DTE Energy 2013.12.31 10K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

Form 10-K

|

| | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013 |

¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-11607

DTE ENERGY COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

Michigan | | 38-3217752 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

One Energy Plaza, Detroit, Michigan | | 48226-1279 |

(Address of principal executive offices) | | (Zip Code) |

313-235-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, without par value | | New York Stock Exchange |

2011 Series I 6.5% Junior Subordinated Debentures due 2061 | | New York Stock Exchange |

2012 Series C 5.25% Junior Subordinated Debentures due 2062 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer þ | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

On June 28, 2013, the aggregate market value of the Registrant’s voting and non-voting common equity held by non-affiliates was approximately $11.7 billion (based on the New York Stock Exchange closing price on such date). There were 177,086,236 shares of common stock outstanding at January 31, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information in DTE Energy Company’s definitive Proxy Statement for its 2014 Annual Meeting of Common Shareholders to be held May 1, 2014, which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than 120 days after the end of the registrant’s fiscal year covered by this report on Form 10-K, is incorporated herein by reference to Part III (Items 10, 11, 12, 13 and 14) of this Form

10-K.

DTE Energy Company

Annual Report on Form 10-K

Year Ended December 31, 2013

Table of Contents

|

| | |

| | Page |

| |

| |

|

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

|

| | |

| |

EX-4.282 |

EX-4.283 |

EX-12.56 |

EX-21.9 |

EX-23.27 |

EX-31.87 |

EX-31.88 |

EX-32.87 |

EX-32.88 |

EX-99.55 |

EX-99.56 |

101.INS XBRL Instance Document |

101.SCH XBRL Taxonomy Extension Schema |

101.CAL XBRL Taxonomy Extension Calculation Linkbase |

101.DEF XBRL Taxonomy Extension Definition Linkbase |

101.LAB XBRL Taxonomy Extension Label Linkbase |

101.PRE XBRL Taxonomy Extension Presentation Linkbase |

DEFINITIONS |

| | |

| ASC | Accounting Standards Codification |

| | |

| ASU | Accounting Standards Update |

| | |

| CFTC | U.S. Commodity Futures Trading Commission |

| | |

| Citizens | Citizens Fuel Gas Company, which distributes natural gas in Adrian, Michigan |

| | |

| Company | DTE Energy Company and any subsidiary companies |

| | |

| Customer Choice | Michigan legislation giving customers the option to choose alternative suppliers for electricity and gas |

| | |

| DTE Electric | DTE Electric Company (a direct wholly owned subsidiary of DTE Energy Company) and subsidiary companies. Formerly known as The Detroit Edison Company. |

| | |

| DTE Energy | DTE Energy Company, directly or indirectly the parent of DTE Electric, DTE Gas and numerous non-utility subsidiaries |

| | |

| DTE Gas | DTE Gas Company (an indirect wholly owned subsidiary of DTE Energy) and subsidiary companies. Formerly known as Michigan Consolidated Gas Company. |

| | |

| EPA | United States Environmental Protection Agency |

| | |

| FASB | Financial Accounting Standards Board |

| | |

| FERC | Federal Energy Regulatory Commission |

| | |

| FTRs | Financial transmission rights are financial instruments that entitle the holder to receive payments related to costs incurred for congestion on the transmission grid. |

| | |

| GCR | A Gas Cost Recovery mechanism authorized by the MPSC that allows DTE Gas to recover through rates its natural gas costs. |

| | |

| MCIT | Michigan Corporate Income Tax |

| | |

| MDEQ | Michigan Department of Environmental Quality |

| | |

| MISO | Midcontinent Independent System Operator, Inc. |

| | |

| MPSC | Michigan Public Service Commission |

| | |

| Non-utility | An entity that is not a public utility. Its conditions of service, prices of goods and services and other operating related matters are not directly regulated by the MPSC. |

| | |

| NRC | United States Nuclear Regulatory Commission |

| | |

| Production tax credits | Tax credits as authorized under Sections 45K and 45 of the Internal Revenue Code that are designed to stimulate investment in and development of alternate fuel sources. The amount of a production tax credit can vary each year as determined by the Internal Revenue Service. |

| PSCR | A Power Supply Cost Recovery mechanism authorized by the MPSC that allows DTE Electric to recover through rates its fuel, fuel-related and purchased power costs. |

| | |

| RDM | A Revenue Decoupling Mechanism authorized by the MPSC that is designed to minimize the impact on revenues of changes in average customer usage. |

| | |

| Securitization | DTE Electric financed specific stranded costs at lower interest rates through the sale of rate reduction bonds by a wholly-owned special purpose entity, The Detroit Edison Securitization Funding LLC. |

| | |

| Subsidiaries | The direct and indirect subsidiaries of DTE Energy Company |

| | |

| VIE | Variable Interest Entity |

|

| | |

| Units of Measurement | |

| | |

| Bcf | Billion cubic feet of gas |

| | |

| Bcfe | Conversion metric using a standard ratio of one barrel of oil and/or natural gas liquids to 6 Mcf of natural gas equivalents. |

| | |

| BTU | Heat value (energy content) of fuel |

| | |

| dth/d | Decatherms per day |

| | |

| kWh | Kilowatthour of electricity |

| | |

| Mcf | Thousand cubic feet of gas |

| | |

| MMcf | Million cubic feet of gas |

| | |

| MW | Megawatt of electricity |

| | |

| MWh | Megawatthour of electricity |

FORWARD-LOOKING STATEMENTS

Certain information presented herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of DTE Energy. Words such as “anticipate,” “believe,” “expect,” “projected,” “aspiration” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated or budgeted. Many factors may impact forward-looking statements including, but not limited to, the following:

| |

• | impact of regulation by the FERC, MPSC, NRC, CFTC and other applicable governmental proceedings and regulations, including any associated impact on rate structures; |

| |

• | the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation; including legislative amendments and Customer Choice programs; |

| |

• | economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation and thefts of electricity and natural gas; |

| |

• | environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; |

| |

• | health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; |

| |

• | changes in the cost and availability of coal and other raw materials, purchased power and natural gas; |

| |

• | the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; |

| |

• | volatility in the short-term natural gas storage markets impacting third-party storage revenues; |

| |

• | volatility in commodity markets, deviations in weather and related risks impacting the results of our energy trading operations; |

| |

• | access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; |

| |

• | instability in capital markets which could impact availability of short and long-term financing; |

| |

• | the timing and extent of changes in interest rates; |

| |

• | the level of borrowings; |

| |

• | the potential for increased costs or delays in completion of significant construction projects; |

| |

• | changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; |

| |

• | the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; |

| |

• | the cost of protecting assets against, or damage due to, terrorism or cyber attacks; |

| |

• | employee relations and the impact of collective bargaining agreements; |

| |

• | the availability, cost, coverage and terms of insurance and stability of insurance providers; |

| |

• | cost reduction efforts and the maximization of plant and distribution system performance; |

| |

• | the effects of competition; |

| |

• | changes in and application of accounting standards and financial reporting regulations; |

| |

• | changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; |

| |

• | binding arbitration, litigation and related appeals; and |

| |

• | the risks discussed in our public filings with the Securities and Exchange Commission. |

New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

Part I

Items 1. and 2. Business and Properties

General

In 1995, DTE Energy incorporated in the State of Michigan. Our utility operations consist primarily of DTE Electric and DTE Gas. We also have three other segments that are engaged in a variety of energy-related businesses.

DTE Electric is a Michigan corporation organized in 1903 and is a public utility subject to regulation by the MPSC and the FERC. DTE Electric is engaged in the generation, purchase, distribution and sale of electricity to approximately 2.1 million customers in southeastern Michigan.

DTE Gas is a Michigan corporation organized in 1898 and is a public utility subject to regulation by the MPSC and the FERC. DTE Gas is engaged in the purchase, storage, transportation, distribution and sale of natural gas to approximately 1.2 million customers throughout Michigan and the sale of storage and transportation capacity.

Our other businesses are involved in 1) natural gas pipelines, gathering and storage; 2) power and industrial projects; and 3) energy marketing and trading operations.

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, and all amendments to such reports are available free of charge through the Investors - Reports and Filings page of our website: www.dteenergy.com, as soon as reasonably practicable after they are filed with or furnished to the Securities and Exchange Commission (SEC). Our previously filed reports and statements are also available at the SEC’s website: www.sec.gov.

The Company’s Code of Ethics and Standards of Behavior, Board of Directors’ Mission and Guidelines, Board Committee Charters, and Categorical Standards of Director Independence are also posted on its website. The information on the Company’s website is not part of this or any other report that the Company files with, or furnishes to, the SEC.

Additionally, the public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

References in this Report to “we,” “us,” “our,” “Company” or “DTE” are to DTE Energy and its subsidiaries, collectively.

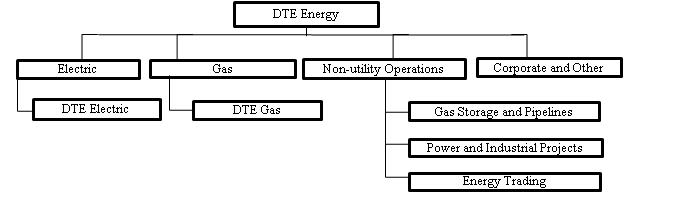

Corporate Structure

Based on the following structure, we set strategic goals, allocate resources, and evaluate performance. See Note 22 of the Notes to Consolidated Financial Statements in Item 8 of this Report for financial information by segment for the last three years.

Electric

| |

• | The Electric segment consists principally of DTE Electric, which is engaged in the generation, purchase, distribution and sale of electricity to approximately 2.1 million residential, commercial and industrial customers in southeastern Michigan. |

Gas

| |

• | The Gas segment consists of DTE Gas and Citizens. DTE Gas is engaged in the purchase, storage, transportation, distribution and sale of natural gas to approximately 1.2 million residential, commercial and industrial customers throughout Michigan and the sale of storage and transportation capacity. Citizens distributes natural gas in Adrian, Michigan to approximately 17,000 customers. |

Non-utility Operations

| |

• | Gas Storage and Pipelines consists of natural gas pipelines, gathering and storage businesses. |

| |

• | Power and Industrial Projects is comprised primarily of projects that deliver energy and utility-type products and services to industrial, commercial and institutional customers; produce reduced emissions fuel and sell electricity from biomass-fired energy projects. |

| |

• | Energy Trading consists of energy marketing and trading operations. |

Corporate and Other

| |

• | Corporate and other includes various holding company activities, holds certain non-utility debt and energy-related investments. |

Refer to our Management’s Discussion and Analysis in Item 7 of this Report for an in-depth analysis of each segment’s financial results. A description of each business unit follows.

ELECTRIC

Description

Our Electric segment consists principally of DTE Electric, an electric utility engaged in the generation, purchase, distribution and sale of electricity to approximately 2.1 million customers in southeastern Michigan. DTE Electric is regulated by numerous federal and state governmental agencies, including, but not limited to, the MPSC, the FERC, the NRC, the EPA and the MDEQ. Electricity is generated from our fossil-fuel plants, a hydroelectric pumped storage plant, a nuclear plant and our wind and other renewable assets, and is purchased from electricity generators, suppliers and wholesalers. The electricity we produce and purchase is sold to three major classes of customers: residential, commercial and industrial, throughout southeastern Michigan.

Revenue by Service

|

| | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

| (In millions) |

Residential | $ | 2,351 |

| | $ | 2,354 |

| | $ | 2,182 |

|

Commercial | 1,883 |

| | 1,898 |

| | 1,704 |

|

Industrial | 799 |

| | 784 |

| | 692 |

|

Other | 45 |

| | 152 |

| | 458 |

|

Subtotal | 5,078 |

| | 5,188 |

| | 5,036 |

|

Interconnection sales (a) | 121 |

| | 105 |

| | 118 |

|

Total Revenue | $ | 5,199 |

| | $ | 5,293 |

| | $ | 5,154 |

|

______________________________

| |

(a) | Represents power that is not distributed by DTE Electric. |

Weather, economic factors, competition and electricity prices affect sales levels to customers. Our peak load and highest total system sales generally occur during the third quarter of the year, driven by air conditioning and other cooling-related demands. Our operations are not dependent upon a limited number of customers, and the loss of any one or a few customers would not have a material adverse effect on DTE Electric.

Fuel Supply and Purchased Power

Our power is generated from a variety of fuels and is supplemented with purchased power. We expect to have an adequate supply of fuel and purchased power to meet our obligation to serve customers. Our generating capability is heavily dependent upon the availability of coal. Coal is purchased from various sources in different geographic areas under agreements that vary in both pricing and terms. We expect to obtain the majority of our coal requirements through long-term contracts, with the balance to be obtained through short-term agreements and spot purchases. We have long-term and short-term contracts for the purchase of approximately 29.4 million tons of low-sulfur western coal to be delivered from 2014 through 2016 and approximately 1.6 million tons of Appalachian coal to be delivered in 2014. All of these contracts have pricing schedules. We have approximately 92% of our 2014 expected coal requirements under contract. Given the geographic diversity of supply, we believe we can meet our expected generation requirements. We lease a fleet of rail cars and have our expected western coal rail requirements under contract through 2018. All of our expected eastern coal rail requirements are under contract through 2016. Our expected vessel transportation requirements for delivery of purchased coal to our generating facilities are under contract through 2014.

DTE Electric participates in the energy market through MISO. We offer our generation in the market on a day-ahead and real-time basis and bid for power in the market to serve our load. We are a net purchaser of power that supplements our generation capability to meet customer demand during peak cycles or during major plant outages.

Properties

DTE Electric owns generating plants and facilities that are located in the State of Michigan. Substantially all of our property is subject to the lien of a mortgage.

Generating plants owned and in service as of December 31, 2013 are shown in the following table. The Company's renewable energy generation, principally wind turbines, is described below. |

| | | | | | | | | |

| | Location by Michigan | | Summer Net Rated Capability (a) | | |

Plant Name | | County | | (MW) | | (%) | | Year in Service |

Fossil-fueled Steam-Electric | | | | |

| | | | |

Belle River (b) | | St. Clair | | 1,036 |

| | 9.9 | | 1984 and 1985 |

Greenwood | | St. Clair | | 798 |

| | 7.7 | | 1979 |

Monroe (c) | | Monroe | | 3,022 |

| | 29.0 | | 1971, 1973 and 1974 |

River Rouge | | Wayne | | 537 |

| | 5.2 | | 1957 and 1958 |

St. Clair | | St. Clair | | 1,386 |

| | 13.3 | | 1953, 1954, 1959, 1961 and 1969 |

Trenton Channel | | Wayne | | 631 |

| | 6.0 | | 1949 and 1968 |

| | | | 7,410 |

| | 71.1 | | |

Oil or Gas-fueled Peaking Units | | Various | | 989 |

| | 9.5 | | 1966-1971, 1981 and 1999 |

Nuclear-fueled Steam-Electric Fermi 2 (d) | | Monroe | | 1,102 |

| | 10.6 | | 1988 |

Hydroelectric Pumped Storage Ludington (e) | | Mason | | 917 |

| | 8.8 | | 1973 |

| | | | 10,418 |

| | 100.0 | | |

_______________________________________

| |

(a) | Summer net rated capabilities of generating plants in service are based on periodic load tests and are changed depending on operating experience, the physical condition of units, environmental control limitations and customer requirements for steam, which otherwise would be used for electric generation. |

| |

(b) | The Belle River capability represents DTE Electric’s entitlement to 81% of the capacity and energy of the plant. See Note 9 of the Notes to the Consolidated Financial Statements in Item 8 of this Report. |

| |

(c) | The Monroe generating plant provided 38% of DTE Electric’s total 2013 power generation. |

| |

(d) | Fermi 2 has a design electrical rating (net) of 1,150 MW. |

| |

(e) | Represents DTE Electric’s 49% interest in Ludington with a total capability of 1,872 MW. See Note 9 of the Notes to the Consolidated Financial Statements in Item 8 of this Report. |

In 2008, a renewable portfolio standard was established for Michigan electric providers targeting 10% of electricity sold to retail customers from renewable energy by 2015. DTE Electric had approximately 900 MW of owned or contracted renewable energy generation, principally wind turbines located in Gratiot, Tuscola, Huron and Sanilac counties in Michigan, at December 31, 2013, which is projected to represent approximately 9.6% of electricity that will be sold to retail customers in 2015. Approximately 690 MW was in commercial operation at December 31, 2013. DTE Electric expects to meet the 10% renewable portfolio standard with the commercial operation of an additional 210 MW in 2014 and 50 MW in 2015.

DTE Electric owns and operates 669 distribution substations with a capacity of approximately 33,418,000 kilovolt-amperes (kVA) and approximately 428,600 line transformers with a capacity of approximately 23,272,000 kVA.

Circuit miles of electric distribution lines owned and in service as of December 31, 2013:

|

| | | | | | |

| | Circuit Miles |

Operating Voltage-Kilovolts (kV) | | Overhead | | Underground |

4.8 kV to 13.2 kV | | 27,739 |

| | 14,578 |

|

24 kV | | 182 |

| | 692 |

|

40 kV | | 2,289 |

| | 383 |

|

120 kV | | 54 |

| | 8 |

|

| | 30,264 |

| | 15,661 |

|

There are numerous interconnections that allow the interchange of electricity between DTE Electric and electricity providers external to our service area. These interconnections are generally owned and operated by ITC Transmission, an unrelated company, and connect to neighboring energy companies.

Regulation

DTE Electric's business is subject to the regulatory jurisdiction of various agencies, including, but not limited to, the MPSC, the FERC and the NRC. The MPSC issues orders pertaining to rates, recovery of certain costs, including the costs of generating facilities and regulatory assets, conditions of service, accounting and operating-related matters. DTE Electric's MPSC-approved rates charged to customers have historically been designed to allow for the recovery of costs, plus an authorized rate of return on our investments. The FERC regulates DTE Electric with respect to financing authorization and wholesale electric activities. The NRC has regulatory jurisdiction over all phases of the operation, construction, licensing and decommissioning of DTE Electric's nuclear plant operations. We are subject to the requirements of other regulatory agencies with respect to safety, the environment and health.

See Notes 3, 10, 11 and 19 of the Notes to Consolidated Financial Statements in Item 8 of this Report.

Energy Assistance Programs

Energy assistance programs, funded by the federal government and the State of Michigan, remain critical to DTE Electric’s ability to control its uncollectible accounts receivable and collections expenses. DTE Electric’s uncollectible accounts receivable expense is directly affected by the level of government-funded assistance its qualifying customers receive. We work continuously with the State of Michigan and others to determine whether the share of funding allocated to our customers is representative of the number of low-income individuals in our service territory. We also partner with federal, state and local officials to attempt to increase the share of low-income funding allocated to our customers. Changes in the level of funding provided to our low-income customers will affect the level of uncollectible expense.

Strategy and Competition

We strive to be the preferred supplier of electrical generation in southeast Michigan. We can accomplish this goal by working with our customers, communities and regulatory agencies to be a reliable, low-cost supplier of electricity. To ensure generation and network reliability we continue to make capital investments in our generating plants and distribution system, which will improve plant availability, operating efficiencies and environmental compliance in areas that have a positive impact on reliability with the goal of high customer satisfaction.

Our distribution operations focus on improving reliability, restoration time and the quality of customer service. We seek to lower our operating costs by improving operating efficiencies. Revenues from year to year will vary due to weather conditions, economic factors, regulatory events and other risk factors as discussed in the “Risk Factors” in Item 1A. of this Report.

The electric Customer Choice program in Michigan allows our electric customers to purchase their electricity from alternative electric suppliers of generation services, subject to limits. Customers choosing to purchase power from alternative electric suppliers represented approximately 10% of retail sales in 2013, 2012 and 2011. Customers participating in the electric Customer Choice program consist primarily of industrial and commercial customers. MPSC rate orders and 2008 energy legislation enacted by the State of Michigan have placed a 10% cap on the total potential Customer Choice related migration, mitigating some of the unfavorable effects of electric Customer Choice on our financial performance and full service customer rates. We expect that in 2014 customers choosing to purchase power from alternative electric suppliers will represent approximately 10% of retail sales.

Competition in the regulated electric distribution business is primarily from the on-site generation of industrial customers and from distributed generation applications by industrial and commercial customers. We do not expect significant competition for distribution to any group of customers in the near term.

GAS

Description

Our Gas segment consists of DTE Gas and Citizens. DTE Gas is a natural gas utility engaged in the purchase, storage, transportation, distribution and sale of natural gas to approximately 1.2 million residential, commercial and industrial customers throughout Michigan and the sale of storage and transportation capacity. Citizens distributes natural gas in Adrian, Michigan to approximately 17,000 customers.

Revenue is generated by providing the following major classes of service: gas sales, end user transportation, intermediate transportation, and gas storage.

Revenue by Service

|

| | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

| (In millions) |

Gas sales | $ | 1,093 |

| | $ | 957 |

| | $ | 1,150 |

|

End user transportation | 212 |

| | 198 |

| | 194 |

|

Intermediate transportation | 59 |

| | 58 |

| | 58 |

|

Storage and other | 110 |

| | 102 |

| | 103 |

|

Total Revenue | $ | 1,474 |

| | $ | 1,315 |

| | $ | 1,505 |

|

| |

• | Gas sales — Includes the sale and delivery of natural gas primarily to residential and small-volume commercial and industrial customers. |

| |

• | End user transportation — Gas delivery service provided primarily to large-volume commercial and industrial customers. Additionally, the service is provided to residential customers, and small-volume commercial and industrial customers who have elected to participate in our gas Customer Choice program. End user transportation customers purchase natural gas directly from marketers, producers or brokers and utilize our pipeline network to transport the gas to their facilities or homes. |

| |

• | Intermediate transportation — Gas delivery service is provided to producers, brokers and other gas companies that own the natural gas, but are not the ultimate consumers. Intermediate transportation customers use our gathering and high-pressure transportation system to transport the natural gas to storage fields, processing plants, pipeline interconnections or other locations. |

| |

• | Storage and other — Includes revenues from natural gas storage, appliance maintenance, facility development and other energy-related services. |

Our gas sales, end user transportation and intermediate transportation volumes, revenues and net income are impacted by weather. Given the seasonal nature of our business, revenues and net income are concentrated in the first and fourth quarters of the calendar year. By the end of the first quarter, the heating season is largely over, and we typically realize substantially reduced revenues and earnings in the second quarter and losses in the third quarter. The impacts of changes in average customer usage are minimized by the RDM. Effective with the self implementation of rates on November 1, 2012, the RDM was terminated. The DTE Gas partial rate case settlement agreement approved by the MPSC in December 2012 created a new RDM effective November 1, 2013 which decouples weather normalized distribution revenue inside caps. The caps are tied to expected customer conservation attributable to DTE Gas's energy efficiency program, or 1.125% in year one, increasing to 2.25% for the second and future periods.

Our operations are not dependent upon a limited number of customers, and the loss of any one or a few customers would not have a material adverse effect on our Gas segment.

Natural Gas Supply

Our gas distribution system has a planned maximum daily send-out capacity of 2.5 Bcf, with approximately 67% of the volume coming from underground storage for 2013. Peak-use requirements are met through utilization of our storage facilities, pipeline transportation capacity, and purchased gas supplies. Because of our geographic diversity of supply and our pipeline transportation and storage capacity, we are able to reliably meet our supply requirements. We believe natural gas supply and pipeline capacity will be sufficiently available to meet market demands in the foreseeable future.

We purchase natural gas supplies in the open market by contracting with producers and marketers, and we maintain a diversified portfolio of natural gas supply contracts. Supplier, producing region, quantity, and available transportation diversify our natural gas supply base. We obtain our natural gas supply from various sources in different geographic areas (Gulf Coast, Mid-Continent, Canada and Michigan) under agreements that vary in both pricing and terms. Gas supply pricing is generally tied to the New York Mercantile Exchange and published price indices to approximate current market prices combined with MPSC approved fixed price supplies with varying terms and volumes through 2016.

We are directly connected to interstate pipelines, providing access to most of the major natural gas supply producing regions in the Gulf Coast, Mid-Continent and Canadian regions. Our primary long-term transportation supply contracts are as follows:

|

| | | |

| Availability (MMcf/d) | | Contract Expiration |

Great Lakes Gas Transmission L.P. | 30 | | 2014 |

Viking Gas Transmission Company | 21 | | 2017 |

Vector Pipeline L.P. | 50 | | 2015 |

ANR Pipeline Company | 224 | | 2028 |

Panhandle Eastern Pipeline Company | 75 | | 2029 |

Properties

We own distribution, storage and transportation properties that are located in the State of Michigan. Our distribution system includes approximately 19,000 miles of distribution mains, approximately 1,162,000 service pipelines and approximately 1,311,000 active meters. We own approximately 2,000 miles of transmission pipelines that deliver natural gas to the distribution districts and interconnect our storage fields with the sources of supply and the market areas.

We own storage properties relating to four underground natural gas storage fields with an aggregate working gas storage capacity of approximately 139 Bcf. These facilities are important in providing reliable and cost-effective service to our customers. In addition, we sell storage services to third parties.

Most of our distribution and transportation property is located on property owned by others and used by us through easements, permits or licenses. Substantially all of our property is subject to the lien of a mortgage.

We lease a portion of our pipeline system to the Vector Pipeline Partnership (an affiliate) through a capital lease arrangement. See Note 18 of the Notes to Consolidated Financial Statements in Item 8 of the Report.

Regulation

DTE Gas's business is subject to the regulatory jurisdiction of the MPSC, which issues orders pertaining to rates, recovery of certain costs, including the costs of regulatory assets, conditions of service, accounting and operating-related matters. DTE Gas's MPSC-approved rates charged to customers have historically been designed to allow for the recovery of costs, plus an authorized rate of return on our investments. DTE Gas operates natural gas storage and transportation facilities in Michigan as intrastate facilities regulated by the MPSC and provides intrastate storage and transportation services pursuant to an MPSC-approved tariff.

DTE Gas also provides interstate storage and transportation services in accordance with an Operating Statement on file with the FERC. The FERC's jurisdiction is limited and extends to the rates, non-discriminatory requirements, and the terms and conditions applicable to storage and transportation provided by DTE Gas in interstate markets. FERC granted DTE Gas authority to provide storage and related services in interstate commerce at market-based rates. DTE Gas provides transportation services in interstate commerce at cost-based rates approved by the MPSC and filed with the FERC.

We are subject to the requirements of other regulatory agencies with respect to safety, the environment and health.

See Notes 11 and 19 of the Notes to the Consolidated Financial Statements in Item 8 of this Report.

Energy Assistance Program

Energy assistance programs, funded by the federal government and the State of Michigan, remain critical to DTE Gas’s ability to control its uncollectible accounts receivable and collections expenses. DTE Gas’s uncollectible accounts receivable expense is directly affected by the level of government-funded assistance its qualifying customers receive. We work continuously with the State of Michigan and others to determine whether the share of funding allocated to our customers is representative of the number of low-income individuals in our service territory. We also partner with federal, state and local officials to attempt to increase the share of low-income funding allocated to our customers. Changes in the level of funding provided to our low-income customers will affect the level of uncollectible expense.

Strategy and Competition

Our strategy is to be the preferred provider of natural gas services in Michigan. We expect future sales volumes to decline due to reduced natural gas usage by customers due to more efficient furnaces and appliances, and an increased emphasis on conservation of energy usage. We continue to provide energy-related services that capitalize on our expertise, capabilities and efficient systems. We continue to focus on lowering our operating costs by improving operating efficiencies.

Competition in the gas business primarily involves other natural gas transportation providers, as well as providers of alternative fuels and energy sources. The primary focus of competition for end user transportation is cost and reliability. Some large commercial and industrial customers have the ability to switch to alternative fuel sources such as coal, electricity, oil and steam. If these customers were to choose an alternative fuel source, they would not have a need for our end-user transportation service. In addition, some of these customers could bypass our pipeline system and have their gas delivered directly from an interstate pipeline. We compete against alternative fuel sources by providing competitive pricing and reliable service, supported by our storage capacity.

Our extensive transportation pipeline system has enabled us to market 400 to 500 Bcf annually for intermediate storage and transportation services for Michigan gas producers, marketers, distribution companies and other pipeline companies. We operate in a central geographic location with connections to major Midwestern interstate pipelines that extend throughout the Midwest, eastern United States and eastern Canada.

DTE Gas’s storage capacity is used to store natural gas for delivery to DTE Gas's customers as well as sold to third parties, under a variety of arrangements for periods up to three years. Prices for storage arrangements for shorter periods are generally higher, but more volatile than for longer periods. Prices are influenced primarily by market conditions, weather and natural gas pricing.

GAS STORAGE AND PIPELINES

Description

Gas Storage and Pipelines controls two natural gas storage fields, intrastate lateral and intrastate gathering pipeline systems, and has ownership interests in two interstate pipelines serving the Midwest, Ontario and Northeast markets. The pipeline and storage assets are primarily supported by long-term, fixed-price revenue contracts.

Properties

The Gas Storage and Pipelines business holds the following property:

|

| | | | | | | |

Property Classification | | % Owned | | Description | | Location |

Pipelines | | | | | | |

Vector Pipeline | | 40 | % | | 348-mile pipeline connecting Chicago, Michigan and Ontario market centers | | IL, IN, MI & Ontario |

Millennium Pipeline | | 26 | % | | 182-mile pipeline serving markets in the Northeast | | NY |

Bluestone Lateral | | 100 | % | | 44-mile pipeline delivering Marcellus Shale gas to Millennium Pipeline and Tennessee Pipeline | | PA & NY |

Susquehanna gathering system | | 100 | % | | Gathering system delivering Southwestern Energy's Marcellus Shale gas production to Bluestone Lateral | | PA |

Michigan gathering systems | | 100 | % | | Gathers production gas in northern Michigan | | MI |

Storage | | | | | | |

Washington 10 | | 100 | % | | 75 Bcf of storage capacity | | MI |

Washington 28 | | 50 | % | | 16 Bcf of storage capacity | | MI |

The assets of these businesses are well integrated with other DTE Energy operations. Pursuant to an operating agreement, DTE Gas provides physical operations, maintenance, and technical support for the Washington 10 and 28 storage facilities and for the Michigan gathering systems.

Regulation

The Gas Storage and Pipelines business operates natural gas storage facilities in Michigan as intrastate facilities regulated by the MPSC and provides intrastate storage and related services pursuant to an MPSC-approved tariff. We also provide interstate services in accordance with an Operating Statement on file with the FERC. Vector and Millennium Pipelines provide interstate transportation services in accordance with their FERC-approved tariffs. Bluestone Lateral is regulated as an intrastate pipeline by applicable agencies in the states of New York and Pennsylvania.

Strategy and Competition

Our Gas Storage and Pipelines business expects to continue its steady growth plan by expanding existing assets and developing new assets that are typically supported with long−term customer commitments. We have competition from other pipelines and storage providers. The Gas Storage and Pipelines business focuses on asset development opportunities in the Midwest−to−Northeast region to supply natural gas to meet growing demand. Much of the growth in demand for natural gas is expected to occur in the Eastern Canada and the Northeast U.S. regions. We believe that the Vector and Millennium Pipelines are well positioned to provide access routes and low−cost expansion options to these markets. In addition, we believe that Millennium Pipeline is well positioned for growth in production from the Marcellus shale, especially with respect to Marcellus production in Northern Pennsylvania and along the southern tier of New York. Gas Storage and Pipelines has an agreement with Southwestern Energy Services Company and affiliates to support its Bluestone Lateral and Susquehanna gathering system. Bluestone Lateral is a 44-mile pipeline in Susquehanna County, Pennsylvania and Broome County, New York with the southern portion of the pipeline placed in service in 2012 and the northern portion placed in service in the first quarter of 2013. We expect to continue steady growth in the Gas Storage and Pipelines business and are evaluating new pipeline and storage investment opportunities that could include additional Millennium expansions and laterals, Bluestone laterals and gathering expansions and other Marcellus midstream development or partnering opportunities. Our operations are dependent upon a limited number of customers, and the loss of any one or a few customers could have a material adverse effect on the Gas Storage and Pipelines business.

POWER AND INDUSTRIAL PROJECTS

Description

Power and Industrial Projects is comprised primarily of projects that deliver energy and utility-type products and services to industrial, commercial and institutional customers; produce reduced emissions fuel and sell electricity from biomass-fired energy projects. This business segment provides services using project assets usually located on or near the customers' premises in the steel, automotive, pulp and paper, airport and other industries as follows:

Steel and Petroleum Coke: We produce metallurgical coke from two coke batteries with a capacity of 1.4 million tons per year. We have an investment in a third coke battery with a capacity of 1.2 million tons per year. We also provide pulverized coal and petroleum coke to the steel, pulp and paper, and other industries.

Onsite Energy: We provide power generation, steam production, chilled water production, wastewater treatment and compressed air supply to industrial customers. We provide utility-type services using project assets usually located on or near the customers' premises in the automotive, airport, chemical and other industries.

Wholesale Power and Renewables: We own and operate four biomass-fired electric generating plants with a capacity of 183 MWs. We own a coal-fired power plant currently undergoing conversion to biomass with an in-service date in 2014. The electric output is sold under long term power purchase agreements. We also develop landfill gas recovery systems that capture the gas and provide local utilities, industry and consumers with an opportunity to use a competitive, renewable source of energy, in addition to providing environmental benefits by reducing greenhouse gas emissions.

Reduced Emissions Fuel (REF): We own and operate nine REF facilities. Our facilities blend a proprietary additive with coal used in coal-fired power plants resulting in reduced emissions of Nitrogen Oxide (NO) and Mercury (Hg). Qualifying facilities are eligible to generate tax credits for ten years upon achieving certain criteria. The value of a tax credit is adjusted annually by an inflation factor published by the Internal Revenue Service. The value of the tax credit is reduced if the reference price of coal exceeds certain thresholds. The economic benefit of the REF facilities is dependent upon the generation of production tax credits. We placed in service five REF facilities in 2009 and an additional four REF facilities in 2011. To optimize income and cash flow from the REF operations, we sold membership interests at two of the facilities in 2011 and at two additional facilities in 2013. We continue to optimize these facilities by seeking investors for facilities operating at DTE Electric and other utility sites. Additionally, we intend to relocate certain underutilized facilities to alternative coal-fired power plants which may provide increased production and emission reduction opportunities in 2014 and future years.

Properties and Other

The following are significant properties operated by the Power and Industrial Projects segment:

|

| | | | |

Facility | | Location | | Service Type |

Steel and Petroleum Coke | | | | |

Pulverized Coal Operations | | MI | | Pulverized Coal |

Coke Production | | MI, PA & IN | | Metallurgical Coke Supply |

Other Investment in Coke Production and Petroleum Coke | | IN & MS | | Metallurgical Coke Supply and Pulverized Petroleum Coke |

| | | | |

On-Site Energy | | | | |

Automotive | | Various sites in | | Electric Distribution, Chilled Water, |

| | MI, IN, OH & NY | | Waste Water, Steam, Cooling Tower Water, Reverse Osmosis Water, Compressed Air, Mist and Dust Collectors |

Airports | | MI & PA | | Electricity, Hot and Chilled Water |

Chemical Manufacturing | | IL, KY & OH | | Electricity, Steam, Natural Gas, Compressed Air and Wastewater |

Consumer Manufacturing | | OH | | Electricity, Steam, Hot and Chilled Water, Sewer, Compressed Air |

Business Park | | FL, OH & PA | | Electricity, Steam, Hot and Chilled Water, Compressed Air |

Hospital | | CA | | Electricity, Steam and Chilled Water |

| | | | |

Wholesale Power and Renewables | | | | |

Pulp and Paper | | AL | | Electric Generation and Steam |

Renewables | | CA, MN & WI | | Electric Generation |

Landfill Gas Recovery | | Various U.S. sites | | Electric Generation and Landfill Gas |

| | | | |

| | | | |

REF | | MI, OK, IL & OH | | REF Supply |

|

| | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

| (In millions) |

Production Tax Credits Generated (Allocated to DTE Energy) | | | | | |

REF | $ | 44 |

| | $ | 35 |

| | $ | 1 |

|

Power Generation | 8 |

| | 7 |

| | 4 |

|

Landfill Gas Recovery | 1 |

| | 1 |

| | 1 |

|

| $ | 53 |

| | $ | 43 |

| | $ | 6 |

|

Regulation

Certain electric generating facilities within Power and Industrial Projects have market-based rate authority from the FERC to sell power. The facilities are subject to FERC reporting requirements and market behavior rules. Certain Power and Industrial projects are also subject to the applicable laws, rules and regulations related to the Commodity Futures Trading Commission, U.S. Department of Homeland Security and Department of Energy.

Strategy and Competition

Power and Industrial Projects will continue leveraging its energy-related operating experience and project management capability to develop and grow our steel, renewable power, on-site energy, landfill gas recovery and REF businesses. We also will continue to pursue opportunities to provide asset management and operations services to third parties. There are limited competitors for our existing disparate businesses who provide similar products and services. Our operations are dependent upon a limited number of customers, and the loss of any one or a few customers could have a material adverse effect on the Power and Industrial Projects business.

We anticipate building around our core strengths in the markets where we operate. In determining the markets in which to compete, we examine closely the regulatory and competitive environment, new and pending legislation, the number of competitors and our ability to achieve sustainable margins. We plan to maximize the effectiveness of our related businesses as we expand. As we pursue growth opportunities, our first priority will be to achieve value-added returns.

We intend to focus on the following areas for growth:

| |

• | Selling membership interests in our REF projects; |

| |

• | Relocating our underutilized REF facilities to alternative coal-fired power plants which may provide increased production and emission reduction opportunities in 2014 and future years; |

| |

• | Acquiring and developing landfill gas recovery facilities, renewable energy projects, and other energy projects which may qualify for tax credits; and |

| |

• | Providing operating services to owners of industrial and power plants. |

ENERGY TRADING

Description

Energy Trading focuses on physical and financial power, gas and coal marketing and trading, structured transactions, enhancement of returns from DTE Energy’s asset portfolio, and optimization of contracted natural gas pipeline transportation and storage, and generating capacity positions. Energy Trading also provides natural gas, power and related services which may include the management of associated storage and transportation contracts on the customers’ behalf under FERC Asset Management Arrangements, and the supply or purchase of renewable energy credits to various customers. Our customer base is predominantly utilities, local distribution companies, pipelines, producers and generators, and other marketing and trading companies. We enter into derivative financial instruments as part of our marketing and hedging activities. These financial instruments are generally accounted for under the mark-to-market method, which results in the recognition in earnings of unrealized gains and losses from changes in the fair value of the derivatives. We utilize forwards, futures, swaps and option contracts to mitigate risk associated with our marketing and trading activity as well as for proprietary trading within defined risk guidelines. Energy Trading also provides commodity risk management services to the other businesses within DTE Energy.

Significant portions of the Energy Trading portfolio are economically hedged. Most financial instruments and physical power and gas contracts are deemed derivatives; whereas, natural gas inventory, contracts for pipeline transportation, renewable energy credits and certain storage assets are not derivatives. As a result, this segment may experience earnings volatility as derivatives are marked-to-market without revaluing the underlying non-derivative contracts and assets. The segment’s strategy is to economically manage the price risk of these underlying non-derivative contracts and assets with futures, forwards, swaps and options. This results in gains and losses that are recognized in different interim and annual accounting periods.

Regulation

Energy Trading has market-based rate authority from the FERC to sell power and blanket authority from the FERC to sell natural gas at market prices. Energy Trading is subject to FERC reporting requirements and market behavior rules. Energy Trading is also subject to the applicable laws, rules and regulations related to the Commodity Futures Trading Commission, U.S. Department of Homeland Security and Department of Energy.

Strategy and Competition

Our strategy for the Energy Trading business is to deliver value-added services to our customers. We seek to manage this business in a manner consistent with and complementary to the growth of our other business segments. We focus on physical marketing and the optimization of our portfolio of energy assets. We compete with electric, gas and coal marketers, financial institutions, traders, utilities and other energy providers. The Energy Trading business is dependent upon the availability of capital and an investment grade credit rating. The Company believes it has ample available capital capacity to support Energy Trading activities. We monitor our use of capital closely to ensure that our commitments do not exceed capacity. A material credit restriction would negatively impact our financial performance. Competitors with greater access to capital or at a lower cost may have a competitive advantage. We have risk management and credit processes to monitor and mitigate risk.

CORPORATE AND OTHER

Description

Corporate and Other includes various holding company activities and holds certain non-utility debt and energy-related investments.

ENVIRONMENTAL MATTERS

We are subject to extensive environmental regulation. We expect to continue recovering environmental costs related to utility operations through rates charged to our customers. The following table summarizes our estimated significant future environmental expenditures based upon current regulations. Actual costs to comply could vary substantially. Additional costs may result as the effects of various substances on the environment are studied and governmental regulations are developed and implemented.

|

| | | | | | | | | | | | | | | |

| Electric | | Gas | | Non-utility | | Total |

| (In millions) |

Air | $ | 1,420 |

| | $ | — |

| | $ | — |

| | $ | 1,420 |

|

Water | 80 |

| | — |

| | 18 |

| | 98 |

|

Contaminated and other sites | 8 |

| | 28 |

| | — |

| | 36 |

|

Estimated total future expenditures through 2021 | $ | 1,508 |

| | $ | 28 |

| | $ | 18 |

| | $ | 1,554 |

|

Estimated 2014 expenditures | $ | 280 |

| | $ | 5 |

| | $ | 10 |

| | $ | 295 |

|

Estimated 2015 expenditures | $ | 95 |

| | $ | 6 |

| | $ | 8 |

| | $ | 109 |

|

Air - DTE Electric is subject to the EPA ozone and fine particulate transport and acid rain regulations that limit power plant emissions of sulfur dioxide and nitrogen oxides. Since 2005, the EPA and the State of Michigan have issued additional emission reduction regulations relating to ozone, fine particulate, regional haze, mercury and other air pollution. These rules have led to additional emission controls on fossil-fueled power plants to reduce nitrogen oxide and sulfur dioxide, with further emission controls planned for reductions of mercury and other emissions. Future rulemakings could require additional controls for sulfur dioxide, nitrogen oxides and other hazardous air pollutants over the next few years.

Water - In response to an EPA regulation, DTE Electric is required to examine alternatives for reducing the environmental impacts of the cooling water intake structures at several of its facilities. Based on the results of completed studies and expected future studies, DTE Electric may be required to install technologies to reduce the impacts of the water intakes. However, the types of technologies are unknown at this time. The EPA is expected to finalize regulations on cooling water intake in early 2014. The EPA has also issued proposed steam electric effluent guidelines. When finalized, these guidelines are expected to require additional wastewater discharge controls.

Contaminated and Other Sites - Prior to the construction of major interstate natural gas pipelines, gas for heating and other uses was manufactured locally from processes involving coal, coke or oil. The facilities, which produced gas, have been designated as manufactured gas plant (MGP) sites. Gas segment owns, or previously owned, fifteen such former MGP sites. DTE Electric owns, or previously owned, three former MGP sites. The Company anticipates the cost amortization methodology approved by the MPSC for DTE Gas, which allows DTE Gas to amortize the MGP costs over a ten-year period beginning with the year subsequent to the year the MGP costs were incurred, and the cost deferral and rate recovery mechanism for Citizens approved by the City of Adrian, will prevent MGP environmental costs from having a material adverse impact on the Company's results of operations.

We are also in the process of cleaning up other sites where contamination is present as a result of historical and ongoing utility operations. These other sites include an engineered ash storage facility, electrical distribution substations, gas pipelines, electric generating power plants, and underground and aboveground storage tank locations. Cleanup activities associated with these sites will be conducted over the next several years. Any significant change in assumptions, such as remediation techniques, nature and extent of contamination and regulatory requirements, could impact the estimate of remedial action costs for these sites and affect the Company's financial position and cash flows and the rates we charge our customers.

The EPA has published proposed rules to regulate coal ash, which may result in a designation of coal ash as a hazardous waste. The EPA could apply some, or all, of the disposal and reuse standards that have been applied to other existing hazardous wastes. Some of the regulatory actions currently being contemplated could have a significant impact on our operations and financial position and the rates we charge our customers. It is not possible to quantify the impact of those expected rulemakings at this time.

See Notes 11 and 19 of the Notes to Consolidated Financial Statements in Item 8 of this Report and Management’s Discussion and Analysis in Item 7 of this Report.

EMPLOYEES

We had approximately 9,900 employees as of December 31, 2013, of which approximately 4,900 were represented by unions. There are several bargaining units for the Company’s represented employees. The majority of represented employees are under contracts that expire in 2016 and 2017.

Item 1A. Risk Factors

There are various risks associated with the operations of DTE Energy's utility and non-utility businesses. To provide a framework to understand the operating environment of DTE Energy, we are providing a brief explanation of the more significant risks associated with our businesses. Although we have tried to identify and discuss key risk factors, others could emerge in the future. Each of the following risks could affect our performance.

We are subject to rate regulation. Electric and gas rates for our utilities are set by the MPSC and the FERC and cannot be changed without regulatory authorization. We may be negatively impacted by new regulations or interpretations by the MPSC, the FERC or other regulatory bodies. Our ability to recover costs may be impacted by the time lag between the incurrence of costs and the recovery of the costs in customers' rates. Our regulators also may decide to disallow recovery of certain costs in customers' rates if they determine that those costs do not meet the standards for recovery under our governing laws and regulations. Our utilities typically self-implement base rate changes six months after rate case filings in accordance with Michigan law. However, if the final rates authorized by our regulators in the final rate order are lower than the amounts we collected during the self-implementation period, we must refund the difference with interest. Our regulators may also disagree with our rate calculations under the various tracking and decoupling mechanisms that are intended to mitigate the risk to our utilities of certain aspects of our business. If we cannot agree with our regulators on an appropriate reconciliation of those mechanisms, it may impact our ability to recover certain costs through our customer rates. Our regulators may also decide to eliminate these mechanisms in future rate cases, which may make it more difficult for us to recover our costs in the rates we charge customers. We cannot predict what rates an MPSC order will authorize in future rate cases. New legislation, regulations or interpretations could change how our business operates, impact our ability to recover costs through rates or require us to incur additional expenses.

Changes to Michigan's electric Customer Choice program could negatively impact our financial performance. The State of Michigan currently experiences a hybrid market, where the MPSC continues to regulate electric rates for our customers, while alternative electric suppliers charge market-based rates. Energy legislation enacted by the State of Michigan in 2008, placed a 10% cap on the total potential electric Customer Choice related migration. However, even with the legislated 10% cap on participation , there continues to be legislative and financial risk associated with the electric Customer Choice program. Electric Customer Choice migration is sensitive to market price and full service electric price changes.

Environmental laws and liability may be costly. We are subject to and affected by numerous environmental regulations. These regulations govern air emissions, water quality, wastewater discharge and disposal of solid and hazardous waste. Compliance with these regulations can significantly increase capital spending, operating expenses and plant down times and can negatively affect the affordability of the rates we charge to our customers.

Uncertainty around future environmental regulations creates difficulty planning long-term capital projects in our generation fleet and gas distribution businesses. These laws and regulations require us to seek a variety of environmental licenses, permits, inspections and other regulatory approvals. We could be required to install expensive pollution control measures or limit or cease activities, including the retirement of certain generating plants, based on these regulations. Additionally, we may become a responsible party for environmental cleanup at sites identified by a regulatory body. We cannot predict with certainty the amount and timing of future expenditures related to environmental matters because of the difficulty of estimating clean up costs. There is also uncertainty in quantifying liabilities under environmental laws that impose joint and several liability on potentially responsible parties.

We may also incur liabilities as a result of potential future requirements to address climate change issues. Proposals for voluntary initiatives and mandatory controls are being discussed both in the United States and worldwide to reduce greenhouse gases such as carbon dioxide, a by-product of burning fossil fuels. If increased regulation of greenhouse gas emissions are implemented, the operations of our fossil-fuel generation assets may be significantly impacted. Since there can be no assurances that environmental costs may be recovered through the regulatory process, our financial performance may be negatively impacted as a result of environmental matters.

Future environmental regulation of natural gas extraction techniques including hydraulic fracturing being discussed both at the United States federal level and by some states may affect the profitability of natural gas extraction businesses which could affect demand for and profitability of our gas transportation businesses.

Operation of a nuclear facility subjects us to risk. Ownership of an operating nuclear generating plant subjects us to significant additional risks. These risks include, among others, plant security, environmental regulation and remediation, changes in federal nuclear regulation and operational factors that can significantly impact the performance and cost of operating a nuclear facility. While we maintain insurance for various nuclear-related risks, there can be no assurances that such insurance will be sufficient to cover our costs in the event of an accident or business interruption at our nuclear generating plant, which may affect our financial performance.

The supply and/or price of energy commodities and/or related services may impact our financial results. We are dependent on coal for much of our electrical generating capacity. Our access to natural gas supplies is critical to ensure reliability of service for our utility gas customers. Our non-utility businesses are also dependent upon supplies and prices of energy commodities and services. Price fluctuations, fuel supply disruptions and changes in transportation costs could have a negative impact on the amounts we charge our utility customers for electricity and gas and on the profitability of our non-utility businesses. We have hedging strategies and regulatory recovery mechanisms in place to mitigate some of the negative fluctuations in commodity supply prices in our utility and non-utility businesses, but there can be no assurances that our financial performance will not be negatively impacted by price fluctuations. The price of energy also impacts the market for our non-utility businesses that compete with utilities and alternative electric suppliers.

The supply and/or price of other industrial raw and finished inputs and/or related services may impact our financial results. We are dependent on supplies of certain commodities, such as copper and limestone, among others, and industrial materials and services in order to maintain day-to-day operations and maintenance of our facilities. Price fluctuations or supply interruptions for these commodities and other items could have a negative impact on the amounts we charge our customers for our utility products and on the profitability of our non-utility businesses.

Adverse changes in our credit ratings may negatively affect us. Regional and national economic conditions, increased scrutiny of the energy industry and regulatory changes, as well as changes in our economic performance, could result in credit agencies reexamining our credit rating. While credit ratings reflect the opinions of the credit agencies issuing such ratings and may not necessarily reflect actual performance, a downgrade in our credit rating below investment grade could restrict or discontinue our ability to access capital markets and could result in an increase in our borrowing costs, a reduced level of capital expenditures and could impact future earnings and cash flows. In addition, a reduction in our credit rating may require us to post collateral related to various physical or financially settled contracts for the purchase of energy-related commodities, products and services, which could impact our liquidity.

Poor investment performance of pension and other postretirement benefit plan assets and other factors impacting benefit plan costs could unfavorably impact our liquidity and results of operations. Our costs of providing non-contributory defined benefit pension plans and other postretirement benefit plans are dependent upon a number of factors, such as the rates of return on plan assets, the level of interest rates used to measure the required minimum funding levels of the plans, future government regulation, and our required or voluntary contributions made to the plans. The performance of the debt and equity markets affects the value of assets that are held in trust to satisfy future obligations under our plans. We have significant benefit obligations and hold significant assets in trust to satisfy these obligations. These assets are subject to market fluctuations and will yield uncertain returns, which may fall below our projected return rates. A decline in the market value of the pension and other postretirement benefit plan assets will increase the funding requirements under our pension and other postretirement benefit plans if the actual asset returns do not recover these declines in the foreseeable future. Additionally, our pension and other postretirement benefit plan liabilities are sensitive to changes in interest rates. As interest rates decrease, the liabilities increase, resulting in increasing benefit expense and funding requirements. Also, if future increases in pension and other postretirement benefit costs as a result of reduced plan assets are not recoverable from our utility customers, the results of operations and financial position of our company could be negatively affected. Without sustained growth in the plan investments over time to increase the value of our plan assets, we could be required to fund our plans with significant amounts of cash. Such cash funding obligations could have a material impact on our cash flows, financial position, or results of operations.

Our ability to access capital markets is important. Our ability to access capital markets is important to operate our businesses. Turmoil in credit markets may constrain our ability, as well as the ability of our subsidiaries, to issue new debt, including commercial paper, and refinance existing debt at reasonable interest rates. In addition, the level of borrowing by other energy companies and the market as a whole could limit our access to capital markets. Our long term revolving credit facilities do not expire until 2018, but we regularly access capital markets to refinance existing debt or fund new projects at our utilities and non-utility businesses, and we cannot predict the pricing or demand for those future transactions.

Construction and capital improvements to our power facilities and distribution systems subject us to risk. We are managing ongoing and planning future significant construction and capital improvement projects at multiple power generation and distribution facilities and our gas distribution system. Many factors that could cause delays or increased prices for these complex projects are beyond our control, including the cost of materials and labor, subcontractor performance, timing and issuance of necessary permits, construction disputes and weather conditions. Failure to complete these projects on schedule and on budget for any reason could adversely affect our financial performance and operations at the affected facilities and businesses.

Our non-utility businesses may not perform to our expectations. We rely on our non-utility operations for an increasing portion of our earnings. If our current and contemplated non-utility investments do not perform at expected levels, we could experience diminished earnings and a corresponding decline in our shareholder value.

Our participation in energy trading markets subjects us to risk. Events in the energy trading industry have increased the level of scrutiny on the energy trading business and the energy industry as a whole. In certain situations we may be required to post collateral to support trading operations, which could be substantial. If access to liquidity to support trading activities is curtailed, we could experience decreased earnings potential and cash flows. Energy trading activities take place in volatile markets and expose us to risks related to commodity price movements, deviations in weather and other related risks. We routinely have speculative trading positions in the market, within strict policy guidelines we set, resulting from the management of our business portfolio. To the extent speculative trading positions exist, fluctuating commodity prices can improve or diminish our financial results and financial position. We manage our exposure by establishing and enforcing strict risk limits and risk management procedures. During periods of extreme volatility, these risk limits and risk management procedures may not work as planned and cannot eliminate all risks associated with these activities.

Our ability to utilize production tax credits may be limited. To reduce U.S. dependence on imported oil, the Internal Revenue Code provides production tax credits as an incentive for taxpayers to produce fuels and electricity from alternative sources. We generated production tax credits from coke production, landfill gas recovery, biomass fired electric generation, reduced emission fuel, renewable energy generation and gas production operations. All production tax credits taken after 2011 are subject to audit by the Internal Revenue Service (IRS). If our production tax credits were disallowed in whole or in part as a result of an IRS audit, there could be additional tax liabilities owed for previously recognized tax credits that could significantly impact our earnings and cash flows.

Weather significantly affects operations. Deviations from normal hot and cold weather conditions affect our earnings and cash flow. Mild temperatures can result in decreased utilization of our assets, lowering income and cash flow. Ice storms, tornadoes, or high winds can damage the electric distribution system infrastructure and power generation facilities and require us to perform emergency repairs and incur material unplanned expenses. The expenses of storm restoration efforts may not be fully recoverable through the regulatory process.

Unplanned power plant outages may be costly. Unforeseen maintenance may be required to safely produce electricity or comply with environmental regulations. As a result of unforeseen maintenance, we may be required to make spot market purchases of electricity that exceed our costs of generation. Our financial performance may be negatively affected if we are unable to recover such increased costs.

We rely on cash flows from subsidiaries. DTE Energy is a holding company. Cash flows from our utility and non-utility subsidiaries are required to pay interest expenses and dividends on DTE Energy debt and securities. Should a major subsidiary not be able to pay dividends or transfer cash flows to DTE Energy, our ability to pay interest and dividends would be restricted.

Renewable portfolio standards and energy efficiency programs may affect our business. We are subject to existing Michigan and potential future federal legislation and regulation requiring us to secure sources of renewable energy. We expect to comply with the existing state legislation, but we do not know what requirements may be added by federal legislation. In addition, there could be additional state requirements increasing the percentage of power required to be provided by renewable energy sources. We cannot predict the financial impact or costs associated with complying with potential future legislation and regulations. Compliance with these requirements can significantly increase capital expenditures and operating expenses and can negatively affect the affordability of the rates we charge to our customers.

We are also required by Michigan legislation to implement energy efficiency measures and provide energy efficiency customer awareness and education programs. These requirements necessitate expenditures and implementation of these programs creates the risk of reducing our revenues as customers decrease their energy usage. We cannot predict how these programs will impact our business and future operating results.

Regional and national economic conditions can have an unfavorable impact on us. Our utility and non-utility businesses follow the economic cycles of the customers we serve and credit risk of counterparties we do business with. Should national or regional economic conditions deteriorate, reduced volumes of electricity and gas, and demand for energy services we supply, collections of accounts receivable, reductions in federal and state energy assistance funding, and potentially higher levels of lost gas or stolen gas and electricity could result in decreased earnings and cash flow.