false--12-31FY2019000093709810000001000000300000030000001000000060000000500000050000000.0000250.0000257500000007500000007059655969065491705965596906549100000.0000250.00002520000000200000000000P1YP4Y0.370.280.370.270.420.270.01420.00620.0250.01420.0250.016

0000937098

2019-01-01

2019-12-31

0000937098

2019-06-30

0000937098

2020-02-06

0000937098

tnet:ProfessionalServicesMember

2018-01-01

2018-12-31

0000937098

2017-01-01

2017-12-31

0000937098

2018-01-01

2018-12-31

0000937098

tnet:InsuranceServicesMember

2018-01-01

2018-12-31

0000937098

tnet:InsuranceServicesMember

2019-01-01

2019-12-31

0000937098

tnet:ProfessionalServicesMember

2017-01-01

2017-12-31

0000937098

tnet:InsuranceServicesMember

2017-01-01

2017-12-31

0000937098

tnet:ProfessionalServicesMember

2019-01-01

2019-12-31

0000937098

2019-12-31

0000937098

2018-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2016-12-31

0000937098

2017-12-31

0000937098

us-gaap:RetainedEarningsMember

2019-01-01

0000937098

us-gaap:RetainedEarningsMember

2018-12-31

0000937098

us-gaap:RetainedEarningsMember

2017-01-01

0000937098

us-gaap:RetainedEarningsMember

2017-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2017-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2017-01-01

2017-12-31

0000937098

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2018-01-01

2018-12-31

0000937098

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2018-12-31

0000937098

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0000937098

2016-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2019-12-31

0000937098

us-gaap:RetainedEarningsMember

2018-01-01

0000937098

us-gaap:RetainedEarningsMember

2019-12-31

0000937098

us-gaap:RetainedEarningsMember

2016-12-31

0000937098

us-gaap:AccountingStandardsUpdate201409Member

us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Member

2018-01-01

0000937098

srt:MinimumMember

2019-01-01

2019-12-31

0000937098

us-gaap:HealthCareMember

2019-12-31

0000937098

us-gaap:HealthCareMember

2018-12-31

0000937098

srt:MaximumMember

2019-01-01

2019-12-31

0000937098

srt:MinimumMember

us-gaap:SoftwareDevelopmentMember

2019-01-01

2019-12-31

0000937098

srt:MaximumMember

us-gaap:FurnitureAndFixturesMember

2019-01-01

2019-12-31

0000937098

srt:MinimumMember

tnet:SoftwareAndOfficeEquipmentMember

2019-01-01

2019-12-31

0000937098

srt:MinimumMember

us-gaap:FurnitureAndFixturesMember

2019-01-01

2019-12-31

0000937098

srt:MaximumMember

us-gaap:SoftwareDevelopmentMember

2019-01-01

2019-12-31

0000937098

srt:MaximumMember

tnet:SoftwareAndOfficeEquipmentMember

2019-01-01

2019-12-31

0000937098

us-gaap:NonUsMember

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2019-01-01

2019-12-31

0000937098

us-gaap:AccountingStandardsUpdate201602Member

tnet:DifferenceBetweenGuidanceInEffectBeforeAndAfterTopic842Member

2019-12-31

0000937098

tnet:CalculatedUnderGuidanceInEffectBeforeTopic842Member

2019-12-31

0000937098

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

us-gaap:CashAndCashEquivalentsMember

2019-12-31

0000937098

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000937098

us-gaap:CashAndCashEquivalentsMember

2019-12-31

0000937098

us-gaap:CashAndCashEquivalentsMember

2018-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

us-gaap:CashAndCashEquivalentsMember

2018-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

2018-12-31

0000937098

tnet:PayrollFundsCollectedMember

2019-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:CashAndCashEquivalentsMember

2018-12-31

0000937098

tnet:InsuranceCarriersSecurityDepositsMember

us-gaap:CashAndCashEquivalentsMember

2018-12-31

0000937098

us-gaap:AvailableforsaleSecuritiesMember

2019-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2019-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:CashAndCashEquivalentsMember

2019-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

2019-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2019-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

us-gaap:CashAndCashEquivalentsMember

2018-12-31

0000937098

tnet:PayrollFundsCollectedMember

2018-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

2019-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

us-gaap:CashAndCashEquivalentsMember

2019-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

2018-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:CashAndCashEquivalentsMember

2018-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

2018-12-31

0000937098

tnet:InsuranceCarriersSecurityDepositsMember

us-gaap:CashAndCashEquivalentsMember

2019-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

2019-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:CashAndCashEquivalentsMember

2019-12-31

0000937098

tnet:StandbyLetterofCreditCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2019-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:AvailableforsaleSecuritiesMember

2019-12-31

0000937098

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000937098

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

us-gaap:OtherDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:ExchangeTradedFundsMember

2019-12-31

0000937098

us-gaap:OtherDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:AssetBackedSecuritiesMember

2019-12-31

0000937098

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0000937098

us-gaap:ExchangeTradedFundsMember

2018-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

2019-12-31

0000937098

us-gaap:CorporateDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:OtherDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2019-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

us-gaap:CommercialPaperMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:OtherDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CertificatesOfDepositMember

2019-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:OtherDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2019-12-31

0000937098

us-gaap:CommercialPaperMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:CommercialPaperMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2019-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CertificatesOfDepositMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:AssetBackedSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ExchangeTradedFundsMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:OtherDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:CommercialPaperMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:OtherDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:CommercialPaperMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ExchangeTradedFundsMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:ExchangeTradedFundsMember

2018-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:CommercialPaperMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:OtherDebtSecuritiesMember

2018-12-31

0000937098

us-gaap:OtherCurrentLiabilitiesMember

2019-12-31

0000937098

us-gaap:OtherCurrentAssetsMember

2019-12-31

0000937098

us-gaap:FurnitureAndFixturesMember

2018-12-31

0000937098

us-gaap:LeaseholdImprovementsMember

2019-12-31

0000937098

us-gaap:OfficeEquipmentMember

2018-12-31

0000937098

us-gaap:LeaseholdImprovementsMember

2018-12-31

0000937098

tnet:ProjectsInProgressMember

2019-12-31

0000937098

us-gaap:FurnitureAndFixturesMember

2019-12-31

0000937098

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-12-31

0000937098

tnet:ProjectsInProgressMember

2018-12-31

0000937098

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2018-12-31

0000937098

us-gaap:OfficeEquipmentMember

2019-12-31

0000937098

us-gaap:CustomerContractsMember

2018-12-31

0000937098

us-gaap:CustomerContractsMember

2019-12-31

0000937098

us-gaap:DevelopedTechnologyRightsMember

2018-12-31

0000937098

us-gaap:DevelopedTechnologyRightsMember

2019-12-31

0000937098

us-gaap:DevelopedTechnologyRightsMember

2019-01-01

2019-12-31

0000937098

us-gaap:CustomerContractsMember

2019-01-01

2019-12-31

0000937098

tnet:WorksiteEmployeeMember

2019-12-31

0000937098

tnet:WorksiteEmployeeMember

2018-12-31

0000937098

srt:MinimumMember

2019-12-31

0000937098

srt:MaximumMember

2019-12-31

0000937098

tnet:A2018TermLoanAMember

us-gaap:LoansPayableMember

2019-12-31

0000937098

us-gaap:RevolvingCreditFacilityMember

tnet:A2018RevolverMember

us-gaap:BridgeLoanMember

2019-12-31

0000937098

us-gaap:RevolvingCreditFacilityMember

tnet:A2018RevolverMember

2019-12-31

0000937098

tnet:A2018TermLoanAMember

us-gaap:LoansPayableMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0000937098

tnet:A2018TermLoanAMember

us-gaap:LoansPayableMember

2018-06-30

0000937098

tnet:A2018TermLoanAMember

us-gaap:LoansPayableMember

us-gaap:PrimeRateMember

2019-01-01

2019-12-31

0000937098

tnet:A2018TermLoanAMember

us-gaap:LoansPayableMember

2018-12-31

0000937098

tnet:EmployeeStockPurchasePlanMember

2019-01-01

2019-12-31

0000937098

us-gaap:EmployeeStockMember

2019-12-31

0000937098

srt:MaximumMember

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2019-01-01

2019-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2019-01-01

2019-12-31

0000937098

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-12-31

0000937098

srt:MaximumMember

us-gaap:EmployeeStockOptionMember

us-gaap:CommonClassAMember

2019-01-01

2019-12-31

0000937098

srt:MinimumMember

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2019-01-01

2019-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2017-01-01

2017-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2018-01-01

2018-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2019-01-01

2019-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2019-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsMember

2019-01-01

2019-12-31

0000937098

tnet:TimeBasedRestrictedStockAwardsMember

2019-01-01

2019-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsMember

2018-12-31

0000937098

tnet:TimeBasedRestrictedStockAwardsMember

2018-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsMember

2019-12-31

0000937098

tnet:TimeBasedRestrictedStockAwardsMember

2019-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2018-12-31

0000937098

us-gaap:EmployeeStockOptionMember

2017-01-01

2017-12-31

0000937098

us-gaap:EmployeeStockOptionMember

2018-01-01

2018-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2019-01-01

2019-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2018-01-01

2018-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2017-01-01

2017-12-31

0000937098

us-gaap:GeneralAndAdministrativeExpenseMember

2017-01-01

2017-12-31

0000937098

us-gaap:CostOfSalesMember

2017-01-01

2017-12-31

0000937098

tnet:SystemsDevelopmentAndProgrammingCostsMember

2019-01-01

2019-12-31

0000937098

tnet:SystemsDevelopmentAndProgrammingCostsMember

2017-01-01

2017-12-31

0000937098

us-gaap:SellingAndMarketingExpenseMember

2019-01-01

2019-12-31

0000937098

tnet:SystemsDevelopmentAndProgrammingCostsMember

2018-01-01

2018-12-31

0000937098

us-gaap:CostOfSalesMember

2018-01-01

2018-12-31

0000937098

us-gaap:GeneralAndAdministrativeExpenseMember

2019-01-01

2019-12-31

0000937098

us-gaap:SellingAndMarketingExpenseMember

2018-01-01

2018-12-31

0000937098

us-gaap:GeneralAndAdministrativeExpenseMember

2018-01-01

2018-12-31

0000937098

us-gaap:CostOfSalesMember

2019-01-01

2019-12-31

0000937098

us-gaap:SellingAndMarketingExpenseMember

2017-01-01

2017-12-31

0000937098

us-gaap:RestrictedStockUnitsRSUMember

2019-01-01

2019-12-31

0000937098

us-gaap:PerformanceSharesMember

2019-12-31

0000937098

us-gaap:RestrictedStockUnitsRSUMember

2019-12-31

0000937098

us-gaap:PerformanceSharesMember

2019-01-01

2019-12-31

0000937098

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-12-31

0000937098

us-gaap:EmployeeStockOptionMember

2019-12-31

0000937098

tnet:PerformanceBasedRestrictedStockAwardsMember

2018-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2018-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2019-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsMember

2019-12-31

0000937098

tnet:PerformanceBasedRestrictedStockAwardsMember

2019-01-01

2019-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsMember

2019-01-01

2019-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsMember

2018-12-31

0000937098

tnet:PerformanceBasedRestrictedStockAwardsMember

2019-12-31

0000937098

srt:MinimumMember

2017-01-01

2017-12-31

0000937098

srt:MaximumMember

2018-01-01

2018-12-31

0000937098

srt:MaximumMember

2017-01-01

2017-12-31

0000937098

srt:MinimumMember

2018-01-01

2018-12-31

0000937098

2019-02-06

0000937098

us-gaap:EmployeeStockMember

2018-01-01

2018-12-31

0000937098

us-gaap:RestrictedStockMember

2019-01-01

2019-12-31

0000937098

us-gaap:StockOptionMember

2019-01-01

2019-12-31

0000937098

us-gaap:StockOptionMember

2017-01-01

2017-12-31

0000937098

us-gaap:StockOptionMember

2018-01-01

2018-12-31

0000937098

us-gaap:RestrictedStockMember

2018-01-01

2018-12-31

0000937098

us-gaap:RestrictedStockMember

2017-01-01

2017-12-31

0000937098

us-gaap:EmployeeStockMember

2017-01-01

2017-12-31

0000937098

us-gaap:EmployeeStockMember

2019-01-01

2019-12-31

0000937098

us-gaap:StateAndLocalJurisdictionMember

2018-12-31

0000937098

us-gaap:StateAndLocalJurisdictionMember

2019-12-31

0000937098

us-gaap:InternalRevenueServiceIRSMember

2019-01-01

2019-12-31

0000937098

us-gaap:InternalRevenueServiceIRSMember

2019-01-18

2019-01-18

0000937098

tnet:A2019EquityIncentivePlanMember

2019-01-01

2019-12-31

0000937098

srt:BoardOfDirectorsChairmanMember

2019-01-01

2019-12-31

0000937098

srt:BoardOfDirectorsChairmanMember

2017-01-01

2017-12-31

0000937098

srt:BoardOfDirectorsChairmanMember

2018-01-01

2018-12-31

0000937098

2019-01-01

2019-03-31

0000937098

2018-04-01

2018-06-30

0000937098

2018-01-01

2018-03-31

0000937098

2019-04-01

2019-06-30

0000937098

2019-10-01

2019-12-31

0000937098

2019-07-01

2019-09-30

0000937098

2018-07-01

2018-09-30

0000937098

2018-10-01

2018-12-31

tnet:segment

iso4217:USD

xbrli:shares

tnet:reporting_unit

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2019

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36373

TRINET GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | | |

Delaware | | 95-3359658 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

One Park Place, | Suite 600 | | |

Dublin, | CA | | 94568 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (510) 352-5000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock par value $0.000025 per share | TNET | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| | | | | |

Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The New York Stock Exchange on June 30, 2019, was $3.0 billion.

The number of shares of Registrant’s Common Stock outstanding as of February 6, 2020 was 68,750,437.

Portions of the Registrant’s Definitive Proxy Statement to be issued in connection with its Annual Meeting of Stockholders, scheduled to be held on June 4, 2020, are incorporated by reference into Part III of this Form 10-K.

TRINET GROUP, INC.

Form 10-K - Annual Report

For the Year Ended December 31, 2019

TABLE OF CONTENTS

|

| | |

| Form 10-K Cross Reference | Page |

| | |

| Part I, Item 1. | |

| Part I, Item 1A. | |

| Part I, Item 1B. | |

| Part I, Item 2. | |

| Part I, Item 3. | |

| Part I, Item 4. | |

| Part II, Item 5. | |

| Part II, Item 6. | |

| Part II, Item 7. | |

| Part II, Item 7A. | |

| Part II, Item 8. | |

| | |

| | |

| | |

| | |

| | |

| Part II, Item 9. | |

| Part II, Item 9A. | |

| Part II, Item 9B. | |

| Part III, Item 10. | |

| Part III, Item 11. | |

| Part III, Item 12. | |

| Part III, Item 13. | |

| Part III, Item 14. | |

| Part IV, Item 15. | |

| Part IV, Item 16. | |

| | |

Glossary of Acronyms and Abbreviations

Acronyms and abbreviations are used throughout this report, particularly in Part I, Item 1. Business; Part 1, Item 1A. Risk Factors; Part II, Item 7. MD&A; Part II, Item 7A. Quantitative and Qualitative Disclosures About Market Risk and Part II, Item 8. Financial Statements and Supplementary Data.

|

| |

AB5 | Assembly Bill 5 |

ACA | The Patient Protection and Affordable Care Act |

ACH | Automated Clearinghouse Transaction |

AFS | Available-for-sale |

ASC | Accounting standards codification |

ASU | Accounting standards update |

CCPA | California Consumer Privacy Act of 2018 |

COBRA | Consolidated Omnibus Budget Reconciliation Act |

COPS | Cost of providing services |

COSO | Committee of Sponsoring Organizations of Treadway Commission |

D&A | Depreciation and amortization expenses |

DOL | U.S. Department of Labor |

EBITDA | Earnings before interest expense, taxes, depreciation and amortization of intangible assets |

EPLI | Employment Practices Liability Insurance |

EPS | Earnings Per Share |

ERISA | Employee Retirement Income Security Act of 1974 |

ESAC | Employer Services Assurance Corporation |

ESPP | Employee stock purchase plan |

ETR | Effective tax rate |

FASB | Financial Accounting Standards Board |

FLSA | Fair Labor Standards Act |

G&A | General and administrative |

GAAP | Generally Accepted Accounting Principles in the United States |

HIPAA | Health Insurance Portability and Accountability Act of 1996 |

HITECH Act | Health Information Technology for Economic and Clinical Health Act of 2009 |

HR | Human Resources |

IBNP | Incurred but not yet paid |

IBNR | Incurred but not yet reported |

IGP | Indemnity Guarantee Payment |

IRS | Internal Revenue Service |

ISR | Insurance service revenues |

LDF | Loss development factor |

LIBOR | London Inter-bank Offered Rate |

MCT | Medical cost trend |

MD&A | Management's Discussion and Analysis of Financial Condition and Results of Operations |

NIM | Net Insurance Margin |

NISR | Net Insurance Service Revenues |

NSR | Net service revenues |

OE | Operating expenses |

|

| |

PCAOB | Public Company Accounting Oversight Board |

PEO | Professional Employer Organization |

PFC | Payroll funds collected |

PHI | Protected Health Information |

PSR | Professional service revenues |

ROU | Right-of-use |

RSA | Restricted Stock Award |

RSU | Restricted Stock Unit |

SBC | Stock Based Compensation |

S&M | Sales and marketing |

S&P 500 | Standard and Poor's 500 Stock Index |

SD&P | Systems development and programming |

SEC | Securities and Exchange Commission |

SMB | Small to midsize business |

TCJA | Tax Cuts and Jobs Act of 2017 |

U.S. | United States |

WSE | Worksite employee |

Cautionary Note Regarding Forward-Looking Statements

For purposes of this Annual Report, the terms “TriNet,” “the Company,” “we,” “us” and “our” refer to TriNet Group, Inc., and its subsidiaries. This Annual Report on Form 10-K (Form 10-K) contains statements that are not historical in nature, are predictive in nature, or that depend upon or refer to future events or conditions or otherwise contain forward-looking statements within the meaning of Section 21 of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as, but not limited to, “ability,” “anticipate,” “believe,” “can,” “continue,” “could,” “design,” “estimate,” “expect,” “forecast,” “hope,” “impact,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” “value,” “will,” “would” and similar expressions or variations intended to identify forward-looking statements. Examples of forward-looking statements include, among others, TriNet’s expectations regarding: the impact of our vertical approach, our ability to leverage our scale and industry HR experience to deliver vertical product and service offerings; the growth of our customer base; planned improvements to our technology platform; our ability to drive operating efficiencies and improve the customer experience; the impact of our customer service initiatives; the volume and severity of insurance claims; metrics that may be indicators of future financial performance; the relative value of our benefit offerings versus those SMBs can independently obtain; the principal competitive drivers in our market; our plans to retain clients and manage client attrition; our investment strategy and its impact on our ability to generate future interest income, net income, and Adjusted EBITDA; seasonal trends and their impact on our business; fluctuations in the period-to-period timing of when we incur certain operating expenses; the estimates and assumptions we use to prepare our financial statements; and other expectations, outlooks and forecasts on our future business, operational and financial performance.

Important factors that could cause actual results, level of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements are discussed above and throughout this Form 10-K, including under Part I, Item 1A. Risk Factors, and Part II, Item 7. MD&A, and in the other periodic filings we make with the SEC, and including risk factors associated with: our ability to mitigate the business risks we face as a co-employer; our ability to manage unexpected changes in workers’ compensation and health insurance claims and costs by worksite employees; the effects of volatility in the financial and economic environment on the businesses that make up our client base; the impact of the concentration of our clients in certain geographies and industries; the impact of failures or limitations in the business systems we rely upon; adverse changes in our insurance coverage or our relationships with key insurance carriers; our ability to manage our client attrition; our ability to improve our technology to satisfy regulatory requirements and meet the expectations of our clients; our ability to effectively integrate businesses we have acquired or may acquire in the future; our ability to effectively manage and improve our operational processes; our ability to attract and retain qualified personnel; the effects of increased competition and our ability to compete effectively; the impact on our business of cyber-attacks and security breaches; our ability to secure our information technology infrastructure and our confidential, sensitive and personal information from cyber-attacks and security breaches; our ability to comply with constantly evolving data privacy and security laws; our ability to manage changes in, uncertainty regarding, or adverse application of the complex laws and regulations that govern our business; changing laws and regulations governing health insurance and employee benefits; our ability to be recognized as an employer of worksite employees under federal and state regulations; changes in the laws and regulations that govern what it means to be an employer, employee or independent contractor; our ability to comply with the laws and regulations that govern PEOs and other similar industries; the outcome of existing and future legal and tax proceedings; fluctuation in our results of operation and stock price due to factors outside of our control, such as the volume and severity of our workers’ compensation and health insurance claims and the amount and timing of our insurance costs, operating expenses and capital expenditure requirements; our ability to comply with the restrictions of our credit facility and meet our debt obligations; and the impact of concentrated ownership in our stock. Any of these factors could cause our actual results to differ materially from our anticipated results.

Forward-looking statements are not guarantees of future performance, but are based on management’s expectations as of the date of this Form 10-K and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from our current expectations and any past results, performance or achievements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

The information provided in this Form 10-K is based upon the facts and circumstances known at this time, and any forward-looking statements made by us in this Form 10-K speak only as of the date of this Form 10-K. We undertake no obligation to revise or update any of the information provided in this Form 10-K, except as required by law.

Part II, Item 6. Selected Financial Data and Part II, Item 7. MD&A of this Form 10-K include references to our performance measures presented in conformity with GAAP and other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plans. Refer to the Non-GAAP Financial Measures in Part II, Item 6. Selected Financial Data for definitions and reconciliations from GAAP measures.

PART I

Item 1. Business

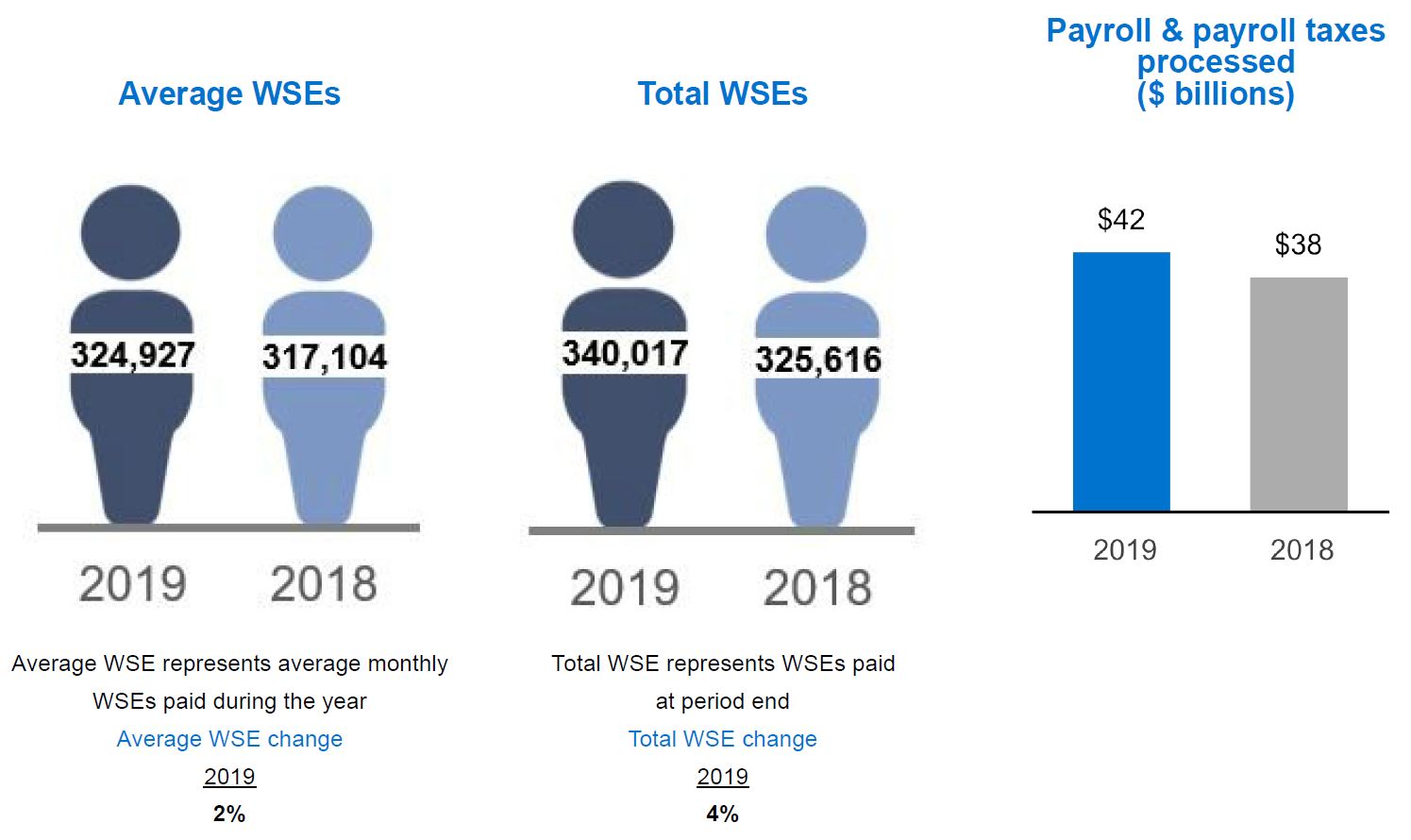

TriNet is a leading provider of HR expertise, payroll services, employee benefits and employment risk mitigation services for SMBs. Since our founding in 1988, TriNet has served, and continues to serve, thousands of SMBs. For the year ended December 31, 2019, we processed $41.7 billion in payroll and payroll taxes for our clients and ended 2019 with approximately 18,900 clients and 340,000 WSEs, primarily in the U.S.

Our Products and Services

We deliver a comprehensive suite of products and services, that facilitates the administration and management of various HR-related functions for our clients, including compensation and benefits, payroll processing, employee data, health insurance and workers' compensation programs, and other transactional HR needs using our technology platform and HR, benefits and compliance expertise.

We also leverage our scale and industry HR experience to deliver product and service offerings for SMBs in specific industries. We believe our approach, which we call our vertical approach, is a key differentiator for us and creates additional value for our clients by allowing our product and service offerings to address HR needs in different client industries. We offer six industry-tailored vertical products, TriNet Financial Services, TriNet Life Sciences, TriNet Main Street, TriNet Nonprofit, TriNet Professional Services, and TriNet Technology.

Our comprehensive HR products and solutions include the following capabilities:

|

| | | | | | | | |

| | | | | | | | |

HR CONSULTING EXPERTISE | | BENEFIT OPTIONS | | PAYROLL SERVICES | | RISK MITIGATION | | TECHNOLOGY

PLATFORM |

| | | | | | | | |

HR Consulting Expertise

HR Consulting ExpertiseWe use the collective knowledge and experience of our teams of HR, benefits, risk management and compliance professionals to help clients manage many of the administrative, regulatory and practical requirements associated with being employers. Our HR professionals and services help clients address a variety of HR issues, including consulting on talent management, retention and terminations, benefits enrollment, immigration and visas, payroll tax credits, labor law and regulatory developments and many other industry-specific and general HR topics. Depending on their needs, our clients and WSEs have access to varying levels of service and support from our HR professionals ranging from call center support for basic questions, to pooled HR resources, to onsite consulting and services. Our HR professionals also provide additional specialized HR consulting and services upon request.

Benefit Options

Benefit OptionsWe utilize our scale to provide our clients and WSEs access to a broad range of cost-effective, TriNet-sponsored employee benefit and insurance programs at a cost that we believe most of our clients would be unable to obtain on their own. We believe that our TriNet-sponsored programs help clients compete for talent against larger businesses. Our benefit and insurance programs are designed to comply with federal, state and local regulations, and our benefit and insurance service offerings include plan selection and administration, enrollment management, leave management, plan document distribution and WSE and client communications.

Under our benefit and insurance programs, we pay third-party insurance carriers for WSE insurance benefits and reimburse insurance carriers or third-party administrators for claims payments within our insurance deductible layer, where applicable.

We sponsor and administer several fully insured employee benefit plans through a broad range of carriers, including group health, dental, vision, short- and long-term disability, and life insurance as an employer plan sponsor under Section 3(5) of ERISA. We also offer other benefit programs to WSEs, including flexible spending accounts, health savings accounts, retirement benefits, COBRA benefits, supplemental insurance, commuter benefits, home insurance, critical illness insurance, accident insurance, hospital indemnity, pet insurance, and auto insurance. For further discussion of our fully insured programs including policies where we reimburse our carriers for certain amounts relating to claims, refer to Note 1 in Part II, Item 8. Financial Statements and Supplementary Data, of this Form 10-K.

Payroll Services

Payroll ServicesWe help clients manage all aspects of their employee compensation by providing multi-state payroll processing, tax administration services and other payroll-related services, such as time and attendance management, time off and overtime tracking, and expense management solutions. Our clients and WSEs can access payroll and tax information using our online and mobile tools. Our tax administration services include calculating, withholding, remitting and reporting certain federal, state and local payroll and unemployment taxes on behalf of clients and WSEs.

Risk Mitigation

Risk Mitigation We monitor employment-related legal and regulatory developments at the federal, state, and levels to help our clients comply with employment laws and mitigate many of the risks associated with being an employer. We provide guidance on employment laws and regulations, including those relating to minimum wage, unemployment insurance, family and medical leave and anti-discrimination. We also ensure that our TriNet-sponsored benefit plans comply with applicable laws and regulations, like the ACA, reducing this compliance burden to our clients.

We provide fully insured workers' compensation insurance coverage for our clients and WSEs through insurance policies that we negotiate with our third-party insurance carriers. We manage the deductible risk that we assume in connection with these policies by being selective in the types of businesses that we take on as new clients, and by monitoring claims data and the performance of our carriers and third-party claims management service providers. In addition, we advise clients on workers’ compensation best practices, including by performing workplace assessment consultations and assisting with client efforts to identify conditions or practices that might lead to employee injuries.

We also provide EPLI coverage for our clients through insurance policies that we obtain from a third-party EPLI carrier. These policies provide coverage for certain claims that arise in the course of the employment relationship, such as discrimination, harassment, and certain other employee claims, with a per-claim retention amount. The retention amount is split between the client and TriNet. Our HR professionals assist our clients in implementing HR best practices to help avoid and reduce the cost of employment-related liabilities. Litigation defense is conducted by our preferred outside employment law firms.

Technology Platform

Technology Platform Our technology platform includes online and mobile tools that allow our clients and WSEs to store, view, and manage HR information and administer a variety of HR transactions, such as payroll processing, tax administration, employee onboarding and termination, compensation reporting, expense management, and benefits enrollment and administration. Our online tools also incorporate workforce analytics, allowing clients to generate HR data, payroll, total compensation and other custom reports.

In 2019, we continued to make significant investments in our technology platform on projects intended to provide our users with improved functionality, HR management options, and security. We intend to continue to invest in our technology platform to improve its functionality, ease of use, security and the overall user experience for our clients and WSEs. We believe the continued investment in and improvement of our technology platform will drive operating efficiencies and improve the client experience.

We invested approximately $74 million, $81 million and $74 million, during 2019, 2018 and 2017, respectively, developing our technology platform.

Our Co-Employment Model

We operate using a co-employment model, under which employment-related responsibilities are allocated by contract between us and our clients. This model allows WSEs to receive the full benefit of our services, including access to TriNet-sponsored employee benefit plan offerings. Each of our clients enters into a client service agreement with us that defines the suite of professional and insurance services and benefits to be provided by us, the fees payable to us, and the division of responsibilities between us and our clients as co-employers. WSEs also separately acknowledge the co-employment relationship and the allocation of employment-related responsibilities between TriNet and our clients. The division of responsibilities under our client service agreements is typically as follows:

TriNet Responsibilities

We generally assume responsibility for, and manage certain risks associated with:

| |

• | payments of salaries, wages and certain other compensation to WSEs from our own bank accounts (based on client reports and payments), including the processing of garnishment and wage deduction orders, |

| |

• | reporting of wages, withholding and deposit of associated payroll taxes as the employer of record, |

| |

• | provision and maintenance of workers' compensation insurance and workers' compensation claims processing, |

| |

• | access to, and administration of, group health, welfare, and retirement benefits to WSEs under TriNet-sponsored benefit plans, |

| |

• | compliance with applicable law for certain employee benefits offered to WSEs, |

| |

• | administration of unemployment claims, and |

| |

• | provision of various HR policies and agreements, including employee handbooks and worksite employee agreements describing the co-employment relationship. |

Client Responsibilities

Our clients are responsible for employment-related responsibilities that we do not specifically assume, generally including:

| |

• | day-to-day management of their worksites and WSEs, |

| |

• | compliance with laws associated with the classification of employees as exempt or non-exempt, such as overtime pay and minimum wage law compliance, |

| |

• | accurate and timely reporting to TriNet of compensation and deduction information, including information relating to hours worked, rates of pay, salaries, wages and other compensation, and work locations, |

| |

• | accurate and timely reporting to TriNet of information relating to workplace injuries, employee hires and termination, and certain other information relevant to TriNet’s services, |

| |

• | provision and administration of any employee benefits not provided by TriNet such as equity incentive plans, |

| |

• | compliance with all laws and regulations applicable to the clients' workplace and business, including work eligibility laws, laws relating to workplace safety or the environment, laws relating to family and medical leave, laws pertaining to employee organizing efforts and collective bargaining and employee termination notice requirements, |

| |

• | payment of TriNet invoices, which include salary, wages and other relevant compensation to WSEs and applicable employment taxes and service fees, and |

| |

• | all other matters for which TriNet does not assume responsibility under the client service agreement, such as intellectual property ownership and protection and liability for products produced and services provided by the client company to its own customers. |

As a result of our co-employment relationships, we are liable for payment of salary, wages and certain other compensation to the WSEs as reported and paid to us by the client, and are responsible for providing specified employee benefits to such persons to the extent provided in each client service agreement and under federal and state law. In most instances, clients are required to remit payment prior to the applicable payroll date by wire transfer or ACH.

We also assume responsibility for payment and liability for the withholding and remittance of federal and state income and employment taxes with respect to salaries, wages and certain other compensation paid to WSEs, although we reserve the right to seek recourse against our clients for any liabilities arising out of their conduct. We perform these functions as the statutory employer for federal employment tax purposes, since our clients transfer legal control over these payroll functions to us. The laws that govern the payment of salaries, wages and related payroll taxes for our WSEs are complex and the various federal, state and local laws that govern such payments can vary significantly. Based on applicable law in any jurisdiction, we or our client may be held ultimately liable for those obligations if we fail to remit taxes.

Sales and Marketing

Our Sales Organization

We sell our solutions primarily through our direct sales organization. We have aligned our sales organization by industry vertical with the goal of growing profitable market share in our targeted industries. This vertical approach deepens our network of relationships and gives us an understanding of the unique HR needs facing SMBs in those industries. Our sales representatives are supported by marketing, lead generation efforts, and referral sources and networks.

We sponsor and participate in associations and events around the country and utilize these forums to target specific vertical and geographic markets. We also generate sales opportunities within key industry verticals, through marketing alliances and other indirect channels, such as accounting firms, venture capital firms, incubators, insurance brokers, and vertical market industry associations. Additionally, we utilize digital marketing programs, including digital advertising, search and email marketing, to create awareness and interest in our products.

Our Marketing Organization

Our marketing organization is charged with driving overall brand awareness, managing lead generation, creating and managing our website and other online properties, creating content for our outbound and inbound marketing efforts, media relations, and managing our sponsorships, major marketing events, and client communications. In 2019 our marketing team focused on strategic marketing, communications and branding initiatives, in part by augmenting our comprehensive company re-branding campaign, Incredible Starts Here, with our marketing campaign, People Matter, that included social media and advertising across digital, television, radio and out-of-home media.

Legal and Regulatory

Our business operates in a complex legal and regulatory environment due to a myriad of federal, state and local laws and regulations that impact our business. Below is a summary of what we believe are the most important legal and regulatory issues for our business. For additional information on the impact of these and other laws and regulations on our business and results of operations, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - Legal and Compliance Risks.

Employer Status

We sponsor our employee benefit plan offerings as the employer of our WSEs under the Internal Revenue Code of 1986, as amended (the Code), ERISA and applicable state law. The multiple definitions of “employer” under both the Code and ERISA are not clear and most are defined in part by complex multi-factor tests under common law. We believe that we qualify as an “employer” of our WSEs in the U.S. under both the Code and ERISA, as well as various state laws, but this status could be subject to challenge by various regulators. For additional information on our employer status and its impact on our business and results of operations, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - If we are not recognized as an employer of worksite employees under federal and state regulations, we and our clients could be adversely impacted.

Health Insurance and Health Care Reform

Our sponsored employee health plan offerings are an important component of the products and services that we provide. The future of health care reform continues to evolve in the U.S. For example, the passage of the ACA in 2010 implemented sweeping health care reforms with staggered effective dates from 2010 through 2022, and many provisions in the ACA still require the issuance of additional guidance from the DOL, the IRS, the U.S. Department of Health and Human Services and various U.S. states. Passage of the TCJA in 2017 eliminated the individual mandate tax penalty under the ACA beginning in 2019, while retaining employer ACA obligations. States have developed, and will continue to develop, varying approaches to state-based health exchanges. Further significant changes to health care statutes, regulations and policy at the federal, state and local levels could occur in 2020 and beyond, including the potential further modification, amendment or repeal of the ACA, and we may need to adapt the manner in which we conduct our business as a result of any such changes. For additional information on the ACA and its impact on our business and results of operations, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - Changing laws and regulations governing health insurance and other traditional employee benefits at the federal, state and local level could negatively affect our business.

Data Privacy and Security Regulations

We collect , store, use, retain, disclose, transfer and otherwise process a significant amount of confidential, sensitive and personal information from and about our actual and potential clients, WSEs and corporate employees, and we are subject to a variety of federal, state and foreign laws, rules, and regulations in connection with such activities. As a sponsor of employee benefit plans, we also have access to certain protected health information (PHI) of our WSEs and corporate employees. Management of PHI is subject to several regulations at the federal level, including HIPAA and the HITECH Act. HIPAA contains restrictions and health data privacy, security and breach notification requirements with respect to the use and disclosure of PHI. Further, there are penalties and fines for HIPAA violations. Because TriNet sponsored health plans are covered entities under HIPAA, we are required to comply with HIPAA's portability, privacy, and security requirements. We are also subject, among other applicable federal laws, rules and regulations, to the rules and regulations promulgated under the authority of the Federal Trade Commission. The U.S. Congress has considered, but not yet passed, several comprehensive federal data privacy bills over the past few years, such as the CONSENT Act, which was intended to be similar to the landmark 2018 European Union General Data Protection Regulations. We expect federal data privacy laws to continue to evolve.

At the state and local level, there is increased focus on regulating the collection, storage, use, retention, security, disclosure, transfer and other processing of confidential, sensitive and personal information. In recent years, we have seen significant changes to data privacy regulations across the U.S., including the enactment of the California Consumer Privacy Act of 2018 (CCPA), which went into effect in January 2020. The CCPA increases privacy rights for California residents and imposes obligations on companies that process their personal information, including an obligation to provide certain new disclosures to such residents. The CCPA provides for civil penalties for violations, as well as a private right of action for certain data breaches that result in the loss of personal information. This private right of action may increase the likelihood of, and risks associated with, data breach litigation. The CCPA was amended in September 2018 and October 2019, and further amendments may be enacted.

New legislation proposed or enacted in Illinois, Massachusetts, New Jersey, New York, Rhode Island, Washington and other states, including a proposed right to privacy amendment to the Vermont Constitution, impose, or has the potential to impose, additional obligations on companies that collect , store, use, retain, disclose, transfer and otherwise process confidential, sensitive and personal information, and will continue to shape the data privacy environment nationally. In addition, all 50 U.S. states, the District of Columbia and Canada have enacted data breach notification laws that may require us to notify WSEs, clients, employees, third parties or regulators in the event of unauthorized access to or disclosure of personal or confidential information. Complying with existing and new data privacy and security regulations could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business. Any failure to comply with existing and new data privacy and security regulations could result in significant penalties, damage our reputation and otherwise have a material adverse effect on our business. For additional information on the privacy and security of the confidential, sensitive and personal information and PHI we possess and the potential impact to our business if we fail to protect such information, refer to each of the risk factors included in Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - Data Privacy and Security Risks.

PEO Licensing Laws

Nearly all states have adopted laws and regulations for licensing, registration, certification or recognition of PEOs and the IRS has implemented a federal licensing program for PEOs. We expect states without such laws and regulations to adopt them in the future. While these laws and regulations can vary widely, most regulators monitor the financial health and other relevant business information of PEOs on an annual or quarterly basis. In some cases, these laws and regulations codify and clarify the co-employment relationship for certain payroll, unemployment, workers' compensation and other employment-related purposes or require specific client contractual terms and/or WSE disclosures. We believe we comply in all material respects with the applicable PEO laws and regulations in each state and jurisdiction in which we operate. For additional information, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - If we fail to qualify as a co-employer of WSEs under applicable federal and state licensing rules, or if we are deemed to be operating in certain insurance-related industries, we and our clients could be adversely impacted.

Payroll and Unemployment Taxes

We must also comply with the federal and state payroll tax and unemployment tax requirements that apply where our clients are located. Tax reform efforts, and other payroll tax changes, at the federal, state and local level can impact our payroll tax reporting obligations for our clients and the products and services we can provide. State unemployment tax rates vary by state based, in part, on prior years’ compensation and unemployment claims experience and may also vary based on the overall claims experience of a PEO. As a result, depending on where clients are located, the fees we charge for unemployment taxes can be higher or lower than a client could obtain alone. In some cases, the unemployment taxes we pay can also be retroactively increased to cover deficiencies in the unemployment tax funds.

Other Employment Regulations

We must also comply with labor and employment laws, which can change frequently at the federal, state and local level. In particular, regulatory focus on the classification of employers, employees and independent contractors has the potential to significantly change how we and other PEOs operate and the products and services that we and other PEOs can provide to our clients and WSEs. For example, in September 2019 California passed AB5, a law that could potentially reclassify client independent contractors as employees. Similarly, in January 2020, the DOL issued a new rule broadening the definition of joint employer used under the Fair Labor Standards Act (FLSA). We do not believe that we are a joint employer under the new DOL rule, but the impact of new regulations like these could lead to increased legal claims against us or our clients, increase our compliance costs, or require changes to how we operate our business and the products and services we provide to our clients and WSEs. For additional information, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - The definition of employers, employees and independent contractors is evolving. Changes to the laws and regulations that govern what it means to be an employer or an employee may require us to make significant changes in our operations and may negatively affect our business.

Acquisitions

Historically, we have pursued acquisitions to both expand our product capabilities and supplement our growth across geographies and certain industry verticals. Our acquisition targets have included PEOs and other HR solution providers as well as technology companies or technology product offerings to supplement or enhance our existing HR solutions. We intend to continue to pursue acquisitions, where appropriate, that will enable us to add new clients and WSEs, expand our presence in certain geographies or industry verticals and offer our clients and WSEs more attractive products and services.

Client Industries and Geographies

Our clients are distributed across a variety of industries, including technology, professional services, financial services, life sciences, not-for-profit, property management, retail, manufacturing, and hospitality. Our clients execute annual service contracts with us that automatically renew. Generally, our clients may cancel these contracts with thirty days' notice to us and we may cancel these contracts with thirty days' notice.

Nearly all of our revenues are generated within the United States and its territories and substantially all our long-lived assets are located in the United States.

Seasonality

Our business is affected by seasonality in client business activity and WSE product selection, health claims costs and payroll taxes:

| |

• | Clients generally change their payroll service providers at the beginning of the payroll tax year; as a result, we have historically experienced our highest volumes of new and exiting clients in the month of January. |

| |

• | WSEs select our benefit products during their respective open enrollment periods, which occur throughout the year. We have historically experienced the largest proportion of WSE benefit changes in the first and fourth quarters. |

| |

• | Health claims cost tend to increase throughout the year as the utilization of medical services above each WSE's deductible causes our insurance costs to increase. In addition, the overall use of medical services by WSEs, including elective procedures, tends to increase later in the calendar year. |

| |

• | Certain payroll tax related billings are based on the WSE's annual taxable wage base up to a set cap. WSEs frequently meet these wage base caps in the first two quarters of the year, depending on the WSE's compensation level, resulting in lower related billing contributions to PSR in the latter half of the year. |

Competition

We face competition from:

| |

• | PEOs that compete directly with us, |

| |

• | HR and information systems departments and personnel of companies that administer employee benefits, payroll and HR for their companies in-house, |

| |

• | providers of certain endpoint HR services, including payroll, employee benefits, business process outsourcers with high-volume transaction and administrative capabilities, and other third-party administrators, |

| |

• | employee benefit exchanges that provide benefits administration services over the Internet to companies that otherwise maintain their own employee benefit plans, |

| |

• | alternative and non-traditional benefit providers, and |

| |

• | insurance brokers who allow third-party HR systems to integrate with their technology platform. |

Our competitors include large PEOs such as the TotalSource unit of Automatic Data Processing, Inc., the PEO operations of Paychex, Inc. and Insperity, Inc., as well as specialized and smaller PEOs and similar HR service providers with PEO operations. To the extent that we and other companies providing these services are successful in growing our businesses, we anticipate that future competitors will enter this industry.

We believe that our services are attractive to many SMBs in part because of our ability to provide access to a broad range of TriNet-sponsored workers' compensation, health insurance and other benefits programs on a cost-effective basis. We compete with insurance brokers and other providers of insurance and benefits coverage, and our offerings must be priced competitively with those provided by these competitors in order for us to attract and retain our clients.

We believe that we compete based upon the breadth and depth of our benefit plans, vertical market expertise, total cost of service, brand awareness and reputation, ability to innovate and respond to client needs rapidly, access to online and mobile solutions, and subject matter expertise. We believe that we are competitive across these factors. For additional information about our competition, please refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - To succeed, we must work to improve our products and services to meet the expectations of our clients and applicable regulations. If we fail to meet those expectations and regulations, we may lose clients and harm our business.

Intellectual Property

We own or license from third parties various computer software, as well as other intellectual property rights, used in our business. Generally, we protect our intellectual property rights through the use of confidentiality and non-disclosure agreements and policies with our employees and third-party partners and vendors. We also own registered trademarks in the United States, Canada and the European Union covering our name and other trademarks and logos that we believe are materially important to our operations.

Corporate Employees

We refer to our employees that are not co-employed with our clients as our corporate employees. We had approximately 2,900 corporate employees as of December 31, 2019. Our corporate employees are not covered by a collective bargaining agreement.

Corporate and Other Available Information

We were incorporated in 1988 as TriNet Employer Group, Inc., a California corporation. We reincorporated as TriNet Merger Corporation, a Delaware corporation, in 2000 and during that year changed our name to TriNet Group, Inc. Our principal executive office is located at One Park Place, Suite 600, Dublin, CA 94568 and our telephone number is (510) 352-5000. Our website address is www.trinet.com. Information contained in or accessible through our website is not a part of this report.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports are available free of charge at investor.trinet.com as soon as reasonably practicable after we file such material with, or furnish it to, the SEC. Alternatively, the public may access these reports at the SEC's website at www.sec.gov. The contents of these websites are not incorporated into this report and are not part of this report.

Item 1A. Risk Factors

Below is a discussion of the risks that we believe are significant to our business. These risks are not the only ones we face. We may face additional risks that we do not currently consider to be significant or of which we are not currently aware, and any of these risks could cause our actual results to differ materially from historical or anticipated results. You should carefully consider these risks along with the other information provided in this Annual Report, including the information in "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our accompanying consolidated financial statements, as well as the information under the heading "Cautionary Note Regarding Forward-Looking Statements" before investing in any of our securities. We may amend, supplement or add to the risk factors described below from time to time in future reports filed with the SEC.

Operational Risks

Our co-employment relationship with our worksite employees exposes us to business risks.

We are the co-employer of our WSEs. As the co-employer of our WSEs, we assume certain risks and obligations of an employer. For instance, we face the risk of providing access to health benefits to our WSEs even if the cost of providing benefits exceeds the fees received from our clients. The extent of our responsibility for other aspects of our co-employer relationship with our WSEs remains subject to regulatory uncertainty at the federal, state and local levels. For example, under certain circumstances, we may be found to be responsible for paying salaries, wages and related payroll taxes of our WSEs, even if our clients have not timely remitted payments to us.

Our WSEs work in our clients' workplaces. Our ability to control the workplace environment of our clients is limited. As a co-employer of WSEs, we may be subject to liability for violations of labor and employment laws, workers' compensation laws, industry-specific laws that apply to the businesses our clients operate, and other laws that apply to our clients or to employers generally. We may also be liable for acts and omissions by our clients or WSEs, even if we do not violate such laws or participate in such acts or omissions. Federal and state positions regarding co-employment relationships can change, and have frequently changed in the past, with varying degrees of impact on our operations. We cannot predict when changes will occur or forecast whether any particular future changes will be favorable or unfavorable to our operations. Any such changes could reduce or eliminate the attractiveness of using a PEO and/or significantly increase our compliance costs and the cost to provide our products or services, which could result in a material adverse effect on our financial condition and results of operations.

We seek to mitigate these risks through agreements and insurance coverage and by requiring certain clients to pre-fund certain obligations. Our agreements with our clients divide responsibilities between us and our clients and provide that our clients will indemnify us for any liability attributable to their own or our WSEs' conduct. However, we may not be able to effectively enforce or collect on these obligations. In addition, we maintain insurance coverage, including workers’ compensation and EPLI coverage, to limit our and our clients' exposure to various WSE-related claims, but subject to split by contract, we are still responsible for any deductible layer under such insurance and such insurance generally excludes coverage for claims relating to the classification of employees as exempt or non-exempt, other wage and hour issues, and employment contract disputes. We cannot assure you that our insurance will be sufficient in amount or scope to cover all claims that may be asserted against us and for which we are unable to obtain indemnification from our clients.