UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to 13 OR 15(D)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 28, 2012

| ACL Semiconductors Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 000-50140 | 16-1642709 | ||

| (State or other jurisdiction | (Commission | (IRS Employer | ||

| of incorporation) | File Number) | Identification No.) |

| Room 1701, 17/F, Tower 1 |

| Enterprise Square, 9 Sheung Yuet Road |

| Kowloon Bay, Kowloon, Hong Kong |

| (Address of principal executive offices) (Zip Code) |

| 011-852- 2799-1996 |

| (Registrant’s telephone number, including area code) |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 1.01. | Entry into a Material Definitive Agreement |

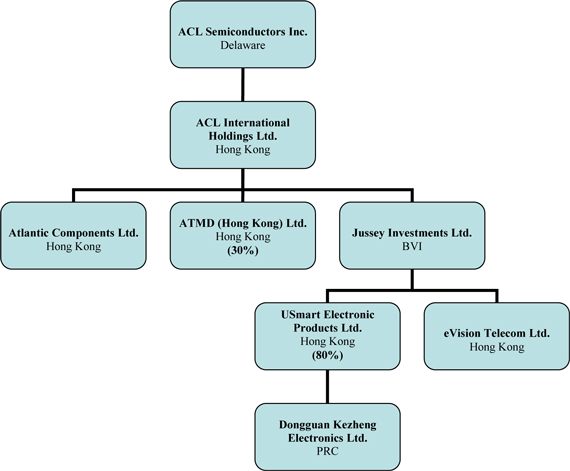

On September 28, 2012, ACL International Holdings Limited (“ACL Holdings” or the “Purchaser”), a Hong Kong incorporated company wholly owned by ACL Semiconductors Inc. (the “Company”), entered into an Agreement of Sale and Purchase (the “SPA”), pursuant to which it will acquire (the “Acquisition”) 100% of the outstanding equity of Jussey Investments Limited (“Jussey”), a company incorporated in British Virgin Islands and which owns (i) 100% equity interest in eVision Telecom Limited (“eVision”), a Hong Kong incorporated company, and (ii) 80% equity interest in USmart Electronic Products Limited (“USmart”), a Hong Kong incorporated company, which owns 100% equity interest in Dongguan Kezheng Electronics Limited (“Kezheng”), a wholly foreign-owned enterprise (“WFOE”) organized under the laws of the People's Republic of China (the “PRC”).

Under the terms of the SPA, the Company, through ACL Holdings, will purchase from Mr. Zhiming Li, a PRC resident (the “Shareholder” or “Seller”) who owns 100% of the outstanding equity (the “Shares”) of Jussey. No prior material relationship existed between the Shareholder and the Company, any of its affiliates, or any of its directors or officers. Pursuant to the SPA, the purchase price to be paid by ACL Holdings for the Shares is approximately US$1,846,797.89 (HK$14,405,023.55) in the aggregate (the “purchase price”). The purchase price is payable in cash in full within 5 business days after the completion of the Acquisition. A copy of the SPA is attached hereto as Exhibit 2.1. Please refer to Item 2.01 below with respect to the description of the SPA, which description is qualified in its entirety by reference to Exhibit 2.1.

Item 2.01. Completion of Acquisition or Disposition of Assets

On September 28, 2012, pursuant to the SPA, the Company, through ACL Holdings, completed the Acquisition and, as a result, acquired the business of USmart and eVision. To cope with the acquisition, the Company has hired an Independent professional valuation firm to valuate the business of USmart and eVision. In addition, Jussey was introduced to the Company by Fairburn Holdings Limited, a company incorporated under the laws of British Virgin Islands (“Fairburn”). The Company expects to enter into a finder and consulting agreement with Fairburn and pay Fairburn for its services.

USmart was founded in 2006 and, through either itself or Kezheng, which has a factory located in Dongguan, PRC, provides both ODM (Original Design Manufacturing) and OEM (Original Equipment Manufacturing) services for various electronic products, such as computer and peripherals, flash storage devices and home electronic products. USmart has its own research and development (“R&D”) and production teams. With the support from eVision, the business of which is described below, USmart is capable of providing its customers with total solutions from design to manufacture. USmart also holds its own brands—USmart and VSmart, which can be used on a broad spectrum of products including covering memory storage devices, visual and audio products such as digital flat screen television, DAB (Digital Audio Broadcasting) radios, digital photo frames, and other home electronic products. In 2010, USmart began its business development in the telecommunication industry, and successfully obtained the W-CDMA (Wideband CDMA is one of the third-generation (“3G”) wireless standards) license from Intel Mobile Communications GmbH., which offers cellular platforms for global phone makers. W-CDMA baseband is adapted by China Unicom, one of the three major telecommunication carriers in the PRC.

Founded in 2011, eVision is a Hong Kong based solution house that specializes in CDMA2000 (also known as Evolution-Data Optimized or “EV-DO”) platform. CDMA2000 is one of the 3G wireless standards. This standard is adapted by China Telecom, one of the three major telecommunication carriers in China. The principal function of eVision is to provide CDMA2000 solutions to USmart. In May 2011, eVision entered into an exclusive R&D servicing agreement (the “Servicing Agreement”) with an independent third party in the PRC (the “R&D House”), a solution house that works closely with South China University of Technology and has a R&D team consisting of members with advanced academic qualifications. The R&D House holds, on behalf of eVision, a CDMA2000 software license granted by VIA Telecom Co. Ltd. According to the Servicing Agreement, the R&D House provides R&D services relating to CDMA2000 technology exclusively to eVision, and eVision holds the sole and exclusive right, title and interest to and in the aforementioned license and any R&D results/products obtained or developed by the R&D House during the term of the Servicing Agreement. eVision will also hold all the intellectual property rights that are obtained or developed by the R&D House in the course of such research.

After the Acquisition, the Company is expected to continue to operate both USmart and eVision separately, and each subsidiary will maintain it separate offices. eVision is expected to continue providing support to USmart regarding CDMA2000 3G standard, and USmart is expected to continue to focus on developing and manufacturing its 3G smartphones. By acquiring Jussey, the Company is expected to diversify its product portfolio, to evolve from a distributor to a manufacturer with R&D capacities, and to develop and have its own products and brands. With 3G baseband licenses obtained from USmart and eVision, the Company also expects to strengthen its competitive position in the telecom market. As a result of the Acquisition, the Company expects to benefit from vertical integration of its business and the newly acquired PRC-based design and manufacturing capacities.

The Company’s post-acquisition organization structure is summarized below:

The SPA contains customary representations and warranties regarding the financial condition and operations of Jussey. Under the terms of the SPA, the Shareholder has agreed to indemnify Purchaser in respect of any breach of any of the Shareholder’s warranties and in respect of any loss, liability, claim or expense incurred by the Purchaser by reason (whether direct or indirect) of any of the warranties being untrue, incorrect or misleading. No prior material relationship existed between the Shareholder and the Company, any of its affiliates, or any of its directors or officers.

After the Acquisition, the Company continues to hold 30% equity interest in ATMD (Hong Kong) Limited, a joint venture between the Company and Tomen Devices Corporation.

| Item 8.01. | Other Events. |

On September 28, 2012, the Company issued a press release regarding the transaction described above. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

| (a) | Financial Statement of Business Acquired |

The audited financial statements of Jussey for the years ended March 31, 2012 and 2011 are filed herewith as Exhibit 99.2.

| (b) | Pro Forma Financial Information |

The pro forma financial information for the Company and its subsidiaries concerning the Acquisition is filed herewith as Exhibit 99.2.

| (c) | Exhibits |

The following exhibits are filed with this Form 8-K.

Exhibits

| Exhibit No | Description | ||

| 2.1 | Agreement of Sale and Purchase between ACL International Holdings Limited and Zhiming Li, dated September 28, 2012 | ||

| 99.1 | Press Release dated September 28, 2012 | ||

| 99.2 | (a) | The audited financial statements of Jussey for the years ended March 31, 2012 and 2011, and | |

| (b) | The pro forma financial information for the three and six months ended June 30, 2012 of the Company and its subsidiaries concerning the Acquisition. | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ACL SEMICONDUCTORS INC. | ||

| Dated: September 28, 2012 | ||

| By: | /s/ Kun-Lin Lee | |

| Name: Kun-Lin Lee | ||

| Title: Chief Financial Officer | ||

(Holder of PRC Resident

Card No.441421197405195933) of

(Holder of PRC Resident

Card No.441421197405195933) of  (“the

vendor”); and

(“the

vendor”); and