|

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

||

|

|

For the fiscal year ended

|

|

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

||

|

|

Date of event requiring this shell company report __________________

|

|

|

|

For the transition period from_________________to___________________.

|

Tel: +

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

|

|

|

|

Title of Class

|

Number of Shares Outstanding

|

|

|

Ordinary shares

|

|

|

|

Accelerated Filer ☐

|

Non-accelerated Filer ☐

|

|

Emerging Growth Company

|

|

|

|

PART I |

Page | ||

|

1 | |||

|

1 | |||

|

1 | |||

|

39 | |||

| 178 | |||

| 179 | |||

| 209 | |||

|

240 | |||

|

249 | |||

|

253 | |||

| 254 | |||

| 263 | |||

| 271 | |||

|

PART II |

|||

| 271 | |||

| 271 | |||

| 271 | |||

| 272 | |||

| 273 | |||

| 273 | |||

|

274 | |||

|

274 | |||

|

274 | |||

|

274 | |||

|

276 | |||

| 276 | |||

| 276 | |||

|

276 | |||

|

278 | |||

|

278 | |||

|

278 | |||

|

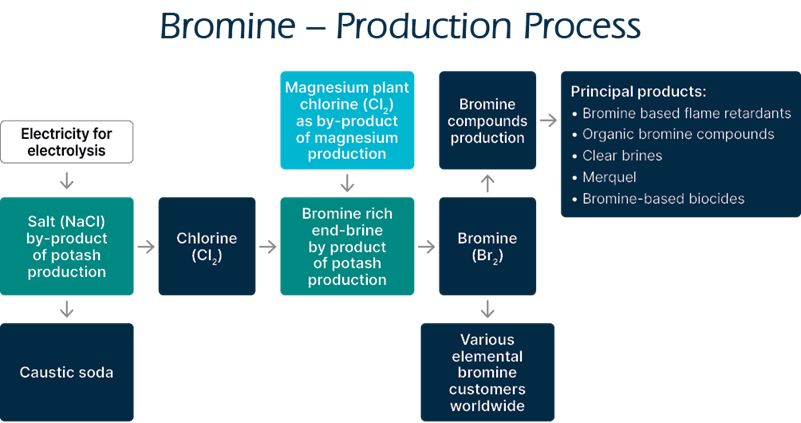

Bromine |

A chemical element used as a basis for a wide variety of

uses and compounds, and mainly as a component in flame retardants or fire prevention substances. Unless otherwise stated, the term “bromine”

refers to elemental bromine. |

|

CDP |

Carbon Disclosure Project – A leading non-profit organization

in the greenhouse gas emissions reporting field. |

|

CFR |

Cost and Freight. In a CFR transaction, the prices of goods

to customer include, in addition to FOB expenses, marine shipping costs and all other costs that arise after the goods leave the seller’s

factory gates and up to the destination port. |

|

CLP |

Classification, Labeling and Packaging of Substances and

Mixtures– EU regulation. |

|

CPI |

The Consumer Price Index, as published by Israeli's Central

Bureau of Statistics. |

|

CRU |

Intelligence Company that provides information on global

mining, metal and fertilizers market. |

|

ICL ADS |

ICL América do Sul (formerly Compass Minerals América

do Sul S.A.). |

|

Dead Sea Bromine |

Dead Sea Bromine Ltd., a subsidiary in the Industrial Products

segment. |

|

MAP |

Monoammonium Phosphate, a fertilizer containing nitrate and

phosphorus oxide. |

|

GTSP |

Granular Triple Superphosphate, used as fertilizer, a source

of high phosphorus. |

|

GSSP |

Granular Single Superphosphate, used as a phosphate fertilizer.

|

|

Green Hydrogen |

Hydrogen produced by splitting water into hydrogen and oxygen

using renewable electricity. |

|

DAP |

Diammonium Phosphate - a fertilizer containing nitrate and

phosphorus oxide. |

|

EPA |

US Environmental Protection Agency. |

|

EU |

European Union. |

|

FAO |

The Food and Agriculture Organization of the United Nations.

|

|

FOB |

Free on-Board expenses are expenses for overland transportation,

loading costs and other costs, up to and including the port of origin. In FOB transaction, the seller pays the FOB expenses, and the buyer

pays the other costs from the port of origin onwards. |

|

CPT |

Cost Per Tonne. |

|

CIF

|

Cost, Insurance, and Freight. In CIF transaction, the price

of goods includes, as well as FOB expenses, the expenses for insurance, shipping and any other costs that arise after the goods leave

the factory gates and up to the destination port. |

|

ICL Haifa (Fertilizers & Chemicals) |

Fertilizers and Chemicals Ltd., a subsidiary in the Growing

Solutions segment. |

|

GHG |

Greenhouse Gases – air emissions contributing to climate

change. |

|

Granular |

Fertilizer having granular particles. |

|

ICL Boulby |

A UK subsidiary in the Potash segment. |

|

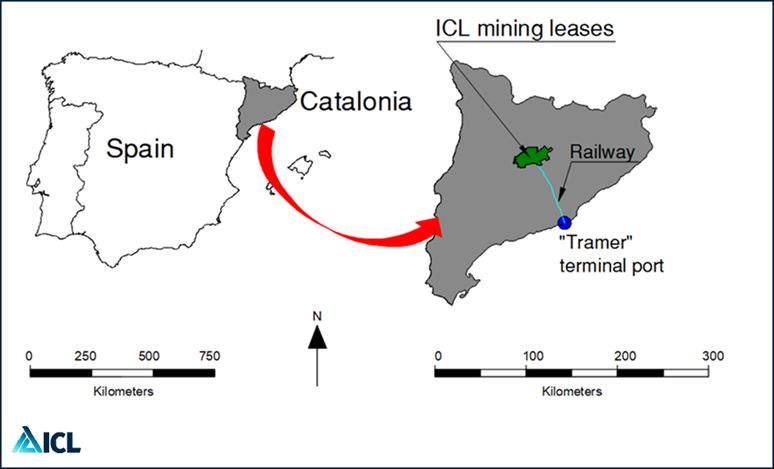

ICL Iberia (Iberpotash) |

Iberpotash S.A., a Spanish subsidiary in the Potash

segment. |

|

IC |

Israel Corporation Ltd. |

|

Indicated Mineral Resource |

That part of a mineral resource for which quantity and grade

or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with

an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine

planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence

than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral

reserve. |

|

Inferred Mineral Resource |

That part of a mineral resource for which quantity and grade

or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with

an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic

extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological

confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic

viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project and may not be

converted to a mineral reserve. |

|

DSW |

Dead Sea Works Ltd., a subsidiary in the Potash segment.

|

|

DSM |

Dead Sea Magnesium Ltd., a subsidiary in the Potash

segment. |

|

ICL Neot Hovav |

Subsidiaries in the Neot Hovav area in the south of Israel,

including facilities of Bromine Compounds Ltd included in the Industrial Products segment. |

|

Rotem Israel |

Rotem Amfert Negev Ltd., a subsidiary in the Phosphate

Solutions segment. |

|

IFA |

The International Fertilizers Industry Association, an international

association of fertilizers manufacturers. |

|

ILA |

Israel Land Authority. |

|

IMF |

International Monetary Fund. |

|

K |

The element potassium, one of the three main plant nutrients.

|

|

KNO3

|

Potassium Nitrate, a soluble fertilizer containing N&P

used as a stand-alone product or as a key component of some water-soluble blends. |

|

KOH |

Potassium hydroxide 50% liquid. |

|

MGA |

Merchant grade phosphoric acid. |

|

Measured Mineral Resource |

That part of a mineral resource for which quantity and grade

or quality are estimated and based on conclusive geological evidence and sampling. The level of geological certainty associated with a

measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient

detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource

has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource,

a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. |

|

Mineral Reserve |

An estimate of tonnage and grade or quality of indicated

and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More

specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and

allowances for losses that may occur when the material is mined or extracted. |

|

Mineral Resource |

A concentration or occurrence of material of economic interest

in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A

mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining

dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or

in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

|

MoEP |

Israel Ministry of Environmental Protection. |

|

N |

The element nitrogen, one of the three main plant nutrients.

|

|

P |

The element phosphorus, one of the three main plant nutrients,

which is also used as a raw material in industry. |

|

PK |

Complex fertilizer comprised primarily of two primary nutrients

(P.K). |

|

NPK |

Complex fertilizer comprised primarily of three primary nutrients

(N.P.K). |

|

NYSE |

The New York Stock Exchange. |

|

Phosphate |

Phosphate rock that contains the element phosphorus. Its

concentration is measured in units of P2O5.

|

|

Polyhalite |

A mineral marketed by ICL under the brand name Polysulphate™,

composed of potash, sulphur, calcium, and magnesium. Used in its natural form as a fully soluble and natural fertilizer, which is also

used for organic agriculture and as a raw material for production of fertilizers. |

|

Probable Mineral Reserve |

The economically mineable part of an Indicated and, in some

cases, a Measured Mineral Resource. Quantity, grade and/or quality of Probable Mineral Reserves are computed from information similar

to that used for Proven Mineral Reserves, but the sites for survey, sampling and measurement are further apart or are otherwise less efficiently

spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

|

|

Proven Mineral Reserve |

The economically mineable part of a Measured Mineral Resource.

Proven Mineral Reserve quantities are computed from information received from explorations, channels, wells, and drilling; grade and/or

quality are computed from the results of detailed sampling. The sites for inspection, sampling and measurement for proven reserves are

spaced so closely to each other so that the geologic character is well defined so the size, shape, depth and mineral content of reserves

can be reliably determined. |

|

Chlorine |

A chemical, raw material in various productions process.

A byproduct of Dead Sea Magnesium production. |

|

Sylvinite |

A byproduct from the production of Magnesium from the raw

material – Carnallite. Transferred to DSW as an additional source for potash production. |

|

Polymer |

A chemical compound containing a long chain of repeating

units linked by a chemical bond and created by polymerization. |

|

Potash |

Potassium chloride (KCl), used as a plant’s main source

of potassium. |

|

P2O5

|

Phosphorus pentoxide. |

|

TCFD |

Task Force on Climate-Related Financial Disclosures.

|

|

REACH |

Registration, Evaluation, Authorization and Restriction of

Chemicals, a framework within the EU. |

|

Reserves |

The part of a mineral deposit that could be economically

and legally extracted or produced at the time of the Mineral Reserve determination. Reserves are divided between “proven reserves”

and “probable reserves”. |

|

Salt |

Unless otherwise specified, sodium chloride (NaCl).

|

|

S |

Sulphur – a chemical used for the production of sulfuric

acid for sulfate and phosphate fertilizers, and other chemical processes. |

|

Soluble NPK |

Soluble fertilizer containing the three basic elements for

plant development (nitrogen, phosphorus and potash). |

|

Standard |

Fertilizer has small particles. |

|

Tami |

Tami (IMI) Research and Development Institute Ltd.,

the central research institute of ICL. |

|

TASE |

Tel Aviv Stock Exchange, Ltd. |

|

USDA |

United States Department of Agriculture. |

|

WPA |

White Phosphoric Acid, purified from MGA. |

|

UK |

The United Kingdom. |

|

Urea |

A white granular or pill solid fertilizer containing 46%

nitrogen. |

|

YTH/YPC |

The Chinese partner in the Company’s joint venture

YPH in China. |

|

4D |

Clean green phosphoric acid, used as a raw material for purification

processes. |

|

PM |

Particular matter. |

|

For the Years Ended December 31,

| |||

|

2023 |

2022 |

2021 | |

|

US$ millions | |||

|

Sales |

7,536

|

10,015 |

6,955 |

|

Gross profit |

2,671

|

5,032 |

2,611 |

|

Operating income |

1,141

|

3,516 |

1,210 |

|

Income before taxes on income |

974

|

3,404 |

1,092 |

|

Net income attributable to the shareholders of the Company

|

647

|

2,159 |

783 |

|

Earnings per share (in dollars): |

|||

|

Basic earnings per share |

0.50

|

1.68 |

0.61 |

|

Diluted earnings per share |

0.50

|

1.67 |

0.60 |

|

Weighted average number of ordinary shares outstanding:

|

|||

|

Basic (in thousands) |

1,289,361

|

1,287,304 |

1,282,807 |

|

Diluted (in thousands) |

1,290,668

|

1,289,947 |

1,287,051 |

|

Dividends declared per share (in dollars) |

0.27

|

0.91 |

0.21 |

|

For the Years Ended December 31,

| |||

|

2023 |

2022 |

2021 | |

|

US$ millions | |||

|

Statements of Financial Position Data: |

|||

|

Total assets |

11,627

|

11,750 |

11,080 |

|

Total liabilities |

5,590

|

6,037 |

6,344 |

|

Total equity |

6,037

|

5,713 |

4,736 |

|

For the Year Ended December 31,

| |||

|

2023 |

2022 |

2021 | |

|

US$ millions | |||

|

Operating income |

1,141 |

3,516 |

1,210 |

|

Provision for early retirement (1)

|

16 |

- |

- |

|

Write-off of assets and provision for site closure (2)

|

49 |

- |

1 |

|

Legal proceedings, dispute and other settlement expenses

(3) |

(2) |

22 |

5 |

|

Charges related to the security situation in Israel (4)

|

14 |

- |

- |

|

Divestment related items and transaction costs (5)

|

- |

(29) |

(22) |

|

Total adjustments to operating income |

77 |

(7) |

(16) |

|

Adjusted operating income |

1,218 |

3,509 |

1,194 |

|

Net income attributable to the shareholders of the

Company |

647 |

2,159 |

783 |

|

Total adjustments to operating income |

77 |

(7) |

(16) |

|

Total tax adjustments (6)

|

(9) |

198 |

57 |

|

Total adjusted net income - shareholders of the Company

|

715 |

2,350 |

824 |

| (1) |

For 2023, reflects provisions for early retirement, due to restructuring

at certain sites, as part of the Company’s global efficiency plan. |

| (2) |

For 2023, reflects mainly a write-off of assets related to restructuring

at certain sites, including site closures and facility modifications, as part of the Company’s global efficiency plan. For 2021,

reflects the write-off of a pilot investment in Spain that did not materialize and an increase in restoration costs, offset by a reversal

of impairment due to the strengthening of phosphate prices. |

| (3) |

For 2023, reflects a reversal of a legal provision. For 2022,

reflects mainly the costs of a mediation settlement regarding the claims related to the Ashalim Stream incident. For 2021, reflects mainly

settlement costs related to the termination of a partnership between ICL Iberia and Nobian, as well as reimbursement of arbitration costs

related to a potash project in Ethiopia. |

| (4) |

For 2023, reflects charges relating to the security situation

in Israel deriving from the war which commenced on October 7, 2023. |

| (5) |

For 2022, reflects a capital gain related to the sale of an asset

in Israel and the Company’s divestment of a 50%-owned joint venture, Novetide. For 2021, reflects mainly a capital gain related

to the sale of an asset in Israel and the divestment of the Industrial Products segment's Zhapu site in China. |

| (6) |

For 2023, reflects the tax impact of adjustments made to operating

income. For 2022, reflects tax expenses in respect of prior years following a settlement with Israel’s Tax Authority regarding Israel's

surplus profit levy, which outlines understandings for the calculation of the levy, including the measurement of fixed assets, as well

as the tax impact of adjustments made to operating income. |

| • |

Our ability to operate and/or expand our production and operating

facilities worldwide is dependent on our receipt of, and compliance

with, permits issued by governmental authorities. A decision by a government authority to deny any of our permit applications may impair

the Company’s business and its operations. |

| • |

Our mineral extraction operations are dependent on concessions,

licenses and permits granted to us by the respective governments in the countries in which we operate. |

| • |

Securing the future of phosphate mining operations at Rotem Israel

depends on obtaining several approvals and permits from the authorities in Israel. |

| • |

Compliance with and changes in environmental laws and regulations

could require us to make substantial capital expenditures and incur costs and liabilities and adversely affect our performance.

|

| • |

We are exposed to risks related to climate change and natural

disasters, impacts of climate-related transition risks, including current and future laws and regulations, as well as other factors resulting

from climate change, which could adversely impact our business, financial condition, results of operations or liquidity. |

| • |

Our operations and sales are exposed to high volatility in supply

and demand, pricing fluctuations in commodity markets, expansion of production capacity and competition from some of the world’s

largest chemical and mining companies, as well as mergers of key producer/customer/supplier. |

| • |

Our operations could be adversely affected by price increases

or shortages with respect to water, energy and our principal raw materials. |

| • |

The accumulation of salt at the bottom of Pond 5, the central

evaporation pond in our solar evaporation ponds system used to extract minerals from the Dead Sea in Israel, requires regular harvesting

salt to maintain a fixed brine volume and thereby sustain the production capacity of extracted minerals and prevent potential damage to

the foundations and structures of hotels and other buildings situated close to the edge of the pond. |

| • |

We are exposed to risks associated with our international activity,

which could adversely affect our sales to customers as well as our operations and assets in various countries. Some of these factors may

also make it less attractive to distribute cash generated by our operations outside Israel to our shareholders, use cash generated by

our operations in one country to fund our operations or repayments of our indebtedness in another country and support other corporate

purposes or the distribution of dividends. |

| • |

Changes in our evaluations and estimates, which serve as a basis

for analyzing our contingent liabilities and for the recognition and measurement of assets and liabilities, including provisions for waste

removal and the reclamation of mines, may materially and adversely affect our business, financial condition and results of operations.

|

| • |

Due to the nature of our operations, we may be exposed to the

risk of adverse ecological events, which may result in impacts that exceed the boundaries of our facilities, cause environmental damage

or damage to human health/life and lead to the shutdown of our sites or administrative, civil and/or criminal proceedings. |

| • |

Accidents occurring during our industrial and mining operations,

including failure to ensure the safety of our workers and processes, could adversely affect our business. |

| • |

Geopolitical changes such as war or political sanctions may materially

and adversely affect our business, financial condition and results of operations. |

| • |

Geological and mining conditions and/or effects of prior mining

that may not be fully identified/assessed within the available data or that may differ from those based on our experience; |

| • |

Assumptions concerning future prices of products, operating costs,

updates to the statistical model and geological parameters according to past experience and developing practices in this field, mining

technology improvements, development costs and reclamation costs; and |

| • |

Assumptions concerning future effects of regulation, including

the issuance of required permits and taxes imposed by governmental agencies. |

| • |

Difficulties and costs associated with complying with a wide variety

of complex laws, treaties and regulations, including the US. Foreign Corrupt Practices Act (the “FCPA”), the UK. Bribery Act

of 2010 and Section 291A of the Israeli Penal Law; |

| • |

Unexpected changes in regulatory environments and increased government

ownership and regulation in the countries in which we operate; |

| • |

Political and economic instability, including civil unrest, inflation

and adverse economic conditions resulting from governmental attempts to reduce inflation, such as imposition of higher interest rates

and wage and price controls; |

| • |

Public health crises, such as pandemics and epidemics; and

|

| • |

The imposition of tariffs, exchange controls, trade barriers or

sanctions, new taxes or tax rates or other restrictions, including the current trade dispute between the US and China. |

| • |

The duration, severity and extent of a war, along with the necessary

measures undertaken by government authorities or other organizations to manage and mitigate its effects. |

| • |

The possibility of temporary closures of our facilities or the

facilities of our suppliers, customers, their contract manufacturers, and the possibility of certain industries shutting down. |

| • |

The ability to purchase raw materials in times of shortages resulting

from supply chain disruptions and production shutdowns. |

| • |

The ability of our suppliers, contractors and third-party providers

to meet their obligations to us at previously anticipated costs and timelines without significant disruption. |

| • |

Our ability to continue to meet the manufacturing and supply arrangements

with our customers at previously anticipated costs and timelines without significant disruption. |

| • |

The duration and severity of the sustained global or local recession,

and the uncertainty as to when economy will fully recover. |

| • |

Significant disruption of global financial markets and credit

markets, which may reduce our ability to access capital or our customers’ ability to pay us for past or future purchases, which

could negatively affect our liquidity. |

| • |

Some government incentive programs may be discontinued, expire

cancelled or changed; |

| • |

Governments may initiate new legislation or amend existing legislation

in order to impose additional and/or increased fiscal liabilities on our business, such as additional royalties, natural resource taxes

or required investments, as has occurred in Israel, for example, with respect to the Law for Taxation of Profits from Natural Resources;

|

| • |

The applicable tax rates may increase; |

| • |

We may no longer be able to meet the requirements for continuing

to qualify for some incentive programs; |

| • |

Changes in trade agreements between countries, such as in the

trade agreements between the United States and China. |

| • |

Changes in international taxation laws, as may be adopted by several

countries we operate in, or sell to, may result in additional taxes or high tax rates being imposed on our operations. |

Additionally, our operations are subject to Israeli law, specifically the Israeli Protection of Privacy Law and the Israeli Protection of Privacy Regulations (Data Security). These legal frameworks establish principles and obligations related to the processing of personal data within the jurisdiction of Israel, emphasizing lawful processing, data subject rights, and the implementation of robust data security measures.

| • |

The composition of our Board of Directors (other than external

directors, as described under “Item 6 - Directors, Senior Management and Employees— C. Board Practices”; |

| • |

Mergers, acquisitions, divestitures or other business combinations;

|

| • |

Future issuances of ordinary shares or other securities;

|

| • |

Amendments to our Articles of Association, excluding provisions

of the Articles of Association that were determined by virtue of the Special State Share;

and |

| • |

Dividend distribution policy. |

| • |

Expiration or termination of licenses and/or concessions;

|

| • |

General stock market conditions; |

| • |

Decisions by governmental entities that affect us; |

| • |

Variations in our and our competitors’ results of operations;

|

| • |

Changes in earnings estimates or recommendations by securities

analysts; and |

| • |

General market conditions and other factors, including factors

unrelated to our operating performance. |

| • |

In February 2024, the Company completed the acquisition of Nitro

1000, a manufacturer, developer and provider of biological crop inputs in Brazil, for a consideration of $30 million. |

| • |

In January 2022, the Company completed the sale of its 50% share

in its joint venture, Novetide Ltd. |

| • |

In January 2021 and in July 2021, the Company completed the acquisitions

of Agro Fertiláqua Participações S.A., one of Brazil's leading specialty plant nutrition companies, and the South American

Plant Nutrition business of Compass Minerals América do Sul S.A. (hereinafter - ADS), respectively. |

| • |

Access to one of the world’s richest, longest‑life

and lowest‑cost sources of potash and bromine (the Dead Sea). |

| • |

A potash mine and processing facilities in Spain. |

| • |

Bromine compounds processing facilities in Israel, the Netherlands

and China. |

| • |

A unique integrated phosphate value chain that extends from phosphate

rock mines in Israel and in China to value‑added downstream products produced in facilities located in Israel, Europe, the US, Brazil

and China. Our specialty phosphates serve the food industry by providing texture and stability solutions to the meat, meat alternatives,

poultry, sea food, dairy and bakery markets, as well as numerous other industrial markets, such as metal treatment, water treatment, oral

care, carbonated drinks, asphalt modification, paints and coatings and more. |

| • |

Polysulphate® resources in the UK. |

| • |

Customized, highly effective specialty fertilizers that provide

improved value to the grower, as well as essential nutrition for plant development, optimization of crop yields and reduced environmental

impact. |

| • |

A focused and highly experienced team of technical experts that

develop production processes, new applications, formulations and products for our agricultural and industrial markets. |

| • |

A strong crop nutrition sales and marketing infrastructure that

optimizes distribution channels of commodity, specialty and semi-specialty fertilizers by leveraging its commercial excellence, global

operational efficiency, region-specific knowledge, agronomic and R&D capabilities, logistical assets and customer relationships.

|

| • |

Research & Development and Innovation: We benefit from

our proximity to Israel’s global-leading high-tech and agri-tech eco-system, as well as our vast agronomy and chemistry knowledge

that we have accumulated over decades. Our extensive global R&D infrastructure includes 23 R&D and Innovation centers around the

world that employ 300 highly experienced personnel who have obtained our 700 active patents in 210 patent families. ICL's R&D unit

supports the development of new, innovative products, applications and formulations for each of our operating segments through internal

research, employee ideation and collaborative research with third parties. |

| • |

An extensive global logistics and distribution network with operations

in over 30 countries. |

| • |

Unique portfolio of mineral assets.

Access to these assets provides us with a consistent, reliable supply of raw materials, allows for large scale-production, and

supports our integrated value chain of specialty products. |

| • |

Diversification into higher value‑added

specialty products leverages our integrated business model. The Company’s integrated production processes are based on a

synergistic value chain that allows us to both efficiently convert raw materials into value‑added downstream products and to utilize

the by‑products. For example, in phosphates, we utilize backward integration to produce specialty phosphates for the food industry

and for industrial applications. These businesses benefit from higher growth rates, higher margins and lower volatility compared to commodity

phosphates. In addition, as a by‑product of the potash production at the Dead Sea, we generate brines with the highest bromine concentration

globally. Our bromine‑based products serve various industries such as the electronics, construction, oil and gas, and automotive

industries. |

| • |

Leading positions in markets with

high barriers to entry. ICL has leadership positions in many of the key markets in which it operates. It is the clear leader in

the bromine market, with approximately one third of global production, as well as most of the excess capacity in the market. In the potash

market, our Dead Sea operations have a leading competitive position and, according to CRU, the Dead Sea is among the most competitive

potash suppliers to China, India and Brazil. ICL also has the largest market share in specialty phosphates, in the combined markets of

North America, Europe and Latin America, and it is the sole producer of Polysulphate®. ICL has leadership positions in additional

product lines, such as phosphorous-based flame retardants, PK fertilizers in Europe, and soluble phosphate‑based fertilizers.

|

| • |

Strategically located production

and logistics assets. We benefit from the proximity of our facilities, both in Israel and Europe, to developed economies (Western

Europe) and emerging markets (such as China, India and Brazil). In Israel, we ship from two seaports: The Port of Ashdod (with access

to Europe and South America) and the Port of Eilat (with access to Asia, Africa and Oceania). Access to these two ports provides us with

two distinct advantages versus our competitors: (1) lower plant‑to‑port, ocean freight, and transportation costs from

our ports to our target markets, which lowers our overall cost structure; and (2) faster time to market, due to our proximity to

end‑markets, which allows us to opportunistically fill short lead‑time orders and strengthen our position with our customers.

|

| • |

Strong cash generation and closely

monitored capital allocation approach. A continuous focus on cash generation and the optimization of capital expenditures (CAPEX)

and working capital – as well as the implementation of efficiency measures – enabled us to continue to generate a strong operating

cash flow of $1,595 million in 2023. ICL's capital allocation approach balances its long‑term value creation through investments

in its growth, with its commitment to providing a solid dividend yield, while aiming to maintain an investment grade rating of at least

BBB- by S&P and Fitch. In 2020, the Company’s Board of Directors resolved to extend our dividend policy of a payout ratio of

up to 50% of annual adjusted net income, until further notice. In respect to 2023 adjusted net income, the Company declared total dividends

in the amount of $357 million, reflecting a dividend yield rate of approximately 4.68% (based on the average share price for the year).

See “Item 8 - Financial Information— A. Consolidated Statements and Other Financial Information”.

|

| • |

Professional expertise and culture

of collaboration and determination. Our operations are managed by an international management team with extensive industry experience.

ICL develops leaders with strong experience in their fields and focuses on nurturing and empowering talent through a global platform of

qualification, collaboration and communication, in order to drive change and innovation within the Company.

|

|

Sub-business line |

Product |

Primary Applications |

Primary End‑Markets

|

|

Flame retardants |

Bromine, phosphorus and magnesium-Based Flame Retardants

|

Plastic, building materials and textile production

|

Electronics, automotive, building, construction and textiles

|

|

Industrial solutions |

Elemental Bromine |

Chemical reagent |

Tire manufacturing, pharmaceuticals and agro, PTA and flame

retardants |

|

Brominated and Phosphorus compounds |

Raw materials for pharmaceuticals and agro |

Pharmaceuticals and agro | |

|

Industrial service |

Functional fluids, Biocides (Water treatment and disinfection),

Merquel and MBr |

Power plants and other industrial facilities |

|

|

Clear Brines |

Oil and gas drillings |

Oil and gas | |

|

Energy storage |

Brominated electrolytes, Phosphorus based active salt for

electrolytes |

Battery producers | |

|

Specialty minerals |

Magnesia Products |

Pharma and Supplementals, health care, transformer steel, catalysts,

fuel and oil additives. |

Supplementals, multivitamins, transformer steel and health

care |

|

Calcium Carbonate |

Supplementals and pharma |

Supplementals and pharma | |

|

Solid MgCl2, KCl |

Deicing, food, oil drilling, pharma |

De-icing, sodium replacement, KCl for drugs. Multi-vitamins,

oil drilling companies, small industrial niche markets |

| • |

In January 2023, the Company signed a long-term supply agreement

to supply un-dried vacuum salt (UVS). |

| • |

In February 2023, the Company signed an agreement with a local

contractor for the production of rock salt intended for shipment and sale to various markets, primarily focusing on the UK and North European

countries. |

| • |

In March 2023, as part of the divestment agreement of Sal Vesta,

the Company signed a long-term take-or-pay supply agreement with Compañía Salinera Salins Ibérica, S.L. for specialty salt

products. |

| • |

The relatively low average cost of potash production at the Dead

Sea, using the sun as a solar energy source in the evaporation process. |

| • |

Logistical advantages due to our strategic geographical location

and access to nearby ports in Israel and Europe, along with our relative proximity to customers, result in highly competitive marine and

overland shipping costs as well as expedited delivery times. |

| • |

Climate advantages, stemming from the hot and dry conditions of

the Dead Sea, enable us to store substantial quantities of potash in an open area at a minimal cost. This capability allows us to sustain

continuous production in Sodom and at full capacity, regardless of fluctuations in global potash demand. |

| • |

Our mine in Spain is one of the few in western Europe, creating

logistics advantages in supplying European customers. |

| • |

An integrated value chain that uses phosphate rock mined in Israel

(at Rotem Israel), as well as in China (YPH), to produce green phosphoric acid which serves mainly as a raw material to produce the segment's

products and products in our Growing Solutions segment. |

| • |

Logistical advantages due to the segment's geographical location

and diversification, proximity to ports in Israel and Europe and relative proximity to our customers. |

| • |

Our ability as a global fertilizer producer to combine potash

and phosphate fertilizers in the same shipment, which enables us to service smaller customers, particularly in Brazil and the US.

|

| • |

The segment enjoys a competitive advantage in specialty phosphates

deriving from product features, quality, service, technical application support, a global manufacturing footprint and a very broad product

line. |

| • |

YPH provides an integrative phosphate platform in China with beneficial

access to the Chinese market. In addition, the segment enjoys a competitive cost advantage in its phosphate activities, due to access

to low‑cost phosphate rock with long‑term reserves. |

| • |

The segment has a diversity of integrated solutions which were

designed specifically to match the customer's unique needs. |

| • |

Highly qualified R&D capabilities and existing know-how that

facilitate delivering products in areas of global megatrends (e.g. in the energy storage market). |

| • |

Market position: currently, we are the sole producer of Polysulphate®

worldwide. |

| • |

Our ability to increase production at a relatively low capital

expenditure. |

| • |

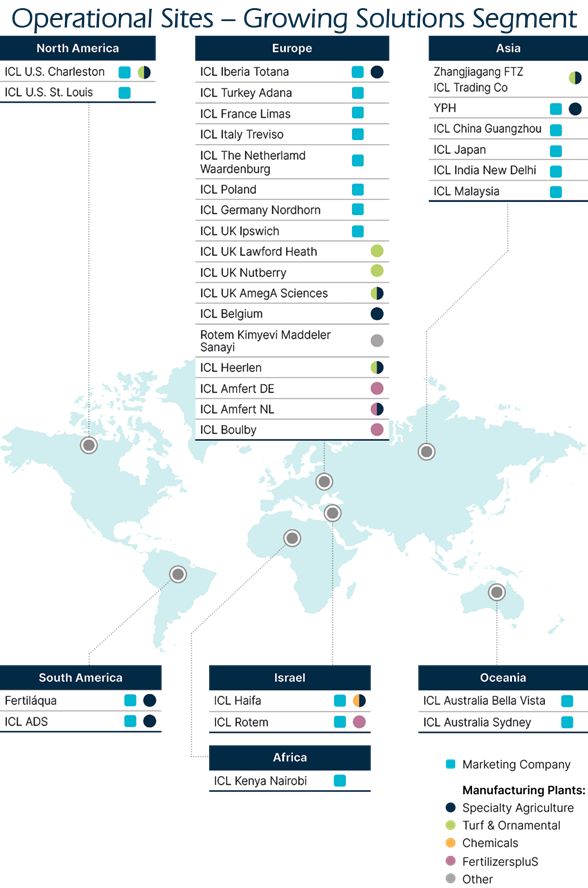

Worldwide production capabilities: ICL Growing Solutions' principal

production facilities include plants in Israel (soluble compound fertilizers, liquid fertilizers, and soluble NPK fertilizers), Spain

(liquid fertilizers, and soluble NPK fertilizers), the UK (Polysulphate, PotashpluS, products for water conservation and peat incorporated

in growing media), China (soluble compound fertilizers and soluble NPK fertilizers), the Netherlands (controlled‑release fertilizers

and fertilizer blends), Belgium (soluble NPK fertilizers), the US (controlled‑release fertilizers) and Brazil (liquid fertilizers,

water-soluble fertilizers, controlled-release fertilizers, improved efficiency phosphorus fertilizers, secondary nutrients fertilizers,

and micronutrients fertilizers). |

| • |

In the beginning of 2024, the Company completed the acquisition

of Nitro 1000, a manufacturer, developer and provider of biological crop inputs in Brazil. This addition of biologicals manufacturing

capacity helps expand the segment’s product offerings, while positioning the Company for further expansions into new and adjacent

end-markets. Nitro 1000’s products mainly target soybean, corn and sugar cane crops, and their application replaces or optimizes

the use of fertilizers. These products help farmers increase profitability, as well as offer more sustainable options. |

| • |

Controlled‑release fertilizers (CRF) allow accurate release

of nutrients over time. CRFs have a special coating that allows prolonged release of nutrients from over several weeks and up to 18 months

compared to regular fertilizers that dissolve in the soil and are immediately available but therefore leach partially into the soil. ICL

Growing Solutions offers leading global and regional brand-name products including Osmocote, Agroblen, Agrocote, Agromaster, Polyblen

and Producote. In 2023, we launched additional CFR products including CRF with specific biostimulants and coated KCl and TSP. |

| • |

Osmocote is the most used controlled‑release fertilizer

by ornamental growers worldwide. The brand is known to deliver high quality ornamental plants due to its consistent release of nutrients

and unique patterned and programmed release technologies. We continue to invest in new technologies as well as field trials to test and

confirm the high reliability of our products. During the past few years, the Company has developed several new technologies for Ag crops,

such as “Dual Coating Technology” (which optimizes the release to ornamental plants) and “E-Max Release Technology”

(a new coating technology with improved release characteristics, mainly for urea). In 2022, ICL launched a biodegradable coated fertilizer

technology - eqo.x, featuring controlled-release urea tailored for open field agriculture. This innovation aims to empower farmers to

optimize crop performance, while minimizing environmental impact through reduced nutrient loss and enhanced nutrient use efficiency (NUE).

In 2023, the segment introduced eqo.x release technology in the professional turf market for turf brands, such as, Sierrablen and ProTurf.

These pioneering release technologies represent the first offering in the market to feature a CRF coating for urea that biodegrades more

rapidly, and they are specifically designed to meet new EU fertilizer standards scheduled to take effect in 2026. |

| • |

Soluble fertilizers, which are fully water‑soluble, are

commonly used for fertilization through drip irrigation systems to optimize fertilizer efficiency in the root zone to maximize yields

and some of them can also be used for foliar applications. Our well-known brands for fertigation include Peters, Universol, Solinure,

Agrolution, Nova, Fertiflow and more. Our leading brands for foliar application are Agroleaf Liquid, Agroleaf Power and Nutrivant. ICL

develops specific formulations for different applications and crops. In South America, products such as Profol, Kellus, Tonus, Translok,

Forcy, Nutritio, Vegetação and Dimi Tônico are used as high technology products for farmers to improve plant nutrition

and physiology through foliar fertilization. There are specific formulations for specific crops, greenhouses and/or open fields, as well

as for different water types. One of the products that was launched in 2023 is the water-soluble fertilizers with nitrification inhibitor,

which is expected to reduce the nitrogen losses in the soil. |

| • |

‘Straight fertilizers’ are crystalline, free‑flowing

and high purity phosphorus and potassium soluble fertilizers such as MKP, MAP and PeKacid. Our key brands include NovaPeak, Nova PeKacid

& NovaMAP. PeKacid is a patented product of ICL. It is the only solid, highly acidifying, water-soluble fertigation product that contains

both phosphorus and potassium. The product is ideal for hard water conditions where an acidifying effect is required, as well as for keeping

dripping lines clean. |

| • |

Liquid fertilizers are used for intensive agriculture and are

integrated in irrigation systems (mainly drip systems). Our product line includes mostly tailor‑made formulations designed for specific

soil & water/climate conditions and crop needs. |

| • |

Peat is a growing medium for various crops in which generally

controlled‑release fertilizers and plant‑protection products are mixed in. Specific formulations of growing media are tailored

to meet the requirements of specific plants, including those cultivated in greenhouse bedding plants and outdoor nurseries. one of our

peats is the "Levington” brand, a well-known ICL brand. The integration of growing media products into our UK portfolio enhances

ICL’s ability to offer a holistic and efficient solution to our customers. We are dedicated to adopting more circular products and

expanding our selection of growing media offerings with Fibagro Advance, an outstanding peat alternative manufactured in the UK. This

innovative and advanced woodfibre product is being used as a key component in professional growing media mixes and provides professional

growers with sustainable growing solutions. |

| • |

Water conservation and soil conditioning products are new product

lines developed by the segment. Water conservation products are used in professional turf to keep water in the root-zone. Our key brands

are H2Flo and H2Pro. These products improve water use efficiency. This new technology is also used in agriculture to allow better water

availability around the root-zone of crops. |

| • |

Bio-stimulants technologies, such as Triplus, Improver, Concorde,

Vegetação and Dimi Tônicoare, are being successfully used by farmers to increase their productivity and alleviate abiotic

stress, such as drought, salinity, and others. |

| • |

Adjuvants are essential to enhance foliar nutrition, herbicides

and crop protection spray. We offer the South American market adjuvant technologies, including Helper, Tensor Max and AD+ as well as various

formulations that address the primary challenges facing farmers, such as drift and run off. |

| • |

Our Polysulphate® and Polysulphate®-based fertilizers,

customized to meet the needs of different crops and soil types, maximize yields and allow more precise and efficient applications.

|

| • |

Polysulphate® contributes to and follows the main market

trends in the field of increased nutrient-use efficiency, low carbon footprint and organic fertilizers.

|

| • |

PotashpluS – a compressed mixture of Polysulphate®

and potash. The product includes potassium, sulphur, calcium and magnesium. |

| • |

PKpluS – a unique combination of phosphate, potash and Polysulphate®.

|

| • |

NPKpluS – a unique combination of Nitrogen, phosphate, potash

and Polysulphate®. This product includes all 6 macro nutrients in one granule. |

| • |

A strong, efficient and integrated supply chain with in-house

access to high quality raw materials, mostly phosphate and potash, which is based on an extensive product portfolio and multi-location

production. |

| • |

Unique R&D and product development capabilities, creating

a strong platform for future growth in controlled-release fertilizers, fertigation, foliar soluble fertilizers, bio-stimulants, water

efficiency and innovative, next generation products. |

| • |

Added value production process technology – custom-made

formulations that meet our customers’ unique needs. |

| • |

A highly skilled global agronomic sales team that provides professional

advice and consultation which fosters distributors' loyalty. |

| • |

Full product portfolio (one-stop shop). |

| • |

ICL’s well-known and leading brands. |

| • |

Direct working relationships with farmers (B2C) especially in

Brazil, Israel and India, providing service at the field level and acceleration of the innovation cycle. |

|

|

|

|

|

| • |

We are constantly exploring new technologies to use secondary

source phosphate as an alternative to virgin raw materials. We are developing future resources for our fertilizer products, including

a technology roadmap for recycling and recovery of phosphorus and nitrogen from secondary sources. |

| • |

PuraLoop® is an innovative phosphorus fertilizer manufactured

by us from reacting 100% SSA (sewage sludge ash). This pioneering fertilizer addresses the critical issue of resource conservation in

agriculture and promotes sustainable farming. |

| • |

Pearl® is a sustainably recycled phosphorus that we produce

that helps to close the phosphorus cycle. It is recovered from high concentrations of phosphorus in diverse water streams, preventing

losses into aquatic environments while preserving finite rock phosphate resources. It is integrated into our premium controlled-release

fertilizer, Sierrablen Plus®. |

| • |

MagiK®, a powerful organic multi-nutrient for crops used

as additive for fertilization product, was developed from a by-product stream of our magnesium production process. |

| • |

Fibagro Advance is a peat alternative growing media that uses

waste from the timber industry and a thermo-mechanical process to create a unique matrix that improves moisture and nutrient retention.

The product has a lower carbon footprint compared to peat and other peat alternatives. |

| • |

ICL is one of the co-founders of the PolyStyrene Loop (PSL) recycling

project in the Netherlands. The project focuses on recycling polystyrene foam demolition waste, recovering materials for new insulation,

and reclaiming resources like bromine for sustainable polymeric flame retardants. The valuable bromine which it contains is recovered

and re-used in a new polymeric flame-retardant. |

| • |

Our Ambition Creates Excellence (ACE) program has been expanded

(from the original ambitious energy savings plan) to include the development of a standardized approach for Circular Economy that is designed

to systematically review ICL’s waste streams, by-products and other outputs from our operations and identify opportunities to develop

new and useful products, as well as to optimize our operations. |

| • |

As part of our Circular Economy efforts in China, the Company

develops a variety of different uses for Phosphogypsum, which is our Chinese site's only by-product that has not yet been fully utilized.

In addition to existing solutions that have been developed and implemented, the Company has developed, together with local authorities,

a solution for an old mine's rehabilitation. In 2023, more than 5.5 million cubic meters of phosphogypsum were utilized successfully.

|

| • |

At ICL Dead Sea, salt is used as infrastructure in the rehabilitation

of roads, construction of wall barriers and batteries, as well as in other infrastructure projects. |

| • |

ICL Periclase is working to reduce its remnant Magnesia waste

and reuse it for the benefit of Circular Economy. During 2023, ICL Periclase implemented a project that uses magnesia powder, a non-hazardous

material, to fill sinkholes in the Dead Sea region. |

| • |

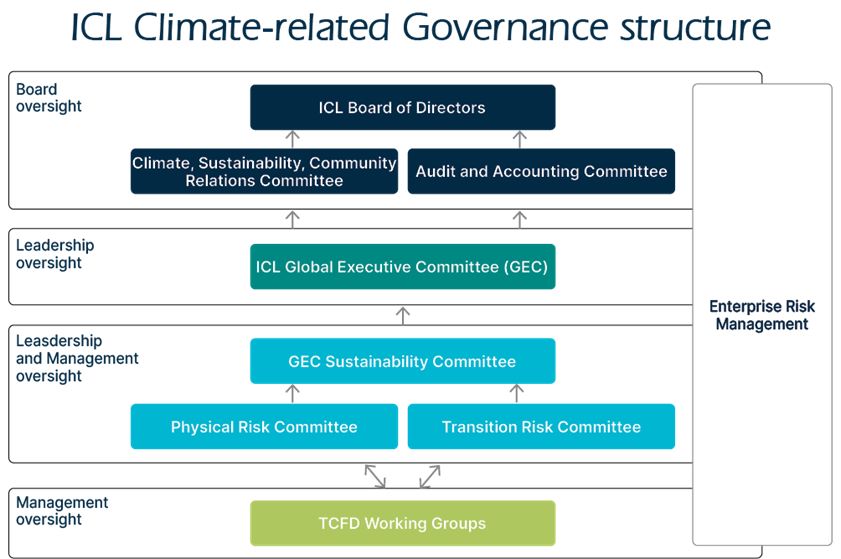

Climate risk management is an integral part of our overall approach

of doing the right thing, in the right way, every day. ICL’s Board is responsible for setting ICL’s overall strategic direction,

including related to sustainability, climate and ESG related matters. The Board views climate change as a material component of the Company's

strategy. |

| • |

The Board has appointed a Climate, Sustainability and Community

Relations Committee (“CSC Committee”) to oversee climate-related issues, including but not limited to, climate-change risk

assessment and mitigation plans, installation of renewable energy facilities, site decarbonization plans, implementation of Circular Economy

activities, achieving water saving targets and implementation of various policies relating to environmental impact. The CSC Committee

is chaired by Dr. Miriam Haran, a leading environmental expert with substantial experience in environmental and climate-related matters.

The CSC Committee comprises three additional directors on the Board who possess significant industrial and risk management experience,

including related to environmental matters. |

| • |

The CSC Committee convenes quarterly, as scheduled, unless additional

meetings are necessitated for ad hoc purposes. The meetings include review of updates regarding the Company’s latest ESG related

events, changes in underlying regulations, ESG risk assessments and ESG management systems, as well as review and approval of policies

and procedures when relevant. In addition, the CSC Committee holds annual discussions regarding, among other things, climate risk and

mitigation measures, TCFD disclosures, the Company’s ESG Report and ICL’s sustainability KPI matrix and targets. Progress

against climate-related goals and targets and monitoring progress vis-a-vis the Company’s GHG decarbonization targets is also discussed

during these meetings (for more information, refer to the ‘Metrics and Targets’ section below). |

| • |

The Board’s Audit & Accounting Committee, as determined

in ICL’s Board Manual, is responsible for, among other responsibilities, overseeing ICL’s risk management, including monitoring

the Company’s activities to manage and mitigate identified risks, as well as to ensure our Company’s compliance with relevant

regulations. Accordingly, ICL’s Enterprise Risk Management (“ERM”), which includes climate related risks, is discussed

at least on a bi-annual basis, and any material changes are updated on a regular basis. |

| • |

ICL’s ERM approach and constituting documents, including

our ERM policy and procedures, follow the risk management methodology of the Committee of Sponsoring Organizations of the Treadway Committee

(COSO). That methodology is defined as “the culture, capabilities, and practices, integrated with strategy setting and its performance,

that organizations rely on to manage risk in creating, preserving, and realizing value”. |

| • |

ICL’s Global Executive Committee (“GEC”), comprised

of our senior executive management members, meets on a weekly basis and is responsible for overseeing the Company’s actions, policies

and initiatives designed to ensure that ICL’s material ESG and climate-related risks are being appropriately addressed and managed.

It also renders decisions on various issues including sustainability, climate and ESG matters. This includes the formation of annual budgets,

deliberations regarding major capital and operational expenditures for climate mitigation activities related to low carbon production

products and services, climate-related transactions (including acquisitions, mergers and divestitures) and the implementation of our climate

transition plan. |

| • |

To assist the GEC to better monitor and oversee ICL’s sustainability,

climate and ESG related matters, the GEC appointed a GEC Sustainability Committee, an advisory committee which convenes on a quarterly

basis. The GEC Sustainability Committee is chaired by our EVP, Chief Legal and Sustainability Officer, and is comprised of our CFO, the

EVP, Chief Risk Officer, ICL Potash Division President, who is also in charge of ICL’s global EHS, the Chief Procurement & CAPEX

Officer, the Chief Innovation and Technology Officer and the ICL Phosphate Specialty Solutions Division President. |

| • |

Two separate management-level committees report to the GEC Sustainability

Committee on climate related risks: (i) a Physical Risk Committee and (ii) a Transition Risk Committee, which are supported by our global

sustainability and risk management teams, which manage both physical and transitional climate-related matters. The purpose of these committees

is to identify potential climate related risks and opportunities, assess their impact on ICL’s operational and logistic sites, manage

their financial transition, and determine mitigating actions to minimize ICL’s exposure to risk according to the respective ICL

risk appetite. The chairs of the committees meet on a periodical basis to synchronize their activities. |

| • |

Physical risks: 2030, 2040

and 2050, using the Intergovernmental Panel on Climate Change (IPCC) Shared Socio‐Economic

Pathways (SSPs), SSP1-2.6 (Low emissions scenario), SSP 2-4.5 (Medium emissions scenario) and SSP5-8.5 (Business as usual/High emissions

scenario). |

| • |

Transition risks and opportunities:

2030, 2040 and 2050, using six scenarios; Net Zero, Announced Pledges Scenario (APS) and Stated Policies Scenario (STEPS) developed

by the International Energy Agency (IEA) as well as the Network for Greening the Financial System (NGFS) Net Zero, Below 2˚C and

Nationally Determined Contributions (NDC’s) scenarios. All scenarios use carbon prices as an input in their modelling. As a part

of the scenario analysis for 2023, ICL has considered the impact of carbon pricing mechanisms on Scope 1,2 and 3 emissions. |

(1-100), as reflected in our climate models which provide additional synthetic information regarding the propensity of an asset to be subject to significant hazard intensities given the physical local climate properties. Local climate specificities are based on the Köppen Geiger climate classification, which is one of the most widely used climate classification systems. The average local exposure score is computed for all considered assets across a geography. Water stress in Israel is mitigated due to the development of non-conventional water sources by the Israeli government, such as treated wastewater and desalination. As a result, water production capacity in Israel exceeds demand, reducing potable water scarcity and water stress risks in the country.

|

Transition risks |

Description

and Response |

|

Policy &

legal

Carbon pricing mechanisms |

Risk

description: Regulatory developments in countries or jurisdictions

where we operate, exposure to carbon trading schemes, cross-border tax and adjustment mechanisms, increases in existing carbon pricing,

and carbon taxes on energy and supplies are expected to lead to increased costs for ICL. Since carbon pricing mechanisms are still in

development in most areas globally, it is expected that the risk exposure will increase over time.

ICL

response: In recent years, we have undertaken proactive measures to reduce ICL's carbon footprint as part of our decarbonization

roadmap that includes increasing energy efficiency and transitioning to lower carbon energy sources. We have already achieved a 22.2%

reduction in scope 1-2. Consequently, we are actively improving our understanding of our GHG emissions' impacts and actively striving

to reduce GHG emissions throughout our value chain enabling us to reduce our exposure to carbon pricing risks. In 2023, we conducted an

analysis to quantify the risks arising from carbon pricing mechanisms on both our direct (Scope 1 & 2) and indirect (Scope 3) operations.

Our aim was to comprehensively understand the financial risks across diverse scenarios and timeframes. The analysis outputs will improve

our financial preparedness and planning and foster strategic decision-making to mitigate risks linked with carbon pricing transitions.

We will further mitigate exposure to this risk by incorporating the outputs of the analysis into our decarbonization roadmap.

Time

horizon: STEPS – 2030, 2040 and 2050

Potential

impact: Medium to high, particularly within the 2050-time horizon.

|

|

Reputation

Increased stakeholders concern regarding environmental performance |

Risk

description: There has been an increased focus, including from investors, the public, and governmental and non-governmental authorities,

regarding environmental, social and governance (ESG) matters, including with respect to climate change and GHG emissions. As ICL operates

in a carbon intensive sector, increased stakeholder concerns and expectations regarding operational and product-related environmental

performance could have an impact on our reputation (preference for our products or investor confidence).

ICL response: ICL’s commitment to ambitious climate targets

is aligned with the Paris Agreement. Therefore, in recent years we have undertaken proactive measures to reduce ICL's carbon footprint

and actively improved our understanding of ICL’s GHG emissions (Scope 1-2-3), coupled with developing low-carbon products and services,

raising awareness and creating the proper governance structure to support climate related risks and opportunities, and increasing transparency

throughout our public disclosure and reports.

Time

horizon: Medium

Potential

impact: Medium to high |

|

Technology

Requirements for clean energy |

Risk

description: We acknowledge that our sector relies heavily on energy, and as the global demand shifts towards greener sources of

energy, there is a heightened need to invest in renewable energy procurement. Both external policies and internal targets drive this imperative.

However, transitioning to alternative energy sources may result in increased operational costs.

ICL

response: ICL recognizes the necessity of sustainable energy practices. By entering long term renewable Power Purchase Agreements

(PPAs) and utilizing energy attributes certificates (EACs), we adeptly reduce our scope 2 emissions, mitigating energy transition risk

and strengthening our portfolio to increase operational resilience.

Time

horizon: Short-Medium

Potential

impact: Low |

|

Transition risks |

Description and Response

|

|

Technology

The ability to implement direct operational reduction measures

|

Risk

description: Increasing global pressures to reduce GHG emissions

highlight the necessity for companies to upgrade their infrastructure, ensuring adherence to environmental standards and energy efficiency

goals. This could result in increased costs to upgrade and improve ICL's infrastructure, such

as energy efficiencies and optimization of production processes, to reduce our direct scope 1 emissions.

ICL

response: ICL has already initiated a process of addressing this risk by deploying a team of experts internally (our ACE program)

which focuses on identifying initiatives to reduce scope 1 emissions through, among others, energy efficiency measures at various ICL

sites. In addition, following our commitment to establish science-based emission reduction targets, ICL is currently further investigating

abatement initiatives to further reduce our scope 1 emissions in the years ahead, such as green hydrogen production in primary locations.

Time

horizon: Medium - Long

Potential

impact: High |

|

Markets

Reduced demand due to chronic changes in weather patterns

|

Risk

description: An increase in the temperature and volatile precipitation, chronic changes in regional climates which can result in

shifts in the average growing season, growing conditions and crop mix, may result in reduced demand for commodity fertilizers.

ICL

response: ICL is actively monitoring market trends and weather-related agricultural growing conditions in regard to climate change.

ICL’s believe its diverse products and services portfolio, which supports precision agriculture and other products that contribute

to plant resilience, will better support farmers in a changing environment.

Time

horizon: Medium to long

Potential

impact: Medium |

|

Opportunities |

Description and Response

|

|

Markets

Increased market demand for sustainable solutions

|

Opportunity

description: We anticipate several market opportunities arising from sustainable novel solutions and shifts in the markets driven

by climate change which could lead to increased revenue. These new solutions will also broaden ICL's outlook on new low carbon markets,

enhancing our potential for growth and market penetration.

ICL

response: As a global specialty minerals company, we are keenly observing new market opportunities in sustainable solutions.

Our 2023 downstream scenario analysis

revealed opportunities in several major global markets for specialty and low carbon fertilizers due to the impact of climate change scenarios

on agricultural yields. Based on the analysis projected for 2030 and 2050, we observed escalating demand attributed to climate change-induced

alterations in agricultural requirements.

Moreover, the increased demand for

electricity storage solutions and batteries can be facilitated by our product portfolio. These emerging opportunities position us to expand

our market presence and generate increased revenue.

Time

Horizon: SSP1-26, SSP2-45, SSP5-85 – 2030 and 2050 | Medium to Long

Potential

impact: Medium to High |

|

Opportunities |

Description and Response

|

|

Products

and Services

Improved product offerings |

Opportunity description:

We anticipate an increase in consumer

demand for products and services that support climate-change mitigation and adaptation, including specialty fertilizers and energy storage

solutions, which is expected to propel revenue growth.

ICL response:

Our products and services cater to

the emerging needs of climate-change mitigation and adaptation. Our product portfolio features among others, highly effective specialty

fertilizers that facilitate optimal nutrient release that help growers worldwide reduce their fertilizer usage and simultaneously achieve

higher quality crops and yields with lower environmental impacts. ICL’s CRFs and bio-stimulants support plant nutrition and minimize

N2O emission in the use phase, reducing GHG emissions and

supporting climate change mitigation. Furthermore, we anticipate an increase in demand for Energy Storage Solutions (ESS), a necessary

step in the transition to renewable energy. Energy storage is a potentially significant source of growth for our phosphate-based and bromine-based

specialty products. Therefore, our focus is expanding to include such solutions with our product portfolio, for example, by utilizing

phosphate raw materials to produce Lithium Iron Phosphate (LFP). For further information about our sustainable solutions, see "Strategy

– Products and Services" above.

Climate-change mitigation requires

a transition to alternative energy sources. These in return, require energy storage solutions in order to become mainstream.

Time

horizon: Medium

Potential

impact: High |

|

Resource

Efficiency & Energy Source

Transition to Sustainable Energy Practices

|

Opportunity description:

Maximizing resource efficiency and

transitioning to alternative energy sources present an opportunity for ICL.

ICL response: ICL has dedicated teams and forums that focus on opportunities

in energy efficiency. By prioritizing these initiatives, we anticipate a reduction in operational costs and environmental footprint as

renewable energy is projected to be more cost-effective (in part due to lower carbon taxes) compared to fossil fuels. Our strategy involves

sourcing and expanding our renewable energy mix, facilitating a shift towards heightened electrification across our operations. Furthermore,

we're intensifying our efforts to digitize, and analyse site level GHG data which allows us to improve data management and quality to

support our journey to become more resource efficient and to reduce our footprint. Looking ahead, we're exploring the possibility of green

hydrogen production at our primary location, aligning with our long-term sustainability goals.

Time

horizon: Medium - Long

Potential

impact: Medium |

|

Resilience

Future Resilience |

Opportunity description:

We believe that increasing the resilience of our Company represents a strong opportunity through initiatives

aimed at improving efficiency, designing innovative production processes, and developing new products. These efforts will ensure that

we maintain our competitive advantage and remain prepared for a low-carbon future. ICL response:

Our approach to advancing sustainable

practices significantly contributes to our resilience. Our research, development, and innovation focus on solutions that aim to align

with the SDGs. This in turn provides ICL with a long-term vision to pursue major market opportunities, including innovative climate-resilient

solutions that enhance business resilience. For more about our sustainable solutions, see Strategy – Products and Services.

Additionally, enhanced access to green

financing resulting from a reduced Company-wide carbon footprint and clear sustainability strategy, unlocks additional resources that

further bolster our resilience. For more about our see Strategy – Sustainable Finance.

Time

horizon: Medium to long

Potential

impact: Medium |

| • |

Tier 1 Risks (High-Level/ Material Risks): The designated risk

owners are required to develop a treatment plan aimed at mitigating the impact or likelihood of the risk. During the development of treatment

plans for top risks, we take into consideration factors such as feasibility, cost-effectiveness, required resources, and the timeline

for completion. We ensure that any proposed treatment aligns with legal and governance requirements. The execution of plans is monitored

for timeliness. We regularly reassess risk evaluations as an integral part of our monitoring routines established in our Global Risk Policy.

|

| • |

Tier 2 and Tier 3 Risks (Medium to Low-Level Risks): We have established

periodic processes to ensure that we capture significant changes in risk exposure, needing further examination. |

|

Year 2023 (3)

|

Year 2022 (2)

|

2021 |

Year 2018 (1)

|

2022 VS 2018 | ||

|

Scope 1 |

Tonnes CO2e

(thousands) |

2,102 |

2,126 |

2,158 |

2,220 |

(5.3)% |

|

Scope 2

Market-based |

Tonnes CO2e

(thousands) |

186 |

281 |

380 |

720 |

(74.2)% |

|

Total scope 1+2 GHG emission |

Tonnes CO2e

(thousands) |

2,288 |

2,407 |

2,538 |

2,940 |

(22.2)% |

| (1) |

2018 is the baseline year for ICL’s decarbonization roadmap.

|

| (2) |

On a “same site basis” (excluding facilities acquired

in Brazil during 2021), 2022 Scope 1 and Scope 2 (market-based) emissions were 2,107 and 281 thousand tonnes CO2e,

respectively. |

| (3) |

2023 independent assurance process was performed in accordance

with the International Standard on Assurance Engagements ISAE 3000 (Revised) |

| • |

Development of fertilizers with better nutrient-use efficiency

and reduction of emissions. |

| • |

Development of biological bio-stimulants that stimulate plant

growth and provide resilience to various stress conditions. |

| • |

Development of products that

improve water use efficiency. |

| • |

Investigating opportunities to integrate waste steams into our

production processes, fostering a closed-loop circular economy and developing future sources for sustainable fertilizer products.

|

| • |

Including integration of secondary source Phosphate technologies

(Circular Economy) for immediate use in our production facilities in Europe and development of future sources for our fertilizer products,

including a technology road map for recycling and recovery of phosphorous and nitrogen from secondary sources to transform our products

into sustainable fertilizers. |

| • |

Continued diversification and development of a product portfolio

of meat substitutes: ICL and Plantible Foods have partnered to launch ROVITARIS® Binding Solution, a revolutionary clean label binding

solution for plant-based meat and seafood applications that may replace most chemically processed binders. |

| • |

Development of a battery materials portfolio that includes Lithium

Iron Phosphate (LFP) cathode active material, brominated electrolytes and Phosphorus based active salt for electrolytes for current generation

and next-generation lithium-ion batteries (Energy Storage Solutions). |

| • |

The Front-End Innovation group has scouted more than 500 food

tech start-ups to identify disruptive technologies for ICL Phosphate Specialties. Following the investment in Protera SAS and Plantible

Foods Inc., ICL Planet Startup Hub invested in Arkeon GmbH, a start-up converting CO2

into nutritious amino acids and sustainable protein. The teams continue to seek innovation partners in transformation of sustainable food

systems. |

| • |

We developed a data-driven impact and evidence assessment tool

for all RD&I projects to maximize ICL’s actions on tackling climate change, advancing food security and other contributions

to human health and wellbeing. This decision-making tool is integrated into the product development process. In 2023, we completed six

case studies and incorporated this tool into our new product development process. |

| • |

Commissioning a high efficiency gas-fired combined heat and power

(CHP) plant at our Sodom facility to supply ICL’s facilities in Israel, replacing older oil-fired power generation systems.

|

| • |

Transitioning to the procurement of renewably generated electricity

across all ICL sites, starting with the procurement of renewable electricity for ICL sites in Europe and expanding to sites in the US,

Israel, China and Brazil. |

| • |

Decommissioning our oil shale-based power generation at Rotem

(Israel), in favor of a more efficient gas-fired power plant with significantly lower GHG emissions. |

| • |

Recovering heat from various chemical reactions to produce zero

emission power for utilization by ICL sites. |

| • |

Improved measurement of GHG emissions, including increasing the

accessibility to site-level carbon metrics and analytics for our operational managers and management through digital dashboards for up-to-date

reporting of emissions at site and product levels. |

| • |

Eliminating or reducing process GHG emissions through changes

to chemical processes and production lines. |

| • |

Converting our remaining production facilities that utilize high-emitting

fossil fuels to energy generated from natural gas, renewable sources and waste heat. |

| • |

Increasing energy efficiency by phasing out inefficient production

technologies, streamlining our production facilities, increasing the efficiency of our consumption of heat and steam, and recovering heat

where possible. |

| • |