Exhibit 13

LETTER TO THE SHAREHOLDERS

Dear STRATTEC Shareholders,

As a company, we were not satisfied with Fiscal 2017’s performance, both from an earnings and an EVA® perspective. While making progress in certain areas, it was not reflected in our scorecard. Because our financial operating results did not reach satisfactory hurdle rates this past year, we are committed to doing better next year and there are good reasons why this should happen.

Fiscal 2017’s profits were reduced due to sizable investments in product engineering that we were making for upcoming production releases. Other impacts came from situations where we could have done better or initiatives which didn’t materialize due to factors beyond our control. For example, our 2015 investment in India was based on aggressive growth plans by our customers. Now General Motors and Ford are either pulling out or cutting back in India.

Our efforts toward diversification of technology and markets have not been successful. We originally invested in STRATTEC Advanced Logic to bring new technology to the automotive market while at the same time leveraging our aftermarket distribution system into new non-automotive markets. Fingerprint recognition technology is still promising, but the path to profitability has proved to be much more costly than planned. The business suffered from higher expenses, delayed product launches and slower than expected market acceptance. Without the impact of STRATTEC Advanced Logic, our Earnings Per Share would have been improved by over 20%.

Capital expenditures were above normal because of the construction of our new joint venture facility in Leon, Mexico plus the need for new equipment throughout our operations to support additional capacity and new product programs. We are excited about the recent completion of the construction phase of the Leon plant. It is designed to manufacture painted door handles for both existing and future customers currently in, or moving to that region. The start-up costs of building a new factory impacted us throughout Fiscal 2017. We expect these costs to continue over the next two fiscal years, but at a declining rate as we ramp up production. There has been a significant migration of automotive assembly to the central part of Mexico. Ultimately, our investment there will result in a significant increase in sales for ADAC-STRATTEC de Mexico.

ACTIONS

For Fiscal 2018, we are focused on efficiently launching new business already won, fine tuning processes, cutting marginally profitable business, reducing costs and making capital investments to insure quality and improve efficiency. We have already taken a number of actions which will have predictable and positive impacts on our profitability in 2018.

Effective July 1, we are no longer funding the losses of STRATTEC Advanced Logic. The burden of funding has been shifted to our joint venture partners who are actively trying to move the business forward.

A program is now in place to help us better understand the soft costs related to managing and producing some older products. As a result, an initiative is currently underway to phase out and/or institute substantial price increases for products which require inordinate amounts of support.

| 2017 STRATTEC Annual Report | 2 |

LETTER TO THE SHAREHOLDERS

We have recently reduced salaried headcount to better align our organization with current strategies. While it is always difficult to separate loyal and talented Associates from the company, it is an action that needed to be taken.

By realigning priorities, we have freed up talented people to work on more critical projects. A new corporate team has been created to focus on cost reduction and process improvement. It is expected to ultimately generate significant benefits to our bottom line.

After winning record amounts of new business in Fiscal Year 2016, this year we were faced with very challenging timelines for design and production. I want to thank our Associates for their efforts to satisfy our customers’ needs and expectations. However, as part of this effort, we were faced with unusually high costs of external engineering services to execute on the new business. Those high engineering costs will not have to be repeated this year as we shift from a design phase to a production phase. Instead of costing money, production will begin to benefit us with additional sales and margin.

Lastly, we restructured our organization to ensure that our design and manufacturing processes meet stricter quality standards. A comprehensive Quality Improvement Plan was developed and is currently being implemented. The benefits of those changes are now just beginning to be realized.

VAST

VAST (Vehicle Access System Technology) is a unique partnership between STRATTEC and two privately owned companies, WITTE Automotive of Velbert Germany and ADAC Automotive of Grand Rapids, Michigan. We are now in the process of re-branding ourselves as the VAST Automotive Group, which is a better description of our partnership and our global business. Our jointly owned business in China remains strong and is showing good results. We are also seeing the benefits from better coordination between VAST China and the other VAST locations throughout the world. We are pleased with the progress made by our organizations in leveraging our collective strengths, technologies and global footprint.

SUMMARY

We have already taken actions to grow our business, focus our strategies and find ways to be more cost efficient and become more profitable. I appreciate the efforts of nearly 4000 STRATTEC Associates for working hard and taking steps to create a bright future for all of us. We are committed to make Fiscal 2018 a better year and to position ourselves for continued growth in profitability.

On behalf of your Board of Directors, your management team and myself, thank you, our fellow shareholders, for your continuing support during a year of less favorable results.

Sincerely,

Frank J. Krejci

President & Chief Executive Officer

| 2017 STRATTEC Annual Report | 3 |

FINANCIAL HIGHLIGHTS

(IN MILLIONS)

| 2017 | 2016 | 2015 | |||||||||||||

|

|

|

||||||||||||||

| Net Sales |

$ | 417.3 | $ | 401.4 | $ | 411.5 | |||||||||

| Gross Profit |

60.2 | 64.8 | 72.7 | ||||||||||||

| Income from Operations |

13.7 | 20.9 | 31.1 | ||||||||||||

| Net Income Attributable to STRATTEC |

7.2 | 9.1 | 20.7 | ||||||||||||

| Total Assets |

273.7 | 242.2 | 230.8 | ||||||||||||

| Total Debt |

30.0 | 20.0 | 10.0 | ||||||||||||

| STRATTEC Shareholders’ Equity |

151.1 | 139.3 | 140.3 | ||||||||||||

ECONOMIC VALUE ADDED (EVA®)

We believe that EVA® represents an accurate measure of STRATTEC’s overall performance and shareholder value. All U.S. associates and many of our Mexico-based salaried associates participate in incentive plans that are based upon our ability to add economic value to the enterprise. The EVA® performance for 2017 was a negative $2.4 million which represents a $4.5 million reduction from 2016. (For further explanation of our EVA® Plan, see our 2017 definitive Proxy Statement.)

| Net Operating Profit After Cash-Basis Taxes |

$ | 10.5 | ||||||||

| Average Monthly Net Capital Employed |

$ | 129.1 | ||||||||

| Cost of Capital |

10% | |||||||||

|

|

|

|||||||||

| Capital Charge |

12.9 | |||||||||

|

|

|

|||||||||

| Economic Value Added |

$ | (2.4 | ) | |||||||

|

|

|

EVA® is not a traditional financial measurement under U.S. GAAP and may not be similar to EVA® calculations used by other companies. However, STRATTEC believes the reporting of EVA® provides investors with greater visibility of economic profit. The following is a reconciliation of the relevant GAAP financial measures to the non-GAAP measures used in the calculation of STRATTEC’s EVA®.

| Net Operating Profit After Cash-Basis Taxes: |

|||||

| 2017 Net Income Attributable to STRATTEC as Reported |

$ | 7.2 | |||

| Deferred Tax Provision |

1.9 | ||||

| Other |

1.4 | ||||

|

|

|

||||

| Net Operating Profit After Cash-Basis Taxes |

$ | 10.5 | |||

|

|

|

||||

| Average Monthly Net Capital Employed: |

|||||

| Total STRATTEC Shareholders’ Equity as Reported at July 2, 2017 |

$ | 151.1 | |||

| Long-Term Liabilities |

33.1 | ||||

| Long-Term Assets – Other than Property, Plant and Equipment |

(33.1 | ) | |||

| Other |

(22.6 | ) | |||

|

|

|

||||

| Net Capital Employed At July 2, 2017 |

$ | 128.5 | |||

| Impact of 12 Month Average |

0.6 | ||||

|

|

|

||||

| Average Monthly Net Capital Employed |

$ | 129.1 | |||

|

|

|

||||

EVA® is a registered trademark of Stern, Stewart & Co.

| 2017 STRATTEC Annual Report | 4 |

COMPANY DESCRIPTION

BASIC BUSINESS

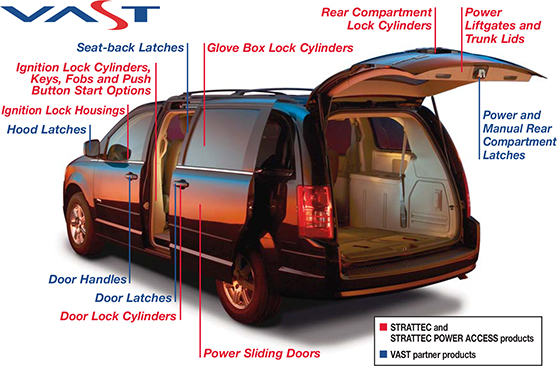

STRATTEC SECURITY CORPORATION designs, develops, manufactures and markets automotive access control products including mechanical locks and keys, electronically enhanced locks and keys, steering column and instrument panel ignition lock housings, latches, power sliding side door systems, power lift gate systems, power deck lid systems, door handles and related products for North American automotive customers. We also supply global automotive manufacturers through a unique strategic joint venture relationship with WITTE Automotive of Velbert, Germany and ADAC Automotive of Grand Rapids, Michigan called VAST Automotove Group (“VAST”). Under this relationship STRATTEC, WITTE and ADAC market each company’s products to global customers under the VAST brand name. Our products are shipped to customer locations in the United States, Canada, Mexico, Europe, South America, Korea, China and India, and we provide full service and aftermarket support.

HISTORY

The product line that became STRATTEC was part of Briggs & Stratton Corporation’s founding business in 1908. In 1995, STRATTEC was spun off from Briggs & Stratton through a tax-free distribution to the then-existing Briggs & Stratton shareholders and has been an independent public company for over twenty-two years.

Our history in the automotive security business spans almost 110 years. STRATTEC has been the world’s largest producer of automotive locks and keys since the late 1920s, and we currently maintain a dominant share of the North American markets for these products.

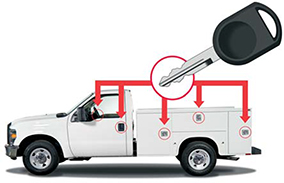

PRODUCTS

Our traditional products are lock sets (locks and keys) for cars and light trucks. Typically, two keys are provided with each vehicle lockset. Most of the vehicles we currently supply are using keys with sophisticated radio frequency identification technology for additional theft prevention. Keys with remote entry devices integrated into a single unit and bladeless electronic keys have been added to our product line and are gaining in popularity.

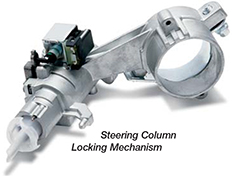

Ignition lock housings represent a growing access control product for us. These housings are the mating part for our ignition locks and typically are part of the steering column structure, although there are instrument panel-mounted versions for certain vehicle applications. These housings are either die cast from zinc or injection molded plastic and may include electronic components for theft deterrent systems.

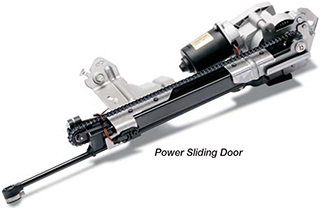

We are also developing additional access control products, including trunk latches, lift gate latches, tailgate latches, hood latches, side door latches and related hardware. With our acquisition of Delphi Corporation’s Power Products Group in fiscal 2009,we are now supplying power access devices for sliding side doors, lift gates and trunk lids. Through

| 2017 STRATTEC Annual Report | 5 |

COMPANY DESCRIPTION

a joint venture formed with ADAC Automotive during fiscal 2007, we also supply door handle components and related vehicle access hardware.

To maintain a strong focus on each of these access control products, we have Product Business Managers who oversee the product’s entire life cycle, including product concept, application, manufacturing, warranty analysis, service/aftermarket, and financial/commercial issues. The Product Business Managers work closely with our sales organization, our engineering group, and our manufacturing operations to assure their products are receiving the right amount of quality attention so that their value to STRATTEC and the market place is enhanced.

MARKETS

We are a direct supplier to OEM automotive and light truck manufacturers as well as other transportation-related manufacturers. Our largest customers are Fiat Chrysler Automobiles, General Motors Company and Ford Motor Company. Our access control product mix varies by customer, but generally our overall sales tend to be highest in lock and key, followed by power access (produced by STRATTEC Power Access), ignition lock housings, the door handle and trim components produced by ADAC-STRATTEC de Mexico and latch mechanisms.

Direct sales to various OEMs represented approximately 74% of our total sales for fiscal 2017. The remainder of our revenue is received primarily through sales to the OEM service channels, the aftermarket and Tier 1 automotive supplier customers, and sales of certain products to non-automotive commercial customers.

Sales to our major automotive customers, both OEM and Tier 1, are coordinated through direct sales personnel located in our Detroit-area office. Sales are also facilitated through daily interaction between our Program Managers, Application Engineers and other product engineering personnel. Sales to other OEM customers are accomplished through a combination of our sales personnel located in Detroit and personnel in our Milwaukee headquarters office.

The majority of our OEM products are sold in North America. While some exporting is done to Tier 1 and automotive assembly plants in Europe, Asia and South America, we are in the process of expanding our presence in these markets and elsewhere through the Vehicle Access Systems Technology LLC (VAST LLC) joint venture we jointly own with WITTE Automotive and ADAC Automotive. VAST is described in more detail on pages 8 and 9.

OEM service and replacement parts are sold to the OEM’s own service operations. In addition, we distribute our components and security products to the automotive aftermarket through approximately 50 authorized wholesale distributors, as well as other marketers and users of component parts, including export customers. Increasingly, our products find their way into the retail channel, specifically the hardware store channel. Our ability to provide a full line of keys to that channel has been accomplished through the introduction of the STRATTEC “XL” key line. This extension to our line includes keys

| 2017 STRATTEC Annual Report | 6 |

COMPANY DESCRIPTION

that we currently do not supply on an OEM basis, including keys for Toyota, Honda and other popular domestic and import vehicles. This extended line of keys enables automotive repair specialists to satisfy consumer needs for repair or replacement parts. Our aftermarket activities are serviced through a warehousing operation in El Paso, Texas.

CUSTOMER SALES FOCUS

To bring the proper focus to the relationships with our major customers, we have seven customer-focused teams, each with a Director of Sales, one or two Engineering Program Managers and various Customer Application Engineers. In addition to customer teams for General Motors, Ford and Fiat Chrysler, we currently have teams for New Domestic Vehicle Manufacturers (primarily the Japanese and Korean automotive manufactures), Driver Control/Ignition Lock Housing customers, Tier 1 customers, and Service and Aftermarket customers. Sales and engineering for ADAC-STRATTEC LLC are supported by our partner in this joint venture, ADAC Automotive.

Each Sales Director is responsible for the overall relationship between STRATTEC and a specific customer group. Program Managers are responsible for coordinating cross functional activities while managing new product programs for their customers.

PRODUCT ENGINEERING FOCUS

To best serve our customers’ product needs, STRATTEC’s engineering resources are organized into groups which focus on specific access control applications. We currently have six engineering groups: Locks and Keys, Aftermarket, Latches, Power Access Devices, Driver Control/Ignition Lock Housings and Electrical. Each group has a Product Business Manager, an Engineering Manager and a complement of skilled engineers who design and develop products for specific applications. In doing this, each engineering group works closely with the Customer teams, Engineering Program Managers, and Application Engineers.

Underlying this organization is a formalized product development process to identify and meet customer needs in the shortest possible time. By following this streamlined development system, we shorten product lead times, tighten our response to market changes and provide our customers with the optimum value solution to their security/access control requirements. STRATTEC is also ISO/TS 16949 and ISO 14001 certified. This means we embrace the philosophy that quality should exist not only in the finished product, but in every step of our processes as well.

| 2017 STRATTEC Annual Report | 7 |

COMPANY DESCRIPTION

OPERATIONS

A significant number of the components that go into our products are manufactured at our headquarters in Milwaukee, Wisconsin. This facility produces zinc die cast components, stampings and milled key blades. We have three owned production facilities currently in operation in Juarez, Mexico operating as STRATTEC de Mexico. Plant No. 1 houses assembly operations for locksets and ignition lock housings. Plant No. 2 was built during fiscal 2009 to replace a leased facility. It houses our key finishing and plastic injection molding operations, as well as dedicated space for the assembly operations of ADAC-STRATTEC de Mexico. Plant No. 3 was purchased in fiscal 2015 and houses both latch and power access assembly operations for STRATTEC Power Access de Mexico. Plant No. 4 is currently under construction in Leon, Mexico and will house our custom paint system for door handles and assembly for ADAC-STRATTEC de Mexico. This facility is planned to be operational during the first quarter of fiscal year 2018.

ADVANCED DEVELOPMENT

Research and development activities are centered around a dedicated research engineering staff we call our Advanced Development Group. This group has the responsibility for developing future products that will keep us in the forefront of the markets we serve. We primarily focus on electronic and mechanical access control products and modularization of related access/security control components. Once our Advanced Development Group establishes a proof-of-concept product utilizing new technology, any further product development is then shifted to our engineering groups for commercialization and product applications.

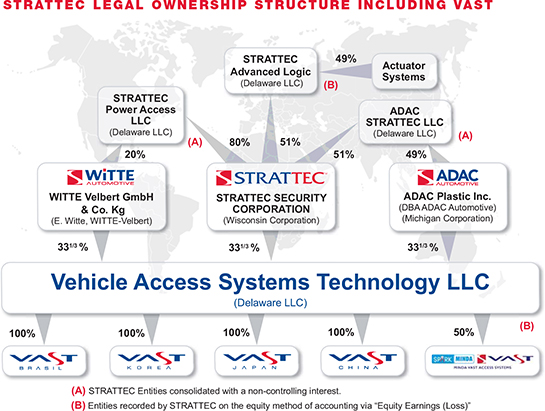

VEHICLE ACCESS SYSTEMS TECHNOLOGY LLC (VAST)

In fiscal 2001, we entered into a formal alliance with WITTE-Velbert GmbH, an automotive supplier based in Germany which designs, develops, manufactures and markets automotive access control products for European-based customers. This alliance consisted of two initiatives. The first was a set of legal agreements which allowed STRATTEC to manufacture and market WITTE’s core products in North America, and WITTE to manufacture and market STRATTEC’s core products in Europe. The second initiative was a 50:50 joint venture,

| 2017 STRATTEC Annual Report | 8 |

COMPANY DESCRIPTION

WITTE-STRATTEC LLC, to invest in operations with local partners in strategic markets outside of Europe and North America.

In February of 2006, we announced the expansion of this alliance and related joint venture with the addition of a third partner, ADAC Plastics, Inc. ADAC, of Grand Rapids, Michigan, adds North American expertise in door handles, a part of WITTE’s core product line that STRATTEC did not support, and an expertise in color-matched painting of these components.

With the expansion of the alliance, we can offer a full range of access control related products available on a global basis to support customer programs. To identify this powerful combination of independent companies focused on working together, we renamed the joint venture Vehicle Access Systems Technology LLC (VAST LLC). We now refer to the combination of the alliance structure and joint venture as “VAST Automotive Group” (VAST). WITTE is now called WITTE Automotive, and ADAC is now doing business as ADAC Automotive. We have adopted a common graphic image in which we share a logo mark and colors, and a specific VAST logo used on the partners’ printed and electronic presentation materials. What is now VAST made investments with a local partner in Brazil in September, 2001, and local partners in China in March, 2002. However, during fiscal 2010, VAST LLC purchased the remaining 40 percent interest of its local partners in the China venture. VAST China is now wholly owned by VAST LLC and had annual net sales of approximately $128 million during fiscal 2017. This was an important step which gives STRATTEC a one-third interest in VAST China’s activities in the important growing Chinese/Asian market. In March, 2014, VAST LLC

| 2017 STRATTEC Annual Report | 9 |

COMPANY DESCRIPTION

purchased the remaining 49 percent interest of its local partner in Brazil, which had annual net sales of approximately $1 million during fiscal 2017.

On April 30, 2015 VAST LLC executed a purchase agreement to become a 50:50 Joint Venture partner with Minda Management Services Limited, an affiliate of both Minda Corporation Limited and Spark Minda, Ashok Minda Group of New Delhi, India (collectively, “Minda”). VAST acquired a fifty percent equity interest in the former Minda-Valeo Security Systems joint venture entity, based in Pune, India, for approximately $12 million. This joint venture entity was renamed Minda-VAST Access Systems (“Minda-VAST”). Minda-VAST has operations in Pune and Delhi and had annual sales of approximately $34 million during fiscal year 2017. Minda is a leading manufacturer of security & access products and handles, for both OEMs and the aftermarket in India.

VAST is the embodiment of STRATTEC’s, WITTE’s and ADAC’s globalization strategy. We are developing VAST as a global brand with which we are jointly pursuing business with identified global customers. Those identified customers are General Motors, Ford, Fiat/Chrysler, Volkswagen, Honda, Toyota, Renault/Nissan and Hyundai/Kia.

To manage our customer relationships and coordinate global ventures and activities, we have established a VAST Management Group led by a President. The Management Group includes three Vice Presidents, one each from WITTE, STRATTEC and ADAC. With the focus provided by this Management Group, VAST is able to manage global programs with a single point of contact for customers, with the added advantage of providing regional support from the partners’ operating entities. Combined with VAST LLC’s ventures in China and Brazil, and sales/engineering offices in Japan and Korea, this structure establishes our global footprint.

| 2017 STRATTEC Annual Report | 10 |

COMPANY DESCRIPTION

ADAC-STRATTEC de MEXICO

During fiscal 2007, we formed a new entity with ADAC Automotive called ADAC-STRATTEC LLC including a wholly owned Mexican subsidiary ADAC-STRATTEC de Mexico (ASdM). The purpose of this joint venture is to produce certain ADAC and STRATTEC products utilizing ADAC’s plastic molding injection expertise and STRATTEC’s assembly capability. ASdM currently operates out of defined space in STRATTEC de Mexico Plant No. 2 located in Juarez, Mexico. Products from this joint venture include non-painted door handle components and exterior trim components for OEM customers producing in North America. STRATTEC owns 51% of this joint venture and its financial results are consolidated into STRATTEC’s financial statements. In our fiscal years ending 2017 and 2016, ASdM was profitable and represented $67.7 and $61.4 million, respectively, of our consolidated net sales. STRATTEC de Mexico Plant No. 4 is currently under construction in Leon, Mexico and will house our custom paint system for door handles and assembly for ADAC-STRATTEC de Mexico. This facility is planned to be operational during the first quarter of fiscal year 2018.

STRATTEC has introduced the BOLT line of products, the world’s first codeable padlock. In a simple one-step process, users can code the padlock to their vehicle key. This provides significant convenience by reducing the number of keys users need to secure their lockers, storage sheds and vehicle accessories such as tool boxes, trailer hitches, etc. You can buy this product direct at www.boltlock.com.

| 2017 STRATTEC Annual Report | 11 |

COMPANY DESCRIPTION

STRATTEC POWER ACCESS LLC

During fiscal year 2009, we formed a new subsidiary with WITTE Automotive called STRATTEC POWER ACCESS LLC (SPA) to acquire the North American business of the Delphi Power Products Group. WITTE is a 20 percent minority owner. SPA in turn owns a Mexican subsidiary, STRATTEC POWER ACCESS de Mexico. The purpose of this subsidiary is to produce power access devices for sliding side doors, lift gates and trunk lids. STRATTEC POWER ACCESS de Mexico currently operates out of defined space in STRATTEC de Mexico Plant No. 3 located in Juarez, Mexico. Financial results for SPA are consolidated in STRATTEC’s financial statements. For fiscal years ending 2017 and 2016, SPA was profitable and represented $84.5 and $83.7 million, respectively, of our consolidated net sales.

STRATTEC ADVANCED LOGIC LLC

During the fourth quarter of fiscal year 2013, we formed a new joint venture with Actuator Systems LLC called NextLock LLC subsequently renamed STRATTEC Advanced Logic. The initial capitalization of the joint venture was $1.5 million. The purpose of this joint venture is to assemble and sell the next generation of biometric security products based upon the residential and commercial designs of Actuator Systems. This joint venture had minimal sales activity in both fiscal 2017 and 2016. During fiscal year 2015, STRATTEC Advanced Logic signed a marketing agreement with Westinghouse Security Products to sell under the Westinghouse brand name (see also www.westinghousesecurity.com). STRATTEC owns 51% of this joint venture and its financial results are accounted for on the equity method of accounting. During fiscal 2018, we, along with our joint venture partner, intend to wind down and discontinue operating the business of STRATTEC Advanced Logic.

SEASONAL NATURE OF THE BUSINESS

The manufacturing of components used in automobiles is driven by the normal peaks and valleys associated with the automotive industry. Typically, the months of July and August are relatively slow as summer vacation shutdowns and model year changeovers occur at the automotive assembly plants. September volumes increase rapidly as each new model year begins. This volume strength continues through October and into early November. As the holiday and winter seasons approach, the demand for automobiles slows, as does production. March usually brings a major sales and production increase, which then continues through most of June. This results in our first fiscal quarter sales and operating results typically being our weakest, with the remaining quarters being more consistent.

ECONOMIC VALUE COMMITMENT

The underlying philosophy of our business and the means by which we measure our performance is Economic Value Added (EVA®). Simply stated, economic value is created when our business enterprise yields a return greater than the cost of capital we and our shareholders have invested in STRATTEC. The amount by which our return exceeds the cost of our capital is EVA®. In line with this philosophy, EVA® bonus plans are in effect for all of our U.S. associates, outside directors and many of our Mexico-based salaried associates as an incentive to help positively drive the economic value of our business.

STRATTEC’s significant market presence is the result of over a 100-year commitment to creating quality products and systems that are responsive to changing needs. As technologies advance and markets grow, STRATTEC retains that commitment to meeting and exceeding the expectations of our customers, and providing economic value to our shareholders.

| 2017 STRATTEC Annual Report | 12 |

| 2017 STRATTEC Annual Report | 13 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following Discussion and Analysis should be read in conjunction with STRATTEC SECURITY CORPORATION’s accompanying Financial Statements and Notes thereto. Unless otherwise indicated, all references to years or quarters refer to fiscal years or fiscal quarters of STRATTEC.

EXECUTIVE OVERVIEW

Historically, a significant portion of our total net sales are to domestic automotive OEMs (General Motors, Ford and Fiat Chrysler). During the past two decades these customers lost North American market share to the New Domestic automotive manufacturers (primarily the Japanese and Korean automotive manufacturers). In addition to our dependence on our customers’ maintaining their market share, our financial performance depends in large part on conditions in the overall automotive industry, which in turn, are dependent upon the U.S. and global economies. During fiscal years 2017, 2016 and 2015, the above domestic automotive OEMs together represented 60 percent, 63 percent and 65 percent, respectively, of our total net sales.

During fiscal years 2017 and 2016, we experienced stronger sales demand for our components from our major North American customers noted above as it relates to light trucks and both sport utility and car based utility vehicles in comparison to passenger cars, which was likely influenced by lower gas prices. If gas prices continue to remain low over the next year, we anticipate this consumer buying trend will continue.

Fiscal 2017 net sales were $417 million compared to $401 million in 2016 and $411 million in 2015. Net income attributable to STRATTEC for fiscal 2017 was $7.2 million compared to $9.1 million in 2016 and $20.7 million in 2015. The financial health of our three largest customers continues to improve. General Motors, Ford and Fiat Chrysler continued to report profitable results after implementing significant restructuring plans that modified their cost structures by closing manufacturing facilities, reducing benefits and wages and eliminating certain models and brands in 2009 and 2010. With the new United Auto Workers contracts signed in the United States during November 2015, our major customers will be migrating passenger car production from the United States into Mexico over the next 3-5 years to improve their overall profitability on these vehicles. STRATTEC and our joint venture partner ADAC Automotive are currently building a new production facility in Leon, Mexico to capture these new opportunities as it relates to painted door handles and assemblies in the Mexican market.

As we look out into the future, the July 2017 projections from our third-party forecasting service indicate that North American light vehicle production will show steady to flat improvement for the next five years. By model year, based on these projections we are expecting a 2017 build of 17.8 million vehicles, 17.7 million vehicles for 2018, 17.5 million vehicles for 2019, 18.2 million vehicles for 2020 and 18.7 million vehicles for 2021. As part of this third party projection, General Motors Company and the Ford Motor Company are expected to experience flat vehicle production volumes in their production levels during this time period. Fiat Chrysler, however, is expected to slightly decrease production as they eliminate or reduce passenger car production on certain models during this time horizon. Of course, all of these forecasts are subject to variability based on what happens in the overall North American and global economies, especially as it relates to the current levels of employment, availability of consumer credit, home equity values, fluctuating fuel prices, changes in customer preferences regarding product quality issues, including related to recall and product warranty coverage issues, and other key factors that we believe could determine whether consumers can or will purchase new vehicles.

Focus and Strategy Going Forward

STRATTEC’s long-term strategy is focused on maximizing long-term shareholder value by driving profitable growth. Our management believes productivity improvements and cost reductions are critical to our competitiveness, while enhancing the value we deliver to our customers. In order to accomplish this, we have been pursuing, and we intend to continue to pursue over the foreseeable future, the following objectives as summarized below:

| • | Streamline and standardize processes to increase productivity and improve the quality of our products |

| • | Maintain a disciplined and flexible cost structure to leverage scale and optimize asset utilization and procurement |

| • | Maintain our strong financial position by deploying capital spending targeted for growth and productivity improvement |

| • | Leverage the “VAST Brand” with customer relationships to generate organic growth from global programs |

| • | Offer our customers innovative products and cost savings solutions to meet their changing demands |

| • | Explore and execute targeted mergers and acquisitions with a disciplined due diligence approach and critical financial analysis to drive shareholder value |

| 2017 STRATTEC Annual Report | 14 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

We use several key performance indicators to gauge progress toward achieving these objectives. These indicators include net sales growth, operating margin improvement, return on capital employed and cash flow from operations.

RESULTS OF OPERATIONS

2017 Compared to 2016

| Years Ended | |||||||||||||||||||||||||||||||||

| July 2, 2017 | July 3, 2016 | ||||||||||||||||||||||||||||||||

| Net Sales (millions of dollars) |

$ | 417.3 | $ | 401.4 | |||||||||||||||||||||||||||||

Net Sales to each of our customers or customer groups in the current year and prior year were as follows (millions of dollars):

| Years Ended | |||||||||||||||||||||||||||||||

| July 2, 2017 |

July 3, 2016 | ||||||||||||||||||||||||||||||

| Fiat Chrysler Automobiles |

$ | 100.6 | $ | 115.9 | |||||||||||||||||||||||||||

| General Motors Company |

88.6 | 79.9 | |||||||||||||||||||||||||||||

| Ford Motor Company |

62.3 | 57.3 | |||||||||||||||||||||||||||||

| Tier 1 Customers |

72.4 | 67.3 | |||||||||||||||||||||||||||||

| Commercial and Other OEM Customers |

60.3 | 49.3 | |||||||||||||||||||||||||||||

| Hyundai / Kia |

33.1 | 31.7 | |||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||

| Total |

$ | 417.3 | $ | 401.4 | |||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||

Net sales were $417.3 million in 2017 compared to $401.4 million in 2016. Our 2017 fiscal year was the typical 52 weeks while our 2016 fiscal year was 53 weeks. The impact of the additional week of customer shipments during the prior year increased 2016 sales by approximately $7.5 million. Sales to Fiat Chrysler Automobiles in the current year decreased in comparison to the prior year due to lower customer vehicle production volume and lower content on components we supply, in particular on the Chrysler 200, which was discontinued in December 2016, and lower volume during 2017 on the new Chrysler Pacifica Minivan. Increased sales to General Motors Company in the current year over the prior year was attributed to higher customer production volumes and content on vehicles for which we supply components, partially offset by agreed upon price reductions that became effective as of the start of the 2016 calendar year. Increased sales to Ford Motor Company in the current year as compared to the prior year were attributed to increased product content on locksets and latches, in particular for the F-150 pick-up truck. Sales to Tier 1 Customers and Commercial and other OEM Customers during the current year increased in comparison to the prior year as a result of higher electronic content and volume. These customers primarily represent purchasers of vehicle access control products, such as latches, fobs, driver controls, and door handles and related components that have been developed in recent years to complement our historic core business of locks and keys. The increased sales to Hyundai / Kia in the current year over the prior year were due to higher levels of production on the Kia Sedona minivan for which we supply components.

| Years Ended | |||||||||||||||||||||||||||||||||

| July 2, 2017 | July 3, 2016 | ||||||||||||||||||||||||||||||||

| Cost of Goods Sold (millions of dollars) |

$ | 357.2 | $ | 336.6 | |||||||||||||||||||||||||||||

Direct material costs are the most significant component of our cost of goods sold and comprised $236.1 million or 66.1 percent of cost of goods sold in the current year compared to $224.9 million or 66.8 percent of cost of goods sold in the prior year. This increase in our direct material costs of $20.6 million or 6.1 percent was due to increased sales volumes in the current year as compared to the prior year and increased scrap and sorting costs resulting from internal manufacturing process quality issues incurred in the current year as compared to the prior year as well as current year obsolescence costs related to inventory intended for STRATTEC Advanced Logic, LLC (“SAL LLC”), our biometric joint venture.

The remaining components of cost of goods sold consist of labor and overhead costs which increased $9.4 million or 8.4 percent to $121.1 million in the current year from $111.7 million in the prior year as the variable portion of these costs increased due to the increase in sales volumes between years. Additionally, the current year as compared to the prior year included higher payroll, benefit, outside service, and maintenance costs related to quality improvement initiatives undertaken during the current year, higher than expected production and expediting costs to meet certain customer schedules, higher royalty costs associated with sales of service parts to aftermarket customers, higher wage costs for our Mexico operations resulting from wage increases implemented to encourage work force retention in consideration of the peso devaluation, and start-up costs related to our new Leon, Mexico facility. These costs were partially offset by a reduction of approximately $5.8 million in the U.S. dollar value of our Mexican operations due to a favorable Mexican peso to U.S. dollar exchange rate between these years as well as a reduction in warranty

| 2017 STRATTEC Annual Report | 15 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

expense provisions. The average U.S. dollar/Mexican peso exchange rate increased to approximately 19.29 pesos to the dollar in the current year from approximately 17.22 pesos to the dollar in the prior year. Warranty recoveries and expense provision reversals in the current year totaled $843,000 compared to expense provisions of $583,000 in the prior year.

| Years Ended | ||||||||||

| July 2, 2017 | July 3, 2016 | |||||||||

| Gross Profit (millions of dollars) |

$60.2 | $64.8 | ||||||||

| Gross Profit as a percentage of net sales |

14.4% | 16.1% | ||||||||

The reduction in gross profit and gross profit as a percentage of net sales in the current year as compared to the prior year were the result of agreed upon customer price reductions that became effective at the start of the 2016 calendar year, a less favorable sales mix in the current year as compared to the prior year, which current year included a lower percentage of sales in the power access and OEM service product lines as compared to the prior year period reducing gross profit margins in the current year period, increased costs related to quality improvement initiatives undertaken during the current year, higher than expected production and expediting costs to meet certain customer schedules, higher royalty costs associated with sales of service parts to aftermarket customers, higher wage costs for our Mexican operations, and start-up costs incurred related to our new Leon, Mexico facility, all of which were partially offset by a favorable Mexican peso to U.S. dollar exchange rate affecting the cost of our Mexican operations and a reduction in warranty expense provisions during the current year as compared to the prior year, all as discussed above.

Engineering, Selling and Administrative Expenses in the current year and prior year were as follows:

| Years Ended | ||||||||||

| July 2, 2017 | July 3, 2016 | |||||||||

| Expenses (millions of dollars) |

$46.5 | $43.9 | ||||||||

| Expenses as a percentage of net sales |

11.1% | 10.9% | ||||||||

Engineering, selling and administrative expenses increased approximately $2.6 million between years while the prior year included an additional week of expense as a result of the 53 week fiscal year. The increase in these costs in the current year as compared to the prior year was due to higher new product program development costs for which we are utilizing third party vendors for a portion of the development work.

Income from operations in the current year was $13.7 million compared to $20.9 million in the prior year. This decrease was the result of reduced gross profit margins during 2017 as well as an increase in engineering, selling and administrative expenses in the current year as compared to the prior year, all as discussed above.

The equity earnings (loss) of joint ventures was comprised of the following in the current year and prior year (thousands of dollars):

| Years Ended | ||||||||||

| July 2, 2017 | July 3, 2016 | |||||||||

| Vehicle Access Systems Technology LLC |

$ | 2,593 | $ | (639 | ) | |||||

| STRATTEC Advanced Logic, LLC |

(1,927 | ) | (1,596 | ) | ||||||

|

|

|

|

|

|||||||

| $ | 666 | $ | (2,235 | ) | ||||||

|

|

|

|

|

|||||||

Our Vehicle Access Systems Technology LLC (“VAST LLC”) joint ventures in China and India continue to report profitable operating results while our joint venture in Brazil continues to report losses due to the weak automotive build in that region. The 2016 equity loss of joint ventures for VAST LLC included a $6 million impairment charge related to its Minda-VAST Access Systems joint venture in India. STRATTEC’s portion of this impairment charge totaled $2 million. STRATTEC is not the primary beneficiary and does not control SAL LLC. Accordingly, our investment in SAL LLC is accounted for using the equity method. Even though we maintain a 51 percent ownership interest in SAL LLC, effective with our fiscal 2015 fourth quarter, 100 percent of the funding for SAL LLC was being made through loans from STRATTEC to SAL LLC. Therefore, STRATTEC began recognizing 100 percent of the losses of SAL LLC up to our committed financial support. During fiscal 2018, we, along with our joint venture partner, intend to wind down and discontinue operating the business of SAL LLC.

| 2017 STRATTEC Annual Report | 16 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Included in other income, net in the current year and prior year were the following items (thousands of dollars):

| Years Ended | ||||||||||

| July 2, 2017 | July 3, 2016 | |||||||||

| Foreign Currency Transaction Gain |

$ | 1,128 | $ | 2,559 | ||||||

| Unrealized Gain (Loss) on Mexican Peso Forward Contracts |

2,010 | (889 | ) | |||||||

| Realized Loss on Mexican Peso Forward Contracts |

(1,650 | ) | (1,196 | ) | ||||||

| Rabbi Trust Gain (Loss) |

296 | (41 | ) | |||||||

| Other |

523 | 235 | ||||||||

|

|

|

|

|

|||||||

| $ | 2,307 | $ | 668 | |||||||

|

|

|

|

|

|||||||

Foreign currency transaction gains and losses resulted from activity associated with foreign denominated assets held by our Mexican subsidiaries. We entered into the Mexican peso currency forward contracts during fiscal 2016 and 2017 to minimize earnings volatility resulting from changes in exchange rates affecting the U.S. dollar cost of our Mexican operations. Unrealized gains and losses recognized as a result of mark-to-market adjustments as of July 2, 2017 may or may not be realized, depending upon the actual Mexican peso to U.S. dollar exchange rates experienced during the balance of the contract period. The Rabbi Trust assets fund our amended and restated supplemental executive retirement plan. The investments held in the Trust are considered trading securities.

Our effective income tax rate for 2017 was 26.1 percent compared to 26.4 percent in 2016. Our income tax provision for each of 2017 and 2016 was affected by the non-controlling interest portion of our pre-tax income. The non-controlling interest impacts the effective tax rate as our ADAC-STRATTEC LLC and STRATTEC POWER ACCESS LLC entities are taxed as partnerships for U.S. tax purposes.

2016 Compared to 2015

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Net Sales (millions of dollars) |

$401.4 | $411.5 | ||||||||

Net Sales to each of our customers or customer groups in 2016 and 2015 were as follows (millions of dollars):

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Fiat Chrysler Automobiles |

$ | 115.9 | $ | 116.9 | ||||||

| General Motors Company |

79.9 | 105.8 | ||||||||

| Ford Motor Company |

57.3 | 45.5 | ||||||||

| Tier 1 Customers |

67.3 | 71.3 | ||||||||

| Commercial and Other OEM Customers |

49.3 | 41.7 | ||||||||

| Hyundai / Kia |

31.7 | 30.3 | ||||||||

|

|

|

|

|

|||||||

| Total |

$ | 401.4 | $ | 411.5 | ||||||

|

|

|

|

|

|||||||

Net sales were $401.4 million in 2016 compared to $411.5 million in 2015. Our 2016 fiscal year was 53 weeks while our 2015 fiscal year was the typical 52 weeks. The impact of the additional week of customer shipments during 2016 increased sales by approximately $7.5 million. The overall reduction in sales in 2016 as compared to 2015 was due to increased service parts sales to General Motors during 2015, as well as 2016 customer vehicle production volume reductions on models for which we supply components, temporary shut-downs at customer production facilities, and agreed upon customer price reductions. The decreased sales to Fiat Chrysler Automobiles in 2016 were due to reduced product content on certain vehicle models for which we supply components. Additionally, during 2016, Fiat Chrysler Automobiles temporarily shutdown production at its Sterling Heights, Michigan and Toluca, Mexico assembly plants which are primarily responsible for the production of the Chrysler 200 and Dodge Journey due to reduced sales demand for these vehicles. This shutdown reduced our sales by $8.9 million during 2016. These impacts were mostly offset by an increase in 2016 in Chrysler Pacifica minivan production volumes for which we supply components. During 2015, Fiat Chrysler implemented a temporary shutdown at its Windsor, Canada assembly plant to re-tool for production of the new Chrysler Pacifica minivan, which shutdown decreased our sales to Fiat Chrysler by $18 million. The negative effect of that shutdown was partially offset by increased service sales during 2015 in comparison to 2016. The decrease in sales to General Motors Company in 2016 was attributed to incremental service parts sales of $34 million shipped in 2015 for parts used to support a recall campaign. Those incremental sales did not continue during 2016. In addition, 2016 included $2.0 million of agreed upon price reductions, which began January 1, 2016 while 2015 included a $3.3 million sales concession that we granted to

| 2017 STRATTEC Annual Report | 17 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

General Motors during 2015. Increased sales to Ford Motor Company in 2016 were attributed to higher vehicle production volumes and content on models for which we supply components, in particular for components we supply for F-150 pick-up trucks. Sales to Tier 1 Customers during 2016 decreased in comparison to 2015 due to lower production volume on passenger cars for which we supply driver control and door handle components. Sales to commercial and other OEM Customers during 2016 increased in comparison to 2015. These customers represent purchasers of vehicle access control products, such as latches, fobs, driver controls, and door handles and related components that we have developed in recent years to complement our historic core business of locks and keys. The increase in sales to Hyundai / Kia in 2016 was principally due to higher levels of sales on the Kia Sedona minivan for which we supply components.

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Cost of Goods Sold (millions of dollars) |

$336.6 | $338.8 | ||||||||

Direct material costs are the most significant component of our cost of goods sold and comprised $224.9 million or 66.8 percent of cost of goods sold in 2016 compared to $217.1 million or 64.1 percent of cost of goods sold in 2015. The increase in material costs year over year of $7.8 million or 3.6 percent was impacted by our product sales mix in 2016 as compared to 2015. 2016 included increased sales of power access products as compared to 2015. Power access products typically have a higher purchased content percentage as compared to our other access control products. In addition, increased scrap costs in 2016 associated with new product launches contributed to the year over year increase in material costs.

The remaining components of cost of goods sold consist of labor and overhead costs which decreased $10.0 million or 8.2 percent in 2016 as compared to 2015 as the variable portion of these costs decreased due to the reduced sales volumes in 2016. In addition, 2016 included a year-over-year decrease in customer warranty provisions of $8.4 million as 2015 included provisions for expected warranty payments to be settled in future periods, a reduction of approximately $8.7 million in the U.S. dollar value of our Mexican operations due to a favorable Mexican peso to U.S. dollar exchange rate and a reduction of approximately $2.4 million in expense provisions for the accrual of bonuses under our incentive bonus plans between years. Additionally, during 2015, a lump sum bonus totaling $311,000 was paid to our Milwaukee represented hourly workers resulting from the ratification of a new 4-year labor contract. The average U.S. dollar/Mexican peso exchange rate increased to approximately 17.22 pesos to the dollar in 2016 from approximately 14.34 pesos to the dollar in 2015. These favorable impacts were partially offset by higher depreciation expense in 2016, increased 2016 manufacturing start-up costs associated with new product launches, and higher costs during 2016 associated with diversifying our products portfolio.

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Gross Profit (millions of dollars) |

$64.8 | $72.7 | ||||||||

| Gross Profit as a percentage of net sales |

16.1% | 17.7% | ||||||||

The reduction in gross profit in 2016 as compared to 2015 was the result of the reduction in sales partially offset by the reduction in cost of goods sold as discussed above. The reduction in gross profit as a percentage of net sales in 2016 as compared to 2015 was the result of reduced sales of service parts related to the General Motors customer recall campaign noted above, which typically have higher gross profit margins as compared to gross profit margins on parts sold for new vehicle production, agreed upon customer price reductions that became effective at the start of the 2016 calendar year, reduced customer production volumes resulting in less favorable absorption of our fixed manufacturing costs, higher depreciation expense, increased 2016 manufacturing start-up costs associated with new product launches and higher costs associated with diversifying our products portfolio. These unfavorable impacts to the gross profit margin as a percentage of net sales were partially offset by a decrease in expense provisions for the accrual of bonuses under our incentive bonus plans, a reduction in the U.S. dollar value of the cost of our Mexican operations due to a favorable Mexican peso to U.S. dollar exchange rate between these years and a lump sum bonus paid to our Milwaukee represented hourly workers during 2015 resulting from the ratification of a new 4-year labor contract, all as discussed above.

Engineering, Selling and Administrative Expenses in 2016 and 2015 were as follows:

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Expenses (millions of dollars) |

$43.9 | $41.5 | ||||||||

| Expenses as a percentage of net sales |

10.9% | 10.1% | ||||||||

| 2017 STRATTEC Annual Report | 18 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Engineering, selling and administrative expenses increased approximately $2.4 million between periods. Higher selling and engineering costs associated with current product programs, an additional week of expense during 2016 as a result of the 53 week fiscal year and higher engineering costs for new programs for which we are utilizing third party vendors for a portion of the development work were partially offset by a reduction of $1.9 million in expense provisions for the accrual of bonuses under our incentive bonus plans in 2016 as compared to 2015.

Income from operations in 2016 was $20.9 million compared to $31.1 million in 2015. This decrease was the result of reduced sales and reduced gross profit margins during 2016 as well as an increase in engineering, selling and administrative expenses, all as discussed above.

The equity (loss) earnings of joint ventures was comprised of the following in 2016 and 2015 (thousands of dollars):

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Vehicle Access Systems Technology LLC |

$ | (639 | ) | $ | 1,251 | |||||

| STRATTEC Advanced Logic, LLC |

(1,596 | ) | (2,039 | ) | ||||||

|

|

|

|

|

|||||||

| $ | (2,235 | ) | $ | (788 | ) | |||||

|

|

|

|

|

|||||||

The 2016 equity loss of joint ventures for Vehicle Access Systems Technology LLC included a $6 million impairment charge related to its Minda-VAST Access Systems joint venture in India. STRATTEC’s portion of this impairment charge totaled $2 million. STRATTEC is not the primary beneficiary and does not control STRATTEC Advanced Logic, LLC (“SAL LLC”). Accordingly, our investment in SAL LLC is accounted for using the equity method. Even though we maintain a 51 percent ownership interest in SAL LLC, effective with our fiscal 2015 fourth quarter, 100 percent of the funding for SAL LLC was being made through loans from STRATTEC to SAL LLC. Therefore, STRATTEC began recognizing 100 percent of the losses of SAL LLC up to our committed financial support, which losses included write-offs of fixed assets and inventory totaling $381,000 in 2015. In addition, the following losses were included in our 2016 and 2015 Equity (Loss) Earnings of Joint Ventures for SAL LLC (thousands of dollars):

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Loss on Guarnantee of SAL LLC Vendor Contract |

$ | - | $ | 123 | ||||||

| Loss on Loan to SAL LLC |

225 | 100 | ||||||||

| Loss on Guarantee of SAL LLC Credit Facility |

247 | 488 | ||||||||

|

|

|

|

|

|||||||

| $ | 472 | $ | 711 | |||||||

|

|

|

|

|

|||||||

Effective November 1, 2014, a license agreement was signed with Westinghouse allowing SAL LLC to do business as Westinghouse Security. Payments required under this license agreement were guaranteed by STRATTEC. As of July 3, 2016 and June 28, 2015, STRATTEC had recorded a liability equal to the estimated fair value of the guarantee of these payments of $250,000, which amount was equal to the future payments required to be made under the license agreement as of these dates. STRATTEC’s proportionate share of the guarantee of these payments based on our ownership percentage in SAL LLC totaled $127,000, and accordingly, our investment in SAL LLC was increased by this amount as of July 3, 2016 and June 28, 2015. Our joint venture partner did not guarantee their proportionate share of the payments required under the license agreement. As a result, in 2015, STRATTEC recorded a loss of $123,000 which was equal to our partner’s proportionate share, based upon their ownership interest in the joint venture, of the fair value of the STRATTEC guarantee.

During the fourth quarter of 2015, a loan was made from STRATTEC to SAL LLC in support of operating expenses and working capital needs. As of June 28, 2015, the outstanding loan amount totaled $100,000. A valuation reserve of $100,000 was recorded related to this loan as of June 28, 2015. During 2016, additional loans totaling $225,000 were made from STRATTEC to SAL LLC in support of operating expenses and working capital needs. An additional valuation reserve of $225,000 was recorded related to the additional loans during 2016. As of July 3, 2016, the outstanding loan amount totaled $325,000, which was fully offset by a valuation reserve of $325,000.

SAL LLC had a $1.5 million revolving credit facility with BMO Harris Bank N.A. with a maturity date of February 16, 2016 (the “SAL Credit Facility”), which was fully guaranteed by STRATTEC. Outstanding borrowings under the SAL Credit Facility as of February 16, 2016 and June 28, 2015 totaled $1.5 million and $995,000, respectively. SAL LLC did not have cash available to pay the outstanding debt balance as of the maturity date. Therefore, STRATTEC made a payment of $1.5 million on its guarantee on February 16, 2016. Prior to making the guarantee payment, STRATTEC had a recorded liability related to the guarantee of $1.5 million and $995,000 at February 16, 2016 and June 28, 2015, respectively, which amounts were equal to the estimated fair value of the

| 2017 STRATTEC Annual Report | 19 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

guarantee as of these dates. STRATTEC’s proportionate share of the guarantee based on our ownership percentage in SAL LLC totaled $765,000 and $507,000, respectively, as of February 16, 2016 and June 28, 2015, and accordingly, our investment in SAL LLC included these amounts as of these dates. Our joint venture partner did not guarantee their proportionate share of the SAL Credit Facility. As a result, we recorded a loss equal to our partner’s proportionate share of the fair value of the STRATTEC guarantee based upon our partner’s ownership interest in the joint venture of $488,000 during fiscal 2015 and $247,000 during 2016.

Included in other income, net in 2016 and 2015 were the following items (thousands of dollars):

| Years Ended | ||||||||||

| July 3, 2016 | June 28, 2015 | |||||||||

| Foreign Currency Transaction Gain |

$ | 2,559 | $ | 3,075 | ||||||

| Unrealized Loss on Peso Forward Contracts |

(889 | ) | - | |||||||

| Realized Loss on Peso Forward Contracts |

(1,196 | ) | - | |||||||

| Rabbi Trust (Loss) Gain |

(41 | ) | 96 | |||||||

| Other |

235 | 310 | ||||||||

|

|

|

|

|

|||||||

| $ | 668 | $ | 3,481 | |||||||

|

|

|

|

|

|||||||

Foreign currency transaction gains resulted from activity associated with foreign denominated assets held by our Mexican subsidiaries. We entered into the Mexican peso currency forward contracts during fiscal 2016 to minimize earnings volatility resulting from changes in exchange rates affecting the U.S. dollar cost of our Mexican operations. Unrealized losses recognized as a result of mark-to-market adjustments as of July 3, 2016 may or may not be realized, depending upon the actual Mexican peso to U.S. dollar exchange rates experienced during the balance of the contract period. The Rabbi Trust assets fund our amended and restated supplemental executive retirement plan. The investments held in the Trust are considered trading securities.

Our effective income tax rate for 2016 was 26.4 percent compared to 27.6 percent in 2015. Our income tax provision for 2015 was affected by a lower statutory tax rate for income subject to tax in Mexico as compared to the statutory tax rate for income subject to tax in the U.S. as well as a net reduction in our liability for unrecognized tax benefits of approximately $852,000. Our income tax provision for each of 2016 and 2015 was affected by the non-controlling interest portion of our pre-tax income. The decrease in the effective tax rate between periods was the result of a year-over-year increase in the non-controlling interest percentage of our pre-tax income. The non-controlling interest impacts the effective tax rate as ADAC-STRATTEC LLC and STRATTEC POWER ACCESS LLC entities are taxed as partnerships for U.S. tax purposes.

LIQUIDITY AND CAPITAL RESOURCES

Outstanding Receivable Balances from Major Customers

Our primary source of cash flow is from our major customers, which include Fiat Chrysler Automobiles LLC, General Motors Company and Ford Motor Company. As of the date of filing this Annual Report with the Securities and Exchange Commission, all of our customers are making payments on their outstanding accounts receivable in accordance with the payment terms included on their purchase orders. A summary of our outstanding receivable balances from our major customers as of July 2, 2017 was as follows (millions of dollars):

| Fiat Chrysler Automobiles |

$ | 17.1 | |||

| General Motors Company |

$ | 13.4 | |||

| Ford Motor Company |

$ | 8.6 |

Cash Balances in Mexico

We earn a portion of our operating income in Mexico. During 2017, we changed our assertion regarding the permanent reinvestment of earnings from two of our Mexican subsidiaries. Prior to 2017, the accumulated undistributed earnings from such subsidiaries were considered to be permanently reinvested in Mexico. During 2017, the strength of the U.S. dollar to the Mexican peso significantly decreased the U.S. tax cost associated with a distribution from the Mexican subsidiaries as compared to the U.S. tax cost associated with such a distribution in prior periods. Consequently, we changed our assertion regarding the permanent reinvestment of earnings from these Mexican subsidiaries. Such earnings are no longer considered permanently reinvested. We repatriated $15.8 million from Mexico to the U.S. during 2017. As of July 2, 2017, $948,000 of our $8.4 million cash and cash equivalents balance was held in Mexico. These funds, with some restrictions and tax implications, are available for repatriation as deemed necessary.

| 2017 STRATTEC Annual Report | 20 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Cash Flow Analysis

| Years Ended | |||||||||||||||

| July 2, 2017 | July 3, 2016 | June 28, 2015 | |||||||||||||

| Cash Flows from (millions of dollars): |

|||||||||||||||

| Operating Activities |

$ | 23.1 | $ | 8.2 | $ 31.5 | ||||||||||

| Investing Activities |

$ | (39.5 | ) | $ | (25.3 | ) | $ (30.8 | ) | |||||||

| Financing Activities |

$ | 9.2 | $ | 7.2 | $ 5.8 | ||||||||||

The increase in cash provided by operating activities between 2016 and 2017 reflected a net decrease in working capital requirements between the two years of $21.7 million, with the net decrease in our working capital requirements being made up of the following working capital changes (millions of dollars):

| Increase (Decrease) in Working Capital Requirements | ||||||

| 2017 |

2016 |

Change | ||||

| Accounts Receivable |

$ 1.7 | $ 5.1 | $ (3.4) | |||

| Inventories |

$ (3.2) | $ 3.9 | $ (7.1) | |||

| Customer Tooling |

$ 4.6 | $ 3.5 | $ 1.1 | |||

| Other Assets |

$ 1.9 | $ 6.0 | $ (4.1) | |||

| Accounts Payable and Other Liabilities |

$ (5.2) | $ 3.0 | $ (8.2) | |||

The year over year change in the accounts receivable balances reflected a larger increase in accounts receivable balances during 2016 as compared to 2017. Higher sales during the fourth quarter of 2016 as compared to the fourth quarter of 2015 caused receivable balances to increase during fiscal 2016. The increase in the receivable balance during 2017 was the result of sales being more heavily weighted to the end of the fourth quarter of 2017 as compared to the fourth quarter of 2016. The year over year change in inventory reflected an increase in inventory balances as of July 3, 2016, which was the result of lower sales of parts we supply for certain customer vehicle programs towards the end of fiscal 2016. The year over year change in customer tooling balances, which consisted of costs incurred for the development of tooling that will be directly reimbursed by the customer whose parts are produced from the tool, was the result of the timing of tooling development spending required to meet customer production requirements and related customer reimbursements. The year over year change in other assets was the result of a reduction in the income tax recoverable balance in 2017 as compared to an increase in the income tax recoverable balance in 2016, which changes were based on the required income tax provision and the timing and amounts of Federal and state tax payments made. The year over year change in the accounts payable and other liability balances was impacted by changes in accounts payable balances, accrued salaries and benefits balances and warranty reserve balances. The year over year change in accounts payable and accrued liability balances reflected a decrease in working capital requirements in 2017 compared to an increase in working capital requirements in 2016. 2017 included an increase in accounts payable balances of $7.2 million, due to obtaining a change in payment terms from 30 days to 45 days with several large vendors and the timing of purchases and payments with our vendors based on normal payment terms, and an increase of $1.8 million in accrued payroll and benefit liabilities mostly due to an increase in wages and benefits in Mexico, as discussed above under Analysis of Results of Operations. These impacts were partially offset by $2.8 million of customer warranty payments during 2017, which were previously accrued, as well as $843,000 of reversals during 2017 of previously accrued customer warranty accruals. 2016 included cash payments made under our incentive bonus plans of $5.2 million and $3.2 million of customer warranty payments, which were previously accrued, partially offset by an increase in accounts payable balances of $4.6 million as a result of the timing of purchases and payments with our vendors based on normal payment terms.

Other significant cash payments impacting net cash provided by operating activities during both the current year and prior year periods included cash contributions made to our qualified pension plan and cash payments made for Federal, state and foreign income taxes. Cash contributions made to our qualified pension plan totaled $5.0 million during 2017 compared to $3.0 million during 2016. Net cash payments and recoveries for Federal, state and foreign income taxes totaled $318,000 during 2017 compared to $4.7 million during 2016.

The decrease in cash provided by operating activities between 2015 and 2016 reflected a net increase in working capital requirements between the two years of $23.4 million, with the increase in our working capital requirements being made up of the following working capital changes (millions of dollars):

| Increase (Decrease) in Working Capital Requirements | ||||||

| 2016 |

2015 |

Change | ||||

| Accounts Receivable |

$ 5.1 | $ (9.2) | $ 14.3 | |||

| Inventories |

$ 3.9 | $ 4.3 | $ (0.4) | |||

| Customer Tooling |

$ 3.5 | $ (1.8) | $ 5.3 | |||

| Other Assets |

$ 6.0 | $ 3.3 | $ 2.7 | |||

| Accounts Payable and Other Liabilities |

$ 3.0 | $ 1.5 | $ 1.5 | |||

| 2017 STRATTEC Annual Report | 21 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

The year over year change in the accounts receivable balances reflected an increase in accounts receivable balances during 2016 compared to a reduction in accounts receivable balances during 2015. Receivable balances were increased at the start of the 2015 fiscal year as a result of $11 million of additional service parts sales in conjunction with General Motors’ recall campaign during the fourth quarter of 2014. The receivable balances related to the additional service parts sales were collected during 2015 reducing the accounts receivable balances during fiscal 2015. Additionally, higher sales during the fourth quarter of 2016 as compared to the fourth quarter of 2015 caused receivable balances to increase during fiscal 2016. The year over year change in customer tooling balances, which consisted of costs incurred for the development of tooling that will be directly reimbursed by the customer whose parts are produced from the tool, was the result of the timing of tooling development spending required to meet customer production requirements and related customer reimbursements. The year over year change in other assets was the result of a larger increase in the income tax recoverable balance in 2016 as compared to 2015, which was based on the required income tax provision and the timing and amounts of Federal and state tax payments made. The year over year change in the accounts payable and other liability balances was impacted by changes in accounts payable balances, accrued salaries and benefits balances and warranty reserve balances. The year over year change in accounts payable balances decreased working capital requirements $12.8 million between years. The changes in the accounts payable balances during each of the 2016 and 2015 years resulted from the timing of purchases and payments with our vendors based on normal payment terms. Additionally, increased accounts payable balances at June 2014 related to the General Motors’ recall campaign which were paid during 2015 increased the 2015 working capital requirements. The year over year change in accrued payroll and benefits balances increased working capital requirements $2.9 million between years as the accrual of bonuses under our incentive bonus program decreased between years. The provision for bonuses under our incentive bonus plans decreased $4.2 million between years while actual cash payments made decreased $2.1 million between years. The year over year change in warranty reserve balances increased working capital requirements $11.4 million between years. Warranty provisions decreased $8.4 million between years while warranty payments increased $2.6 million between years.

Other significant cash payments impacting net cash provided by operating activities during both 2016 and 2015 included cash contributions made to our qualified pension plan and cash payments made for Federal, state and foreign income taxes. Cash contributions made to our qualified pension plan totaled $3.0 million during both 2016 and 2015. Cash payments made for Federal, state and foreign income taxes totaled $4.7 million during 2016 compared to $14.8 million during 2015.

Net cash used by investing activities of $39.5 million during 2017, $25.3 million during 2016 and $30.8 million during 2015 included capital expenditures of $37.0 million, $23.5 million and $26.1 million, respectively. Capital expenditures during each year were made in support of requirements for new product programs and the upgrade and replacement of existing equipment. The 2017 and 2016 capital expenditures included $12.8 million and $7.0 million, respectively for the purchase of land, equipment and the construction of a new facility in Leon, Mexico, which is expected to be used primarily to paint and assemble door handle products by ADAC-STRATTEC LLC. See further discussion related to this new facility under Future Capital Expenditures below. The 2015 capital expenditures included $2.1 million and $4.5 million for the purchase of additional facilities in Juarez, Mexico and Auburn Hills, Michigan, respectively. The Michigan building is being used as a sales and engineering office and replaced two then leased facilities in Michigan. The Juarez, Mexico building is being used as an additional facility to support current operations and was acquired in anticipation of both new and potential business awards in Mexico. Net cash used by investing activities during 2017, 2016 and 2015 also included an investment in our VAST LLC joint venture of $400,000, $220,000 and $4.4 million, respectively. The 2017 and 2016 investments were made for the purpose of funding general operating expenses for Sistema de Acesso Veicular Ltda (formerly known as VAST do Brasil). The 2015 investment was made in support of the acquisition of a fifty percent equity interest in a joint venture entity, Minda VAST Access Systems, based in Pune, India, and in support of general operating expenses for the Brazilian entity. Additionally, during 2016, a $1.5 million investment in SAL LLC was made as the result of the payment on a guarantee of their debt facility. Loans were made by each partner, STRATTEC, WITTE and ADAC to our joint venture, VAST LLC, totaling $215,000 for each partner in 2015. The loans were made in support of VAST LLC’s purchase of the non-controlling interest in the Brazilian entity and in support of funding general operating expenses of the Brazilian entity. Repayments of this outstanding loan balance totaling $100,000 were made from VAST LLC to each partner during both 2017 and 2016. Loans were made from STRATTEC to SAL LLC totaling $2.2 million during 2017, $225,000 during 2016 and $100,000 during 2015 in support of operating expenses and working capital needs.

Net cash provided by financing activities of $9.2 million during 2017 included $36.0 million of borrowings under credit facilities, $241,000 of proceeds from stock purchases and option plan exercises, $21,000 in excess tax benefits from option plan exercises, and $2.9 million in non-controlling interest contributions to ADAC-STRATTEC LLC in accordance with the ADAC-STRATTEC debt facility provisions, partially offset by $26 million for repayments of borrowings under credit facilities, $2.0 million for regular quarterly dividend payments to shareholders and $2.0 million for dividend payments to non-controlling interests in our subsidiaries. Net cash provided by financing activities of $7.2 million during 2016 included $26.5 million of borrowings under credit facilities, $473,000 of proceeds from stock purchases and option plan exercises and $170,000 in excess tax benefits from option plan

| 2017 STRATTEC Annual Report | 22 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

exercises, partially offset by $16.5 million for repayments of borrowings under credit facilities, $1.9 million for regular quarterly dividend payments to shareholders and $1.6 million for dividend payments to non-controlling interests in our subsidiaries. Net cash provided by financing activities of $5.8 million during 2015 included $9.0 million of borrowings under credit facilities, $553,000 of proceeds from stock purchases and option plan exercises and $367,000 in excess tax benefits from option plan exercises, partially offset by $1.5 million for repayments of borrowings under credit facilities, $1.7 million for regular quarterly dividend payments to shareholders and $882,000 for dividend payments to non-controlling interests in our subsidiaries.

Qualified Defined Benefit Pension Plan

Our qualified defined benefit pension plan balance, included in other long-term assets in our accompanying Consolidated Balance Sheets, totaled $13.1 million at July 2, 2017 and $72,000 at July 3, 2016. The change in the other long-term assets balance related to this plan during 2017 was the result of the net impact of pension contributions, the actuarially calculated pension expense, reclassification adjustments from accumulated other comprehensive loss and the impact of the change in the year-end funded status of the plan, which was impacted by excess asset returns and contributions. The 2017 pre-tax changes in plan assets and benefit obligations related to this plan recognized in other comprehensive income increased our other long-term asset balance by approximately $9.2 million at July 2, 2017 compared to July 3, 2016. The resulting tax impact decreased our deferred income tax asset balance by $3.4 million at July 2, 2017 in comparison to the balance as of July 3, 2016.

VAST LLC Cash Requirements