UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM N-CSR

CERTIFIED SHAREHOLDER

REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08928

HSBC PORTFOLIOS

(Exact name of registrant as

specified in charter)

452 FIFTH AVENUE

NEW

YORK, NY 10018

(Address of

principal executive offices) (Zip code)

CITI FUND SERVICES

3435

STELZER ROAD

COLUMBUS, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-782-8183

|

Date of fiscal year end: October 31 | |

|

Date of reporting period: October 31, 2012 |

Item 1. Reports to Stockholders.

HSBC Global Asset Management (USA) Inc.

HSBC World Selection™

Funds

Annual Report

October 31, 2012

| WORLD SELECTION FUNDS | Class A | Class B | Class C | ||

| Aggressive Strategy Fund | HAAGX | HBAGX | HCAGX | ||

| Balanced Strategy Fund | HAGRX | HSBGX | HCGRX | ||

| Moderate Strategy Fund | HSAMX | HSBMX | HSCMX | ||

| Conservative Strategy Fund | HACGX | HBCGX | HCCGX | ||

| Income Strategy Fund | HINAX | HINBX | HINCX |

| Table of Contents |

Annual Report - October 31, 2012

| Glossary of Terms | ||

| Chairman’s Message | 4 | |

| President’s Message | 5 | |

| Commentary From the Investment Manager | 6 | |

| Portfolio Reviews | 8 | |

| Portfolio Composition | 18 | |

| Schedules of Portfolio Investments | ||

| Aggressive Strategy Fund | 20 | |

| Balanced Strategy Fund | 21 | |

| Moderate Strategy Fund | 22 | |

| Conservative Strategy Fund | 23 | |

| Income Strategy Fund | 24 | |

| Statements of Assets and Liabilities | 26 | |

| Statements of Operations | 27 | |

| Statements of Changes in Net Assets | 28 | |

| Financial Highlights | 34 | |

| Notes to Financial Statements | 39 | |

| Report of Independent Registered Public Accounting Firm | 48 | |

| Other Federal Income Tax Information | 49 | |

| Table of Shareholder Expenses | 50 | |

| HSBC Portfolios | ||

| Schedules of Portfolio Investments | ||

| HSBC Growth Portfolio | 52 | |

| HSBC Opportunity Portfolio | 54 | |

| Statements of Assets and Liabilities | 56 | |

| Statements of Operations | 57 | |

| Statements of Changes in Net Assets | 58 | |

| Financial Highlights | 59 | |

| Notes to Financial Statements | 60 | |

| Report of Independent Registered Public Accounting Firm | 65 | |

| Table of Shareholder Expenses | 66 | |

| Board of Trustees and Officers | 68 | |

| Other Information | 70 | |

The World Selection Funds (the “Funds”) are “fund of funds” which aim to provide superior risk adjusted returns relative to a single asset class investment over the long term by investing primarily in underlying funds. The underlying funds may include mutual funds managed by HSBC Global Asset Management (USA) Inc. (the “Adviser”), mutual funds managed by investment advisers that are not associated with the Adviser and exchange traded funds (“ETFs”) (collectively, “Underlying Funds”). The Funds may also purchase or hold exchange traded notes (“ETNs”). The Funds’ broadly diversified investment approach across various asset classes and investment styles aims to contribute to achieving their objectives. Each World Selection Fund has a strategic asset allocation which represents a carefully constructed blend of asset classes, regions and currencies to meet the longer term investment goals.

| Glossary of Terms |

BofA Merrill Lynch U.S. High Yield Master II Index is an unmanaged index that tracks the performance of USD-denominated, below investment grade corporate debt publicly issued in the U.S. domestic market.

Barclays U.S. Aggregate Bond Index is an unmanaged index generally representative of investment-grade, fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year.

Barclays U.S. High-Yield Corporate Bond Index is an unmanaged index that measures the non-investment grade, USD-denominated, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. The index excludes emerging markets debt.

Citigroup U.S. Domestic 3-Month Treasury Bill Index is an unmanaged market value-weighted index of public obligations of the U.S. Treasury with maturities of three months.

Gross Domestic Product (“GDP”) measures the market value of the goods and services produced by labor and property in the United States.

Morgan Stanley Capital International Europe Australasia and Far East (“MSCI EAFE”) Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of the following 22 developed market countries: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

Russell 2000® Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

Standard & Poor’s MidCap 400 Index is an unmanaged index that is the most widely used index for mid-sized companies. The S&P MidCap 400 covers 7% of the U.S. equities market, and is part of a series of S&P U.S. indices that can be used as building blocks for portfolio composition.

Standard & Poor’s 500 (“S&P 500”) Index is an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities.

Securities indices assume reinvestment of all distributions and interest payments and do not take in account brokerage fees or expenses. Securities in the Funds do not match those in the indices and performance of the Funds will differ. Investors cannot invest directly in an index.

| Chairman’s Message |

December 20, 2012

To Our

Shareholders:

These are challenging times for investors.

Perhaps the central reason is the slow but remorseless unwinding of a multi-decade build-up in global debt, following the recent sharp decline in the global economy. Much of this debt has been devalued—including, for example, debt associated with U.S. housing stock or Greek government debt.

Despite these modest declines, U.S. private debt—which includes household debt from such things as credit cards and mortgages—remains high. Some historical perspective: In 1951, private sector debt stood at just 53% of the U.S. Gross Domestic Product1 (GDP); today, that debt stands at 159%—a very high level, though down from its 2007 peak of 179%.

The turning point appears to be 2007. In that year, aggressive monetary and fiscal policies were enacted in the U.S. to stimulate the flagging economy. The result has been soaring government debt. Projections from the Congressional Budget Office suggest that the ratio of federal debt to GDP could reach 100% by the middle of the next decade—and that doesn’t reflect the increasing cost of entitlement programs.

These increasing claims on national income are worrisome, profoundly so, and have sparked intense and important debate—between Keynesians and monetarists; between free market capitalists and fans of European-style welfare economies; and, most recently, between Democrats and Republicans in the recent election.

So far, these growing claims by government on private sector income and wealth have failed to push interest rates higher. However, they have arguably, tempered the kind of growth and employment gains one would historically associate with recovery. In fact, the Federal Reserve’s Quantative Easing programs and “Operation Twist” have pushed rates to low levels, frustrating investors’ search for yield and leading our advisor and service providers to absorb about $17 million in fee waivers last year. Without these waivers our money market funds would have provided lower yields. Thus, it is no surprise that total money market fund assets have declined.

Regulators and others, parsing the entrails of the sharp recession, have proposed to change the regulation of such funds in order to prevent a future “run” on the funds during any period of economic upheaval. Proposals include a floating NAV, and variations of stable net asset value that include capital buffers.

Our other funds performed well in this difficult environment, as the following pages show.

Furthermore, the fund group continued to nourish its strategy of providing top-notch emerging market asset management products. Our most recent offering is the HSBC RMB Fixed Income Fund, which affords access to the Renminbi, the official offshore currency of the People’s Republic of China, through a portfolio of “Dim Sum” bonds. As the leading international bank in mainland China, HSBC is uniquely positioned to manage such a vehicle.

On behalf of my colleagues, I thank our investment advisor and portfolio managers, our other service providers, and you, our shareholders, for your support. We will continue to work hard to merit that confidence.

| Michael Seely |

| Chairman, HSBC Funds |

1 For additional information, please refer to the Glossary of Terms.

This literature must be preceded or accompanied by an effective prospectus for the HSBC Funds. Investors should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The prospectus contains this and other important information about the investment company. To obtain more information, for clients of HSBC Securities (USA) Inc., please call 1-888-525-5757 or visit www.investorfunds.us.hsbc.com. For other investors and prospective investors, please call the Funds directly at 1-888-936-4722. Investors should read the prospectus carefully before investing or sending money.

4 HSBC FAMILY OF FUNDS

| President’s Message |

Dear Shareholder,

We are please to send to you the HSBC Funds annual report, covering the Funds’ fiscal year ended October 31, 2012. This report offers detailed information about your Funds’ investments and results. We encourage you to review it carefully.

Inside these pages you will find a letter from the Funds’ Chairman, Michael Seely, in which he comments on recent market developments. The report also includes commentary from the Funds’ portfolio managers in which they discuss the investment markets and their respective Fund’s performance. Each commentary is accompanied by the Fund’s return for the period, listed alongside the returns of its benchmark index and peer group average for comparative purposes.

On June 8 of this year we continued to expand our emerging markets funds offering by launching the HSBC RMB Fixed Income Fund. This Fund gives investors exposure to the Chinese Renminbi (“RMB”) bond market, sometimes referred to as the “dim sum” bond market. The Fund joins the HSBC Emerging Markets Local Debt Fund, HSBC Emerging Markets Debt Fund, HSBC Total Return Fund and the HSBC Frontier Markets Fund in our emerging markets segment.

In closing, we would like to thank you for investing through the HSBC Funds. We continue to focus the HSBC Fund Family investment solutions to assist our shareholders in reaching their financial goals. We appreciate the trust you place in us, and will continue working to earn it. Please contact us at any time with questions or concerns.

| Richard A. Fabietti |

| President |

HSBC FAMILY OF FUNDS 5

| Commentary From the Investment Manager |

U.S. Economic Review

The global economy made only moderate progress in its ongoing recovery from a historic downturn during the 12-month period between November 1, 2011 and October 31, 2012. Governments around the world fueled the turnaround with aggressive monetary stimulus as policymakers struggled to revive growth against a backdrop, at least in the developed world, of bloated public debt. The Federal Reserve Board (the “Fed”) maintained the federal funds rate—a key factor in lending rates—at a historically low target range between 0.00% to 0.25%, and announced that it would keep the rate in that range until at least 2015.

The period began among concerns that the eurozone debt crisis would cause a new global recession. The situation in Europe improved somewhat during the first months of 2012, largely due to the European Central Bank’s (ECB) efforts to support liquidity. However, the prospect of another global recession loomed throughout much of the period as numerous economic indicators, such as industrial production and unemployment growth, proved disappointing. Although the U.S. economy continued to expand during the period, the pace of its growth slowed.

We believe the ECB helped to stem a liquidity crisis and alleviate fears of deepening credit problems in the eurozone. In December 2011 the ECB began distributing inexpensive loans to European banks as part of its long-term refinancing operation (LTRO) and in March 2012 began doling out an even larger amount of money in similar loans. The LTRO appeared to stabilize financial markets in the short term; nevertheless, significant uncertainties remain regarding the long-term prospects of European economies to regain their competitiveness and prevent default. The ability of Italy and Spain to reestablish market confidence remained in doubt; in addition, the long-term impact of austerity programs on economic growth raised concerns.

Slowing growth in major world economies, including the U.S. and China, presented a significant setback for the global economy. U.S. Gross Domestic Product (“GDP”)1 increased at an annualized rate of 4.1% during the last quarter of 2011, then slowed to 2.7% or less for the remainder of the period under review. Industrial production growth was weak in both developed and emerging markets. U.S. consumer confidence improved somewhat, although real income growth and consumer savings were low. While job growth remained slow, during the last quarter of the period the unemployment rate fell below 8% for the first time in four years. During the period, the U.S. housing market showed significant signs of improvement as sales increased and inventory declined. Towards the end of the period, better economic news was seen from China, the world’s second-largest economy, leading many commentators to suggest that Chinese economic growth had turned a corner. One positive consequence of the slowdown in the global economy was a decrease in the rate of inflation in both developed and emerging economies.

Market Review

U.S. stocks posted strong gains. The first two months of the period were characterized by high volatility, as investors responded to ongoing debt problems and slowing economic growth. Equities began a strong rally in the final weeks of 2011 that continued throughout much of the period, with the exception of a pullback during the late spring. Stocks’ robust performance, despite economic setbacks, was supported in part by the actions of central banks, including the ECB’s launch of a new bond buying scheme it described as “unlimited” and the Fed’s third round of “quantitative easing.” The S&P 500 Index1 of large-company stocks returned 15.21% for the 12 months through October 2012. Small-cap shares slightly outperformed mid- and large-caps: For the same period, the Russell 2000® Index1 of small-company stocks returned 12.08%, and the S&P 400 MidCap Index1 returned 12.11%.

The debt crisis in Europe, along with slowing growth in developing economies, led to less impressive performance for foreign stocks. The Morgan Stanley Capital International Europe Australasia and Far East (“MSCI EAFE”) Index1 of international stocks in developed markets returned 4.61% for the 12-month period.

Fixed-income securities generated significant gains during the period, as global economic worries continued to drive demand for lower-risk assets. Yields on U.S. government bonds reached record lows as an increasing number of investors pursued a flight to safety. Low inflation, healthy corporate balance sheets, consumer and corporate deleveraging and a stabilizing housing market supported gains in corporate fixed-income markets, including both investment and high yield bonds. For the 12-month period the Barclays U.S. Aggregate Bond Index1, which tracks the broad investment-grade fixed-income market, returned 5.25%, while the Barclays U.S. High-Yield Corporate Bond Index1 returned 13.61%.

1 For additional information, please refer to the Glossary of Terms.

6 HSBC FAMILY OF FUNDS

| Portfolio Reviews (Unaudited) |

(Class A Shares, Class B Shares and Class C Shares)

by Randeep Brar, CFA, Senior Vice

President/Portfolio Manager

Caroline Hitch, Senior Portfolio

Manager

The Aggressive Strategy Fund (the “Fund”) is a “fund of funds” which seeks long-term growth of capital by investing primarily in underlying funds. The underlying funds may include mutual funds managed by HSBC Global Asset Management (USA) Inc. (the “Adviser”), mutual funds managed by investment advisers that are not associated with the Adviser and exchange traded funds (“ETFs”) (collectively, “Underlying Funds”). The Fund may also purchase or hold exchange traded notes (“ETNs”).

Investment Concerns

Allocation Risk: The risk that the Adviser’s target asset and sector allocations and changes in target asset and sector allocations cause the Fund to underperform other similar funds or cause you to lose money, and that the Fund may not achieve its target asset and sector allocations.

Underlying Fund Selection Risk: The risk that the Fund may invest in Underlying Funds that underperform other similar funds or the markets more generally, due to poor investment decisions by the investment adviser(s) for the Underlying Funds or otherwise. Underlying Funds also have their own expenses, which the Fund bears in addition to its own expenses.

Equity Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in equity securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in equity securities.

Fixed Income Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in fixed income securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in fixed income securities.

Foreign Securities/Emerging Markets Risk: Foreign securities, including those of emerging market issuers, are subject to additional risks including international trade, currency, political, and regulatory risks. Securities of emerging market issuers generally have more risk than securities issued by issuers in more developed foreign markets.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

The Fund returned 7.72% (without sales charge) for the Class A Shares for the 12-month period ended October 31, 2012. That compared to a 15.21% total return for the Fund’s primary benchmark, the S&P 500 Index1.

The Fund measures performance against several additional reference indices: the MSCI EAFE Index1 (5.15% return for the 12 months through October 31, 2012), Barclays U.S. Aggregate Bond Index1 (5.25% return), Bank of America/Merrill Lynch U.S. High Yield Master II Index1 (13.18% return) and Citigroup U.S. Domestic 3-Month Treasury Bill Index1 (0.06% return).

Portfolio Performance

Investors during the 12-month period were concerned by a range of global economic issues, including the continuing eurozone debt crisis, China’s economic slowdown and U.S. fiscal issues. Those concerns contributed to considerable volatility in the financial markets during the period.

Still, most major equity markets posted positive returns during the 12 months through October 31, 2012. That performance was driven primarily by strong returns during the first and third quarters in 2012 and extended to other “risky” asset classes such as high-yield bonds. The financial markets during the period also benefited from various central bank actions including the U.S. Federal Reserve’s decision to launch a third round of quantitative easing and a new bond buying program outlined by the European Central Bank (ECB) to stem the eurozone debt crisis.

In that environment, the Fund enjoyed positive absolute performance, and the period was rewarding for investors. The Fund benefited from its strategic allocation to riskier asset classes, which performed well in absolute terms during the period. In particular, the Fund’s high allocation to small-, mid- and large-cap U.S. equities (55%-60% of the Fund’s total portfolio) contributed substantially to its total return during the period. An overweight position in emerging market equities held for most of the period was less successful in relative terms. However, we continued to believe that companies in emerging regions offered attractive valuations against a strengthening macroeconomic picture.*

Within the Fund’s fixed-income segment, we favored corporate bonds—such as U.S. high-yield bonds—over government bonds. We believed corporate bonds offered better total return potential than other options in the fixed-income market. That strategy benefited the Fund’s absolute performance during the period. The Fund’s exposure to emerging market debt was beneficial. In absolute terms, the Fund benefited from its exposure to alternative asset classes, particularly global property and private equity, during the period.*

| * |

Portfolio composition is subject to change. | |

| 1 |

For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

8 HSBC FAMILY OF FUNDS

| Portfolio Reviews (Unaudited) |

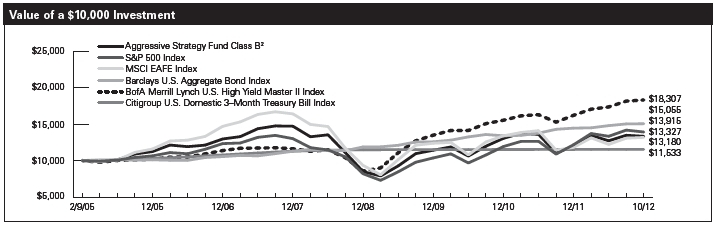

The charts above represent a historical since inception performance comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| Average Annual | Expense | ||||||||||||||

| Fund Performance | Total Return (%) | Ratio (%)4 | |||||||||||||

| Inception | 1 | 5 | Since | ||||||||||||

| As of October 31, 2012 | Date | Year | Year | Inception | Gross | Net | |||||||||

| Aggressive Strategy Fund Class A1 | 2/14/05 | 2.33 | -3.30 | 3.67 | 2.19 | 1.88 | |||||||||

| Aggressive Strategy Fund Class B2 | 2/9/05 | 2.87 | -3.03 | 3.79 | 2.94 | 2.63 | |||||||||

| Aggressive Strategy Fund Class C3 | 6/9/05 | 5.83 | -3.03 | 4.02 | 2.94 | 2.63 | |||||||||

| S&P 500 Index5 | — | 15.21 | 0.36 | 4.37 | 6 | N/A | N/A | ||||||||

| MSCI EAFE Index5 | — | 5.15 | -5.35 | 3.64 | 6 | N/A | N/A | ||||||||

| Barclays U.S. Aggregate Bond Index5 | — | 5.25 | 6.38 | 5.44 | 6 | N/A | N/A | ||||||||

| BofA Merrill Lynch U.S. High Yield Master II Index5 | — | 13.18 | 9.12 | 8.14 | 6 | N/A | N/A | ||||||||

| Citigroup U.S. Domestic 3-Month Treasury Bill Index5 | — | 0.06 | 0.57 | 1.86 | 6 | N/A | N/A | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through March 1, 2013.

Certain returns shown include monies received by series of HSBC Portfolios (formerly, HSBC Investor Portfolios) (the “Portfolios”), in which the Fund invests, in respect of one-time class action settlements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolios not received the payments.

| 1 | Reflects the maximum sales charge of 5.00%. | |

| 2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. | |

| 3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. | |

| 4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2012. The Adviser has entered into a contractual expense limitation agreement with the Fund under which it will limit total expenses of the Fund (excluding interest, taxes, brokerage commissions, extraordinary expenses and estimated indirect expenses attributable to the Fund’s investments in investment companies other than the HSBC Growth Portfolio and the HSBC Opportunity Portfolio) to an annual rate of 1.50%, 2.25%, and 2.25% for Class A Shares, Class B Shares and Class C Shares, respectively. The expense limitation shall be in effect until March 1, 2013. The expense ratios reflected include Acquired Fund fees and expenses. Additional information pertaining to the October 31, 2012 expense ratios can be found in the financial highlights. | |

| 5 | For additional information, please refer to the Glossary of Terms. | |

| 6 | Return for the period February 9, 2005 to October 31, 2012. |

The Fund’s performance is primarily measured against the S&P 500 Index, an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

HSBC FAMILY OF FUNDS 9

| Portfolio Reviews (Unaudited) |

(Class A Shares, Class B Shares and Class C Shares)

by Randeep Brar, CFA, Senior Vice

President/Portfolio Manager

Caroline Hitch, Senior Portfolio

Manager

The Balanced Strategy Fund (the “Fund”) is a “fund of funds” which seeks long-term growth of capital by investing primarily in underlying funds. The underlying funds may include mutual funds managed by HSBC Global Asset Management (USA) Inc. (the “Adviser”), mutual funds managed by investment advisers that are not associated with the Adviser and exchange traded funds (“ETFs”) (collectively, “Underlying Funds”). The Fund may also purchase or hold exchange traded notes (“ETNs”).

Investment Concerns

Allocation Risk: The risk that the Adviser’s target asset and sector allocations and changes in target asset and sector allocations cause the Fund to underperform other similar funds or cause you to lose money, and that the Fund may not achieve its target asset and sector allocations.

Underlying Fund Selection Risk: The risk that the Fund may invest in Underlying Funds that underperform other similar funds or the markets more generally, due to poor investment decisions by the investment adviser(s) for the Underlying Funds or otherwise. Underlying Funds also have their own expenses, which the Fund bears in addition to its own expenses.

Equity Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in equity securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in equity securities.

Fixed Income Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in fixed income securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in fixed income securities.

Foreign Securities/Emerging Markets Risk: Foreign securities, including those of emerging market issuers, are subject to additional risks including international trade, currency, political, and regulatory risks. Securities of emerging market issuers generally have more risk than securities issued by issuers in more developed foreign markets.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

The Fund returned 8.51% (without sales charge) for the Class A Shares for the 12-month period ended October 31, 2012. That compared to a 15.21% total return for the Fund’s primary benchmark, the S&P 500 Index1.

The Fund measures performance against several additional reference indices: the MSCI EAFE Index1 (5.15% return for the 12 months through October 31, 2012), Barclays U.S. Aggregate Bond Index1 (5.25% return), Bank of America/Merrill Lynch U.S. High Yield Master II Index1 (13.18% return) and Citigroup U.S. Domestic 3-Month Treasury Bill Index1 (0.06% return).

Portfolio Performance

Investors during the 12-month period were concerned by a range of global economic issues, including the continuing eurozone debt crisis, China’s economic slowdown and U.S. fiscal issues. Those concerns contributed to considerable volatility in the financial markets during the period.

Still, most major equity markets posted positive returns during the 12 months through October 31, 2012. That performance was driven primarily by strong returns during the first and third quarters in 2012 and extended to other “risky” asset classes such as high-yield bonds. The financial markets during the period also benefited from various central bank actions including the U.S. Federal Reserve’s decision to launch a third round of quantitative easing and a new bond buying program outlined by the European Central Bank (ECB) to stem the eurozone debt crisis.

In that environment, the Fund enjoyed positive absolute performance, and the period was rewarding for investors. The Fund benefited from its strategic allocation to riskier asset classes, which performed well in absolute terms during the period. In particular, the Fund’s allocation to small-, mid- and large-cap U.S. equities (40%-45% of the Fund’s total portfolio) contributed substantially to its total return during the period. The overweight position in emerging market equities held for most of the period was less successful in relative terms. However, we continued to believe that companies in emerging regions offered attractive valuations against a strengthening macroeconomic picture.*

Within the Fund’s fixed-income segment, we favored corporate bonds—such as U.S. high-yield bonds—over government bonds. We believed corporate bonds offered better total return potential than other options in the fixed-income market. That strategy benefited the Fund’s absolute performance during the period. The Fund’s exposure to emerging market debt was beneficial. In absolute terms, the Fund benefited from its exposure to alternative asset classes, particularly global property and private equity, during the period.*

| * |

Portfolio composition is subject to change. | |

| 1 |

For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

10 HSBC FAMILY OF FUNDS

| Portfolio Reviews (Unaudited) |

|

Balanced Strategy Fund |

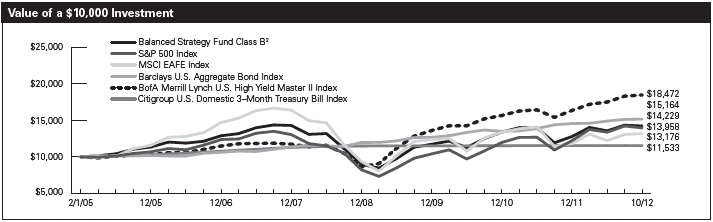

The charts above represent a historical since inception performance comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| Average Annual | Expense | |||||||||||||||||||

| Fund Performance | Total Return (%) | Ratio (%)4 | ||||||||||||||||||

| Inception | 1 | 5 | Since | |||||||||||||||||

| As of October 31, 2012 | Date | Year | Year | Inception | Gross | Net | ||||||||||||||

| Balanced Strategy Fund Class A1 | 2/8/05 | 3.04 | -1.34 | 4.44 | 1.79 | 1.79 | ||||||||||||||

| Balanced Strategy Fund Class B2 | 2/1/05 | 3.66 | -1.07 | 4.66 | 2.54 | 2.54 | ||||||||||||||

| Balanced Strategy Fund Class C3 | 4/27/05 | 6.77 | -1.06 | 4.95 | 2.54 | 2.54 | ||||||||||||||

| S&P 500 Index5 | — | 15.21 | 0.36 | 4.40 | 6 | N/A | N/A | |||||||||||||

| MSCI EAFE Index5 | — | 5.15 | -5.35 | 3.62 | 6 | N/A | N/A | |||||||||||||

| Barclays U.S. Aggregate Bond Index5 | — | 5.25 | 6.38 | 5.52 | 6 | N/A | N/A | |||||||||||||

| BofA Merrill Lynch U.S. High Yield Master II Index5 | — | 13.18 | 9.12 | 8.25 | 6 | N/A | N/A | |||||||||||||

| Citigroup U.S. Domestic 3-Month Treasury Bill Index5 | — | 0.06 | 0.57 | 1.86 | 6 | N/A | N/A | |||||||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower.

Certain returns shown include monies received by series of HSBC Portfolios (formerly, HSBC Investor Portfolios) (the “Portfolios”), in which the Fund invests, in respect of one-time class action settlements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolios not received the payments.

| 1 | Reflects the maximum sales charge of 5.00%. | |

| 2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. | |

| 3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. | |

| 4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2012. The expense ratios reflected include Acquired Fund fees and expenses. Additional information pertaining to the October 31, 2012 expense ratios can be found in the financial highlights. | |

| 5 | For additional information, please refer to the Glossary of Terms. | |

| 6 | Return for the period February 1, 2005 to October 31, 2012. |

The Fund’s performance is primarily measured against the S&P 500 Index, an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| HSBC FAMILY OF FUNDS | 11 |

| Portfolio Reviews (Unaudited) |

|

Moderate

Strategy Fund |

by Randeep Brar, CFA, Senior Vice

President/Portfolio Manager

Caroline Hitch, Senior Portfolio

Manager

The Moderate Strategy Fund (the “Fund”) is a “fund of funds” which seeks long-term growth of capital by investing primarily in underlying funds. The underlying funds may include mutual funds managed by HSBC Global Asset Management (USA) Inc. (the “Adviser”), mutual funds managed by investment advisers that are not associated with the Adviser and exchange traded funds (“ETFs”) (collectively, “Underlying Funds”). The Fund may also purchase or hold exchange traded notes (“ETNs”).

Investment Concerns

Allocation Risk: The risk that the Adviser’s target asset and sector allocations and changes in target asset and sector allocations cause the Fund to underperform other similar funds or cause you to lose money, and that the Fund may not achieve its target asset and sector allocations.

Underlying Fund Selection Risk: The risk that the Fund may invest in Underlying Funds that underperform other similar funds or the markets more generally, due to poor investment decisions by the investment adviser(s) for the Underlying Funds or otherwise. Underlying Funds also have their own expenses, which the Fund bears in addition to its own expenses.

Equity Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in equity securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in equity securities.

Fixed Income Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in fixed income securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in fixed income securities.

Foreign Securities/Emerging Markets Risk: Foreign securities, including those of emerging market issuers, are subject to additional risks including international trade, currency, political, and regulatory risks. Securities of emerging market issuers generally have more risk than securities issued by issuers in more developed foreign markets.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

The Fund returned 8.24% (without sales charge) for the Class A Shares for the 12-month period ended October 31, 2012. That compared to a 15.21% total return for the Fund’s primary benchmark, the S&P 500 Index1.

The Fund measures performance against several additional reference indices: the MSCI EAFE Index1 (5.15% return for the 12 months through October 31, 2012), Barclays U.S. Aggregate Bond Index1 (5.25% return), Bank of America/Merrill Lynch U.S. High Yield Master II Index1 (13.18% return) and Citigroup U.S. Domestic 3-Month Treasury Bill Index1 (0.06% return).

Portfolio Performance

Investors during the 12-month period were concerned by a range of global economic issues, including the continuing eurozone debt crisis, China’s economic slowdown and U.S. fiscal issues. Those concerns contributed to considerable volatility in the financial markets during the period.

Still, most major equity markets posted positive returns during the 12 months through October 31, 2012. That performance was driven primarily by strong returns during the first and third quarters in 2012 and extended to other “risky” asset classes such as high-yield bonds. The financial markets during the period also benefited from various central bank actions including the U.S. Federal Reserve’s decision to launch a third round of quantitative easing and a new bond buying program outlined by the European Central Bank (ECB) to stem the eurozone debt crisis.

In that environment, the Fund enjoyed positive absolute performance, and the period was rewarding for investors. The Fund benefited from its strategic allocation to riskier asset classes, which performed well in absolute terms during the period. In particular, the Fund’s allocation to small-, mid-, and large-cap U.S. equities (25%-35% of the Fund’s total portfolio) contributed substantially to its total return during the period. An overweight position in emerging market equities held for most of the period was less successful in relative terms. However, we continued to believe that companies in emerging regions offered attractive valuations against a strengthening macroeconomic picture.*

The Fund’s allocation to U.S. fixed-income securities (20%-25% of the Fund’s total portfolio) and U.S. high-yield debt (10%-15% of the Fund’s total portfolio) also benefited performance during the period. Within the Fund’s fixed-income segment, we favored corporate bonds—such as U.S. high-yield bonds—over government bonds. We believed corporate bonds offered better total return potential than other options in the fixed-income market. That strategy benefited the Fund’s absolute performance. The Fund’s exposure to emerging market debt was beneficial. In absolute terms, the Fund benefited from its exposure to alternative asset classes, particularly global property and private equity, during the period.*

|

* |

Portfolio composition is subject to change. | |

|

1 |

For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

| 12 | HSBC FAMILY OF FUNDS |

| Portfolio Reviews (Unaudited) | |

| Moderate Strategy Fund |

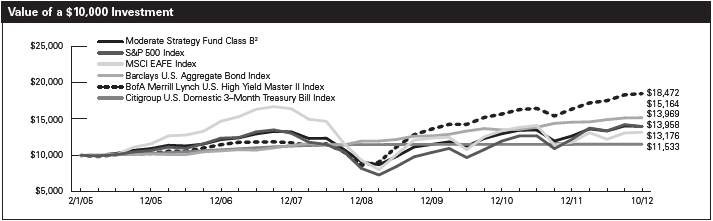

The charts above represent a historical since inception performance comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| Average Annual | Expense | |||||||||||||||||

| Fund Performance | Total Return (%) | Ratio (%)4 | ||||||||||||||||

| Inception | 1 | 5 | Since | |||||||||||||||

| As of October 31, 2012 | Date | Year | Year | Inception | Gross | Net | ||||||||||||

| Moderate Strategy Fund Class A1 | 2/3/05 | 2.86 | -0.03 | 4.25 | 1.80 | 1.80 | ||||||||||||

| Moderate Strategy Fund Class B2 | 2/1/05 | 3.43 | 0.26 | 4.41 | 2.55 | 2.55 | ||||||||||||

| Moderate Strategy Fund Class C3 | 6/9/05 | 6.49 | 0.27 | 4.39 | 2.55 | 2.55 | ||||||||||||

| S&P 500 Index5 | — | 15.21 | 0.36 | 4.40 | 6 | N/A | N/A | |||||||||||

| MSCI EAFE Index5 | — | 5.15 | -5.35 | 3.62 | 6 | N/A | N/A | |||||||||||

| Barclays U.S. Aggregate Bond Index5 | — | 5.25 | 6.38 | 5.52 | 6 | N/A | N/A | |||||||||||

| BofA Merrill Lynch U.S. High Yield Master II Index5 | — | 13.18 | 9.12 | 8.25 | 6 | N/A | N/A | |||||||||||

| Citigroup U.S. Domestic 3-Month Treasury Bill Index5 | — | 0.06 | 0.57 | 1.86 | 6 | N/A | N/A | |||||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower.

Certain returns shown include monies received by series of HSBC Portfolios (formerly, HSBC Investor Portfolios) (the “Portfolios”), in which the Fund invests, in respect of one-time class action settlements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolios not received the payments.

| 1 | Reflects the maximum sales charge of 5.00%. | |

| 2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. | |

| 3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. | |

| 4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2012. The expense ratios reflected include Acquired Fund fees and expenses. Additional information pertaining to the October 31, 2012 expense ratios can be found in the financial highlights. | |

| 5 | For additional information, please refer to Glossary of Terms. | |

| 6 | Return for the period February 1, 2005 to October 31, 2012. |

The Fund’s performance is primarily measured against the S&P 500 Index, an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| HSBC FAMILY OF FUNDS | 13 |

| Portfolio Reviews (Unaudited) |

| Conservative Strategy Fund (Class A Shares, Class B Shares and Class C Shares) |

by Randeep Brar, CFA, Senior Vice

President/Portfolio Manager

Caroline Hitch, Senior Portfolio

Manager

The Conservative Strategy Fund (the “Fund”) is a “fund of funds” which seeks long-term growth of capital by investing primarily in underlying funds. The underlying funds may include mutual funds managed by HSBC Global Asset Management (USA) Inc. (the “Adviser”), mutual funds managed by investment advisers that are not associated with the Adviser and exchange traded funds (“ETFs”) (collectively, “Underlying Funds”). The Fund may also purchase or hold exchange traded notes (“ETNs”).

Investment Concerns

Allocation Risk: The risk that the Adviser’s target asset and sector allocations and changes in target asset and sector allocations cause the Fund to underperform other similar funds or cause you to lose money, and that the Fund may not achieve its target asset and sector allocations.

Underlying Fund Selection Risk: The risk that the Fund may invest in Underlying Funds that underperform other similar funds or the markets more generally, due to poor investment decisions by the investment adviser(s) for the Underlying Funds or otherwise. Underlying Funds also have their own expenses, which the Fund bears in addition to its own expenses.

Equity Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in equity securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in equity securities.

Fixed Income Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in fixed income securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in fixed income securities.

Foreign Securities/Emerging Markets Risk: Foreign securities, including those of emerging market issuers, are subject to additional risks including international trade, currency, political, and regulatory risks. Securities of emerging market issuers generally have more risk than securities issued by issuers in more developed foreign markets.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

The Fund returned 8.00% (without sales charge) for the Class A Shares for the 12-month period ended October 31, 2012. That compared to a 15.21% total return for the Fund’s primary benchmark, the S&P 500 Index1.

The Fund measures performance against several additional reference indices: the MSCI EAFE Index1 (5.15% return for the 12 months through October 31, 2012), Barclays U.S. Aggregate Bond Index1 (5.25% return), Bank of America/Merrill Lynch U.S. High Yield Master II Index1 (13.18% return) and Citigroup U.S. Domestic 3-Month Treasury Bill Index1 (0.06% return).

Portfolio Performance

Investors during the 12-month period were concerned by a range of global economic issues, including the continuing eurozone debt crisis, China’s economic slowdown and U.S. fiscal issues. Those concerns contributed to considerable volatility in the financial markets during the period.

Still, most major equity markets posted positive returns during the 12 months through October 31, 2012. That performance was driven primarily by strong returns during the first and third quarters in 2012 and extended to other “risky” asset classes such as high-yield bonds. The financial markets during the period also benefited from various central bank actions including the U.S. Federal Reserve’s decision to launch a third round of quantitative easing and a new bond buying program outlined by the European Central Bank (ECB) to stem the eurozone debt crisis.

In that environment, the Fund enjoyed positive absolute performance, and the period was rewarding for investors. The Fund benefited from its strategic allocation to riskier asset classes that performed well in absolute terms. The Fund’s allocation to small-, mid-, and large-cap U.S. equities (15%-20% of the Fund’s total portfolio) contributed substantially to its total return during the period.*

The Fund’s allocation to U.S. fixed-income securities (about 40% of the Fund’s total portfolio) and U.S. high-yield debt (10%-15% of the Fund’s total portfolio) also benefited performance during the period. Within the Fund’s fixed-income segment, we favored corporate bonds—such as U.S. high-yield bonds—over government bonds. We believed corporate bonds offered better total return potential than other options in the fixed-income market. That strategy benefited the Fund’s absolute performance during the period. The Fund’s exposure to emerging market debt was beneficial. In absolute terms, the Fund benefited from its exposure to alternative asset classes, particularly global property and private equity, during the period.*

| * | Portfolio composition is subject to change. | |

| 1 | For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

| 14 | HSBC FAMILY OF FUNDS |

| Portfolio Reviews (Unaudited) | |

| Conservative Strategy Fund |

The charts above represent a historical since inception performance comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| Average Annual | Expense | |||||||||||||||||

| Fund Performance | Total Return (%) | Ratio (%)4 | ||||||||||||||||

| Inception | 1 | 5 | Since | |||||||||||||||

| As of October 31, 2012 | Date | Year | Year | Inception | Gross | Net | ||||||||||||

| Conservative Strategy Fund Class A1 | 2/23/05 | 2.56 | 1.11 | 3.95 | 1.95 | 1.95 | ||||||||||||

| Conservative Strategy Fund Class B2 | 2/17/05 | 3.21 | 1.37 | 3.99 | 2.70 | 2.70 | ||||||||||||

| Conservative Strategy Fund Class C3 | 4/19/05 | 6.28 | 1.38 | 4.53 | 2.70 | 2.70 | ||||||||||||

| S&P 500 Index5 | — | 15.21 | 0.36 | 4.28 | 6 | N/A | N/A | |||||||||||

| MSCI EAFE Index5 | — | 5.15 | -5.35 | 3.31 | 6 | N/A | N/A | |||||||||||

| Barclays U.S. Aggregate Bond Index5 | — | 5.25 | 6.38 | 5.55 | 6 | N/A | N/A | |||||||||||

| BofA Merrill Lynch U.S. High Yield Master II Index5 | — | 13.18 | 9.12 | 8.14 | 6 | N/A | N/A | |||||||||||

| Citigroup U.S. Domestic 3-Month Treasury Bill Index5 | — | 0.06 | 0.57 | 1.87 | 6 | N/A | N/A | |||||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower.

Certain returns shown include monies received by the Portfolios, in which the Fund invests, in respect of one-time class action settlements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolios not received the payments.

| 1 | Reflects the maximum sales charge of 5.00%. | |

| 2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. | |

| 3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. | |

| 4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2012. The expense ratios reflected include Acquired Fund fees and expenses. Additional information pertaining to the October 31, 2012 expense ratios can be found in the financial highlights. | |

| 5 | For additional information, please refer to the Glossary of Terms. | |

| 6 | Return for the period February 17, 2005 to October 31, 2012. |

The Fund’s performance is primarily measured against the S&P 500 Index, an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| HSBC FAMILY OF FUNDS | 15 |

| Portfolio Reviews (Unaudited) |

| Income Strategy Fund (Class A Shares, Class B Shares and Class C Shares) |

Randeep Brar, CFA, Senior Vice

President/Portfolio Manager

Caroline Hitch, Senior Portfolio

Manager

The Income Strategy Fund (the “Fund”) is a “fund of funds” which primarily seeks current income and secondarily seeks to provide long-term growth of capital by investing primarily in underlying funds. The underlying funds may include mutual funds managed by HSBC Global Asset Management (USA) Inc. (the “Adviser”), mutual funds managed by investment advisers that are not associated with the Adviser and exchange traded funds (“ETFs”) (collectively, “Underlying Funds”). The Fund may also purchase or hold exchange traded notes (“ETNs”).

Investment Concerns

Allocation Risk: The risk that the Adviser’s target asset and sector allocations and changes in target asset and sector allocations cause the Fund to underperform other similar funds or cause you to lose money, and that the Fund may not achieve its target asset and sector allocations.

Underlying Fund Selection Risk: The risk that the Fund may invest in Underlying Funds that underperform other similar funds or the markets more generally, due to poor investment decisions by the investment adviser(s) for the Underlying Funds or otherwise. Underlying Funds also have their own expenses, which the Fund bears in addition to its own expenses.

Equity Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in equity securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in equity securities.

Fixed Income Securities Risk: A portion of the assets of the Fund is allocated to Underlying Funds investing primarily in fixed income securities. Therefore, the value of the Fund may increase or decrease as a result of its indirect interest in fixed income securities.

Foreign Securities/Emerging Markets Risk: Foreign securities, including those of emerging market issuers, are subject to additional risks including international trade, currency, political, and regulatory risks. Securities of emerging market issuers generally have more risk than securities issued by issuers in more developed foreign markets.

The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

The Fund returned 5.02% (without sales charge) for the Class A Shares for the period between its inception on March 20, 2012 and October 31, 2012. That compared to a 1.78% total return for the Fund’s primary benchmark, the S&P 500 Index1, during the same period.

The Fund measures performance against several additional reference indices: the MSCI EAFE Index1 (-0.20% return for the period between March 20, 2012 and October 31, 2012), Barclays U.S. Aggregate Bond Index1 (4.51% return), Bank of America/Merrill Lynch U.S. High Yield Master II Index1 (7.49% return) and Citigroup U.S. Domestic 3-Month Treasury Bill Index1 (0.05% return).

Portfolio Performance

Investors during the 12-month period were concerned by a range of global economic issues, including the continuing eurozone debt crisis, China’s economic slowdown and U.S. fiscal issues. Those concerns contributed to considerable volatility in the financial markets during the period.

Still, most major equity markets posted positive returns during the 12 months through October 31, 2012. That performance was driven primarily by strong returns during the first and third quarters in 2012 and extended to other “risky” asset classes such as high-yield bonds. The financial markets during the period also benefited from various central bank actions including the U.S. Federal Reserve’s decision to launch a third round of quantitative easing and a new bond buying program outlined by the European Central Bank (ECB) to stem the eurozone debt crisis.

The Fund’s allocation to U.S. fixed-income securities (40%-45% of the Fund’s total portfolio) contributed substantially to its total return during the period. In the fixed-income market, we favored corporate bonds—such as U.S. high-yield bonds—over government bonds. We believed corporate bonds offered better total return potential than other options in the fixed-income market. That strategy benefited the Fund’s absolute performance. The Fund’s exposure to emerging market debt was beneficial. In absolute terms, the Fund benefited from its exposure to global property during the period.*

|

* |

Portfolio composition is subject to change. | |

|

1 |

For additional information, please refer to the Glossary of Terms. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

| 16 | HSBC FAMILY OF FUNDS |

| Portfolio Reviews (Unaudited) | |

| Income Strategy Fund |

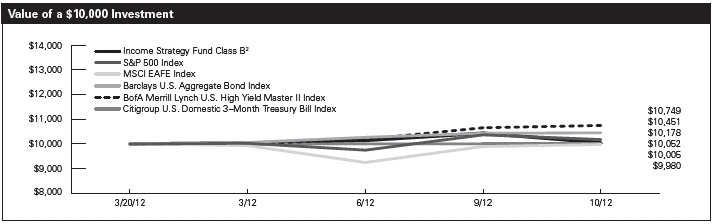

The charts above represent a historical since inception performance comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| Aggregate | Expense | |||||||||||

| Fund Performance | Total Return (%) | Ratio (%)4 | ||||||||||

| Inception | Since | |||||||||||

| As of October 31, 2012 | Date | Inception | Gross | Net | ||||||||

| Income Strategy Fund Class A1 | 3/20/12 | 0.02 | 2.25 | 2.10 | ||||||||

| Income Strategy Fund Class B2 | 3/20/12 | 0.52 | 3.00 | 2.85 | ||||||||

| Income Strategy Fund Class C3 | 3/20/12 | 3.47 | 3.00 | 2.85 | ||||||||

| S&P 500 Index5 | — | 1.78 | 6 | N/A | N/A | |||||||

| MSCI EAFE Index5 | — | -0.20 | 6 | N/A | N/A | |||||||

| Barclays U.S. Aggregate Bond Index5 | — | 4.51 | 6 | N/A | N/A | |||||||

| BofA Merrill Lynch U.S. High Yield Master II Index5 | — | 7.49 | 6 | N/A | N/A | |||||||

| Citigroup U.S. Domestic 3-Month Treasury Bill Index5 | — | 0.05 | 6 | N/A | N/A | |||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through March 1, 2013.

Certain returns shown include monies received by the Portfolios, in which the Fund invests, in respect of one-time class action settlements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolios not received the payments.

| 1 | Reflects the maximum sales charge of 4.75%. | |

| 2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. | |

| 3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. | |

| 4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2012. HSBC Global Asset Management (USA) Inc. has entered into a contractual expense limitation agreement with the Fund under which it will limit total expenses of the Fund (excluding interest, taxes, brokerage commissions, extraordinary expenses and estimated indirect expenses attributable to the Fund’s investments in investment companies) to an annual rate of 1.50%, 2.25% and 2.25% for Class A Shares, Class B Shares and Class C Shares, respectively. The expense limitation shall be in effect until March 1, 2013. The expense ratios reflected include Acquired Fund fees and expenses. Additional information pertaining to the October 31, 2012 expense ratios can be found in the financial highlights. | |

| 5 | For additional information, please refer to the Glossary of Terms. | |

| 6 | Return for the period March 21, 2012 to October 31, 2012. |

The Fund’s performance is primarily measured against the S&P 500 Index, an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

| HSBC FAMILY OF FUNDS | 17 |

| Portfolio Reviews |

| Portfolio

Composition* October 31, 2012 (Unaudited) |

| Aggressive Strategy Fund | |||

| Percentage of | |||

| Investment Allocation | Investments at Value (%) | ||

| Domestic Equities | 59.5 | ||

| International Equities | 26.2 | ||

| Fixed Income | 9.0 | ||

| Alternatives | 5.2 | ||

| Cash | 0.1 | ||

| Total | 100.0 | ||

| Balanced Strategy Fund | |||

| Percentage of | |||

| Investment Allocation | Investments at Value (%) | ||

| Domestic Equities | 43.4 | ||

| International Equities | 25.5 | ||

| Fixed income | 21.6 | ||

| Alternatives | 9.4 | ||

| Cash | 0.1 | ||

| Total | 100.0 | ||

| Moderate Strategy Fund | |||

| Percentage of | |||

| Investment Allocation | Investments at Value (%) | ||

| Fixed Income | 35.8 | ||

| Domestic Equities | 29.5 | ||

| International Equities | 24.6 | ||

| Alternatives | 9.1 | ||

| Cash | 1.0 | ||

| Total | 100.0 | ||

| Conservative Strategy Fund | |||

| Percentage of | |||

| Investment Allocation | Investments at Value (%) | ||

| Fixed Income | 53.3 | ||

| Domestic Equities | 18.2 | ||

| International Equities | 19.4 | ||

| Alternatives | 8.0 | ||

| Cash | 1.1 | ||

| Total | 100.0 | ||

| Income Strategy Fund | |||

| Percentage of | |||

| Investment Allocation | Investments at Value (%) | ||

| Fixed Income | 67.8 | ||

| International Equities | 14.8 | ||

| Domestic Equities | 8.8 | ||

| Cash | 7.2 | ||

| Alternatives | 1.4 | ||

| Total | 100.0 | ||

| HSBC Growth Portfolio | |||

| Percentage of | |||

| Investment Allocation | Investments at Value (%) | ||

| Computers & Peripherals | 8.1 | ||

| IT Services | 8.0 | ||

| Internet Software & Services | 5.4 | ||

| Specialty Retail | 4.8 | ||

| Biotechnology | 4.5 | ||

| Internet & Catalog Retail | 4.4 | ||

| Chemicals | 4.4 | ||

| Health Care Providers & | |||

| Services | 4.2 | ||

| Health Care Equipment & | |||

| Supplies | 4.1 | ||

| Investment Companies | 3.9 | ||

| Road & Rail | 3.9 | ||

| Machinery | 3.9 | ||

| Hotels, Restaurants & Leisure | 3.8 | ||

| Textiles, Apparel & Luxury | |||

| Goods | 3.4 | ||

| Aerospace & Defense | 3.4 | ||

| Software | 3.3 | ||

| Communications Equipment | 3.3 | ||

| Oil, Gas & Consumable Fuels | 3.2 | ||

| Capital Markets | 2.8 | ||

| Food & Staples Retailing | 2.7 | ||

| Media | 1.8 | ||

| Energy Equipment & Services | 1.8 | ||

| Real Estate Investment Trusts | |||

| (REITs) | 1.6 | ||

| Health Care Technology | 1.4 | ||

| Construction & Engineering | 1.3 | ||

| Wireless Telecommunication | |||

| Services | 1.3 | ||

| Business Services | 1.3 | ||

| Auto Components | 1.1 | ||

| Personal Products | 0.8 | ||

| Diversified Financial Services | 0.6 | ||

| Household Durables | 0.5 | ||

| Trading Companies & | |||

| Distributors | 0.4 | ||

| Semiconductors & | |||

| Semiconductor Equipment | 0.3 | ||

| Pharmaceuticals | 0.3 | ||

| Total | 100.0 | ||

| * | Portfolio composition is subject to change. |

| 18 | HSBC FAMILY OF FUNDS |

| Portfolio Reviews | |

| Portfolio Composition*

(continued) October 31, 2012 (Unaudited) |

| HSBC Opportunity Portfolio | |||

| Percentage of | |||

| Investment Allocation | Investments at Value (%) | ||

| Specialty Retail | 11.3 | ||

| Software | 6.5 | ||

| Health Care Equipment & | |||

| Supplies | 6.3 | ||

| Machinery | 5.6 | ||

| Oil, Gas & Consumable Fuels | 5.4 | ||

| IT Services | 4.7 | ||

| Chemicals | 4.2 | ||

| Health Care Providers & | |||

| Services | 4.2 | ||

| Trading Companies & | |||

| Distributors | 4.2 | ||

| Capital Markets | 3.6 | ||

| Aerospace & Defense | 3.4 | ||

| Commercial Banks | 3.3 | ||

| Investment Companies | 3.2 | ||

| Semiconductors & | |||

| Semiconductor Equipment | 3.1 | ||

| Containers & Packaging | 3.1 | ||

| Road & Rail | 2.9 | ||

| Food Products | 2.6 | ||

| Insurance | 2.2 | ||

| Electrical Equipment | 2.1 | ||

| Commercial Services & | |||

| Supplies | 2.1 | ||

| Life Sciences Tools & Services | 2.0 | ||

| Real Estate Management & | |||

| Development | 1.9 | ||

| Biotechnology | 1.8 | ||

| Energy Equipment & Services | 1.7 | ||

| Professional Services | 1.5 | ||

| Communications Equipment | 1.4 | ||

| Pharmaceuticals | 1.2 | ||

| Building Products | 1.2 | ||

| Textiles, Apparel & Luxury | |||

| Goods | 1.1 | ||

| Household Durables | 0.9 | ||

| Media | 0.7 | ||

| Electronic Equipment, | |||

| Instruments & Components | 0.6 | ||

| Total | 100.0 | ||

| * | Portfolio composition is subject to change. |

| HSBC FAMILY OF FUNDS | 19 |

| HSBC AGGRESSIVE STRATEGY FUND |

| Schedule of Portfolio Investments—as of October 31, 2012 |

| Affiliated Investment Companies—1.8% | ||||

| Shares | Value ($) | |||

| HSBC Emerging Markets Debt Fund, | ||||

| Class I Shares | 11,078 | 126,737 | ||

| HSBC Emerging Markets Local Debt | ||||

| Fund, Class I Shares | 18,023 | 177,882 | ||

| HSBC Prime Money Market Fund, | ||||

| Class I Shares, 0.16%(a) | 13,222 | 13,222 | ||

| TOTAL AFFILIATED INVESTMENT | ||||

| COMPANIES (COST $299,635) | 317,841 | |||

| Affiliated Portfolios—14.2% | ||||

| HSBC Growth Portfolio | 1,775,216 | |||

| HSBC Opportunity Portfolio | 746,179 | |||

| TOTAL AFFILIATED PORTFOLIOS | 2,521,395 | |||

| Unaffiliated Investment Companies—49.5% | ||||

| Artisan Value Fund, Class IV Shares | 105,448 | 1,173,639 | ||

| Brown Advisory Growth Equity Fund, | ||||

| Institutional Shares | 82,312 | 1,179,538 | ||

| Columbia High Yield Bond Fund, | ||||

| Class Z Shares | 242,351 | 707,665 | ||

| CRM Small/Mid Cap Value Fund, | ||||

| Institutional Shares | 50,369 | 747,992 | ||

| Delaware Emerging Markets Fund, | ||||

| Class I Shares | 72,597 | 980,066 | ||

| Dreyfus Global Real Estate Securities | ||||

| Fund, Class I Shares | 5,098 | 41,705 | ||

| EII Global Property Fund, | ||||

| Institutional Shares | 3,787 | 61,879 | ||

| Janus Flexible Bond Fund, | ||||

| Institutional Shares | 2,463 | 27,290 | ||

| JPMorgan Equity Income Fund, | ||||

| Class I Shares | 171,328 | 1,780,099 | ||

| JPMorgan High Yield Fund, | ||||

| Select Shares | 87,586 | 709,454 | ||

| Lord Abbett Core Fixed | ||||

| Income Fund, Institutional Shares | 3,314 | 37,780 | ||

| Metropolitan West Total Return Bond | ||||

| Fund, Institutional Shares | 2,509 | 27,766 | ||

| Northern Institutional Diversified | ||||

| Assets Portfolio, 0.01%(a) | 8,252 | 8,252 | ||

| PIMCO Total Return Fund, | ||||

| Institutional Shares | 4,407 | 51,077 | ||

| T. Rowe Price New Income Fund, | ||||

| Retail Shares | 3,730 | 37,185 | ||

| Trilogy Emerging Markets Equity Fund, | ||||

| Institutional Shares | 139,326 | 1,196,807 | ||

| TOTAL UNAFFILIATED INVESTMENT | ||||

| COMPANIES (COST $8,665,325) | 8,768,194 | |||

| Exchange Traded Funds—34.7% | ||||

| iShares MSCI EAFE Index Fund | 35,454 | 1,899,271 | ||

| iShares MSCI Emerging Markets | ||||

| Index Fund | 5,318 | 218,623 | ||

| PowerShares Global Listed Private | ||||

| Equity Portfolio ETF | 89,734 | 869,522 | ||

| SPDR S&P 500 ETF Trust | 22,345 | 3,154,667 | ||

| TOTAL EXCHANGE TRADED | ||||

| FUNDS (COST $6,032,192) | 6,142,083 | |||

| TOTAL INVESTMENT | ||||

| SECURITIES—100.2% | 17,749,513 | |||

| (a) | The rate represents the annualized one-day yield that was in effect on October 31, 2012. |

| ETF | Exchange Traded Fund | |

| SPDR | Standard & Poor’s Depositary Receipt |

| 20 HSBC FAMILY OF FUNDS | See notes to financial statements. |

| HSBC BALANCED STRATEGY FUND |

| Schedule of Portfolio Investments—as of October 31, 2012 |

| Affiliated Investment Companies—10.0% | ||||

| Shares | Value ($) | |||

| HSBC Emerging Markets Debt Fund, | ||||

| Class I Shares | 293,710 | 3,360,039 | ||

| HSBC Emerging Markets Local Debt | ||||

| Fund, Class I Shares | 187,999 | 1,855,546 | ||

| HSBC Prime Money Market Fund, | ||||

| Class I Shares, 0.16%(a) | 7,556 | 7,556 | ||

| TOTAL AFFILIATED INVESTMENT | ||||

| COMPANIES (COST $4,836,314) | 5,223,141 | |||

| Affiliated Portfolios—10.4% | ||||

| HSBC Growth Portfolio | 3,824,374 | |||

| HSBC Opportunity Portfolio | 1,624,550 | |||

| TOTAL AFFILIATED PORTFOLIOS | 5,448,924 | |||

| Unaffiliated Investment Companies—53.7% | ||||

| Artisan Value Fund, Class IV Shares | 227,496 | 2,532,033 | ||

| Brown Advisory Growth Equity Fund, | ||||

| Institutional Shares | 178,174 | 2,553,228 | ||

| Columbia High Yield Bond Fund, | ||||

| Class Z Shares | 1,175,885 | 3,433,583 | ||

| CRM Small/Mid Cap Value Fund, | ||||

| Institutional Shares | 108,410 | 1,609,891 | ||

| Delaware Emerging Markets Fund, | ||||

| Class I Shares | 108,478 | 1,464,449 | ||

| Dreyfus Global Real Estate Securities | ||||

| Fund, Class I Shares | 55,301 | 452,358 | ||

| EII Global Property Fund, | ||||

| Institutional Shares | 43,222 | 706,244 | ||

| Janus Flexible Bond Fund, | ||||

| Institutional Shares | 50,653 | 561,240 | ||

| JPMorgan Equity Income Fund, | ||||

| Class I Shares | 368,891 | 3,832,780 | ||

| JPMorgan High Yield Fund, | ||||

| Select Shares | 424,964 | 3,442,207 | ||

| Lord Abbett Core Fixed Income Fund, | ||||

| Institutional Shares | 68,813 | 784,464 | ||

| Metropolitan West Total Return Bond | ||||

| Fund, Institutional Shares | 51,863 | 574,120 | ||

| Northern Institutional Diversified | ||||

| Assets Portfolio, Institutional Shares, | ||||

| 0.01%(a) | 63,560 | 63,560 | ||

| PIMCO Commodity RealReturn | ||||

| Strategy Fund, Institutional Shares | 350,739 | 2,409,579 | ||

| PIMCO Total Return Fund, | ||||

| Institutional Shares | 90,502 | 1,048,916 | ||

| T. Rowe Price New Income Fund, | ||||

| Retail Shares | 79,799 | 795,595 | ||

| Trilogy Emerging Markets Equity Fund, | ||||

| Institutional Shares | 202,901 | 1,742,917 | ||

| TOTAL UNAFFILIATED | ||||

| INVESTMENT COMPANIES | ||||

| (COST $28,035,238) | 28,007,164 | |||

| Exchange Traded Funds—26.3% | ||||

| iShares iBoxx $ Investment Grade | ||||

| Corporate Bond Fund | 5,505 | 677,225 | ||

| iShares MSCI EAFE Index Fund | 73,713 | 3,948,805 | ||

| iShares MSCI Emerging Markets | ||||

| Index Fund | 13,515 | 555,602 | ||

| PowerShares Global Listed Private | ||||

| Equity Portfolio ETF | 189,053 | 1,831,924 | ||

| SPDR S&P 500 ETF Trust | 47,714 | 6,736,263 | ||

| TOTAL EXCHANGE TRADED | ||||

| FUNDS (COST $13,458,954) | 13,749,819 | |||

| TOTAL INVESTMENT | ||||

| SECURITIES—100.4% | 52,429,048 | |||

| (a) | The rate represents the annualized one-day yield that was in effect on October 31, 2012. |

| ETF | Exchange Traded Fund | |

| SPDR | Standard & Poor’s Depositary Receipt |

| See notes to financial statements. | HSBC FAMILY OF FUNDS 21 |

| HSBC MODERATE STRATEGY FUND |

| Schedule of Portfolio Investments—as of October 31, 2012 |

| Affiliated Investment Companies—12.2% | ||||

| Shares | Value ($) | |||

| HSBC Emerging Markets Debt Fund, | ||||

| Class I Shares | 274,281 | 3,137,780 | ||

| HSBC Emerging Markets Local Debt | ||||

| Fund, Class I Shares | 209,161 | 2,064,417 | ||

| HSBC Prime Money Market Fund, | ||||