | 247 | 244 | 17 | 16 | 16 | ||||||||||||||||||

| California |

204 | 181 | 203 | 12 | 12 | 13 | ||||||||||||||||||

| New York |

190 | 165 | 136 | 11 | 11 | 9 | ||||||||||||||||||

| International |

117 | 109 | 98 | 7 | 7 | 6 | ||||||||||||||||||

| Florida |

71 | 58 | 71 | 4 | 4 | 5 | ||||||||||||||||||

| All others |

845 | 745 | 788 | 49 | 50 | 51 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 1,726 | 1,505 | 1,540 | 100 | 100 | 100 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Mortgage services revenues. Mortgage services operating revenues increased $50.8 million, or 45.3%, and $20.3 million, or 22.2%, in 2012 and 2011, respectively. The increases in 2012 and 2011 were primarily due to a significant rise in demand for our servicing support services, including loan modification services. The service offerings in our mortgage services segment continue to expand, with new servicing support projects driving the increase in revenues during 2012. The acquisition of PMH Financial in the third quarter 2011 also contributed to the 2011 increase in mortgage services revenues. Demand for mortgage services offerings are influenced by the number and scale of government programs and lender projects which may result in significant fluctuations in mortgage services revenues. Demand from lenders is increasingly being driven by their desire to more broadly outsource aspects of their servicing support operations, a trend that we expect will continue in 2013. As the real estate market recovers and distressed servicing projects naturally retrench, new service offerings have been introduced which allow our customers to outsource various aspects of their servicing operations to us. Our focus is on providing mortgage process outsourcing services which are high-quality, flexible and responsive. We expect these service offerings to be more sustainable over market cycles.

Investment income. Investment income decreased $1.7 million, or 10.9%, and $2.9 million, or 15.7%, in 2012 and 2011, respectively. The decrease in 2012 was primarily due to decreases in average yield. Certain investment gains and losses, which are included in our results of operations in investment and other gains – net, were realized as part of the ongoing management of our investment portfolio for the purpose of improving performance. The decrease in 2011 was primarily due to decreases in yield which were partially offset by a $1.2 million royalty payment.

In 2012, investment and other gains – net included realized gains of $8.0 million from the sale of debt securities and other investments available-for-sale and sale of fixed assets, partially offset by realized losses of $0.8 million for the impairment of cost-basis investments.

In 2011, investment and other gains – net included realized gains of $10.7 million from the sale of debt instruments and investments available-for-sale, which were offset by a $4.3 million loss on a third-party loan guarantee obligation, and a $3.5 million impairment of cost-basis investments.

19

Table of Contents

In 2010, investment and other gains – net included realized gains of $11.8 million from the sale of debt instruments and investments available-for-sale, $6.3 million primarily from a transfer of the rights to internally developed software, $1.2 million from the sale of interests in subsidiaries and $3.0 million from the sale of real estate.

Retention by agencies. Amounts retained by title agencies are based on agreements between the agencies and our title underwriters. On average, amounts retained by independent agencies, as a percentage of revenues generated by them, were 82.3%, 82.5% and 82.4% in the years 2012, 2011 and 2010, respectively. The average retention percentage may vary from year-to-year due to the geographical mix of agency operations, the volume of title revenues and, in some states, laws or regulations. Due to the variety of such laws or regulations, as well as competitive factors, the average retention rate can differ significantly from state to state. Although general conditions in the real estate industry are improving nationwide, the recovery in specific markets has varied considerably. In addition, a high proportion of our independent agencies are in states with retention rates greater than 80% and the markets in those states have recovered relatively faster than the nation as a whole, which has resulted in our average retention percentage remaining in the 82%—83% range. We expect our average retention rate to remain in this range over the near to medium term. However, we continue to adjust independent agency contracts in an economically sound manner, and we expect the mix of agency business to normalize as real estate markets continue to stabilize nationally resulting in lower average retention percentages in the aggregate. The slight increase in agent retention in 2011 was attributable to a shift in geographic mix of revenues from independent agents, as relatively more revenues were realized in states with lower remittance rates, thus lowering the overall average remittance rate. The fluctuations in 2010 were also affected by the uneven recovery of real estate markets across the nation; those states with higher agency retention percentages experienced a disproportionate increase in transaction activity in 2009.

We began the process of vetting our network of independent agencies several years ago with the emphasis on managing for quality and profitability. Since fourth quarter 2008, our average annual remittance rate per independent agency has increased more than 95 percent while we have reduced the number of independent agencies in our network by approximately 40 percent. Further, the policy loss ratio of our current independent agency network for the year ended December 31, 2012 is less than one-third of its level in the comparable 2008 period.

Selected cost ratios (by segment). The following table shows employee costs and other operating expenses as a percentage of related title insurance and mortgage services operating revenues.

| Employee costs (%) | Other operating (%) | |||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Title |

19.7 | 20.4 | 19.8 | 14.8 | 15.2 | 15.2 | ||||||||||||||||||

| Mortgage services |

60.9 | 63.0 | 66.0 | 8.7 | 5.3 | 10.3 | ||||||||||||||||||

These two categories of expenses are discussed below in terms of year-to-year monetary changes.

Employee costs. Our employee costs and certain other operating expenses are sensitive to inflation. Employee costs for the combined business segments increased $72.6 million, or 15.5%, in 2012 and $2.3 million, or 0.5%, in 2011. The number of persons we employed at December 31, 2012, 2011 and 2010 was approximately 6,300, 5,600 and 5,700, respectively.

In 2012, we increased our employee headcount company-wide by approximately 691, or 12.3% including acquisitions. The increase in headcount was largely driven by new mortgage services contracts (see discussion below). Employee costs were also influenced by increased contract labor for the aforementioned mortgage services contracts as well as higher incentive compensation expense driven by the improvement in pretax earnings before noncontrolling interest.

20

Table of Contents

In 2011, we reduced our employee headcount company-wide by approximately 240, or 4.2% excluding acquisitions. This decrease was partially offset by the acquisition of PMH Financial in 2011, which added approximately 100 employees. Employee costs were also influenced by increased incentive compensation expense driven by the improvement in pretax earnings before noncontrolling interest.

In 2010, we reduced our employee headcount company-wide by 130, or 2.2%, excluding the effects of divestitures. In 2010, employee costs were reduced primarily due to the sale and deconsolidation of several subsidiaries, partially offset by increases in state unemployment tax rates in certain states.

In our mortgage services segment, total employee costs as a percentage of operating revenue fell to 61.1% from 62.9% in 2011. Actual costs increased $30.5 million, or 39.1%, in 2012, primarily due to increases in staffing requirements to support new contracts awarded in late 2011 and early 2012. In 2011, actual costs increased $4.4 million, or 5.9%, primarily due to increases in staffing driven by increased demand for our loan modification services.

Other operating expenses. Other operating expenses include costs that are fixed in nature, costs that follow, to varying degrees, changes in transaction volumes and revenues and costs that fluctuate independently of revenues. Costs that are fixed in nature include attorney fees, equipment rental, insurance, professional fees, rent and other occupancy expenses, repairs and maintenance, technology costs, telephone and title plant rent. Costs that follow, to varying degrees, changes in transaction volumes and revenues include fee attorney splits, bad debt expenses, certain mortgage services expenses, copy supplies, delivery fees, outside search fees, postage, premium taxes and title plant expenses. Costs that fluctuate independently of revenues include auto expenses, general supplies, litigation defense and settlement costs, promotion costs and travel.