Table of Contents

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PETRÓLEOS MEXICANOS

(Exact name of Issuer as specified in its charter)

MEXICAN PETROLEUM

(Translation of registrant’s name into English)

PEMEX EXPLORACIÓN Y PRODUCCIÓN (PEMEX EXPLORATION AND PRODUCTION)

PEMEX TRANSFORMACIÓN INDUSTRIAL (PEMEX INDUSTRIAL TRANSFORMATION)

PEMEX PERFORACIÓN Y SERVICIOS (PEMEX DRILLING AND SERVICES)

PEMEX LOGÍSTICA (PEMEX LOGISTICS) and

PEMEX COGENERACIÓN Y SERVICIOS (PEMEX COGENERATION AND SERVICES)

(Exact names of co-registrants as specified in their charters and translations of co-registrants’ names into English)

| United Mexican States (State or other jurisdiction of incorporation or organization of Issuer) |

United Mexican States (State or other jurisdiction of incorporation or organization of co-registrants) |

1311 (Primary Standard Industrial Classification Code Number) |

Not Applicable (I.R.S. Employer Identification Number) |

| Avenida Marina Nacional No. 329 Colonia Verónica Anzures Ciudad de México 11300 México Telephone: (52-55) 1944-2500 (Address, including zip code, and telephone number, including area code, of Issuer’s principal executive offices) |

Avenida Marina Nacional No. 329 Colonia Verónica Anzures Ciudad de México 11300 México Telephone: (52-55) 1944-2500 (Address, including zip code, and telephone number, including area code, of co-registrants’ principal executive offices) | |

| Ignacio Arroyo Kuribreña P.M.I. Holdings North America, Inc. 909 Fannin, Suite 3200 Houston, Texas 77010 Telephone: 713-567-0182 (Name, address and telephone number of agent for service) |

Copies to: Jorge U. Juantorena Grant M. Binder Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 Facsimile: 212-225-3999 |

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

CALCULATION OF REGISTRATION FEE

|

| ||||||||

|

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Unit(1) |

Proposed Maximum Aggregate Offering |

Amount of Registration Fee(1) | ||||

|

5.500% Notes due 2019 |

U.S. $750,000,000 |

100% | U.S. $750,000,000 |

U.S. $75,525.00 | ||||

|

6.375% Notes due 2021 |

U.S. $1,250,000,000 |

100% | U.S. $1,250,000,000 |

U.S. $125,875.00 | ||||

|

6.875% Notes due 2026 |

U.S. $3,000,000,000 |

100% | U.S. $3,000,000,000 |

U.S. $302,100.00 | ||||

| Guaranties |

U.S. $5,000,000,000 |

— | — | None(2) | ||||

|

| ||||||||

|

| ||||||||

| (1) | The securities being registered are offered (i) in exchange for 5.500% Notes due 2019, 6.375% Notes due 2021 and 6.875% Notes due 2026, previously sold in transactions exempt from registration under the Securities Act of 1933 and (ii) upon certain resales of the securities by broker-dealers. The registration fee has been computed based on the face value of the securities solely for the purpose of calculating the amount of the registration fee, pursuant to Rule 457 under the Securities Act of 1933. |

| (2) | Pursuant to Rule 457(n), no separate fee is payable with respect to the guaranties. |

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

|

Prospectus |

Petróleos Mexicanos

Exchange Offers

for

U.S.$750,000,000 5.500% Notes due 2019

U.S.$1,250,000,000 6.375% Notes due 2021

U.S.$3,000,000,000 6.875% Notes due 2026

unconditionally guaranteed by

Pemex Exploration and Production

Pemex Industrial Transformation

Pemex Drilling and Services

Pemex Logistics

Pemex Cogeneration and Services

Terms of the Exchange Offers

We are not making an offer to exchange securities in any jurisdiction where the offer is not permitted.

Investing in the securities issued in the exchange offers involves certain risks. See “Risk Factors” beginning on page 11.

Neither the U.S. Securities and Exchange Commission (the SEC) nor any state securities commission in the United States of America (the United States) has approved or disapproved the securities to be distributed in the exchange offers, nor have they determined that this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

, 2016

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 10 | ||||

| 11 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 35 | ||||

| 52 | ||||

| 55 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 62 |

ii

Table of Contents

Terms such as “we,” “us” and “our” generally refer to Petróleos Mexicanos and its consolidated subsidiaries, unless the context otherwise requires.

We will apply, through our listing agent, to have the new securities admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. The old securities are currently admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange.

The information contained in this prospectus is the exclusive responsibility of the issuer and the guarantors and has not been reviewed or authorized by the Comisión Nacional Bancaria y de Valores (National Banking and Securities Commission, or the CNBV) of the United Mexican States, which we refer to as Mexico. Petróleos Mexicanos filed a notice in respect of the offerings of both the old securities and the new securities with the CNBV at the time the old securities of each series were issued. Such notice is a requirement under the Ley del Mercado de Valores (Securities Market Law) in connection with an offering of securities outside of Mexico by a Mexican issuer. Such notice is solely for information purposes and does not imply any certification as to the investment quality of the new securities, the solvency of the issuer or the guarantors or the accuracy or completeness of the information contained in this prospectus. The new securities have not been and will not be registered in the Registro Nacional de Valores (National Securities Registry), maintained by the CNBV, and may not be offered or sold publicly in Mexico. Furthermore, the new securities may not be offered or sold in Mexico, except through a private placement made to institutional or qualified investors conducted in accordance with Article 8 of the Securities Market Law.

We are responsible for the information contained in this prospectus. We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of the document.

We have filed a registration statement with the SEC on Form F-4 covering the new securities. This prospectus does not contain all of the information included in the registration statement. Any statement made in this prospectus concerning the contents of any contract, agreement or other document is not necessarily complete. If we have filed any of those contracts, agreements or other documents as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract, agreement or other document is qualified in its entirety by reference to the actual document.

Petróleos Mexicanos is required to file periodic reports and other information (File No. 0-99) with the SEC under the Securities Exchange Act of 1934, as amended (which we refer to as the Exchange Act). We will also furnish other reports as we may determine appropriate or as the law requires. You may read and copy the registration statement, including the attached exhibits, and any reports or other information we file, at the SEC’s public reference room in Washington, D.C. You can request copies of these documents, upon payment of a duplicating fee, by writing to the SEC’s Public Reference Section at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference rooms. In addition, any filings we make electronically with the SEC will be available to the public over the Internet at the SEC’s website at http://www.sec.gov under the name “Mexican Petroleum.”

You may also obtain copies of these documents at the offices of the Luxembourg listing agent, KBL European Private Bankers S.A.

The SEC allows Petróleos Mexicanos to “incorporate by reference” information it files with the SEC, which means that Petróleos Mexicanos can disclose important information to you by referring you to those documents.

1

Table of Contents

The information incorporated by reference is considered to be part of this prospectus, and later information filed with the SEC will update and supersede this information. We incorporate by reference the documents filed by Petróleos Mexicanos listed below:

| • | Petróleos Mexicanos’ annual report on Form 20-F for the year ended December 31, 2015, filed with the SEC on Form 20-F on May 16, 2016, which we refer to as the Form 20-F; |

| • | Petróleos Mexicanos’ report relating to certain recent developments and our unaudited condensed consolidated results as of and for the three–months period ended March 31, 2016, which was furnished to the SEC on Form 6-K on July 8, 2016, which we refer to as our July 6-K; and |

| • | all of Petróleos Mexicanos’ annual reports on Form 20-F, and all reports on Form 6-K that are designated in such reports as being incorporated into this prospectus, filed with the SEC pursuant to Section 13(a), 13(c) or 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of the exchange offers. |

You may request a copy of any document that is incorporated by reference in this prospectus and that has not been delivered with this prospectus, at no cost, by writing or telephoning Petróleos Mexicanos at: Gerencia Jurídica Financiera, Petróleos Mexicanos, Avenida Marina Nacional No. 329, Colonia Verónica Anzures, Ciudad de México, México 11300, telephone (52-55) 1944-9325, or by contacting our Luxembourg listing agent at the address indicated on the inside back cover of this prospectus, as long as any of the new securities are admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange, and the rules of such stock exchange so require. To ensure timely delivery, investors must request this information no later than five business days before the date they must make their investment decision.

ELECTRONIC DELIVERY OF DOCUMENTS

We are delivering copies of this prospectus in electronic form through the facilities of The Depository Trust Company (DTC). You may obtain paper copies of the prospectus by contacting the Luxembourg listing agent at its address specified on the inside back cover of this prospectus. By participating in the exchange offers, you will be consenting to electronic delivery of these documents.

References in this prospectus to “U.S. dollars,” “U.S. $,” “dollars” or “$” are to the lawful currency of the United States. References in this prospectus to “pesos” or “Ps.” are to the lawful currency of Mexico. We use the term “billion” in this prospectus to mean one thousand million.

This prospectus contains translations of certain peso amounts into U.S. dollars at specified rates solely for your convenience. You should not construe these translations as representations that the peso amounts actually represent the actual U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless we indicate otherwise, the U.S. dollar amounts included herein have been translated from pesos at an exchange rate of Ps. 17.4015 to U.S. $1.00, which is the exchange rate that the Secretaría de Hacienda y Crédito Público (the Ministry of Finance and Public Credit) instructed us to use on March 31, 2016.

On August 19, 2016, the noon buying rate for cable transfers in New York reported by the Federal Reserve Bank was Ps. 18.2525 = U.S. $1.00.

2

Table of Contents

PRESENTATION OF FINANCIAL INFORMATION

The audited consolidated financial statements of Petróleos Mexicanos, subsidiary entities and subsidiary companies as of December 31, 2015 and 2014 and for the years ended December 31, 2015, 2014 and 2013 are included in Item 18 of the Form 20-F incorporated by reference in this prospectus and the registration statement covering the new securities. We refer to these financial statements as the 2015 financial statements. These consolidated financial statements were prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IASB). We refer in this document to “International Financial Reporting Standards as issued by the IASB” as IFRS. These financial statements were audited in accordance with the International Standards on Auditing, as required by the CNBV, and in accordance with the standards of the Public Company Accounting Oversight Board (PCAOB) (United States) for purposes of filing with the SEC.

We have incorporated by reference in this prospectus the unaudited condensed consolidated interim financial statements of Petróleos Mexicanos, subsidiary entities and subsidiary companies as of March 31, 2016 and for the three–month periods ended March 31, 2016 and 2015 (which we refer to as the March 2016 interim financial statements), which were not audited and were prepared in accordance with International Accounting Standard (IAS) 34 “Interim Financial Reporting” of IFRS.

3

Table of Contents

The following summary highlights selected information from this prospectus and may not contain all of the information that is important to you. This prospectus includes specific terms of the new securities we are offering, as well as information regarding our business and detailed financial data. We encourage you to read this prospectus in its entirety.

4

Table of Contents

5

Table of Contents

6

Table of Contents

7

Table of Contents

8

Table of Contents

9

Table of Contents

This selected financial data set forth below is derived in part from, and should be read in conjunction with, our 2015 financial statements and our March 2016 interim financial statements, which are each incorporated by reference in this prospectus.

| As of and for the Year Ended December 31,(1)(2) |

As of and for the Three Months Ended March 31,(1)(3) |

|||||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | ||||||||||||||||||||||

| (in millions of pesos, except ratios) | ||||||||||||||||||||||||||||

| Statement of Comprehensive Income Data |

||||||||||||||||||||||||||||

| Net sales |

Ps. | 1,558,454 | Ps. | 1,646,912 | Ps. | 1,608,205 | Ps. | 1,586,728 | Ps. | 1,166,362 | Ps. | 279,499 | Ps. | 224,989 | ||||||||||||||

| Operating income |

861,311 | 905,339 | 727,622 | 615,480 | (154,387 | ) | 48,433 | 31,099 | ||||||||||||||||||||

| Financing income |

4,198 | 2,532 | 8,736 | 3,014 | 14,991 | 1,762 | 1,780 | |||||||||||||||||||||

| Financing cost |

(35,154 | ) | (46,011 | ) | (39,586 | ) | (51,559 | ) | (67,774 | ) | (15,157 | ) | (19,587 | ) | ||||||||||||||

| Derivative financial instruments (cost) income—Net |

(1,697 | ) | (6,258 | ) | 1,311 | (9,439 | ) | (21,450 | ) | (16,185 | ) | 8,944 | ||||||||||||||||

| Exchange (loss)—Net |

(60,143 | ) | 44,846 | (3,951 | ) | (76,999 | ) | (154,766 | ) | (16,613 | ) | (19,024 | ) | |||||||||||||||

| Net (loss) income for the period |

(106,942 | ) | 2,600 | (170,058 | ) | (265,543 | ) | (712,567 | ) | (100,546 | ) | (62,013 | ) | |||||||||||||||

| Statement of Financial Position Data (end of period) |

||||||||||||||||||||||||||||

| Cash and cash equivalents |

114,977 | 119,235 | 80,746 | 117,989 | 109,369 | 128,607 | 141,014 | |||||||||||||||||||||

| Total assets |

1,981,374 | 2,024,183 | 2,047,390 | 2,128,368 | 1,775,654 | 2,142,976 | 1,824,817 | |||||||||||||||||||||

| Long-term debt |

672,657 | 672,618 | 750,563 | 997,384 | 1,300,873 | 1,105,196 | 1,428,261 | |||||||||||||||||||||

| Total long-term liabilities |

1,624,752 | 2,059,445 | 1,973,446 | 2,561,930 | 2,663,922 | 2,688,677 | 2,812,045 | |||||||||||||||||||||

| Total equity (deficit) |

103,177 | (271,066 | ) | (185,247 | ) | (767,721 | ) | (1,331,676 | ) | (852,363 | ) | (1,394,491 | ) | |||||||||||||||

| Statement of Cash Flows |

||||||||||||||||||||||||||||

| Depreciation and amortization |

127,380 | 140,538 | 148,492 | 143,075 | 167,951 | 36,971 | 27,005 | |||||||||||||||||||||

| Acquisition of wells, pipelines, properties, plant and equipment(3) |

167,014 | 197,509 | 245,628 | 230,679 | 253,514 | 40,969 | 25,277 | |||||||||||||||||||||

| Other Financial Data |

||||||||||||||||||||||||||||

| Ratio of earnings to fixed charges(4)(5)(6) |

— | 1.01 | — | — | — | — | — | |||||||||||||||||||||

Note:

| (1) | Includes Petróleos Mexicanos, the subsidiary entities and the subsidiary companies listed in Note 4 to our 2015 financial statements and in Note 4 to our March 2016 interim financial statements. |

| (2) | Information derived from our 2015 financial statements. |

| (3) | Unaudited. Information derived from our March 2016 interim financial statements, which were furnished to the SEC as part of the July 6-K. |

| (4) | Includes capitalized financing cost. See Note 12 to our 2015 financial statements, “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources” in the Form 20-F and Note 3(g) to our March 2016 interim financial statements. |

| (5) | Earnings, for this purpose, consist of pre-tax income (loss) from continuing operations before income from equity investment shares, plus fixed charges, minus interest capitalized during the period, plus the amortization of interest capitalized during the period and plus dividends received on equity investees. Pre-tax income (loss) is calculated after the deduction of hydrocarbon duties, but before the deduction of the hydrocarbon income tax and other income taxes. Fixed charges for this purpose consist of the sum of interest expense plus interest capitalized during the period, plus amortization premiums related to indebtedness and plus the estimated interest within rental expense. Fixed charges do not take into account exchange gain or loss attributable to our indebtedness. |

| (6) | Earnings for the years ended December 31, 2011, 2013, 2014 and 2015 and for the three—months ended March 31, 2015 and 2016 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 106,476 million, Ps. 165,217 million, Ps. 283,640 million and Ps. 765,161 million, for the years ended December 31, 2011, 2013, 2014 and 2015, respectively, and Ps. 100,217 million and Ps. 62,628 million for the three—months ended March 31, 2015 and 2016, respectively. |

Source: 2015 financial statements and March 2016 interim financial statements.

10

Table of Contents

Risk Factors Related to Our Operations

Crude oil and natural gas prices are volatile and low crude oil and natural gas prices adversely affect our income and cash flows and the amount of hydrocarbon reserves that we have the right to extract and sell.

International crude oil and natural gas prices are subject to global supply and demand and fluctuate due to many factors beyond our control. These factors include competition within the oil and natural gas industry, the prices and availability of alternative sources of energy, international economic trends, exchange rate fluctuations, expectations of inflation, domestic and foreign government regulations or international laws, political and other events in major oil and natural gas producing and consuming nations and actions taken by oil exporting countries, trading activity in oil and natural gas and transactions in derivative financial instruments (which we refer to as DFIs) related to oil and gas.

When international crude oil, petroleum product and/or natural gas prices are low, we generally earn less revenue and, therefore, generate lower cash flows and earn less income before taxes and duties because our costs remain roughly constant. Conversely, when crude oil, petroleum product and natural gas prices are high, we earn more revenue and our income before taxes and duties increases. Crude oil export prices, which had generally traded above U.S. $75.00 per barrel since October 2009 and traded above U.S. $100.00 per barrel as recently as July 30, 2014, began to fall in August 2014. After a gradual decline that resulted in per barrel prices falling to U.S. $91.16 at September 30, 2014, this decline sharply accelerated in October 2014 and prices fell to U.S. $53.27 per barrel at the end of 2014, with a weighted average price for the year of U.S. $86.00 per barrel. During 2015, the weighted average Mexican crude oil export price was approximately U.S. $44.17 per barrel and fell to U.S. $26.54 per barrel by the end of December 2015. This decline in crude oil prices had a direct effect on our results of operations and financial condition for the year ended December 31, 2015. So far in 2016, the weighted average Mexican crude oil export price has fallen to a low of U.S. $20.70 per barrel, the lowest in twelve years, but has since rebounded to U.S. $42.37 per barrel as of June 8, 2016. Future declines in international crude oil and natural gas prices will have a similar negative impact on our results of operations and financial condition. These fluctuations may also affect estimates of the amount of Mexico’s hydrocarbon reserves that we have the right to extract and sell. See “—Risk Factors Related to our Relationship with the Mexican Government—Information on Mexico’s hydrocarbon reserves in the Form 20-F is based on estimates, which are uncertain and subject to revisions” below and “Item 11—Quantitative and Qualitative Disclosures About Market Risk—Changes in Exposure to Main Risks—Market Risk—Hydrocarbon Price Risk” in the Form 20-F.

We have a substantial amount of indebtedness and other liabilities and are exposed to liquidity constraints, which could make it difficult for us to obtain financing on favorable terms, could adversely affect our financial condition, results of operations and ability to repay our debt and, ultimately, our ability to operate as a going concern.

We have a substantial amount of debt, which we have incurred primarily to finance the capital expenditures needed to carry out our capital investment projects. Due to our heavy tax burden, our cash flow from operations in recent years has not been sufficient to fund our capital expenditures and other expenses and, accordingly, our debt has significantly increased and our working capital has decreased. The sharp decline in oil prices that began in late 2014 has had a negative impact on our ability to generate positive cash flows, which, together with our continued heavy tax burden, has further exacerbated our ability to fund our capital expenditures and other expenses from cash flow from operations. Therefore, in order to develop our hydrocarbon reserves and amortize scheduled debt maturities, we will need to raise significant amounts of financing from a broad range of funding sources.

As of March 31, 2016, our total indebtedness, including accrued interest, was approximately U.S. $93.3 billion (Ps. 1,622.9 billion), in nominal terms, which represents a 7.5% increase (an 8.7% increase in peso terms) compared to our total indebtedness, including accrued interest, of approximately U.S. $86.8 billion

11

Table of Contents

(Ps. 1,493.4 billion) as of December 31, 2015. As of December 31, 2015, our total indebtedness, including accrued interest, was approximately U.S. $86.8 billion (Ps. 1,493.4 billion), in nominal terms, which represents a 11.7% increase (a 30.6% increase in peso terms) compared to our total indebtedness, including accrued interest, of approximately U.S. $77.7 billion (Ps. 1,143.3 billion) as of December 31, 2014. 26.7% of our existing debt as of December 31, 2015, or U.S. $23.1 billion, is scheduled to mature in the next three years. As of December 31, 2015, we had negative working capital of U.S. $10.2 billion. Our level of debt may increase further in the short or medium term and may have an adverse effect on our financial condition, results of operations and liquidity position. To service our debt and to raise funds for our capital expenditures, we have relied and may continue to rely on a combination of cash flows provided by operations, drawdowns under our available credit facilities and the incurrence of additional indebtedness. In addition, we have taken recent action to improve our financial condition, as described in more detail under “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Overview—Changes to Our Business Plan” in the Form 20-F.

Certain rating agencies have expressed concerns regarding: (1) the total amount of our debt; (2) the significant increase in our indebtedness over the last several years; (3) our negative free cash flow during 2015, primarily resulting from our significant capital investment projects and the declining price of oil; (4) our substantial unfunded reserve for retirement pensions and seniority premiums, which was equal to U.S. $74.4 billion as of December 31, 2015; and (5) the resilience of our operating expenses notwithstanding the sharp decline in oil prices that began in late 2014. On January 29, 2016, Standard & Poor’s announced the downgrade of our stand-alone credit profile from BB+ to BB. On March 31, 2016, Moody’s Investors Service announced the revision of our global foreign currency and local currency credit ratings from Baa1 to Baa3 and changed the outlook for its credit ratings to negative. On July 26, 2016, Fitch Ratings announced the downgrade of our global local currency credit ratings from A- to BBB+.

Any further lowering of our credit ratings may have adverse consequences on our ability to access the financial markets and/or our cost of financing. If we were unable to obtain financing on favorable terms, this could hamper our ability to (1) obtain further financing and (2) invest in projects financed through debt and impair our ability to meet our principal and interest payment obligations with our creditors. As a result, we may be exposed to liquidity constraints and may not be able to service our debt or make the capital expenditures required to maintain our current production levels and to maintain, and increase, the proved hydrocarbon reserves assigned to us by the Mexican Government, which may adversely affect our financial condition and results of operations. See “—Risk Factors Related to our Relationship with the Mexican Government—We must make significant capital expenditures to maintain our current production levels, and to maintain, as well as increase, the proved hydrocarbon reserves assigned to us by the Mexican Government. Reductions in our income, adjustments to our capital expenditures budget and our inability to obtain financing may limit our ability to make capital investments” below.

If such constraints occur at a time when our cash flow from operations is less than the resources necessary to fund our capital expenditures or to meet our debt service obligations, in order to provide additional liquidity to our operations, we could be forced to further reduce our planned capital expenditures, implement further austerity measures and/or sell additional non-strategic assets in order to raise funds. A reduction in our capital expenditure program could adversely affect our financial condition and results of operations. Additionally, such measures may not be sufficient to permit us to meet our obligations.

Our consolidated financial statements have been prepared under the assumption that we will continue as a going concern. However, our independent auditors have stated in their most recent report in the Form 20-F that there is substantial doubt about our ability to continue as a going concern as a result of our recurring losses from operations and our negative working capital and negative equity. Our consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty. If the actions we are taking to improve our financial condition, which are described in detail under “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Overview—Changes to Our Business Plan” in the Form 20-F, are not successful, we may not be able to continue operating as a going concern.

12

Table of Contents

We are an integrated oil and gas company and are exposed to production, equipment and transportation risks, criminal acts and deliberate acts of terror.

We are subject to several risks that are common among oil and gas companies. These risks include production risks (fluctuations in production due to operational hazards, natural disasters or weather, accidents, etc.), equipment risks (relating to the adequacy and condition of our facilities and equipment) and transportation risks (relating to the condition and vulnerability of pipelines and other modes of transportation). More specifically, our business is subject to the risks of explosions in pipelines, refineries, plants, drilling wells and other facilities, oil spills, hurricanes in the Gulf of Mexico and other natural or geological disasters and accidents, fires and mechanical failures. Criminal attempts to divert our crude oil, natural gas or refined products from our pipeline network and facilities for illegal sale have resulted in explosions, property and environmental damage, injuries and loss of life.

Our facilities are also subject to the risk of sabotage, terrorism and cyber-attacks. In July 2007, two of our pipelines were attacked. In September 2007, six different sites were attacked and 12 of our pipelines were affected. The occurrence of these incidents related to the production, processing and transportation of oil and oil products could result in personal injuries, loss of life, environmental damage from the subsequent containment, clean-up and repair expenses, equipment damage and damage to our facilities. A shutdown of the affected facilities could disrupt our production and increase our production costs. As of the date of this prospectus, there have been no similar occurrences since 2007. Although we have established an information security program, which includes cybersecurity systems and procedures to protect our information technology, and have not yet suffered a cyber-attack, if the integrity of our information technology were ever compromised due to a cyber-attack, our business operations could be disrupted and our proprietary information could be lost or stolen.

We purchase comprehensive insurance policies covering most of these risks; however, these policies may not cover all liabilities, and insurance may not be available for some of the consequential risks. There can be no assurance that accidents or acts of terror will not occur in the future, that insurance will adequately cover the entire scope or extent of our losses or that we may not be found directly liable in connection with claims arising from accidents or other similar events. See “Item 4—Information on the Company—Business Overview—PEMEX Corporate Matters—Insurance” in the Form 20-F.

Developments in the oil and gas industry and other factors may result in substantial write-downs of the carrying amount of certain of our assets, which could adversely affect our operating results and financial condition.

We evaluate on an annual basis, or more frequently where the circumstances require, the carrying amount of our assets for possible impairment. Our impairment tests are performed by a comparison of the carrying amount of an individual asset or a cash-generating unit with its recoverable amount. Whenever the recoverable amount of an individual asset or cash-generating unit is less than its carrying amount, an impairment loss is recognized to reduce the carrying amount to the recoverable amount.

Changes in the economic, regulatory, business or political environment in Mexico or other markets where we operate, such as the recent significant decline in international crude oil and gas prices and the devaluation of the peso against the U.S. dollar, among other factors, may result in the recognition of impairment charges in certain of our assets. Due to the continuing decline in oil prices, we have performed impairment tests of our non-financial assets (other than inventories and deferred taxes) at the end of each quarter. As of December 31, 2015, we recognized an impairment charge of Ps. 477,945 million. As of March 31, 2016, we did not recognize an impairment charge. See Note 12(c) to our unaudited condensed consolidated interim financial statements for further information about the impairment of certain of our assets. Future developments in the economic environment, in the oil and gas industry and other factors could result in further substantial impairment charges, adversely affecting our operating results and financial condition.

13

Table of Contents

Increased competition in the energy sector due to the new legal framework in Mexico could adversely affect our business and financial performance.

The Mexican Constitution and the Ley de Hidrocarburos (Hydrocarbons Law) allows other oil and gas companies, in addition to us, to carry out certain activities related to the energy sector in Mexico, including exploration and extraction activities. As of the date of this prospectus, the Mexican Government has entered into production sharing contracts with other oil and gas companies following the competitive bidding processes held in July and September 2015 for shallow water blocks and in December 2015 for exploratory blocks and discovered fields in onshore areas. Additional competitive bidding processes will take place in the future, including bids for deep water fields in December of this year. As a result, we face competition for the right to explore and develop new oil and gas reserves in Mexico. We will also likely face competition in connection with certain refining, transportation and processing activities. In addition, increased competition could make it difficult for us to hire and retain skilled personnel. For more information, see “Item 4—Information on the Company—History and Development—Recent Energy Reform” in the Form 20-F. If we are unable to compete successfully with other oil and gas companies in the energy sector in Mexico, our results of operations and financial condition may be adversely affected.

We are subject to Mexican and international anti-corruption, anti-bribery and anti-money laundering laws. Our failure to comply with these laws could result in penalties, which could harm our reputation and have an adverse effect on our business, results of operations and financial condition.

We are subject to Mexican and international anti-corruption, anti-bribery and anti-money laundering laws. See “Item 4—Information on the Company—General Regulatory Framework” in the Form 20-F. Although we maintain policies and processes intended to comply with these laws, including the review of our internal control over financial reporting, we cannot ensure that these compliance policies and processes will prevent intentional, reckless or negligent acts committed by our officers or employees.

If we fail to comply with any applicable anti-corruption, anti-bribery or anti-money laundering laws, we and our officers and employees may be subject to criminal, administrative or civil penalties and other remedial measures, which could have material adverse effects on our business, financial condition and results of operations. Any investigation of potential violations of anti-corruption, anti-bribery or anti-money laundering laws by governmental authorities in Mexico or other jurisdictions could result in an inability to prepare our consolidated financial statements in a timely manner. This could adversely impact our reputation, ability to access the financial markets and ability to obtain contracts, assignments, permits and other government authorizations necessary to participate in our industry, which, in turn, could have adverse effects on our business, results of operations and financial condition.

Our compliance with environmental regulations in Mexico could result in material adverse effects on our results of operations.

A wide range of general and industry-specific Mexican federal and state environmental laws and regulations apply to our operations; these laws and regulations are often difficult and costly to comply with and carry substantial penalties for non-compliance. This regulatory burden increases our costs because it requires us to make significant capital expenditures and limits our ability to extract hydrocarbons, resulting in lower revenues. For an estimate of our accrued environmental liabilities, see “Item 4—Information on the Company—Environmental Regulation—Environmental Liabilities” in the Form 20-F. However, growing international concern over greenhouse gas emissions and climate change could result in new laws and regulations that could adversely affect our results of operations and financial condition. International agreements, including the recent Paris Agreement approved by the Mexican Government, contemplate coordinated efforts to combat climate change. While it is still too early to know how these new agreements will be implemented, we may become subject to market changes, including carbon taxes, efficiency standards, cap-and-trade and emission allowances and credits. These measures could increase our operating and maintenance costs, increase the price of our

14

Table of Contents

hydrocarbon products and possibly shift consumer demand to lower-carbon sources. See “Item 4—Environmental Regulation—Global Climate Change and Carbon Dioxide Emissions Reduction” in the Form 20-F for more information on the Mexican Government’s current legal and regulatory framework for combatting climate change.

Risk Factors Related to Mexico

Economic conditions and government policies in Mexico and elsewhere may have a material impact on our operations.

A deterioration in Mexico’s economic condition, social instability, political unrest or other adverse social developments in Mexico could adversely affect our business and financial condition. Those events could also lead to increased volatility in the foreign exchange and financial markets, thereby affecting our ability to obtain new financing and service our debt. Additionally, the Mexican Government announced budget cuts in November 2015 and February 2016 in response to the recent decline in international crude oil prices, and it may cut spending in the future. See “—Risk Factors Related to our Relationship with the Mexican Government—The Mexican Government controls us and it could limit our ability to satisfy our external debt obligations or could reorganize or transfer us or our assets” below. These cuts could adversely affect the Mexican economy and, consequently, our business, financial condition, operating results and prospects.

In the past, Mexico has experienced several periods of slow or negative economic growth, high inflation, high interest rates, currency devaluation and other economic problems. These problems may worsen or reemerge, as applicable, in the future and could adversely affect our business and ability to service our debt. A worsening of international financial or economic conditions, such as a slowdown in growth or recessionary conditions in Mexico’s trading partners, including the United States, or the emergence of a new financial crisis, could have adverse effects on the Mexican economy, our financial condition and our ability to service our debt.

Changes in Mexico’s exchange control laws may hamper our ability to service our foreign currency debt.

The Mexican Government does not currently restrict the ability of Mexican companies or individuals to convert pesos into other currencies. However, we cannot provide assurances that the Mexican Government will maintain its current policies with regard to the peso. In the future, the Mexican Government could impose a restrictive exchange control policy, as it has done in the past. Mexican Government policies preventing us from exchanging pesos into U.S. dollars could hamper our ability to service our foreign currency obligations, including our debt, the majority of which is denominated in currencies other than pesos.

Political conditions in Mexico could materially and adversely affect Mexican economic policy and, in turn, our operations.

Political events in Mexico may significantly affect Mexican economic policy and, consequently, our operations. On December 1, 2012, Mr. Enrique Peña Nieto, a member of the Partido Revolucionario Institucional (Institutional Revolutionary Party, or PRI), formally assumed office for a six-year term as the President of Mexico. As of the date of this prospectus, no political party holds a simple majority in either house of the Mexican Congress.

Mexico has experienced a period of increasing criminal activity, which could affect our operations.

In recent years, Mexico has experienced a period of increasing criminal activity, primarily due to the activities of drug cartels and related criminal organizations. In addition, the development of the illicit market in fuels in Mexico has led to increases in theft and illegal trade in the fuels that we produce. In response, the Mexican Government has implemented various security measures and has strengthened its military and police forces, and we have also established various strategic measures aimed at decreasing incidents of theft and other

15

Table of Contents

criminal activity directed at our facilities and products. See “Item 8—Financial Information—Legal Proceedings—Actions Against the Illicit Market in Fuels” in the Form 20-F. Despite these efforts, criminal activity continues to exist in Mexico, some of which may target our facilities and products. These activities, their possible escalation and the violence associated with them, in an extreme case, may have a negative impact on our financial condition and results of operations.

Risk Factors Related to our Relationship with the Mexican Government

The Mexican Government controls us and it could limit our ability to satisfy our external debt obligations or could reorganize or transfer us or our assets.

We are controlled by the Mexican Government and our annual budget may be adjusted by the Mexican Government in certain respects. Pursuant to the Petróleos Mexicanos Law, Petróleos Mexicanos was transformed from a decentralized public entity to a productive state-owned company on October 7, 2014. The Petróleos Mexicanos Law establishes a special regime governing, among other things, our budget, debt levels, administrative liabilities, acquisitions, leases, services and public works. This special regime provides Petróleos Mexicanos with additional technical and managerial autonomy and, subject to certain restrictions, with additional autonomy with respect to our budget. Notwithstanding this increased autonomy, the Mexican Government still controls us and has the power to adjust our financial balance goal, which represents our targeted net cash flow for the fiscal year based on our projected revenues and expenses, and our annual wage and salary expenditures, subject to the approval of the Cámara de Diputados (Chamber of Deputies).

The adjustments to our annual budget mentioned above may compromise our ability to develop the reserves assigned to us by the Mexican Government and to successfully compete with other oil and gas companies that enter the Mexican energy sector. See “Item 4—Information on the Company—History and Development—Capital Expenditures and Investments—Capital Expenditures Budget” in the Form 20-F for more information about our February 2015 and February 2016 budget adjustments and “—General Regulatory Framework” in the Form 20-F for more information about the Mexican Government’s authority with respect to our budget. In addition, the Mexican Government’s control over us could adversely affect our ability to make payments under any securities issued by Petróleos Mexicanos. Although Petróleos Mexicanos is wholly owned by the Mexican Government, our financing obligations do not constitute obligations of and are not guaranteed by the Mexican Government.

The Mexican Government’s agreements with international creditors may affect our external debt obligations. In certain past debt restructurings of the Mexican Government, Petróleos Mexicanos’ external indebtedness was treated on the same terms as the debt of the Mexican Government and other public sector entities, and it may be treated on similar terms in any future debt restructuring. In addition, Mexico has entered into agreements with official bilateral creditors to reschedule public sector external debt. Mexico has not requested restructuring of bonds or debt owed to multilateral agencies.

The Mexican Government has the power, if the Mexican Constitution and federal law were further amended, to further reorganize our corporate structure, including a transfer of all or a portion of our assets to an entity not controlled, directly or indirectly, by the Mexican Government. See “—Risk Factors Related to Mexico” above.

We pay significant special taxes and duties to the Mexican Government, which may limit our capacity to expand our investment program or negatively impact our financial condition generally.

We are required to make significant payments to the Mexican Government, including in the form of taxes and duties, which may limit our ability to make capital investments. In 2015, approximately 37.5% of our sales revenues was used for payments to the Mexican Government in the form of taxes and duties, which constituted a substantial portion of the Mexican Government’s revenues.

16

Table of Contents

The Secondary Legislation includes changes to the fiscal regime applicable to us, particularly with respect to the exploration and extraction activities that we carry out in Mexico. Beginning in 2016, we have the obligation, subject to the conditions set forth in the Petróleos Mexicanos Law, to pay a state dividend in lieu of certain payments that we paid at the discretion of the Mexican Government. This state dividend will be calculated by the Ministry of Finance and Public Credit as a percentage of the net income that we generate through activities subject to the Ley de Ingresos sobre Hidrocarburos (Hydrocarbons Revenue Law) on an annual basis and approved by the Mexican Congress in accordance with the terms of the Petróleos Mexicanos Law. The amount we pay each year under this state dividend will decrease in subsequent years, reaching 0% by 2026. The Mexican Government has announced that we will not be required to pay a state dividend in 2016. See “Item 8—Financial Information—Dividends” in the Form 20-F for more information. Although the changes to the fiscal regime applicable to us are designed in part to reduce the Mexican Government’s reliance on payments made by us, we cannot provide assurances that we will not be required to continue to pay a large proportion of our sales revenue to the Mexican Government. See “Item 4—Information on the Company—Taxes, Duties and Other Payments to the Mexican Government—Fiscal Regime” in the Form 20-F. As of the date of this prospectus, we are assessing the impact that these changes may have on us. In addition, the Mexican Government may change the applicable rules in the future.

The Mexican Government has imposed price controls in the domestic market on our products.

The Mexican Government has from time to time imposed price controls on the sales of natural gas, liquefied petroleum gas, gasoline, diesel, gas oil intended for domestic use, fuel oil and other products. As a result of these price controls, we have not been able to pass on all of the increases in the prices of our product purchases to our customers in the domestic market when the peso depreciates in relation to the U.S. dollar. A depreciation of the peso increases our cost of imported oil and oil products, without a corresponding increase in our revenues unless we are able to increase the price at which we sell products in Mexico. We do not control the Mexican Government’s domestic policies and the Mexican Government could impose additional price controls on the domestic market in the future. The imposition of such price controls would adversely affect our results of operations. For more information, see “Item 4—Information on the Company—Business Overview—Refining—Pricing Decrees” and “Item 4—Information on the Company—Business Overview—Gas and Basic Petrochemicals—Pricing Decrees” in the Form 20-F.

The Mexican nation, not us, owns the hydrocarbon reserves located in Mexico and our right to continue to extract these reserves is subject to the approval of the Ministry of Energy.

The Mexican Constitution provides that the Mexican nation, not us, owns all petroleum and other hydrocarbon reserves located in Mexico.

Article 27 of the Mexican Constitution provides that the Mexican Government will carry out exploration and production activities through agreements with third parties and through assignments to and agreements with us. The Secondary Legislation allows us and other oil and gas companies to explore and extract the petroleum and other hydrocarbon reserves located in Mexico, subject to assignment of rights by the Ministry of Energy and entry into agreements pursuant to a competitive bidding process.

Access to crude oil and natural gas reserves is essential to an oil and gas company’s sustained production and generation of income, and our ability to generate income would be materially and adversely affected if the Mexican Government were to restrict or prevent us from exploring or extracting any of the crude oil and natural gas reserves that it has assigned to us or if we are unable to compete effectively with other oil and gas companies in future bidding rounds for additional exploration and production rights in Mexico. For more information, see “—We must make significant capital expenditures to maintain our current production levels, and to maintain, as well as increase, the proved hydrocarbon reserves assigned to us by the Mexican Government. Reductions in our income, adjustments to our capital expenditures budget and our inability to obtain financing may limit our ability to make capital investments” below.

17

Table of Contents

Information on Mexico’s hydrocarbon reserves in the Form 20-F is based on estimates, which are uncertain and subject to revisions.

The information on oil, gas and other reserves set forth in the Form 20-F is based on estimates. Reserves valuation is a subjective process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner; the accuracy of any reserves estimate depends on the quality and reliability of available data, engineering and geological interpretation and subjective judgment. Additionally, estimates may be revised based on subsequent results of drilling, testing and production. These estimates are also subject to certain adjustments based on changes in variables, including crude oil prices. Therefore, proved reserves estimates may differ materially from the ultimately recoverable quantities of crude oil and natural gas. Downward revisions in our reserve estimates could lead to lower future production, which could have an adverse effect on our results of operations and financial condition. See “—Risk Factors Related to Our Operations—Crude oil and natural gas prices are volatile and low crude oil and natural gas prices adversely affect our income and cash flows and the amount of hydrocarbon reserves that we have the right to extract and sell” above. We revise annually our estimates of hydrocarbon reserves that we are entitled to extract and sell, which may result in material revisions to these estimates. Our ability to maintain our long-term growth objectives for oil production depends on our ability to successfully develop our reserves, and failure to do so could prevent us from achieving our long-term goals for growth in production.

We must make significant capital expenditures to maintain our current production levels, and to maintain, as well as increase, the proved hydrocarbon reserves assigned to us by the Mexican Government. Reductions in our income, adjustments to our capital expenditures budget and our inability to obtain financing may limit our ability to make capital investments.

Because our ability to maintain, as well as increase, our oil production levels is highly dependent upon our ability to successfully develop existing hydrocarbon reserves and, in the long term, upon our ability to obtain the right to develop additional reserves, we continually invest capital to enhance our hydrocarbon recovery ratio and improve the reliability and productivity of our infrastructure. During 2015, our exploratory activity led to the incorporation to proved reserves of approximately 120 million barrels of oil equivalent. This amount, however, was less than the reductions made due to revisions, delimitations and decreased development and production in 2015. Accordingly, our total proved reserves decreased by 22.1%, from 12,380 million barrels of crude oil equivalent as of December 31, 2014 to 9,632 million barrels of crude oil as of December 31, 2015. See “Item 4—Information on the Company—Business Overview—Exploration and Production—Reserves” in the Form 20-F for more information about the factors leading to this decline, including the results of Round Zero. Our crude oil production decreased by 1.0% from 2012 to 2013, by 3.7% from 2013 to 2014 and by 6.7% from 2014 to 2015, primarily as a result of the decline of production in the Cantarell, Aceite Terciario del Golfo (which we refer to as ATG), Delta del Grijalva, Crudo Ligero Marino and Ixtal-Manik projects.

The recent energy reform in Mexico outlined a process, commonly referred to as Round Zero, for the determination of our initial allocation of rights to continue to carry out exploration and production activities in Mexico. On August 13, 2014, the Ministry of Energy granted us the right to continue to explore and develop areas that together contain 95.9% of Mexico’s estimated proved reserves of crude oil and natural gas. The development of the reserves that were assigned to us pursuant to Round Zero, particularly the reserves in the deep waters of the Gulf of Mexico and in shale oil and gas fields in the Burgos basin, will demand significant capital investments and will pose significant operational challenges. Our right to develop the reserves assigned to us through Round Zero is conditioned on our ability to develop such reserves in accordance with our development plans, which were based on our technical, financial and operational capabilities at the time. See “Item 4—History and Development—Recent Energy Reform—Assignment of Exploration and Production Rights” in the Form 20-F. We cannot provide assurances that we will have or will be able to obtain, in the time frame that we expect, sufficient resources or the technical capacity necessary to explore and extract the reserves that the Mexican Government assigned to us as part of Round Zero, or that it may grant to us in the future. The decline in oil prices has forced us to make adjustments to our budget, including a significant reduction of our

18

Table of Contents

capital expenditures. Unless we are able to increase our capital expenditures, we may not be able to develop the reserves assigned to us in accordance with our development plans. We would lose the right to continue to extract these reserves if we fail to develop them in accordance with our development plans, which could adversely affect our operating results and financial condition. In addition, increased competition in the oil and gas sector in Mexico may increase the costs of obtaining additional acreage in bidding rounds for the rights to new reserves.

Our ability to make capital expenditures is limited by the substantial taxes and duties that we pay to the Mexican Government, the ability of the Mexican Government to adjust certain aspects of our annual budget, cyclical decreases in our revenues primarily related to lower oil prices and any constraints on our liquidity. The availability of financing may limit our ability to make capital investments that are necessary to maintain current production levels and increase the proved hydrocarbon reserves that we are entitled to extract. Nevertheless, the recent energy reform has provided us with opportunities to enter into strategic alliances and partnerships, which may reduce our capital commitments and allow us to participate in projects for which we are more competitive. For more information, see “Item 4—Information on the Company—History and Development—Capital Expenditures and Investments” and “—Recent Energy Reform” in the Form 20-F. For more information on the liquidity constraints we are exposed to, see “—We have a substantial amount of indebtedness and other liabilities and are exposed to liquidity constraints, which could make it difficult for us to obtain financing on favorable terms and adversely affect our financial condition, results of operations and ability to repay our debt” above.

We may claim some immunities under the Foreign Sovereign Immunities Act and Mexican law, and your ability to sue or recover may be limited.

We are public-sector entities of the Mexican Government. Accordingly, you may not be able to obtain a judgment in a U.S. court against us unless the U.S. court determines that we are not entitled to sovereign immunity with respect to that action. Under certain circumstances, Mexican law may limit your ability to enforce judgments against us in the courts of Mexico. We also do not know whether Mexican courts would enforce judgments of U.S. courts based on the civil liability provisions of the U.S. federal securities laws. Therefore, even if you were able to obtain a U.S. judgment against us, you might not be able to obtain a judgment in Mexico that is based on that U.S. judgment. Moreover, you may not be able to enforce a judgment against our property in the United States except under the limited circumstances specified in the Foreign Sovereign Immunities Act of 1976, as amended. Finally, if you were to bring an action in Mexico seeking to enforce our obligations under any securities issued by Petróleos Mexicanos, satisfaction of those obligations may be made in pesos, pursuant to the laws of Mexico.

Our directors and officers, as well as some of the experts named in the Form 20-F, reside outside the United States. Substantially all of our assets and those of most of our directors, officers and experts are located outside the United States. As a result, investors may not be able to effect service of process on our directors or officers or those experts within the United States.

Risks Related to Non-Participation in the Exchange Offers

If holders of old securities do not participate in the exchange offers, the old securities will continue to be subject to transfer restrictions.

Holders of old securities that are not registered under the Securities Act who do not exchange their unregistered old securities for new securities will continue to be subject to the restrictions on transfer that are listed on the legends of those old securities. These restrictions will make the old securities less liquid. To the extent that old securities are tendered and accepted in the exchange offers, the trading market, if any, for the old securities would be reduced.

19

Table of Contents

Risks Related to the New Securities

The market for the new securities or the old securities may not be liquid, and market conditions could affect the price at which the new securities or the old securities trade.

The issuer will apply, through its listing agent, to have the new securities admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. All of the old securities are currently admitted to trading on the Euro MTF. In the event that the new securities are admitted to trading on the Euro MTF, we will use our best efforts to maintain such listing; provided that if legislation is adopted in Luxembourg in a manner that would require us to publish our financial statements according to accounting principles or standards that are materially different from those we apply in our financial reporting under the securities laws of Mexico and the United States or that would otherwise impose requirements on us or the guarantors that we determine in good faith are unduly burdensome, the issuer may de-list the new securities and/or the old securities. The issuer will use its reasonable best efforts to obtain an alternative admission to listing, trading or quotation for such securities by another listing authority, exchange or system within or outside the European Union, as the issuer may reasonably decide, although there can be no assurance that such alternative listing will be obtained.

In addition, the issuer cannot promise that a market for either the new securities or the old securities will be liquid or will continue to exist. Prevailing interest rates and general market conditions could affect the price of the new securities or the old securities. This could cause the new securities or the old securities to trade at prices that may be lower than their principal amount or their initial offering price.

The new securities will contain provisions that permit the issuer to amend the payment terms of the new securities without the consent of all holders.

The new securities will contain provisions regarding acceleration and voting on amendments, modifications and waivers which are commonly referred to as collective action clauses. Under these provisions, certain key terms of a series of the new securities may be amended, including the maturity date, interest rate and other payment terms, without the consent of all of the holders. See “Description of the New Securities—Modification and Waiver.”

The rating of the new securities may be lowered or withdrawn depending on various factors, including the rating agencies’ assessments of our financial strength and Mexican sovereign risk.

The rating of the new securities addresses the likelihood of payment of principal at their maturity. The rating also addresses the timely payment of interest on each payment date. The rating of the new securities is not a recommendation to purchase, hold or sell the new securities, and the rating does not comment on market price or suitability for a particular investor.

On January 29, 2016, Standard & Poor’s announced the downgrade of our stand-alone credit profile from BB+ to BB. On March 31, 2016, Moody’s Investors Service announced the revision of our global foreign currency and local currency credit ratings from Baa1 to Baa3 and changed the outlook for its credit ratings to negative. Any further downgrade in or withdrawal of our corporate or debt ratings may adversely affect the rating and price of the new securities. We cannot assure you that the rating of the new securities or our corporate rating will continue for any given period of time or that the rating will not be further lowered or withdrawn. This downgrade is not, and any further downgrade in or withdrawal of the ratings will not be, an event of default under the indenture. An assigned rating may be raised or lowered depending, among other things, on the respective rating agency’s assessment of our financial strength, as well as its assessment of Mexican sovereign risk generally. Any further downgrade in or withdrawal of the rating of the new securities or our corporate rating may adversely affect the price of the new securities.

20

Table of Contents

This prospectus contains words, such as “believe,” “expect,” “anticipate” and similar expressions that identify forward-looking statements, which reflect our views about future events and financial performance. We have made forward-looking statements that address, among other things, our:

| • | exploration and production activities, including drilling; |

| • | activities relating to import, export, refining, petrochemicals and transportation of petroleum, natural gas and oil products; |

| • | activities relating to our lines of business, including the generation of electricity; |

| • | projected and targeted capital expenditures and other costs, commitments and revenues; |

| • | liquidity and sources of funding, including our ability to continue operating as a going concern; |

| • | strategic alliances with other companies; and |

| • | the monetization of certain of our assets. |

Actual results could differ materially from those projected in such forward-looking statements as a result of various factors that may be beyond our control. These factors include, but are not limited to:

| • | changes in international crude oil and natural gas prices; |

| • | effects on us from competition, including on our ability to hire and retain skilled personnel; |

| • | limitations on our access to sources of financing on competitive terms; |

| • | our ability to find, acquire or gain access to additional reserves and to develop the reserves that we obtain successfully; |

| • | uncertainties inherent in making estimates of oil and gas reserves, including recently discovered oil and gas reserves; |

| • | technical difficulties; |

| • | significant developments in the global economy; |

| • | significant economic or political developments in Mexico; |

| • | developments affecting the energy sector; and |

| • | changes in our legal regime or regulatory environment, including tax and environmental regulations. |

Accordingly, you should not place undue reliance on these forward-looking statements. In any event, these statements speak only as of their dates, and we undertake no obligation to update or revise any of them, whether as a result of new information, future events or otherwise.

For a discussion of important factors that could cause actual results to differ materially from those contained in any forward-looking statement, you should read “Risk Factors” above.

We will not receive any cash proceeds from the issuance of the new securities under the exchange offers. In consideration for issuing the new securities as contemplated in this prospectus, we will receive in exchange an equal principal amount of old securities, which will be cancelled. Accordingly, the exchange offers will not result in any increase in our indebtedness or the guarantors’ indebtedness. The net proceeds we received from issuing the old securities were and are being used to finance our investment program.

21

Table of Contents

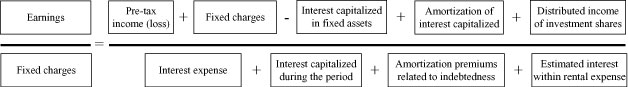

RATIO OF EARNINGS TO FIXED CHARGES

PEMEX’s ratio of earnings to fixed charges is calculated as follows:

Earnings, for this purpose, consist of pre-tax income (loss) from continuing operations before income from equity investees, plus fixed charges, minus interest capitalized during the period, plus the amortization of interest capitalized during the period and plus distributed income of investment shares. Pre-tax income (loss) is calculated after the deduction of hydrocarbon duties, but before the deduction of the hydrocarbon income tax and other income taxes. Fixed charges for this purpose consist of the sum of interest expense plus interest capitalized during the period, plus amortization premiums related to indebtedness and plus the estimated interest within rental expense. Fixed charges do not take into account exchange gain or loss attributable to PEMEX’s indebtedness.

The following table sets forth PEMEX’s consolidated ratio of earnings to fixed charges for the years ended December 31, 2011, 2012, 2013, 2014 and 2015 and for the three-months periods ended March 31, 2015 and 2016 in accordance with IFRS.

|

|

For the period ended | |||||||||||||||||||||||||||

|

|

December 31, | March 31, | ||||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | ||||||||||||||||||||||

| Ratio of earnings to fixed charges(1): |

— | 1.01 | — | — | — | — | — | |||||||||||||||||||||

| (1) | Earnings for the years ended December 31, 2011, 2013, 2014 and 2015 and for the three months ended March 31, 2015 and 2016 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 106,476 million, Ps. 165,217 million, Ps. 283,640 million and Ps. 765,161 million, for the years ended December 31, 2011, 2013, 2014 and 2015, respectively, and Ps. 100,217 million and Ps. 62,628 million for the three months ended March 31, 2015 and 2016, respectively. |

22

Table of Contents

The following table sets forth the capitalization of PEMEX at March 31, 2016.

| At March 31, 2016(1)(2) | ||||||||

| (millions of pesos or U.S. dollars) | ||||||||

| Long-term external debt |

Ps. | 1,136,573 | U.S. $ | 65,315 | ||||

| Long-term domestic debt |

291,688 | 16,762 | ||||||

|

|

|

|

|

|||||

| Total long-term debt(3) |

1,428,261 | 82,077 | ||||||

|

|

|

|

|

|||||

| Certificates of Contribution “A”(4) |

194,605 | 11,183 | ||||||

| Mexican Government contributions to Petróleos Mexicanos |

43,731 | 2,513 | ||||||

| Legal reserve |

1,002 | 58 | ||||||

| Accumulated other comprehensive result |

(306,829 | ) | (17,632 | ) | ||||

| (Deficit) from prior years |

(1,265,244 | ) | (72,709 | ) | ||||

| Net (loss) for the period |

(62,047 | ) | (3,566 | ) | ||||

|

|

|

|

|

|||||

| Total controlling interest |

(1,394,782 | ) | (80,153 | ) | ||||

| Total non-controlling interest |

291 | 17 | ||||||

|

|

|

|

|

|||||

| Total (deficit) equity |

(1,394,491 | ) | (80,136 | ) | ||||

|

|

|

|

|

|||||

| Total capitalization |

Ps. | 33,770 | U.S. $ | 1,941 | ||||

|

|

|

|

|

|||||

Note: Numbers may not total due to rounding.

| (1) | Unaudited. Convenience translations into U.S. dollars of amounts in pesos have been made at the established exchange rate of Ps. 17.4015 = U.S. $1.00 at March 31, 2016. Such translations should not be construed as a representation that the peso amounts have been or could be converted into U.S. dollar amounts at the foregoing or any other rate. |

| (2) | As of the date of this prospectus, there has been no material change in our capitalization since March 31, 2016 except for our undertaking of (a) the new financings disclosed under “Liquidity and Capital Resources—Recent Financing Activities”’ in the July 6-K; (b) the new financings described in “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Financing Activities” in the Form 20-F. |

| (3) | Total long-term debt does not include short-term indebtedness of Ps. 194,612 million (U.S. $11,184 million) at March 31, 2016. |

| (4) | Equity instruments held by the Mexican Government. |

Source: March 2016 interim financial statements.

23

Table of Contents

The guarantors—Pemex Exploration and Production, Pemex Industrial Transformation, Pemex Drilling and Services, Pemex Logistics and Pemex Cogeneration and Services—are productive state-owned companies of the Mexican Government. On March 27, 2015, the Board of Directors of Petróleos Mexicanos approved the acuerdos de creación (creation resolutions) of each guarantor. The guarantors were later formed upon the effectiveness of their respective creation resolutions, as follows: (i) Pemex Exploration and Production and Pemex Cogeneration and Services were created on June 1, 2015; (ii) Pemex Drilling and Services was created on August 1, 2015; (iii) Pemex Logistics was created on October 1, 2015 and (iv) Pemex Industrial Transformation was created on November 1, 2015. For more information about the guarantors, including their creation, see “Item 4—Information on the Company—History and Development—Energy Reform” in the Form 20-F. Each of the guarantors is a legal entity empowered to own property and carry on business in its own name. The executive offices of each of the guarantors are located at Avenida Marina Nacional No. 329, Colonia Verónica Anzures, Ciudad de México 11300, México. Our telephone number, which is also the telephone number for the guarantors, is (52-55) 1944-2500.

As of the date of this prospectus, the activities of the issuer and the guarantors are regulated primarily by:

| • | the Petróleos Mexicanos Law, which took effect, with the exception of certain provisions, on October 7, 2014, and repeals the Petróleos Mexicanos Law that became effective as of November 29, 2008; and |

| • | the Hydrocarbons Law, which took effect on August 12, 2014 and repeals the Ley Reglamentaria del Artículo 27 Constitucional en el Ramo del Petróleo (Regulatory Law to Article 27 of the Mexican Constitution Concerning Petroleum Affairs). |

The operating activities of the issuer are allocated among the guarantors and the other subsidiary entities, Pemex Fertilizers and Pemex Ethylene, each of which has the characteristics of a subsidiary of the issuer. The principal business lines of the guarantors are as follows:

| • | Pemex Exploration and Production explores for and exploits crude oil and natural gas and transports, stores and markets these hydrocarbons; |

| • | Pemex Industrial Transformation refines, processes, imports, exports, markets, and sells hydrocarbons, oil, natural gas and petrochemicals; |

| • | Pemex Drilling and Services performs well drilling, termination and repair and related well services; |

| • | Pemex Logistics provides oil, petroleum products and petrochemicals transportation and storage and other related services to us and to others through pipelines, and maritime and land channels, as well as the sale of storage and management services; and |

| • | Pemex Cogeneration and Services generates, supplies and sells electric and thermal energy generated in our industrial processes, including at our cogeneration plants, and provides technical services and management associated with these activities. |

For further information about the legal framework governing the guarantors, including the modifications implemented and to be implemented pursuant to the Secondary Legislation, see “Item 4—Information on the Company—History and Development” in the Form 20-F. Copies of the Petróleos Mexicanos Law that took effect on October 7, 2014 will be available at the specified offices of Deutsche Bank Trust Company Americas and the paying agent and transfer agent in Luxembourg.

For information relating to the financial statements of the guarantors, see Note 27 to the 2015 financial statements and Note 4 to the March 2016 interim financial statements. As of the date of this prospectus, none of the guarantors publish their own financial statements.

24

Table of Contents

This is a summary of the exchange offers and the material provisions of the exchange and registration rights agreement that we entered into on February 4, 2016 with the initial purchasers of the 2019 old securities, the 2021 old securities and the 2026 old securities. This section may not contain all the information that you should consider regarding the exchange offers and the exchange and registration rights agreement before participating in the exchange offers. For more detail, you should refer to the exchange and registration rights agreement, which we have filed with the SEC as an exhibit to the registration statement. You can obtain a copy of the document by following the instructions under the heading “Where You Can Find More Information.”

Background and Purpose of the Exchange Offers

We sold the 2019 old securities, the 2021 old securities and the 2026 old securities to a group of initial purchasers pursuant to a terms agreements dated January 28, 2016. The initial purchasers then resold the old securities to other purchasers in offshore transactions in reliance on Regulation S of the Securities Act and to qualified institutional buyers in reliance on Rule 144A under the Securities Act.

We also entered into an exchange and registration rights agreement with the initial purchasers of the 2019 old securities, the 2021 old securities and the 2026 old securities. As long as we determine that applicable law permits us to make the exchange offers, this exchange and registration rights agreement requires that we use our best efforts to:

| Action |

Date Required | |

| 1. File a registration statement for a registered exchange offer relating to new securities with terms substantially similar to the relevant series of old securities |

September 30, 2016 | |

| 2. Cause the registration statement to be declared effective by the SEC and promptly begin the exchange offer after the registration statement is declared effective |

March 1, 2017 | |