UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

Or

For the transition period from ____________ to ______________

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Peoples Republic of

(Address of principal executive offices) (Zip Code)

86-25-52096831

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

| Title of each class registered | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered under Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

As of June 30, 2021, the aggregate market value

of the common stock held by non-affiliates of the registrant was approximately $

As of March 30, 2022, there were

DOCUMENTS INCORPORATED BY REFERENCE

None.

EVER-GLORY INTERNATIONAL GROUP, INC.

FORM 10-K

For the Year Ended December 31, 2021

TABLE OF CONTENTS

i

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this Annual Report on Form 10-K, which are not historical facts, are forward-looking statements, as the term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements, whether expressed or implied, are subject to risks and uncertainties which can cause actual results to differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to:

| ● | Competition within our industry; | |

| ● | Seasonality of our sales; | |

| ● | Our investments in new product development; | |

| ● | Our plans to open new retail stores; | |

| ● | Our ability to integrate our acquired businesses; | |

| ● | Our relationships with our major customers; | |

| ● | The popularity of our products; | |

| ● | Relationships with suppliers and cost of supplies; | |

| ● | Financial and economic conditions in Asia, Japan, Europe and the U.S.; | |

| ● | Regulatory requirements in the PRC and countries in which we operate; | |

| ● | Anticipated effective tax rates in future years; | |

| ● | Regulatory requirements affecting our business; | |

| ● | Currency exchange rate fluctuations; | |

| ● | Our financing needs; and | |

| ● | Our ability to attract additional investment capital on attractive terms. |

Forward-looking statements also include the assumptions underlying or relating to any of the foregoing or other such statements. When used in this report, the words “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “continue,” and similar expressions are generally intended to identify forward-looking statements.

These forward-looking statements are subject to numerous assumptions, risks and uncertainties that may cause our actual results to be materially different from any future results expressed or implied by us in those statements. Some of these risks are described in “Risk Factors” in Item 1A of this Annual Report. These risk factors should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All written and oral forward looking statements made in connection with this annual report that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given these uncertainties, we caution investors not to unduly rely on our forward-looking statements. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events. Further, the information about our intentions contained in this document is a statement of our intention as of the date of this document and is based upon, among other things, the existing regulatory environment, industry conditions, market conditions and prices, the economy in general and our assumptions as of such date. We may change our intentions, at any time and without notice, based upon any changes in such factors, in our assumptions or otherwise.

ii

PART I

ITEM 1. BUSINESS

Overview and Corporate History

Ever-Glory International Group, Inc., sometimes referred to in this report as “Ever-Glory”, the “Company”, “we”, or “us”, through its subsidiaries, is a retailer of branded fashion apparel and a leading global apparel supply chain solution provider. Ever-Glory offers apparel to woman under its own brands “La go go”, “Velwin”, “idole” and “Jizhu” and currently operates over 880 retail locations in China. Ever-Glory is also a leading global apparel supply chain solution provider with a focus on middle-to-high end casual wear, outerwear, and sportswear brands. Ever-Glory serves a number of well-known domestic and international brands and retail stores by providing a complete set of services of supply chain management on fabric development and design, sampling, sourcing, quality control, manufacturing, logistics, customs clearance, distribution, etc.

The Company was incorporated in Florida on October 19, 1994. We changed our name from Andean Development Corporation to “Ever-Glory International Group, Inc.” on November 17, 2005.

The following is a description of our corporate history and structure:

Perfect Dream Limited (“Perfect Dream”) was incorporated in the British Virgin Islands on July 1, 2004. Perfect Dream was originally formed as a holding company, and it became our wholly-owned subsidiary as a result of a share exchange transaction completed in November 2005.

In January 2005, Perfect Dream acquired 100% of Goldenway Nanjing Garments Company Limited (“Goldenway”). Goldenway, a wholly foreign-owned enterprise in People’s Republic of China (“PRC”), was incorporated on December 31, 1993. Goldenway is principally engaged in outsourcing and sale of garments. Prior to acquisition by Perfect Dream, Goldenway was a joint venture held by Jiangsu Ever-Glory International Group Corporation (“Jiangsu Ever-Glory”).

On November 9, 2006, Perfect Dream entered into a purchase agreement with Ever-Glory Enterprises (HK) Limited (“Ever-Glory Hong Kong”) whereby we acquired a 100% interest in Nanjing New-Tailun Garments Co, Ltd. (“New-Tailun”) from Ever-Glory Hong Kong. New-Tailun is a 100% foreign-owned enterprise incorporated in the PRC and is engaged in the manufacturing and sale of garments.

On August 27, 2007, Perfect Dream acquired Nanjing Catch-Luck Garments Co, Ltd. (“Catch-Luck”), which further expanded our production capacity. Catch-Luck is primarily engaged in the manufacturing and sale of garments in China.

Shanghai La Go Go Fashion Company Limited (“LA GO GO”), a joint venture of Goldenway and Shanghai La Chapelle Garment and Accessories Company Limited (“La Chapelle”), was incorporated in the PRC on January 24, 2008. Goldenway invested approximately $0.8 million (approximately RMB 6.0 million) in cash, and La Chapelle invested approximately $0.6 million (RMB 4.0 million) in cash, for a 60% and 40% ownership interest, respectively, in LA GO GO. In connection with the formation of LA GO GO, Goldenway made a strategic investment in La Chapelle by acquiring a 10% equity interest in La Chapelle with a cash payment of RMB 10 million (approximately USD$1.4 million). The business objective of the joint venture was to establish and create a leading brand of ladies’ garments for the mainland Chinese market. On March 23, 2009, Goldenway transferred all of its ownership interest in LA GO GO to Ever-Glory International Group Apparel Inc. (“Ever-Glory Apparel”), a wholly-owned subsidiary of Goldenway. On April 23, 2010, Ever-Glory Apparel acquired the 40% non-controlling interest in LA GO GO from La Chapelle for approximately $0.9 million (RMB 6.2 million), bringing our ownership in LA GO GO to 100%. In connection with such acquisition, and in order to focus on our core business, Goldenway sold the 10% equity interest in La Chapelle to the original shareholders of La Chapelle and, in return, received a total cash payment of RMB 12.4 million (approximately $1.8 million).

1

Ever-Glory Apparel was incorporated in the PRC on January 6, 2009. Goldenway invested approximately $16.9 million (RMB110.0 million) into Ever-Glory Apparel. Ever-Glory Apparel is principally engaged in the import and export of apparel, fabric and accessories. Ever-Glory Apparel began to function as our primary import and export agent since 2010.

On March 19, 2012, Nanjing Tai Xin Garments Trading Company Limited (“Tai Xin”), a wholly owned subsidiary of Ever-Glory Apparel was incorporated in PRC. Tai Xin is primarily engaged in the purchasing of raw materials used in the garment manufacturing.

Ever-Glory International Group (HK) Ltd. (“Ever-Glory HK”), a wholly owned subsidiary of Perfect Dream, was incorporated in Samoa on September 15, 2009. Ever-Glory HK is principally engaged in the import and export of apparel, fabric and accessories.

Ever-Glory Supply Chain Service Co., Limited (“Ever-Glory Supply”), a wholly-owned subsidiary of Ever-Glory Apparel, was incorporated in Hong Kong in 2017. Ever-Glory Supply is principally engaged in the import and export of apparel, fabric and accessories.

On March 2019, Haian Tai Xin Garments Trading Company Limited (“Haian Tai Xin”), a wholly owned subsidiary of Ever-Glory Apparel was incorporated in PRC. Haian Tai Xin is engaged in the business of garments manufacturing. Ever-Glory Apparel, Ever-Glory Supply and Ever-Glory HK focus on the import and export business.

In March 2020, the Company incorporated Nanjing Rui Lian Technology Company Limited (“Nanjing Rui Lian”), which is a Company’s wholly-owned PRC subsidiary. Nanjing Rui Lian is engaged in the business of garments trading.

Goldenway focuses primarily on quality and production control, and coordinates with outsourced contract manufacturers. New-Tailun focuses on the Japanese market, and has strengths in the design, production, sale and marketing of jeans and trousers. Catch-Luck is geared toward the European market, and it designs and makes products that complement the product lines of our other subsidiaries. Tai Xin is primarily engaged in the purchasing of raw materials used in the garment manufacturing. Shanghai LA GO GO focuses on establishing and creating a leading brand of ladies’ apparel for the mainland Chinese market.

On November 20, 2013, Jiangsu La Go Go Fashion Company Limited (“Jiangsu LA GO GO”), a joint venture of Ever-Glory Apparel and Catch-Luck, was incorporated in PRC. The business objective of Jiangsu LA GO GO is to carry out our retail operations in different geographic markets than LA GO GO.

On January 26, 2014, Shanghai Ya Lan Fashion Company Limited (“Ya Lan”), a wholly owned subsidiary of Shanghai LA GO GO, was incorporated in PRC. The business objective of Ya Lan is to establish and create another leading brand “Velwin” of ladies’ garments for the mainland Chinese market.

On March 19, 2014, Xizang He Meida Trading Company Limited (“He Meida”), a wholly owned subsidiary of Ever-Glory Apparel, was incorporated in PRC. The business objective of HeMeida is to develop online operation of our retail business in the mainland Chinese market. In April 2021,He Meida was closed.

On April 29, 2014, Tianjin La Go Go Fashion Company Limited (“Tianjin LA GO GO”), a joint venture of Ever-Glory Apparel and Catch-Luck, was incorporated in PRC. The business objective of Tianjin LA GO GO is to carry out our retail operations in different geographic markets other than Jiangsu LA GO GO.

On July 24, 2014, ChuzhouHuirui Garments Company Limited (“Huirui”), a wholly owned subsidiary of Ever-Glory Apparel, was incorporated in PRC. Huirui is primarily engaged in the management of our outsourced manufacturing factories.

On June 26, 2014, Shanghai LA GO GO entered into a contract with Shanghai Yiduo Fashion Company Limited (“Yiduo”) to acquire 78% of the shares of Yiduo. The Company gained effective control of Yiduo by the end of March 2015 and Yiduo was consolidated on March 31, 2015. The business objective of Yiduo is to establish and create another leading brand “idole” of ladies’ garments for the mainland Chinese market. In December 2020, Yiduo entered into the bankruptcy liquidation process.

2

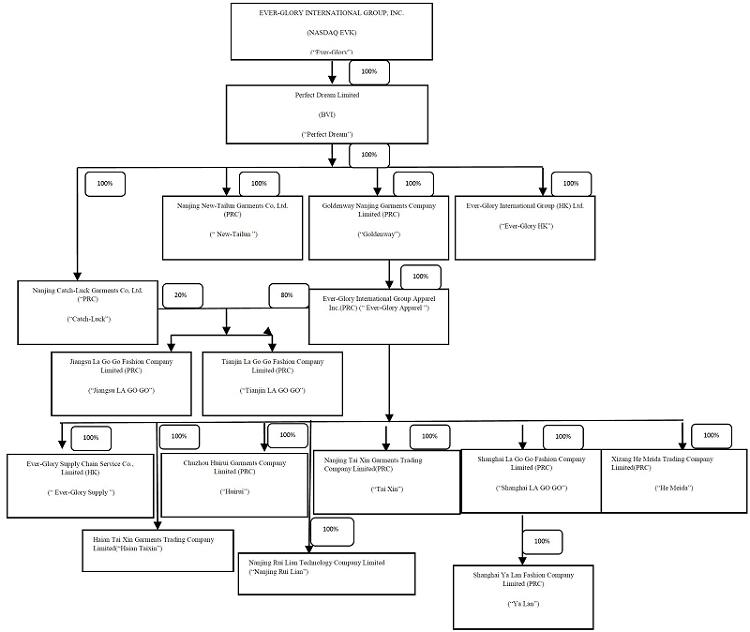

As a result of the foregoing acquisitions and transactions, our current corporate structure is illustrated below.

Business Operations

Our wholesale operations include a complete set of services of supply chain management and worldwide sale of apparel to well-known domestic and international casual wear, sportswear and outerwear brands and retailers in major markets. We conduct our original design manufacturing (“ODM”) operations through nine wholly owned subsidiaries which are located in the Nanjing Jiangning Economic and Technological Development Zone and Shang Fang Town in the Jiangning District in Nanjing, Jiangsu province, China, and Chuzhou, Anhui province, China, which are Ever-Glory International Group Apparel Inc. (“Ever-Glory Apparel”), Goldenway Nanjing Garments Company Limited (“Goldenway”), Nanjing New-Tailun Garments Company Limited (“New Tailun”), Nanjing Catch-Luck Garments Co., Ltd. (“Catch-Luck”), Haian Tai Xin Garments Trading Company Limited (“Haian Tai Xin”), Nanjing Rui Lian Technology Company Limited (“Nanjing Rui Lian”), and ChuzhouHuirui Garments Co., Ltd. (“Huirui”). We have one wholly owned subsidiary registered in Samoa: Ever-Glory International Group (HK) Ltd. (“Ever-Glory HK”). We also have one wholly owned subsidiary registered in Hongkong: Ever-Glory Supply Chain Service Co., Limited (“Ever-Glory Supply”). In our fiscal year ended December 31, 2021, our wholesale segment achieved total sales of $184.9 million.

3

Although we have our own manufacturing capacity, we currently outsource most of the manufacturing to our strategic long-term contractors as part of our overall business strategy. Outsourcing allows us to maximize our production capacity and remain flexible while reducing capital expenditures and the costs of keeping skilled workers on production lines during times of seasonally lower sales. We inspect products manufactured by our long-term contractors to ensure that they meet our high-quality control standards. Total unit output from our manufacturing facilities and outsourced partners is more than 11.5 million pieces in 2021. See Production and Quality Control below.

Our retail business objective is to establish and develop leading brands of women’s wear and to build a nationwide retail distribution channel in China. We conduct our retail operations through Shanghai LA GO GO Fashion Company Limited (“Shanghai LA GO GO”), Jiangsu LA GO GO Fashion Company Limited (“Jiangsu LA GO GO”), Tianjin LA GO GO Fashion Company Limited (“Tianjin LA GO GO”), Shanghai Ya Lan Fashion Company Limited (“Ya Lan”), Xizang He Meida Trading Company Limited (“He Meida”), Shanghai Yiduo Fashion Company Limited (“Yiduo”) and Nanjing Tai Xin Garments Trading Company Limited (“Tai Xin”). The Company deconsolidated Yiduo due to its bankruptcy in December 2020. Fortunately, the Company retained Yiduo developed brand “idole” as the brand was transferred to La Go Go long before Yiduo’s bankruptcy. In April 2021,He Meida was closed. As of December 31, 2021, we had approximately 3,453 retail employees and operated 880 retail stores in China. We achieved total retail sales of $146.1 million in the fiscal year of 2021.

Wholesale Segment

Products

We manufacture a broad array of products in various categories for the women’s, men’s and children’s apparel markets. Within those categories, various product classifications including high and middle grade casualwear, sportswear and outwear, including the following product lines:

| Women’s Clothing: | coats, jackets, slacks, skirts, shirts, trousers, and jeans |

| Men’s Clothing: | vests, jackets, trousers, skiwear, shirts, coats, and jeans |

| Children’s Clothing: | coats, vests, down jackets, trousers, knitwear, and jeans |

Customers

We manufacture garments for a number of well-known retail chains and famous domestic and international brands. We also have our own in-house design capabilities and can provide our customers with a selection of original designs that the customer may have manufactured-to-order. We normally supply our customers through purchase orders and we have no long-term supply contracts with any of them.

4

In the fiscal year ended December 31, 2021, approximately 52.1% of our sales revenue came from customers in China, 16.7% of our wholesales revenue came from customers in United Kingdom and other European countries, 22.0% from customers in the United States, and 9.2% from customers in Japan. In 2021, sales to our five largest customers generated approximately 37.8% of our total wholesale sales and one customer represented more than 10% of our total wholesale sales. In 2020, sales to our five largest customers generated approximately 38.7% of our total wholesale sales and there is no customer represented more than 10% of our total wholesale sales.

Substantially all of our long-lived assets were located in the PRC as of December 31, 2021 and 2020.

Suppliers

We purchase the majority of our raw materials (including fabric, fasteners, thread, buttons, labels and related materials) directly from numerous local fabric and accessories suppliers in China. For our wholesale business, collectively, purchases from our five largest suppliers represented approximately 20.4% and 18.2% of total raw material purchases in 2021 and 2020, respectively. No single supplier provided more than 10% of our total purchases.

We also purchased finished goods from contract manufacturers. For our wholesale business, collectively, purchases from our five largest contract manufacturers represented approximately 45.3% and 45.1% of total finished goods purchases in 2021 and 2020, respectively. One contract manufacturers provided approximately 27.0% of our total finished goods purchases in 2021.Two contract manufacturers provided approximately 12.6% and 11.2% of our total finished goods purchases in 2020.

For our wholesale business, we generally agree to pay our suppliers within 30 to 90 days after our receipt of goods. We typically place orders for materials from suppliers when we receive orders from our customers. On average, the materials will generally be consumed by production in approximately 20 days.

Sales and Marketing

We have set up our own merchandising department to interface with our customers. We believe we have developed good and stable business relationships with our main customers in Europe, the U.S., Japan and China. Our sales staff typically works directly with our customers and arranges the terms of the contracts with them.

Our management believes that we continue to benefit from our solid reputation for providing high quality goods and professional service in the markets where we have a presence, which provides us further opportunities to work with desirable customers. Our marketing strategy aims to attract customers with outstanding brands from top markets. We seek to attract customers mainly from Europe, the U.S., Japan, and China. In addition, we look for customers with strong brand recognition and product lines that require high quality manufacturing and generate sufficient sales volume to support our sizeable production capacity. Referrals from existing customers have been and will continue to be a fruitful source of new customers. In addition, we aim to maintain an active presence in trade shows around the world, including those in Europe, the U.S., Japan, and China.

Production and Quality Control

In 2021, approximately 2.2% of the products we sold to wholesale customers were in our own manufacturing facilities. We typically outsource the manufacturing of a large portion of our products based upon factory capacity and customer demand. The number of outside contract manufacturers to which we outsource is expected to increase in order to meet the anticipated growth in demand from our customers.

As of December 31, 2021, our total production capacity, including outsourced production, reached 11.5 million pieces per year. As of December 31, 2020, our total production capacity, including outsourced production, reached 7.6 million pieces per year. .At present, we believe our production capacity is sufficient to meet customer demand.

We are committed to designing and manufacturing high quality garments. We place the highest standard on quality control because we emphasize the high quality of our products. We have implemented strict quality control and craft discipline systems. Before we manufacture large quantities, we obtain the approval from our customers either through in-person visits to the factories or by shipping samples of our products to our customers for testing, inspection and feedback. This ensures that our products perfectly meet specifications prior to production. In addition, our trained professional quality control personnel periodically inspect the manufacturing process and quality of our apparel products. Our factory is ISO 9001:2000 certified. ISO 9000 is a family of standards for quality management systems maintained by ISO, International Organization for Standardization, and is administered by accreditation and certification bodies. We have been independently audited and certified to be in conformance with ISO 9001 which certifies that formalized business processes are being applied.

5

Due to our strict quality control and testing process, we have not undergone any significant product or merchandise recalls, and we generally do not receive any significant requests by our customers to return finished goods. Product returns are not a material factor in our business.

We anticipate continuing outsourcing a large portion of our production. Management believes that outsourcing allows us to maximize our production flexibility while reducing significant capital expenditure and the costs associated with managing a large production workforce. We contract for the production of a portion of our products through various outside independent manufacturers. Quality control reviews are done by our employees during and after production before the garments leave the outsourcing factories to ensure that material and component qualities and the products “fits” are in accordance with our specifications. We inspect prototypes of each product prior to cutting by the contractors and conduct a final inspection of finished products prior to shipment to ensure that they meet our high standards.

Delivery and Transportation

We generally do not hold any significant inventory of finished goods for more than ninety days, as we typically ship finished goods to our customers upon completion.

Competition

The garment manufacturing industry is highly competitive, particularly in China. Our competitors include garment manufacturers of all sizes, both within China and elsewhere in the world, many of which have greater financial and manufacturing resources than us. We have been in the garment manufacturing business since 1993 and believe that we have earned a reputation of producing high quality products with high efficiency, competitive prices, and excellent customer service. We believe we provide one-stop total solutions and more valuable products for our customers.

Currently, we have several small-to-large sized competitors in China including some state-owned trading groups and private garment companies. We believe we differentiate ourselves from the competition and will be able to effectively compete with our competitors due to our persistent pursuit of quality control, a diversified casual wear product lineup, and in-house design talent. In addition, we believe we derive advantages from our customer feedback in the supply chain and the use of our advanced Enterprise Resource Planning (“ERP”) system. Our ERP system integrates many of our operational processes into one system including order processing, statistical analysis, purchasing, manufacturing, logistics and financial control systems, providing management with instantaneous feedback on important aspects of our business operations.

Governmental Regulations/Quotas

In 2021, we were not subject to any export quota imposed by countries where our customers are located. Nevertheless, we have noticed that many European countries tightened their chemical inspection requirements after the removal of quotas. In addition, there can be no assurance that additional trade restrictions will not be imposed on the export of our products in the future. Such actions could result in increases in the cost of our products generally and may adversely affect our operating results. On a longer-term basis, we believe that our customer mix and our ability to adjust the types of apparel we manufacture will mitigate our exposure to such trade restrictions in the future.

We are also required to comply with Chinese laws and regulations that apply to some of the products we produce for shipment to the countries to which we export. In order to address these Chinese compliance issues, we have established an advanced fabric testing center to ensure that our products meet certain quality and safety standards in the U.S. and EU. In addition, we work closely with our customers so that they understand our testing and inspection process.

6

Seasonality

Our business is affected by seasonal trends, with higher levels of wholesale sales in our third and fourth quarters and higher retail sales in our first and fourth quarters. These trends result primarily from the timing of seasonal demand and shipments in our wholesale business and holiday periods in China where our retail business operates.

Retail Segment

As of December 31, 2021, we had 880 retail stores in China selling our own brand clothing. We believe our advantages in the retail segments include our ability to promptly respond to market trends, our quick turn-around in design and production, and appropriate pricing. In 2021, we achieved total net sales of approximately US$146.1 million for our retail business. We operate most of our retail stores in so-called Tier-2 or Tier-3 cities in China, such as Zhengzhou in Henan province, Taizhou in Jiangsu province, etc. We also have penetrated Tier-1 cities, such as Beijing and Shanghai.

Suppliers

We purchase the majority of our raw materials (including fabric, fasteners, thread, buttons, labels and related materials) directly from numerous local fabric and accessories suppliers. For our retail business, collectively, purchases from our five largest suppliers represented approximately 90.9% of total purchases in 2021. There were four suppliers which provided more than 10% of our total raw materials purchases in 2021. We have not experienced difficulty in obtaining raw materials that are essential to our business.

We also purchase finished goods from contract manufacturers. For our retail business, collectively, our five largest contract manufacturers represented approximately 22.6% of total finished goods purchases in 2021. There was no one contract manufacturer which provided more than 10% of our total finished goods purchases in 2021. We have not experienced difficulty in obtaining finished products from our contract manufacturers.

For our retail business, we generally agree to pay our suppliers within 30-180 days after the receipt of goods. We typically place orders for materials from suppliers when the style has been confirmed by our chief designer. On average, the supplies we hold in stock will generally be consumed in production in approximately 20 days.

Customers

We currently have four retail brands. “La Go Go” seeks to appeal to fashionable urban females between the ages of 23 to 28. “Ji Zhu” focuses on females between the ages of 23 to 30. “Velwin” targets females between the ages of 28 to 33 while “idole” targets females between the ages of 28 to 35. Our products are priced at a middle-to-high level in order to appeal to our targeted customers.

Design and Production

We have our own design, production, and quality control departments. Our retail brands release new designs twice a year, during October for the spring/summer season and May for the autumn/winter season. Our design team produces approximately 5,000 designs each year. Each of our retail brands hosts its own order-placing fair twice each year to determine the new products to be released for the spring/summer and autumn/winter season based on the orders placed by all the regional sales managers at such order-placing fair; our chief designer then decides the designs to be manufactured. The production department will then produce samples for the designer’s approval. Our quality control department checks the quality of the final products by follow-up inspection. The final products will be shipped to the logistics and distribution centers for sale.

Sales and Marketing

Products of our retail brands are sold in flagship stores, stores-within-a-store and e-commerce platforms. The sales department is responsible for developing new sales channels. According to our new store opening plan, the ratio of flagship stores and stores-within-a-store are carefully balanced. The store-within-a-store enters into contracts with department stores. The flagship stores are carefully chosen at prominent locations and have lease agreements with each property owner. Under our return and exchange policy, products may be returned or exchanged for any reason within 15 days. During 2021, the return and exchange rate was very low and was not a material factor in our operations.

7

Store Operation

As of December 31, 2021, we had 880 stores, including 166 flagship stores, with each store generating average revenue of approximately $13,833 per month. The majority of our retail stores are situated as stores-within-a-store in large, mid-tier department stores located in over 20 provinces in China.

Trademarks

We regard our trademarks as an important part of our business due to the name recognition of our customers. We obtained trademark registration at the China Trademark Office for the mark “La Go Go” in class 25 and class 18 in 2010. We obtained trademark registration at the China Trademark Office for the marks “Sea to Sky”, “Velwin” and “Idole” separately in 2012, 2014 and 2015. As of December 31, 2021, we were not aware of any valid claim or challenges to our right to use our registered trademark or any counterfeit or other infringement to our registered trademark.

Information Technology

We recognize the importance of high-quality information management systems in the retail operation. As a result, we use Management Systems to monitor and manage the merchandise planning, inventory and sales information.

Research and Development

We have invested in the research and development of high-tech fabrics.

Our Growth Strategy

Our strategy to grow and expand our business includes the following:

Supply chain management:

| ● | Expand the global sourcing network | |

| ● | Explore the overseas low-cost manufacturing base | |

| ● | Focus on high value-added products and continue our strategy to produce mid-to-high end apparel | |

| ● | Continue to emphasize on product design and technology application | |

| ● | Seek strategic acquisitions of international distributors that could enhance global sales and distribution network | |

| ● | Maintain stable revenue growth in the export markets while shifting focus to higher margin wholesale markets such as mainland China. |

Retail business development:

| ● | Build our brands to be recognized as major players in the mid-to-high women’s apparel market in China; | |

| ● | Expand the retail network throughout China | |

| ● | Improve the retail stores’ efficiency and increase same-store sales | |

| ● | Continue to launch flagship stores in Tier-1 cities and increase penetration and coverage in Tier-2 and Tier-3 cities | |

| ● | Take advantage of our position as a multi-brand operator |

8

Employees

As of December 31, 2021, we had over 4,300 employees. None of our employees belong to a labor union. We have never experienced a labor strike or work stoppage. We are in full compliance with the Chinese labor laws and regulations and are committed to providing safe and comfortable working conditions and accommodations for our employees.

Labor Costs

The manufacture of garments is a labor-intensive business. Although much of our production process is automated and mechanized, we rely on skilled labor to make our products. During the year ended December 31, 2021, our labor cost increased due to the shortage of skilled workers and rising labor cost in China.

Working Conditions and Employee Benefits

We consider our social responsibilities to our workers to be an important objective, and we are committed to providing a safe, clean, comfortable working environment and accommodations. Our employees are also entitled to paid holidays and vacations. In addition, we frequently monitor our third-party manufacturers’ working conditions to ensure their compliance with related labor laws and regulations. We are in full compliance with our obligations to contribute a certain percentage of our employees’ salaries to social insurance funds, as mandated by the PRC government. We expect the amount of contribution to the government’s social insurance funds to increase in the future as we expand our workforce and operations.

Compliance with Environmental Laws

Based on the present nature of our operations, we do not believe that environmental laws and the cost of compliance with those laws have or will have a material impact on our operations.

Description of Property

In 2021, we operated four facilities on certain land in the Nanjing Jiangning Economic and Technological Development Zone and Huifeng Road, which are located in Nanjing and Chuzhou, China. For further details concerning our property, see Item 2 of this report regarding Properties.

Taxation

Most of our operating subsidiaries, except Ever-Glory HK, are incorporated in the PRC and therefore are governed by PRC income tax laws and are subject to the PRC enterprise income tax. Each of our consolidated entities files its own separate tax return, and we do not file a consolidated tax return.

Goldenway was incorporated in the PRC and is subject to PRC income tax laws and regulations. Goldenway’s income tax rate is 25%.

New-Tailun, Haian Tai Xin, Nanjing Rui Lian and Catch-Luck were incorporated in the PRC and are subject to PRC income tax laws and regulations. Their income tax rate is 25%.

Shanghai LA GO GO was established on January 24, 2008, and its income tax rate is 25%.

Jiangsu LA GO GO was established on November 20, 2013, and its income tax rate is 25%.

Tianjin LA GO GO was established on April 29, 2014, and its income tax rate is 25%.

9

Shanghai YA LAN was established on January 24, 2014, and its income tax rate is 25%.

Shanghai Yiduo was acquired on March 31, 2015, and its income tax rate is 25%.

Huirui was acquired on July 24, 2014, and its income tax rate is 25%.

Ever-Glory Apparel was established on January 6, 2010, and its income tax rate is 25%.

He Meida was established on March 19, 2014. The local government has implemented an income tax reduction from 15% to 9% valid through December 31, 2020.

Tai Xin was established on March 19, 2012, its income tax rate is 25%.

Perfect Dream was incorporated in British Virgin Islands on July 1, 2004 and has no liabilities for income tax.

Ever-Glory HK was incorporated in Samoa on September 15, 2009 and does not have any income tax obligation.

Ever-Glory Supply Chain Service Co., Limited was incorporated in Hongkong on December 27, 2017. Under the current laws of Hongkong, its income tax rate is 8.25% when its profit is under HKD 2.0 million and its income tax rate is 16.5% when its profit is over HKD 2.0 million.

All of our income tax expenses are related to our operations in China.

On April 4, 2018, the Ministry of Finance and the State Administration of Taxation issued the Notice on Adjustment of VAT Rates, which came into effect on May 1, 2018. According to the abovementioned notice, the taxable goods previously subject to VAT rates of 17% respectively become subject to lower VAT rates of 16% starting from May 1, 2018. According to the 2019 government work report, the VAT rates of 16% will be reduced to 13%. Tax rate changes have little effect on the company.

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Annual Report before making an investment decision with regard to our securities. The statements contained in or incorporated into this Annual Report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Industry

Our sales are influenced by general economic cycles. A prolonged period of depressed consumer spending would have a material adverse effect on our profitability.

Apparel is a cyclical industry that is dependent upon the overall level of consumer spending. Purchase of apparel generally declines during recessionary periods when disposable income is low. Our customers anticipate and respond to adverse changes in economic conditions and uncertainty by reducing inventories and canceling orders. As a result, any substantial deterioration in general economic conditions, increases in energy costs or interest rates, acts of war, acts of nature or terrorist or political events that diminish consumer spending and confidence in any of the regions in which we compete, could reduce our sales and adversely affect our business and financial condition. We currently sell to customers in the U.S., the EU and Japan. Accordingly, economic conditions and consumer spending patterns in these regions could affect our sales, and an economic downturn in one or more of these regions could have an adverse effect on our business.

10

Intense competition in the worldwide apparel industry could reduce our sales and prices.

We face a variety of competitive challenges from other apparel manufacturers both in China and other countries. Some of these competitors have greater financial and marketing resources than we do and may be able to adapt to changes in consumer preferences or retail requirements more quickly, devote greater resources to the marketing and sale of their products or adopt more aggressive pricing policies than we can. As a result, we may not be able to compete with them if we cannot continue enhancing our marketing and management strategies, quality and value or responding appropriately to consumer’s needs.

Our ability to increase our revenues and profits depends upon our ability to offer innovative and upgraded products at attractive price points.

The worldwide apparel industry is characterized by constant product innovation due to changing consumer preferences and by the rapid replication of new products by competitors. As a result, our growth depends in large part on our ability to continuously and rapidly respond to customer requirements for innovative and stylish products at a competitive pace, intensity, and price. Failure on our part to regularly and rapidly respond to customer requirements could adversely affect our ability to retain our existing customers or to acquire new customers which would limit our sales growth.

The worldwide apparel industry is subject to ongoing pricing pressure.

The apparel market is characterized by low barriers to entry for both suppliers and marketers, global sourcing through suppliers located throughout the world, trade liberalization, continuing movement of product sourcing to lower cost countries, ongoing emergence of new competitors with widely varying strategies and resources, and an increasing focus on apparel in the mass merchant channel of distribution. These factors contribute to ongoing pricing pressure throughout the supply chain. This pressure has and may continue to:

| ● | require us to reduce wholesale prices on existing products; | |

| ● | result in reduced gross margins across our product lines; | |

| ● | increase pressure on us to further reduce our production costs and our operating expenses. |

Any of these factors could adversely affect our business and financial condition.

Fluctuations in the price, availability and quality of raw materials could increase our cost of goods and decrease our profitability.

We purchase raw materials directly from local fabric and accessory suppliers. We may also import specialty fabrics to meet specific customer requirements. We also purchase finished goods from other contract manufacturers. The prices we charge for our products are dependent in part on the market price for raw materials used to produce them. The price, availability and quality of our raw materials may fluctuate substantially, depending on a variety of factors, including demand, crop yields, weather patterns, supply conditions, transportation costs, government regulation, economic climates, and other unpredictable factors. Any raw material price increases could increase our cost of goods and decrease our profitability unless we are able to pass higher prices on to our customers.

For the wholesale business, we did not rely on any supplier for more than 10% of all our total raw material purchases in 2021and 2020. We relied on one manufacturers for 27.0% of purchased finished goods in 2021 and two manufacturers for 12.6% and 11.2% of purchased finished goods in 2020. For the retail business, we did not rely on any one manufacturer for more than 10% of all of our total purchased finished goods during 2021nd 2020. We do not have any long-term written agreements with any of these suppliers and do not anticipate entering into any such agreements in the near future. However, we always execute a written agreement for each order placed with our suppliers. We do not believe that loss of any of these suppliers would have a material adverse effect on our ability to obtain finished goods or raw materials essential to our business because we believe we can locate other suppliers in a timely manner.

11

Risks Relating to Our Business

Our wholesale business depends on some key customers for a significant portion of our sales. A significant adverse change in a customer relationship or in a customer’s performance or financial position could harm our business and financial condition.

For the year ended December 31, 2021, our five largest customers represented approximately 37.8% of our total net sales. For the year ended December 31, 2020, our five largest customers represented approximately38.7% of our total net sales. The garment manufacturing industry has experienced substantial consolidation in recent years, which has resulted in increased customer leverage over suppliers, greater exposure for suppliers to credit risk and an increased emphasis by customers on inventory management and productivity.

A decision by a major customer, whether motivated by competitive considerations, strategic shifts, financial requirements or difficulties, economic conditions or otherwise, to decrease its purchases from us or to change its manner of doing business with us, could adversely affect our business and financial condition. In addition, while we have long-standing customer relationships, we do not have long-term contracts with any of our customers.

As a result, purchases generally occur on an order-by-order basis, and the relationship, as well as particular orders, can generally be terminated by either party at any time. We do not believe that there is any material risk of loss of any of these customers during the next 12 months. We also believe that the unexpected loss of these customers could have material adverse effect on our earnings or financial condition. While we believe that we could replace these customers within 12 months, the loss of which will not have material adverse effect on our financial condition in the long term. None of our affiliates are officers, directors, or material shareholders of any of these customers.

Our business relies heavily on our ability to identify changes in fashion trends.

Our results of operations depend in part on our ability to effectively predict and respond to changing fashion tastes by offering appropriate products. Failure to effectively follow the changing fashion trend will lead to higher seasonal inventory levels. Our continuous ability to respond to the changing customer demands constitutes a material risk to the growth of our retail business. For our wholesale business, if we are unable to swiftly respond to the changing fashion trend, the sample we designed for our customers may not be accepted or the products based on our design may be put into inventory, and thus have a negative impact on the number of orders the customers may place with us.

Our ability to attract customers to the stores heavily depends on their location.

Our flagship stores and the store-within-a-stores are selectively located in what we believe to be prominent locations or popular department stores to generate customer traffic. The availability and/or cost of appropriate locations for the existing or future stores may fluctuate for reasons beyond our control. If we are unable to secure these locations or to renew store leases on acceptable terms, we may not continue to attract customers, which will have a material adverse effect on our sales and results of operations.

We may be unable to expand our retail business by opening profitable new stores.

Our future growth in our retail segment requires our continuous increase of new flagship stores and stores-within-a-store in selected cities, improve our operating capabilities, and retaining and hiring qualified sales personnel in these stores. There can be no assurance that we will be able to achieve our store expansion goals, nor any assurance that our newly opened stores will achieve revenue or profitability levels comparable to those of our existing stores. If our stores fail to achieve acceptable revenue, we may incur significant costs associated with closing those stores.

There may be conflicts of interest between Mr. Kang’s role as the Chairman of the Board and CEO of our Company and his role as the majority owner of other entities that we do business with.

Jiangsu Ever-Glory is an entity engaged in importing/exporting, apparel-manufacture, real-estate development, car sales and other activities. Jiangsu Ever-Glory is controlled by Mr. Kang.

12

The Company and Jiangsu Ever-Glory sometimes purchase raw materials for each other in order to obtain cheaper prices. The Company purchased raw materials on Jiangsu Ever-Glory’s behalf and sold to Jiangsu Ever-Glory at cost for $3.8 million and $0.9 million during 2021 and 2020, respectively. Jiangsu Ever-Glory purchased raw materials on the Company’s behalf and sold to the Company at cost for $0.4 million and $1.5 million during 2021 and 2020, respectively.

In March 2012, in consideration of the guarantees and collateral provided by Jiangsu Ever-Glory and Nanjing Knitting, the Company agreed to provide Jiangsu Ever-Glory a counter guarantee in the form of cash of not less than 70% of the maximum aggregate lines of credit obtained by the Company. Jiangsu Ever-Glory is obligated to return the full amount of the counter-guarantee funds provided upon the expiration or termination of the underlying lines of credit and is to pay an annual interest at the rate of 6.0% of the amounts provided. As of December 31, 2021 and 2020, Jiangsu Ever-Glory had provided guarantees for approximately $0.0 million (RMB 0.0 million) and $36.0 million (RMB 235.0 million) of lines of credit obtained by the Company, respectively. Jiangsu Ever-Glory and Nanjing Knitting have also provided their assets as collateral for certain of these lines of credit. As of December 31, 2021and 2020, the value of the collateral, as per appraisals obtained by the banks in connection with these lines of credit is approximately $4.4 million (RMB 28.2 million) which was provided assets as collateral by Jiangsu Ever-Glory, and $31.5million (RMB 205.5 million)which was provided assets as collateral by Jiangsu Ever-Glory and Nanjing Knitting, respectively. Mr. Kang has also provided a personal guarantee for $0.0 million (RMB 0.0 million) and $14.8 million (RMB 96.3 million) at the years ended of December 31, 2021 and 2020, respectively.

As of December 31, 2020, $3.1 million (RMB 20.0 million) was outstanding due from Jiangsu Ever-Glory under the counter guarantee agreement. During the year ended December 31, 2021, an additional $0.7 million (RMB 4.2million) was provided to and repayment of $3.8 million (RMB 24.2 million) was received from Jiangsu Ever-Glory under the counter-guarantee agreement. As of December 31, 2021 the amount of the counter-guarantee had decreased to $0.0 million (RMB 0.0 million) , which was 0.0% of the aggregate amount of lines of credit. This amount plus accrued interest of ($0.3) million (2021) and $0.04 million (2020) have been classified as a reduction of equity, consistent with the guidance of SEC Staff Accounting Bulletins 4E and 4G. As of December 31, 2021 and 2020, the amount classified as a reduction of equity was $0.0 million and $3.4 million, respectively. Interest of 0.5% is charged on net amounts due from Jiangsu Ever-Glory at each month end. Since January 1, 2019, the interest rate has changed to 0.3625% as the bank benchmark interest rate decreased. Interest income for the years ended December 31, 2021 and 2020 was approximately ($0.3) million and $0.04 million, respectively.

It is possible that the terms of the export and import agency transactions and the counter guarantee may not be the same as those that would result from transactions between unrelated parties. Despite of Mr. Kang’s fiduciary duty to us as the CEO and a director, in the event of any conflicts of interests between us and Jiangsu Ever-Glory, he may not act in our best interests and such conflicts of interests may not be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations.

For a further discussion of these related party transactions, see Notes 12 Related party transactions in the footnotes to the consolidated financial statements and Item 13. Certain Relationships and Related Transactions, and Director Independence

In case Jiangsu Ever-Glory fails to repay the fund we provided to it under the Counter Guarantee Agreement according to its terms, we will suffer significant financial losses.

Despite of management’s belief that Jiangsu Ever-Glory is financially capable of repaying all amount we provided under the counter guarantee and Jiangsu Ever-Glory’s repayment certain portion of the fund by the end of first quarter of 2021, it is possible that we would not be able to collect all amount from Jiangsu Ever-Glory due to factors beyond our control. There is no restriction on how Jiangsu Ever-Glory can use the fund except that it is not allowed to invest in high-risk investments. We were told that Jiangsu Ever-Glory had used the entire amount of the fund we provided under the counter guarantee for its own operations. It is possible that we will not be able to collect the entire amount from Jiangsu Ever-Glory due to reasons beyond its control such as its operational failure or deterioration of the overall economic conditions. In such event, we, as the primary obligor under the lines of credit, would be obligated to repay the entire outstanding borrowing after the banks seek collection from the assets collateralized by Jiangsu Ever-Glory. As a result, we may suffer financial losses which will have material negative effects on our financial condition and results of operations.

13

Expansion of both our wholesale and retail business depends on our ability to obtain continuous financing at acceptable terms. Failure to do so will result in negative impact on our results of operations.

We have historically relied on debt financing from Chinese banks to satisfy our financing needs. Due to Chinese banks’ stringent underwriting policy to non-state-owned businesses, borrowers generally have to provide properties and land use rights as collaterals or obtain third party guarantees from either high-net-worth individuals or businesses with strong credits with the banks. Although we have certain properties and land use rights to be used as collateral, the value of those properties is not high enough for us to obtain sufficient bank loans to support our projected growth. Therefore, Mr. Kang previously provided personal guarantees and Jiangsu Ever-Glory provided personal guarantees and assets collateral as security interests for the bank loans. In the event Mr. Kang or Jiangsu Ever-Glory refuses to provide sufficient security interests in the future or continue the guarantee and collateral provided in the past, we may not be able to obtain the bank loans on acceptable terms as required by our business plan. As a result, we may have to delay or reduce our retail expansion and limit our wholesale development which may materially harm our business, financial condition, and results of operations.

We depend on key personnel, and our ability to grow and compete will be harmed if we do not retain the continued services of such personnel.

We depend on the efforts and expertise of our management team. The loss of services of one or more members of this team, each of whom have substantial experience in the garment industry, could have an adverse effect on our business. If we are unable to hire and retain qualified management or if any member of our management leaves, such departure could have an adverse effect on our operations. In particular, we believe we have benefited substantially from the leadership and strategic guidance of our CEO and Chairman of the Board, Mr. Edward Yihua Kang.

Our ability to anticipate and effectively respond to changing fashion trends depends in part on our ability to attract and retain key personnel in our design, merchandising and marketing areas. In addition, if we experience material growth, we will need to attract and retain additional qualified personnel. The market for qualified and talented design and marketing personnel in the apparel industry is intensely competitive, and we cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods. If we are unable to attract or retain qualified personnel as needed, our growth will be hampered and our operating results could be materially adversely affected.

If we fail to protect our trademark and maintain the value of our retail brands, our retail sales are likely to decline.

We intend to vigorously protect our registered trademarks against infringement, but we may be unable to do so. The unauthorized reproduction or other misappropriation of our trademarks would diminish the value of our brands, which could reduce demand for our products or the prices at which we can sell our products. Our ability to grow our retail operation significantly depends on the value and image of the brands. Our brands could be adversely affected if we fail to maintain and promote the brands by marketing efforts.

Failure to maintain and/or upgrade our information technology systems may have an adverse effect on our operation.

We rely on various information technology systems to manage our operations, and we regularly evaluate these systems against our current and expected requirements. Although we have no current plans to implement modifications or upgrades to our systems, we will eventually be required to make changes to legacy systems and acquire new systems with new functionality. We are considering additional investments in updating our ERP system to help us improve our internal control system and to meet compliance requirements under Section 404. We are also continuing to develop and update our internal information systems on a timely basis to meet our business expansion needs. Any information technology system disruptions, if not anticipated and appropriately mitigated, could have an adverse effect on our business and operations.

14

We may engage in future acquisitions and strategic investments that dilute the ownership percentage of our shareholders and require the use of cash, incur debt or assume contingent liabilities.

As part of our business strategy, we expect to continue to review opportunities to buy or invest in other businesses or technologies that we believe would enhance our manufacturing capabilities, or that may otherwise offer growth opportunities. If we buy or invest in other businesses in the future, this may require the use of cash, or we may incur debt or assume contingent liabilities.

As part of our business strategy, we expect to continue to review opportunities to buy or invest in other businesses or technologies that we believe would complement our current products, expand the breadth of our markets or enhance our technical capabilities, or that may otherwise offer growth opportunities. If we buy or invest in other businesses, products or technologies in the future, we could:

| ● | incur significant unplanned expenses and personnel costs; | |

| ● | issue stock that would dilute our current shareholders’ percentage ownership; | |

| ● | use cash, which may result in a reduction of our liquidity; | |

| ● | incur debt; assume liabilities; and | |

| ● | spend resources on unconsummated transactions. |

We may not realize the anticipated benefits of past or future acquisitions and strategic investments, and integration of acquisitions may disrupt our business and management.

We may in the future acquire or make strategic investments in additional companies. We may not realize the anticipated benefits of these or any other acquisitions or strategic investments, which involve numerous risks, including:

| ● | our inability to integrate the purchased operations, technologies, personnel or products into our existing operations and/or over geographically disparate locations; | |

| ● | unanticipated costs, litigation and other contingent liabilities; | |

| ● | diversion of management’s attention from our core business; | |

| ● | adverse effects on existing business relationships with suppliers and customers; | |

| ● | incurrence of acquisition-related costs or amortization costs for acquired intangible assets that could impact our operating results; | |

| ● | inability to retain key customers, distributors, vendors and other business partners of the acquired business; and | |

| ● | potential loss of our key employees or the key employees of an acquired organization; |

If we are not be able to integrate businesses, products, technologies or personnel that we acquire, or to realize expected benefits of our acquisitions or strategic investments, our business and financial results may be adversely affected.

15

Changes in international trade policies and international barriers to trade, or the emergence of a trade war, may have an adverse effect on our business and expansion plans.

Political events, international trade disputes, and other business interruptions could harm or disrupt international commerce and the global economy, and could have a material adverse effect on us and our customers, service providers, and other partners. International trade disputes could result in tariffs and other protectionist measures which may materially and adversely affect our business. Tariffs could increase the cost of the goods and products which could affect customers’ spending levels. In addition, political uncertainty surrounding international trade disputes and the potential of the escalation to trade war and global recession could have a negative effect on customer confidence, which could materially and adversely affect our business. We may have also access to fewer business opportunities, and our operations may be negatively impacted as a result. In addition, the current and future actions or escalations by either the United States or China that affect trade relations may cause global economic turmoil and potentially have a negative impact on our markets, our business, or our results of operations, and we cannot provide any assurances as to whether such actions will occur or the form that they may take.

International political instability and concerns about other international crises may increase our cost of doing business and disrupt our business.

International political instability may halt or hinder our ability to do business and may increase our costs. Various events, including the occurrence or threat of terrorist attacks, increased national security measures in the EU, the United States and other countries, and military action and armed conflicts, can suddenly increase international tensions. Increases in energy prices will also impact our costs and could harm our operating results. In addition, concerns about other international crises, such as the global outbreak of COVID-19, spread of avian influenza, or bird flu, and West Nile viruses, may have an adverse effect on the world economy and could adversely affect our business operations or the operations of our OEM partners, contract manufacturer and suppliers. This political instability and concerns about other international crises may, for example:

| ● | negatively affect the reliability and cost of transportation; | |

| ● | negatively affect the desire and ability of our employees and customers to travel; | |

| ● | adversely affect our ability to obtain adequate insurance at reasonable rates; | |

| ● | require us to take extra security precautions for our operations; and | |

| ● | furthermore, to the extent that air or sea transportation is delayed or disrupted, our operations may be disrupted, particularly if shipments of our products are delayed. |

Business interruptions could adversely affect our business.

Our operations and the operations of our suppliers and customers are vulnerable to interruption by fire, earthquake, hurricanes, power loss, telecommunications failure, and other events beyond our control. In the event of a major natural disaster, we could experience business interruptions, destruction of facilities and loss of life. In the event that a material business interruption occurs that affects us or our suppliers or customers, shipments could be delayed, and our business and financial results could be harmed.

16

The Covid-19 pandemic has adversely affected, and may continue to adversely affect, our results of operations.

The Covid-19 pandemic adversely impacted our business in fiscal year 2021. Among other things, the product manufacturing, logistics and fulfillment of us and certain third-party merchants and brands that cooperated with us were adversely affected due to various travel restrictions and quarantine measures imposed in China. We have implemented preventative measures to protect the health and safety of our employees and made appropriate adjustments to our business operations in response to the pandemic’s impact.

While we have seen gradual recovery of our overall business resulting from improving health statistics in China since March 2020, the pandemic continued to have an adverse effect on our business and results of operations for the past few months and we anticipate the negative impact of the pandemic may continue. As a result, our results of operations for fiscal year 2022 and any period thereof could be worse than our results of operations for fiscal year 2021 and corresponding periods thereof.

The duration and magnitude of the impact from the pandemic on our business will depend on numerous evolving factors that cannot be accurately predicted or assessed, including the duration and scope of the pandemic, the negative impact it has on the Chinese and global economy, its impact on unemployment and consumer confidence, our ability to successfully navigate the impact of the pandemic, as well as actions governments, businesses and individuals take in response to the pandemic.

Unfavorable global economic conditions, including as a result of health and safety concerns, could adversely affect our business, financial condition or results of operations.

Our results of operations could be adversely affected by general conditions in the global economy, including conditions that are outside of our control, such as the impact of health and safety concerns from the outbreak of COVID-19. The outbreak in China has resulted in the reduction of customer traffic and temporary closures of shopping malls as mandated by the provincial governments in various provinces of China from late January to March 2020, which had adversely affected our retail business with a decline in sales since February 2020. Our wholesale business is also significantly affected as we were facing a sharp decline in our order quantities. Some of our wholesale clients cancelled or postponed orders with us. Due to the Chinese factories’ shutdowns and traffic restrictions during the outbreak of COVID-19 in China and potential shutdowns and traffic restrictions in the countries where our suppliers are located, our supply chain and business operations of our suppliers may be affected from time to time. Disruptions from the closure of supplier and manufacturer facilities, interruptions in the supply of raw materials and components, personnel absences, or restrictions on the shipment of our or our suppliers’ or customers’ products, could have adverse ripple effects on our manufacturing output and delivery schedule. We also face difficulties in collecting our accounts receivables due to the effects of COVID-19 on our customers and risk gaining a large amount of bad debt. Global health concerns, such as COVID-19, could also result in social, economic, and labor instability in the countries and localities in which we or our suppliers and customers operate.

Although China has already begun to recover from the outbreak of COVID-19, the epidemic continues to spread on a global scale and there is the risk of the epidemic returning to China in the future, thereby causing further business interruption. While the potential economic impact brought by and the duration of COVID-19 may be difficult to assess or predict, a widespread pandemic could result in significant disruption of global financial markets, reducing our ability to access capital, which could in the future negatively affect our liquidity. In addition, a recession or market correction resulting from the spread of COVID-19 could materially affect our business and the value of our common stock. If our future sales continue to decline significantly, we may risk facing bankruptcy due to our recurring fixed expenses. The extent to which COVID-19 impacts our results will depend on many factors and future developments, including new information about COVID-19 and any new government regulations which may emerge to contain the virus, among others.

Changes to United States tax, tariff and import/export regulations may have a negative effect on global economic conditions, financial markets and our business.

The current political climate has introduced greater uncertainty with respect to trade policies, tariffs and government regulations affecting trade between the U.S. and other countries, especially to trade between U.S. and China. Our products are sold to many countries including the U.S. Major developments in tax policy or trade relations, such as the disallowance of tax deductions for imported products or the imposition of unilateral tariffs on imported products, could have a material adverse effect on our business, results of operations and liquidity.

17

Risks Related to Doing Business in China

Our failure to comply with cybersecurity and data protection laws and regulations could lead to government enforcement actions and significant penalties against us, and adversely impact our operating results.

We are subject relating various risks and costs associated with to the collection, use, sharing, retention, security, and transfer of confidential and private information, such as personal information and other data. This data is wide ranging and relates to our customers, suppliers, and other counterparties and third parties. Our compliance obligations include those relating to the relevant PRC laws in this regard. These PRC laws apply not only to third-party transactions, but also to transfers of information between us and our subsidiaries in China, and among us, our subsidiaries in China, and other parties with which we have commercial relations. These laws continue to develop, and the PRC government may adopt other rules and restrictions in the future. Non-compliance could result in penalties or other significant legal liabilities.

Pursuant to the PRC Cybersecurity Law, which was promulgated by the Standing Committee of the National People’s Congress on November 7, 2016 and took effect on June 1, 2017, personal information and important data collected and generated by a critical information infrastructure operator in the course of its operations in China must be stored in China, and if a critical information infrastructure operator purchases internet products and services that affects or may affect national security, it should be subject to cybersecurity review by the CAC. Due to the lack of further interpretations, the exact scope of “critical information infrastructure operator” remains unclear. On December 28, 2021, the CAC and other relevant PRC governmental authorities jointly promulgated the Cybersecurity Review Measures (the “new Cybersecurity Review Measures”) to replace the original Cybersecurity Review Measures. The new Cybersecurity Review Measures took effect on February 15, 2022. Pursuant to the new Cybersecurity Review Measures, if critical information infrastructure operators purchase network products and services, or network platform operators conduct data processing activities that affect or may affect national security, they will be subject to cybersecurity review. A network platform operator holding more than one million users/users’ individual information also shall be subject to cybersecurity review before listing abroad. The cybersecurity review will evaluate, among others, the risk of critical information infrastructure, core data, important data, or a large amount of personal information being influenced, controlled or maliciously used by foreign governments and risk of network data security after going public overseas.

In addition, the PRC Data Security Law, which was promulgated by the Standing Committee of the National People’s Congress on June 10, 2021 and took effect on September 1, 2021, requires data collection to be conducted in a legitimate and proper manner, and stipulates that, for the purpose of data protection, data processing activities must be conducted based on data classification and hierarchical protection system for data security. As the Data Security Law was recently promulgated, we may be required to make further adjustments to our business practices to comply with this law. If our data processing activities were found to be not in compliance with this law, we could be ordered to make `corrections, and under certain serious circumstances, such as severe data divulgence, we could be subject to penalties, including the revocation of our business licenses or other permits. Furthermore, the recently issued Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law require (i) speeding up the revision of the provisions on strengthening the confidentiality and archives management relating to overseas issuance and listing of securities and (ii) improving the laws and regulations relating to data security, cross-border data flow, and management of confidential information. As there remain uncertainties regarding the further interpretation and implementation of those laws and regulations, we cannot assure you that we will be compliant such new regulations in all respects, and we may be ordered to rectify and terminate any actions that are deemed illegal by the regulatory authorities and become subject to fines and other sanctions. As a result, we may be required to suspend our relevant businesses, shut down our website, take down our operating applications, or face other penalties, which may materially and adversely affect our business, financial condition, and results of operations.

On August 20, 2021, the Standing Committee of the National People’s Congress of China promulgated the Personal Information Protection Law of the PRC, or the PIPL, which took effect in November 2021. As the first systematic and comprehensive law specifically for the protection of personal information in the PRC, the PIPL provides, among others, that (i) an individual’s consent shall be obtained to use sensitive personal information, such as biometric characteristics and individual location tracking, (ii) personal information operators using sensitive personal information shall notify individuals of the necessity of such use and impact on the individual’s rights, and (iii) where personal information operators reject an individual’s request to exercise his or her rights, the individual may file a lawsuit with a People’s Court. As uncertainties remain regarding the interpretation and implementation of the PIPL, we cannot assure you that we will comply with the PIPL in all respects, we may become subject to fines and/or other penalties which may have material adverse effect on our business, operations and financial condition.

While we take measures to comply with all applicable data privacy and protection laws and regulations, we cannot guarantee the effectiveness of the measures undertaken by us. However, compliance with any additional laws could be expensive, and may place restrictions on our business operations and the manner in which we interact with our users. In addition, any failure to comply with applicable cybersecurity, privacy, and data protection laws and regulations could result in proceedings against us by government authorities or others, including notification for rectification, confiscation of illegal earnings, fines, or other penalties and legal liabilities against us, which could materially and adversely affect our business, financial condition, results of operations and the value of our common stock. In addition, any negative publicity on our website or platform’s safety or privacy protection mechanism and policy could harm our public image and reputation and materially and adversely affect our business, financial condition, and results of operations.

18

The ongoing trade war between China and the United States, and its potential escalation internationally, may have an adverse effect on our business operations and revenues.