Consolidated

Financial Statements as of December 31, 2023

Together

with independent auditors’

CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31,

2023

TABLE OF CONTENTS

|

Independent

Auditor's report on Consolidated Financial

Statements

|

|

Cover

|

|

Consolidated

Statement of Financial Position

|

|

Consolidated

Statement of Income

|

|

Consolidated

Statement of Other Comprehensive Income – Not

used

|

|

Consolidated

Statement of Changes in Shareholders’ Equity

|

|

Consolidated

Statement of Cash Flows

|

|

Notes

to the Consolidated Financial Statements

|

|

1.

General Informationand purpose of these consolidated financial

statements

|

|

2.

Economic context

|

|

3.

Accounting standards policies and basis for

preparation

|

|

4.

Areas of higher professional judgment and significant accounting

estimates

|

|

5.

Statement of cash flows

|

|

6. Debt

securities at fair value through profit or loss

|

|

7.

Derivative instruments

|

|

8.

Financial Instruments

|

|

9.

Loans and other financing arrangements

|

|

10.

Other debt securities

|

|

11.

Other financial assets and liabilities

|

|

12.

Other non-financial assets and liabilities

|

|

13.

Liabilities at fair value through profit or loss

|

|

14.

Income tax

|

|

15.

Negotiable obligations issued

|

|

16.

Provisions

|

|

17.

Capital Stock

|

|

18.

Interest income and adjustments / fee and commission

income

|

|

19.

Interest expense and adjustments / fee and commission

expense

|

|

20. Net

income from measurement of financial instruments at fair value

through profit or loss

|

|

21.

Exchange rate differences on gold and foreign currency

|

|

22.

Other operating income / (expense)

|

|

23.

Expenses by function and nature

|

|

24.

Employee benefits

|

|

25.

Segment reporting

|

|

26.

Off-balance sheet accounts

|

|

27.

Transactions and balances with related parties

|

|

28.

Financial risk factors

|

|

29.

Capital management

|

|

30.

Additional information required by the Argentine Central

Bank

|

|

31.

Subsequent events

|

|

Schedule A –

Not used

|

|

Schedule B –

Consolidated Classification of Loans and Other Financing

Arrangements by Status and Guarantees Received

|

|

Schedule C –

Consolidated Concentration of Loans and Other Financing

Arrangements

|

|

Schedule D –

Consolidated Breakdown of Loans and Other Financing Arrangements by

Maturity Dates

|

|

Schedule E –

Not used

|

|

Schedule F –

Consolidated Changes in Propertyand Equipment. Consolidated Change

in Investment Property.

|

|

Schedule G –

Consolidated Changes in Intangible Assets.

|

|

Schedule H –

Consolidated Concentration of Deposits

|

|

Schedule I –

Consolidated Breakdown of Financial Liabilities by Maturity

Dates

|

|

Schedule J –

Not used

|

|

Schedule K –

Not used

|

|

Schedule L –

Not used

|

|

Schedule M –

Not used

|

|

Schedule N –

Not used

|

|

Schedule O –

Not used

|

|

Schedule P –

Consolidated Categories of Financial Assets and

Liabilities

|

|

Schedule Q –

Consolidated Breakdown of P&L

|

|

Schedule R –

Consolidated Allowance for Loan Losses

|

Independent

Auditor's Report

To the Shareholders

and Board of Directors of

Banco Hipotecario

S.A.

Opinion

We have audited the

consolidated financial statements of Banco Hipotecario S.A. and its

subsidiaries, which comprise the consolidated statement of

financial position as of December 31, 2023, and the related

consolidated statements of income, changes in shareholders’

equity, and cash flows for the year then ended, and the related

notes to the consolidated financial statements.

In our opinion, the

accompanying consolidated financial statements present fairly, in

all material respects, the financial position of Banco Hipotecario

S.A. and its subsidiaries as of December 31, 2023, and the results

of their operations and their cash flows for the years then ended

in accordance with International Financial Reporting Standards

(IFRS) as issued by de International Accounting Standards Board

(IFRS).

Basis

for Opinion

We conducted our

audit in accordance with auditing standards generally accepted in

the United States of America (GAAS). Our responsibilities under

those standards are further described in the Auditor's

Responsibilities for the Audit of the Consolidated Financial

Statements section of our report. We are required to be independent

of Banco Hipotecario S.A. and to meet our other ethical

responsibilities, in accordance with the relevant ethical

requirements relating to our audits. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our audit opinion.

Responsibilities

of Management for the Consolidated Financial

Statements

Management is

responsible for the preparation and fair presentation of these

consolidated financial statements in accordance with IFRS, and for

the design, implementation, and maintenance of internal control

relevant to the preparation and fair presentation of consolidated

financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the

consolidated financial statements, management is required to

evaluate whether there are conditions or events, considered in the

aggregate, that raise substantial doubt about Banco Hipotecario

S.A.'s ability to continue as a going concern for at least 12

months from December 31, 2023.

Auditor’s

Responsibilities for the Audit of the Consolidated Financial

Statements

Our objectives are

to obtain reasonable assurance about whether the consolidated

financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance but is not absolute assurance and

therefore is not a guarantee that an audit conducted in accordance

with GAAS will always detect a material misstatement when it

exists. The risk of not detecting a material misstatement resulting

from fraud is higher than for one resulting from error, as fraud

may involve collusion, forgery,intentional omissions,

misrepresentations, or the override of internal control.

Misstatements are considered material if there is a substantial

likelihood that,individually or in the aggregate, they would

influence the judgment made by a reasonable user based on the

consolidated financial statements.

In performing an

audit in accordance with GAAS, we:

●

Exercise

professional judgment and maintain professional skepticism

throughout the audit.

●

Identify and assess

the risks of material misstatement of the consolidated financial

statements, whether due to fraud or error, and design and perform

audit procedures responsive to those risk.Such procedures include

examining, on a test basis, evidence regarding the amounts and

disclosures in the consolidated financial statements.

●

Obtain an

understanding of internal control relevant to the audit in order to

design audit procedures that are appropriate in the circumstances,

but not for the purpose of expressing an opinion on the

effectiveness of Banco Hipotecario S.A.'s internal control.

Accordingly, no such opinion is expressed.

●

Evaluate the

appropriateness of accounting policies used and the reasonableness

of significant accounting estimates made by management, as well as

evaluate the overall presentation of the consolidated financial

statements.

●

Conclude whether,

in our judgment, there are conditions or events,considered in the

aggregate, that raise substantial doubt about Banco Hipotecario

S.A.'s ability to continue as a going concern for a reasonable

period of time.

We are required to

communicate with those charged with governance regarding, among

other matters, the planned scope and timing of the audit,

significant audit findings, and certain internal

control–related matters that we identified during the

audit.

Other

matter

The accompanying

consolidated statement of financial position of Banco Hipotecario

S.A. as of December 31, 2022, and the related consolidated

statements of income, changes in shareholders’ equity and

cash flows for the year then ended, were not audited, reviewed or

compiled by us, and, accordingly, we do not express an opinion or

any other form of assurance on them.

Buenos Aires,

Argentina

June 18,

2024

|

Abelovich, Polano

& Asociados S.R.L.

(Partner)

|

|

Noemí I.

Cohn

|

BANCO

HIPOTECARIO S.A.

|

Registered

office:

|

Reconquista 151

– City of Buenos Aires – Argentine

Republic

|

|

Main

activity:

|

Banking

|

|

Taxpayer’s

Identification Number (CUIT):

|

30-50001107–

2

|

|

By-laws’ date

of registration with the Public Registry of Commerce:

|

September 28,

1997

|

|

Date of

registration of the latest amendment to the by-laws:

|

January

23, 2019 (No. 1643 of Stock Corporations Book 93)

|

|

Expiration date of

the by-laws:

|

99

years from the date of incorporation (September 28,

1997)

|

|

Capital structure as of 12/31/2023

|

|||||

|

Shares

|

|

||||

|

Number

|

Type

|

Nominal

value

|

No. of

votes per share

|

Class

|

Subscribed

and paid-in

|

|

(In

thousands of ARS)

|

|||||

|

664,376,845

|

Common

registered

shares

|

1

|

1

|

A

|

664,377

|

|

75,000,000

|

1

|

1

|

C

|

75,000

|

|

|

760,623,155

|

1

|

3

|

D

|

760,623

|

|

|

1,500,000,000

|

|

|

|

1,500,000

|

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As of

December 31, 2023 (Audited) and 2022 (Unaudited)

In

thousands of Argentine Pesos, except otherwise

indicated

|

ITEM

|

NOTES

|

12/31/2023

(Audited)

|

12/31/2022

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Cash

and bank deposits (Schedule P)

|

5

|

98,793,594

|

86,250,455

|

|

Debt

securities at fair value through profit or loss (Schedule

P)

|

6

|

143,883,964

|

399,176,701

|

|

Derivative

instruments (Schedule P)

|

7

|

402,791

|

225,669

|

|

Reverse

Repurchase transactions (Schedule P)

|

8.1

|

950,133,490

|

305,748,324

|

|

Other

financial assets (Schedule P)

|

11.1

|

35,762,410

|

32,668,506

|

|

Loans

and other financing arrangements (Schedule B, C, P)

|

9

|

142,587,921

|

236,551,990

|

|

Other

debt securities (Schedule B, C, P)

|

10

|

33,146,129

|

86,973,279

|

|

Financial

assets pledged as collateral (Schedule P)

|

30.2

|

18,509,983

|

13,207,366

|

|

Current

income tax assets

|

14

|

-

|

1,030,133

|

|

Investments

in equity instruments (Schedule P)

|

|

5,773,485

|

3,834,817

|

|

Investments

in associates and joint ventures

|

30.3

|

32,005,000

|

-

|

|

Property

and equipment (Schedule F)

|

12.1

|

40,026,528

|

39,839,891

|

|

Intangible

assets (Schedule G)

|

12.2

|

2,244,147

|

1,955,727

|

|

Deferred

income tax assets

|

14

|

226,520

|

856,772

|

|

Other

non-financial assets

|

12.3

|

10,014,762

|

9,814,550

|

|

Non-current

assets held for sale

|

12.4

|

-

|

42,182,825

|

|

TOTAL

ASSETS

|

1,513,510,724

|

1,260,317,005

|

|

The

complete notes and schedules are an integral part of these

consolidated financial statements

1

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (CONT.)

As of

December 31, 2023 (Audited) and 2022 (Unaudited)

In

thousands of Argentine Pesos, except otherwise

indicated

|

ITEM

|

NOTES

|

12/31/2023

(Audited)

|

12/31/2022

(Unaudited)

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

Deposits

(Schedule H, P)

|

|

1,130,083,634

|

921,025,197

|

|

Liabilities

at fair value through profit or loss (Schedule P)

|

13

|

27,630,045

|

-

|

|

Derivative

instruments (Schedule P)

|

7

|

-

|

485

|

|

Other

financial liabilities (Schedule P)

|

11.2

|

49,476,514

|

76,203,661

|

|

Loans

from the BCRA (*) and other financial institutions (Schedule

P)

|

5

|

2,752,729

|

919,023

|

|

Negotiable

obligations issued (Schedule P)

|

5 and

15

|

38,320,559

|

44,846,508

|

|

Current

income tax liabilities

|

14

|

3,258,487

|

2,075,575

|

|

Provisions

|

16

|

3,075,855

|

3,438,852

|

|

Deferred

income tax liabilities

|

14

|

11,019,897

|

10,782,547

|

|

Other

non-financial liabilities

|

12.5

|

33,007,936

|

39,209,013

|

|

TOTAL

LIABILITIES

|

1,298,625,656

|

1,098,500,861

|

|

|

|

|

|

|

|

SHAREHOLDERS’

EQUITY

|

|

|

|

|

Capital

stock

|

17

|

1,500,000

|

1,500,000

|

|

Inflation

adjustment of Capital Stock

|

|

133,272,047

|

133,272,047

|

|

Reserves

|

|

18,855,083

|

-

|

|

Retained

earnings / (acummulated deficit)

|

|

3,894,015

|

(6,178,380)

|

|

Income

for the year

|

|

51,701,861

|

28,927,478

|

|

|

|

|

|

|

Shareholders’

equity attributable to parent’s shareholders

|

|

209,223,006

|

157,521,145

|

|

Shareholders’

equity attributable to non-controlling interests

|

|

5,662,062

|

4,294,999

|

|

|

|

|

|

|

TOTAL

SHAREHOLDERS’ EQUITY

|

214,885,068

|

161,816,144

|

|

|

TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

1,513,510,724

|

1,260,317,005

|

|

(*)

Argentine Central Bank

The

complete notes and schedules are an integral part of these

consolidated financial statements.

2

CONSOLIDATED STATEMENT OF INCOME

For the

fiscal years ended December 31, 2023 (Audited) and 2022

(Unaudited)

In

thousands of Argentine Pesos, except otherwise

indicated

|

Item

|

Note

|

12/31/2023

(Audited)

|

12/31/2022

(Unaudited)

|

|

|

|

|

|

|

Interest income and

adjustments (Schedule Q)

|

18

|

627,989,269

|

285,583,103

|

|

Interest expense

and adjustments (Schedule Q)

|

19

|

(675,540,055)

|

(330,226,111)

|

|

Net

interest expense

|

|

(47,550,786)

|

(44,643,008)

|

|

|

|

|

|

|

Fee and commission

income (Schedule Q)

|

18

|

29,539,474

|

33,532,214

|

|

Fee and commission

expense (Schedule Q)

|

19

|

(1,942,338)

|

(2,305,002)

|

|

Net

fee and commission income

|

|

27,597,136

|

31,227,212

|

|

|

|

|

|

|

Net income from

measurement of financial instruments at fair value through profit

or loss (Schedule Q)

|

20

|

377,379,843

|

235,234,135

|

|

(Loss)/income from

assets written-off measured at amortized cost

|

|

(8,016,142)

|

27,798

|

|

Foreign currency

exchange differences

|

21

|

(19,526,415)

|

613,496

|

|

Other operating

income

|

22

|

47,594,766

|

51,141,242

|

|

Loan

loss

|

|

(4,913,049)

|

(5,644,793)

|

|

Net

operating income

|

|

372,565,353

|

267,956,082

|

|

|

|

|

|

|

Employee

benefits

|

24

|

(74,056,391)

|

(69,420,272)

|

|

Administrative

expenses

|

23

|

(33,095,030)

|

(32,017,948)

|

|

Depreciation and

impairment of assets

|

|

(4,710,997)

|

(5,509,694)

|

|

Other operating

expenses

|

22

|

(79,996,839)

|

(79,885,776)

|

|

Operating

income

|

|

180,706,096

|

81,122,392

|

|

|

|

|

|

|

Loss on net

monetary position

|

|

(121,309,392)

|

(23,746,303)

|

|

Net

income before income tax

|

|

59,396,704

|

57,376,089

|

|

|

|

|

|

|

Income tax

expense

|

14

|

(6,681,681)

|

(28,869,875)

|

|

|

|

|

|

|

NET

INCOME FOR THE YEAR

|

52,715,023

|

28,506,214

|

|

|

Net

income for the year attributable to parent’s

shareholders

|

51,701,861

|

28,927,478

|

|

|

Net

income/(loss) for the year attributable to non-controlling

interests

|

1,013,162

|

(421,264)

|

|

The

complete notes and schedules are an integral part of these

consolidated financial statements.

3

CONSOLIDATED STATEMENT OF INCOME (CONT.)

For the

fiscal years ended December 31, 2023 (Audited) and 2022

(Unaudited)

In

thousands of Argentine Pesos, except otherwise

indicated

|

Earnings

per Share

|

12/31/2023

(Audited)

|

12/31/2022

(Unaudited)

|

|

|

|

|

|

NUMERATOR

|

|

|

|

Income attributable

to parent’s shareholders

|

51,701,861

|

28,927,478

|

|

|

|

|

|

Income attributable

to parent’s shareholders adjusted to reflect the effect of

dilution

|

51,701,861

|

28,927,478

|

|

|

|

|

|

DENOMINATOR

|

|

|

|

Weighted average of

outstanding common shares for the fiscal year

|

1,474,940

|

1,473,240

|

|

|

|

|

|

Weighted average of

outstanding common shares for the fiscal year adjusted to reflect

the effects of dilution

|

1,474,940

|

1,473,240

|

|

|

|

|

|

BASIC

EARNINGS PER SHARE

|

35.054

|

19.635

|

|

DILUTED

EARNINGS PER SHARE

|

35.054

|

19.635

|

The

complete notes and schedules are an integral part of these

consolidated financial statements.

4

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

For the

fiscal years ended December 31, 2023 (Audited) and 2022

(Unaudited)

In

thousands of Argentine Pesos, except otherwise

indicated

|

|

Capital

Stock

|

|

|

|

|

|

|

|

|

Changes

|

Outstanding

|

Treasury

|

Inflation

adjustment of capital stock

|

Legal

reserve

|

Retained

earnings

|

Total

Shareholders’ equity attributable to parent’s

shareholders

|

Total

Shareholders’ equity attributable to non-controlling

interests

|

Total

Shareholder’s equity

|

|

Balances

as of 12.31.22 (Unaudited)

|

1,473,832

|

26,168

|

133,272,047

|

-

|

22,749,098

|

157,521,145

|

4,294,999

|

161,816,144

|

|

Distribution of

unappropriated retained earnings / (losses) – Approved by the

Shareholders’ Meeting held on 03/30/2023 (*)

|

-

|

-

|

-

|

18,855,083

|

(18,855,083)

|

-

|

-

|

-

|

|

Share-based

payments under compensation plan

|

2,231

|

(2,231)

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Other

changes

|

-

|

-

|

-

|

-

|

-

|

-

|

353,901

|

353,901

|

|

Net income for the

year

|

-

|

-

|

-

|

-

|

51,701,861

|

51,701,861

|

1,013,162

|

52,715,023

|

|

Balances

as of 12.31.2023 (Audited)

|

1,476,063

|

23,937

|

133,272,047

|

18,855,083

|

55,595,876

|

209,223,006

|

5,662,062

|

214,885,068

|

The

complete notes and schedules are an integral part of these

consolidated financial statements.

(*) See

Note 3.4.

5

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

(CONT.)

for the

fiscal years ended December 31, 2023 (Audited) and 2022

(Unaudited)

In

thousands of Argentine Pesos, except otherwise

indicated

|

|

Capital

Stock

|

|

|

|

|

|

|

|

Changes

|

Outstanding

|

Treasury

|

Inflation

adjustment of Capital stock

|

Retained

earnings /accumulated deficit

|

Total

Shareholders’ equity attributable to parent’s

shareholders

|

Total

Shareholders’ equity attributable to non-controlling

interests

|

Total

Shareholder’s equity

|

|

Balances

as of 12.31.2021

|

1,472,210

|

27,790

|

158,756,798

|

(31,663,131)

|

128,593,667

|

3,657,219

|

132,250,886

|

|

Absorption of

unappropriated retained earnings / (losses) – Approved by the

Shareholders’ Meeting held on 03/30/2022

|

-

|

-

|

(25,484,751)

|

25,484,751

|

-

|

-

|

-

|

|

Share-based

payments under compensation plan

|

1,622

|

(1,622)

|

-

|

-

|

-

|

-

|

-

|

|

Distribution of

subsidiary dividends

|

-

|

-

|

-

|

-

|

-

|

1,059,044

|

1,059,044

|

|

Net income / (loss)

for the year

|

-

|

-

|

-

|

28,927,478

|

28,927,478

|

(421,264)

|

28,506,214

|

|

Balances

as of 12.31.2022 (Unaudited)

|

1,473,832

|

26,168

|

133,272,047

|

22,749,098

|

157,521,145

|

4,294,999

|

161,816,144

|

The

complete notes and schedules are an integral part of these

consolidated financial statements.

6

CONSOLIDATED STATEMENT OF CASH FLOWS

for the fiscal years ended December 31, 2023 (Audited) and 2022

(Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

|

ITEM

|

12/31/2023

(Audited)

|

12/31/2022

(Unaudited)

|

|

|

|

|

|

Net

income before income tax

|

59,396,704

|

57,376,089

|

|

|

|

|

|

Adjustments

to obtain cash flows from operating activities

|

|

|

|

Loss on net

monetary position

|

121,309,392

|

23,746,303

|

|

Depreciation and

impairment of assets

|

4,710,997

|

5,509,694

|

|

Loan loss, net of

reversed allowances

|

4,236,783

|

5,082,007

|

|

Provisions (Note

22)

|

6,855,524

|

6,401,546

|

|

Net interest

expense

|

47,550,786

|

44,643,008

|

|

Net income from

measurement of financial instruments at fair value through profit

or loss

|

(376,949,059)

|

(234,963,018)

|

|

Loss from valuation

of non-current assets held for sale, investment property and

property and equipment (Note 22)

|

7,939,722

|

24,645,353

|

|

(Net

increase) / net decrease from operating assets

|

|

|

|

Debt securities at

fair value through profit or loss

|

361,870,024

|

(77,851,522)

|

|

Derivative

instruments

|

(330,324)

|

678,061

|

|

Reverse repurchase

transactions

|

(381,919,945)

|

407,192,186

|

|

Loans and other

financing arrangements

|

|

|

|

Non-financial

public sector

|

(127)

|

13

|

|

Financial

sector

|

(1,512,791)

|

4,844,052

|

|

Non-financial

private sector and foreign residents

|

50,584,509

|

28,103,322

|

|

Other debt

securities

|

30,647,943

|

54,929,443

|

|

Financial assets

pledged as collateral

|

(14,268,801)

|

1,584,235

|

|

Investments in

equity instruments

|

(4,542,039)

|

(2,287,772)

|

|

Other

assets

|

(108,693,978)

|

(77,303,124)

|

|

Net

increase / (net decrease) from operating liabilities

|

|

|

|

Deposits

|

|

|

|

Non-financial

public sector

|

23,632,494

|

(192,007,083)

|

|

Financial

sector

|

114

|

(539)

|

|

Non-financial

private sector and foreign residents

|

141,255,165

|

(103,206,310)

|

|

Liabilities at fair

value through profit or loss

|

27,630,045

|

(1,859,337)

|

|

Derivative

instruments

|

(620,466)

|

(573,062)

|

|

Repurchase

transactions

|

(541,195)

|

(231,379)

|

|

Other

liabilities

|

70,346,430

|

118,726,814

|

|

Income tax

paid

|

(116,546)

|

(141,585)

|

|

Total

cash flows generated by operating activities

|

68,471,361

|

93,037,395

|

The

complete notes and schedules are an integral part of these

consolidated financial statements.

7

CONSOLIDATED STATEMENT OF CASH FLOWS (CONT.)

for the fiscal years ended December 31, 2023 (Audited) and 2022

(Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

|

ITEM

|

12/31/2023

(Audited)

|

12/31/2022

(Unaudited)

|

|

Cash

flows from investing activities

|

|

|

|

Payments

|

|

|

|

Purchase of

property and equipment, intangible assets and other

assets

|

(2,855,010)

|

(1,844,766)

|

|

Collections

|

|

|

|

Sale of property

and equipment and other assets

|

36,345

|

189,270

|

|

Total

cash flows used in investing activities

|

(2,818,665)

|

(1,655,496)

|

|

Cash

flows from financing activities

|

|

|

|

Payments

|

|

|

|

Unsubordinated

negotiable obligations (Note 5)

|

(11,475,432)

|

(78,864,537)

|

|

Loans from domestic

financial institutions (Note 5)

|

(4,357,416)

|

(189,654,477)

|

|

Other payments

related to financing activities

|

(4,954,997)

|

(4,744,498)

|

|

Collections

|

|

|

|

Unsubordinated

negotiable obligations (Note 5)

|

-

|

13,020,486

|

|

Loans to domestic

financial institutions (Note 5)

|

3,424,251

|

188,854,324

|

|

Total

cash flows used in financing activities

|

(17,363,594)

|

(71,388,702)

|

|

|

|

|

|

Effect

of exchange rate variations

|

22,807,530

|

9,857,071

|

|

|

|

|

|

Effect

of loss on net monetary position of cash

|

(58,553,493)

|

(53,463,536)

|

|

|

|

|

|

TOTAL

VARIATION IN CASH FLOWS

|

|

|

|

Net increase /

(decrease) for the year

|

12,543,139

|

(23,613,268)

|

|

Cash at beginning

of year, restated

|

86,250,455

|

109,863,723

|

|

Cash at year

end

|

98,793,594

|

86,250,455

|

Notes

and schedules are an integral part of these consolidated financial

statements.

8

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

1. GENERAL

INFORMATION

Banco

Hipotecario S.A. (hereinafter, the “Bank” or “the

Entity”) is a financial institution subject to the Financial

Institutions Law No. 21526.

The

Bank is the result of the privatization of the then Banco

Hipotecario Nacional (an institution established in 1886), pursuant

to Law No. 24855 passed on July 2, 1997 and enacted by the National

Executive Branch (PEN) through Decree No. 677 dated July 22, 1997,

and regulatory Decree No. 924/97, whereby Banco Hipotecario

Nacional was declared "subject to privatization" under the terms of

Law No. 23696 and transformed into a corporation ("sociedad anónima"). The new entity

arising from this transformation does business under the name of

"Banco Hipotecario Sociedad Anónima", and as a commercial bank

in accordance with Law No. 21526. The Bank provides retail and

corporate banking services. In addition, through its subsidiaries,

it provides life and personal accident insurance.

These

consolidated financial statements as of and for the fiscal year

ended December 31, 2023 include the Bank and its subsidiaries, that

is, companies and structured entities controlled by the Bank

(collectively, the “Group”).

The

companies controlled by the Group include:

● BACS Banco de

Crédito y Securitización S.A. (BACS): An investment bank

engaged in designing financial solutions for businesses, including

securitizations and credit portfolio management. The Bank owns a

62.28% stake in BACS' capital stock and votes.

● BHN Sociedad de

Inversión S.A.: The holding entity of BHN Vida S.A. and BHN

Seguros Generales S.A. The Bank directly and indirectly owns a 100%

stake in BHN Sociedad de Inversión S.A.’s capital stock

and votes. In turn, the Bank indirectly owns 100% of the shares in

Toronto Trust Gestión Mutual Fund and 37.46% of the shares in

Toronto Trust Argentina 2021.

The

structured entities controlled by the Bank include:

●

CHA Financial

Trusts Series IX to XIV

In the

case of mutual funds, at each period-end, the Bank analyzes the

shares held in order to conclude on the existence of control at

each date. This analysis considers not only the direct and indirect

investments held by the Group but also the composition of the rest

of the investors in order to conclude on the need for consolidation

under IFRS 10.

Purpose of these financial statements

One of the Group’s main shareholders is IRSA Inversiones y

Representaciones (“IRSA”), a Company which shares are

publicly offered and listed on the New York Stock Exchange (NYSE).

These consolidated financial statements have been prepared to

satisfy IRSA’s reporting requirements under the applicable

standards issues by Securities and Exchange Commission

(SEC).

The accounting standards and basis of preparation followed in the

preparation of these consolidated financial statements are

described in Note 3.

2. CHANGES

IN THE MACROECONOMIC CONTEXT AND FINANCIAL AND CAPITAL

SYSTEMS

The Group operates amidst an economic environment whose main

variables have shown substantial volatility, such as high inflation

level and the decline in economic activity that began in previous

years.

In particular, and concerning financial assets, measures were taken

as regards the extension of maturities and/or restructuring of

government securities.

As of the date of these financial statements, the Group maintains

public sector debt instruments affected by the measured referred to

above.

Besides, the

BCRA took several measures primarily aimed at facilitating credit

access by economic players, including, without

limitation:

a) Restrictions on

positions held by entities in Bills issued by the BCRA

(LELIQ);

b) Ceiling rates on

credit card financing arrangements and floor rates on time

deposits;

c) A financing line

for Micro, Small & Medium Entities' (MSME) productive

investments that financial institutions are required to

hold.

During

the last quarter of 2023, certain impacts on some of the relevant

economic and financial variables have deepened, such as a

devaluation of the peso, an increase in prices due to accelerated

inflation and volatility in the value of securities and shares,

among others. As of the date of these financial statements, the

circumstances described above have not changed.

The

events described in this Note affect the Group's operations, as

well as the calculation of credit losses and the valuation of

public sector debt instruments.

9

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

The

Group’s Management permanently monitors the evolution of the

aforementioned circumstances in order to define possible actions to

be taken and identify possible impacts on its equity and financial

position, which would be required to disclose in the financial

statements.

3. ACCOUNTING

STANDARDS POLICIES AND BASIS FOR PREPARATION

Banco

Hipotecario S.A. is a financial institution subject to Financial

Institutions Law No. 21526 and, as such, is also required to comply

with the regulations established by the BCRA in its capacity as

Regulator of Financial Institutions. The Bank is also required to

comply with the regulations set by the Argentine Securities

Commission (“CNV”), in accordance with Law No.

26831.

These

consolidated financial statements were approved by the Board of

Directors at a virtual meeting held on June 18, 2024.

3.1.

Basis of presentation of financial statements

These

consolidated financial statements have been prepared in accordance

with the International Financial Reporting Standards (IFRS) issued

by the International Accounting Standards Board (IASB) and the

interpretations issued by the International Financial Reporting

Interpretation Committee (IFRIC). All the IFRSs in force as of the

date of preparation of these consolidated financial statements have

been applied.

The BCRA, through Communications “A” 5541 and its

amendments, established a convergence plan towards the adoption of

IFRS as issued by the IASB, and the interpretations issued by the

IFRIC, for the entities under its supervision, effective for fiscal

years commencing January 1, 2018, with certain

exceptions.

The Group has presented its local financial statements under these

rules on February 22, 2024.

The

Group’s management has concluded that these consolidated

financial statements fairly present its financial position,

financial performance and cash flows.

In

preparing these consolidated financial statements, the Group is

required to make estimates and assessments affecting the reported

amounts of assets and liabilities, the disclosure of contingencies,

as well as the reported amounts of income and expenses during the

year. In this sense, estimates are made, for instance, to calculate

the allowance for credit risk, the useful life of property&

equipment, depreciation and amortization, the recoverable value of

assets, the income tax expense, some labor-related costs, and the

provisions for contingencies and labor, civil and commercial

lawsuits and the fair value of certain financial instruments.

Future actual results may differ from the estimates and assessments

made as of the date these consolidated financial statements were

prepared.

The

areas involving a higher degree of judgment or complexity or the

areas in which the assumptions and estimates are material for these

consolidated financial statements are described in Note

4.

3.2.

Functional and presentation currency

All of

the Group’s entities consider the Argentine Peso as

functional and presentation currency. All amounts are stated in

thousands of pesos, unless otherwise specified.

International

Accounting Standard No. 29 “Financial Reporting in

Hyperinflationary Economies” (“IAS 29”) requires

that the financial statements of an entity whose functional

currency is that of a hyperinflationary economy be stated in terms

of the current measurement unit at the end of the reporting

year.

The

standard sets out a number of factors that should be considered to

conclude that an economy is hyperinflationary under IAS 29,

including a cumulative inflation rate for three consecutive years

close to, or in excess of, 100%. Therefore, pursuant to IAS 29, the

Argentine peso is considered a currency of a hyperinflationary

economy as from July 1, 2018.

Such

restatement should be made as if the economy had always been

hyperinflationary, using a general price index that reflects the

changes in the purchasing power of the currency. In order to make

such restatement, a series of indexes are prepared and published on

a monthly basis by the Argentine Federation of Professional

Councils of Economic Sciences (FACPCE, as per its Spanish acronym),

which combine:

●

For items

subsequent to December 2016: Consumer Price Index (CPI) compiled by

the Argentine Institute of Statistics and Census

(“INDEC”); and

●

For items prior to

December 2016: The price index released by the Argentine Federation

of Professional Councils of Economic Sciences (FACPCE), based on

the Wholesale Domestic Price Index (IPIM, Spanish acronym) compiled

by INDEC.

Considering

the index referred above, inflation for the fiscal years ended

December 31, 2023 and 2022 was 211.41% and 94.79%,

respectively.

10

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

Under

IAS 29, assets and liabilities that are not stated in the measuring

unit current at the end of the reporting year should be adjusted by

applying the relevant price index. The adjusted value of a

non-monetary item is written down if it exceeds its recoverable

value.

In

applying IAS 29 to the consolidated statement of financial

position, the Group has relied on the following methodology and

criteria:

●

Non-monetary assets

were restated by applying the price index. The restated amounts

were reduced to their recoverable values, by applying the relevant

IFRS, where appropriate.

●

Monetary assets

were not restated.

●

Assets and

liabilities contractually related to changes in prices, such as

index-linked securities and loans, were measured on the basis of

the relevant contract.

●

Deferred income tax

assets and liabilities were recalculated on the basis of the

restated amounts.

●

As of January 1,

2019, all shareholders' equity items, other than Unappropriated

retained earnings/ losses, were restated by applying the relevant

price index, as from the date of contribution or origination. In

subsequent years, all shareholders' equity items were restated by

applying the relevant price index as from the beginning of the year

or the contribution date, if later.

In

applying IAS 29 to the consolidated statements of income and cash

flows, the Group has relied on the following methodology and

criteria:

●

All items of the

consolidated statements of income and cash flows were restated in

terms of the measuring unit current at the end of the reporting

year.

●

The gain or loss on

net monetary position is recognized in the consolidated statement

of income.

●

Gains or losses on

cash are disclosed in the statement of cash flows separately from

cash flows from operating, investing, and financing activities, as

a reconciling item between cash at the beginning of the year and at

year-end.

Comparative

information was restated in terms of the measuring unit current as

of December 31, 2023.

3.3.

Going Concern

As of the date of issuance of these consolidated financial

statements, there are no uncertainties with respect to events or

conditions that may raise doubts about whether the Group may

continue operating normally as a going concern.

3.4.

Distribution of retained earnings

On

March 30, 2023, the Shareholders' Meeting resolved to distribute

retained earnings accumulated as of December 31, 2022, allocating

them to the Legal Reserve.

3.5.

Comparative information

The

unaudited information contained in these consolidated financial

statements and in their respective notes as of December 31, 2022,

is presented for comparative purposes only with the information as

of December 31, 2023.

3.6.

Accounting standards issued

a)The following standards and amendments to standards became

effective on January 1, 2023; they have not had a material impact

on the Group's financial statements:

●

Disclosures of

accounting policies (amendment to IAS 1 and IFRS Practical

Statement 2).

●

Definition of

accounting estimate (amendment to IAS 8).

●

Deferred tax

related to assets and liabilities arising from a single transaction

(amendment to IAS 12).

b) Insurance contracts (IFRS 17).

On

January 1, 2023, the Group adopted IFRS 17 ‘Insurance

Contracts’. The Group has determined that reasonable and

supportable information was available for all contracts in force at

the transition date. Accordingly, the Group has: identified,

recognized and measured each group of insurance contracts and each

insurance acquisition cash flows asset in this category as if IFRS

17 had always applied; derecognized any existing balances that

would not exist if IFRS 17 had always applied; and recognized any

resulting net difference in equity.

At the

transition date, the implementation of this Standard was not

material for the Group.

c)The following standards and amendments to standards are

effective as from January 1, 2024. The Group understands that they

will not have a significant impact on its financial

statements:

●

Classification of

liabilities as current or non-current (amendment to IAS 1).

Effective as from January 1, 2024.

●

Lease liability in

a sale and leaseback (amendment to IFRS 16). Effective as from

January 1, 2024.

11

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

●

Sale or

contribution of assets between an investor and its associate or

joint venture (amendments to IFRS 10 and IAS 28). No effective

date.

3.7.

Consolidation

Subsidiaries

are entities (or investees), including structured entities, over

which the Group has control because (i) it has the power to direct

the investee’s relevant activities substantially affecting

its returns, (ii) it has exposure to, or rights in, variable

returns by reason of its equity interest in the investee, and (iii)

it has the ability to use its power over the investee to affect the

amount of the investor's returns. The existence and effect of

substantive rights, including potential substantive voting rights,

is taken into account when assessing whether the Group has

influence on another entity. For a right to be substantive, it must

be exercisable by its holder when decisions about the direction of

the entity's relevant activities need to be made. The Group may

have control over an entity, even if it is entitled to less than a

majority of voting rights.

In

addition, other investors’ protective rights, such as those

related to substantive changes to the investee's activities or only

applicable under exceptional circumstances, do not prevent the

Group from having power over an investee. Subsidiaries are

consolidated since the date control is transferred to the Group and

are removed from consolidation since the date on which control

ceases.

Mutual

funds: the Group acts as a mutual fund manager. In determining

whether the Group controls such mutual funds, the aggregate Group's

financial interest in the fund is assessed (which includes the

share in the fund's return and management fees), considering also

that shareholders are not entitled to remove the manager without

cause. In cases where the financial interest is less than 37%, the

Group concludes that it acts as an agent for the shareholders and,

therefore,it does not consolidate such mutual funds with respect to

the mutual funds that have been consolidated.

The following table shows the Group's subsidiaries and controlled

structured entities that are consolidated:

|

|

|

|

PERCENTAGE

INTEREST

|

|||

| Company | Principal Line of Business | Closing date |

12/31/2023 (Audited)

|

12/31/2022 (Unaudited)

|

||

|

|

|

|

Direct

|

Direct and Indirect

|

Direct

|

Direct and Indirect

|

|

BACS

Banco de Crédito y Securitización S.A. (a)

|

Financial

Institution.

|

Dec-31

|

62.28%

|

62.28%

|

62.28%

|

62.28%

|

|

BHN

Sociedad de Inversión S.A. (b)

|

Investment

in companies engaged in the insurance or any other

business.

|

Dec-31

|

99.99%

|

100.00%

|

99.99%

|

100.00%

|

|

Financial

Trusts CHA Series IX to XIV

|

Trust

Fund

|

Dec-31

|

100.00%

|

100.00%

|

100.00%

|

100.00%

|

All companies are based in Argentina and their local and functional

currency is the Argentine Peso.

(a)

As

of December 31, 2023 and 2022, BACS consolidates its financial

statements with: BACS Administradora de Activos S.A. S.G.F.C.I. and

it owns 0.01% of BHN Sociedad de Inversión Sociedad

Anónima.

(b)

BHN

Sociedad de Inversión Sociedad Anónima owns a 99.99%

interest in BHN Vida S.A. and BHN Seguros Generales S.A. In turn,

it indirectly owns 100% of the shares in Toronto Trust Gestión

Mutual Fund and 37.46% of the shares in Toronto Trust Argentina

2021 Mutual Fund.

For

purposes of the consolidation, the Group relied on the

subsidiaries’ financial statements for the fiscal year ended

December 31, 2023, which are consistent with the same period of the

Bank's financial statements. Such financial statements have been

adjusted to reflect identical criteria as those applied by the Bank

in preparing its consolidated financial statements. These

adjustments and reconciliations were subject to management’s

monitoring and confirmation mechanisms considering all significant

items with differing treatment in the applied standards, mainly

including deferred tax, lease reporting and actuarial

reserves.

Accounts

receivable and payable and gains (losses) from inter-company

transactions were eliminated from the consolidated financial

statements.

A

non-controlling interest is a subsidiary's share of net income

(loss) and shareholders’ equity attributable to interests

which are not owned by the Bank, either directly or indirectly. The

non-controlling interest is disclosed as a separate item of the

Group's shareholders’ equity.

12

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

3.8.

Transactions with the non-controlling interest

The Group considers transactions with the non-controlling interest

as if they were transactions with the Group's shareholders. When

acquiring a non-controlling interest, the difference between the

price paid and the respective interest in the carrying amount of

the subsidiary's net assets acquired is recognized in

shareholders’ equity. The gains and losses on the disposal of

equity interests are also recognized in shareholders’ equity,

to the extent control is maintained. The non-controlling interest

constitutes an item separate from the Group’s equity and

profit or loss.

3.9.

Joint Arrangements

Joint arrangements are contractual arrangements whereby the Group

and other party(ies) have joint control of such arrangement. In

accordance with IFRS 11, investments in joint arrangements are

classified as joint ventures or joint operations according to each

investor’s contractual rights and obligations, without

considering the arrangement’s legal structure. A joint

venture is a joint arrangement whereby the parties that have joint

control of the arrangement have rights to the net assets of the

arrangement. A joint operation is an arrangement whereby the

parties that have joint control of the arrangement have rights to

the assets and obligations for the liabilities, relating to the

arrangement.

The Group has assessed the nature of its joint arrangements and has

determined that BHSA’s interest in Edificio del Plata Trust

is a joint operation, and therefore it acts as a joint

operator.

In accordance with the provisions of IFRS 11 “Joint

Arrangements”, the Group recognizes in connection with its

interest in the joint operation:

(a)

its assets, including its share in any assets held

jointly;

(b)

its liabilities, including its share in any liabilities incurred

jointly;

(c)

its revenue from ordinary activities generated by the sale of its

share of the output arising from the joint operation;

(d)

its share of the revenue from the sale of the output by the joint

operation; and

(e)

its expenses, including its share of any expenses incurred

jointly.

A joint

operator shall account for the assets, liabilities, revenues and

expenses relating to its interest in a joint operation in

accordance with the IFRSs applicable to the particular assets,

liabilities, revenues and expenses.

In

addition, at each closing date, it is determined whether there is

any objective evidence of impairment of the assets relating to the

investment in the joint operation. If that is the case, the Group

calculates the amount of impairment as the difference between the

recoverable value of the assets of the joint operation and its

carrying value, and recognizes such difference under “Other

operating expenses” in the statement of income.

When

the Group enters into a transaction with a joint operation in which

it is a joint operator, such as a sale or contribution of assets,

it is conducting the transaction with the other parties to the

joint operation and, as such, the joint operator shall recognize

gains and losses resulting from such a transaction only to the

extent of the other parties’ interests in the joint

operation. When such transactions provide evidence of a reduction

in the net realizable value of the assets to be sold or contributed

to the joint operation, or of an impairment loss of those assets,

those losses shall be fully recognized by the joint

operator.

3.10.

Segment reporting

An

operating segment is a component of an entity (a) that engages in

business activities from which it may earn revenues and incur

expenses (including revenues and expenses relating to transactions

with other components of the same entity), (b) whose operating

profits or losses are regularly reviewed by Management to make

decisions about resources to be allocated to the segment and assess

its performance, and (c) for which confidential financial

information is available.

Operating

segments are reported consistently with the internal reports

submitted to:

(i)

Key

management personnel, the utmost authority in charge of making

operating decisions and allocating resources and assessing the

performance of the operating segments; and

(ii)

The

Board of Directors, responsible for making the Group's strategic

decisions.

3.11.

Foreign currency

Transactions

in foreign currency are translated into functional currency at the

exchange rates prevailing on the transaction or valuation dates

when items are measured at closing. Gains and losses in foreign

currency on the settlement of these transactions and on the

translation of monetary assets and liabilities into foreign

currency at the exchange rates prevailing at closing are recognized

in the consolidated statement of income under “foreign

currency exchange differences,” except when they are deferred

in equity due to transactions that qualify as cash flow hedges,

where applicable.

Balances

denominated in US Dollars are valued at the spot exchange rate

defined by the BCRA at the closing of the last business day of each

month.

Foreign

currencies other than US Dollars have been converted to US Dollars

at the spot exchange rates reported by the BCRA.

3.12.

Cash and bank deposits

The item Cash and bank deposits includes cash available,

unrestricted deposits held in banks.

13

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

3.13.

Financial instruments

Initial recognition

The Group recognizes a financial asset or liability in its

consolidated financial statements when it becomes a party to the

financial instrument contract.

Purchases and sales of financial instruments with delivery of the

assets within the term generally set forth by market regulations

and conditions are recognized on the transaction’s trading

date on which the Group commits itself to buy or sell the

asset.

These financial assets are initially recognized at fair value, plus

incremental transaction costs directly attributable.

Where the fair value differs from the transaction cost, the Group

recognizes the difference as follows:

When

fair value is consistent with the financial asset or liability

market value or is based on a valuation method relying on market

values only, the difference between the fair value upon initial

recognition and the transaction cost is recognized as profit or

loss.

In

other cases, the difference is deferred as a profit or loss only to

the extent that there is a change in any factor (including time)

that the market participants would consider when determining the

price of the asset or liability.

Financial assets

a - Debt instruments

The Group classifies as debt instruments such instruments that are

considered financial liabilities for the issuer, including loans,

government and corporate securities, bonds, and accounts receivable

from customers under non-recourse arrangements.

Classification

As set out in IFRS 9, the Group classifies financial assets as

subsequently measured at amortized cost, at fair value through

other comprehensive income or at fair value through profit or loss,

based on:

a)

the

Group’s business model to manage financial assets;

and

b)

the

characteristics of contractual cash flows of the financial

asset.

Business model

The business model is the manner in which the Group manages a set

of financial assets to achieve a specific business goal. It

represents the manner in which the Group maintains instruments for

cash generation.

The Group may follow several business models, whose objective

is:

Holding

instruments until maturity in order to obtain contractual cash

flows;

Holding

instruments in portfolio to collect contractual cash flows and, in

turn, sell them if deemed convenient; or

Holding

instruments for trading.

The Group's business model does not depend on management's intended

purposes for an individual instrument. Accordingly, this condition

is not a classification approach of instruments on an individual

basis. Instead, such classification is determined at a higher level

of aggregation.

The Group only reclassifies an instrument when the business model

for managing financial assets has changed.

Characteristics of cash flows

The Group assesses whether the return on cash flows from the

aggregated instruments does not substantially differ from the

contribution it would receive as principal and interest; otherwise,

such instruments should be measured at fair value through profit or

loss.

Based on the aforementioned, financial assets are classified into

three categories:

i)

Financial

assets measured at amortized cost:

Financial assets are measured at amortized cost when:

(a)

the

financial asset is held within a business model whose objective is

to maintain financial assets to collect contractual cash flows;

and

(b)

the

contractual conditions of the financial asset give rise, on certain

specified dates, to cash flows which are solely payments of

principal and interest (SPPI) on the principal amount

outstanding.

These financial instruments are initially recognized at fair value

plus the incremental and directly attributable transaction costs

and are subsequently measured at amortized cost.

The amortized cost of a financial asset is equal to its acquisition

cost, net of accumulated amortization plus accrued interest

(calculated by applying the effective rate method), net of

impairment losses, if any.

ii)

Financial

assets at fair value through other comprehensive

income:

14

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

Financial assets are measured at fair value through other

comprehensive income when:

(a)

the

financial asset is held within a business model whose objective is

achieved by both collecting contractual cash flows and selling

financial assets; and

(b)

the

contractual conditions of the financial asset give rise, on certain

specified dates, to cash flows which are SPPI on the principal

amount outstanding.

These financial instruments are initially recognized at fair value

plus the incremental and directly attributable transaction costs

and are subsequently measured at fair value through other

comprehensive income. Impairment losses or reversals, interest

income, and exchange gains and losses are recognized in profit or

loss. The rest of the changes in fair value are included in other

comprehensive income under a separate equity item. Upon the sale or

disposal of the instrument, the accumulated gains or losses

previously recognized in other comprehensive income are

reclassified from equity to the statement of income.

iii)

Financial

assets at fair value through profit or loss:

Financial assets at fair value through profit or loss

include:

Instruments

held for trading;

Instruments

specifically designated at fair value through profit or loss;

and

Instruments

whose contractual terms do not represent cash flows but rather SPPI

on principal amount outstanding.

These financial instruments are initially recognized at fair value

and any subsequent change in the fair value is recognized in the

statement of income.

The Group classifies a financial instrument as held for trading if

such instrument is acquired for the main purpose of selling or

repurchasing it in the short term, or if it is part of a portfolio

of financial instruments which are managed jointly and for which

there is evidence of short-term profits.

In addition, financial assets may be designated at fair value

through profit or loss when, in doing so, the Group eliminates or

substantially reduces a measurement or recognition

inconsistency.

b - Equity instruments

Equity instruments are those agreements that evidence a residual

interest in the assets of an entity after deducting all its

liabilities.

Such instruments are measured at fair value through profit or loss,

except where management has availed, at the time of their initial recognition,

of the irrevocable option to measure them at fair value through

other comprehensive income. This method may only be applied when

instruments are not held for trading and changes in the fair value

are recognized in Other Comprehensive Income (OCI), with no

subsequent reclassification to profit or loss. Dividends receivable

from such instrument will be recognized in profit or loss only at

the time the Group becomes entitled to receive

payment.

Financial assets measured at fair value through profit or

loss: The Group may, upon

initial recognition, avail of the irrevocable option to designate

an asset at fair value through profit or loss, if and only if

exercising such option results in improved financial reporting

because:

the

Group eliminates or substantially reduces measurement or

recognition inconsistencies which would otherwise be revealed in

valuation;

if

financial assets and liabilities are managed and performance is

assessed on a fair value basis, according to a documented

investment or risk management strategy; or

if

a host contract contains one or more embedded

derivatives.

Derecognition of financial assets

The Group derecognizes a financial asset only if any of the

following conditions is met:

1.

Upon

termination of the Group’s interests in the cash flows

provided by the financial asset; or

2.

Upon

the transfer of the financial asset pursuant to the requirements in

Section 3.2.4 of IFRS 9.

The Group derecognizes financial assets that had been transferred

only if the following conditions are met:

1.

When

the Group has transferred its contractual rights to collect future

cash flows;

2.

When

the Group retains the contractual rights to collect cash flows, but

assumes a repurchase obligation upon satisfaction of the following

three requirements:

a.

The

Group is not required to pay any amount without receiving cash

flows from the transfer of the asset; and

b.

The

Group is not allowed to sell the financial asset; and

c.

The

Group is required to submit the cash flows it has committed

to.

15

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

Financial liabilities

Classification

The Group classifies its financial liabilities, other than

derivative financial instruments, guarantees issued and loan

commitments as measured at amortized cost. Derivative financial

instruments are measured at fair value through profit or

loss.

Financial

guarantees are contracts pursuant to which the Group is required to

make specified payments to reimburse the holder for a loss incurred

due to a specified debtor's failure to honor its payment

obligations in accordance with the contractual terms of a debt

instrument.

The

liability arising from financial guarantees issued is initially

recognized at fair value. Such liability is subsequently measured

at the higher of the amortized amount and the present value of any

expected payment to settle the liability when such payment is

deemed probable.

Derecognition of financial liabilities

The Group derecognizes financial liabilities upon settlement; that

is, when the financial liability has been settled or paid off, or

the contract has expired.

3.14.

Derivative instruments

Derivative instruments are carried at fair value.

All derivative instruments are accounted for as assets when fair

value is positive and as liabilities when fair value is negative,

relative to the agreed-upon price. Changes in the fair value of

derivative instruments are recognized in profit or loss for the

year.

The Group does not use hedge accounting.

3.15.

Reverse repurchase and repurchase transactions

Reverse Repuchase transactions

According to the derecognition criteria set out in IFRS 9, these

transactions are considered as secured borrowings since the risk

has not been transferred to the counterparty.

Financing arrangements granted in the form of reverse repurchase

transactions are recorded under “Repurchase

Transactions” accounts. At the end of each month, accrued

interest receivable is charged to “Repurchase

Transactions” accounts with offsetting entry in

“Interest Income.”

The underlying assets received for reverse repurchases transactions

are recorded under Off-Balance Sheet Items. The assets received

which have been sold by the Group are not deducted, but rather

derecognized when the repurchase transaction finishes, recording an

in-kind liability to reflect the obligation to deliver the security

sold.

Repurchase transactions

Financing arrangements received in the form of repurchase

transactions are booked under “Repurchase Transactions”

accounts.

In these transactions, when the recipient of the underlying asset

becomes entitled to sell it or pledge it as a collateral, the asset

involved is reclassified to “Financial assets pledged as

collateral”.

At

the end of each month, accrued interest payable is charged to the

“Repurchase Transactions” accounts with offsetting

entry in “Interest Expense.”

3.16.

Allowances for credit risks

Expected Credit Losses

The

Group takes a forward-looking approach in assessing the expected

credit losses (“ECL”) associated with financial assets

measured at amortized cost or at fair value through other

comprehensive income, and the exposure from loan commitments and

financial guarantee contracts. Likewise, all the financial assets

valued at fair value though profit and loss are excluded from the

impairment model.

The Group measures the ECLs from a financial instrument in a manner

that reflects:

(a)

an unbiased

probability-weighted amount which is determined by assessing a

range of possible outcomes;

(b)

the

time value of money; and

(c)

reasonable

and supportable information that is available without undue cost or

effort on the reporting date, about past events, current conditions

and forecasts of future economic conditions.

Grouping of instruments for losses measured on a collective

basis

To assess the ECL on a collective basis, the Group make a grouping

of exposures based on shared risks characteristics, such that risk

exposures within group are homogeneous.

The Group has identified the following categories of

debtors:

16

Notes to the

consolidated financial statements as of December 31, 2023 (Audited)

and December 31, 2022 (Unaudited)

In thousands of Argentine Pesos, except otherwise

indicated

-

Commercial Portfolio: covers all financing except loans for

consumption or housing and commercial loans assimilable to

consumption.

-

Securities portfolio: includes public and private issuances of debt

securities acquired in the secondary market or through primary

bidding and valued for accounting purposes at cost plus

yield.

-

Consumer Portfolio: includes financing excluded in the previous

point.

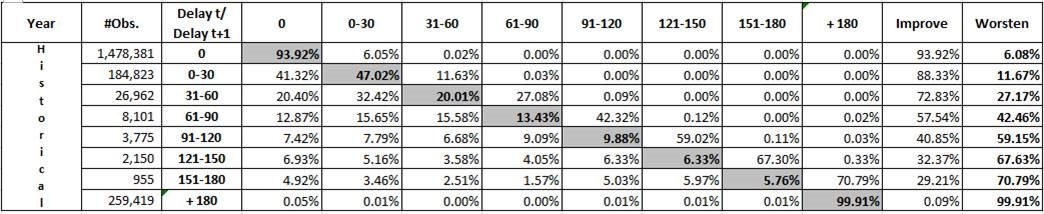

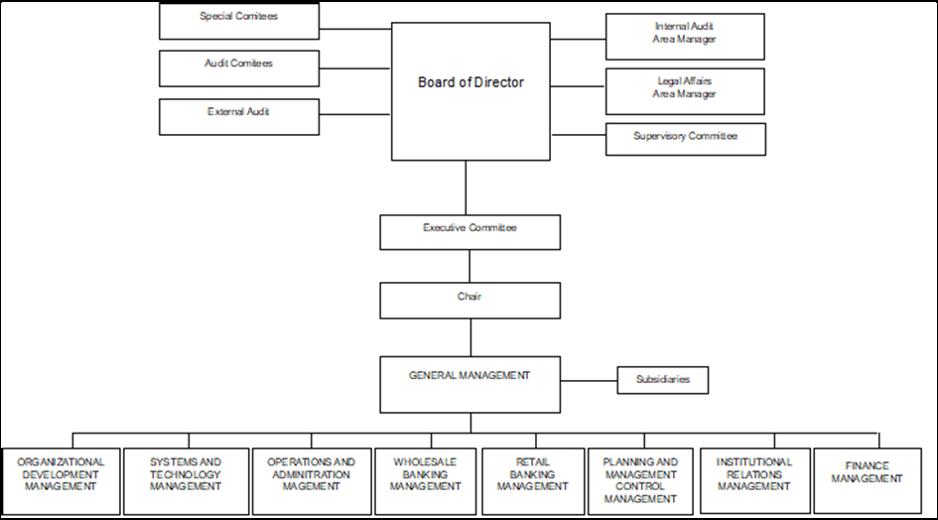

For its