|

Delaware

|

01-0864848

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

Douglas L. Madsen, Esq.

Chapman and Cutler LLP

1717 Rhode Island Avenue, NW

Washington, D.C. 20036

(202) 478-6444

|

James S. Stringfellow, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

4 Times Square

New York, New York 10036

(212) 735-3000

|

|

Title of each class of securities to

be registered |

Amount to be

registered(b)(c) |

Proposed maximum offering

price per unit(d) |

Proposed maximum aggregate

offering price(d) |

Amount of

registration fee |

|

Notes

|

__

|

__

|

__

|

__

|

|

Collateral Certificate(e)

|

__

|

__

|

__

|

__

|

|

(a)

|

Pursuant to Rule 415(a)(6) under the Securities Act of 1933, this Registration Statement and the prospectus included herein relate to $28,623,899,022 aggregate principal amount of Notes that were previously registered, but which remain unsold, under a registration statement on Form S-3 (File nos. 333-166895, 333-166895-01 and 333-166895-02), initially filed on June 19, 2013 with an initial effective date of July 8, 2013. A filing fee of $878,753.70 was previously paid in connection with such unsold Notes.

|

|

(b)

|

With respect to any securities issued with original issue discount, the amount to be registered is calculated based on the initial public offering price thereof.

|

|

(c)

|

With respect to any securities denominated in any foreign currency, the amount to be registered shall be the U.S. dollar equivalent thereof based on the prevailing exchange rate at the time such security is first offered.

|

|

(d)

|

Estimated solely for the purpose of calculating the registration fee.

|

|

(e)

|

This Registration Statement and the prospectus included herein also relate to a Collateral Certificate, which is pledged as security for the Notes, and which, pursuant to Commission regulations, is deemed to constitute part of any distribution of the Notes. No additional consideration will be paid by the purchasers of the Notes for the Collateral Certificate and, pursuant to Rule 457(t) under the Securities Act, no separate registration fee for the Collateral Certificate is required to be paid.

|

| The issuing entity will issue and sell: | Class [•](201[•]‑[•]) Notes |

| Principal amount | $[•] |

| Interest rate | [[•]‑month LIBOR plus] [•]% per year [(determined as described in this prospectus)] |

| Interest payment dates | [•]th day of each month, beginning in [•] 201[•] |

| Expected principal payment date | [•] [•], 20[•] |

| Legal maturity date | [•] [•], 20[•] |

| Expected issuance date | [•] [•], 201[•] |

| Price to public | $[•] (or [•]%) |

| Underwriting discount | $[•] (or [•]%) |

| Proceeds to the issuing entity | $[•] (or [•]%) |

|

You should consider the discussion under “Risk Factors” beginning on page 36 of this prospectus before you purchase any notes.

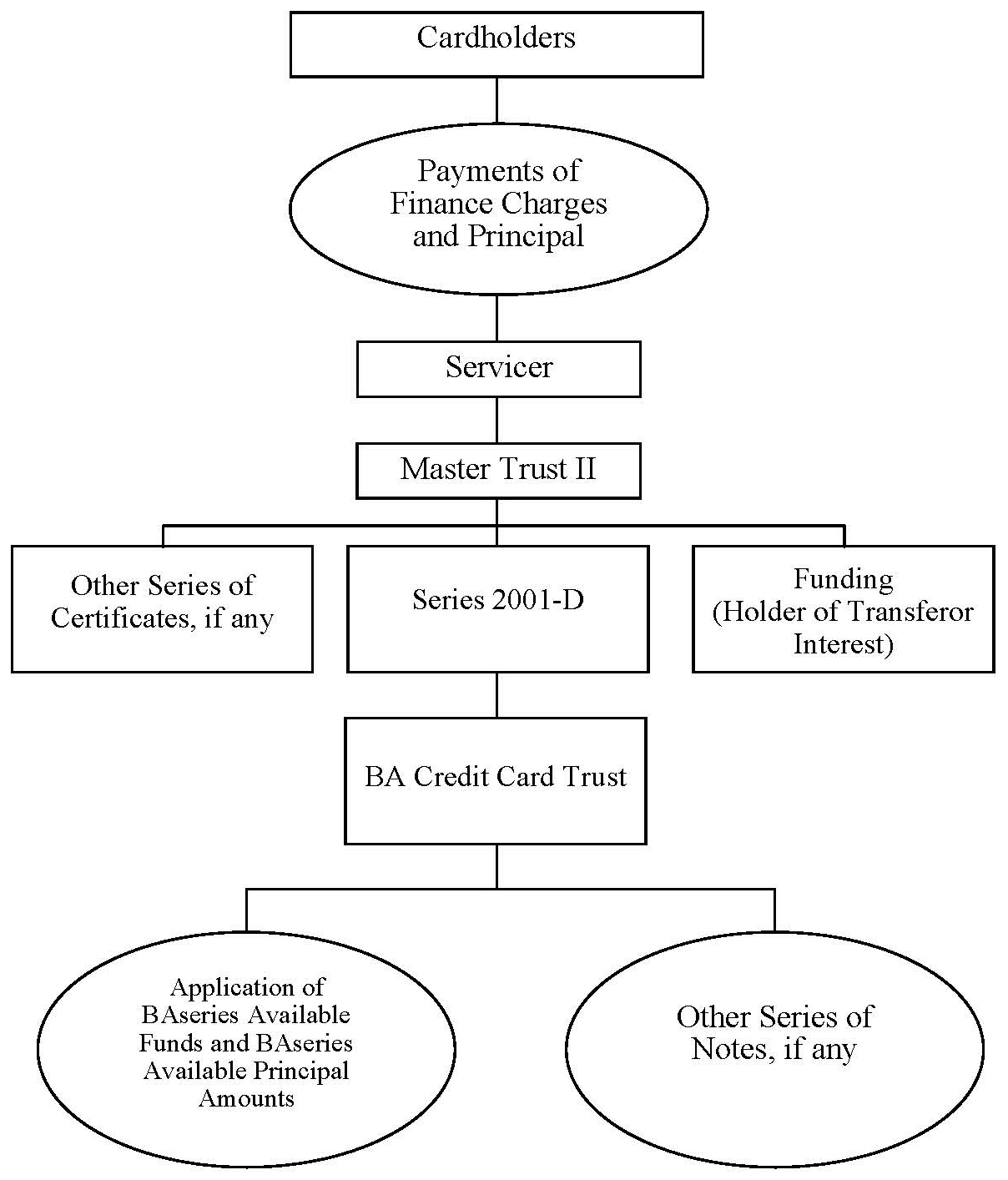

The primary asset of the issuing entity is the collateral certificate, Series 2001‑D. The collateral certificate represents an undivided interest in BA Master Credit Card Trust II. Master Trust II’s assets include receivables arising in a portfolio of unsecured consumer revolving credit card accounts.

The notes are obligations of the issuing entity only and are not obligations of BA Credit Card Funding, LLC, Bank of America, National Association, their affiliates or any other person.

The notes of all series are secured by a shared security interest in the collateral certificate and the collection account, but each tranche of notes is entitled to the benefits of only that portion of the assets allocated to it under the indenture and the indenture supplement. Noteholders will have no recourse to any other assets of the issuing entity for payment of the BAseries notes.

The notes are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality.

|

| · | local, regional and national business, political or economic conditions may differ from those expected; |

| · | the effects and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board, may adversely affect Funding’s or BANA’s business; |

| · | the timely development and acceptance of new products and services may be different than anticipated; |

| · | technological changes instituted by Funding or BANA and by persons who may affect Funding’s or BANA’s business may be more difficult to accomplish or more expensive than anticipated or may have unforeseen consequences; |

| · | the ability to increase market share and control expenses may be more difficult than anticipated; |

| · | competitive pressures among financial services companies may increase significantly; |

| · | Funding’s or BANA’s reputation risk arising from negative public opinion; |

| · | changes in laws and regulations may adversely affect Funding, BANA or their businesses; |

| · | changes in accounting policies and practices, as may be adopted by regulatory agencies and the Financial Accounting Standards Board, may affect expected financial reporting or business results; |

| · | the costs, effects and outcomes of litigation may adversely affect Funding, BANA or their businesses; and |

| · | Funding or BANA may not manage the risks involved in the foregoing as well as anticipated. |

|

Page

|

|

|

THE CLASS [•](201[•] [•]) NOTES

|

1

|

|

Summary of Terms

|

1

|

|

PROSPECTUS SUMMARY

|

7

|

|

Securities Offered

|

7

|

|

Risk Factors

|

7

|

|

Issuing Entity

|

7

|

|

Funding

|

7

|

|

Master Trust II

|

8

|

|

BANA and Affiliates

|

8

|

|

Indenture Trustee

|

9

|

|

Owner Trustee

|

10

|

|

Asset Representations Reviewer

|

10

|

|

Parties, Transferred Assets and Operating Documents

|

11

|

|

Series, Classes and Tranches of Notes

|

12

|

|

BAseries Notes

|

12

|

|

Interest Payments

|

13

|

|

Expected Principal Payment Date and Legal Maturity Date

|

14

|

|

Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount of Notes

|

15

|

|

Subordination

|

16

|

|

BAseries Credit Enhancement

|

17

|

|

BAseries Required Subordinated Amount

|

18

|

|

Limit on Repayment of All Notes

|

19

|

|

Sources of Funds to Pay the Notes

|

19

|

|

BAseries Class C Reserve Account

|

23

|

|

Flow of Funds and Application of Finance Charge and Principal Collections

|

23

|

|

Revolving Period

|

24

|

|

Early Redemption of Notes

|

24

|

|

Optional Redemption by the Issuing Entity

|

25

|

|

Events of Default

|

26

|

|

Events of Default Remedies

|

27

|

|

BAseries Issuing Entity Accounts

|

27

|

|

Security for the Notes

|

27

|

|

Limited Recourse to the Issuing Entity

|

28

|

|

BAseries Accumulation Reserve Account

|

28

|

|

Shared Excess Available Funds

|

29

|

|

Registration, Clearing and Settlement

|

29

|

|

Stock Exchange Listing

|

29

|

|

Ratings

|

29

|

|

ERISA Eligibility

|

30

|

|

Tax Status

|

30

|

|

Denominations

|

30

|

|

Application of Collections of Finance Charges and Principal Payments Received by BANA as Servicer of Master Trust II

|

31

|

|

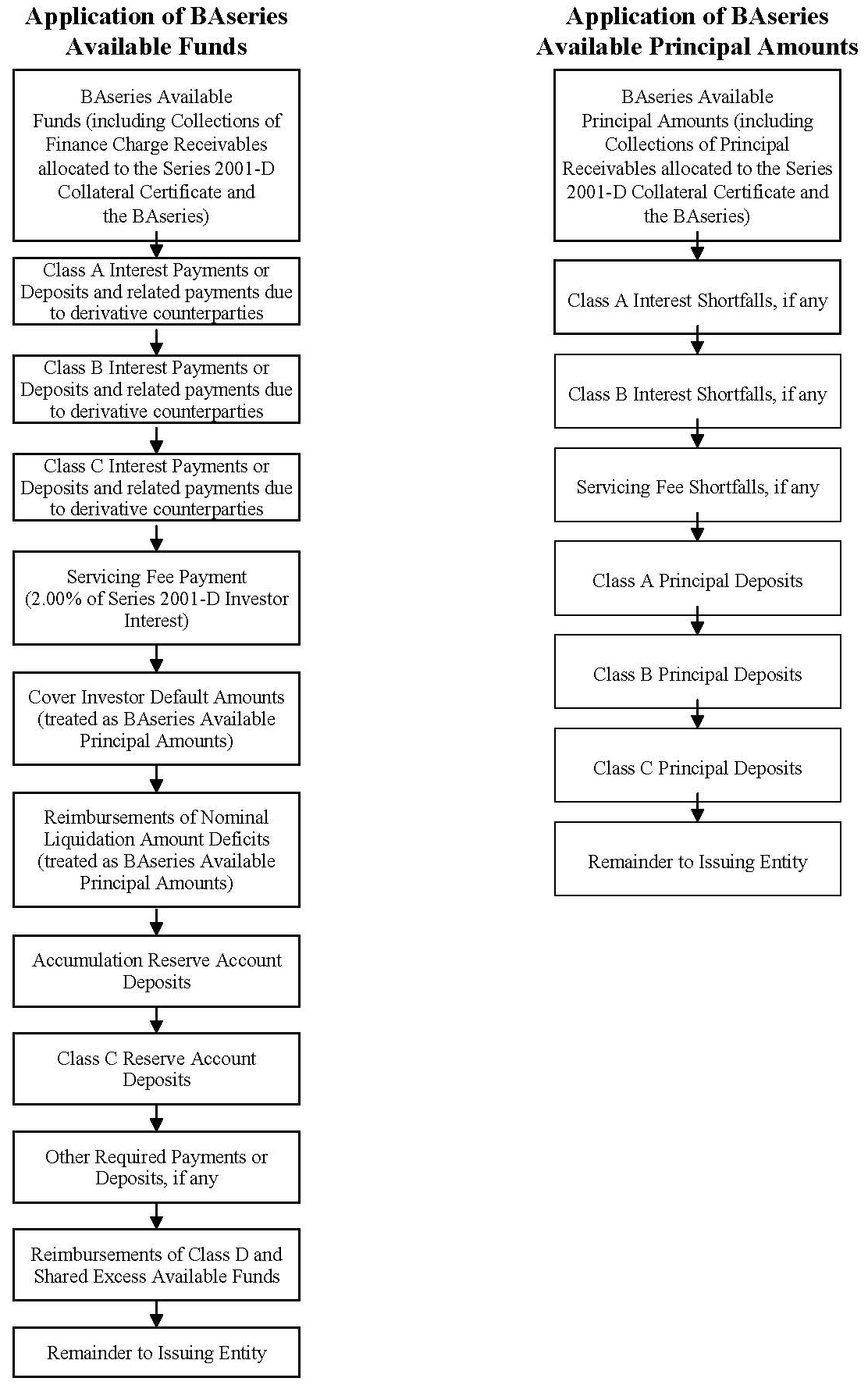

Application of BAseries Available Funds

|

32

|

|

Application of BAseries Available Principal Amounts

|

32

|

|

Fees and Expenses Payable from BAseries Available Funds and BAseries Available Principal Amounts

|

33

|

|

Page

|

|

|

BAseries Required Subordinated Amounts and Required Class D Investor Interest

|

34

|

|

RISK FACTORS

|

36

|

|

TRANSACTION PARTIES; LEGAL PROCEEDINGS; AFFILIATIONS, RELATIONSHIPS AND RELATED TRANSACTIONS

|

59

|

|

BA Credit Card Trust

|

59

|

|

BA Master Credit Card Trust II

|

60

|

|

BA Credit Card Funding, LLC

|

62

|

|

BANA and Affiliates

|

62

|

|

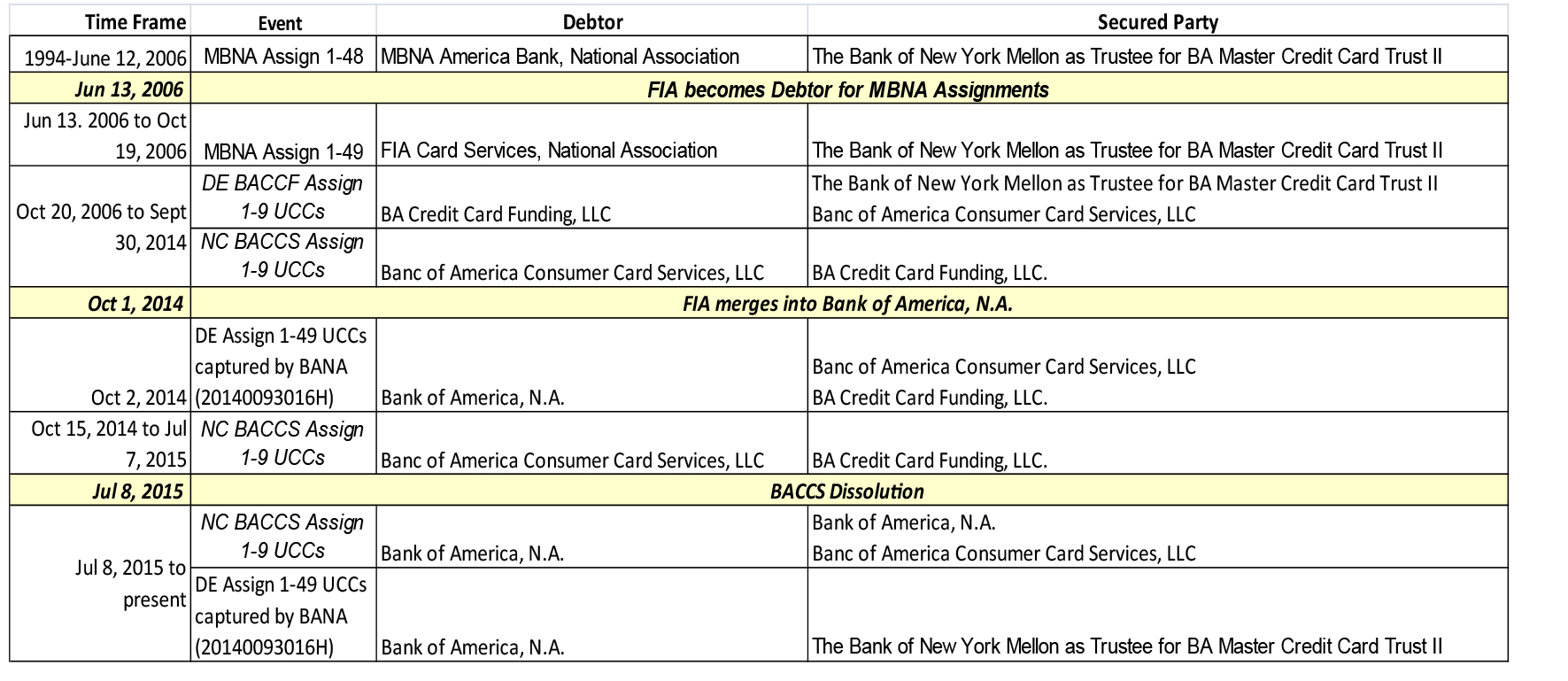

Merger of FIA into BANA

|

64

|

|

Removal and Dissolution of BACCS

|

64

|

|

[Credit Risk Retention]

|

65

|

|

Certain Interests in Master Trust II and the Issuing Entity

|

66

|

|

Industry Developments

|

67

|

|

Litigation

|

67

|

|

Regulatory Developments

|

68

|

|

The Bank of New York Mellon

|

68

|

|

Wilmington Trust Company

|

69

|

|

[Providers of Derivatives]

|

69

|

|

[Clayton Fixed Income Services LLC]

|

69

|

|

USE OF PROCEEDS

|

70

|

|

THE NOTES

|

70

|

|

General

|

70

|

|

Interest

|

71

|

|

Principal

|

72

|

|

Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount

|

73

|

|

Stated Principal Amount

|

74

|

|

Outstanding Dollar Principal Amount

|

74

|

|

Nominal Liquidation Amount

|

74

|

|

Final Payment of the Notes

|

76

|

|

Subordination of Interest and Principal

|

77

|

|

Required Subordinated Amount

|

77

|

|

Early Redemption of Notes

|

83

|

|

Issuances of New Series, Classes and Tranches of Notes

|

84

|

|

Payments on Notes; Paying Agent

|

86

|

|

Denominations

|

87

|

|

Record Date

|

87

|

|

Governing Law

|

87

|

|

Form, Exchange and Registration and Transfer of Notes

|

87

|

|

Book Entry Notes

|

88

|

|

The Depository Trust Company

|

89

|

|

Clearstream Banking

|

90

|

|

Euroclear

|

90

|

|

Page

|

|

|

Distributions on Book Entry Notes

|

91

|

|

Global Clearing and Settlement Procedures

|

91

|

|

Definitive Notes

|

92

|

|

Replacement of Notes

|

92

|

|

SOURCES OF FUNDS TO PAY THE NOTES

|

93

|

|

The Collateral Certificate

|

93

|

|

Deposit and Application of Funds

|

95

|

|

Deposit and Application of Funds for the BAseries

|

97

|

|

BAseries Available Funds

|

97

|

|

Application of BAseries Available Funds

|

98

|

|

Targeted Deposits of BAseries Available Funds to the Interest Funding Account

|

99

|

|

Allocation to Interest Funding Subaccounts

|

99

|

|

Payments Received from Derivative Counterparties for Interest on Foreign Currency Notes

|

100

|

|

Deposits of Withdrawals from the Class C Reserve Account to the Interest Funding Account

|

100

|

|

Allocations of Reductions from Charge Offs

|

100

|

|

Limits on Reallocations of Charge Offs to a Tranche of Class C Notes from Tranches of Class A and Class B

|

101

|

|

Limits on Reallocations of Charge Offs to a Tranche of Class B Notes from Tranches of Class A Notes

|

101

|

|

Allocations of Reimbursements of Nominal Liquidation Amount Deficits

|

101

|

|

Application of BAseries Available Principal Amounts

|

102

|

|

Reductions to the Nominal Liquidation Amount of Subordinated Classes from Reallocations of BAseries Available Principal Amounts

|

104

|

|

Limit on Allocations of BAseries Available Principal Amounts and BAseries Available Funds

|

105

|

|

Targeted Deposits of BAseries Available Principal Amounts to the Principal Funding Account

|

106

|

|

Allocation to Principal Funding Subaccounts

|

108

|

|

Limit on Deposits to the Principal Funding Subaccount of Subordinated Notes; Limit on Repayments of all Tranches

|

109

|

|

Payments Received from Derivative Counterparties for Principal

|

109

|

|

Deposits of Withdrawals from the Class C Reserve Account to the Principal Funding Account

|

110

|

|

Withdrawals from Interest Funding Subaccounts

|

110

|

|

Withdrawals from Principal Funding Account

|

110

|

|

Targeted Deposits to the Class C Reserve Account

|

112

|

|

Withdrawals from the Class C Reserve Account

|

112

|

|

Targeted Deposits to the Accumulation Reserve Account

|

113

|

|

Withdrawals from the Accumulation Reserve Account

|

113

|

|

Final Payment of the Notes

|

114

|

|

Page

|

|

|

Pro Rata Payments Within a Tranche

|

114

|

|

Shared Excess Available Funds

|

114

|

|

Issuing Entity Accounts

|

115

|

|

Derivative Agreements

|

116

|

|

Sale of Credit Card Receivables

|

116

|

|

Sale of Credit Card Receivables for BAseries Notes

|

117

|

|

Limited Recourse to the Issuing Entity; Security for the Notes

|

118

|

|

THE INDENTURE

|

119

|

|

Indenture Trustee

|

119

|

|

Owner Trustee

|

121

|

|

Issuing Entity Covenants

|

122

|

|

Early Redemption Events

|

123

|

|

Events of Default

|

124

|

|

Events of Default Remedies

|

124

|

|

Meetings

|

126

|

|

Voting

|

126

|

|

Amendments to the Indenture and Indenture Supplements

|

127

|

|

Tax Opinions for Amendments

|

129

|

|

Addresses for Notices

|

130

|

|

Issuing Entity’s Annual Compliance Statement

|

130

|

|

Indenture Trustee’s Annual Report

|

130

|

|

List of Noteholders

|

130

|

|

Reports

|

131

|

|

BANA’S CREDIT CARD ACTIVITIES

|

133

|

|

General

|

133

|

|

Origination, Account Acquisition, Credit Lines and Use of Credit Card Accounts

|

133

|

|

Card Processing Reseller and Total System Services, Inc.

|

135

|

|

Interchange

|

135

|

|

BANA’S CREDIT CARD PORTFOLIO

|

135

|

|

Billing and Payments

|

136

|

|

Risk Control and Fraud

|

136

|

|

Delinquencies and Collection Efforts

|

137

|

|

Charge Off Policy

|

137

|

|

Renegotiated Loans and Re Aged Accounts

|

137

|

|

RECEIVABLES TRANSFER AGREEMENTS GENERALLY

|

138

|

|

THE RECEIVABLES PURCHASE AGREEMENT

|

138

|

|

Sale of Receivables

|

138

|

|

Representations and Warranties

|

139

|

|

Repurchase Obligations

|

139

|

|

Reassignment of Other Receivables

|

140

|

|

Amendments

|

141

|

|

Termination

|

141

|

|

MASTER TRUST II

|

141

|

|

Page

|

|

|

General

|

141

|

|

Master Trust II Trustee

|

142

|

|

The Receivables

|

144

|

|

Review of Receivables in Master Trust II Portfolio

|

145

|

|

Demands for Repurchases of Receivables in Master Trust II Portfolio

|

147

|

|

Investor Certificates

|

147

|

|

Conveyance of Receivables

|

148

|

|

Addition of Master Trust II Assets

|

149

|

|

Removal of Accounts

|

150

|

|

Collection and Other Servicing Procedures

|

153

|

|

Current Consolidated Payment Prioritization Methodology Not Fully Comparable with Previous Payment Prioritization Methodologies

|

153

|

|

Master Trust II Accounts

|

155

|

|

Investor Percentage

|

155

|

|

Application of Collections

|

155

|

|

Defaulted Receivables; Rebates and Fraudulent Charges

|

158

|

|

Master Trust II Termination

|

158

|

|

Pay Out Events

|

158

|

|

Servicing Compensation and Payment of Expenses

|

160

|

|

The Class D Certificate

|

161

|

|

New Issuances

|

162

|

|

Representations and Warranties

|

163

|

|

Certain Matters Regarding the Servicer and the Transferor

|

166

|

|

Servicer Default

|

167

|

|

Evidence as to Compliance

|

168

|

|

Amendments to the Master Trust II Agreement

|

169

|

|

Treatment of Noteholders

|

171

|

|

Certificateholders Have Limited Control of Actions

|

172

|

|

NEW REQUIREMENTS FOR SEC SHELF REGISTRATION

|

172

|

|

CEO Certification

|

173

|

|

Asset Representations Review

|

173

|

|

General

|

173

|

|

Delinquency Trigger

|

174

|

|

Voting Trigger

|

176

|

|

Asset Review

|

177

|

|

Limitation on Liability; Indemnification

|

180

|

|

Eligibility of Asset Representations Reviewer

|

180

|

|

Resignation and Removal of the Asset Representations Reviewer

|

180

|

|

Asset Representations Reviewer Compensation

|

181

|

|

Amendment of the Asset Representations Review Agreement

|

182

|

|

Dispute Resolution

|

182

|

|

Investor Communication

|

186

|

|

CONSUMER PROTECTION LAWS

|

186

|

|

FEDERAL INCOME TAX CONSEQUENCES

|

187

|

|

Page

|

|

|

General

|

187

|

|

Description of Opinions

|

188

|

|

Tax Characterization of the Issuing Entity and the Notes

|

188

|

|

Consequences to Holders of the Offered Notes

|

190

|

|

State and Local Tax Consequences

|

193

|

|

BENEFIT PLAN INVESTORS

|

193

|

|

Prohibited Transactions

|

194

|

|

Potential Prohibited Transactions from Investment in Notes

|

194

|

|

Prohibited Transactions between the Benefit Plan and a Party in Interest

|

194

|

|

Prohibited Transactions between the Issuing Entity or Master Trust II and a Party in Interest

|

195

|

|

Investment by Benefit Plan Investors

|

195

|

|

Tax Consequences to Benefit Plans

|

196

|

|

[UNDERWRITING][PLAN OF DISTRIBUTION]

|

196

|

|

LEGAL MATTERS

|

199

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

199

|

|

GLOSSARY OF DEFINED TERMS

|

201

|

|

THE MASTER TRUST II PORTFOLIO

|

A I 1

|

|

General

|

A I 1

|

|

Delinquency and Principal Charge Off Experience

|

A I 1

|

|

Revenue Experience

|

A I 4

|

|

Principal Payment Rates

|

A I 5

|

|

The Receivables

|

A I 5

|

|

OUTSTANDING SERIES, CLASSES, AND TRANCHES OF NOTES

|

A II 1

|

|

OUTSTANDING MASTER TRUST II SERIES OF INVESTOR CERTIFICATES

|

A III 1

|

|

Transaction Parties

|

|

|

Issuing Entity of the Notes

|

BA Credit Card Trust (issuing entity)

|

|

Issuing Entity of the Collateral Certificate

|

BA Master Credit Card Trust II (master trust II)

|

|

Sponsor, Servicer and Originator

|

Bank of America, National Association (BANA)

|

|

Transferor and Depositor

|

BA Credit Card Funding, LLC (Funding)

|

|

Master Trust II Trustee, Indenture Trustee

|

The Bank of New York Mellon

|

|

Owner Trustee

|

Wilmington Trust Company

|

|

Asset Representations Reviewer

|

[Clayton Fixed Income Services LLC]

|

|

[Derivative Counterparty]

|

[NAME OF COUNTERPARTY]

|

|

Assets

|

|

|

Primary Asset of the Issuing Entity

|

Master trust II, Series 2001‑D Collateral Certificate

|

|

Collateral Certificate

|

Undivided interest in master trust II

|

|

Primary Assets of Master Trust II

|

Receivables in unsecured consumer revolving credit card accounts

|

|

Receivables (as of beginning of the day

|

Principal receivables: $[•]

|

|

on [•] [•], 201[•])

|

Finance charge receivables: $[•]

|

|

Asset Backed Securities Offered

|

Class [•](201[•]‑[•])

|

|

Class

|

Class [•]

|

|

Series

|

BAseries

|

|

Initial Principal Amount

|

$[•]

|

|

Initial Nominal Liquidation Amount

|

$[•]

|

|

Expected Issuance Date

|

[•] [•], 201[•] |

|

[Subordination

|

[The Class B(201[•]‑[•]) notes will be subordinated to the Class A notes.]] [The Class C(201[•]‑[•]) notes will be subordinated to the Class A and Class B notes.]]

|

|

[Credit Enhancement

|

[Subordination of the Class B notes, the Class C notes and the Class D certificate] [Subordination of the Class C notes and the Class D certificate] [Subordination of the Class D certificate]]

|

|

[Credit Enhancement Amount

|

Required Subordinated Amount and Required Class D Investor Interest]

|

|

[Required Subordinated Amount of

Class B Notes |

Applicable required subordination percentage of Class B notes multiplied by the adjusted outstanding dollar principal amount of the Class A(201[•]‑[•]) notes.]

|

|

[Required Subordination Percentage of

Class B Notes |

[•]%. However, see “Prospectus Summary—BAseries Required Subordinated Amounts and Required Class D Investor Interest” and “The Notes—Required Subordinated Amount” for a discussion of the calculation of the applicable stated percentage and the method by which the applicable stated percentage may be changed in the future.]

|

|

[Required Subordinated Amount of

Class C Notes |

[Applicable required subordination percentage of Class C notes multiplied by the adjusted outstanding dollar principal amount of the Class A(201[•]‑[•]) notes.] [An amount equal to [•]% of the adjusted outstanding dollar principal amount of the Class B(201[•]‑[•]) notes that are not providing credit enhancement to the Class A notes, plus 100% of the adjusted outstanding dollar principal amount of the Class B(201[•]‑[•]) notes’ pro rata share of the Class A required subordinated amount of Class C notes for all Class A notes. See “The Notes—Required Subordinated Amount” for a discussion of the calculation of the Class B(201[•]‑[•]) notes’ required subordinated amount of Class C notes, and the method by which that calculation may be changed in the future.]]

|

|

[Required Subordination Percentage of

Class C Notes |

[•]%. However, see “Prospectus Summary—BAseries Required

|

|

Subordinated Amounts and Required Class D Investor Interest” and “The Notes—Required Subordinated Amount” for a discussion of the calculation of the applicable stated percentage and the method by which the applicable stated percentage may be changed in the future.]

|

|

|

Required Class D Investor Interest

|

The required Class D investor interest is approximately equal to 10.50% of the sum of the aggregate adjusted outstanding dollar principal amount of the BAseries notes. See “Prospectus Summary—BAseries Required Subordinated Amounts and Required Class D Investor Interest” and “The Notes—Required Subordinated Amount—The Class D Certificate” for a more specific description of how the required Class D investor interest is calculated.

|

|

Accumulation Reserve Account Targeted

Deposit |

0.5% of the outstanding dollar principal amount of the Class [•](201[•]‑[•]) notes; provided, however, that if the Class [•](201[•]-[•]) notes require only one budgeted deposit to accumulate and pay the principal of the Class [•](201[•]-[•]) notes on the expected principal payment date, the accumulation reserve account targeted deposit will be zero. See “Prospectus Summary—BAseries Accumulation Reserve Account” for a description of how the accumulation reserve account targeted deposit can be changed.

|

|

[Class C Reserve Account

Targeted Deposit |

Nominal liquidation amount of all BAseries notes multiplied by the applicable funding percentage.]

|

|

[Funding Percentage

|

Three‑month average

|

|

|

excess available funds

|

Funding %

|

|

|

4.50% or greater

|

0.00%

|

|

|

4.00% to 4.49%

|

1.25%

|

|

|

3.50% to 3.99%

|

2.00%

|

|

|

3.00% to 3.49%

|

2.75%

|

|

|

2.50% to 2.99%

|

3.50%

|

|

|

2.00% to 2.49%

|

4.50%

|

|

|

1.99% or less

|

6.00%

|

|

Increases in the funding percentage will lead to a larger targeted deposit to the Class C reserve account, and therefore also to the related Class C reserve subaccount for these Class C(201[•]‑[•]) notes. Funds on deposit in this Class C reserve subaccount will be available to cover shortfalls in interest and principal on the Class C(201[•]‑[•]) notes. However, amounts on deposit in the Class C reserve subaccount may have been reduced due to withdrawals to cover shortfalls in interest or principal due in prior periods. In addition, the Class C reserve subaccount may not be fully funded if Available Funds after giving effect to prior required deposits are insufficient to make the full targeted deposit into the Class C reserve subaccount.]

|

|

|

[Excess Available Funds Percentage

|

Excess of Portfolio Yield over Base Rate. See “Prospectus Summary—BAseries Class C Reserve Account.”]

|

|

[[Asset‑Backed Securities][Other Interests]

|

|

|

Not Offered

|

[Description of [asset‑backed securities][other interests] not offered by this prospectus.]]

|

|

Interest

|

|

|

Interest Rate

|

[London interbank offered rate for U.S. dollar deposits for a [•]‑month period [(or, for the first interest accrual period, the rate that corresponds to the actual number of days in the first interest accrual period)] (LIBOR) as of each LIBOR determination date plus] [•]% per year.

|

|

[LIBOR Determination Dates

|

[•] [•], 201[•] for the period from and including the issuance date to but excluding [•] [•], 201[•], and for each interest accrual period thereafter, the date that is two London Business Days before each distribution date.]

|

|

Distribution Dates

|

The [•]th day of each calendar month (or the next Business Day if the [•]th is not a Business Day)

|

|

[London Business Day

|

London, New York, New York, Newark, Delaware, and Charlotte, North Carolina banking day.]

|

|

Interest Accrual Method

|

[Actual] [30]/360

|

|

Interest Accrual Periods

|

From and including the issuance date to but excluding the [•]th day of the calendar month in which the first interest payment date occurs and then from and including the [•]th day of each calendar month to but excluding the [•]th day in the next calendar month. The first interest accrual period will begin on and include the issuance date for the Class [•](201[•]‑[•]) notes and end on but exclude the first interest payment date for the Class [•](201[•]‑[•]) notes, [•] [•], 201[•].

|

|

Interest Payment Dates

|

Each distribution date starting on [•] [•], 201[•]

|

|

First Interest Payment Date

|

[•] [•], 201[•]

|

|

[First Interest Payment

|

$[•]]

|

|

Business Day

|

New York, New York, Newark, Delaware, and Charlotte, North Carolina banking day

|

|

Principal

|

|

|

Expected Principal Payment Date

|

[•][•], 20[•] |

|

Legal Maturity Date

|

[•][•], 20[•] |

|

Revolving Period End

|

Between 12 and 1 months prior to expected principal payment date

|

|

Servicing Fee

|

2% of the Series 2001‑D investor interest

|

|

[Derivative Agreement

|

The Class [•](201[•]‑[•]) notes will have the benefit of an interest rate swap agreement (referred to as the derivative agreement) provided by [NAME OF COUNTERPARTY], as derivative counterparty. Under the derivative agreement, for each Transfer Date:

|

|

·

|

the derivative counterparty will make a payment to the issuing entity, based on the outstanding dollar principal amount of the Class [•](201[•]‑[•]) notes, at a rate equal to [•]% per year; and

|

|

|

·

|

the issuing entity will make a payment to the derivative counterparty, based on the outstanding dollar principal amount of the Class [•](201[•]‑[•]) notes, at a rate not to exceed [•]-month LIBOR (for the related interest period) plus [•]% per year.

|

|

For a more detailed discussion of the derivative agreement, see “Prospectus Summary—Sources of Funds to Pay the Notes—Derivative Agreement for Class [•](201[•]‑[•]) Notes.”]

|

|

|

[Derivative Counterparties

|

Add name, organizational form and general character of the business of any derivative counterparty to the extent required. Disclose other information regarding the derivative counterparty as required, including, but not limited to, a description of any material affiliations or business agreements/arrangements with any other material transaction party.]

|

|

Early Redemption Events

|

Early redemption events applicable to the Class [•](201[•]‑[•]) notes include the following: (i) the occurrence of the expected principal payment date for such notes; (ii) each of the Pay Out Events described under “Master Trust II—Pay Out Events” in this prospectus; (iii) the issuing entity becoming an “investment company” within the meaning of the Investment Company Act of 1940, as amended; (iv) for any date the amount of Excess Available Funds for the BAseries averaged over the 3 preceding calendar months is less than the Required Excess Available Funds for the BAseries for such date[; and (v) specify any other early redemption event]. See “The Indenture—Early Redemption Events” in this prospectus.

|

| [If an early redemption event (other than clause (iii) above) applicable to the Class [•](201[•]‑[•]) notes occurs and the derivative agreement has not been terminated or an interest reserve account event has not occurred, Available Principal Amounts allocable to the Class [•](201[•]‑[•]) notes together with any amounts in the principal funding subaccount for the Class [•](201[•]‑[•]) notes will not be paid to the holders of the Class [•](201[•]‑[•]) notes, but instead will be retained in the principal funding subaccount and paid to the Class [•](201[•]‑[•]) noteholders on the expected principal payment date of the Class [•](201[•]‑[•]) notes. See “The Class [•](201[•]‑[•]) Notes—Early Redemption of Notes.” | |

|

If following an early redemption event for the Class [•](201[•]‑[•]) notes (i) the derivative agreement terminates, (ii) an interest reserve account event occurs, (iii) the issuing entity becomes an ”investment company” within the meaning of the Investment Company Act of 1940, as amended or (iv) an event of default and acceleration of the Class [•](201[•]‑[•]) notes occurs, Available Principal Amounts will be paid to the Class [•](201[•]‑[•]) noteholders. See ”The Class [•](201[•]‑[•]) Notes—Early Redemption of Notes.”

|

|

|

See “Prospectus Summary—Sources of Funds to Pay the Notes—Derivative Agreement for Class [•](201[•]‑[•]) Notes” for a description of the events leading to the occurrence of an interest reserve account event.]

|

|

|

Events of Default

|

Events of default applicable to the Class [•](201[•]‑[•]) notes include the following: (i) the issuing entity’s failure, for a period of 35 days, to pay interest upon such notes when such interest becomes due and payable; (ii) the issuing entity’s failure to pay the principal amount of such notes on the applicable legal maturity date; (iii) the issuing entity’s default in the performance, or breach, of any other of its covenants or warranties, as discussed in this prospectus; and (iv) the occurrence of certain events of bankruptcy, insolvency, conservatorship or receivership of the issuing entity. See “The Indenture—Events of Default” in this prospectus.

|

|

Optional Redemption

|

If the nominal liquidation amount is less than 5% of the highest outstanding dollar principal amount.

|

|

ERISA Eligibility

|

Yes, subject to important considerations described under “Benefit Plan Investors” in this prospectus (investors are cautioned to consult with their counsel). By purchasing the Class [•](201[•]‑[•]) notes, each investor purchasing on behalf of employee benefit plans or individual retirement accounts will be deemed to certify that the purchase and subsequent holding of the notes by the investor would be exempt from the prohibited transaction rules of ERISA and/or Section 4975 of the Internal Revenue Code.

|

| Tax Treatment | Debt for U.S. federal income tax purposes, subject to important considerations described under “Federal Income Tax Consequences” in this prospectus (investors are cautioned to consult with their tax counsel). |

|

[Stock Exchange Listing

|

The issuing entity will apply to list the Class [•](201[•]‑[•]) notes on a stock exchange in Europe. The issuing entity cannot guarantee that the application for the listing will be accepted or that, if accepted, the listing will be maintained. To determine whether the Class [•](201[•]‑[•]) notes are listed on a stock exchange you may contact the issuing entity c/o Wilmington Trust Company, Rodney Square North, 1100 N. Market Street, Wilmington, Delaware 19890‑0001, telephone number: (302) 651‑1000.]

|

|

Clearing and Settlement

|

DTC/Clearstream/Euroclear

|

| · | the Class [•](201[•]‑[•]) note interest rate [for the applicable interest accrual period]; multiplied by |

| · | [the actual number of days in the related interest accrual period divided by 360; multiplied by] |

| · | the outstanding dollar principal amount of the Class [•](201[•]‑[•]) notes as of the related record date. |

|

·

|

Stated Principal Amount. The stated principal amount of a note is the amount that is stated on the face of the note to be payable to the holder. It can be denominated in U.S. dollars or a foreign currency.

|

| · | Outstanding Dollar Principal Amount. For U.S. dollar notes, the outstanding dollar principal amount is the same as the initial dollar principal amount of the notes, less principal payments to noteholders. For foreign currency notes, the outstanding dollar principal amount is the U.S. dollar equivalent of the initial dollar principal amount of the notes, less dollar payments to derivative counterparties for principal. |

| · | Nominal Liquidation Amount. The nominal liquidation amount of a note is a U.S. dollar amount based on the outstanding dollar principal amount of the note, but after deducting: |

| – | that note’s share of reallocations of Available Principal Amounts used to pay interest on senior classes of notes or a portion of the master trust II servicing fee allocated to its series; |

|

–

|

that note’s share of charge‑offs resulting from uncovered Investor Default Amounts; and

|

|

–

|

amounts on deposit in the principal funding subaccount for that note;

|

| · | the principal funding subaccounts for the senior classes of notes of that series are prefunded in an amount such that the subordinated notes that have reached their expected principal payment date are no longer necessary to provide the required subordination; |

| · | new tranches of subordinated notes of that series are issued so that the subordinated notes that have reached their expected principal payment date are no longer necessary to provide the required subordination; |

| · | enough notes of senior classes of that series are repaid so that the subordinated notes that have reached their expected principal payment date are no longer necessary to provide the required subordination; or |

| · | the subordinated notes reach their legal maturity date. |

| · | the nominal liquidation amount of your Class [•](201[•]-[•]) notes has been reduced by charge‑offs due to uncovered Investor Default Amounts [or as a result of reallocations of Available Principal Amounts to pay interest on senior classes of notes or a portion of the master trust II servicing fee, and those amounts have not been reimbursed from Available Funds]; or |

| · | receivables are sold (i) following the insolvency of Funding, (ii) following an event of default and acceleration or (iii) on the legal maturity date, and the proceeds from the sale of receivables, plus any available amounts on deposit in the applicable subaccounts allocable to your notes are insufficient. |

| · | Collateral Certificate. The collateral certificate is an investor certificate issued as a part of “Series 2001‑D” by master trust II to the issuing entity. It represents an undivided interest in master trust II. Master trust II owns primarily receivables arising in selected MasterCard, Visa and American Express revolving credit card accounts. BANA or Funding has transferred, and Funding may continue to transfer, credit card receivables to master trust II in accordance with the terms of the master trust II agreement. Both collections of principal receivables and finance charge receivables will be allocated among holders of interests in master trust II—including the collateral certificate—based generally on the investment in principal receivables of each interest in master trust II. If collections of receivables allocable to the collateral certificate are less than expected, payments of principal of and interest on the notes could be delayed or remain unpaid. |

| · | Derivative Agreements. Some notes may have the benefit of one or more derivative agreements, including interest rate swaps, or other agreements described in “Sources of Funds to Pay the Notes—Derivative Agreements.” |

| · | The Issuing Entity Accounts. The issuing entity will establish a collection account for the purpose of receiving collections of finance charge receivables and principal receivables and other related amounts from master trust II payable under the collateral certificate. The issuing entity may establish supplemental accounts for any series, class or tranche of notes. |

| (i) | a fraction, the numerator of which is the actual number of days in the interest period relating to such Transfer Date, and the denominator of which is 360; |

| (ii) | a rate not to exceed LIBOR prevailing on the related LIBOR determination date with respect to such interest period plus [•]% per year; and |

| (iii) | the outstanding dollar principal amount of the Class [•](201[•]‑[•]) notes at the end of the prior month (or, with respect to the Transfer Date related to the initial interest period, the initial dollar principal amount of the Class [•](201[•]‑[•]) notes). |

| (i) | the termination of the issuing entity pursuant to the terms of the indenture; |

| (ii) | the payment in full of the Class [•](201[•]‑[•]) notes; |

| (iii) | the expected principal payment date for the Class [•](201[•]‑[•]) notes; |

| (iv) | the insolvency, conservatorship or receivership of the derivative counterparty; |

| (v) | the failure on the part of the issuing entity or the derivative counterparty to make any payment under the derivative agreement within the applicable grace period, if any; |

| (vi) | illegality on the part of the issuing entity or the derivative counterparty to be a party to, or perform an obligation under, the derivative agreement; |

| (vii) | either the issuing entity or the derivative counterparty will, or there is a substantial likelihood that it will, be required to pay certain taxes or deduct or withhold part of payment received for or on account of a tax; |

| (viii) | failure of the derivative counterparty to provide certain organizational or financial information to the issuing entity to the extent that the aggregate significance percentage of all the derivative products provided by the derivative counterparty or its affiliates to the issuing entity is 10% or more; and |

| (ix) | the issuing entity amends the master trust II agreement, the Series 2001-D supplement, the trust agreement, the indenture or the BAseries indenture supplement without the consent of the derivative counterparty in a manner that would have an adverse effect on the derivative counterparty or would adversely impact the issuing entity’s ability to perform under the derivative agreement. |

| · | the occurrence of the Class [•](201[•]‑[•]) notes’ expected principal payment date; |

| · | each of the Pay Out Events applicable to Series 2001‑D, as described under “Master Trust II—Pay Out Events”; or |

| · | the issuing entity becoming an “investment company” within the meaning of the Investment Company Act of 1940, as amended. |

| · | the issuing entity’s failure, for a period of 35 days, to pay interest upon the Class [•](201[•]‑[•]) notes when such interest becomes due and payable; |

| · | the issuing entity’s failure to pay the principal amount of the Class [•](201[•]‑[•]) notes on the applicable legal maturity date; |

| · | the issuing entity’s default in the performance, or breach, of any other of its covenants or warranties in the indenture for a period of 60 days after either the indenture trustee or the holders of 25% of the aggregate outstanding dollar principal amount of the outstanding Class [•](201[•]‑[•]) notes has provided written notice requesting remedy of such breach, and, as a result of such default, the interests of the Class [•](201[•]‑[•]) noteholders are materially and adversely affected and continue to be materially and adversely affected during the 60‑day period; and |

| · | the occurrence of certain events of bankruptcy, insolvency, conservatorship or receivership of the issuing entity. |

| · | if the conditions specified in “The Indenture—Events of Default Remedies” are satisfied and, for subordinated notes of a multiple tranche series [like the [Class B][Class C](201[•]‑[•]) notes], only to the extent that payment is permitted by the subordination provisions of the senior notes of the same series; or |

| · | on the legal maturity date of the Class [•](201[•]‑[•]) notes. |

| · | the collateral certificate; |

| · | the collection account; |

| · | the applicable principal funding subaccount; |

| · | the applicable interest funding subaccount; [and] |

| · | the applicable accumulation reserve subaccount[; and] |

| · | [name of any additional issuing entity accounts for the Class [•](201[Ÿ]‑[Ÿ]) notes; and] |

|

·

|

[the applicable Class C reserve subaccount].

|

| · | the portion of collections of principal receivables and finance charge receivables received by the issuing entity under the collateral certificate allocated to the BAseries and available to the [Class A(201[•]‑[•]) notes] [[Class B(201[•]‑[•]) notes] [Class C(201[•]‑[•]) notes] after giving effect to any reallocations, payments and deposits for senior notes]; |

| · | funds in the applicable issuing entity accounts for that tranche of notes; and |

| · | payments received under any applicable derivative agreement for that tranche of notes. |

Received by BANA as Servicer of Master Trust II

BAseries Available Principal Amounts

|

FEES AND EXPENSES PAYABLE FROM BASERIES AVAILABLE FUNDS:

|

||

|

Fee

|

Payee

|

Amount

|

|

Servicing Fee

|

Servicer

|

2.00% of Series 2001‑D Investor Interest

|

|

FEES AND EXPENSES PAYABLE FROM BASERIES AVAILABLE PRINCIPAL AMOUNTS:

|

||

|

Fee

|

Payee

|

Amount

|

|

Servicing Fee Shortfalls

|

Servicer

|

Any accrued but unpaid servicing fees

|

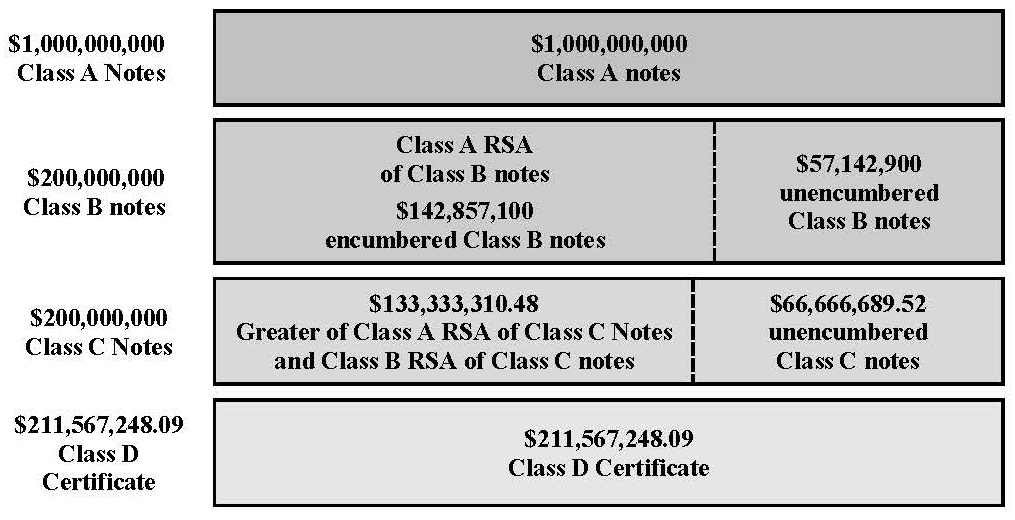

| · | For the $1,000,000,000 of Class A notes, the RSA of subordinated notes is $269,841,200. Of that amount, the RSA of Class B notes is $142,857,100 (which is 14.28571% of $1,000,000,000) and the RSA of Class C notes is $126,984,100 (which is 12.69841% of $1,000,000,000). |

| · | Encumbered Class B notes consist of that portion of the Class B notes that provide credit enhancement to the Class A notes (which is equal to the Class A RSA of Class B notes or $142,857,100). |

| · | Unencumbered Class B notes consist of that portion of the Class B notes that do not provide credit enhancement to the Class A notes. This unencumbered amount is equal to the aggregate amount of Class B notes ($200,000,000) minus the encumbered Class B notes ($142,857,100). |

|

·

|

For the $57,142,900 of unencumbered Class B notes, the RSA of Class C notes is $6,349,210.48 (which is 11.11111% of $57,142,900).

|

| · | For the $200,000,000 of Class B notes, the RSA of Class C notes is $133,333,310.48, or 100% of the Class A RSA of Class C notes ($126,984,100) plus the Class B RSA of Class C notes for the unencumbered Class B notes ($6,349,210.48). |

| · | Encumbered Class C notes consist of that portion of the Class C notes that provide credit enhancement to the Class A or the Class B notes (which is equal to the greater of the Class A RSA of Class C notes and the Class B RSA of Class C Notes, or $133,333,310.48). |

| · | Unencumbered Class C notes consist of that portion of the Class C notes that do not provide credit enhancement to the Class A or Class B notes. This unencumbered amount is equal to the aggregate amount of Class C notes ($200,000,000) minus the encumbered Class C notes ($133,333,310.48), or $66,666,689.52. |

| · | The required Class D Investor Interest equals the sum of: |

| – | (i) The adjusted outstanding dollar principal amount of the Class A notes, divided by 0.6825 ($1,465,201,465.20), minus (ii) the adjusted outstanding dollar principal amount of the Class A notes ($1,000,000,000), minus (iii) the aggregate Class A required subordinated amount of Class B notes ($142,857,100), minus (iv) the aggregate Class A required subordinated amount of Class C notes ($126,984,100), for a total of $195,360,265.20; |

| – | (i) (A) the adjusted outstanding dollar principal amount of the Class B notes minus the aggregate Class A required subordinated amount of Class B notes, divided by (B) 0.795 ($71,877,861.64), minus (ii) the adjusted outstanding dollar principal amount of the Class B notes minus the aggregate Class A required subordinated amount of Class B notes ($57,142,900), minus (iii) (A) the adjusted outstanding dollar principal amount of the Class B notes minus the aggregate Class A required subordinated amount of Class B notes, times (B) 0.1111111 ($6,349,210.48), for a total of $8,385,751.16; and |

| – | (i) (A) the adjusted outstanding dollar principal amount of the Class C notes minus the aggregate Class B required subordinated amount of Class C notes, divided by (B) 0.895 ($74,487,921.25), minus (ii) the adjusted outstanding dollar principal amount of the Class C notes minus the aggregate Class B required subordinated amount of Class C notes ($66,666,689.52), for a total of $7,821,231.73. |

| · | one or more obligations were issued by the trust as of September 27, 2010; |

| · | the transfer satisfied specified conditions for sale accounting treatment under generally accepted accounting principles in effect for reporting periods before November 15, 2009; |

| · | the transfer involved a securitization of the financial assets; |

| · | the depository institution received adequate consideration for the transfer; and |

| · | the financial assets were not transferred fraudulently, in contemplation of the depository institution’s insolvency, or with the intent to hinder, delay, or defraud the depository institution or its creditors. |

| · | authorize BANA to assign or to stop performing its obligations under the transaction documents, including its obligations to service the receivables, to make payments or deposits, to repurchase receivables, or to provide administrative services for Funding or the issuing entity; |

| · | prevent the appointment of a successor servicer or the appointment of a successor provider of administrative services for Funding or the issuing entity; |

| · | alter the terms on which BANA continues to service the receivables, to provide administrative services for Funding or the issuing entity, or to perform its other obligations under the transaction documents, including the amount or the priority of the fees paid to BANA; |

| · | prevent or limit the commencement of an early redemption of the notes, or instead do the opposite and require the early redemption to commence; |

| · | prevent or limit the early liquidation of the receivables or the collateral certificate and the termination of master trust II or the issuing entity, or instead do the opposite and require those to occur; or |

| · | prevent or limit continued transfers of receivables or continued distributions on the collateral certificate, or instead do the opposite and require those to continue. |

| · | Funding, master trust II, or the issuing entity, and its assets (including the receivables or the collateral certificate), should be substantively consolidated with the bankruptcy estate of Funding or an affiliate or the separate legal existence of Funding, master trust II, or the issuing entity should be disregarded based on a “piercing the corporate veil” or similar theory; or |

| · | the receivables or the collateral certificate are necessary for Funding or an affiliate to reorganize. |

| · | authorize Funding or an affiliate to assign or to stop performing its obligations under the transaction documents, including its obligations to make payments or deposits or to repurchase receivables; |

| · | alter the terms on which Funding or an affiliate continues to perform its obligations under the transaction documents, including the amount or the priority of the fees paid to Funding or an affiliate; |

|

·

|

prevent or limit the commencement of an early redemption of the notes, or instead do the opposite and require the early redemption to commence;

|

| · | prevent or limit the early liquidation of the receivables or the collateral certificate and the termination of master trust II or the issuing entity, or instead do the opposite and require those to occur; or |

| · | prevent or limit continued transfers of receivables or continued distributions on the collateral certificate, or instead do the opposite and require those to continue. |

| · | the rate of repayment of credit card balances by cardholders, which may be slower or faster than expected which may cause payment on the notes to be earlier or later than expected; |

| · | the extent of credit card usage by cardholders, and the creation of additional receivables in the accounts designated to master trust II; and |

| · | the rate of default by cardholders. |

| · | the portion of the Available Principal Amounts and Available Funds allocated to the BAseries and available to your tranche of notes after giving effect to any reallocations and payments and deposits for senior notes; |

| · | funds in the applicable issuing entity accounts for your tranche of notes; and |

| · | payments received under any applicable derivative agreement for your tranche of notes. |

| · | enough senior notes are repaid so that the subordinated notes are no longer necessary to provide the required subordination; |

| · | new subordinated notes are issued so that the subordinated notes which are payable are no longer necessary to provide the required subordination; |

| · | the principal funding subaccounts for the senior notes are prefunded so that the subordinated notes are no longer necessary to provide the required subordination; or |

| · | the subordinated notes reach their legal maturity date. |

| · | acquiring and holding the collateral certificate, other certificates of beneficial interest in master trust II, and the other assets of the issuing entity and the proceeds from these assets, and granting a security interest in these assets; |

| · | issuing notes, including the Class [•](201[•]‑[•]) notes; |

| · | making payments on the notes; and |

| · | engaging in other activities that are necessary or incidental to accomplish these limited purposes, and which are not contrary to maintaining the status of the issuing entity as a “qualifying special purpose entity” under applicable accounting literature. |

| · | the collateral certificate; |

| · | derivative agreements that the issuing entity will enter into from time to time to manage interest rate or currency risk relating to certain series, classes or tranches of notes; and |

| · | funds on deposit in the issuing entity accounts. |

| · | acquiring and holding the receivables in revolving credit card accounts designated to master trust II and granting a security interest in these receivables; |

| · | issuing investor certificates; |

| · | making payments on the investor certificates and transferor certificate; and |

| · | engaging in other activities that are necessary or incidental to accomplish these limited purposes, and which are not contrary to maintaining the status of master trust II as a “qualifying special purpose entity” under applicable accounting literature. |

1 To be included in prospectuses in connection with issuances of notes after the compliance date for the U.S. risk retention rule.

3 Insert amount reported as of the end of the most recent distribution period for which a Form 10‑D has been filed prior to the date of the prospectus.

| · | If after giving effect to the proposed principal payment there is still a sufficient amount of subordinated notes to support the outstanding senior notes. See “Sources of Funds to Pay the Notes—Deposit and Application of Funds for the BAseries—Targeted Deposits of BAseries Available Principal Amounts to the Principal Funding Account” and “—Allocation to Principal Funding Subaccounts.” For example, if a tranche of Class A notes has been repaid, this generally means that, unless other Class A notes are issued, at least some Class B notes and Class C notes may be repaid when such Class B notes and Class C notes are expected or required to be repaid even if other tranches of Class A notes are outstanding. |

| · | If the principal funding subaccounts for the senior classes of notes have been sufficiently prefunded as described in “Sources of Funds to Pay the Notes—Deposit and Application of Funds for the BAseries—Targeted Deposits of BAseries Available Principal Amounts to the Principal Funding Account—Prefunding of the Principal Funding Account for Senior Classes.” |

| · | If new tranches of subordinated notes are issued so that the subordinated notes that have reached their expected principal payment date are no longer necessary to provide the required subordination. |

| · | If the subordinated tranche of notes reaches its legal maturity date and there is a sale of credit card receivables as described in “Sources of Funds to Pay the Notes—Sale of Credit Card Receivables.” |

| · | If Available Funds allocable to a series of notes are insufficient to fund the portion of Investor Default Amounts allocable to such series of notes (which will be allocated to each series of notes pro rata based on the Weighted Average Available Funds Allocation Amount of all notes in such series) such Investor Default Amounts will result in a reduction of the nominal liquidation amount of such series. Within each series, subordinated classes of notes will bear the risk of reduction in their nominal liquidation amount due to charge‑offs resulting from uncovered Investor Default Amounts before senior classes of notes. |

|

·

|

In a multiple tranche series, including the BAseries, while these reductions will be initially allocated pro rata to each tranche of notes, they will then be reallocated to the subordinated classes of notes in that series in succession, beginning with the most subordinated classes. However, these reallocations will be made from senior notes to subordinated notes only to the extent that such senior notes have not used all of their required subordinated amount. For any tranche, the required subordinated amount will be determined in connection with the issuance of such notes. For multiple tranche series, these reductions will generally be allocated within each class pro rata to each outstanding tranche of the related class based on the Weighted Average Available Funds Allocation Amount of such tranche. Reductions that cannot be reallocated to a subordinated tranche will reduce the nominal liquidation amount of the tranche to which the reductions were initially allocated.

|

| · | If Available Principal Amounts are reallocated from subordinated notes of a series to pay interest on senior notes, any shortfall in the payment of the master trust II servicing fee or any other shortfall of Available Funds which Available Principal Amounts are reallocated to cover, the nominal liquidation amount of those subordinated notes will be reduced by the amount of the reallocations. The amount of the reallocation of Available Principal Amounts will be applied to reduce the nominal liquidation amount of the subordinated classes of notes in that series in succession, to the extent of such senior tranches’ required subordinated amount of the related subordinated notes, beginning with the most subordinated classes. No Available Principal Amounts will be reallocated to pay interest on a senior class of notes or any portion of the master trust II servicing fee if such reallocation would result in the reduction of the nominal liquidation amount of such senior class of notes. For a multiple tranche series, these reductions will generally be allocated within each class pro rata to each outstanding tranche of the related class based on the Weighted Average Available Funds Allocation Amount of such tranche. |

| · | The nominal liquidation amount of a note will be reduced by the amount on deposit in its respective principal funding subaccount. |

| · | The nominal liquidation amount of a note will be reduced by the amount of all payments of principal of that note. |

| · | Upon a sale of credit card receivables after the insolvency of Funding, an event of default and acceleration or on the legal maturity date of a note, the nominal liquidation amount of such note will be automatically reduced to zero. See “Sources of Funds to Pay the Notes—Sale of Credit Card Receivables.” |

| · | the date of the payment in full of the stated principal amount of and all accrued, past due and additional interest on those notes; |

| · | the date on which the outstanding dollar principal amount of the notes is reduced to zero and all accrued, past due and additional interest on those notes is paid in full; |

| · | the legal maturity date of those notes, after giving effect to all deposits, allocations, reallocations, sale of credit card receivables and payments to be made on that date; or |

| · | the date on which a sale of receivables has taken place for such tranche, as described in “Sources of Funds to Pay the Notes—Sale of Credit Card Receivables.” |

| (i) | a fraction, the numerator of which is the Class A required subordinated amount of Class C notes for all Class A BAseries notes that require any credit enhancement from Class B BAseries notes, and the denominator of which is the aggregate adjusted outstanding dollar principal amount of all Class B BAseries notes; plus |

| (ii) | 11.11111% (referred to as the unencumbered percentage) multiplied by a fraction, the numerator of which is the aggregate adjusted outstanding dollar principal amount of all Class B BAseries notes minus the required subordinated amount of Class B notes for all Class A BAseries notes, and the denominator of which is the aggregate adjusted outstanding dollar principal amount of all Class B BAseries notes. |

| · | a decrease in the aggregate Adjusted Outstanding Dollar Principal Amount of Class A BAseries notes, |

| · | a decrease in the Class A required subordinated amount of Class B or Class C notes for outstanding tranches of Class A BAseries notes, or |

| · | the issuance of additional Class B BAseries notes. |

| · | received confirmation from each rating agency that has rated any outstanding notes that the change will not result in the reduction, qualification or withdrawal of its then‑current rating of any outstanding notes in the BAseries; |

| · | delivered an opinion of counsel that for federal income tax purposes (1) the change will not adversely affect the tax characterization as debt of any outstanding series or class of investor certificates issued by master trust II that were characterized as debt at the time of their issuance, (2) following the change, master trust II will not be treated as an association, or a publicly traded partnership, taxable as a corporation, and (3) such change will not cause or constitute an event in which gain or loss would be recognized by any holder of an investor certificate issued by master trust II; and |

| · | delivered an opinion of counsel that for federal income tax purposes (1) the change will not adversely affect the tax characterization as debt of any outstanding series, class or tranche of notes of the issuing entity that were characterized as debt at the time of their issuance, (2) following the change, the issuing entity will not be treated as an association, or publicly traded partnership, taxable as a corporation, and (3) such change will not cause or constitute an event in which gain or loss would be recognized by any holder of such notes. |

| · | the aggregate nominal liquidation amount of all tranches of outstanding Class B notes on that date, after giving effect to any issuances, deposits, allocations, reallocations or payments for Class B notes to be made on that date; minus |

| · | the aggregate amount of the Class A required subordinated amount of Class B notes for all other Class A notes which are outstanding on that date, after giving effect to any issuances, deposits, allocations, reallocations or payments for Class A notes to be made on that date. |

| · | the aggregate nominal liquidation amount of all tranches of outstanding Class C notes on that date, after giving effect to any issuances, deposits, allocations, reallocations or payments for Class C notes to be made on that date; minus |

| · | the aggregate amount of the Class A required subordinated amount of Class C notes for all tranches of Class A notes for which the Class A required subordinated amount of Class B notes is equal to zero which are outstanding on that date, after giving effect to any issuances, deposits, allocations, reallocations or payments for Class A notes to be made on that date. |

| · | the aggregate nominal liquidation amount of all tranches of Class C notes which are outstanding on that date, after giving effect to any issuances, deposits, allocations, reallocations or payments for Class C notes to be made on that date; minus |

| · | the sum of: |

| – | the aggregate amount of the Class B required subordinated amount of Class C notes for all other tranches of Class B notes which are outstanding on that date, after giving effect to any issuances, deposits, allocations, reallocations or payments for any BAseries notes to be made on that date; plus |

| – | the aggregate amount of the Class A required subordinated amount of Class C notes for all tranches of Class A notes for which the Class A required subordinated amount of Class B notes is equal to zero which are outstanding on that date, after giving effect to any issuances, deposits, allocations, reallocations or payments for those Class A notes to be made on that date. |

| · | If after giving effect to the proposed principal payment there is still a sufficient amount of subordinated notes to support the outstanding senior notes. See “Sources of Funds to Pay the Notes—Deposit and Application of Funds for the BAseries—Targeted Deposits of BAseries Available Principal Amounts to the Principal Funding Account” and “—Allocation to Principal Funding Subaccounts.” For example, if a tranche of Class A notes has been repaid, this generally means that, unless other Class A notes are issued, at least some Class B notes and Class C notes may be repaid when they are expected to be repaid even if other tranches of Class A notes are outstanding. |

|

·

|

If the principal funding subaccounts for the senior classes of notes have been sufficiently prefunded as described in “Sources of Funds to Pay the Notes—Deposit and Application of Funds for the BAseries—Targeted Deposits of BAseries Available Principal Amounts to the Principal Funding Account—Prefunding of the Principal Funding Account for Senior Classes.”

|

| · | If new tranches of subordinated notes are issued so that the subordinated notes that have reached their expected principal payment date are no longer necessary to provide the required subordination. |

| · | If the subordinated tranche of notes reaches its legal maturity date and there is a sale of credit card receivables as described in “Sources of Funds to Pay the Notes—Sale of Credit Card Receivables.” |

| · | (i) the Adjusted Outstanding Dollar Principal Amount of the Class A notes (other than the Class A(2001‑Emerald) notes), divided by 0.6825, minus (ii) the Adjusted Outstanding Dollar Principal Amount of the Class A notes (other than the Class A(2001‑Emerald) notes), minus (iii) the aggregate Class A required subordinated amount of Class B notes, minus (iv) the aggregate Class A required subordinated amount of Class C notes minus the Class A required subordinated amount of Class C notes for the Class A(2001‑Emerald) notes; plus |

| · | (i) the Adjusted Outstanding Dollar Principal Amount of the Class A(2001‑Emerald) notes, divided by 0.85, minus (ii) the Adjusted Outstanding Dollar Principal Amount of the Class A(2001‑Emerald) notes, minus (iii) the Class A required subordinated amount of Class C notes for the Class A(2001‑Emerald) notes; plus |

| · | (i) (A) the Adjusted Outstanding Dollar Principal Amount of the Class B notes minus the aggregate Class A required subordinated amount of Class B notes, divided by (B) 0.795, minus (ii) the Adjusted Outstanding Dollar Principal Amount of the Class B notes minus the aggregate Class A required subordinated amount of Class B notes, minus (iii) (A) the Adjusted Outstanding Dollar Principal Amount of the Class B notes minus the aggregate Class A required subordinated amount of Class B notes, times (B) 0.1111111; plus |

| · | (i) (A) the Adjusted Outstanding Dollar Principal Amount of the Class C notes minus the sum of (x) the aggregate Class B required subordinated amount of Class C notes plus (y) the Class A required subordinated amount of Class C notes for the Class A(2001‑Emerald) notes, divided by (B) 0.895, minus (ii) the Adjusted Outstanding Dollar Principal Amount of the Class C notes minus the sum of (A) the aggregate Class B required subordinated amount of Class C notes plus (B) the Class A required subordinated amount of Class C notes for the Class A(2001‑Emerald) notes. |

| · | received confirmation from each rating agency that has rated any outstanding notes that the change will not result in the reduction, qualification or withdrawal of its then‑current rating of any outstanding notes; |

| · | delivered an opinion of counsel that for federal income tax purposes (1) the change will not adversely affect the tax characterization as debt of any outstanding series or class of investor certificates issued by master trust II that were characterized as debt at the time of their issuance, (2) following the change, master trust II will not be treated as an association, or a publicly traded partnership, taxable as a corporation, and (3) such change will not cause or constitute an event in which gain or loss would be recognized by any holder of an investor certificate issued by master trust II; and |

| · | delivered an opinion of counsel that for federal income tax purposes (1) the change will not adversely affect the tax characterization as debt of any outstanding series, class or tranche of notes of the issuing entity that were characterized as debt at the time of their issuance, (2) following the change, the issuing entity will not be treated as an association, or publicly traded partnership, taxable as a corporation, and (3) such change will not cause or constitute an event in which gain or loss would be recognized by any holder of such notes. |

| · | first, on or before the third Business Day before a new issuance of notes, the issuing entity gives the indenture trustee and the rating agencies written notice of the issuance; |

| · | second, on or prior to the date that the new issuance is to occur, the issuing entity delivers to the indenture trustee and each rating agency a certificate to the effect that: |

|

—

|

the issuing entity reasonably believes that the new issuance will not at the time of its occurrence or at a future date (i) cause an early redemption event or event of default, (ii) adversely affect the amount of funds available to be distributed to noteholders of any series, class or tranche of notes or the timing of such distributions, or (iii) adversely affect the security interest of the indenture trustee in the collateral securing the outstanding notes;

|

|

—

|

all instruments furnished to the indenture trustee conform to the requirements of the indenture and constitute sufficient authority under the indenture for the indenture trustee to authenticate and deliver the notes;

|

|

—

|

the form and terms of the notes have been established in conformity with the provisions of the indenture;

|

|

—

|

all laws and requirements relating to the execution and delivery by the issuing entity of the notes have been complied with, the issuing entity has the power and authority to issue the notes, and the notes have been duly authorized and delivered by the issuing entity, and, assuming due authentication and delivery by the indenture trustee, constitute legal, valid and binding obligations of the issuing entity enforceable in accordance with their terms (subject to certain limitations and conditions), and are entitled to the benefits of the indenture equally and ratably with all other notes, if any, of such series, class or tranche outstanding subject to the terms of the indenture, each indenture supplement and each terms document; and

|

|

—

|

the issuing entity shall have satisfied such other matters as the indenture trustee may reasonably request;

|

| · | third, the issuing entity delivers to the indenture trustee and the rating agencies an opinion of counsel that for federal income tax purposes (i) the new issuance will not adversely affect the tax characterization as debt of any outstanding series or class of investor certificates issued by master trust II that were characterized as debt at the time of their issuance, (ii) following the new issuance, master trust II will not be treated as an association, or a publicly traded partnership, taxable as a corporation, and (iii) the new issuance will not cause or constitute an event in which gain or loss would be recognized by any holder of an investor certificate issued by master trust II; |

| · | fourth, the issuing entity delivers to the indenture trustee and the rating agencies an opinion of counsel that for federal income tax purposes (i) the new issuance will not adversely affect the tax characterization as debt of any outstanding series, class or tranche of notes that were characterized as debt at the time of their issuance, (ii) following the new issuance, the issuing entity will not be treated as an association, or publicly traded partnership, taxable as a corporation, (iii) such issuance will not cause or constitute an event in which gain or loss would be recognized by any holder of such outstanding notes, and (iv) except as provided in the related indenture supplement, following the new issuance of a series, class or tranche of notes, the newly issued series, class or tranche of notes will be properly characterized as debt; |

| · | fifth, the issuing entity delivers to the indenture trustee an indenture supplement and terms document relating to the applicable series, class or tranche of notes; |

| · | sixth, no Pay Out Event with respect to Series 2001‑D has occurred or is continuing as of the date of the new issuance; |