WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2019 ANNUAL REPORT

Table of Contents

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2019 ANNUAL REPORT

BUSINESS DESCRIPTION

Washington Federal Bank, National Association, a federally-insured national bank dba WaFd Bank (the “Bank” or “WaFd Bank”), was founded on April 24, 1917 in Ballard, Washington and is engaged primarily in providing lending, depository, insurance and other banking services to consumers, mid-sized to large businesses, and owners and developers of commercial real estate. Washington Federal, Inc., a Washington corporation (the “Company”), was formed as the Bank’s holding company in November, 1994. As used throughout this document, the terms “Washington Federal” or the “Company” refer to the Company and its consolidated subsidiaries, and the term “Bank” refers to the operating subsidiary, Washington Federal Bank, National Association. The Company is headquartered in Seattle, Washington.

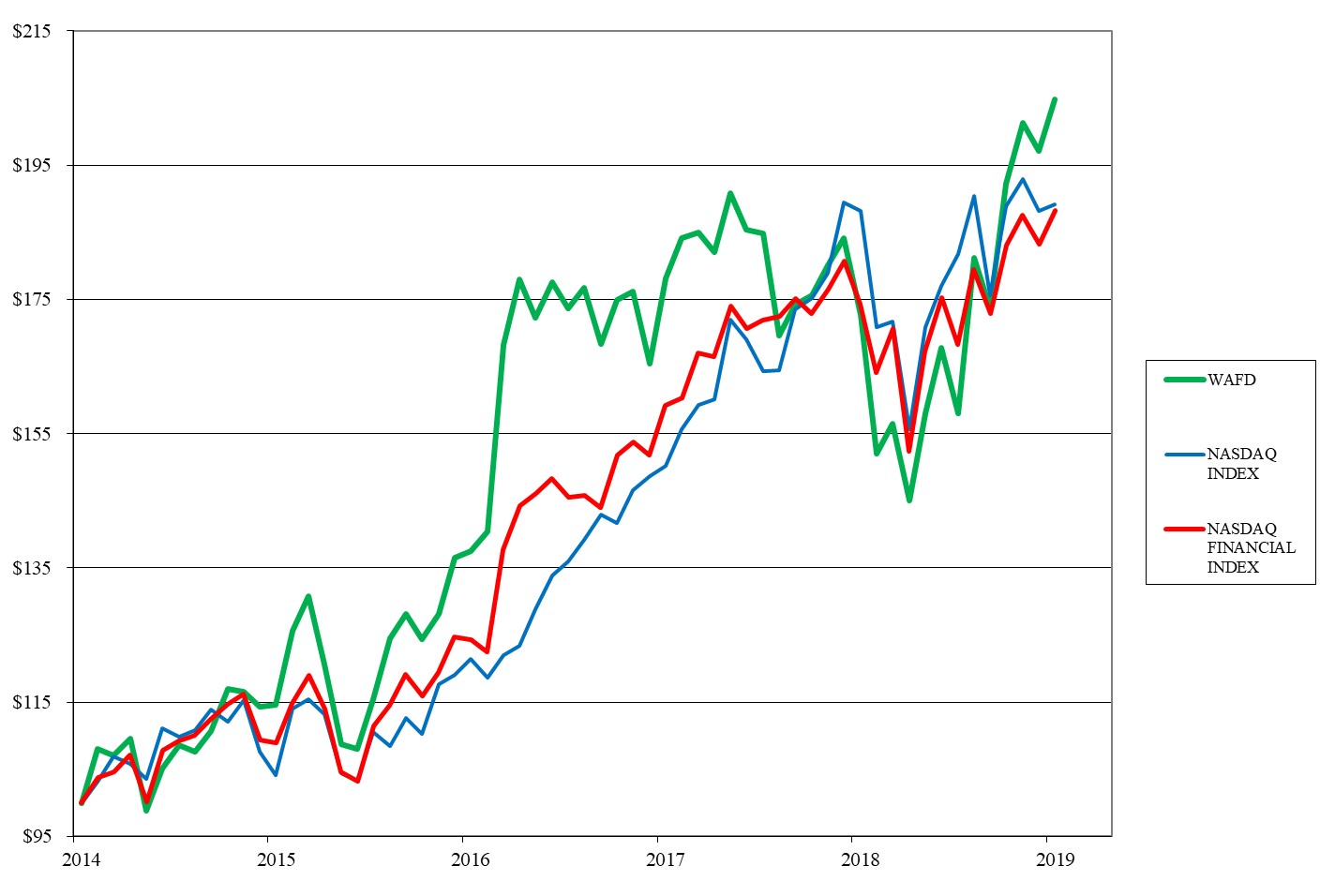

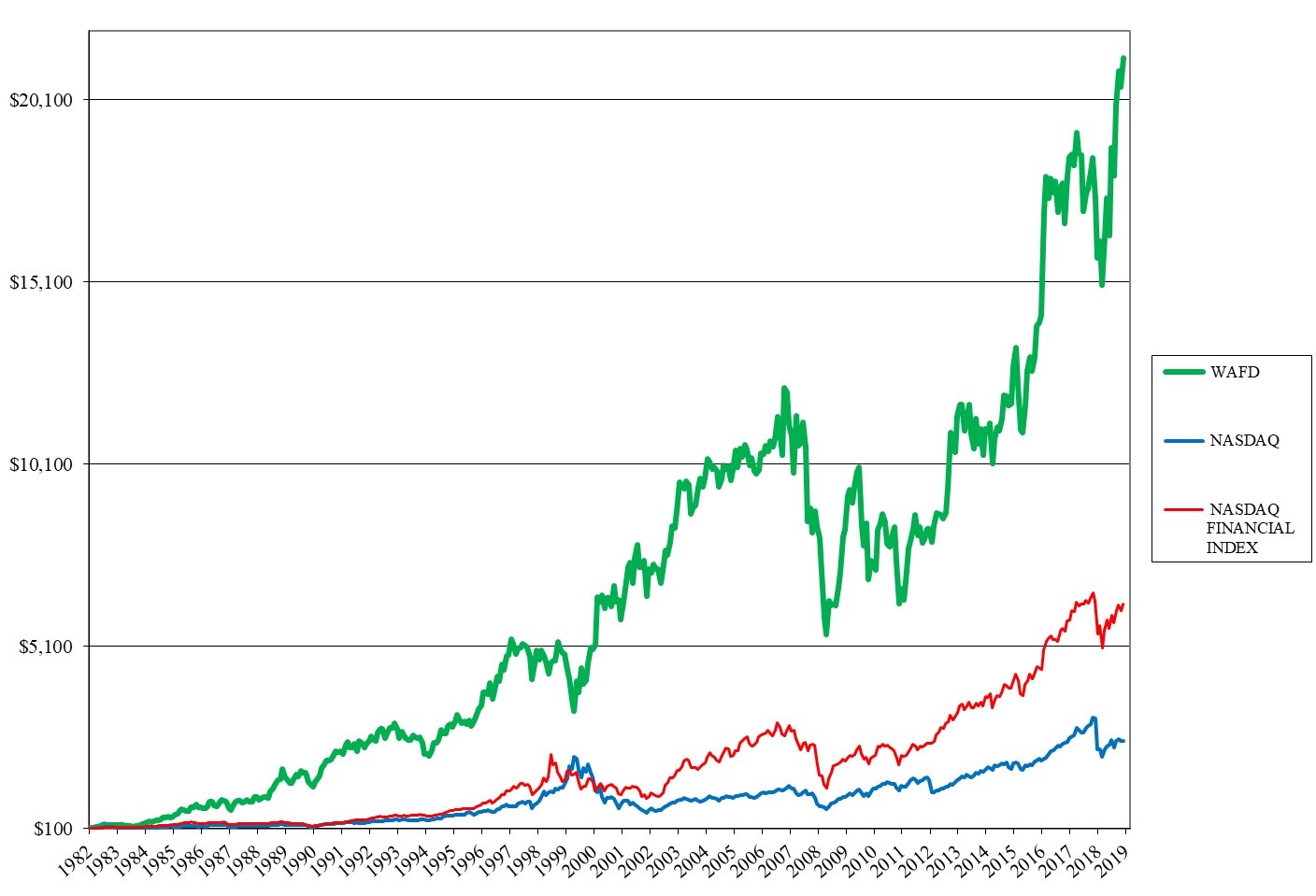

On November 9, 1982 the Company listed and began trading on the NASDAQ. Profitable operations have been recorded every year since and the Company ranks in the top 15% of the 100 largest publicly traded U.S. banks in terms of capital strength. As of September 30, 2019, the stock traded at 100 times its original 1982 offering price, has paid 146 consecutive quarterly cash dividends and has returned 14,234% total shareholder return to those who invested 37 years ago.

Over the years, the Company has expanded to serve banking clients in eight western states. While much has changed since its founding, one constant has been the commitment to doing business with integrity and treating employees, clients and investors fairly. Our tagline “invested here” is intended to reflect our people-first values and express the Company’s dedication to helping our neighborhoods and communities thrive.

FINANCIAL HIGHLIGHTS

|

| | | | | | | |

As of and for the year end September 30, | 2019 | 2018 | % Change |

| (In thousands, except per share and ratio data) |

Assets | $ | 16,474,910 |

| $ | 15,865,724 |

| +3.8% |

Cash and cash equivalents | 419,158 |

| 268,650 |

| +56.0 |

Investment securities | 503,183 |

| 415,454 |

| +21.1 |

Loans receivable, net | 11,930,575 |

| 11,477,081 |

| +4.0 |

Mortgage-backed securities | 2,426,039 |

| 2,524,923 |

| (3.9) |

Customer deposits | 11,990,764 |

| 11,387,146 |

| +5.3 |

FHLB advances and other borrowings | 2,250,000 |

| 2,330,000 |

| (3.4) |

Shareholders’ equity | 2,032,995 |

| 1,996,908 |

| +1.8 |

Net income | 210,256 |

| 203,850 |

| +3.1 |

Diluted earnings per share | 2.61 |

| 2.40 |

| +8.8 |

Dividends per share | 0.79 |

| 0.67 |

| +17.9 |

Shareholders’ equity per share | 25.79 |

| 24.14 |

| +6.8 |

Shares outstanding | 78,841 |

| 82,711 |

| (4.7) |

Return on average shareholders’ equity | 10.46 | % | 10.16 | % | +3.0 |

Return on average assets | 1.28 |

| 1.31 |

| (2.3) |

Efficiency ratio (1) (2) | 52.09 |

| 50.37 |

| +3.4 |

| |

(1) | Calculated as total operating costs divided by net interest income, plus other income (excluding non-operating gains) |

| |

(2) | Efficiency ratio for the year ended September 30, 2018 excludes the impact of $8,550,000 reduction to non-interest income related to FDIC loss share valuation adjustments. |

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2019 ANNUAL REPORT

ANNUAL REPORT 2019

Fellow Shareholder,

Fiscal 2019 was another record-breaking year for your Company, Washington Federal. Net income for the year was $210,256,000, a 3.1% increase over the $203,850,000 generated last year. Earnings per share, perhaps the most important measure of performance for shareholders, increased to $2.61 per share, 8.8% higher than the previous record of $2.40 set in 2018. In this letter last year, I spoke of our stock trading below its intrinsic value at the time. It is gratifying to see how our stock appreciated in value since then, generating a total shareholder return of over 18% for the fiscal year.

Banking, if done correctly, should be a boring business. In its simplest form, a bank is a financial intermediary. We take in deposits from those who have worked hard and built a surplus and lend that money out to credit-worthy borrowers. The difference between what we earn on the loans and what we pay to depositors is the main driver of our profitability, known as the net interest margin. This year, we turned our focus to growing organically and found success growing deposits by $604 million or 5%. Even more importantly, we were able to grow transaction accounts by $501 million or 8%. We attribute this growth to significantly improved capabilities in our commercial treasury management system and a cloud-based online and mobile banking solution for our consumer clients. As of June 30, 2019, our weighted average market share of the total deposits in our eight states is only 0.87%, demonstrating the significant opportunity we have to gain additional market share if we’re able to execute on our vision of becoming a digital-first bank that anticipates the needs of our clients and makes banking simple, reliable and FAST.

Net loan growth totaled $453 million or 4% as market interest rates declined causing loan pre-payments to accelerate. The quality of loans originated is perhaps the most important attribute of banks that survive the downturns in economic cycles. Recessions happen, as do economic booms. The key from our perspective is to have a strong enough balance sheet to remain a reliable resource for our clients in both good times and bad. Acknowledging we are experiencing one of the longest economic expansions of our lifetimes, we are preparing for a potential downturn by maintaining:

| |

1) | Strong tangible capital and an allowance for loan losses. Together, these totaled $1.9 billion at year end. |

| |

2) | Client selectivity. We underwrite loans assuming economic stresses will occur and seek borrowers who are fiscally conservative. This type of borrower typically does not maximize leverage and has capital and liquidity buffers to offset future volatility. |

| |

3) | Ample liquidity. At year end, we had on-balance-sheet liquidity of $2.8 billion plus an additional $5.9 billion in borrowing capacity. |

Experience has shown we have historically taken less credit risk than our peers and it is our intent to continue to grant credit judiciously. That said, we understand that we can and likely will make mistakes that will become evident during the next downturn with the benefit of hindsight. Risks may be inherent in our balance sheet and the market today that are different than what we have faced historically. For these reasons, we believe in maintaining a capital level that is larger than most of our peers. The ratio we focus on is tangible common equity plus allowance as a percentage of tangible assets. As of September 30, 2019, this ratio was 11.48% and the bank ranked #15 of the largest 100 publicly traded banks in the United States.

As the saying goes, “beauty is in the eye of the beholder,” and the same can be said of stock valuations. I have increasingly been focused on a measure we refer to as “return on market cap.” It is calculated by taking after-tax earnings for the last four quarters and dividing by our current market capitalization. It is another way of looking at the very common price-to-earnings ratio. The return on market cap is simply the inverse of the P/E ratio. As of the writing of this letter, WAFD stock return on market cap is 7.26%. When compared to other available investments, coupled with our belief in our prospects for growth, we see the stock price still trading below its intrinsic value, and thus have continued to repurchase shares. Currently, the Board has authorized repurchases up to an additional 8 million shares.

As part of our strategic plan, we are intentionally increasing our investments in operations, specifically in the areas of technology and regulatory compliance. For the year, our operating expenses increased by $19 million or 7% and we expect to continue making investments that will improve the banking experience for our clients. One of our core values is that we are disciplined in our actions. In the area of expenses, that means if we make an investment, we expect to see results. What are some of the results of these investments?

| |

1) | Organic growth of loans and deposits as mentioned above. |

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2019 ANNUAL REPORT

| |

2) | Significant improvement in our net promoter score from 17 in 2017, to 34 in 2018 and now 48 in 2019. In terms of scale, a score of 50 is thought to be excellent and basically means that our clients are far more likely to recommend us today than they were three years ago. |

| |

3) | Our mobile bank app is now a 4.8-star rating, a significant improvement from the 2.5 stars one year ago. |

Future investments will center on improved mobile and online banking experiences, more efficient loan origination systems, and the automation of back office workflows to better understand our clients and anticipate their needs.

During the year, we announced the evolution of our brand name to WaFd Bank. Through the years, we heard that the name “Washington Federal” caused confusion about what we did. Some told us they weren’t sure if we were a part of the Federal government or perhaps a credit union. We are solving this by re-branding to WaFd Bank. This name pays tribute to our incredible 102-year legacy of doing the right thing for our clients and shareholders, and at the same time confirms to the world we are a “bank.” The early feedback is quite positive, with most clients viewing this as a non-event. Some even tell us, “I thought that was already your name” or that “the new branding is fresh and clean.”

We were fortunate during the past year to attract two well-qualified directors onto our Board. Stephen Graham is a partner with the law firm Fenwick & West LLP with expertise in corporate governance, mergers and acquisitions and securities regulation matters. Linda Brower is a career banking executive, having served in leadership roles at both US Bank and WaFd Bank. She has significant experience in bank operations, human capital, technology and compliance. We welcome both Linda and Steve to our Board of Directors and believe they will both contribute to the long-term success of your company.

At the annual meeting in January, we will bid farewell to Director Anna Johnson, who will be stepping down from the Board after 25 years of dedicated service. Anna has played an integral part in setting the strategic direction for the bank and connecting us firmly to the values that serve as our foundation for all our decisions. A small business owner, she has provided unique perspective on the challenges our clients face and where the bank can add value.

Mr. Mark Schoonover is transitioning into retirement after ten years at the Bank as our Chief Credit Officer. Mark has been instrumental in executing our credit standards and working through the wave of problem assets that came with the Great Recession. Mr. Bob Peters is also transitioning into retirement from his role as the leader of our commercial bank for the last five years. Bob has significantly expanded our skillset in commercial banking and introduced the Bank to many clients that will help drive our growth going forward. Replacing Mark and Bob are Ryan Mauer as Chief Credit Officer and James Endrizzi as the Senior Vice President of Commercial Banking. We are fortunate to have their combined 50 years of banking experience and will benefit from their first-hand knowledge of what differentiates WaFd Bank from others in the industry.

I conclude by saying how thankful I am for the incredible team of employees that make WaFd Bank a special place. In addition to the financial results shown in this report, our team has contributed over 15,400 hours of community service and donated over $1,466,000 dollars to charitable causes. Because of the intelligence and hard work of the nearly 2,000 employees that choose to build their careers here, the record results described above were possible for all of us as shareholders.

I look forward to seeing you at your Company’s Annual Meeting of Shareholders, scheduled for the Washington Athletic Club, 1325 6th Avenue in downtown Seattle, on January 22, 2020 at 2 p.m. In the meantime, we invite you to help our business grow and prosper by referring your friends, neighbors, and the businesses you associate with to WaFd Bank for all their banking needs. We look forward to serving you in the coming new year.

Sincerely,

Brent J. Beardall

President and Chief Executive Officer

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2019 ANNUAL REPORT

Back row from left to right: Ryan Mauer, Senior Vice President & Chief Credit Officer; Vince Beatty, Executive Vice President & Chief Financial Officer; Cathy Cooper, Executive Vice President Retail Banking; James Endrizzi, Senior Vice President Commercial Banking

Front row from left to right: Brent Beardall, President & Chief Executive Officer; Kim Robison, Executive Vice President Operations

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

We make statements in this Annual Report that constitute forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates,” “intends,” “forecasts,” “projects” and other similar expressions, as well as future or conditional verbs such as “will,” “should,” “would” and “could,” are intended to help identify such forward-looking statements. These statements are not historical facts, but instead represent current expectations, plans or forecasts of the Company and are based on the beliefs and assumptions of the management of the Company and the information available to management at the time that these disclosures were prepared. The Company intends for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and often are beyond the Company's control. Actual outcomes and results may differ materially from those expressed in, or implied by, the Company's forward-looking statements.

You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties discussed elsewhere in this report, and under "Item 1A. Risk Factors” contained in our Form 10-K for the fiscal year ended September 30, 2019, and in any of the Company's other subsequent Securities and Exchange Commission filings, which could cause our future results to differ materially from the plans, objectives, goals, estimates, intentions and expectations expressed in forward-looking statements:

| |

• | a deterioration in economic conditions, including declines in the real estate market and home sale volumes and financial stress on borrowers as a result of the uncertain economic environment; |

| |

• | the effects of a severe economic downturn, including high unemployment rates and declines in housing prices and property values, in the Company's primary market areas; |

| |

• | the effects of and changes in monetary and fiscal policies of the Board of Governors of the Federal Reserve System and the U.S. Government; |

| |

• | fluctuations in interest rate risk and changes in market interest rates, including risk related to LIBOR reform; |

| |

• | the Company's ability to make accurate assumptions and judgments about the collectability of its loan portfolio, including the creditworthiness of its borrowers and the value of the assets securing these loans; |

| |

• | legislative and regulatory limitations, including those arising under the Dodd-Frank Act and potential limitations in the manner in which the Company conducts its business and undertakes new investments and activities; |

| |

• | the ability of the Company to obtain external financing to fund its operations or obtain this financing on favorable terms; |

| |

• | changes in other economic, competitive, governmental, regulatory, and technological factors affecting the Company's markets, operations, pricing, products, services and fees; |

| |

• | the success of the Company at managing the risks involved in the remediation efforts associated with its Bank Secrecy Act program, costs of enhancements to the Bank’s BSA program are greater than anticipated; and governmental authorities undertake enforcement actions or legal proceedings with respect to the Bank’s BSA program beyond those contemplated by the Consent Order, and the potential impact of such matters on the success, timing and ability to pursue the Company’s growth or other business initiatives; |

| |

• | the success of the Company at managing the risks involved in the foregoing and managing its business; and |

| |

• | the timing and occurrence or non-occurrence of events that may be subject to circumstances beyond the Company's control. |

All forward-looking statements speak only as of the date on which such statements are made, and the Company undertakes no obligation to update or revise any forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events, changes to future operating results over time, or the impact of circumstances arising after the date the forward-looking statement was made.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

GENERAL

Washington Federal Bank, National Association, a federally-insured national bank dba WaFd Bank (the “Bank” or “WaFd Bank”), was founded on April 24, 1917 in Ballard, Washington and is engaged primarily in providing lending, depository, insurance and other banking services to consumers, mid-sized to large businesses, and owners and developers of commercial real estate. Washington Federal, Inc., a Washington corporation (the “Company”), was formed as the Bank’s holding company in November, 1994. As used throughout this document, the terms “Washington Federal” or the “Company” refer to the Company and its consolidated subsidiaries, and the term “Bank” refers to the operating subsidiary, Washington Federal Bank, National Association. The Company is headquartered in Seattle, Washington.

The Company's fiscal year end is September 30. All references to 2019, 2018 and 2017 represent balances as of September 30, 2019, September 30, 2018, and September 30, 2017, or activity for the fiscal years then ended.

CRITICAL ACCOUNTING POLICIES

Preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions that affect reported amounts of certain assets, liabilities, revenues and expenses in the Company's consolidated financial statements. Accordingly, estimated amounts may fluctuate from one reporting period to another due to changes in assumptions underlying estimated values.

The Company has determined that the only accounting policy critical to an understanding of the consolidated financial statements of Washington Federal relates to the methodology for determining the amount of the allowance for loan losses. The Company maintains an allowance to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio.

The general loan loss allowance is established by applying a loss percentage factor to the different loan types. For example, residential real estate loans are not individually analyzed for impairment and loss exposure because of the significant number of loans, their relatively small balances and their historically low level of losses. See the "Asset Quality and Allowance for Loan Losses" section below for additional information about establishing the loss factors. Specific allowances may be established for loans that are deemed to be individually impaired.

INTEREST RATE RISK

The primary source of income for the Company is net interest income, which is the difference between the interest income generated by interest-earning assets and the interest expense incurred for interest-bearing liabilities. The level of net interest income is a function of the average balance of interest-earning assets and interest-bearing liabilities and the difference between the yield on earning assets and the cost of interest-bearing liabilities. Both the pricing and mix of the Company's interest-earning assets and interest-bearing liabilities influence these factors. All else being equal, if the interest rates on the Company's interest-bearing liabilities increase at a faster pace than the interest rates on its interest-earning assets, the result would be a reduction in net interest income and with it, a reduction in net earnings.

Based on management's assessment of the current interest rate environment, the Company has taken steps, including growing commercial loans having shorter average lives and transaction deposit accounts, to position itself for changing interest rates.

The Company's balance sheet strategy, in conjunction with low operating costs, has allowed the Company to manage interest rate risk, within guidelines established by the Board of Directors, through all interest rate cycles. It is management's objective to grow the dollar amount of net interest income through the rate cycles, acknowledging that there will be some periods of time when that will not be feasible.

Management relies on various measures of interest rate risk, including modeling of changes in the Company's forecasted net interest income under various rate change scenarios, the impact of interest rate changes on the net portfolio value ("NPV") and an asset/liability maturity gap analysis.

Net Interest Income Sensitivity. We estimate the sensitivity of our net interest income to changes in market interest rates using an interest rate simulation model that includes assumptions related to the level of balance sheet growth, deposit repricing characteristics and the rate of prepayments for multiple interest rate change scenarios. Interest rate sensitivity depends on certain

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

repricing characteristics in our interest-earning assets and interest-bearing liabilities, including the maturity structure of assets and liabilities and their repricing characteristics during the periods of changes in market interest rates. The analysis assumes a constant balance sheet. Actual results would differ from the assumptions used in this model, as management monitors and adjusts loan and deposit pricing and the size and composition of the balance sheet to respond to changing interest rates.

In the event of an immediate and parallel increase of 200 basis points in both short- and long-term interest rates, the model estimates that net interest income would increase by 1.4% in the next year. This compares to an estimated decrease of 1.9% as of the September 30, 2018, analysis. It is noted that a flattening yield curve where the spread between short-term rates and long-term rates decreases would likely result in lower net interest income. Management estimates that a gradual increase of 300 basis points in short-term rates and 100 basis points in long-term rates over two years would result in no meaningful change in net interest income in the first year and a decrease of 2.1% in the second year, assuming a constant balance sheet and no management intervention.

NPV Sensitivity. The NPV is an estimate of the market value of shareholders' equity at a point in time. It is derived by calculating the difference between the present value of expected cash flows from interest-earning assets and the present value of expected cash flows from interest-paying liabilities and off-balance-sheet contracts. The sensitivity of the NPV to changes in interest rates provides a longer term view of interest rate risk as it incorporates all future expected cash flows. As of September 30, 2019, in the event of an immediate and parallel increase of 200 basis points in interest rates, the NPV is estimated to decline by $258 million, or 10.5%, and the NPV-to-total assets ratio to decline to 13.9% from a base of 14.6%. As of September 30, 2018, in the event of an immediate and parallel increase of 200 basis points in interest rates, the NPV was estimated to decline by $418 million, or 18.2%, and the NPV-to-total assets ratio to decline to 12.9% from a base of 14.7%. The decrease in the sensitivity of the NPV ratio to this assumed change in interest rates is primarily due to the flattening of the yield curve and changes in balance sheet mix year over year.

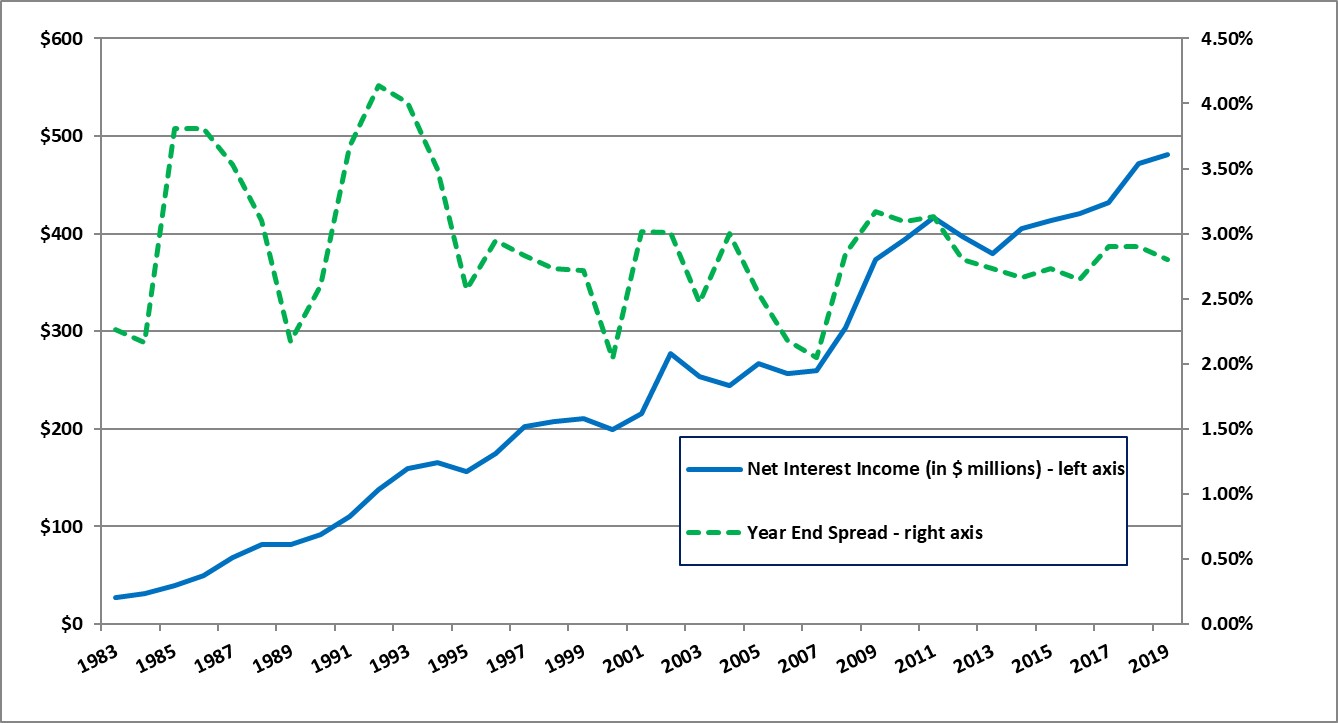

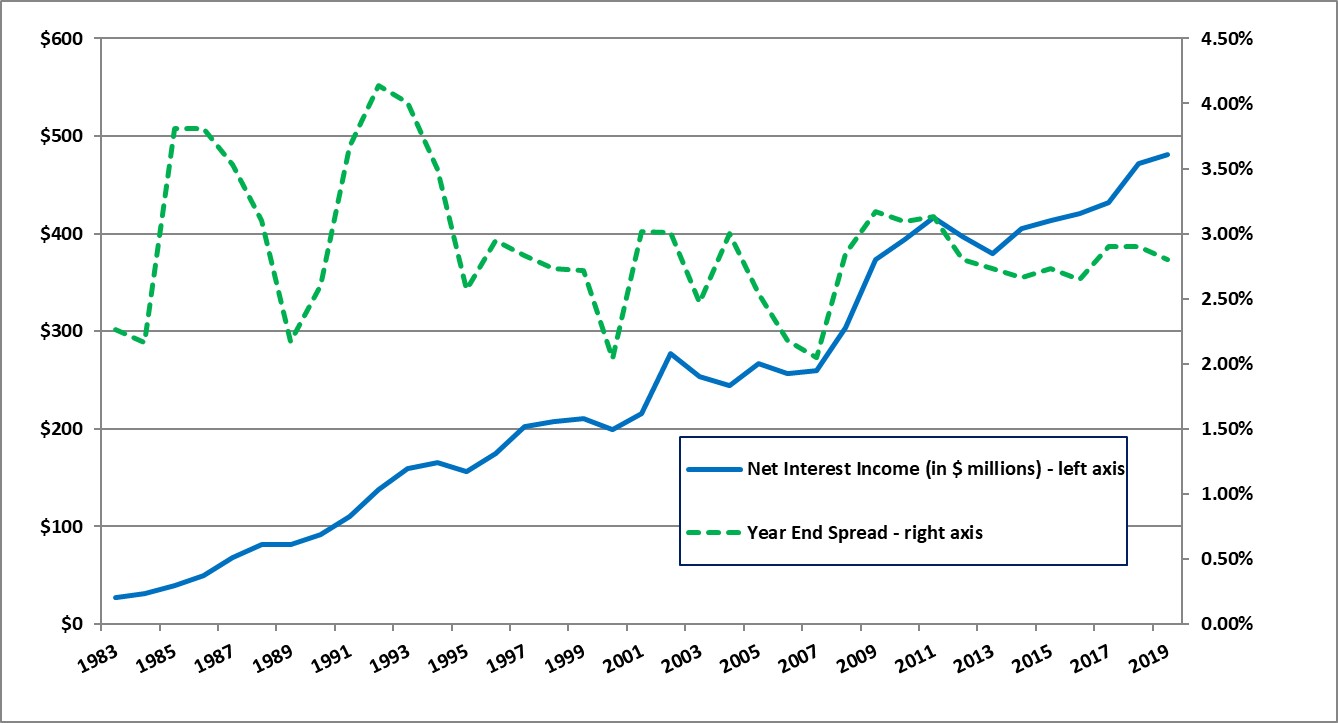

Interest Rate Spread. The interest rate spread is measured as the difference between the rate on interest-earning assets and the rate on interest-bearing liabilities at the end of each period. The interest rate spread was 2.80% at September 30, 2019 and 2.90% at September 30, 2018. As of September 30, 2019, the weighted average rate on interest-earning assets increased by 3 basis points to 4.10% compared to September 30, 2018. The improved rate on interest-earning assets is due primarily to changes in asset mix as commercial loans comprised a higher proportion of assets. As of September 30, 2019, the weighted average rate on interest-bearing liabilities increased by 13 basis points to 1.30% compared to September 30, 2018. The higher rate on interest-bearing liabilities is due primarily to rising interest rates on customer deposits, partially offset by a lower rate on FHLB borrowings due to lower rates on new FHLB advances and maturing advances with higher rates.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| SEP 2019 | | JUN 2019 | | MAR 2019 | | DEC 2018 | | SEP 2018 | | JUN 2018 | | MAR 2018 | | DEC 2017 |

Interest rate on loans and mortgage-backed securities | 4.25 | % | | 4.32 | % | | 4.32 | % | | 4.28 | % | | 4.19 | % | | 4.13 | % | | 4.06 | % | | 3.99 | % |

Interest rate on other interest-earning assets | 2.10 |

| | 2.37 |

| | 2.33 |

| | 2.25 |

| | 2.13 |

| | 2.18 |

| | 1.87 |

| | 1.59 |

|

Combined, all interest-earning assets | 4.10 |

| | 4.21 |

| | 4.20 |

| | 4.17 |

| | 4.07 |

| | 4.01 |

| | 3.94 |

| | 3.85 |

|

Interest rate on customer accounts | 1.08 |

| | 1.13 |

| | 1.09 |

| | 0.99 |

| | 0.87 |

| | 0.75 |

| | 0.65 |

| | 0.57 |

|

Interest rate on borrowings | 2.49 |

| | 2.58 |

| | 2.77 |

| | 2.75 |

| | 2.66 |

| | 2.64 |

| | 2.62 |

| | 2.56 |

|

Combined cost of funds | 1.30 |

| | 1.39 |

| | 1.39 |

| | 1.31 |

| | 1.17 |

| | 1.08 |

| | 0.99 |

| | 0.93 |

|

Interest rate spread | 2.80 | % | | 2.82 | % | | 2.81 | % | | 2.86 | % | | 2.90 | % | | 2.93 | % | | 2.95 | % | | 2.92 | % |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The chart below shows the volatility of our period end net interest spread (dashed line measured against the right axis) compared to the relatively consistent growth in net interest income (solid line measured against the left axis). The relative consistency of net interest income is accomplished by actively managing the size and composition of the balance sheet through different rate cycles.

Net Interest Margin. The net interest margin is measured using the net interest income divided by average interest-earning assets for the period. The net interest margin decreased to 3.16% for the year ended September 30, 2019, from 3.27% for the year ended September 30, 2018. The yield on interest-earning assets increased 22 basis points to 4.42% and the cost of interest-bearing liabilities increased by 34 basis points to 1.34%. The higher yield on interest-earning assets is primarily the result of changes in asset mix as commercial loans comprised a higher proportion of assets. The higher cost on interest-bearing liabilities is due primarily to rising interest rates on customer deposits, partially offset by a lower rate on FHLB borrowings due to lower rates on new FHLB advances and maturing advances with higher rates.

For the year ended September 30, 2019, average interest-earning assets increased by 5.1% to $15,203,819,000, up from $14,459,452,000 for the year ended September 30, 2018. During 2019, average loans receivable increased $612,351,000, or 5.5%, while the combined average balances of mortgage-backed securities, other investment securities and cash increased by $126,052,000 or 4.0%. Management views organic loan growth as the highest and best use of capital; thus the focus on primarily growing loans receivable.

During 2019, average customer deposit accounts increased $594,681,000 or 5.4% and the average balance of FHLB borrowings increased by $149,095,000, or 6.3%, from 2018.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following table sets forth the information explaining the changes in the net interest income and net interest margin for 2019 compared to the prior year.

|

| | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended September 30, 2019 | | Twelve Months Ended September 30, 2018 |

| Average Balance | | Interest | | Average Rate | | Average Balance | | Interest | | Average Rate |

| (In thousands) | | (In thousands) |

Assets | | | | | | | | | | | |

Loans receivable | $ | 11,814,480 |

| | $ | 568,096 |

| | 4.81 | % | | $ | 11,202,129 |

| | $ | 515,807 |

| | 4.60 | % |

Mortgaged-backed securities | 2,554,653 |

| | 74,485 |

| | 2.92 |

| | 2,543,796 |

| | 70,407 |

| | 2.77 |

|

Cash & investments | 699,340 |

| | 22,290 |

| | 3.19 |

| | 584,145 |

| | 15,456 |

| | 2.65 |

|

FHLB & FRB stock | 135,346 |

| | 6,595 |

| | 4.87 |

| | 129,382 |

| | 5,413 |

| | 4.18 |

|

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total interest-earning assets | 15,203,819 |

| | 671,466 |

| | 4.42 | % | | 14,459,452 |

| | 607,083 |

| | 4.20 | % |

Other assets | 1,160,302 |

| | | | | | 1,155,819 |

| |

|

| |

|

|

Total assets | $ | 16,364,121 |

| | | | | | $ | 15,615,271 |

| |

| |

|

| | | | | | | | | | | |

Liabilities and Equity | | | | | | | | | | | |

Customer accounts | $ | 11,663,142 |

| | $ | 122,216 |

| | 1.05 | % | | $ | 11,068,461 |

| | $ | 72,492 |

| | 0.65 | % |

FHLB advances | 2,533,890 |

| | 68,190 |

| | 2.69 |

| | 2,384,795 |

| | 62,452 |

| | 2.62 |

|

|

| |

| |

|

| |

| |

| |

|

|

Total interest-bearing liabilities | 14,197,032 |

| | 190,406 |

| | 1.34 | % | | 13,453,256 |

| | 134,944 |

| | 1.00 | % |

Other liabilities | 156,557 |

| | | | | | 155,950 |

| | | | |

Total liabilities | 14,353,589 |

| | | | | | 13,609,206 |

| | | | |

Shareholders' equity | 2,010,532 |

| | | | | | 2,006,065 |

| | | | |

Total liabilities and equity | $ | 16,364,121 |

| | | | | | $ | 15,615,271 |

| | | | |

Net interest income | | | $ | 481,060 |

| | | | | | $ | 472,139 |

| | |

Net interest margin | | | | | 3.16 | % | | | | | | 3.27 | % |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

ASSET QUALITY & ALLOWANCE FOR LOAN LOSSES

The Company maintains an allowance to absorb losses inherent in the loan portfolio. The amount of the allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company's methodology for determining the appropriateness of the allowance is primarily based on a general allowance methodology and also includes specific reserves. The Company also has a reserve for unfunded commitments.

The loan loss allowance is primarily established by applying a loss percentage factor to the different loan types. Management believes loan types are the most relevant factor in the allowance calculation for groups of homogeneous loans as the risk characteristics within these groups are similar. The loss percentage factor is made up of two parts - the historical loss factor (“HLF”) and the qualitative loss factor (“QLF”).

The HLF takes into account historical charge-offs by loan type. The Company estimates a loss rate for each loan category by using charge-off data over a historical period that encompasses a full credit cycle. These rates are then multiplied by an estimated loss emergence period. The loss emergence period is the likely period of time during which a consumer or commercial loan borrower experiencing financial difficulty might be utilizing their cash reserves prior to becoming delinquent on their loan.

The QLF is based on management's continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, delinquency trends, current economic conditions, collateral values, geographic concentrations, seasoning of the loan portfolio, specific industry conditions and the duration of the current business cycle. These factors are considered by loan type. Single-family residential loan sub-types are evaluated in groups by loan size, loan to value, as well as non-owner or owner occupied. In addition, loan growth or declines for each loan category are taken into consideration.

The total allowance for loan losses increased by $2,277,000, or 1.76%, from $129,257,000 as of September 30, 2018, to $131,534,000 at September 30, 2019. As of September 30, 2019, the Company had $439,000 of specific reserves for loans deemed to be individually impaired and the remaining balance of $131,095,000 is general allowance, which was comprised of $78,280,000 related to HLF and $52,815,000 related to QLF. The Company released $1,650,000 of allowance for loan losses in 2019 due primarily to net recoveries of $3,577,000, comprised of $15,053,000 in recoveries and $11,476,000 in charge offs, partially offset by reserving for overall growth in the loan portfolio.

Unfunded commitments tend to vary depending on the Company's loan mix and the proportionate share of commercial loans. The reserve for unfunded loan commitments was $6,900,000 as of September 30, 2019, compared to $7,250,000 as of September 30, 2018.

The ratio of the allowance for loan losses and reserves for unfunded loan commitments to total gross loans was 1.04% as of September 30, 2019, and 1.06% as of September 30, 2018. Management believes the allowance for loan losses and reserves for unfunded loan commitments is sufficient to absorb estimated losses inherent in the portfolio of loans and unfunded commitments.

The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company's control, which may result in losses or recoveries differing from those estimated.

Restructured loans. Restructured single-family residential loans are reserved for under the Company's loan loss reserve methodology. Most troubled debt restructured ("TDR") loans are performing and accruing loans where the borrower has proactively approached the Company about modifications due to temporary financial difficulties. Each request is individually evaluated for merit and likelihood of success. The concession for these loans is typically a payment reduction through a rate reduction of 100 to 200 basis points for a specific term, usually six to twelve months. Interest-only payments may also be approved during the modification period.

The balance of outstanding TDRs decreased to $121,677,000 as of September 30, 2019, from $156,858,000 as of September 30, 2018. As of September 30, 2019, 95.9% of the restructured loans were performing. During 2019, there were additions of $1,265,000 and reductions of $36,445,000 due to prepayments and transfers to real estate owned ("REO"). As of September 30, 2019, 92.0% of restructured loans are comprised of single-family residential loans.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Concessions for construction, land A&D and multi-family loans are typically an extension of maturity combined with a rate reduction of normally 100 basis points. Before granting approval to modify a loan in a TDR, a borrower’s ability to repay is considered by evaluating current income levels, debt-to-income ratio, credit score, loan payment history and an updated evaluation of the secondary repayment source.

If a loan is on non-accrual status before becoming a TDR, it will stay on non-accrual status following restructuring until it has been performing for at least six months, at which point it may be moved to accrual status. If a loan is on accrual status before it becomes a TDR, and it is concluded that a full repayment is highly probable, it will remain on accrual status following restructuring. If the homogeneous restructured loan does not perform, it is placed in non-accrual status when it is 90 days delinquent. For commercial loans, six consecutive payments on newly restructured loan terms are required prior to returning the loan to accrual status. After the required six consecutive payments are made, a management assessment may conclude that collection of the entire principal and interest due is still in doubt. In those instances, the loan will remain on non-accrual. A loan that defaults and is subsequently modified would impact the Company's delinquency trend, which is part of the QLF component of the general reserve calculation. Any modified loan that re-defaults and is charged-off would impact the HLF component of our general reserve calculation.

Non-performing assets. Non-performing assets were $43,826,000, or 0.27% of total assets, at September 30, 2019, compared to $70,093,000, or 0.44% of total assets, at September 30, 2018.

The following table provides detail related to the Company's non-performing assets.

|

| | | | | | | | | | | | | | | |

| | September 30, | | | | |

Non-Performing Assets | | 2019 | | 2018 | | $ Change | | % Change |

| | (In thousands) | | |

Non-accrual loans: | | | | | | | | |

Single-family residential | | $ | 25,271 |

| | $ | 27,643 |

| | $ | (2,372 | ) | | (8.6 | )% |

Construction | | — |

| | 2,427 |

| | (2,427 | ) | | (100.0 | ) |

Land – acquisition & development (A&D) | | 169 |

| | 920 |

| | (751 | ) | | (81.6 | ) |

Land – consumer lot loans | | 246 |

| | 787 |

| | (541 | ) | | (68.7 | ) |

Commercial real estate | | 5,835 |

| | 8,971 |

| | (3,136 | ) | | (35.0 | ) |

Commercial & industrial | | 1,292 |

| | 14,394 |

| | (13,102 | ) | | (91.0 | ) |

HELOC | | 907 |

| | 523 |

| | 384 |

| | 73.4 |

|

Consumer | | 11 |

| | 21 |

| | (10 | ) | | (47.6 | ) |

Total non-accrual loans | | 33,731 |

| | 55,686 |

| | (21,955 | ) | | (39.4 | ) |

Real estate owned | | 6,781 |

| | 11,298 |

| | (4,517 | ) | | (40.0 | ) |

Other property owned | | 3,314 |

| | 3,109 |

| | 205 |

| | 6.6 |

|

Total non-performing assets | | $ | 43,826 |

| | $ | 70,093 |

| | $ | (26,267 | ) | | (37.5 | )% |

The ratio of the allowance for loan losses to non-accrual loans increased to 390% as of September 30, 2019, from 232% as of September 30, 2018.

LIQUIDITY AND CAPITAL RESOURCES

The principal sources of funds for the Company's activities are loan repayments (including prepayments), net deposit inflows, repayments and sales of investments, borrowings and retained earnings. The Company's principal sources of revenue are interest on loans and interest and dividends on investments.

The Company's shareholders' equity at September 30, 2019, was $2,032,995,000, or 12.34% of total assets, as compared to $1,996,908,000, or 12.59% of total assets, at September 30, 2018. The Company's shareholders' equity was impacted in the year by net income of $210,256,000, the payment of $63,318,000 in cash dividends, $123,854,000 of treasury stock purchases, as well as other comprehensive income of $6,998,000. The Company paid out 30.1% of its 2019 earnings in cash dividends to common shareholders, compared with 27.5% last year. For the year ended September 30, 2019, the Company returned 89.0% of net income to shareholders in the form of cash dividends and share repurchases as compared to 108.0% for the year ended September 30, 2018. Management believes the Company's strong net worth position allows it to manage balance sheet risk and provide the capital support needed for controlled growth in a regulated environment.

The Bank has a credit line with the Federal Home Loan Bank of Des Moines ("FHLB") up to 45% of total assets depending on specific collateral eligibility. This line provides a substantial source of additional liquidity if needed. As of September 30, 2019, the Bank had $2,340,944,000 of additional borrowing capacity at the FHLB.

The Bank has entered into borrowing agreements with the FHLB to borrow funds under a short-term floating rate cash management advance program and fixed-rate term advance agreements. All borrowings are secured by stock of the FHLB, deposits with the FHLB, and a blanket pledge of qualifying loans receivable as provided in the agreements with the FHLB. The Bank is also eligible to borrow under the Federal Reserve Bank's primary credit program.

The Company's cash and cash equivalents were $419,158,000 at September 30, 2019, which is a 56.0% increase from the balance of $268,650,000 as of September 30, 2018. See “Interest Rate Risk” above and the “Statement of Cash Flows” included in the financial statements for details regarding this change.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CHANGES IN FINANCIAL CONDITION

Cash and cash equivalents: Cash and cash equivalents increased to $419,158,000 at September 30, 2019, as compared to $268,650,000 at September 30, 2018. The change was primarily due to normal liquidity management activities.

Available-for-sale investment securities: Available-for-sale securities increased $170,785,000, or 13.0%, during the year ended September 30, 2019, to $1,485,742,000, primarily due to purchases of $358,709,000 partially offset by principal repayments of $224,118,000 and a change in net unrealized gain (loss) of $39,195,000. Sales of available-for-sale securities totaled $491,000 during the year ended September 30, 2019. As of September 30, 2019, the Company had a net unrealized gain on available-for-sale securities of $27,671,000, which is recorded net of tax as part of shareholders' equity.

Held-to-maturity investment securities: Held-to-maturity securities decreased by $181,940,000, or 11.2%, during the year ended September 30, 2019, to $1,443,480,000 primarily due to principal repayments and maturities of $178,147,000. There were no held-to-maturity securities purchased or sold during the year ended September 30, 2019. Rising interest rates may cause these securities to be subject to unrealized losses. As of September 30, 2019, the net unrealized gain on held-to-maturity securities was $19,615,000, which management attributes to the change of interest rates since acquisition.

Loans receivable: Loans receivable, net of related contra accounts, increased $453,494,000, or 4.0%, to $11,930,575,000 at September 30, 2019, from $11,477,081,000 one year earlier. This increase resulted primarily from originations of $4,120,471,000 and loan repayments of $3,638,622,000 during the year ended September 30, 2019. Commercial loan originations accounted for 72.1% of total originations and consumer originations were 27.9% as the Company continues to focus on commercial lending, coupled with growing economies in all major markets in which we operate.

The following table presents the gross loan balances by category and the year-over-year change.

|

| | | | | | | | | | | | | | | | |

| September 30, 2019 | | September 30, 2018 | | Change |

| (In thousands) | | (In thousands) | | $ | % |

Gross loans by category | | | | | | | | |

Single-family residential | $ | 5,835,194 |

| 43.8 | % | | $ | 5,798,966 |

| 45.1 | % | | $ | 36,228 |

| 0.6% |

Construction | 2,038,052 |

| 15.3 |

| | 1,890,668 |

| 14.7 |

| | 147,384 |

| 7.8 |

Construction - custom | 540,741 |

| 4.1 |

| | 624,479 |

| 4.9 |

| | (83,738 | ) | (13.4) |

Land - acquisition & development | 204,107 |

| 1.5 |

| | 155,204 |

| 1.2 |

| | 48,903 |

| 31.5 |

Land - consumer lot loans | 99,694 |

| 0.7 |

| | 102,036 |

| 0.8 |

| | (2,342 | ) | (2.3) |

Multi-family | 1,422,674 |

| 10.7 |

| | 1,385,125 |

| 10.8 |

| | 37,549 |

| 2.7 |

Commercial real estate | 1,631,170 |

| 12.3 |

| | 1,452,168 |

| 11.3 |

| | 179,002 |

| 12.3 |

Commercial & industrial | 1,268,695 |

| 9.5 |

| | 1,140,874 |

| 8.9 |

| | 127,821 |

| 11.2 |

HELOC | 142,178 |

| 1.1 |

| | 130,852 |

| 1.0 |

| | 11,326 |

| 8.7 |

Consumer | 129,883 |

| 1.0 |

| | 173,306 |

| 1.3 |

| | (43,423 | ) | (25.1) |

Total gross loans | 13,312,388 |

| 100 | % | | 12,853,678 |

| 100 | % | | 458,710 |

| 3.6% |

Less: | | | | | | | | |

Allowance for probable losses | 131,534 |

| | | 129,257 |

| | | 2,277 |

| 1.8 |

Loans in process | 1,201,341 |

| | | 1,195,506 |

| | | 5,835 |

| 0.5 |

Net deferred fees, costs and discounts | 48,938 |

| | | 51,834 |

| | | (2,896 | ) | (5.6) |

Total loan contra accounts | 1,381,813 |

| | | 1,376,597 |

| | | 5,216 |

| 0.4 |

Net loans | $ | 11,930,575 |

| | | $ | 11,477,081 |

| | | $ | 453,494 |

| 4.0% |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following table shows the change in the geographic distribution by state of the gross loan portfolio.

|

| | | | | | |

September 30, | 2019 | 2018 | Change |

Washington | 42.7 | % | 43.6 | % | (0.9 | ) |

Oregon | 16.6 |

| 16.3 |

| 0.3 |

|

Arizona | 11.9 |

| 12.4 |

| (0.5 | ) |

Utah | 7.5 |

| 7.8 |

| (0.3 | ) |

Texas | 7.4 |

| 6.0 |

| 1.4 |

|

New Mexico | 5.3 |

| 5.1 |

| 0.2 |

|

Idaho | 4.8 |

| 4.5 |

| 0.3 |

|

Nevada | 2.1 |

| 2.1 |

| — |

|

Other (1) | 1.7 |

| 2.2 |

| (0.5 | ) |

| 100 | % | 100 | % | |

(1) Includes loans in other states and purchased loan pools.

Non-performing assets: NPAs decreased to $43,826,000 as of September 30, 2019, from $70,093,000 at September 30, 2018, a 37.5% decrease. The decrease was primarily a result of a $21,955,000 decrease in non-accrual loans and real estate owned declining by $4,517,000. Other property owned of $3,314,000 as of September 30, 2019 is comprised of $1,116,000 of equipment acquired through foreclosure on a commercial loan and a $2,198,000 government guarantee related to that same loan. Non-performing assets as a percentage of total assets was 0.27% at September 30, 2019, compared to 0.44% at September 30, 2018.

Restructured Loans: Total restructured loans declined to $121,677,000 as of September 30, 2019, from $156,858,000 as of September 30, 2018. As of September 30, 2019, $116,659,000 or 95.9% of the restructured loans were performing. Non-performing restructured loans of $5,018,000 are included in NPAs. Total non-performing assets and restructured loans as a percent of total assets has declined to 0.97% as of September 30, 2019, from 1.39% as of September 30, 2018.

Real estate owned: As of September 30, 2019, real estate owned totaled $6,781,000, a decrease of $4,517,000, or 40.0%, from $11,298,000 as of September 30, 2018, as the Company continued to liquidate foreclosed properties. During 2019, the Company sold real estate owned properties for total net proceeds of $8,659,000.

Interest Receivable: Interest receivable was $48,857,000 as of September 30, 2019, an increase of $1,562,000, or 3.3%, since September 30, 2018. The increase was primarily a result of the 4.0% rise in loans receivable partially offset by a slight decrease in interest rates.

Bank Owned Life Insurance: Bank-owned life insurance increased to $222,076,000 as of September 30, 2019 from $216,254,000 as of September 30, 2018, primarily as a result of increases in the cash surrender value of the policies. The investments in bank-owned life insurance serve to assist in funding the growth of employee benefit costs.

Intangible assets: The Company's intangible assets totaled $309,247,000 at September 30, 2019 compared to $311,286,000 as of September 30, 2018. The balance at September 30, 2019 is comprised of $301,368,000 of goodwill and the unamortized balance of the core deposit and other intangibles of $7,879,000.

Customer accounts: As of September 30, 2019, customer deposits totaled $11,990,764,000 compared with $11,387,146,000 at September 30, 2018, a $603,618,000, or 5.3%, increase. During 2019, the Company was able to increase transaction accounts by $501,458,000 or 7.6% and time deposits increased by $102,160,000 or 2.1%.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

| | | | | | | | | | | | | | | | | | | |

($ in thousands) | September 30, 2019 | | September 30, 2018 |

| Deposit Account Balance | | As a % of Total Deposits | | Weighted

Average Rate | | Deposit Account Balance | | As a % of Total Deposits | | Weighted

Average Rate |

Non-interest checking | $ | 1,621,343 |

| | 13.5 | % | | — | % | | $ | 1,401,226 |

| | 12.4 | % | | — | % |

Interest checking | 1,984,576 |

| | 16.6 |

| | 0.61 |

| | 1,778,520 |

| | 15.6 |

| | 0.50 |

|

Savings | 753,574 |

| | 6.3 |

| | 0.13 |

| | 836,501 |

| | 7.3 |

| | 0.11 |

|

Money market | 2,724,308 |

| | 22.7 |

| | 0.82 |

| | 2,566,096 |

| | 22.5 |

| | 0.65 |

|

Time deposits | 4,906,963 |

| | 40.9 |

| | 1.91 |

| | 4,804,803 |

| | 42.2 |

| | 1.50 |

|

Total | $ | 11,990,764 |

| | 100 | % | | 1.08 | % | | $ | 11,387,146 |

| | 100 | % | | 0.87 | % |

The following table shows the geographic distribution by state for customer deposits.

|

| | | | | | | | | | | | | |

(In thousands) (1) | September 30, 2019 | September 30, 2018 | $ Change |

Washington | $ | 5,502,418 |

| 45.9 | % | $ | 5,420,674 |

| 47.6 | % | $ | 81,744 |

|

Oregon | 2,337,401 |

| 19.5 |

| 2,176,713 |

| 19.1 |

| 160,688 |

|

Arizona | 1,352,365 |

| 11.3 |

| 1,262,122 |

| 11.1 |

| 90,243 |

|

New Mexico | 1,023,479 |

| 8.5 |

| 893,521 |

| 7.8 |

| 129,958 |

|

Idaho | 867,250 |

| 7.2 |

| 822,497 |

| 7.2 |

| 44,753 |

|

Nevada | 384,491 |

| 3.2 |

| 366,838 |

| 3.2 |

| 17,653 |

|

Utah | 345,208 |

| 2.9 |

| 307,778 |

| 2.7 |

| 37,430 |

|

Texas | 178,152 |

| 1.5 |

| 137,003 |

| 1.2 |

| 41,149 |

|

| $ | 11,990,764 |

| 100 | % | $ | 11,387,146 |

| 100 | % | $ | 603,618 |

|

(1) During 2019, commercial account deposits that were previously serviced in and assigned to Washington were reassigned to their respective geographical region. September 30, 2018 amounts have been reclassified to align with the new assignments.

FHLB advances: Total FHLB advances were $2,250,000,000 at September 30, 2019, as compared to $2,330,000,000 at September 30, 2018. The weighted average rate for FHLB borrowings was 2.49% as of September 30, 2019 and 2.66% at September 30, 2018. The decrease is primarily due to lower rates on new FHLB advances and maturing advances with higher rates. The Company has entered into interest rate swaps to hedge interest rate risk and convert certain FHLB advances to fixed rate payments. Taking into account these hedges, the weighted average effective maturity of FHLB advances at September 30, 2019 is 2.8 years.

Contractual obligations: The following table presents the Company's significant fixed and determinable contractual obligations, within the categories described below, by contractual maturity or payment amount.

|

| | | | | | | | | | | | | | | | |

September 30, 2019 | | Total | | Less than

1 Year | | 1 to 5

Years | | Over 5

Years |

| | (In thousands) |

Customer accounts (1) | | $ | 11,990,764 |

| | $ | 10,573,640 |

| | $ | 1,415,088 |

| | $ | 2,036 |

|

Debt obligations (2) | | 2,250,000 |

| | 950,000 |

| | 1,150,000 |

| | 150,000 |

|

Operating lease obligations | | 34,211 |

| | 5,838 |

| | 17,842 |

| | 10,531 |

|

| | $ | 14,274,975 |

| | $ | 11,529,478 |

| | $ | 2,582,930 |

| | $ | 162,567 |

|

(1) Includes non-maturing customer transaction accounts.

(2) Represents final maturities of debt obligations.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

These obligations, except for the operating leases, are included in the Consolidated Statements of Financial Condition. The payment amounts of the operating lease obligations represent those amounts contractually due.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

For highlights of the quarter-by-quarter results for the years ended September 30, 2019, and 2018, see Note R, “Selected Quarterly Financial Data (Unaudited)”.

COMPARISON OF 2019 RESULTS WITH 2018

Net Income: Net income increased $6,406,000, or 3.1%, to $210,256,000 for the year ended September 30, 2019, as compared to $203,850,000 for the year ended September 30, 2018.

Net Interest Income: For the year ended September 30, 2019, net interest income was $481,060,000, an increase of $8,921,000 or 1.9% from the year ended September 30, 2018. The increase was primarily driven by a higher average balance on interest-earning assets partially offset by a decrease in net interest margin. For the year ended September 30, 2019, average earning assets increased 5.1% to $15,203,819,000, up from $14,459,452,000 for the year ended September 30, 2018. During 2019, the average balance of loans receivable increased $612,351,000 or 5.5%, while the combined average balances of mortgage backed securities, other investment securities and cash increased by $126,052,000 or 4.0%. The net interest margin decreased to 3.16% for the year ended September 30, 2019, from 3.27% for the year ended September 30, 2018. The yield on interest-earning assets increased 22 basis points to 4.42% and the cost of interest-bearing liabilities increased by 34 basis points to 1.34%. The higher yield on interest-earning assets is primarily the result of changes in mix as loans receivable comprised a greater proportion of interest-earning assets and commercial loans comprised a higher percentage of the loan portfolio. The higher cost on interest-bearing liabilities is due primarily to rising interest rates on customer deposits, partially offset by lower rates on new FHLB advances and maturing advances with higher rates.

The following table sets forth certain information explaining changes in interest income and interest expense for the period indicated compared to the same period one year ago. For each category of interest-earning asset and interest-bearing liability, information is provided on changes attributable to (1) changes in volume (changes in volume multiplied by old rate) and (2) changes in rate (changes in rate multiplied by old volume). The change in interest income and interest expense attributable to changes in both volume and rate has been allocated proportionately to the change due to volume and the change due to rate.

Rate / Volume Analysis:

|

| | | | | | | | | |

| Comparison of Year Ended September 30, 2019 and

September 30, 2018 |

($ in thousands) | Volume | Rate | Total |

Interest income: | | | |

Loans receivable | $ | 28,489 |

| $ | 23,800 |

| $ | 52,289 |

|

Mortgaged-backed securities | 298 |

| 3,780 |

| 4,078 |

|

Investments (1) | 3,878 |

| 4,138 |

| 8,016 |

|

| | | |

All interest-earning assets | 32,665 |

| 31,718 |

| 64,383 |

|

| | | |

Interest expense: | | | |

Customer accounts | 3,992 |

| 45,732 |

| 49,724 |

|

FHLB advances and other borrowings | 4,020 |

| 1,718 |

| 5,738 |

|

| | | |

All interest-bearing liabilities | 8,012 |

| 47,450 |

| 55,462 |

|

| | | |

Change in net interest income | $ | 24,653 |

| $ | (15,732 | ) | $ | 8,921 |

|

(1) Includes interest on cash equivalents and dividends on FHLB & FRB stock.

Provision (Release) for Loan Losses: The Company recorded a release of allowance for loan losses of $1,650,000 for the year ended September 30, 2019, as compared to a release of $5,450,000 for the year ended September 30, 2018. The releases recorded for both periods were a result of strong net recoveries and the overall quality of the loan portfolio as a result of a continued strong

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

economy, offset by reserving for net growth in the loan portfolio. The Company had recoveries, net of charge-offs, of $3,577,000 for the year ended September 30, 2019, compared with $11,050,000 of net recoveries for the year ended September 30, 2018.

Unfunded commitments tend to vary depending on our loan mix and the proportional share of commercial loans. The reserve for unfunded commitments was $6,900,000 as of September 30, 2019, which is a decrease from $7,250,000 at September 30, 2018. Management believes the allowance for loan losses plus the reserve for unfunded commitments, totaling $138,434,000, or 1.04% of gross loans, is sufficient to absorb estimated losses inherent in the portfolio. See Note E for further discussion and analysis of the allowance for loan losses as of and for the year ended September 30, 2019.

Other Income: Other income was $62,318,000 for the year ended September 30, 2019, an increase of $18,240,000, or 41.4%, from $44,078,000 for the year ended September 30, 2018. The increase is primarily due to a net gain of $10,200,000 recognized in 2019 from sales of fixed assets and $8,550,000 of expense recognized in 2018 related to termination of all remaining FDIC loss-share agreements. Deposit fee income was $24,882,000 for the year ended September 30, 2019, compared to $25,904,000 for the year ended September 30, 2018.

Other Expense: Operating expense was $283,063,000 for the year ended September 30, 2019, an increase of $18,741,000, or 7.1%, from the $264,322,000 for the year ended September 30, 2018. The Company has continued to make strategic investments in people, process and technology with the objectives of enhancing compliance, growing market share and ultimate earnings. These investments have led to higher operating expenses. Compensation and benefits costs increased $10,034,000 year-over-year. Information technology costs increased by $4,312,000 and other expenses increased by $4,491,000 as both were elevated primarily due to Bank Secrecy Act ("BSA") program enhancements and other technology platform improvements. The Company’s efficiency ratio of 52.1% for 2019 is higher than the 50.4% for 2018, the increase being due to higher expenses noted above partially offset by higher revenue in 2019. The number of staff, including part-time employees on a full-time equivalent basis, was 1,971 and 1,877 at September 30, 2019 and 2018, respectively. Total operating expense for the years ended September 30, 2019, and 2018 equaled 1.73% and 1.69%, respectively, of average assets.

Gain (Loss) on Real Estate Owned: Net gain on real estate owned was $810,000 for the year ended September 30, 2019, compared to a net loss of $102,000 for the year ended September 30, 2018. This amount includes ongoing maintenance expense, periodic valuation adjustments, and gains (losses) on sales of REO.

Income Tax Expense: Income tax expense was $52,519,000 for the year ended September 30, 2019, a decrease of $874,000, or 1.64%, from the $53,393,000 for the year ended September 30, 2018. The effective tax rate for 2019 was 19.99% as compared to 20.76% for the year ended September 30, 2018. On December 22, 2017, a new tax law was enacted that provides for significant changes to the U.S. Internal Revenue Code of 1986 (as amended), such as a reduction in the federal corporate tax rate from 35% to 21% effective from January 1, 2018 forward and changes or limitations to certain tax deductions. The Company has a fiscal year end of September 30, resulting in a blended federal statutory tax rate of 24.53% for its fiscal year 2018 and a rate of 21.00% for 2019. The effective tax rate of 19.99% for 2019 is lower than the statutory rate mainly due to the effect of state taxes, bank-owned life insurance, investments in low income housing tax credit partnerships and tax-exempt loans to municipal entities and other qualified borrowers as well as the resolution of a previously unrecognized tax benefit.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

COMPARISON OF 2018 RESULTS WITH 2017

Net Income: Net income increased $30,318,000, or 17.5%, to $203,850,000 for the year ended September 30, 2018, as compared to $173,532,000 for the year ended September 30, 2017.

Net Interest Income: For the year ended September 30, 2018, net interest income was $472,139,000, an increase of $40,213,000 or 9.3% from the year ended September 30, 2017. The increase was primarily driven by a higher average balance on loans receivable. For the year ended September 30, 2018, average earning assets increased 4.8% to $14,459,452,000, up from $13,803,646,000 for the year ended September 30, 2017. During 2018, the average balance of loans receivable increased $799,783,000 or 7.7%, while the combined average balances of mortgage backed securities, other investment securities and cash decreased by $152,634,000 or 4.7%. The net interest margin increased to 3.27% for the year ended September 30, 2018, from 3.13% for the year ended September 30, 2017. The yield on earning assets increased 22 basis points to 4.20% and the cost of interest-bearing liabilities increased by 8 basis points to 1.00%. The higher yield on earning assets is primarily the result of rising short-term interest rates, which causes the yield on adjustable-rate loans and investments as well as cash to increase, but also due to changes in mix as loans receivable comprised a greater proportion of earning assets. The higher cost on interest-bearing liabilities is due primarily to rising interest rates on customer deposits, partially offset by a lower rate on FHLB borrowings due to the maturity of some higher cost long-term FHLB advances.

The following table sets forth certain information explaining changes in interest income and interest expense for the period indicated compared to the same period one year ago. For each category of interest-earning asset and interest-bearing liability, information is provided on changes attributable to (1) changes in volume (changes in volume multiplied by old rate) and (2) changes in rate (changes in rate multiplied by old volume). The change in interest income and interest expense attributable to changes in both volume and rate has been allocated proportionately to the change due to volume and the change due to rate.

Rate / Volume Analysis:

|

| | | | | | | | | |

| Comparison of Year Ended September 30, 2018 and

September 30, 2017 |

($ in thousands) | Volume | Rate | Total |

Interest income: | | | |

Loans receivable | $ | 36,820 |

| $ | 8,464 |

| $ | 45,284 |

|

Mortgaged-backed securities | (418 | ) | 10,213 |

| 9,795 |

|

Investments (1) | (2,970 | ) | 6,056 |

| 3,086 |

|

| | | |

All interest-earning assets | 33,432 |

| 24,733 |

| 58,165 |

|

| | | |

Interest expense: | | | |

Customer accounts | 2,371 |

| 18,098 |

| 20,469 |

|

FHLB advances and other borrowings | 6,160 |

| (8,677 | ) | (2,517 | ) |

| | | |

All interest-bearing liabilities | 8,531 |

| 9,421 |

| 17,952 |

|

| | | |

Change in net interest income | $ | 24,901 |

| $ | 15,312 |

| $ | 40,213 |

|

(1) Includes interest on cash equivalents and dividends on FHLB & FRB stock.

Provision (Release) for Loan Losses: The Company recorded a release of allowance for loan losses of $5,450,000 for the year ended September 30, 2018, as compared to a release of $2,100,000 for the year ended September 30, 2017. The releases recorded for both periods were a result of strong net recoveries and the overall quality of the loan portfolio as a result of a continued strong economy, offset by reserving for net growth in the loan portfolio. The Company had recoveries, net of charge-offs, of $11,050,000 for the year ended September 30, 2018, compared with $14,307,000 of net recoveries for the year ended September 30, 2017.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Unfunded commitments tend to vary depending on our loan mix and the proportional share of commercial loans. The reserve for unfunded commitments was $7,250,000 as of September 30, 2018, which is a decrease from $7,750,000 at September 30, 2017. Management believes the allowance for loan losses plus the reserve for unfunded commitments, totaling $136,507,000, or 1.06% of gross loans, is sufficient to absorb estimated losses inherent in the portfolio. See Note E for further discussion and analysis of the allowance for loan losses as of and for the year ended September 30, 2018.

Other Income: Other income was $44,078,000 for the year ended September 30, 2018, a decrease of $8,137,000, or 15.6%, from $52,215,000 for the year ended September 30, 2017. The decrease is primarily due to an $8,550,000 charge recorded in 2018 for asset and liability valuation adjustments associated with FDIC loss-share agreements. The Bank initiated discussions with the FDIC in December 2017 regarding early termination of its remaining FDIC loss-share agreements, which related to the Horizon Bank and Home Valley Bank acquisitions. In May 2018, the Bank finalized the early termination agreement and paid $39,906,000 to settle the FDIC clawback liability. Under the termination agreement, all rights and obligations of the Bank and the FDIC have been resolved and completed. As such, future recoveries, gains, losses and expenses related to the previously covered assets will now be recognized entirely by the Bank and the FDIC will no longer share in such gains or losses. During 2017, the Company recorded a gain of $3,499,000 on the sale of available-for-sale investment securities while there were no such sales during 2018. Deposit fee income was $25,904,000 for the year ended September 30, 2018, compared to $22,643,000 for the year ended September 30, 2017 as 2018 included the impact of a full year of fee income related to the Company's "Green Checking" product.

Other Expense: Operating expense was $264,322,000 for the year ended September 30, 2018, an increase of $32,803,000, or 14.2%, from the $231,519,000 for the year ended September 30, 2017. The Company initiated several strategic investments in 2018 that resulted in higher operating expenses. Those investments included a 5% salary increase for all employees earning less than $100,000 annually; the establishment of a second technology team located in Boise, Idaho; the creation of an internal training team; and several new processes and systems. Compensation and benefits costs increased $11,297,000 year-over-year primarily due to the 5% salary increase noted above, headcount increases and cost-of-living adjustments. Information technology costs increased by $5,784,000 and other expenses increased by $11,947,000 as both were elevated primarily due to Bank Secrecy Act ("BSA") program enhancements and other technology platform improvements. The Company had approximately $4,100,000 of non-recurring BSA related costs in the 4th fiscal quarter of 2018 and estimates that it will incur an additional $6,000,000 of non-recurring costs for BSA program improvements spread over the next three quarters. Additionally, charitable contributions increased $551,000 from the prior year as the Company fulfilled the first year of its previously announced commitment to fund its foundation by $1,000,000 annually for the next five years. Product delivery costs increased by $2,400,000 primarily due to enhanced features provided with the "Green Checking" product. The Company’s efficiency ratio of 50.4% for 2018 is higher than the 47.8% for 2017. The increase in the efficiency ratio is due to higher expenses noted above partially offset by higher revenue in 2018. The number of staff, including part-time employees on a full-time equivalent basis, was 1,877 and 1,818 at September 30, 2018 and 2017, respectively. Total operating expense for the years ended September 30, 2018, and 2017 equaled 1.69% and 1.55%, respectively, of average assets.

Gain (Loss) on Real Estate Owned: Net loss on real estate owned was $102,000 for the year ended September 30, 2018, compared to a net gain of $1,494,000 for the year ended September 30, 2017. This amount includes ongoing maintenance expense, periodic valuation adjustments, and gains (losses) on sales of REO.

Income Tax Expense: Income tax expense was $53,393,000 for the year ended September 30, 2018, a decrease of $29,291,000, or 35.43%, from the $82,684,000 for the year ended September 30, 2017. The effective tax rate for 2018 was 20.76% as compared to 32.27% for the year ended September 30, 2017. On December 22, 2017, a new tax law was enacted that provides for significant changes to the U.S. Internal Revenue Code of 1986 (as amended), such as a reduction in the federal corporate tax rate from 35% to 21% effective from January 1, 2018 forward and changes or limitations to certain tax deductions. The Company has a fiscal year end of September 30, resulting in a blended federal statutory tax rate of 24.53% for its fiscal year 2018. Tax expense for fiscal year 2018 includes a number of discrete items, the largest of which is a discrete tax benefit of $5.4 million related to the revaluation of deferred tax assets and liabilities to reflect the change in statutory tax rate. The effective tax rate of 20.76% for 2018 is lower than the statutory rate due to the effect of bank-owned life insurance, investments in low income housing tax credit partnerships and tax-exempt loans to municipal entities and other qualified borrowers.

SELECTED FINANCIAL DATA

|

| | | | | | | | | | | | | | | |

Year ended September 30, | 2019 | 2018 | 2017 | 2016 | 2015 |

| | (In thousands, except per share data) |

Interest income | $ | 671,466 |

| $ | 607,083 |

| $ | 548,918 |

| $ | 536,793 |

| $ | 530,553 |

|

Interest expense | 190,406 |

| 134,944 |

| 116,992 |

| 116,544 |

| 117,072 |

|

Net interest income | 481,060 |

| 472,139 |

| 431,926 |

| 420,249 |

| 413,481 |

|

Provision (reversal) for loan losses | (1,650 | ) | (5,450 | ) | (2,100 | ) | (6,250 | ) | (11,162 | ) |

Other income | 63,128 |

| 43,976 |

| 53,709 |

| 57,082 |

| 49,727 |

|

Other expense | 283,063 |

| 264,322 |

| 231,519 |

| 235,447 |

| 224,851 |

|

Income before income taxes | 262,775 |

| 257,243 |

| 256,216 |

| 248,134 |

| 249,519 |

|

Income taxes | 52,519 |

| 53,393 |

| 82,684 |

| 84,085 |

| 89,203 |

|

Net income | $ | 210,256 |

| $ | 203,850 |

| $ | 173,532 |

| $ | 164,049 |

| $ | 160,316 |

|

Per share data | | | | | |

Basic earnings | $ | 2.61 |

| $ | 2.40 |

| $ | 1.95 |

| $ | 1.79 |

| $ | 1.68 |

|

Diluted earnings | 2.61 |

| 2.40 |

| 1.94 |

| 1.78 |

| 1.67 |

|

Cash dividends | 0.79 |

| 0.67 |

| 0.84 |

| 0.55 |

| 0.54 |

|

| | | | | |

September 30, | 2019 | 2018 | 2017 | 2016 | 2015 |

Total assets | $ | 16,474,910 |

| $ | 15,865,724 |

| $ | 15,253,580 |

| $ | 14,888,063 |

| $ | 14,568,324 |

|

Loans receivable, net | 11,930,575 |

| 11,477,081 |

| 10,882,622 |

| 9,910,920 |

| 9,170,634 |

|

Mortgage-backed securities | 2,426,039 |

| 2,524,923 |

| 2,489,544 |

| 2,490,510 |

| 2,906,440 |

|

Investment securities | 503,183 |

| 415,454 |

| 423,521 |

| 849,983 |

| 1,117,339 |

|

Cash and cash equivalents | 419,158 |

| 268,650 |

| 313,070 |

| 450,368 |

| 284,049 |

|

Customer accounts | 11,990,764 |

| 11,387,146 |

| 10,835,008 |

| 10,600,852 |

| 10,631,703 |

|

FHLB advances | 2,250,000 |

| 2,330,000 |

| 2,225,000 |

| 2,080,000 |

| 1,830,000 |

|

Shareholders’ equity | 2,032,995 |

| 1,996,908 |

| 2,005,688 |

| 1,975,731 |

| 1,955,679 |

|

Number of | | | | | |

Customer accounts | 450,375 |

| 449,339 |

| 449,793 |

| 491,098 |

| 517,871 |

|

Loans | 37,551 |

| 37,992 |

| 39,688 |

| 41,418 |

| 41,036 |

|

Offices | 238 |

| 235 |

| 237 |

| 238 |

| 247 |

|

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

|

| | | | | | | |

| September 30, 2019 | | September 30, 2018 |

| (In thousands, except share data) |

ASSETS | | | |

Cash and cash equivalents | $ | 419,158 |

| | $ | 268,650 |

|

Available-for-sale securities, at fair value | 1,485,742 |

| | 1,314,957 |

|

Held-to-maturity securities, at amortized cost | 1,443,480 |

| | 1,625,420 |

|

Loans receivable, net of allowance for loan losses of $131,534 and $129,257 | 11,930,575 |

| | 11,477,081 |

|

Interest receivable | 48,857 |

| | 47,295 |

|

Premises and equipment, net | 274,015 |

| | 267,995 |

|

Real estate owned | 6,781 |

| | 11,298 |

|

FHLB & FRB stock | 123,990 |

| | 127,190 |

|

Bank owned life insurance | 222,076 |

| | 216,254 |

|

Intangible assets, including goodwill of $301,368 and $301,368 | 309,247 |

| | 311,286 |

|

Federal and state income tax assets, net | — |

| | 1,804 |

|

Other assets | 210,989 |

| | 196,494 |

|

| $ | 16,474,910 |

| | $ | 15,865,724 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Liabilities | | | |

Customer accounts | | | |

Transaction deposit accounts | $ | 7,083,801 |

| | $ | 6,582,343 |

|

Time deposit accounts | 4,906,963 |

| | 4,804,803 |

|

| 11,990,764 |

| | 11,387,146 |

|

FHLB advances | 2,250,000 |

| | 2,330,000 |

|

Advance payments by borrowers for taxes and insurance | 57,830 |

| | 57,417 |

|

Federal and state income tax liabilities, net | 5,104 |

| | — |

|

Accrued expenses and other liabilities | 138,217 |

| | 94,253 |

|

| 14,441,915 |

| | 13,868,816 |

|

Shareholders’ equity | | | |

Common stock, $1.00 par value, 300,000,000 shares authorized; 135,539,806 and 135,343,417 shares issued; 78,841,463 and 82,710,911 shares outstanding | 135,540 |

| | 135,343 |

|

Paid-in capital | 1,672,417 |

| | 1,666,609 |

|

Accumulated other comprehensive income (loss), net of taxes | 15,292 |

| | 8,294 |

|

Treasury stock, at cost; 56,698,343 and 52,632,506 shares | (1,126,163 | ) | | (1,002,309 | ) |

Retained earnings | 1,335,909 |

| | 1,188,971 |

|

| 2,032,995 |

| | 1,996,908 |

|

| $ | 16,474,910 |

| | $ | 15,865,724 |

|

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

23

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

|

| | | | | | | | | |

Year ended September 30, | 2019 | 2018 | 2017 |

| (In thousands, except share data) |

INTEREST INCOME | | | |

Loans receivable | $ | 568,096 |