2024 |

Darden Restaurants, Inc. Annual Meeting of Shareholders and Proxy Statement |

|

|

Wednesday, September 18, 2024, 10:00 a.m., Eastern Time |

|

|

Our Brands |

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ |

|

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2024 |

Darden Restaurants, Inc. Annual Meeting of Shareholders and Proxy Statement |

|

|

Wednesday, September 18, 2024, 10:00 a.m., Eastern Time |

|

|

Our Brands |

|

|

|

|

August 5, 2024 |

Dear Shareholders: |

On behalf of your Board of Directors, it is my pleasure to invite you to attend the 2024 Annual Meeting of Shareholders of Darden Restaurants, Inc. We will hold the Annual Meeting on Wednesday, September 18, 2024, at 10:00 a.m., Eastern Time, online via the internet at www.virtualshareholdermeeting.com/DRI2024. All holders of our outstanding common shares as of the close of business on July 24, 2024, are entitled to vote at the meeting. We will furnish proxy materials to shareholders via the internet, which allows us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. The notice of meeting and Proxy Statement contain important details about the business to be conducted at the Annual Meeting. Please read these documents carefully. We will provide an opportunity during the meeting for discussion of each item of business and we anticipate responding to shareholder questions as described in this Proxy Statement. If you will need special assistance during the meeting because of a disability, please contact Matthew R. Broad, Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary, Darden Restaurants, Inc., 1000 Darden Center Drive, Orlando, Florida 32837, phone (407) 245-6789. Whether or not you plan to attend, it is important that your shares be represented and voted at the meeting. Please refer to the proxy card or Notice of Availability of Proxy Materials for more information on how to vote your shares at the meeting. Your vote is important. Thank you for your support.

Sincerely,

Cynthia T. Jamison Chair of the Board of Directors |

Notice of 2024 Annual

Meeting of Shareholders

To be held on September 18, 2024

|

||

Date and Time: Wednesday, September 18, 2024 |

Place: Online, via the internet at |

Record Date: Wednesday, July 24, 2024 |

Items of Business |

|

How to Vote |

||

|

|

|

|

|

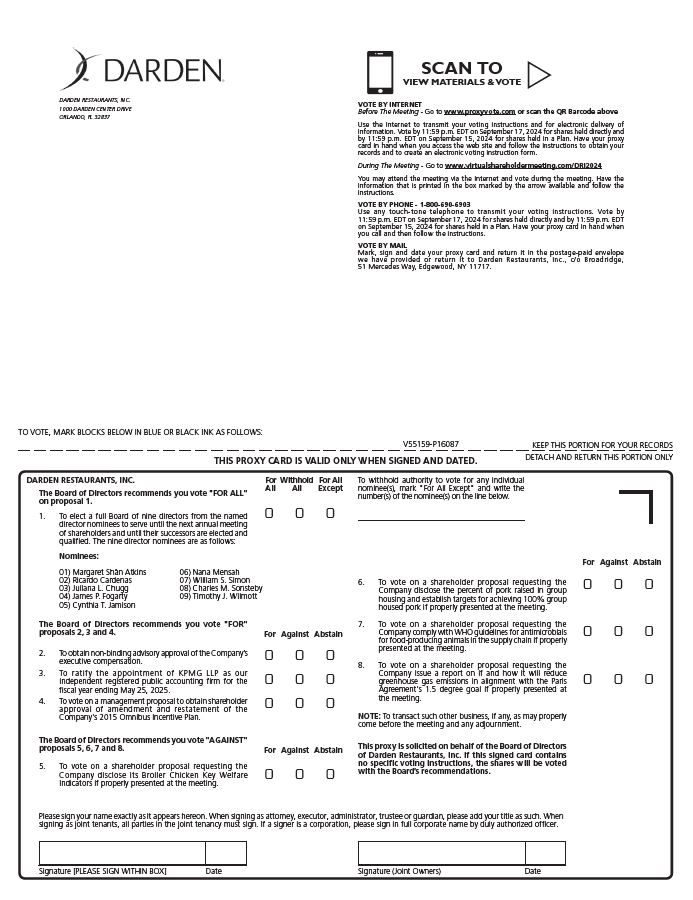

Item 1. To elect as directors the nine named director nominees to serve until the next annual meeting of shareholders and until their successors are elected and qualified.

Item 2. To obtain non-binding advisory approval of the Company’s executive compensation.

Item 3. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending May 25, 2025.

Item 4. To vote on a management proposal to obtain shareholder approval of amendment and restatement of the Company's 2015 Omnibus Incentive Plan.

Item 5. To vote on a shareholder proposal requesting the Company disclose its Broiler Chicken Key Welfare Indicators if properly presented at the meeting.

Item 6. To vote on a shareholder proposal requesting the Company disclose the percent of pork raised in group housing and establish targets for achieving 100% group housed pork if properly presented at the meeting.

Item 7. To vote on a shareholder proposal requesting the Company comply with WHO guidelines for antimicrobials for food-producing animals in the supply chain if properly presented at the meeting.

Item 8. To vote on a shareholder proposal requesting the Company issue a report on if and how it will reduce greenhouse gas emissions in alignment with the Paris Agreement's 1.5 degree goal if properly presented at the meeting.

Item 9. To transact such other business, if any, as may properly come before the meeting and any adjournment. Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to be held on September 18, 2024 The accompanying Proxy Statement and our 2024 Annual Report on Form 10-K are available at www.darden.com. In addition, you may access these materials at www.proxyvote.com. On August 5, 2024, we mailed a Notice of Internet Availability of Proxy Materials to certain shareholders, containing instructions for voting online and for requesting a paper copy of the Proxy Statement and 2024 Annual Report on Form 10-K. |

Vote by going to the website shown on your proxy card or Notice of Availability of Proxy Materials and following the instructions for Internet voting set forth on such proxy card or Notice |

|

Vote by completing, signing, dating and returning the proxy card |

|

Vote by telephone at the number shown on your proxy card and following the instructions on such proxy card (If you reside in the United States or Canada) |

|

Shareholders of record and beneficial owners will be able to vote their shares electronically during the Annual Meeting. However, even if you plan to participate in the Annual Meeting online, we recommend that you vote by proxy so that your votes will be counted if you later decide not to participate in the Annual Meeting. |

||

Who Can Vote |

||||

You can vote during the Annual Meeting and any adjournment if you were a holder of record of our common stock at the close of business on July 24, 2024. |

||||

Date of Mailing |

||||

This Notice of the Annual Meeting of Shareholders and the Proxy Statement are first being distributed or otherwise furnished to shareholders on or about August 5, 2024. |

||||

By Order of the Board of Directors

|

||||

Matthew R. Broad Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary |

|

DARDEN RESTAURANTS, INC. 1000 Darden Center Drive Orlando, Florida 32837 |

||

Table of Contents

1 |

|

|

||

2 |

|

|

||

3 |

|

|

||

4 |

|

|

||

6 |

|

49 |

||

6 |

|

|

|

|

6 |

|

|

||

8 |

|

|

||

|

|

|

|

|

|

|

|

||

10 |

|

|

||

10 |

|

52 |

||

11 |

|

|

|

|

12 |

|

|

||

13 |

|

56 |

||

13 |

|

56 |

||

14 |

|

57 |

||

14 |

|

|

|

|

15 |

|

63 |

||

|

|

63 |

||

16 |

|

63 |

||

17 |

|

|

||

|

|

|

|

|

|

|

|

64 |

|

20 |

|

|

|

|

|

|

|

66 |

|

|

|

67 |

||

20 |

|

|

|

|

|

|

|

|

|

|

|

68 |

||

28 |

|

|

|

|

|

|

|

69 |

|

|

|

69 |

||

|

|

70 |

||

29 |

|

71 |

||

|

|

|

73 |

|

|

|

74 |

||

|

|

79 |

||

|

|

80 |

||

30 |

|

|

||

|

|

|

81 |

|

|

|

|

|

|

|

|

81 |

||

43 |

|

|

|

|

|

|

|

|

|

|

|

82 |

||

|

|

|

|

|

|

|

|

||

|

|

82 |

||

46 |

|

|

|

|

|

|

|

|

83 |

|

111 |

||

83 |

|

|

|

|

85 |

|

111 |

||

86 |

|

|

|

|

87 |

|

|

||

88 |

|

111 |

||

|

|

|

|

|

89 |

|

|

||

96 |

|

112 |

||

97 |

|

|

|

|

|

|

|

A-1 |

|

102 |

|

|

|

|

|

|

|

|

|

|

|

B-1 |

||

103 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

105 |

|

|

|

Proxy Statement for Annual Meeting of Shareholders to be held on September 18, 2024 |

The Board of Directors (the Board) of Darden Restaurants, Inc. (Darden, the Company, we, us or our) is soliciting your proxy for use at the Annual Meeting of Shareholders to be held on September 18, 2024. This Proxy Statement summarizes information concerning the matters to be presented at the meeting and related information that will help you make an informed vote at the meeting. This Proxy Statement and the proxy card are first being distributed or otherwise furnished to shareholders on or about August 5, 2024. Capitalized terms used in this Proxy Statement that are not otherwise defined are defined in Appendix A to this document.

Proxy Statement Summary

This summary highlights certain information discussed in more detail in this Proxy Statement.

2024 Annual Meeting of Shareholders

|

|

Date & Time: |

Wednesday, September 18, 2024, 10:00 a.m., E.T. |

|

|

Location: |

Online, via the internet at www.virtualshareholdermeeting.com/DRI2024 |

Matters Presented for Vote at the Meeting

The matters to be voted upon at this meeting, along with the Board’s recommendation, are set forth below.

Proposals |

Required |

Board |

Page |

|

Proposal 1. Election of Nine Directors from the Following Nominees: - M. Shân Atkins - Ricardo Cardenas - Juliana L. Chugg - James P. Fogarty - Cynthia T. Jamison - Nana Mensah - William S. Simon - Charles M. Sonsteby - Timothy J. Wilmott |

Majority of |

✓ |

For Each Nominee |

p. 20 |

Proposal 2. Advisory Approval of the Company’s Executive Compensation |

Majority of |

✓ |

For |

p. 28 |

Proposal 3. Ratification of Appointment of the Company’s Independent Registered Public Accounting Firm for the Fiscal Year Ending May 25, 2025 |

Majority of |

✓ |

For |

p. 29 |

Proposal 4. Management Proposal: Shareholder Approval of Amended and Restated 2015 Omnibus Incentive Plan |

Majority of |

✓ |

For |

p. 30 |

Proposal 5. Shareholder Proposal Requesting the Company Disclose its Broiler Chicken Key Welfare Indicators |

Majority of |

× |

Against |

p. 43 |

Proposal 6. Shareholder Proposal Requesting the Company Disclose the Percent of Pork Raised in Group Housing and Establish Targets for Achieving 100% Group Housed Pork |

Majority of |

× |

Against |

p. 46 |

Proposal 7. Shareholder Proposal Requesting the Company comply with WHO Guidelines for Antimicrobials for Food-Producing Animals in the Supply Chain |

Majority of |

× |

Against |

p. 49 |

Proposal 8. Shareholder Proposal Requesting the Company Issue a Report on if and how it will Reduce Greenhouse Gas Emissions in Alignment with the Paris Agreement's 1.5 Degree Goal |

Majority of |

× |

Against |

p. 52 |

2024 Proxy Statement 1

About Darden

Darden is a full-service restaurant company, and as of May 26, 2024, we owned and operated 2,031 restaurants through subsidiaries in the United States and Canada under the Olive Garden®, LongHorn Steakhouse®, Ruth's Chris Steak House®, Yard House®, Cheddar’s Scratch Kitchen®, The Capital Grille®, Seasons 52®, Eddie V’s Prime Seafood®, Bahama Breeze®, and The Capital Burger® trademarks. As of May 26, 2024, we also had 146 restaurants operated by independent third parties pursuant to area development and franchise agreements and 4 restaurants operating under contractual agreements.

Strategy Summary

Throughout fiscal 2024, our operating philosophy remained focused on strengthening the core operational fundamentals of the business by providing an outstanding guest experience rooted in culinary innovation, attentive service, engaging atmosphere, and integrated marketing. Darden enables each brand to reach its full potential by leveraging our scale, insights, and experience in a way that protects uniqueness and competitive advantages.

We manage our business organized around one core mission and one driving philosophy that keeps us focused on actions that will help us to be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere, making every guest loyal.

A full-service restaurant company with …

1 Mission |

Be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere making every guest loyal. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Competitive Advantages |

Significant Scale |

● |

Extensive Data & Insights |

● |

Rigorous Strategic Planning |

● |

Results- Oriented Culture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Driving Philosophy |

Back-To-Basics |

||||||

Culinary Innovation & Execution |

● |

Attentive Service |

● |

Engaging Atmosphere |

● |

Integrated Marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 Iconic Brands |

|

||||||

2 Darden Restaurants, Inc.

Key Fiscal 2024 Performance Highlights

Fiscal 2024 was a successful year, despite the challenging sales environment that emerged in the back half of the year. Our teams did a great job of executing our strategy as we pursued our mission to be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere, making every guest loyal. Our strength begins with our proven strategy. Our four competitive advantages of Significant Scale, Extensive Data & Insights, Rigorous Strategic Planning, and our Results-Oriented Culture position us well to successfully navigate any environment. We continue to leverage our advantages and our superior financial position, to make the right long-term investments in our business and execute against our strategy. In fiscal 2024, we leveraged our advantages to complete our acquisition of Ruth’s Chris Steak House and successfully integrate the company-owned restaurants and 5,000 Ruth’s Chris team members into Darden. Ruth’s Chris was accretive to our full-year diluted net earnings per share results by $0.10 (excluding costs of $0.35 per share related to acquisition and integration). Our Back-to-Basics Operating Philosophy continues to guide us as we pursue our mission: “Be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere making every guest loyal.” As we begin fiscal 2025, we continue leveraging these advantages and expanding our portfolio of iconic brands. On July 17, 2024, we announced our agreement to acquire Chuy’s Holdings, Inc., owner and operator of restaurants under the Chuy's Fine Tex-Mex® trademark (Chuy's). Chuy's currently operates 101 restaurants in 15 states generating total revenues over $450 million. We expect to close the deal in the second quarter of fiscal 2025, subject to customary closing conditions. |

|

We ended fiscal 2024 with the following key financial results: |

|

|

|

|

$8.53 Diluted net EPS |

|

|

|

|

|

$1.03B Net earnings from continuing operations |

|

|

|

|

|

$1.6B Net cash from operations |

|

|

|

|

|

$1.1B Cash returned to shareholders through dividends and share repurchases |

|

|

|

|

|

1.6% Same-restaurant sales growth |

|

Key People Highlights |

|

|

We invested in our greatest asset - our people, our team members, in many ways including: Offering a compelling employment proposition: during fiscal 2024, on average, our hourly team members earned more than $23 an hour, inclusive of income earned through gratuities. In fiscal 2024, we continued our Fast Fluency restaurant team member benefit begun in fiscal 2023, which offers Spanish-speaking team members the chance to learn English for free. The Darden Foundation continues the Next Course Scholarship program to help the children or dependents of Darden team members reach their educational goals. For fiscal 2024, more than 100 children or dependents of Darden team members were awarded scholarships worth $3,000 each. In fiscal 2024, we invested an additional $3 million in subsidies to reduce or keep flat the medical premiums that our team members pay to participate in our medical insurance programs. We served our communities with a focus on fighting hunger in fiscal 2024: we donated $2.0 million to Feeding America through the Darden Foundation, including providing ten additional mobile food trucks to local food banks with exceptionally high need, and contributed 5.4 million pounds of food through our Harvest program – amounting to 4.5 million meals. |

|

37 Net new restaurants opened (excluding Ruth's Chris Steak House) |

|

|

|

|

Ended fiscal 2024 with 80 company owned and operated Ruth's Chris Steak House restaurants. |

|

|

|

|

|

|

2024 Proxy Statement 3

Director Highlights

Our Directors |

|

|

|

Committee Memberships |

|||

Nominees for Election at 2024 Meeting and Primary Occupation |

Age |

Director Since |

A |

C |

F |

N |

MARGARET SHÂN ATKINS Retired Co-Founder and Managing Director, |

67 |

2014 |

● |

|

|

|

RICARDO CARDENAS President and Chief Executive Officer, Darden Restaurants, Inc. |

56 |

2022 |

|

|

|

|

JULIANA L. CHUGG Retired Executive Vice President and Chief Brand |

56 |

2022 |

|

|

|

● |

JAMES P. FOGARTY CEO, FULLBEAUTY Brands, Inc. |

56 |

2014 |

|

|

|

|

CYNTHIA T. JAMISON, Chair of the Board Retired turnaround CFO |

64 |

2014 |

|

|

|

|

NANA MENSAH Chairman and Chief Executive Officer, |

72 |

2016 |

|

|

● |

|

WILLIAM S. SIMON Senior Advisor to KKR & Co. |

64 |

2014 |

|

|

|

|

CHARLES M. SONSTEBY Retired Vice Chairman, |

70 |

2014 |

|

|

|

|

TIMOTHY J. WILMOTT Retired Chief Executive Officer, |

66 |

2018 |

|

● |

|

|

A = Audit C = Compensation F = Finance N = Nominating and Governance ● = Chair = Member

4 Darden Restaurants, Inc.

Nominee Highlights

|

|

|

9 Nominees |

||

Each of our nine director nominees is committed to our core values (integrity and fairness, respect and caring, inclusion and diversity, always learning – always teaching, being “of service,” teamwork and excellence). We seek directors who have an inquisitive and objective perspective, practical wisdom, mature judgment and a wide range of experience in the business world. The Company strives to maintain a Board that reflects gender, ethnic, racial and other diversity and also fosters diversity of thought. In 2021, we amended our Director Nomination Protocols to commit that the initial candidate pool for any vacancy on the Board, including any pool developed by a search firm, will include candidates with diversity of gender, race and/or ethnicity.

2024 Proxy Statement 5

Corporate Governance Highlights

Our Board seeks to maintain the highest standards of corporate governance and ethical business conduct, including the following highlights:

• Our current Board Chair is an independent director and eight of our nine nominees for the Board are independent; |

|

• The Board met in executive session at each of its quarterly meetings during fiscal 2024; |

|

|

|

• All directors are elected annually and we have a majority vote standard for uncontested elections; |

|

• Directors and executive officers are subject to robust stock ownership requirements; |

|

|

|

• All Board committees are composed of only independent directors; |

|

• 10 percent of shareholders can call a special meeting; and |

|

|

|

• The Board and committees conduct annual self-assessments; |

|

• We have no supermajority voting requirements. |

Executive Compensation Highlights

Our fiscal 2024 compensation programs were designed to create a strong alignment between pay and performance for our executives. Highlights of our executive compensation programs include:

• At the Company’s 2023 Annual Meeting, approximately 96.5 percent of the votes cast were in favor of the advisory vote to approve executive compensation; and |

|

• Over 89 percent of our CEO’s and 76 percent of our other Named Executive Officers’ (NEOs) target total direct compensation for fiscal 2024 was tied to performance. |

We have included a detailed Executive Summary in the “Compensation Discussion and Analysis” section of this Proxy Statement.

Sustainability Highlights

We are committed to protecting our planet for future generations and sourcing food with care.

Darden’s current key Sustainability areas of focus are:

|

Protecting our |

With more than 2000 restaurant locations, we view conservation efforts at our restaurants as the first line of action in managing climate risks and resource volatility. |

To that end, we track and report to our management and the Board on the following metrics annually:

Taking Action on Climate - Greenhouse gas (GHG) emissions (Scope 1 & 2)

Energy – Average Usage per Restaurant

Water – Average Usage per Restaurant

Waste – Recycling Rate

We are committed to providing disclosure to our shareholders on these and other sustainability metrics. We disclose all of these metrics on our corporate website, www.darden.com, and we include the GHG emissions in our annual report on Form 10-K.

6 Darden Restaurants, Inc.

Climate Risk Evaluation and Management |

Darden is addressing sources of climate change from its operations and supply chain through diligent assessment, transparent disclosures and collaborative engagement on solutions.

In fiscal 2024, Darden increased the robustness of the assessment and the disclosure of environmental metrics by:

The results will inform strategy and action in the areas of energy, GHG emissions, waste and water for Darden’s operations and our supply chain. Environmental disclosures are reported in our annual Impact Report which is downloadable from the "Our Impacts" section of our website at www.darden.com.

|

Sourcing Food with |

We lead in food safety and quality while also caring for farm animals and holding our suppliers to our Food Principles. We know that where our ingredients come from and how they are grown are integral elements in the recipe for preparing great food for our guests. Darden’s Food Principles are our foundation for sourcing food for our guests sustainably. |

Darden takes animal welfare very seriously. A key tenet of our approach is to work with protein suppliers who are committed to the improvement of animal welfare. We have a responsibility to ensure that animals are treated with respect and care in the process of providing nutritious food that is served in our restaurants. Our Animal Welfare Policy defines Darden’s position and outlines our approach and strategy in this area.

In 2019, we established an Animal Welfare Council, which unites a cross-functional group of academics and thought leaders in the care of animals in food supply chains. This group is supporting Darden in our continued efforts to improve animal welfare outcomes and, most recently, started to map out a framework and process for working with protein suppliers on key welfare areas defined within our Animal Welfare Policy.

In fiscal 2024, Darden launched a pilot project designed by our Animal Welfare Council to work with a majority of our poultry suppliers to determine and measure key welfare indicators (KWIs) that reflect the health of the environment that broiler chickens live in, their quality of nutrition, and level of care from hatch to processing. The KWIs we identified for this pilot program are: footpad scoring, leg bruising, broken or dislocated wings, dead on arrivals, acceptable bird placement, method of

2024 Proxy Statement 7

stunning, stun effectiveness, knife effectiveness and postmortem inspection. We will continue collecting and analyzing the data with our Animal Welfare Council into fiscal 2025.

Additional measures we take to ensure best practices in our food sourcing include:

|

We require third-party audits to ensure that our Animal Welfare Policy is upheld by suppliers producing our animal products. |

Ø |

We manage our suppliers by: |

Ø |

Restaurant leaders are thoroughly trained on our robust food safety and restaurant cleanliness practices and conduct in-depth walk-throughs twice each day. |

|

|

Ø |

We use a third-party partner to conduct quarterly inspections at every restaurant to validate our strict food safety protocols. |

Please visit the Our Impact section of our website at www.darden.com for updates on our animal welfare efforts.

Inclusion and Diversity Highlights

|

At Darden, everyone is welcome to a seat at our table. |

Our History Shapes Our Commitment

When our founder Bill Darden opened his first restaurant in 1938, he employed anyone willing to work hard, work smart and grow with the company – without regard to race, gender or background.

Ensuring an inclusive and diverse workplace is at the very heart of Darden and our brands. We are strengthened by a diversity of cultures, perspectives, backgrounds and ideas. We honor each other’s heritage and uniqueness. We prioritize our inclusion and diversity efforts not just because it is the right thing to do – but because it makes us better. It leads to innovation of thought, fuels our growth as a company and creates great places to work for our team members. Our strategy to uphold our founder’s legacy is rooted in advancing workplace diversity, creating an inclusive environment and building on our commitment.

8 Darden Restaurants, Inc.

The Board reviews and evaluates human capital metrics, strategic objectives and other initiatives with respect to the Company’s workforce. We have added detailed human capital metrics to our annual report on Form 10-K and to our corporate website. We have also added our EEO-1 data to our corporate website disclosure. Some key inclusion and diversity highlights are set forth below.

|

||

Our Team (as of year-end fiscal 2024 unless otherwise indicated) |

||

|

|

|

Our strategy to uphold our founder’s legacy is rooted in advancing workplace diversity, creating an inclusive environment and building on our commitment. We report details about these strategic initiatives on our corporate website.

|

|

|

|

|

Advance Workplace |

|

Create an Inclusive |

|

Build on Our |

|

|

|

|

|

✓ Increase our pipeline of diverse leaders ✓ Ensure all levels of our team reflect the diversity of our talent in our industry and communities ✓ Expand inclusive hiring and development best practices across all our brands and support center teams |

|

✓ Expand inclusion and diversity awareness and training to all team member populations ✓ Equip all leaders with the tools and resources to foster an inclusive environment for team members and guests ✓ Utilize Employee Resource Groups to engage, educate, retain and advance our team |

|

✓ Make a positive impact in the communities we serve ✓ Continue to invest in diverse suppliers |

2024 Proxy Statement 9

Corporate Governance and Board Administration

Our Board is Committed to the Highest Standards of Corporate Governance and Ethical Business Conduct

Corporate governance guidelines, policies and practices are the foundation for the effective and ethical governance of all public companies. Our Board is committed to the highest standards of corporate governance and ethical business conduct, providing accurate information with transparency and complying fully with the laws and regulations applicable to our business. The Company’s corporate governance structure is designed to ensure that the Company’s policies and practices are aligned with shareholder interests and corporate governance best practices. Executive management supports the Board’s commitment to be transparent through shareholder outreach efforts. We offer our shareholders an opportunity to engage in dialogue with us about aspects of our corporate governance and discuss any areas of concern. Our corporate governance practices are governed by our Articles of Incorporation, Bylaws, Corporate Governance Guidelines, Board committee charters, Shareholder Communication Procedures, Codes of Business Conduct and Ethics and Insider Trading Policy. You can access these documents at www.darden.com under Investors — Governance to learn more about the framework for our corporate governance practices. Copies are also available in print, free of charge, to any shareholder upon written request addressed to our Corporate Secretary.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines that specifically address the Company’s key governance practices and policies. The Nominating and Governance Committee of the Board oversees governance issues and recommends changes to the Company’s governance guidelines, policies and practices as appropriate. Our Corporate Governance Guidelines cover many important topics, including:

10 Darden Restaurants, Inc.

The Corporate Governance Guidelines also include policies on certain subjects, including those that:

Director Independence

Our Corporate Governance Guidelines require that at least two-thirds of the Board be independent directors, as defined under the rules (the NYSE Rules) of the New York Stock Exchange (NYSE). The NYSE Rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act), include the additional requirements that members of the Audit Committee may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company other than their director compensation and may not be affiliated with the Company or its subsidiaries. The NYSE Rules and Rule 10C-1 under the Exchange Act provide that when determining the independence of members of the Compensation Committee, the Board must consider all factors specifically relevant to determining whether a director has a relationship to the Company which is material to the director’s ability to be independent from management in connection with Compensation Committee duties, including, but not limited to, consideration of the sources of compensation of Compensation Committee members, including any consulting, advisory or other compensatory fees paid by the Company, and whether any Compensation Committee member is affiliated with the Company or any of its subsidiaries or affiliates. Compliance by Audit Committee members and Compensation Committee members with these requirements is separately assessed by the Board.

The Board has reviewed, considered and discussed each current director’s relationships, both direct and indirect, with the Company in order to determine whether such director meets the independence requirements of the applicable sections of the NYSE Rules (there are no nominees for election as directors at the Annual Meeting who are not current directors). The Board has affirmatively determined that, other than Mr. Cardenas, who is employed by the Company, eight of the nine nominees (Mmes. Atkins, Chugg and Jamison and Messrs. Fogarty, Mensah, Simon, Sonsteby and Wilmott) have no direct or indirect material relationship with us (other than their service as directors)

2024 Proxy Statement 11

and qualify as independent under the NYSE Rules. The Board has also affirmatively determined that each member of the Audit Committee and the Compensation Committee meets the applicable requirements of the NYSE Rules and the Exchange Act.

In making independence determinations, the Board considers that in the ordinary course of business, transactions may occur between the Company, including its subsidiaries, and entities with which some of our directors are or have been affiliated. The Board has concluded that any such transactions were immaterial in fiscal 2024.

The Company’s Corporate Governance Guidelines include a policy pertaining to related party transactions in which Interested Transactions with a Related Party, as those terms are defined below, are prohibited without prior approval of the Board. The Board will review the material facts of the proposed transaction and will either approve or disapprove of the transaction. In making its determination, the Board considers whether the Interested Transaction is consistent with the best interests of the Company and its shareholders and whether the Interested Transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances, as well as the extent of the Related Party’s interest in the transaction. A director may not participate in any discussion or approval of an Interested Transaction for which he or she is a Related Party, except to provide all material information as requested. Only those directors that meet the requirements for designation as a “qualified director” under the Florida Business Corporation Act will participate in the approval of an Interested Transaction. If an Interested Transaction will be ongoing, the Board may establish guidelines for the Company’s management to follow in its dealings with the Related Party.

An “Interested Transaction” as defined in the policy is any transaction, arrangement or relationship (or series of similar transactions, arrangements or relationships) in which (i) the amount involved exceeds $120,000 in any fiscal year, (ii) the Company is a participant, and (iii) any Related Party has or will have a direct or indirect interest (other than solely as a result of being a director or a less than 10 percent beneficial owner of another entity), but does not include any salary or compensation paid by the Company to a director or for the employment of an executive officer that is required to be reported in the Company’s proxy statement (or that would have been so reported if the executive officer was a “named executive officer” as that term is defined in the rules of the Securities and Exchange Commission).

A “Related Party” as defined in the policy is any (i) person who is or was since the beginning of the last fiscal year an executive officer, director or nominee for election as a director of the Company, (ii) beneficial owner of more than five percent of the Company’s common stock, or (iii) immediate family member of any of the foregoing.

An “immediate family member” as defined in the policy is any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the person in question and any person (other than a tenant or employee) sharing the household of the person in question.

There are no Interested Transactions or related party transactions or relationships required to be reported in this Proxy Statement under Item 404 of the SEC’s Regulation S-K.

12 Darden Restaurants, Inc.

Director Election Governance Practices

We do not have a “classified board” or other system where directors’ terms are staggered; instead, our full Board is elected annually. The Company’s Bylaws provide that in an uncontested election, each director will be elected by a majority of the votes cast; provided that, if the election is contested, the directors will be elected by a plurality of the votes cast. In an uncontested election, if a nominee for director who is a director at the time of election does not receive the vote of at least the majority of the votes cast at any meeting for the election of directors at which a quorum is present, the director will promptly tender his or her resignation to the Board and remain a director until the Board appoints an individual to fill the office held by such director.

The Nominating and Governance Committee will recommend to the Board whether to accept or reject the tendered resignation or whether other action should be taken. The Board is required to act on the tendered resignation, taking into account the Nominating and Governance Committee’s recommendation, and publicly disclose (by a press release, a filing with the SEC or other broadly disseminated means of communication) its decision and the rationale within 90 days from the date of certification of the election results. If a director’s resignation is not accepted by the Board, such director will continue to serve until his or her successor is duly elected, or his or her earlier resignation or removal. If a director’s resignation is accepted by the Board, then the Board, in its sole discretion, may fill the vacancy or decrease the size of the Board. To be eligible to be a nominee for election or reelection as a director of the Company, a person must deliver to our Corporate Secretary a written agreement that he or she will abide by these requirements.

Under our Bylaws, the Board will consist of not less than three nor more than fifteen members as determined from time to time by resolution of the Board. The Board currently consists of nine members, all of whom have agreed to stand for re-election at the 2024 Annual Meeting.

Board Leadership Structure

Our Board believes that it is important to retain the flexibility to allocate the responsibilities of the Chair and the CEO in a way that it considers to be in the best interests of the Company and our shareholders. The Company’s Corporate Governance Guidelines provide that the positions of Chair of the Board and CEO may, in the judgment of the Board, be combined, and if the Chair position is held by the CEO or another non-independent director, then the independent directors will choose a Lead Independent Director from among the independent directors. The Board believes that the decision as to whether the same person should serve in the roles of Chair and CEO should be made by the Board, from time to time, in its business judgment after considering the relevant factors, including the specific needs of the business and the best interests of the shareholders.

The Board believes that separating the roles of CEO and Chair is the proper structure for our Company at this time. As the final step in our recent leadership transition, in September 2023 our previous Executive Chairman, Eugene I. Lee, Jr. retired from the Board and the Board elected Ms. Jamison, an independent director, to serve as Chair of the Board. As Chair, Ms. Jamison brings governance experience, including service as an independent chair of other public company boards, deep knowledge of our financial reporting and risk oversight process from serving as the Chair of our Audit Committee for 8 years, as well as independent oversight and expertise from outside the Company and industry. Our President and CEO, Mr. Cardenas, brings a long history of Company management experience in areas including finance, operations, strategy and prior service as Chief Financial Officer of the Company.

The Company’s Corporate Governance Guidelines provide that the Chair will preside at meetings of the Board, except that when the Chair and CEO roles are combined, the Lead Independent Director

2024 Proxy Statement 13

will preside at the Board’s executive sessions of independent directors. The Chair or, when the Chair and CEO roles are combined, the Lead Independent Director approves Board meeting agendas, including approving meeting schedules to assure that there is sufficient time for discussion of all agenda items, and other information sent to the Board, advises the committee chairs with respect to agendas and information needs relating to committee meetings, serves as liaison between the CEO and the independent directors, has the authority to call meetings of the independent directors as he or she deems appropriate and is available for consultation and direct communications if requested by major shareholders. The Chair and the Lead Independent Director, as applicable, will perform other duties as the Board may from time to time delegate to assist the Board in fulfilling its responsibilities. The independent directors may meet without management present at any other times as determined by the Chair or, when the Chair and CEO roles are combined, the Lead Independent Director.

Succession Planning

The Board is actively engaged and involved in talent management. The Board reviews the Company’s people strategy in support of its business strategy at least annually. This includes a detailed discussion of the Company’s leadership bench and succession plans with a focus on key positions at the senior leadership level. Annually, the CEO provides the Board with an assessment of senior executives and their potential to succeed him, and an assessment of persons considered successors to senior executives. The Nominating and Governance Committee also recommends policies regarding succession in the event of an emergency impacting the CEO or the planned retirement of the CEO. Strong potential leaders are given exposure and visibility to Board members through formal presentations and informal events. More broadly, the Board reviews and evaluates human capital metrics, strategic objectives and other initiatives with respect to the overall workforce, including diversity, recruiting and development programs.

Director Education

To foster our value of always learning – always teaching, the Corporate Governance Guidelines encourage director education. Upon initial election to the Board of Directors, the Company’s management conducts an orientation program of materials and briefing sessions to educate new directors about the Company’s business and other topics to assist them in carrying out their duties. Directors may also attend a variety of external continuing education programs of their own selection at the Company’s expense. In addition, the Board receives regular updates from management and external experts regarding new developments in corporate governance, legal developments or other appropriate topics from time to time.

14 Darden Restaurants, Inc.

Board Role in Oversight of Risk Management

Full Board The ultimate responsibility for risk oversight rests with the Board. The Board assesses major risks facing the Company and reviews options for their mitigation. Each Committee of the Board reviews the policies and practices developed and implemented by management to assess and manage risks relevant to the Committee’s responsibilities, and reports to the full Board on the results of its discussions. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit |

|

Compensation |

|

|

Finance |

|

Nominating and Governance Committee |

||||

Oversees the Company’s financial reporting processes and internal controls, including the process for assessing risk of fraudulent financial reporting and significant financial risk exposures, and the steps management has taken to monitor, mitigate and report those exposures. In addition to its other duties, the Audit Committee oversees the Company’s policies and procedures regarding compliance with applicable laws and regulations and the Company’s Codes of Business Conduct and Ethics. The Audit Committee also oversees and discusses with management the Company’s enterprise risk management (ERM) process and the comprehensive assessment of key strategic financial, operational and regulatory risks identified by management, including cybersecurity and data protection risks. The Audit Committee discusses ERM with the full Board, which is ultimately responsible for oversight of this process. |

|

Provides oversight of the risks associated with the Compensation Committee responsibilities in its charter; reviews the Company’s incentive and other compensation arrangements to confirm that compensation does not encourage unnecessary or excessive risk taking and reviews and discusses, at least annually, the relationship between risk management policies and practices, corporate strategy and executive compensation; and discusses with the Company’s management the results of its review and any disclosures required by Item 402(s) of Regulation S-K relating to the Company’s compensation risk management. |

|

|

Oversees the Company’s major financial risk exposures and management’s monitoring, mitigation activities and policies in connection with financial risk, including: capital structure; investment portfolio, including employee benefit plan investments; financing arrangements, credit and liquidity; proposed major transactions, such as mergers, acquisitions, reorganizations and divestitures; share repurchase programs; hedging or use of derivatives; commodity risk management; cash investment; liquidity management; short-term borrowing programs; interest rate risk; foreign exchange risk; off balance sheet arrangements, if any; proposed material financially-related amendments to the Company’s indentures, bank borrowings and other instruments; and reputational risk to the extent such risk arises from the topics under discussion. The Finance Committee also reviews the adequacy of the insurance coverage on the Company’s assets. |

|

Oversees risks related to the Company’s corporate governance; director succession planning; political and charitable contributions; insider trading; climate, environmental and social responsibility; and reputational risk to the extent such risk arises from the topics under discussion. |

||||

2024 Proxy Statement 15

Compliance and Ethics Office and Codes of Business Conduct and Ethics

Our Compliance and Ethics Office (Compliance Office), with the support of our management and Board, aims to ensure that all of our employees, business partners, franchisees and suppliers adhere to high ethical business standards, and is under the direction of our Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary. At the core of the Compliance Office is Darden’s Code of Conduct that applies to all Company employees (Employee Code of Conduct). We also have a Code of Ethics for CEO and Senior Financial Officers (CEO and Senior Financial Officer Code of Ethics) that highlights specific responsibilities of our CEO and senior financial officers, and a Code of Business Conduct and Ethics for Members of the Board of Directors (the Board Code of Conduct, and together with the Employee Code of Conduct and the CEO and Senior Financial Officer Code of Ethics, our Codes of Business Conduct and Ethics). A major objective of the Compliance Office is to educate and raise awareness of our Employee Code of Conduct, applicable regulations, and related policies. Our Codes of Business Conduct and Ethics are posted on our website at www.darden.com under Investors — Governance. We require all of our officers, director-level employees, and certain other employees to complete an annual training course and certification regarding compliance with the Employee Code of Conduct and other Company policies. Any amendment to, or waiver of, the Codes of Business Conduct and Ethics as they relate to a member of the Board of Directors, the CEO, the Chief Financial Officer, any senior financial officer or any executive officer listed in the “Stock Ownership of Management” section of this Proxy Statement will be disclosed promptly by posting such amendment or waiver on our website at www.darden.com under Investors — Governance.

We promote ethical behavior by encouraging our employees to talk to supervisors or other personnel when in doubt about the best course of action in a particular situation. To encourage employees to raise questions and report possible violations of laws or our Codes of Business Conduct and Ethics, we will not allow retaliation for reports made in good faith. We also provide a confidential hotline to allow employees to confidentially and anonymously report concerns regarding questionable accounting behavior. We are also committed to promoting compliance and ethical behavior by the third parties with whom we conduct business and have implemented Codes of Business Conduct that are acknowledged by our international franchisees and certain suppliers.

16 Darden Restaurants, Inc.

Executive Officers of the Registrant

Our executive officers as of the date of this Proxy Statement are listed below.

|

|

|

Ricardo Cardenas, age 56

|

|

Our President and Chief Executive Officer since May 2022. Prior to that, Mr. Cardenas served as our President and Chief Operating Officer from January 2021 to May 2022 and Senior Vice President, Chief Financial Officer from March 2016 to January 2021. He was Senior Vice President, Chief Strategy Officer of the Company from September 2015 to March 2016, prior to which he served as Senior Vice President, Finance, Strategy and Technology from 2014 to 2015. He was Executive Vice President of Operations for LongHorn Steakhouse from 2013 to 2014 and Senior Vice President of Operations for LongHorn Steakhouse’s Philadelphia Division from 2012 to 2013. He served as Senior Vice President of Finance for Red Lobster, which the Company previously owned, from 2010 to 2012. Mr. Cardenas originally joined the Company in 1984 as an hourly employee and served in various positions of increasing responsibility, including Vice President of Finance for Olive Garden, prior to the positions described above. |

|

|

|

|

|

|

Matthew R. Broad, age 64

|

|

Our Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary since 2015. Prior to joining Darden, he served as Executive Vice President, General Counsel and Chief Compliance Officer for OfficeMax, Incorporated from 2004 to 2013. Prior to that, he was Associate General Counsel with Boise Cascade Corporation from 1989 to 2004. |

|

|

|

|

|

|

Todd A. Burrowes, age 61

|

|

Our President of Business Development since May 2024. He served as President, LongHorn Steakhouse from 2015 to 2024. He rejoined the Company after serving as President, Ruby Tuesday Concept and Chief Operations Officer of Ruby Tuesday, Inc. from 2013 to 2015. Prior to that, he served as Executive Vice President of Operations for LongHorn Steakhouse from 2008 until 2013. He joined the Company in 2002 as Regional Manager of LongHorn Steakhouse before being promoted to Director of Management Training. In 2004, he was promoted to Regional Vice President of Operations for LongHorn Steakhouse. |

|

|

|

|

|

|

Susan M. Connelly, age 53

|

|

Our Senior Vice President, Chief Communications and Public Affairs Officer since 2019. She served as Senior Vice President, Communications and Corporate Affairs from 2015 to 2019. She joined the Company in 2007 as Director, State and Local Government Relations and was promoted to Vice President, Government Relations in 2014. |

|

|

|

|

|

|

2024 Proxy Statement 17

|

|

|

Daniel J. Kiernan, age 63

|

|

Our President, Olive Garden since 2018, prior to which he was our Executive Vice President of Operations for Olive Garden from 2011 to 2018. He began his career with Olive Garden in 1992 as a Manager in Training and has held a series of roles of increasing responsibility with Olive Garden, serving as a General Manager from 1993 to 1994, as Director of Operations from 1994 to 2002, as Senior Vice President of the Chicago Division from 2002 to 2008 and as Senior Vice President, Operations Excellence from 2008 to 2011. |

|

|

|

|

|

|

Sarah H. King, age 54

|

|

Our Senior Vice President, Chief People and Diversity Officer since May 2021, prior to which she served as Senior Vice President, Chief Human Resources Officer from September 2017 to May 2021. Prior to joining Darden, Sarah spent 19 years with Wyndham Worldwide Corporation in various human resources leadership positions worldwide. Most recently, from 2010 through 2017, she served as Executive Vice President, Human Resources for Wyndham Vacation Ownership. |

|

|

|

|

|

|

John W. Madonna, age 48

|

|

Our Senior Vice President, Corporate Controller since 2016, prior to which he served as our Senior Vice President, Accounting beginning in 2015. Prior to that, he was a Director in Corporate Reporting from 2010 through 2013 when he was promoted to Senior Director, Corporate Reporting and then to Vice President of Corporate Reporting in 2014. He joined the Company in 2005 as Manager, Corporate Reporting and moved to the LongHorn Steakhouse team in 2009 as Manager, Financial Planning & Analysis. |

|

|

|

|

|

|

M. John Martin, age 64

|

|

Our President, Specialty Restaurant Group, which includes The Capital Grille and Eddie V’s as well as Seasons 52, Bahama Breeze and Yard House, since August 2020. Prior to that, he was President of The Capital Grille beginning in 2004, additionally was President of Eddie V’s beginning in 2014 and President of Seasons 52 beginning in 2018. He joined The Capital Grille in 1990 and held several positions of increasing responsibility before being promoted to Vice President of Operations in 2001. |

|

|

|

|

|

|

Douglas J. Milanes, age 61

|

|

Our Senior Vice President, Chief Supply Chain Officer since 2015, prior to which he served as Senior Vice President, Purchasing from 2013 to 2015. Prior to joining Darden, Doug served as Vice President, Global Procurement and Operations for Pfizer Inc. from 2008 to 2012 and as Chief Financial Officer for Pfizer’s Capsugel Division from 2005 to 2008. |

|

|

|

18 Darden Restaurants, Inc.

|

|

|

|

|

|

Rajesh Vennam, age 49

|

|

Our Senior Vice President, Chief Financial Officer since December 2022. Prior to that, he served as Senior Vice President, Chief Financial Officer and Treasurer from January 2021 to December 2022. He served as Senior Vice President, Corporate Finance and Treasurer of the Company from September 2020 to January 2021 and Senior Vice President, Finance and Analytics from May 2016 through September 2020. From November 2014 through May 2016, Mr. Vennam served as Vice President, Financial Planning and Analysis and Investor Relations for The Fresh Market, Inc., a specialty grocery retailer which during the period of Mr. Vennam’s service was publicly traded on the NASDAQ exchange. From 2013 to 2014, Mr. Vennam served in a variety of roles at Red Lobster, ultimately serving as Senior Vice President of Financial Planning & Analysis and Treasury of Red Lobster Hospitality, LLC, the entity to which the Company sold its Red Lobster restaurants in 2014. From 2010 through 2013, Mr. Vennam served as Director of Financial Planning & Analysis for LongHorn Steakhouse. Mr. Vennam joined the Company in 2003 and served in a variety of positions of increasing responsibility, including as a Manager of Treasury prior to the positions described above. |

|

|

|

|

|

|

Laura Williamson, age 55

|

|

Our President of LongHorn Steakhouse since May 2024. Prior to that, she served as Senior Vice President of Finance for Olive Garden from April 2023 to May 2024. She served as Senior Vice President, Finance for LongHorn Steakhouse from 2014 through 2023. Ms. Williamson began her career with Darden in 1997 as Supervisor of Sales Cash. Since then, she has held many positions of increasing responsibility in various areas of Accounting, Brand Finance and Enterprise Finance. Her experience includes eight years with Red Lobster at the Analyst, Sr. Analyst, Manager and Director levels, roles supporting Darden Restaurants as Director of Finance and Strategy, Director of Corporate Analysis and as Senior Director of Finance for Olive Garden. |

|

|

|

|

|

|

2024 Proxy Statement 19

PROPOSALS TO BE VOTED ON |

Proposal 1

Election of Nine Directors from the Named Director Nominees

Our Board of Directors currently has nine members, and each director stands for election every year. The Nominating and Governance Committee believes that a nine member Board of Directors is currently appropriate for Darden. In keeping with good governance practices, the Board will continue to seek a diversity of talent and experience to draw upon and to ensure its ability to appropriately staff the various committees of the Board. The Board also will continue to self-evaluate and to consider various matters as to its size. As appropriate, the Board may determine to increase or decrease its size, including in order to facilitate Board refreshment, succession planning and to accommodate the availability of an outstanding candidate.

The following nine director nominees are standing for election at this 2024 Annual Meeting of Shareholders to hold office until the 2025 Annual Meeting of Shareholders or until their successors are elected and qualified. All were nominated at the recommendation of our Nominating and Governance Committee and all have previously served on the Board. Each of the director nominees has consented to being named in this Proxy Statement and to serve as a director if elected. If a director nominee is not able to serve, proxies may be voted for a substitute nominated by the Board. However, we do not expect this to occur.

✓

|

Your Board recommends that you vote FOR each of the nominees to the Board.

|

20 Darden Restaurants, Inc.

Board Nominees

The following information is as of the date of this Proxy Statement. Included is information provided by each nominee, such as his or her age, all positions currently held, principal occupation and business experience for the past five years, and the names of other publicly-held companies of which he or she currently serves as a director or has served as a director during the past five years. In addition to the specific information presented below regarding the experience, qualifications, attributes and skills that led our Board to the conclusion that the nominee should serve as a director, we also believe that each of our director nominees has a reputation for integrity, honesty and adherence to high ethical standards. Darden’s mission is to be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere making every guest loyal. This mission is supported by our core values of integrity and fairness, respect and caring, inclusion and diversity, always learning – always teaching, being “of service,” teamwork and excellence. As noted in our Corporate Governance Guidelines, our directors should reflect these core values, possess the highest personal and professional ethics, and be committed to representing the long-term interests of our shareholders. They must also have an inquisitive and objective perspective, practical wisdom and mature judgment.

Board Summary

9 Nominees

Our Board’s composition reflects our core value of inclusion and diversity along many metrics of diversity, reflecting racial and ethnic diversity, gender diversity and a wide diversity of areas of expertise and experience, as reflected in the graphics below.

Independence |

Racial/Ethnic Diversity |

Gender Diversity |

Tenure |

|

|

|

|

|

|

|

|

2024 Proxy Statement 21

Board Nominee Experience and Expertise Matrix

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATIONAL AND FUNCTIONAL EXPERIENCE AND EXPERTISE |

|

|

|

|

|

|

|

|

|

Restaurant Industry |

|

l |

|

|

l |

l |

l |

l |

|

Retail or Hospitality Operations |

l |

l |

l |

l |

l |

l |

l |

l |

|

Consumer Marketing/Brand Building |

l |

|

l |

l |

|

l |

l |

|

|

Information Technology / Cybersecurity |

|

l |

|

l |

l |

|

l |

|

l |

Supply Chain/Logistics |

|

|

|

|

|

|

l |

l |

|

Real Estate Development |

|

|

|

|

|

|

l |

|

|

Franchising |

|

|

|

|

l |

l |

|

l |

|

Mergers and Acquisitions/Business Development |

l |

l |

|

l |

|

l |

l |

l |

l |

Corporate Governance |

l |

|

|

|

l |

|

|

l |

|

International Operations |

|

|

|

|

|

l |

l |

l |

|

Finance and Accounting |

l |

l |

|

l |

l |

|

|

l |

|

Human Resources / Human Capital Management |

|

|

l |

|

|

|

|

|

l |

Legal |

|

|

|

|

|

|

|

|

|

Public Policy |

|

|

|

|

|

|

|

|

|

Social and Environmental Responsibility |

|

|

|

|

|

|

|

|

|

l = Cornerstone element of career success |

= Meaningful involvement during career, including directorships |

22 Darden Restaurants, Inc.

Biographies

|

|

|

|

|

|

|

|

|

|

MARGARET SHÂN ATKINS Ms. Atkins is a retired consumer and retail executive. She was most recently Co-Founder and Managing Director of Chetrum Capital LLC, a private investment firm, a position she held from 2001 through 2017. Prior to founding Chetrum, she spent most of her executive career in the consumer/retail sector, including various positions with Sears, Roebuck & Co., a major North American retailer where she was promoted to Executive Vice President in 1999, and fourteen years with Bain & Company, an international management consultancy, where she was a leader in the global consumer and retail practice. She began her career as a public accountant at what is now PricewaterhouseCoopers LLP, a major accounting firm, and holds designations as a Chartered Professional Accountant and Chartered Accountant (Ontario) and as a Certified Public Accountant (Illinois). She also holds the highest level of certification as a professional director in both the USA (NACD.DC) and Canada (ICD.D). Current Public Directorships: • SpartanNash Company, a national grocery wholesaler/retailer and distributor of food products to the worldwide U.S. military commissary system, since 2003 Prior Public Board Service Within the Past Five Years: • Aurora Cannabis, Inc., one of the world’s largest and leading cannabis companies, from 2019 to 2023 • SunOpta, Inc., a North American manufacturer of natural and organic food products, from 2014 to 2019 • LSC Communications, Inc., a leading provider of long and short-run printing services to the book, catalog and magazine publishing industries, from 2016 to 2021 Qualifications: The Nominating and Governance Committee concluded that Ms. Atkins is qualified and should serve, in part, because of her retail industry, operations, strategic planning and financial expertise, and public-company director experience. |

|

|

Age 67 |

Tenure 9 |

|

|

|

|

Independent Director Director since 2014 Darden Committees: · Audit (Chair) · Nominating and Governance |

|

|

||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RICARDO (RICK) CARDENAS Mr. Cardenas was named President and Chief Executive Officer and elected to the Board of Directors effective May 2022. Prior to that, Mr. Cardenas served as our President and Chief Operating Officer from January 2021 to May 2022 and Senior Vice President, Chief Financial Officer from March 2016 to January 2021. He was Senior Vice President, Chief Strategy Officer of the Company from September 2015 to March 2016, prior to which he served as Senior Vice President, Finance, Strategy and Technology from 2014 to 2015. He was Executive Vice President of Operations for LongHorn Steakhouse from 2013 to 2014 and Senior Vice President of Operations for LongHorn Steakhouse’s Philadelphia Division from 2012 to 2013. He served as Senior Vice President of Finance for Red Lobster, which the Company previously owned, from 2010 to 2012. Mr. Cardenas originally joined the Company in 1984 as an hourly employee and served in various positions of increasing responsibility, including Vice President of Finance for Olive Garden, prior to the positions described above. Current Public Directorships: • Tractor Supply Company, an operator of retail farm and ranch stores, since 2019 Prior Public Board Service Within the Past Five Years: None Qualifications: The Nominating and Governance Committee concluded that Mr. Cardenas is qualified and should serve, in part, because of his extensive senior management and leadership experience with our Company. |

|

|

Age 56 |

Tenure 2.5 |

|

|

|

|

President and Chief Executive Officer Director since 2022 Darden Committees: · None |

|

|

||

|

|

|

|||

|

|

|

|

|

|

2024 Proxy Statement 23

|

|

|

|

||

|

|

|

JULIANA L. CHUGG

Ms. Chugg is the retired Executive Vice President and Chief Brand Officer of Mattel, Inc. a leading global toy company and owner of a portfolio of children’s and family entertainment franchises, a position she held from 2015 through 2018. Prior to that, she served as Partner of Noble Endeavors LLC during 2015. Ms. Chugg has also served in various leadership roles at General Mills, Inc. and its predecessor Pillsbury from 1996 through 2014, including serving as Senior Vice President of General Mills, Inc. and President of the Meals division from 2010 through 2014.

Current Public Directorships:

• VF Corporation, one of the world’s largest apparel, footwear and accessories companies, since 2009 • MasterBrand Inc., the largest residential cabinet manufacturer in North America, since 2022

Prior Public Board Service Within the Past Five Years:

• Kontoor Brands, Inc., a global lifestyle apparel company, from 2019 through 2021 • Caesars Entertainment Corporation, a global leader in gaming and hospitality, from 2018 through 2020

Qualifications:

The Nominating and Governance Committee concluded that Ms. Chugg is qualified and should serve, in part, because of her retail and food industry brand management, marketing, operations and strategic planning expertise, and public-company director experience. |

||

|

Age 56 |

Tenure 2.5 |

|

|

|

|

Independent Director Director since 2022 Darden Committees: · Audit · Nominating and Governance |

|

|

||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JAMES P. FOGARTY

Mr. Fogarty has been the CEO at FULLBEAUTY Brands, Inc., a privately-held branded multi-channel retailer focused on fashion apparel and home goods for plus-sized women and men, since June 2019. Previously, he was the CEO and a director of Orchard Brands, a multi-channel marketer of apparel and home products, from 2011 until its sale in 2015, at which time he became a Senior Advisor to Bluestem Group Inc., the acquirer of Orchard Brands, through 2015. Prior to that, Mr. Fogarty was a private investor from 2010 to 2011. From 2009 until 2010, Mr. Fogarty was President, CEO and director of Charming Shoppes, Inc., a multi-brand, specialty apparel retailer. Other prior executive positions held by Mr. Fogarty include Managing Director of Alvarez & Marsal, an independent global professional services firm, from 1994 until 2009, President and COO of Lehman Brothers Holdings (subsequent to its Chapter 11 bankruptcy filing) from 2008 until 2009, President and CEO of American Italian Pasta Company, the largest producer of dry pasta in North America, from 2005 through 2008, CFO of Levi Strauss & Co., a brand-name apparel company, from 2003 until 2005, and from 2001 through 2003, he served as Senior Vice President and CFO and for a period as a director of The Warnaco Group, a global apparel maker.

Current Public Directorships:

None

Prior Public Board Service Within the Past Five Years: • Assertio Therapeutics, Inc. (formerly known as Depomed Inc.), a specialty pharmaceutical company, Chairman of the Board from 2016 to 2020 through its merger with Zyla Life Sciences

Qualifications: The Nominating and Governance Committee concluded that Mr. Fogarty is qualified and should serve, in part, because of his operational and turnaround experience, and his significant executive officer and director experience at a variety of public and private companies. |

||

|

Age 56 |

Tenure 10 |

|

|

|

|

Independent Director Director since 2014 Darden Committees: · Finance · Nominating and Governance |

|

|

||

|

|

|

|||

24 Darden Restaurants, Inc.

|

|

|

|

|

|

|

|

|

CYNTHIA T. JAMISON Ms. Jamison is a retired turnaround CFO. She most recently served as CFO of AquaSpy, Inc. from 2010 to 2013. Prior to AquaSpy she held six other CFO and/or COO roles in both public and private companies as a Partner with Tatum, LLC, an executive services firm focusing exclusively on providing interim CFO Services to public and private equity companies. She also led the CFO Practice at Tatum for four years where she had responsibility for over 300 CFO Partners and sat on the firm’s Operating Committee. Prior to joining Tatum, she served as CFO of Chart House Enterprises, a publicly traded restaurant company, from 1998-1999 and previously held various executive positions at Allied Domecq Retailing USA, Kraft General Foods, and Arthur Andersen. She holds the designation of Certified Public Accountant (Illinois); in addition, she is an NACD Fellow and a frequent faculty member at NACD Master Classes. She recently completed a four year appointment to the Financial Accounting Standards Advisory Council (FASAC), an Advisory Board to FASB. Current Public Directorships: • The ODP Corporation, parent of Office Depot, Inc., a global supplier of office products and services, since 2013 • Big Lots, Inc. (Non-Executive Chairman), a discount retailer, since 2015 Prior Public Board Service Within the Past Five Years: • Tractor Supply Company, an operator of retail farm and ranch stores, from 2002 to 2023 Qualifications: The Nominating and Governance Committee concluded that Ms. Jamison is qualified and should serve, in part, because of her status as a financial expert and experienced audit committee member and chair, as well as her senior management, leadership, financial and strategic planning, corporate governance and public company executive compensation experience. |

||

|

Age 64 |

Tenure 10 |

|

|

|

|

Chair of the Board Independent Director Director since 2014 Darden Committees: · None |

|

|

||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NANA MENSAH Mr. Mensah has been the Chairman and Chief Executive Officer of ‘XPORTS, Inc., a privately held company that exports food packaging and food processing equipment to distributors and wholesalers outside of the United States, since 2005, and previously served as Chief Executive Officer during 2003 and from 2000 through 2002. He has extensive experience as a restaurant operations executive including serving as the Chief Operating Officer of Church’s Chicken, a division of AFC Enterprises, Inc. and one of the world’s largest quick-service restaurant chains, from 2003 to 2004, and as President and Chief Operating Officer of Long John Silver’s Restaurants, Inc., the world’s largest chain of seafood quick-service restaurants, from 1997 until it was sold in 1999. Additionally, Mr. Mensah has served as President, U.S. Tax Services of H&R Block Inc., a tax, mortgage and financial services company, from January 2003 until March 2003. Current Public Directorships: None Prior Public Board Service Within the Past Five Years: None Qualifications: The Nominating and Governance Committee concluded that Mr. Mensah is qualified and should serve, in part, because of his extensive experience in the restaurant industry, including operating, turnaround, international and mergers and acquisitions and his experience as a public company director. |

||

|

Age 72 |

Tenure 8 |

|

|

|

|

Independent Director Director since 2016 Darden Committees: · Compensation (Chair) · Finance |

|

|

||

|

|

|

|||

|

|

|

|

|

|

2024 Proxy Statement 25

|

|

|

|

|

|

|

|

|