Table of Contents

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PETRÓLEOS MEXICANOS

(Exact name of Issuer as specified in its charter)

MEXICAN PETROLEUM

(Translation of registrant’s name into English)

PEMEX-EXPLORACIÓN Y PRODUCCIÓN (PEMEX-EXPLORATION AND PRODUCTION)

PEMEX-REFINACIÓN (PEMEX-REFINING)

and

PEMEX-GAS Y PETROQUÍMICA BÁSICA (PEMEX-GAS AND BASIC PETROCHEMICALS)

(Exact names of co-registrants as specified in their charters and translations of co-registrants’ names into English)

| United Mexican States | United Mexican States | 1311 | Not Applicable | |||

| (State or other jurisdiction of incorporation or organization of Issuer) | (State or other jurisdiction of incorporation or organization of co-registrants) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) | |||

| Avenida Marina Nacional No. 329 Colonia Petróleos Mexicanos México, D.F. 11311 México Telephone: (52-55) 1944-2500 |

Avenida Marina Nacional No. 329 Colonia Petróleos Mexicanos México, D.F. 11311 México Telephone: (52-55) 1944-2500 | |||||

| (Address, including zip code, and telephone number, including area code, of Issuer’s principal executive offices) |

(Address, including zip code, and telephone number, including area code, of co-registrants’ principal executive offices) | |||||

Copies to:

| Fernando Luna Canut Houston, Texas 77010 Telephone: 713-567-0182 |

Wanda J. Olson Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 Facsimile: 212-225-3999 | |||||

| (Name, address and telephone number of agent for service) | ||||||

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum |

Proposed Maximum Offering Price(1) |

Amount of Registration Fee(1) | ||||

| 4.875% Notes due 2022 |

U.S.$2,100,000,000 | 100% | U.S.$2,100,000,000 | U.S. $240,660.00 | ||||

| 6.500% Bonds due 2041 |

U.S.$1,250,000,000 | 100% | U.S.$1,250,000,000 | U.S. $143,250.00 | ||||

| 5.50% Bonds due 2044 |

U.S.$1,750,000,000 | 100% | U.S.$1,750,000,000 | U.S. $200,550.00 | ||||

| Guaranties |

U.S.$5,100,000,000 | — | — | None(2) | ||||

|

| ||||||||

|

| ||||||||

| (1) | The securities being registered are offered (i) in exchange for 4.875% Notes due 2022, 6.500% Bonds due 2041 and 5.50% Bonds due 2044, previously sold in transactions exempt from registration under the Securities Act of 1933 and (ii) upon certain resales of the securities by broker-dealers. The registration fee has been computed based on the face value of the securities solely for the purpose of calculating the amount of the registration fee, pursuant to Rule 457 under the Securities Act of 1933. |

| (2) | Pursuant to Rule 457(n), no separate fee is payable with respect to the guaranties. |

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Prospectus

Petróleos Mexicanos

Exchange Offers

for

U.S. $2,100,000,000 4.875% Notes due 2022

U.S. $1,250,000,000 6.500% Bonds due 2041

U.S. $1,750,000,000 5.50% Bonds due 2044

unconditionally guaranteed by

Pemex-Exploration and Production

Pemex-Refining

Pemex-Gas and Basic Petrochemicals

Terms of the Exchange Offers

We are not making an offer to exchange securities in any jurisdiction where the offer is not permitted.

Investing in the securities issued in the exchange offers involves certain risks. See “Risk Factors” beginning on page 14.

Neither the U.S. Securities and Exchange Commission (the SEC) nor any state securities commission in the United States of America (the United States) has approved or disapproved the securities to be distributed in the exchange offers, nor have they determined that this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

•, 2012

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 12 | ||||

| 14 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 28 | ||||

| 40 | ||||

| 60 | ||||

| 64 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

Table of Contents

Terms such as “we,” “us” and “our” generally refer to Petróleos Mexicanos and its consolidated subsidiaries, unless the context otherwise requires.

We will apply, through our listing agent, to have the new securities admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. The old securities are currently admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange.

The information contained in this prospectus is the exclusive responsibility of the issuer and the guarantors and has not been reviewed or authorized by the Comisión Nacional Bancaria y de Valores (National Banking and Securities Commission, or the CNBV) of the United Mexican States, which we refer to as Mexico. Petróleos Mexicanos filed a notice in respect of the offerings of both the old securities and the new securities with the CNBV at the time the old securities of each series were issued. Such notice is a requirement under the Ley de Mercado de Valores (the Securities Market Law) in connection with an offering of securities outside of Mexico by a Mexican issuer. Such notice is solely for information purposes and does not imply any certification as to the investment quality of the new securities, the solvency of the issuer or the guarantors or the accuracy or completeness of the information contained in this prospectus. The new securities have not been and will not be registered in the Registro Nacional de Valores (National Securities Registry), maintained by the CNBV, and may not be offered or sold publicly in Mexico. Furthermore, the new securities may not be offered or sold in Mexico, except through a private placement made to institutional or qualified investors conducted in accordance with article 8 of the Securities Market Law.

You should rely only on the information provided in this prospectus. We have authorized no one to provide you with different information. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of the document.

We have filed a registration statement with the SEC on Form F-4 covering the new securities. This prospectus does not contain all of the information included in the registration statement. Any statement made in this prospectus concerning the contents of any contract, agreement or other document is not necessarily complete. If we have filed any of those contracts, agreements or other documents as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract, agreement or other document is qualified in its entirety by reference to the actual document.

Petróleos Mexicanos is required to file periodic reports and other information (File No. 0-99) with the SEC under the Securities Exchange Act of 1934, as amended (which we refer to as the Exchange Act). We will also furnish other reports as we may determine appropriate or as the law requires. You may read and copy the registration statement, including the attached exhibits, and any reports or other information we file, at the SEC’s public reference room in Washington, D.C. You can request copies of these documents, upon payment of a duplicating fee, by writing to the SEC’s Public Reference Section at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference rooms. In addition, any filings we make electronically with the SEC will be available to the public over the Internet at the SEC’s website at http://www.sec.gov under the name “Mexican Petroleum.”

You may also obtain copies of these documents at the offices of the Luxembourg listing agent, KBL European Private Bankers S.A.

Table of Contents

The SEC allows Petróleos Mexicanos to “incorporate by reference” information it files with the SEC, which means that Petróleos Mexicanos can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and later information filed with the SEC will update and supersede this information. We incorporate by reference the documents filed by Petróleos Mexicanos listed below:

| • | Petróleos Mexicanos’ annual report on Form 20-F for the year ended December 31, 2011, filed with the SEC on Form 20-F on April 30, 2012, which we refer to as the “Form 20-F”; |

| • | Petróleos Mexicanos’ report relating to our unaudited condensed consolidated results as of and for the three month period ended March 31, 2012, furnished to the SEC on Form 6-K on June 19, 2012, which we refer to as the “Form 6-K”; and |

| • | all of Petróleos Mexicanos’ annual reports on Form 20-F, and all reports on Form 6-K that are designated in such reports as being incorporated into this prospectus, filed with the SEC pursuant to Section 13(a), 13(c) or 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of the exchange offers. |

You may request a copy of any document that is incorporated by reference in this prospectus and that has not been delivered with this prospectus, at no cost, by writing or telephoning Petróleos Mexicanos at: Gerencia Jurídica de Finanzas, Avenida Marina Nacional No. 329, Colonia Petróleos Mexicanos, México D.F. 11311, telephone (52-55) 1944-9325, or by contacting our Luxembourg listing agent at the address indicated on the inside back cover of this prospectus, as long as any of the new securities are admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange, and the rules of such stock exchange so require. To ensure timely delivery, investors must request this information no later than five business days before the date they must make their investment decision.

ELECTRONIC DELIVERY OF DOCUMENTS

We are delivering copies of this prospectus in electronic form through the facilities of The Depository Trust Company (DTC). You may obtain paper copies of the prospectus by contacting the exchange agent or the Luxembourg listing agent at their respective addresses specified on the inside back cover of this prospectus. By participating in the exchange offers, you will (unless you have requested paper delivery of documents) be consenting to electronic delivery of these documents.

References in this prospectus to “U.S. dollars,” “U.S. $,” “dollars” or “$” are to the lawful currency of the United States. References in this prospectus to “pesos” or “Ps.” are to the lawful currency of Mexico. We use the term “billion” in this prospectus to mean one thousand million.

This prospectus contains translations of certain peso amounts into U.S. dollars at specified rates solely for your convenience. You should not construe these translations as representations that the peso amounts actually represent the actual U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless we indicate otherwise, the U.S. dollar amounts included herein have been translated from pesos at an exchange rate of Ps. 12.8489 to U.S. $1.00, which is the exchange rate that the Secretaría de Hacienda y Crédito Público (the Ministry of Finance and Public Credit) instructed us to use on March 31, 2012.

On June 29, 2012, the noon buying rate for cable transfers in New York reported by the Federal Reserve Bank was Ps. 13.4110 = U.S. $1.00.

2

Table of Contents

PRESENTATION OF FINANCIAL INFORMATION

The audited consolidated financial statements of Petróleos Mexicanos, subsidiary entities and subsidiary companies as of December 31, 2010 and 2011 and for each of the years in the three-year period ended December 31, 2011 are included in Item 18 of the Form 20-F incorporated by reference in this prospectus and the registration statement covering the new securities. We refer to these financial statements as the 2011 financial statements. These consolidated financial statements were prepared in accordance with Normas de Información Financiera Mexicanas (Mexican Financial Reporting Standards, which we refer to as Mexican FRS or NIFs).

Commencing January 1, 2008, we no longer use inflation accounting unless the economic environment in which we operate qualifies as “inflationary” under Mexican FRS. As a result, amounts in this prospectus and in the reports incorporated herein are presented in nominal terms; however, such amounts do reflect inflationary effects recognized up to December 31, 2007. See Note 3(a) to the 2011 financial statements.

Our consolidated financial statements for the years ended December 31, 2007, 2008, 2009 and 2010 have been reclassified in certain accounts with the purpose of making them comparable with our consolidated financial statements as of December 31, 2011. In addition, during 2011, accounting changes were made, as disclosed in Note 3(ab) to the 2011 financial statements. As a result, the consolidated financial statements as of December 31, 2010, the statements of financial position as of December 31, 2008, 2009 and 2010 and the statements of operations for the years then ended were adjusted to recognize the effects of the application of FRS C-4 “Inventories.”

Mexican FRS differ in certain significant respects from United States Generally Accepted Accounting Principles (which we refer to as U.S. GAAP). The principal differences between our net income and equity under U.S. GAAP and Mexican FRS as of and for each of the years ended December 31, 2009, 2010 and 2011 are described in Note 21 to the 2011 financial statements and in “Item 5—Operating and Financial Review and Prospects—U.S. GAAP Reconciliation” of the Form 20-F.

Beginning with the fiscal year starting January 1, 2012, Mexican issuers that disclose information through the Bolsa Mexicana de Valores, S.A.B. de C.V. (the Mexican Stock Exchange, which we refer to as the BMV) are required to prepare financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. We have begun presenting financial statements in accordance with IFRS for the year ending December 31, 2012, with an official IFRS adoption date of January 1, 2012 and a transition date to IFRS of January 1, 2011. In accordance with the revised regulations, we filed interim financial statements under IFRS with the BMV on May 2, 2012.

We have incorporated by reference in this prospectus the condensed consolidated interim financial statements of Petróleos Mexicanos, subsidiary entities and subsidiary companies as of March 31, 2012 and for the three month periods ended March 31, 2011 and 2012 (which we refer to as the March 2012 interim financial statements), which were not audited and were prepared in accordance with IFRS.

3

Table of Contents

The March 2012 interim financial statements were prepared in accordance with International Accounting Standard (IAS) 34 “Interim Financial Reporting” and with the first-time adoption rules established in IFRS 1 “First-time Adoption of International Financial Reporting Standards” (“IFRS 1”). IFRS 1 permits us to change our election of optional IFRS transition exemptions even if such exemptions have already been used in the preparation of published interim financial statements. If we change policies, classifications or transitions elections prior to the issuance of our consolidated financial statements as of and for the year ending December 31, 2012 as permitted by IFRS 1, we are not required to re-issue our financial statements for previous interim periods.

IFRS differ in certain significant respects from Mexican FRS and U.S. GAAP. The principal changes to our accounting policies and effects on our consolidated financial statements resulting from the adoption of IFRS are described in Notes 2 and 13 to the March 2012 interim financial statements, in “Item 5—Operating and Financial Review and Prospects—Recently Issued Accounting Standards” of the Form 20-F and in “Selected Financial Data” of the Form 6-K.

4

Table of Contents

The following summary highlights selected information from this prospectus and may not contain all of the information that is important to you. This prospectus includes specific terms of the new securities we are offering, as well as information regarding our business and detailed financial data. We encourage you to read this prospectus in its entirety.

5

Table of Contents

6

Table of Contents

7

Table of Contents

8

Table of Contents

9

Table of Contents

10

Table of Contents

11

Table of Contents

The selected financial data set forth below as of and for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 has been prepared in accordance with Mexican FRS and reconciled to U.S. GAAP. This information is derived in part from, and should be read in conjunction with, the 2011 financial statements, which are incorporated by reference in this prospectus.

| Year Ended December 31,(1) | ||||||||||||||||||||

| 2007(2) | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||

| (in millions of pesos, except ratios) | ||||||||||||||||||||

| Income Statement Data |

||||||||||||||||||||

| Amounts in accordance with |

||||||||||||||||||||

| Net sales |

Ps. | 1,139,257 | Ps. | 1,328,950 | Ps. | 1,089,921 | Ps. | 1,282,064 | Ps. | 1,558,429 | ||||||||||

| Operating income |

593,652 | 572,365 | 428,570 | 546,457 | 681,425 | |||||||||||||||

| Comprehensive financing result |

(20,047 | ) | (107,512 | ) | (15,308 | ) | (11,969 | ) | (91,641 | ) | ||||||||||

| Net income (loss) for the year |

(18,308 | ) | (110,823 | ) | (94,370 | ) | (46,527 | ) | (91,483 | ) | ||||||||||

| Amounts in accordance with |

||||||||||||||||||||

| Net sales |

1,139,257 | 1,328,950 | 1,089,921 | 1,282,064 | 1,558,429 | |||||||||||||||

| Operating income |

584,703 | 629,119 | 460,239 | 567,525 | 675,896 | |||||||||||||||

| Comprehensive financing result (cost) income |

(25,610 | ) | (123,863 | ) | (5,094 | ) | (3,277 | ) | (106,616 | ) | ||||||||||

| Net income (loss) for the period |

(32,642 | ) | (66,512 | ) | (52,280 | ) | (16,507 | ) | (109,949 | ) | ||||||||||

| Statement of Financial Position Data |

||||||||||||||||||||

| Amounts in accordance with |

||||||||||||||||||||

| Cash and cash equivalents |

170,997 | 114,224 | 159,760 | 133,587 | 117,100 | |||||||||||||||

| Total assets |

1,330,281 | 1,238,091 | 1,333,583 | 1,395,197 | 1,533,345 | |||||||||||||||

| Long-term debt |

424,828 | 495,487 | 529,258 | 575,171 | 672,275 | |||||||||||||||

| Total long-term liabilities |

990,909 | 1,033,987 | 1,155,917 | 1,299,245 | 1,473,794 | |||||||||||||||

| Equity (deficit) |

49,908 | 28,139 | (65,294 | ) | (111,302 | ) | (193,919 | ) | ||||||||||||

| Amounts in accordance with |

||||||||||||||||||||

| Total assets |

1,211,719 | 1,240,718 | 1,321,570 | 1,402,672 | 1,515,359 | |||||||||||||||

| Equity (deficit) |

(198,083 | ) | (144,166 | ) | (423,159 | ) | (227,882 | ) | (326,202 | ) | ||||||||||

| Other Financial Data |

||||||||||||||||||||

| Amounts in accordance with |

||||||||||||||||||||

| Depreciation and amortization |

72,592 | 89,840 | 76,891 | 96,482 | 97,753 | |||||||||||||||

| Investments in fixed assets at cost(3) |

155,121 | 132,092 | 213,232 | 184,584 | 175,850 | |||||||||||||||

| Ratio of earnings to fixed charges: |

||||||||||||||||||||

| Mexican FRS(4) |

— | — | — | — | — | |||||||||||||||

| U.S. GAAP(4) |

— | — | — | — | — | |||||||||||||||

| (1) | Includes Petróleos Mexicanos, the subsidiary entities and the subsidiary companies (including the Pemex Project Funding Master Trust, the Fideicomiso Irrevocable de Administración No. F/163 (Fideicomiso F/163) and Pemex Finance, Ltd.). |

| (2) | Figures for 2007 are stated in constant pesos as of December 31, 2007. |

| (3) | Includes capitalized comprehensive financing result. The amount of our investment in fixed assets in 2007 was derived from our accounting records, but does not appear directly in the corresponding statement of changes in financial position. Beginning with our 2008 fiscal year, the amount presented for investment in fixed assets is that which is included in the statement of cash flows. See Note 3(l) to our 2011 financial statements and “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources” in the Form 20-F. |

| (4) | Under Mexican FRS, earnings for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 16,174 million, Ps. 96,481 million, Ps. 88,542 million, Ps. 45,873 million and Ps. 89,529 million for the years ended December 31, 2007, 2008, 2009, 2010 and 2011, respectively. Under U.S. GAAP, earnings for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 33,160 million, Ps. 55,626 million, Ps. 46,658 million, Ps. 16,112 million and Ps. 110,034 million for the years ended December 31, 2007, 2008, 2009, 2010 and 2011, respectively. |

Source: PEMEX’s 2011 financial statements.

12

Table of Contents

The selected financial data set forth below as of and for the three month periods ended March 31, 2011 and 2012 has been prepared in accordance with IFRS, which differs in significant respects from Mexican FRS and U.S. GAAP. As a result, the information presented under IFRS is not comparable to our financial information previously reported under Mexican FRS and U.S. GAAP as of and for the years ended December 31, 2007, 2008, 2009, 2010 and 2011. The main adjustments and reclassifications resulting from our adoption of IFRS are described in Notes 2 and 13 to the March 2012 interim financial statements incorporated by reference herein.

| March 31,(1) | ||||||||||||

| 2011 | 2012 | 2012 | ||||||||||

| (in millions of pesos, except ratios) | (in millions of U.S. dollars, except ratios)(2) |

|||||||||||

| Statement of Comprehensive Income Data |

||||||||||||

| Amounts in accordance with IFRS: |

||||||||||||

| Net sales |

Ps.352,700 | Ps.411,325 | U.S. $ | 32,012 | ||||||||

| Operating income |

191,544 | 247,707 | 19,278 | |||||||||

| Comprehensive financing result—net |

9,104 | 32,560 | 2,534 | |||||||||

| Net income (loss) for the period |

1,538 | 33,881 | 2,637 | |||||||||

| Statement of Financial Position Data (end of period) |

||||||||||||

| Amounts in accordance with IFRS: |

||||||||||||

| Cash and cash equivalents |

n.a. | 107,968 | 8,403 | |||||||||

| Total assets |

n.a. | 1,991,572 | 154,999 | |||||||||

| Long-term debt |

n.a. | 636,735 | 49,556 | |||||||||

| Total long-term liabilities |

n.a. | 1,574,524 | 122,542 | |||||||||

| Equity (deficit) |

n.a. | 171,826 | 13,373 | |||||||||

| Other Financial Data |

||||||||||||

| Amounts in accordance with IFRS: |

||||||||||||

| Depreciation and amortization |

32,473 | 35,076 | 2,730 | |||||||||

| Investments in fixed assets at cost(3) |

26,441 | 36,429 | 2,835 | |||||||||

| Ratio of earnings to fixed charges(4) |

1.4308 | 3.4047 | 3.4047 | |||||||||

| Note: | n.a. = Not applicable. |

| (1) | Includes Petróleos Mexicanos, the subsidiary entities and the subsidiary companies (including Pemex Finance, Ltd. in 2011 and 2012, and the Pemex Project Funding Master Trust and the Fideicomiso F/163 in 2011). |

| (2) | Translations into U.S. dollars of amounts in pesos have been made at the exchange rate established by SHCP for accounting purposes of Ps. 12.8489 = U.S. $1.00 at March 31, 2012. Such translations should not be construed as a representation that the peso amounts have been or could be converted into U.S. dollar amounts at the foregoing or any other rate. |

| (3) | Includes capitalized comprehensive financing result. See Note 3(h) to our March 2012 interim financial statements. |

| (4) | Earnings, for this purpose, consist of pretax income (loss) from continuing operations before income from equity investees, plus fixed charges, minus interest capitalized during the period, plus the amortization of capitalized interest during the period and plus dividends received on equity investments. Pretax income (loss) is calculated after the deduction of hydrocarbon duties, but before the deduction of the hydrocarbon income tax and other income taxes. Fixed charges for this purpose consist of the sum of interest expense plus interest capitalized during the period. Fixed charges do not take into account exchange gain or loss attributable to PEMEX’s indebtedness. |

Source: PEMEX’s March 2012 interim financial statements.

13

Table of Contents

Risk Factors Related to the Operations of PEMEX

Crude oil and natural gas prices are volatile and low crude oil and natural gas prices adversely affect PEMEX’s income and cash flows and the amount of Mexico’s hydrocarbon reserves.

International crude oil and natural gas prices are subject to global supply and demand and fluctuate due to many factors beyond our control. These factors include competition within the oil and natural gas industry, the prices and availability of alternative sources of energy, international economic trends, exchange rate fluctuations, expectations of inflation, domestic and foreign government regulations or international laws, political and other events in major oil and natural gas producing and consuming nations and actions taken by Organization of the Petroleum Exporting Countries (OPEC) members and other oil exporting countries, trading activity in oil and natural gas and transactions in derivative financial instruments related to oil and gas.

When international crude oil and natural gas prices are low, we earn less export sales revenue and, therefore, generate lower cash flows and earn less income, because our costs remain roughly constant. Conversely, when crude oil and natural gas prices are high, we earn more export sales revenue and our income before taxes and duties increases. As a result, future fluctuations in international crude oil and natural gas prices will have a direct effect on our results of operations and financial condition, and may affect Mexico’s hydrocarbon reserves estimates. See “Risk Factors Related to the Relationship between PEMEX and the Mexican Government—Information on Mexico’s hydrocarbon reserves is based on estimates, which are uncertain and subject to revisions” and “Item 11—Quantitative and Qualitative Disclosures about Market Risk—Hydrocarbon Price Risk” in the Form 20-F.

PEMEX is an integrated oil and gas company and is exposed to production, equipment and transportation risks, criminal acts and deliberate acts of terror.

We are subject to several risks that are common among oil and gas companies. These risks include production risks (fluctuations in production due to operational hazards, natural disasters or weather, accidents, etc.), equipment risks (relating to the adequacy and condition of our facilities and equipment) and transportation risks (relating to the condition and vulnerability of pipelines and other modes of transportation). More specifically, our business is subject to the risks of explosions in pipelines, refineries, plants, drilling wells and other facilities, hurricanes in the Gulf of Mexico and other natural or geological disasters and accidents, fires and mechanical failures. Criminal attempts to divert our crude oil, natural gas or refined products from our pipeline network and facilities for illegal sale have resulted in explosions, property and environmental damage, injuries and loss of lives.

Our facilities are also subject to the risk of sabotage, terrorism and cyber attacks. In July 2007, two of our pipelines were attacked. In September 2007, six different sites were attacked and 12 of our pipelines were affected. The occurrence of any of these events or of accidents connected with production, processing and transporting oil and oil products could result in personal injuries, loss of life, environmental damage with resulting containment, clean-up and repair expenses, equipment damage and damage to our facilities. A shutdown of the affected facilities could disrupt our production and increase our production costs. As of the date of this prospectus, there have been no similar occurrences since 2007. Although we have established cybersecurity systems and procedures to protect our information technology and have not yet suffered a cyber attack, if the integrity of our information technology were ever compromised due to a cyber attack, our business operations could be disrupted and our proprietary information could be lost or stolen.

14

Table of Contents

We purchase comprehensive insurance policies covering most of these risks; however, these policies may not cover all liabilities, and insurance may not be available for some of the consequential risks. There can be no assurance that accidents or acts of terror will not occur in the future, that insurance will adequately cover the entire scope or extent of our losses or that we may not be found directly liable in connection with claims arising from these or other events. See “Item 4—Information on the Company—Business Overview—PEMEX Corporate Matters—Insurance” in the Form 20-F.

PEMEX has a substantial amount of liabilities that could adversely affect our financial condition and results of operations.

We have a substantial amount of debt. As of December 31, 2011, our total indebtedness, excluding accrued interest, was approximately U.S. $55.31 billion, in nominal terms, which is a 3.9% increase as compared to our total indebtedness, excluding accrued interest, of approximately U.S. $53.2 billion at December 31, 2010. Our level of debt may increase further in the near or medium term and may have an adverse effect on our financial condition and results of operations.

To service our debt, we have relied and may continue to rely on a combination of cash flows provided by operations, drawdowns under our available credit facilities and the incurrence of additional indebtedness. Certain rating agencies have expressed concerns regarding the total amount of our debt, our increase in indebtedness over the last several years and our substantial unfunded reserve for retirement pensions and seniority premiums, which as of December 31, 2011 was equal to approximately U.S. $52.2 billion. Due to our heavy tax burden, we have resorted to financings to fund our capital investment projects. Any further lowering of our credit ratings may have adverse consequences on our ability to access the financial markets and/or our cost of financing. If we were unable to obtain financing on favorable terms, this could hamper our ability to obtain further financing as well as hamper investment in facilities financed through debt. As a result, we may not be able to make the capital expenditures needed to maintain our current production levels and to maintain, as well as increase, Mexico’s proved hydrocarbon reserves, which may adversely affect our financial condition and results of operations. See “—Risk Factors Related to the Relationship between PEMEX and the Mexican Government—PEMEX must make significant capital expenditures to maintain its current production levels, and to maintain, as well as increase, Mexico’s proved hydrocarbon reserves. Mexican Government budget cuts, reductions in PEMEX’s income and inability to obtain financing may limit PEMEX’s ability to make capital investments.”

PEMEX’s compliance with environmental regulations in Mexico could result in material adverse effects on its results of operations.

A wide range of general and industry-specific Mexican federal and state environmental laws and regulations apply to our operations; these laws and regulations are often difficult and costly to comply with and carry substantial penalties for non-compliance. This regulatory burden increases our costs because it requires us to make significant capital expenditures and limits our ability to extract hydrocarbons, resulting in lower revenues. For an estimate of our accrued environmental liabilities, see “Item 4—Information on the Company—Environmental Regulation—Environmental Liabilities” in the Form 20-F. In addition, we have agreed with third parties to make investments to reduce our carbon dioxide emissions. See “Item 4—Information on the Company—Environmental Regulation—Carbon Dioxide Emissions Reduction” in the Form 20-F.

| 1 | Note: U.S. dollar amounts included in this paragraph and the following paragraph have been translated from pesos at the December 31, 2011 exchange rate of Ps. 13.9904 to U.S. $1.00. |

15

Table of Contents

PEMEX publishes less U.S. GAAP financial information than U.S. companies are required to file with the SEC.

Until December 31, 2011, we prepared our financial statements according to Mexican FRS, which differ in certain significant respects from U.S. GAAP. See “Item 3—Key Information—Selected Financial Data,” and “Item 5—Operating and Financial Review and Prospects—U.S. GAAP Reconciliation” in the Form 20-F and Note 21 to our 2011 financial statements. We have begun presenting our financial statements in accordance with IFRS beginning with our fiscal year ending December 31, 2012. As a foreign issuer, we were not required to prepare quarterly U.S. GAAP financial information, and we therefore generally prepared a reconciliation of our net income (loss) and equity (deficit) under Mexican FRS to U.S. GAAP as well as explanatory notes and additional disclosure required under U.S. GAAP on a yearly basis only. Beginning with our 2012 fiscal year, we will not be required to reconcile our annual or quarterly financial statements to U.S. GAAP. As a result, there may be less or different publicly available information about us than there is about U.S. issuers.

PEMEX’s financial information prepared under IFRS is not comparable to its financial information prepared under Mexican FRS.

Our March 2012 interim financial statements, which are incorporated by reference in this prospectus, have been prepared in accordance with IFRS. IFRS differ in certain significant respects from Mexican FRS and U.S. GAAP, and as a result, the financial information presented in our March 2012 interim financial statements is not comparable to the financial information presented in our 2011 financial statements. The main adjustments and reclassifications resulting from our adoption of IFRS are described in Notes 2 and 13 to the March 2012 interim financial statements.

Risk Factors Related to the Relationship between PEMEX and the Mexican Government

The Mexican Government controls PEMEX and it could limit PEMEX’s ability to satisfy its external debt obligations or could reorganize or transfer PEMEX or its assets.

Petróleos Mexicanos is a decentralized public entity of the Mexican Government, and therefore the Mexican Government controls us, as well as our annual budget, which is approved by the Cámara de Diputados (Chamber of Deputies). However, our financing obligations do not constitute obligations of and are not guaranteed by the Mexican Government. The Mexican Government has the power to intervene directly or indirectly in our commercial and operational affairs. Intervention by the Mexican Government could adversely affect our ability to make payments under any securities issued by us.

The Mexican Government’s agreements with international creditors may affect our external debt obligations. In certain past debt restructurings of the Mexican Government, Petróleos Mexicanos’ external indebtedness was treated on the same terms as the debt of the Mexican Government and other public sector entities. In addition, Mexico has entered into agreements with official bilateral creditors to reschedule public sector external debt. Mexico has not requested restructuring of bonds or debt owed to multilateral agencies.

The Mexican Government would have the power, if the Constitución Política de los Estados Unidos Mexicanos (Political Constitution of the United Mexican States) and federal law were amended, to reorganize PEMEX, including a transfer of all or a portion of Petróleos Mexicanos and the subsidiary entities or their assets to an entity not controlled by the Mexican Government. Such a reorganization or transfer could adversely affect production, cause a disruption in our workforce and our operations and cause us to default on certain obligations. See also “—Considerations Related to Mexico” below.

16

Table of Contents

Petróleos Mexicanos and the subsidiary entities pay special taxes and duties to the Mexican Government, which may limit PEMEX’s capacity to expand its investment program.

PEMEX pays a substantial amount of taxes and duties to the Mexican Government, particularly on the revenues of Pemex-Exploration and Production, which may limit PEMEX’s ability to make capital investments. In 2011, approximately 56.2% of the sales revenues of PEMEX was used to pay taxes and duties to the Mexican Government. These special taxes and duties constitute a substantial portion of the Mexican Government’s revenues. For further information, see “Item 4—Information on the Company—Taxes and Duties” and “Item 5—Operating and Financial Review and Prospects—IEPS Tax, Hydrocarbon Duties and Other Taxes” in the Form 20-F.

The Mexican Government has entered into agreements with other nations to limit production.

Although Mexico is not a member of OPEC, in the past it has entered into agreements with OPEC and non-OPEC countries to reduce global crude oil supply. We do not control the Mexican Government’s international affairs and the Mexican Government could agree with OPEC or other countries to reduce our crude oil production or exports in the future. A reduction in our oil production or exports could reduce our revenues.

The Mexican Government has imposed price controls in the domestic market on PEMEX’s products.

The Mexican Government has from time to time imposed price controls on the sales of natural gas, liquefied petroleum gas (LPG), gasoline, diesel, gas oil intended for domestic use and fuel oil number 6, among others. As a result of these price controls, we have not been able to pass on all of the increases in the prices of our product purchases to our customers in the domestic market. We do not control the Mexican Government’s domestic policies and the Mexican Government could impose additional price controls on the domestic market in the future. The imposition of such price controls would adversely affect our results of operations. For more information, see “Item 4—Information on the Company—Business Overview—Refining—Pricing Decrees” and “Item 4—Information on the Company—Business Overview—Gas and Basic Petrochemicals—Pricing Decrees” in the Form 20-F.

The Mexican nation, not PEMEX, owns the hydrocarbon reserves in Mexico.

The Political Constitution of the United Mexican States provides that the Mexican nation, not PEMEX, owns all petroleum and other hydrocarbon reserves located in Mexico. Although Mexican law gives Pemex-Exploration and Production the exclusive right to exploit Mexico’s hydrocarbon reserves, it does not preclude the Mexican Congress from changing current law and assigning some or all of these rights to another company. Such an event would adversely affect our ability to generate income.

Information on Mexico’s hydrocarbon reserves is based on estimates, which are uncertain and subject to revisions.

The information on oil, gas and other reserves set forth in the Form 20-F is based on estimates. Reserves valuation is a subjective process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner; the accuracy of any reserves estimate depends on the quality and reliability of available data, engineering and geological interpretation and subjective judgment. Additionally, estimates may be revised based on subsequent

17

Table of Contents

results of drilling, testing and production. These estimates are also subject to certain adjustments based on changes in variables, including crude oil prices. Therefore, proved reserves estimates may differ materially from the ultimately recoverable quantities of crude oil and natural gas. See “—Risk Factors Related to the Operations of PEMEX—Crude oil and natural gas prices are volatile and low crude oil and natural gas prices adversely affect PEMEX’s income and cash flows and the amount of Mexico’s hydrocarbon reserves.” Pemex-Exploration and Production revises its estimates of Mexico’s hydrocarbon reserves annually, which may result in material revisions to our estimates of Mexico’s hydrocarbon reserves.

PEMEX must make significant capital expenditures to maintain its current production levels, and to maintain, as well as increase, Mexico’s proved hydrocarbon reserves. Mexican Government budget cuts, reductions in PEMEX’s income and inability to obtain financing may limit PEMEX’s ability to make capital investments.

We invest funds to maintain, as well as increase, the amount of extractable hydrocarbon reserves in Mexico. We also continually invest capital to enhance our hydrocarbon recovery ratio and improve the reliability and productivity of our infrastructure. While the replacement rate for proved hydrocarbon reserves has increased in recent years, from 77.1% in 2009 to 85.8% in 2010, the overall replacement rate remained less than 100% until 2011, which represents a decline in Mexico’s proved hydrocarbon reserves. Nevertheless, in 2011 the replacement rate for proved hydrocarbon reserves was 101.1%. Pemex-Exploration and Production’s crude oil production decreased by 6.8% from 2008 to 2009, by 1.0% from 2009 to 2010 and by 1.0% from 2010 to 2011, primarily as a result of the decline of production in the Cantarell project. Our ability to make capital expenditures is limited by the substantial taxes that we pay to the Mexican Government and cyclical decreases in our revenues primarily related to lower oil prices. In addition, budget cuts imposed by the Mexican Government and the availability of financing may also limit our ability to make capital investments. For more information, see “Item 4—Information on the Company—History and Development—Capital Expenditures and Investments” in the Form 20-F.

PEMEX may claim some immunities under the Foreign Sovereign Immunities Act and Mexican law, and your ability to sue or recover may be limited.

Petróleos Mexicanos and the subsidiary entities are decentralized public entities of the Mexican Government. Accordingly, you may not be able to obtain a judgment in a U.S. court against us unless the U.S. court determines that we are not entitled to sovereign immunity with respect to that action. In addition, Mexican law does not allow attachment prior to judgment or attachment in aid of execution upon a judgment by Mexican courts upon the assets of Petróleos Mexicanos or the subsidiary entities. As a result, your ability to enforce judgments against us in the courts of Mexico may be limited. We also do not know whether Mexican courts would enforce judgments of U.S. courts based on the civil liability provisions of the U.S. federal securities laws. Therefore, even if you were able to obtain a U.S. judgment against us, you might not be able to obtain a judgment in Mexico that is based on that U.S. judgment. Moreover, you may not be able to enforce a judgment against our property in the United States except under the limited circumstances specified in the Foreign Sovereign Immunities Act of 1976, as amended (the Immunities Act). Finally, if you were to bring an action in Mexico seeking to enforce our obligations under any of our securities, satisfaction of those obligations may be made in pesos, pursuant to the laws of Mexico.

PEMEX’s directors and officers, as well as some of the experts named in this document or the Form 20-F, reside outside the United States. Substantially all of our assets and those of most of our directors, officers and experts are located outside the United States. As a result, you may not be able to effect service of process on our directors or officers or those experts within the United States.

18

Table of Contents

Considerations Related to Mexico

Economic conditions and government policies in Mexico and elsewhere may have a material impact on PEMEX’s operations.

A deterioration in Mexico’s economic condition, social instability, political unrest or other adverse social developments in Mexico could adversely affect our business and financial condition. Those events could also lead to increased volatility in the foreign exchange and financial markets, thereby affecting our ability to obtain new financing and service foreign debt. Additionally, the Mexican Government may cut spending in the future. These cuts could adversely affect our business, financial condition and prospects. In the past, Mexico has experienced several periods of slow or negative economic growth, high inflation, high interest rates, currency devaluation and other economic problems. These problems may worsen or reemerge, as applicable, in the future, and could adversely affect our business and our ability to service our debt. A worsening of international financial or economic conditions, including a slowdown in growth or recessionary conditions in Mexico’s trading partners, including the United States, or the emergence of a new financial crisis, could have adverse effects on the Mexican economy, our financial condition and our ability to service our debt.

Changes in exchange rates or in Mexico’s exchange control laws may hamper the ability of PEMEX to service its foreign currency debt.

The Mexican Government does not currently restrict the ability of Mexican companies or individuals to convert pesos into U.S. dollars or other currencies, and Mexico has not had a fixed exchange rate control policy since 1982. However, in the future, the Mexican Government could impose a restrictive exchange control policy, as it has done in the past. We cannot provide assurances that the Mexican Government will maintain its current policies with regard to the peso or that the peso’s value will not fluctuate significantly in the future. The peso has been subject to significant devaluations against the U.S. dollar in the past and may be subject to significant fluctuations in the future. Mexican Government policies affecting the value of the peso could prevent us from paying our foreign currency obligations.

Most of our debt is denominated in U.S. dollars. In the future, we may incur additional indebtedness denominated in U.S. dollars or other currencies. Declines in the value of the peso relative to the U.S. dollar or other currencies may increase our interest costs in pesos and result in foreign exchange losses to the extent that we have not hedged the exposure with derivative financial instruments.

For information on historical peso/U.S. dollar exchange rates, see “Item 3—Key Information—Exchange Rates” in the Form 20-F.

Political conditions in Mexico could materially and adversely affect Mexican economic policy and, in turn, PEMEX’s operations.

Political events in Mexico may significantly affect Mexican economic policy and, consequently, our operations. On December 1, 2006, Felipe de Jesús Calderón Hinojosa formally assumed office for a six-year term as the President of Mexico. Currently, no political party holds a simple majority in either house of the Mexican Congress.

Presidential and federal congressional elections in Mexico were held on July 1, 2012. Each Mexican presidential election results in a change in administration, as presidential reelection is not permitted in Mexico. We cannot predict whether changes in Mexican governmental policy will result from the change in administration. Any such change could adversely affect economic conditions or the industry in which we operate in Mexico and therefore our results of operations and financial position.

19

Table of Contents

Mexico has experienced a period of increasing criminal violence and such activities could affect PEMEX’s operations.

Recently, Mexico has experienced a period of increasing criminal violence, primarily due to the activities of drug cartels and related criminal organizations. In response, the Mexican Government has implemented various security measures and has strengthened its military and police forces. Despite these efforts, drug-related crime continues to exist in Mexico. These activities, their possible escalation and the violence associated with them, in an extreme case, may have a negative impact on our financial condition and results of operations.

Risks Related to Non-Participation in the Exchange Offers

If holders of old securities do not participate in the exchange offers, the old securities will continue to be subject to transfer restrictions.

Holders of old securities that are not registered under the Securities Act who do not exchange their unregistered old securities for new securities will continue to be subject to the restrictions on transfer that are listed on the legends of those old securities. These restrictions will make the old securities less liquid. To the extent that old securities are tendered and accepted in the exchange offers, the trading market, if any, for the old securities would be reduced.

Risks Related to the New Securities

The market for the new securities or the old securities may not be liquid, and market conditions could affect the price at which the new securities or the old securities trade.

The issuer will apply, through its listing agent, to have the new securities admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. All of the old securities are currently admitted to trading on the Euro MTF. In the event that the new securities are admitted to trading on the Euro MTF, we will use our best efforts to maintain such listing; provided that if legislation is adopted in Luxembourg in a manner that would require us to publish our financial statements according to accounting principles or standards that are materially different from those we apply in our financial reporting under the securities laws of Mexico and the United States or that would otherwise impose requirements on us or the guarantors that we determine in good faith are unduly burdensome, the issuer may de-list the new securities and/or the old securities. The issuer will use its reasonable best efforts to obtain an alternative admission to listing, trading or quotation for such securities by another listing authority, exchange or system within or outside the European Union, as the issuer may reasonably decide, although there can be no assurance that such alternative listing will be obtained.

In addition, the issuer cannot promise that a market for either the new securities or the old securities will be liquid or will continue to exist. Prevailing interest rates and general market conditions could affect the price of the new securities or the old securities. This could cause the new securities or the old securities to trade at prices that may be lower than their principal amount or their initial offering price.

20

Table of Contents

The new securities will contain provisions that permit the issuer to amend the payment terms of the new securities without the consent of all holders.

The new securities will contain provisions regarding acceleration and voting on amendments, modifications and waivers which are commonly referred to as “collective action clauses.” Under these provisions, certain key terms of a series of the new securities may be amended, including the maturity date, interest rate and other payment terms, without the consent of all of the holders. See “Description of the New Securities—Modification and Waiver.”

21

Table of Contents

This prospectus contains words, such as “believe,” “expect,” “anticipate” and similar expressions that identify forward-looking statements, which reflect our views about future events and financial performance. We have made forward-looking statements that address, among other things, our:

| • | drilling and other exploration activities; |

| • | import and export activities; |

| • | projected and targeted capital expenditures and other costs, commitments and revenues; and |

| • | liquidity. |

Actual results could differ materially from those projected in such forward-looking statements as a result of various factors that may be beyond our control. These factors include, but are not limited to:

| • | changes in international crude oil and natural gas prices; |

| • | effects on us from competition; |

| • | limitations on our access to sources of financing on competitive terms; |

| • | significant developments in the global economy; |

| • | significant economic or political developments in Mexico; |

| • | developments affecting the energy sector; and |

| • | changes in our regulatory environment. |

Accordingly, you should not place undue reliance on these forward-looking statements. In any event, these statements speak only as of their dates, and we undertake no obligation to update or revise any of them, whether as a result of new information, future events or otherwise.

For a discussion of important factors that could cause actual results to differ materially from those contained in any forward-looking statement, you should read “Risk Factors” above.

We will not receive any cash proceeds from the issuance of the new securities under the exchange offers. In consideration for issuing the new securities as contemplated in this prospectus, we will receive in exchange an equal principal amount of old securities, which will be cancelled. Accordingly, the exchange offers will not result in any increase in our indebtedness or the guarantors’ indebtedness. The net proceeds we received from issuing the old securities were and are being used to finance our investment program.

22

Table of Contents

RATIO OF EARNINGS TO FIXED CHARGES

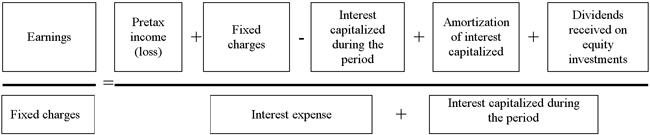

PEMEX’s ratio of earnings to fixed charges is calculated as follows:

Earnings, for this purpose, consist of pretax income (loss) from continuing operations before income from equity investees, plus fixed charges, minus interest capitalized during the period, plus the amortization of interest capitalized during the period and plus dividends received on equity investments. Pretax income (loss) is calculated after the deduction of hydrocarbon duties, but before the deduction of the hydrocarbon income tax and other income taxes. Fixed charges for this purpose consist of the sum of interest expense plus interest capitalized during the period. Fixed charges do not take into account exchange gain or loss attributable to PEMEX’s indebtedness.

Mexican FRS differs in certain significant respects from U.S. GAAP. The material differences as they relate to PEMEX’s financial statements are described in Note 21 to the 2011 financial statements. IFRS differs in certain significant respects from Mexican FRS. The material differences as they relate to PEMEX’s financial statements are described in Notes 2 and 13 to the March 2012 interim financial statements. In addition, IFRS differs in significant respects from U.S. GAAP; however, no reconciliation was or will be prepared for the first quarter of 2012.

The following table sets forth PEMEX’s consolidated ratio of earnings to fixed charges for each of the years in the five-year period ended December 31, 2011, in accordance with Mexican FRS and U.S. GAAP, and for the three month periods ended March 31, 2011 and 2012 in accordance with IFRS.

| For the period ended | ||||||||||||||||||||||||||||

| December 31, | March 31, | |||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||||||||

| Ratio of earnings to fixed charges: |

||||||||||||||||||||||||||||

| Mexican FRS(1) |

— | — | — | — | — | n.a. | n.a. | |||||||||||||||||||||

| U.S. GAAP(1) |

— | — | — | — | — | n.a. | n.a. | |||||||||||||||||||||

| IFRS |

n.a. | n.a. | n.a. | n.a. | n.a. | 1.4308 | 3.4047 | |||||||||||||||||||||

| Note: | n.a = Not applicable. |

| (1) | Under Mexican FRS, earnings for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 16,174 million, Ps. 96,481 million, Ps. 88,542 million, Ps. 45,873 million and Ps. 89,529 million for the years ended December 31, 2007, 2008, 2009, 2010 and 2011, respectively. Under U.S. GAAP, earnings for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 33,160 million, Ps. 55,626 million, Ps. 46,658 million, Ps. 16,112 million and Ps. 110,034 million for the years ended December 31, 2007, 2008, 2009, 2010 and 2011, respectively. |

Source: PEMEX’s financial statements.

23

Table of Contents

The following table sets forth the capitalization of PEMEX at March 31, 2012, as calculated in accordance with IFRS.

| At March 31, 2012(1)(2) | ||||||||

| (millions of pesos or U.S. dollars) |

||||||||

| Long-term external debt |

Ps.529,146 | U.S.$ | 41,182 | |||||

| Long-term domestic debt |

107,589 | 8,373 | ||||||

|

|

|

|

|

|||||

| Total long-term debt(3) |

636,735 | 49,555 | ||||||

|

|

|

|

|

|||||

| Certificates of Contribution “A”(4) |

49,605 | 3,861 | ||||||

| Mexican Government contributions to Petróleos Mexicanos |

182,177 | 14,178 | ||||||

| Legal reserve |

988 | 77 | ||||||

| Other comprehensive income (loss) |

(28,380 | ) | (2,209 | ) | ||||

| Accumulated losses from prior years |

(66,445 | ) | (5,171 | ) | ||||

| Net income for the period |

33,881 | 2,637 | ||||||

|

|

|

|

|

|||||

| Total equity (deficit) |

171,826 | 13,373 | ||||||

|

|

|

|

|

|||||

| Total capitalization |

Ps.808,561 | U.S.$ | 62,928 | |||||

|

|

|

|

|

|||||

| Note: | Numbers may not total due to rounding. |

| (1) | Unaudited. Convenience translations into U.S. dollars of amounts in pesos have been made at the established exchange rate of Ps. 12.8489 = U.S. $1.00 at March 31, 2012. Such translations should not be construed as a representation that the peso amounts have been or could be converted into U.S. dollar amounts at the foregoing or any other rate. |

| (2) | As of the date of this prospectus, there has been no material change in the capitalization of PEMEX since March 31, 2012, except for PEMEX’s undertaking of (a) the new financings described in “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Financing Activities—2012 Financing Activities” in the Form 20-F, (b) the new financings described in “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Recent Financing Activities” in the Form 6-K, (c) the issuance by Petróleos Mexicanos of U.S. $1,750,000,000 of 2044 old securities on June 26, 2012 and (d) the anticipated issuance on July 6, 2012 by Petróleos Mexicanos of U.S. $800,000,000 of notes due 2022 guaranteed by Export-Import Bank of the United States. |

| (3) | Total long-term debt does not include short-term indebtedness of Ps. 106.9 billion (U.S. $8.3 billion) at March 31, 2012 or accrued interest. |

| (4) | Equity instruments held by the Mexican Government. |

Source: PEMEX’s March 2012 interim financial statements.

24

Table of Contents

The guarantors—Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals—are decentralized public entities of Mexico, which were created by the Mexican Congress on July 17, 1992 out of operations that had previously been directly managed by Petróleos Mexicanos. Each of the guarantors is a legal entity empowered to own property and carry on business in its own name. The executive offices of each of the guarantors are located at Avenida Marina Nacional No. 329, Colonia Petróleos Mexicanos, México, D.F. 11311, México. Our telephone number, which is also the telephone number for the guarantors, is (52-55) 1944-2500.

The activities of the issuer and the guarantors are regulated primarily by:

| • | the Ley Reglamentaria del Artículo 27 Constitucional en el Ramo del Petróleo (Regulatory Law to Article 27 of the Political Constitution of the United Mexican States Concerning Petroleum Affairs, or the Regulatory Law); |

| • | the Ley de Petróleos Mexicanos (Petróleos Mexicanos Law); and |

| • | the Reglamento de la Ley de Petróleos Mexicanos (Regulations to the Petróleos Mexicanos Law). |

The operating activities of the issuer are allocated among the guarantors and the other subsidiary entity, Pemex-Petrochemicals, each of which has the characteristics of a subsidiary of the issuer. The principal business lines of the guarantors are as follows:

| • | Pemex-Exploration and Production explores for and exploits crude oil and natural gas and transports, stores and markets these hydrocarbons; |

| • | Pemex-Refining refines petroleum products and derivatives that may be used as basic industrial raw materials and stores, transports, distributes and markets these products and derivatives; and |

| • | Pemex-Gas and Basic Petrochemicals processes natural gas, natural gas liquids and derivatives that may be used as basic industrial raw materials and stores, transports, distributes and markets these products and produces, stores, transports, distributes and markets basic petrochemicals. |

For further information about the legal framework governing the guarantors, see “Item 4—Information on the Company—History and Development” in the Form 20-F. Copies of the Petróleos Mexicanos Law will be available at the specified offices of Deutsche Bank Trust Company Americas and the paying agent and transfer agent in Luxembourg.

The guarantors have been consolidated with PEMEX in the 2011 financial statements included in the Form 20-F and the March 2012 interim financial statements included in the Form 6-K incorporated by reference in this prospectus. See Notes 18 and 22 to the 2011 financial statements and Note 10 to the March 2012 interim financial statements for the selected consolidating statement of financial position, statement of operations and statement of cash flow data for the guarantors that are utilized to produce the consolidated financial statements of PEMEX. None of the guarantors publish their own financial statements.

The following is a brief description of each guarantor.

25

Table of Contents

Pemex-Exploration and Production

Pemex-Exploration and Production explores for and produces crude oil and natural gas, primarily in the northeastern and southeastern regions of Mexico and offshore in the Gulf of Mexico. In nominal peso terms, our capital investment in exploration and production activities decreased by 9.1% in 2011. As a result of our investments in previous years, our total hydrocarbon production reached a level of approximately 3,720 thousand barrels of oil equivalent per day in 2011. Pemex-Exploration and Production’s crude oil production decreased by 1.0% from 2010 to 2011, averaging 2,550 thousand barrels per day in 2011, primarily as a result of the decline of the Cantarell project, which was partially offset by increased crude oil production in the following projects: Ku-Maloob-Zaap, Crudo Ligero Marino, Delta del Grijalva, Ixtal Manik, Yaxché and Ogarrio-Magallanes.

Pemex-Exploration and Production’s natural gas production (excluding natural gas liquids) decreased by 6.1% from 2010 to 2011, averaging 6,594 million cubic feet per day in 2011. This decrease in natural gas production was a result of lower volumes from the Cantarell, Burgos and Veracruz projects. Exploration drilling activity decreased by 15.4% from 2010 to 2011, from 39 exploratory wells completed in 2010 to 33 exploratory wells completed in 2011. Development drilling activity decreased by 20.8% from 2010 to 2011, from 1,264 development wells completed in 2010 to 1,001 development wells completed in 2011. In 2011, we completed the drilling of 1,034 wells in total. Our drilling activity in 2011 was focused on increasing the production of non-associated gas in the Burgos, Veracruz and Macuspana projects and of heavy crude oil in the Ku-Maloob-Zaap and Cantarell projects.

In 2011, our reserves replacement rate (referred to as the RRR) was 101.1%, which was 15.3 percentage points higher than its RRR in 2010, which was 85.8%.

Our well-drilling activities during 2011 led to significant onshore and offshore discoveries. The main discoveries included heavy crude oil reserves located in the Southeastern basins, specifically in the Northeastern and Southwestern Marine regions, and light crude oil reserves located in both the Southwestern Marine and Southern regions. In addition, exploration activities in the Northern region led to the discovery of additional non-associated gas reserves in the Burgos and Veracruz basins. Our current challenge with respect to these discoveries is their immediate development in order to increase current production levels.

Pemex-Exploration and Production’s production goals for 2012 include increasing its crude oil production to approximately 2.6 million barrels per day and maintaining natural gas production above 6.0 billion cubic feet per day, in order to better satisfy domestic demand for natural gas, and thus lower the rate of increase of imports of natural gas and natural gas derivatives.

For further information about Pemex-Exploration and Production, see “Item 4—Information on the Company—Business Overview—Exploration and Production” in the Form 20-F.

Pemex-Refining

Pemex-Refining converts crude oil into gasoline, jet fuel, diesel, fuel oil, asphalts and lubricants. It also distributes and markets most of these products throughout Mexico, where it experiences significant demand for its refined products. At the end of 2011, Pemex-Refining’s atmospheric distillation refining capacity reached 1,690 thousand barrels per day, incorporating additional capacity due to the reconfiguration of the Minatitlán refinery. In 2011, Pemex-Refining produced 1,190 thousand barrels per day of refined products as compared to 1,229 thousand barrels per day of refined products in 2010. The 3.2% decrease in refined products production was mainly due to several operational issues faced by the national refining system.

26

Table of Contents

For further information about Pemex-Refining, see “Item 4—Information on the Company—Business Overview—Refining” in the Form 20-F.

Pemex-Gas and Basic Petrochemicals

Pemex-Gas and Basic Petrochemicals processes wet natural gas in order to obtain dry natural gas, LPG and other natural gas liquids. Additionally, it transports, distributes and sells natural gas and LPG throughout Mexico and produces and sells several basic petrochemical feedstocks, which are used by Pemex-Refining or Pemex-Petrochemicals. In 2011, Pemex-Gas and Basic Petrochemicals’ total sour natural gas processing capacity remained constant at 4,503 million cubic feet per day. Pemex-Gas and Basic Petrochemicals processed 3,445 million cubic feet per day of sour natural gas in 2011, a 0.7% increase from the 3,422 million cubic feet per day of sour natural gas processed in 2010. It produced 389 thousand barrels per day of natural gas liquids in 2011, a 1.6% increase from the 383 thousand barrels per day of natural gas liquids production in 2010. It also produced 3,692 million cubic feet of dry gas per day in 2011, 2.0% more than the 3,618 million cubic feet of dry gas per day produced in 2010.

For further information about Pemex-Gas and Basic Petrochemicals, see “Item 4—Information on the Company—Business Overview—Gas and Basic Petrochemicals” in the Form 20-F.

27

Table of Contents

This is a summary of the exchange offers and the material provisions of the exchange and registration rights agreements that we entered into on January 17, 2012 with the initial purchasers of the 2022 old securities, on October 18, 2011 with the initial purchasers of the 2041 old securities and on June 26, 2012 with the initial purchasers of the 2044 old securities. This section may not contain all the information that you should consider regarding the exchange offers and the exchange and registration rights agreements before participating in the exchange offers. For more detail, you should refer to the exchange and registration rights agreements, which we have filed with the SEC as exhibits to the registration statement. You can obtain copies of these documents by following the instructions under the heading “Where You Can Find More Information.”

Background and Purpose of the Exchange Offers

We sold the 2022 old securities to a group of initial purchasers pursuant to a terms agreement dated January 17, 2012. We sold the 2041 old securities to a group of initial purchasers pursuant to a terms agreement dated October 12, 2011. We sold the 2044 old securities to a group of initial purchasers pursuant to a terms agreement dated June 19, 2012. The initial purchasers then resold the 2022 old securities, the 2041 old securities and the 2044 old securities to other purchasers in offshore transactions in reliance on Regulation S of the Securities Act and to qualified institutional buyers in reliance on Rule 144A under the Securities Act.

We also entered into exchange and registration rights agreements with the initial purchasers of the 2022 old securities, the initial purchasers of the 2041 old securities and the initial purchasers of the 2044 old securities. As long as we determine that applicable law permits us to make the exchange offers, these exchange and registration rights agreements require that we use our best efforts to:

| Action |

Date Required | |

| 1. File a registration statement for a registered exchange offer relating to new securities with terms substantially similar to the relevant series of old securities |

September 30, 2012 | |

| 2. Cause the registration statement to be declared effective by the SEC and promptly begin the exchange offer after the registration statement is declared effective |

March 1, 2013 | |

| 3. Issue the new securities in exchange for all old securities of the relevant series tendered in the exchange offer |

April 5, 2013 |

The exchange offers described in this prospectus will satisfy our obligations under the exchange and registration rights agreements relating to the 2022 old securities, the 2041 old securities and the 2044 old securities.

28

Table of Contents

General Terms of the Exchange Offers

We are offering, upon the terms and subject to the conditions set forth in this prospectus, to exchange the old securities for new securities.

| New Securities Series |

Corresponding Old Securities Series | |

| 2022 new securities | 2022 old securities | |

| 2041 new securities | 2041 old securities | |

| 2044 new securities | 2044 old securities |

As of the date of this prospectus, the following amounts of each series of old securities are outstanding:

| • | U.S. $2,100,000,000 aggregate principal amount of 2022 old securities; |

| • | U.S. $1,250,000,000 aggregate principal amount of 2041 old securities; and |

| • | U.S. $1,750,000,000 aggregate principal amount of 2044 old securities. |

The exchange offer for the 2041 old securities does not relate to the U.S. $1,250,000,000 6.500% Bonds due 2041 that we issued on June 2, 2011, of which U.S. $20,120,000 in aggregate principal amount is outstanding following the SEC-registered exchange offer that we concluded in October 2011.

Upon the terms and subject to the conditions set forth in this prospectus, we will accept for exchange all old securities that are validly tendered and not withdrawn before 5:00 p.m., New York City time, on the expiration date. We will issue new securities of each series in exchange for an equal principal amount of outstanding old securities of the corresponding series accepted in the exchange offers. Holders may tender their old securities only in a principal amount of U.S. $10,000 and integral multiples of U.S. $1,000 in excess thereof. Subject to these requirements, you may tender less than the aggregate principal amount of any series of old securities you hold, as long as you appropriately indicate this fact in your acceptance of the exchange offers.

We are sending this prospectus to all holders of record of the 2022 old securities, the 2041 old securities and the 2044 old securities as of —, 2012. However, we have chosen this date solely for administrative purposes, and there is no fixed record date for determining which holders of old securities are entitled to participate in the exchange offers. Only holders of old securities, their legal representatives or their attorneys-in-fact may participate in the exchange offers.

The exchange offers are not conditioned upon any minimum principal amount of old securities being tendered for exchange. However, our obligation to accept old securities for exchange is subject to certain conditions as set forth below under “—Conditions to the Exchange Offers.”

Any holder of old securities that is an “affiliate” of Petróleos Mexicanos or an “affiliate” of any of the guarantors may not participate in the exchange offers. We use the term “affiliate” as defined in Rule 405 of the Securities Act. We believe that, as of the date of this prospectus, no such holder is an “affiliate” as defined in Rule 405.

29

Table of Contents

We will have formally accepted validly tendered old securities when we give written notice of our acceptance to the exchange agent. The exchange agent will act as our agent for the purpose of receiving old securities from holders and delivering new securities to them in exchange.

The new securities issued pursuant to the exchange offers will be delivered as promptly as practicable following the expiration date. If we do not extend the expiration date, then we would expect to deliver the new securities on or about •, 2012.

Resale of New Securities

Based on interpretations by the staff of the SEC set forth in no-action letters issued to other issuers, we believe that you may offer for resale, resell or otherwise transfer the new securities issued in the exchange offers without compliance with the registration and prospectus delivery provisions of the Securities Act. However, this right to freely offer, resell and transfer exists only if:

| • | you are not a broker-dealer who purchased the old securities directly from us for resale pursuant to Rule 144A under the Securities Act or any other available exemption under the Securities Act; |

| • | you are not an “affiliate” of ours or any of the guarantors, as that term is defined in Rule 405 of the Securities Act; and |

| • | you are acquiring the new securities in the ordinary course of your business, you are not participating in, and do not intend to participate in, a distribution of the new securities and you have no arrangement or understanding with any person to participate in a distribution of the new securities. |

If you acquire new securities in the exchange offers for the purpose of distributing or participating in a distribution of the new securities or you have any arrangement or understanding with respect to the distribution of the new securities, you may not rely on the position of the staff of the SEC enunciated in the no-action letters to Morgan Stanley & Co. Incorporated (available June 5, 1991) and Exxon Capital Holdings Corporation (available April 13, 1988), or interpreted in the SEC interpretative letter to Shearman & Sterling LLP (available July 2, 1993), or similar no-action or interpretative letters, and you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any secondary resale transaction.

Each broker-dealer participating in the exchange offers must deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the new securities received in exchange for old securities that were acquired as a result of market-making activities or other trading activities. By acknowledging this obligation and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act.