UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2012

Or

|

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to ______________

Commission file number: 0-28806

|

EVER-GLORY INTERNATIONAL GROUP, INC.

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

|

|

Florida

|

|

65-0420146

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

Ever-Glory Commercial Center,

509 Chengxin Road, Jiangning Development Zone,

Nanjing, Jiangsu Province,

Peoples Republic of China

(Address of principal executive offices) (Zip Code)

86-25-52096875

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

|

Title of each class registered:

|

|

Name of each exchange on which registered:

|

|

Common Stock

|

|

NYSE MKT LLC

|

Securities registered under Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

| |

|

|

Non-accelerated filer ¨ (Do not check if smaller reporting company)

|

Smaller Reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2012, 14,765,942 shares of common stock were outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant, as of June 30, 2012, the last business day of the 2nd fiscal quarter, was approximately $23,182,529 based on the closing price of $1.57 for the registrant’s common stock as reported on the NYSE MKT LLC. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

As of March 28, 2013, there were 14,777,610 shares of our common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EVER-GLORY INTERNATIONAL GROUP, INC.

FORM 10-K

For the Year Ended December 31, 2012

TABLE OF CONTENTS

| |

|

Page

|

|

Cautionary Note Regarding Forward-Looking Statements

|

|

i

|

| |

|

|

|

|

Part I

|

|

|

|

| |

|

|

|

|

Item 1.

|

Business

|

|

1

|

|

Item 1A.

|

Risk Factors

|

|

7

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

17

|

|

Item 2.

|

Properties

|

|

17

|

|

Item 3.

|

Legal Proceedings

|

|

17

|

|

Item 4.

|

Mine Safety Disclosures

|

|

17

|

| |

|

|

|

|

Part II

|

|

|

|

| |

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

18

|

|

Item 6.

|

Selected Financial Data

|

|

18

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

18

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

|

26

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

F-1

|

|

Item 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

27

|

|

Item 9A.

|

Controls and Procedures

|

|

27

|

|

Item 9B.

|

Other Information

|

|

28

|

| |

|

|

|

|

Part III

|

|

|

|

| |

|

|

|

|

Item 10.

|

Directors, Executive Officers, and Corporate Governance

|

|

29

|

|

Item 11.

|

Executive Compensation

|

|

32

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

36

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

36

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

38

|

| |

|

|

|

|

Part IV

|

|

|

|

| |

|

|

|

|

Item 15

|

Exhibits, Financial Statement Schedules

|

|

39

|

| |

|

|

|

|

Signatures

|

|

41

|

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this Annual Report on Form 10-K, which are not historical facts, are forward-looking statements, as the term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements, whether expressed or implied, are subject to risks and uncertainties which can cause actual results to differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to:

| |

●

|

Competition within our industry;

|

| |

●

|

Seasonality of our sales;

|

| |

●

|

Our investments in new product development;

|

| |

●

|

Our plans to open new retail stores;

|

| |

●

|

Our ability to integrate our acquired businesses;

|

| |

●

|

Our relationships with our major customers;

|

| |

●

|

The popularity of our products;

|

| |

●

|

Relationships with suppliers and cost of supplies;

|

| |

●

|

Financial and economic conditions in Asia, Japan, Europe and the U.S.;

|

| |

●

|

Regulatory requirements in the PRC and countries in which we operate;

|

| |

●

|

Anticipated effective tax rates in future years;

|

| |

●

|

Regulatory requirements affecting our business;

|

| |

●

|

Currency exchange rate fluctuations;

|

| |

●

|

Our financing needs; and

|

| |

●

|

Our ability to attract additional investment capital on attractive terms.

|

Forward-looking statements also include the assumptions underlying or relating to any of the foregoing or other such statements. When used in this report, the words “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “continue,” and similar expressions are generally intended to identify forward-looking statements.

These forward-looking statements are subject to numerous assumptions, risks and uncertainties that may cause our actual results to be materially different from any future results expressed or implied by us in those statements. Some of these risks are described in “Risk Factors” in Item 1A of this Annual Report. These risk factors should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All written and oral forward looking statements made in connection with this annual report that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given these uncertainties, we caution investors not to unduly rely on our forward-looking statements. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events. Further, the information about our intentions contained in this document is a statement of our intention as of the date of this document and is based upon, among other things, the existing regulatory environment, industry conditions, market conditions and prices, the economy in general and our assumptions as of such date. We may change our intentions, at any time and without notice, based upon any changes in such factors, in our assumptions or otherwise.

PART I

Item 1. BUSINESS

Overview and Corporate History

Ever-Glory International Group, Inc., sometimes referred to in this report as “Ever-Glory”, the “ Company ,” “ we ”, or “ us ”, through its subsidiaries, is an apparel supply chain management provider, manufacturer, distributor and retailer based in the People’s Republic of China, with customers in China, the United States, Europe and Japan. Our business is focused on middle to high-end casual wear, outerwear and sportswear brands for men, women and children. As a holding company, we oversee the operations of our subsidiaries and provide our subsidiaries with resources and services in financial, legal, administrative and other areas. The Company was incorporated in Florida on October 19, 1994. We changed our name from Andean Development Corporation to “Ever-Glory International Group, Inc.” on November 17, 2005.

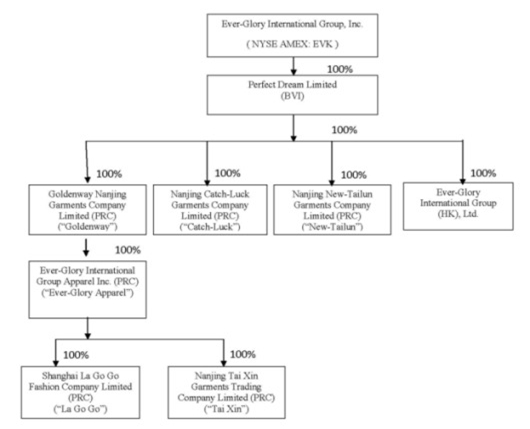

The following is a description of our corporate history and structure:

Perfect Dream Limited (“Perfect Dream”) was incorporated in the British Virgin Islands on July 1, 2004. Perfect Dream was originally formed as a holding company, and it became our wholly-owned subsidiary as a result of a share exchange transaction completed in November 2005.

In January 2005, Perfect Dream acquired 100% of Goldenway Nanjing Garments Company Limited (“ Goldenway ”). Goldenway, a wholly foreign-owned enterprise in People’s Republic of China (“ PRC ”) was incorporated on December 31, 1993. Goldenway is principally engaged in outsourcing and sale of garments. Prior to acquisition by Perfect Dream, Goldenway was a joint venture held by Jiangsu Ever-Glory International Group Corporation (“ Jiangsu Ever-Glory ”).

On November 9, 2006, Perfect Dream entered into a purchase agreement with Ever-Glory Enterprises (HK) Limited (“ Ever-Glory Hong Kong ”) whereby we acquired a 100% interest in Nanjing New-Tailun Garments Co, Ltd. (“ New-Tailun ”) from Ever-Glory Hong Kong. New-Tailun is a 100% foreign-owned enterprise incorporated in the PRC and is engaged in the manufacturing and sale of garments.

On August 27, 2007, we acquired Nanjing Catch-Luck Garments Co, Ltd. (“Catch-Luck”), which further expanded our production capacity. Catch-Luck is primarily engaged in the manufacturing and sale of garments in China. Shanghai La Go Go Fashion Company Limited (“LA GO GO”), a joint venture of Goldenway and Shanghai La Chapelle Garment and Accessories Company Limited (“La Chapelle”), was incorporated in the PRC on January 24, 2008. Goldenway invested approximately $0.8 million (approximately RMB 6.0 million) in cash, and La Chapelle invested approximately $0.6 million (RMB 4.0 million) in cash, for a 60% and 40% ownership interest, respectively, in LA GO GO. In connection with the formation of LA GO GO, Goldenway made a strategic investment in La Chapelle by acquiring a 10% equity in La Chapelle with a cash payment of RMB 10 million (approximately USD$1.35 million). The business objective of the joint venture is to establish and create a leading brand of ladies’ garments for the mainland Chinese market. On March 23, 2009, Goldenway transferred all of its ownership interest in LA GO GO to Ever-Glory International Group Apparel Inc.(“ Ever-Glory Apparel ”), a wholly-owned subsidiary of Goldenway. On April 23, 2010, Ever-Glory Apparel acquired the 40% non-controlling interest in LA GO GO from La Chapelle for approximately $0.9 million (RMB 6.2 million), bringing our ownership in LA GO GO to 100%. In connection with such acquisition, and in order to focus on our core business, Golden Way sold the 10% equity interest in La Chapelle to the original shareholders of La Chapelle and, in return, received a total cash payment of RMB 12.36 million (approximately $1.8 million).

Ever-Glory Apparel was incorporated in the PRC on January 6, 2009. Goldenway invested approximately $6.6 million (RMB45.0 million) into Ever-Glory Apparel. Ever-Glory Apparel is principally engaged in the import and export of apparel, fabric and accessories. Ever-Glory Apparel began to function as our primary import and export agent during 2010.

On March 19, 2012, Nanjing Tai Xin Garments Trading Company Limited (“Tai Xin”), a wholly owned subsidiary of Ever-Glory Apparel was incorporated in PRC. Tai Xin is primarily engaged in the purchasing of raw materials used in the garment manufacturing.

Ever-Glory International Group (HK) Ltd. (“Ever-Glory HK”), a wholly-owned subsidiary of Perfect-Dream, was incorporated in Samoa on September 15, 2009. Ever-Glory HK is principally engaged in the import and export of apparel, fabric and accessories.

Ever-Glory Apparel and Ever-Glory HK focus on the import and export business. Goldenway focuses primarily on quality and production control, and coordinating with outsourced contract manufacturers. New-Tailun focuses on the Japanese market, and has strengths in the design, production, sale and marketing of jeans and trousers. Catch-Luck is geared toward the European market, and it designs and makes products that complement the product lines of our other subsidiaries. Tai xin is primarily engaged in the purchasing of raw materials used in the garment manufacturing. LA GO GO focuses on establishing and creating a leading brand of ladies’ apparel for the mainland Chinese market.

As a result of the foregoing acquisitions and transactions, we presently own and operate seven subsidiaries in China (including Hong Kong) as of the date of this annual report. Our corporate structure is illustrated below.

Business Operations

Our wholesale operations include manufacturing and worldwide sale of apparel to well-known casual wear, sportswear and outerwear brands and retailers in major markets. We manufacture our apparel products in two manufacturing facilities owned by Catch-Luck and New-Tailun, which are located in the Nanjing Jiangning Economic and Technological Development Zone and Shang Fang Town, respectively, in Nanjing, China. We conduct our original design manufacturing (“ ODM ”) operations through three wholly-owned subsidiaries in China: Goldenway, New-Tailun, and Catch-Luck. In our fiscal year ended December 31, 2012, our wholesale segment achieved total sales of $171.0 million.

Although we have our own manufacturing capacity, we currently outsource most of the manufacturing to our strategic long term contractors as part of our overall business strategy. Outsourcing allows us to maximize our production capacity and remain flexible while reducing capital expenditures and the costs of keeping skilled workers on production lines during times of seasonally lower sales. We inspect products manufactured by our long-term contractors to ensure that they meet our high quality control standards. Total annual output from our manufacturing facilities and outsourced partners is more than 17.8 million pieces in 2012. See Production and Quality Control below.

Our retail operation is conducted by our subsidiary, LA GO GO, whose business objective is to establish and create a leading brand of women’s wear and to build a nationwide retail distribution channel in China. LA GO GO had approximately 3,750 employees as of December 31, 2012. As of December 31, 2012, we operated 727 retail stores in China and had total sales of $108.6 million.

Wholesale Segment

Products

We manufacture a broad array of products in various categories for the women’s, men’s and children’s markets. Within those categories, various product classifications including high and middle grade casual-wear, sportswear and outwear, including the following product lines:

|

Women’s Clothing:

|

coats, jackets, slacks, skirts, shirts, trousers, and jeans

|

|

Men’s Clothing:

|

vests, jackets, trousers, skiwear, shirts, coats and jeans

|

|

Children’s Clothing:

|

coats, vests, down jackets, trousers, knitwear and jeans

|

Customers

We manufacture garments for a number of well-known retail chains and famous international brands. We also have our own in-house design capabilities and can provide our customers with a selection of original designs that the customer may have manufactured-to-order. We ordinarily supply our customers’ through purchase orders and we have no long-term supply contracts with any of them.

In the fiscal year ended December 31, 2012, approximately 63.9% of our sales revenue came from customers in China, 7.7% of our sales revenue came from customers in Germany, 13.6% of our sales revenue came from customers in United Kingdom and other European countries, 6.5% from customers in the United States, and 8.3% from customers in Japan. In 2012, two customers represented more than ten percent of our total wholesale sales (approximately 11.1% and 10.8% of total sales). Also, in 2012, sales to our five largest customers generated approximately 44.9% of our total wholesale sales.

Substantially all of our long-lived assets were attributable to the PRC as of December 31, 2012 and 2011.

Suppliers

We purchase the majority of our raw materials (including fabric, fasteners, thread, buttons, labels and related materials) directly from numerous local fabric and accessories suppliers in China. For our wholesale business, collectively, purchases from our five largest suppliers represented approximately 16.4% and 15.8% of total raw material purchases in 2012 and 2011, respectively. No single supplier provided more than 10% of our total purchases.

We also purchased finished goods from contract manufacturers. For our wholesale business, collectively, purchases from our five largest contract manufacturers represented approximately 36.9% and 40.0% of total finished goods purchases in 2012 and 2011, respectively. One contract manufacturer provided approximately 13.9% and 13.0% of our total finished goods purchases in 2012 and 2011, respectively.

For our wholesale business, we generally agree to pay our suppliers within 30-90 days after our receipt of goods. We typically place orders for materials from suppliers when we receive orders from our customers. On average, the materials will generally be consumed by production in approximately 20 days.

Sales and Marketing

We have set up our own merchandising department to interface with our customers. We believe we have developed good and stable business relationships with our main customers in Europe, the U.S., Japan and China. Our sales staff typically work directly with our customers and arrange the terms of the contracts with them.

Our management believes that we continue to benefit from our solid reputation for providing high quality goods and professional service in the markets where we have a presence, which provides us further opportunities to work with desirable customers. Our marketing strategy aims to attract customers with the strongest brands within the strongest markets. We seek to attract customers mainly from Europe, the U.S., Japan, and China. In addition, we look for customers with strong brand appeal and product lines that require high quality manufacturing and generate sufficient sales volume to support our sizeable production capacity. Referrals from existing customers have been and continue to be a fruitful source of new customers. In addition, we aim to maintain an active presence in trade shows around the world, including those in Europe, the U.S., Japan, and China.

Production and Quality Control

In 2012, we manufactured approximately 20% of the products we sell to wholesale customers in our own manufacturing facilities. We typically outsource the manufacturing of a large portion of our products based upon factory capacity and customer demand. The number of outside contract manufacturers to which we outsource is expected to increase in order to meet the anticipated growth in demand from our customers.

As of December 31, 2012, our total production capacity, including outsourced production, reached 17.8 million pieces per year. At present, we believe our production capacity is sufficient to meet customer demand.

We are committed to designing and manufacturing high quality garments. We place a higher standard on quality control because we emphasize the high quality of our products. We have implemented strict quality control and craft discipline systems. Before we manufacture large quantities, we obtain the approval from our customers either through in-person visits to the factories or by shipping samples of our products to our customers for testing, inspection and feedback. This ensures that our products perfectly meet specifications prior to production. In addition, our trained professional quality control personnel periodically inspect the manufacturing process and quality of our apparel products. Our factory is ISO 9001:2000 certified. ISO 9000 is a family of standards for quality management systems maintained by ISO, International Organization for Standardization, and is administered by accreditation and certification bodies. We have been independently audited and certified to be in conformance with ISO 9001 which certifies that formalized business processes are being applied.

Due to our strict quality control and testing process, we have not undergone any significant product or merchandise recalls, and we generally do not receive any significant requests by our customers to return finished goods. Product returns are not a material factor in our business.

We anticipate to continue outsourcing a large portion of our production. Management believes that outsourcing allows us to maximize our production flexibility while reducing significant capital expenditure and the costs associated with managing a large production workforce. We contract for the production of a portion of our products through various outside independent manufacturers. Quality control reviews are done by our employees during and after production before the garments leave the outsourcing factories to ensure that material and component qualities and the products “fits” are in accordance with our specifications. We inspect prototypes of each product prior to cutting by the contractors, and conduct a final inspection of finished products prior to shipment to ensure that they meet our high standards.

Delivery and Transportation

We generally do not hold any significant inventory of finished goods for more than ninety days, as we typically ship finished goods to our customers upon completion.

Competition

The garment manufacturing industry is highly competitive, particularly in China. Our competitors include garment manufacturers of all sizes, both within China and elsewhere in the world, many of which have greater financial and manufacturing resources than us. We have been in the garment manufacturing business since 1993 and believe that we have earned a reputation for producing high quality products efficiently and at competitive prices, with excellent customer service. We believe we provide one-stop-service and more valuable products for our customers.

Currently, we have several competitors in China including small to large sized companies including some state-owned trading groups and private garment companies. We believe we differentiate ourselves from the competition and will be able to effectively compete with our rivals due to our persistent pursuit of quality control, a diversified casual wear product lineup, and in-house design talent. In addition, we believe we derive advantages from the rapid feedback we receive from our customers in the supply chain and using our advanced Enterprise Resource Planning (“ ERP ”) system. Our ERP system integrates many of our operational processes into one system including order processing, statistical analysis, purchasing, manufacturing, logistics and financial control systems, providing management with instantaneous feedback on important aspects of our business operations.

Governmental Regulations/Quotas

In 2012, we were not subject to any export quota imposed by countries where our customers are located. Nevertheless, we have noticed that many European countries tightened their chemical inspection requirements after the removal of quotas. In addition, there can be no assurance that additional trade restrictions will not be imposed on the export of our products in the future. Such actions could result in increases in the cost of our products generally and may adversely affect our results of operations. On a longer term basis, we believe that our customer mix and our ability to adjust the types of apparel we manufacture will mitigate our exposure to such trade restrictions in the future.

We are also required to comply with Chinese laws and regulations that apply to some of the products we produce for shipment to the countries to which we export. In order to address these Chinese compliance issues, we have established an advanced fabric testing center to ensure that our products meet certain quality and safety standards in the U.S. and EU. In addition, we work closely with our customers so that they understand our testing and inspection process.

Seasonality

Our business is affected by seasonal trends, with higher levels of wholesale sales in our third and fourth quarters and higher retail sales in our first and fourth quarters. These trends result primarily from the timing of seasonal demand and shipments in our wholesale business and holiday periods in China where our retail business operates.

Retail Segment

As of December 31, 2012, LA GO GO had 727 retail stores in China to sell its own brand clothing. We believe our advantages in the retail segments include our ability to promptly respond to market trends, our quick turn-around in design and production, and appropriate pricing. In 2012, we achieved total net sales of approximately US $108.6 million for our retail business. We operate most of our retail stores in so-called Tier-2 or Tier-3 cities in China, such as Zhengshou in Henan province, Taizhou in Jiangsu province, etc. We also have penetrated into Tier-1 cities, such as Beijing and Shanghai.

Suppliers

We purchase the majority of our raw materials (including fabric, fasteners, thread, buttons, labels and related materials) directly from numerous local fabric and accessories suppliers. For our retail business, collectively, purchases from our five largest suppliers represented approximately 30.7% of total purchases in 2012. No single supplier provided more than 10% of our total purchases in 2012. We have not experienced difficulty in obtaining raw materials essential to our business.

We also purchase finished goods from contract manufacturers. For our retail business, collectively, our five largest contract manufacturers represented approximately 15.2% of total finished goods purchases in 2012. There was one contract manufacturer which provided more than 10% of our total finished goods purchases in 2012. We have not experienced difficulty in obtaining finished products from our contract manufacturers.

For our retail business, we generally agree to pay our suppliers within 30-180 days after our receipt of goods. We typically place orders for materials from suppliers when the style has been confirmed by our chief of design. On average, the supplies we hold in stock will generally be consumed in production in approximately 20 days.

Customers

LA GO GO seeks to appeal to fashionable urban females between the ages of 20 to 30. Our products are priced at a middle-to-high level in order to appeal to our targeted customers.

Design and Production

We have our own design, production and quality control departments. LA GO GO releases new designs twice a year, during October for the spring/summer season and May for the autumn/winter season. Our design team attends many fashion shows each year to track the trend in Europe, Japan and Asia. Our design team produces approximately 1,700 designs each year. LA GO GO hosts its own order-placing fair twice each year to determine the new products to be released for the spring/summer and autumn/winter season based on the orders placed by all the regional sales managers at such fair; our chief designer then decides the design to be manufactured. The production department will then produce samples for the designer’s approval. Our quality control department checks the quality of the final products by follow-up inspection. The final products will be shipped to the logistics and distribution center for sale.

Sales and Marketing

Our LA GO GO products are sold in flagship stores, and stores-within-a-store. The sales department is responsible for developing new sales channels. According to our new store opening plan, the ratio of flagship stores and stores-within-a-store are carefully balanced. The store-within-a-store enters into contracts with department stores. The flagship stores are carefully chosen at prominent locations and have lease agreements with each property owner. Under our return and exchange policy, products may be returned or exchanged for any reason within 15 days. During 2012, the return and exchange rate was very low and was not a material factor in our operations.

Store Operation

As of December 31, 2012, we had 727 stores, including 35 flagship stores, with each store generating average revenue of approximately $ 12,400 per month. The majority of our retail stores are situated as stores-within-a-store in large, mid-tier department stores located in over 20 provinces in China.

Trademarks

We regard our trademarks as an important part of our business due to the name recognition of our customers. We obtained trademark registration at the China Trademark Office for the mark “LA GO GO” in class 25 and class 18 in 2010. As of December 31, 2012, we are not aware of any valid claim or challenges to our right to use our registered trademark nor any counterfeit or other infringement to our registered trademark.

Information Technology

We recognize the importance of high-quality information management systems in the retail operation. As a result, we use “Parkson Retail Management Systems”, a comprehensive and mature retail management application in China, to monitor and manage the merchandise planning, inventory and sales information.

Our Growth Strategy

Our strategy to grow and expand our business includes the following:

Supply chain management:

| |

●

|

Expand the global sourcing network

|

| |

●

|

Invest in the overseas low-cost manufacturing base

|

| |

●

|

Focus on high value-added products and continue our strategy to produce mid to high end apparel

|

| |

●

|

Continue to emphasize on product design and technology application

|

| |

●

|

Seek strategic acquisitions of international distributors that could enhance global sales and distribution network

|

| |

● |

Maintain stable revenue increase in the export markets while shifting focus to higher margin wholesale markets such as mainland China.

|

Retail business development:

| |

●

|

Build the LA GO GO brand to be recognized as a major player in the mid-end women's apparel market in China;

|

| |

●

|

Expand the LA GO GO retail network throughout China

|

| |

●

|

Improve the LA GO GO retail stores’ efficiency and increase same-store sales

|

| |

●

|

Continue to launch LA GO GO flagship stores in Tier-1 Cities and increase penetration and coverage in Tier-2 and Tier-3 Cities

|

|

|

●

|

Become a multi-brand operator by seeking opportunities for long-term cooperation with reputable international brands and by facilitating international brands entry into the Chinese market.

|

Employees

As of December 31, 2012, we had over 5,100 employees. None of our employees belong to a labor union. We have never experienced a labor strike or work stoppage. We are in full compliance with the Chinese labor laws and regulations and are committed to providing safe and comfortable working conditions and accommodations for our employees.

Labor Costs

The manufacture of garments is a labor-intensive business. Although much of our production process is automated and mechanized, we rely on skilled labor to make our products. During the year ended December 31, 2012, our labor cost increased due to the shortage of skilled workers and rising labor cost in China.

Working Conditions and Employee Benefits

We consider our social responsibilities to our workers to be an important objective, and we are committed to providing a safe, clean, comfortable working environment and accommodations. Our employees are also entitled to paid holidays and vacations. In addition, we frequently monitor our third party manufacturers’ working conditions to ensure their compliance with related labor laws and regulations. We are in full compliance with our obligations to contribute a certain percentage of our employees’ salaries to social insurance funds, as mandated by the PRC government. We expect the amount of contribution to the government’s social insurance funds to increase in the future as we expand our workforce and operations.

Compliance with Environmental Laws

Based on the present nature of our operations, we do not believe that environmental laws and the cost of compliance with those laws have or will have a material impact on our operations.

Description of Property

In 2012, we operated three facilities on certain land in the Nanjing Jiangning Economic and Technological Development Zone and in Shangfang Town, which are located in Nanjing, China. For further details concerning our property, see Item 2 of this report regarding Properties.

Taxation

Most of our operating subsidiaries, except Ever-Glory HK, are incorporated in the PRC and therefore are governed by PRC income tax laws and are subject to the PRC enterprise income tax. Each of our consolidated entities files its own separate tax return, and we do not file a consolidated tax return.

Goldenway was incorporated in the PRC and is subject to PRC income tax laws and regulations. In 2012, Goldenway’s income tax rate was 25%.

New-Tailun and Catch-Luck were incorporated in the PRC and are subject to PRC income tax laws and regulations. According to the relevant laws and regulations in the PRC, enterprises with foreign investment in the PRC are entitled to full exemption from income tax for two years beginning from the first year the enterprises become profitable and have accumulated profits and a 50% income tax reduction for the subsequent three years. New-Tailun and Catch-Luck were approved as wholly foreign-owned enterprises in 2006 and are entitled to the income tax exemptions in 2006 and 2007. In 2007, no income tax was recorded by New-Tailun and Catch-Luck as these entities were entitled to full exemption from income tax. Starting from 2008 and through 2010, New-Tailun and Catch-Luck were entitled to a 50% reduction of the income tax rate of 25%. Therefore these two subsidiaries were taxed at 12.5% for 2009, 2010. In 2011, New-Tailun and Catch-Luck were subject to PRC income tax at 25%.

LA GO GO was established on January 24, 2008, its income tax rate is 25%.

Ever-Glory Apparel was established on January 6, 2010, its income tax rate is 25%.

Tai Xin was established on March 19, 2012, its income tax rate is 25%.

Perfect Dream was incorporated in British Virgin Islands on July 1, 2004, and has no liabilities for income tax.

Ever-Glory HK was incorporated in Samoa on September 15, 2009 and does not have any income tax obligation.

All of our income tax expenses are related to our operations in China.

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Annual Report before making an investment decision with regard to our securities. The statements contained in or incorporated into this Annual Report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Industry

Our sales are influenced by general economic cycles. A prolonged period of depressed consumer spending would have a material adverse effect on our profitability.

Apparel is a cyclical industry that is dependent upon the overall level of consumer spending. Purchase of apparel generally declines during recessionary periods when disposable income is low. Our customers anticipate and respond to adverse changes in economic conditions and uncertainty by reducing inventories and canceling orders. As a result, any substantial deterioration in general economic conditions, increases in energy costs or interest rates, acts of war, acts of nature or terrorist or political events that diminish consumer spending and confidence in any of the regions in which we compete, could reduce our sales and adversely affect our business and financial condition. We currently sell to customers in the U.S., the EU and Japan. Accordingly, economic conditions and consumer spending patterns in these regions could affect our sales, and an economic down turn in one or more of these regions could have an adverse effect on our business.

Intense competition in the worldwide apparel industry could reduce our sales and prices.

We face a variety of competitive challenges from other apparel manufacturers both in China and other countries. Some of these competitors have greater financial and marketing resources than we do and may be able to adapt to changes in consumer preferences or retail requirements more quickly, devote greater resources to the marketing and sale of their products or adopt more aggressive pricing policies than we can. As a result, we may not be able to compete with them if we cannot continue enhancing our marketing and management strategies, quality and value or responding appropriately to consumers needs.

Our ability to increase our revenues and profits depends upon our ability to offer innovative and upgraded products at attractive price points.

The worldwide apparel industry is characterized by constant product innovation due to changing consumer preferences and by the rapid replication of new products by competitors. As a result, our growth depends in large part on our ability to continuously and rapidly respond to customer requirements for innovative and stylish products at a competitive pace, intensity, and price. Failure on our part to regularly and rapidly respond to customer requirements could adversely affect our ability to retain our existing customers or to acquire new customers which would limit our sales growth.

The worldwide apparel industry is subject to ongoing pricing pressure.

The apparel market is characterized by low barriers to entry for both suppliers and marketers, global sourcing through suppliers located throughout the world, trade liberalization, continuing movement of product sourcing to lower cost countries, ongoing emergence of new competitors with widely varying strategies and resources, and an increasing focus on apparel in the mass merchant channel of distribution. These factors contribute to ongoing pricing pressure throughout the supply chain. This pressure has and may continue to:

| |

●

|

require us to reduce wholesale prices on existing products;

|

| |

●

|

result in reduced gross margins across our product lines;

|

|

|

●

|

increase pressure on us to further reduce our production costs and our operating expenses.

|

Any of these factors could adversely affect our business and financial condition.

Fluctuations in the price, availability and quality of raw materials could increase our cost of goods and decrease our profitability.

We purchase raw materials directly from local fabric and accessory suppliers. We may also import specialty fabrics to meet specific customer requirements. We also purchase finished goods from other contract manufacturers. The prices we charge for our products are dependent in part on the market price for raw materials used to produce them. The price, availability and quality of our raw materials may fluctuate substantially, depending on a variety of factors, including demand, crop yields, weather patterns, supply conditions, transportation costs, government regulation, economic climates and other unpredictable factors. Any raw material price increases could increase our cost of goods and decrease our profitability unless we are able to pass higher prices on to our customers.

As of December 31, 2012 and 2011, we did not rely on any raw material supplier for more than 10% of all of our total raw material purchases. For the wholesale business, we relied on one manufacturers for 13.9 and 13.0% of purchased finished goods in 2012 and 2011, respectively. For the retail business, we did not rely on any one manufacturer for more than 10% of all of our total purchased finished goods during 2012 and 2011. We do not have any long-term written agreements with any of these suppliers and do not anticipate entering into any such agreements in the near future. However, we always execute a written agreement for each order placed with our suppliers. We do not believe that loss of any of these suppliers would have a material adverse effect on our ability to obtain finished goods or raw materials essential to our business because we believe we can locate other suppliers in a timely manner.

Risks Relating to Our Business

Our wholesale business depends on some key customers for a significant portion of our sales. A significant adverse change in a customer relationship or in a customer’s performance or financial position could harm our business and financial condition.

For the year ended December 31, 2012, our five largest customers represented approximately 44.9 % of our total net sales. For the year ended December 31, 2011, our top five largest customers represented approximately 52% of our total net sales. The garment manufacturing industry has experienced substantial consolidation in recent years, which has resulted in increased customer leverage over suppliers, greater exposure for suppliers to credit risk and an increased emphasis by customers on inventory management and productivity.

A decision by a major customer, whether motivated by competitive considerations, strategic shifts, financial requirements or difficulties, economic conditions or otherwise, to decrease its purchases from us or to change its manner of doing business with us, could adversely affect our business and financial condition. In addition, while we have long-standing customer relationships, we do not have long-term contracts with any of our customers.

As a result, purchases generally occur on an order-by-order basis, and the relationship, as well as particular orders, can generally be terminated by either party at any time. We do not believe that there is any material risk of loss of any of these customers during the next 12 months. We also believe that the unexpected loss of these customers could have material adverse effect on our earnings or financial condition. While we believe that we could replace these customers within 12 months, the loss of which will not have material adverse effect on our financial condition in the long term. None of our affiliates are officers, directors, or material shareholders of any of these customers.

Our business relies heavily on our ability to identify changes in fashion trends.

Our results of operations depend in part on our ability to effectively predict and respond to changing fashion tastes by offering appropriate products. Failure to effectively follow the changing fashion trend will lead to higher seasonal inventory levels. Our continuous ability to respond to the changing customer demands constitutes a material risk to the growth of our retail business. For our wholesale business, if we are unable to swiftly respond to the changing fashion trend, the sample we designed for our customers may not be accepted or the products based on our design may be put into inventory, and thus have a negative impact on the amount of orders the customers may place with us.

Our ability to attract customers to the stores heavily depends on their location.

Our flagship stores and the store-within-a-stores are selectively located in what we believe to be prominent locations or popular department stores to generate customer traffic. The availability and/or cost of appropriate locations for the existing or future stores may fluctuate for reasons beyond our control. If we are unable to secure these locations or to renew store leases on acceptable terms, we may not continue to attract the amount of customers, which will have a material adverse effect on our sales and results of operations.

We may be unable to expand our LA GO GO retail business by opening profitable new stores.

Our future growth in our retail segment requires our continuous increase of new flagship stores and stores-within-a-store in selected cities, improve our operating capabilities, and retaining and hiring qualified sales personnel in these stores. There can be no assurance that we will be able to achieve our store expansion goals, nor any assurance that our newly opened stores will achieve revenue or profitability levels comparable to those of our existing stores. If our stores fail to achieve acceptable revenue, we may incur significant costs associated with closing those stores.

There maybe conflicts of interest between Mr. Kang’s role as the Chairman of the Board and CEO of our Company and his role as the majority owner of other entities that we do business with.

We had certain transactions with Jiangsu Ever-Glory International Enterprise Group Company (“Jiangsu Ever-Glory”), an entity majority owned and controlled by Mr. Kang. Jiangsu Ever-Glory is engaged in importing/exporting, apparel-manufacture, real-estate development, car sales and other businesses We utilized Jiangsu Ever-Glory as our agent to agent to assist with our import and export transactions and our international transportation projects. Import transactions primarily consist of purchases of raw materials and accessories designated by the Company’s customers for use in garment manufacture. Export transactions consist of our sales to markets outside of China. In return for these services, Jiangsu Ever-Glory charged us a fee of approximately 3% of export sales manufactured in China and 1% of export sales manufactured overseas. For import transactions, we may make advance payments, through Jiangsu Ever-Glory, for the raw material purchases, or Jiangsu Ever-Glory may make advance payments on our behalf. For export transactions, accounts receivable for export sales are remitted by our customers through Jiangsu Ever-Glory, who forwards the payments to us. We and Jiangsu Ever-Glory have agreed that balances from import and export transactions may be offset. Amounts due to (from) Jiangsu Ever-Glory are typically settled within 60-90 days. Accounts receivable for the years ended December 31, 2012 and 2011 was $214,226 and $19,999,373 respectively. Accounts payable for the years ended December 31, 2012 and 2011 was $ 53,680 and $2,399,226 respectively. We charge an interest of 0.5% (an annual interest of 6%) on net amounts due at each month end. Interest income for the years ended December 31, 2012 and 2011 was $1,261,903 and $635,479, respectively.

As of December 31, 2012, Jiangsu Ever-Glory has provided guarantees for approximately US$ 44.48 million (RMB 281 million) of lines of credit obtained by us. Jiangsu Ever-Glory and its non-controlling subsidiary have also provided their assets as collaterals for some of these lines of credits. The value of the collaterals, as per appraisals obtained by the banks in connection with these lines of credits is approximately US$20.90 million (RMB 132 million). In consideration of the guarantees and collaterals provided by Jiangsu Ever-Glory, we agreed to provide Jiangsu Ever-Glory a counter-guarantee in the form of cash of not less than 70% of the maximum aggregate lines of credit obtained by us. Jiangsu Ever-Glory is obligated to return the full amount of the counter guarantee funds provided upon expiration or termination of the underlying lines of credit and is to pay annual interest at the rate of 6.0% of amounts provided. The oral agreements between us and Jiangsu Ever-Glory was later documented in a written Counter-Guarantee Agreement dated April 15, 2013 which is filed as an exhibit to this annual report. During the year ended December 31, 2012, US$32.13 million (RMB 203 million), which is out of the bank borrowing we obtained during that period, was provided to Jiangsu Ever-Glory under the counter guarantee, all of which was outstanding at December 31, 2012. Through March 31, 2013, approximately $4.75 million (RMB 30 million) was provided under the counter guarantee and approximately $15.67 million (RMB99 million) was returned and therefore, as of March 31, 2013, approximately $ 21.21 million (RMB 134 million) was outstanding.

It is possible that the terms of the export and import agency transactions and the counter guarantee may not be the same as those that would result from transactions between unrelated parties. Despite of Mr. Kang’s fiduciary duty to us as the CEO and a director, in the event of any conflicts of interests between us and Jiangsu Ever-Glory, he may not act in our best interests and such conflicts of interests may not be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations.

For a further discussion of these related party transactions, see Notes 13 Related party transactions in the footnotes to the consolidated financial statements and Item 13. Certain Relationships and Related Transactions, and Director Independence

In case Jiangsu Ever-Glory fails to repay the fund we provided to it under the Counter Guarantee Agreement according to its terms, we will suffer significant financial losses.

Despite of management’s belief that Jiangsu Ever-Glory is financially capable of repaying all amount we provided under the counter guarantee and Jiangsu Ever-Glory’s oral agreement to repay certain portion of the fund by the end of second quarter of 2013, it is possible that we would not be able to collect all amount from Jiangsu Ever-Glory due to factors beyond our control. There is no restriction on how Jiangsu Ever-Glory can use the fund except that it is not allowed to invest in high risk investments. We were told that Jiangsu Ever-Glory had used the entire amount of the fund we provided under the counter guarantee for its own operations. It is possible that we will not be able to collect the entire amount from Jiangsu Ever-Glory due to reasons beyond its control such as its operational failure or deterioration of the overall economic conditions. In such event, we, as the primary obligor under the lines of credit, would be obligated to repay the entire outstanding borrowing after the banks seek collection from the assets collateralized by Jiangsu Ever-Glory. As a result, we may suffer financial losses which will have material negative effects on our financial condition and results of operations.

Expansion of both our wholesale and retail business depends on our ability to obtain continuous financing at acceptable terms. Failure to do so will result in negative impact on our results of operations.

We have historically relied on debt financing from Chinese banks to satisfy our financing needs. Due to Chinese banks’ stringent underwriting policy to non-state-owned businesses, borrowers generally have to provide land use rights as collaterals or obtain third party guarantees from either high-net-worth individuals or businesses with strong credits with the banks. Although we have certain land use rights to be used as collateral, the value of those properties are not high enough for us to obtain sufficient bank loans to support our projected growth. Therefore, Mr. Kang previously provided personal guarantees and Jiangsu Ever-Glory provided personal guarantees and assets collateral as security interests for the bank loans. In the event Mr. Kang or Jiangsu Ever-Glory refuses to provide sufficient security interests in the future or continue the guarantee and collateral provided in the past, we may not be able to obtain the bank loans on acceptable terms as required by our business plan. As a result, we may have to delay or reduce our retail expansion and limit our wholesale development which may materially harm our business, financial condition and results of operations.

We depend on key personnel, and our ability to grow and compete will be harmed if we do not retain the continued services of such personnel.

We depend on the efforts and expertise of our management team. The loss of services of one or more members of this team, each of whom have substantial experience in the garment industry, could have an adverse effect on our business. If we are unable to hire and retain qualified management or if any member of our management leaves, such departure could have an adverse effect on our operations. In particular, we believe we have benefited substantially from the leadership and strategic guidance of our CEO and Chairman of the Board, Mr. Edward Yihua Kang.

Our ability to anticipate and effectively respond to changing fashion trends depends in part on our ability to attract and retain key personnel in our design, merchandising and marketing areas. In addition, if we experience material growth, we will need to attract and retain additional qualified personnel. The market for qualified and talented design and marketing personnel in the apparel industry is intensely competitive, and we cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods. If we are unable to attract or retain qualified personnel as needed, our growth will be hampered and our operating results could be materially adversely affected.

If we fail to protect our trademark and maintain the value of our LA GO GO brand, our retail sales are likely to decline.

We intend to vigorously protect our registered trademark against infringement, but we may be unable to do so. The unauthorized reproduction or other misappropriation of our trademark would diminish the value of our brand, which could reduce demand for our products or the prices at which we can sell our products. Our ability to grow our retail operation significantly depends on the value and image of the LA GO GO brand. Our brand could be adversely affected if we fail to maintain and promote the LA GO GO brand by marketing efforts.

Failure to maintain and/or upgrade our information technology systems may have an adverse effect on our operation.

We rely on various information technology systems to manage our operations, and we regularly evaluate these systems against our current and expected requirements. Although we have no current plans to implement modifications or upgrades to our systems, we will eventually be required to make changes to legacy systems and acquire new systems with new functionality. We are considering additional investments in updating our ERP system to help us improve our internal control system and to meet compliance requirements under Section 404. We are also continuing to develop and update our internal information systems on a timely basis to meet our business expansion needs. Any information technology system disruptions, if not anticipated and appropriately mitigated, could have an adverse effect on our business and operations.

We may engage in future acquisitions and strategic investments that dilute the ownership percentage of our shareholders and require the use of cash, incur debt or assume contingent liabilities.

As part of our business strategy, we expect to continue to review opportunities to buy or invest in other businesses or technologies that we believe would enhance our manufacturing capabilities, or that may otherwise offer growth opportunities. If we buy or invest in other businesses in the future, this may require the use of cash, or we may incur debt or assume contingent liabilities.

As part of our business strategy, we expect to continue to review opportunities to buy or invest in other businesses or technologies that we believe would complement our current products, expand the breadth of our markets or enhance our technical capabilities, or that may otherwise offer growth opportunities. If we buy or invest in other businesses, products or technologies in the future, we could:

| |

●

|

incur significant unplanned expenses and personnel costs;

|

| |

|

|

| |

●

|

issue stock that would dilute our current shareholders’ percentage ownership;

|

| |

●

|

use cash, which may result in a reduction of our liquidity;

|

| |

|

|

| |

●

|

incur debt; assume liabilities; and

|

| |

●

|

spend resources on unconsummated transactions.

|

We may not realize the anticipated benefits of past or future acquisitions and strategic investments, and integration of acquisitions may disrupt our business and management.

We may in the future acquire or make strategic investments in additional companies. We may not realize the anticipated benefits of these or any other acquisitions or strategic investments, which involve numerous risks, including:

| |

●

|

our inability to integrate the purchased operations, technologies, personnel or products into our existing operations and/or over geographically disparate locations;

|

| |

●

|

unanticipated costs, litigation and other contingent liabilities;

|

| |

●

|

diversion of management’s attention from our core business;

|

| |

●

|

adverse effects on existing business relationships with suppliers and customers;

|

| |

●

|

incurrence of acquisition-related costs or amortization costs for acquired intangible assets that could impact our operating results;

|

|

|

●

|

inability to retain key customers, distributors, vendors and other business partners of the acquired business; and

|

| |

●

|

potential loss of our key employees or the key employees of an acquired organization;

|

If we are not be able to integrate businesses, products, technologies or personnel that we acquire, or to realize expected benefits of our acquisitions or strategic investments, our business and financial results may be adversely affected.

International political instability and concerns about other international crises may increase our cost of doing business and disrupt our business.

International political instability may halt or hinder our ability to do business and may increase our costs. Various events, including the occurrence or threat of terrorist attacks, increased national security measures in the EU, the United States and other countries, and military action and armed conflicts, can suddenly increase international tensions. Increases in energy prices will also impact our costs and could harm our operating results. In addition, concerns about other international crises, such as the spread of severe acute respiratory syndrome (“SARS”), avian influenza, or bird flu, and West Nile viruses, may have an adverse effect on the world economy and could adversely affect our business operations or the operations of our OEM partners, contract manufacturer and suppliers. This political instability and concerns about other international crises may, for example:

| |

●

|

negatively affect the reliability and cost of transportation;

|

|

|

●

|

negatively affect the desire and ability of our employees and customers to travel;

|

|

|

●

|

adversely affect our ability to obtain adequate insurance at reasonable rates;

|

|

|

●

|

require us to take extra security precautions for our operations; and

|

|

|

●

|

furthermore, to the extent that air or sea transportation is delayed or disrupted, our operations may be disrupted, particularly if shipments of our products are delayed.

|

Business interruptions could adversely affect our business.

Our operations and the operations of our suppliers and customers are vulnerable to interruption by fire, earthquake, hurricanes, power loss, telecommunications failure and other events beyond our control. In the event of a major natural disaster, we could experience business interruptions, destruction of facilities and loss of life. In the event that a material business interruption occurs that affects us or our suppliers or customers, shipments could be delayed and our business and financial results could be harmed.

Risks Related to Doing Business in China

Because our assets are located overseas, shareholders may not receive distributions that they would otherwise be entitled to if we were declared bankrupt or insolvent.

Our assets are, for the most part, located in the PRC. Because our assets are located overseas, our assets may be outside of the jurisdiction of U.S. courts if we are the subject of an insolvency or bankruptcy proceeding. As a result, if we declared bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were to be located within the U.S., under U.S. bankruptcy law.

Export quotas imposed by WTO and countries where our customers are located may negatively affect our business and operations, particularly if the Chinese government changes its allocation of such quotas to us.

Pursuant to a World Trade Organization (“WTO”) agreement, effective January 1, 2005, the United States and other WTO member countries agreed to remove quotas applicable to textiles. However, as the removal of quotas resulted in an import surge from China, the U.S. took action in May 2005, and imposed safeguard quotas on seven categories of goods, including certain classes of apparel products, arousing strong objection from China. In 2008, US and EU both lifted these safeguard quotas on products from China. However, there is no assurance that any quota or additional trade restrictions will not be imposed on the exportation of our products in the future. Such actions could result in increases in the cost of our products generally and may adversely affect our results of operations.

Adverse changes in economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

All of our business operations are currently conducted in the PRC, under the jurisdiction of the PRC government. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors of China. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Since early 2004, the PRC government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

Unprecedented rapid economic growth in China may increase our costs of doing business, and may negatively impact our profit margins and/or profitability.

Our business depends in part upon the availability of relatively low-cost labor and materials. Rising wages in China may increase our overall costs of production. In addition, rising raw material costs, due to strong demand and greater scarcity, may increase our overall costs of production. If we are not able to pass these costs on to our customers in the form of higher prices, our profit margins and/or profitability could decline.

Our labor costs are likely to increase as a result of changes in Chinese labor laws.

We expect to experience an increase in our cost of labor due to recent changes in Chinese labor laws which are likely to increase costs further and impose restrictions on our relationship with our employees. In June 2007, the National People’s Congress of the PRC enacted new labor law legislation called the Labor Contract Law and more strictly enforced existing labor laws. The new law, which became effective on January 1, 2008, amended and formalized workers’ rights concerning overtime hours, pensions, layoffs, employment contracts and the role of labor unions. In addition, under the new law, employees who either have worked for a company for 10 years or more or who have had two consecutive fixed-term contracts must be given an “open-ended employment contract” that, in effect, constitutes a lifetime, permanent contract, which is terminable only in the event the employee materially breaches the company’s rules and regulations or is in serious dereliction of his duty. Should we become subject to such non-cancelable employment contracts, our employment related risks could increase significantly and we may be limited in our ability to downsize our workforce in the event of an economic downturn. No assurance can be given that we will not in the future be subject to labor strikes or that it will not have to make other payments to resolve future labor issues caused by the new laws. Furthermore, there can be no assurance that the labor laws will not change further or that their interpretation and implementation will vary, which may have a negative effect upon our business and results of operations.

Fluctuation in the value of Chinese RMB relative to other currencies may have a material adverse effect on our business and/or an investment in our shares.

The value of RMB against the U.S. Dollar, the Euro and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. In the last decade, the RMB has been pegged at RMB 8.2765 to one U.S. Dollar. Following the removal of the peg to the U.S. Dollar and pressure from the United States, the People’s Bank of China also announced that the RMB would be pegged to a basket of foreign currencies, rather than being strictly tied to the U.S. Dollar, and would be allowed to float trade within a narrow 0.3% daily band against this basket of currencies. The PRC government has stated that the basket is dominated by the U.S. Dollar, the Euro, Japanese Yen and South Korean Won, with a smaller proportion made up of the British Pound, Thai Baht, Russian Ruble, Australian Dollar, Canadian Dollar and Singapore Dollar. There can be no assurance that the relationship between the RMB and these currencies will remain stable over time, especially in light of the significant political pressure on the Chinese government to permit the free flotation of the RMB, which could result in greater and more frequent fluctuations in the exchange rate between the RMB, the U.S. Dollar, and the Euro. If the RMB were to increase in value against the U.S. Dollar and other currencies, for example, consumers in the U.S., Japan and Europe would experience an increase in the relative prices of goods and services produced by us, which might translate into a decrease in sales. In addition, if the RMB were to decline in value against these other currencies, the financial value of your investment in our shares would also decline.

The State Administration of Foreign Exchange (“SAFE”) restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively and to pay dividends.

All of our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account”, which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account”, which includes the registered capital and foreign currency loans of a PRC entity. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiaries desire to borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance our PRC operating subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or their respective local counterparts. These limitations could affect our PRC operating subsidiaries’ ability to obtain foreign exchange through debt or equity financing.

The PRC government also may at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining foreign currency, we may be unable to pay dividends or meet obligations that may be incurred in the future that require payment in foreign currency.

You may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited, because our subsidiaries are incorporated in non-U.S. jurisdictions, we conduct substantially all of our operations in China, and a majority of our officers reside outside the United States.

Although we are incorporated in Florida, we conduct substantially all of our operations in China through our wholly owned subsidiaries in China. The majority of our officers reside outside the United States and some or all of the assets of those persons are located outside of the United States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in China in the event that you believe that your rights have been infringed under the securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the PRC may render you unable to enforce a judgment against our assets or the assets of our directors and officers.

As a result of all of the above, our public shareholders may have more difficulty in protecting their interests through actions against our management, directors or major shareholders than would shareholders of a corporation doing business entirely within the United States.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we can not assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

If we make equity compensation grants to persons who are PRC citizens, they may be required to register with SAFE. We may also face regulatory uncertainties that could restrict our ability to adopt equity compensation plans for our directors and employees and other parties under PRC laws .

On March 28, 2007, SAFE issued the “Operating Procedures for Administration of Domestic Individuals Participating in the Employee Stock Ownership Plan or Stock Option Plan of An Overseas Listed Company, also know as “Circular 78.” It is not clear whether Circular 78 covers all forms of equity compensation plans or only those which provide for the granting of stock options. For any plans which are so covered and are adopted by a non-PRC listed company, such as our company, after March 28, Circular 78 requires all participants who are PRC citizens to register with and obtain approvals from SAFE prior to their participation in the plan. In addition, Circular 78 also requires PRC citizens to register with SAFE and make the necessary applications and filings if they participated in an overseas listed company’s covered equity compensation plan prior to March 28. We believe that the registration and approval requirements contemplated in Circular 78 will be burdensome and time consuming.

In the future, we may adopt an equity incentive plan and make numerous stock option grants under the plan to our officers, directors and employees, some of whom are PRC citizens and may be required to register with SAFE. If it is determined that any of our equity compensation plans are subject to Circular 78, failure to comply with such provisions may subject us and participants in our equity incentive plan who are PRC citizens to fines and legal sanctions and prevent us from being able to grant equity compensation to our PRC employees. In that case, our ability to compensate our employees and directors through equity compensation would be hindered and our business operations may be adversely affected.