UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM | |||||

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended July 2, 2021

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Commission File Number: 000-30235

| ||

| (Exact name of registrant as specified in its charter) | ||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | ||||

(650 ) 837-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days). Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||||||||

| Emerging growth company | |||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

As of July 26, 2021, there were 315,048,788 shares of the registrant’s common stock outstanding.

EXELIXIS, INC.

QUARTERLY REPORT ON FORM 10-Q

INDEX

| Page | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

EXELIXIS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

(unaudited)

| June 30, 2021 | December 31, 2020 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Short-term investments | |||||||||||

| Trade receivables, net | |||||||||||

| Inventory | |||||||||||

| Prepaid expenses and other current assets | |||||||||||

| Total current assets | |||||||||||

| Long-term investments | |||||||||||

| Property and equipment, net | |||||||||||

| Deferred tax assets, net | |||||||||||

| Goodwill | |||||||||||

| Other long-term assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued compensation and benefits | |||||||||||

| Accrued clinical trial liabilities | |||||||||||

| Rebates and fees due to customers | |||||||||||

| Accrued collaboration liabilities | |||||||||||

| Other current liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Long-term portion of deferred revenues | |||||||||||

| Long-term portion of operating lease liabilities | |||||||||||

| Other long-term liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies | |||||||||||

| Stockholders’ equity: | |||||||||||

Preferred stock, $ | |||||||||||

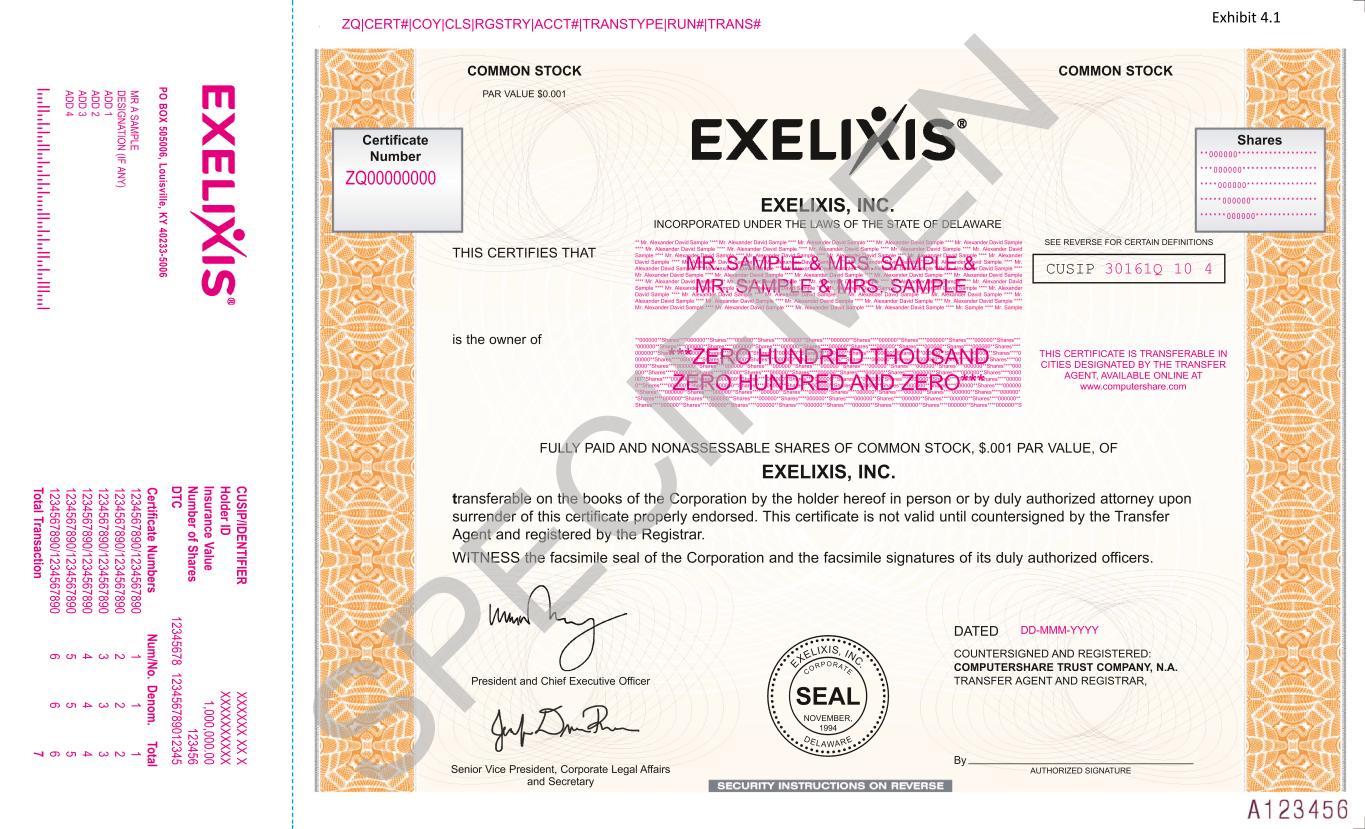

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive income | |||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

3

EXELIXIS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Net product revenues | $ | $ | $ | $ | |||||||||||||||||||

| License revenues | |||||||||||||||||||||||

| Collaboration services revenues | |||||||||||||||||||||||

| Total revenues | |||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Cost of goods sold | |||||||||||||||||||||||

| Research and development | |||||||||||||||||||||||

| Selling, general and administrative | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| Income from operations | |||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||

| Other income (expense), net | ( | ( | |||||||||||||||||||||

| Income before income taxes | |||||||||||||||||||||||

| Provision for income taxes | |||||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Net income per share: | |||||||||||||||||||||||

| Basic | $ | $ | $ | $ | |||||||||||||||||||

| Diluted | $ | $ | $ | $ | |||||||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

EXELIXIS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||

Net unrealized gains (losses) on available-for-sale debt securities, net of tax impact of ($ | ( | ( | |||||||||||||||||||||

| Comprehensive income | $ | $ | $ | $ | |||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

4

EXELIXIS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands)

(unaudited)

| Three Months Ended June 30, 2021 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

Balance at March 31, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Issuance of common stock under equity incentive and stock purchase plans | — | — | |||||||||||||||||||||||||||||||||

| Stock transactions associated with taxes withheld on equity awards | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

Balance at June 30, 2021 | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||

| Three Months Ended June 30, 2020 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Income (Loss) | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

Balance at March 31, 2020 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | |||||||||||||||||||||||||||||||

| Issuance of common stock under equity incentive and stock purchase plans | — | — | |||||||||||||||||||||||||||||||||

| Stock transactions associated with taxes withheld on equity awards | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

Balance at June 30, 2020 | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||

Continued on next page

5

EXELIXIS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY - Continued

(in thousands)

(unaudited)

| Six Months Ended June 30, 2021 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

Balance at December 31, 2020 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Issuance of common stock under equity incentive and stock purchase plans | — | — | |||||||||||||||||||||||||||||||||

| Stock transactions associated with taxes withheld on equity awards | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

Balance at June 30, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Six Months Ended June 30, 2020 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

Balance at December 31, 2019 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||

Other comprehensive income | — | — | — | — | |||||||||||||||||||||||||||||||

| Issuance of common stock under equity incentive and stock purchase plans | — | — | |||||||||||||||||||||||||||||||||

| Stock transactions associated with taxes withheld on equity awards | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

Balance at June 30, 2020 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

6

EXELIXIS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| Six Months Ended June 30, | |||||||||||

| 2021 | 2020 | ||||||||||

| Net income | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation | |||||||||||

| Stock-based compensation | |||||||||||

| Non-cash lease expense | |||||||||||

| Deferred taxes | |||||||||||

| Other, net | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Trade receivables, net | ( | ( | |||||||||

| Inventory | ( | ( | |||||||||

| Prepaid expenses and other assets | ( | ( | |||||||||

| Deferred revenue | |||||||||||

| Accounts payable and other liabilities | |||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of property, equipment and other | ( | ( | |||||||||

| Purchases of investments | ( | ( | |||||||||

| Proceeds from maturities and sales of investments | |||||||||||

| Net cash (used in) provided by investing activities | ( | ||||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from issuance of common stock under equity incentive plans | |||||||||||

| Taxes paid related to net share settlement of equity awards | ( | ( | |||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Net increase in cash, cash equivalents and restricted cash equivalents | |||||||||||

| Cash, cash equivalents and restricted cash equivalents at beginning of period | |||||||||||

| Cash, cash equivalents and restricted cash equivalents at end of period | $ | $ | |||||||||

| Supplemental cash flow disclosures: | |||||||||||

| Non-cash operating activities: | |||||||||||

| Right-of-use assets obtained in exchange for lease obligations | $ | $ | |||||||||

| Non-cash investing activities: | |||||||||||

| Unpaid liabilities incurred for purchases of property and equipment | $ | $ | |||||||||

| Unpaid liabilities incurred in asset acquisition | $ | $ | |||||||||

| Unpaid liabilities incurred for unsettled investment purchases | $ | $ | |||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

7

EXELIXIS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

Exelixis, Inc. (Exelixis, we, our or us) is an oncology-focused biotechnology company that strives to accelerate the discovery, development and commercialization of new medicines for difficult-to-treat cancers. We have invented and brought to market novel, effective and tolerable therapies using our drug discovery and development resources and capabilities and commercialization platform; we will continue to build on this foundation, working toward providing cancer patients with additional treatment options.

Since we were founded in 1994, four products resulting from our discovery efforts have progressed through clinical development, received regulatory approval and established a commercial presence in various geographies around the world. Our flagship molecule, cabozantinib, is an inhibitor of multiple tyrosine kinases including MET, AXL, VEGF receptors and RET and has been approved by the U.S. Food and Drug Administration (FDA) and foreign regulatory authorities as two products: CABOMETYX® (cabozantinib) tablets approved for advanced renal cell carcinoma (RCC), both alone and in combination with Bristol Myers Squibb Company’s OPDIVO® (nivolumab), and for previously treated hepatocellular carcinoma (HCC); and COMETRIQ® (cabozantinib) capsules approved for progressive, metastatic medullary thyroid cancer (MTC). For these types of cancer, cabozantinib has become or is becoming a standard of care.

The other two products resulting from our discovery efforts are: COTELLIC® (cobimetinib), an inhibitor of MEK, approved as part of multiple combination regimens to treat specific forms of advanced melanoma and marketed under a collaboration with Genentech, Inc. (a member of the Roche Group) (Genentech); and MINNEBRO® (esaxerenone), an oral, non-steroidal, selective blocker of the mineralocorticoid receptor, approved for the treatment of hypertension in Japan and licensed to Daiichi Sankyo Company, Limited (Daiichi Sankyo).

Leveraging the revenue stream derived from our cabozantinib franchise and other marketed products, we are expanding our oncology product pipeline through drug discovery efforts, which encompass both small molecule and biologics programs with multiple modalities and mechanisms of action.

Basis of Presentation

Segment Information

We operate in one business segment that focuses on the discovery, development and commercialization of new medicines for difficult-to-treat cancers. Our Chief Executive Officer, as the chief operating decision-maker, manages and

8

All of our long-lived assets are located in the U.S. See “Note 2. Revenues” for enterprise-wide disclosures about product sales, revenues from major customers and revenues by geographic region.

Use of Estimates

The preparation of the accompanying Condensed Consolidated Financial Statements conforms to accounting principles generally accepted in the U.S., which requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities, equity, revenues and expenses, and related disclosures. On an ongoing basis, we evaluate our significant estimates. We base our estimates on historical experience and on various other market-specific and other relevant assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results could differ materially from those estimates.

Significant Accounting Policies

Except for the foreign currency forward contracts for non-designated hedges, there have been no material changes to our significant accounting policies during the six months ended June 30, 2021, as compared to the significant accounting policies disclosed in Note 1 – Significant Accounting Policies included in our Annual Report on Form 10-K for the year ended December 31, 2020.

Foreign Currency Forward Contracts for Non-Designated Hedges

We may use forward foreign currency exchange contracts (forward contracts) to hedge certain operational exposures resulting from potential changes in foreign currency exchange rates. Our strategy is to enter into forward contracts so that increases or decreases in our foreign currency exposures are offset by gains or losses on the foreign currency forward contracts thereby mitigating the risks and volatility associated with our foreign currency transactions. We do not apply hedge accounting treatment to these non-designated hedging instruments. We do not hold or issue derivative instruments for trading or speculative purposes.

Our forward contracts are generally short-term in duration. Given the short duration of the forward contracts, amounts recorded generally are not significant. We account for our derivative instruments as either assets or liabilities on our Condensed Consolidated Balance Sheets and measure them at fair value. Derivatives not designated as hedging instruments are adjusted to fair value through earnings in other income (expense), net in the Condensed Consolidated Statements of Income.

Recently Adopted Accounting Pronouncements

On January 1, 2021, we adopted the Accounting Standards Board’s (FASB) Accounting Standards Update (ASU) 2019-12, Income Taxes (Topic 740)-Simplifying the Accounting for Income Taxes (ASU 2019-12). ASU 2019-12 simplifies the accounting for income taxes by removing certain exceptions to the general principles in Accounting Standards Codification (ASC) Topic 740, Income Taxes and clarifying and amending existing guidance. Our adoption of ASU 2019-12 did not have a significant impact on the accompanying Condensed Consolidated Financial Statements.

Recent Accounting Pronouncements Not Yet Adopted

There were no new accounting pronouncements issued since our filing of the Annual Report on Form 10-K for the year ended December 31, 2020, which could have a significant effect on our condensed consolidated financial statements.

9

NOTE 2. REVENUES

Revenues consisted of the following (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Product revenues: | |||||||||||||||||||||||

| Gross product revenues | $ | $ | $ | $ | |||||||||||||||||||

| Discounts and allowances | ( | ( | ( | ( | |||||||||||||||||||

| Net product revenues | |||||||||||||||||||||||

| Collaboration revenues: | |||||||||||||||||||||||

| License revenues | |||||||||||||||||||||||

| Collaboration services revenues | |||||||||||||||||||||||

| Total collaboration revenues | |||||||||||||||||||||||

| Total revenues | $ | $ | $ | $ | |||||||||||||||||||

The percentage of total revenues by customer who individually accounted for 10% or more of our total revenues were as follows:

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Ipsen Pharma SAS | % | % | % | % | |||||||||||||||||||

| Affiliates of McKesson Corporation | % | % | % | % | |||||||||||||||||||

| Affiliates of CVS Health Corporation | % | % | % | % | |||||||||||||||||||

| Affiliates of AmerisourceBergen Corporation | % | % | % | % | |||||||||||||||||||

| Affiliates of Optum Specialty Pharmacy | % | % | % | % | |||||||||||||||||||

| Accredo Health, Incorporated | % | % | % | % | |||||||||||||||||||

| Takeda Pharmaceutical Company Limited | % | % | % | % | |||||||||||||||||||

The percentage of trade receivables by customer who individually accounted for 10% or more of our trade receivables were as follows:

| June 30, 2021 | December 31, 2020 | ||||||||||

| Ipsen Pharma SAS | % | % | |||||||||

| Affiliates of McKesson Corporation | % | % | |||||||||

| Affiliates of AmerisourceBergen Corporation | % | % | |||||||||

| Affiliates of CVS Health Corporation | % | % | |||||||||

| Takeda Pharmaceutical Company Limited | % | % | |||||||||

Revenues by geographic region were as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| U.S. | $ | $ | $ | $ | |||||||||||||||||||

| Europe | |||||||||||||||||||||||

| Japan | |||||||||||||||||||||||

| Total revenues | $ | $ | $ | $ | |||||||||||||||||||

10

Total revenues include net product revenues attributed to geographic regions based on the ship-to location and license and collaboration services revenues attributed to geographic regions based on the location of our collaboration partners’ headquarters.

Net product revenues and license revenues are recorded in accordance with ASC Topic 606, Revenue from Contracts with Customers (Topic 606). License revenues include the recognition of the portion of milestones payments allocated to the transfer of intellectual property licenses for which it had become probable in the current period that the milestone would be achieved and a significant reversal of revenues would not occur, as well as royalty revenues and our share of profits under our collaboration agreement with Genentech. Collaboration services revenues were recorded in accordance with ASU 2018-18, Collaborative Arrangements (Topic 808): Clarifying the Interaction between Topic 808 and Topic 606 and by analogy to Topic 606. Collaboration services revenues include the recognition of deferred revenues for the portion of upfront and milestone payments allocated to our research and development services performance obligations, development cost reimbursements earned under our collaboration agreements, product supply revenues, net of product supply costs, and the royalties we paid on sales of products containing cabozantinib by our collaboration partners. We received notification that, effective January 1, 2021, Royalty Pharma plc (Royalty Pharma) acquired from GlaxoSmithKline (GSK) all rights, title and interest in royalties on net product sales containing cabozantinib for non-U.S. markets for the full term of the royalty and for the U.S. market through September 2026, after which time U.S. royalties will revert back to GSK.

Net product revenues by product were as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| CABOMETYX | $ | $ | $ | $ | |||||||||||||||||||

| COMETRIQ | |||||||||||||||||||||||

| Net product revenues | $ | $ | $ | $ | |||||||||||||||||||

Product Sales Discounts and Allowances

The activities and ending reserve balances for each significant category of discounts and allowances, which constitute variable consideration, were as follows (in thousands):

Chargebacks, Discounts for Prompt Payment and Other | Other Customer Credits/Fees and Co-pay Assistance | Rebates | Total | ||||||||||||||||||||

Balance at December 31, 2020 | $ | $ | $ | $ | |||||||||||||||||||

| Provision related to sales made in: | |||||||||||||||||||||||

| Current period | |||||||||||||||||||||||

| Prior periods | ( | ( | |||||||||||||||||||||

| Payments and customer credits issued | ( | ( | ( | ( | |||||||||||||||||||

Balance at June 30, 2021 | $ | $ | $ | $ | |||||||||||||||||||

The allowance for chargebacks, discounts for prompt payment and other are recorded as a reduction of trade receivables, net and the remaining reserves are recorded as rebates and fees due to customers in the accompanying Condensed Consolidated Balance Sheets.

Contract Assets and Liabilities

We receive payments from our collaboration partners based on billing schedules established in each contract. Amounts are recorded as accounts receivable when our right to consideration is unconditional. We may also recognize revenue in advance of the contractual billing schedule and such amounts are recorded as a contract asset when recognized. We may be required to defer recognition of revenue for upfront and milestone payments until we perform our obligations under these arrangements, and such amounts are recorded as deferred revenue upon receipt or when due. For those contracts that have multiple performance obligations, contract assets and liabilities are reported on a net basis at the contract level.

11

| June 30, 2021 | December 31, 2020 | ||||||||||

| Contract assets | |||||||||||

Current portion(1) | $ | $ | |||||||||

Long-term portion(1) | |||||||||||

| Total contract assets | $ | $ | |||||||||

| Contract liabilities: | |||||||||||

Current portion(2) | $ | $ | |||||||||

Long-term portion(2) | |||||||||||

| Total contract liabilities | $ | $ | |||||||||

____________________

(1) Presented in prepaid and other current assets and other long-term assets, respectively, on the accompanying Condensed Consolidated Balance Sheets.

Contract assets as of June 30, 2021 are primarily related to a $12.5 million development milestone that we deemed probable of achievement and recognized $11.8 million of revenues during the three months ended June 30, 2021. Contract liabilities as of June 30, 2021 are primarily related to deferred revenues from Takeda Pharmaceutical Company Limited (Takeda).

During the six months ended June 30, 2021 and 2020, we recognized $4.8 million and $3.4 million, respectively, in revenues that were included in the beginning deferred revenues balance for those periods.

During the three and six months ended June 30, 2021, we recognized $40.6 million and $67.8 million, respectively, in revenues for performance obligations satisfied in previous periods, as compared to $62.0 million and $82.2 million for the corresponding periods in 2020. Such revenues were primarily related to royalty payments allocated to the license performance obligations for our collaborations with Ipsen Pharma SAS (Ipsen), Takeda, Daiichi Sankyo and Genentech.

As of June 30, 2021, $86.9 million of the combined transaction prices for our Ipsen and Takeda collaborations were allocated to performance obligations that had not yet been satisfied. See “Note 3. Collaboration Agreements— Cabozantinib Collaborations - Performance Obligations and Transaction Prices for our Ipsen and Takeda Collaborations” to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2020 for information about the expected timing to satisfy these performance obligations.

NOTE 3. COLLABORATION AGREEMENTS, IN-LICENSING ARRANGEMENTS AND BUSINESS DEVELOPMENT ACTIVITIES

We have established multiple collaborations with leading pharmaceutical companies for the commercialization and further development of our cabozantinib franchise. Additionally, we have entered into several research collaborations and in-licensing arrangements to further enhance our early-stage pipeline and expand our ability to discover, develop and commercialize novel therapies with the goal of providing new treatment options for cancer patients and their physicians. We also entered into other collaborations with leading pharmaceutical companies for other compounds and programs in our portfolio.

See “Note 3. Collaboration Agreements” to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2020, or as further described below, for additional information on each of our collaboration agreements and in-licensing arrangements.

Cabozantinib Collaborations

Ipsen Collaboration

In February 2016, we entered into a collaboration agreement with Ipsen for the commercialization and further development of cabozantinib. Under the terms of the collaboration agreement, as amended, Ipsen received exclusive commercialization rights for current and potential future cabozantinib indications outside of the U.S. and Japan. We have

12

also agreed to collaborate with Ipsen on the development of cabozantinib for current and potential future indications. The parties’ efforts are governed through a joint steering committee and appropriate subcommittees established to guide and oversee the collaboration’s operation and strategic direction; provided, however, that we retain final decision-making authority with respect to cabozantinib’s ongoing development.

During the second quarter of 2021, Ipsen opted into and is now co-funding the development costs for COSMIC-311, our phase 3 pivotal trial evaluating cabozantinib versus placebo in patients with radioactive iodine differentiated thyroid cancer who have progressed after up to two VEGF receptor-targeted therapies. Under the terms of the Agreement, Ipsen is now obligated to reimburse us for their share of the COSMIC-311 global development costs, as well as an additional payment calculated as a percentage of such costs, triggered by the timing of the exercise of its option. We determined that the decision to opt into and co-fund the development costs for COSMIC-311 represented a contract modification for additional distinct services at their standalone selling price and therefore was treated as a separate contract under Topic 606. Accordingly, collaboration services revenues for the three and six months ended June 30, 2021, includes a cumulative catch up for Ipsen’s share of global development costs incurred since the beginning of the study and through the end of the period.

Revenues under the collaboration agreement with Ipsen were as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| License revenues | $ | $ | $ | $ | |||||||||||||||||||

| Collaboration services revenues | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

As of June 30, 2021, $46.2 million of the transaction price was allocated to our research and development services performance obligations that has not yet been satisfied.

Takeda Collaboration

In January 2017, we entered into a collaboration and license agreement with Takeda for the commercialization and further development of cabozantinib. Pursuant to this collaboration and license agreement, as amended, Takeda has exclusive commercialization rights for current and potential future cabozantinib indications in Japan, and the parties have agreed to collaborate on the clinical development of cabozantinib in Japan. The operation and strategic direction of the parties’ collaboration is governed through a joint executive committee and appropriate subcommittees.

Revenues under the collaboration agreement with Takeda were as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| License revenues | $ | $ | $ | $ | |||||||||||||||||||

| Collaboration services revenues | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

As of June 30, 2021, $40.7 million of the transaction price was allocated to our research and development services performance obligations that has not yet been satisfied.

GSK and Royalty Pharma

In October 2002, we established a product development and commercialization collaboration agreement with GSK, that required us to pay a 3 % royalty to GSK on the worldwide net sales of any product incorporating cabozantinib by us and our collaboration partners. As disclosed in Note 2, we received notification that, effective January 1, 2021, Royalty Pharma acquired from GSK all rights, title and interest in royalties on net product sales containing cabozantinib for non-U.S. markets for the full term of the royalty and for U.S. market through September 2026, after which time U.S. royalties will revert back to GSK. Royalties earned by GSK and Royalty Pharma in connection with our sales of cabozantinib are included in cost of goods sold and as a reduction of collaboration services revenues for sales by our collaboration partners. Such royalties were $12.1 million and $22.2 million during the three and six months ended June 30, 2021, respectively, as compared to $7.6 million and $15.7 million in the corresponding periods in 2020.

13

Genentech Collaboration

In December 2006, we out-licensed the development and commercialization of cobimetinib to Genentech under a worldwide collaboration agreement. In November 2015, the FDA approved cobimetinib, under the brand name COTELLIC, in combination with Genentech’s ZELBORAF® (vemurafenib) for the treatment of patients with BRAF V600E or V600K mutation-positive advanced melanoma. COTELLIC in combination with ZELBORAF has also been approved in the European Union and multiple additional countries for use in the same indication. In July 2020, the FDA also approved COTELLIC for use in combination with ZELBORAF and TECENTRIQ® (atezolizumab) for the treatment of patients with BRAF V600 mutation-positive advanced melanoma in previously untreated patients. License revenues under the collaboration agreement with Genentech were as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Profits on U.S. commercialization | $ | $ | $ | $ | |||||||||||||||||||

| Royalty revenues on ex-U.S. sales | $ | $ | $ | $ | |||||||||||||||||||

Research Collaborations, In-Licensing Arrangements and Other Business Development Activities

During the six months ended June 30, 2021, in support of our development pipeline, we entered into additional collaboration and in-licensing arrangements with Adagene, Inc. (Adagene) and WuXi Biologics Ireland Limited (WuXi Bio), and amended our existing collaboration agreement with StemSynergy Therapeutics, Inc. (StemSynergy). In conjunction with each of these arrangements we have made aggregate upfront payments totaling $17.0 million and will make payments for potential future development milestones of up to $58.5 million, regulatory milestones of up to $139.0 million and commercial milestones of up to $377.5 million, each in the aggregate per product, as well as royalties on future net product sales. Additionally, we entered into an asset purchase agreement with GamaMabs Pharma SA (GamaMabs), pursuant to which we made an upfront payment of $5.0 million for the initial technology transfer, and subject to certain conditions, will make a $9.0 million payment upon closing of the transaction. We will also make payments for potential future development milestones of up to $42.0 million and regulatory milestones of up to $22.5 million, per product.

NOTE 4. CASH AND INVESTMENTS

Cash, Cash Equivalents and Restricted Cash Equivalents

| June 30, 2021 | December 31, 2020 | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash equivalents included in other long-term assets | |||||||||||

| Cash, cash equivalents, and restricted cash equivalents as reported in the accompanying Condensed Consolidated Statements of Cash Flows | $ | $ | |||||||||

Restricted cash equivalents are used to collateralize letters of credit and consist of money-market funds and certificates of deposit with original maturities of 90 days or less. The restricted cash equivalents are classified as other long-term assets based upon the remaining term of the underlying restriction. As of June 30, 2021, restricted cash equivalents included $45.3 million of short-term investments, which is collateral under our January 2021 standby letter of credit to guarantee our obligation to fund a portion of the total tenant improvements related to our build-to-suit lease at our corporate campus. As we fund these tenant improvements, our restricted cash becomes available for operations.

14

Cash, Cash Equivalents, Restricted Cash Equivalents and Investments

Cash, cash equivalents, restricted cash equivalents and investments consisted of the following (in thousands):

| June 30, 2021 | |||||||||||||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||

| Debt securities available-for-sale: | |||||||||||||||||||||||

| Commercial paper | $ | $ | $ | $ | |||||||||||||||||||

| Corporate bonds | ( | ||||||||||||||||||||||

| U.S. Treasury and government-sponsored enterprises | ( | ||||||||||||||||||||||

| Municipal bonds | ( | ||||||||||||||||||||||

| Total debt securities available-for-sale | ( | ||||||||||||||||||||||

| Cash | |||||||||||||||||||||||

| Money market funds | |||||||||||||||||||||||

| Certificates of deposit | |||||||||||||||||||||||

| Total cash, cash equivalents, restricted cash equivalents and investments | $ | $ | $ | ( | $ | ||||||||||||||||||

| December 31, 2020 | |||||||||||||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||

| Debt securities available-for-sale: | |||||||||||||||||||||||

| Commercial paper | $ | $ | $ | $ | |||||||||||||||||||

| Corporate bonds | ( | ||||||||||||||||||||||

| U.S. Treasury and government-sponsored enterprises | ( | ||||||||||||||||||||||

| Municipal bonds | ( | ||||||||||||||||||||||

| Total debt securities available-for-sale | ( | ||||||||||||||||||||||

| Cash | |||||||||||||||||||||||

| Money market funds | |||||||||||||||||||||||

| Certificates of deposit | |||||||||||||||||||||||

Total cash, cash equivalents, restricted cash equivalents and investments | $ | $ | $ | ( | $ | ||||||||||||||||||

Interest receivable was $3.3 million and $4.5 million as of June 30, 2021 and December 31, 2020, respectively, and is included in prepaid expenses and other current assets in the accompanying Condensed Consolidated Balance Sheets.

Realized gains and losses on the sales of investments were insignificant during the three and six months ended June 30, 2021 and 2020.

15

We manage credit risk associated with our investment portfolio through our investment policy, which limits purchases to high-quality issuers and limits the amount of our portfolio that can be invested in a single issuer. The fair value and gross unrealized losses on debt securities available-for-sale in an unrealized loss position were as follows (in thousands):

| June 30, 2021 | |||||||||||

Fair Value | Gross Unrealized Losses | ||||||||||

| Commercial paper | $ | $ | |||||||||

| Corporate bonds | ( | ||||||||||

| U.S. Treasury and government-sponsored enterprises | ( | ||||||||||

| Municipal bonds | ( | ||||||||||

| Total | $ | $ | ( | ||||||||

| December 31, 2020 | |||||||||||

Fair Value | Gross Unrealized Losses | ||||||||||

| Corporate bonds | $ | $ | ( | ||||||||

| U.S. Treasury and government-sponsored enterprises | ( | ||||||||||

| Municipal bonds | ( | ||||||||||

| Total | $ | $ | ( | ||||||||

All securities presented have been in an unrealized loss position for less than 12 months. There were 53 and 14 investments in an unrealized loss position as of June 30, 2021 and December 31, 2020, respectively. During the six months ended June 30, 2021 and 2020, we did no

The fair value of debt securities available-for-sale by contractual maturity was as follows (in thousands):

| June 30, 2021 | December 31, 2020 | ||||||||||

| Maturing in one year or less | $ | $ | |||||||||

| Maturing after one year through five years | |||||||||||

| Total debt securities available-for-sale | $ | $ | |||||||||

NOTE 5. FAIR VALUE MEASUREMENTS

Fair value reflects the amounts that would be received upon sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy has the following three levels:

•Level 1 - quoted prices (unadjusted) in active markets for identical assets and liabilities;

•Level 2 - inputs other than level 1 that are observable either directly or indirectly, such as quoted prices in active markets for similar instruments or on industry models using data inputs, such as interest rates and prices that can be directly observed or corroborated in active markets;

•Level 3 - unobservable inputs that are supported by little or no market activity that are significant to the fair value measurement

16

The classifications within the fair value hierarchy of our financial assets that were measured and recorded at fair value on a recurring basis were as follows (in thousands):

| June 30, 2021 | |||||||||||||||||

Level 1 | Level 2 | Total | |||||||||||||||

| Commercial paper | $ | $ | $ | ||||||||||||||

| Corporate bonds | |||||||||||||||||

| U.S. Treasury and government-sponsored enterprises | |||||||||||||||||

| Municipal bonds | |||||||||||||||||

| Total debt securities available-for-sale | |||||||||||||||||

| Money market funds | |||||||||||||||||

| Certificates of deposit | |||||||||||||||||

| Total financial assets carried at fair value | $ | $ | $ | ||||||||||||||

| December 31, 2020 | |||||||||||||||||

Level 1 | Level 2 | Total | |||||||||||||||

| Commercial paper | $ | $ | $ | ||||||||||||||

| Corporate bonds | |||||||||||||||||

| U.S. Treasury and government-sponsored enterprises | |||||||||||||||||

| Municipal bonds | |||||||||||||||||

| Total debt securities available-for-sale | |||||||||||||||||

| Money market funds | |||||||||||||||||

| Certificates of deposit | |||||||||||||||||

| Total financial assets carried at fair value | $ | $ | $ | ||||||||||||||

When available, we value investments based on quoted prices for those financial instruments, which is a Level 1 input. Our remaining investments are valued using third-party pricing sources, which use observable market prices, interest rates and yield curves observable at commonly quoted intervals for similar assets as observable inputs for pricing, which is a Level 2 input.

The carrying amount of our remaining financial assets and liabilities, which include cash, receivables and payables, approximate their fair values due to their short-term nature.

Forward Foreign Currency Contracts

In January 2021, we initiated an operational hedging program and entered into forward contracts to hedge certain operational exposures for the changes in foreign currency exchanges rates associated with assets or liabilities denominated in foreign currencies, primarily the Euro.

As of June 30, 2021, we had one forward contract outstanding to sell €9.3 million. The forward contract has a maturity of three months , is recorded at fair value and is included in prepaid expenses and other current assets in the Condensed Consolidated Balance Sheets. The unrealized gain/loss on the settlement of the forward contract is not material as of June 30, 2021. The forward contract is considered a Level 2 in the fair value hierarchy of our fair value measurements. For the six months ended June 30, 2021, we recognized $0.3 million net gains on the maturity of our forward contracts, which is included in other income (expense), net on our Condensed Consolidated Statements of Income.

17

NOTE 6. INVENTORY

Inventory consisted of the following (in thousands):

| June 30, 2021 | December 31, 2020 | ||||||||||

| Raw materials | $ | $ | |||||||||

| Work in process | |||||||||||

| Finished goods | |||||||||||

| Total | $ | $ | |||||||||

Balance Sheet classification: | |||||||||||

| Current portion included in inventory | $ | $ | |||||||||

| Long-term portion included in other long-term assets | |||||||||||

| Total | $ | $ | |||||||||

Write-downs related to excess and expiring inventory were $2.3 million and $1.3 million for the six months ended June 30, 2021 and 2020, respectively.

NOTE 7. STOCK-BASED COMPENSATION

We allocated the stock-based compensation expense for our equity incentive plans and our Employee Stock Purchase Plan (ESPP) as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Research and development | $ | $ | $ | $ | |||||||||||||||||||

| Selling, general and administrative | |||||||||||||||||||||||

| Total stock-based compensation expense | $ | $ | $ | $ | |||||||||||||||||||

Stock-based compensation for each type of award under our equity incentive plans and ESPP were as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Stock options | $ | $ | $ | $ | |||||||||||||||||||

| Restricted stock units | |||||||||||||||||||||||

| Performance stock units | |||||||||||||||||||||||

| ESPP | |||||||||||||||||||||||

| Total stock-based compensation expense | $ | $ | $ | $ | |||||||||||||||||||

As of June 30, 2021, 8,254,455 shares were available for grant under the Exelixis, Inc. 2017 Equity Incentive Plan (as amended and restated, the 2017 Plan). The share reserve is reduced by 1 share for each share issued pursuant to a stock option and 1.5 shares for full value awards granted in the form of restricted stock units (RSUs).

During the six months ended June 30, 2021, we granted 1,733,554 stock options with a weighted average exercise price of $22.50 per share and a weighted average grant date fair value of $9.70 per share. As of June 30, 2021, there were 15,443,578 stock options outstanding and $32.2 million of related unrecognized compensation expense.

During the six months ended June 30, 2021, we granted 3,575,190 service-based RSUs with a weighted average grant date fair value of $21.76 per share. As of June 30, 2021, there were 8,314,774 RSUs outstanding and $149.0 million of related unrecognized compensation expense.

Stock options and RSUs granted to employees during the six months ended June 30, 2021 have vesting conditions and contractual lives of a similar nature to those described in “Note 8. Employee Benefit Plans” of the Notes to

18

Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

In March 2021, we awarded 1,027,650 (the target amount) performance-based (PSUs), subject to a performance and a market condition (the 2021 PSUs). Pursuant to the terms of 2021 PSUs, the holders of the awards may earn up to 200 % of the target amount of shares, depending on the level of achievement of the performance condition related to certain net product revenues and a total shareholder return (TSR) market condition. The TSR market condition is based on our relative TSR percentile rank compared to companies in the NASDAQ Biotechnology Index during the performance period, which is January 2, 2021 through December 29, 2023. Fifty percent of the shares earned subject to the performance and market conditions will vest at the end of the performance period and the remainder will vest approximately one year later subject to employee’s continuous service. The 2021 PSUs will be forfeited if the performance condition at or above a threshold level is not achieved by December 29, 2023.

A Monte Carlo simulation model was used to determine the grant date fair value of $24.54 for the 2021 PSUs based on the following assumptions:

Fair value of the Company’s common stock on grant date | $ | ||||

Expected volatility | % | ||||

Risk-free interest rate | % | ||||

Dividend yield | % | ||||

The Monte Carlo simulation model also assumed correlations of returns of the stock prices of the Company’s common stock and the common stock of a peer group of companies and historical stock price volatility of the peer group of companies. The valuation model also used terms based on the length of the performance period and compound annual growth rate goals for total stockholder return based on the provisions of the award.

As of June 30, 2021, there were 8,709,765 PSUs outstanding and $155.7 million of related unrecognized compensation expense. Expense recognition for PSUs commences when it is determined that achievement of the performance target is probable. For more information about our PSUs, see “Note 8. Employee Benefit Plans” of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

NOTE 8. PROVISION FOR INCOME TAXES

19

NOTE 9. NET INCOME PER SHARE

Net income per share - basic and diluted, were computed as follows (in thousands, except per share amounts):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Numerator: | |||||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Denominator: | |||||||||||||||||||||||

Weighted-average common shares outstanding — basic | |||||||||||||||||||||||

| Dilutive securities | |||||||||||||||||||||||

Weighted-average common shares outstanding — diluted | |||||||||||||||||||||||

| Net income per share — basic | $ | $ | $ | $ | |||||||||||||||||||

| Net income per share — diluted | $ | $ | $ | $ | |||||||||||||||||||

Dilutive securities included outstanding stock options and Performance Stock Options, unvested RSUs and PSUs and ESPP contributions.

Certain potential common shares were excluded from our calculation of weighted-average common shares outstanding - diluted because either they would have had an anti-dilutive effect on net income per share or they were related to shares from PSUs that were contingently issuable and the contingency had not been satisfied at the end of the reporting period. The weighted-average potential common shares excluded from our calculation were as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Anti-dilutive securities and contingently issuable shares excluded | |||||||||||||||||||||||

NOTE 10. COMMITMENTS AND CONTINGENCIES

20

8,497,284 and U.S. Patent No. 8,877,776, the latest of which expires on October 8, 2030, and equitable relief enjoining MSN from infringing these patents. These lawsuits against MSN have been consolidated, and a bench trial has been scheduled for May 2022.

In May 2021, we received notice letters from Teva Pharmaceuticals Development, Inc. and Teva Pharmaceuticals USA, Inc. (individually and collectively referred to as Teva) regarding an ANDA Teva submitted to the FDA, requesting approval to market a generic version of CABOMETYX tablets. Teva’s notice letters included a Paragraph IV certification with respect to our U.S. Patent Nos. 9,724,342 (formulations), 10,034,873 (methods of treatment) and 10,039,757 (methods of treatment), which are listed in the Orange Book and expire in 2033, 2031 and 2031, respectively. Teva’s notice letters did not provide a Paragraph IV certification against any additional CABOMETYX patents. On June 17, 2021, we filed a complaint in the Delaware District Court for patent infringement against Teva, along with Teva Pharmaceutical Industries Limited, asserting U.S. Patent Nos. 9,724,324 (formulations), 10,034,873 (methods of treatment) and 10,039,757 (methods of treatment) arising from Teva’s ANDA filing with the FDA. We are seeking, among other relief, an order that the effective date of any FDA approval of Teva’s ANDA would be a date no earlier than the expiration of all of U.S. Patent Nos. 9,724,342, 10,034,873 and 10,039,757, the latest of which expires on July 9, 2033, and equitable relief enjoining Teva and Teva Pharmaceutical Industries Limited from infringing these patents.

The sale of any generic version of CABOMETYX earlier than its patent expiration could significantly decrease our revenues derived from the U.S. sales of CABOMETYX and thereby materially harm our business, financial condition and results of operations. It is not possible at this time to determine the likelihood of an unfavorable outcome or estimate of the amount or range of any potential loss.

We may also from time to time become a party or subject to various other legal proceedings and claims, either asserted or unasserted, which arise in the ordinary course of business. Some of these proceedings have involved, and may involve in the future, claims that are subject to substantial uncertainties and unascertainable damages.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This Quarterly Report on Form 10-Q contains forward-looking statements. These statements are based on Exelixis, Inc.’s (Exelixis, we, our or us) current expectations, assumptions, estimates and projections about our business and our industry and involve known and unknown risks, uncertainties and other factors that may cause our company’s or our industry’s results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied in, or contemplated by, the forward-looking statements. Our actual results and the timing of events may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such a difference include those discussed in “Risk Factors” in Part II, Item 1A of this Quarterly Report on Form 10-Q, as well as those discussed elsewhere in this report. These and many other factors could affect our future financial and operating results. We undertake no obligation to update any forward-looking statement to reflect events after the date of this report.

This discussion and analysis should be read in conjunction with our condensed consolidated financial statements and accompanying notes included in this report and the consolidated financial statements and accompanying notes thereto included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 submitted to the Securities and Exchange Commission (SEC) on February 10, 2021.

Overview

We are an oncology-focused biotechnology company that strives to accelerate the discovery, development and commercialization of new medicines for difficult-to-treat cancers. We have invented and brought to market novel, effective and tolerable therapies using our drug discovery and development resources and capabilities and commercialization platform; we will continue to build on this foundation, working toward providing cancer patients with additional treatment options.

Since we were founded in 1994, four products resulting from our discovery efforts have progressed through clinical development, received regulatory approval and established a commercial presence in various geographies around the world. Our flagship molecule, cabozantinib, is an inhibitor of multiple tyrosine kinases including MET, AXL, VEGF receptors and RET and has been approved by the U.S. Food and Drug Administration (FDA) and foreign regulatory authorities as two products: CABOMETYX® (cabozantinib) tablets approved for advanced renal cell carcinoma (RCC), both alone and in combination with Bristol-Myers Squibb Company’s (BMS) OPDIVO® (nivolumab), and for previously treated hepatocellular

21

carcinoma (HCC); and COMETRIQ® (cabozantinib) capsules approved for progressive, metastatic medullary thyroid cancer (MTC). For these types of cancer, cabozantinib has become or is becoming a standard of care.

The other two products resulting from our discovery efforts are: COTELLIC® (cobimetinib), an inhibitor of MEK, approved as part of multiple combination regimens to treat specific forms of advanced melanoma and marketed under a collaboration with Genentech, Inc. (a member of the Roche Group) (Genentech); and MINNEBRO® (esaxerenone), an oral, non-steroidal, selective blocker of the mineralocorticoid receptor, approved for the treatment of hypertension in Japan and licensed to Daiichi Sankyo Company, Limited (Daiichi Sankyo).

Leveraging the revenue stream derived from our cabozantinib franchise and other marketed products, we are expanding our oncology product pipeline through drug discovery efforts, which encompass both small molecule and biologics programs with multiple modalities and mechanisms of action.

Cabozantinib Franchise

On January 22, 2021, the FDA approved CABOMETYX in combination with OPDIVO as a first-line treatment of patients with advanced RCC. This regulatory milestone expands upon the FDA’s prior approvals of CABOMETYX as a monotherapy for previously treated patients with advanced RCC in April 2016 and for previously untreated patients with advanced RCC in December 2017. Additionally, in January 2019, the FDA approved CABOMETYX for the treatment of patients with HCC who have been previously treated with sorafenib.

To develop and commercialize CABOMETYX and COMETRIQ outside the U.S., we have entered into license agreements with Ipsen Pharma SAS (Ipsen) and Takeda Pharmaceutical Company Limited (Takeda). We granted to Ipsen the rights to develop and commercialize cabozantinib outside of the U.S. and Japan, and to Takeda the rights to develop and commercialize cabozantinib in Japan. Both Ipsen and Takeda also contribute financially and operationally to the further global development and commercialization of the cabozantinib franchise in other potential indications, and we continue to work closely with them on these activities. Utilizing its regulatory expertise and established international oncology marketing network, Ipsen has continued to execute on its commercialization plans for CABOMETYX, having received regulatory approvals and launched in multiple territories outside of the U.S., including in the European Union (EU) and Canada, as a treatment for advanced RCC and for HCC in adults who have previously been treated with sorafenib. In addition, in March 2021, Ipsen and BMS received regulatory approval from the European Commission (EC) for CABOMETYX in combination with OPDIVO as a first-line treatment for patients with advanced RCC, and both Ipsen and BMS plan to submit applications to approve the combination in other territories beyond the EU. With respect to the Japanese market, Takeda received Manufacturing and Marketing Approvals in 2020 from the Japanese Ministry of Health, Labour and Welfare (MHLW) of CABOMETYX as a treatment of patients with curatively unresectable or metastatic RCC and as a treatment of patients with unresectable HCC who progressed after cancer chemotherapy. In October 2020, Takeda and Ono Pharmaceutical Co., Ltd., BMS’ development and commercialization partner in Japan, submitted a supplemental application to the Japanese MHLW for Manufacturing and Marketing Approval of CABOMETYX in combination with OPDIVO for the treatment of patients with unresectable, advanced or metastatic RCC.

In addition to our regulatory and commercialization efforts in the U.S. and the support provided to our collaboration partners for rest-of-world regulatory and commercialization activities, we are also pursuing other indications for cabozantinib that have the potential to increase the number of cancer patients who could benefit from this medicine. We are evaluating cabozantinib, both as a single agent and in combination with other therapies, in a broad development program comprising over 100 ongoing or planned clinical trials across multiple indications. We, along with our collaboration partners, sponsor some of the trials, and independent investigators conduct the remaining trials through our Cooperative Research and Development Agreement (CRADA) with the National Cancer Institute’s Cancer Therapy Evaluation Program (NCI-CTEP) or our investigator-sponsored trial (IST) program. Informed by the available data from these clinical trials, we advanced the development program for the cabozantinib franchise with potentially label-enabling trials. One pivotal trial that has resulted from this effort is COSMIC-311, our phase 3 pivotal trial evaluating cabozantinib versus placebo in patients with radioactive iodine (RAI)-refractory differentiated thyroid cancer (DTC) who have progressed after up to two VEGF receptor-targeted therapies. In December 2020, we announced that COSMIC-311 had met the primary endpoint of demonstrating significant improvement in progression-free survival (PFS), and in February 2021, we announced the FDA had granted Breakthrough Therapy Designation to cabozantinib as a potential treatment for patients with RAI-refractory DTC who have progressed following prior therapy. Study results from COSMIC-311 were presented at the 2021 American Society of Clinical Oncology (ASCO) Annual Meeting and published in The Lancet Oncology. They further served as the basis for the supplemental New Drug Application (sNDA) we submitted to the FDA in June 2021 seeking approval for CABOMETYX to treat patients 12 and older with DTC who have progressed following prior therapy and who are RAI-refractory (if RAI is

22

appropriate), and in August 2021, we announced that the FDA had accepted our sNDA, granted Priority Review and assigned a Prescription Drug User Fee Act (PDUFA) goal date, or target action date, of December 4, 2021. Building on preclinical and clinical observations that cabozantinib in combination with immune checkpoint inhibitors (ICIs) may promote a more immune-permissive tumor environment, we initiated numerous pivotal studies to further explore these combination regimens. The first of these studies to deliver results was CheckMate -9ER, a phase 3 pivotal trial evaluating the combination of cabozantinib and nivolumab compared to sunitinib in previously untreated advanced or metastatic RCC. We, along with our collaboration partner, BMS, announced in April 2020 that the trial met its primary endpoint of PFS at final analysis, as well as the secondary endpoints of overall survival (OS) at a pre-specified interim analysis and objective response rate (ORR), and showed that the combination of cabozantinib with nivolumab significantly improved the three key efficacy outcomes as compared with sunitinib, doubling PFS and ORR and reducing the risk of disease progression or death by 40% compared with sunitinib. Data from CheckMate -9ER served as the basis for the FDA’s and EC’s approval of CABOMETYX in combination with OPDIVO as a first-line treatment of patients with advanced RCC in January 2021 and March 2021, respectively. We are also collaborating with BMS on COSMIC-313, a phase 3 pivotal trial evaluating the triplet combination of cabozantinib, nivolumab and ipilimumab versus the combination of nivolumab and ipilimumab in patients with previously untreated advanced intermediate- or poor-risk RCC. Enrollment for COSMIC-313 was completed in March 2021, and we expect to report top-line results of the event-driven analyses from the trial in the late 2021 or early 2022 timeframe.

In an effort to expand our exploration of combinations with ICIs, we also initiated multiple trials evaluating cabozantinib in combination with F. Hoffmann-La Roche Ltd.’s (Roche) ICI, atezolizumab. COSMIC-021 is a broad phase 1b study evaluating the safety and tolerability of cabozantinib in combination with atezolizumab in patients with a wide variety of locally advanced or metastatic solid tumors. Based on encouraging efficacy and safety data that has emerged from the trial, certain cohorts have been or may be further expanded, including the cohorts of patients with non-small cell lung cancer (NSCLC) who have been previously treated with an ICI and metastatic castration-resistant prostate cancer (mCRPC) who have been previously treated with enzalutamide and/or abiraterone acetate and experienced radiographic disease progression in soft tissue (Cohort 6). Data from Cohort 6, announced in May 2021, resulted in an investigator assessed ORR of 27% and a blinded independent radiology committee assessed ORR of 18%. We intend to discuss these data with the FDA to determine next steps toward a potential regulatory submission for the combination regimen for patients with high-risk mCRPC and plan to present detailed results of the COSMIC-021 trial at a medical meeting in the second half of 2021. Since the initiation of the trial, data from COSMIC-021 have been instrumental in guiding our clinical development strategy for cabozantinib in combination with ICIs, including supporting the initiation of COSMIC-312, a phase 3 pivotal trial evaluating cabozantinib in combination with atezolizumab versus sorafenib in previously untreated advanced HCC, and three phase 3 pivotal trials in collaboration with Roche, CONTACT-01, CONTACT-02 and CONTACT-03, evaluating the combination of cabozantinib with atezolizumab in patients with metastatic NSCLC, mCRPC and advanced RCC, respectively. CONTACT-01 and CONTACT-03 are sponsored by Roche and co-funded by us; CONTACT-02 is sponsored by us and co-funded by Roche. In June 2021, we announced results from COSMIC-312. The trial met one of the primary endpoints, demonstrating significant improvement in PFS at the planned primary analysis, reducing the risk of disease progression or death by 37% compared with sorafenib (hazard ratio: 0.63; 99% confidence internal: 0.44-0.91; P=0.0012). A prespecified interim analysis for the second primary endpoint of OS, conducted at the same time as the primary analysis for PFS, showed a trend favoring the combination of cabozantinib and atezolizumab but did not reach statistical significance. Safety for the combination appeared to be consistent with the known safety profiles of the individual medicines, and no new safety signals were identified. Based on the preliminary OS data, we anticipate that the probability of reaching statistical significance at the time of the final analysis is low, but the trial will continue as planned to the final analysis of OS, with results anticipated in early 2022. We plan to present the trial results at a future medical meeting and intend to discuss the results with the FDA to determine next steps toward a potential regulatory submission for the combination regimen for patients with previously untreated advanced HCC.

Pipeline Activities

Our small molecule discovery programs are supported by a robust and expanding infrastructure, including a library of 4.6 million compounds. We have extensive experience in the identification and optimization of drug candidates against multiple target classes for oncology, inflammation and metabolic diseases. The first compound to advance from our recent drug discovery efforts is XL092, a next-generation oral tyrosine kinase inhibitor that targets VEGF receptors, MET, AXL, MER and other kinases implicated in cancer’s growth and spread. In designing XL092, we sought to build upon our experience with cabozantinib, retaining the target profile of cabozantinib while improving key characteristics, including the pharmacokinetic half-life. To date, we have announced two large phase 1b clinical trials studying XL092, STELLAR-001 and STELLAR-002. STELLAR-001 is a phase 1b clinical trial evaluating XL092, both as a monotherapy and in combination with

23

either atezolizumab or avelumab, an ICI developed by Merck KGaA, Darmstadt, Germany and Pfizer Inc., which is currently enrolling patients with advanced solid tumors. We expect that once recommended doses of single-agent XL092 and XL092 in combination with atezolizumab or avelumab are established, the trial will begin to enroll expansion cohorts for patients with clear cell and non-clear cell RCC, colorectal cancer (CRC), hormone-receptor positive breast cancer, mCRPC and urothelial carcinoma (UC). STELLAR-002 is a phase 1b clinical trial that will evaluate XL092 in combination with either nivolumab, nivolumab and ipilimumab, or nivolumab and bempegaldesleukin, an investigational CD122-preferential IL-2–pathway agonist developed by Nektar Therapeutics (Nektar). We expect to begin enrolling patients with advanced solid tumors in dose-escalation cohorts for STELLAR-002 during the second half of 2021. Depending on the dose-escalation results, STELLAR-002 may enroll expansion cohorts for patients with clear cell and non-clear cell RCC, mCRPC and UC, and to better understand the individual contribution of the therapies, treatment arms in the expansion cohorts may include XL092 as a single-agent, XL092 in combination with nivolumab, XL092 in combination with nivolumab and ipilimumab, and XL092 in combination with nivolumab and bempegaldesleukin.

We augment our small molecule discovery activities through research collaborations and in-licensing arrangements with other companies. The most advanced compound to emerge from these arrangements is XL102 (formerly AUR102), the lead program targeting cyclin-dependent kinase 7 under our collaboration with Aurigene Discovery Technologies Limited (Aurigene). In December 2020, based on encouraging preclinical data, we exercised our exclusive option to license XL102 from Aurigene. Following the FDA’s acceptance of our Investigational New Drug (IND) application in December 2020, we initiated a phase 1 clinical trial of the compound in January 2021.

Beyond small molecules, we have also launched rigorous efforts to discover and advance biologic drug candidates, such as bispecific antibodies, antibody drug conjugates (ADCs) and other innovative biologics that have the potential to become anti-cancer therapies. ADCs in particular present a unique opportunity for new cancer treatments, given their capabilities to deliver anti-cancer payload drugs to targets with increased precision while minimizing impact on healthy tissues, and have been validated by the multiple regulatory approvals for the commercial sale of ADCs since the beginning of 2020. To facilitate the growth of these biologics programs, we have established multiple research collaborations and in-licensing arrangements, expanding our access to antibodies or other binders, which are the starting point for use with additional technology platforms that we employ to generate next-generation ADCs or bispecific antibodies. We have already made significant progress under these arrangements and believe we will continue to do so. For example, based on promising preclinical data for XB002 (formerly known as ICON-2), the lead Tissue Factor ADC program under our research collaboration with Iconic Therapeutics, Inc. (Iconic), we exercised our exclusive option to license XB002 in December 2020. Following the FDA’s acceptance of our IND for XB002 in April 2021, we initiated a phase 1 clinical trial in June 2021. We have expanded our access to antibodies through arrangements with WuXi Biologics Ireland Limited (WuXi Bio), focused on leveraging WuXi Bio’s panel of monoclonal antibodies against an undisclosed target for the development of ADC, bispecific and certain other novel tumor-targeting biologics, and through the execution of an asset purchase agreement with GamaMabs Pharma SA (GamaMabs), under which we will, upon the closing of the asset purchase and subject to certain conditions, acquire all rights, title and interest in GamaMabs’ antibody program directed at anti-Müllerian hormone receptor 2 (AMHR2), a novel oncology target with relevance in multiple forms of cancer. These antibodies, as well as those originating from collaboration with Invenra, Inc., provide starting points for the construction of ADCs through our collaborations with NBE-Therapeutics AG and/or Catalent, Inc.’s wholly owned subsidiaries Redwood Bioscience, Inc., R.P. Scherer Technologies, LLC and Catalent Pharma Solutions, Inc., utilizing their site-specific conjugation technologies and payloads. In addition, our collaboration with Adagene Inc. (Adagene), focused on using Adagene’s SAFEbodyTM technology to develop novel masked ADCs or other innovative biologics, provides potential for developing ADCs or other biologics with improved therapeutic index.

We will continue to engage in business development initiatives aimed at acquiring and in-licensing promising oncology platforms and assets and then further characterize and develop them utilizing our established preclinical and clinical development infrastructure. In total, we are advancing drug candidates across approximately 20 ongoing discovery programs toward and through preclinical development, and subject to preclinical data, we have the potential to submit multiple INDs later in 2021.

COVID-19 Update

As of the date of this Quarterly Report on Form 10-Q, the COVID-19 pandemic continues to have a modest impact on our business operations, in particular with respect to our clinical trial and commercial activities. We have and continue to undertake considerable efforts to mitigate the various problems presented by this crisis, including as described below:

24

Clinical Trials. To varying degrees and at different rates across our global clinical trials, we experienced declines in screening and enrollment activity during the early days of the COVID-19 pandemic, as well as delays in new site activations and restrictions on the access to treatment sites that is necessary to monitor clinical study progress and administration. Beginning during the second quarter of 2020 and since that time, however, that trend reversed, and screening and enrollment activity began to increase. As a result, we and our collaboration partners, including principal investigators and personnel at clinical trial sites, have been successful overall in preventing material delays to our ongoing and planned clinical trials due to the COVID-19 pandemic. We have done this through ongoing assessment of the COVID-19 pandemic’s impact and, wherever possible, taking proactive steps in compliance with guidance issued by the FDA, EMA and other regulatory agencies to support the safety of our patients and their access to treatment, as well as to maintain the high quality of our clinical trials. We recognize, however, that we may have to make further operational adjustments to our ongoing and planned clinical trials and that patient enrollment, and new clinical trial site initiations may again be slowed due to recurring COVID-19 outbreaks and potential reintroduction of certain restrictions intended to mitigate the spread of COVID-19.

Drug Discovery and Preclinical Development. We have fully resumed drug discovery in our laboratories following a temporary suspension of these activities while we observed the shelter in place orders issued by the State of California and Alameda County. While this temporary suspension combined with interruptions in the portion of drug discovery work outsourced to third-party contractors in regions first impacted by COVID-19 caused us to experience modest delays in the advancement of certain of our early-stage programs, we continued to substantially progress our product pipeline despite the COVID-19 pandemic, including the submission of INDs for XL102 and XB002.

Commercial Activities. Despite the challenges posed by the COVID-19 pandemic, including requiring us to temporarily shift to telephonic and virtual interactions with healthcare professionals, we believe our commercial business was only modestly impacted. Our field employees have now partially resumed their in-person promotional activities while supplementing these activities with telephonic and virtual interactions and we believe they are well-positioned to execute on our commercial objectives.

Supply Chain. We have not experienced production delays or seen any significant impairment to our supply chain as a result of the COVID-19 pandemic. In addition, we continue to maintain substantial safety stock inventories for our commercial drug substance and drug products, which should be sufficient to maintain robust long-term supply. We continue to work closely with our third-party contract manufacturers, distributors, suppliers, comparator drug sourcing vendors and collaboration partners to safeguard both the timely production and delivery of our products.