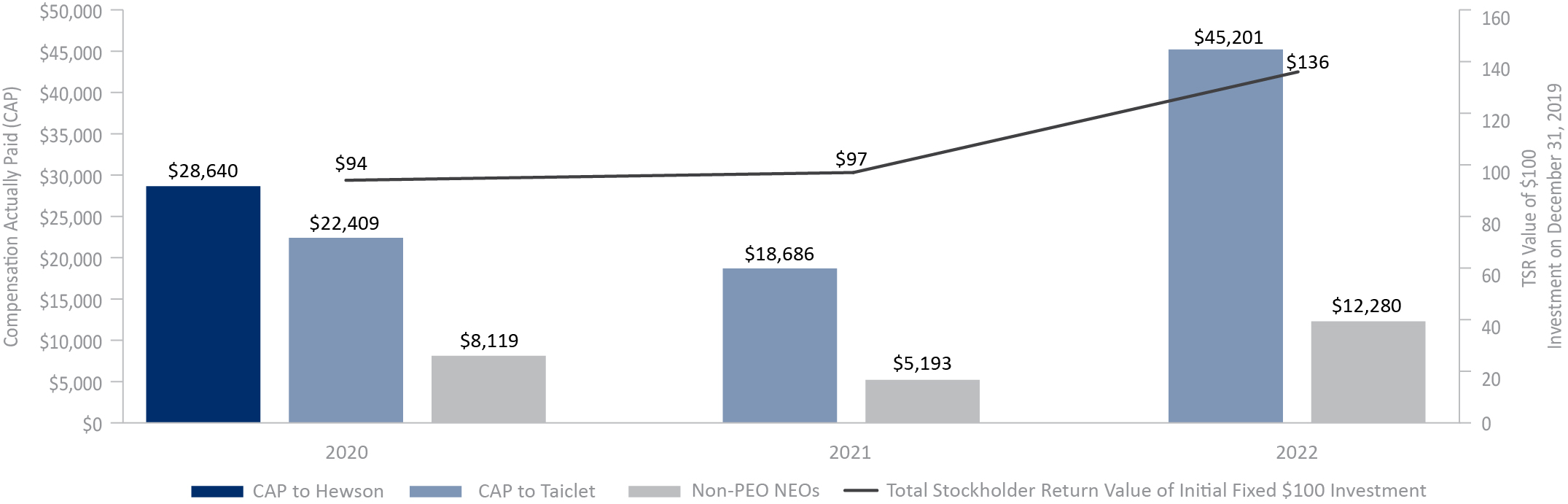

LOCKHEED MARTIN CORPORATION0000936468DEF 14Afalse00009364682022-01-012022-12-310000936468lmt:TaicletMember2022-01-012022-12-31iso4217:USD0000936468lmt:HewsonMember2022-01-012022-12-31xbrli:pure0000936468lmt:TaicletMember2021-01-012021-12-310000936468lmt:HewsonMember2021-01-012021-12-3100009364682021-01-012021-12-310000936468lmt:TaicletMember2020-01-012020-12-310000936468lmt:HewsonMember2020-01-012020-12-3100009364682020-01-012020-12-3100009364682020-06-152020-12-3100009364682020-01-012020-06-140000936468ecd:PeoMemberlmt:AdjustmentExclusionOfChangeInPensionValueMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:AdjustmentExclusionOfStockAwardsMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:TaicletMemberlmt:AdjustmentInclusionOfPensionServiceCostMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:AdjustmentEquityAwardAdjustmentsMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:AdjustmentExclusionOfChangeInPensionValueMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:AdjustmentExclusionOfStockAwardsMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:TaicletMemberlmt:AdjustmentInclusionOfPensionServiceCostMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:AdjustmentEquityAwardAdjustmentsMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:AdjustmentExclusionOfChangeInPensionValueMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:AdjustmentExclusionOfStockAwardsMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:TaicletMemberlmt:AdjustmentInclusionOfPensionServiceCostMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:AdjustmentEquityAwardAdjustmentsMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:AdjustmentExclusionOfChangeInPensionValueMemberlmt:HewsonMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:AdjustmentExclusionOfStockAwardsMemberlmt:HewsonMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:HewsonMemberlmt:AdjustmentInclusionOfPensionServiceCostMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:AdjustmentEquityAwardAdjustmentsMemberlmt:HewsonMember2020-01-012020-12-310000936468lmt:AdjustmentExclusionOfChangeInPensionValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000936468lmt:AdjustmentExclusionOfStockAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000936468ecd:NonPeoNeoMemberlmt:AdjustmentInclusionOfPensionServiceCostMember2022-01-012022-12-310000936468lmt:AdjustmentEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000936468lmt:AdjustmentExclusionOfChangeInPensionValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000936468lmt:AdjustmentExclusionOfStockAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000936468ecd:NonPeoNeoMemberlmt:AdjustmentInclusionOfPensionServiceCostMember2021-01-012021-12-310000936468lmt:AdjustmentEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000936468lmt:AdjustmentExclusionOfChangeInPensionValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000936468lmt:AdjustmentExclusionOfStockAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000936468ecd:NonPeoNeoMemberlmt:AdjustmentInclusionOfPensionServiceCostMember2020-01-012020-12-310000936468lmt:AdjustmentEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearUnvestedMemberlmt:TaicletMember2022-01-012022-12-310000936468lmt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearVestedMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedInPriorYearsVestedMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:EquityAwardsThatFailedToMeetVestingConditionsMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberlmt:TaicletMember2022-01-012022-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearUnvestedMemberlmt:TaicletMember2021-01-012021-12-310000936468lmt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearVestedMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedInPriorYearsVestedMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:EquityAwardsThatFailedToMeetVestingConditionsMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberlmt:TaicletMember2021-01-012021-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearUnvestedMemberlmt:TaicletMember2020-01-012020-12-310000936468lmt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearVestedMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedInPriorYearsVestedMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsThatFailedToMeetVestingConditionsMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberlmt:TaicletMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearUnvestedMemberlmt:HewsonMember2020-01-012020-12-310000936468lmt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberlmt:HewsonMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsGrantedDuringTheYearVestedMemberlmt:HewsonMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:HewsonMemberlmt:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsThatFailedToMeetVestingConditionsMemberlmt:HewsonMember2020-01-012020-12-310000936468ecd:PeoMemberlmt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberlmt:HewsonMember2020-01-012020-12-310000936468lmt:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000936468lmt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000936468lmt:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000936468ecd:NonPeoNeoMemberlmt:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310000936468lmt:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-01-012022-12-310000936468ecd:NonPeoNeoMemberlmt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-01-012022-12-310000936468lmt:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000936468lmt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000936468lmt:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000936468ecd:NonPeoNeoMemberlmt:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310000936468lmt:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-01-012021-12-310000936468ecd:NonPeoNeoMemberlmt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-01-012021-12-310000936468lmt:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000936468lmt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000936468lmt:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000936468ecd:NonPeoNeoMemberlmt:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310000936468lmt:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-01-012020-12-310000936468ecd:NonPeoNeoMemberlmt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2020-01-012020-12-31000093646832022-01-012022-12-31000093646812022-01-012022-12-31000093646822022-01-012022-12-31000093646842022-01-012022-12-31000093646852022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | |

| ☑ | | Filed by the Registrant |

| ☐ | | Filed by a Party other than the Registrant |

| | | |

| Check the appropriate box: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under § 240.14a-12 |

Lockheed Martin Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ☑ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2023 Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Voting Matters and Board Recommendations | | | |

| | |

| Lockheed Martin Virtual

Annual Meeting When:

Thursday, April 27, 2023, 9:00 a.m. EDT Live Webcast Access:

Online audio webcast at: www.meetnow.global/LMT2023 (You may log in beginning at 8:30 a.m. EDT) Who Can Vote:

Stockholders of record at the close of business on February 24, 2023 are entitled to vote. Whether or not you plan to attend the Annual Meeting, we encourage you to vote and submit your proxy in advance of the meeting by one of the methods described below. See Frequently Asked Questions beginning on page 91 for additional information regarding accessing the Annual Meeting and how to vote your shares. |

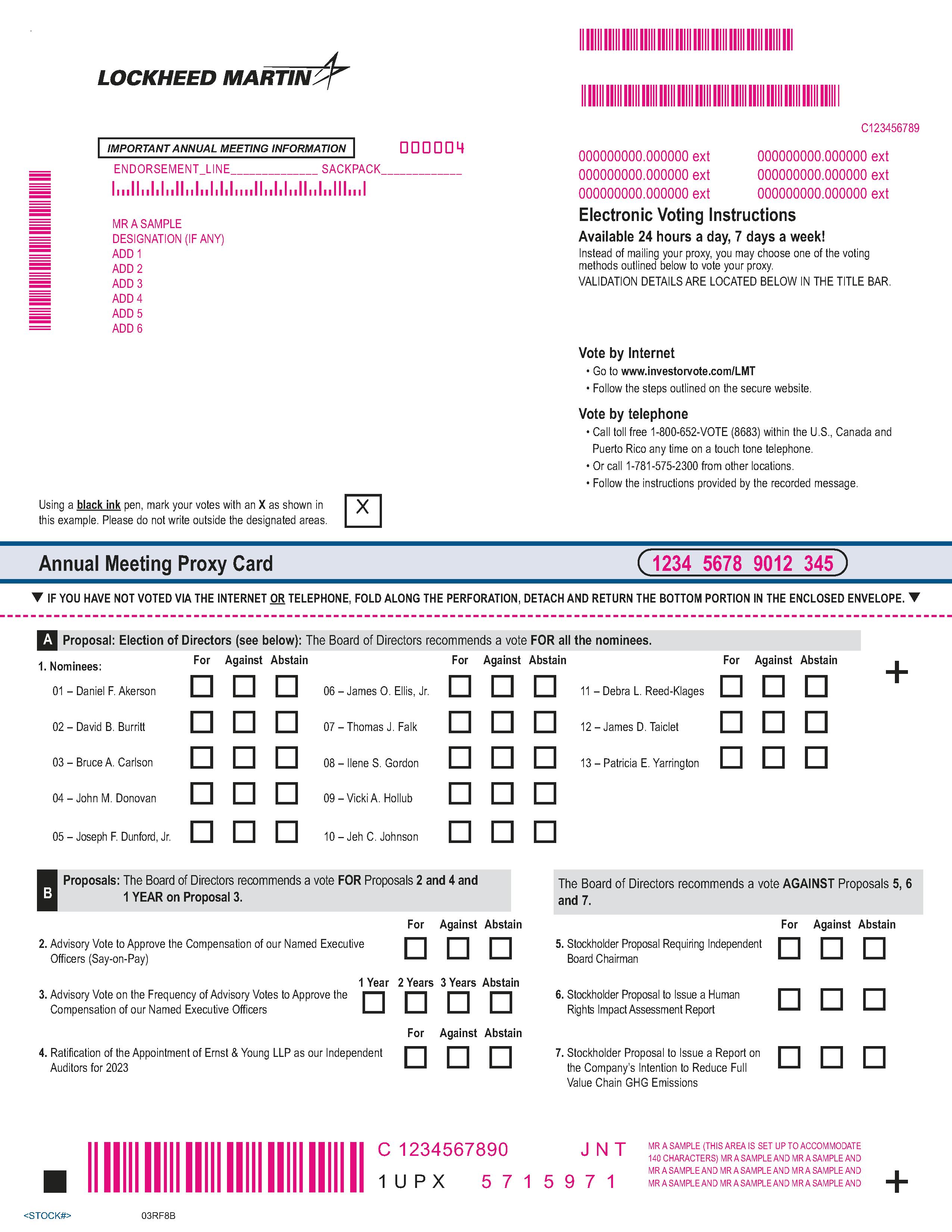

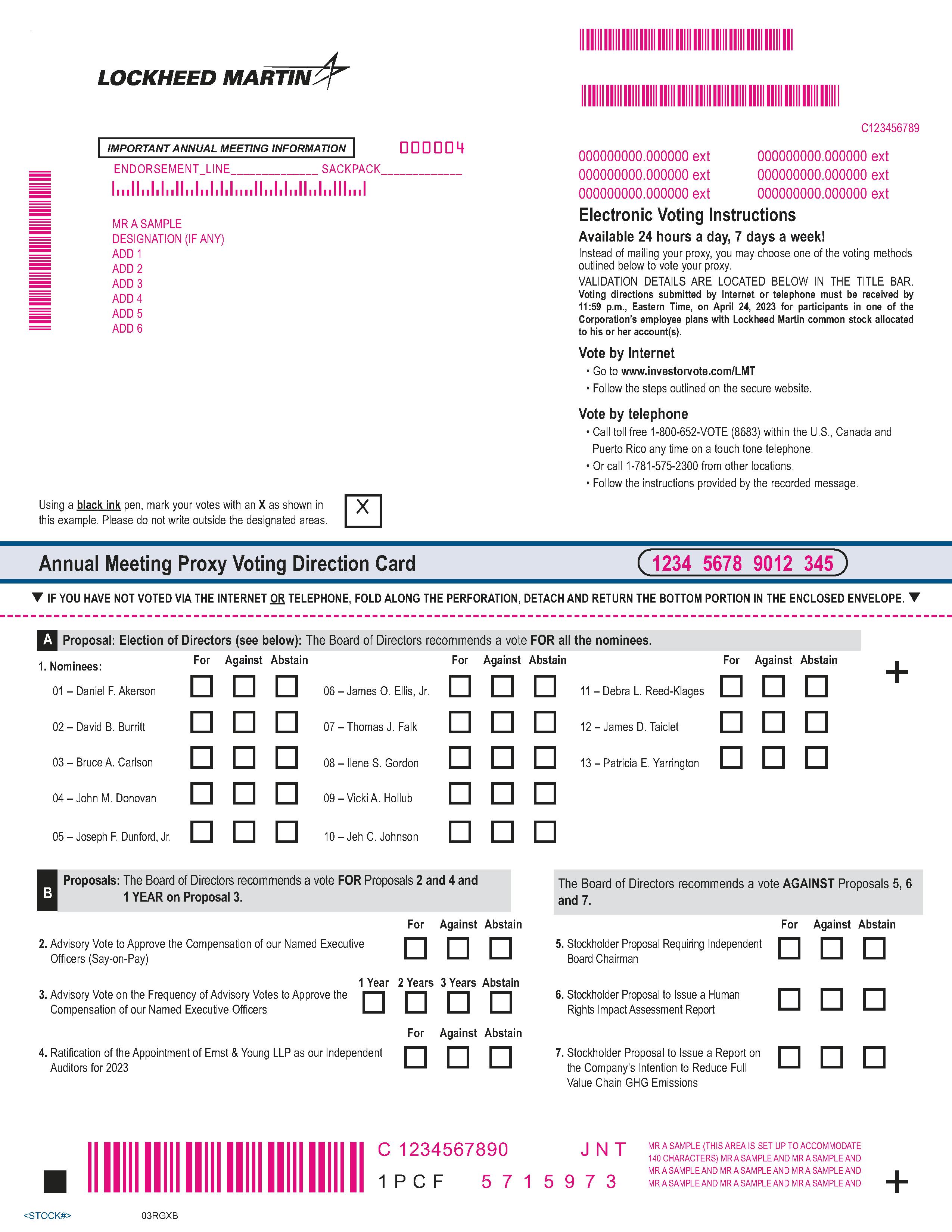

| Proposal 1 | | Election of 13 Directors | | FOR | |

| | | See page 6 for further information. | each Director Nominee | |

| Proposal 2 | | Advisory Vote to Approve the Compensation of our Named Executive Officers (Say-on-Pay) | | FOR | |

| | | See page 39 for further information. | | | |

| Proposal 3 | | Advisory Vote on the Frequency of

Votes to Approve the Compensation of our Named Executive Officers | | FOR | |

| One Year | |

| | | | |

| | | See page 40 for further information. | | |

| Proposal 4 | | Ratification of the Appointment of Ernst & Young LLP as our Independent Auditors for 2023 | | FOR | |

| | | See page 79 for further information. | | | |

| Proposals 5 - 7 | | Stockholder Proposals as described in the proxy statement, if properly presented | | AGAINST | |

| | See pages 82-90 for further information. | | | |

| | | | | | | | |

| | | | | | | | |

The 2023 Annual Meeting will be conducted exclusively online through a live audio webcast to facilitate stockholder attendance and to enable stockholders to participate fully and equally, regardless of size of holdings, resources or physical location. Our 2022 Annual Report, which is not part of the proxy soliciting materials, is enclosed if the proxy materials were mailed to you and is also available online at www.edocumentview.com/LMT. The proxy materials or a Notice of Internet Availability were first sent to stockholders on or about March 14, 2023. We will consider the seven proposals above and any other matters that may properly come before the meeting. Your vote is extremely important. Please vote at your earliest convenience to ensure the presence of a quorum at the meeting. Promptly voting your shares in accordance with the instructions you receive will save the expense of additional solicitation. | | How to Vote in Advance: |

| | Via Internet:

At the website listed on the Notice of Internet Availability, proxy card or voting instruction form you received. |

| | |

| | By Telephone:

Call the telephone number provided on the proxy card or voting instruction form you received. |

| | |

| | By Mail:

Mark, date and sign your proxy card or voting instruction form and return it in the accompanying postage prepaid envelope. |

Sincerely,

Maryanne R. Lavan

Senior Vice President, General Counsel and Corporate Secretary

March 14, 2023

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on April 27, 2023: The 2023 Proxy Statement and 2022 Annual Report are available at www.edocumentview.com/LMT. |

|

Letter from Your Board of Directors

| | | | | | | | |

March 14, 2023 Dear Stockholders: | | |

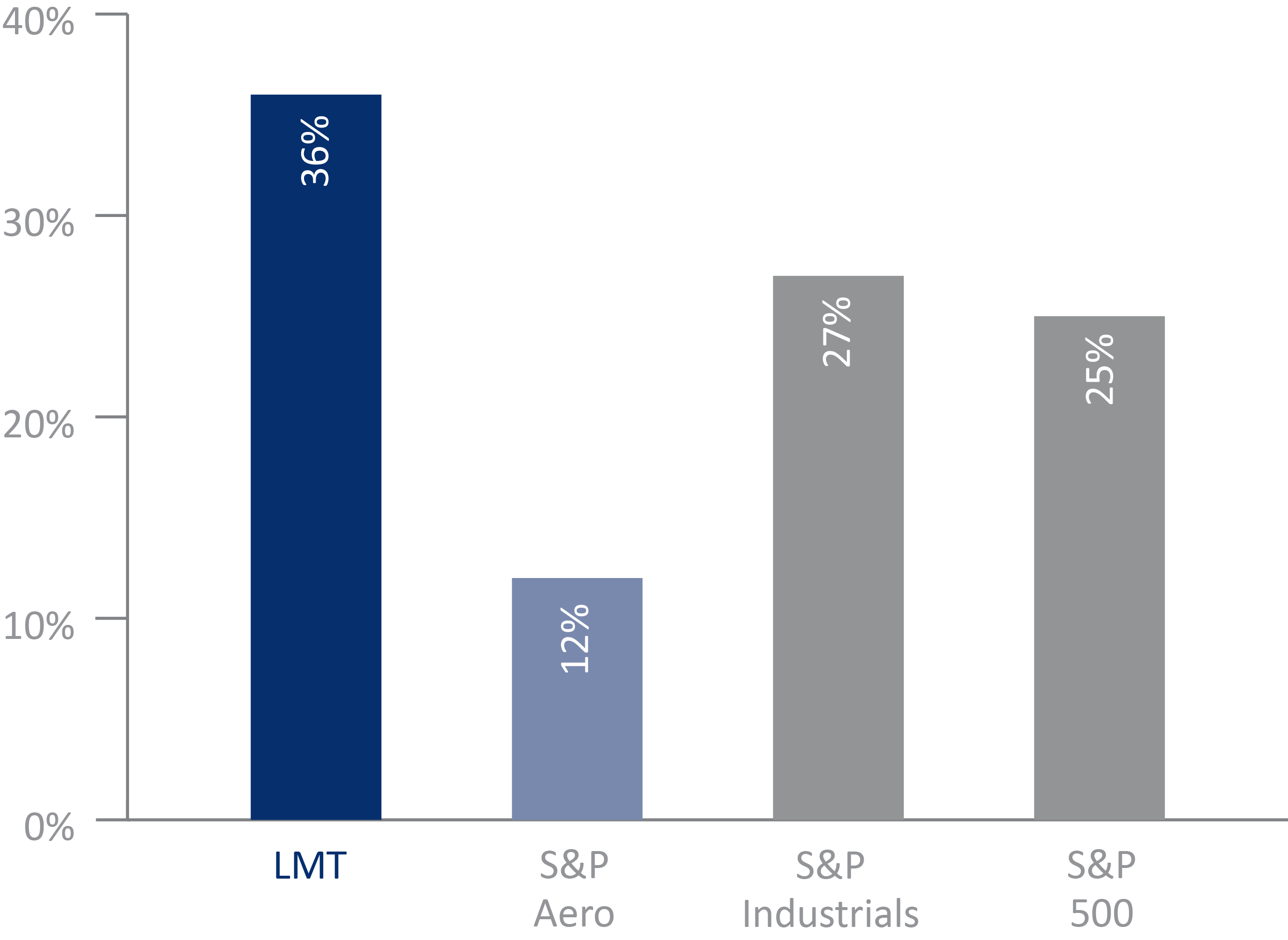

We hope you will join us at our virtual 2023 Annual Meeting of Stockholders on April 27, 2023. We encourage your attendance and engagement as we cover management and stockholder proposals as well as respond to your questions and comments. As we embark on a journey of enterprise-wide transformation and leadership in global security, we are committed to our company’s core values. These values inspire and unite our 116,000 teammates from diverse cultures and backgrounds across more than 30 countries. Every day, we work to meet the needs of the U.S. Government and its allies as we focus on deterrence through networked capabilities. Our customers’ need for joint all-domain operations is shaping Lockheed Martin to be fast, agile and innovative pathfinders to keep our customers “ahead of ready.” We are accelerating the delivery of 21st Century Security solutions to meet our customers’ hardest challenges. In this 2023 Proxy Statement, you will see we are doing this as responsible corporate citizens focused on positive outcomes and as global stewards for sustainable and ethical business practices. We are confident in our company’s strategy for long-term growth, which comes not only through continuing to innovate and deliver for our customers, but also through the choices we make and the methods we use to accomplish our goals. As a Board, we actively partnered with management to oversee progress in key areas aligned with our strategy and core values, and we are proud of the following 2022 achievements: •Customer Mission Success: We completed 94% of targeted Mission Success events. These are events such as key deliveries, flight tests and demonstrations that we identified at the beginning of the year as important to our customers and our program performance. •Stockholder Value: We created significant stockholder value, returning $10.9 billion to stockholders through dividend payments and share repurchases and achieving one- and three-year total stockholder returns of 40% and 36%, respectively. •OneLM Transformation (1LMX): We invested $400 million in digital and business transformation as part of a multi-year program to transform our processes and deliver capability to our customers that will enhance our speed, agility, insights and value. •R&D and Capital Investments: We increased our company-funded research and development and capital investments to meet emerging challenges and help accelerate the delivery of capabilities our customers need. •Supply Chain: We made progress on our transformation efforts designed to increase savings, improve supplier performance, increase organizational efficiency and decrease supply chain risk and developed an enterprise-wide approach for increasing multi-tier supply chain risk management. •Military & Veteran Support: Veterans make up a fifth of our workforce. We donated more than $9.6 million to ensure service members, veterans and their families are prepared, well-supported and enabled to fully participate and thrive in society. | | |

| |

|

| |

Do What’s Right | |

| |

| |

| Respect Others | |

| |

| |

| Perform with Excellence | |

| |

| | | | | | | | |

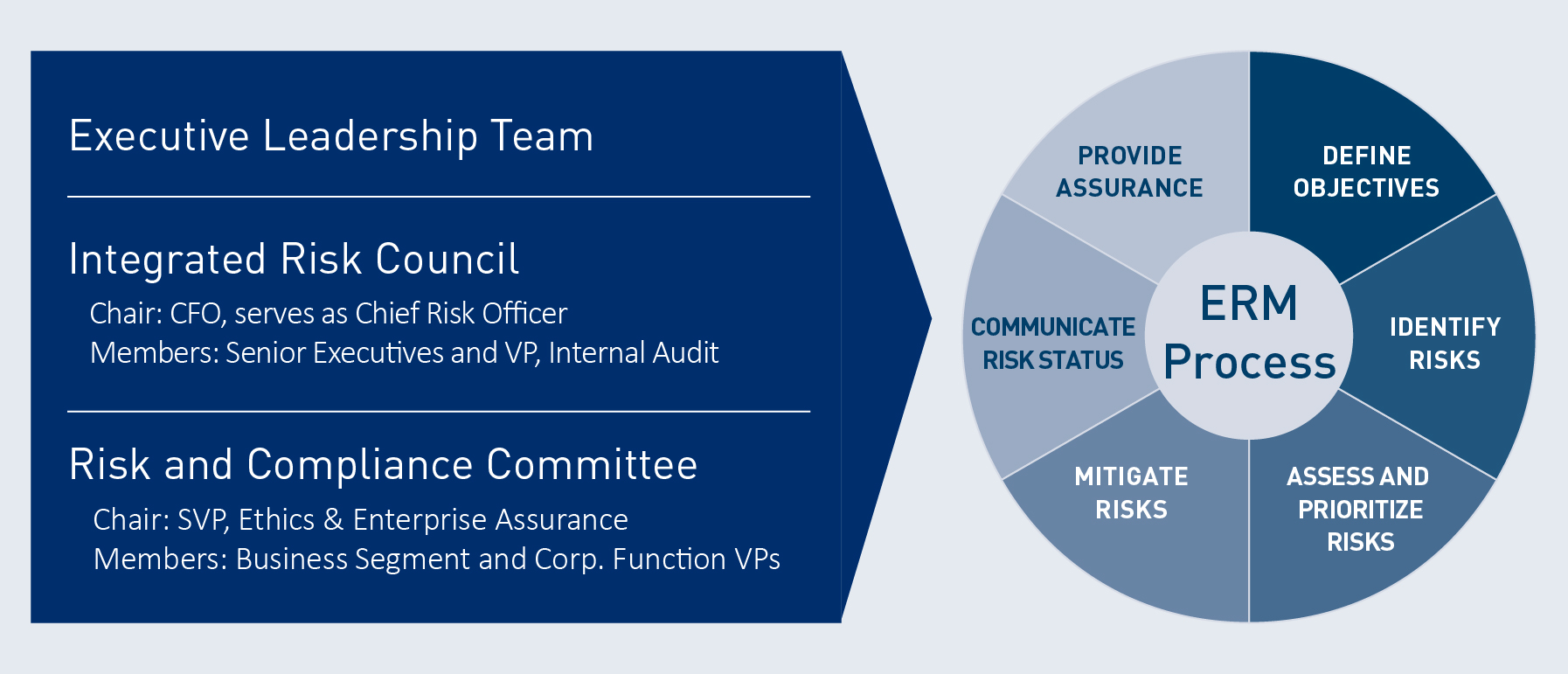

•Employee Culture: We launched several learning curriculums focused on preparing our leaders and workforce to effectively navigate change and adapt to new ways of working with an emphasis on inclusion and flexibility. Lockheed Martin’s focused efforts around culture, transformation, leadership development and the employee experience contributed to our ranking as the top Aerospace and Defense Employer and 11th best company overall in the 2022 Forbes World’s Best Employers survey. •Internal Audit and Enterprise Risk Management: We enhanced enterprise assurance through increased use of data analytics and automated risk surveillance. •Environmental: We accelerated our 2030 decarbonization goals, restated them on an absolute basis, and updated the baseline year, increasing our targets to 36% reduction of carbon and 40% use of renewables. We also published a climate lobbying assessment report in response to investor interest. •Human Rights: We continued to engage with our investors on human rights issues and published an updated Human Rights Report providing greater transparency into our policies, programs and commitments related to human rights. •Governance and Board of Directors: We have 38% gender and ethnic diversity among our Board nominees. During 2022, we updated our Governance Guidelines to make explicit the Board’s commitment to diversity in our Board member searches. •Stockholder Engagement: We solicited ongoing feedback from investors through our year-round stockholder engagement program, which in 2022 included engagements with stockholders representing nearly half of our outstanding shares. Our energy, ingenuity and values have made us the world’s leader in integrated deterrence. In this Proxy Statement, you will learn more about our Board and governance practices, our approach to Environmental, Social, and Governance (ESG) topics, our executive compensation structure and other important aspects of our company. It is an honor to serve as your Board of Directors and we are thankful for your continued trust. Your vote is important to us and we encourage you to promptly cast your votes in consideration of our recommendations. With respect and gratitude, Your Lockheed Martin Board of Directors |

Table of Contents

| | | | | | | | | | | |

| | | |

| Frequently Requested Information | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

About Lockheed Martin

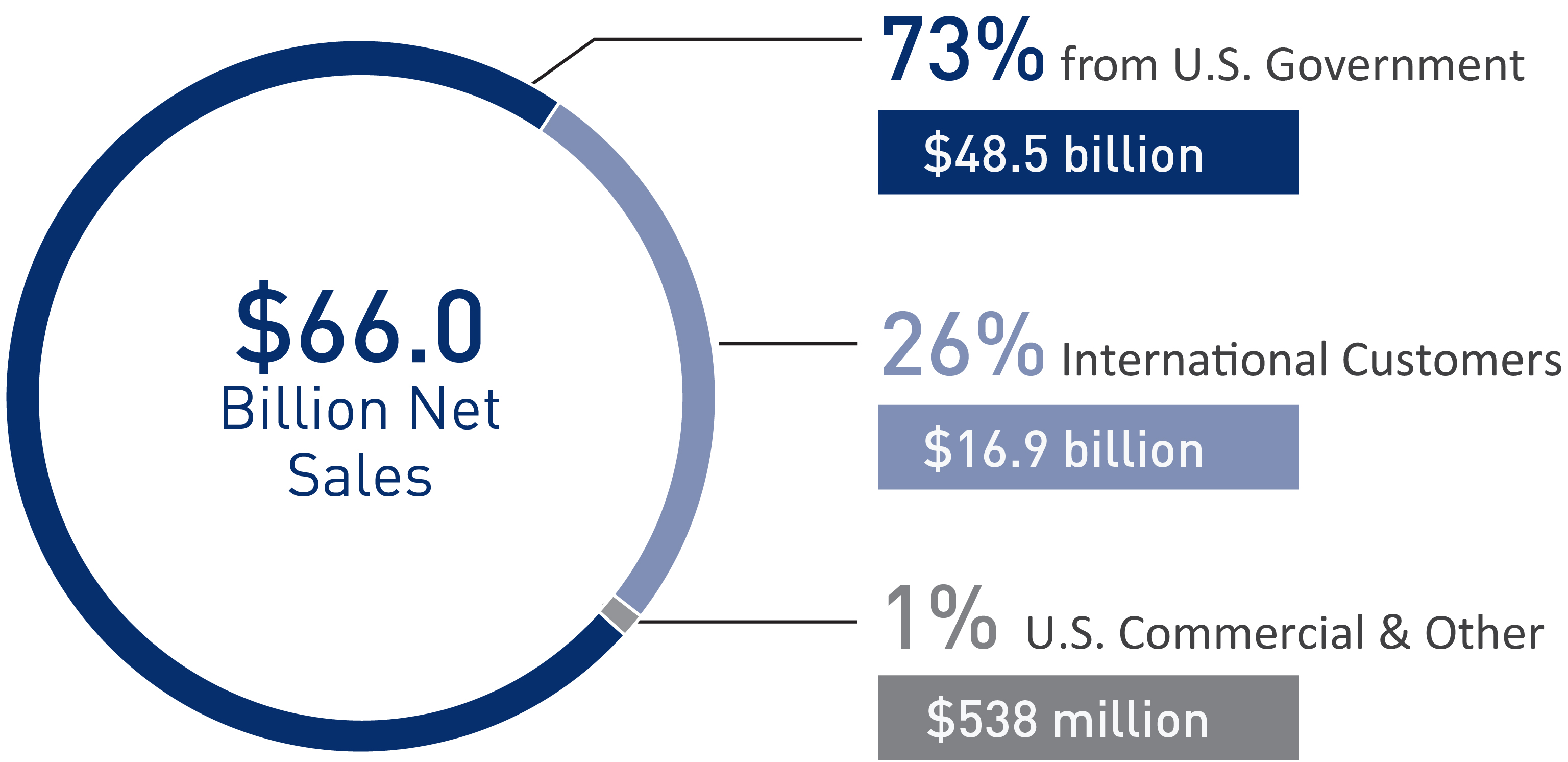

Lockheed Martin Corporation (Lockheed Martin, the Company, us or we) (NYSE: LMT) is a global security and aerospace company principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. We also provide a broad range of management, engineering, technical, scientific, logistics, system integration and cybersecurity services. We serve both U.S. and international customers with products and services that have defense, civil and commercial applications, with our principal customers being agencies of the U.S. Government.

| | | | | | | | | | | |

Financial Strength: 2022 Results | Industry-Leading Portfolio (2022 Sales) |

| |

| $27.0B AERONAUTICS |

| |

| $11.3B MISSILES AND FIRE CONTROL |

| |

| |

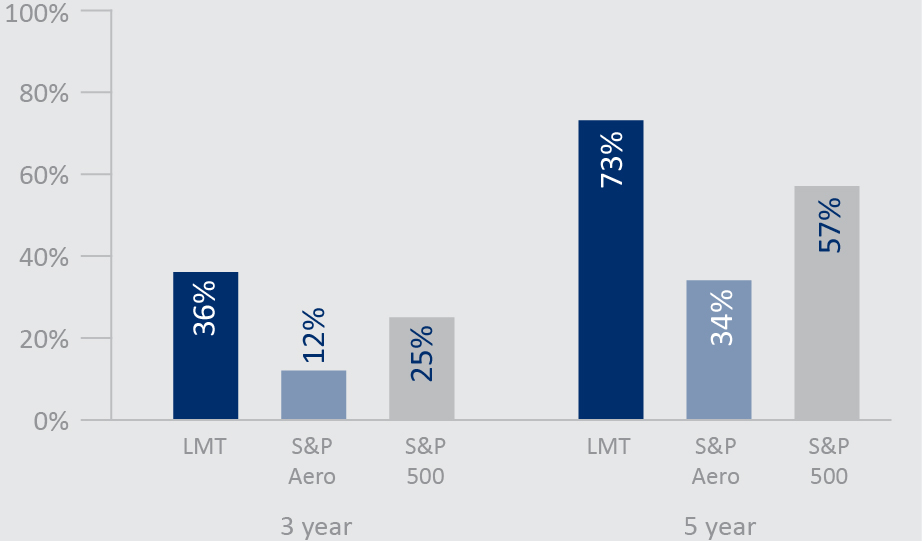

| 73% 5-year Total Stockholder Return | | $16.2B ROTARY AND MISSION SYSTEMS |

| |

| |

| 7% Increase to Annual Dividend | | $11.5B SPACE |

| |

| $5.7B Net Earnings |

| |

| | | | | | | | | | | | | | | | | |

| Countries with 250+ Employees | People |

| | | | | |

| 100,000+ United States | | 1,500+ United Kingdom | | 116,000 Total Employees |

| | | | | |

| 1,500+ Poland | | 1,250+ Canada | | 60,000 Engineers, Scientists and IT Professionals |

| | | | | |

| 1,000+ Australia | | 250+ New Zealand | | More than one in five employees is a veteran |

| | | |

Employee data as of December 31, 2022

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 1 |

Strategic Objectives

Our Mission: Enhance defense, security and scientific discovery by delivering reliable, innovative and affordable solutions for our customers’ most daunting challenges.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Lead | Innovate | Drive | Grow | |

| | | | | | | | | | |

| our industry with our customers to deliver superior 21st Century Security capability | to rapidly deliver capability through technology development, commercial technology application and new business models | operational excellence throughout the Company and efficiency throughout the industry | organically through franchise program captures, international expansion and through capital and acquisition investments that support our strategic goals | |

| | | | | | | | | | |

| | | | | | | | | | |

| KEY ENABLERS | |

| | DISCRIMINATING TECHNOLOGY | | DIGITAL TRANSFORMATION | | STRATEGIC PARTNERSHIPS | | FISCAL DISCIPLINE | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | TALENT & CULTURE | | | |

21st Century Security

Lockheed Martin’s vision for 21st Century Security is to accelerate the adoption of advanced networking and leading-edge technologies into our national defense enterprise, while enhancing the performance and value of our platforms and products for our customers. The aim of 21st Century Security is to integrate new and existing systems across all domains with advanced, open-architecture networking and operational technologies to make forces more agile, adaptive and unpredictable. A few of the key enabling technologies that we are prioritizing to make 21st Century Security a reality are listed below:

| | | | | | | | | | | | | | |

| | | | |

ARTIFICIAL INTELLIGENCE AND AUTONOMY | HYPERSONICS | DIRECTED ENERGY | EDGE COMPUTING | SPECTRUM DOMINANCE |

Sustainability

At Lockheed Martin, we foster innovation, integrity and security to protect the environment, strengthen communities and propel responsible growth. We integrate environmental, social and governance practices throughout our business and our employees actively strengthen the quality of life where we live and work. In 2022 we updated the two carbon-related goals shown below, which will accelerate our carbon reduction and renewable energy strategies. See the Environmental, Social and Governance section starting on page 32 for more information on our Sustainability efforts.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Carbon Reduction | | | | Renewable Energy | |

| | | | | |

| By 2030, reduce Scope 1 and 2 absolute carbon emissions by 36% from a 2020 baseline. | | | By 2030, match 40% of electricity used across Lockheed Martin global operations with electricity produced from renewable sources. | |

| | | |

Proxy Statement Voting Roadmap

This voting roadmap highlights selected information on each of the proposals and does not contain all of the information that you should consider in deciding how to vote your shares. Refer to the full descriptions of each proposal prior to voting.

| | | | | | | | | | | | | | | | | | | | | | | |

| PROPOSAL 1 | | | | | | |

| | | | | | | |

| Election of Directors The Board has nominated the following 13 directors for election to the Board: | | The Board recommends a vote FOR each director nominee | |

| Daniel F. Akerson Joseph F. Dunford, Jr. Vicki A. Hollub Patricia E. Yarrington | David B. Burritt James O. Ellis, Jr. Jeh C. Johnson | Bruce A. Carlson Thomas J. Falk Debra L. Reed-Klages | John M. Donovan Ilene S. Gordon James D. Taiclet | |

| See page 6 | | | | |

| | | | | | | |

Director Nominee Qualifications and Attributes

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

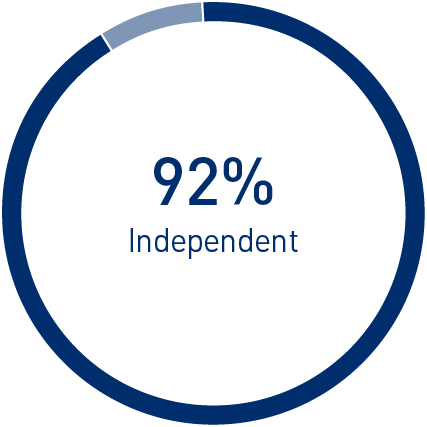

| BOARD DIVERSITY | | BOARD REFRESHMENT | | BOARD INDEPENDENCE |

38% Gender and Ethnic Diversity | | 7 New Directors in Past 5 Years | 67 Average Age | | 12 Independent |

| | | | | | | | | | | |

| Female | | | 0-5 years | | 60 – 65 | | |

| | | | | | | | |

| African-American | | | 6-10 years | | 66 – 70 | | |

| | | | | | | |

| Veteran | | | 11+ years | | 71 – 75 | | |

| | | | | | | | | | |

| | | | 7 Years Average Tenure | | |

| | | | | | | | | | | | | | |

| CORE COMPETENCIES | | | | |

|

| CEO Leadership Experience | Senior Military /

Government Experience | Financial Expertise | Environmental, Social and Governance Expertise | Cybersecurity Expertise |

| | | | |

8 Directors | 4 Directors | 9 Directors | 10 Directors | 4 Directors |

| | | | | | | | | | | | | | | | | | | | | | | |

| STRATEGIC SKILLS ENHANCED IN THE PAST 5 YEARS |

| | | | | | | |

| Lead | Innovate | Drive | Grow |

| | | | | | | |

| 21st Century Security /Defense Industry Transformation | | AI, Autonomy, Advanced Comms, Hypersonics, Space | | Operational Execution and Efficiency | | International Business

Expansion |

| | | | | | | |

| 5G.MIL®/ Digital & Networking Open Architecture | | Business and Digital Transformation | | Supply Chain

Excellence | | Business Model / Commercial Partnerships |

See page 8 for a matrix of the nominees’ individual strategic skills, core competencies and attributes followed by a description of each skill and competency.

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 3 |

Proxy Statement Voting Roadmap

| | | | | | | | | | | | | | | | | |

| PROPOSAL 2 | | | | |

| | | | | |

| Advisory Vote to Approve the Compensation of our Named Executive Officers (Say-On-Pay) See page 39 | | The Board recommends a vote FOR this proposal | |

| | | | | |

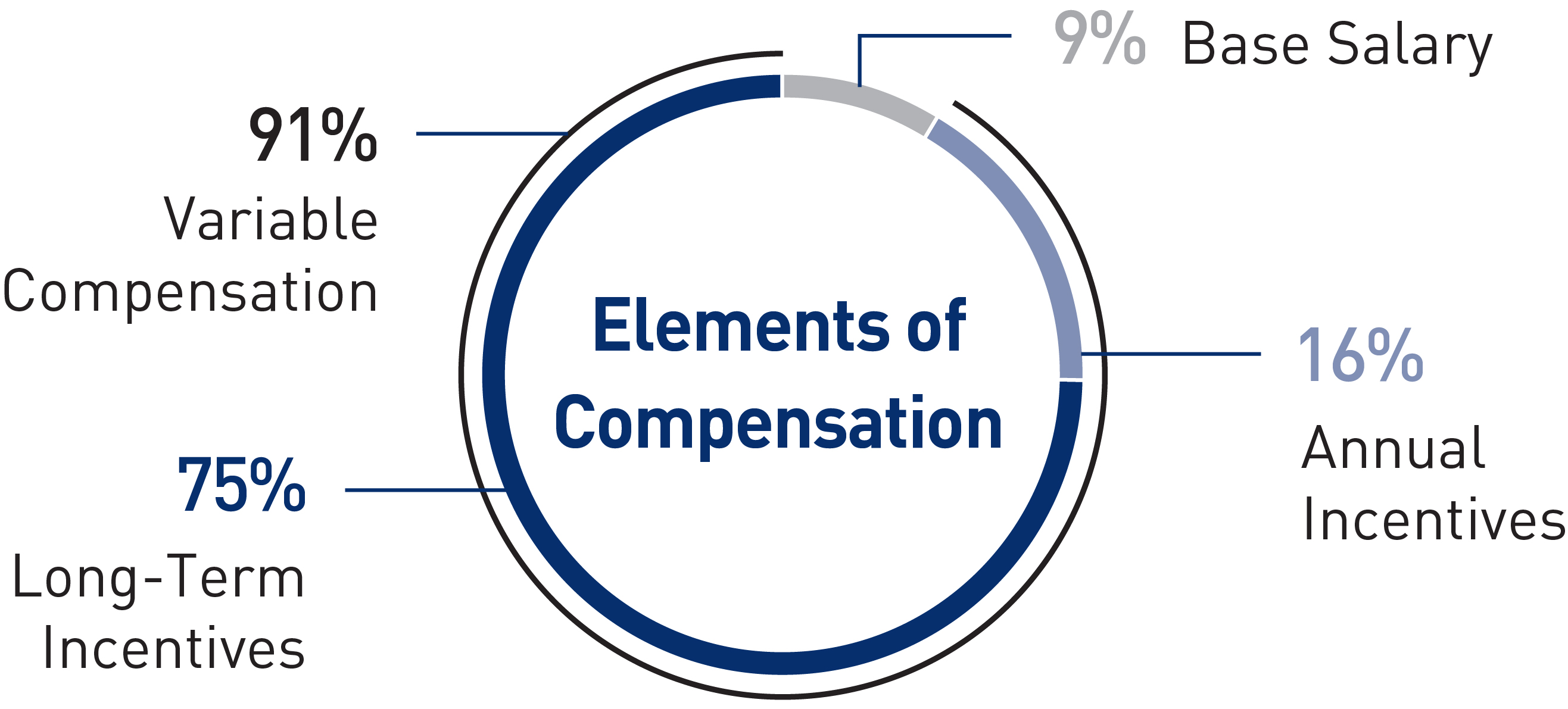

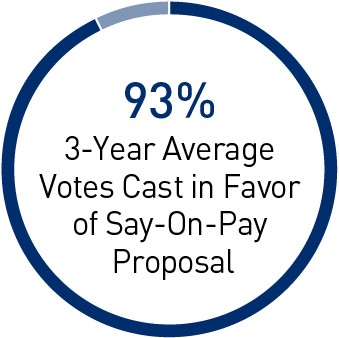

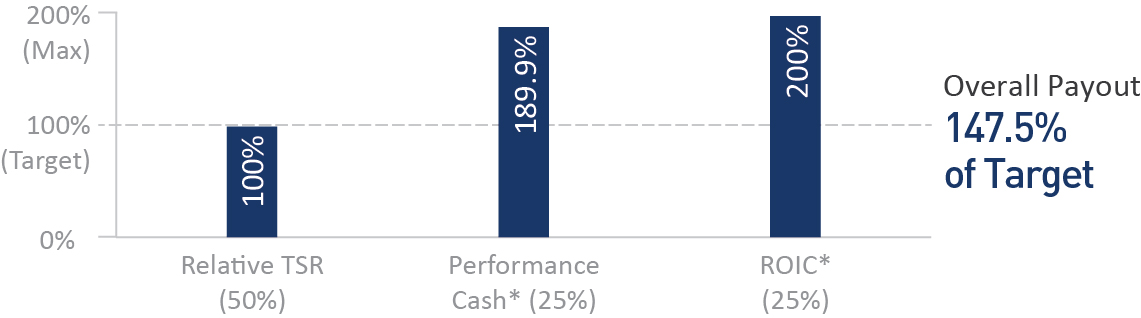

Executive Compensation Highlights

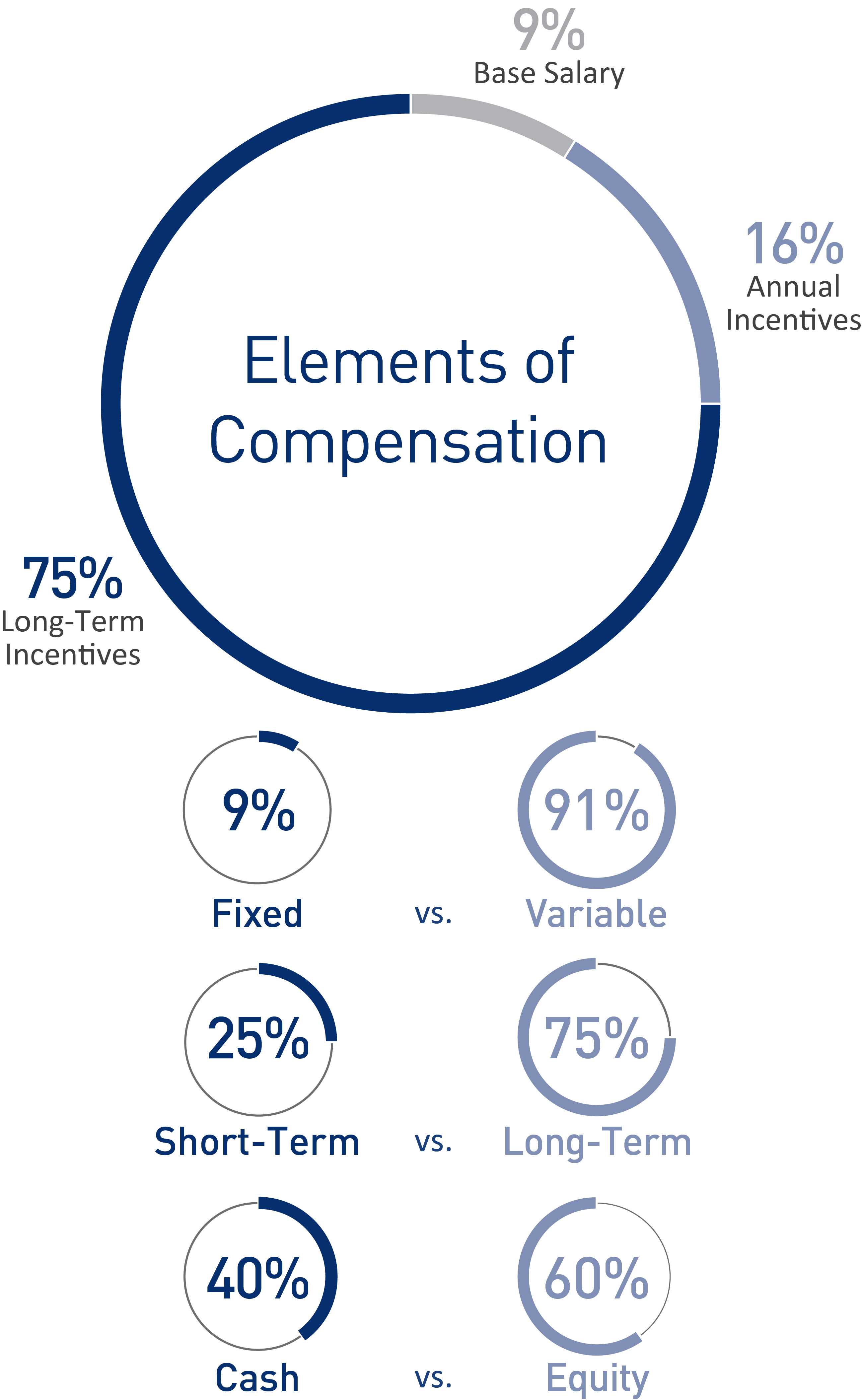

Our executive compensation program, underpinned by our pay-for-performance philosophy, delivers compensation to our named executive officers (NEOs) that is intrinsically and strongly linked to Company performance.

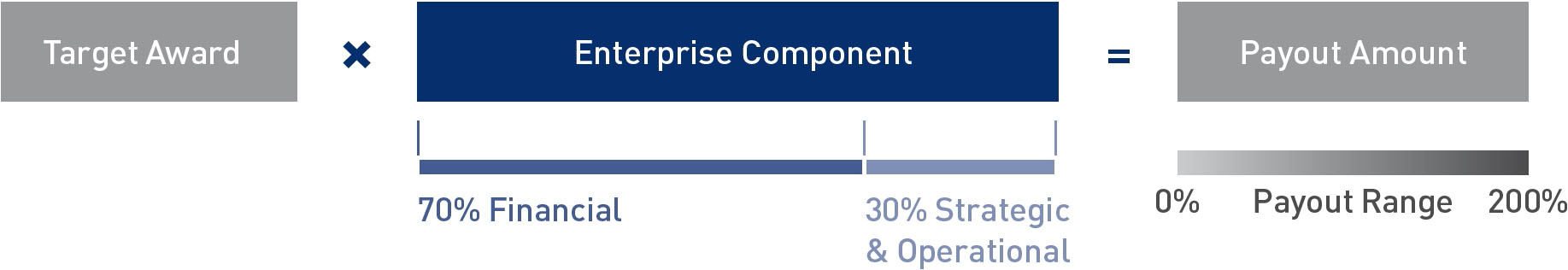

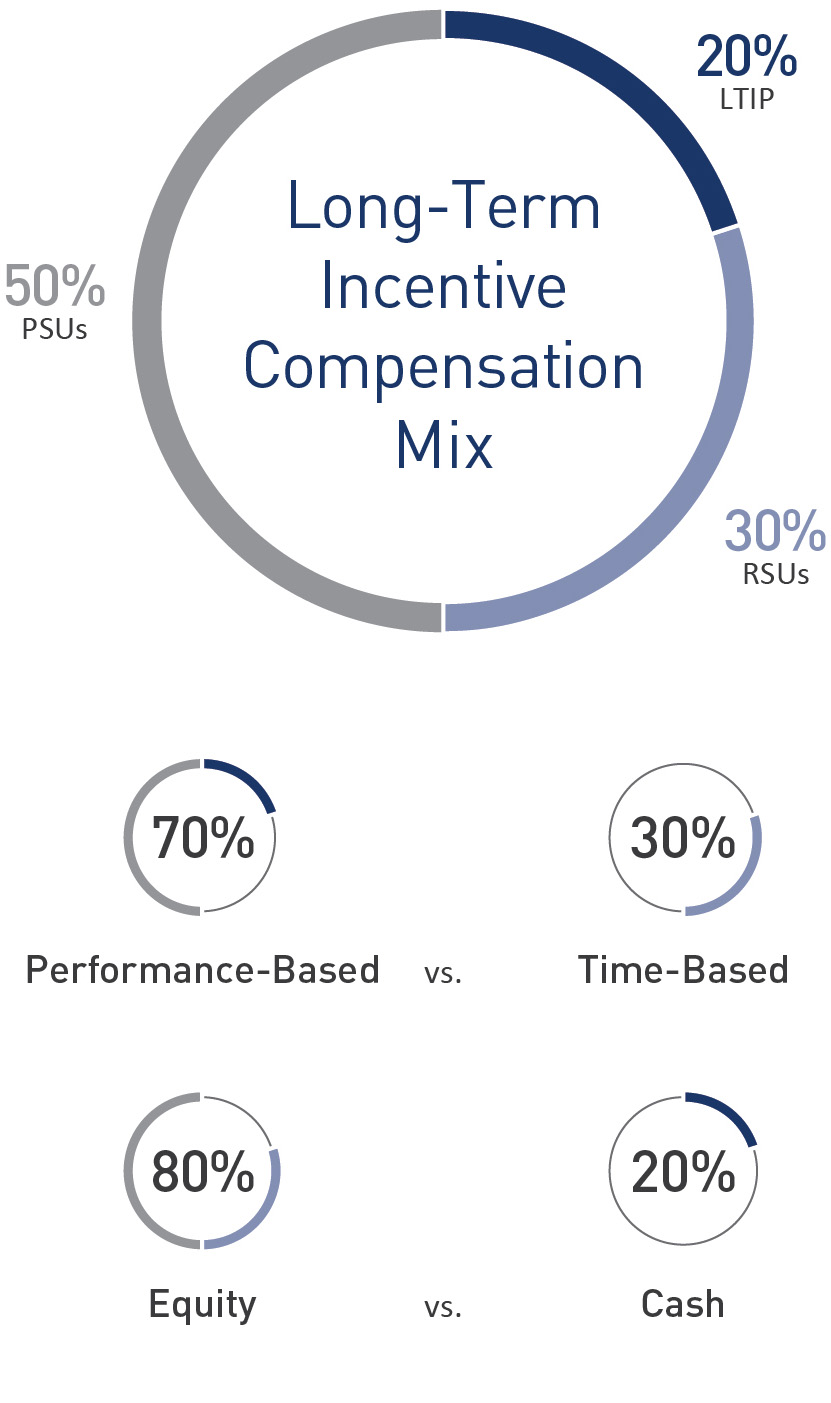

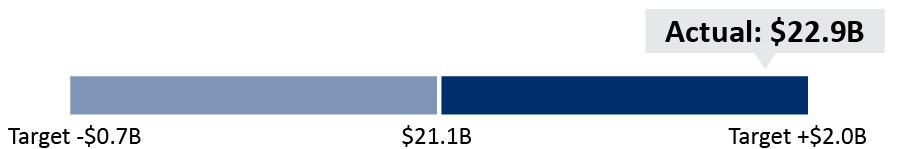

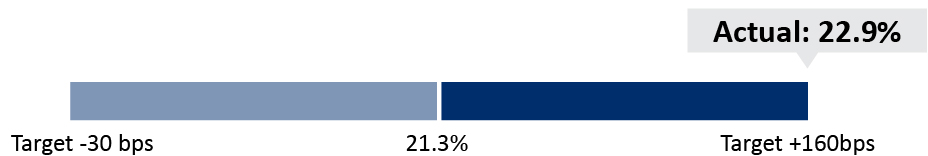

In February 2022, the Compensation Committee approved the 2022 incentive opportunities for NEOs. There were no changes to our overall annual or long-term incentive plan design for 2022. However, the Compensation Committee approved the use of Free Cash Flow to replace Cash From Operations and Performance Cash under the annual and long-term incentive plans, respectively. Use of Free Cash Flow better aligns with the Company’s strategy as it incorporates capital expenditures. The Compensation Committee also approved environmental, social and governance as a distinct category under the strategic and operational goals of our annual incentive program for 2022.

| | | | | | | | |

| | |

| 2022 CEO TARGET OPPORTUNITY MIX | | 2022 ANNUAL INCENTIVE |

| | Component Weightings and Achievements |

| | |

| | |

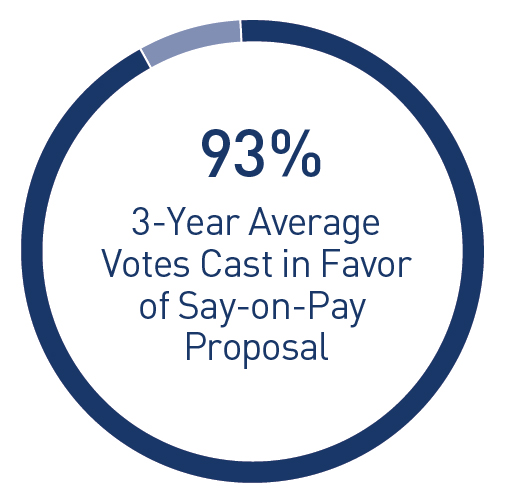

3-YEAR SAY-ON-PAY RESULTS | | 2020-2022 LONG-TERM INCENTIVES |

| | Component Weightings and Achievements |

| |

| | *See Appendix A for the definitions of Non-GAAP measures. |

Compensation Best Practices

| | | | | | | | | | | | | | |

| | |

| Best Practices in Our Programs | | | Practices We Do Not Engage In or Allow |

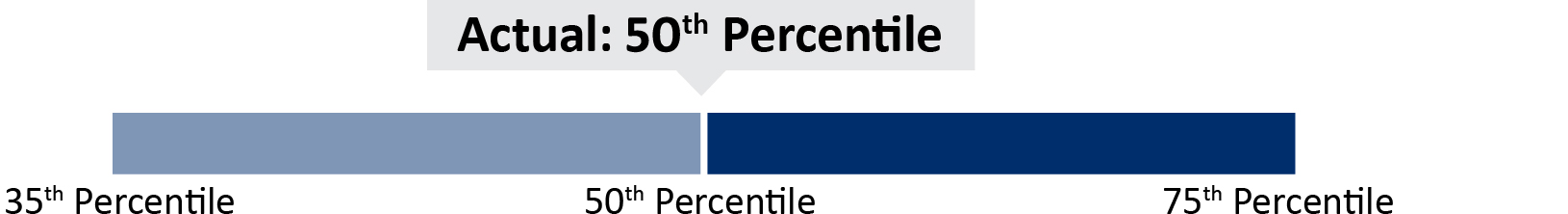

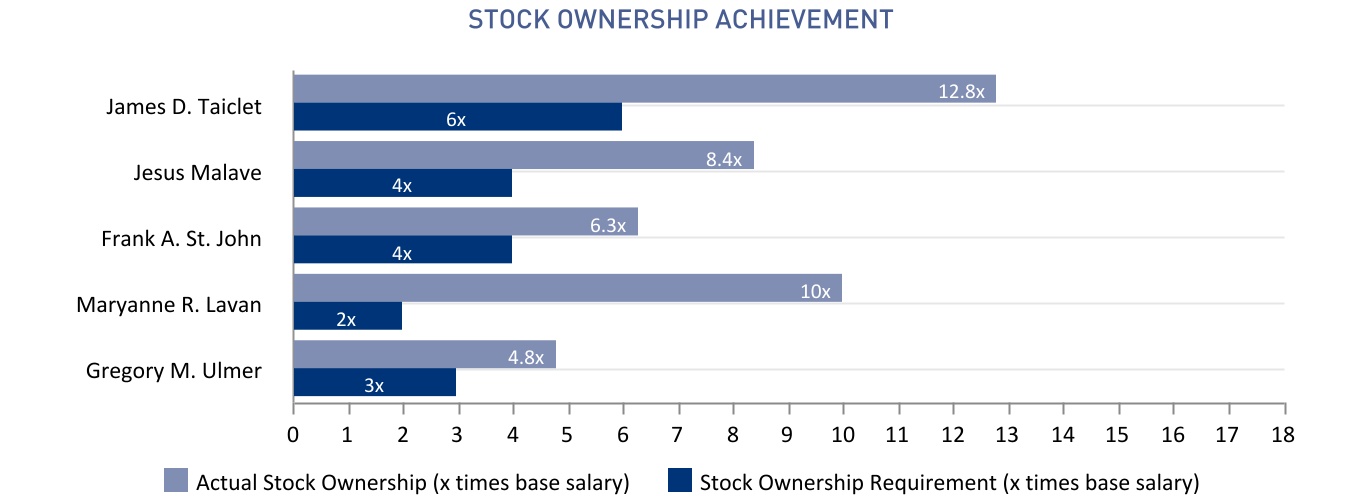

•Pay aligns with performance •Market-based (50th percentile) approach for determining NEO target pay levels •Caps on annual and long-term incentives, including when Total Stockholder Return (TSR) is negative •Clawback policy on variable pay •Double-trigger provisions for change in control •Robust stock ownership requirements •Low equity burn rate and dilution •No payment of dividends or dividend equivalents on unvested equity awards •ESG goals included under our annual incentive plan | | •No employment agreements •No option backdating, cash-out of underwater options or repricing (no employee options granted since 2012) •No gross-ups upon a change in control •No individual change in control agreements •No automatic acceleration of unvested incentive awards in the event of termination •No enhanced retirement formula or inclusion of long-term incentives in pensions •No enhanced death benefits for executives •No hedging or pledging of Company stock |

Proxy Statement Voting Roadmap

| | | | | | | | | | | | | | | | | |

| PROPOSAL 3 | | | | |

| | | | | |

| Advisory Vote on the Frequency of Advisory Votes to Approve the Compensation of our NEOs See page 40 | | The Board recommends a vote FOR an ANNUAL stockholder advisory vote | |

| | | | | |

We are required by law to hold an advisory vote on the frequency of Say-on-Pay votes every six years. Stockholders may vote to hold the advisory vote on Say-on-Pay every one, two or three years. In 2017, our stockholders voted in favor of holding Say-on-Pay votes annually, which the Board adopted as its standard. In light of investor expectations and prevailing market practice, we ask stockholders to support the continuation of a frequency period of “ONE YEAR” (an annual vote) for future votes on Say-on-Pay.

| | | | | | | | | | | | | | | | | |

| PROPOSAL 4 | | | | |

| | | | | |

| Ratification of Appointment of Independent Auditors See page 79 | | The Board recommends a vote FOR this proposal | |

| | | | | |

The Audit Committee has appointed Ernst & Young LLP (Ernst & Young), an independent registered public accounting firm, as the independent auditors to perform an integrated audit of the Company’s consolidated financial statements and internal control over financial reporting for the year ending December 31, 2023. The Board believes obtaining stockholder ratification of the appointment is a sound corporate governance practice and recommends that stockholders ratify the appointment of Ernst & Young because it continues to perform at a high level and remains independent and objective.

| | | | | | | | | | | | | | | | | |

| PROPOSALS 5-7 | | | | |

| | | | | |

| Stockholder Proposals (in each case, if properly presented at the meeting) See pages 82-90 | | The Board recommends a vote AGAINST each of the stockholder proposals | |

| | | | | |

Each stockholder proposal in this Proxy Statement is followed by the response of the Board. For reasons set forth in the responses, the Board believes each stockholder proposal is not in the best interest of the stockholders and recommends a vote AGAINST each proposal, if properly presented at the meeting.

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 5 |

Proposal 1

| | | | | | | | | | | | | | | | | |

| | | | | |

| Election of Directors | | The Board recommends a vote FOR each director nominee | |

| | | | | |

The Board, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated the following 13 directors for election to the Board for a one-year term. If elected, each director will hold office until the 2024 Annual Meeting and until their successor is elected and qualified. Please see the following pages for additional information on the director nominees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BOARD LEADERSHIP | | | | | | |

| CHAIRMAN | | INDEPENDENT LEAD DIRECTOR | | | | | | |

| James D.

Taiclet Age: 62

Director

Since: 2018 | | | Daniel F.

Akerson Age: 74

Director

Since: 2014 | | | David B.

Burritt Age: 67

Director

Since: 2008 | | | Bruce A.

Carlson Age: 73

Director

Since: 2015 |

| | | Independent | | | Independent | | | Independent | |

Chairman, President & CEO,

Lockheed Martin Corporation Committees: None Other Public Boards: None | | Retired Chairman & CEO, General Motors Company Committees: N* Other Public Boards: NOVONIX Limited | | President & CEO, United States

Steel Corporation (U.S. Steel) Committees: A, N Other Public Boards: U.S. Steel (Executive) | | Retired United States Air

Force General Committees: C, N Other Public Boards: None |

| John M.

Donovan Age: 62

Director

Since: 2021 | | | Joseph F.

Dunford, Jr. Age: 67

Director

Since: 2020 | | | James O.

Ellis, Jr. Age: 75 Director

Since: 2004 | | | Thomas J.

Falk Age: 64

Director

Since: 2010 |

| Independent | | | Independent | | | Independent | | | Independent | |

Retired CEO, AT&T Communications, LLC Committees: A**, C Other Public Boards: Palo Alto Networks (Lead Independent Director; Nominating & Governance*; Compensation and People; Security) | | Senior Managing Director & Partner of Liberty Strategic Capital; Retired United States Marine Corps General; Former Chairman of the Joint Chiefs of Staff Committees: C**, N Other Public Boards: Satellogic Inc. | | Retired President and Chief Executive Officer of the Institute of Nuclear Power Operations Committees: A, C* Other Public Boards: Dominion Energy, Inc.

| | Retired Chairman & CEO,

Kimberly-Clark Corporation Committees: A*, M Other Public Boards: None |

| Ilene S.

Gordon Age: 69

Director

Since: 2016 | | | Vicki A.

Hollub Age: 63

Director

Since: 2018 | | | Jeh C.

Johnson Age: 65

Director

Since: 2018 | | |

|

| Independent | | | Independent | | | Independent | | | | |

Retired Chairman & CEO, Ingredion Incorporated Committees: A, M* Other Public Boards: International Paper Company (Governance*; Executive; Management Development & Compensation) | | President & CEO,

Occidental Petroleum Corporation Committees: M, N Other Public Boards: Occidental | | Partner at Paul, Weiss, Rifkind, Wharton & Garrison LLP; Former Secretary of Homeland Security Committees: C, N Other Public Boards: MetLife, Inc. (Audit; Governance & Corp. Responsibility) and U.S. Steel (Audit; Corp. Governance & Sustainability) | |

|

| Debra L.

Reed-Klages Age: 66

Director

Since: 2019 | | | Patricia E. Yarrington Age: 66 Director Since: 2021 | | | | | A Audit C Classified Business and Security M Management Development and Compensation N Nominating and Corporate Governance * Chair ** After the Annual Meeting, Mr. Donovan will become Chair of the Compensation Committee and step down from the Audit Committee and Mr. Dunford will become Chair of the Classified Business and Security Committee |

| Independent | | | Independent | | | | |

Retired Chairman, President & CEO,

Sempra Energy Committees: M, N

Other Public Boards: Chevron Corporation (Audit*);

Caterpillar Inc. (Presiding Director; Executive Committee; Nominating and Governance Committee*) | | Retired Chief Financial Officer, Chevron Corporation Committees: A, M Other Public Boards: None | | | |

Proposal 1: Election of Directors

Board Composition and Effectiveness

Our Board seeks to operate with the highest degree of effectiveness, supporting a dynamic boardroom culture that encourages diverse, independent thought and intelligent debate on critical matters to achieve a higher level of success for the Company and its stockholders. This requires the right mix of people who bring diverse perspectives, characteristics, business and professional experiences, and competencies, as well as professional integrity, sound judgment and collegiality. This provides the foundation for robust dialogue, informed advice and collaboration in the boardroom.

The 13 director nominees are all incumbent directors. Through the annual self-evaluation process, including one-on-one discussions with the independent Lead Director, the Board determined that the director nominees possess the skills and experience to continue providing effective oversight of the Company. Each director nominee was originally selected through our Board Nomination process described on page 27 and continues to be well-qualified to serve the Company’s and stockholders’ interests. The strategic skills, core competencies and certain attributes of the nominees are set forth on the following page followed by individual biographies. In addition, each nominee has demonstrated their commitment to devote sufficient time to their service on the Board and are in compliance with our overboarding policy. All nominees other than Jim Taiclet, our Chairman, President and CEO, are independent.

Commitment to Board Diversity | | | | | | | | | | | |

At Lockheed Martin, we recognize diversity and inclusion as a business imperative and strategic asset to our investors. We believe that our business accomplishments are a result of the efforts of our employees around the world, and that a diverse employee population will result in a better understanding of our customers’ needs. Our success with a diverse workforce also informs our views about the value of a board of directors that has persons of diverse skills, experiences and backgrounds. Diversity in skills and backgrounds ensures that the widest range of options and viewpoints are expressed in the boardroom. To this end, the Board seeks to identify candidates with areas of knowledge or experience that will expand or complement the Board’s existing expertise in overseeing a technologically-advanced global security and aerospace company. In September 2022, the Board amended the Corporate Governance Guidelines (Governance Guidelines) to make explicit the Governance Committee’s commitment to actively seeking out highly-qualified women and individuals from minority groups as well as candidates with diverse backgrounds, experiences and skills as part of each search the Company undertakes. The Nominating and Corporate Governance Committee implements these guidelines in the identification and review of Board candidates and assesses the effectiveness of these guidelines by including questions regarding the diversity of the Board membership in the Board’s annual self-evaluation. The current composition of our Board and recent refreshment reflects those efforts and the importance of diversity to our Board. Over the past five years, our Board’s gender and racial/ethnic diversity has been enhanced with the additions of Pat Yarrington (2021), Debra Reed-Klages (2019), Vicki Hollub (2018) and Jeh Johnson (2018). We have also added two veterans over the past five years and new Board members have collectively enhanced each of the core competencies and strategic skills outlined on the following page. | | |

|

| | |

| 38% | |

| Gender and Ethnic Diversity

31% Women 8% African American 38% Veterans | |

| | | |

| | | |

Board Attendance

| | | | | | | | | | | |

Our Board is committed to their Board service. In 2022, there were six Board meetings. Directors are expected to attend all Board meetings and meetings of the committees on which they serve. All directors on the Board during 2022 attended more than 75 percent of the total Board and committee meetings to which they were assigned and overall attendance of the Board as a whole was 99 percent. Board members are also encouraged to attend the annual meeting of stockholders and all director nominees for the 2023 Annual Meeting attended the 2022 Annual Meeting. | | |

|

| | |

| 99% | |

| Average attendance of directors as a group at Board and committee meetings during 2022 | |

| | | |

| | | |

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 7 |

Proposal 1: Election of Directors

Director Nominees’ Strategic Skills, Core Competencies and Attributes

The following chart summarizes the strategic skills and core competencies that the Board considers valuable to effective governance and successful oversight of our corporate strategy and illustrates how the director nominees individually and collectively represent these key skills and competencies. Descriptions of the skills and competencies are on the following page. The lack of an indicator for a particular item does not mean that the director does not possess that skill or competency; rather, the indicator represents that the item is a core skill or competency of that director. The chart also provides the personal attributes of the director nominees. Director nominees are listed by tenure in descending order from left to right.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Lead | | | | | | | | | | | | | | |

21st Century Security / Def. Ind. Transformation | l | | | l | | | | l | l | | l | | l |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

5G.MIL / Digital & Networking Open Archit. | | | | | | | | | l | | | | l |

| | | | | | | | | | | | | |

| Innovate | | | | | | | | | | | | | | |

AI, Autonomy, Advanced Comms, Hypersonics, Space | l | | | | l | | | | l | | l | | l |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Business and Digital Transformation | | | l | l | | | | | l | | | l | l |

| | | | | | | | | | | | | |

| Drive | | | | | | | | | | | | | | |

Operational Execution and Efficiency | l | l | l | l | l | l | l | l | l | l | l | l | l |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Supply Chain Excellence | | l | l | l |

| | l | | l | l | | | |

| | | | | | | | | | | | | |

| Grow | | | | | | | | | | | | | | |

International Business Expansion | l | l | l | l | | l | l | l | l | | l | l | l |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Business Model /Commercial Partnerships | | l | l | l | | l | l | | l | l | | | l |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

M&A Expertise | | | l | l | | l | l | l | l | l | | l | l |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Senior Leadership Experience (most senior position held) | Four-Star Admiral | CEO | Chair and CEO | Chair and CEO | Four-Star General | Chair and CEO | CEO | Cabinet Sec. | Chair and CEO | Chair and CEO | Four-Star General | CFO | CEO |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Financial Expertise | | l | l | l | | l | l | | l | l | | l | l |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Environment, Social and Governance Expertise | | l | l | l | l | l | l | l | l | l | | l | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Cybersecurity Expertise | | | | | | | | l | l | | l | | l |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Senior Military / Government Experience | l | | | | l | | | l | | | l | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Race / Ethnicity | White | White | White | White | White | White | White | Black | White | White | White | White | White |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Veteran of the U.S. Armed Forces | l | | | l | l | | | | l | | l | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Gender (Male / Female) | M | M | M | M | M | F | F | M | M | F | M | F | M |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Age | 75 | 67 | 64 | 74 | 73 | 69 | 63 | 65 | 62 | 66 | 67 | 66 | 62 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Tenure (rounded years) | 18 | 15 | 13 | 9 | 8 | 7 | 5 | 5 | 5 | 3 | 3 | 2 | 1 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 11+ years | 6-10 years | 1-5 years |

| | | | | | | | | | | | | | |

Proposal 1: Election of Directors

Description of Strategic Skills, Core Competencies and Attributes

The core competencies and strategic skills that we value for the Board align with our mission and strategic objectives to Lead, Innovate, Drive and Grow to make 21st Century Security a reality. We believe the Board is more effective by collectively having a mix of these core competencies and strategic skills and these have been enhanced through recent refreshment.

| | | | | | | | | |

| | | |

21st Century Security / Defense Industry Transformation | We are increasingly confronting an evolving threat landscape that is demanding advanced capabilities and a need for better predictability and capacity faster than ever before. Our 21st Century Security strategy is about taking the best of defense and commercial technology to make forces agile, adaptive and unpredictable, so that they stay ready for any mission - today and in the future. Directors with experience in leading transformation and in the defense, commercial and telecom sectors provide important perspectives as we aim to execute industry partnerships and lead bringing these sectors together to deliver transformational capabilities for national defense. |

| |

| |

5G.MIL / Digital & Networking Open Architecture | Lockheed Martin's 5G.MIL solutions integrate military communications with tactical gateway capabilities (.MIL) and enhanced 5G technology to enable seamless, resilient and secure connectivity and data flow across all battlefield assets. Directors with industry experience or technological expertise contribute to an understanding of network-enabled technologies and open architectures to enable our 21st Century Security vision. |

| |

| | |

AI, Autonomy, Adv. Comms, Hypersonics, Space | Technologies such as Artificial Intelligence, Autonomy, Advanced Communications, Hypersonics and Space are key technology priorities for the Company. Directors with technology backgrounds contribute to an understanding of these technology priorities and our oversight of key investments in these areas. |

| |

| |

Business and Digital Transformation | Directors with experience in business processes and systems and their evolution provide valuable insights as we execute our mission-driven business and digital transformation program that is critical to innovate and deliver the speed, agility and insights our customers need. |

| |

| | |

Operational Execution and Efficiency | Our future success requires us to drive a culture of operational excellence, efficiency and consistent performance. Directors with experience in areas such as complex manufacturing and other large, complicated operations contribute to the understanding of these challenges. |

| |

| |

Supply Chain Excellence | Lockheed Martin has a diverse and complex multi-tiered supply chain that is critical to our success. Directors with expertise in the management of the upstream and downstream relationships with suppliers and customers provide important perspectives on managing supply chain challenges and driving its affordability and resiliency. |

| |

| | |

International Business Expansion | We are a global business with a presence in more than 50 countries. One of our key growth priorities is to expand our business internationally. Directors with experience understanding the complexities and risks of international business help the Company to achieve its international objectives. |

| |

| |

Business Model /Commercial Partnerships | A key element of our 21st Century Security strategy is to collaborate with innovative commercial companies outside of the traditional aerospace and defense industry to leverage their technologies for military applications as well as to develop new business models for the defense industry. Directors with commercial experience contribute to an understanding of these new business models and related growth opportunities. |

| |

| |

M&A Expertise | We look to leverage inorganic growth and portfolio alignment by pursuing strategically aligned targets with ventures, acquisitions and other investments as well as dispositions. Directors with mergers and acquisitions experience contribute to the Board’s understanding of these opportunities. |

| |

| | | |

| Senior Leadership Experience | All directors have senior leadership experience. We look to have a balance of directors with public company CEO leadership experience, public company CFO experience and other experience managing large, complex organizations. |

| | |

| | |

| Financial Expertise | All directors have the ability to understand financial statements. Directors who qualify as an “audit committee financial expert” have additional education and experience that enables them to provide additional oversight of financial statements and capital allocation decisions as well as important financial metrics in measuring our performance. |

| | |

| | |

| Environment, Social and Governance Expertise | Directors with environmental, social and governance experience, including employee safety and health, climate-related risks, political risks and cybersecurity, play an important role in the Board’s oversight of risks and the Company’s sustainability initiatives. |

| | |

| | |

| Cybersecurity Expertise | Directors with experience in cybersecurity, intelligence and data protection, including U.S. cybersecurity policy and the U.S. Government’s cybersecurity efforts and cybersecurity threats, contribute to the Board’s oversight of cybersecurity risks and digital transformation efforts. |

| | |

| | |

| Senior Military / Government Experience | Directors with experience serving in senior military or government roles bring an important perspective and understanding of our customers and relevant policy issues. |

| | |

| | | |

| Race / Ethnicity, Veteran, Gender, Age, Tenure | Our Board believes a balance of director diversity and tenure is a strategic asset to our investors. See the discussion of Board Composition on page 7. Directors who are veterans of the U.S. Armed Forces also contribute to an understanding of our customers and mission. |

| | |

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 9 |

Proposal 1: Election of Directors

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Vice Chairman of The Carlyle Group from March 2014 to December 2015. Mr. Akerson was Chairman of the Board of Directors and Chief Executive Officer of General Motors Company from January 2011 until his retirement in January 2014. Prior to joining General Motors, he was a Managing Director of The Carlyle Group, serving as the Head of Global Buyout from July 2009 to August 2010 and as Co-Head of U.S. Buyout from June 2003 to June 2009. Mr. Akerson previously served as Chairman of the U.S. Naval Academy Foundation from 2015 until 2021 and served on the board of directors of KLDiscovery Inc. from December 2019 until January 2020 and CommScope Holding Company, Inc. from April 2019 until December 2020. Experience, Strategic Skills and Core Competencies •Core leadership skills and experience with the demands and challenges of the global marketplace •Extensive operating, marketing and senior management experience in a succession of major companies in challenging, highly competitive industries •Enterprise risk management, financial, investment and mergers and acquisitions expertise |

| | | |

| Daniel F. Akerson Age 74 Director since 2014 Independent Lead Director Committees Nominating and Corporate Governance, Chair Other Public Boards* NOVONIX Limited | | |

| | |

| | |

| | | | 21st Century Security / Defense Industry Transformation | | Business and Digital Transformation | | Business Model / Commercial Partnerships |

| | | | CEO Leadership

Experience | | Environment, Social and Governance Expertise | | Financial Expertise |

| | | | International Business Expansion | | M&A Expertise | | Operational Execution and Efficiency |

| | | | Supply Chain Excellence | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography President and Chief Executive Officer of United States Steel Corporation (U.S. Steel) since May 2017. Mr. Burritt was also named to U.S. Steel’s board of directors at that time. Mr. Burritt previously served as President and Chief Operating Officer of U.S. Steel from February 2017 to May 2017; Chief Financial Officer from September 2013 to May 2017; and Executive Vice President from September 2013 to February 2017. Prior to joining U.S. Steel, Mr. Burritt served as Chief Financial Officer of Caterpillar Inc. until his retirement in 2010, after more than 32 years with the company. Experience, Strategic Skills and Core Competencies •Expertise in public company accounting, risk management, disclosure, financial system management, manufacturing and commercial operations and business transformation from roles as CEO and CFO at U.S. Steel and CFO and Controller at Caterpillar Inc. •Over 40 years’ experience with the demands and challenges of the global marketplace from his positions at U.S. Steel and Caterpillar Inc. |

| | | |

| David B. Burritt Age 67 Director since 2008 Independent Director Committees Audit; Nominating and Corporate Governance Other Public Boards* U.S. Steel | | |

| | |

| | |

| | | | Business Model / Commercial Partnerships | | CEO and CFO Leadership

Experience | | Environment, Social and Governance Expertise |

| | | | Financial Expertise | | International Business Expansion | | Operational Execution and Efficiency |

| | | | Supply Chain Excellence | | | | |

| | | | | | | | | |

* Other public board committees are listed on page 6.

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Retired U.S. Air Force General, Mr. Carlson has been chairman of Utah State University’s Space Dynamics Laboratory Guidance Council since June 2013 and chairman of its board of directors since 2018. Previously, Mr. Carlson served as the 17th Director of the National Reconnaissance Office from 2009 until 2012. He retired from the U.S. Air Force in 2009 after more than 37 years of service, including service as Commander, Air Force Materiel Command at Wright-Patterson AFB, Ohio; Commander, Eighth Air Force at Barksdale AFB, Louisiana; and Director for Force Structure, Resources and Assessment (J-8) for the Joint Staff. Mr. Carlson previously served on the board of directors of Benchmark Electronics Inc. from July 2017 until October 2021. Experience, Strategic Skills and Core Competencies •Industry-specific expertise and knowledge of our core customer, including aircraft and satellite development and acquisition experience from his service in senior leadership positions with the military •Experience with the demands and challenges associated with managing large organizations from his service as a Commander and Joint Staff Director of the Joint Chiefs and the National Reconnaissance Office •Skilled in executive management, logistics and military procurement |

| | | |

| Bruce A. Carlson Age 73 Director since 2015 Independent Director Committees Classified Business and Security; Nominating and Corporate Governance Other Public Boards None | | |

| | |

| | |

| | | | AI, Autonomy, Advanced Comms, Hypersonics, Space | | Environment, Social and Governance Expertise | | Operational Execution and Efficiency |

| | | | Senior Military / Government Experience | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Retired Chief Executive Officer of AT&T Communications, LLC, a wholly-owned subsidiary of AT&T Inc. Mr. Donovan served as CEO from August 2017 until his retirement in October 2019. He was Chief Strategy Officer and Group President of AT&T Technology and Operations from January 2012 through August 2017, and Chief Technology Officer of AT&T Inc. from April 2008 through January 2012. He is a member of the President’s National Security Telecommunications Advisory Committee. Experience, Strategic Skills and Core Competencies •Expertise in technology and innovation, including the transition to 5G networks, artificial intelligence and machine learning •Skilled in overseeing global information, software development, supply chain, network operations and big data organizations •Experience in cybersecurity, including Lead Independent Director of a leading cybersecurity company and Cybersecurity & Infrastructure Security Agency (CISA) committee leadership |

| | | |

| John M. Donovan Age 62 Director since 2021 Independent Director Committees* Audit; Classified Business and Security Other Public Boards** Palo Alto Networks | | |

| | |

| | |

| | | | 21st Century Security / Defense Industry Transformation | | 5G.MIL / Digital & Networking Open Architecture | | AI, Autonomy, Advanced Comms, Hypersonics, Space |

| | | | Business and Digital Transformation | | Business Model / Commercial Partnerships | | CEO Leadership

Experience |

| | | | Cybersecurity Expertise | | Financial Expertise | | International Business Expansion |

| | | | M&A Expertise | | Operational Execution and Efficiency | | |

| | | | | | | | |

| | | | | | | | | |

* Effective after the Annual Meeting and assuming his re-election, Mr. Donovan will become a member and the Chair of the Compensation Committee and step down from the Audit Committee.

** Other public board committees are listed on page 6.

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 11 |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Retired U.S. Marine Corps General, Mr. Dunford has served as a senior managing director and partner of Liberty Strategic Capital and as a member of the firm’s investment committee since February 2022. Previously, he served as the 19th Chairman of the Joint Chiefs of Staff from 2015 until his retirement in September 2019. His previous assignments include serving as the 36th Commandant of the Marine Corps and the Commander of all U.S. and NATO Forces in Afghanistan. He is a Senior Fellow at the Belfer Center, Harvard University, and Chairman of the Board of the Semper Fi and America’s Fund. Experience, Strategic Skills and Core Competencies •Industry-specific expertise and knowledge of our core customer from his service in senior leadership positions with the military •Experience with the demands and challenges associated with managing large organizations from his service as a Commander and Chairman of the Joint Chiefs of Staff •Skilled in executive management, logistics, military procurement and cybersecurity threats |

| | | |

| Joseph F. Dunford, Jr. Age 67 Director since 2020 Independent Director Committees* Classified Business and Security; Nominating and Corporate Governance Other Public Boards** Satellogic Inc. | | |

| | |

| | |

| | | | 21st Century Security / Defense Industry Transformation | | AI, Autonomy, Advanced Comms, Hypersonics, Space | | Cybersecurity Expertise |

| | | | International Business Expansion | | Operational Execution and Efficiency | | Senior Military / Government Experience |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Admiral Ellis has served as an Annenberg Distinguished Fellow at the Hoover Institution at Stanford University since 2014. Previously, he served as President and Chief Executive Officer of the Institute of Nuclear Power Operations from May 2005 until his retirement in May 2012. Mr. Ellis retired from active duty in July 2004 after serving as Admiral and Commander, United States Strategic Command, Offutt Air Force Base, Nebraska. He formerly served as a director of Level 3 Communications, Inc. from March 2005 to November 2017. Experience, Strategic Skills and Core Competencies •Industry-specific expertise and knowledge of our core customers from his service in senior leadership positions with the military and the private sector •Expertise in aeronautical and aerospace engineering, information technology and emerging energy issues; classified program expertise •Over 40 years’ experience in managing and leading large and complex technology-focused organizations, in large part as a result of serving for 35 years as an active duty member of the United States Navy |

| | | |

| James O. Ellis, Jr. Age 75 Director since 2004 Independent Director Committees* Audit; Classified Business and Security, Chair Other Public Boards** Dominion Energy, Inc. | | |

| | |

| | |

| | | | 21st Century Security / Defense Industry Transformation | | AI, Autonomy, Advanced Comms, Hypersonics, Space | | International Business Expansion |

| | | | Operational Execution and Efficiency | | Senior Military / Government Experience | | |

| | | | | | | | |

| | | | | | | | | |

* Effective after the Annual Meeting and assuming his re-election, Mr. Dunford will become Chair of the Classified Business and Security Committee. Mr. Ellis will remain a member of the Committee.

** Other public board committees are listed on page 6.

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Executive Chairman of Kimberly-Clark Corporation from January 2019 through December 2019. Having served 36 years at Kimberly-Clark Corporation, Mr. Falk was Chairman of the Board and Chief Executive Officer from 2003 until December 2018; Chief Executive Officer from 2002 and President and Chief Operating Officer from 1999 to 2002. Experience, Strategic Skills and Core Competencies •Experience with the demands and challenges associated with managing global organizations from his experience as Chairman and Chief Executive Officer of Kimberly-Clark Corporation •Knowledge of financial system management, public company accounting, disclosure requirements and financial markets •Skilled in manufacturing, human capital management, compensation, governance and public company boards |

| | | |

| Thomas J. Falk Age 64 Director since 2010 Independent Director Committees Audit, Chair; Management Development and Compensation Other Public Boards None | | |

| | |

| | |

| | | | Business and Digital Transformation | | Business Model / Commercial Partnerships | | CEO Leadership

Experience |

| | | | Environment, Social and Governance Expertise | | Financial Expertise | | International Business Expansion |

| | | | M&A Expertise | | Operational Execution and Efficiency | | Supply Chain Excellence |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Executive Chairman of the Board of Ingredion Incorporated from January 2018 through July 2018. Previously, Ms. Gordon was Chairman of the Board, President and Chief Executive Officer of Ingredion Incorporated from May 2009 through December 2017. Ingredion Incorporated is a publicly traded corporation that manufactures food ingredients globally. Ms. Gordon served as a director of International Flavors & Fragrances, Inc. from February 2021 to February 2023. Experience, Strategic Skills and Core Competencies •Experience with the demands and challenges associated with managing global organizations from her experience as Chairman, President and Chief Executive Officer of Ingredion Incorporated •Knowledge of financial system management, public company accounting, disclosure requirements and financial markets •Skilled in marketing, human capital management, compensation, governance and public company boards |

| | | |

| Ilene S. Gordon Age 69 Director since 2016 Independent Director Committees* Audit; Management Development and Compensation, Chair Other Public Boards** International Paper Company | | |

| | |

| | |

| | | | Business Model / Commercial Partnerships | | CEO Leadership

Experience | | Environment, Social and Governance Expertise |

| | | | Financial Expertise | | International Business Expansion | | M&A Expertise |

| | | | Operational Execution and Efficiency | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

* Effective after the Annual Meeting and assuming his re-election, Mr. Donovan will become a member and the Chair of the Compensation Committee. Ms. Gordon will remain a member of the Committee.

** Other public board committees are listed on page 6.

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 13 |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography President and Chief Executive Officer of Occidental Petroleum Corporation (Occidental), an international oil and gas exploration and production company, since April 2016. Having served more than 30 years at Occidental, Ms. Hollub served as President and Chief Operating Officer from 2015 to 2016; Senior Executive Vice President, Occidental and President, Oxy Oil and Gas - Americas from 2014 to 2015; and Executive Vice President, Occidental and Executive Vice President, U.S. Operations and Oxy Oil and Gas from 2013 to 2014. Experience, Strategic Skills and Core Competencies •Broad insight and experience with the demands and challenges associated with managing global organizations from her experience as President and Chief Executive Officer of Occidental and more than three decades in executive and operational roles •Expertise in the Middle East region and Latin America •Skilled in enterprise risk management, environmental, safety and sustainability, including leading carbon capture, utilization and storage and other decarbonization initiatives |

| | | |

| Vicki A. Hollub Age 63 Director since 2018 Independent Director Committees Management Development and Compensation; Nominating and Corporate Governance Other Public Boards* Occidental | | |

| | |

| | |

| | | | Business Model / Commercial Partnerships | | CEO Leadership

Experience | | Environment, Social and Governance Expertise |

| | | | Financial Expertise | | International Business Expansion | | M&A Expertise |

| | | | Operational Execution and Efficiency | | Supply Chain Excellence | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Partner at the international law firm of Paul, Weiss, Rifkind, Wharton & Garrison LLP, and co-head of the Cybersecurity and Data Protection practice, since January 2017. Previously, Mr. Johnson served as U.S. Secretary of Homeland Security from December 2013 to January 2017; and as General Counsel of the U.S. Department of Defense and as General Counsel of the U.S. Department of the Air Force. Mr. Johnson is presently a director of the Council on Foreign Relations, and formerly served as a director of PG&E Corporation from May 2017 to March 2018. Experience, Strategic Skills and Core Competencies •Expertise in national security, leadership development and organizational preparedness from his service as U.S. Secretary of Homeland Security •Industry-specific expertise and insight into our core customers, including requirements for acquisition of products and services, from prior senior leadership positions with the military •Experience with large organization management and assessing human resources, equipment, cybersecurity, and financial requirements, as well as reputational risks |

| | | |

| Jeh C. Johnson Age 65 Director since 2018 Independent Director Committees Classified Business and Security; Nominating and Corporate Governance Other Public Boards* MetLife, Inc. U.S. Steel | | |

| | |

| | |

| | | | 21st Century Security /Defense Industry Transformation | | Cybersecurity Expertise | | Environment, Social and Governance Expertise |

| | | | International Business Expansion | | M&A Expertise | | Operational Execution and Efficiency |

| | | | Senior Military / Government Experience | | | | |

| | | | | | | | |

| | | | | | | | | |

* Other public board committees are listed on page 6.

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Retired in December 2018 as Executive Chairman of Sempra Energy. Ms. Reed-Klages served as Chairman, President and Chief Executive Officer of Sempra Energy from March 2017 to May 2018; Chairman and Chief Executive Officer of Sempra Energy from December 2012 to March 2017; and Chief Executive Officer of Sempra Energy from June 2011 to December 2012. Previously, Ms. Reed-Klages served as an Executive Vice President of Sempra Energy and as President and Chief Executive Officer of SDG&E and SoCalGas, Sempra Energy’s regulated California utilities. Ms. Reed-Klages was also previously President, Chief Operating Officer and CFO of SDG&E and SoCalGas. She previously served on the boards of directors of Halliburton Company from January 2001 to September 2018 and Oncor Electric Delivery Company LLC during 2018. Experience, Strategic Skills and Core Competencies •Experience with the demands and challenges associated with managing global organizations from her experience as Chairman, President and Chief Executive Officer of Sempra Energy •Skilled in enterprise risk management, environmental, safety and sustainability •Knowledge of financial system management, compensation, governance and public company board experience |

| | | |

| Debra L. Reed-Klages Age 66 Director since 2019 Independent Director Committees Management Development and Compensation; Nominating and Corporate Governance Other Public Boards* Chevron Corporation Caterpillar Inc. | | |

| | |

| | |

| | | | Business Model / Commercial Partnerships | | CEO Leadership

Experience | | Environment, Social and Governance Expertise |

| | | | Financial Expertise | | M&A Expertise | | Operational Execution and Efficiency |

| | | | Supply chain Excellence | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Chairman since March 2021 and President and Chief Executive Officer of Lockheed Martin since June 2020. Previously, Mr. Taiclet served as Chairman, President and Chief Executive Officer of American Tower Corporation from February 2004 until March 2020 and Executive Chairman from March 2020 to May 2020. Prior to that, Mr. Taiclet served as President of Honeywell Aerospace Services, a unit of Honeywell International and as Vice President, Engine Services at Pratt & Whitney, a unit of United Technologies Corporation. Experience, Strategic Skills and Core Competencies •Effective leadership and executive experience as Chairman, President and CEO of Lockheed Martin Corporation and American Tower Corporation •Expertise in management at large-scale, multinational corporations, including regulatory compliance, corporate governance, capital markets and financing, strategic planning and investor relations •Industry-specific expertise from service as a U.S. Air Force officer and pilot and as an executive at Lockheed Martin, Honeywell Aerospace Services and Pratt & Whitney |

| | | |

| James D. Taiclet Age 62 Director since 2018 Chairman, President and CEO Committees None Other Public Boards None | | |

| | |

| | |

| | | | 21st Century Security / Defense Industry Transformation | | 5G.MIL / Digital & Networking Open Architecture | | AI, Autonomy, Advanced Comms, Hypersonics, Space |

| | | | Business and Digital Transformation | | Business Model / Commercial Partnerships | | CEO Leadership

Experience |

| | | | Cybersecurity Expertise | | Environment, Social and Governance Expertise | | Financial Expertise |

| | | | | International Business Expansion | | M&A Expertise | | Operational Execution and Efficiency |

| | | | | Supply Chain Excellence | | | | |

| | | | | | | | | |

* Other public board committees are listed on page 6.

| | | | | | | | |

| www.lockheedmartin.com | 2023 Proxy Statement | 15 |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | Biography Retired Vice President and Chief Financial Officer of Chevron Corporation, one of the world’s leading integrated energy companies. Ms. Yarrington served as CFO of Chevron from January 2009 until her retirement in March 2019. During her 38 years at Chevron, she also served as Vice President and Treasurer from 2007 through 2008, Vice President of Policy, Government and Public Affairs from 2002 to 2007 and Vice President of Strategic Planning from 2000 to 2002. Previously, Ms. Yarrington served on the boards of directors of Chevron Phillips Chemical Company LLC (a 50-50 joint venture with Phillips 66) and the Federal Reserve Bank of San Francisco, serving as the Chairman of the Bank’s board from 2013 to 2014. Experience, Strategic Skills and Core Competencies •Expertise in public company accounting, risk management, disclosure, and financial system management from her role as CFO at Chevron •Over 38 years of experience with the demands and challenges of the global marketplace from her positions at Chevron |

| | | |

| Patricia E. Yarrington Age 66 Director since 2021 Independent Director Committees Audit; Management Development and Compensation Other Public Boards None | | |

| | |

| | |

| | | | Business and Digital Transformation | | CFO Leadership Experience | | Environment, Social and Governance Expertise |

| | | | Financial Expertise | | International Business Expansion | | M&A Expertise |

| | | | Operational Execution and Efficiency | | | | |

| | | | | | | | | |

| | | | | | | | | |

Corporate Governance

We believe that good corporate governance strengthens the Board and management, enhances public trust and is integral to achieving long-term stockholder value. This section provides an overview of Lockheed Martin’s corporate governance policies and practices.

Our Alignment with Governance Standards

In 2018, we signed on to the Commonsense Principles 2.0, which are intended to provide a basic framework for sound, long-term oriented governance. Our governance practices also comply with the Investor Stewardship Group (ISG) Corporate Governance Principles for U.S. Listed Companies. Below, we identify each of the ISG’s governance principles and how our practices are aligned.

| | | | | | | | | | | |

| | | |

Principle 1: Boards are accountable to stockholders | | | |

| | |

|  Annual election of directors Annual election of directors Majority voting standard for uncontested director elections Majority voting standard for uncontested director elections  Directors not receiving majority support must tender resignation to Board for consideration Directors not receiving majority support must tender resignation to Board for consideration |  Market-standard proxy access right for stockholders Market-standard proxy access right for stockholders  No poison pill No poison pill  Full disclosure on corporate governance and Board practices Full disclosure on corporate governance and Board practices |

| | | |

| | | |

| | | |

Principle 2: Stockholders should be entitled to voting rights in proportion to their economic interest | |  One class of voting stock One class of voting stock  “One share, one vote” standard “One share, one vote” standard | |

| | | |

| | | |

| | | |

Principle 3: Boards should be responsive to stockholders and be proactive in order to understand their perspectives | |  Proactive, year-round engagement with stockholders, including participation of independent directors as appropriate Proactive, year-round engagement with stockholders, including participation of independent directors as appropriate  Engagement topics during 2022 included: Board composition, diversity and refreshment, stockholder rights, climate risks and related climate change goals, workforce diversity and inclusion, executive compensation, human rights and our Human Rights Report, the conflict in Ukraine, lobbying and political spending and other environmental, social and governance (ESG) matters Engagement topics during 2022 included: Board composition, diversity and refreshment, stockholder rights, climate risks and related climate change goals, workforce diversity and inclusion, executive compensation, human rights and our Human Rights Report, the conflict in Ukraine, lobbying and political spending and other environmental, social and governance (ESG) matters |

| | | |

| | | |

| | | |

Principle 4: Boards should have a strong, independent leadership structure | |  Engaged independent Lead Director Engaged independent Lead Director  Annual review of Board leadership structure Annual review of Board leadership structure  Independent chairs of all Board committees Independent chairs of all Board committees | |

| | | |

| | | |

| | | |