UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36373

TRINET GROUP, INC.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

|

95-3359658 |

|

( State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

|

|

|

|

1100 San Leandro Blvd., Suite 400 San Leandro, CA |

|

94577 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (510) 352-5000

Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $0.000025 Per Share; Common stock traded on the New York Stock Exchange.

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

x (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The New York Stock Exchange on June 30, 2014, was $537,714,485.

The number of shares of Registrant’s Common Stock outstanding as of March 18, 2015 was 70,672,600.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Stockholders, scheduled to be held on May 21, 2015, are incorporated by reference into Part III of this Report.

TriNet, Inc.

Form 10-K – Annual Report

For the Fiscal Year End December 31, 2014

TABLE OF CONTENTS

2

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “would” and similar expressions or variations intended to identify forward-looking statements. These statements are not guarantees of future performance, but are based on management’s expectations as of the date of this report and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements. Important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include, but are not limited to, those identified below and those discussed in the section titled “Risk Factors” included under Part I, Item 1A below. All information provided in this report is as of the date of this report and we undertake no duty to update this information except as required by law.

Company Overview

TriNet is a leading provider of a comprehensive human resources solution for small to medium-sized businesses, or SMBs. We enhance business productivity by enabling our clients to outsource their HR function to one strategic partner and allowing them to focus on operating and growing their core businesses. Our HR solution includes services such as payroll processing, human capital consulting, employment law compliance and employee benefits, including health insurance, retirement plans and workers compensation insurance. Our services are delivered by our expert team of HR professionals and enabled by our proprietary, cloud-based technology platform, which allows our clients and their employees to efficiently conduct their HR transactions anytime and anywhere. We believe we are a leader in the industry due to our size, our presence in the United States and Canada and the number of clients and employees that we serve.

We utilize a co-employment model pursuant to which both we and our clients become employers of our clients’ employees, which we refer to as worksite employees, or WSEs. This model affords us a close and embedded relationship with our clients and their employees. Under the co-employment model, employment-related liabilities are contractually allocated between us and our clients. We assume responsibility for, and manage the risks associated with, each clients’ employee payroll obligations, including the liability for payment of salaries and wages to each client employee, the payment of payroll taxes and, at the client’s option, responsibility for providing group health, welfare, workers compensation and retirement benefits to such individuals. Unlike a payroll service provider, we issue each WSE a payroll check drawn on our bank accounts and contract with insurance carriers to provide health and workers compensation insurance to WSEs under TriNet’s name.

We serve thousands of clients in specific industry vertical markets, including technology, life sciences, property management, professional services, banking and financial services, retail, manufacturing and hospitality services, as well as non-profit entities. As of December 31, 2014, we served over 10,000 clients in all 50 states, the District of Columbia and Canada and co-employed approximately 288,000 WSEs. In 2014, we processed over $25 billion in payroll and payroll tax payments for our clients.

Our total revenues consist of professional service revenues and insurance service revenues. For 2014 and 2013, 16% and 17% of our total revenues, respectively, consisted of professional service revenues, and 84% and 83% of our total revenues, respectively, consisted of insurance service revenues. We earn professional service revenues by processing HR transactions, such as payroll and employment tax withholding, and providing labor and benefit law compliance services, on behalf of our clients. We earn insurance service revenues by providing risk-based, third-party plans to our clients, primarily employee health benefit plans and workers compensation insurance.

For professional service revenues, we recognize as revenues the fees we earn for processing HR transactions, which fees do not include the payroll that is paid to us by the client and paid out to WSEs or remitted as taxes. We recognize as insurance service revenues all insurance-related billings and administrative fees collected from clients and withheld from WSEs for risk-based insurance plans provided through third-party insurance carriers, primarily employee health insurance and workers compensation insurance. We in turn pay premiums to third-party insurance carriers for these insurance benefits, as well as reimburse them for claim payments within our insurance deductible layer. These premiums and reimbursements are classified as insurance costs on our statements of operations. To augment our financial information prepared in accordance with GAAP, we use internally a non-GAAP financial measure, Net Insurance Service Revenues, which consists of insurance service revenues less insurance costs. We also use a measure of total non-GAAP revenue, or Net Service Revenues, which is the sum of professional service revenues and Net Insurance Service Revenues. For 2014, 67% of our Net Service Revenues consisted of professional service revenues and 33% of our Net Service Revenues consisted of Net Insurance Service Revenues.

3

We have grown our business organically and through strategic acquisitions. For 2014, 2013 and 2012, our total revenues were $2.2 billion, $1.6 billion, and $1.0 billion respectively, Net Service Revenues were $507.2 million, $417.7 million and $269.0 million, respectively, and our net income was $15.5 million, $13.1 million and $31.8 million, respectively. For 2014, 2013 and 2012, our Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization or Adjusted EBITDA was $165.3 million, $136.0 million and $95.4 million, respectively. We conduct our business primarily in the United States, and all of our clients are U.S. employers. However, we provide services with respect to certain of our clients’ employees in Canada. The percentage of our total revenues attributable to WSEs in Canada was less than 1% for each of 2014, 2013 and 2012.

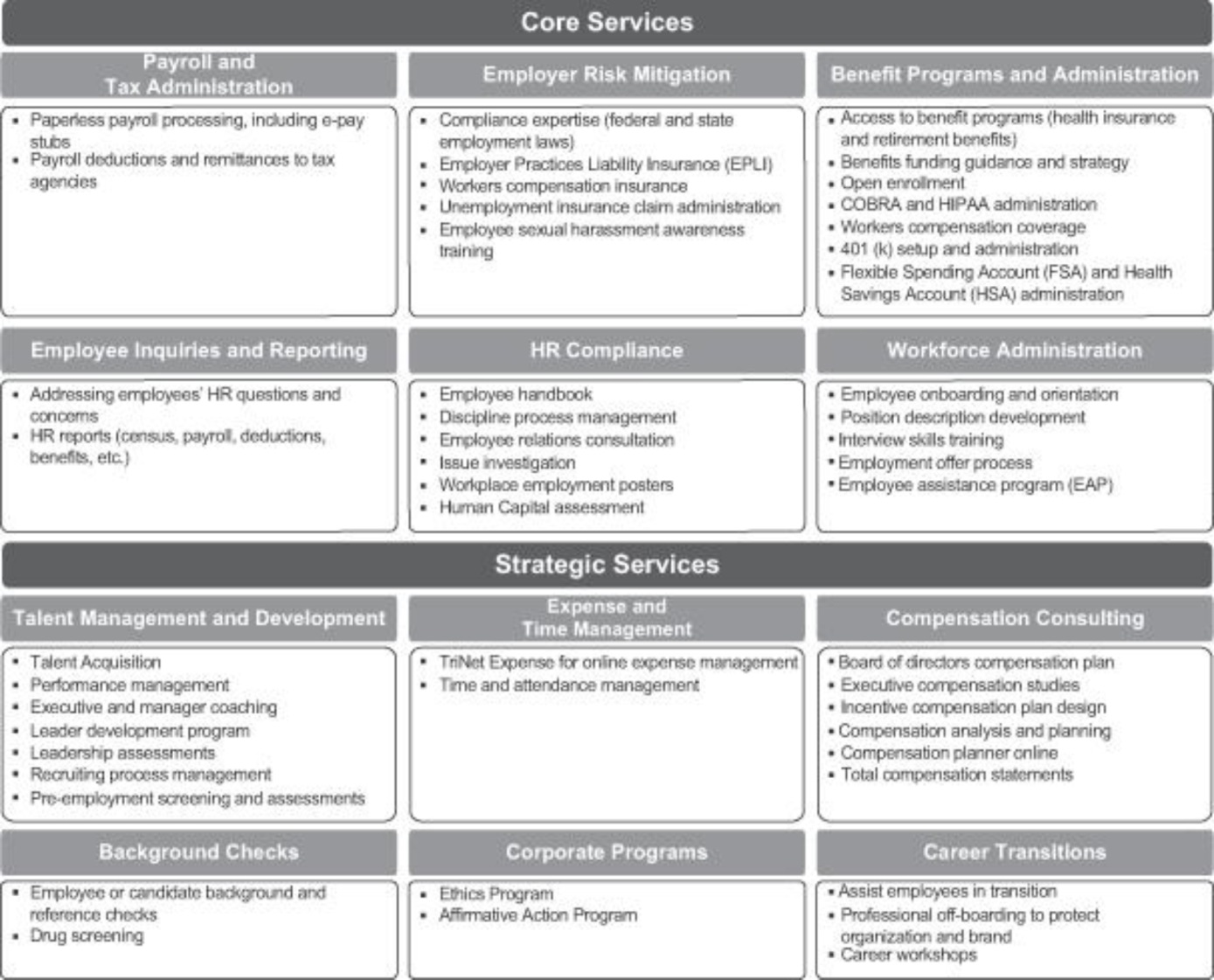

Our Services

We provide a comprehensive suite of core HR services that allows our clients to outsource their HR function. We also provide a set of strategic services to support and enhance each stage of our clients’ growth. Our services are supported by our network of HR experts and integrated through a single-sign-on, proprietary, cloud-based SaaS platform, designed so that our clients have access to big-company benefits, excellent service and a scalable HR infrastructure. The following diagram depicts the services that we offer:

Benefits Programs and Risk Management

We provide benefits to our WSEs and clients under arrangements with a variety of vendors that provide employee benefit plans, workers compensation insurance and employee practices liability insurance. These agreements typically have a term of one year and generally may be terminated by either us or the insurance carrier partner on 90 days’ notice.

Risk management is a core competency of our company. We leverage the insight that we have gained over our 25-year operating history as well as our robust risk management capabilities to mitigate the risks associated with providing workers compensation and employee benefit plans to our clients. Our programs are fully insured by top-rated insurance carriers, which limits our ultimate exposure or potential losses. We assess all workers compensation and medical benefits risks on an individual client basis and annually adjust pricing to reflect their current risk based on Health Insurance Portability and Accountability Act or HIPAA-compliant analytics.

4

Employee Benefit Plans

We sponsor a number of fully-insured employee benefit plans, including group health, dental, vision and group and individual life insurance, legal services, commuter benefits, home insurance, critical illness insurance, pet insurance and auto insurance, as an employer plan sponsor under Section 3(5) of Employee Retirement Income Security Act or ERISA. Approximately 41% of our 2014 health insurance premiums were for policies with respect to which our carriers set the premiums and for which we were not responsible for any deductible. The remainder of our health insurance premiums are for policies with respect to which we agree to reimburse our carriers for any claims that they pay within our deductible layer. Our agreements with our health insurance carriers with respect to these policies typically include limits to our exposure for individual claims, which we refer to as pooling limits, and limits to our maximum aggregate exposure for claims in a given policy year, which we refer to as stop losses. We have experienced variability in the level of our insurance claims based on the unpredictable nature of large claims. We manage the risk that we assume in connection with these policies by utilizing group risk assessments and HIPAA-compliant analytics and pricing these policies accordingly. Following our initial pricing of these policies, we analyze claims data for each client on an ongoing basis and seek to adjust our prices on each client’s annual anniversary date as appropriate.

We believe that our provision of group health insurance is one of the most important employee benefits we provide to our WSEs. We provide group health insurance coverage to our WSEs through a national network of carriers including Aetna, Blue Shield of California, Blue Cross and Blue Shield of Florida, Kaiser Permanente, MetLife and United Healthcare, all of which provide fully insured policies for our WSEs.

Workers Compensation Insurance

We provide fully-insured workers compensation insurance coverage to our WSEs through agreements that we negotiate with our third-party insurance providers ACE, AIG, The Hartford, Lumberman’s Mutual and American Zurich Insurance Company. These agreements typically obligate us to reimburse our carriers up to $1 million per claim. We manage the risk that we assume in connection with these policies by: being selective in terms of the types of businesses that we take on as clients; performing workplace assessment, safety consultation, accident investigation and other risk management services at our client locations to help prevent claims and remediate them when they occur; and monitoring claims data and the performance of our carriers and third-party claims management services to improve our actuarial projections.

Employment Practices Liability Insurance

We provide employment practices liability insurance, or EPLI, through several insurance carriers, including Allied World Assurance Company, Lexington Insurance Company and Beazley. These policies provide for a per-claim deductible. For most of our clients, the deductible is split between the client and TriNet, with the client paying its deductible first. Our legal department manages all employee practices liabilities claims processing and defense, while the actual litigation defense is conducted by one of several employment law firms that we retain to assist with the cases.

Our Technology Platform

We have a proprietary, cloud-based technology platform that allows clients and employees real-time access to a suite of secure online HR resources. Our platform is designed to function as the core system of record for all of our clients’ HR activities and allows our clients to enjoy 24/7, ubiquitous access. Through the use of our online self-service tools, managers can effectively manage employee hiring and termination, administer employee payroll, view real-time benefits data and create compensation reports. Single-sign-on system functionality allows employees to manage their own payroll information, enroll in benefits and view paystubs, W-2s and more. Employees can also view real-time workflow data, such as requests and approvals for personal time off. As a result of our long-standing partnerships and the significant investments that we have made in our platform, our technology and benefits services partners have integrated with our platform, allowing employees to access a unified view of all of their pertinent HR information.

We invest significant capital to create and offer state-of-the-art HR technology tailored to our vertical markets. Our proprietary, cloud-based platform enables us to provide our clients with the best and latest version of our software. We leverage our existing online platform to build additional products and features, including a full-service mobile platform.

We maintain a proprietary, cloud-based HR information system. Our clients receive the efficiencies of an enterprise-level platform without the significant cost of in-house installation or ongoing maintenance. Features include:

|

· |

multi-tenant system enabling multiple clients and WSEs to share one version of our system while isolating each client’s and WSE’s data; |

|

· |

rule-based provisioning ensuring that all users are authenticated, authorized and validated before they can access our platform; |

5

|

· |

redundant processing centers to protect client data from loss; and |

|

· |

integrated benefits and payroll processing for faster, more accurate data; and flexible and extensible platform architecture. |

From 2010 through 2014, we invested approximately $125.5 million in our technology platform. We plan to continue to invest to upgrade and improve our platform.

Sales and Marketing

We sell our solutions primarily through our direct sales organization, which consists of sales representatives, sales management and sales operations and support personnel. Our sales representatives focus on serving clients in specific vertical markets. The number of sales representatives has grown substantially in recent years, from 114 Total Sales Representatives as of December 31, 2010 to 385 Total Sales Representatives as of December 31, 2014. We recruit and hire sales professionals who have experience in a specific industry vertical market, and we also seek sales professionals with a background in selling business services such as accounting, HR or sales solutions. As of December 31, 2014, we had approximately 60 regional sales offices.

We also employ a broad range of awareness and demand-generation marketing programs, including billboards, digital and print advertising, e-mail, direct mail and social media. We have an internal public relations team that works with an external agency to promote relevant content to target media outlets. We sponsor and participate in associations and events around the country and utilize these forums to target specific vertical and geographic markets.

Clients

We serve thousands of clients in a variety of industries, including technology, life sciences, property management, professional services, banking and financial services, retail, manufacturing and hospitality services, as well as non-profit entities. We have grown our number of clients from approximately 5,600 as of December 31, 2010 to over 10,000 clients as of December 31, 2014. We have also grown our number of WSEs from approximately 97,000 in 46 states and the District of Columbia as of December 31, 2010 to approximately 288,000 in all 50 states, the District of Columbia and Canada as of December 31, 2014.

The Co-Employment Model

We deliver our services through a co-employment model, pursuant to which both we and our clients are employers of our clients’ workforce. Our co-employment model affords us a close and embedded relationship with our clients and their employees. In this arrangement, we assume certain aspects of the employer/employee relationship, according to a contract between us and our client. Each of our clients enters into a client service agreement with us that defines the bundled suite of services and benefits to be provided by us, the fees payable to us, and the division of responsibilities between us and our client as co-employers. We currently co-employ employees only in the United States and Canada, but in some cases also provide payroll processing services for our clients’ employees outside these countries utilizing third-party vendors. Each of our customer services agreements has a one-year term that guarantees its pricing terms and typically may be terminated by either party upon 30 days’ prior written notice. The division of responsibilities under our client service agreements is typically as follows:

TriNet Responsibilities

|

· |

Payment to WSEs of salaries, commissions, bonuses, vacations, paid time off, sick pay, paid leaves of absence and severance payments as reported by the client, related tax reporting and remittance and processing of garnishment and wage deduction orders; |

|

· |

maintenance of workers compensation insurance and workers compensation claims processing; |

|

· |

provision and administration of employee benefits that we provide to the WSEs; |

|

· |

compliance with applicable law for employee benefits offered to WSEs; |

|

· |

processing of unemployment claims; |

|

· |

provision and promulgation of HR policies, including an employee handbook describing the co-employment relationship; and |

|

· |

HR consulting services. |

6

Client Responsibilities

|

· |

Compliance with laws associated with the classification of employees as exempt or non-exempt, such as overtime pay and minimum wage law compliance; |

|

· |

accurate and timely reporting to TriNet of compensation and deduction information, including information relating to salaries, commissions, bonuses, vacations, paid time off, sick pay, paid leaves of absence and severance payments; |

|

· |

accurate and timely reporting to TriNet of information relating to workplace injuries, employee hires and termination, and other information relevant to TriNet’s services; |

|

· |

provision and administration of any employee benefits not provided by TriNet (e.g., equity incentive plans); |

|

· |

compliance with all laws and regulations applicable to the client’s workplace and business, including work eligibility laws, laws relating to workplace safety or the environment, laws relating to family and medical leave, laws pertaining to employee organizing efforts and collective bargaining and employee termination notice requirements; and |

|

· |

all other matters for which TriNet does not assume responsibility under the client service agreement, such as intellectual property ownership and protection and liability for products produced and/or services provided. |

As a result of our co-employment relationship with each of our WSEs, we are liable for payment of salary, wages and other compensation to the WSEs as reported by the client and are responsible for providing specified employee benefits to such persons, regardless of whether the client pays the associated amounts to us. In most instances, clients are required to remit payment prior to the applicable payroll date by wire transfer or automated clearinghouse transaction. Although we are ultimately liable under the terms of our client service agreements, as the employer for payroll purposes, to pay employees for work previously performed, we are not obligated to continue to provide services to the client if payment has not been made. For the year ended December 31, 2014, our bad debt expense was approximately $1.4 million.

We also assume responsibility for payment and liability for the withholding and remittance of federal and state income and employment taxes with respect to wages and salaries paid to WSEs. In the event we fail to meet these obligations, the client may be held ultimately liable for those obligations. We secure insurance to ensure that our clients are not required to be responsible for taxes in the event we fail to meet these obligations.

Strategic Acquisitions

We operate in a highly fragmented industry and have completed numerous strategic acquisitions over the course of the past decade. We intend to continue to pursue strategic acquisitions that will enable us to add new clients and employees to our existing business and offer our clients and their employees more comprehensive and attractive services. Our recent acquisitions are listed below:

|

· |

In July 2013, we acquired Ambrose Employer Group, LLC, which we refer to as, Ambrose, a New York-based company that provides premium HR services primarily to WSEs in the financial services industry in the New York area. Through our acquisition of Ambrose, we acquired approximately 13,000 WSEs, approximately 1,000 clients and 12 sales representatives. |

|

· |

In October 2012, we acquired South Carolina-based SOI Holdings, Inc., which we refer to as, SOI, which expanded our presence in the property management and food services industry vertical markets. Through our acquisition of SOI, we acquired approximately 66,000 WSEs, approximately 1,500 clients and 92 sales representatives. |

|

· |

In May 2012, we acquired Los Angeles-based technology company App7, Inc., which does business under the name of, and which we refer to as, ExpenseCloud, which enabled us to enhance our technology platform with additional expense management capabilities. |

|

· |

In April 2012, we acquired Oklahoma-based 210 Park Avenue Holding, Inc., which does business under the name of, and which we refer to as, Accord, through which we expanded our presence in the hospitality and manufacturing industry vertical markets. Through our acquisition of Accord, we acquired approximately 14,000 WSEs, approximately 500 clients and 8 sales representatives. |

|

· |

In June 2009, we acquired Florida-based Gevity HR Inc., which we refer to as, Gevity, which has provided us with insurance and risk-management expertise and a national presence through its East Coast processing facility. Through our acquisition of Gevity, we acquired approximately 92,000 WSEs and approximately 6,000 clients. Following our acquisition of Gevity, we elected to change the pricing terms with certain of Gevity’s clients, terminate Gevity’s relationships with certain of its clients, significantly restructure Gevity’s and our combined sales forces and migrate all of Gevity’s WSEs to our technology platform. As a result of these actions, our revenues fell short of our expectations in 2010 and declined in 2011, and we incurred restructuring charges of $2.4 million, $5.9 million and $6.2 million in the years ended December 31, 2011, 2010 and 2009, respectively. |

7

Because many of the companies we have acquired were focused on specific industries, our acquisitions have allowed us to expand our vertical service offerings into areas such as financial services, property management and food services, hospitality and manufacturing in which we did not previously have a significant presence. In addition, we have acquired sales representatives with experience in these vertical markets. Our acquisitions have provided us with additional clients and WSEs to allow us to continue to leverage our operations over a larger client base.

Our Growth Strategies

Our goal is to become the leading HR solutions provider to SMBs. Our strategies to achieve that goal include the following:

|

· |

Continue to Penetrate the SMB Market Using Our Vertical Market Approach. Our focus on serving clients in specific industry vertical markets has given us deep, substantive knowledge of the HR needs facing SMBs in those industries. This enables us to provide a bundled solution of services to each client that is tailored to its specific needs and better enables us to attract sales professionals with industry expertise. We intend to continue this focus on industry vertical markets. We also regularly assess additional and new industry vertical markets and intend to add them, either through acquisition or internal development, selectively based on what we believe the market opportunity is. |

|

· |

Expand Our Direct Sales Force. We believe that the SMB market remains significantly underpenetrated for a bundled HR solution such as ours. We intend to continue to invest in our direct sales force to enable us to identify and acquire new clients across our target vertical markets, in addition to expanding our sales force to target new vertical markets. |

|

· |

Grow With Our Clients by Enhancing the Breadth and Quality of Our Services. We intend to continue to expand the breadth and quality of our HR solution. We believe that this will allow us to continue to enhance the value proposition for our clients, as well as grow and retain them longer by providing additional high-quality service offerings. |

|

· |

Continue to Enhance Our Technology Platform. We intend to continue to invest in and improve our proprietary, cloud-based technology platform, including mobile applications, in order to provide our clients with enhanced features and functionality with which to conduct their HR transactions, manage employees and analyze employee benefits data. This may include acquiring or developing additional functionality or technology. |

|

· |

Continue to Grow Through Strategic Acquisitions. We have successfully completed numerous strategic acquisitions over the course of the past decade, which has allowed us to enhance and expand our presence in both existing and new target industries, as well as expand our solution and technology platform. We intend to continue to pursue strategic acquisitions that will enable us to leverage our existing assets and offer our clients more comprehensive and attractive services. |

We believe that if effectively pursued, these strategies represent opportunities for us to increase the demand for our services. We also face challenges to our growth strategy. We must be able to convince SMBs of the benefits of outsourcing their HR function, effectively execute our strategies and minimize client attrition, in addition to addressing or responding to other issues identified below under “Risk Factors.”

U.S. Legal and Regulatory Environment

General

Numerous federal and state laws and regulations relating to employment matters, benefit plans and income and employment taxes affect our operations. Many of these laws, such as ERISA, were enacted before the development of the co-employment relationship that we use and other non-traditional employment relationships, such as temporary employment and other employment-related outsourcing arrangements. Therefore, many of these laws do not specifically address the obligations and responsibilities of our industry, the participants in which are referred to as professional employer organizations. Other federal and state laws and regulations, such as the Patient Protection and Affordable Care Act, are relatively new, and administrative agencies and federal and state courts have only begun to interpret and apply these regulations to our industry. The development of additional regulations and interpretation of those regulations can be expected to evolve over time.

While we believe that our operations are currently in compliance in all material respects with applicable federal and state statutes and regulations, the topics discussed below summarize what we believe are the most important regulatory aspects of our business.

Employer Status

In order for WSEs to receive the full benefit of our benefits offerings, it is important that we constitute the “employer” of the WSEs under the Internal Revenue Code of 1986 or the Code and ERISA. The definitions of “employer” under both the Code and ERISA are not clear and are defined in part by complex multi-factor tests under common law. We believe that we qualify as an

8

“employer” of our WSEs in the United States under both the Code and ERISA, and we implement processes to protect and preserve this status.

Tax Qualified Plans. In order to qualify for favorable tax treatment under the Code, certain employee benefit plans such as 401(k) retirement plans and cafeteria plans must be established and maintained by an employer for the exclusive benefit of its employees. Generally, an entity is an “employer” of certain workers for federal employment tax purposes if an employment relationship exists between the entity and the workers under the common law test of employment. The common law test of employment, as applied by the IRS, involves an examination of many factors to ascertain whether an employment relationship exists between a worker and a purported employer. Our 401(k) retirement plans are operated pursuant to guidance provided by the IRS for the operation of defined contribution plans maintained by co-employers that benefit WSEs. This guidance provides qualification standards for such plans. All of our 401(k) retirement plans have received determination letters from the IRS confirming the qualified status of the plans. The IRS 401(k) guidance and qualification requirement are not applicable to the operation of our cafeteria plans.

ERISA Regulations. Employee pension and welfare benefit plans are also governed by ERISA. ERISA defines an “employer” as “any person acting directly as an employer, or indirectly in the interest of an employer, in relation to an employee benefit plan.” ERISA defines the term “employee” as “any individual employed by an employer.” The courts have held that the common law test of employment must be applied to determine whether an individual is an employee or an independent contractor under ERISA. However, in applying that test, control and supervision are less important for ERISA purposes when determining whether an employer has assumed responsibility for an individual’s benefits status. A definitive judicial interpretation of “employer” in the context of a professional employer organization has not been established, and the U.S. Department of Labor has issued guidance that certain entities in the HR outsourcing industry do not qualify as common law employers of WSEs for ERISA purposes. If we were found not to be an employer for ERISA purposes, our plans would not comply with ERISA, and fines and penalties could be imposed. In addition, our ERISA plans would not enjoy, with respect to WSEs, the full preemption of state laws provided by ERISA and could be subject to various state laws and regulation.

Patient Protection and Affordable Care Act

The Patient Protection and Affordable Care Act or the Act, implements sweeping health care reforms with staggered effective dates from 2010 through 2018, and many provisions in the Act require the issuance of additional guidance from the U.S. Department of Labor, the IRS, the U.S. Department of Health and Human Services and the states. The Act imposes a number of new mandates on the coverage required to be provided under health insurance plans beginning in 2010, with additional requirements staged in subsequent years. We believe that our group health plans comply with existing mandates. However, the guidance issued to date by the IRS and the U.S. Department of Health and Human Services have not addressed, or in some instances are unclear, as to their application in the co-employer context or whether such provisions should be applied at the client level. As a result, we are not yet able to predict all of the impacts to our business, and to our clients, resulting from the Act.

State Unemployment Taxes

State unemployment taxes are based on taxable wages and tax rates assigned by each state. The tax rates vary by state and are determined, in part, based on our prior years’ compensation experience in each state. Certain rates are also determined, in part, by each client’s own compensation experience. In addition, states have the ability under law to increase unemployment tax rates, including retroactively, to cover deficiencies in the unemployment tax funds. Due to the adverse U.S. economic conditions during recent years and the associated reductions in employment levels, the state unemployment funds have experienced a significant increase in the number of unemployment claims. Accordingly, state unemployment tax rates increased substantially over the past few years. Employers in certain states are also experiencing higher federal unemployment tax rates as a result of certain states not repaying their unemployment loans from the federal government in a timely manner. We have taken steps to mitigate the risk of fluctuations in state and federal unemployment tax rates, including reporting and remitting unemployment insurance taxes or contributions at the customer level and/or under the customer’s own account number in approximately 30 states, and we will continue to seek such reporting relationships in the future.

State Regulation of Co-Employers

Forty-two states have adopted provisions for licensing, registration, certification or recognition of co-employers, and others are considering such regulation. Such laws vary from state to state but generally provide for monitoring or ensuring the fiscal responsibility of professional employer organizations, and in some cases codify and clarify the co-employment relationship for unemployment, workers compensation and other purposes under state law. We believe we are in compliance in all material respects with the requirements in all 42 states. Regardless of whether a state has licensing, registration or certification requirements for co-employers, we must comply with a number of other state and local regulations that could impact our operations, such as state and local taxes, licensing, zoning and business regulations.

9

Competition

We face significant competition on a national and regional level from a number of companies purporting to deliver a range of bundled services that are generally similar to the services we provide. The National Association of Professional Employer Organizations, or NAPEO, estimates that there are between 700 and 900 such entities currently operating in the United States. We are one of only four professional employer organizations or PEOs accredited by the Employer Services Assurance Corporation that offers services in all 50 states and believe that we are one of the largest PEOs in the industry. Our competitors include large professional employer organizations such as the TotalSource unit of Automatic Data Processing, Inc. and Insperity, Inc., as well as specialized and small professional employer organization service providers. If and to the extent that we and other companies providing these services are successful in growing our businesses, we anticipate that future competitors will enter this industry.

In addition to competition from other professional employer organizations, we also face competition in the form of companies serving their HR needs in traditional manners. These forms of competition include:

|

· |

HR and information systems departments and personnel of companies that perform their own administration of benefits, payroll and HR; |

|

· |

providers of certain endpoint HR services, including payroll, benefits and business process outsourcers with high-volume transaction and administrative capabilities, such as Automatic Data Processing, Inc., Paychex, Inc. and other third-party administrators; and |

|

· |

benefits exchanges that provide benefits administration services over the Internet to companies that otherwise maintain their own benefit plans. |

We believe that our services are attractive to many SMBs in part because of our ability to provide workers compensation, health care and other benefits programs to them on a cost-effective basis. We compete with insurance brokers and other providers of this coverage in this regard, and our offerings must be priced competitively with those provided by these competitors in order for us to attract and retain our clients.

We believe the principal competitive factors in our market include the following:

|

· |

level of customer satisfaction; |

|

· |

ease of customer setup and on-boarding; |

|

· |

breadth and depth of benefit plans and online functionality; |

|

· |

vertical market expertise; |

|

· |

total cost of service; |

|

· |

brand awareness and reputation; |

|

· |

ability to innovate and respond to customer needs rapidly; and |

|

· |

subject matter expertise. |

We believe that we compete favorably on the basis of each of these factors.

Seasonality and Insurance Variability

Our business is affected by cyclicality in business activity and WSE behavior. Historically, we have experienced our highest monthly addition of WSEs, as well as our highest monthly levels of client attrition, in the month of January, primarily because clients that change their payroll service providers tend to do so at the beginning of a calendar year. In addition, we experience higher levels of client attrition in connection with renewals of the health insurance we provide for our WSEs, in the event that such renewals result in increased premiums that we pass on to our clients. We have also historically experienced higher insurance claim volumes in the second and third quarters of a fiscal year than in the first and fourth quarters of a fiscal year, as WSEs typically access their health care providers more often in the second and third quarters of a fiscal year, which has negatively impacted our insurance costs in these quarters. We have also experienced variability on a quarterly basis in the level of our insurance claims based on the unpredictable nature of large claims. These historical trends may change, and other seasonal trends and variability may develop that make it more difficult for us to manage our business.

10

Intellectual Property

Our success depends in part on intellectual property rights to the services that we develop. We rely on a combination of contractual rights, including non-disclosure agreements, trade secrets, copyrights and trademarks, to establish and protect our intellectual property rights in our names, services, methodologies and related technologies. If we lose intellectual property protection or the ability to secure intellectual property protection on any of our names, confidential information or technology, this could harm our business. Our intellectual property rights may not prevent competitors from independently developing services and methodologies similar to ours, and the steps we take might be inadequate to deter infringement or misappropriation of our intellectual property by competitors, former employees or other third parties, any of which could harm our business. We currently have one pending U.S. patent application covering our technology. We own registered trademarks in the United States, Canada and the European Union that have various expiration dates unless renewed through customary processes. Our trademark registrations may be unenforceable or ineffective in protecting our trademarks. Our trademarks may be unenforceable in countries outside of the United States, which may adversely affect our ability to build our brand outside of the United States.

Although we believe that our conduct of our business does not infringe on the intellectual property rights of others, third parties may nevertheless assert infringement claims against us in the future. We may be required to modify our products, services, internal systems or technologies, or obtain a license to permit our continued use of those rights. We may be unable to do so in a timely manner, or upon reasonable terms and conditions, which could harm our business. In addition, future litigation over these matters could result in substantial costs and resource diversion. Adverse determinations in any litigation or proceedings of this type could subject us to significant liabilities to third parties and could prevent us from using some of our services, internal systems or technologies.

Corporate Employees

We refer to our employees, excluding employees that we co-employ on behalf of our clients, as our corporate employees. We had 2,057 corporate employees as of December 31, 2014. We believe our relations with our corporate employees are good. None of our corporate employees is covered by a collective bargaining agreement.

Directors and Executive Officers

|

Name |

|

|

Principal Occupation(s) |

|

Executive Officers |

|

|

|

|

Burton M. Goldfield |

|

|

President, Chief Executive Officer and Director, TriNet |

|

William Porter |

|

|

Vice President and Chief Financial Officer, TriNet |

|

Gregory L. Hammond |

|

|

Executive Vice President and Chief Legal Officer, TriNet |

|

John Turner |

|

|

Senior Vice President of Sales, TriNet |

|

|

|

|

|

|

Non-Employee Directors |

|

|

|

|

H. Raymond Bingham |

|

|

Advisory Director, General Atlantic LLC (a global growth equity investment firm) |

|

Katherine August-deWilde |

|

|

President and Chief Operating Officer, First Republic Bank (commercial bank specializing in private banking, business banking and wealth management) |

|

Martin Babinec |

|

|

Founder and Chairman, Upstate Venture Connect (a nonprofit corporation focused on the creation of new companies and jobs across Upstate New York); Founder and Chairman, StartFast Venture Accelerator (a mentorship-driven startup accelerator based in New York) |

|

Kenneth Goldman |

|

|

Chief Financial Officer, Yahoo! Inc. (an Internet services company) |

|

David C. Hodgson |

|

|

Managing Director, General Atlantic LLC (a global growth equity investment firm) |

|

John Kispert |

|

|

President and Chief Executive Officer, Spansion, Inc. (a provider of flash memory-based embedded systems solutions until acquired by Cypress Semiconductor in March 2015) |

|

Wayne B. Lowell |

|

|

Chairman and Chief Executive Officer, Senior Whole Health Holdings, Inc. (a health insurance company focused on providing health insurance coverage to senior citizens) |

Corporate and Other Available Information

We were incorporated in 1988 as TriNet Employer Group, Inc., a California corporation. We reincorporated as TriNet Merger Corporation, a Delaware corporation, in 2000 and during that year changed our name to TriNet Group, Inc. Our principal executive offices are located at 1100 San Leandro Blvd., Suite 400, San Leandro, CA 94577 and our telephone number is (510) 352-5000. Our website address is www.trinet.com. Information contained in or accessible through our website is not a part of this report.

11

On the Investor Relations page of our Internet website at http://www.trinet.com, we make available, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Information on our website is not incorporated into this report and is not a part of this report.

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and all of the other information contained in this report, including our consolidated financial statements and related notes. If any of the following risks materialize, our business, financial condition and results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline, and you may lose some or all of your investment.

Risks Related to Our Business and Industry

Our success depends on growth in market acceptance of the human resources outsourcing and related services we provide.

Our success depends on the willingness of SMBs to outsource their HR function to a third-party service provider. We estimate that fewer than 5% of U.S. employees of businesses with fewer than 500 employees are part of a co-employment arrangement, in which all or some portion of the employer’s HR function was outsourced to a single third-party provider such as TriNet. We believe that our growth opportunity is primarily a function of our ability to penetrate the SMB market. Many companies have invested substantial personnel, infrastructure and financial resources in their own internal HR organizations and therefore may be reluctant to switch to our solution. Companies may not engage us for other reasons, including a desire to maintain control over all aspects of their HR activities, a belief that they manage their HR activities more effectively using their internal administrative organizations, perceptions about the expenses associated with our services, perceptions about whether our services comply with laws and regulations applicable to them or their businesses, or other considerations that may not always be evident. Additional concerns or considerations may also emerge in the future. We must address our potential clients’ concerns and explain the benefits of our approach in order to convince them to change the way that they manage their HR activities, particularly in parts of the United States where our company and solution are less well-known. If we are not successful in addressing potential clients’ concerns and convincing companies that our solution can fulfill their HR needs, then the market for our solution may not develop as we anticipate and our business may not grow.

If we are unable to rapidly grow our sales force, we will not be able to grow our business at the rate that we anticipate, which could harm our business, results of operations and financial condition.

In order to raise awareness of the benefits of our services and identify and acquire new clients, we must rapidly grow our direct sales force, which consists of regional sales representatives who focus on serving clients in specific industry vertical markets. Competition for skilled sales personnel is intense, and we cannot assure you that we will be successful in attracting, training and retaining qualified sales personnel, or that our newly hired sales personnel will function effectively, either individually or as a group. In addition, our newly hired sales personnel are typically not productive for up to a year following their hiring. This results in increased near-term costs to us relative to the sales contributions of these newly hired sales personnel. If we are unable to rapidly grow and effectively train our sales force, our revenues likely will not increase at the rate that we anticipate, which could harm our business, results of operations and financial condition.

We are subject to client attrition.

We regularly experience significant client attrition due to a variety of factors, including increases in administrative fees and insurance costs, disruption caused by the transition of WSEs we have gained through acquisition to our technology platform, client business failure, competition and clients determining to bring HR administration in-house. Our standard client service agreement can be cancelled by us or by the client without penalty with 30 days’ prior written notice. Clients who intend to cease doing business with us often elect to do so effective as of the beginning of a calendar year. As a result, we have historically experienced our largest concentration of client attrition in the first quarter of each year. In addition, we experience higher levels of client attrition in connection with renewals of the health insurance we provide for WSEs in the event that such renewals result in increased premiums that we pass on to our clients. If we were to experience client attrition in excess of our projected annual attrition rate of approximately 20% of our installed WSE base, as we did in 2010 and 2011, it could harm our business, results of operations and financial condition.

Our acquisition strategy creates risks for our business.

We have completed numerous acquisitions of other businesses, and we expect that we will continue to grow through acquisitions of other businesses, assets or technologies. We may fail to identify attractive acquisition candidates or we may be unable to reach acceptable terms for future acquisitions. If we are unable to complete acquisitions in the future, our ability to grow our business will be impaired.

12

We may pay for acquisitions by issuing additional shares of our common stock, which would dilute our stockholders, or by issuing debt, which could include terms that restrict our ability to operate our business or pursue other opportunities and subject us to meaningful debt service obligations. We may also use significant amounts of cash to complete acquisitions. To the extent that we complete acquisitions in the future, we likely will incur future depreciation and amortization expenses associated with the acquired assets. We may also record significant amounts of intangible assets, including goodwill, which could become impaired in the future. Acquisitions involve numerous other risks, including:

|

· |

difficulties integrating the operations, technologies, services and personnel of the acquired companies, including the migration of WSEs from an acquired company’s technology platform to ours; |

|

· |

challenges maintaining our internal standards, controls, procedures and policies; |

|

· |

diversion of management’s attention from other business concerns; |

|

· |

over-valuation by us of acquired companies; |

|

· |

litigation resulting from activities of the acquired company, including claims from terminated employees, customers, former stockholders and other third parties; |

|

· |

insufficient revenues to offset increased expenses associated with the acquisitions and unanticipated liabilities of the acquired companies; |

|

· |

insufficient indemnification or security from the selling parties for legal liabilities that we may assume in connection with our acquisitions; |

|

· |

entering markets in which we have no prior experience and may not succeed; |

|

· |

risks associated with foreign acquisitions, such as communication and integration problems resulting from geographic dispersion and language and cultural differences, compliance with foreign laws and regulations and general economic or political conditions in other countries or regions; |

|

· |

potential loss of key employees of the acquired companies; and |

|

· |

impairment of relationships with clients and employees of the acquired companies or our clients and employees as a result of the integration of acquired operations and new management personnel. |

If we fail to integrate newly acquired businesses effectively, we might not achieve the growth, service enhancement or operational efficiency objectives of the acquisitions, and our business, results of operations and financial condition could be harmed.

Unexpected changes in workers compensation and health insurance claims by worksite employees could harm our business.

Our insurance costs are impacted significantly by our WSEs’ health and workers compensation insurance claims experience. We establish reserves to provide for the estimated costs of reimbursing our workers compensation and health insurance carriers for paying claims within the deductible layer in accordance with their insurance policies. Estimating these reserves involves our consideration of a number of factors and requires significant judgment. If there is an unexpected increase in the severity or frequency of claims, such as due to our WSEs generating additional claims activity, or if we subsequently receive updated information indicating insurance claims were higher than previously estimated and reported, our insurance costs could be higher in that period or subsequent periods as we adjust our reserves accordingly. We have also experienced variability in our insurance claims based on the unpredictable nature of large claims. In addition, we may be unable to increase our pricing to offset increases in insurance costs on a timely basis. A number of factors affect claim activity levels, such as changes in general economic conditions, proposed and enacted regulatory changes and disease outbreaks.

Our quarterly results of operations may fluctuate as a result of numerous factors, many of which are outside of our control.

Our quarterly results of operations are likely to fluctuate, and our results in some quarters may be below the expectations of research analysts and our investors, which could cause the price of our common stock to decline. Some of our significant expenses, such as insurance costs for our WSEs, rent expense and debt expense, may require significant lead time to reduce. If we do not achieve our expected revenues targets, we may be unable to adjust our costs quickly enough to offset any revenues shortfall, which could harm our results of operations. Some of the important factors that may cause our revenues, results of operations and cash flows to fluctuate from quarter to quarter include:

|

· |

the number and severity of health and workers compensation insurance claims by WSEs and the timing of claims information provided by our insurance carriers; |

|

· |

the number of our new clients initiating service and the number of WSEs employed by each new client; |

|

· |

our loss of existing clients; |

13

|

· |

reduction in the number of WSEs at existing clients; |

|

· |

the timing of client payments and payment defaults by clients; |

|

· |

the amount and timing of our operating expenses and capital expenditures; |

|

· |

costs associated with our acquisitions of companies, assets and technologies; |

|

· |

payments or drawdowns on our credit facility, or any amendments to our obligations under our credit facility; |

|

· |

expenses we incur for geographic and service expansion; |

|

· |

our regulatory compliance costs; |

|

· |

changes to our credit ratings by rating agencies; |

|

· |

changes in our effective tax rate; |

|

· |

extraordinary expenses such as litigation or other dispute-related settlement payments; and |

|

· |

the impact of new accounting pronouncements. |

Many of the above factors are discussed in more detail elsewhere in this “Risk Factors” section and in the section of this report titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Many of these factors are outside our control, and the variability and unpredictability of these factors could cause us to fail to meet our expectations for revenues or results of operations for a given period. In addition, the occurrence of one or more of these factors might cause our results of operations to vary widely, which could lead to negative impacts on our margins, short-term liquidity or ability to retain or attract key personnel, and could cause other unanticipated issues. Accordingly, we believe that quarter-to-quarter comparisons of our revenues, results of operations and cash flows may not be meaningful and should not be relied upon as an indication of our future performance.

Our business is subject to numerous state and federal laws, and uncertainty as to the application of these laws, or adverse applications of these laws, as well as changes in applicable laws, could adversely affect our business.

Our operations are governed by numerous federal, state and local laws relating to labor, tax, benefits, insurance and employment matters. We are a professional employer organization, and by entering into a co-employment relationship with WSEs, we assume certain obligations, responsibilities and potential legal risks of an employer under these laws. However, many of these laws (such as the Employee Retirement Income Security Act, or ERISA, and federal and state employment tax laws) do not specifically address the obligations and responsibilities of a provider of outsourced HR in a co-employment relationship, and the definition of employer under these laws is not uniform. In addition, many states have not addressed the co-employment relationship for purposes of compliance with applicable state laws governing the relationship between employers and employees and state insurance laws. There is even greater uncertainty on the federal level, such as the application of immigration reform to a co-employment relationship, and tax credits for small businesses that utilize a co-employment relationship.

We are not able to predict whether broader federal or state regulation governing the co-employment relationship will be implemented, or if it is, how it will affect us. Any adverse application or interpretation (in courts, agencies or otherwise) of new or existing federal or state laws to the co-employment relationship with our WSEs and clients could harm our business. If federal, state or local jurisdictions were to change their regulatory framework related to outsourced HR, or introduce new laws governing our industry that were materially different from existing laws, those changes could reduce or eliminate the need for some of our services, or could require that we make significant changes in our methods of doing business, which could increase our cost of doing business. Changes in regulations could also affect the extent and type of benefits employers can or must provide employees, the amount and type of taxes employers and employees are required to pay or the time within which employers must remit taxes to the applicable authority. These changes could substantially decrease our revenues and substantially increase our cost of doing business. If we fail to educate and assist our clients regarding new or revised legislation that impacts them, our reputation could be harmed.

Although some states do not explicitly regulate professional employer organizations, 42 states have passed laws that have licensing, certification or registration requirements applicable to professional employer organizations or recognize the professional employer organization model, and other states may implement such requirements in the future. Laws regulating professional employer organizations vary from state to state, but generally provide for oversight of the fiscal responsibility of professional employer organizations, and in some cases codify and clarify the co-employment relationship for processing unemployment claims, workers compensation and other purposes under state law. We may be required to spend significant time and resources to satisfy licensing requirements or other applicable regulations in some states, and we may not be able to satisfy these requirements or regulations in all states, which could prohibit us from doing business in such states. In addition, we cannot assure you that we will be able to renew our licenses in all states.

14

If we are not recognized as an employer of worksite employees under federal and state regulations, we and our clients could be adversely impacted.

In order for WSEs to receive the full benefit of our benefits offerings, it is important that we act and qualify as an employer of the WSEs under the Internal Revenue Code of 1986, or the Code, and ERISA. In addition, our status as an employer is important for purposes of ERISA preemption of state laws. The definition of employer under various laws is not uniform, and under both the Code and ERISA the term is defined in part by complex multi-factor tests under common law. We believe that we qualify as an employer of our WSEs in the United States under both the Code and ERISA, and we implement processes to protect and preserve this status. However, the U.S. Department of Labor has issued guidance that certain entities in the HR outsourcing industry do not qualify as common law employers of WSEs for ERISA purposes. If we were found not to be an employer under the Code, our WSEs may not receive the favorable tax treatment for any plans intended to qualify under Section 401 of the Code, including our 401(k) plans and cafeteria plans, which could have a material adverse effect on our business. If we were found not to be an employer for ERISA purposes, our plans would not comply with ERISA, and fines and penalties could be imposed. In addition, if we were found not to be an employer for ERISA purposes, we and our plans would not enjoy the full preemption of state laws provided by ERISA and could be subject to varying state laws and regulations, including laws governing multiple employer welfare arrangements, or MEWAs, as well as to claims based upon state laws.

We and our clients could be adversely impacted by health care reform.

The Patient Protection and Affordable Care Act and the Heath Care and Education Reconciliation Act of 2010, which we refer to collectively as the Act, entail sweeping health care reforms with staggered effective dates through 2018, and many provisions of the Act require the issuance of additional guidance from the U.S. Departments of Labor and Health and Human Services, the Internal Revenue Service, or IRS, and U.S. states. A number of key provisions of the Act have begun to take effect over the last year, including the establishment of state and federally run insurance exchanges, insurance market reforms, “pay or play” penalties on applicable large employers and the imposition and assessment of excise taxes on the health insurance industry and reinsurance taxes on insurers and third-party administrators. Collectively, these items have the potential to significantly change the insurance marketplace for employers and how employers offer or provide insurance to employees.

As a co-employer of our clients’ WSEs, we assume or share many of the employer-related responsibilities and legal risks and assist our clients in complying with many employment-related governmental regulations. Generally, the Act and subsequently issued guidance by the IRS and the U.S. Department of Health and Human Services have not addressed, or in some instances are unclear, as to their application in the co-employment relationship. For example, the Act provides for a small business tax credit for eligible companies offering health care coverage to employees. We believe that these tax credits are available to our clients that meet the qualification requirements; however, the Act and subsequently issued IRS guidance do not expressly address the issue of whether small business clients of a professional employer organization may still qualify as small businesses eligible for such tax credits. As a result of this uncertainty, we are not yet able to determine the impacts to our business, and to our clients, resulting from the Act. In future periods, the changes may result in increased costs to us and our clients and could affect our ability to attract and retain clients. Additionally, we may be limited or delayed in our ability to increase service fees to offset any associated potential increased costs resulting from compliance with the Act. Furthermore, the uncertainty surrounding the terms and application of the Act may delay or inhibit the decisions of potential clients to outsource their HR needs. Any of these developments could harm our business, results of operations and financial condition.

We may have additional tax liabilities, which could harm our business, operating results, financial condition and prospects.

Significant judgments and estimates are required in determining our provision for income taxes and other tax liabilities. Our provision for income taxes, results of operations and cash flows may be impacted if any of our tax positions are challenged and successfully disputed by the tax authorities. In determining the adequacy of our tax provision, we assess the likelihood of adverse outcomes that could result if our tax positions were challenged by the IRS and other tax authorities. The tax authorities in the United States regularly examine our income and other tax returns. For example, in connection with an IRS examination of prior federal income tax returns filed by Gevity, a company we acquired in 2009, we received a technical advice memorandum from the IRS taking the position that approximately $10.1 million of tax credits taken by Gevity, and an additional approximately $1.5 million taken by us after acquiring Gevity, should be reversed, which position we dispute. The ultimate outcome of these examinations and tax disputes cannot be predicted with certainty. Should the IRS or other tax authorities assess additional taxes as a result of examinations, we may be required to record charges to operations that could have a material impact on our results of operations, financial position or cash flows.

15

Our business and operations have experienced rapid growth in recent periods, and if we are unable to effectively manage this growth, our business and results of operations may suffer.

We have experienced rapid growth and have significantly expanded our operations in recent periods, which has placed a strain on our management and our administrative, operational and financial infrastructure. Managing this growth requires us to further refine our operational, financial and management controls and reporting systems and procedures.

Our ability to effectively manage any significant growth of our business will depend on a number of factors, including our ability to do the following:

|

· |

effectively recruit, integrate, train and motivate a large number of new employees, including our direct sales force, while retaining our existing employees, maintaining the beneficial aspects of our corporate culture and effectively executing our business plan; |

|

· |

satisfy our existing clients and identify and acquire new clients; |

|

· |

enhance the breadth and quality of our services; |

|

· |

continue to improve our operational, financial and management controls; and |

|

· |

make sound business decisions in light of the scrutiny associated with operating as a public company. |

These activities will require significant operating and capital expenditures and allocation of valuable management and employee resources, and we expect that our growth will continue to place significant demands on our management and on our operational and financial infrastructure.

Our future financial performance and our ability to execute on our business plan will depend, in part, on our ability to effectively manage any future growth. We cannot assure you that we will be able to do so in an efficient or timely manner, or at all. In particular, any failure to successfully implement systems enhancements and improvements will likely negatively impact our ability to manage our expected growth, ensure uninterrupted operation of key business systems and comply with the rules and regulations that are applicable to public companies. If we fail to manage our growth effectively, our costs and expenses may increase more than we expect them to, which in turn could harm our business, results of operations and financial condition.

We may not be able to sustain our revenue growth rate or profitability in the future.

While we have achieved profitability on an annual basis in each of the last four fiscal years, we expect our operating expenses to increase substantially in the near term, particularly as we make significant investments in our sales and marketing organization, expand our operations and infrastructure and enhance the breadth and quality of our services. If our revenues do not increase to offset these increases in our operating expenses, we may not be profitable in future periods.

Moreover, you should not consider our historical revenue growth to be indicative of our future performance. As we grow our business, our revenue growth rates may slow in future periods due to a number of reasons, which may include slowing demand for our services, increasing competition, a decrease in the growth of our overall market, our failure, for any reason, to continue to capitalize on growth opportunities, the maturation of our business or the decline in the number of SMBs in our target markets.

Our industry is highly competitive, which may limit our ability to maintain or increase our market share or improve our results of operations.

We face significant competition on a national and regional level from a number of companies purporting to deliver a range of bundled services that are generally similar to the services we provide, including large professional employer organizations such as the TotalSource unit of Automatic Data Processing, Inc. and Insperity, Inc., as well as specialized and small professional employer organization service providers. If and to the extent that we and other companies providing these services are successful in growing our businesses, we anticipate that future competitors will enter this industry. Some of our current, and any future, competitors have or may have greater marketing and financial resources than we do, and may be better positioned than we are in certain markets. Increased competition in our industry could result in price reductions or loss of market share, any of which could harm our business. We expect that we will continue to experience competitive pricing pressure. If we cannot compete effectively, our market share, business, results of operations and financial condition may suffer.

16

In addition to competition from other professional employer organizations, we also face competition in the form of companies and third parties serving HR needs in traditional manners. These forms of competition include:

|

· |

HR and information systems departments and personnel of companies that perform their own administration of benefits, payroll and other HR functions; |

|

· |

providers of certain endpoint HR services, including payroll, benefits and business process outsourcers with high-volume transaction and administrative capabilities, such as Automatic Data Processing, Inc., Paychex, Inc. and other third-party administrators; and |

|

· |

benefits exchanges that provide benefits administration services over the Internet to companies that otherwise maintain their own benefit plans. |

We believe that our services are attractive to many SMBs in part because of our ability to provide workers compensation, health care and other benefits programs to them on a cost-effective basis. We compete with insurance brokers and other providers of this coverage in this regard, and our offerings must be priced competitively with those provided by these competitors in order for us to attract and retain our clients.

We may not be successful in convincing potential clients that the use of our services is a superior, cost-effective means of satisfying their HR obligations relative to the way in which they currently satisfy these obligations.

If we cannot compete effectively against other professional employer organizations or against the alternative means by which companies meet their HR obligations, our market share, business, results of operations and financial condition may suffer.

Adverse changes in our relationships with key vendors could impair the quality of our solution.

Our success depends in part on our ability to establish and maintain arrangements and relationships with vendors that supply us with essential components of our services. These service providers include insurance carriers to provide health and workers compensation insurance coverage for WSEs, as well as other vendors such as couriers used to deliver client payroll checks and banks used to electronically transfer funds from clients to their employees. Failure by these service providers, for any reason, to deliver their services in a timely manner could result in material interruptions to our operations, impact client relations, and result in significant penalties or other liabilities to us. Our agreements with many of these service providers typically have a term of one year. However, we engage some service providers, such as payroll couriers, on an as needed basis at published rates. In addition, many of our employee benefit plan agreements may be terminated by the insurance companies on 90 days’ notice. If any of these vendors decided to terminate its relationship with us, we may have difficulty obtaining replacement services at reasonable rates or on a timely basis, if at all. The loss of any one or more of our key vendors, or our inability to partner with certain vendors that are better-known or more desirable to our clients or potential clients, could impair the quality of our solution and harm our business.

We depend on licenses to third-party software in order to provide our services.