UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-02658

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

Registrant’s telephone number, including area code: (713 ) 625-8100

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class of stock) | Trading Symbol(s) | (Name of each exchange on which registered) | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☑ | ☐ | Accelerated filer | ☐ | Non-accelerated filer | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the Common Stock (based upon the closing stock price of the Common Stock of Stewart Information Services Corporation, as reported by the NYSE on June 30, 2022) held by non-affiliates of the Registrant was approximately $1.3 billion.

On February 17, 2023, there were 27,193,457 outstanding shares of the Registrant's Common Stock.

Documents Incorporated by Reference

FORM 10-K ANNUAL REPORT

YEAR ENDED DECEMBER 31, 2022

TABLE OF CONTENTS

| Item | Page | |||||||

| 1 | ||||||||

| 1A. | ||||||||

| 1B. | ||||||||

| 2 | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 5 | ||||||||

| 7 | ||||||||

| 7A. | ||||||||

| 8 | ||||||||

| 9 | ||||||||

| 9A. | ||||||||

| 9B. | ||||||||

| 10 | ||||||||

| 11 | ||||||||

| 12 | ||||||||

| 13 | ||||||||

| 14 | ||||||||

| 15 | ||||||||

| 16 | ||||||||

As used in this report, “we,” “us,” “our,” the “Company” and “Stewart” mean Stewart Information Services Corporation and our subsidiaries, unless the context indicates otherwise.

PART I

Item 1. Business

Founded in 1893, Stewart Information Services Corporation (NYSE:STC) (Stewart) is a customer-focused, global title insurance and real estate services company offering products and services through our direct operations, network of approved agencies and other companies within the Stewart family. One of the largest title companies in the industry, Stewart provides services to homebuyers and sellers, residential and commercial real estate professionals, mortgage lenders and servicers, title agencies, real estate attorneys and home builders. Stewart also provides appraisal management services, online notarization and closing services, search and valuation services, credit and real estate data services, home and personal insurance services, tax-deferred exchanges, and technology services to streamline the real estate process. Stewart is headquartered in Houston, Texas and operates primarily throughout the United States (U.S.) and has regional offices in Australia, Canada, the Caribbean, Europe, Mexico and the United Kingdom.

We currently report our business in three segments: title insurance and related services (title), real estate solutions, and corporate and other. Refer to Note 18 to our audited consolidated financial statements and Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) for financial information related to our segments.

Title Segment

Title insurance and related services include the functions of searching, examining, closing and insuring the condition of the title to real property. The title segment also includes home and personal insurance services, Internal Revenue Code Section 1031 tax-deferred (Section 1031) exchanges, and digital customer engagement platform services.

Examination and closing. The purpose of a title examination is to ascertain the ownership of the property being transferred, debts that are owed on it and the scope of the title policy coverage. This involves searching for and examining documents such as deeds, mortgages, wills, divorce decrees, court judgments, liens, assessments and tax records.

At the closing or settlement of a sale transaction, the seller executes and delivers a deed to the new owner. The buyer typically signs new mortgage documents and closing funds are disbursed to the seller, the prior lender, real estate brokers, the title company and others. Certain documents, such as the deed and mortgage or deed of trust, are then recorded in the public records. A title insurance policy is generally issued to both the new lender and the owner at the closing of the transaction.

At the closing or settlement of a refinance transaction, the borrower executes and delivers a mortgage or deed of trust to the lender. The borrower typically signs the mortgage documents and closing funds are ordinarily disbursed to the prior lender, the title company and others. Certain documents are then recorded in the public records. A title insurance policy is generally issued to the new lender at the closing or recording of the transaction.

Title insurance policies. Lenders in the United States generally require title insurance as a condition to making a loan on real estate, including securitized lending, as this assures lenders of the priority of their lien position on the real estate property. Also, the purchasers of the real estate property want insurance to protect against claims that may arise against the title to the property. The face amount of the owner's policy is normally the purchase price in a purchase transaction, while the face amount of the lender's policy is the amount of the related loan when financing is involved in either purchase or refinance transaction.

1

Title insurance is substantially different from other types of insurance. Fire, auto, health and life insurance policies protect against future losses and events. In contrast, title insurance generally insures against losses from past events and seeks to protect the policyholder or lender by eliminating covered risks through the examination and settlement process. In essence, subject to its exceptions, conditions and exclusions, an owner's title insurance policy provides a warranty to the policyholder that the title to the property is free from defects that might impair ownership rights, or in the case of a lender's policy, that there is priority of lien position. Most other forms of insurance provide protection for a limited period of time and, hence the policy must be periodically renewed. Title insurance, however, is issued for a one-time premium and the owner's policy provides protection for as long as the owner owns the property, or has liability in connection with the property, or a lender under its policy has its insured lien on the property. Also, a title insurance policy does not have a finite contract term, whereas most other lines of insurance have definite beginning and ending dates for coverage. Although an owner's title insurance policy provides protection for as long as the owner owns the property being covered, the title insurance company generally does not have information about which policies are still effective. Most other lines of insurance receive periodic premium payments and policy renewals thereby allowing the insurance company to know which policies are effective. In certain circumstances, we may provide post-policy coverage and we may provide coverage against certain known risks after analyzing the underwriting risks.

Losses. Losses on policies occur when a title defect is not discovered during the examination and settlement process. Reasons for losses include, but are not limited to, forgeries, misrepresentations, unrecorded or undiscovered liens, the failure to pay off existing liens, mortgage lending fraud, mishandling or defalcation of settlement funds, issuance by independent agencies of unauthorized coverage and defending policyholders when covered claims are filed against an owner's or lender's interest in the property. Losses may also occur for coverage that we may provide under Closing Protection Letters.

Some claimants seek damages in excess of policy limits. Those claims are based on various legal theories. We vigorously defend against spurious claims and provide protection for covered claims up to the limits set forth in the policy. We have from time-to-time incurred losses in excess of policy limits. Experience shows that most policy claims and claim payments are made in the first eight years after the policy has been issued, although claims can also be reported and paid many years later. By their nature, claims are often complex, vary greatly in dollar amounts and are affected by economic and market conditions, the specific facts of the individual claim and the legal environment existing at the time claims are processed.

Our liability for estimated title losses comprises estimates of both known claims and incurred but unreported claims expected to be paid in the future for policies issued as of the balance sheet date. The amount of our loss reserve represents the aggregate future payments (net of recoveries) that we expect to make on policy losses and in costs to settle claims. In accordance with industry practice, these amounts have not been discounted to their present values. Estimating future title loss payments is difficult due to the complex nature of title claims, the length of time over which claims are paid, the significant variance in dollar amounts of individual claims and other factors. The amounts provided for policy losses are based on reported claims, historical loss payment experience and the current legal and economic environment. Estimated provisions for current year policy losses are charged to income in the same year the related premium revenues are recognized. Annual provisions for policy losses also include changes in the estimated aggregate liability on policies issued in prior years.

Amounts shown as our estimated liability for future loss payments are continually reviewed by us for reasonableness and adjusted as appropriate. We have consistently followed the same basic method of estimating and recording our loss reserves for more than 30 years. As part of our process, we also obtain input from third-party actuaries regarding our methodology and resulting reserve calculations. While we are responsible for determining our loss reserves, we utilize this actuarial input to assess the overall reasonableness of our estimated reserves.

See Critical Accounting Estimates - Title Loss Reserves under Item 7 - MD&A for information on current year policy losses and consolidated balance sheet reserves.

2

Factors affecting revenues. Title insurance revenues are closely related to the level of activity in the real estate markets we serve and the prices at which real estate sales are made. Real estate sales are directly affected by the availability and cost of money to finance purchases. Other factors include consumer confidence, demand by buyers, foreign currency exchange rates, supply chains, inventory and weather. In periods of low interest rates, loan refinancing transactions are also an important contributor to revenues. These factors may override the seasonal nature of the title business. Generally, our first quarter is the least active and our second and third quarters are the most active in terms of title insurance revenues. Refer to Item 7 - MD&A, Results of Operations - Industry Data for comparative information on home sales, mortgage interest rates and loan activity, and Critical Accounting Estimates - Factors Affecting Revenues for additional details on principal factors affecting revenues.

Customers. The primary sources of title insurance business are attorneys, builders, developers, home buyers and home sellers, lenders, mortgage brokers, and real estate brokers and agents. Titles insured include residential and various asset classes of commercial properties, including but not limited to, office, hotel, multi-family, industrial, retail, undeveloped acreage, farms, ranches, wind and solar power installations and other energy-related projects.

Service, location, financial strength, company size and related factors affect customer orders. Increasing market share is accomplished primarily by providing superior service. The parties to a closing are concerned with accuracy, expertise, responsiveness, timeliness and cost. The rates charged to customers vary from state to state, and are regulated, to varying degrees and in different ways, in most states.

The financial strength and stability of the title underwriter are important factors in maintaining and increasing our business, particularly commercial business. We are rated as investment grade by the title industry’s leading rating agencies. Our wholly-owned and principal underwriter, Stewart Title Guaranty Company (Guaranty), is currently rated “A Double Prime” by Demotech Inc., "A-" by Fitch Ratings Ltd., and "A- " by A.M. Best. Similarly, our wholly-owned and second largest underwriter, Stewart Title Insurance Company (STIC), is also highly rated by such rating companies. These ratings are not credit ratings. Instead, the ratings are based on quantitative, and in some cases qualitative, information and reflect the conclusions of the rating agencies with respect to our financial strength, results of operations and ability to pay policyholder claims. These ratings are not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency.

Market share. Title insurance statistics are compiled quarterly by the American Land Title Association (ALTA), the title industry’s national trade association. Based on 2022 statutory premiums written through the nine months ended September 30, 2022, Guaranty is one of the leading title insurers in the United States. Our largest competitors are Fidelity National Financial, Inc. (FNF) whose principal underwriters are Chicago Title Insurance Company and Fidelity National Title Insurance Company, First American Financial Corporation (First American) which includes First American Title Insurance Company, and Old Republic Title Insurance Group (Old Republic) which includes Old Republic National Title Insurance Company. We also compete with other title insurer companies, as well as abstractors, attorneys who issue title opinions and attorney-owned title insurance funds. A number of homebuilders, financial institutions, real estate brokers and others own or control title insurance agencies, some of which issue policies underwritten by Guaranty.

During 2022, continuing with our strategy of investing opportunistically to build a stronger and more resilient company, we acquired FNC Title Services, LLC, which specializes in providing title insurance and settlement services to reverse mortgage, conventional and commercial closings nationwide, and BCHH, LLC, a national provider of title and settlement services to individual and institutional investors and lenders.

Refer to "Title revenues by geographic location" within the Results of Operations discussion under Item 7 - MD&A for the breakdown of title revenues by major geographic location.

Regulations. Title insurance companies are subject to comprehensive state regulations covering premium rates, agency licensing, policy forms, trade practices, reserve requirements, investments and the transfer of funds between an insurer and its parent or its subsidiaries and any similar related party transactions. Kickbacks and similar practices are prohibited by most state and federal laws. See Item 1A - Risk Factors: Our Insurance Subsidiaries Must Comply With Extensive Government Regulations.

3

Real Estate Solutions Segment

The real estate solutions segment supports the real estate mortgage industry by primarily providing appraisal management services, online notarization and closing solutions, credit and real estate information services, and search and valuation services. We provide these services through Stewart Valuation Intelligence (formerly, separate companies United States Appraisals and Pro-Teck Services Ltd.), NotaryCam, Inc., Signature Closers, LLC, Informative Research, and Equimine (which operates as PropStream). These companies are integral to our goal of streamlining the real estate and loan transaction lifecycle through end-to-end, customer-focused and technology-based solutions.

Factors affecting revenues. As in the title segment, real estate solutions revenues are closely related to the level of activity in the real estate market, including interest rates, new or refinancing origination activity, and home sales volumes. Companies that compete with our real estate solutions businesses vary across a wide range of industries and include the major title insurance underwriters mentioned under “Title Segment - Market share” as well as other title agents, appraisal management companies, and real estate technology and business process outsourcing providers.

Customers. Customers for our real estate solutions products and services primarily include mortgage lenders and servicers, mortgage brokers, realtors, and mortgage and real estate investors. Many of the services and products offered by our real estate solutions business are used by professionals and intermediaries who have been retained to assist consumers with the sale, purchase, mortgage, transfer, recording and servicing of real estate transactions. To that end, timely, accurate and compliant services are critical to our customers since these factors directly affect the service they provide to their customers. Financial strength, scale, robust processes to ensure legal and regulatory compliance, marketplace presence, high quality customer support, and reputation as a reliable, compliant solution are important factors in attracting new business.

Corporate and Other Segment

The corporate and other segment is primarily comprised of the parent holding company and our centralized administrative services departments. During 2022, the corporate and other segment included results of a real estate brokerage company that was acquired in late 2021 and subsequently sold during the second quarter 2022.

General

Investment policies. Our investment portfolios primarily reside in Guaranty and STIC, both of which are domestic underwriters, and two of our other international regulated insurance underwriters. These underwriters maintain investments in accordance with certain statutory requirements for the funding of premium reserves and deposits, or, in the case of our international operations, for the maintenance of certain capital ratios required by regulators. The activities of the portfolios are overseen by investment committees comprised of certain senior executives. Their oversight includes such activities as policy setting, determining appropriate asset classes with different and distinct risk/return profiles so as to prudently diversify the portfolio, and approving and managing service vendors (investment managers and custodians). We also utilize the expertise of third-party investment advisors to maximize returns while managing risk. Our investment policies are designed to comply with regulatory requirements as applicable law imposes restrictions upon the types and amounts of investments that may be made by our regulated insurance subsidiaries. Further, our investment policies require that investments are managed with a view to balancing profitability, liquidity, and risk (interest rate risk, credit risk, currency rate risk and liquidity risk) and consideration of negative impacts to earnings per share and income taxes.

As of December 31, 2022, approximately 86% of our combined debt and equity securities investment portfolios consisted of fixed income securities. Also as of that date, approximately 95% of the fixed income investments are held in securities that are A-rated or higher, and substantially all of the fixed income portfolios are rated investment grade (percentages are based on the fair value of the securities). In addition to our debt and equity securities investment portfolios, we maintain certain money-market and other short-term investments. For more details on market risks related to our investment securities portfolio, refer to Part II, Item 7A, Quantitative and Qualitative Disclosures About Market Risk.

4

Trademarks. We have developed and acquired numerous automated products and processes that are crucial to both our title and real estate solutions operations. These systems automate most facets of the real estate transaction. Among these trademarked products and processes are AIM+®, AgencySecure®, PropertyInfo®, SureClose®, TitleSearch®, eTitleSearch®, Virtual Underwriter®, StewartNow®, Valuation Intelligence®, NotaryCam®, Cloudvirga® and PropStream®. We consider these trademarks, which can be renewed every ten years, to be important to our business.

Human capital resources. As of December 31, 2022, we employed approximately 7,100 people, with approximately 6,100 employees located in the U. S. and approximately 1,000 employees located internationally. We consider our relationship with our employees to be critical to both our operations and performance. We are committed to attracting, developing, retaining, and motivating a diverse and inclusive group of employees, and we do so in a variety of ways.

For additional information about our workforce, sustainability efforts, human capital programs and initiatives, specifically our Culture of Caring, visit our website (www.stewart.com) and review our 2021 Environmental, Social and Governance (ESG) Report.

Recruiting

Stewart is committed to recruiting strategies – policies, practices, decision-making and more – grounded in fairness, equity, and inclusivity. Stewart is an equal employment opportunity employer, and our commitment extends to all facets of employment.

Inclusion and diversity

Stewart is committed to an inclusive workplace that values all employees equally, regardless of age, race, ethnicity, sexual orientation, or gender identification and committed to providing a supportive diverse professional work environment that is free of and prohibits discrimination against any employee or applicant for employment as defined by applicable laws as well as best practices in corporate governance. All phases of employment, including but not limited to, recruiting, selection, employment, placement, promotion, transfer, demotion, reduction of force and termination, benefits, training, and compensation are guided by the Company policies regarding conduct, including Stewart’s Equal Opportunity Employer statement, Human Rights policy and our Code of Business Conduct and Ethics. Stewart's Code of Business Conduct and Ethics is reviewed and acknowledged annually by our employees and by our Board of Directors.

We continue our journey and commitment to inclusion and belonging through our Diversity, Equity, and Inclusion (DE&I) Council, which introduces practices and programs that benefit our workplace and drive systemic change within the workplace and the communities in which we live and work. Stewart’s DE&I Council meets frequently to discuss critical topics, weigh in on important challenges our employees are facing, and ensure we are focused on strategic priorities grounded in our overall DE&I commitment.

Learning and development

Stewart’s approach to talent development encourages continuous learning and professional development for all employees across the organization, creates transparency around job expectations through a deliberate goal setting, performance, coaching and feedback process, allows Stewart employees to take ownership of their career, and provides them with the resources needed to be successful in their current as well as future roles.

Compensation, benefits and well-being

Stewart cares about the health, safety, and well-being of our employees and their families, and provides a variety of valuable health and welfare benefits, including but not limited to, medical, dental and vision coverage, life and disability insurance, 401(k) plan match, participation in an employee stock purchase plan (ESPP), health savings account, flexible spending account, an employee assistance program, emotional health and wellness programs, local community based charitable programs through the Stewart Title Foundation, and global employee appreciation and recognition programs.

5

Employee engagement and recognition

In partnership with an outside firm, we conducted a U.S. employee engagement survey in early 2022 to better and more formally understand employee sentiment and gain actionable feedback on culture and engagement. The results have helped guide our path forward on keeping employees engaged, ensuring Stewart is a place where our employees are proud to work, and strengthening our relationship with the communities we serve. Additionally, based on the survey feedback received from our employees, we have been recognized in the Top Workplaces program as a 2023 Top Workplace USA and for Employee Appreciation, Employee Well-Being, as well as several regional Top Workplaces awards.

Cybersecurity. While Stewart regularly defends against, responds to and mitigates risks from information technology (IT) systems and software vulnerabilities, broader cybersecurity threats and data security incidents, we experienced no known material cyber breaches during the three-year period ended December 31, 2022. In the event a material breach or an IT disruption takes place in the future, we have an incident response team in place to take immediate actions, work with local and national law enforcement, and notify the appropriate regulators, our Board of Directors and impacted parties. In addition, we would work with the NYSE to disclose the scope and effect of the breach or disruption through an appropriate Form 8-K filing, without providing information that could affect any law enforcement investigation. Stewart utilizes considerable resources in its cybersecurity efforts, both in network, system and application security as well as in the protection of personal, private and confidential information. Firewalls, application security, encryption, access control, vulnerability management and intrusion detection systems are some, but not all, of the resources used in the Company’s efforts to prevent cybersecurity breaches.

Stewart is regularly assessed against the cybersecurity frameworks of the National Institute of Standards and Technology (NIST CSF), and also evaluated for compliance with the SSAE-18 Systems and Organization Controls (SOC) standards of the American Institute of Certified Public Accountants (AICPA). In addition, the Company has a comprehensive and continuous information security awareness program that includes function and behavior-based training. Finally, vendor risk management is an essential part of the Company’s Enterprise Governance Risk and Compliance (GRC) program. All vendors are assessed and measured against standard security frameworks. Approved vendors are continuously monitored for performance and compliance, and vendor security requirements are well defined and included with all master service agreements and contracts. Vendor performance and compliance is continuously monitored throughout the calendar year and reassessed or audited annually. Our Chief Information Security Officer updates the Company’s Audit Committee quarterly on our cybersecurity preparedness, as well as providing ad hoc updates as needed.

Available information. We electronically file annual, quarterly and other reports and information with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934, as amended (Exchange Act). Our electronic filings can be accessed at the SEC's website at www.sec.gov. We also make available upon written request, free of charge, or through our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Code of Ethics and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

The references in this annual report on Form 10-K to our website address or any third party’s website address, including the SEC’s website, do not constitute incorporation by reference of the information contained in those websites and should not be considered part of this document unless otherwise expressly stated.

Transfer agent. Our transfer agent is Computershare, which can be contacted via regular mail at P.O. Box 43006, Providence, RI 02940-3006 and via its website (https://www-us.computershare.com/investor).

CEO and CFO certifications. The CEO and CFO certifications required under Section 302 of the Sarbanes-Oxley Act are filed as exhibits to our 2022 Form 10-K. Stewart submitted during 2022 its annual CEO Certification under Section 303A.12(a) of the New York Stock Exchange (NYSE) Listed Company Manual.

6

Item 1A. Risk Factors

You should consider the following risk factors, as well as the other information presented in this report and our other filings with the SEC, in evaluating our business and any investment in Stewart. These risks could materially and adversely affect our business, financial condition and results of operations. In that event, the trading price of our Common Stock could decline materially.

Strategic Risk Factors

Acquisitions or strategic investments we have made or may make could turn out to be unsuccessful.

As part of our investment and growth strategy, we frequently monitor and analyze opportunities to acquire or make a strategic investment in new or other businesses where we believe we can have sustained success and improve Stewart’s scale and profitability. The negotiation of potential acquisitions or strategic investments as well as the integration of an acquired business or new personnel, could result in a substantial diversion of management resources. Future acquisitions could likewise involve numerous additional risks such as potential losses from unanticipated litigation or levels of claims and inability to generate sufficient revenue to offset acquisition costs. As we pursue or consummate a strategic transaction or investment, we may value the acquired or funded company or operations incorrectly, fail to integrate the acquired operations appropriately into our own operations, fail to successfully manage our operations as our product and geographical diversity increases, expend unforeseen costs during the acquisition or integration process, or encounter other unanticipated risks or challenges. If we succeed in consummating a strategic investment, we may fail to value it accurately or divest it or otherwise realize the value which we originally invested or have subsequently reflected in our consolidated financial statements. Any failure by us to effectively limit such risks or implement our acquisitions or strategic investment strategies could have a material adverse effect on our business, financial condition or results of operations.

Innovations introduced by real estate industry participants, including Stewart and our competitors, may be potentially disruptive and could adversely affect Stewart

Various initiatives are introduced by real estate industry participants, including Stewart and our competitors, utilizing innovative technologies, processes and techniques in order to improve the manner and timeliness of delivering products and services, increase efficiency, improve the quality of products and services and customer experience, and enhance risk management. These efforts include implementing advanced technologies to automate and streamline certain manual processes during, but not limited to, search and examination, title insurance policy issuance, and real estate transaction settlement. Innovations by our competitors may change the demand for our products and services, the manner our products and services are ordered or fulfilled, and the revenue or profitability derived from our products and services. Further, in developing and implementing our own innovation initiatives, we have made and will likely continue to make significant investments. Depending on factors relating to our operations, the real estate industry and the macroeconomic environment, these innovative investments may not be successful, may result in increased claims, reputational damage or other material impact on Stewart, or could disrupt our business operations by significantly diverting management's attention.

Rapid changes in our industry require secure, timely and cost-effective technological responses. Our earnings may be adversely affected if we are unable to effectively use technology to address regulatory changes and increase productivity.

We believe that our future success depends, in part, on our ability to anticipate changes in the industry and to offer products and services that meet evolving standards on a timely and cost-effective basis. To do so requires a flexible and secure technology architecture which can continuously comply with changing regulations, improve productivity, lower costs, reduce risk and enhance the customer experience. Inability to meet these requirements and any unanticipated downtime in our technology may have a material adverse effect on our earnings.

7

Operational Risk Factors

Adverse changes in economic conditions, especially those affecting the levels of real estate and mortgage activity, may reduce our revenues.

Our financial condition and results of operations are affected by changes in economic conditions, particularly mortgage interest rates, credit availability, real estate prices and consumer confidence. Our revenues and earnings have fluctuated in the past due to the cyclical nature of the housing industry and we expect them to continue to fluctuate in the future.

The demand for our title insurance-related and real estate solutions offerings is dependent primarily on the volume of residential and commercial real estate transactions. The volume of these transactions historically has been influenced by such factors as mortgage interest rates, inventory, affordability, availability of financing and the overall state of the economy. Typically, when interest rates are increasing or when the economy is experiencing a downturn, real estate activity declines. As a result, the title insurance industry tends to experience decreased revenues and earnings, and potentially increased claims experience.

Our revenues and results of operations have been and may in the future be adversely affected by a decline in home prices, real estate activity and the availability of financing alternatives. Deterioration in the macroeconomic environment generally causes weakness or adverse changes in the level of real estate activity, which could have a material adverse effect on our consolidated financial condition or results of operations, including impairment of our goodwill and long-lived assets. Also, we may not be able to accurately predict the effects of periods or expectations of high or rapidly rising inflation rates, and governmental responses thereto, and may not respond in a timely or adequate manner to mitigate the negative effects of such inflation, such as decreases in the demand for our products and services and higher labor and other expenses.

Our claims experience may require us to increase our provision for title losses or to record additional reserves, either of which would adversely affect our earnings.

We estimate our future loss payments, and our assumptions about future losses may prove inaccurate. Provisions for policy losses on policies written within a given year are charged to income in the same year the related premium revenues are recognized. The amounts provided are based on reported claims, historical loss payment experience and the current legal and economic environment. Losses that are higher than anticipated are an indication that total losses for a given policy year may be higher than originally calculated. Changes in the total estimated future loss for prior policy years are recorded in the period in which the estimate changes. Claims are often complex and involve uncertainties as to the dollar amount and timing of individual payments. Claims are often paid many years after a policy is issued. From time-to-time, we experience large losses, including losses from independent agency defalcations, wire fraud, title policies that have been issued or worsening loss payment experience, any of which may require us to increase our title loss reserves. These events are unpredictable and may have a material adverse effect on our earnings.

The issuance of our title insurance policies and related activities by title agents, which operate with substantial independence from us, could adversely affect our operations.

Our title insurance subsidiaries issue a significant portion of their policies through independent title agents. There is no guarantee that these title agents will fulfill their contractual obligations to us as contemplated, although such contracts include limitations that are designed to limit our risk with respect to their activities. In addition, regulators are increasingly seeking to hold title companies responsible for the actions of these title agents and, under certain circumstances, the Company may be held liable directly to third parties for actions (including defalcations) or omissions of these agents. Case law in certain states also suggests that the Company is liable for the actions or omissions of its agents in those states, regardless of contractual limitations. As a result, the Company’s use of title agents could result in increased claims on the Company’s policies issued through agents and an increase in other costs and expenses.

8

Competition in the title insurance industry may affect our revenues.

Competition in the title insurance industry is intense, particularly with respect to price, service and expertise. Larger commercial customers and mortgage originators also look to the size and financial strength of a title insurer. Although we are one of the leading title insurance underwriters based on market share, FNF, First American and Old Republic each has substantially greater gross revenues than we do and their holding companies have significantly greater capital. Further, other title insurance companies, collectively, hold a considerable share of the market. Although we are not aware of any current initiatives to reduce regulatory barriers to entering our industry, any such reduction could result in new competitors, including financial services firms or institutions, entering the title insurance business. From time-to-time, new entrants enter the marketplace with alternative products to traditional title insurance, although many of these alternative products have been disallowed by title insurance regulators. Further, advances in technologies could, over time, significantly disrupt the traditional business model of financial services and real estate-related companies, including title insurance. These alternative products or disruptive technologies, if permitted by regulators, could have a material adverse effect on our revenues and earnings.

Information technology (IT) systems present potential targets for cybersecurity attacks.

Our operations are reliant on technology and data. Our IT systems and our vendors' IT systems are used to store and process sensitive information regarding our operations and financial position as well as any information pertaining to our customers and vendors. While we take the utmost precautions, we cannot guarantee safety from all cyber threats, IT system or software vulnerabilities, wire fraud and attacks to our systems. Any successful breach of security could result in loss of sensitive data, spread of inaccurate or confidential information, disruption of operations, theft of escrowed funds, endangerment of employees, damage to our assets and increased costs to respond. Although we maintain cyber liability insurance to help protect us financially, there is no assurance that the instances noted above would not have a negative impact on cash flows, litigation status and/or our reputation, which could have a material adverse effect on our business, financial condition and results of operations. In the event of a material cybersecurity breach, we have an incident response team in place to take immediate actions, work with local and national law enforcement, notify impacted parties as well as appropriate state regulators and the NYSE.

Climate change and extreme weather events could adversely affect our operations and financial performance

Our operations and financial performance could be adversely impacted by climate change and extreme weather events, especially if these occurrences negatively impact the overall real estate market and the broader economy. With respect to our investment portfolio, both individual corporate securities, as well as securities issued by municipalities could also see their value affected by such events. Given the unpredictable and uncertain nature of climate change and weather with respect to size, severity, frequency, geography, and duration, we are unable to quantify the true impact these events would have on our business and operations. As a result of the growing importance that climate change has on both the Company’s operations as well as society in general, Stewart has made a formal statement on its commitment to the health of the global environment. The Company will also continue to update investors on the progress it is making to positively contribute to environmental preservation through its annual ESG reports. These and other environmental-related documents can be found in the Investor Relations - Governance section of the Company's website.

9

Errors and fraud relating to fund transfers may adversely affect us

The Company relies on its systems, employees and banks to transfer its own funds and the funds of third parties. These transfers are susceptible to user input error, fraud, system interruptions and other similar errors that, from time to time, result in lost funds or delayed transactions. Our email and computer systems, and systems used by other parties involved in a transaction have been subject to and are likely to continue to be the target of, fraudulent attacks, including attempts to cause us or the other parties to improperly transfer funds. Funds transferred to a fraudulent recipient are often not recoverable and in certain instances, we may be liable for those unrecovered funds. Our controls and procedures in place to prevent transfer errors and fraud may prove inadequate and may result in financial losses, reputational harm, loss of customers or other adverse consequences which could be material to Stewart.

Widespread health crises could adversely impact our business operations

Widespread health crises and responses to such events could adversely affect the Company. Although the title insurance industry has been deemed essential in the United States, health crises and measures to address them may cause disruptions in the real estate market and on our business operations. These disruptions, which may include, among others, decreased volume of orders and other business activity, delayed closing of real estate transactions, office closures, and decreased value of investments and other assets, may significantly impact our future results of operations and financial position.

Regulatory and Compliance Risk Factors

A downgrade of our underwriters by rating agencies may reduce our revenues.

Ratings are a significant component in determining the competitiveness of insurance companies with respect to commercial title policies. Our domestic underwriters, Guaranty and STIC, have historically been highly rated by the rating agencies that cover us. These ratings are not credit ratings. Instead, the ratings are based on quantitative, and in some cases qualitative, information and reflect the conclusions of the rating agencies with respect to our financial strength, results of operations and ability to pay policyholder claims. Our ratings are subject to continual review by the rating agencies, and we cannot be assured that our current ratings will be maintained. If our ratings are downgraded from current levels by the rating agencies, our ability to retain existing customers and develop new customer relationships may be negatively impacted, which could result in a material adverse impact on our consolidated financial condition or results of operations.

Our insurance subsidiaries must comply with extensive government regulations. These regulations and the enforcement environment could adversely affect our ability to increase our revenues and operating results.

The Consumer Financial Protection Bureau (CFPB) is charged with protecting consumers by enforcing federal consumer protection laws and regulations. The CFPB is an independent agency and funded by the United States Federal Reserve System. Its jurisdiction includes banks, credit unions, securities firms, payday lenders, mortgage servicing operations, foreclosure relief services, debt collectors and other financial companies. The nature and extent of these regulations include, but are not limited to: conducting rule-making, supervision, and enforcement of federal consumer protection laws; restricting unfair, deceptive, or abusive acts or practices; marshalling consumer complaints; promoting financial education; researching consumer behavior; monitoring financial markets for new risks to consumers; and enforcing laws that outlaw discrimination and other unfair treatment in consumer finance.

Governmental authorities regulate our insurance subsidiaries in the various states and international jurisdictions in which we do business. These regulations generally are intended for the protection of policyholders rather than stockholders. The nature and extent of these regulations vary from jurisdiction to jurisdiction, but typically involve:

•approving or setting of insurance premium rates;

•standards of solvency and minimum amounts of statutory capital and surplus that must be maintained;

•limitations on types and amounts of investments;

•establishing reserves, including statutory premium reserves, for losses and loss adjustment expenses;

•regulating underwriting and marketing practices;

•regulating dividend payments and other transactions among affiliates;

10

•prior approval for the acquisition and control of an insurance company or of any company controlling an insurance company;

•licensing of insurers, agencies and, in certain states, escrow officers;

•regulation of reinsurance;

•restrictions on the size of risks that may be insured by a single company;

•deposits of securities for the benefit of policyholders;

•approval of policy forms;

•methods of accounting; and

•filing of annual and other reports with respect to financial condition and other matters.

These regulations may impede or impose burdensome conditions on rate increases or other actions that we might want to take to enhance our operating results. In addition, state regulators perform periodic examinations of insurance companies, which could result in increased compliance or legal expenses.

We may also be subject to additional state or federal regulations prescribed by legislation such as the Dodd-Frank Act or by regulations issued by the CFPB, Department of Labor, Office of the Comptroller of the Currency, Occupational Safety and Health Administration, Department of the Treasury or other agencies. Additionally, we have in the past and may in the future be subject to investigations or inquiries from regulators, including state attorneys general. We incur costs as a result of such investigations or inquiries, including increased compliance costs, which may impact our operating results.

Finally, changes in regulations or new regulations in our industry may be introduced that would have a material adverse effect on our business or result in increased costs of compliance.

Dividends from our insurance underwriting subsidiaries are an important source for capital planning.

We are a holding company and we receive dividends from our insurance subsidiaries and unregulated subsidiaries to pay our parent company's operating expenses, debt service obligations and dividends to our common stockholders. While we may have adequate cash available in our parent company and unregulated subsidiaries to fund these obligations, we may depend on dividends from our insurance underwriting subsidiaries to meet cash requirements for acquisitions and other strategic investments. In regard to our insurance subsidiaries, which include Guaranty and STIC, the insurance statutes and regulations of some states require us to maintain a minimum amount of statutory capital and restrict the amount of dividends that our insurance subsidiaries may pay to us. Refer to Note 3 to our audited consolidated financial statements and Item 7 - MD&A - Liquidity and Capital Resources for details on statutory surplus and dividend restrictions.

Financial Risk Factors

Availability of credit may reduce our liquidity and negatively impact our ability to fund operations.

We expect that cash flows from operations and cash available from our underwriters, subject to regulatory restrictions, will be sufficient to fund our operations, pay our claims and fund operational initiatives. To the extent that these funds are not sufficient, we may be required to borrow funds on less than favorable terms or seek funding from the equity market, which may be on terms that are dilutive to existing shareholders.

Unfavorable economic or other business conditions could cause us to record an impairment of all or a portion of our goodwill, other intangible assets and other long-lived assets.

We perform annual impairment tests of the carrying values of our goodwill, other intangible assets and other long-lived assets. We may also perform an evaluation whenever events may indicate an impairment has occurred. In assessing whether an impairment has occurred, we consider whether the performance of our reporting units may be below projections, unexpected declines in our market capitalization, negative macroeconomic trends or negative industry and company-specific trends. We also perform reviews, at the asset group level, if carrying values of our long-lived assets are not recoverable. If we conclude that the carrying values of these assets exceed the fair value or are not recoverable, we may be required to record a noncash impairment of these assets. Any substantial impairment that may be required in the future could have a material adverse effect on our results of operations or financial condition.

11

Our investment portfolio is subject to interest rate and other risks and could experience losses.

We maintain a substantial investment portfolio, primarily consisting of fixed income debt securities and, to a lesser extent, equity securities. Our portfolio holdings are subject to certain economic and financial market risks, including credit risk, interest rate risk, foreign exchange rate risk and liquidity risk. Instability in credit markets and economic conditions can increase the risk of loss in our portfolio. Periodically, we assess the recoverability of the amortized cost of our debt securities investments. If the amortized cost of such investments exceeds the fair value, and we conclude the decline is other-than-temporary, we are required to record an impairment. The impairment could have a material adverse effect on our results of operations or financial condition.

Claims by large classes of claimants may impact our financial condition or results of operations.

We are involved in litigation arising in the ordinary course of business. In addition, we may be, and have been in the past, subject to claims and litigation from large classes of claimants seeking substantial damages not arising in the ordinary course of business. Material pending legal proceedings not in the ordinary course of business, if any, would be disclosed in Part I, Item 3—Legal Proceedings. To date, the impact of the outcome of these proceedings has not been material to our consolidated financial condition or results of operations. However, an unfavorable outcome in any litigation, claim or investigation against us could have a material adverse effect on our consolidated financial condition or results of operations.

Failures at financial institutions at which we deposit funds could adversely affect us.

We deposit substantial fiduciary funds, which are third-party funds, and operating funds in many financial institutions in excess of insured deposit limits. In the event that one or more of these financial institutions fail, there is no guarantee that we could recover the deposited funds in excess of federal deposit insurance, and, as such, we could be held liable for the funds owned by third parties. Under these circumstances, our liability could have a material adverse effect on our results of operations or financial condition.

General Risk Factor

Our business could be disrupted as a result of a threatened proxy contest and other actions of activist stockholders.

We have previously been the subject of actions taken by activist stockholders. When activist activities occur, our business could be adversely affected because we may have difficulty in attracting and retaining customers, agents, mortgage lenders, servicers, employees and board members due to perceived uncertainties as to our future direction and negative public statements about our business; such activities may materially harm our relationships with current and potential customers, investors, lenders, and others; may otherwise materially harm our business, may adversely affect our operating results and financial condition; responding to proxy contests and other similar actions by stockholders is likely to result in our incurring substantial additional costs, including, but not limited to, legal fees, fees for financial advisors, fees for investor relations advisors, and proxy solicitation fees; significantly divert the attention of management, our Board of Directors and our employees; and changes in the composition of our Board of Directors due to activist campaigns may adversely affect our current strategic plan.

We cannot predict, and no assurances can be given as to, the outcome or timing of any matters relating to actions by activist stockholders or the ultimate impact on our business, liquidity, financial condition or results of operations.

Item 1B. Unresolved Staff Comments

None.

12

Item 2. Properties

We currently lease under a non-cancelable operating lease that expires in year 2025 approximately 150,000 square feet of space in an office building in Houston, Texas, which is used for our corporate offices and for offices of several of our subsidiaries. Additionally, we lease space at approximately 560 locations for business operations, administrative and technology centers. These additional locations include significant leased facilities in Arizona (Phoenix, Scottsdale and Tucson), New York (New York), Colorado (Denver), California (Irvine, San Diego, Anaheim and Glendale), Texas (Houston), Canada (Toronto), and Massachusetts (Boston).

Our leases expire through 2033 and we believe we will not have any difficulty obtaining renewals of leases as they expire or, alternatively, leasing comparable properties. The aggregate annual rent expense under all office leases was approximately $51.2 million in 2022.

We also own office buildings in Arizona, Texas, New Mexico, California, New York, Florida and the United Kingdom. These owned properties are not material to our consolidated financial condition. We consider all buildings and equipment that we own or lease to be well maintained, adequately insured and generally sufficient for our purposes.

Item 3. Legal Proceedings

Information regarding our legal proceedings can be found in Note 16 to our audited consolidated financial statements, included in Part IV, Item 15 of this annual report on Form 10-K and is incorporated herein by reference.

Item 4. Mine Safety Disclosures

None.

13

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market and Holders Information. Our Common Stock is listed on the NYSE under the symbol “STC”. As of February 17, 2023, the number of stockholders of record was approximately 4,800 and the closing price of one share of our Common Stock was $45.68.

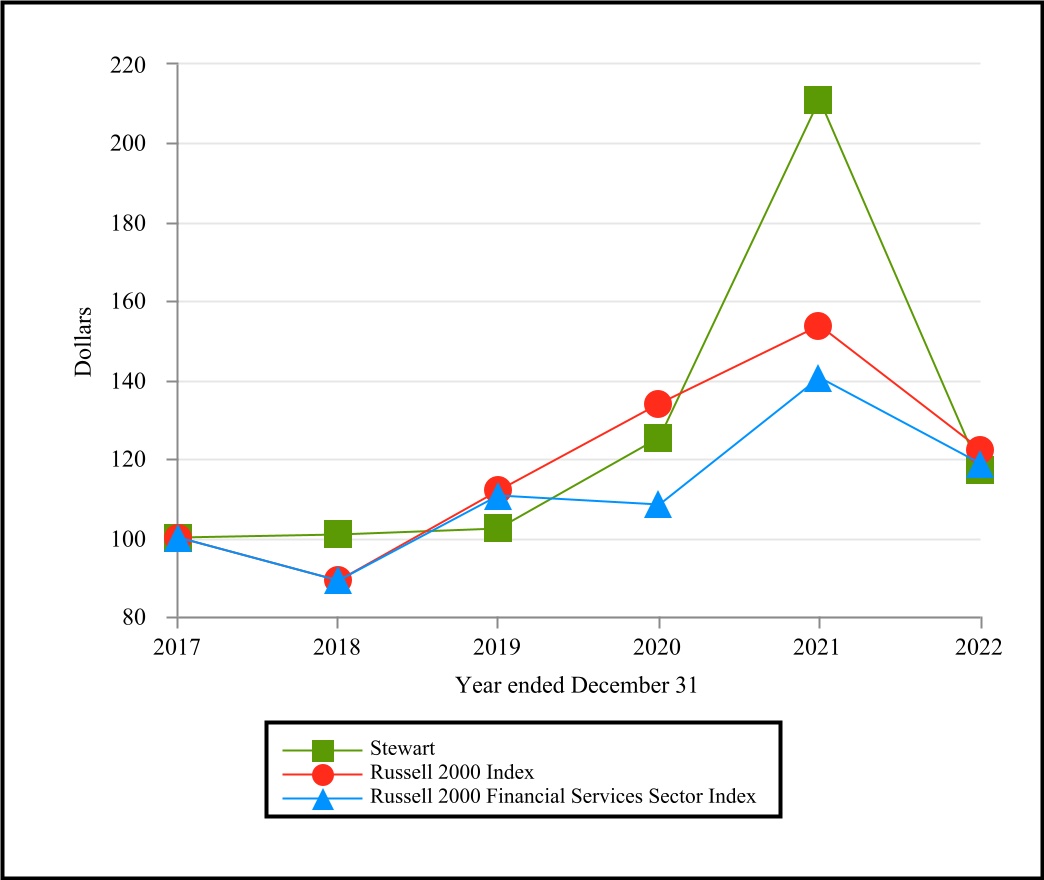

Stock Performance Graph. The following table and graph compares the yearly percentage change in our cumulative total stockholder return on Common Stock with the cumulative total return of the Russell 2000 Index and the Russell 2000 Financial Services Sector Index for the five years ended December 31, 2022. The presented information assumes that the value of the investment in our Common Stock and each index was $100 at December 31, 2017 and that all dividends were reinvested.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||

| Stewart | 100.00 | 100.61 | 102.09 | 125.15 | 210.92 | 117.00 | |||||||||||||||||

| Russell 2000 Index | 100.00 | 89.03 | 111.72 | 133.92 | 153.72 | 122.27 | |||||||||||||||||

| Russell 2000 Financial Services Sector Index | 100.00 | 89.13 | 110.60 | 108.36 | 140.61 | 118.69 | |||||||||||||||||

The performance graph above and the related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Exchange Act, as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

14

Dividends policy. Our current dividend policy anticipates the payment of quarterly dividends in the future. The declaration and payment of dividends will be at the discretion of our Board of Directors and will be dependent upon our future earnings, financial condition and capital requirements. Refer to Liquidity and Capital Resources.

Stock Repurchases. There were no stock repurchases during 2022, except for repurchases of approximately 51,000 shares (aggregate purchase price of approximately $3.3 million) related to statutory income tax withholding on the annual vesting of employee restricted share grants.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A)

MANAGEMENT'S OVERVIEW

On a full year basis, 2022 net income attributable to Stewart was $162.3 million, or $5.94 per diluted share, compared to $323.2 million, or $11.90 per diluted share, in 2021. Pretax income before noncontrolling interests in 2022 was $232.7 million (7.6% pretax margin) compared to $434.0 million (13.1% pretax margin) in 2021. Total 2022 operating revenues decreased 7% to $3.0 billion, compared to $3.3 billion in 2021, while total 2022 operating expenses decreased 1% to $2.8 billion, compared to $2.9 billion in 2021, primarily due to lower title transaction volumes which were partially offset by full year results of acquisitions from 2021. Refer to "Results of Operations" for detailed year-to-year income statement discussions, and "Liquidity and Capital Resources" for an analysis of Stewart's financial condition.

For the fourth quarter 2022, we reported net income attributable to Stewart of $13.3 million ($0.49 per diluted share), compared to net income attributable to Stewart of $85.5 million ($3.12 per diluted share) for the fourth quarter 2021. Fourth quarter 2022 pretax income before noncontrolling interests was $20.8 million compared to pretax income before noncontrolling interests of $114.1 million for the fourth quarter 2021.

Fourth quarter 2022 results included $12.7 million of pretax net realized and unrealized gains, primarily composed of net unrealized gains on fair value changes of equity securities investments and gains related to settlements of company-owned insurance policies, offset by $16.7 million of combined office closure, severance and regulatory settlement and litigation expenses. Fourth quarter 2021 results included $6.5 million of pretax net realized and unrealized gains, primarily composed of net unrealized gains on fair value changes of equity securities investments and net gains related to acquisition contingent liability adjustments, partially offset by net realized losses primarily related to sale of securities investments and other assets and $4.1 million of office closure costs.

Title segment. Summary results of the title segment are as follows (in $ millions, except pretax margin and % change):

| For the Three Months Ended December 31, | |||||||||||||||||

| 2022 | 2021 | % Change | |||||||||||||||

| Operating revenues | 581.6 | 836.4 | (30) | % | |||||||||||||

| Investment income | 6.9 | 3.7 | 85 | % | |||||||||||||

| Net realized and unrealized gains | 10.3 | 4.9 | 110 | % | |||||||||||||

| Pretax income | 26.9 | 118.6 | (77) | % | |||||||||||||

| Pretax margin | 4.5 | % | 14.0 | % | |||||||||||||

Operating revenues for the title segment decreased $254.8 million, or 30%, in the fourth quarter 2022 compared to the fourth quarter 2021, primarily due to volume declines in our direct title and agency operations, while total segment operating expenses decreased $154.6 million, or 21%, primarily as a result of lower revenues. Agency retention expenses in the fourth quarter 2022 decreased $107.8 million, or 30%, consistent with the 30% decline in gross agency revenues, while the average independent agency remittance rate in the fourth quarter 2022 was 17.6% compared to 18.0% in the fourth quarter 2021.

15

Total employee costs and other operating expenses in the fourth quarter 2022 decreased $36.2 million, or 11%, compared to the prior year quarter, and as a percentage of operating revenues, these expenses were 48.9% in the fourth quarter 2022 compared to 38.3% in the fourth quarter 2021, primarily due to lower revenues in the fourth quarter 2022. Title loss expense in the fourth quarter 2022 decreased $11.9 million, or 36%, compared to the prior year quarter, primarily due to lower title revenues. As a percentage of title revenues, title loss expense was 3.7% in the fourth quarter 2022 compared to 4.0% in the fourth quarter 2021.

The title segment’s net realized and unrealized gains in the fourth quarters 2022 and 2021 included net unrealized gains of $11.2 million and $8.1 million, respectively, related to fair value changes of equity securities investments and net realized losses of $0.6 million and $0.8 million, respectively, on sale of investment securities. Additionally, the segment recorded $2.0 million of net losses related to acquisition contingent liability adjustments during the fourth quarter 2021. Investment income in the fourth quarter 2022 increased compared to the prior year quarter, primarily as a result of higher interest income resulting from increased interest rates and higher short-term investments in the fourth quarter 2022.

Direct title revenue information is presented below (in $ millions, except % change):

| For the Three Months Ended December 31, | |||||||||||||||||

| 2022 | 2021 | % Change | |||||||||||||||

| Non-commercial | |||||||||||||||||

| Domestic | 171.3 | 251.0 | (32) | % | |||||||||||||

| International | 24.0 | 38.3 | (37) | % | |||||||||||||

| 195.3 | 289.3 | (32) | % | ||||||||||||||

| Commercial: | |||||||||||||||||

| Domestic | 66.9 | 93.1 | (28) | % | |||||||||||||

| International | 7.7 | 9.4 | (18) | % | |||||||||||||

| 74.6 | 102.5 | (27) | % | ||||||||||||||

| Total direct title revenues | 269.9 | 391.8 | (31) | % | |||||||||||||

Total non-commercial revenues decreased $94.0 million, or 32%, primarily resulting from a 55% decline in residential purchase and refinancing transactions during the fourth quarter 2022 compared to the prior year quarter. Domestic commercial revenues in the fourth quarter 2022 decreased $26.2 million, or 28%, primarily due to lower transaction volume and size compared to the fourth quarter 2021. Average domestic commercial fee per file in the fourth quarter 2022 was $15,100, which was 23% lower compared to $19,700 in the fourth quarter 2021, while average residential fee per file in the fourth quarter 2022 increased 45% to $3,500, compared to $2,400 in the prior year quarter due to a higher purchase mix in the fourth quarter 2022. Total international revenues in the fourth quarter 2022 declined by $16.0 million, or 34%, primarily as a result of lower transaction volumes in our Canadian operations.

Real estate solutions segment. Summary results of the real estate solutions segment are as follows (in $ millions, except % change):

| For the Three Months Ended December 31, | |||||||||||||||||

| 2022 | 2021 | % Change | |||||||||||||||

| Operating revenues | 54.7 | 83.7 | (35) | % | |||||||||||||

| Net realized and unrealized gains | — | 3.3 | (100) | % | |||||||||||||

| Pretax income | 0.4 | 5.3 | (93) | % | |||||||||||||

| Pretax margin | 0.7 | % | 6.1 | % | |||||||||||||

16

Operating revenues for the real estate solutions segment decreased in the fourth quarter 2022 compared to last year’s fourth quarter primarily due to lower transaction volumes influenced by the current high interest rate environment. Combined employee costs and other operating expenses decreased 36% in the fourth quarter 2022, consistent with the reduced operating revenue. Net realized and unrealized gains during the fourth quarter 2021 were primarily driven by net gains related to acquisition contingent liability adjustments. Included in the segment's pretax income were total acquired intangible asset amortization expenses of $5.8 million and $5.6 million in the fourth quarters 2022 and 2021, respectively.

Corporate and other segment. The corporate and other segment recorded $2.5 million of net realized and unrealized gains in the fourth quarter 2022, primarily related to settlement of a company-owned life insurance policy, compared to $1.6 million of net realized losses in the fourth quarter 2021, primarily driven by losses on asset disposals. Segment results for the fourth quarter 2021 included a real estate brokerage company that was acquired in late 2021 and sold in early 2022. Net expenses attributable to corporate operations increased to $9.0 million in the fourth quarter 2022 compared to $7.9 million in the prior year quarter, primarily as a result of higher interest expense resulting from debt.

CRITICAL ACCOUNTING ESTIMATES

Actual results can differ from our accounting estimates. While we do not anticipate significant changes in our estimates, there is a risk that such changes could have a material impact on our consolidated financial condition or results of operations for future periods. The discussion of critical accounting estimates below should be read in conjunction with the related accounting policies disclosed within Note 1 to our audited consolidated financial statements in Part IV of this annual report.

Title loss reserves

Provisions for title losses, as a percentage of title operating revenues, were 3.8%, 4.2% and 5.3% for the years ended December 31, 2022, 2021 and 2020, respectively. Actual loss payment experience, including the impact of large losses, is the primary reason for increases or decreases in our loss provision. A 100 basis point change in the loss provisioning percentage, a reasonable scenario based on our historical loss experience, would have increased or decreased our provision for title losses, and affected pretax operating results by approximately $27.1 million for the year ended December 31, 2022.

We consider our actual claims payments and incurred loss experience, including the frequency and severity of claims, compared to our actuarial estimates of claims payments and incurred losses in determining whether our overall loss experience has improved or worsened relative to prior periods. We also consider the impact of economic or market factors on particular policy years to determine whether the results of those policy years are indicative of future expectations. In addition, large claims (those exceeding $1.0 million on a single claim), including large title losses due to independent agency defalcations, are analyzed and reserved for separately due to the potential higher dollar amount of loss, lower volume of claims reported and sporadic reporting of such claims. We evaluate the frequency and severity of large losses in determining whether our experience has improved or worsened. Our method for recording the reserves for title losses on both an interim and annual basis begins with the calculation of our current loss provision rate which is applied to our current premium revenues, resulting in a title loss expense for the period, except for large claims and escrow losses. This loss provision rate is set to provide for losses on current year policies and is primarily determined using moving average ratios of recent actual policy loss payment experience (net of recoveries) to premium revenues.

Due to the inherent uncertainty in predicting future title policy losses, significant judgment is required by our management and our third-party actuaries in estimating reserves. As a consequence, our ultimate liability may be materially greater or lower than current reserves and/or our third-party actuary’s calculated estimates.

17

Provisions for known claims arise primarily from prior policy years as claims are not typically reported until years after policies are issued. Provisions - Incurred But Not Reported (IBNR) are estimates of claims expected to be incurred over the next 20 years; therefore, it is not unusual or unexpected to experience changes to those estimated provisions in both current and prior policy years as additional loss experience on policy years is obtained. This loss experience may result in changes to our estimate of total ultimate losses expected (i.e., the IBNR policy loss reserve). Current year provisions - IBNR are recorded on policies issued in the current year as a percentage of premiums earned (loss provisioning rate). As claims become known, provisions are reclassified from IBNR to known claims. Adjustments relating to large claims may impact provisions either for known claims or for IBNR.

| 2022 | 2021 | 2020 | ||||||||||||||||||

| (in $ millions) | ||||||||||||||||||||

| Provisions – Known Claims: | ||||||||||||||||||||

| Current year | 20.2 | 22.8 | 14.3 | |||||||||||||||||

| Prior policy years | 84.2 | 55.7 | 68.8 | |||||||||||||||||

| 104.4 | 78.5 | 83.1 | ||||||||||||||||||

| Provisions – IBNR | ||||||||||||||||||||

| Current year | 75.2 | 98.3 | 84.5 | |||||||||||||||||

| Prior policy years | 7.3 | 5.1 | 16.4 | |||||||||||||||||

| 82.5 | 103.4 | 100.9 | ||||||||||||||||||

| Transferred IBNR to Known Claims | (84.2) | (55.7) | (68.8) | |||||||||||||||||

| Total provisions | 102.7 | 126.2 | 115.2 | |||||||||||||||||

In 2022, total known claims provisions increased by $25.9 million, or 33%, primarily due to an increase in reported new and existing large claims relating to prior policy years compared to 2021. Total 2022 provisions - IBNR decreased $20.9 million, or 20%, compared to the prior year, primarily due to lower title premiums and lower provisioning rates from an overall favorable claims experience in 2022. In 2021, total known claims provisions decreased by $4.6 million, or 6%, to $78.5 million primarily due to lower reported claims relating to prior year policies compared to 2020. Total 2021 provisions - IBNR increased by $2.5 million, or 3%, to $103.4 million compared to the prior year, primarily due to increased title premiums in 2021, partially offset by the effect of lower provisioning rates due to favorable claims experience. As a percentage of title operating revenues, current year provisions - IBNR were 2.8%, 3.3% and 3.9% in 2022, 2021 and 2020, respectively.

In addition to title policy claims, we incur losses in our direct operations from escrow, closing and disbursement functions. Escrow losses typically relate to errors or other miscalculations of amounts to be paid at closing, including timing or amount of a mortgage payoff, payment of property or other taxes and payment of homeowners’ association fees, and wire fraud. In those cases, the title insurer incurs the loss under its obligation to ensure that an unencumbered title is conveyed. These losses are recognized as expenses when discovered or when contingencies associated with them (such as litigation) are resolved and are typically paid less than 12 months after the loss is recognized.

Large title losses due to independent agency defalcations typically occur when the independent agency misappropriates funds from escrow accounts under its control. Such losses are usually discovered when the independent agency fails to pay off an outstanding mortgage loan at closing (or immediately thereafter) from the proceeds of the new loan. These incurred losses are typically more severe in terms of dollar value compared with traditional title policy claims since the independent agency is often able, over time, to conceal misappropriation of escrow funds relating to more than one transaction through the constant volume of funds moving through its escrow accounts. In declining real estate markets, lower transaction volumes result in a lower incoming volume of funds, making it more difficult to cover up the misappropriation with incoming funds. Thus, when the defalcation is discovered, it often relates to several transactions. In addition, the overall decline in an independent agency’s revenues, profits and cash flows increases the agency’s incentive to improperly utilize the escrow funds from real estate transactions. For each of the three years ended December 31, 2022, our net title losses due to independent agency defalcations were not material.

18

Internal controls relating to independent agencies include, but are not limited to, periodic audits, site visits and reconciliations of policy inventories and premiums. The audits and site visits cover examination of the escrow account bank reconciliations and an examination of a sample of closed transactions. In some instances, the scope of our review is limited by attorney agencies that cite client confidentiality. Certain states have mandated annual reviews of agencies by their underwriter. We also determine whether our independent agencies have appropriate internal controls as defined by ALTA's best practices and us. However, even with adequate internal controls in place, their effectiveness can be circumvented by collusion or improper override of the controls by management at the independent agencies. To aid in the selection of independent agencies to review, we have developed an agency risk model that aggregates data from different areas to identify possible issues. This is not a guarantee that all independent agencies with deficiencies will be identified. In addition, we are typically not the only underwriter for which an independent agency issues policies, and independent agencies may not always provide complete financial records for our review.

Goodwill impairment