EX-13

Exhibit 13

This Annual Report, including the Financial Review and the Financial Statements and related Notes, contains forward-looking statements, which may include

forecasts of our financial results and condition, expectations for our operations and business, and our assumptions for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results may differ materially from our

forward-looking statements due to several factors. Factors that could cause our actual results to differ materially from our forward-looking statements are described in this Report, including in the “Forward-Looking Statements” and

“Risk Factors” sections, and in the “Regulation and Supervision” section of our Annual Report on Form 10-K for the year ended December 31, 2014 (“2014 Form 10-K”).

When we refer to “the Company,” “we,” “our” or “us” in this Report, we mean IBERIABANK Corporation and Subsidiaries

(consolidated). When we refer to the “Parent,” we mean IBERIABANK Corporation. See the Glossary of Acronyms at the end of this Report for terms used throughout this Report.

To the extent that statements in this Report relate to future plans, objectives, financial results or performance of the Company, these statements are deemed

to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, which are based on management’s current information, estimates and assumptions and the current economic environment,

are generally identified by use of the words “may”, “plan”, “believe”, “expect”, “intend”, “will”, “should”, “continue”, “potential”, “anticipate”,

“estimate”, “predict”, “project” or similar expressions, or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of proposed mergers, the

expected returns and other benefits of the proposed mergers to shareholders, expected improvement in operating efficiency resulting from the mergers, estimated expense reductions, the impact on and timing of the recovery of the impact on tangible

book value, and the effect of the mergers on the Company’s capital ratios. The Company’s actual strategies and results in future periods may differ materially from those currently expected due to various risks and uncertainties.

Actual results could differ materially because of factors such as the level of market volatility, our ability to execute our growth strategy, including the

availability of future bank acquisition opportunities, unanticipated losses related to the integration of, and refinements to purchase accounting adjustments for, acquired businesses and assets and assumed liabilities in these transactions,

adjustments of fair values of acquired assets and assumed liabilities and of deferred taxes in acquisitions, actual results deviating from the Company’s current estimates and assumptions of timing and amounts of cash flows, credit risk of our

customers, effects of the on-going correction in residential real estate prices and reduced levels of home sales, our ability to satisfy new capital and liquidity standards such as those imposed by the Dodd-Frank Act and those adopted by the Basel

Committee and federal banking regulators, sufficiency of our allowance for loan losses, changes in interest rates, access to funding sources, reliance on the services of executive management, competition for loans, deposits and investment dollars,

reputational risk and social factors, changes in government regulations and legislation, increases in FDIC insurance assessments, geographic concentration of our markets and economic conditions in these markets, rapid changes in the financial

services industry, dependence on our operational, technological, and organizational systems or infrastructure and those of third-party providers of those services, hurricanes and other adverse weather events, the modest trading volume of our common

stock, and valuation of intangible assets. Those and other factors that may cause actual results to differ materially from these forward-looking statements are discussed in the Company’s Annual Report on Form 10-K and other filings with the

Securities and Exchange Commission (the “SEC”), available at the SEC’s website, http://www.sec.gov, and the Company’s website, http://www.iberiabank.com, under the heading “Investor Information.” All

information in this discussion is as of the date of this Report. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations.

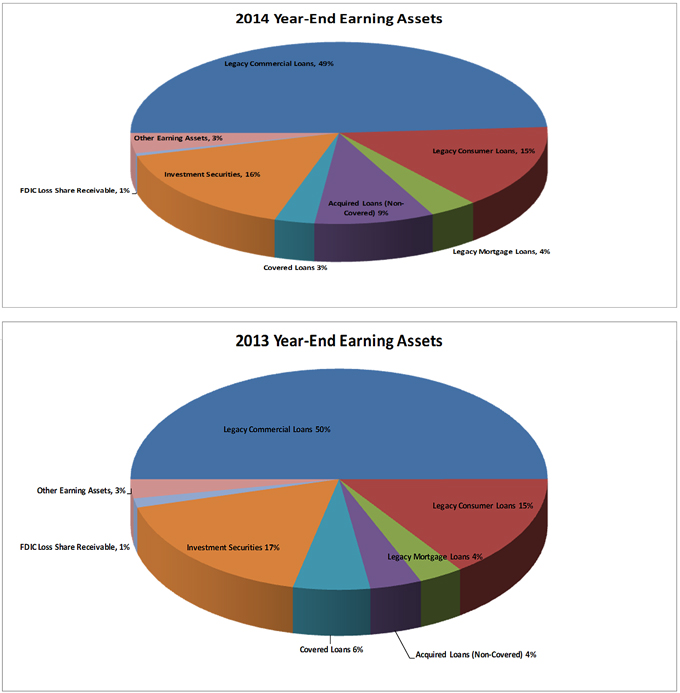

Included in this discussion and analysis are descriptions of the composition, performance, and credit quality of the Company’s loan portfolio. The

Company has two primary descriptions of loans that are used to categorize the portfolio into its distinct risks and rewards to the consolidated financial statements: legacy loans and acquired loans. The accounting for acquired loans can differ

materially from that of legacy loans. Additionally, certain acquired loans were acquired with loss protection provided by the FDIC, and the risks of the loans and foreclosed real estate acquired are significantly different from those assets not

similarly covered by loss share agreements. Accordingly, the Company reports acquired loans subject to the loss share agreements as covered loans.

1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

EXECUTIVE OVERVIEW

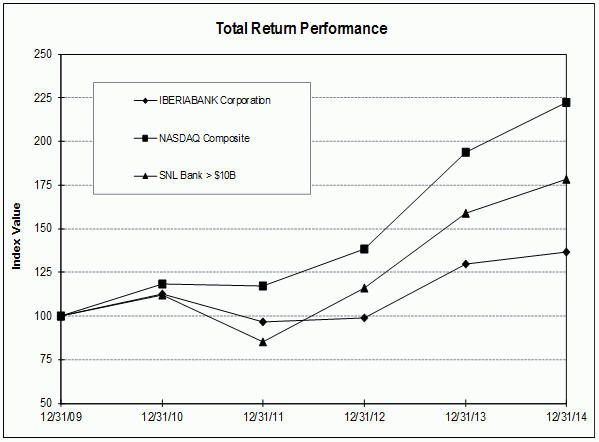

The Company is a $15.8 billion bank

holding company primarily concentrated in commercial banking in the southeastern United States. We are shareholder- and client-focused, expect high performance from our associates, believe in a strong sense of community and strive to make the

Company a great place to work. The Company strives to improve long-term shareholder returns by setting challenging financial goals and executing on these goals in consideration of the current and anticipated operating and regulatory environments.

Management believes that improvement in core earnings drives shareholder value, and the Company has adopted a mission statement that is designed to provide guidance for our management, associates and Board of Directors regarding the sense of purpose

and direction of the Company.

In 2014, the Board of Directors set long-term, strategic goals for executive management. Key long-term financial goals

through 2016 and beyond are as follows:

| |

• |

|

Return on Average Tangible Equity of 13% to 17% |

| |

• |

|

Tangible Efficiency Ratio of 60% or less |

| |

• |

|

Asset Quality in the top 10% of our peers |

| |

• |

|

Double-digit percentage growth in fully-diluted operating EPS |

The Company also continues to focus on

improving operating efficiency and profitability, as executive compensation programs were redesigned to align with strategic goals, profitability focus, and creation of shareholder value. The Company’s short-term incentive programs place

greater emphasis on pre-established performance objectives (as opposed to discretionary objectives), while long-term incentive programs place greater emphasis on performance-based metrics (as opposed to time-based metrics).

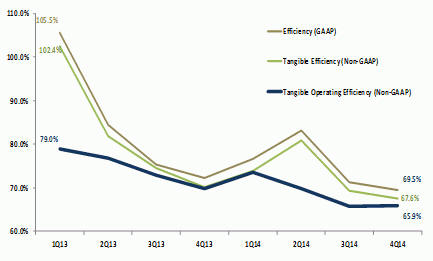

Highlights of the Company’s operating performance in 2014 include:

| |

• |

|

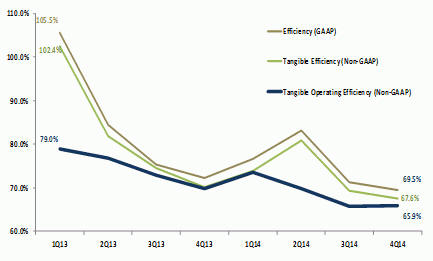

Continued improvement in operating efficiency through increased net revenues and reduced operating expenses: |

| |

• |

|

Non-acquisition-related cost-save initiatives were implemented over the last two years, resulting in annualized benefits of an estimated $11 million in 2014 and $24 million in 2013. |

| |

• |

|

Operating leverage improved as a result of organic revenue growth, driven by new and existing clients and their demand for loans and deposits. |

| |

• |

|

Acquisitions also contributed to the Company’s improvement in operating leverage, as the Company realized cost-saving opportunities on the acquired companies’ expense base through operational synergies while

maintaining the acquirees’ net revenues. |

2

TABLE 1—SELECTED FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31 |

|

| (Dollars in thousands) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| Key Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency Ratio |

|

|

74.87 |

% |

|

|

84.60 |

% |

|

|

77.49 |

% |

|

|

79.50 |

% |

|

|

73.22 |

% |

| Tangible operating efficiency ratio (TE) (Non-GAAP) |

|

|

72.63 |

% |

|

|

82.08 |

% |

|

|

74.91 |

% |

|

|

76.71 |

% |

|

|

70.43 |

% |

| Return on average assets |

|

|

0.72 |

% |

|

|

0.50 |

% |

|

|

0.63 |

% |

|

|

0.49 |

% |

|

|

0.47 |

% |

| Return on average assets, operating basis (Non-GAAP) |

|

|

0.81 |

% |

|

|

0.71 |

% |

|

|

0.67 |

% |

|

|

0.61 |

% |

|

|

0.50 |

% |

| Net interest margin (TE) |

|

|

3.51 |

% |

|

|

3.38 |

% |

|

|

3.58 |

% |

|

|

3.51 |

% |

|

|

3.05 |

% |

| Non-interest income |

|

$ |

173,628 |

|

|

$ |

168,958 |

|

|

$ |

175,997 |

|

|

$ |

131,859 |

|

|

$ |

133,890 |

|

| Non-interest income, operating (Non-GAAP) |

|

|

170,871 |

|

|

|

166,624 |

|

|

|

170,026 |

|

|

|

128,384 |

|

|

|

124,679 |

|

| Non-interest expense |

|

|

474,479 |

|

|

|

473,085 |

|

|

|

432,185 |

|

|

|

373,731 |

|

|

|

304,249 |

|

| Non-interest expense, operating (Non-GAAP) |

|

|

445,959 |

|

|

|

428,543 |

|

|

|

418,174 |

|

|

|

350,269 |

|

|

|

290,183 |

|

| |

• |

|

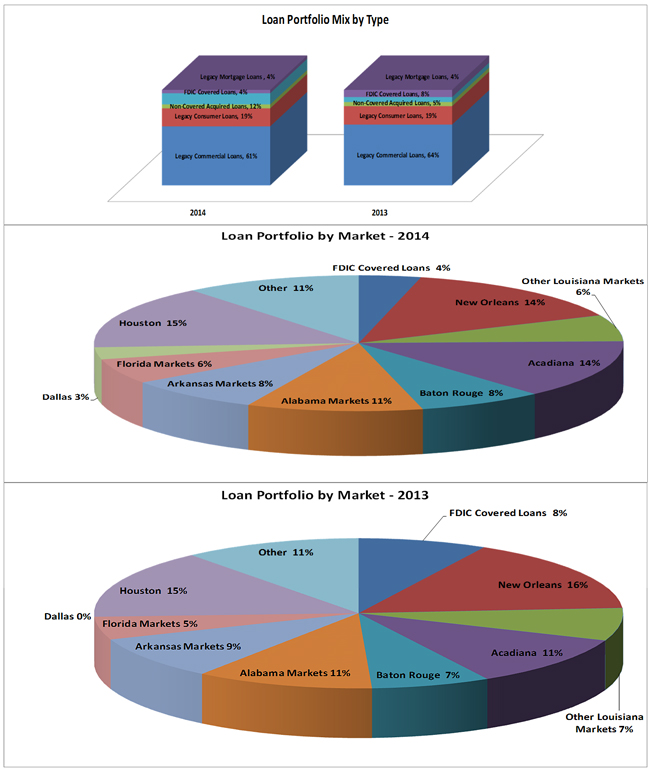

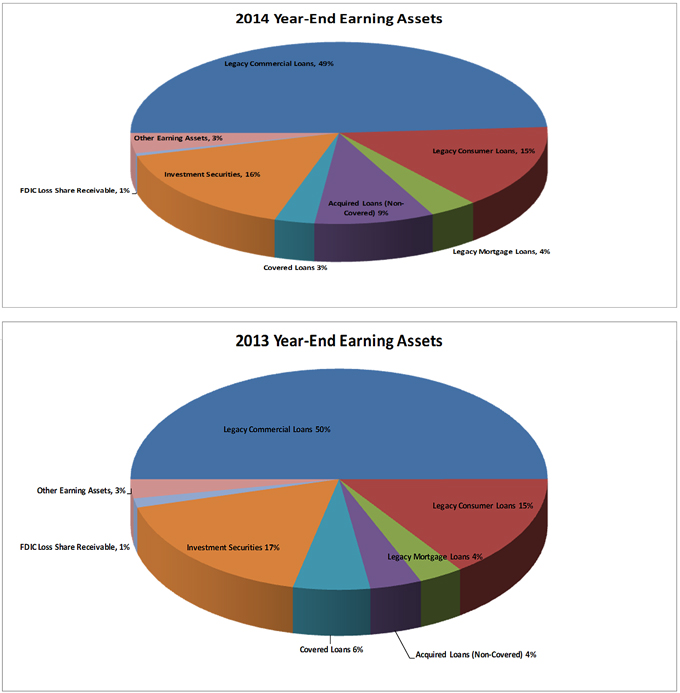

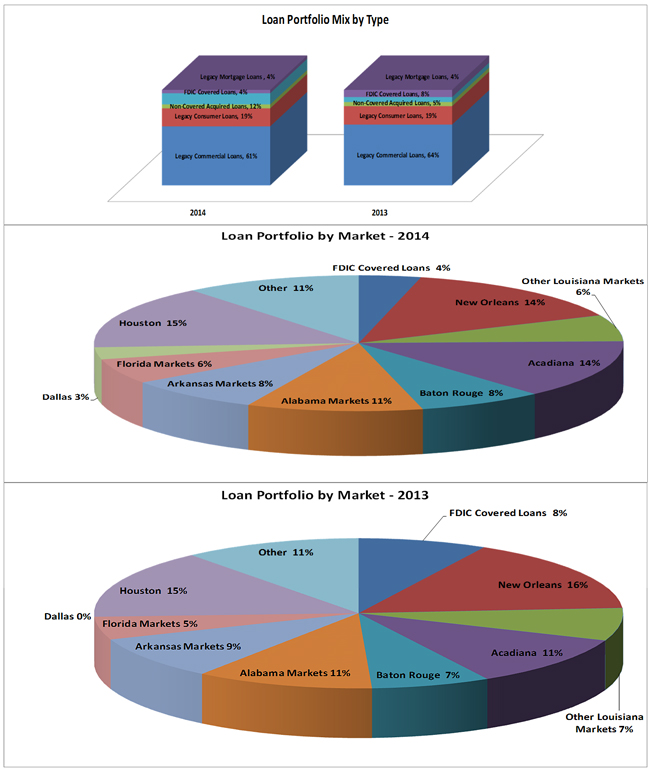

The Company diversified its geographic presence through acquisitions and product mix growth by deepening relationships with commercial clients: |

| |

• |

|

The Company expanded its presence into Dallas, Texas through the acquisition of First Private and announced two acquisitions in Florida, which will continue to result in a more geographically diverse company. In 2014,

the Company also diversified its growth in product mix and fortified its franchises in Louisiana (Teche) and Memphis (Trust One) through separate acquisitions. Additional information on these and other acquisitions is included in the

“Acquisition Activity” section below. |

| |

• |

|

Beginning in 2012 and continuing into 2014, the Company began diversifying its product set, including expanding its operations across the U.S. Gulf Coast region. Over that time period, the Company’s efforts

expanded its presence from Texas to Florida, including expanding into the Dallas, Texas market, and enhancing its presence in South Louisiana, South Florida, and Memphis, Tennessee. The Company has also diversified its product growth over the past

year with additional investments in its retail and small business loan portfolios. This diversification of loan growth between commercial, retail, and small business loans has helped to limit the Company’s exposure to concentrations in certain

markets, industries, and customers. |

| |

• |

|

The Company experienced loan and deposit growth from multiple markets and products: |

| |

• |

|

For the year, legacy loans grew 17%, while the mix of legacy loans moved to 72% commercial, 22% consumer, and 6% mortgage. Of the $1.4 billion in legacy loan growth, 70%, or $961 million, was a result of commercial loan

growth, including $232 million in small business growth, while $419 million was from the Company’s consumer and mortgage loan portfolios. Of the Company’s 21 primary markets, 18 experienced loan growth during the year, led by Houston, New

Orleans, Acadiana and Dallas. |

| |

• |

|

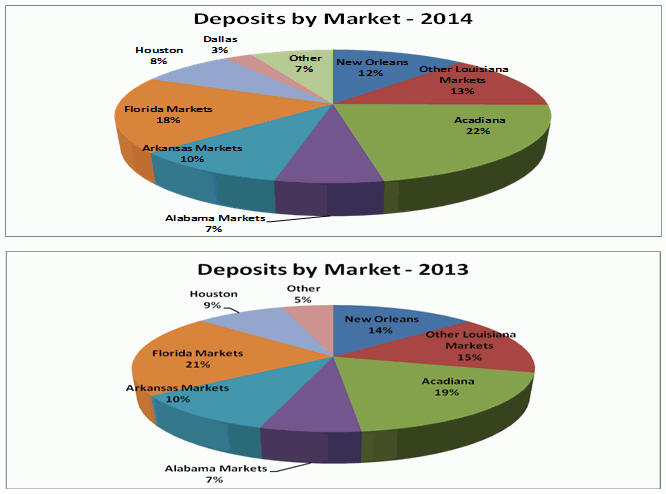

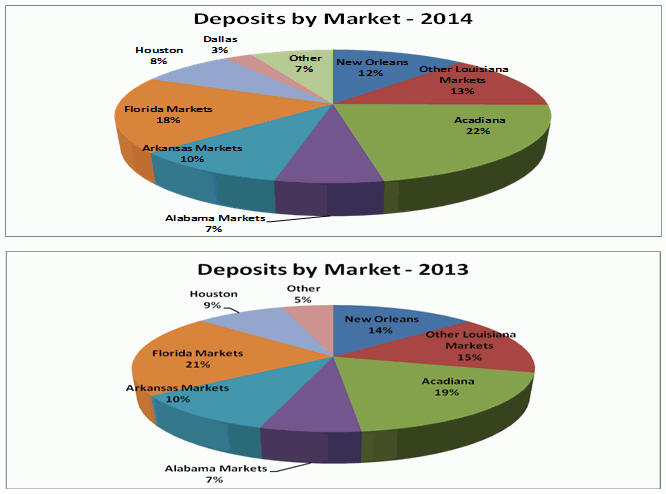

Total deposits grew $1.8 billion, or 17%, during 2014, with $619 million, or 24%, growth in non-interest bearing deposits. Non-interest bearing deposits increased to 26% of total deposits at December 31, 2014, up

from 24% at December 31, 2013. Of the Company’s 21 primary markets, 17 had deposit growth in 2014, led by Acadiana, Houston, Memphis, Dallas, and Huntsville. |

3

| |

• |

|

The Company’s overall asset quality improved, continuing a multi-year trend, despite general economic conditions and a decrease in energy commodity prices toward the end of 2014: |

| |

• |

|

Over the past five years, nonperforming assets in the Company’s legacy loan portfolio have decreased from 1.14% to 0.37% of total legacy loans, while total nonperforming assets have decreased 50 basis points to

0.41% of total assets over the same period. |

During 2014, the Company continued to execute its business model successfully, as evidenced by

solid organic loan growth during the year, despite the challenges of the current operating environment, which include the ever-changing regulatory environment, increased competition, and continued interest rate pressure.

Acquisition Activity

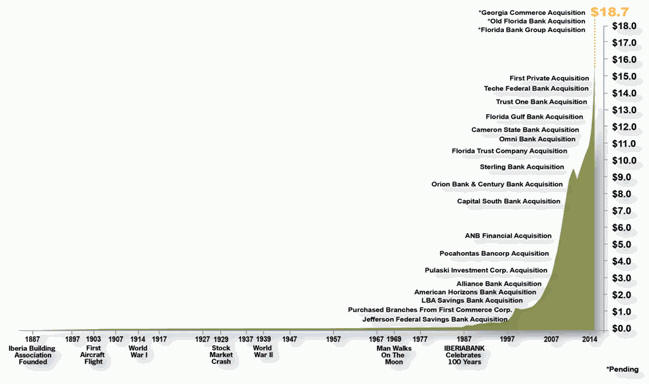

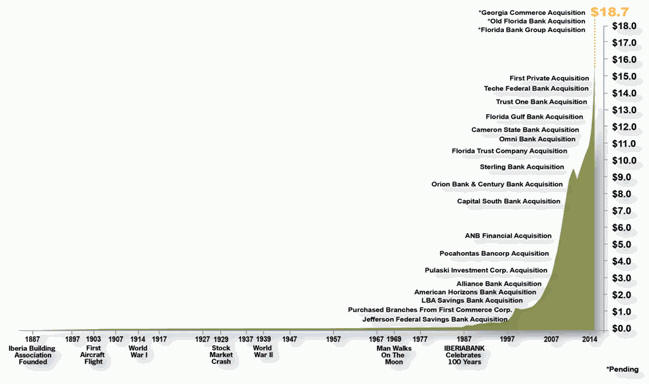

Over the past 15 years, the

Company’s growth has included growth from targeted acquisitions the Company determined would provide additional value to existing shareholders and be a strong strategic fit with the Company. The following diagram shows the Company’s growth

in total assets (dollars are in billions) since its inception.

4

From 2009 through 2014, the Company completed the following acquisitions, presented with selected assets and

liabilities acquired and intangible assets created for each acquisition:

TABLE 2—SUMMARY OF ACQUISITION ACTIVITY FROM 2009 TO 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in millions) |

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition |

|

Acquisition

Date |

|

|

Tangible

Assets

Acquired |

|

|

Total

Loans

Acquired |

|

|

Total

Deposits

Acquired |

|

|

Goodwill |

|

|

Other

Intangible

Assets |

|

| CapitalSouth Bank |

|

|

2009 |

|

|

$ |

610.7 |

|

|

$ |

363.1 |

|

|

$ |

517.9 |

|

|

$ |

— |

|

|

$ |

0.4 |

|

| Orion Bank |

|

|

2009 |

|

|

|

2,377.3 |

|

|

|

961.1 |

|

|

|

1,883.1 |

|

|

|

— |

|

|

|

10.4 |

|

| Century Bank, FSB |

|

|

2009 |

|

|

|

812.0 |

|

|

|

417.6 |

|

|

|

615.8 |

|

|

|

— |

|

|

|

2.2 |

|

| Sterling Bank |

|

|

2010 |

|

|

|

305.5 |

|

|

|

151.3 |

|

|

|

287.0 |

|

|

|

7.1 |

|

|

|

1.6 |

|

| OMNI BANCSHARES, Inc. |

|

|

2011 |

|

|

|

680.7 |

|

|

|

441.4 |

|

|

|

635.6 |

|

|

|

63.8 |

|

|

|

0.8 |

|

| Cameron Bancshares, Inc. |

|

|

2011 |

|

|

|

685.0 |

|

|

|

382.1 |

|

|

|

567.3 |

|

|

|

71.4 |

|

|

|

5.2 |

|

| Florida Trust Company |

|

|

2011 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.1 |

|

|

|

1.3 |

|

| Florida Gulf Bancorp, Inc. |

|

|

2012 |

|

|

|

307.3 |

|

|

|

215.8 |

|

|

|

286.0 |

|

|

|

32.4 |

|

|

|

— |

|

| Trust One Bank - Memphis Operations |

|

|

2014 |

|

|

|

181.9 |

|

|

|

86.5 |

|

|

|

191.3 |

|

|

|

8.6 |

|

|

|

2.6 |

|

| Teche Holding Company |

|

|

2014 |

|

|

|

870.1 |

|

|

|

700.5 |

|

|

|

639.6 |

|

|

|

80.4 |

|

|

|

7.4 |

|

| First Private Holdings, Inc. |

|

|

2014 |

|

|

|

351.4 |

|

|

|

299.3 |

|

|

|

312.3 |

|

|

|

26.3 |

|

|

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Acquisitions, 2009-2014 |

|

|

|

|

|

$ |

7,181.9 |

|

|

$ |

4,018.7 |

|

|

$ |

5,935.9 |

|

|

$ |

290.1 |

|

|

$ |

32.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In addition, during 2014, the Company’s subsidiary, LTC, acquired certain assets from The Title Company, LLC, a title

office in Baton Rouge, Louisiana, and Louisiana Abstract and Title, LLC, a title office in Shreveport, Louisiana. These two acquisitions were immaterial and the assets recognized were primarily from goodwill and additional intangible assets.

During the fourth quarter of 2014, the Company also announced three additional acquisitions that are expected to close in 2015. The Company announced the

signing of a definitive agreement to acquire Florida Bank Group, which will expand the Company’s presence to the Tampa, Florida MSA and extend it into Tallahassee and Jacksonville, Florida. Additionally, the Company signed a definitive

agreement to acquire Old Florida, which will expand the Company’s presence into the Orlando, Florida MSA.

Lastly, the Company signed a definitive

agreement to acquire Georgia Commerce, which will expand the Company’s presence into the Atlanta, Georgia MSA. With the completion of the Georgia Commerce acquisition, the Company will serve all five of the largest MSAs in the southeastern

United States and have a meaningful presence in 10 of the 20 largest MSAs in the region. The Florida Bank Group, Old Florida, and Georgia Commerce acquisitions are subject to customary closing conditions, including the receipt of required regulatory

approvals and the approval of the acquired companies’ shareholders.

5

The Company believes these acquisitions, as well as a continued focus on high quality organic growth, improvements in

operating efficiency, and development of fee-based businesses, will allow the Company to achieve its long-term objectives into 2015 and continue to improve long-term shareholder value.

6

FINANCIAL OVERVIEW

Selected consolidated financial and other data for the past five years is shown in the following tables.

TABLE 3—SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 vs. 2013 |

|

| (Dollars in thousands, except per share data) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

|

$ Change |

|

|

% Change |

|

| Income Statement Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

$ |

504,815 |

|

|

$ |

437,197 |

|

|

$ |

445,200 |

|

|

$ |

420,327 |

|

|

$ |

396,371 |

|

|

$ |

67,618 |

|

|

|

15 |

% |

| Interest expense |

|

|

44,704 |

|

|

|

46,953 |

|

|

|

63,450 |

|

|

|

82,069 |

|

|

|

114,744 |

|

|

|

(2,249 |

) |

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

460,111 |

|

|

|

390,244 |

|

|

|

381,750 |

|

|

|

338,258 |

|

|

|

281,627 |

|

|

|

69,867 |

|

|

|

18 |

|

| Provision for loan losses |

|

|

19,060 |

|

|

|

5,145 |

|

|

|

20,671 |

|

|

|

25,867 |

|

|

|

42,451 |

|

|

|

13,915 |

|

|

|

270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income after provision for loan losses |

|

|

441,051 |

|

|

|

385,099 |

|

|

|

361,079 |

|

|

|

312,391 |

|

|

|

239,176 |

|

|

|

55,952 |

|

|

|

15 |

|

| Non-interest income |

|

|

173,628 |

|

|

|

168,958 |

|

|

|

175,997 |

|

|

|

131,859 |

|

|

|

133,890 |

|

|

|

4,670 |

|

|

|

3 |

|

| Non-interest expense |

|

|

474,479 |

|

|

|

473,085 |

|

|

|

432,185 |

|

|

|

373,731 |

|

|

|

304,249 |

|

|

|

1,394 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

140,200 |

|

|

|

80,972 |

|

|

|

104,891 |

|

|

|

70,519 |

|

|

|

68,817 |

|

|

|

59,228 |

|

|

|

73 |

|

| Income taxes |

|

|

34,750 |

|

|

|

15,869 |

|

|

|

28,496 |

|

|

|

16,981 |

|

|

|

19,991 |

|

|

|

18,881 |

|

|

|

119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

105,450 |

|

|

|

65,103 |

|

|

|

76,395 |

|

|

|

53,538 |

|

|

|

48,826 |

|

|

|

40,347 |

|

|

|

62 |

|

| Earnings per share – basic |

|

|

3.32 |

|

|

|

2.20 |

|

|

|

2.59 |

|

|

|

1.88 |

|

|

|

1.90 |

|

|

|

1.12 |

|

|

|

51 |

|

| Earnings per share – diluted |

|

|

3.30 |

|

|

|

2.20 |

|

|

|

2.59 |

|

|

|

1.87 |

|

|

|

1.88 |

|

|

|

1.10 |

|

|

|

50 |

|

| Cash dividends per share |

|

|

1.36 |

|

|

|

1.36 |

|

|

|

1.36 |

|

|

|

1.36 |

|

|

|

1.36 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31 |

|

|

|

|

|

|

|

| (Dollars in thousands, except per

share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 vs. 2013 |

|

| |

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

|

$ Change |

|

|

% Change |

|

| Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

15,758,605 |

|

|

$ |

13,365,550 |

|

|

$ |

13,129,678 |

|

|

$ |

11,757,928 |

|

|

$ |

10,026,766 |

|

|

$ |

2,393,055 |

|

|

|

18 |

% |

| Cash and cash equivalents |

|

|

548,095 |

|

|

|

391,396 |

|

|

|

970,977 |

|

|

|

573,296 |

|

|

|

337,778 |

|

|

|

156,699 |

|

|

|

40 |

|

| Loans, net of unearned income |

|

|

11,441,044 |

|

|

|

9,492,019 |

|

|

|

8,498,580 |

|

|

|

7,388,037 |

|

|

|

6,035,332 |

|

|

|

1,949,025 |

|

|

|

21 |

|

| Investment securities |

|

|

2,275,813 |

|

|

|

2,090,906 |

|

|

|

1,950,066 |

|

|

|

1,997,969 |

|

|

|

2,019,814 |

|

|

|

184,908 |

|

|

|

9 |

|

| Goodwill and other intangible assets, net |

|

|

548,130 |

|

|

|

425,442 |

|

|

|

429,584 |

|

|

|

401,888 |

|

|

|

263,925 |

|

|

|

122,688 |

|

|

|

29 |

|

| Deposits |

|

|

12,520,525 |

|

|

|

10,737,000 |

|

|

|

10,748,277 |

|

|

|

9,289,013 |

|

|

|

7,915,106 |

|

|

|

1,783,526 |

|

|

|

17 |

|

| Borrowings |

|

|

1,248,996 |

|

|

|

961,043 |

|

|

|

726,422 |

|

|

|

848,276 |

|

|

|

652,579 |

|

|

|

287,953 |

|

|

|

30 |

|

| Shareholders’ equity |

|

|

1,852,849 |

|

|

|

1,530,979 |

|

|

|

1,529,868 |

|

|

|

1,482,661 |

|

|

|

1,303,457 |

|

|

|

321,869 |

|

|

|

21 |

|

| Book value per share (2) |

|

|

55.39 |

|

|

|

51.40 |

|

|

|

51.88 |

|

|

|

50.48 |

|

|

|

48.50 |

|

|

|

3.99 |

|

|

|

8 |

|

| Tangible book value per share (2) (4) |

|

|

39.11 |

|

|

|

37.17 |

|

|

|

37.34 |

|

|

|

36.80 |

|

|

|

38.68 |

|

|

|

1.94 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of and For the Years Ended December 31 |

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| Key Ratios (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.72 |

% |

|

|

0.50 |

% |

|

|

0.63 |

% |

|

|

0.49 |

% |

|

|

0.47 |

% |

| Return on average common equity |

|

|

6.17 |

|

|

|

4.26 |

|

|

|

5.05 |

|

|

|

3.77 |

|

|

|

3.91 |

|

| Return on average tangible common equity (4) |

|

|

9.05 |

|

|

|

6.20 |

|

|

|

7.21 |

|

|

|

5.30 |

|

|

|

5.27 |

|

| Equity to assets at end of period |

|

|

11.76 |

|

|

|

11.45 |

|

|

|

11.65 |

|

|

|

12.61 |

|

|

|

13.00 |

|

| Earning assets to interest-bearing liabilities at end of period |

|

|

135.15 |

|

|

|

132.74 |

|

|

|

127.62 |

|

|

|

121.74 |

|

|

|

119.27 |

|

| Interest rate spread (5) |

|

|

3.40 |

|

|

|

3.26 |

|

|

|

3.43 |

|

|

|

3.34 |

|

|

|

2.84 |

|

| Net interest margin (TE) (5) (6) |

|

|

3.51 |

|

|

|

3.38 |

|

|

|

3.58 |

|

|

|

3.51 |

|

|

|

3.05 |

|

| Non-interest expense to average assets |

|

|

3.24 |

|

|

|

3.64 |

|

|

|

3.57 |

|

|

|

3.43 |

|

|

|

2.95 |

|

| Efficiency ratio (7) |

|

|

74.87 |

|

|

|

84.60 |

|

|

|

77.49 |

|

|

|

79.50 |

|

|

|

73.22 |

|

| Tangible efficiency ratio (TE) (Non-GAAP) (6) (7) |

|

|

72.63 |

|

|

|

82.08 |

|

|

|

74.91 |

|

|

|

76.71 |

|

|

|

70.43 |

|

| Common stock dividend payout ratio |

|

|

42.03 |

|

|

|

62.11 |

|

|

|

52.50 |

|

|

|

73.61 |

|

|

|

74.75 |

|

| Asset Quality Data (Legacy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming assets to total assets at end of period (8) |

|

|

0.41 |

% |

|

|

0.61 |

% |

|

|

0.69 |

% |

|

|

0.86 |

% |

|

|

0.91 |

% |

| Allowance for credit losses to nonperforming loans at end of period (8) |

|

|

246.26 |

|

|

|

175.35 |

|

|

|

150.57 |

|

|

|

132.98 |

|

|

|

122.59 |

|

| Allowance for credit losses to total loans at end of period |

|

|

0.91 |

|

|

|

0.95 |

|

|

|

1.10 |

|

|

|

1.40 |

|

|

|

1.40 |

|

| Consolidated Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

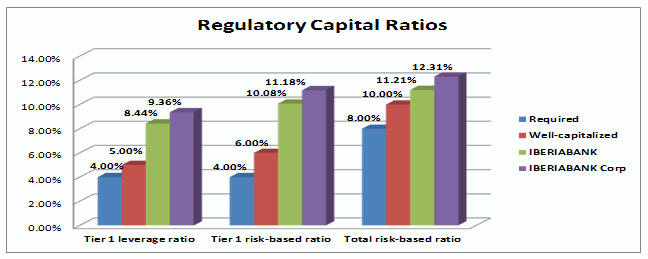

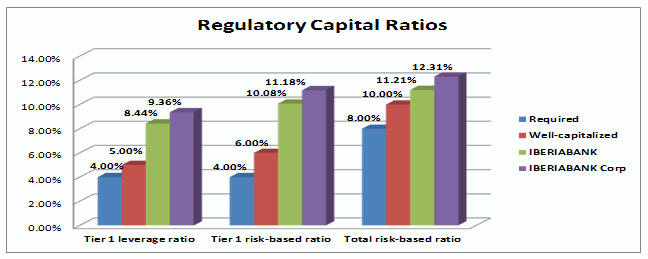

| Tier 1 leverage capital ratio |

|

|

9.36 |

% |

|

|

9.70 |

% |

|

|

9.70 |

% |

|

|

10.45 |

% |

|

|

11.24 |

% |

| Tier 1 risk-based capital ratio |

|

|

11.18 |

|

|

|

11.57 |

|

|

|

12.92 |

|

|

|

14.94 |

|

|

|

18.48 |

|

| Total risk-based capital ratio |

|

|

12.31 |

|

|

|

12.82 |

|

|

|

14.19 |

|

|

|

16.20 |

|

|

|

19.74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

2010 Balance Sheet, Income Statement, and Asset Quality Data, as well as Key Ratios and Consolidated Capital Ratios, are impacted by the Company’s acquisition of

Sterling on July 23, 2010. 2011 data is impacted by the Company’s acquisitions of OMNI and Cameron on May 31, 2011 and FTC on June 14, 2011. 2012 data is impacted by the Company’s acquisition of Florida Gulf on July 31,

2012. 2014 data is impacted by the Company’s acquisitions of certain assets and liabilities of the Trust One - Memphis on January 17, 2014, Teche on May 31, 2014, and First Private on June 30, 2014. |

| (2) |

Shares used for book value purposes are net of shares held in treasury at the end of the period. |

| (3) |

With the exception of end-of-period ratios, all ratios are based on average daily balances during the respective periods. |

| (4) |

Tangible calculations eliminate the effect of goodwill and acquisition-related intangible assets and the corresponding amortization expense on a tax-effected basis where applicable. |

| (5) |

Interest rate spread represents the difference between the weighted average yield on earning assets and the weighted average cost of interest-bearing liabilities. Net interest margin represents net interest income as a

percentage of average net earning assets. |

| (6) |

Fully taxable equivalent (TE) calculations include the tax benefit associated with related income sources that are tax-exempt using a marginal tax rate of 35%. |

| (7) |

The efficiency ratio represents noninterest expense as a percentage of total revenues. Total revenues are the sum of net interest income and noninterest income. |

| (8) |

Nonperforming loans consist of nonaccruing loans and loans 90 days or more past due. Nonperforming assets consist of nonperforming loans and repossessed assets. |

8

The Company’s net income available to common shareholders for the year ended December 31, 2014 totaled

$105 million, or $3.30 per diluted share, compared to $65 million, or $2.20 per diluted share, for 2013. On an operating basis (non-GAAP), per share earnings were $3.73 per share, up $0.61 from the $3.12 in operating earnings per share in 2013. Key

components of the Company’s 2014 performance are summarized below.

| |

• |

|

Net interest income increased $70 million, or 18%, in 2014 when compared to 2013, a result of a $68 million, or 15%, increase in interest income and a $2 million decrease in interest expense. Interest income was

positively affected by a $1.5 billion increase in average earning assets, due to both the addition of acquired earning assets in the current year and the organic growth in loans since December 31, 2013, and a seven basis point increase in the

yield on earning assets. Compared to 2013, the Company’s net interest margin ratio on a tax-equivalent basis increased 13 basis points to 3.51% from 3.38% due to changes in the volume and mix of the Company’s assets and liabilities as well

as rate decreases driven by federal funds, Treasury, and other Company borrowing rate decreases during 2014. |

| |

• |

|

The Company recorded a provision for loan losses of $19 million in 2014, $14 million higher than the provision recorded in 2013. The provision was impacted by loan growth during the period, but was tempered by an

overall improvement in the Company’s asset quality, especially in its legacy portfolio. The improvement in asset quality from December 31, 2013 has offset the need for a higher allowance for loan losses as a result of loan growth in 2014.

As of December 31, 2014, the allowance for loan losses as a percent of total loans was 1.14% compared to 1.51% at December 31, 2013. |

| |

• |

|

Non-interest income increased $5 million, or 3%, when compared to 2013, a result of a $7 million increase in service charges, a $3 million increase in ATM/debit card fee income, $4 million in income from BOLI, and a $2

million increase in broker commissions. These increases were partially offset by a $12 million decrease in mortgage income from 2013. |

| |

• |

|

From 2013 to 2014, non-interest expense increased $1 million, or less than 1%, while operating non-interest expenses increased $17 million, or 4%. The increase in operating non-interest expense was attributable

primarily to the Company’s growth over the past twelve months, including higher salary and employee benefit costs of $14 million and increased occupancy and equipment and other branch expenses resulting from the Company’s expanded

footprint. |

| |

• |

|

The Company paid a quarterly cash dividend of $0.34 per common share in each quarter of 2014, resulting in dividends of $1.36 for the year-to-date period. These amounts were consistent with the dividends paid in 2013

and 2012. |

| |

• |

|

Total assets at December 31, 2014 were $15.8 billion, up $2.4 billion, or 18%, from December 31, 2013. Legacy loan growth of $1.4 billion across many of the Company’s markets, net increases to acquired

loans of $844 million, and $185 million in additional investment securities drove the increase in total assets. Offsetting these increases were decreases in covered assets and the receivables associated with the indemnification agreements with the

FDIC. Due to the amortization and impairment of the FDIC loss share receivables, as well as cash receipts from the FDIC, the balances decreased $93 million, or 57%, since December 31, 2013, and covered loans decreased $275 million since the end

of 2013. |

| |

• |

|

Total loans net of unearned income at December 31, 2014 were $11.4 billion, an increase of $1.9 billion, or 21%, from December 31, 2013. As noted above, loan growth during 2014 was driven by a 25% increase in

non-covered loans. Covered loans decreased 38% from December 31, 2013, as covered loans were paid down or charged-off and submitted for reimbursement and the loss share coverage period for certain non-single family covered loans expired.

|

| |

• |

|

Total customer deposits increased $1.8 billion, or 17%, to $12.5 billion at December 31, 2014. Non-interest-bearing deposits increased $619 million, or 24%, while interest-bearing deposits increased $1.2 billion,

or 14%. Although deposit competition remained intense, the Company was able to generate growth across many of its deposit products. |

| |

• |

|

Shareholders’ equity increased $322 million, or 21% from year-end 2013. The increase was primarily driven by 3.3 million common shares issued in the Teche and First Private acquisitions, which resulted in

additional equity of $215 million, as well as undistributed net income of $61 million and a $24 million increase in accumulated other comprehensive income (net of tax), a result of the change in the unrealized gain in the Company’s available

for sale investment portfolio at the end of 2014. |

The discussion and analysis included herein contains financial information determined by

methods other than in accordance with GAAP. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance. These measures typically adjust GAAP performance measures to exclude the effects of

the amortization of intangibles and include the tax benefit associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain significant activities or transactions that, in management’s

opinion can distort period-to-period comparisons of the Company’s performance. Since the presentation of these GAAP performance measures and their impact differ between companies, management believes presentations of these non-GAAP financial

measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results

determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP disclosures are included in the table below.

9

TABLE 4—RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| (Dollars in thousands, except per

share amounts) |

|

Pre-tax |

|

|

After-tax |

|

|

Per

share (1) |

|

|

Pre-tax |

|

|

After-tax |

|

|

Per

share (1) |

|

|

Pre-tax |

|

|

After-tax |

|

|

Per

share (1) |

|

| Net income (loss) (GAAP) |

|

$ |

140,200 |

|

|

$ |

105,450 |

|

|

$ |

3.30 |

|

|

$ |

80,972 |

|

|

$ |

65,103 |

|

|

$ |

2.20 |

|

|

$ |

104,891 |

|

|

$ |

76,395 |

|

|

$ |

2.59 |

|

| Non-interest and other expense adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merger-related expenses |

|

|

15,093 |

|

|

|

10,104 |

|

|

|

0.32 |

|

|

|

783 |

|

|

|

509 |

|

|

|

0.02 |

|

|

|

5,123 |

|

|

|

3,330 |

|

|

|

0.10 |

|

| Severance expenses |

|

|

6,951 |

|

|

|

4,518 |

|

|

|

0.14 |

|

|

|

2,538 |

|

|

|

1,649 |

|

|

|

0.05 |

|

|

|

2,355 |

|

|

|

1,530 |

|

|

|

0.05 |

|

| (Gain) Loss on sale of long-lived assets, net of impairment |

|

|

7,073 |

|

|

|

4,597 |

|

|

|

0.14 |

|

|

|

37,183 |

|

|

|

24,169 |

|

|

|

0.81 |

|

|

|

2,902 |

|

|

|

1,886 |

|

|

|

0.05 |

|

| Debt prepayment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,307 |

|

|

|

1,500 |

|

|

|

0.05 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| (Reversal of) Provision for FDIC clawback liability |

|

|

(797 |

) |

|

|

(518 |

) |

|

|

(0.02 |

) |

|

|

797 |

|

|

|

518 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Other non-operating non-interest expense |

|

|

200 |

|

|

|

130 |

|

|

|

0.01 |

|

|

|

934 |

|

|

|

607 |

|

|

|

0.01 |

|

|

|

3,631 |

|

|

|

2,360 |

|

|

|

0.08 |

|

| Income tax benefits |

|

|

— |

|

|

|

(2,959 |

) |

|

|

(0.09 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-operating expenses |

|

|

28,520 |

|

|

|

15,872 |

|

|

|

0.50 |

|

|

|

44,542 |

|

|

|

28,952 |

|

|

|

0.97 |

|

|

|

14,011 |

|

|

|

9,106 |

|

|

|

0.28 |

|

| Non-interest income adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Gain) loss on sale of investments, net |

|

|

(773 |

) |

|

|

(502 |

) |

|

|

(0.01 |

) |

|

|

(2,334 |

) |

|

|

(1,517 |

) |

|

|

(0.05 |

) |

|

|

(3,775 |

) |

|

|

(2,453 |

) |

|

|

(0.08 |

) |

| Other non-interest income |

|

|

(1,984 |

) |

|

|

(1,817 |

) |

|

|

(0.06 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,196 |

) |

|

|

(1,427 |

) |

|

|

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-operating income |

|

|

(2,757 |

) |

|

|

(2,319 |

) |

|

|

(0.07 |

) |

|

|

(2,334 |

) |

|

|

(1,517 |

) |

|

|

(0.05 |

) |

|

|

(5,971 |

) |

|

|

(3,880 |

) |

|

|

(0.13 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings (non-GAAP) |

|

|

165,963 |

|

|

|

119,003 |

|

|

|

3.73 |

|

|

|

123,180 |

|

|

|

92,538 |

|

|

|

3.12 |

|

|

|

112,931 |

|

|

|

81,621 |

|

|

|

2.74 |

|

| Provision for (Reversal of) covered and acquired loan losses |

|

|

6,018 |

|

|

|

3,912 |

|

|

|

0.12 |

|

|

|

(786 |

) |

|

|

(511 |

) |

|

|

(0.02 |

) |

|

|

16,867 |

|

|

|

10,964 |

|

|

|

0.37 |

|

| Other provision for loan losses |

|

|

13,042 |

|

|

|

8,477 |

|

|

|

0.27 |

|

|

|

5,932 |

|

|

|

3,856 |

|

|

|

0.13 |

|

|

|

3,804 |

|

|

|

2,472 |

|

|

|

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-provision operating earnings (non-GAAP) |

|

$ |

185,023 |

|

|

$ |

131,392 |

|

|

$ |

4.12 |

|

|

$ |

128,326 |

|

|

$ |

95,883 |

|

|

$ |

3.23 |

|

|

$ |

133,602 |

|

|

$ |

95,057 |

|

|

$ |

3.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Diluted per share amounts may not appear to foot due to rounding. |

| (2) |

After-tax amounts computed using a marginal tax rate of 35%. |

10

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in thousands) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Net interest income (GAAP) |

|

$ |

460,111 |

|

|

$ |

390,244 |

|

|

$ |

381,750 |

|

| Add: Effect of tax benefit on interest income |

|

|

8,609 |

|

|

|

9,452 |

|

|

|

9,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income (TE) (Non-GAAP) |

|

$ |

468,720 |

|

|

$ |

399,696 |

|

|

$ |

391,409 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest income (GAAP) |

|

$ |

173,628 |

|

|

$ |

168,958 |

|

|

$ |

175,997 |

|

| Add: Effect of tax benefit on non-interest income |

|

|

2,947 |

|

|

|

1,964 |

|

|

|

1,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest income (TE) (Non-GAAP) |

|

$ |

176,575 |

|

|

$ |

170,922 |

|

|

$ |

177,978 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest expense (GAAP) |

|

$ |

474,479 |

|

|

$ |

473,085 |

|

|

$ |

432,185 |

|

| Less: Intangible amortization expense |

|

|

5,807 |

|

|

|

4,720 |

|

|

|

5,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible non-interest expense (Non-GAAP) |

|

$ |

468,672 |

|

|

$ |

468,365 |

|

|

$ |

427,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (GAAP) |

|

$ |

105,450 |

|

|

$ |

65,103 |

|

|

$ |

76,395 |

|

| Add: Effect of intangible amortization, net of tax |

|

|

3,775 |

|

|

|

3,068 |

|

|

|

3,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash earnings (Non-GAAP) |

|

$ |

109,225 |

|

|

$ |

68,171 |

|

|

$ |

79,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets (GAAP) |

|

$ |

15,758,605 |

|

|

$ |

13,365,550 |

|

|

$ |

13,129,678 |

|

| Less: Intangible assets, net |

|

|

548,130 |

|

|

|

425,442 |

|

|

|

429,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total tangible assets (Non-GAAP) |

|

$ |

15,210,475 |

|

|

$ |

12,940,108 |

|

|

$ |

12,700,094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets (Non-GAAP) |

|

$ |

14,632,685 |

|

|

$ |

13,003,988 |

|

|

$ |

12,096,972 |

|

| Less: Average intangible assets, net |

|

|

501,770 |

|

|

|

427,485 |

|

|

|

407,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total average tangible assets (Non-GAAP) |

|

$ |

14,130,915 |

|

|

$ |

12,576,503 |

|

|

$ |

11,689,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity (GAAP) |

|

$ |

1,852,849 |

|

|

$ |

1,530,979 |

|

|

$ |

1,529,868 |

|

| Less: intangible assets, net |

|

|

548,130 |

|

|

|

425,442 |

|

|

|

429,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total tangible shareholders’ equity (Non-GAAP) |

|

$ |

1,304,719 |

|

|

$ |

1,105,537 |

|

|

$ |

1,100,284 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average shareholders’ equity (Non-GAAP) |

|

$ |

1,708,051 |

|

|

$ |

1,527,193 |

|

|

$ |

1,513,517 |

|

| Less: Average intangible assets, net |

|

|

501,770 |

|

|

|

427,485 |

|

|

|

407,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average tangible shareholders’ equity (Non-GAAP) |

|

$ |

1,206,281 |

|

|

$ |

1,099,708 |

|

|

$ |

1,105,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average equity (GAAP) |

|

|

6.17 |

% |

|

|

4.26 |

% |

|

|

5.05 |

% |

| Add: Effect of intangibles |

|

|

2.87 |

|

|

|

1.94 |

|

|

|

2.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average tangible common equity (Non-GAAP) |

|

|

9.04 |

% |

|

|

6.20 |

% |

|

|

7.21 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio (GAAP) |

|

|

74.9 |

% |

|

|

84.6 |

% |

|

|

77.5 |

% |

| Less: Effect of tax benefit related to tax-exempt income |

|

|

1.4 |

|

|

|

1.7 |

|

|

|

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio (TE) (Non-GAAP) |

|

|

73.5 |

|

|

|

82.9 |

|

|

|

75.9 |

|

| Less: Effect of amortization of intangibles |

|

|

0.9 |

|

|

|

0.8 |

|

|

|

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible efficiency ratio (TE) (Non-GAAP) |

|

|

72.6 |

% |

|

|

82.1 |

% |

|

|

74.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Yield: |

|

|

|

|

|

|

|

|

|

|

|

|

| Earning assets average balance (GAAP) |

|

$ |

13,235,541 |

|

|

$ |

11,735,392 |

|

|

$ |

10,832,415 |

|

| Add: Adjustments |

|

|

36,620 |

|

|

|

(51,008 |

) |

|

|

(108,256 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earning assets average balance, as adjusted (Non-GAAP) |

|

$ |

13,272,161 |

|

|

$ |

11,684,384 |

|

|

$ |

10,724,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income (GAAP) |

|

$ |

460,111 |

|

|

$ |

390,244 |

|

|

$ |

381,750 |

|

| Add: Adjustments |

|

|

(12,371 |

) |

|

|

(11,092 |

) |

|

|

(44,498 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income, as adjusted (Non-GAAP) |

|

$ |

447,740 |

|

|

$ |

379,152 |

|

|

$ |

337,252 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Yield, as reported |

|

|

3.51 |

% |

|

|

3.38 |

% |

|

|

3.56 |

% |

| Add: Adjustments |

|

|

(0.10 |

) |

|

|

(0.08 |

) |

|

|

(0.37 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Yield, as adjusted (Non-GAAP) |

|

|

3.41 |

% |

|

|

3.30 |

% |

|

|

3.19 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

11

APPLICATION OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

In preparing financial reports, management is required to apply significant judgment to various accounting, reporting and disclosure matters. Management must

use assumptions and estimates to apply these principles where actual measurement is not possible or practical. The accounting principles and methods used by the Company conform with accounting principles generally accepted in the United States and

general bank accounting practices. Estimates and assumptions most significant to the Company relate primarily to the calculation of the allowance for credit losses, the accounting for acquired loans and the related FDIC loss share receivable on

covered loans, and the valuation of goodwill, intangible assets and other purchase accounting adjustments. These significant estimates and assumptions are summarized in the following discussion and are further analyzed in the footnotes to the

consolidated financial statements.

Allowance for Credit Losses (“Legacy ACL”)

The determination of the overall allowance for credit losses has two components, the allowance for legacy credit losses and the allowance for acquired credit

losses. The allowance for acquired impaired credit losses is calculated as described in the “Accounting for Acquired Loans and the Allowance for Acquired Impaired Loans” section below. The Legacy ACL, which represents management’s

estimate of probable losses inherent in the Company’s legacy loan portfolio, excluding acquired loans, involves a high degree of judgment and complexity. The Company’s policy is to establish reserves through provisions for credit losses on

the consolidated statements of comprehensive income for estimated losses on delinquent and other problem loans when it is determined that losses are expected to be incurred on such loans. Management’s determination of the appropriateness of the

Legacy ACL is based on various factors requiring judgments and estimates, including management’s evaluation of the credit quality of the portfolio (determined through the assignment of risk ratings, assessments of past due status and scores

from credit agencies), past loss experience, current economic conditions, the volume and type of lending conducted by the Company, composition of the portfolio, the amount of the Company’s classified assets, seasoning of the loan portfolio, the

status of past due principal and interest payments, and other relevant factors. Two areas in which management exercises judgment are the assessments of risk ratings on the Company’s commercial loan portfolio and the application of qualitative

adjustments to the quantitative measurements across all portfolios. Other changes in estimates included in the estimation of the allowance for credit losses may also have a significant impact on the consolidated financial statements. For further

discussion of the allowance for credit losses, see the Asset Quality and Allowance for Credit Losses sections of this analysis and Note 1 and Note 7 of the footnotes to the consolidated financial statements.

Accounting for Acquired Loans and the Allowance for Acquired Impaired Loans

The Company accounts for its acquisitions under ASC Topic No. 805, Business Combinations, which requires the use of the acquisition method of accounting.

All identifiable assets acquired, including loans, are recorded at fair value. No allowance for credit losses related to the acquired loans is recorded on the acquisition date, as the fair value of the loans acquired incorporates assumptions

regarding credit risk. Loans acquired are recorded on the acquisition date at fair value in accordance with the fair value methodology prescribed in ASC Topic No. 820, Fair Value Measurement, and in the case of covered loans excludes the

shared-loss agreements with the FDIC. These fair value estimates associated with acquired loans include estimates related to market interest rates and undiscounted projections of future cash flows that incorporate expectations of prepayments and the

amount and timing of principal, interest and other cash flows, as well as any shortfalls thereof.

Acquired loans are evaluated at acquisition and

classified as purchased impaired (“acquired impaired”) or purchased non-impaired (“acquired non-impaired”). Acquired impaired loans exhibit (in management’s judgment) credit deterioration since origination to the extent that

it is expected at the time of acquisition that the Company will be unable to collect all contractually required payments and include all covered loans. All other acquired loans are classified as acquired non-impaired.

Over the life of the acquired impaired loans, the Company continues to estimate the amount and timing of cash flows expected to be collected on individual

loans or on pools of loans sharing common risk characteristics. These expected cash flow estimates are updated for new information on a quarterly basis. Once cash flow estimates are updated, the Company evaluates whether the present value of these

cash flows, determined using effective interest rates, have decreased and if so, recognizes provisions for credit losses in its consolidated statement of comprehensive income. For any increases in cash flows expected to be collected, the Company

adjusts the amount of accretable yield recognized on a prospective basis over the respective loan’s or pool’s remaining life.

The allowance for

credit losses for acquired non-impaired loans is calculated similarly to the Legacy ACL.

Because the FDIC reimburses the Company for losses on certain

covered loans acquired in 2009 and 2010, indemnification assets were recorded at fair value as of the acquisition dates. The initial values of the indemnification assets were based on estimated cash flows to be received over the expected life of the

acquired assets, not to exceed the term of the indemnification agreements. The loss sharing term of the Company’s commercial and single family residential indemnification agreements are five years and ten years, respectively, from the date of

acquisition.

12

Because the indemnification assets are measured on the same basis as the indemnified loans, subject to

contractual and collectability limitations, the indemnification assets are impacted by changes in expected cash flows on covered assets. Increases in credit losses expected to occur within the loss share term are recorded as current period increases

to the allowance for credit losses and increase the amount collectible from the FDIC by the applicable loss share percentage. Decreases in credit losses expected to occur within the loss share term reduce the amount collectible from the FDIC and

increase the amount collectible from customers in the form of prospective accretion. Increases in the portion of indemnification asset collectible from customers are amortized to income. Periodic amortization represents the amount that is expected

to result in symmetrical recognition of pool-level accretion and amortization over the shorter of 1) the life of the loans or 2) the life of the shared loss agreement.

The Company assesses the indemnification assets for collectability at the acquisition level based on three sources: 1) the FDIC, 2) OREO transactions, and 3)

customers. Amounts collectible from the FDIC through loss reimbursements are comprised of losses currently expected within the loss share term. For certain covered assets, loss share coverage expires in the next 12 months. At December 31, 2014,

the indemnification asset includes $20 million and $1 million related to these assets that are expected to be collected from the FDIC and OREO transactions, respectively. A current period impairment would be recorded to the extent that events or

circumstances indicate that losses previously expected to occur within the loss share term are expected to occur subsequent to loss share termination. Amounts collectible through expected gains on the sale of OREO are written-up or impaired each

period based on the best available information.

Loss assumptions used to measure the basis of the indemnified loans are consistent with the loss

assumptions used to measure the indemnification assets.

A claim receivable is established within “Other assets” on the Company’s

consolidated balance sheets when a loss is incurred and the indemnification asset is reduced when cash is received from the FDIC.

If expected loss

severities for all acquired impaired loans were to increase by 10%, the Company would recognize a gross increase to the provision for credit losses of $3 million, which would be offset by a decrease of $1 million in the FDIC loss share receivable.

Similarly, if expected loss severities for all acquired impaired loans were to decrease by 10%, the Company would recognize a gross decrease to the provision for credit losses of $1 million, which would be offset by an increase of $0.2 million in

the FDIC loss share receivable.

For further discussion of the Company’s acquisition and loan accounting, see Note 1 and Note 7 of the footnotes to

the consolidated financial statements.

Valuation of Goodwill, Intangible Assets and Other Purchase Accounting Adjustments

The Company accounts for acquisitions in accordance with ASC Topic No. 805, which requires the use of the acquisition method of accounting for business

combinations. Under this method, the Company is required to record the assets acquired, including identified intangible assets, and liabilities assumed, at their fair value, which in many instances involves estimates based on third party valuations,

such as appraisals, or internal valuations based on discounted cash flow analyses or other valuation techniques. The determination of the useful lives of intangible assets is subjective, as is the appropriate amortization period for such intangible

assets. In addition, business combinations typically result in recording goodwill.

The Company performs a goodwill evaluation at least annually. As part

of its testing, the Company first assesses qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the results of the qualitative assessment indicate

impairment, the Company determines the fair value of a reporting unit relative to its carrying amount to determine whether quantitative factors of impairment are present. When the Company determines that the fair value of the reporting unit is below

its carrying amount, the Company determines the fair value of the reporting unit’s assets and liabilities, considering deferred taxes, and then measures impairment loss by comparing the implied fair value of goodwill with the carrying amount of

that goodwill. Based on management’s assessment of the qualitative factors in its goodwill impairment test of its IBERIABANK Reporting Unit, the Company concluded that the fair value of the Company’s reporting unit was more likely than not