Exhibit 99.1

Investor Presentation June 2024 Exhibit 99.1

2 Safe Harbor Statement This presentation contains forward - looking statements within the meaning of federal securities laws, including, among others, st atements about our expectations, plans, strategies or prospects. We generally use the words “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “project,” “assum e,” “guide,” “target,” “forecast,” “see,” “seek,” “can,” “should,” “could,” “would,” “intend,” “predict,” “potential,” “strategy,” “is confident that,” “future,” “opportunity,” “work toward,” and similar expressions to identify forward - looking statements. All statements other than statements of historical or current fact are, or may be deemed to be, forward - looking statements. Such sta tements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances t hat could cause actual results to differ materially from the forward - looking statements. Forward - looking statements speak only as of the date they are made, and we disclaim any int ention or obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Readers of this presentation are cautioned not to rely on these forward - looking statements, since there can be no assurance that these forward - looking statements will prove to be accurate. This cautionary sta tement is applicable to all forward - looking statements contained in this presentation. The risks and uncertainties that may cause actual results to differ materially fro m M asimo’s current expectations are more fully described in Masimo’s reports filed with the U.S. Securities and Exchange Commission (SEC), including our most recent Form 10 - K and Form 1 0 - Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo.com or upon request. The non - GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The non - GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period - to - period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on - going core operating performance. These non - GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non - GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non - GAAP financial measures presented by the Company may be differen t from the non - GAAP financial measures used by other companies. The Company has presented the following non - GAAP financial measures to assist investors in understandi ng the Company’s core net operating results on an on - going basis: non - GAAP revenue (constant currency), pro - forma non - GAAP revenue (constant currency), pro - forma non - GAAP r evenue growth (constant currency), non - GAAP gross profit/margin %, non - GAAP SG&A expense (prior definition and updated definition), non - GAAP R&D expense, non - GAAP liti gation settlements and awards, non - GAAP impairment charge, non - GAAP operating expense % (prior definition and updated definition), non - GAAP operating profit/margin % (p rior definition and updated definition), non - GAAP non - operating income (expense), non - GAAP provision for income taxes (prior definition and updated definition), non - GAAP net income (loss) (prior definition and updated definition), non - GAAP net income (loss) per share (prior definition and updated definition). This presentation also includes cer tain preliminary estimated information of a potential separation of the Company’s consumer business for illustrative and informational purposes and further adjusted for separation it ems. See “Disclaimer Regarding Potential Separation” on the next slide for additional information. These non - GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes these non - GAAP financial measures are important in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, including GAAP to non - GAAP reconcilia tions, please visit the Investor Relations section of the Company’s website at www.masimo.com to access Supplementary Financial Information.

3 Disclaimer Regarding Potential Separation On March 22, 2024, Masimo announced that its Board of Directors has authorized management to evaluate a proposed separation o f t he company’s consumer business (the “Potential Separation”). Masimo’s Board of Directors and management are in the process of evaluating the proposed structure o f t he Potential Separation. Slides 16 - 18 of this presentation include estimates and projections of the financial impact of the Potential Separation; however, the estimates an d p rojections are being provided solely for illustrative and informational purposes and do not purport to contain or present all information relating to any Potential Separation. Moreove r, the method, structure, timing and terms of any Potential Separation are still under consideration and have not been determined, approved or finalized, and the final method, st ructure, timing and terms of any Potential Separation, including the separation of assets and liabilities, may differ materially from what is presented and estimated on Slides 4 an d 1 5 - 23 (collectively, the “Separation Discussion Slides”). There can be no assurance that any Potential Separation that may be implemented will be similar in structure to the structure il lustrated or discussed on the Separation Discussion Slides, that any Potential Separation may be effected at all or the timing of any Potential Separation. Additionally, the es tim ates on the Separation Discussion Slides are illustrative projections that were calculated using the midpoint of Masimo’s 2024 consolidated guidance, which is based on management’s cu rre nt expectations and beliefs, but is subject to uncertainty and risks, and also relies on a number of assumptions and adjustments as described on the Separation Discussion S lid es. Accordingly, all of the information on the Separation Discussion Slides relating to the Potential Separation constitute “forward - looking statements” as described on Slide 2 of this presentation entitled “Safe Harbor Statement”. Investors are strongly cautioned not to place undue reliance on these forward - looking statements, including in respe ct of the financial or operating outlook for the potential separated businesses (including, without limitation, the realization of any expected efficiencies or cost savings). The forward - looking statements on the Separation Discussion Slides are subject to risks and uncertainties, all of which are diff icult to predict and many of which are beyond our control and could cause the actual results of any Potential Separation to differ materially and adversely from those illustra ted on the Separation Discussion Slides as a result of various risk factors, including, but not limited to: risks related to the ability to effect or complete any Potential Separat ion on the terms described on the Separation Discussion Slides, or at all, and to meet any of the conditions related thereto; the approval of any Potential Separation by Masimo’s Board of D ire ctors; the ability of the separated businesses to be successful; expectations around the financial impact of any Potential Separation; potential uncertainty during the pendency o f a ny Potential Separation that could affect Masimo’s financial performance; the possibility that any Potential Separation will not be completed within the anticipated time period or at all; the possibility that any Potential Separation will not achieve its intended benefits; the possibility of disruption, including changes to existing business relationships, dispu tes , litigation or unanticipated costs in connection with any Potential Separation; the impact that any Potential Separation may have on our employees; the uncertainty of the expected fin anc ial performance of Masimo prior to and following completion of any Potential Separation; negative effects of the announcement or pendency of any Potential Separation on the m ark et price of Masimo’s securities and/or on the financial performance of Masimo; evolving legal, regulatory and tax regimes; changes in general economic and/or industry spec ifi c conditions; actions by third parties, including government agencies; as well as other factors more fully described in Masimo’s reports filed with the U.S. Securities and Exc han ge Commission (SEC), including our most recent Form 10 - K and Form 10 - Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo .com or upon request. Except as required by applicable law, Masimo assumes no obligation to, and expressly disclaims any duty or obligation to, pro vid e any additional or updated information or to update any forward - looking statements, whether as a result of new information, future events or results, or otherwise. Nothing in this presentation will, under any circumstances (including by reason of this presentation remaining available and not being superseded or replaced by any other presentation or publication wi th respect to Masimo or the Potential Separation), create an implication that there has been no change in the affairs of Masimo or any Potential Separation since the date of th is presentation.

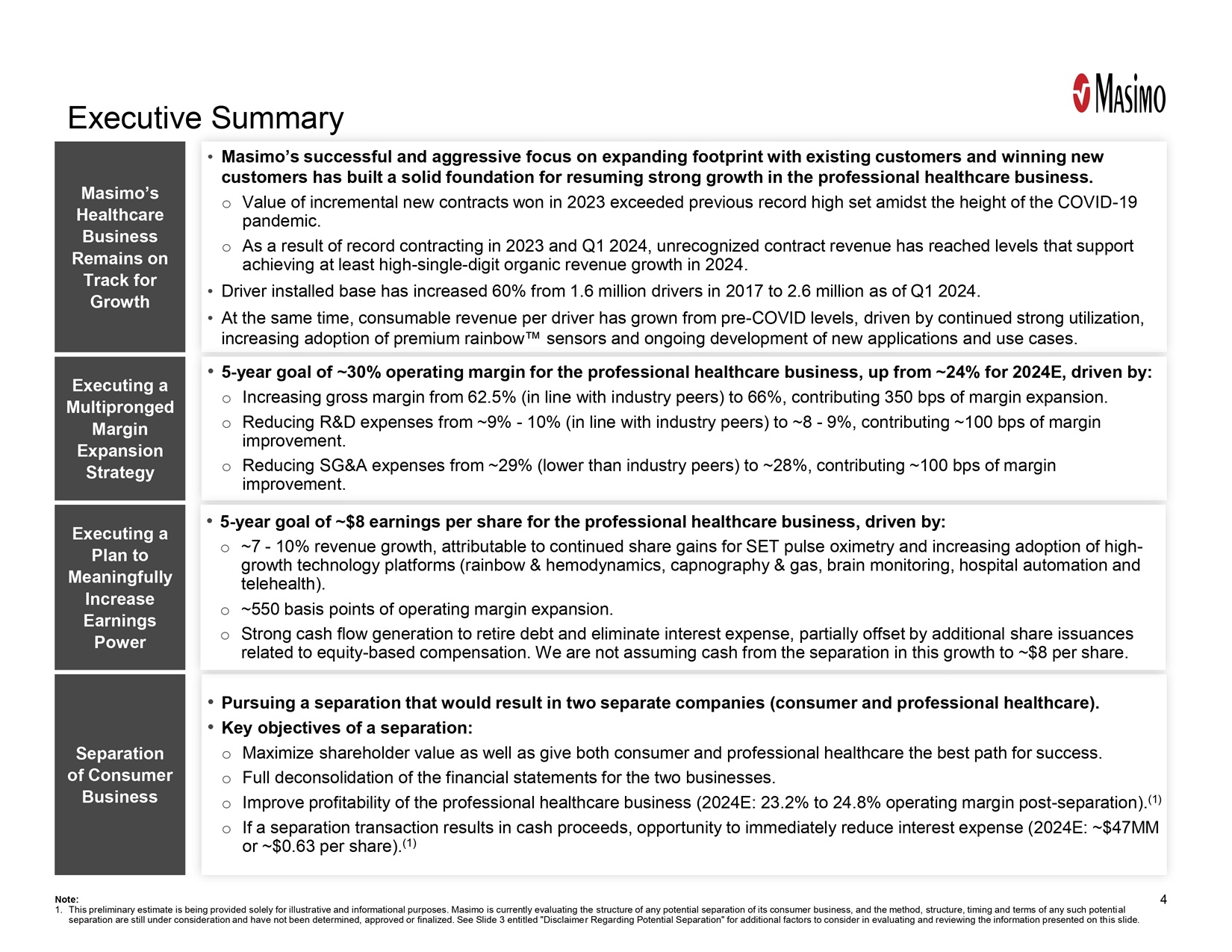

Executive

Summary Separation of Consumer Business Pursuing a separation that would result in two separate companies (consumer and professional

healthcare). Key objectives of a separation: Maximize shareholder value as well as give both consumer and professional healthcare the

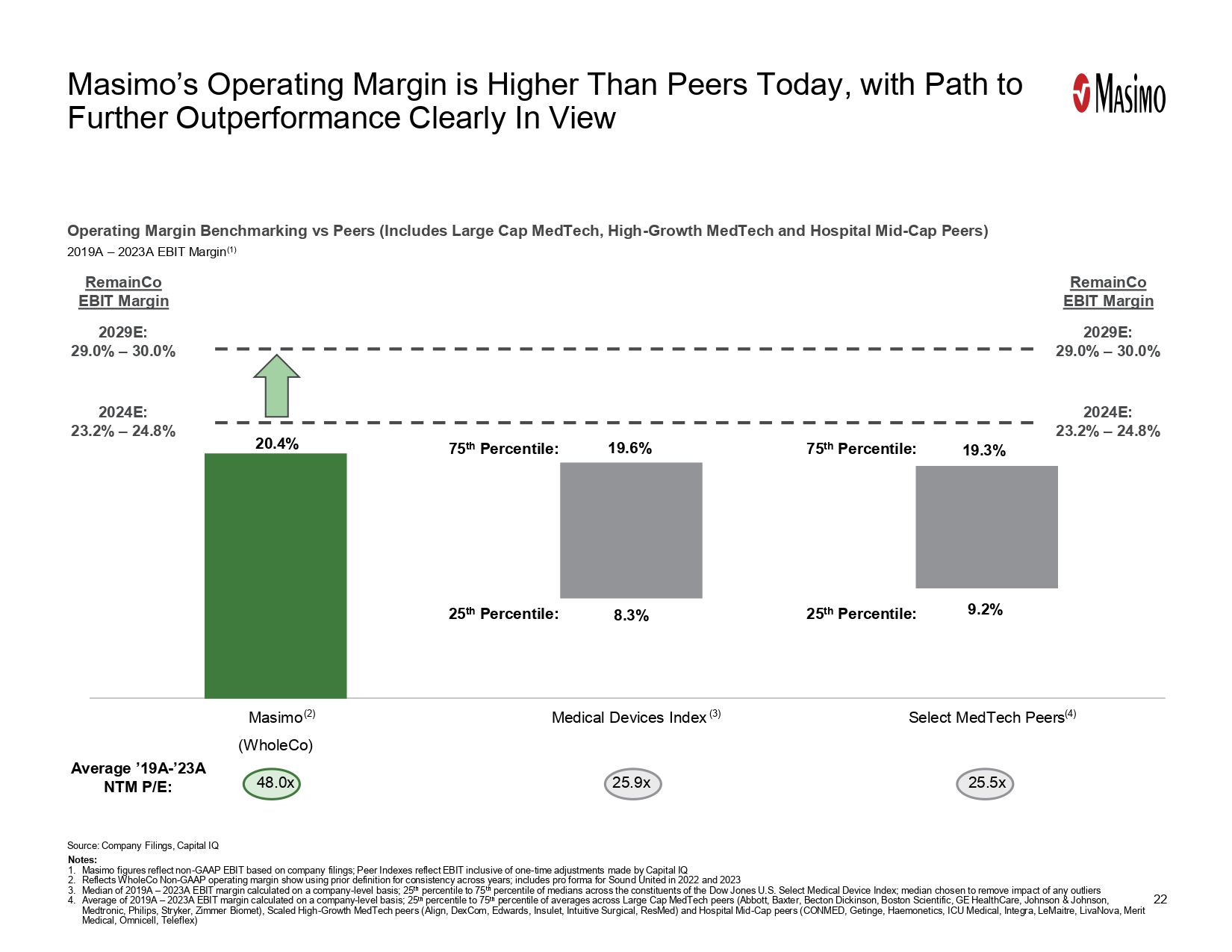

best path for success. Full deconsolidation of the financial statements for the two businesses. Improve profitability of the professional

healthcare business (2024E: 23.2% to 24.8% operating margin post-separation).(1) If a separation transaction results in cash proceeds,

opportunity to immediately reduce interest expense (2024E: ~$47MM or ~$0.63 per share).(1) Masimo’s Healthcare Business Remains

on Track for Growth Masimo’s successful and aggressive focus on expanding footprint with existing customers and winning new customers

has built a solid foundation for resuming strong growth in the professional healthcare business. Value of incremental new contracts won

in 2023 exceeded previous record high set amidst the height of the COVID-19 pandemic. As a result of record contracting in 2023 and Q1

2024, unrecognized contract revenue has reached levels that support achieving at least high-single-digit organic revenue growth in 2024.

Driver installed base has increased 60% from 1.6 million drivers in 2017 to 2.6 million as of Q1 2024. At the same time, consumable revenue

per driver has grown from pre-COVID levels, driven by continued strong utilization, increasing adoption of premium rainbow™ sensors

and ongoing development of new applications and use cases. Executing a Multipronged Margin Expansion Strategy 5-year goal of ~30% operating

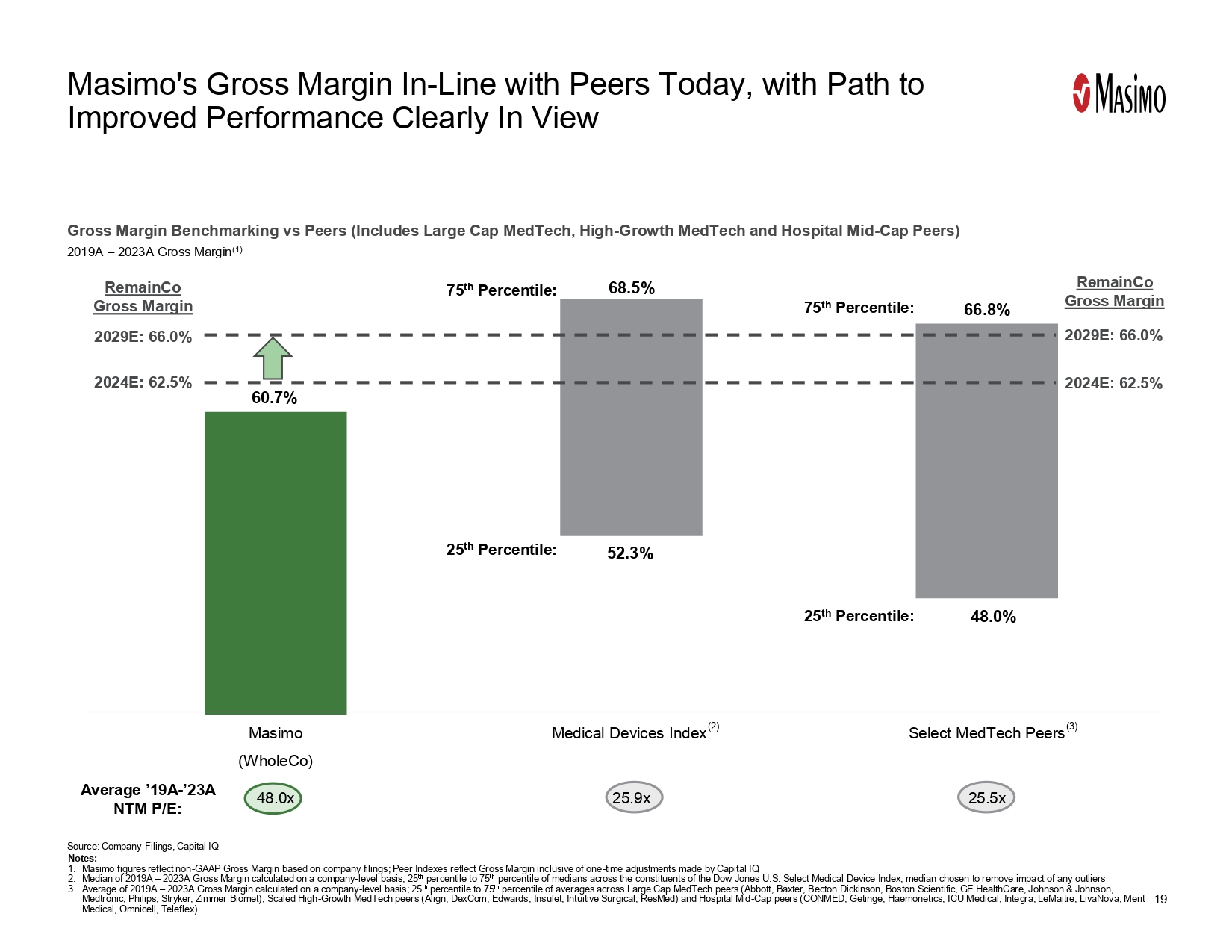

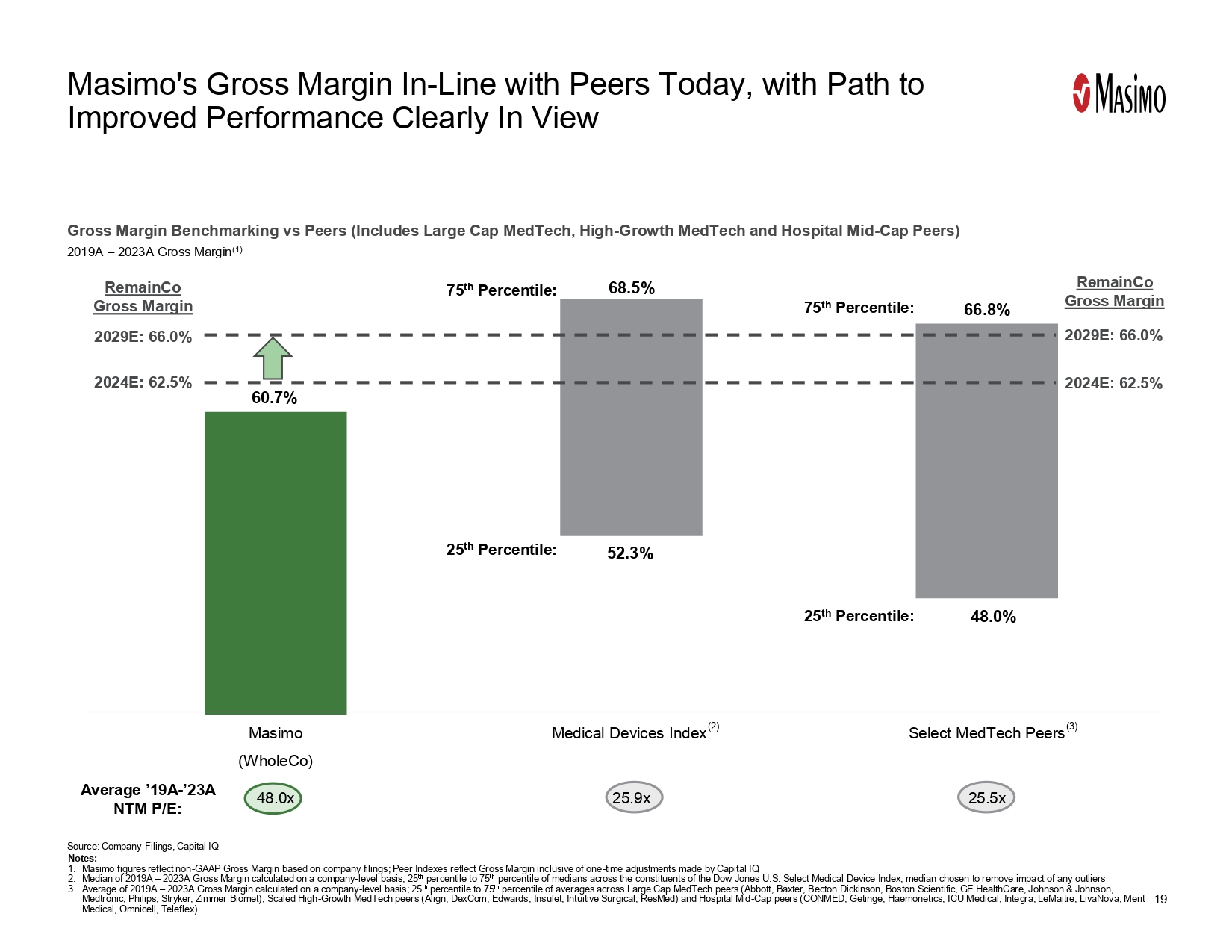

margin for the professional healthcare business, up from ~24% for 2024E, driven by:oIncreasing gross margin from 62.5% (in line with

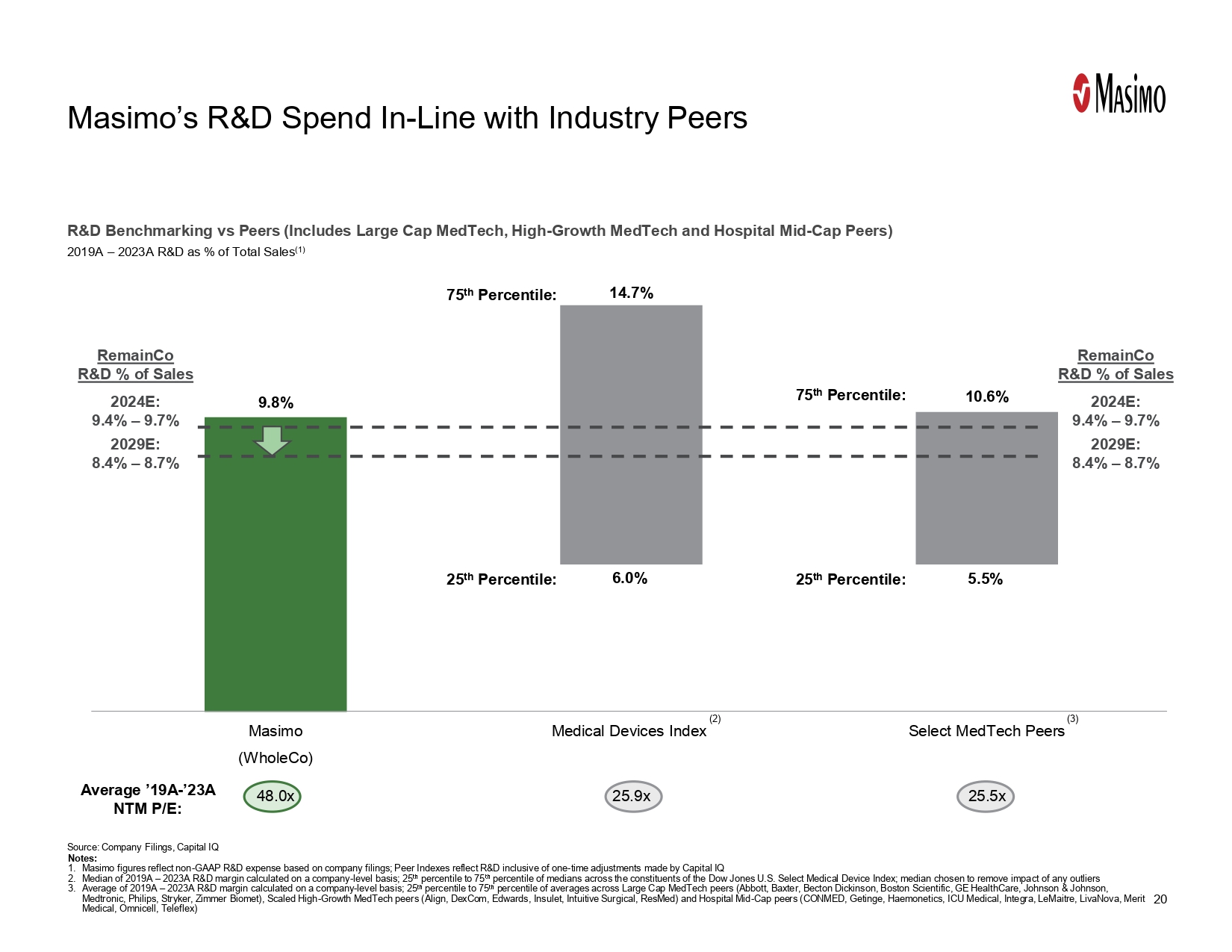

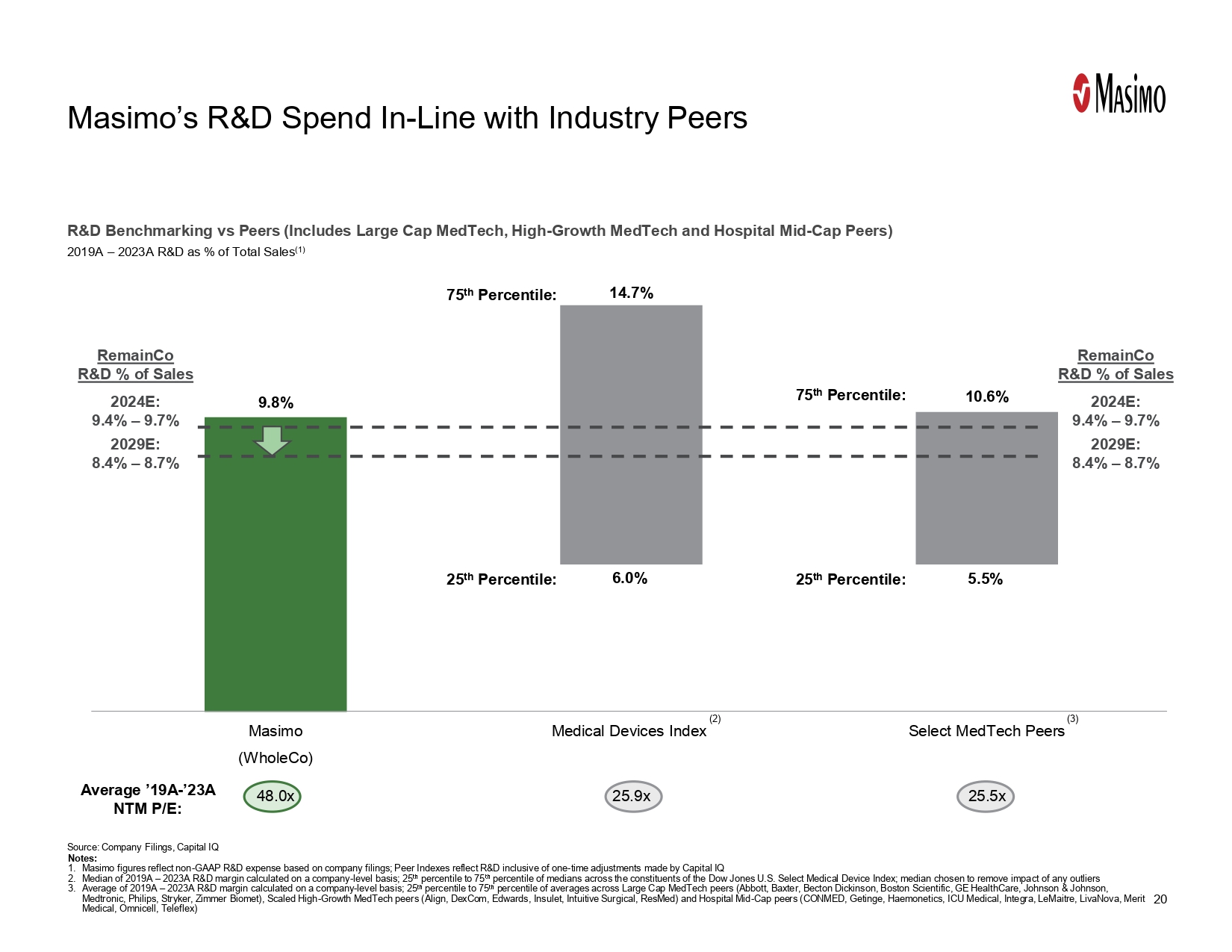

industry peers) to 66%, contributing 350 bps of margin expansion. oReducing R&D expenses from ~9% -10% (in line with industry peers)

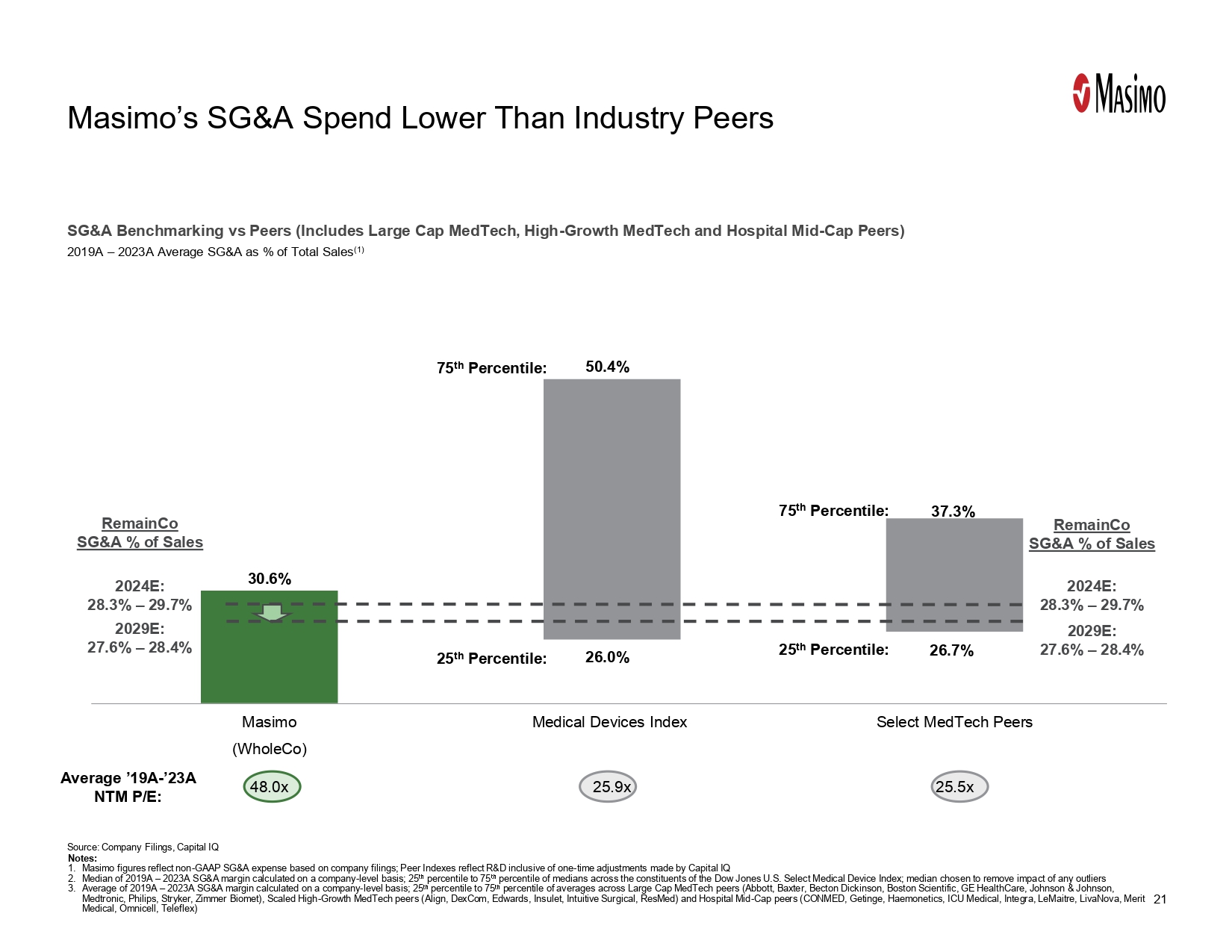

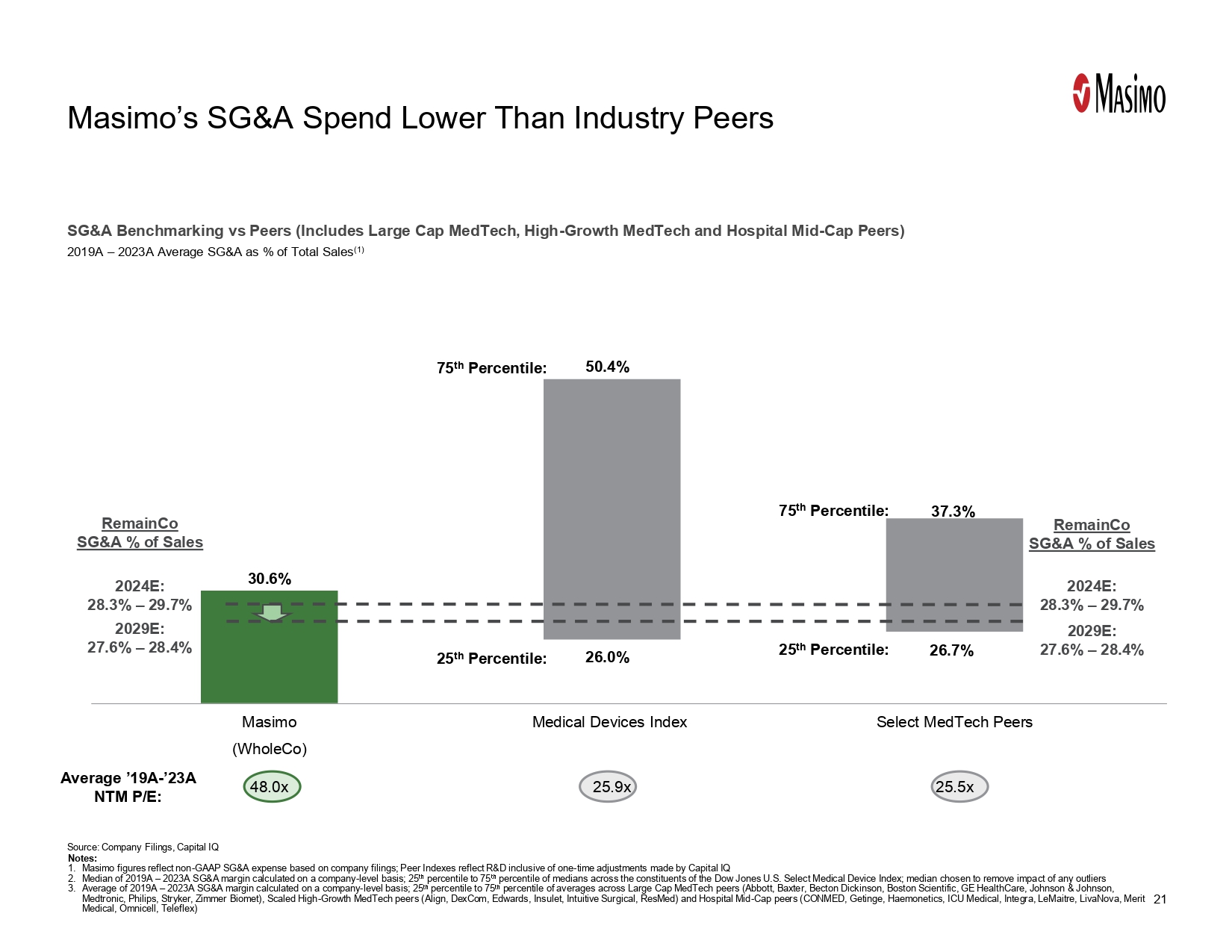

to ~8 -9%, contributing ~100 bps of margin improvement. oReducing SG&A expenses from ~29% (lower than industry peers) to ~28%, contributing

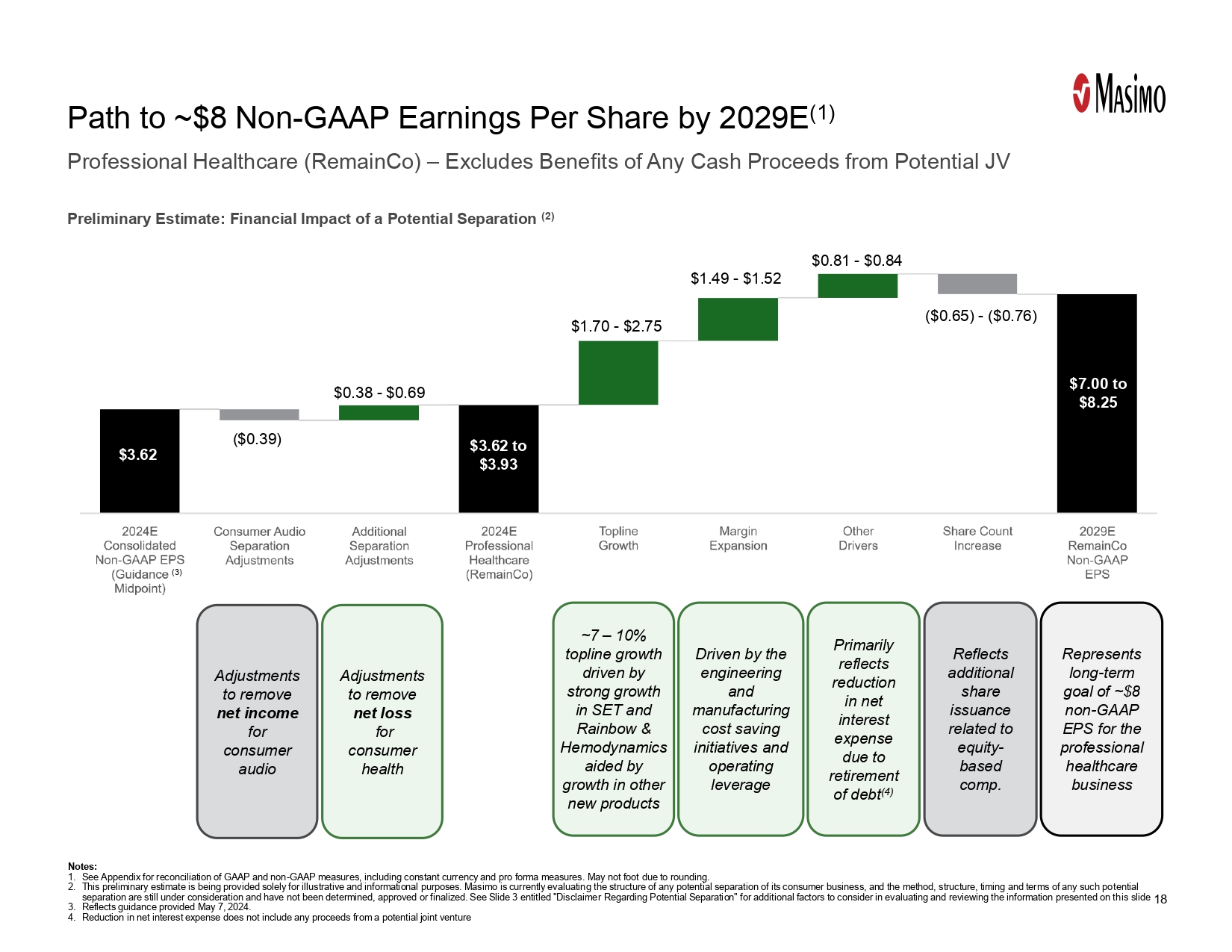

~100 bps of margin improvement. Executing a Plan to Meaningfully Increase Earnings Power 5-year goal of ~$8 earnings per share for the

professional healthcare business, driven by:o~7 -10% revenue growth, attributable to continued share gains for SET pulse oximetry and

increasing adoption of high-growth technology platforms (rainbow & hemodynamics, capnography & gas, brain monitoring, hospital

automation and telehealth). o~550 basis points of operating margin expansion. oStrong cash flow generation to retire debt and eliminate

interest expense, partially offset by additional share issuances related to equity-based compensation. We are not assuming cash from

the separation in this growth to ~$8 per share. Note: 1. This preliminary estimate is being provided solely for illustrative and informational

purposes. Masimo is currently evaluating the structure of any potential separation of its consumer business, and the method, structure,

timing and terms of any such potential separation are still under consideration and have not been determined, approved or finalized.

See Slide 3 entitled "Disclaimer Regarding Potential Separation" for additional factors to consider in evaluating and reviewing

the information presented on this slide.

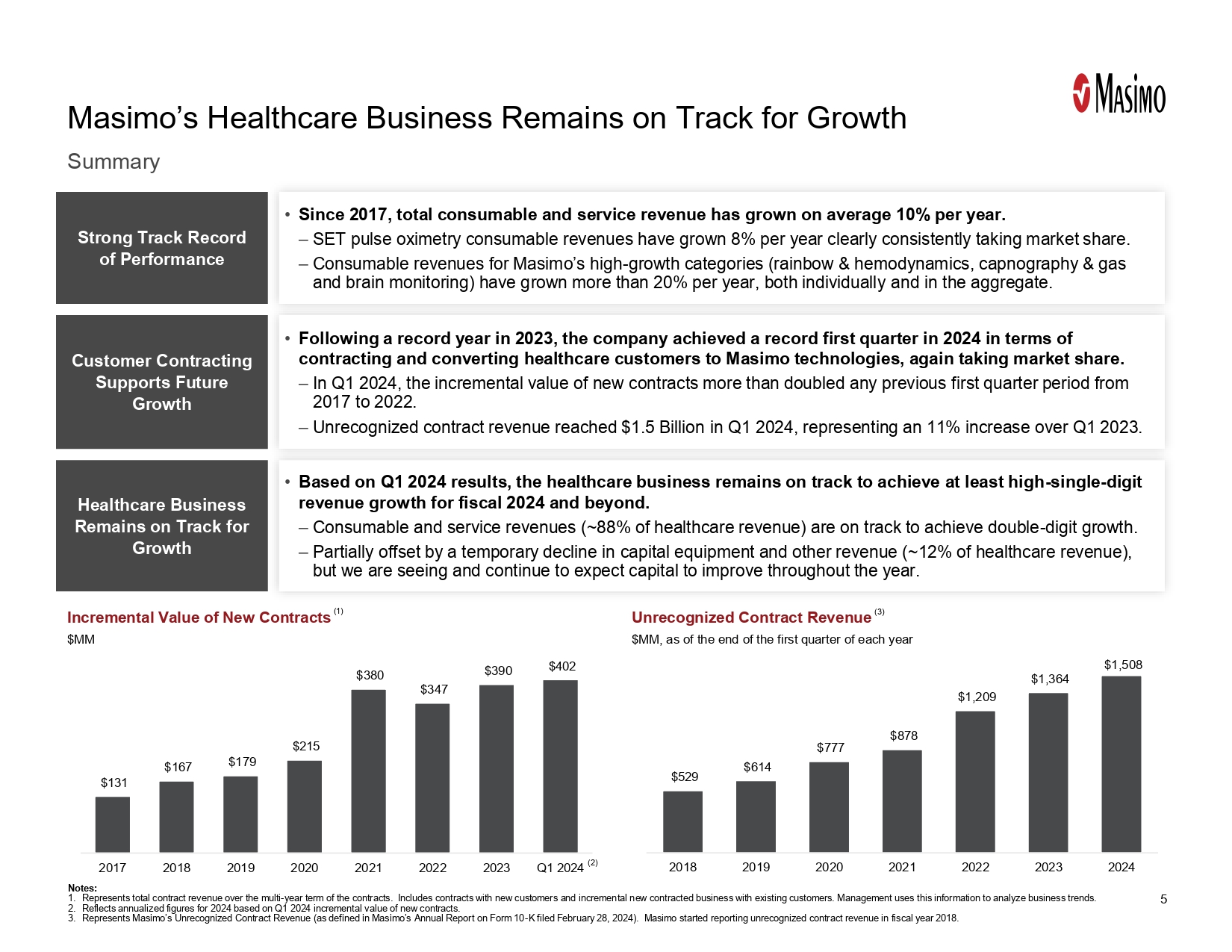

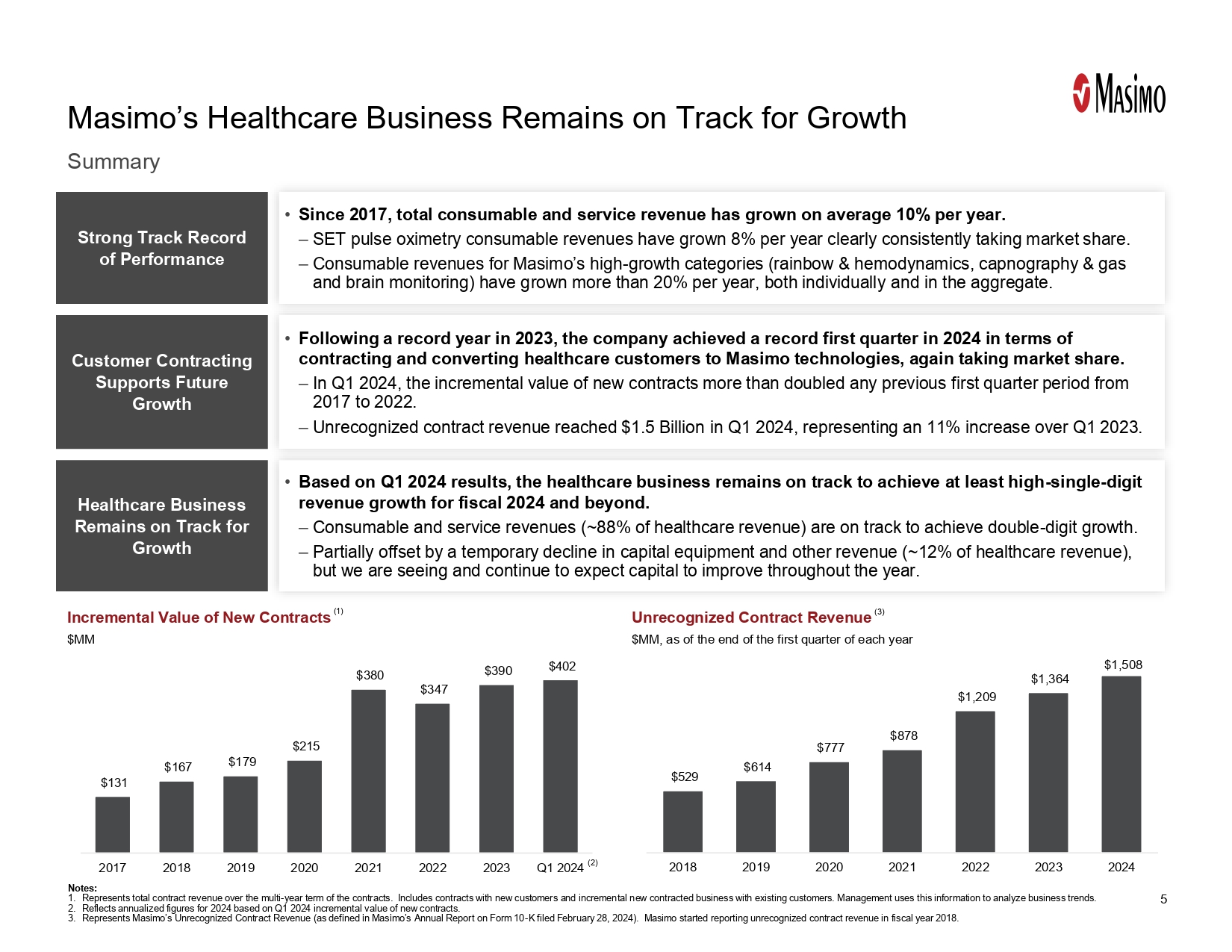

5 Summary Masimo’s Healthcare Business Remains on Track for Growth $131 $167 $179 $215 $380 $347 $390 $402 2017 2018 2019 2020 2021 2022 2023 Q1 2024 Incremental Value of New Contracts $MM $529 $614 $777 $878 $1,209 $1,364 $1,508 2018 2019 2020 2021 2022 2023 2024 Unrecognized Contract Revenue $MM, as of the end of the first quarter of each year Strong Track Record of Performance • Since 2017, total consumable and service revenue has grown on average 10% per year. – SET pulse oximetry consumable revenues have grown 8% per year clearly consistently taking market share. – Consumable revenues for Masimo’s high - growth categories (rainbow & hemodynamics, capnography & gas and brain monitoring) have grown more than 20% per year, both individually and in the aggregate. Customer Contracting Supports Future Growth • Following a record year in 2023, the company achieved a record first quarter in 2024 in terms of contracting and converting healthcare customers to Masimo technologies, again taking market share. – In Q1 2024, the incremental value of new contracts more than doubled any previous first quarter period from 2017 to 2022. – Unrecognized contract revenue reached $1.5 Billion in Q1 2024, representing an 11% increase over Q1 2023. Healthcare Business Remains on Track for Growth • Based on Q1 2024 results, the healthcare business remains on track to achieve at least high - single - digit revenue growth for fiscal 2024 and beyond. – Consumable and service revenues (~88% of healthcare revenue) are on track to achieve double - digit growth. – Partially offset by a temporary decline in capital equipment and other revenue (~12% of healthcare revenue), but we are seeing and continue to expect capital to improve throughout the year. Notes: 1. Represents total contract revenue over the multi - year term of the contracts. Includes contracts with new customers and incremen tal new contracted business with existing customers. Management uses this information to analyze business trends. 2. Reflects annualized figures for 2024 based on Q1 2024 incremental value of new contracts. 3. Represents Masimo’s Unrecognized Contract Revenue (as defined in Masimo’s Annual Report on Form 10 - K filed February 28, 2024). Masimo started reporting unrecognized contract revenue in fiscal year 2018.

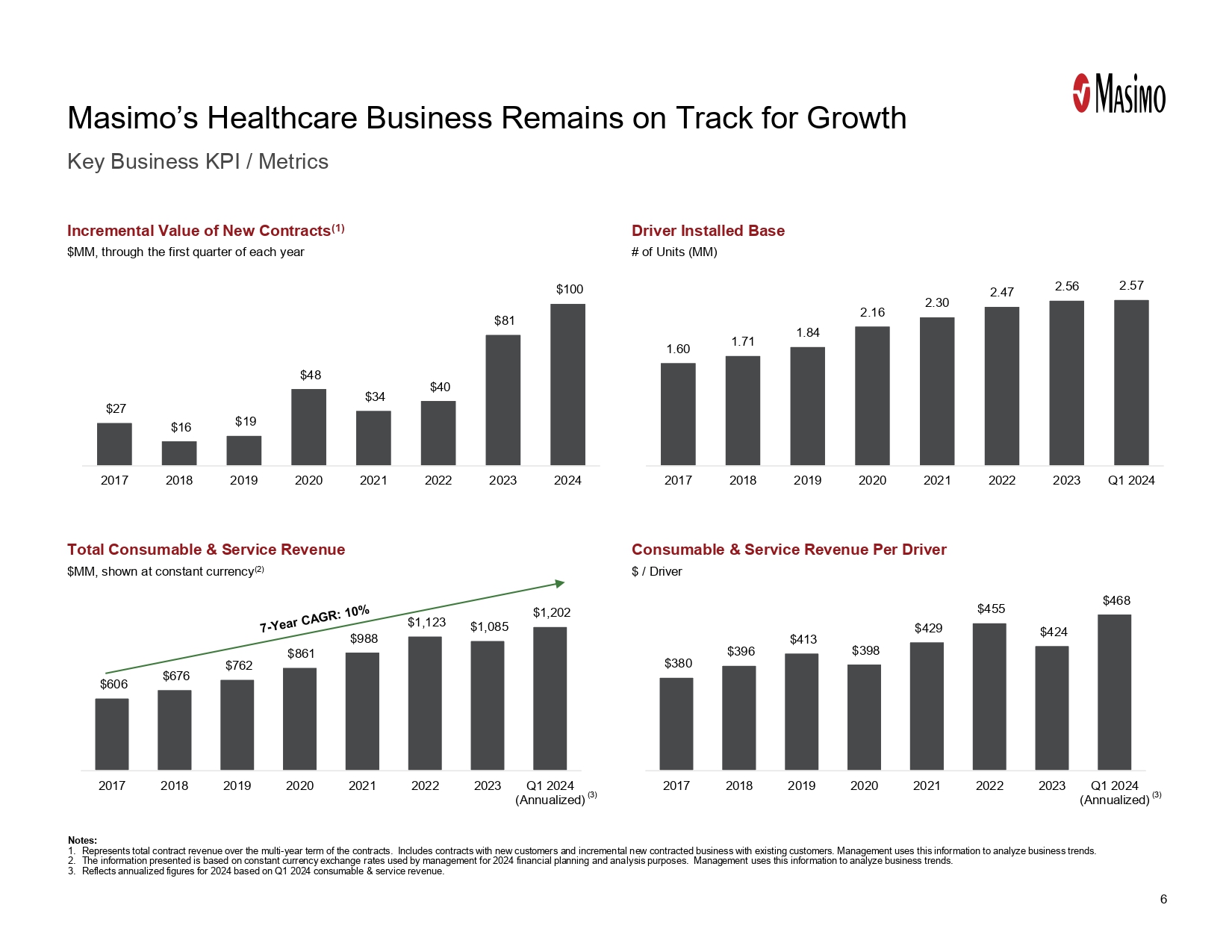

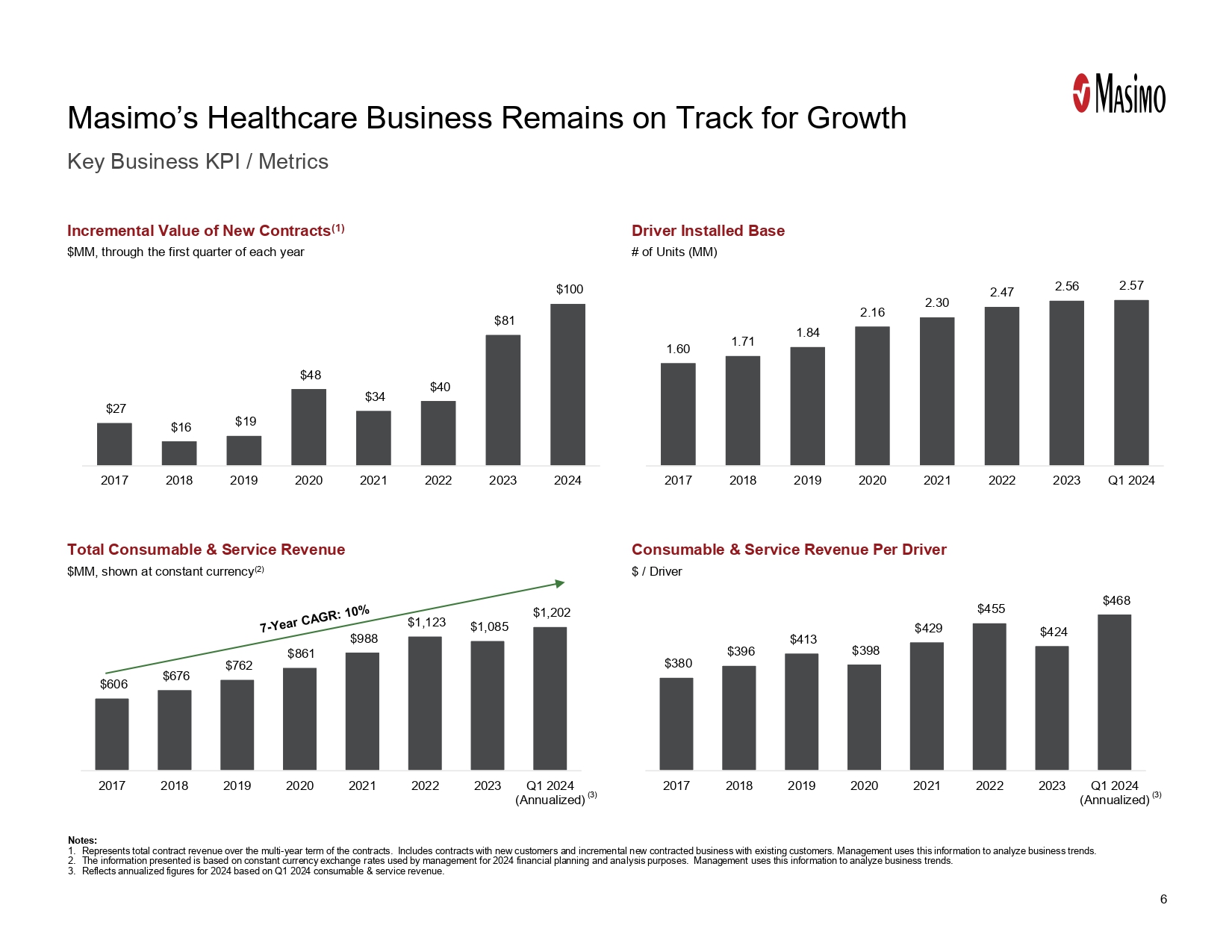

Incremental Value of New Contracts (1) $MM, through the first quarter of each year Driver Installed Base # of Units (MM) Total Consumable & Service Revenue $MM, shown at constant currency (2) Consumable & Service Revenue Per Driver $ / Driver 6 Key Business KPI / Metrics Masimo’s Healthcare Business Remains on Track for Growth $27 $16 $19 $48 $34 $40 $81 $100 2017 2018 2019 2020 2021 2022 2023 2024 1.60 1.71 1.84 2.16 2.30 2.47 2.56 2.57 2017 2018 2019 2020 2021 2022 2023 Q1 2024 $606 $676 $762 $861 $988 $1,123 $1,085 $1,202 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) $380 $396 $413 $398 $429 $455 $424 $468 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) Notes: 1. Represents total contract revenue over the multi - year term of the contracts. Includes contracts with new customers and incremen tal new contracted business with existing customers. Management uses this information to analyze business trends. 2. The information presented is based on constant currency exchange rates used by management for 2024 financial planning and ana lys is purposes. Management uses this information to analyze business trends. 3. Reflects annualized figures for 2024 based on Q1 2024 consumable & service revenue.

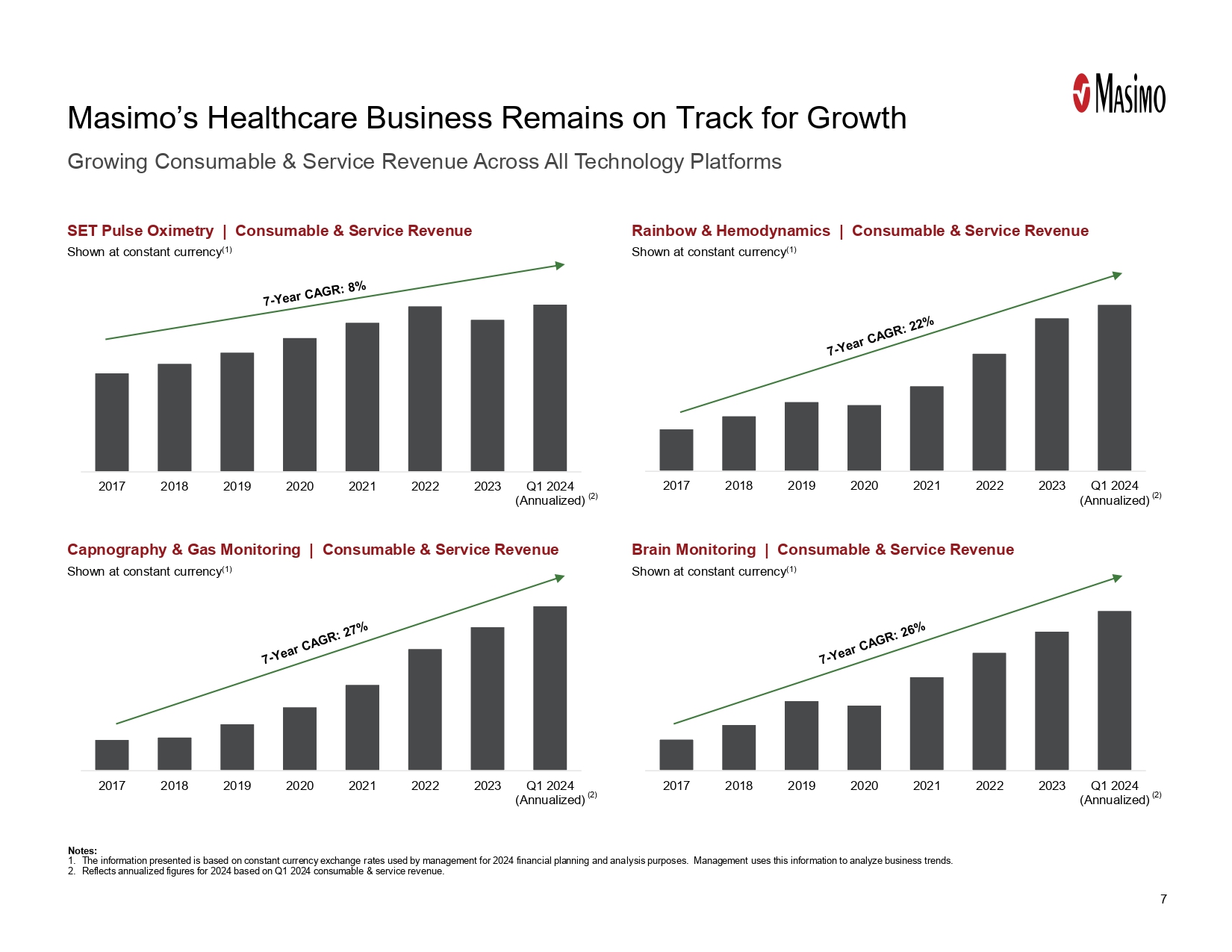

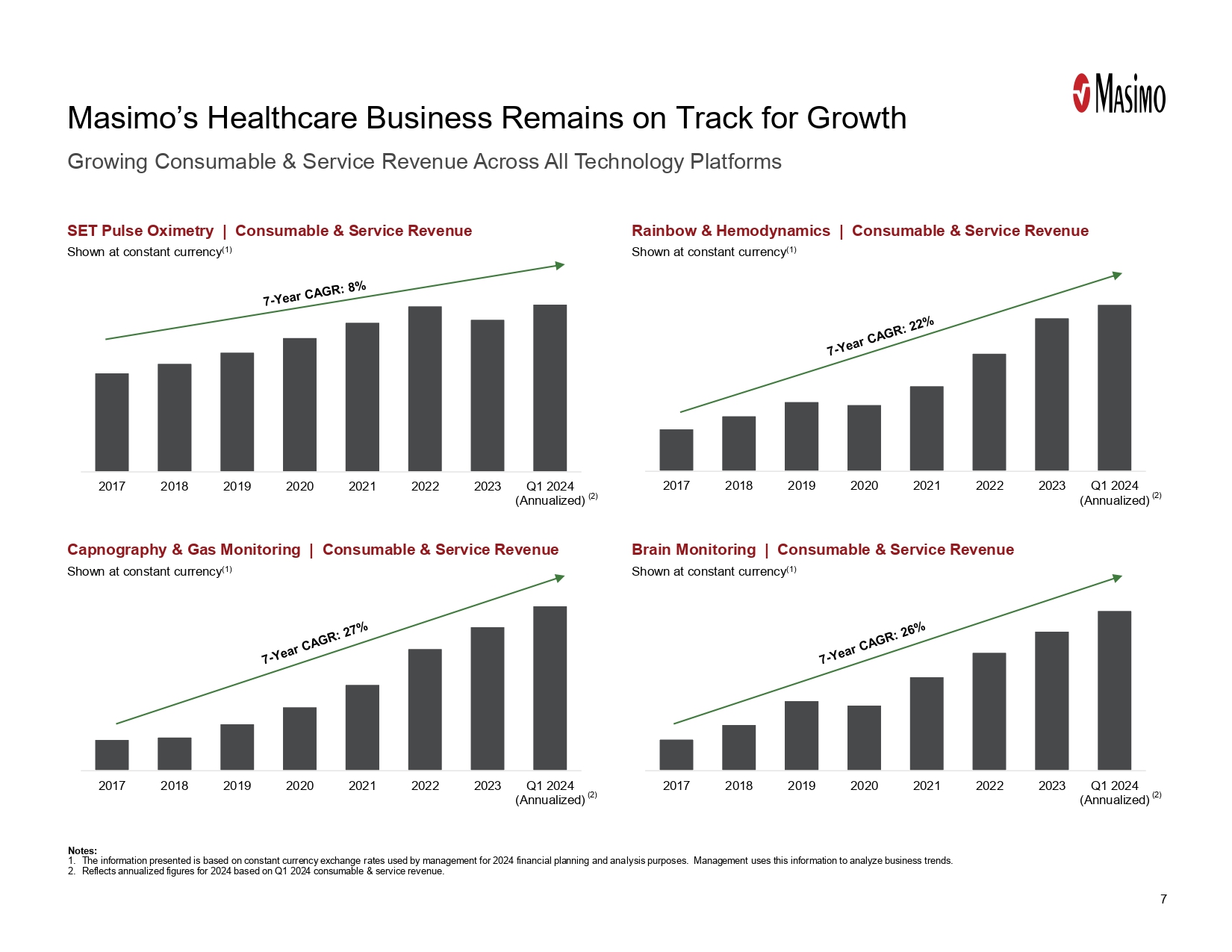

SET Pulse Oximetry | Consumable & Service Revenue Shown at constant currency (1) Rainbow & Hemodynamics | Consumable & Service Revenue Shown at constant currency (1) Capnography & Gas Monitoring | Consumable & Service Revenue Shown at constant currency (1) Brain Monitoring | Consumable & Service Revenue Shown at constant currency (1) 7 Growing Consumable & Service Revenue Across All Technology Platforms Masimo’s Healthcare Business Remains on Track for Growth 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) 2017 2018 2019 2020 2021 2022 2023 Q1 2024 (Annualized) Notes: 1. The information presented is based on constant currency exchange rates used by management for 2024 financial planning and ana lys is purposes. Management uses this information to analyze business trends. 2. Reflects annualized figures for 2024 based on Q1 2024 consumable & service revenue.

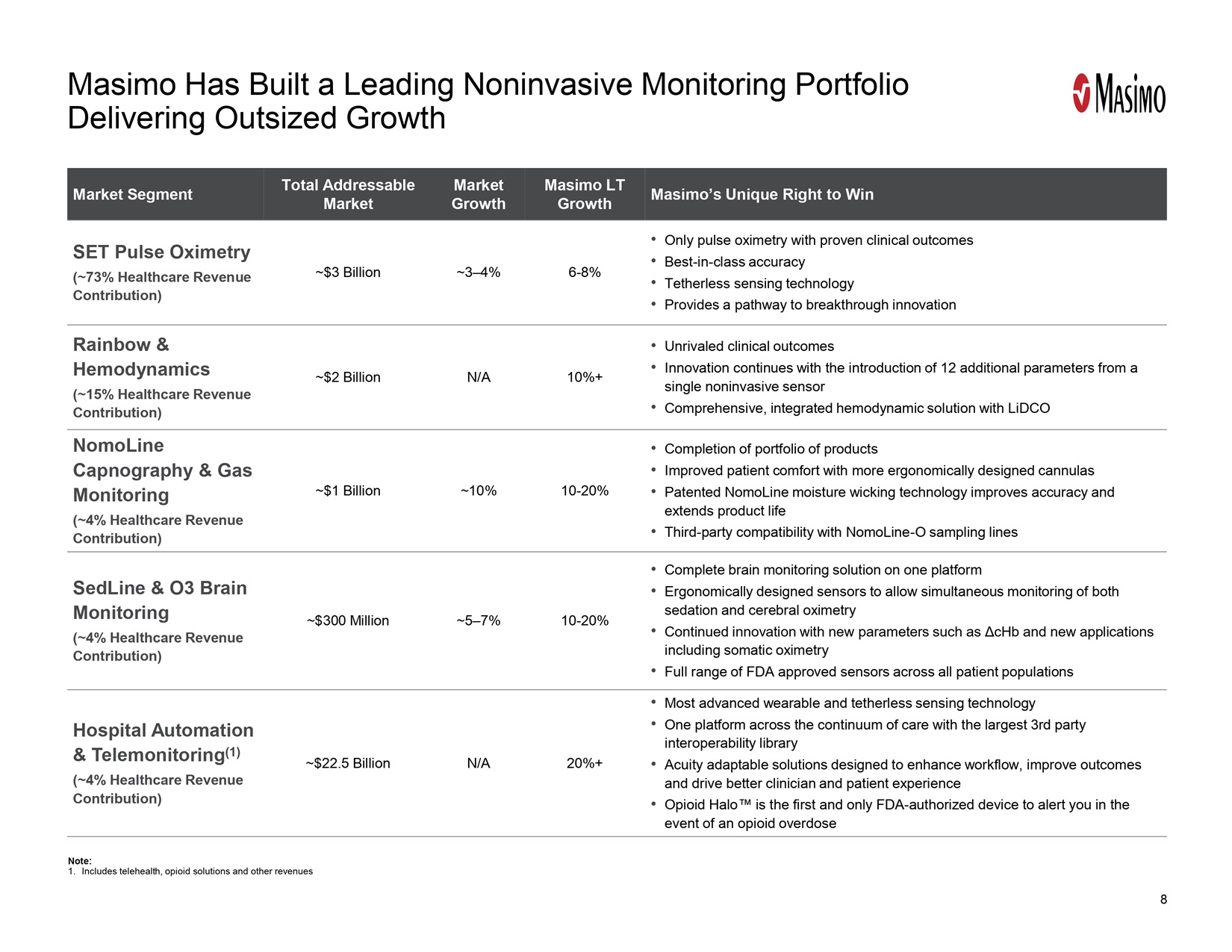

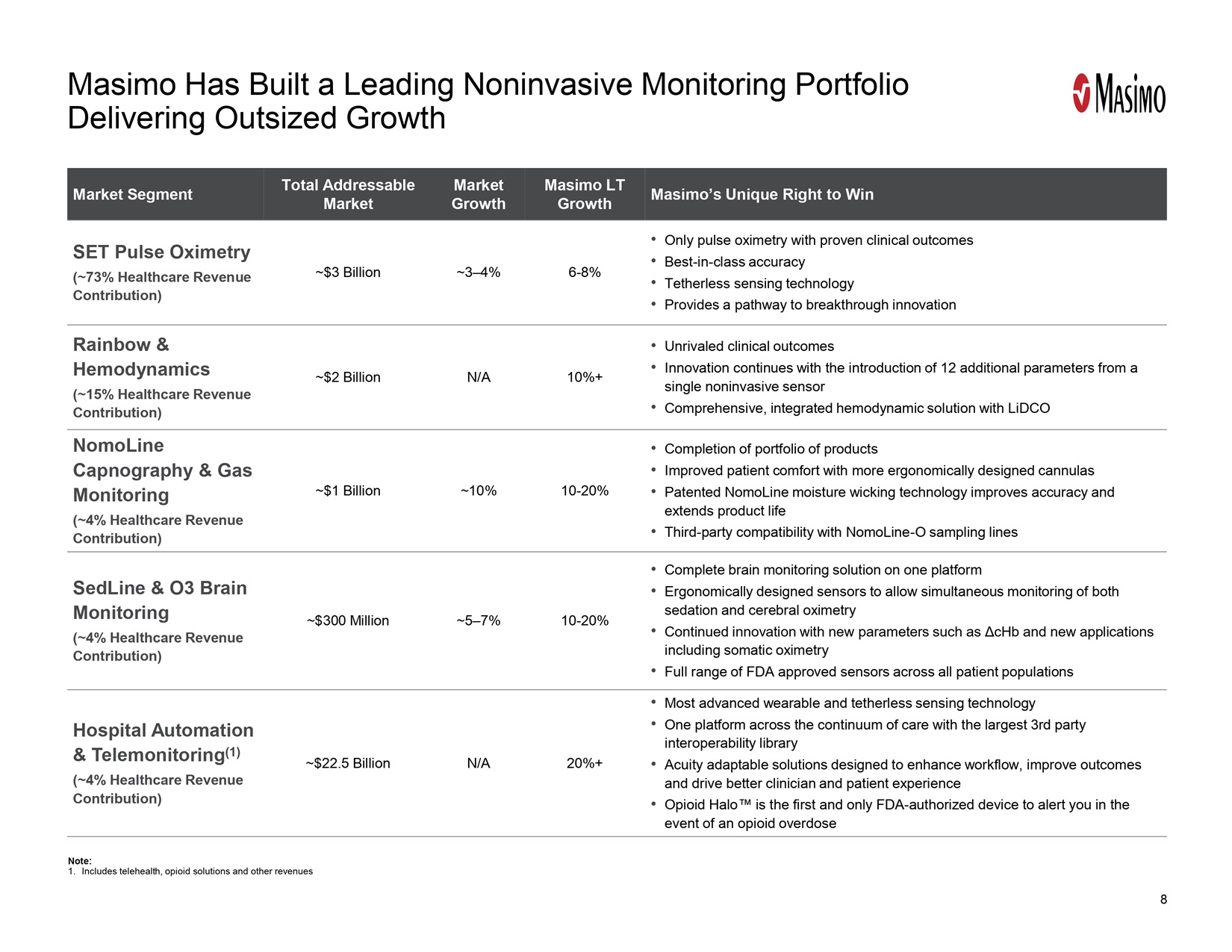

Masimo

Has Built a Leading Noninvasive Monitoring Portfolio Delivering Outsized GrowthMarket Segment Total Addressable Market Market Growth

Masimo LT Growth Masimo’s Unique Right to Win SET PulseOximetry (~73% Healthcare Revenue Contribution) ~$3 Billion ~3–4%

6-8% Only pulse oximetry with proven clinical outcomes Best-in-class accuracy Tetherless sensing technology Provides a pathway to breakthrough

innovation Rainbow& Hemodynamics (~15% Healthcare Revenue Contribution) ~$2 Billion N/A 10%+ Unrivaled clinical outcomes Innovation

continues with the introduction of 12 additional parameters from a single noninvasive sensor Comprehensive, integrated hemodynamic solution

with LiDCO NomoLineCapnography & Gas Monitoring (~4% Healthcare Revenue Contribution) ~$1 Billion ~10% 10-20% Completion of portfolio

of products Improved patient comfort with more ergonomically designed cannulas Patented NomoLine moisture wicking technology improves

accuracy and extends product life Third-party compatibility with NomoLine-O sampling lines SedLine & O3 Brain Monitoring (~4% Healthcare

Revenue Contribution) ~$300 Million ~5–7% 10-20% Complete brain monitoring solution on one platform Ergonomically designed sensors

to allow simultaneous monitoring of both sedation and cerebral oximetry Continued innovation with new parameters such as ΔcHb and

new applications including somatic oximetry Full range of FDA approved sensors across all patient populations Hospital Automation &

Telemonitoring(1) (~4% Healthcare Revenue Contribution) ~$22.5 Billion N/A 20%+ Most advanced wearable and tetherless sensing technology

One platform across the continuum of care with the largest 3rd party interoperability library Acuity adaptable solutions designed to

enhance workflow, improve outcomes and drive better clinician and patient experience Opioid Halo™ is the first and only FDA-authorized

device to alert you in the event of an opioid overdose

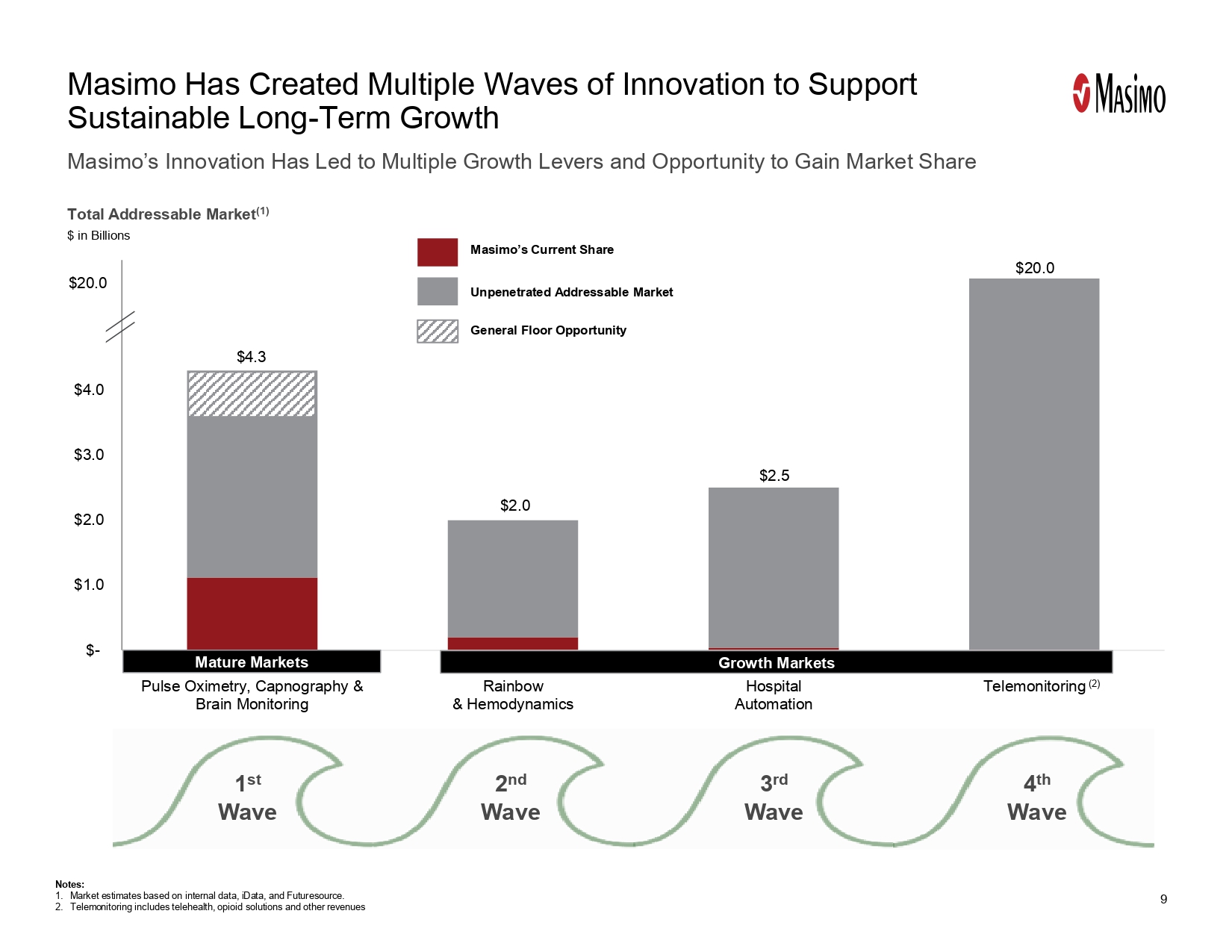

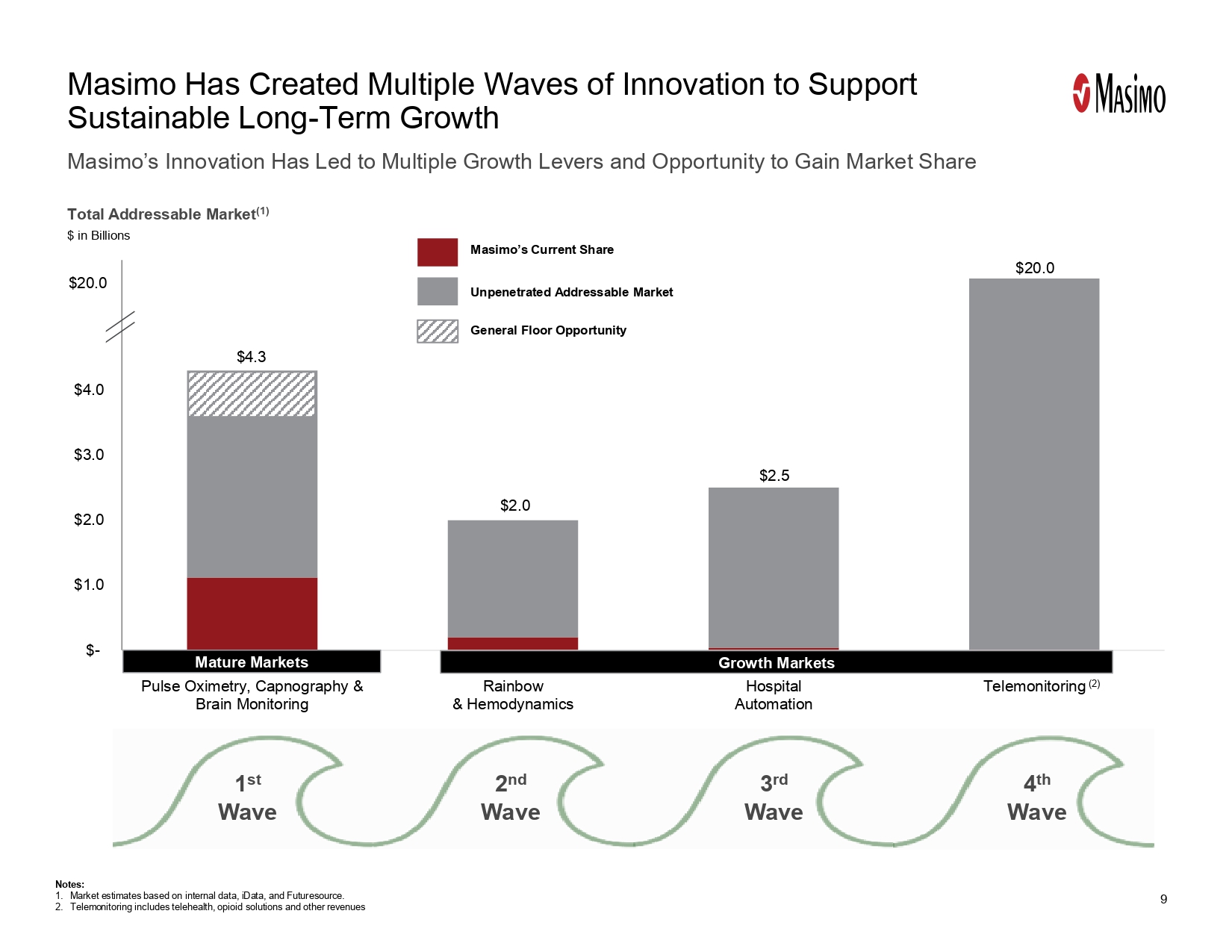

Total Addressable Market (1) $ in Billions 9 Masimo’s Innovation Has Led to Multiple Growth Levers and Opportunity to Gain Market Share Masimo Has Created Multiple Waves of Innovation to Support Sustainable Long - Term Growth $4.3 $2.0 $2.5 $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 Pulse Oximetry, Capnography & Brain Monitoring Rainbow & Hemodynamics Hospital Automation Telemonitoring $20.0 Masimo’s Current Share Unpenetrated Addressable Market General Floor Opportunity Mature Markets Growth Markets 2 nd Wave 1 st Wave 3 rd Wave 4 th Wave

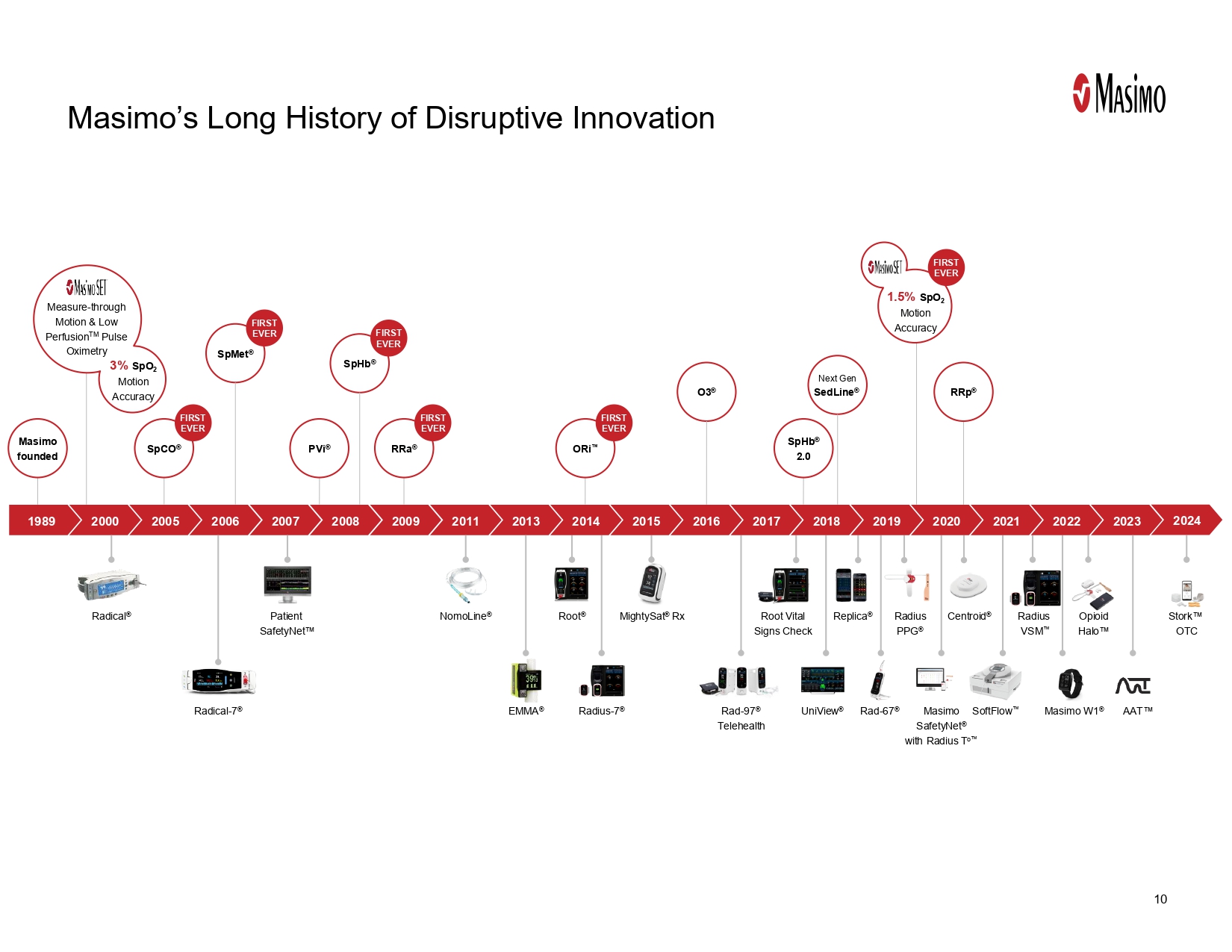

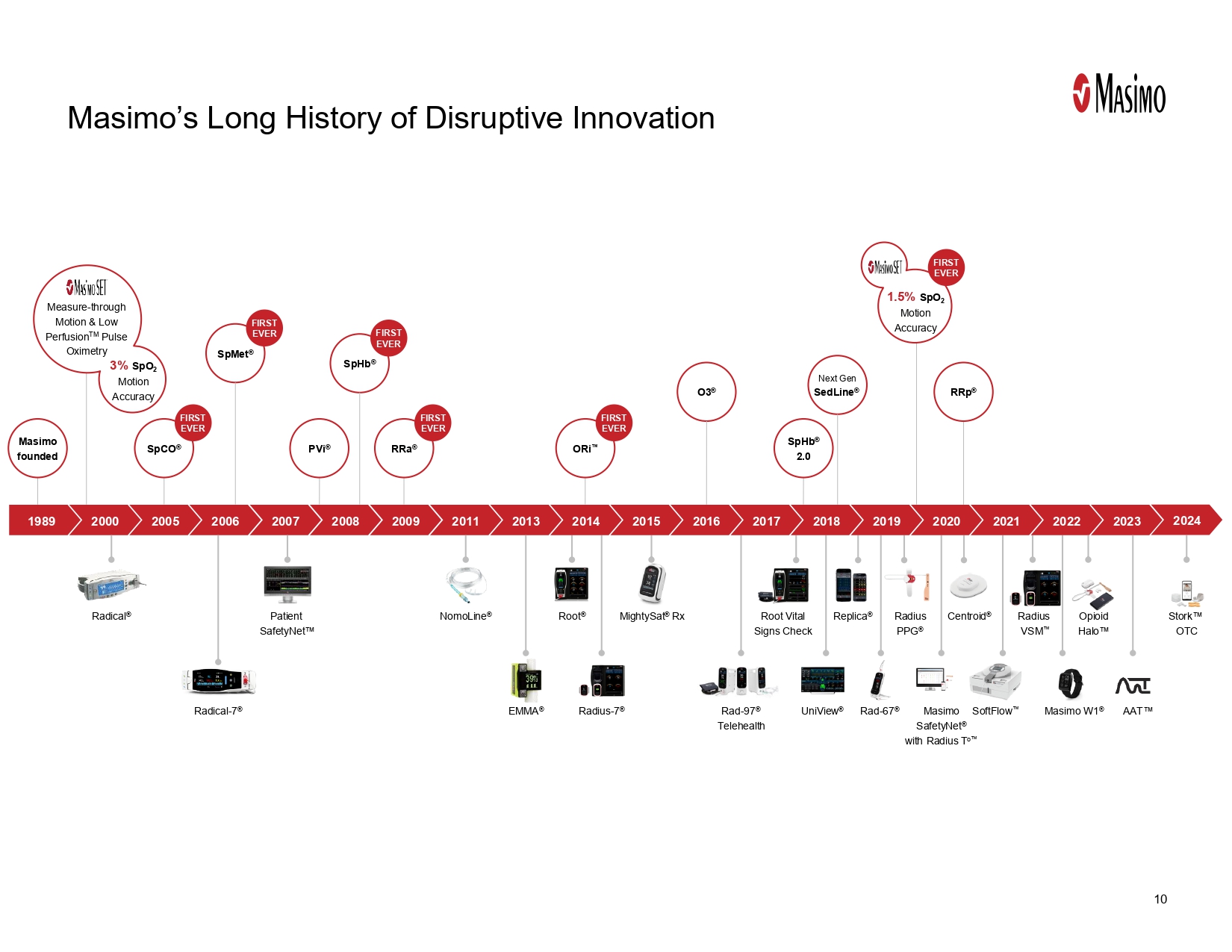

10 Masimo’s Long History of Disruptive Innovation SpCO ® RRa ® SpMet ® PVi ® SpHb ® O3 ® RRp ® Patient SafetyNet NomoLine ® MightySat ® Rx Rad - 97 ® Telehealth Masimo founded 3% SpO 2 Motion Accuracy Measure - through Motion & Low Perfusion TM Pulse Oximetry 1989 2000 2005 2006 2007 2008 2009 2011 2013 1.5% SpO 2 Motion Accuracy SpHb ® 2.0 SedLine ® EMMA ® Radical - 7 ® Root ® Radius - 7 ® Radical ® Root Vital Signs Check Rad - 67 ® Radius PPG ® Masimo SafetyNet ® with Radius T o Centroid ® SoftFlow Radius VSM Masimo W1 ® UniView ® Replica ® 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Opioid Halo AAT Stork OTC ORi 2024

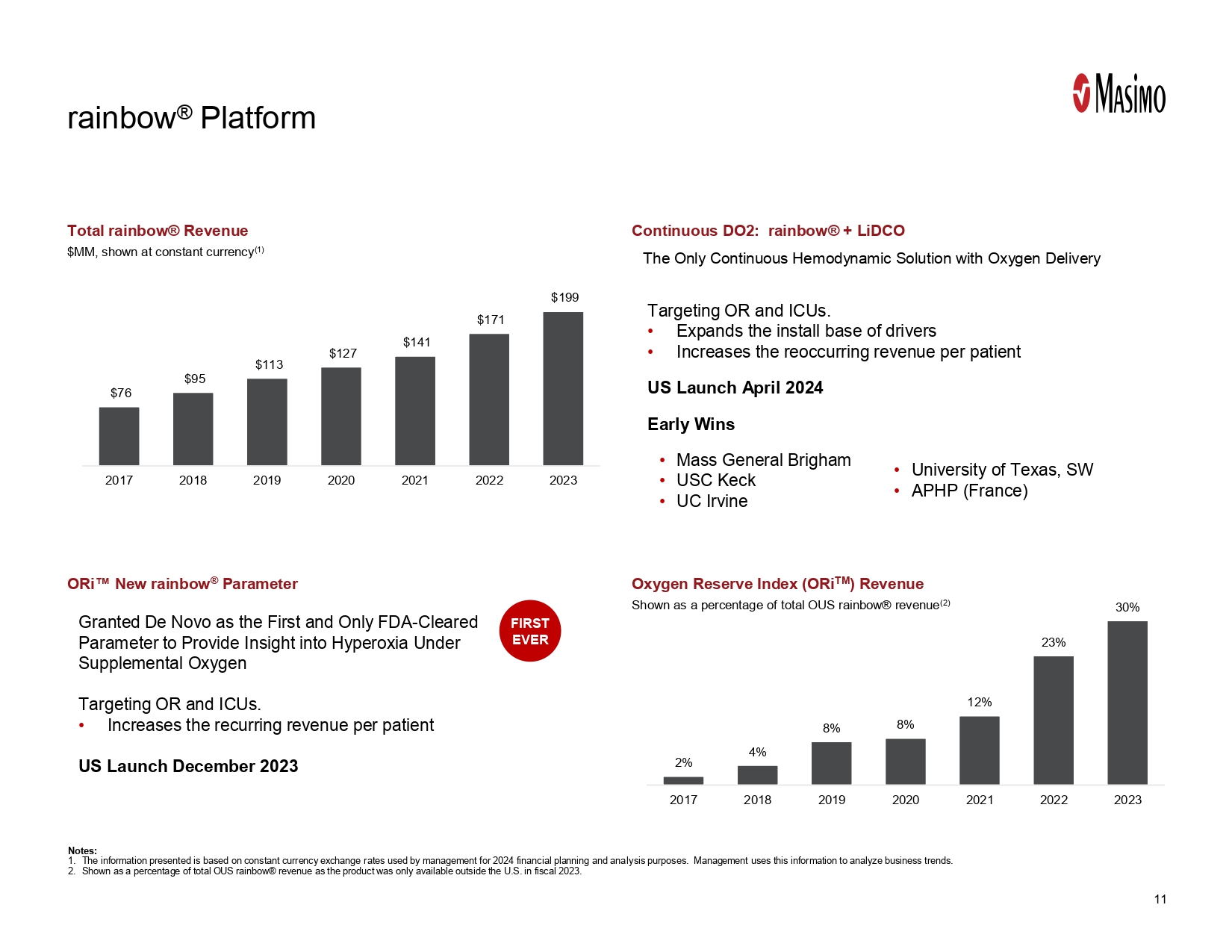

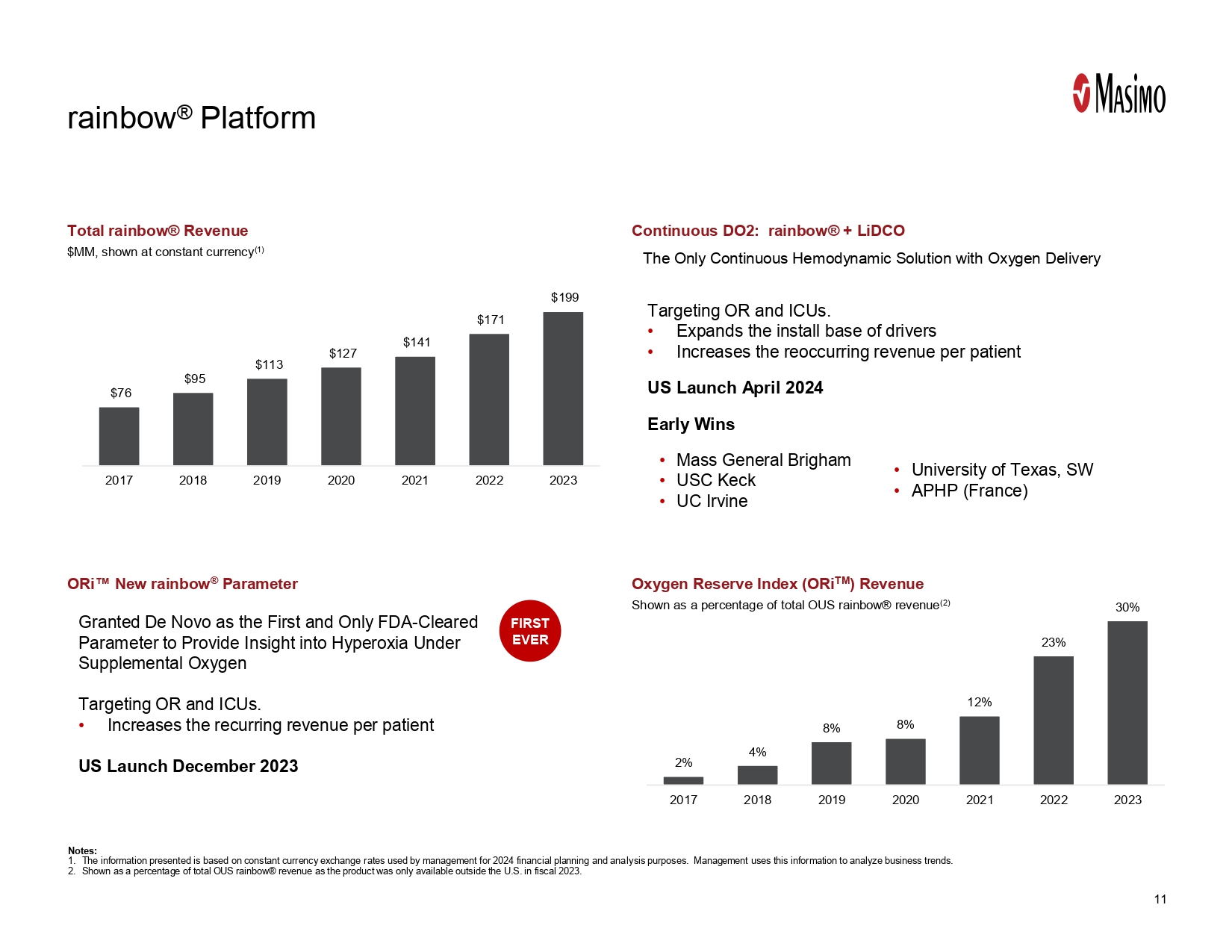

Total rainbow® Revenue $MM, shown at constant currency (1) Continuous DO2: rainbow® + LiDCO ORi New rainbow ® Parameter Oxygen Reserve Index ( ORi TM ) Revenue Shown as a percentage of total OUS rainbow® revenue (2) 11 rainbow ® Platform $76 $95 $113 $127 $141 $171 $199 2017 2018 2019 2020 2021 2022 2023 Targeting OR and ICUs. • Expands the install base of drivers • Increases the reoccurring revenue per patient US Launch April 2024 Early Wins • Mass General Brigham • USC Keck • UC Irvine • University of Texas, SW • APHP (France) The Only Continuous Hemodynamic Solution with Oxygen Delivery Granted De Novo as the First and Only FDA - Cleared Parameter to Provide Insight into Hyperoxia Under Supplemental Oxygen Targeting OR and ICUs. • Increases the recurring revenue per patient US Launch December 2023 FIRST EVER Notes: 1. The information presented is based on constant currency exchange rates used by management for 2024 financial planning and ana lys is purposes. Management uses this information to analyze business trends. 2. Shown as a percentage of total OUS rainbow® revenue as the product was only available outside the U.S. in fiscal 2023. 2% 4% 8% 8% 12% 23% 30% 2017 2018 2019 2020 2021 2022 2023

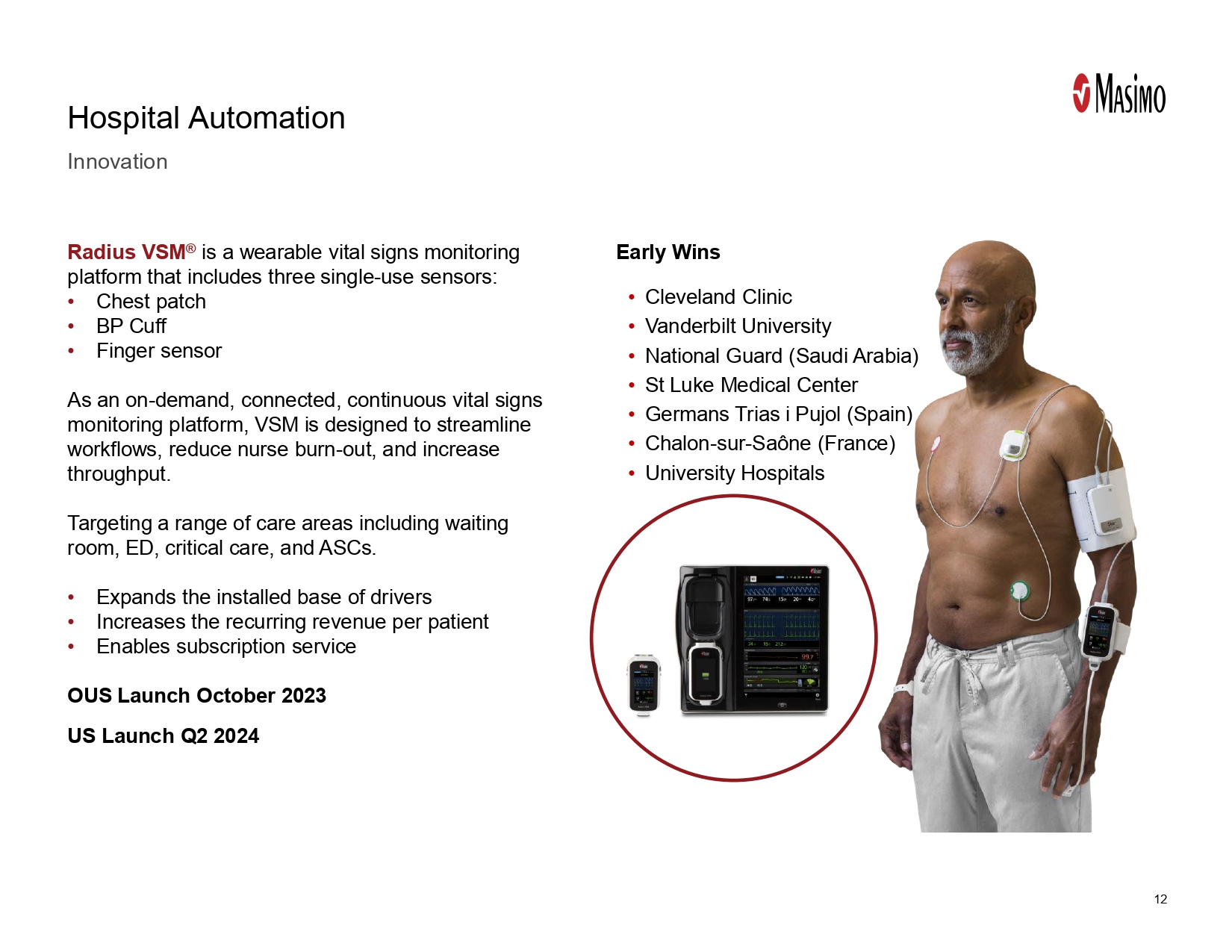

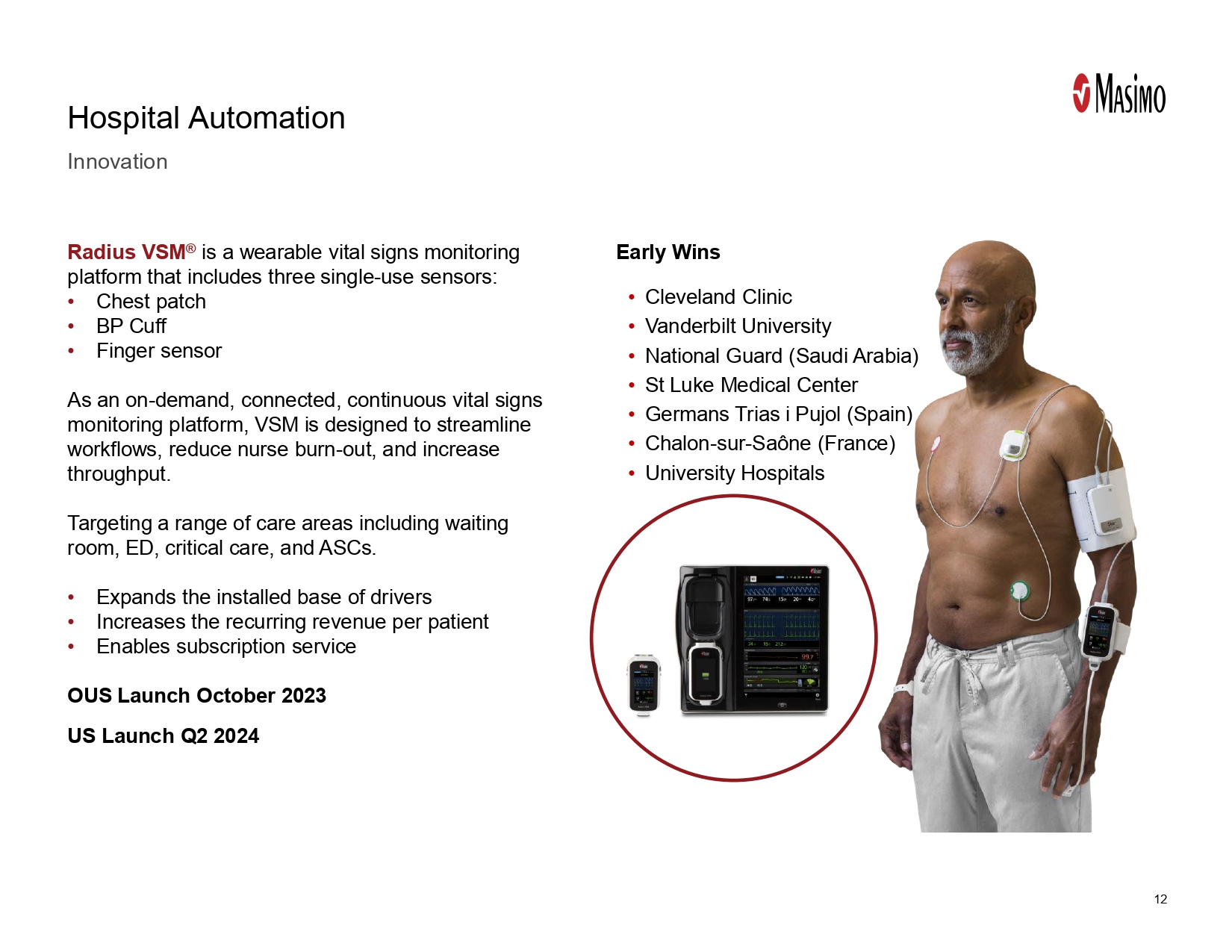

12 Innovation Hospital Automation Early Wins • Cleveland Clinic • Vanderbilt University • National Guard (Saudi Arabia) • St Luke Medical Center • Germans Trias i Pujol (Spain) • Chalon - sur - Saône (France) • University Hospitals Radius VSM ® is a wearable vital signs monitoring platform that includes three single - use sensors: • Chest patch • BP Cuff • Finger sensor As an on - demand, connected, continuous vital signs monitoring platform, VSM is designed to streamline workflows, reduce nurse burn - out, and increase throughput. Targeting a range of care areas including waiting room, ED, critical care, and ASCs. • Expands the installed base of drivers • Increases the recurring revenue per patient • Enables subscription service OUS Launch October 2023 US Launch Q2 2024

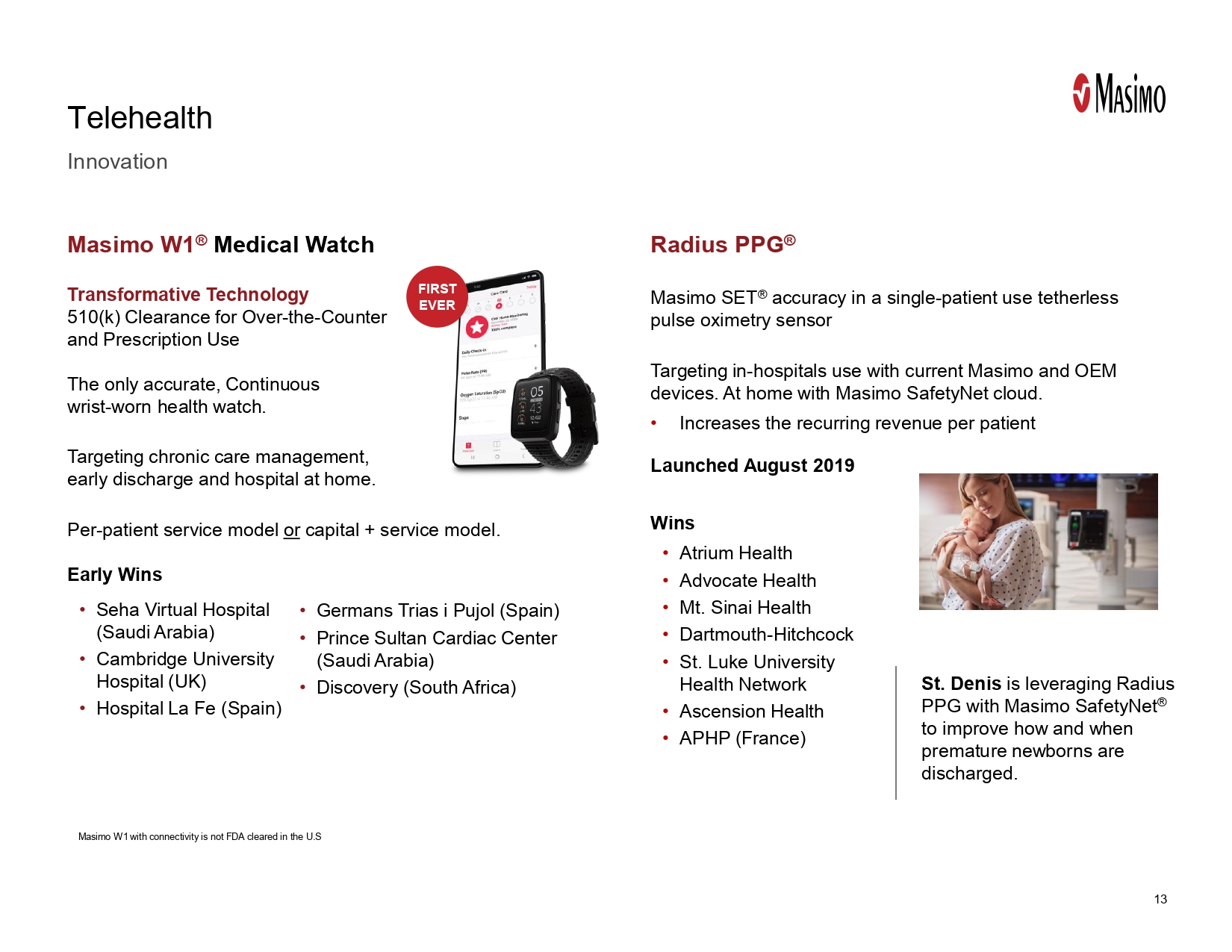

13 Telehealth Masimo W1 ® Medical Watch Transformative Technology 510(k) Clearance for Over - the - Counter and Prescription Use The only accurate, Continuous wrist - worn health watch. Targeting chronic care management, early discharge and hospital at home. Per - patient service model or capital + service model. Early Wins • Seha Virtual Hospital (Saudi Arabia) • Cambridge University Hospital (UK) • Hospital La Fe (Spain) FIRST EVER • Germans Trias i Pujol (Spain) • Prince Sultan Cardiac Center (Saudi Arabia) • Discovery (South Africa) St. Denis is leveraging Radius PPG with Masimo SafetyNet ® to improve how and when premature newborns are discharged. Radius PPG ® Masimo SET ® accuracy in a single - patient use tetherless pulse oximetry sensor Targeting in - hospitals use with current Masimo and OEM devices. At home with Masimo SafetyNet cloud. • Increases the recurring revenue per patient Launched August 2019 Wins • Atrium Health • Advocate Health • Mt. Sinai Health • Dartmouth - Hitchcock • St. Luke University Health Network • Ascension Health • APHP (France) Innovation

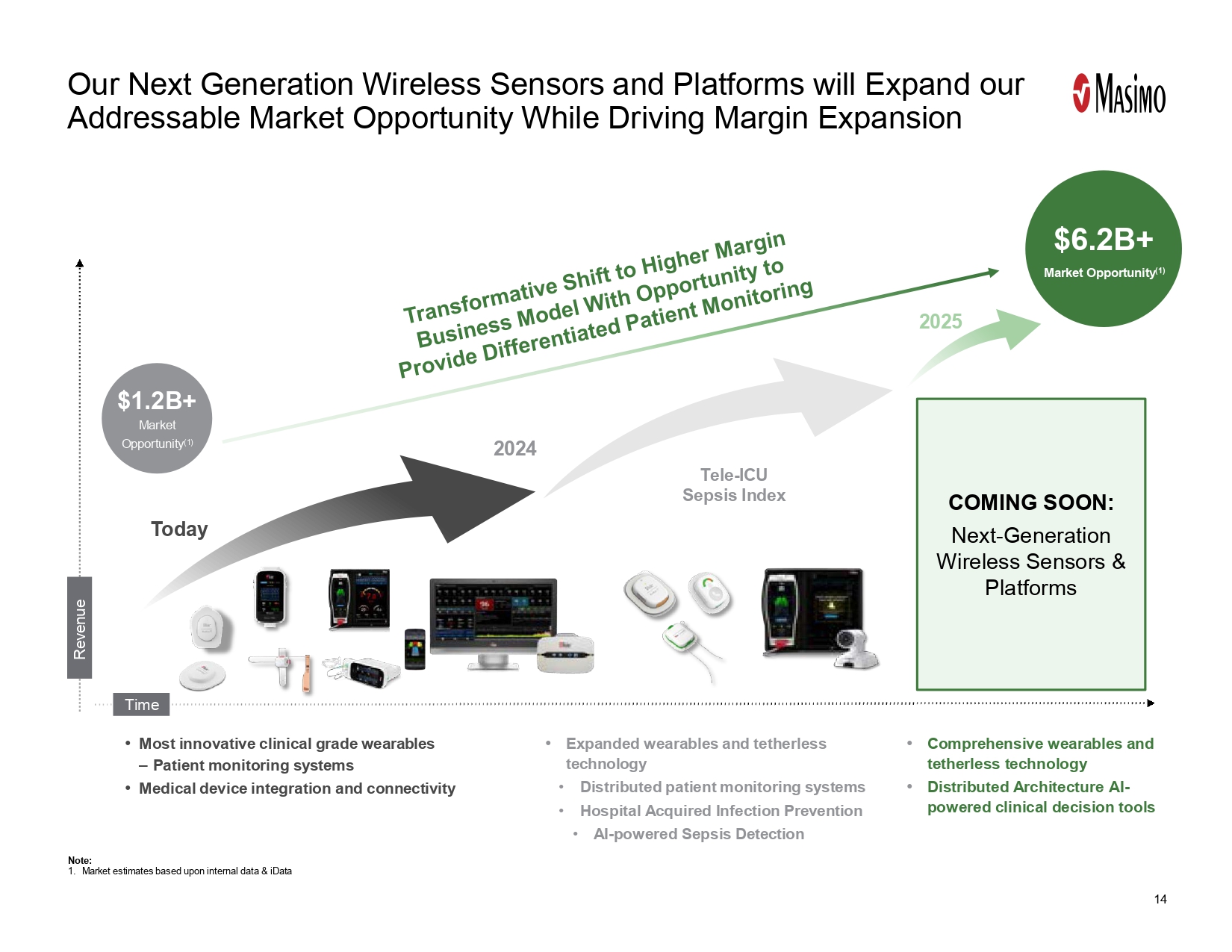

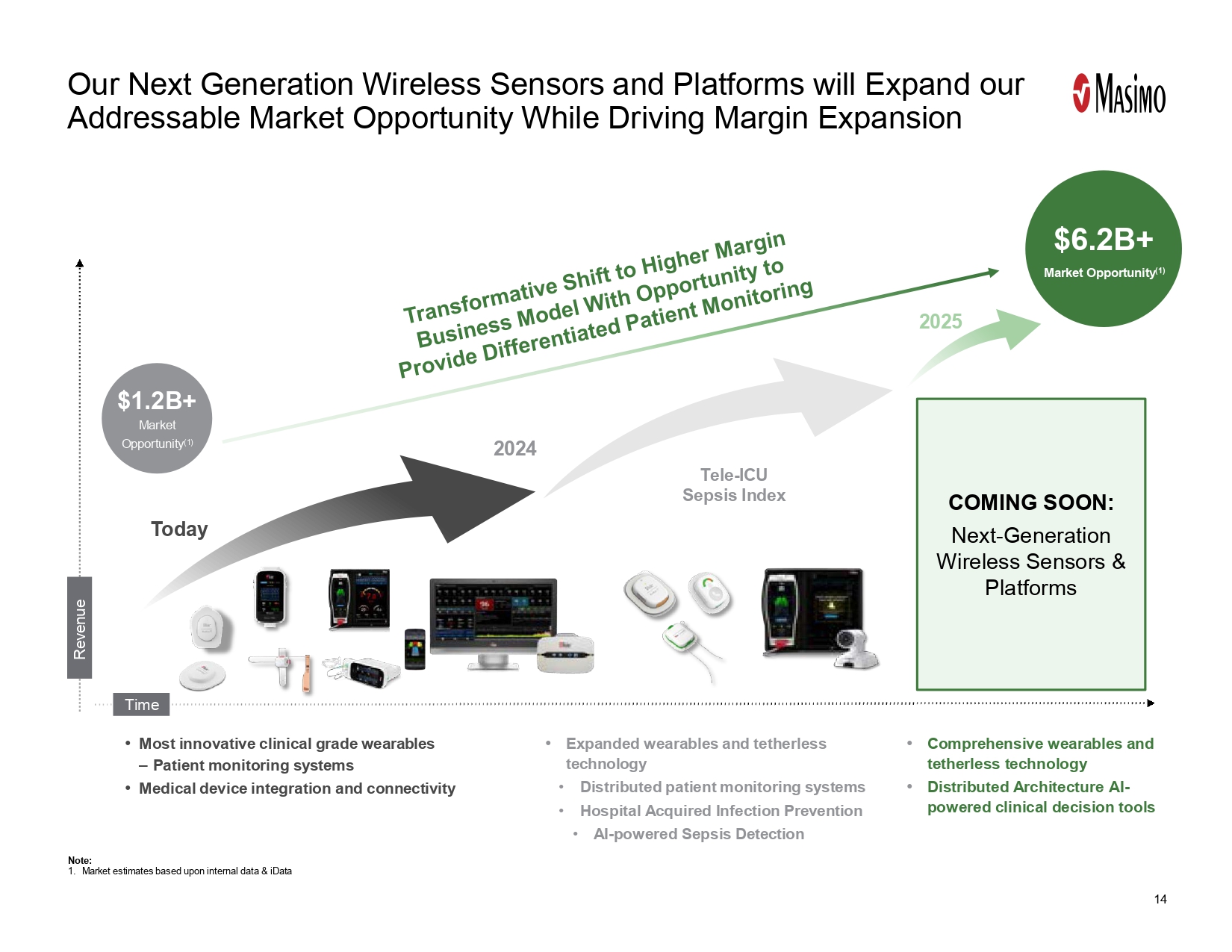

14 Our Next Generation Wireless Sensors and Platforms will Expand our Addressable Market Opportunity While Driving Margin Expansion Today 2024 2025 • Most innovative clinical grade wearables ‒ Patient monitoring systems • Medical device integration and connectivity Reven u e Time $1.2B+ Market Opportunity (1) $6.2B+ Market Opportunity (1) • Expanded wearables and tetherless technology • Distributed patient monitoring systems • Hospital Acquired Infection Prevention • AI - powered Sepsis Detection Tele - ICU Sepsis Index Note: 1. Market estimates based upon internal data & iData COMING SOON: Next - Generation Wireless Sensors & Platforms • Comprehensive wearables and tetherless technology • Distributed Architecture AI - powered clinical decision tools

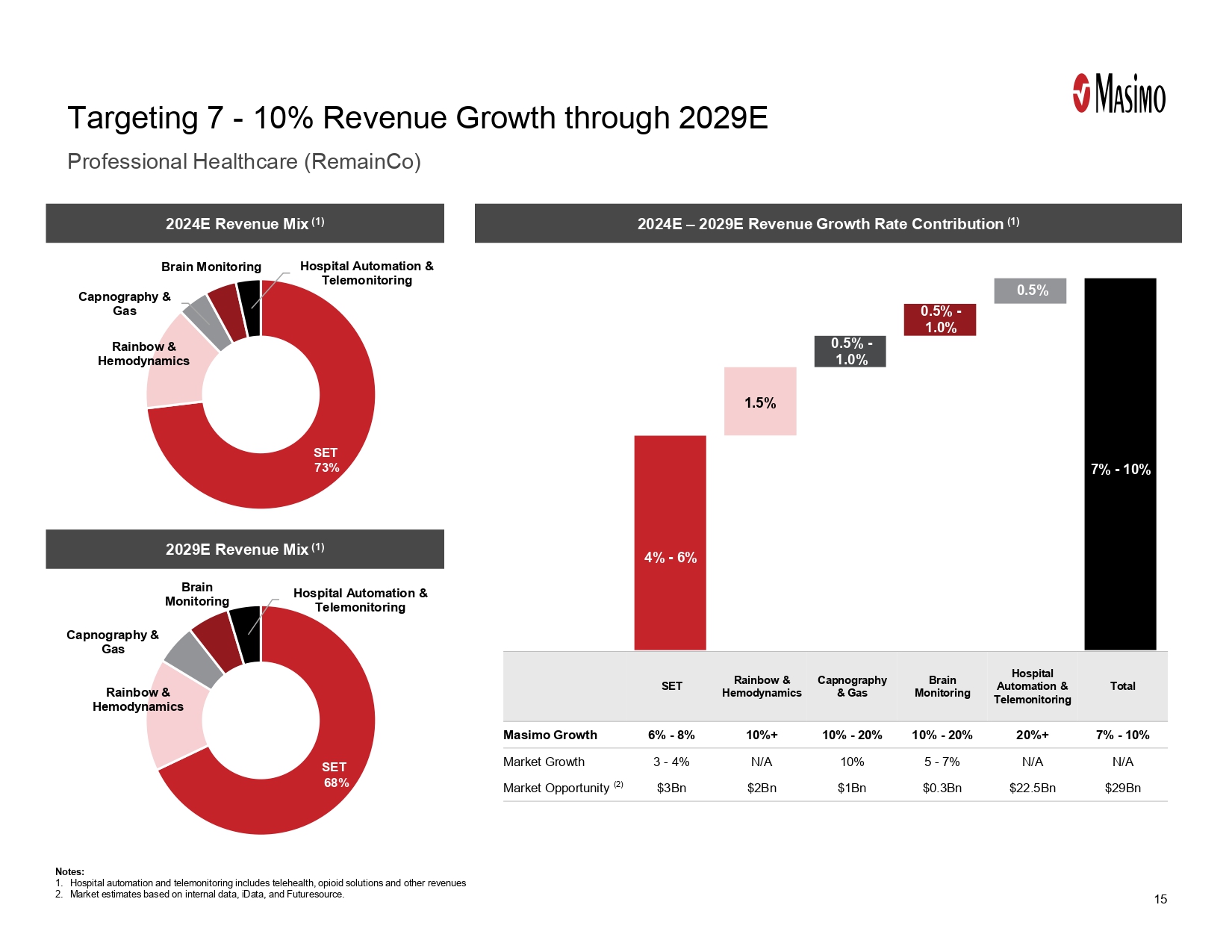

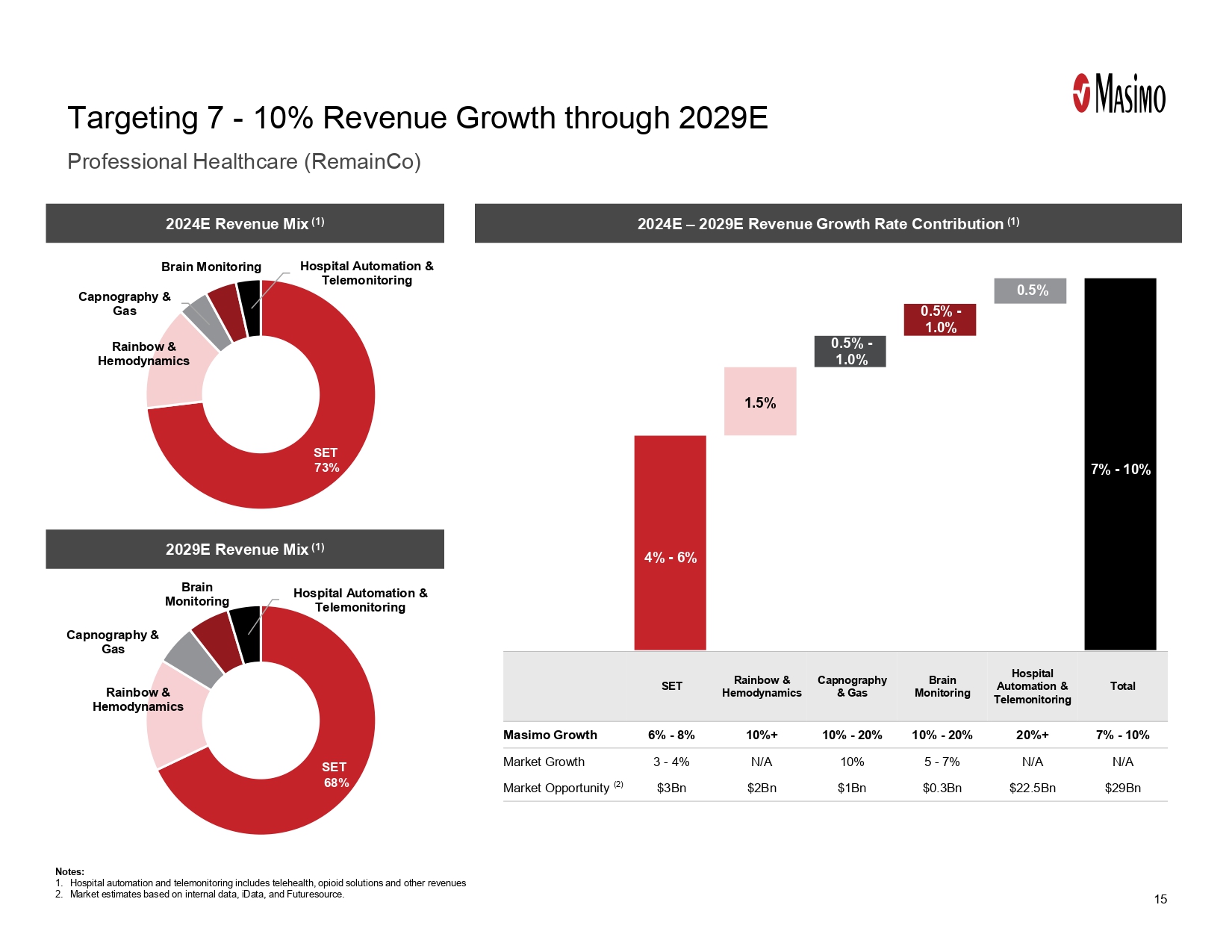

15 Professional Healthcare (RemainCo) Targeting 7 - 10% Revenue Growth through 2029E 2024E Revenue Mix (1) 2024E – 2029E Revenue Growth Rate Contribution (1) 4% - 6% 1.5% 0.5% - 1.0% 0.5% - 1.0% 0.5% 7% - 10% Total Hospital Automation & Telemonitoring Brain Monitoring Capnography & Gas Rainbow & Hemodynamics SET 7% - 10% 20%+ 10% - 20% 10% - 20% 10%+ 6% - 8% Masimo Growth N/A N/A 5 - 7% 10% N/A 3 - 4% Market Growth $29Bn $22.5Bn $0.3Bn $1Bn $2Bn $3Bn Market Opportunity (2) 2029E Revenue Mix (1) SET Rainbow & Hemodynamics Capnography & Gas Brain Monitoring Hospital Automation & Telemonitoring SET Rainbow & Hemodynamics Capnography & Gas Brain Monitoring Hospital Automation & Telemonitoring 73% 68%

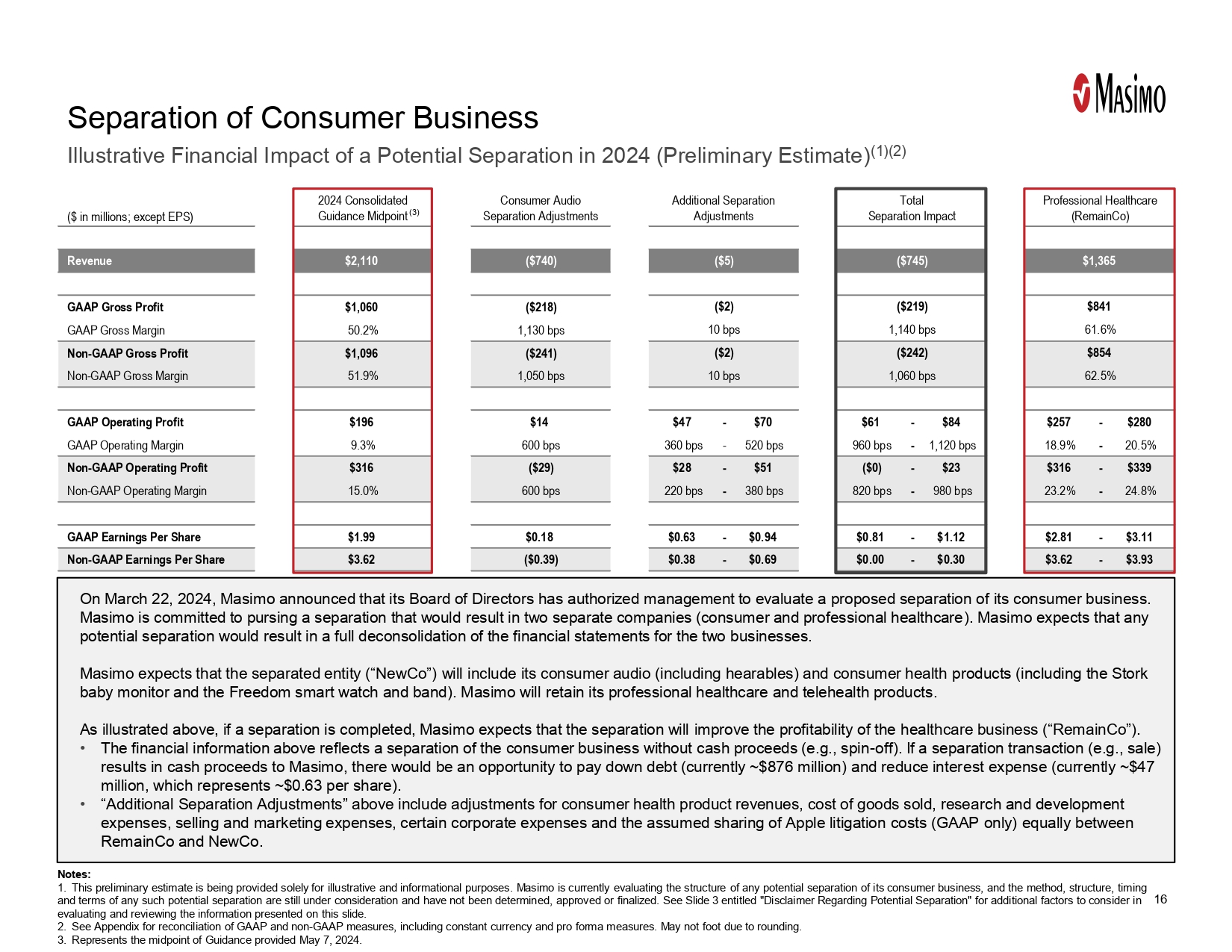

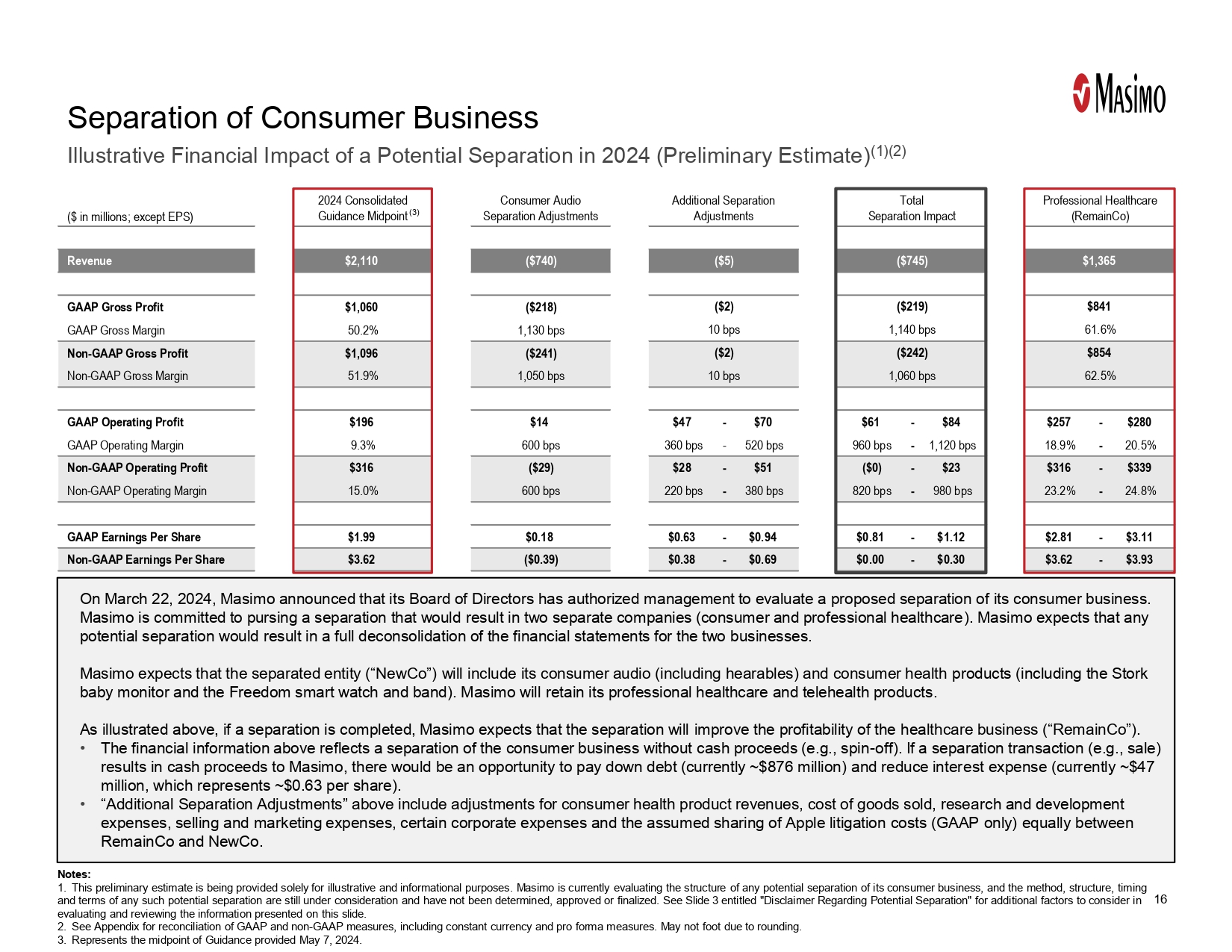

($ in millions; except EPS) Revenue $2,110 ($740) GAAP Gross Profit $1,060 ($218) GAAP Gross Margin 50.2% 1,130 bps Non-GAAP Gross Profit $1,096 ($241) Non-GAAP Gross Margin 51.9% 1,050 bps GAAP Operating Profit $196 $14 $47 - $70 $61 - $84 $257 - $280 GAAP Operating Margin 9.3% 600 bps 360 bps - 520 bps 960 bps - 1,120 bps 18.9% - 20.5% Non-GAAP Operating Profit $316 ($29) $28 - $51 ($0) - $23 $316 - $339 Non-GAAP Operating Margin 15.0% 600 bps 220 bps - 380 bps 820 bps - 980 bps 23.2% - 24.8% GAAP Earnings Per Share $1.99 $0.18 $0.63 - $0.94 $0.81 - $1.12 $2.81 - $3.11 Non-GAAP Earnings Per Share $3.62 ($0.39) $0.38 - $0.69 $0.00 - $0.30 $3.62 - $3.93 ($2) ($242) $854 10 bps 1,060 bps 62.5% ($2) ($219) $841 10 bps 1,140 bps 61.6% ($5) ($745) $1,365 2024 Consolidated Guidance Midpoint Consumer Audio Separation Adjustments Additional Separation Adjustments Total Separation Impact Professional Healthcare (RemainCo) 16 Illustrative Financial Impact of a Potential Separation in 2024 (Preliminary Estimate) (1)(2) Separation of Consumer Business Notes: 1. This preliminary estimate is being provided solely for illustrative and informational purposes. Masimo is currently evaluatin g t he structure of any potential separation of its consumer business, and the method, structure, timing and terms of any such potential separation are still under consideration and have not been determined, approved or finalized. Se e Slide 3 entitled "Disclaimer Regarding Potential Separation" for additional factors to consider in evaluating and reviewing the information presented on this slide. 2. See Appendix for reconciliation of GAAP and non - GAAP measures, including constant currency and pro forma measures. May not foot due to rounding. 3. Represents the midpoint of Guidance provided May 7, 2024. On March 22, 2024, Masimo announced that its Board of Directors has authorized management to evaluate a proposed separation o f i ts consumer business. Masimo is committed to pursing a separation that would result in two separate companies (consumer and professional healthcare ). Masimo expects that any potential separation would result in a full deconsolidation of the financial statements for the two businesses. Masimo expects that the separated entity (“NewCo”) will include its consumer audio (including hearables) and consumer health pro ducts (including the Stork baby monitor and the Freedom smart watch and band). Masimo will retain its professional healthcare and telehealth products. As illustrated above, if a separation is completed, Masimo expects that the separation will improve the profitability of the hea lthcare business (“RemainCo”). • The financial information above reflects a separation of the consumer business without cash proceeds (e.g., spin - off). If a sepa ration transaction (e.g., sale) results in cash proceeds to Masimo, there would be an opportunity to pay down debt (currently ~$876 million) and reduce inter est expense (currently ~$47 million, which represents ~$0.63 per share). • “Additional Separation Adjustments” above include adjustments for consumer health product revenues, cost of goods sold, resea rch and development expenses, selling and marketing expenses, certain corporate expenses and the assumed sharing of Apple litigation costs (GAAP onl y) equally between RemainCo and NewCo.

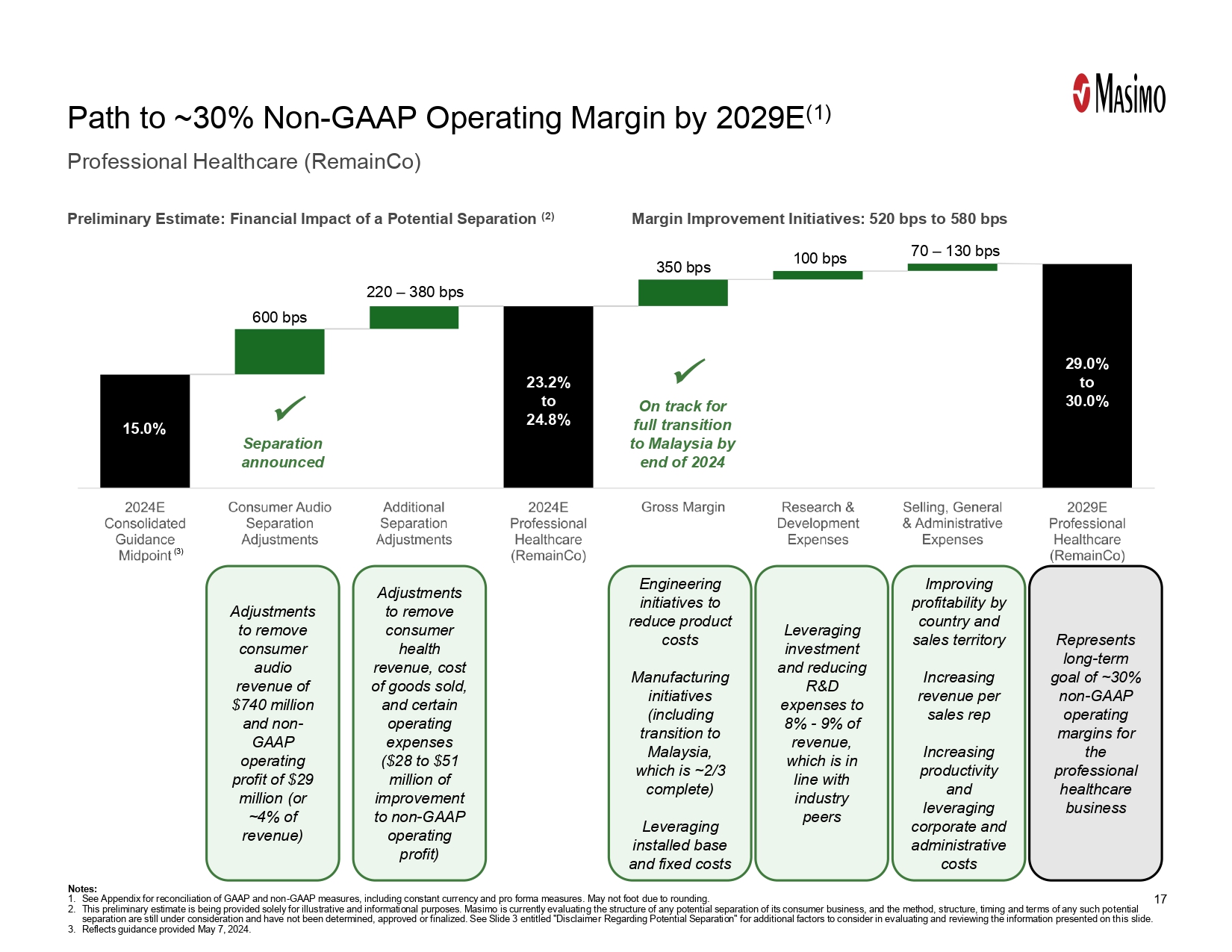

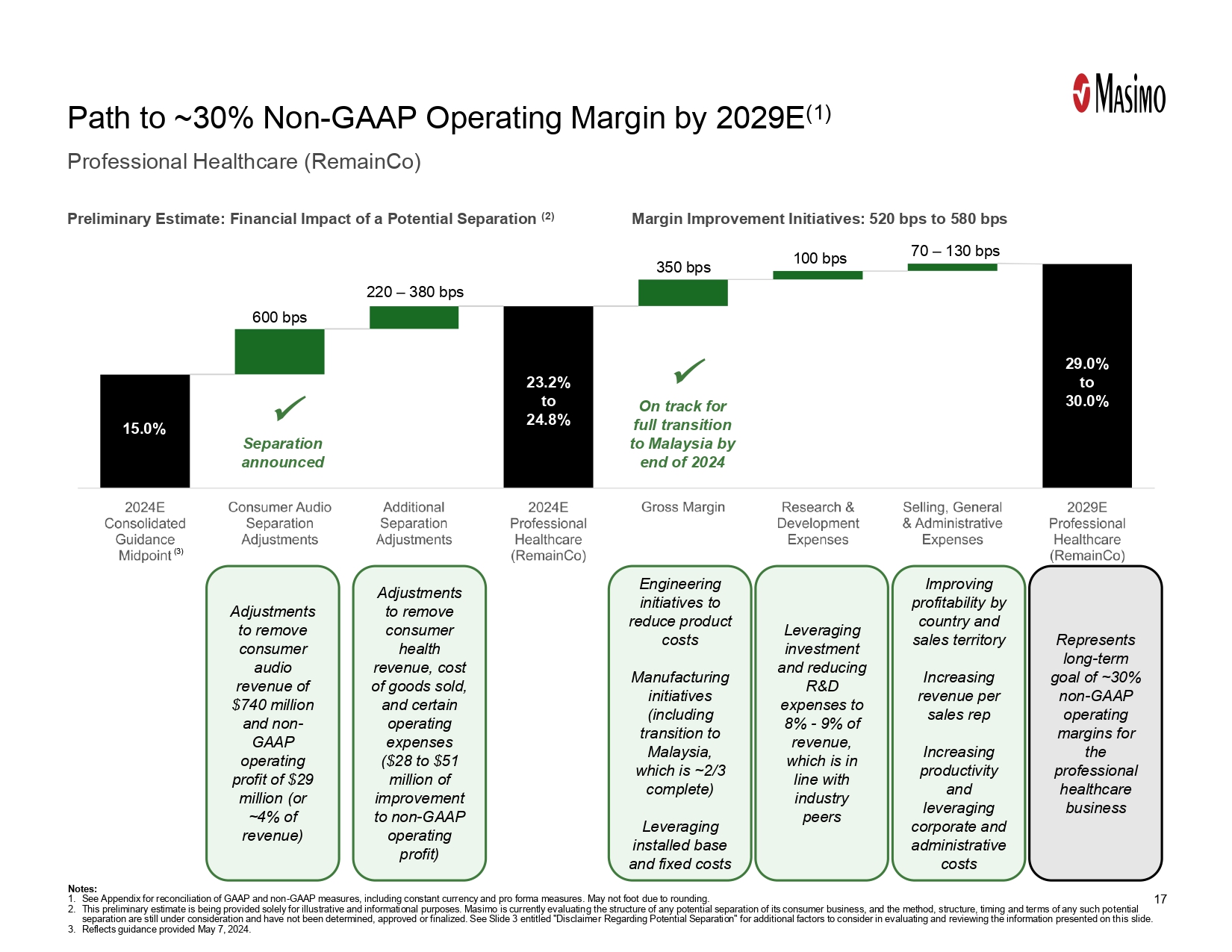

Preliminary Estimate: Financial Impact of a Potential Separation (2) Margin Improvement Initiatives: 520 bps to 580 bps 17 Professional Healthcare (RemainCo) Path to ~30% Non - GAAP Operating Margin by 2029E (1) 15.0% 23.2% to 24.8% 600 bps 220 – 380 bps 350 bps 100 bps 70 – 130 bps 29.0% to 30.0% x On track for full transition to Malaysia by end of 2024 x Separation announced Adjustments to remove consumer audio revenue of $740 million and non - GAAP operating profit of $29 million (or ~4% of revenue) Adjustments to remove consumer health revenue, cost of goods sold, and certain operating expenses ($28 to $51 million of improvement to non - GAAP operating profit) Engineering initiatives to reduce product costs Manufacturing initiatives (including transition to Malaysia, which is ~2/3 complete) Leveraging installed base and fixed costs Leveraging investment and reducing R&D expenses to 8% - 9% of revenue, which is in line with industry peers Improving profitability by country and sales territory Increasing revenue per sales rep Increasing productivity and leveraging corporate and administrative costs Represents long - term goal of ~30% non - GAAP operating margins for the professional healthcare business Notes: 1. See Appendix for reconciliation of GAAP and non - GAAP measures, including constant currency and pro forma measures. May not foot due to rounding. 2. This preliminary estimate is being provided solely for illustrative and informational purposes. Masimo is currently evaluatin g t he structure of any potential separation of its consumer business, and the method, structure, timing and terms of any such po ten tial separation are still under consideration and have not been determined, approved or finalized. See Slide 3 entitled "Disclaime r R egarding Potential Separation" for additional factors to consider in evaluating and reviewing the information presented on th is slide. 3. Reflects guidance provided May 7, 2024.

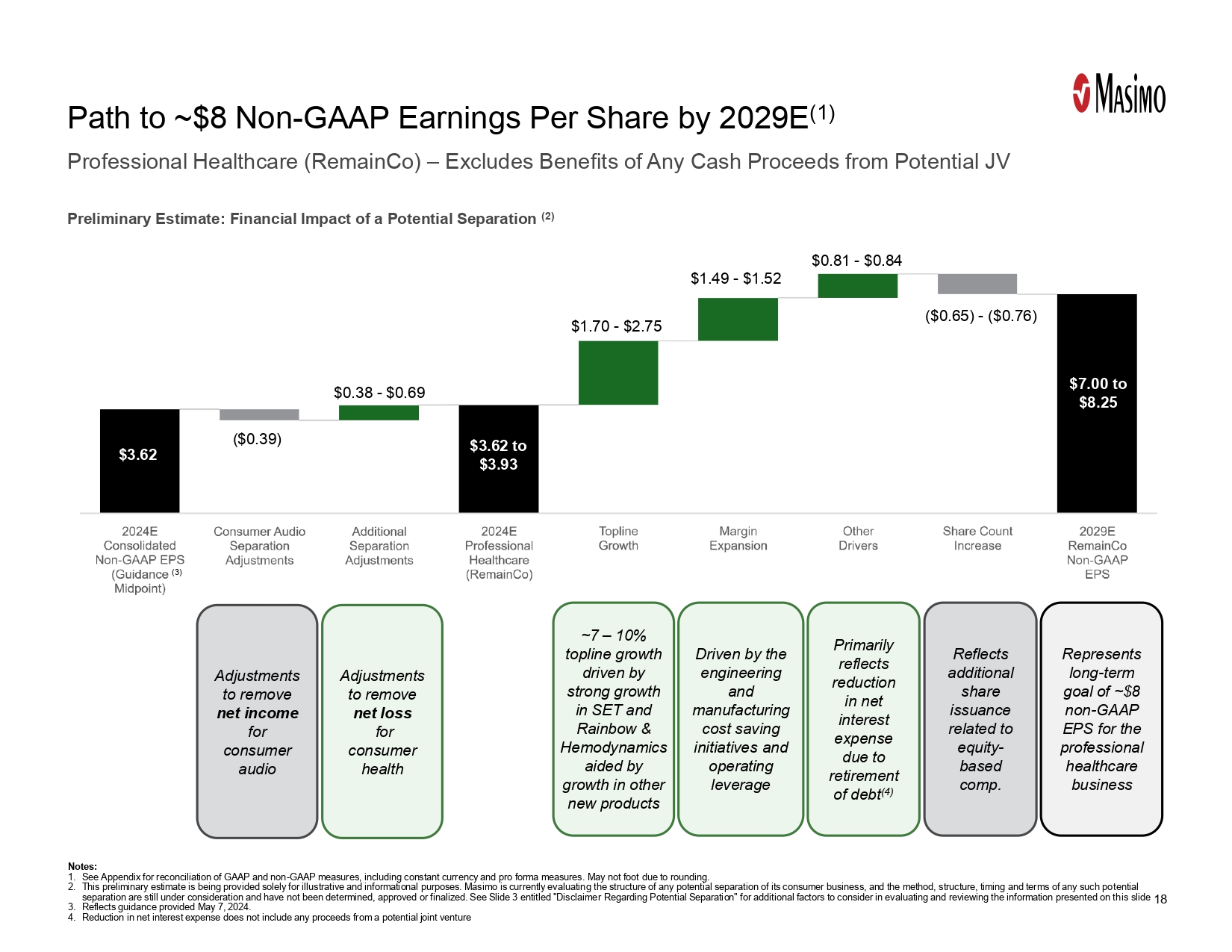

Preliminary Estimate: Financial Impact of a Potential Separation (2) 18 Professional Healthcare (RemainCo) – Excludes Benefits of Any Cash Proceeds from Potential JV Path to ~$8 Non - GAAP Earnings Per Share by 2029E (1) Adjustments to remove net income for consumer audio Adjustments to remove net loss for consumer health ~7 – 10% topline growth driven by strong growth in SET and Rainbow & Hemodynamics aided by growth in other new products Driven by the engineering and manufacturing cost saving initiatives and operating leverage Primarily reflects reduction in net interest expense due to retirement of debt (4) Reflects additional share issuance related to equity - based comp. Represents long - term goal of ~$8 non - GAAP EPS for the professional healthcare business $3.62 $3.62 to $3.93 ($0.39) $0.38 - $0.69 $1.70 - $2.75 $1.49 - $1.52 ($0.65) - ($0.76) $7.00 to $8.25 $0.81 - $0.84 Notes: 1. See Appendix for reconciliation of GAAP and non - GAAP measures, including constant currency and pro forma measures. May not foot due to rounding. 2. This preliminary estimate is being provided solely for illustrative and informational purposes. Masimo is currently evaluatin g t he structure of any potential separation of its consumer business, and the method, structure, timing and terms of any such po ten tial separation are still under consideration and have not been determined, approved or finalized. See Slide 3 entitled "Disclaime r R egarding Potential Separation" for additional factors to consider in evaluating and reviewing the information presented on th is slide 3. Reflects guidance provided May 7, 2024. 4. Reduction in net interest expense does not include any proceeds from a potential joint venture

60.7% 52.3% 48.0% 68.5% 66.8% Masimo (WholeCo) Medical Devices Index Select MedTech Peers 48.0x 25.9x 25.5x Gross Margin Benchmarking vs Peers (Includes Large Cap MedTech, High - Growth MedTech and Hospital Mid - Cap Peers) 2019A – 2023A Gross Margin (1) 19 Masimo's Gross Margin In - Line with Peers Today, with Path to Improved Performance Clearly In View Source: Company Filings, Capital IQ Notes: 1. Masimo figures reflect non - GAAP Gross Margin based on company filings; Peer Indexes reflect Gross Margin inclusive of one - time a djustments made by Capital IQ 2. Median of 2019A – 2023A Gross Margin calculated on a company - level basis; 25 th percentile to 75 th percentile of medians across the constituents of the Dow Jones U.S. Select Medical Device Index; median chosen to remove impa ct of any outliers 3. Average of 2019A – 2023A Gross Margin calculated on a company - level basis; 25 th percentile to 75 th percentile of averages across Large Cap MedTech peers (Abbott, Baxter, Becton Dickinson, Boston Scientific, GE HealthCare, Johnson & Johnson, Medtronic, Philips, Stryker, Zimmer Biomet), Scaled High - Growth MedTech peers (Align, DexCom , Edwards, Insulet , Intuitive Surgical, ResMed) and Hospital Mid - Cap peers (CONMED, Getinge, Haemonetics , ICU Medical, Integra, LeMaitre , LivaNova , Merit Medical, Omnicell, Teleflex) Average ’19A - ’23A NTM P/E: RemainCo Gross Margin 2024E: 62.5% 2029E: 66.0% RemainCo Gross Margin 2024E: 62.5% 2029E: 66.0% 25 th Percentile: 75 th Percentile: 25 th Percentile: 75 th Percentile:

Notes: 1. Masimo figures reflect non - GAAP R&D expense based on company filings; Peer Indexes reflect R&D inclusive of one - time adjustments made by Capital IQ 2. Median of 2019A – 2023A R&D margin calculated on a company - level basis; 25 th percentile to 75 th percentile of medians across the constituents of the Dow Jones U.S. Select Medical Device Index; median chosen to remove impa ct of any outliers 3. Average of 2019A – 2023A R&D margin calculated on a company - level basis; 25 th percentile to 75 th percentile of averages across Large Cap MedTech peers (Abbott, Baxter, Becton Dickinson, Boston Scientific, GE HealthCare, Johnson & Johnson, Medtronic, Philips, Stryker, Zimmer Biomet), Scaled High - Growth MedTech peers (Align, DexCom , Edwards, Insulet , Intuitive Surgical, ResMed) and Hospital Mid - Cap peers (CONMED, Getinge, Haemonetics , ICU Medical, Integra, LeMaitre , LivaNova , Merit Medical, Omnicell, Teleflex) R&D Benchmarking vs Peers (Includes Large Cap MedTech, High - Growth MedTech and Hospital Mid - Cap Peers) 2019A – 2023A R&D as % of Total Sales (1) 20 Masimo’s R&D Spend In - Line with Industry Peers 9.8% 6.0% 5.5% 14.7% 10.6% Masimo (WholeCo) Medical Devices Index Select MedTech Peers 48.0x 25.9x 25.5x Source: Company Filings, Capital IQ 2029E: 8.4% – 8.7% 2024E: 9.4% – 9.7% RemainCo R&D % of Sales 2029E: 8.4% – 8.7% 2024E: 9.4% – 9.7% RemainCo R&D % of Sales Average ’19A - ’23A NTM P/E:

Average ’19A - ’23A NTM P/E: SG&A Benchmarking vs Peers (Includes Large Cap MedTech, High - Growth MedTech and Hospital Mid - Cap Peers) 2019A – 2023A Average SG&A as % of Total Sales (1) 21 Masimo’s SG&A Spend Lower Than Industry Peers 30.6% 26.0% 26.7% 50.4% 37.3% Masimo (WholeCo) Medical Devices Index Select MedTech Peers 48.0x 25.9x 25.5x Source: Company Filings, Capital IQ Notes: 1. Masimo figures reflect non - GAAP SG&A expense based on company filings; Peer Indexes reflect R&D inclusive of one - time adjustment s made by Capital IQ 2. Median of 2019A – 2023A SG&A margin calculated on a company - level basis; 25 th percentile to 75 th percentile of medians across the constituents of the Dow Jones U.S. Select Medical Device Index; median chosen to remove impa ct of any outliers 3. Average of 2019A – 2023A SG&A margin calculated on a company - level basis; 25 th percentile to 75 th percentile of averages across Large Cap MedTech peers (Abbott, Baxter, Becton Dickinson, Boston Scientific, GE HealthCare, Johnson & Johnson, Medtronic, Philips, Stryker, Zimmer Biomet), Scaled High - Growth MedTech peers (Align, DexCom , Edwards, Insulet , Intuitive Surgical, ResMed) and Hospital Mid - Cap peers (CONMED, Getinge, Haemonetics , ICU Medical, Integra, LeMaitre , LivaNova , Merit Medical, Omnicell, Teleflex) RemainCo SG&A % of Sales 2029E: 27.6% – 28.4% 2024E: 28.3% – 29.7% RemainCo SG&A % of Sales 2029E: 27.6% – 28.4% 2024E: 28.3% – 29.7%

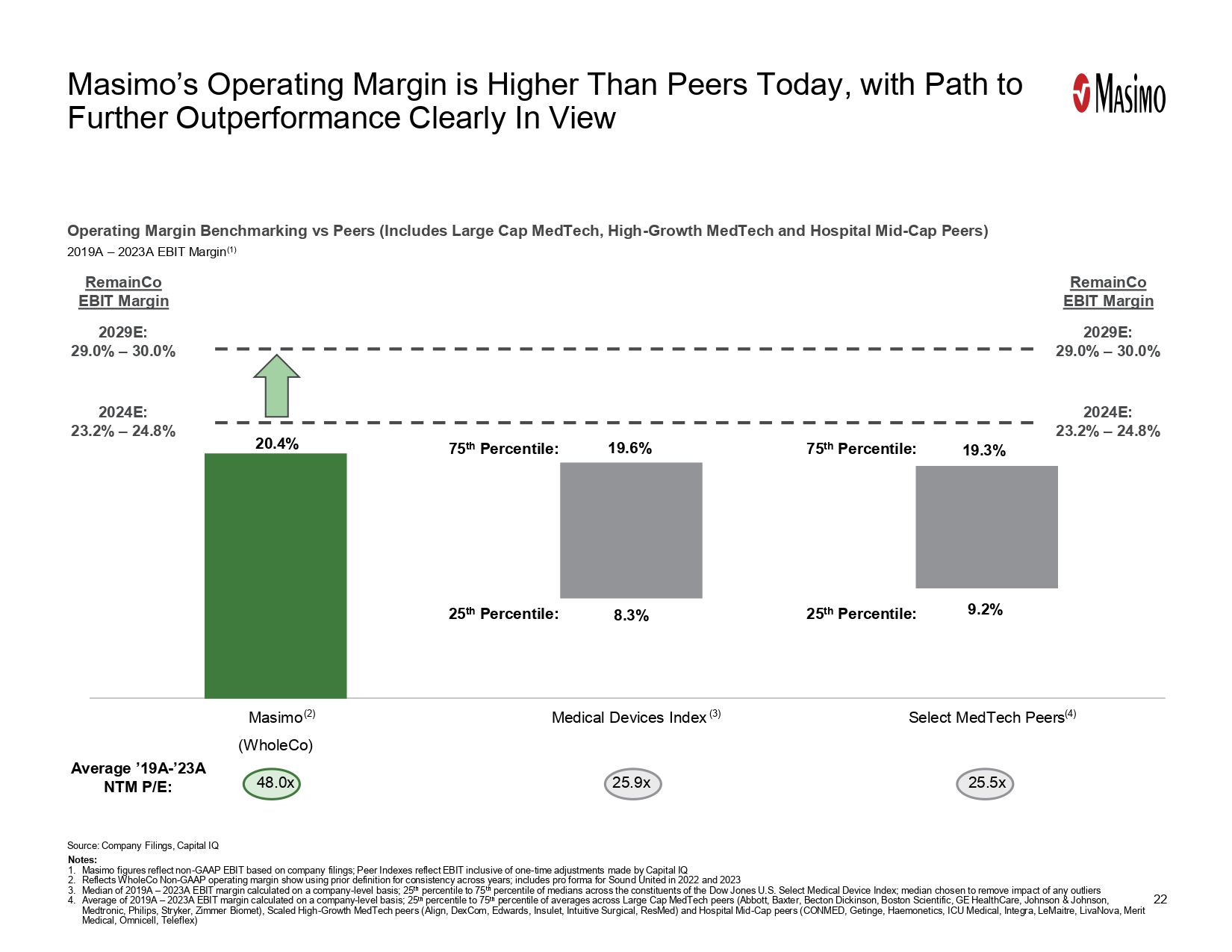

Operating Margin Benchmarking vs Peers (Includes Large Cap MedTech, High - Growth MedTech and Hospital Mid - Cap Peers) 2019A – 2023A EBIT Margin (1) 22 Masimo’s Operating Margin is Higher Than Peers Today , with Path to Further Outperformance Clearly In View Source: Company Filings, Capital IQ Notes: 1. Masimo figures reflect non - GAAP EBIT based on company filings; Peer Indexes reflect EBIT inclusive of one - time adjustments made by Capital IQ 2. Reflects WholeCo Non - GAAP operating margin show using prior definition for consistency across years; includes pro forma for Soun d United in 2022 and 2023 3. Median of 2019A – 2023A EBIT margin calculated on a company - level basis; 25 th percentile to 75 th percentile of medians across the constituents of the Dow Jones U.S. Select Medical Device Index; median chosen to remove impa ct of any outliers 4. Average of 2019A – 2023A EBIT margin calculated on a company - level basis; 25 th percentile to 75 th percentile of averages across Large Cap MedTech peers (Abbott, Baxter, Becton Dickinson, Boston Scientific, GE HealthCare, Johnson & Johnson, Medtronic, Philips, Stryker, Zimmer Biomet), Scaled High - Growth MedTech peers (Align, DexCom , Edwards, Insulet , Intuitive Surgical, ResMed) and Hospital Mid - Cap peers (CONMED, Getinge, Haemonetics , ICU Medical, Integra, LeMaitre , LivaNova , Merit Medical, Omnicell, Teleflex) Average ’19A - ’23A NTM P/E: RemainCo EBIT Margin 2029E: 29.0% – 30.0% 2024E: 23.2% – 24.8% RemainCo EBIT Margin 2029E: 29.0% – 30.0% 2024E: 23.2% – 24.8% 20.4% 8.3% 9.2% 19.6% 19.3% Masimo (WholeCo) Medical Devices Index Select MedTech Peers 48.0x 25.9x 25.5x

23 Key Takeaways Pursuing separation with key objectives to maximize shareholder value and give both consumer and professional healthcare businesses the best path for success. Growing through innovation that enables us to win incremental new contracts, increase sensor utilization, and leverage large driver installed base. Strong cashflow generation; 5 - year earnings per share target (1) of ~$8 a share. 5 - year operating margin target (1) of ~30%. Long - term revenue growth target (1) of ~7 to 10% per annum. Note: 1. Targets refer to professional healthcare business

Appendix

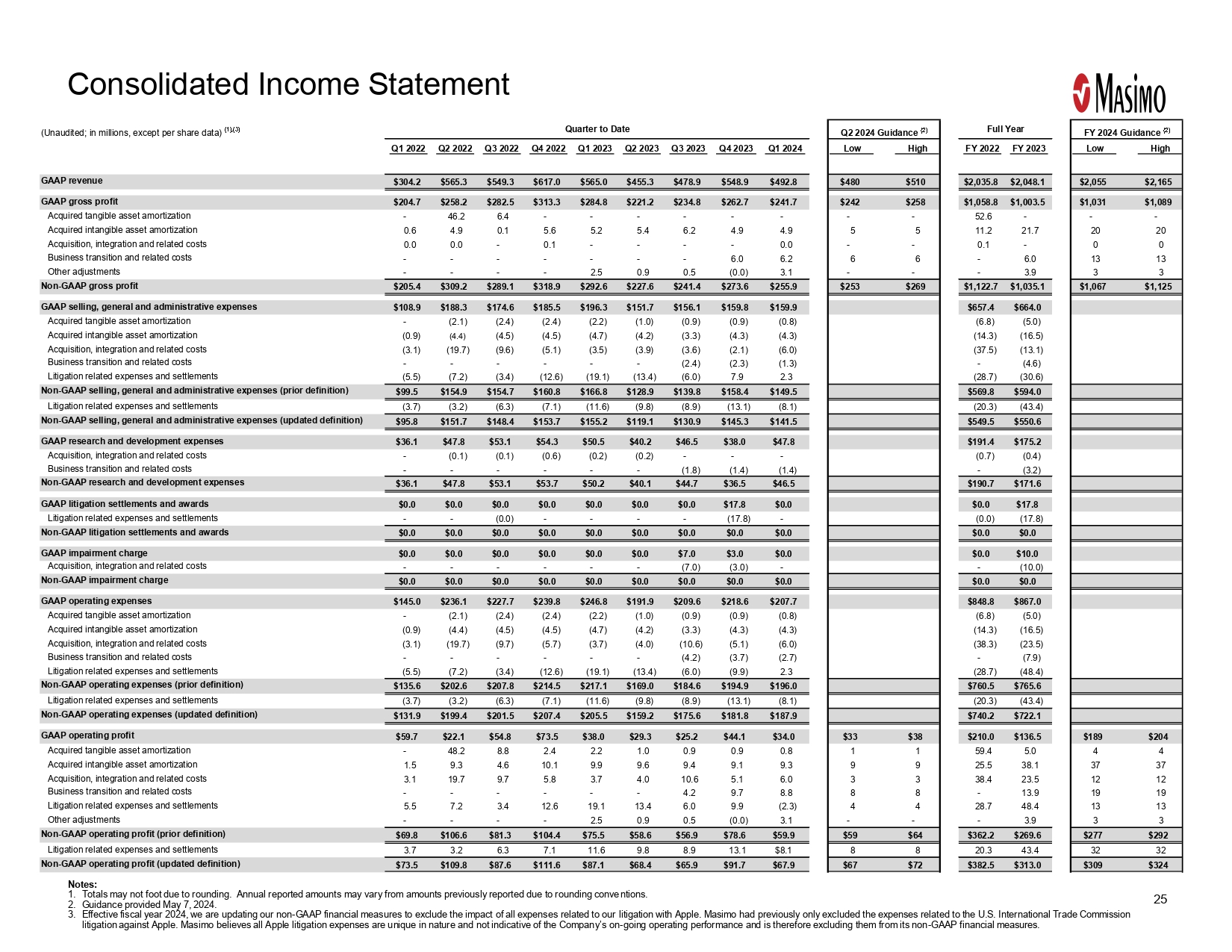

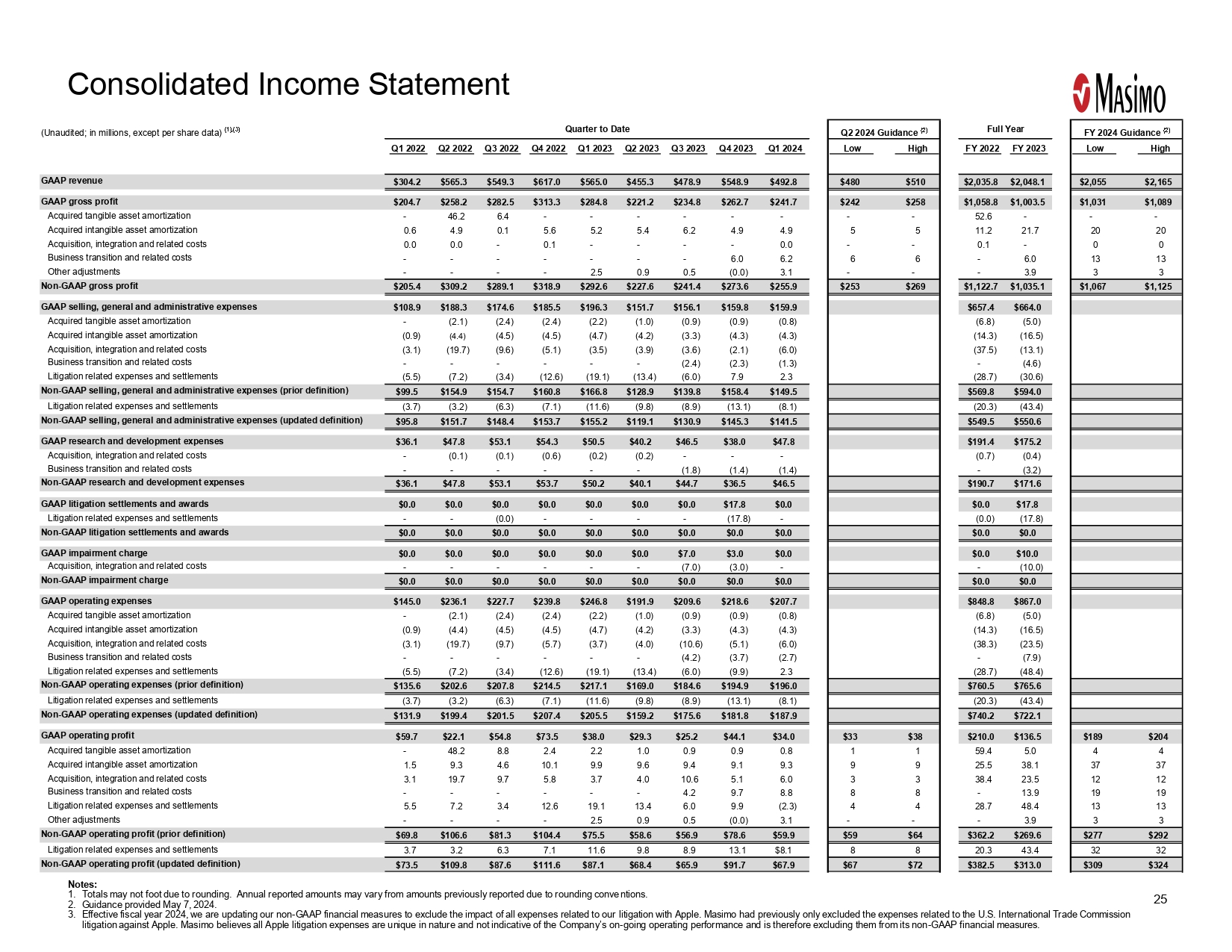

25 (Unaudited; in millions, except per share data) (1),(3) Quarter to Date Q2 2024 Guidance (2) Full Year FY 2024 Guidance (2) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Low High FY 2022 FY 2023 Low High GAAP revenue $304.2 $565.3 $549.3 $617.0 $565.0 $455.3 $478.9 $548.9 $492.8 $480 $510 $2,035.8 $2,048.1 $2,055 $2,165 GAAP gross profit $204.7 $258.2 $282.5 $313.3 $284.8 $221.2 $234.8 $262.7 $241.7 $242 $258 $1,058.8 $1,003.5 $1,031 $1,089 Acquired tangible asset amortization - 46.2 6.4 - - - - - - - - 52.6 - - - Acquired intangible asset amortization 0.6 4.9 0.1 5.6 5.2 5.4 6.2 4.9 4.9 5 5 11.2 21.7 20 20 Acquisition, integration and related costs 0.0 0.0 - 0.1 - - - - 0.0 - - 0.1 - 0 0 Business transition and related costs - - - - - - - 6.0 6.2 6 6 - 6.0 13 13 Other adjustments - - - - 2.5 0.9 0.5 (0.0) 3.1 - - - 3.9 3 3 Non-GAAP gross profit $205.4 $309.2 $289.1 $318.9 $292.6 $227.6 $241.4 $273.6 $255.9 $253 $269 $1,122.7 $1,035.1 $1,067 $1,125 GAAP selling, general and administrative expenses $108.9 $188.3 $174.6 $185.5 $196.3 $151.7 $156.1 $159.8 $159.9 $657.4 $664.0 Acquired tangible asset amortization - (2.1) (2.4) (2.4) (2.2) (1.0) (0.9) (0.9) (0.8) (6.8) (5.0) Acquired intangible asset amortization (0.9) (4.4) (4.5) (4.5) (4.7) (4.2) (3.3) (4.3) (4.3) (14.3) (16.5) Acquisition, integration and related costs (3.1) (19.7) (9.6) (5.1) (3.5) (3.9) (3.6) (2.1) (6.0) (37.5) (13.1) Business transition and related costs - - - - - - (2.4) (2.3) (1.3) - (4.6) Litigation related expenses and settlements (5.5) (7.2) (3.4) (12.6) (19.1) (13.4) (6.0) 7.9 2.3 (28.7) (30.6) Non-GAAP selling, general and administrative expenses (prior definition) $99.5 $154.9 $154.7 $160.8 $166.8 $128.9 $139.8 $158.4 $149.5 $569.8 $594.0 Litigation related expenses and settlements (3.7) (3.2) (6.3) (7.1) (11.6) (9.8) (8.9) (13.1) (8.1) (20.3) (43.4) Non-GAAP selling, general and administrative expenses (updated definition) $95.8 $151.7 $148.4 $153.7 $155.2 $119.1 $130.9 $145.3 $141.5 $549.5 $550.6 GAAP research and development expenses $36.1 $47.8 $53.1 $54.3 $50.5 $40.2 $46.5 $38.0 $47.8 $191.4 $175.2 Acquisition, integration and related costs - (0.1) (0.1) (0.6) (0.2) (0.2) - - - (0.7) (0.4) Business transition and related costs - - - - - - (1.8) (1.4) (1.4) - (3.2) Non-GAAP research and development expenses $36.1 $47.8 $53.1 $53.7 $50.2 $40.1 $44.7 $36.5 $46.5 $190.7 $171.6 GAAP litigation settlements and awards $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $17.8 $0.0 $0.0 $17.8 Litigation related expenses and settlements - - (0.0) - - - - (17.8) - (0.0) (17.8) Non-GAAP litigation settlements and awards $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 GAAP impairment charge $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $7.0 $3.0 $0.0 $0.0 $10.0 Acquisition, integration and related costs - - - - - - (7.0) (3.0) - - (10.0) Non-GAAP impairment charge $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 GAAP operating expenses $145.0 $236.1 $227.7 $239.8 $246.8 $191.9 $209.6 $218.6 $207.7 $848.8 $867.0 Acquired tangible asset amortization - (2.1) (2.4) (2.4) (2.2) (1.0) (0.9) (0.9) (0.8) (6.8) (5.0) Acquired intangible asset amortization (0.9) (4.4) (4.5) (4.5) (4.7) (4.2) (3.3) (4.3) (4.3) (14.3) (16.5) Acquisition, integration and related costs (3.1) (19.7) (9.7) (5.7) (3.7) (4.0) (10.6) (5.1) (6.0) (38.3) (23.5) Business transition and related costs - - - - - - (4.2) (3.7) (2.7) - (7.9) Litigation related expenses and settlements (5.5) (7.2) (3.4) (12.6) (19.1) (13.4) (6.0) (9.9) 2.3 (28.7) (48.4) Non-GAAP operating expenses (prior definition) $135.6 $202.6 $207.8 $214.5 $217.1 $169.0 $184.6 $194.9 $196.0 $760.5 $765.6 Litigation related expenses and settlements (3.7) (3.2) (6.3) (7.1) (11.6) (9.8) (8.9) (13.1) (8.1) (20.3) (43.4) Non-GAAP operating expenses (updated definition) $131.9 $199.4 $201.5 $207.4 $205.5 $159.2 $175.6 $181.8 $187.9 $740.2 $722.1 GAAP operating profit $59.7 $22.1 $54.8 $73.5 $38.0 $29.3 $25.2 $44.1 $34.0 $33 $38 $210.0 $136.5 $189 $204 Acquired tangible asset amortization - 48.2 8.8 2.4 2.2 1.0 0.9 0.9 0.8 1 1 59.4 5.0 4 4 Acquired intangible asset amortization 1.5 9.3 4.6 10.1 9.9 9.6 9.4 9.1 9.3 9 9 25.5 38.1 37 37 Acquisition, integration and related costs 3.1 19.7 9.7 5.8 3.7 4.0 10.6 5.1 6.0 3 3 38.4 23.5 12 12 Business transition and related costs - - - - - - 4.2 9.7 8.8 8 8 - 13.9 19 19 Litigation related expenses and settlements 5.5 7.2 3.4 12.6 19.1 13.4 6.0 9.9 (2.3) 4 4 28.7 48.4 13 13 Other adjustments - - - - 2.5 0.9 0.5 (0.0) 3.1 - - - 3.9 3 3 Non-GAAP operating profit (prior definition) $69.8 $106.6 $81.3 $104.4 $75.5 $58.6 $56.9 $78.6 $59.9 $59 $64 $362.2 $269.6 $277 $292 Litigation related expenses and settlements 3.7 3.2 6.3 7.1 11.6 9.8 8.9 13.1 $8.1 8 8 20.3 43.4 32 32 Non-GAAP operating profit (updated definition) $73.5 $109.8 $87.6 $111.6 $87.1 $68.4 $65.9 $91.7 $67.9 $67 $72 $382.5 $313.0 $309 $324 Notes: 1. Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conve nti ons. 2. Guidance provided May 7, 2024. 3. Effective fiscal year 2024, we are updating our non - GAAP financial measures to exclude the impact of all expenses related to our litigation with Apple. Masimo had previously only excluded the expenses related to the U.S. International Trade Commission litigation against Apple. Masimo believes all Apple litigation expenses are unique in nature and not indicative of the Compan y’s on - going operating performance and is therefore excluding them from its non - GAAP financial measures. Consolidated Income Statement

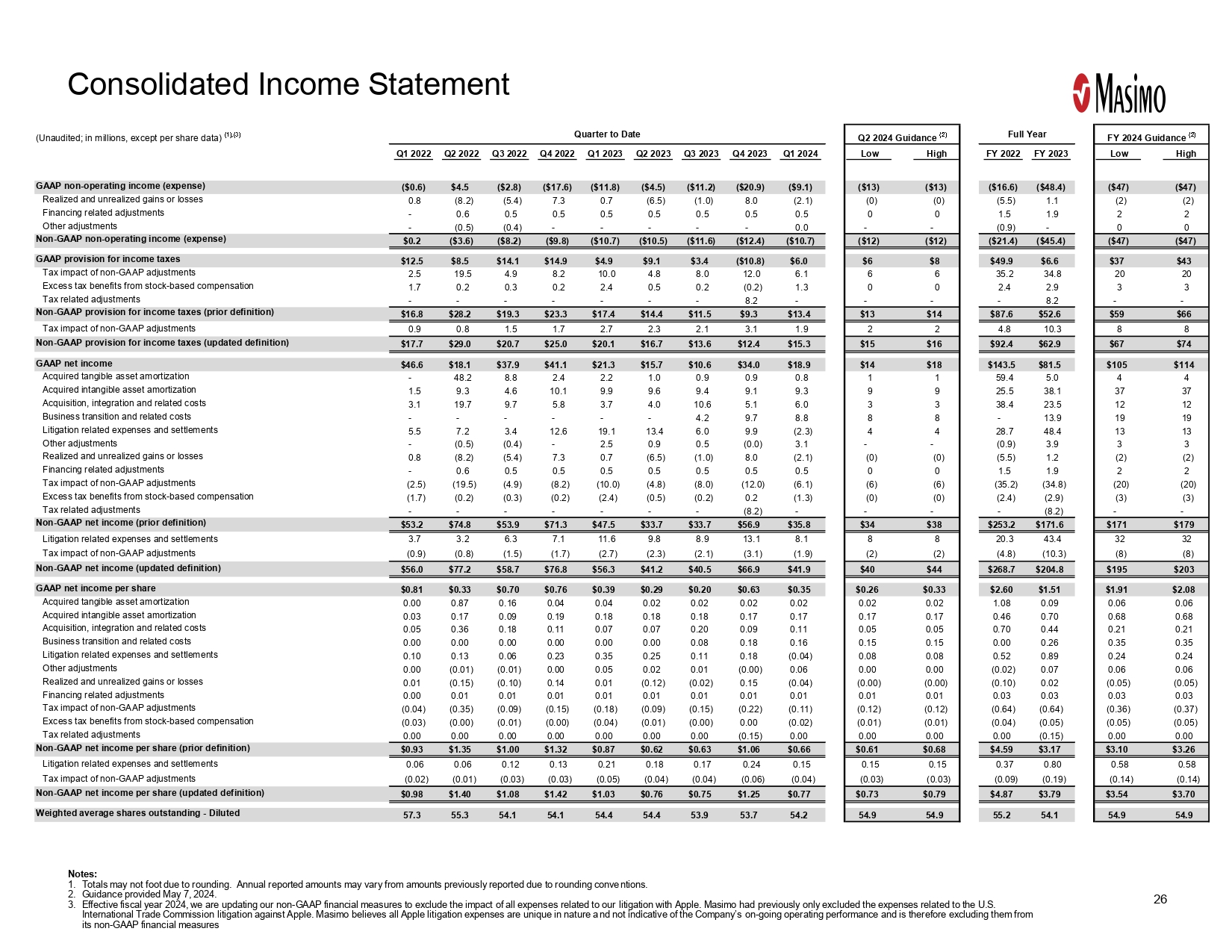

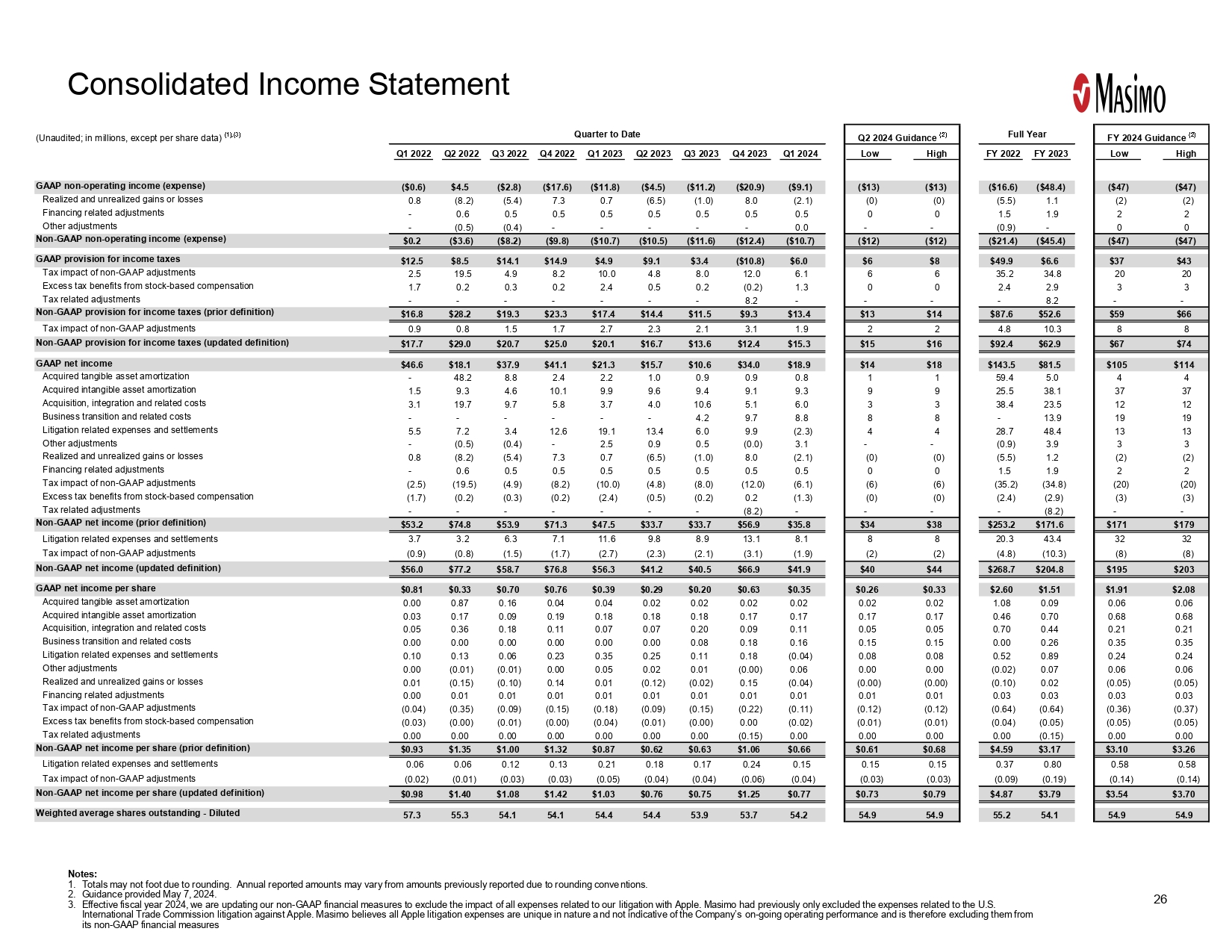

26 Consolidated Income Statement (Unaudited; in millions, except per share data) (1),(3) Quarter to Date Q2 2024 Guidance (2) Full Year FY 2024 Guidance (2) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Low High FY 2022 FY 2023 Low High GAAP non-operating income (expense) ($0.6) $4.5 ($2.8) ($17.6) ($11.8) ($4.5) ($11.2) ($20.9) ($9.1) ($13) ($13) ($16.6) ($48.4) ($47) ($47) Realized and unrealized gains or losses 0.8 (8.2) (5.4) 7.3 0.7 (6.5) (1.0) 8.0 (2.1) (0) (0) (5.5) 1.1 (2) (2) Financing related adjustments - 0.6 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0 0 1.5 1.9 2 2 Other adjustments - (0.5) (0.4) - - - - - 0.0 - - (0.9) - 0 0 Non-GAAP non-operating income (expense) $0.2 ($3.6) ($8.2) ($9.8) ($10.7) ($10.5) ($11.6) ($12.4) ($10.7) ($12) ($12) ($21.4) ($45.4) ($47) ($47) GAAP provision for income taxes $12.5 $8.5 $14.1 $14.9 $4.9 $9.1 $3.4 ($10.8) $6.0 $6 $8 $49.9 $6.6 $37 $43 Tax impact of non-GAAP adjustments 2.5 19.5 4.9 8.2 10.0 4.8 8.0 12.0 6.1 6 6 35.2 34.8 20 20 Excess tax benefits from stock-based compensation 1.7 0.2 0.3 0.2 2.4 0.5 0.2 (0.2) 1.3 0 0 2.4 2.9 3 3 Tax related adjustments - - - - - - - 8.2 - - - - 8.2 - - Non-GAAP provision for income taxes (prior definition) $16.8 $28.2 $19.3 $23.3 $17.4 $14.4 $11.5 $9.3 $13.4 $13 $14 $87.6 $52.6 $59 $66 Tax impact of non-GAAP adjustments 0.9 0.8 1.5 1.7 2.7 2.3 2.1 3.1 1.9 2 2 4.8 10.3 8 8 Non-GAAP provision for income taxes (updated definition) $17.7 $29.0 $20.7 $25.0 $20.1 $16.7 $13.6 $12.4 $15.3 $15 $16 $92.4 $62.9 $67 $74 GAAP net income $46.6 $18.1 $37.9 $41.1 $21.3 $15.7 $10.6 $34.0 $18.9 $14 $18 $143.5 $81.5 $105 $114 Acquired tangible asset amortization - 48.2 8.8 2.4 2.2 1.0 0.9 0.9 0.8 1 1 59.4 5.0 4 4 Acquired intangible asset amortization 1.5 9.3 4.6 10.1 9.9 9.6 9.4 9.1 9.3 9 9 25.5 38.1 37 37 Acquisition, integration and related costs 3.1 19.7 9.7 5.8 3.7 4.0 10.6 5.1 6.0 3 3 38.4 23.5 12 12 Business transition and related costs - - - - - - 4.2 9.7 8.8 8 8 - 13.9 19 19 Litigation related expenses and settlements 5.5 7.2 3.4 12.6 19.1 13.4 6.0 9.9 (2.3) 4 4 28.7 48.4 13 13 Other adjustments - (0.5) (0.4) - 2.5 0.9 0.5 (0.0) 3.1 - - (0.9) 3.9 3 3 Realized and unrealized gains or losses 0.8 (8.2) (5.4) 7.3 0.7 (6.5) (1.0) 8.0 (2.1) (0) (0) (5.5) 1.2 (2) (2) Financing related adjustments - 0.6 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0 0 1.5 1.9 2 2 Tax impact of non-GAAP adjustments (2.5) (19.5) (4.9) (8.2) (10.0) (4.8) (8.0) (12.0) (6.1) (6) (6) (35.2) (34.8) (20) (20) Excess tax benefits from stock-based compensation (1.7) (0.2) (0.3) (0.2) (2.4) (0.5) (0.2) 0.2 (1.3) (0) (0) (2.4) (2.9) (3) (3) Tax related adjustments - - - - - - - (8.2) - - - - (8.2) - - Non-GAAP net income (prior definition) $53.2 $74.8 $53.9 $71.3 $47.5 $33.7 $33.7 $56.9 $35.8 $34 $38 $253.2 $171.6 $171 $179 Litigation related expenses and settlements 3.7 3.2 6.3 7.1 11.6 9.8 8.9 13.1 8.1 8 8 20.3 43.4 32 32 Tax impact of non-GAAP adjustments (0.9) (0.8) (1.5) (1.7) (2.7) (2.3) (2.1) (3.1) (1.9) (2) (2) (4.8) (10.3) (8) (8) Non-GAAP net income (updated definition) $56.0 $77.2 $58.7 $76.8 $56.3 $41.2 $40.5 $66.9 $41.9 $40 $44 $268.7 $204.8 $195 $203 GAAP net income per share $0.81 $0.33 $0.70 $0.76 $0.39 $0.29 $0.20 $0.63 $0.35 $0.26 $0.33 $2.60 $1.51 $1.91 $2.08 Acquired tangible asset amortization 0.00 0.87 0.16 0.04 0.04 0.02 0.02 0.02 0.02 0.02 0.02 1.08 0.09 0.06 0.06 Acquired intangible asset amortization 0.03 0.17 0.09 0.19 0.18 0.18 0.18 0.17 0.17 0.17 0.17 0.46 0.70 0.68 0.68 Acquisition, integration and related costs 0.05 0.36 0.18 0.11 0.07 0.07 0.20 0.09 0.11 0.05 0.05 0.70 0.44 0.21 0.21 Business transition and related costs 0.00 0.00 0.00 0.00 0.00 0.00 0.08 0.18 0.16 0.15 0.15 0.00 0.26 0.35 0.35 Litigation related expenses and settlements 0.10 0.13 0.06 0.23 0.35 0.25 0.11 0.18 (0.04) 0.08 0.08 0.52 0.89 0.24 0.24 Other adjustments 0.00 (0.01) (0.01) 0.00 0.05 0.02 0.01 (0.00) 0.06 0.00 0.00 (0.02) 0.07 0.06 0.06 Realized and unrealized gains or losses 0.01 (0.15) (0.10) 0.14 0.01 (0.12) (0.02) 0.15 (0.04) (0.00) (0.00) (0.10) 0.02 (0.05) (0.05) Financing related adjustments 0.00 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.03 0.03 0.03 0.03 Tax impact of non-GAAP adjustments (0.04) (0.35) (0.09) (0.15) (0.18) (0.09) (0.15) (0.22) (0.11) (0.12) (0.12) (0.64) (0.64) (0.36) (0.37) Excess tax benefits from stock-based compensation (0.03) (0.00) (0.01) (0.00) (0.04) (0.01) (0.00) 0.00 (0.02) (0.01) (0.01) (0.04) (0.05) (0.05) (0.05) Tax related adjustments 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (0.15) 0.00 0.00 0.00 0.00 (0.15) 0.00 0.00 Non-GAAP net income per share (prior definition) $0.93 $1.35 $1.00 $1.32 $0.87 $0.62 $0.63 $1.06 $0.66 $0.61 $0.68 $4.59 $3.17 $3.10 $3.26 Litigation related expenses and settlements 0.06 0.06 0.12 0.13 0.21 0.18 0.17 0.24 0.15 0.15 0.15 0.37 0.80 0.58 0.58 Tax impact of non-GAAP adjustments (0.02) (0.01) (0.03) (0.03) (0.05) (0.04) (0.04) (0.06) (0.04) (0.03) (0.03) (0.09) (0.19) (0.14) (0.14) Non-GAAP net income per share (updated definition) $0.98 $1.40 $1.08 $1.42 $1.03 $0.76 $0.75 $1.25 $0.77 $0.73 $0.79 $4.87 $3.79 $3.54 $3.70 Weighted average shares outstanding - Diluted 57.3 55.3 54.1 54.1 54.4 54.4 53.9 53.7 54.2 54.9 54.9 55.2 54.1 54.9 54.9 Notes: 1. Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conve nti ons. 2. Guidance provided May 7, 2024. 3. Effective fiscal year 2024, we are updating our non - GAAP financial measures to exclude the impact of all expenses related to our litigation with Apple. Masimo had previously only excluded the expenses related to the U.S. International Trade Commission litigation against Apple. Masimo believes all Apple litigation expenses are unique in nature a nd not indicative of the Company’s on - going operating performance and is therefore excluding them from its non - GAAP financial measures

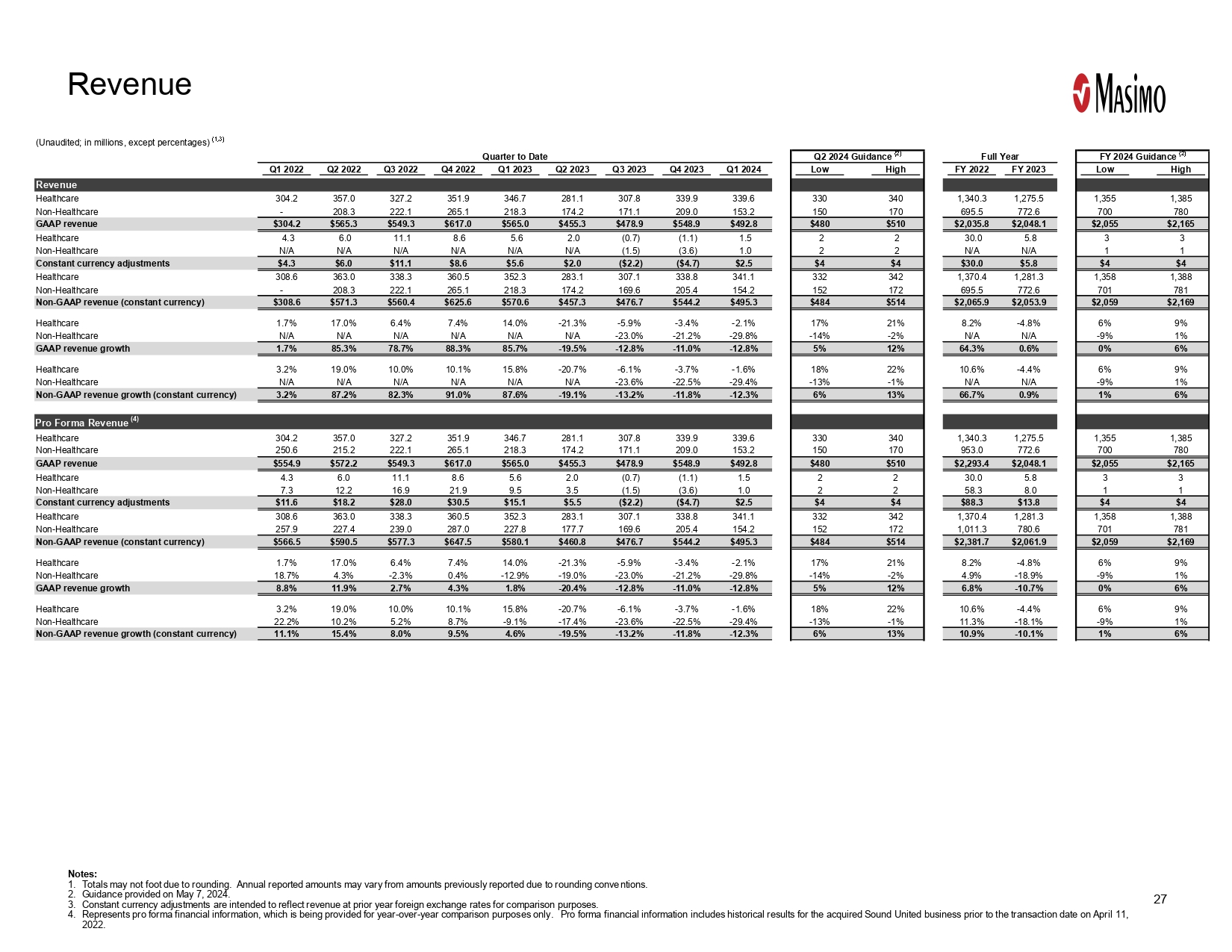

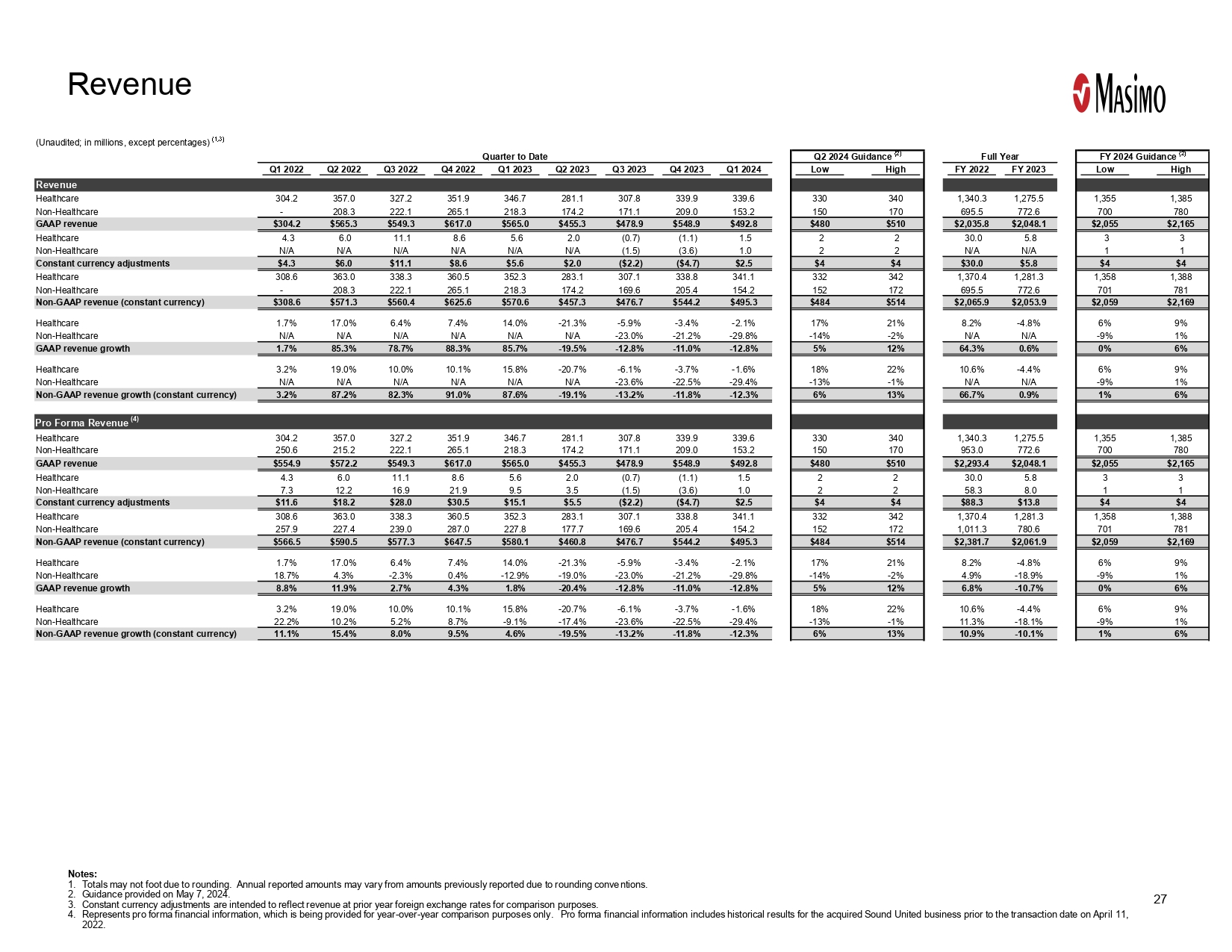

27 Revenue (Unaudited; in millions, except percentages) (1,3) Quarter to Date Q2 2024 Guidance (2) Full Year FY 2024 Guidance (2) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Low High FY 2022 FY 2023 Low High Revenue Healthcare 304.2 357.0 327.2 351.9 346.7 281.1 307.8 339.9 339.6 330 340 1,340.3 1,275.5 1,355 1,385 Non-Healthcare - 208.3 222.1 265.1 218.3 174.2 171.1 209.0 153.2 150 170 695.5 772.6 700 780 GAAP revenue $304.2 $565.3 $549.3 $617.0 $565.0 $455.3 $478.9 $548.9 $492.8 $480 $510 $2,035.8 $2,048.1 $2,055 $2,165 Healthcare 4.3 6.0 11.1 8.6 5.6 2.0 (0.7) (1.1) 1.5 2 2 30.0 5.8 3 3 Non-Healthcare N/A N/A N/A N/A N/A N/A (1.5) (3.6) 1.0 2 2 N/A N/A 1 1 Constant currency adjustments $4.3 $6.0 $11.1 $8.6 $5.6 $2.0 ($2.2) ($4.7) $2.5 $4 $4 $30.0 $5.8 $4 $4 Healthcare 308.6 363.0 338.3 360.5 352.3 283.1 307.1 338.8 341.1 332 342 1,370.4 1,281.3 1,358 1,388 Non-Healthcare - 208.3 222.1 265.1 218.3 174.2 169.6 205.4 154.2 152 172 695.5 772.6 701 781 Non-GAAP revenue (constant currency) $308.6 $571.3 $560.4 $625.6 $570.6 $457.3 $476.7 $544.2 $495.3 $484 $514 $2,065.9 $2,053.9 $2,059 $2,169 Healthcare 1.7% 17.0% 6.4% 7.4% 14.0% -21.3% -5.9% -3.4% -2.1% 17% 21% 8.2% -4.8% 6% 9% Non-Healthcare N/A N/A N/A N/A N/A N/A -23.0% -21.2% -29.8% -14% -2% N/A N/A -9% 1% GAAP revenue growth 1.7% 85.3% 78.7% 88.3% 85.7% -19.5% -12.8% -11.0% -12.8% 5% 12% 64.3% 0.6% 0% 6% Healthcare 3.2% 19.0% 10.0% 10.1% 15.8% -20.7% -6.1% -3.7% -1.6% 18% 22% 10.6% -4.4% 6% 9% Non-Healthcare N/A N/A N/A N/A N/A N/A -23.6% -22.5% -29.4% -13% -1% N/A N/A -9% 1% Non-GAAP revenue growth (constant currency) 3.2% 87.2% 82.3% 91.0% 87.6% -19.1% -13.2% -11.8% -12.3% 6% 13% 66.7% 0.9% 1% 6% Pro Forma Revenue (4) Healthcare 304.2 357.0 327.2 351.9 346.7 281.1 307.8 339.9 339.6 330 340 1,340.3 1,275.5 1,355 1,385 Non-Healthcare 250.6 215.2 222.1 265.1 218.3 174.2 171.1 209.0 153.2 150 170 953.0 772.6 700 780 GAAP revenue $554.9 $572.2 $549.3 $617.0 $565.0 $455.3 $478.9 $548.9 $492.8 $480 $510 $2,293.4 $2,048.1 $2,055 $2,165 Healthcare 4.3 6.0 11.1 8.6 5.6 2.0 (0.7) (1.1) 1.5 2 2 30.0 5.8 3 3 Non-Healthcare 7.3 12.2 16.9 21.9 9.5 3.5 (1.5) (3.6) 1.0 2 2 58.3 8.0 1 1 Constant currency adjustments $11.6 $18.2 $28.0 $30.5 $15.1 $5.5 ($2.2) ($4.7) $2.5 $4 $4 $88.3 $13.8 $4 $4 Healthcare 308.6 363.0 338.3 360.5 352.3 283.1 307.1 338.8 341.1 332 342 1,370.4 1,281.3 1,358 1,388 Non-Healthcare 257.9 227.4 239.0 287.0 227.8 177.7 169.6 205.4 154.2 152 172 1,011.3 780.6 701 781 Non-GAAP revenue (constant currency) $566.5 $590.5 $577.3 $647.5 $580.1 $460.8 $476.7 $544.2 $495.3 $484 $514 $2,381.7 $2,061.9 $2,059 $2,169 Healthcare 1.7% 17.0% 6.4% 7.4% 14.0% -21.3% -5.9% -3.4% -2.1% 17% 21% 8.2% -4.8% 6% 9% Non-Healthcare 18.7% 4.3% -2.3% 0.4% -12.9% -19.0% -23.0% -21.2% -29.8% -14% -2% 4.9% -18.9% -9% 1% GAAP revenue growth 8.8% 11.9% 2.7% 4.3% 1.8% -20.4% -12.8% -11.0% -12.8% 5% 12% 6.8% -10.7% 0% 6% Healthcare 3.2% 19.0% 10.0% 10.1% 15.8% -20.7% -6.1% -3.7% -1.6% 18% 22% 10.6% -4.4% 6% 9% Non-Healthcare 22.2% 10.2% 5.2% 8.7% -9.1% -17.4% -23.6% -22.5% -29.4% -13% -1% 11.3% -18.1% -9% 1% Non-GAAP revenue growth (constant currency) 11.1% 15.4% 8.0% 9.5% 4.6% -19.5% -13.2% -11.8% -12.3% 6% 13% 10.9% -10.1% 1% 6% Notes: 1. Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conve nti ons. 2. Guidance provided on May 7, 2024. 3. Constant currency adjustments are intended to reflect revenue at prior year foreign exchange rates for comparison purposes. 4. Represents pro forma financial information, which is being provided for year - over - year comparison purposes only. Pro forma fin ancial information includes historical results for the acquired Sound United business prior to the transaction date on April 11, 2022.

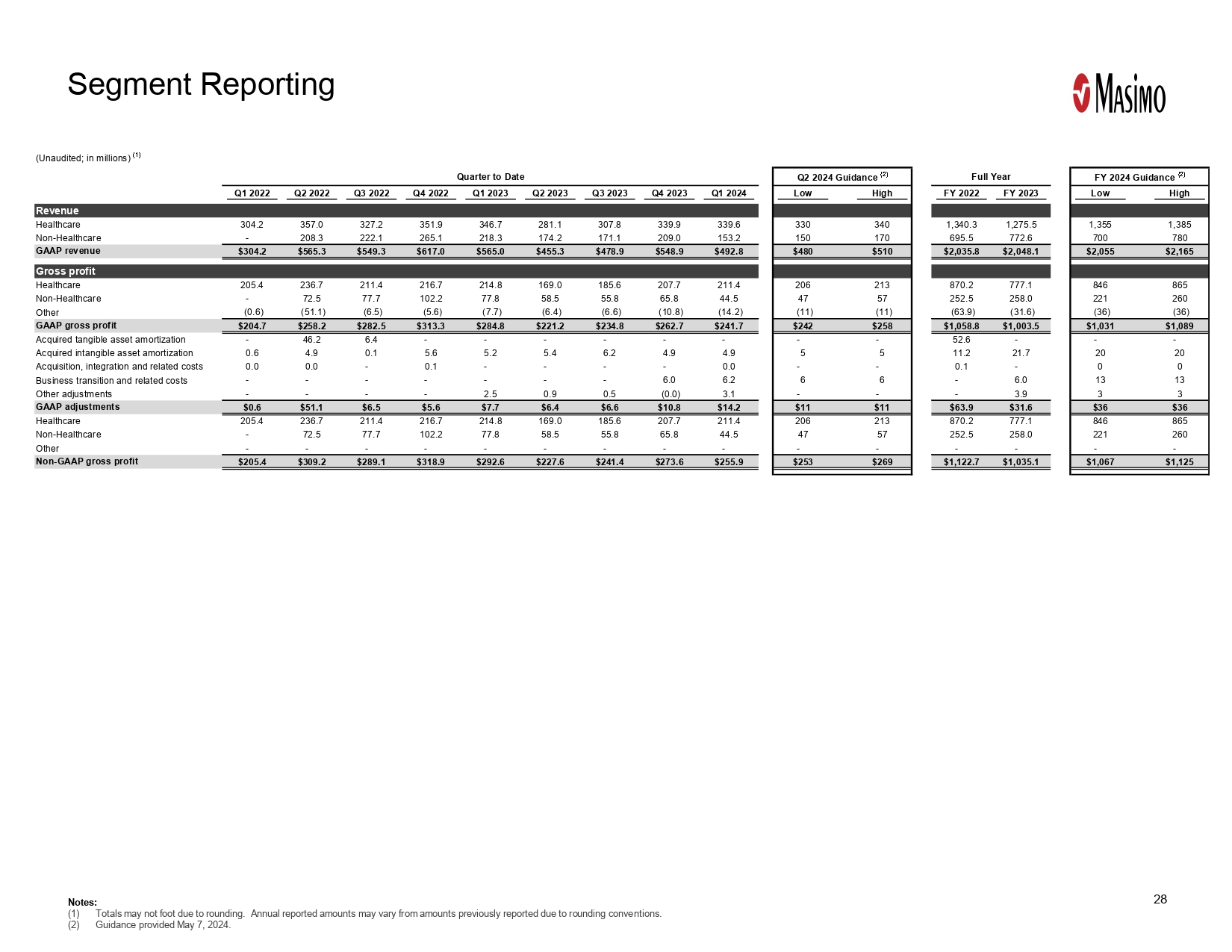

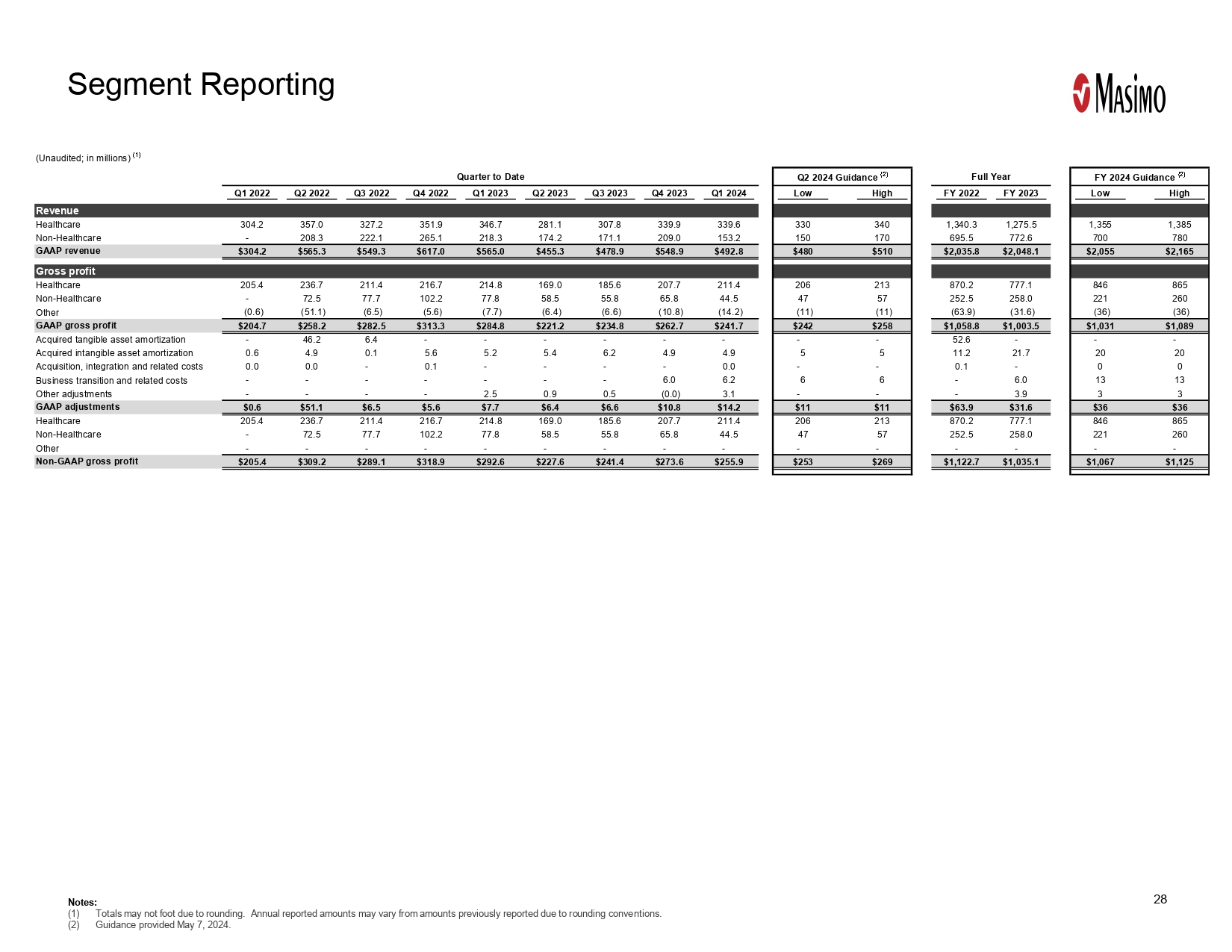

28 Segment Reporting (Unaudited; in millions) (1) Quarter to Date Q2 2024 Guidance (2) Full Year FY 2024 Guidance (2) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Low High FY 2022 FY 2023 Low High Revenue Healthcare 304.2 357.0 327.2 351.9 346.7 281.1 307.8 339.9 339.6 330 340 1,340.3 1,275.5 1,355 1,385 Non-Healthcare - 208.3 222.1 265.1 218.3 174.2 171.1 209.0 153.2 150 170 695.5 772.6 700 780 GAAP revenue $304.2 $565.3 $549.3 $617.0 $565.0 $455.3 $478.9 $548.9 $492.8 $480 $510 $2,035.8 $2,048.1 $2,055 $2,165 Gross profit Healthcare 205.4 236.7 211.4 216.7 214.8 169.0 185.6 207.7 211.4 206 213 870.2 777.1 846 865 Non-Healthcare - 72.5 77.7 102.2 77.8 58.5 55.8 65.8 44.5 47 57 252.5 258.0 221 260 Other (0.6) (51.1) (6.5) (5.6) (7.7) (6.4) (6.6) (10.8) (14.2) (11) (11) (63.9) (31.6) (36) (36) GAAP gross profit $204.7 $258.2 $282.5 $313.3 $284.8 $221.2 $234.8 $262.7 $241.7 $242 $258 $1,058.8 $1,003.5 $1,031 $1,089 Acquired tangible asset amortization - 46.2 6.4 - - - - - - - - 52.6 - - - Acquired intangible asset amortization 0.6 4.9 0.1 5.6 5.2 5.4 6.2 4.9 4.9 5 5 11.2 21.7 20 20 Acquisition, integration and related costs 0.0 0.0 - 0.1 - - - - 0.0 - - 0.1 - 0 0 Business transition and related costs - - - - - - - 6.0 6.2 6 6 - 6.0 13 13 Other adjustments - - - - 2.5 0.9 0.5 (0.0) 3.1 - - - 3.9 3 3 GAAP adjustments $0.6 $51.1 $6.5 $5.6 $7.7 $6.4 $6.6 $10.8 $14.2 $11 $11 $63.9 $31.6 $36 $36 Healthcare 205.4 236.7 211.4 216.7 214.8 169.0 185.6 207.7 211.4 206 213 870.2 777.1 846 865 Non-Healthcare - 72.5 77.7 102.2 77.8 58.5 55.8 65.8 44.5 47 57 252.5 258.0 221 260 Other - - - - - - - - - - - - - - - Non-GAAP gross profit $205.4 $309.2 $289.1 $318.9 $292.6 $227.6 $241.4 $273.6 $255.9 $253 $269 $1,122.7 $1,035.1 $1,067 $1,125 Notes: