|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

|

|

Accelerated Filer ☐

|

|

Non-Accelerated Filer ☐

|

Smaller reporting company

|

|

Emerging growth company ☐

|

|

|

INDEX

|

||

|

PART I.

|

Page No.

|

|

|

Item 1.

|

3

|

|

|

Item 1A.

|

16

|

|

|

Item 1B.

|

26

|

|

|

Item 2.

|

26

|

|

|

Item 3.

|

27

|

|

|

Item 4.

|

27

|

|

|

PART II.

|

||

|

Item 5.

|

27 | |

|

Item 6.

|

29

|

|

|

Item 7.

|

29 | |

|

Item 7A.

|

41

|

|

|

Item 8.

|

43

|

|

|

Item 9.

|

92 | |

|

Item 9A.

|

92

|

|

|

Item 9B.

|

93

|

|

|

Item 9C.

|

93

|

|

|

PART III.

|

||

|

Item 10.

|

93

|

|

|

Item 11.

|

93

|

|

|

Item 12.

|

93 | |

|

Item 13.

|

93

|

|

|

Item 14.

|

93

|

|

|

PART IV.

|

||

|

Item 15.

|

94

|

|

|

Item 16.

|

94

|

|

|

98

|

||

| ITEM 1. |

BUSINESS

|

| • |

Commercial and Light vehicles

|

| • |

Construction

|

| • |

Agriculture

|

| • |

Power Sports

|

| • |

Marine

|

| • |

Hydraulics

|

| • |

Lawn & Garden

|

| • |

Developing new customer relationships

|

| • |

Cross-selling opportunities with existing customers

|

| • |

Introducing new products to both new and existing customers

|

| • |

Increasing content per unit

|

| (1) |

Ignition, Emissions & Fuel, which will include the traditional internal combustion engine (ICE) dependent categories;

|

| (2) |

Wire Sets & Other, which will include spark plug wire sets and other related products, and are product categories we have noted to be in secular decline based upon product life cycle; and

|

| (3) |

Electrical & Safety, which will include powertrain neutral vehicle technologies such as electrical switches/relays, safety related products such as anti-lock brake and vehicle speed sensors,

tire pressure monitoring, park assist sensors, and advanced driver assistance components.

|

| (1) |

AC System Components, which includes compressors, connecting lines, heat exchangers, and expansion devices

|

| (2) |

Other Thermal Components, which includes parts that provide engine, transmission, electric drive motor, and battery temperature management

|

|

Operating Segments as of 2022

|

Planned Operating Segments in 2023

|

|

|

Engine Management:

|

Vehicle Control (Aftermarket):

|

|

|

Ignition, Emissions, Fuel & Safety

|

Ignition, Emissions & Fuel

|

|

|

Wire and Cable

|

Wire Sets and Other

|

|

|

Electrical & Safety

|

||

|

Temperature Control:

|

Temperature Control (Aftermarket):

|

|

|

Compressors

|

AC System Components

|

|

|

Other Climate Control Parts

|

Other Thermal Components

|

|

|

Engineered Solutions (non-Aftermarket):

|

||

|

Commercial Vehicle

|

||

|

Light Vehicle

|

||

|

Construction & Agriculture

|

||

|

All Other

|

| • |

Leveraging our manufacturing and distribution capabilities to secure additional business globally

|

| • |

Supporting the service part operations of vehicle and equipment manufacturers with value-added services and product support for the life of the part

|

| • |

Developing new product lines that complement our existing product offering and that have the potential for high growth

|

| • |

Expanding our product offering in the medium and heavy duty, commercial vehicle, construction and agricultural equipment, power sports, and other end markets

|

| • |

Executing our acquisition strategy

|

| • |

Professional grade products and solutions within our areas of expertise.

|

| • |

Comprehensive product coverage for all vehicles on the road through our offering of professional grade engine management and temperature control products.

|

| • |

Supplier and customer focused initiatives designed to improve order fill rate and maintain high levels of product availability

|

| • |

Expanding our product coverage to include a broader product mix in categories such as

|

| o |

Electrification, including electric vehicles (EVs) and hybrid electric vehicles (HEVs),

|

| o |

Connectivity and safety related products, such as

|

| ➢ |

anti-lock brake (ABS)

|

| ➢ |

vehicle speed sensors

|

| ➢ |

tire pressure monitoring

|

| ➢ |

park assist sensors

|

| ➢ |

advanced driver assistance components to meet the needs of our customers

|

|

Examples of vertically integrated processes:

|

|

|

➢ plastic molding operations

|

➢ automated electronics assembly

|

|

➢ stamping and machining operations

|

➢ design and fabrication of processing and test equipment

|

|

➢ wire extrusion

|

➢ teardown, diagnostics and rebuilding of remanufactured air conditioning compressors,

diesel injectors and diesel pumps

|

|

Engine

Management

Products

|

|

|

Temperature

Control Products

|

|

|

Engine

Management

|

|

|

| • |

Automotive aftermarket retailers, such as O’Reilly Automotive, Inc. (“O’Reilly”), AutoZone, Inc. (“AutoZone”), and Canadian Tire Corporation, Limited.

|

| • |

Automotive aftermarket distributors, including warehouse distributors and program distribution groups, such as Genuine Parts Co. and National Automotive Parts Association (“NAPA”), Auto Value

and All Pro/Bumper to Bumper (Aftermarket Auto Parts Alliance, Inc.), Automotive Distribution Network LLC, The National Pronto Association (“Pronto”), Federated Auto Parts Distributors, Inc. (“Federated”), Pronto and Federated’s

affiliate, the Automotive Parts Services Group or The Group, and Icahn Automotive Group LLC (doing business as Pep Boys, Auto Plus, AAMCO and Precision Tune Auto Care).

|

| • |

Original equipment manufacturers and original equipment service part operations, such as General Motors Co., Ford Motor Co., Woodward, Inc., Deere & Company, Caterpillar Inc., Daimler Truck

AG, Case/New Holland, Eberspacher, Mobile Climate Control, Volvo/Mack Truck, and Harley.

|

|

•

|

a value‑added, knowledgeable sales force;

|

|

•

|

continuous product development, engineering & technical advancement;

|

|

•

|

extensive market leading product coverage in conjunction with market leading brands;

|

| • |

knowledgeable category management, including inventory stocking recommendations for our distributors to get the right parts on the shelf for their marketplace;

|

| • |

rigorous product qualification standards to ensure that our parts meet or exceed exacting performance specifications;

|

| • |

sophisticated parts cataloging systems, including catalogs available online through our website and our mobile application;

|

| • |

inventory levels and responsive logistical systems sufficient to meet the critical delivery requirements of customers;

|

| • |

breadth of manufacturing capabilities; and

|

| • |

award-winning marketing programs, sales support and technical training.

|

| ITEM 1A. |

RISK FACTORS

|

| • |

respond more quickly than we can to new or emerging technologies and changes in customer requirements by devoting greater resources than we can to the development, promotion and sale of automotive products and services;

|

| • |

engage in more extensive research and development;

|

| • |

sell products at a lower price than we do;

|

| • |

undertake more extensive marketing campaigns; and

|

| • |

make more attractive offers to existing and potential customers and strategic partners.

|

| • |

increase our borrowing costs;

|

| • |

limit our ability to obtain additional financing or borrow additional funds;

|

| • |

require that a substantial portion of our cash flow from operations be used to pay principal and interest in our indebtedness, instead of funding working capital, capital expenditures, acquisitions, dividends, stock repurchases, or

other general corporate purposes;

|

| • |

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and

|

| • |

increase our vulnerability to general adverse economic and industry conditions.

|

| • |

general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control;

|

| • |

the ability of our customers to pay timely the amounts we have billed; and

|

| • |

our ability to sell receivables under supply chain financing arrangements.

|

| • |

deferring, reducing or eliminating future cash dividends;

|

| • |

reducing or delaying capital expenditures or restructuring activities;

|

| • |

reducing or delaying research and development efforts;

|

| • |

selling assets;

|

| • |

deferring or refraining from pursuing certain strategic initiatives and acquisitions;

|

| • |

refinancing our indebtedness; and

|

| • |

seeking additional funding.

|

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS

|

| ITEM 2. |

PROPERTIES

|

|

Location

|

State or

Country

|

Principal Business Activity

|

Approx.

Square

Feet

|

Owned or

Expiration

Date

of Lease¹

|

||||

|

Engine Management

|

||||||||

|

Ft. Lauderdale

|

FL

|

Distribution

|

23,300

|

Owned

|

||||

|

Ft. Lauderdale

|

FL

|

Distribution

|

30,000

|

Owned

|

||||

|

Mishawaka

|

IN

|

Manufacturing

|

153,100

|

Owned

|

||||

|

Edwardsville

|

KS

|

Distribution

|

363,500

|

Owned

|

||||

|

Independence

|

KS

|

Manufacturing

|

337,400

|

Owned

|

||||

|

Long Island City

|

NY

|

Administration

|

75,800

|

2033

|

||||

|

Greenville

|

SC

|

Manufacturing

|

184,500

|

Owned

|

||||

|

Disputanta

|

VA

|

Distribution

|

411,000

|

Owned

|

||||

|

Sheboygan Falls

|

WI

|

Manufacturing

|

22,000

|

2025

|

||||

|

Milwaukee

|

WI

|

Manufacturing

|

84,000

|

2028

|

||||

|

Wuxi

|

China

|

Manufacturing

|

27,600

|

2023

|

||||

|

Kirchheim-Teck

|

Germany

|

Distribution

|

27,500

|

2031

|

||||

|

Pécel

|

Hungary

|

Manufacturing

|

33,500

|

2031

|

||||

|

Reynosa

|

Mexico

|

Manufacturing

|

175,000

|

2025

|

||||

|

Reynosa

|

Mexico

|

Manufacturing

|

153,000

|

2023

|

||||

|

Tijuana

|

Mexico

|

Manufacturing

|

37,500

|

2023

|

||||

|

Tijuana

|

Mexico

|

Distribution

|

13,800

|

2023

|

||||

|

Bialystok

|

Poland

|

Manufacturing

|

142,400

|

2027

|

||||

|

Temperature Control

|

||||||||

|

McAllen

|

TX

|

Distribution

|

120,300

|

2027

|

||||

|

Lewisville

|

TX

|

Administration and Distribution

|

415,000

|

2024

|

||||

|

St. Thomas

|

Canada

|

Manufacturing

|

42,500

|

Owned

|

||||

|

Reynosa

|

Mexico

|

Manufacturing

|

82,000

|

2026

|

||||

|

Reynosa

|

Mexico

|

Manufacturing

|

117,500

|

2026

|

||||

|

Reynosa

|

Mexico

|

Manufacturing

|

111,800

|

2024

|

||||

|

Other

|

||||||||

|

Mississauga

|

Canada

|

Administration and Distribution

|

82,400

|

2028

|

||||

|

Irving

|

TX

|

Training Center

|

13,400

|

2027

|

| ITEM 3. |

LEGAL PROCEEDINGS

|

| ITEM 4. |

MINE SAFETY DISCLOSURES

|

| ITEM 5. |

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

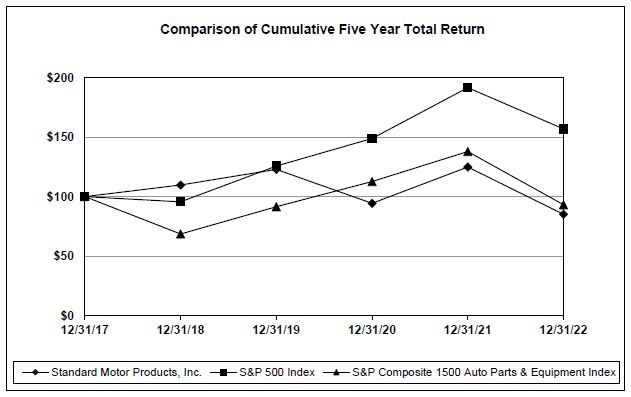

SMP

|

S&P 500

|

S&P 1500 Auto

Parts &

Equipment

Index

|

||||||||||

|

2017

|

100

|

100

|

100

|

|||||||||

|

2018

|

110

|

96

|

69

|

|||||||||

|

2019

|

123

|

126

|

92

|

|||||||||

|

2020

|

94

|

149

|

113

|

|||||||||

|

2021

|

125

|

192

|

138

|

|||||||||

|

2022

|

85

|

157

|

93

|

|||||||||

| ITEM 6. |

(RESERVED)

|

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

December 31,

|

||||||||||||

|

(In thousands, except per share data)

|

2022

|

2021

|

2020

|

|||||||||

|

Net sales

|

$

|

1,371,815

|

$

|

1,298,816

|

$

|

1,128,588

|

||||||

|

Gross profit

|

382,539

|

376,931

|

336,655

|

|||||||||

|

Gross profit %

|

27.9

|

%

|

29

|

%

|

29.8

|

%

|

||||||

|

Operating income

|

104,135

|

128,999

|

108,895

|

|||||||||

|

Operating income %

|

7.6

|

%

|

9.9

|

%

|

9.6

|

%

|

||||||

|

Earnings from continuing operations before income taxes

|

98,332

|

130,465

|

107,379

|

|||||||||

|

Provision for income taxes

|

25,206

|

31,044

|

26,962

|

|||||||||

|

Earnings from continuing operations

|

73,126

|

99,421

|

80,417

|

|||||||||

|

Loss from discontinued operations, net of income taxes

|

(17,691

|

)

|

(8,467

|

)

|

(23,024

|

)

|

||||||

|

Net earnings

|

55,435

|

90,954

|

57,393

|

|||||||||

|

Net earnings attributable to noncontrolling interest

|

84

|

68

|

—

|

|||||||||

|

Net earnings attributable to SMP

|

55,351

|

90,886

|

57,393

|

|||||||||

|

Per share data attributable to SMP – Diluted:

|

||||||||||||

|

Earnings from continuing operations

|

$

|

3.30

|

$

|

4.39

|

$

|

3.52

|

||||||

|

Discontinued operations

|

(0.80

|

)

|

(0.37

|

)

|

(1.01

|

)

|

||||||

|

Net earnings per common share

|

$

|

2.50

|

$

|

4.02

|

$

|

2.51

|

||||||

| • |

the price increases in both our segments, which were implemented to pass through inflationary increases in raw materials, distribution and labor costs,

|

| • |

incremental net sales in our Engine Management Segment from our soot sensor, Trombetta and Stabil acquisitions, and

|

| • |

continued strong customer demand in both our segments, and in particular in our Temperature Control Segment where the elevated customer demand we saw in 2021 held firm in 2022 fueled by record heat across the country and the

replenishment of customer inventory levels after very warm summer conditions in 2021.

|

|

Year Ended December 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

Engine Management:

|

||||||||

|

Ignition, Emission Control, Fuel & Safety Related System Products

|

$

|

824,677

|

$

|

786,514

|

||||

|

Wire and Cable

|

150,566

|

151,422

|

||||||

|

Total Engine Management

|

975,243

|

937,936

|

||||||

|

Temperature Control:

|

||||||||

|

Compressors

|

222,532

|

206,697

|

||||||

|

Other Climate Control Parts

|

159,753

|

141,726

|

||||||

|

Total Temperature Control

|

382,285

|

348,423

|

||||||

|

All Other

|

14,287

|

12,457

|

||||||

|

Total

|

$

|

1,371,815

|

$

|

1,298,816

|

||||

|

Year Ended

December 31,

|

Engine Management

|

Temperature Control

|

Other

|

Total

|

||||||||||||

|

2022

|

||||||||||||||||

|

Net sales (a)

|

$

|

975,243

|

$

|

382,285

|

$

|

14,287

|

$

|

1,371,815

|

||||||||

|

Gross margins

|

262,954

|

102,640

|

16,945

|

382,539

|

||||||||||||

|

Gross margin percentage

|

27

|

%

|

26.8

|

%

|

—

|

%

|

27.9

|

%

|

||||||||

|

2021

|

||||||||||||||||

|

Net sales (a)

|

$

|

937,936

|

$

|

348,423

|

$

|

12,457

|

$

|

1,298,816

|

||||||||

|

Gross margins

|

266,961

|

95,138

|

14,832

|

376,931

|

||||||||||||

|

Gross margin percentage

|

28.5

|

%

|

27.3

|

%

|

—

|

%

|

29

|

%

|

||||||||

| (a) |

Segment net sales include intersegment sales in our Engine Management and Temperature Control segments.

|

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

Page No.

|

|

|

44

|

|

|

45

|

|

|

47

|

|

|

49

|

|

|

50

|

|

|

51

|

|

|

52

|

|

|

53

|

|

|

54

|

|

|

Year Ended December 31,

|

|||||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

|

(Dollars in thousands,

except share and per share data)

|

|||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

||||||

|

Cost of sales

|

|

|

|

|||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Selling, general and administrative expenses

|

|

|

|

|||||||||

|

Intangible asset impairment

|

|

|

|

|||||||||

|

Restructuring and integration expenses

|

|

|

|

|||||||||

|

Other income (expense), net

|

|

|

(

|

)

|

||||||||

|

Operating income

|

|

|

|

|||||||||

|

Other non-operating income, net

|

|

|

|

|||||||||

|

Interest expense

|

|

|

|

|||||||||

|

Earnings from continuing operations before income taxes

|

|

|

|

|||||||||

|

Provision for income taxes

|

|

|

|

|||||||||

|

Earnings from continuing operations

|

|

|

|

|||||||||

|

Loss from discontinued operations, net of income tax benefit of $

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings

|

|

|

|

|||||||||

| Net earnings attributable to noncontrolling interest |

||||||||||||

|

Net earnings attributable to SMP (a)

|

$ | $ | $ | |||||||||

| Net earnings attributable to SMP |

||||||||||||

|

Earnings from continuing operations

|

$ | $ | $ | |||||||||

|

Discontinued operations

|

( |

) | ( |

) | ( |

) | ||||||

| Total |

$ | $ | $ | |||||||||

| Per share data attributable to SMP |

||||||||||||

|

Net earnings per common share – Basic:

|

||||||||||||

|

Earnings from continuing operations

|

$

|

|

$

|

|

$

|

|

||||||

|

Discontinued operations

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings per common share – Basic

|

$

|

|

$

|

|

$

|

|

||||||

|

Net earnings per common share – Diluted:

|

||||||||||||

|

Earnings from continuing operations

|

$

|

|

$

|

|

$

|

|

||||||

|

Discontinued operations

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings per common share – Diluted

|

$

|

|

$

|

|

$

|

|

||||||

|

Dividend declared per share

|

$

|

|

$

|

|

$

|

|

||||||

|

Average number of common shares

|

|

|

|

|||||||||

|

Average number of common shares and dilutive common shares

|

|

|

|

|||||||||

| Year Ended December 31, | ||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

(In thousands)

|

||||||||||||

|

Net earnings

|

$

|

|

$

|

|

$

|

|

||||||

|

Other comprehensive income (loss), net of tax:

|

||||||||||||

|

Foreign currency translation adjustments

|

(

|

)

|

(

|

)

|

|

|||||||

|

Derivative instruments

|

||||||||||||

|

Pension and postretirement plans

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Total other comprehensive income (loss), net of tax

|

(

|

)

|

(

|

)

|

|

|||||||

|

Total comprehensive income

|

|

|

|

|||||||||

|

Comprehensive income (loss) attributable to noncontrolling interest, net of tax:

|

||||||||||||

|

Net earnings

|

|

|

|

|||||||||

|

Foreign currency translation adjustments

|

(

|

)

|

|

|

||||||||

|

Comprehensive income (loss) attributable to noncontrolling interest, net of tax

|

(

|

)

|

|

|

||||||||

|

Comprehensive income attributable to SMP

|

$

|

|

$

|

|

$

|

|

||||||

|

|

December 31,

|

|||||||

|

|

2022

|

2021

|

||||||

|

|

(Dollars in thousands,

except share data)

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Accounts receivable, less allowances for discounts and expected credit losses of $

|

|

|

||||||

|

Inventories

|

|

|

||||||

|

Unreturned customer inventories

|

|

|

||||||

|

Prepaid expenses and other current assets

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

|

||||||||

|

Property, plant and equipment, net

|

|

|

||||||

|

Operating lease right-of-use assets

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Other intangibles, net

|

|

|

||||||

|

Deferred incomes taxes

|

|

|

||||||

|

Investments in unconsolidated affiliates

|

|

|

||||||

|

Other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Current portion of revolving credit facility

|

$

|

|

$

|

|

||||

|

Current portion of term loan and other debt

|

|

|

||||||

|

Accounts payable

|

|

|

||||||

|

Sundry payables and accrued expenses

|

|

|

||||||

|

Accrued customer returns

|

|

|

||||||

|

Accrued core liability

|

|

|

||||||

|

Accrued rebates

|

|

|

||||||

|

Payroll and commissions

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

|

||||||||

|

Long-term debt

|

|

|

||||||

|

Noncurrent operating lease liabilities

|

|

|

||||||

|

Other accrued liabilities

|

|

|

||||||

|

Accrued asbestos liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Commitments and contingencies

|

||||||||

|

|

||||||||

|

Stockholders’ equity:

|

||||||||

|

Common Stock - par value $

|

||||||||

|

Authorized

|

|

|

||||||

|

Capital in excess of par value

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Accumulated other comprehensive income

|

(

|

)

|

(

|

)

|

||||

|

Treasury stock - at cost (

|

(

|

)

|

(

|

)

|

||||

|

Total SMP stockholders’ equity

|

|

|

||||||

|

Noncontrolling interest

|

||||||||

|

Total stockholders’ equity

|

||||||||

|

Total liabilities and stockholders’ equity

|

$

|

|

$

|

|

||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

|

(In thousands)

|

|||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net earnings

|

$

|

|

$

|

|

$

|

|

||||||

|

Adjustments to reconcile net earnings to net cash provided by (used in) operating activities:

|

||||||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

Amortization of deferred financing cost

|

|

|

|

|||||||||

|

Increase (decrease) to allowance for expected credit losses

|

(

|

)

|

|

|

||||||||

|

Increase (decrease) to inventory reserves

|

|

(

|

)

|

|

||||||||

|

Customer bankruptcy charge

|

||||||||||||

|

Intangible asset impairment

|

|

|

|

|||||||||

|

Equity income from joint ventures

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Employee Stock Ownership Plan allocation

|

|

|

|

|||||||||

|

Stock-based compensation

|

|

|

|

|||||||||

|

(Increase) in deferred income taxes

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Increase in tax valuation allowance

|

|

|

|

|||||||||

|

Loss on discontinued operations, net of tax

|

|

|

|

|||||||||

|

Change in assets and liabilities:

|

||||||||||||

|

(Increase) decrease in accounts receivable

|

|

|

(

|

)

|

||||||||

|

(Increase) decrease in inventories

|

(

|

)

|

(

|

)

|

|

|||||||

|

(Increase) in prepaid expenses and other current assets

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Increase (decrease) in accounts payable

|

(

|

)

|

|

|

||||||||

|

Increase (decrease) in sundry payables and accrued expenses

|

(

|

)

|

|

|

||||||||

|

Net changes in other assets and liabilities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash provided by (used in) operating activities

|

(

|

)

|

|

|

||||||||

|

|

||||||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Acquisitions of and investments in businesses

|

(

|

)

|

(

|

)

|

|

|||||||

|

Capital expenditures

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Other investing activities

|

|

|

|

|||||||||

|

Net cash used in investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

|

||||||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

| Borrowings under term loan |

||||||||||||

| Repayments of term loan |

( |

) | ||||||||||

|

Net borrowings (repayments) under revolving credit facilities

|

|

|

(

|

)

|

||||||||

|

Net borrowings (repayments) of other debt and capital lease obligations

|

(

|

)

|

|

(

|

)

|

|||||||

|

Purchase of treasury stock

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

| Payments of debt issuance costs |

( |

) | ||||||||||

|

Increase (decrease) in overdraft balances

|

(

|

)

|

|

(

|

)

|

|||||||

| Dividends paid |

( |

) | ( |

) | ( |

) | ||||||

|

Dividends paid to noncontrolling interest

|

|

(

|

)

|

|

||||||||

|

Net cash provided by (used in) financing activities

|

|

|

(

|

)

|

||||||||

|

Effect of exchange rate changes on cash

|

(

|

)

|

(

|

)

|

|

|||||||

|

Net increase (decrease) in cash and cash equivalents

|

(

|

)

|

|

|

||||||||

|

CASH AND CASH EQUIVALENTS at beginning of year

|

|

|

|

|||||||||

|

CASH AND CASH EQUIVALENTS at end of year

|

$

|

|

$

|

|

$

|

|

||||||

|

|

||||||||||||

|

Supplemental disclosure of cash flow information:

|

||||||||||||

|

Cash paid during the year for:

|

||||||||||||

|

Interest

|

$

|

|

$

|

|

$

|

|

||||||

|

Income taxes

|

$

|

|

$

|

|

$

|

|

||||||

|

|

Common

Stock

|

Capital in

Excess of Par

Value

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Treasury

Stock

|

Total SMP

|

Non-

controlling

Interest

|

Total

|

||||||||||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2019

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$ | $ |

$

|

|

||||||||||||||||

|

Net earnings

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Other comprehensive income, net of tax

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Cash dividends paid ($

|

|

|

(

|

)

|

|

|

( |

) |

(

|

)

|

||||||||||||||||||||||

|

Purchase of treasury stock

|

|

|

|

|

(

|

)

|

( |

) |

(

|

)

|

||||||||||||||||||||||

|

Stock-based compensation

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Employee Stock Ownership Plan

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2020

|

|

|

|

(

|

)

|

(

|

)

|

|

||||||||||||||||||||||||

|

Noncontrolling interest in business acquired

|

||||||||||||||||||||||||||||||||

|

Net earnings

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Other comprehensive loss, net of tax

|

|

|

|

(

|

)

|

|

( |

) |

(

|

)

|

||||||||||||||||||||||

|

Cash dividends paid ($

|

|

|

(

|

)

|

|

|

( |

) |

(

|

)

|

||||||||||||||||||||||

|

Purchase of treasury stock

|

|

|

|

|

(

|

)

|

( |

) |

(

|

)

|

||||||||||||||||||||||

|

Dividends paid to noncontrolling interest

|

( |

) | ( |

) | ||||||||||||||||||||||||||||

|

Stock-based compensation

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Employee Stock Ownership Plan

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2021

|

|

|

|

(

|

)

|

(

|

)

|

|

||||||||||||||||||||||||

|

Net earnings

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Other comprehensive loss, net of tax

|

|

|

|

(

|

)

|

|

( |

) | ( |

) |

(

|

)

|

||||||||||||||||||||

|

Cash dividends paid ($

|

|

|

(

|

)

|

|

|

( |

) |

(

|

)

|

||||||||||||||||||||||

|

Purchase of treasury stock

|

|

|

|

|

(

|

)

|

( |

) |

(

|

)

|

||||||||||||||||||||||

|

Stock-based compensation

|

|

(

|

)

|

|

|

|

|

|||||||||||||||||||||||||

|

Employee Stock Ownership Plan

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2022

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$ | $ |

$

|

|

||||||||||||||||

|

Estimated Life

|

|

|

Buildings

|

|

|

Building improvements

|

|

|

Machinery and equipment

|

|

|

Tools, dies and auxiliary equipment

|

|

|

Furniture and fixtures

|

|

|

Standard

|

Description

|

Date of adoption / Effective date

|

Effects on the financial statements or other significant matters

|

|||

|

ASU 2022-06 /ASU 2020-04, Reference Rate Reform

(Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting

|

These standards are intended to provide optional guidance for a limited time to ease the potential burden in accounting for (or recognizing the effects of)

reference rate reform on financial reporting. The new standards are applicable to contracts that reference LIBOR, or another reference rate, expected to be discontinued due to reference rate reform.

|

ASU 2020-04 effective March 12, 2020 through December 31, 2022, with sunset date extended to December 31, 2024 by ASU 2022–06.

|

During the year ended December 31, 2022, we entered into a new credit agreement and new supply chain financing arrangements that no longer used LIBOR as the reference rate. In connection with these new agreements, the adoption of the

optional guidance provided in the new standards did not materially impact our accounting, consolidated financial statements and related disclosures.

|

|

Purchase price

|

$

|

|

||||||

|

Assets acquired and liabilities assumed:

|

||||||||

|

Receivables

|

$

|

|

||||||

|

Inventory

|

|

|||||||

|

Other current assets (1)

|

|

|||||||

|

Property, plant and equipment, net

|

|

|||||||

|

Operating lease right-of-use assets

|

|

|||||||

|

Intangible assets

|

|

|||||||

|

Goodwill

|

|

|||||||

|

Current liabilities

|

(

|

)

|

||||||

|

Noncurrent operating lease liabilities

|

(

|

)

|

||||||

|

Deferred income taxes

|

(

|

)

|

||||||

|

Net assets acquired

|

$

|

|

||||||

| (1) |

|

|

Purchase price

|

$

|

|

||||||

|

Assets acquired and liabilities assumed:

|

||||||||

|

Receivables

|

$

|

|

||||||

|

Inventory

|

|

|||||||

|

Other current assets (1)

|

||||||||

|

Property, plant and equipment, net

|

|

|||||||

|

Operating lease right-of-use assets

|

|

|||||||

|

Intangible assets

|

|

|||||||

|

Goodwill

|

|

|||||||

|

Current liabilities

|

(

|

)

|

||||||

|

Noncurrent operating lease liabilities

|

(

|

)

|

||||||

|

Deferred income taxes

|

(

|

)

|

||||||

|

Net assets acquired

|

$

|

|

||||||

| (1) |

|

|

Purchase price

|

$

|

|

||||||

|

Assets acquired and liabilities assumed:

|

||||||||

|

Receivables

|

$

|

|

||||||

|

Inventory

|

|

|||||||

|

Other current assets (1)

|

|

|||||||

|

Property, plant and equipment, net

|

|

|||||||

|

Operating lease right-of-use assets

|

|

|||||||

|

Intangible assets

|

|

|||||||

|

Goodwill

|

|

|||||||

|

Current liabilities

|

(

|

)

|

||||||

|

Noncurrent operating lease liabilities

|

(

|

)

|

||||||

|

Deferred income taxes

|

(

|

)

|

||||||

|

Subtotal

|

|

|||||||

|

Fair value of acquired noncontrolling interest

|

(

|

)

|

||||||

|

Net assets acquired

|

$

|

|

||||||

| (1) |

|

|

Purchase Price

|

$

|

|

||||||

|

Assets acquired and liabilities assumed:

|

||||||||

|

Inventory

|

$

|

|

||||||

|

Machinery and equipment, net

|

|

|||||||

|

Intangible assets

|

|

|||||||

|

Net assets acquired

|

$

|

|

||||||

|

|

Workforce

Reduction

|

Other Exit

Costs

|

Total

|

|||||||||

|

Exit activity

liability at December 31, 2020

|

$

|

|

$

|

|

$

|

|

||||||

|

Restructuring

and integration costs:

|

||||||||||||

|

Amounts

provided for during 2021

|

|

|

|

|||||||||

|

Cash payments

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Exit activity

liability at December 31, 2021

|

$

|

|

$

|

|

$

|

|

||||||

|

Restructuring

and integration costs:

|

||||||||||||

|

Amounts

provided for during 2022 (1)

|

|

|

|

|||||||||

|

Cash payments

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

| Reclassification of environmental and other liabilities | ( |

) | ( |

) | ( |

) | ||||||

|

Exit activity

liability at December 31, 2022

|

$

|

|

$

|

|

$

|

|

||||||

| (1) |

|

|

December 31,

2022

|

December 31,

2021

|

|||||||

|

|

(In thousands)

|

|||||||

|

|

||||||||

|

Finished goods

|

$

|

|

$

|

|

||||

|

Work-in-process

|

|

|

||||||

|

Raw materials

|

|

|

||||||

|

Subtotal

|

|

|

||||||

|

Unreturned customer inventories

|

|

|

||||||

|

Total inventories

|

$

|

|

$

|

|

||||

|

December 31,

|

||||||||

|

|

2022

|

2021

|

||||||

|

|

(In thousands)

|

|||||||

|

Land, buildings and improvements

|

$

|

|

$

|

|

||||

|

Machinery and equipment

|

|

|

||||||

|

Tools, dies and auxiliary equipment

|

|

|

||||||

|

Furniture and fixtures

|

|

|

||||||

|

Leasehold improvements

|

|

|

||||||

|

Construction-in-progress

|

|

|

||||||

|

Total property, plant and equipment

|

|

|

||||||

|

Less accumulated depreciation

|

|

|

||||||

|

Total property, plant and equipment, net

|

$

|

|

$

|

|

||||

|

Balance Sheet Information

|

December 31,

|

|||||||

|

Assets

|

2022 | 2021 | ||||||

|

Operating lease right-of-use assets

|

$

|

|

$

|

|

||||

| |

||||||||

|

Liabilities

|

||||||||

|

Sundry payables and accrued expenses

|

$

|

|

$

|

|

||||

|

Noncurrent operating lease liabilities

|

|

|

||||||

|

Total operating lease liabilities

|

$

|

|

$

|

|

||||

| |

||||||||

|

Weighted Average Remaining Lease Term

|

||||||||

|

Operating leases

|

|

|

||||||

| |

||||||||

|

Weighted Average Discount Rate

|

||||||||

|

Operating leases

|

|

%

|

|

%

|

||||

|

Year Ended, December 31,

|

||||||||

|

Expense and Cash Flow Information

|

2022

|

2021

|

||||||

|

Lease Expense

|

||||||||

|

Operating lease expense (a)

|

$

|

|

$

|

|

||||

|

Supplemental Cash Flow Information

|

||||||||

|

Cash Paid for the amounts included in the measurement of lease liabilities:

|

||||||||

|

Operating cash flows from operating leases

|

$

|

|

$

|

|

||||

|

Right-of-use assets obtained in exchange for new lease obligations:

|

||||||||

|

Operating leases (b)

|

$

|

|

$

|

|

||||

| (a) |

|

|

|

(b)

|

|

|

2023

|

$

|

|

||

|

2024

|

|

|||

|

2025

|

|

|||

|

2026

|

|

|||

|

2027

|

|

|||

|

Thereafter

|

|

|||

|

Total lease payments

|

$

|

|

||

|

Less: Interest

|

(

|

)

|

||

|

Present value of lease liabilities

|

$

|

|

|

|

Engine

Management

|

Temperature

Control

|

Total

|

|||||||||

|

Balance as of December 31, 2020:

|

||||||||||||

|

Goodwill

|

$

|

|

$

|

|

$

|

|

||||||

|

Accumulated impairment losses

|

(

|

)

|

|

(

|

)

|

|||||||

|

|

$

|

|

$

|

|

$

|

|

||||||

|

Activity in 2021

|

||||||||||||

|

Acquisition of Trombetta

|

||||||||||||

|

Acquisition of Stabil

|

||||||||||||

|

Foreign currency exchange rate change

|

(

|

)

|

|

(

|

)

|

|||||||

|

Balance as of December 31, 2021:

|

||||||||||||

|

Goodwill

|

|

|

|

|||||||||

|

Accumulated impairment losses

|

( |

) | ( |

) | ||||||||

| $ | $ | $ | ||||||||||

|

Activity in 2022

|

||||||||||||

| Acquisition of Kade | ||||||||||||

| Foreign currency exchange rate change | ( |

) | ( |

) | ||||||||

| Balance as of December 31, 2022: | ||||||||||||

|

Goodwill

|

||||||||||||

|

Accumulated impairment losses

|

( |

) | ( |

) | ||||||||

|

|

$

|

|

$

|

|

$

|

|

||||||

|

December 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

(In thousands)

|

||||||||

|

Customer relationships

|

$

|

|

$

|

|

||||

|

Patents, developed technology and intellectual property

|

||||||||

|

Trademarks and trade names

|

|

|

||||||

|

Non-compete agreements

|

|

|

||||||

|

Supply agreements

|

|

|

||||||

|

Leaseholds

|

|

|

||||||

|

Total acquired intangible assets

|

|

|

||||||

|

Less accumulated amortization (1)

|

(

|

)

|

(

|

)

|

||||

|

Net acquired intangible assets

|

$

|

|

$

|

|

||||

| (1) |

|

|

December 31,

|

||||||||

|

|

2022

|

2021

|

||||||

|

|

(In thousands)

|

|||||||

|

Foshan GWOYNG SMP Vehicle Climate Control & Cooling Products Co. Ltd.

|

$

|

|

$

|

|

||||

|

Foshan FGD SMP Automotive Compressor Co. Ltd

|

|

|

||||||

|

Foshan Che Yijia New Energy Technology Co., Ltd.

|

|

|

||||||

|

Orange Electronic Co. Ltd

|

|

|

||||||

|

Total

|

$

|

|

$

|

|

||||

|

December 31,

|

||||||||

|

|

2022

|

2021

|

||||||

|

|

(In thousands)

|

|||||||

|

Deferred compensation

|

$

|

|

$

|

|

||||

| Noncurrent portion of interest rate swap fair value |

||||||||

| Long term receivables |

||||||||

|

Deferred financing costs, net

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total other assets, net

|

$

|

|

$

|

|

||||

|

|

December 31,

|

|||||||

|

|

2022

|

2021

|

||||||

|

|

(In thousands)

|

|||||||

|

Credit facility – term loan due 2027

|

$

|

|

$

|

|

||||

| Credit facility – revolver due 2027 |

||||||||

| Senior secured facility – revolver due 2023 |

||||||||

|

Other (1)

|

|

|

||||||

|

Total debt

|

$

|

|

$

|

|

||||

|

Current maturities of debt

|

$

|

|

$

|

|

||||

|

Long-term debt

|

|

|

||||||

|

Total debt

|

$

|

|

$

|

|

||||

| (1) |

|

|

Revolving Credit Facility

|

Term Loan Facility

|

Polish Overdraft Facility and Other Debt

|

Total

|

|||||||||||||

|

2023

|

|

|

|

|

||||||||||||

| 2024 |

|

|

|

|

||||||||||||

|

2025

|

|

|

|

|

||||||||||||

|

2026

|

|

|

|

|

||||||||||||

|

2027

|

|

|

|

|

||||||||||||

|

Total

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Less: current maturities

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||

|

Long-term debt

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

(In thousands)

|

||||

|

2023

|

|

|||

|

2024

|

|

|||

|

2025

|

|

|||

|

2026

|

|

|||

|

2027

|

|

|||

|

Total amortization

|

$

|

|

||

|

Foreign

Currency

Translation

|

Unrecognized

Postretirement

Benefit Costs

(Credit)

|

Unrealized

derivative

gains

(losses)

|

Total

|

|||||||||||||

|

Balance at December 31, 2020 attributable to SMP

|

$

|

(

|

)

|

$

|

|

$

|

|

$

|

(

|

)

|

||||||

|

Other comprehensive income before reclassifications

|

(

|

)

|

|

|

(

|

)

|

||||||||||

|

Amounts reclassified from accumulated other comprehensive income

|

|

(

|

)

|

|

(

|

)

|

||||||||||

|

Other comprehensive income, net

|

(

|

)

|

(

|

)

|

|

(

|

)

|

|||||||||

|

Balance at December 31, 2021 attributable to SMP

|

$ |

( |

) | $ |

$ |

$ |

( |

) | ||||||||

|

Other comprehensive income before reclassifications

|

( |

) | (1) | ( |

) | |||||||||||

|

Amounts reclassified from accumulated other comprehensive income

|

( |

) | ||||||||||||||

|

Other comprehensive income, net

|

( |

) | ( |

) | ( |

) | ||||||||||

|

Balance at December 31, 2022 attributable to SMP

|

$

|

(

|

)

|

$

|

|

$

|

|

$

|

(

|

)

|

||||||

|

(1)

|

|

|

|

Year Ended December 31,

|

|||||||

|

Details About Accumulated Other Comprehensive Income Components

|

2022

|

2021

|

||||||

|

Derivative cash flow hedge:

|

||||||||

|

Unrecognized gain (loss) (1)

|

$

|

|

$

|

|

||||

|

Postretirement Benefit Plans:

|

||||||||

|

Unrecognized gain (loss) (2)

|

(

|

)

|

(

|

)

|

||||

|

Total before income tax

|

|

(

|

)

|

|||||

|

Income tax expense (benefit)

|

(

|

)

|

(

|

)

|

||||

|

Total reclassifications attributable to SMP

|

$

|

|

$

|

(

|

)

|

|||

|

(1)

|

|

|

(2)

|

|

|

|

Shares

|

Weighted Average

Grant Date Fair

Value per Share

|

||||||

|

Balance at December 31, 2020

|

|

$

|

|

|||||

|

Granted

|

|

|

||||||

|

Vested

|

(

|

)

|

|

|||||

|

Forfeited

|

(

|

)

|

|

|||||

|

Balance at December 31, 2021

|

|

$

|

|

|||||

|

Granted

|

|

|

||||||

|

Vested

|

(

|

)

|

|

|||||

|

Performance Shares Target Adjustment

|

||||||||

|

Forfeited

|

(

|

)

|

|

|||||

|

Balance at December 31, 2022

|

|

$

|

|

|||||

|

|

U.S. Defined

Contribution

|

|||

|

Year ended December 31,

|

||||

|

2022

|

$

|

|

||

|

2021

|

|

|||

|

2020

|

|

|||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

|

(In thousands)

|

|||||||||||

|

Interest and dividend income

|

$

|

|

$

|

|

$

|

|

||||||

|

Equity income from joint ventures

|

|

|

|

|||||||||

|

Gain (loss) on foreign exchange

|

|

(

|

)

|

(

|

)

|

|||||||

|

Other non-operating income, net

|

|

|

|

|||||||||

|

Total other non-operating income, net

|

$

|

|

$

|

|

$

|

|

||||||

|

December 31, 2022

|

December 31, 2021

|

||||||||||||||||

|

Fair Value

Hierarchy

|

Fair Value

|

Carrying

Amount

|

Fair Value

|

Carrying

Amount

|

|||||||||||||

|

Cash and cash equivalents

|

LEVEL 1

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Deferred compensation

|

LEVEL 1

|

|

|

|

|

||||||||||||

|

Short term borrowings

|

LEVEL 1

|

|

|

|

|

||||||||||||

|

Long-term debt

|

LEVEL 1

|

|

|

|

|

||||||||||||

|

Cash flow interest rate swap

|

LEVEL 2

|

|

|

|

|

||||||||||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

Current:

|

||||||||||||

|

Domestic

|

$

|

|

$

|

|

$

|

|

||||||

|

Foreign

|

|

|

|

|||||||||

|

Total current

|

|

|

|

|||||||||

|

|

||||||||||||

|

Deferred:

|

||||||||||||

|

Domestic

|

|

(

|

)

|

(

|

)

|

|||||||

|

Foreign

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Total deferred

|

|

(

|

)

|

(

|

)

|

|||||||

|

Total income tax provision

|

$

|

|

$

|

|

$

|

|

||||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

U.S. Federal income tax rate of

|

$

|

|

$

|

|

$

|

|

||||||

|

Increase (decrease) in tax rate resulting from:

|

||||||||||||

|

State and local income taxes, net of federal income tax benefit

|

|

|

|

|||||||||

|

Income tax (benefit) attributable to foreign income

|

(

|

)

|

(

|

)

|

|

|||||||

|

Other non-deductible items, net

|

|

(

|

)

|

(

|

)

|

|||||||

|

Change in valuation allowance

|

|

|

|

|||||||||

|

Provision for income taxes

|

$

|

|

$

|

|

$

|

|

||||||

|

|

December 31,

|

|||||||

|

|

2022

|

2021

|

||||||

|

Deferred tax assets:

|

||||||||

|

Inventories

|

$

|

|

$

|

|

||||

|

Allowance for customer returns

|

|

|

||||||

|

Postretirement benefits

|

|

|

||||||

|

Allowance for expected credit losses

|

|

|

||||||

|

Accrued salaries and benefits

|

|

|

||||||

|

Tax credit and NOL carryforwards

|

|

|

||||||

|

Accrued asbestos liabilities

|

|

|

||||||

|

Other

|

|

|

||||||

|

|

|

|

||||||

|

Valuation allowance

|

(

|

)

|

(

|

)

|

||||

|

Total deferred tax assets

|

|

|

||||||

|

Deferred tax liabilities:

|

||||||||

|

Intangible assets acquired, net of amortization

|

||||||||

|

Depreciation

|

|

|

||||||

|

Interest rate swap agreement

|

||||||||

|

Other

|

|

|

||||||

|

Total deferred tax liabilities

|

|

|

||||||

|

|

||||||||

|

Net deferred tax assets

|

$

|

|

$

|

|

||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

Net Earnings Attributable to SMP -

|

||||||||||||

|

Earnings from continuing operations

|

$

|

|

$

|

|

$

|

|

||||||

|

Loss from discontinued operations

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings attributable to SMP

|

$

|

|

$

|

|

$

|

|

||||||

|

|

||||||||||||

|

Basic Net Earnings Per Common Share Attributable to SMP -

|

||||||||||||

|

Earnings from continuing operations per common share

|

$

|

|

$

|

|

$

|

|

||||||

|

Loss from discontinued operations per common share

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings per common share attributable to SMP

|

$

|

|

$

|

|

$

|

|

||||||

|

|

||||||||||||

|

Weighted average common shares outstanding

|

||||||||||||

|

Diluted Net Earnings Per Common Share Attributable to SMP -

|

||||||||||||

|

Earnings from continuing operations per common share

|

$

|

|

$

|

|

$

|

|

||||||

|

Loss from discontinued operations per common share

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings per common share attributable to SMP

|

$

|

|

$

|

|

$

|

|

||||||

|

|

||||||||||||

|

Weighted average common shares outstanding

|

|

|

|

|||||||||

|

Plus incremental shares from assumed conversions:

|

||||||||||||

|

Dilutive effect of restricted stock and performance-based stock

|

|

|

|

|||||||||

|

Weighted average common shares outstanding – Diluted

|

|

|

|

|||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

Restricted and performance shares

|

|

|

|

|||||||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2022

|

2021

|

2020

|

|||||||||

|

Net sales (a):

|

||||||||||||

|

Engine Management

|

$

|

|

$

|

|

$

|

|

||||||

|

Temperature Control

|

|

|

|

|||||||||

|

Other

|

|

|

|

|||||||||

|

Total net sales

|

$

|

|

$

|

|

$

|

|

||||||

|

Intersegment sales (a):

|

||||||||||||

|

Engine Management

|

$

|

|

$

|

|

$

|

|

||||||

|

Temperature Control

|

|

|

|

|||||||||

|

Other

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Total intersegment sales

|

$

|

|

$

|

|

$

|

|

||||||

|

Depreciation and Amortization:

|

||||||||||||

|

Engine Management

|

$

|

|

$

|

|

$

|

|

||||||

|

Temperature Control

|

|

|

|

|||||||||

|

Other

|

|

|

|

|||||||||

|

Total depreciation and amortization

|

$

|

|

$

|

|

$

|

|

||||||

|

Operating income (loss):

|

||||||||||||

|

Engine Management

|

$

|

|

$

|

|

$

|

|

||||||

|

Temperature Control

|

|

|

|

|||||||||

|

Other

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Total operating income

|

$

|

|

$

|

|

$

|

|

||||||

|

Investment in unconsolidated affiliates:

|

||||||||||||

|

Engine Management

|

$

|

|

$

|

|

$

|

|

||||||

|

Temperature Control

|

|

|

|

|||||||||

|

Other

|

|

|

|

|||||||||

|

Total investment in unconsolidated affiliates

|

$

|

|

$

|

|

$

|

|

||||||

|

Capital expenditures:

|

||||||||||||

|

Engine Management

|

$

|

|

$

|

|

$

|

|

||||||

|

Temperature Control

|

|

|

|

|||||||||

|

Other

|

|

|

|

|||||||||

|

Total capital expenditures

|

$

|

|

$